IPO Note | Pharmaceutical

March 15, 2016

Healthcare Global Enterprises

SUBSCRIBE

Issue Open: March 16, 2016

Long term bet

Issue Close: March 18, 2016

Healthcare Global Enterprises Ltd( HCG) is one of the largest cancer care network

Issue Details

in India in terms of the total number of private cancer treatment centers licensed

by the AERB as of May 31, 2015. The HCG network was ranked second in India

Face Value: `10

and first in the South India region and Bengaluru in the oncology segment in the

Present Eq. Paid up Capital: `7.35cr

Times Health All India Critical Care Hospital Ranking Survey 2016 while the

Offer Sale:2.98cr Shares

Milann network was ranked first in India, the South India region and Bengaluru in

Post Eq. Paid up Capital: `8.51cr

the fertility segment in the same survey.

Issue (amount): `611-650cr

Dominant player in the Cancer Care industry: Despite high demand for

Price Band: `205-218

comprehensive cancer care centres, India has only 200-250 comprehensive

cancer centres, which represent just 1 per 6mn people V/s 1 per 0.2mn people in

Post-issue implied mkt. cap `1745cr*- 1855cr**

the US. Also, ~40% of these centres are located in the 8 metropolitan cities and

Note:*at Lower price band and **Upper price band

fewer than 15% of these centres are government operated, which limits access to

advanced and multimodal treatment options available to cancer patients. As a

Book Building

consequence, the majority of cancer care is expected to be provided by the

private/for-profit sector in India. The HCG network is the largest provider of

QIBs

75%

cancer care in India in terms of total number of private cancer treatment centres.

Non-Institutional

15%

As of December 31, 2015, HCG operated 18 HCG cancer centres, including 14

Retail

10%

comprehensive cancer centres, 3 freestanding diagnostic centres and 1 day-care

chemotherapy centre in India. Cancer centres contribute a major part of the

Post Issue Shareholding Pattern(%)

overall revenues of the company.

Promoters Group

25.1

Outlook and Valuation: HCG’s sales have grown at a CAGR of 24.7% over

FY2011-2015 and EBITDA grew by 19% during same period. However, HCG has

MF/Banks/Indian

FIs/FIIs/Public & Others

exhibited a loss in FY2013-2014 primarily due to higher interest cost and

74.9

depreciation. Currently the capacity utilisation of the hospitals at around 50% is

lower and has some room for improvement. In terms of valuations, the company

is valued at 3.3x-3.5x FY2016E (lower- upper ends of the price band) on P/BV

basis. Its comparable peer Apollo Hospitals trades at 5.4x FY2016E P/BV. Given

the company has strong growth potential and would continue to enjoy pricing

power in the long run, only long term investors should subscribe to the issues.

