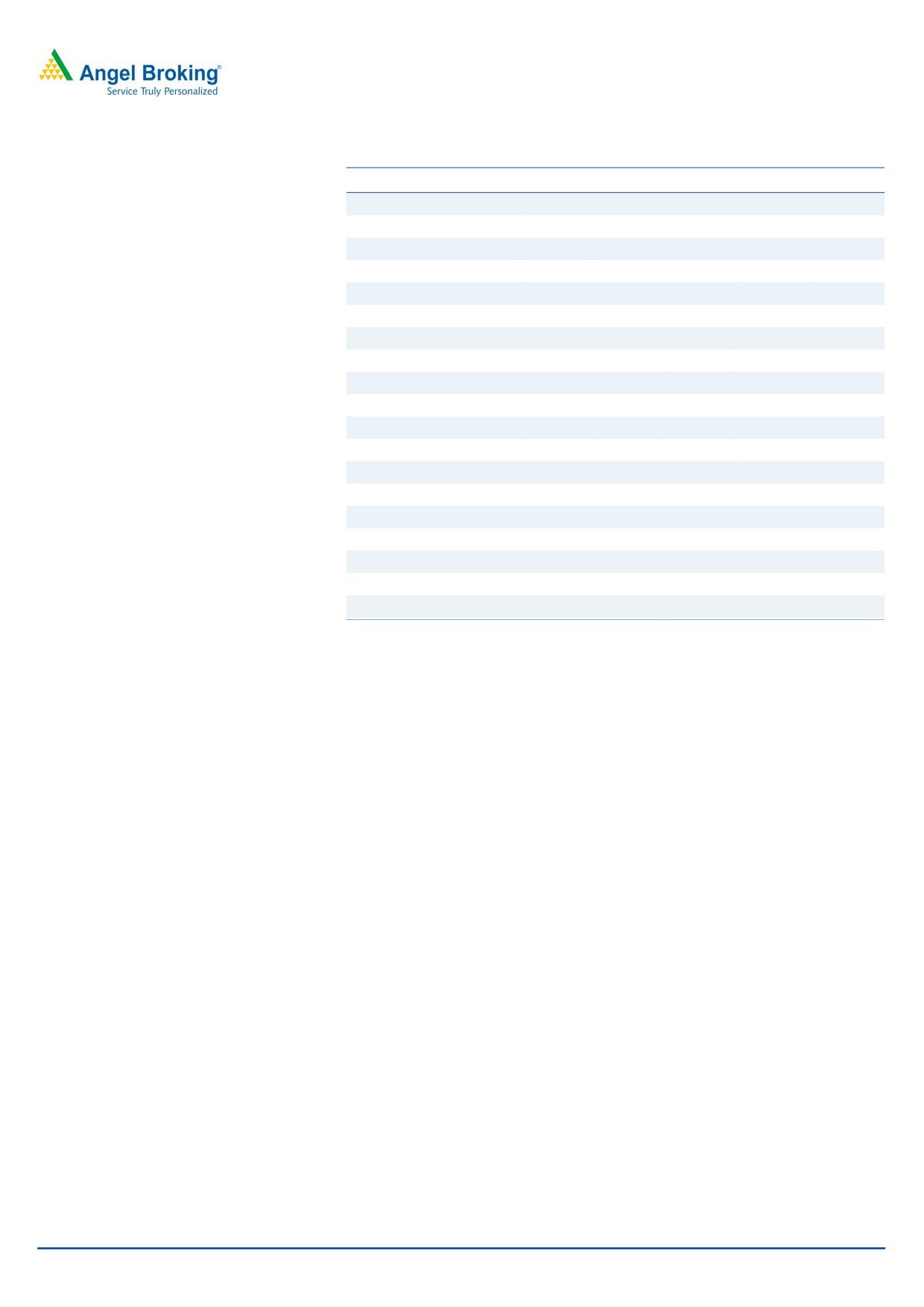

4QFY2016 Result Update | Ceramic Products

May 27, 2016

HSIL

ACCUMULATE

CMP

`290

Company Update

Target Price

`310

Y/E March (` cr)

4QFY16 4QFY15

% chg (yoy)

3QFY16

% chg (qoq)

