3QFY2016 Result Update | FMCG

January 18, 2016

Hindustan Unilever

NEUTRAL

CMP

`811

Performance Highlights

Target Price

-

Quarterly Data

Investment Period

-

(` cr)

3QFY16

3QFY15

% yoy

2QFY16

% qoq

Revenue

7,981

7,774

2.7

7,955

0.3

EBITDA

1,314

1,321

(0.5)

1,304

0.8

Stock Info

Margin (%)

16.5

17.0

(52bp)

17.4

(89bp)

Sector

FMCG

Adj. PAT

1,026

972

5.6

971

5.7

Market Cap (` cr)

1,75,403

Source: Company, Angel Research

Net Debt (` cr)

-5,671

Hindustan Unilever (HUL)’s performance for 3QFY2014 was slightly below

Beta

0.6

consensus expectations. For the quarter, the company’s top-line grew by 2.7% yoy

52 Week High / Low

979 / 771

to `7,981cr while the reported PAT grew ~6% yoy to `1,026cr.

Avg. Daily Volume

96,053

Face Value (`)

1

Key highlights: For 3QFY2016, HUL’s top-line rose by 2.7% yoy to `7,981cr. The

BSE Sensex

24,188

soaps and detergents division posted a flat yoy growth due to weak macros.

Nifty

7,351

However, in the soaps segment, we saw some growth in Dove, Pears and Lifebuoy

as well as double-digit growth in the liquids portfolio. The detergents segment’s

Reuters Code

HLL.BO

saw double-digit growth in Surf and Rin. The personal products division posted a

Bloomberg Code

HUVR@IN

modest growth of 5.6% yoy. The reported growth of this segment was impacted by

delayed winter and owing to one-time realignment of channel spends. In the

Shareholding Pattern (%)

beverages segment, the company reported a growth of 7% yoy primarily led by

Promoters

67.2

volumes, which were driven by activations and market development initiatives by

MF / Banks / Indian Fls

13.9

the company.

FII / NRIs / OCBs

4.8

On the operating profit front, the company reported a de-growth of 0.5% yoy due

Indian Public / Others

14.1

to lower sales growth. Further, the operating profit margin fell by 52bp yoy to

16.5% due to increase in advertisement and other expenses. During the quarter,

Abs. (%)

3m 1yr 3yr

the company incurred `55cr under the exceptional items head, which factored in

provision towards restructuring and sale of properties. After adjusting for it, the

Sensex

(9.5)

(5.9)

20.7

company’s net profit rose by a modest 5.6% yoy to `1,026cr.

HUL

2.5

(0.7)

65.8

Outlook and valuation: We expect HUL to post a ~6% and ~6% CAGR in its top-

3-year price chart

line and bottom-line respectively, over FY2015-16E. At the current market price,

1100

the stock is trading at 37.6x FY2018E earnings. We maintain our Neutral view on

1000

the stock

900

800

Key financials (Consolidated)

700

600

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

500

Net sales

31,972

33,299

35,497

38,230

400

% chg

9.4

4.2

6.6

7.7

Net profit

3,893

4,088

4,328

4,629

% chg

3.3

5.0

5.9

6.9

Source: Company, Angel Research

EBITDA margin (%)

16.9

17.1

17.1

17.1

EPS (`)

18.0

18.9

20.0

21.4

P/E (x)

44.7

42.6

40.2

37.6

P/BV (x)

43.3

37.3

32.5

28.5

RoE (%)

108.5

87.6

80.8

75.9

RoCE (%)

125.3

113.5

105.4

99.8

Amarjeet S Maurya

EV/Sales (x)

5.3

5.0

4.7

4.4

022-39357800 Ext: 6831

EV/EBITDA (x)

31.1

29.4

27.5

25.5

Source: Company, Angel Research; Note: CMP as of January 18, 2016

Please refer to important disclosures at the end of this report

1

Hindustan Unilever | 3QFY2016 Result Update

Exhibit 1: Consolidated quarterly performance

Y/E March (` cr)