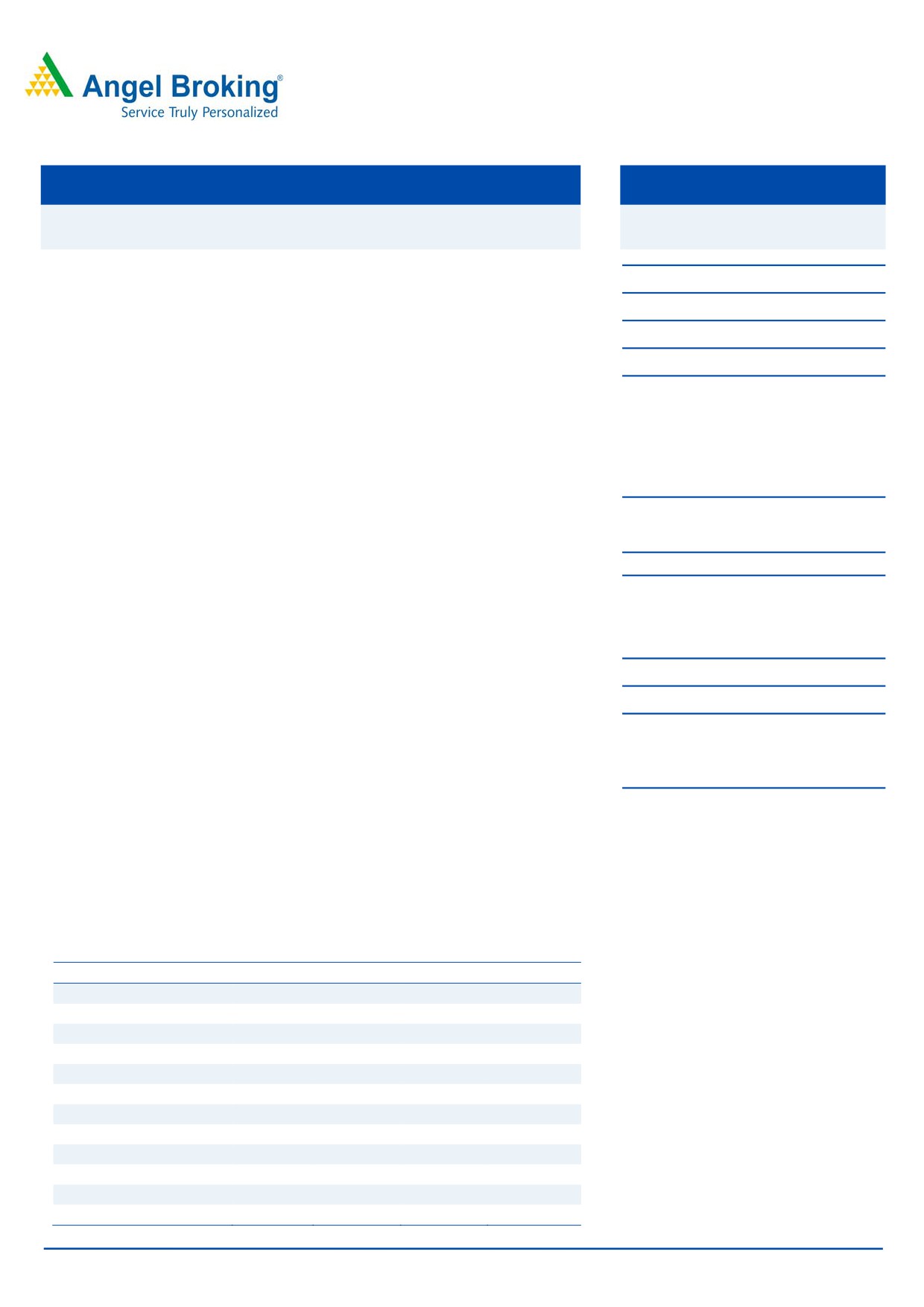

Key Financials

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

Net Sales

267

338

451

519

% chg

24.1

26.9

33.4

15.1

Net (loss)/Profit

(3)

(11)

(36)

6

% chg

-

-

-

-

EPS (`)

-

-

-

0.7

EBITDA Margin (%)

15.5

13.7

8.5

14.7

P/E (x)

-

-

-

294.5

RoE (%)

(1.6)

(4.3)

(13.0)

2.3

RoCE (%)

4.3

2.9

0.4

6.6

P/BV (x)

8.8

6.5

7.0

6.6

Sarabjit Kour Nangra

EV/Sales (x)

7.5

6.2

4.6

3.9

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

48.3

45.2

53.9

26.5

Source: Company, Angel Research; Note :Valuations at upper price band and Equity post IPO

Please refer to important disclosures at the end of this report

1

Healthcare Global Enterprises | IPO Note

Company background

HCG is a specialty healthcare provider in India focused on cancer and fertility.

Under the HCG brand, the company operates the largest cancer care network in

India. The HCG network consists of 14 comprehensive cancer centres, including

its Centre of Excellence in Bengaluru, 3 freestanding diagnostic centres and

1 day-care chemotherapy centre, across India. HCG also provides fertility

treatment under the “Milann” brand and provides clinical reference laboratory

services in India with a specialisation in oncology, including molecular diagnostic

services and genomic testing under the “Triesta” brand.

The HCG network operates through a “hub and spoke” model where the HCG

Centre of Excellence in Bengaluru serves as a hub to the other cancer centres. Out

of the 14 cancer centres under HCG’s network, only four are owned and

controlled by HCG while others are on joint venture or profit sharing basis.