Investment Period

12 Months

Net sales

596

559

6.6

506

17.7

EBITDA

99

106

(6.3)

95

4.0

Stock Info

EBITDA margin (%)

16.6

18.9

(230)bp

18.8

(220)bp

Sector

Ceramic Products

Adjusted PAT

38

40

(4.3)

37

3.1

Source: Company, Angel Research

Market Cap (` cr)

2,095

Net Debt

596

HSIL’s reported standalone numbers for 4QFY2016 have come in mostly in-line

with our estimates. The top-line grew by 6.6% yoy to `596cr. The raw material

Beta

0.8

cost declined by 77bp yoy to 39.9% of sales while employee and other expenses

52 Week High / Low

370 / 224

increased by

139bp yoy and

168bp yoy to

11.1% and

32.4% of sales,

Avg. Daily Volume

18,724

respectively. As a result, the EBITDA margin declined by 230bp yoy to 16.6%.

Interest cost was lower by 49.9% yoy while tax rate was higher at 38.5% vs 30.8%

Face Value (`)

2

in 4QFY2015. Consequently, the bottom-line de-grew by 4.3% yoy to `38cr.

BSE Sensex

26,367

Building products’ performance under pressure; but long term prospects intact:

Nifty

8,070

The quarterly numbers for the core Building products division were under pressure

Reuters Code

HSNT.BO

reflecting overall sluggishness in the new construction market. However, the

Bloomberg Code

HSI.IN

Faucets division continued its strong performance which will likely drive the

revenue growth in the near term. On the profitability front, the company has

made incremental investments in setting up its sales channel for the Consumer

Shareholding Pattern (%)

products division and increased its advertisement spend by roping in some

Promoters

47.1

Bollywood celebrities to endorse products, coupled with initial losses in the

MF / Banks / Indian Fls

26.4

consumer products business which impacted segmental margins during the

quarter. However, the Management has indicated that excluding the cost for

FII / NRIs / OCBs

12.0

development of sales channel, the EBIT margin for the core business is stable. We

Indian Public / Others

14.4

believe that the margin for the segment should improve gradually once the

Consumer products division’s sales pick up. In the longer run, we expect HSIL to

leverage on its strong position/brand in the sanitaryware industry to capitalize on

Abs.(%)

3m 1yr 3yr

improvement in the real-estate sector.

Sensex

13.9

(4.2)

31.6

Packaging products’ profitability improves: Although the segment has posted

HSIL

25.3

(21.5)

166.6

muted growth numbers on the top-line front, the profitability of the segment has

improved on account of a better product mix in terms of revenue composition,

3 Year Daily price chart

better cost management, and due to decline in fuel prices. Going forward, the

500

Management has acknowledged the threat of further prohibition on liquor by state

400

governments but expects the damage to be somewhat offset by rising beer consumption.

300

Outlook and valuation: We has revised downwards our estimates for FY2017

200

for both Building and Packaging products segments but expect FY2018E to be

100

better on account of contribution from newer businesses as well as pick up in

volumes. Further, favorable pricing for the core Building products business should

-

also aid the company in delivering better numbers.

At the current market price, the stock trades at 15.0x its FY2018E earnings. We

Source: Company, Angel Research

have an Accumulate rating on the stock with a target price of `310.

Key Financials (Consolidated)