3QFY16

3QFY15

% yoy

2QFY15

% qoq

9MFY16

9MFY15

% chg

Net Sales

7,981

7,774

2.7

7,955

0.3

24,042

23,130

3.9

Consumption of RM

3,742

3,848

(2.8)

3,899

(4.0)

11,544

11,797

(2.1)

(% of Sales)

46.9

49.5

49.0

48.0

51.0

Staff Costs

402

442

(9.1)

381

5.5

1,146

1,190

(3.7)

(% of Sales)

5.0

5.7

4.8

4.8

5.1

Advertising

1,138

977

16.4

1,145

(0.6)

3,436

2,847

20.7

(% of Sales)

14.3

12.6

14.4

14.3

12.3

Other Expenses

1,385

1,187

16.7

1,226

13.0

3,792

3,418

11.0

(% of Sales)

17.4

15.3

15.4

15.8

14.8

Total Expenditure

6,667

6,454

3.3

6,651

0.2

19,918

19,252

3.5

Operating Profit

1,314

1,321

(0.5)

1,304

0.8

4,124

3,878

6.3

OPM

16.5

17.0

17.4

17.2

16.8

Interest

0

4

(98.8)

0

66.7

0

17

(99.1)

Depreciation

82

73

12.4

76

7.9

233

216

7.9

Other Income

177

527

(66.5)

180

(1.8)

476

1,017

(53.2)

PBT (excl. Ext Items)

1,409

1,771

(20.5)

1,408

0.1

4,366

4,662

(6.3)

Ext (Income)/Expense

PBT (incl. Ext Items)

1,409

1,771

(20.5)

1,408

0.1

4,366

4,662

(6.3)

(% of Sales)

17.6

22.8

16.8

18.2

20.2

Provision for Taxation

437

519

445

1,373

1,365

0.6

(% of PBT)

31.0

29.3

23

31

29

Reported PAT

971

1,252

(22.4)

962

1.0

2,993

3,297

(9.2)

PATM

12.2

16.1

12.9

12.4

14.3

Extra-ordinary Items

(55)

280

(8)

(56)

343

Reported PAT

1,026

972

5.6

971

5.7

3,049

2,954

3.2

Equity shares (cr)

216

216

216

216

216

FDEPS (`)

4.7

4.5

5.6

4.5

5.7

14.1

13.7

3.2

Source: Company, Angel Research

January 18, 2016

2

Hindustan Unilever | 3QFY2016 Result Update

Exhibit 2: Segmental Performance

3QFY2016

3QFY2015

% chg

2QFY2016

% chg 9MFY16 9MFY15

% chg

Income

Soaps & Detergents

3,630

3,600

0.8

3,817

(4.9)

11,301

11,203

0.9

Personal Products

2,593

2,455

5.6

2,346

10.5

7,344

6,757

8.7

Beverages

984

920

7.0

953

3.3

2,852

2,655

7.4

Packaged Foods

470

420

11.8

507

(7.4)

1,585

1,415

12.0

Others

295

354

(16.7)

324

(9.1)

931

1,018

(8.5)

Total Gross Income

7,971

7,748

7,946

24,012

23,048

PBIT segment -wise bifurcation

Soaps & Detergents

509

502

1.3

490

3.8

1,597

1,545

3.4

Personal Products

748

681

9.9

612

22.3

2,073

1,800

15.2

Beverages

173

141

22.6

138

25.4

454

433

4.9

Packaged Foods

15

(21)

(170.3)

27

(44.4)

96

58

66.5

Others

(35)

(4)

839.1

10

(438.5)

(29)

(8)

284.8

Total PBIT

1,410

1,299

1,277

4,191

3,828

Less: Interest Exp

0

4

(98.8)

0

-

0

17

Less: Other Unallocable Exp

1

-

-

PBT

1,409

1,771

1,408

1,409

1,771

PBIT Margin (%)