Issue details

Through the IPO, HCG proposes to offer 2.98cr equity shares for sale by Promoter

and Investors and fresh issues. While the company has put up around 1.82cr offer

for sale shares, the fresh issues are upto 1.16cr shares. Out of offer for sale,

Promoter group is offering 0.018cr shares, while other selling shareholders are

offering 1.8cr shares. The company shall not receive any proceeds from the offer

for sale. The net proceeds will be utilised for the following objects-

Purchase of medical equipments (~`42.2cr),

Investment in information technology software, services and hardware

(~`30.2cr),

Pre-payment of debt (~`147.1cr), and

General corporate purposes.

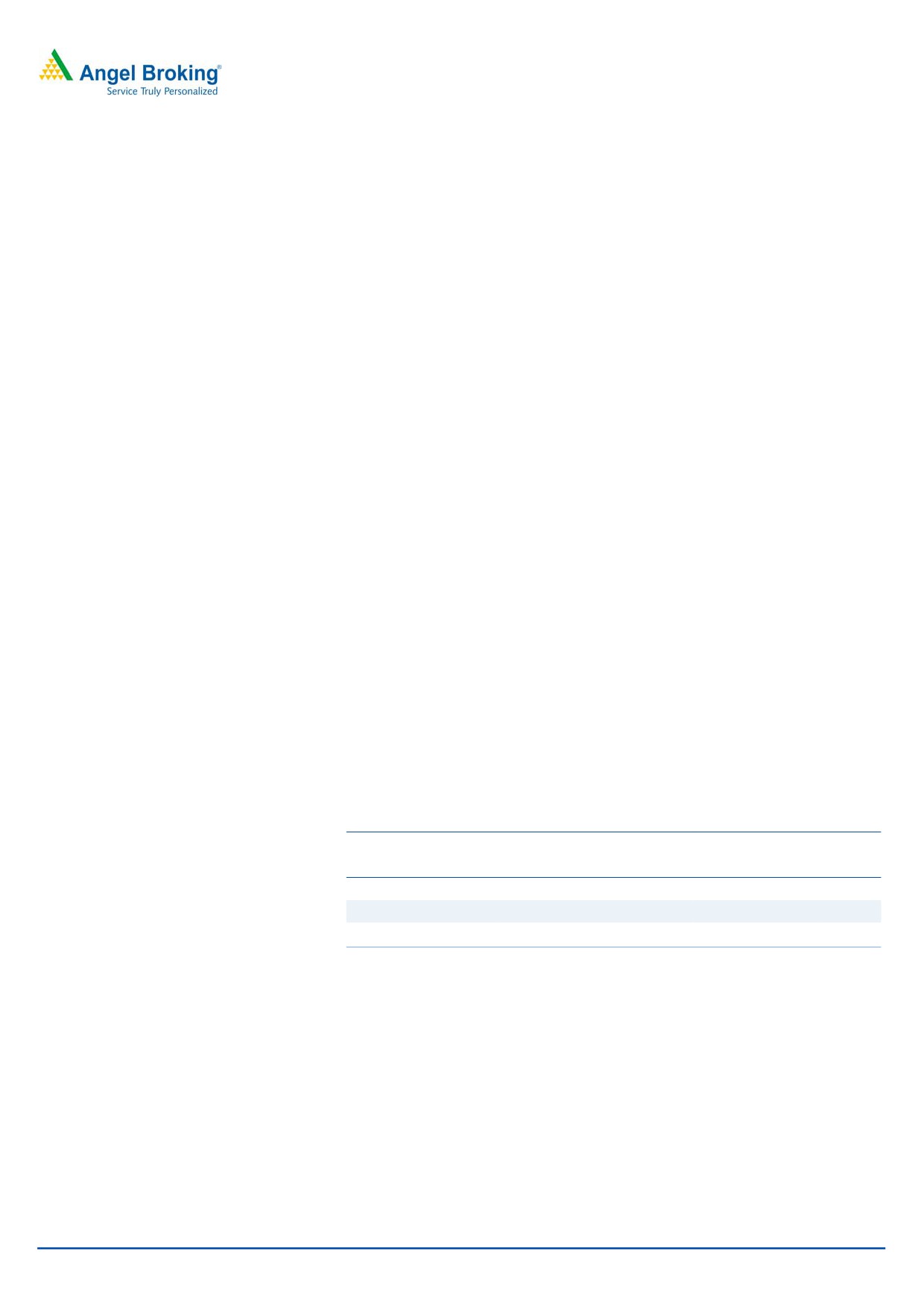

Exhibit 1: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

21,161,084

28.8

19,482,401

22.9

Others

52,388,379

71.3

65,593,585

77.1

Total

73,475,986

100.0

85,075,986

100.0

Source: Company, Angel Research

Industry

Healthcare spending represented an estimated 4% of India's GDP in 2012. At a

market value of US$81.3bn, India was the sixth largest healthcare market globally