Sales OPM

PAT EPS ROE

PE PBV EV/EBITDA EV/sales

Y/E March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016

2,056

15.3

89

12.3

6.6

23.5

1.5

7.2

1.3

Milan Desai

FY2017E

2,223

15.8

111

15.3

7.8

18.9

1.4

6.5

1.3

Tel: 022- 4000 3600 Ext: 6846

FY2018E

2,515

16.3

140

19.4

9.3

15.0

1.4

5.5

1.1

Source: Company, Angel Research; Note: CMP as of May 26, 2016

Please refer to important disclosures at the end of this report

1

HSIL | 4QFY2016 Result Update

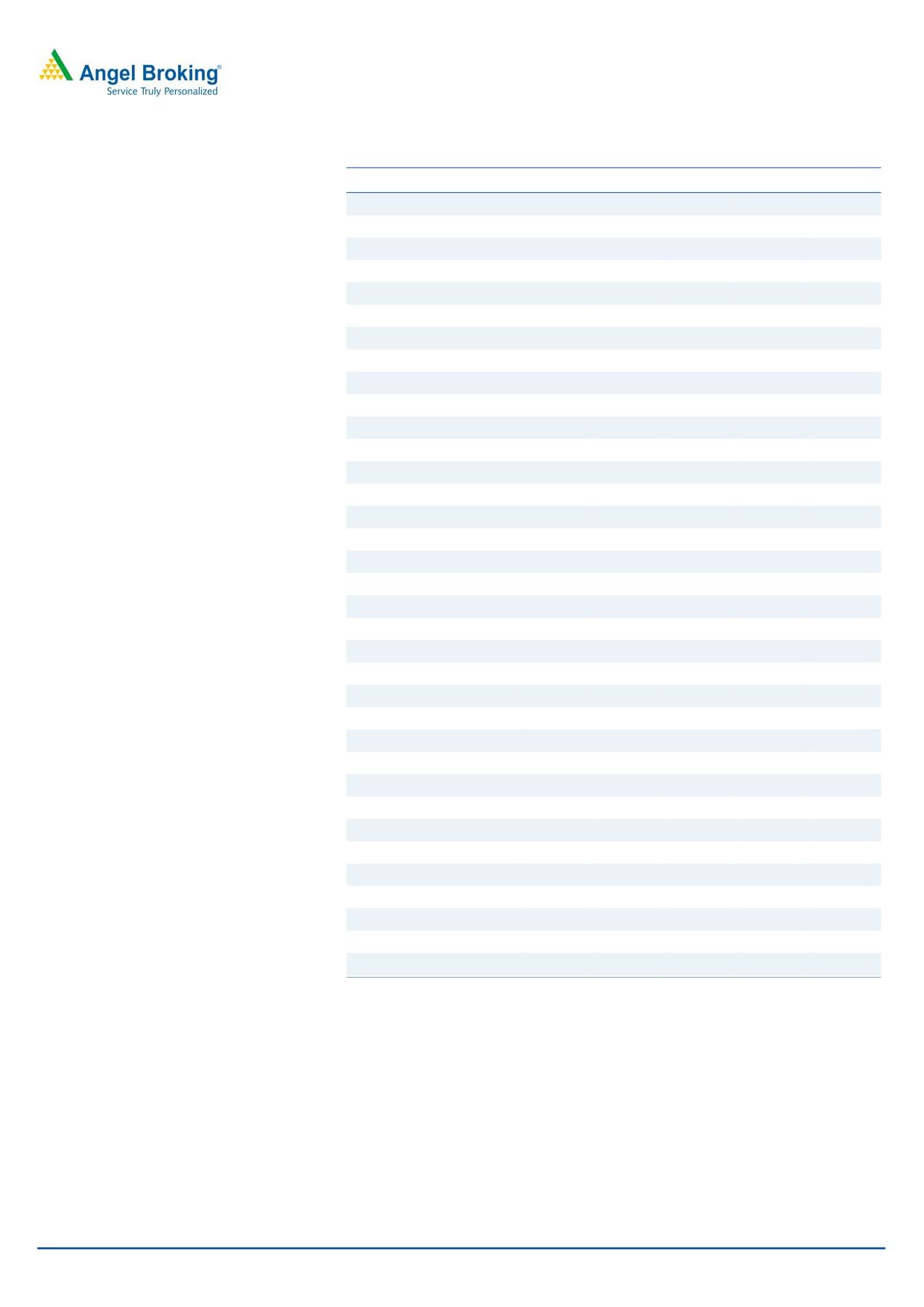

Exhibit 1: 4QFY2016 performance (Standalone)

Y/E March (` cr)

4QFY16

4QFY15

% chg (yoy)

3QFY16

% chg (qoq)

1HFY16

1HFY15

% chg

Net Sales

596

559

6.6

506

17.7

842

836

0.7

Net raw material

238

227

4.6

181

31.3

277

283

(2.0)

(% of Sales)

39.9

40.7

(77)bp

35.8

411bp

32.9

33.8

(92)bp

Staff Costs

66

54

21.9

61

9.1

107

91

18.6

(% of Sales)