Soaps & Detergents

14.0

14.0

12.8

14.1

13.8

Personal Products

28.9

27.7

26.1

28.2

26.6

Beverages

17.6

15.3

14.5

15.9

16.3

Packaged Foods

3.2

(5.1)

5.3

6.1

4.1

Others

(12.0)

(1.1)

3.2

(3.2)

(0.8)

Source: Company, Angel Research

Overall top-line growth flattish

For 3QFY2016, HUL’s top-line rose by 2.7% yoy to `7,981cr. The soaps &

detergents business reported lower growth of 0.8% yoy due to weak macros. The

soaps category’s performance was supported by growth in Dove, Pears and

Lifebuoy as well as double-digit growth in the liquids portfolio. The detergents

segment saw double-digit growth in Surf and Rin.

The personal products division posted a growth of 5.6% yoy. The reported growth

of the segment was impacted by delayed winter and owing to one-time

realignment of channel spends undertaken to drive effectiveness in the market

place. In this segment, skin care delivered volume led growth driven by Fair &

Lovely, Pond’s and Lakme. Fair & Lovely continued to do well and saw an

encouraging response to the BB cream. The performance of Pond’s was led by

premium skin lightening while Lakme’s growth was buoyed by premium

innovations and facewash. Hair care maintained its strong volume led growth

momentum, with Dove and TRESemmé leading the category performance. In oral

care, the overall performance was subdued. Close Up’s growth was driven by

impactful activation while Pepsodent Clove and Salt continued to do well.

In the Beverages segment, the company reported a growth of 7%, primarily led by

volumes, which were driven by activations and market development initiatives by

the company. In the tea segment, Red Label, Taj Mahal and 3 Roses grew well and

January 18, 2016

3

Hindustan Unilever | 3QFY2016 Result Update

Lipton Green Tea registered another quarter of high growth on sustained market

development. In the coffee segment, Bru delivered double-digit growth and

achieved market leadership.