in 2014. The Indian healthcare industry comprises five segments: (i) hospitals,

(ii) pharmaceuticals, (iii) medical insurance, (iv) medical equipment and supplies,

and (v) diagnostics. The hospital segment comprised about 71% of the total

healthcare revenue in India in 2012.

Healthcare delivery in India has two components - public and private. The public,

ie the government healthcare system, focuses on addressing primary healthcare

March 15, 2016

2

Healthcare Global Enterprises | IPO Note

needs across India and particularly so in the rural areas. The government also

manages secondary and tertiary care hospitals across India. The private sector

comprises primarily secondary and tertiary care hospitals predominantly located in

metropolitan, tier I and tier II cities. The private sector accounts for almost 72% of

India's total healthcare expenditure.

The Indian healthcare industry is expected to grow at a CAGR of 17% between

2008 and 2020; and by 2020, the Indian healthcare industry is expected to have

a market value of US$280bn.

The key drivers for the industry are -

Socio-economic changes such as growing health awareness, increasing

per-capita income, increasing penetration of health insurance, increasing

instances of lifestyle diseases and an aging population.

Technological advancements such as continuing development of mobile

technology which will enhance the delivery of healthcare through

telemedicine; affordability of healthcare in India, which will attract more

patients. For example, treatment for major surgeries in India costs

approximately 20% less than the cost in a developed country.

Government policies in India that support the growth in the healthcare industry

such as tax reliefs on hospitals in tier II and tier III cities, which will attract

healthcare investment in these areas.

Amongst the segments HCG is present, Cancer and Fertility offer good potential

for the company. According to a survey, prevalence of cancer in India is estimated

to be in 3.9mn people (in 2015), with 1.1mn reported new cancer cases during

the year. The real incidence of cancer in India could be significantly higher than

the reported figure. Data from large randomised screening trials undertaken in

India suggest that the real incidence of cancer could be 1.5 to 2 times higher than

the reported incidence, or an estimated 1.6 to 2.2mn new cancer cases during

2015. Even at this level, it is lower than in the United States and China, which is

around 1.7mn and 3.4mn respectively.

On the fertility front, estimated 220mn women in India are of reproductive age

(between 20 and 44 years of age) and about 27.5mn couples in this group are

estimated to be suffering from infertility. The number of infertile couples in India is

expected to increase from 27.5mn in 2015 to between 29mn and 32mn by 2020.

The total fertility rate (defined as the average number of children that would be

born to a woman if she experiences the current fertility pattern throughout her

reproductive span (15 to 49 years)) in India has witnessed a rapid decline over the

last few decades, from 3.9 in 1990 to 2.3 in 2013.

Only

1% of

27.5mn couples suffering from infertility presented for fertility

assessment and only 65,000 couples availed IVF (In-vitro fertilization) treatment.

The prevalence of infertility in India has been rising owing to (i) demographic

changes with an increase in the number of women of reproductive age; (ii) lifestyle

changes; (iii) prevalence of several known clinical factors; and (iv) ethnicity.

March 15, 2016

3

Healthcare Global Enterprises | IPO Note

Key investment rational

Significant potential for the Cancer Care industry

Despite high demand for comprehensive cancer care centres, India has only

200-250 comprehensive cancer centres, which represent just 1 per 6mn people

compared to 1 per 0.2mn people in the US. Also, ~40% of these centres are

located in the 8 metropolitan cities and fewer than 15% of these centres are

government operated, which limits access to advanced and multimodal treatment

options available to cancer patients. As a consequence, the majority of cancer care

is expected to be provided by the private/for-profit sector in India. India needs at

least 450 to 550 comprehensive cancer centres by 2020, with a high proportion of

such centres in non-metropolitan cities and towns.