11.1

9.7

139bp

12.0

(88)bp

12.8

10.8

192bp

Other Expenses

193

172

12.5

169

14.1

318

322

(1.0)

(% of Sales)

32.4

30.7

168bp

33.4

(104)bp

37.8

38.5

(68)bp

Total Expenditure

497

453

9.6

411

20.9

703

695

1.1

Operating Profit

99

106

(6.3)

95

4.0

140

141

(1.1)

OPM (%)

16.6

18.9

(230)bp

18.8

(220)bp

16.6

16.9

(32)bp

Interest

9

18

(49.9)

10

(6.4)

20

36

(45.5)

Depreciation

29

31

(6.6)

29

0.5

57

57

1.1

Other Income

1

1

32.7

1

(12.7)

2

2

2.6

PBT

62

58

7.8

58

7.3

65

51

27.9

(% of Sales)

10.4

10.3

11.4

7.7

6.1

Tax

24

17.7

34.9

21

14.7

24

17

39.1

(% of PBT)

38.5

30.8

36.1

36.1

33.2

Reported PAT

38

40

(4.3)

37

3.1

42

34

22.4

PATM

6.4

7.1

245bp

7.3

4.9

4.1

245bp

Source: Company, Angel Research

Exhibit 2: Actual vs. Angel estimates (4QFY2016)

Actual (` cr)

Estimate (` cr)

Var (%)

Total Income

596

581

2.6

EBIDTA

99

96

3.2

EBIDTA margin (%)

16.6

16.6

8bp

Adjusted PAT

38

37

3.1

Source: Company, Angel Research

HSIL’s numbers for 4QFY2016 have come in in-line with our estimates. Its

standalone top-line for the quarter grew by 6.6% yoy to `596cr (vs our estimate of

`581cr). The Building products segment grew by 9.0% yoy to `314cr while the

Packaging products segment grew by 4.1% yoy to `282cr.

The raw material cost was stable during the quarter; however employee and other

expenses grew by 139bp yoy and 168bp yoy to 11.1% and 32.4% of sales,

respectively. This could be attributed to higher costs related to setting up a channel

for the Consumer products division and due to higher advertisement spend. As a

result, the EBITDA margin contracted by 230bp yoy to 16.6%, which is the same as

our estimate. The EBIT margin for the Building products segment declined by

530bp yoy to 13.2% while that of the Packaging products business increased by

265bp yoy to 15.1%.

Owing to lower debt on the balance sheet, the interest expense for the quarter

declined by 49.9% yoy to `9cr but the tax rate was higher at 38.5% vs 30.8% in

4QFY2015. With the operating performance coming under pressure, the net profit

declined by 4.3% yoy to `38cr vis-à-vis our estimate of `37cr.

May 27, 2016

2

HSIL | 4QFY2016 Result Update

Segmental Performance

Exhibit 3: Segmental Review (Standalone)

Y/E Mar (` cr)

4QFY16

4QFY15

% chg (yoy) 3QFY16

% chg (qoq)

Revenue

A) Building Products

314

288

9.0

268

17.4

B) Packaging Products

282

270

4.1

239

18.1

Total

596

559

6.6

506

17.7

EBIT

A) Building Products

41.4

53.2

(22.3)

43.3

(4.4)

B) Packaging Products

42.5

33.6

26.3

35.3

20.3

EBIT Margin(%)

A) Building Products

13.2

18.5

(530)bp

16.2

(300)bp

B) Packaging Products

15.1

12.4

265bp

14.8

28bp

Source: Company, Angel Research

Conference call takeaways

For FY2016, the sanitaryware business grew by ~7% and accounted for 65%

of the Building products business’ revenue. Demand is likely to remain muted

in the near term. The company is likely to raise capacity from 3.8mn pieces to

4.2mn pieces by FY2017E. Utilization levels stood at ~91% for FY2016.

The Faucet division posted robust growth of ~22% for FY2016 and accounted

for 24% of Building products segment’s revenue. The capacity utilization was

at ~65%.

Building products’ margins were under pressure on account of higher ad

spend and expenses related to setting up of a channel for the Consumer

products business. Core business EBIT margins were stable.