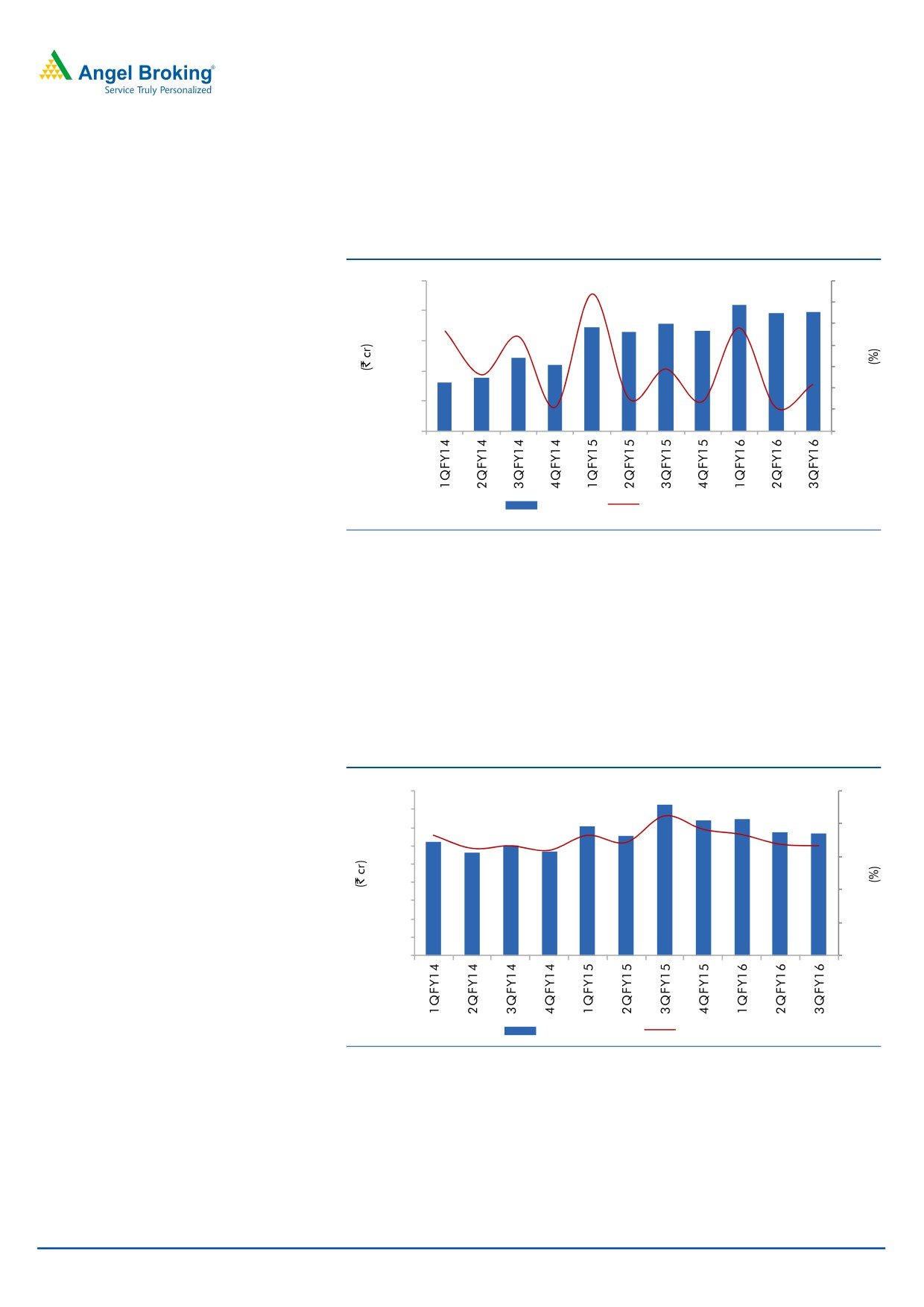

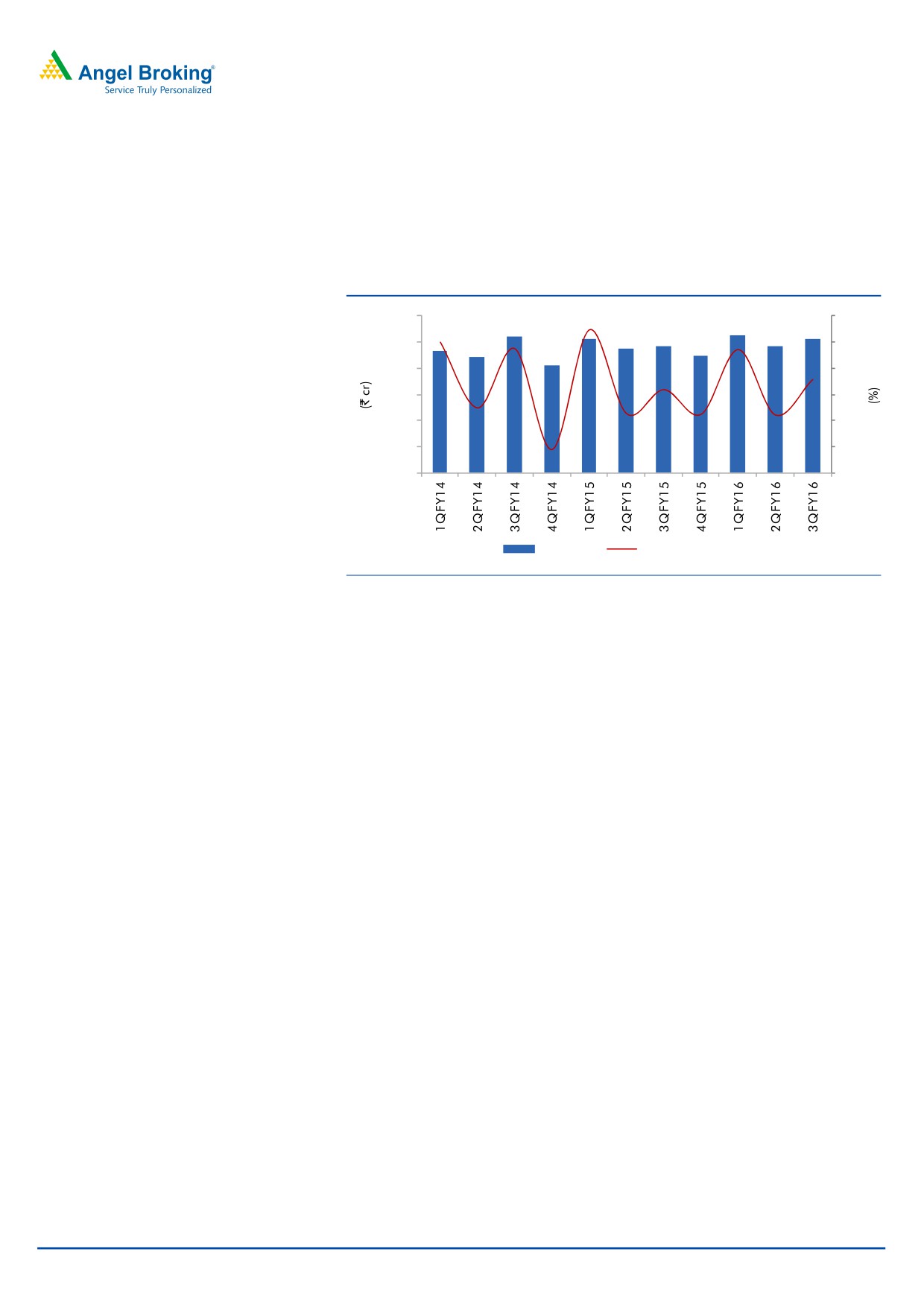

Exhibit 3: Top-line growth trend

8,500

10

8

8,000

6

7,500

4

2

7,000

-

6,500

(2)

6,000

(4)

Net Sales

QoQ growth (%)

Source: Company, Angel Research

Operating margin contracts due to higher advertisement and

other expenses

On the operating profit front, the company reported a de-growth of 0.5% yoy due

to lower sales growth. Further, the operating profit margin fell by 52bp yoy to

16.5% due to increase in advertisement and other expenses, which rose by 169bp

and 209bp as a percentage of sales, respectively.