In addition, there is a significant shortage of oncologists in India. India has only

1 oncologist per 1,600 cancer patients in India, against 1 per 100 cancer patients

in the US as of 2014. Due to the limited access to cancer care in India and inability

of significant sections of the population to pay for quality care, only around

15-20% of cancer patients are currently able to undergo radiation treatment in

India, compared to a potential clinical need of 40-50% of cancer patients.

Dominant player in Cancer Care

The HCG network is the largest provider of cancer care in India in terms of total

number of private cancer treatment centres. As of December 31, 2015, HCG

operated 18 HCG cancer centres, including 14 comprehensive cancer centres,

3 freestanding diagnostic centres and 1 day-care chemotherapy centre in India.

Cancer centres contribute a major part of the overall revenues of the company.

During the six months ended September 30, 2015 and FY2015, HCG registered

18,079 and 37,458 new cancer patients across its network and delivered radiation

therapy to 6,163 and 12,647 patients, respectively. As of 1HFY2016 and FY2015,

HCG network had 912 and 875 available operational beds respectively, which

included intensive care unit (ICU) beds and day-care beds but excluded self-care

beds. For 1HFY2016 and FY2015, HCG network recorded an average length of

stay (ALOS) of 2.90 days and 3.00 days, an average occupancy rate (AOR) of

51.6% and 53.5% and an average revenue per occupied bed (ARPOB) of `26,685

per day and `24,467 per day, respectively.

Overall, HCG’s avg. revenue per bed per day has increased at a CAGR of 13.8%

over FY2013-2015. Patients treated with radiation therapy and chemotherapy

administration has increased at a CAGR of 11.2% and 10.0%, respectively during

FY2013-2015.

Entry into Fertility treatment industry

Fertility treatment is an emerging segment in the Indian healthcare industry which

is currently relatively underdeveloped and fragmented. Of the estimated

27.5mn infertile couples in India, fewer than

0.3mn currently seek fertility

treatment, owing to lack of awareness and access to fertility treatment, as well as

high cost of treatment. Nonetheless, the number of In Vitro Fertilisation (IVF) cycles

performed in India has increased from 7,000 in 2001 to 100,000 in 2015.

Through acquisition of a 50.10% equity interest in BACC Healthcare, HCG now

March 15, 2016

4

Healthcare Global Enterprises | IPO Note

operates 4 Milann fertility centres in Bengaluru. The fragmentation of the market

presents HCG with an opportunity to leverage the expertise of building the HCG

brand into a nationally recognised speciality healthcare brand and to build and

establish the Milann brand across India. Milann fertility centres provide

comprehensive reproductive medicine services, including assisted reproduction,

gynaecological endoscopy and fertility preservation. During FY2015, the Milann

fertility centres registered

8,027 new patients and performed

1,111 IVF

procedures.

Valuation

HCG’s sales have grown at a CAGR of 24.7% over FY2011-2015 and EBITDA

grew by 19% during same period. However, HCG has exhibited a loss in FY2013-

2014 primarily due to higher interest cost and depreciation. There has been a dip

in yoy sales growth in FY2015 due to reduction in Onco drugs on account of

implementation of NLEM pricing. However, HCG guided towards margins

remaining stable despite the fall in prices. Thus, while the company has been

growing at higher growth rates, its profitability has been elusive, as the company

has been in an expansion mode and the same has been financed through debt.

Also, currently the capacity utilisation of the hospitals at around 50% is lower and

has some room for improvement. Thus an improvement in margins along with

improvement in capacity utilisation are key to achieve a high ROE and for the

business to sustain.

In terms of valuations, the company is valued at 3.3x-3.5x FY2016E (lower- upper

ends of the price band) on P/BV basis. Its comparable peer Apollo Hospitals

trades at 5.4x FY2016E P/BV. On EV/sales, the company is trading at 3.0x-3.2x

FY2016E V/s 3.3x FY2016E for Apollo Hospitals. On EV/EBDITA basis, the

company is trading at

19.0-20.1xFY2016E V/s

18.8xFY2016E for Apollo

Hospitals.

The company has strong growth potential and would continue to enjoy pricing

power in the long run. Our estimates puts, that company will take around

3-4 years to get profitable like Apollo Hospitals and hence only long term investors

should subscribe to the issues.

Risks for the company

HCG’s operations and proposed expansions are funded to a large extent by

debt and any increase in interest expense may have an adverse effect on

operations and financial condition.