The Consumer products business’ revenue for the year was at `60cr vs `25cr

in FY2016. For 4QFY2016, the revenue from Consumer products was `13.5cr

and it contributed a loss of `9cr towards the total EBIT for Building products.

All capital expenditure related to the Pipes business is expected to be

capitalized in FY2017.

The Packaging products business is likely to be under pressure. The company

will monitor developments to determine the status of the fourth furnace. The

capacity utilization on basis of three furnaces stood at 95%.

The company’s Retail business continues to be a drag on profitability. The

company is taking measures to curb costs and is selectively closing down loss-

making stores. The Management remains hopeful about the long term

prospects of the business.

May 27, 2016

3

HSIL | 4QFY2016 Result Update

Investment arguments

Enhanced capacity to pay-off once demand scenario improves

HSIL’s Management has guided that it will be increasing its capacity for the

sanitaryware business from the existing 3.8mn pieces to 4.2mn pieces/year. This

was due to be augmented in FY2016 but in light of dampened new construction

market, the expansion was deferred as per our reckoning. The Faucet division is

performing well and the company will look to gear the utilization levels at its faucet

plant where work was previously being outsourced. Although in the near term, the

sanitaryware business is expected to remain under mild pressure as top cities are

facing high inventory levels, the company has been making inroads into Tier II & III

towns to drive volumes. We expect volumes to flow in once the demand scenario

improves.

Packaging Products profitability improves, volumes to remain

lackluster

The poor performing Packaging products business had been a drag on the overall

performance of the company in the past. This was on account of low demand,

over capacity in the industry and rising fuel & raw materials costs. Improvement in

market conditions which resulted in better realizations along with measures taken

by the company such as substituting high cost furnace oil with alternate fuel,

renegotiation of terms with vendors for raw material sourcing, and new product

introductions amongst others, have resulted in improvement in profitability of the

business. Going forward, the volumes for the division are expected to remain under

pressure on account of various state governments mulling over banning liquor sales.

However, the Management has mentioned that it will look to drive volumes from the

beer segment on account of its growing popularity.

Leading position in Building products industry with strong brand

recall to provide an edge

HSIL holds a leading position in the sanitaryware industry (organized segment). Of

the total revenue, ~85% is accounted by the dealer distribution network (amongst

the largest in the industry) while 15% is contributed by institutional sales to large

builders, commercial space developers, hospitals, and hotels. The company has a

wide product offering catering to various price points in the sanitaryware, faucets

and in other product lines. The company has been aggressive in promoting its

brand and has roped in some Bollywood celebrities to push sales.

New businesses to add to Consumer products revenues

The Consumer products business of the company has been entailing investment in

terms of setting up separate sales vertical. The company has launched consumer

electrical products like water and air purifiers, water heaters, etc in the recent past

and expects them to garner a share of ~5% share in the ~`10,000cr market. The

company is focusing on the premium segment which garner gross margins of

~35%.

May 27, 2016

4

HSIL | 4QFY2016 Result Update

Financials

Exhibit 4: Key assumptions (Consolidated)

Key Assumptions

FY2017E

FY2018E

Building Products Sales (` cr)

1,179

1,418

Yoy Growth

14.0

20.3

Packaging Products Sales (` cr)