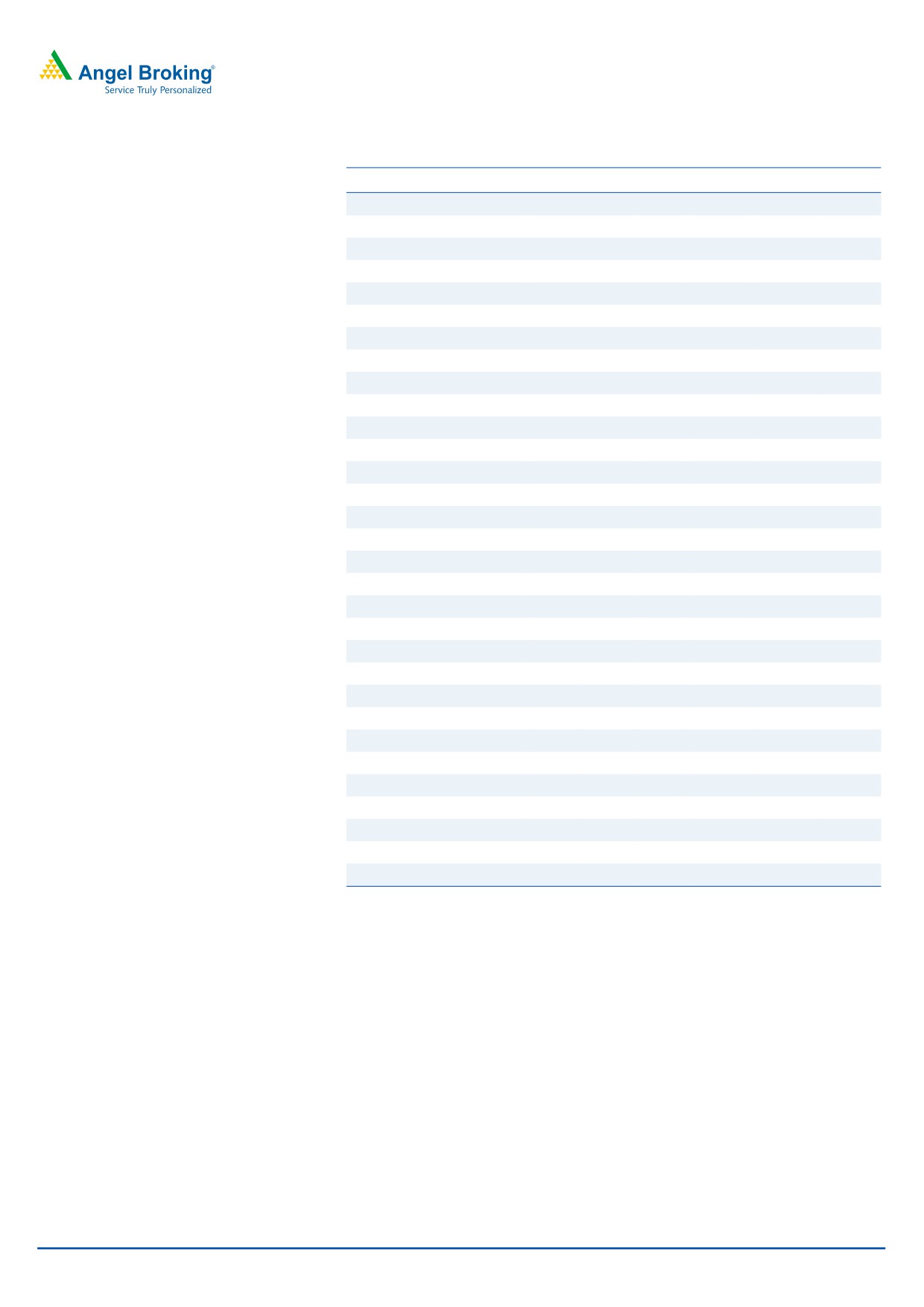

Exhibit 4: Operating profit and margin trend

1,800

25

1,600

1,400

20

1,200

15

1,000

800

10

600

400

5

200

0

0

Operating Profit

Margin (%)

Source: Company, Angel Research

January 18, 2016

4

Hindustan Unilever | 3QFY2016 Result Update

Adjusted PAT grew ~5.6%

During the quarter, the company incurred `55cr under the exceptional items head,

which factored in provision towards restructuring and sale of properties. After

adjusting for it, the company’s net profit rose by a modest 5.6% yoy to `1,026cr.

Exhibit 5: Net Profit and growth trend

1,200

30

1,000

20

800

10

600

-

400

(10)

200

(20)

0

(30)

Net Profit

QOQ growth (%)

Source: Company, Angel Research

January 18, 2016

5

Hindustan Unilever | 3QFY2016 Result Update

Investment rationale

Largest FMCG player with leadership in several categories

HUL has presence across various product categories and has brands in both mass

and premium segments in most of these categories. The company’s products are

available at multiple price points and it is a leader in many of the categories in

which it has presence.

Outlook and valuation

We expect HUL to post a ~6% and ~6% CAGR in its top-line and bottom-line

respectively, over FY2015-16E. At the current market price, the stock is trading at

37.6x FY2018E earnings. We maintain our Neutral view on the stock.

Company background

HUL, a 52% subsidiary of Unilever, is one of India's largest consumer goods

companies. HUL is present across four main product categories - 1) Soaps and

Detergents (50% of revenue); 2) Personal Products (mainly shampoos, skin care

and toothpaste; 30% of revenue); 3) Beverages (mainly tea and coffee; 12% of

revenue); 4) Packaged Foods and Ice cream (6% of revenue); and 5) Others,

mainly consisting of water purifiers. The company, with its iconic brands such as

Lux, Lifebuoy, Surf Excel, Rin, Wheel, Fair & Lovely, Pond's, Vaseline, Lakmé, Dove,

Clinic Plus, Sunsilk, Pepsodent, Close Up, Axe, Brooke Bond, Bru, Knorr, Kissan and

Walls, has a vast presence in rural as well as urban Indian markets, with one of the

largest distribution networks spanning over 6.3mn retail outlets.