As of 1HFY2016, 33% revenues (`93cr) were billed to the third party payers.

In the past, there have been delays and non-payment by third-party payers

(The third-party payers include; (i) central, state and local government bodies;

(ii) private and public insurers, including third-party administrators acting

on behalf of insurers; and (iii) corporate entities that pay for medical

expenses of their employees and in certain cases, their dependents). As of

November 30, 2015, HCG had outstanding gross receivables amounting to

`90cr from third-party payers. Provisions for disallowances reduce the revenue

from operations and provisions for doubtful trade receivables increases

expenses and thus reduce the profitability.

March 15, 2016

5

Healthcare Global Enterprises | IPO Note

Capital intensive business, which makes it a more cash guzzling business, with

higher paybacks.

High concentration of geography and disease segment, which could impact

the operations. More than 30% of the revenue is derived from single centre at

Bengaluru, while Cancer accounts for almost >50% of sales of the company.

Hospital segment is dependent upon high skilled workforce; hence any

shortfall can restrict the growth plans.

March 15, 2016

6

Healthcare Global Enterprises | IPO Note

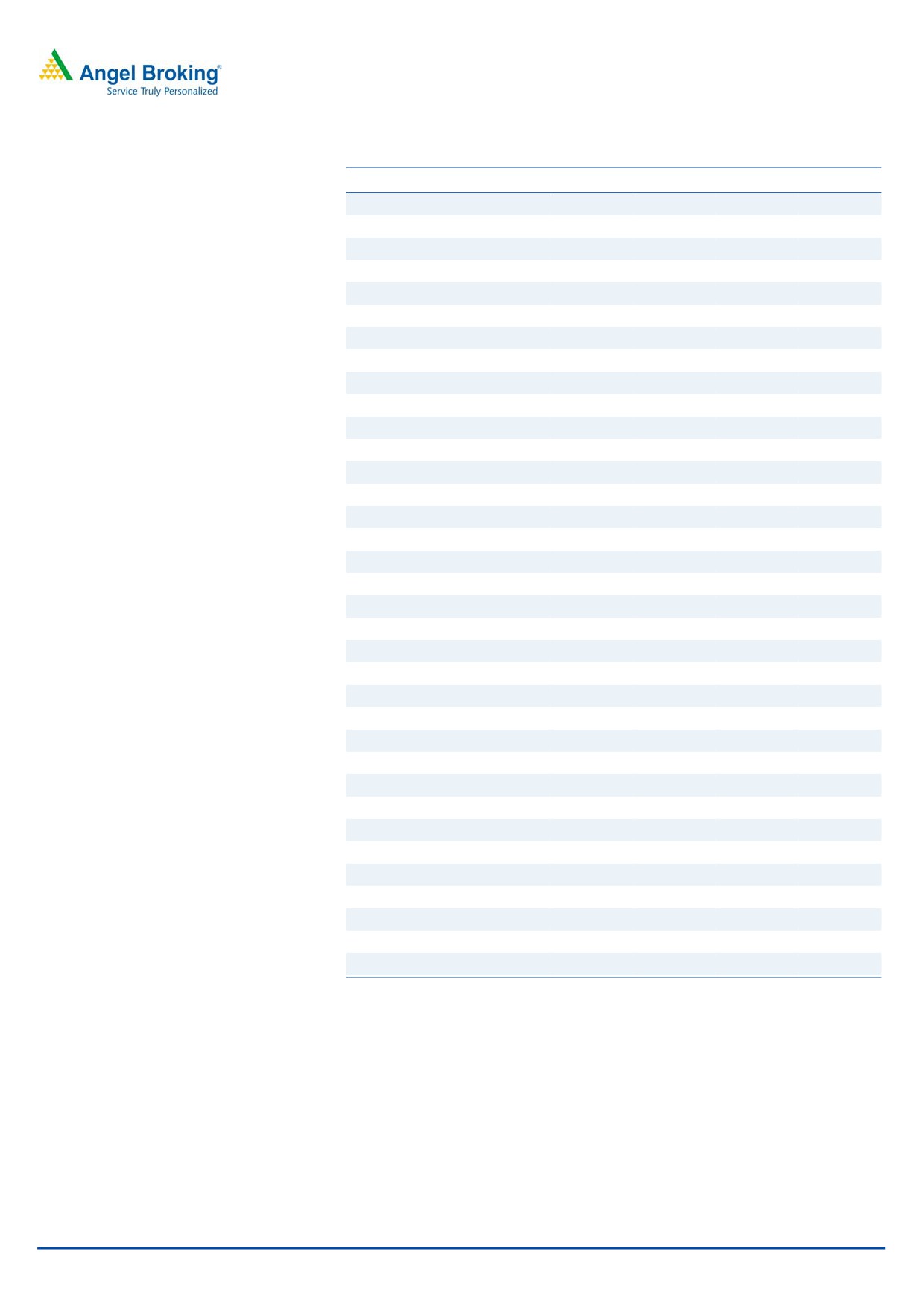

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

Gross sales

267

338

451

519

Less: Excise duty

-

-

-

-

Net sales

267

338

451

519

Other operating income

3.6

2.4

4.0

4.8

Total operating income

270

341

455

524

% chg

24.1

26.1

33.6

15.1

Total expenditure

225

292

413

443

Net raw materials

81

104

133

146

Personnel

42

54

77

82

Other

102

135

203

216

EBITDA

41

46

38

76

% chg

12.1

(17.3)

99.7

(% of Net Sales)

15.5

13.7

8.5

14.7

Depreciation& amortisation

24

30

36

36

Interest & other charges

24

29

32

32

Other income

-

-

-

-

(% of PBT)

-

-

-

-

Share in profit of Associates

-

-

-

-

Recurring PBT

(3)

(10)

(30)

13

% chg

-

-

-

-

Extraordinary expense/(Inc.)

-

-

-

-

PBT (reported)

(3)

(10)

(30)

13

Tax

0

1

5

(2)

(% of PBT)

32.0

30.6

32.7

32.0

PAT (reported)

(3)

(11)

(32)

14

Add: Share of earnings of asso.

-

-

-

-

Less: Minority interest (MI)

0

(0)

4

8

Prior period items

-

-

-

-

PAT after MI (reported)

(3)

(11)

(36)

6

ADJ. PAT

(3)

(11)

(36)

6

% chg

53.5

211.8

235.8

-

(% of Net Sales)

(1.3)

(3.1)

(7.9)

1.2

Basic EPS (`)

(0.4)

(1.2)

(4.2)

0.7

Fully Diluted EPS (`)

(0.4)

(1.2)

(4.2)