933

975

Yoy Growth

2.6

4.5

Source: Company, Angel Research

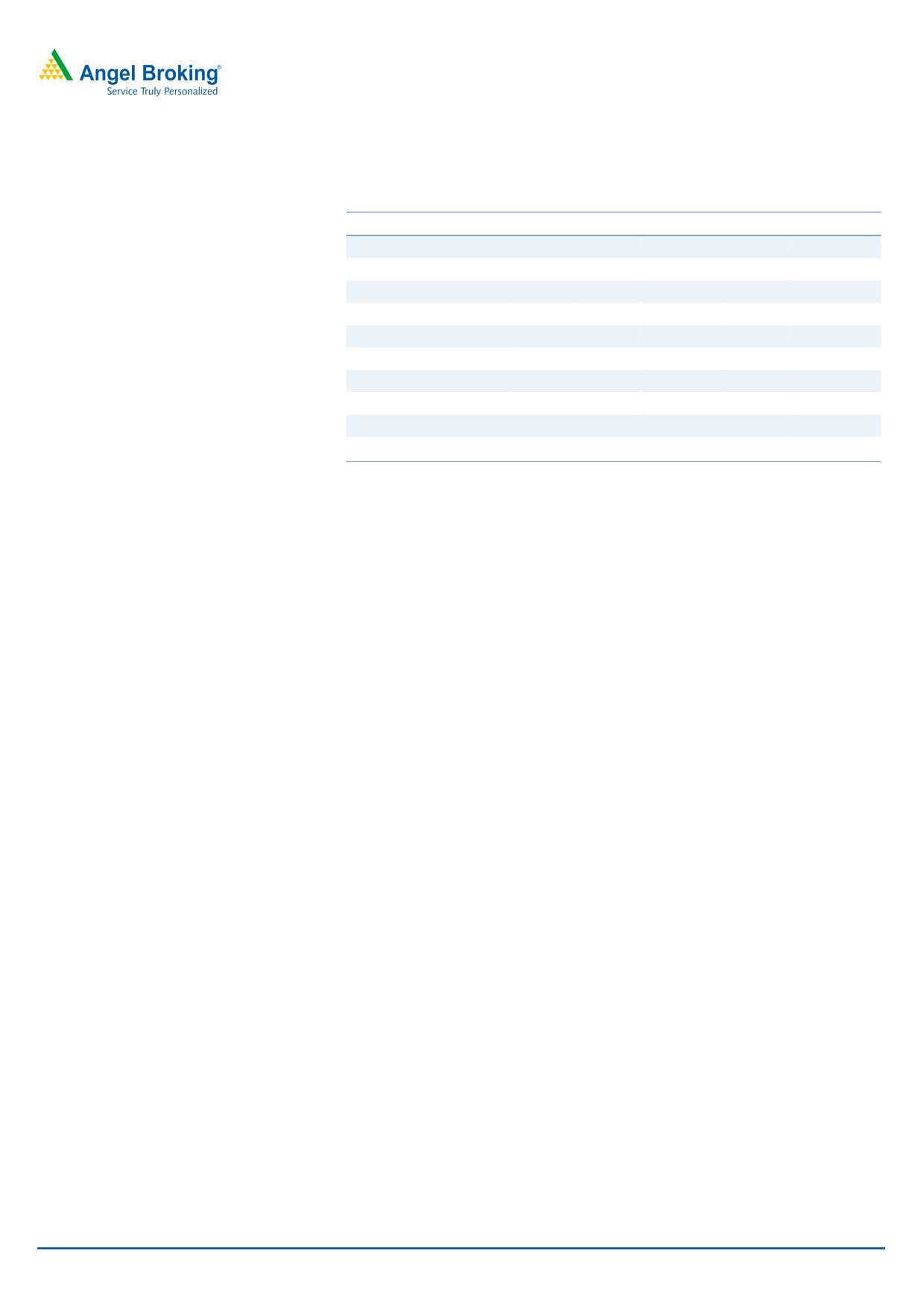

Top-line to post 10.6% CAGR over FY2016-FY2018E

We expect the Building products business to grow at 14.0% in FY2017E on account

of continued performance of the Faucet business and slightly higher contribution

from the Consumer electrical products business. As the Management has guided

that the Pipes business will be capitalized in FY2017E, we expect some contribution

from it towards the Building products segment revenue in FY2018E. The Packaging

products business is expected to post nominal growth over FY2016-18E. As a

result, we expect the top-line to post a revenue CAGR of 10.6% over FY2016-18E

to `2,515cr.