January 18, 2016

6

Hindustan Unilever | 3QFY2016 Result Update

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Total operating income

27,004

29,234

31,972

33,299

35,497

38,230

% chg

15.2

8.3

9.4

4.2

6.6

7.7

Total Expenditure

22,799

24,488

26,558

27,605

29,427

31,693

Raw Materials

14087

14870

16176

16583

17464

18580

Selling & Administrative Exp

3290

3675

3944

4162

4508

4932

Personnel Expenses

1,413

1,573

1,724

1,865

2,059

2,294

Others Expenses

4,009

4,371

4,715

4,995

5,396

5,887

EBITDA

4,205

4,746

5,414

5,694

6,070

6,537

% chg

20.7

12.8

14.1

5.2

6.6

7.7

(% of Net Sales)

15.6

16.2

16.9

17.1

17.1

17.1

Depreciation& Amortisation

251

296

322

350

377

407

EBIT

3,954

4,450

5,091

5,344

5,693

6,130

% chg

21.7

12.5

14.4

5.0

6.5

7.7

(% of Net Sales)

14.6

15.2

15.9

16.0

16.0

16.0

Interest & other Charges

26

41

18

0

0

0

Other Income

1,138

806

1,246

600

600

600

(% of PBT)

22.5

15.4

19.7

10.1

9.5

8.9

Share in profit of Associates

-

-

-

-

-

-

PBT (reported)

5,066

5,215

6,320

5,943

6,293

6,730

Tax

1,227

1,259

1,944

1,842

1,951

2,086

(% of PBT)

24.2

24.1

30.8

31.0

31.0

31.0

PAT (reported)

3,839

3,956

4,376

4,101

4,342

4,644

Less: Minority interest (MI)

10

10

12

13

14

15

PAT after MI (reported)

3,829

3,946

4,363

4,088

4,328

4,629

Prior Period & Extra. Exp./(Inc.)

459

179

470

-

-

-

ADJ. PAT

3,370

3,767

3,893

4,088

4,328

4,629

% chg

24.7

11.8

3.3

5.0

5.9

6.9

(% of Net Sales)

12.5

12.9

12.2

12.3

12.2

12.1

Basic & diluted EPS (`)

15.6

17.4

18.0

18.9

20.0

21.4

Adjusted EPS EPS (`)

15.6

17.4

18.0

18.9

20.0

21.4

% chg

24.7

11.8

3.3

5.0

5.9

6.9

January 18, 2016

7

Hindustan Unilever | 3QFY2016 Result Update

Consolidated Balance Sheet

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

SOURCES OF FUNDS

Equity Share Capital

216

216

216

216

216

216

Reserves& Surplus

2,649

3,321

3,805

4,449

5,141

5,882

Shareholders Funds

2,865

3,537

4,022

4,665

5,358

6,098

Minority Interest

21

22

25

25

25

25

Total Loans

25

46

43

43

43

43

Deferred Tax Liability

218

241

278

278

278

278

Total Liabilities

3,128

3,846

4,367

5,015

5,707

6,447

APPLICATION OF FUNDS

Gross Block

4,418

5,079

5,412

5,712

6,062

6,462

Less: Acc. Depreciation

1,986

2,333

2,591

2,941

3,318

3,725

Net Block

2,431

2,746

2,821

2,771

2,744

2,737

Capital Work-in-Progress

222

373

516

516

516

516

Investments

2,252

2,838

3,025

3,025

3,025

3,025

Current Assets

6,977

7,617

7,869

8,605

9,645

11,082

Inventories

2,706

2,940

2,849

2,737

2,918

3,142

Sundry Debtors

997

1,017

1,011

1,095

1,167

1,257

Cash

1,901

2,516

2,689

3,408

3,786

4,580

Loans & Advances

655

598

731

766

1,065

1,147

Other Assets

718

547

588

599

710

956

Current liabilities

9,181

10,149

10,341

10,379

10,701

11,391

Net Current Assets

(2,204)