0.7

% chg

53.5

211.8

235.8

-

Note: *EPS calculation is based on Post IPO outstanding shares

March 15, 2016

7

Healthcare Global Enterprises | IPO Note

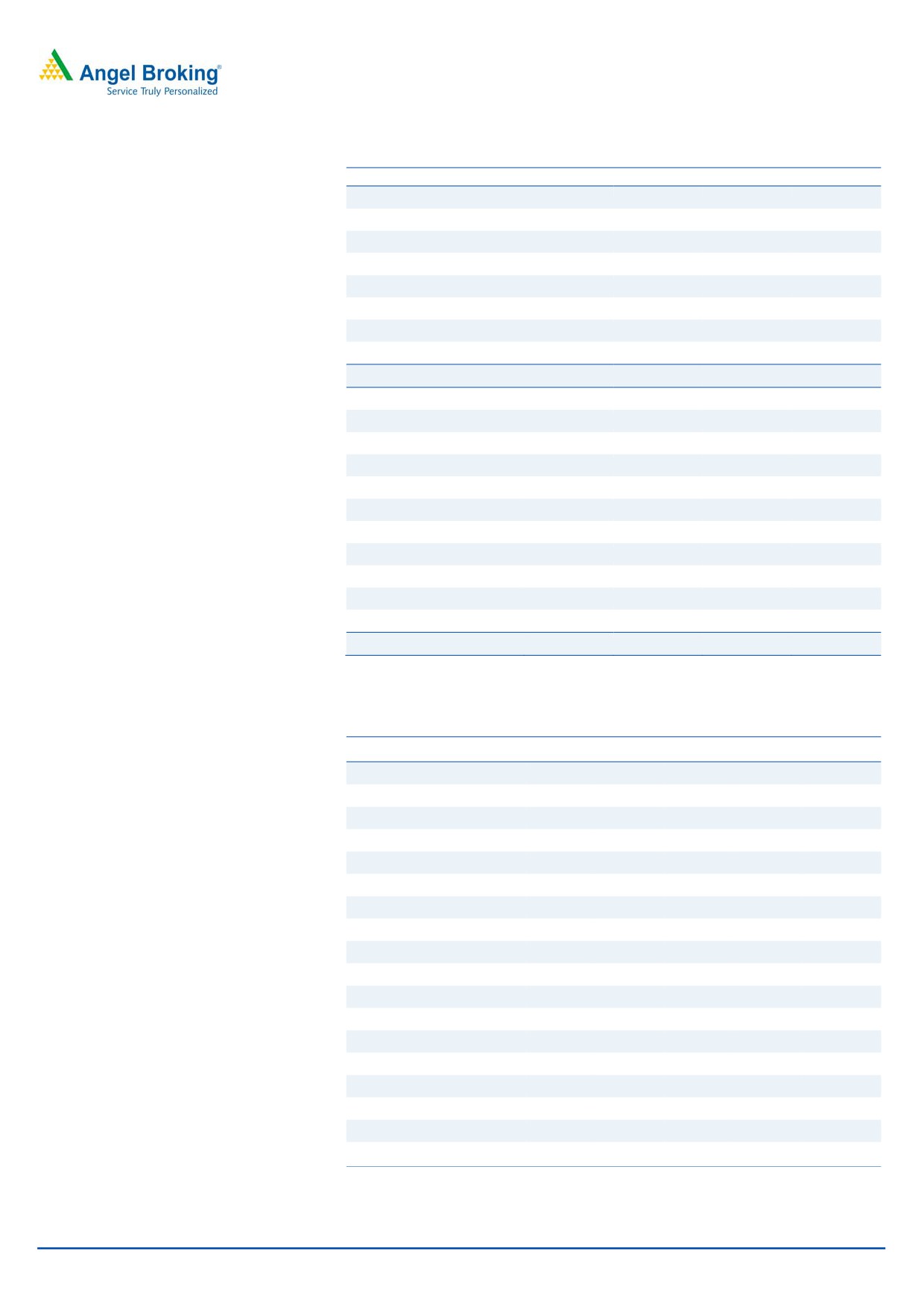

Consolidated Balance Sheet

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

SOURCES OF FUNDS

Equity share capital

59.3

66.9

68.2

70.0

Preference Capital

-

-

-

-

Reserves & surplus

152

217

196

210

Shareholders funds

211

283

264

280

Minority Interest

8.2

12.6

18.3

25.3

Total loans

187

277

270

310

Deferred tax liability

(0)

1

1

(5)

Total liabilities

406

574

553

609

APPLICATION OF FUNDS

Net block

382

448

462

510

Goodwill

10

61

60

61

Investments

0.2

61

2.3

0.1

Current assets

109

134

159

192

Cash

17

11

26

27

Loans & advances

6

7

8

9

Other

86

116

126

156

Current liabilities

98

134

136

161

Net current assets

11

(0)

23

31

Other Current Assets

3.0

5.0

5.0

8.0

Total assets

406

574

553

609

Consolidated Cash Flow Statement

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

Profit before tax

(3)

(10)

(30)

13

(3)

Depreciation

24

30

36

36

24

(Inc)/Dec in Working Capital

(0)

(41)

19

52

(0)

Less: Other income

-

-

-

-

-

Direct taxes paid

0

1

5

(2)

0

Cash Flow from Operations

20

(23)

20

103

20

(Inc.)/Dec.in Fixed Assets

(46)

(89)

(51)

(81)

(46)

(Inc.)/Dec. in Investments

-

-

-

-

-

Other income

-

-

-

-

-

Cash Flow from Investing

(46)

(89)

(51)

(81)

(46)

Issue of Equity

43

80

15

10

43

Inc./(Dec.) in loans

14

90

(8)

40

14

Dividend Paid (Incl. Tax)

-

-

-

-

-

Others

(31)

(64)

38

(70)

(31)

Cash Flow from Financing

26

106

45

(20)

26

Inc./(Dec.) in Cash

0

(6)

15

2

0

Opening Cash balances

16

17

11

26

16

Closing Cash balances

17

11

26

27

17

March 15, 2016

8

Healthcare Global Enterprises | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

March 15, 2016

9