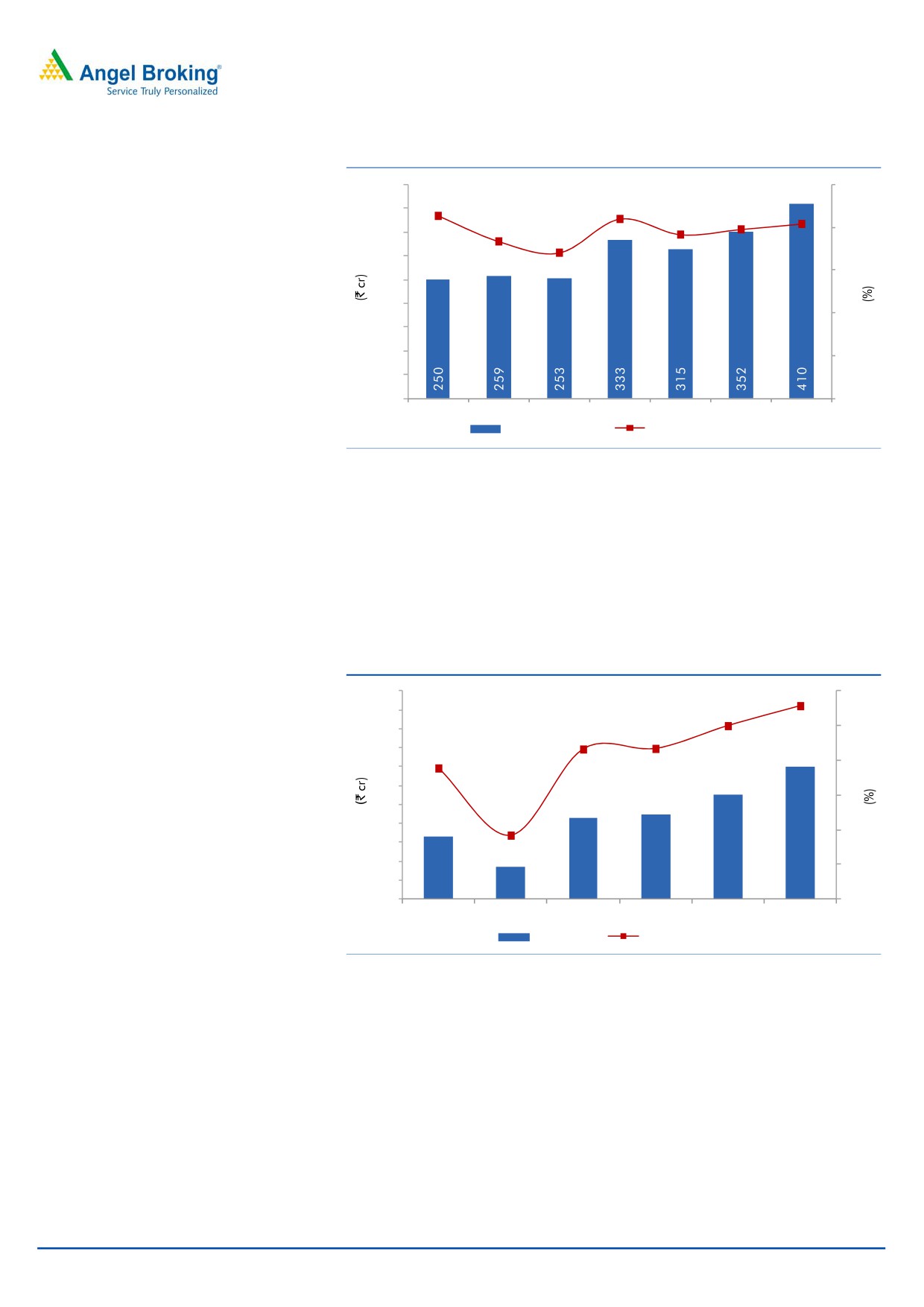

Exhibit 5: Sales growth to rebound

Exhibit 6: Segmental sales trend

3,000

25

1,600

1,400

2,500

20.4

20

1,200

2,000

15

1,000

1,500

13

.1

800

10

600

1,000

8.1

6.6

400

5.5

5

500

3.8

200

-

0

-

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

FY2012

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

Net sales (LHS)

Net sales yoy growth (RHS)

Building Products segment Packaging Products segment

Source: Company, Angel Research

Source: Company, Angel Research

EBITDA to post CAGR of 14.1% over FY2016-18E

As the Management has incurred higher expenses in FY2016 towards

development of sales channel for the Consumer products business and

advertisement, coupled with losses in initial phase for the Consumer business, the

EBITDA margin has contracted by 146bp yoy to 15.3%. With the Consumer

division gaining traction, we expect the margins to improve from here on.