(2,531)

(2,472)

(1,775)

(1,055)

(309)

Deferred Tax Asset

426

421

477

477

477

477

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

3,128

3,846

4,367

5,015

5,707

6,447

January 18, 2016

8

Hindustan Unilever | 3QFY2016 Result Update

Consolidated Cashflow Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Profit before tax

4,460

4,980

5,640

5,943

6,293

6,730

Depreciation

251

296

322

350

377

407

Change in Working Capital

429

429

405

(342)

(6)

(372)

Interest / Dividend (Net)

(140)

(290)

(258)

(225)

0

0

Direct taxes paid

(1,074)

(1,384)

(2,030)

(1,842)

(1,951)

(2,086)

Others

(323)

(212)

(957)

549

(380)

404

Cash Flow from Operations

3,605

3,818

3,124

4,433

4,333

5,083

(Inc.)/ Dec. in Fixed Assets

(7)

111

493

(300)

(350)

(400)

(Inc.)/ Dec. in Investments

70

(586)

(187)

-

-

-

Cash Flow from Investing

63

(475)

306

(300)

(350)

(400)

Issue of Equity

7

2

2

-

-

-

Inc./(Dec.) in loans

25

(15)

(3)

(0)

-

-

Dividend Paid (Incl. Tax)

(4,000)

(2,811)

(3,245)

(3,434)

(3,636)

(3,888)

Interest / Dividend (Net)

212

98

(9)

20

30

(1)

Cash Flow from Financing

(3,764)

(2,728)

(3,256)

(3,414)

(3,605)

(3,889)

Inc./(Dec.) in Cash

(96)

615

173

719

378

794

Opening Cash balances

1,996

1,901

2,516

2,689

3,408

3,786

Closing Cash balances

1,901

2,516

2,689

3,408

3,786

4,580

January 18, 2016

9

Hindustan Unilever | 3QFY2016 Result Update

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

51.6

46.2

44.7

42.6

40.2

37.6

P/CEPS

42.5

40.9

37.0

39.1

36.9

34.4

P/BV

60.7

49.2

43.3

37.3

32.5

28.5

Dividend yield (%)

2.3

1.6

1.9

2.0

2.1

2.2

EV/Sales

6.3

5.8

5.3

5.0

4.7

4.4

EV/EBITDA

40.4

35.5

31.1

29.4

27.5

25.5

EV / Total Assets

13.8

12.1

11.4

10.9

10.2

9.3

Per Share Data (`)

EPS (Basic)

15.6

17.4

18.0

18.9

20.0

21.4

EPS (fully diluted)

15.6

17.4

18.0

18.9

20.0

21.4

Cash EPS

18.9

19.6

21.7

20.6

21.8

23.3

DPS

18.5

13.0

15.0

15.9

16.8

18.0

Book Value

13.2

16.3

18.6

21.6

24.8

28.2

Returns (%)

ROCE

136.8

124.2

125.3

113.5

105.4

99.8

ROE

133.7

111.5

108.5

87.6

80.8

75.9

Turnover ratios (x)

Asset Turnover (Gross Block)

6.1

5.8

5.9

5.8

5.9

5.9

Inventory / Sales (days)

37

37

33

30

30

30

Receivables (days)

13

13

12

12

12

12

Payables (days)

58

62

58

58

57

57

WC cycle (ex-cash) (days)

(8)

(12)

(14)

(16)

(15)

(15)

January 18, 2016

10

Hindustan Unilever | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitian Stock Exchange of India Limited. It is also registered as a Depository Participant

with CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial

interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months. Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in

market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Hindustan Unilever

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

January 18, 2016

11