May 27, 2016

5

HSIL | 4QFY2016 Result Update

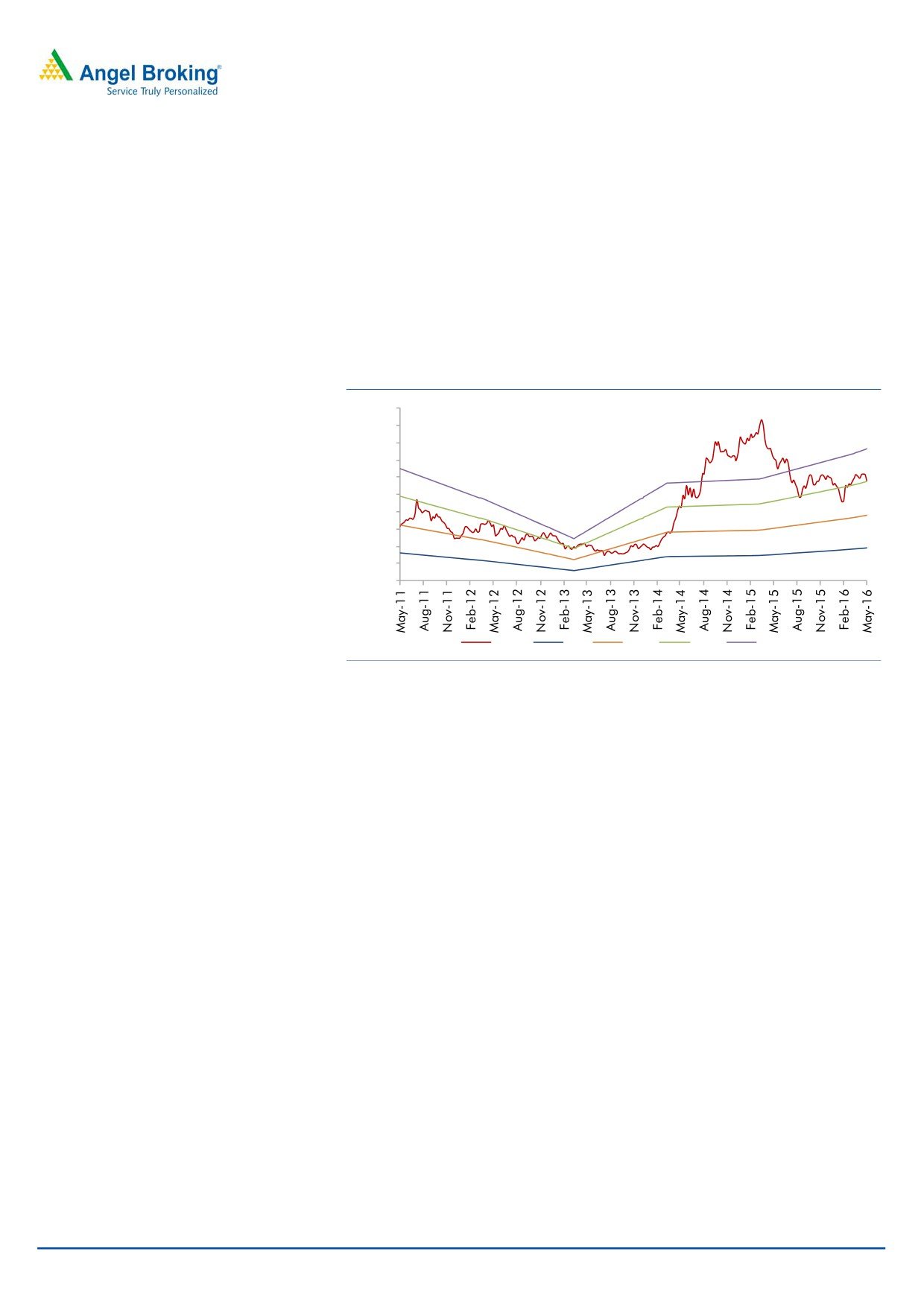

Exhibit 7: EBIDTA margin trend

450

20

16.3

17.1

16.8

400

15.3

15.8

14.7

16

350

13.6

300

12

250

200

8

150

100

4

50

0

0

FY2012

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

EBITDA (LHS)

EBITDA margin (RHS)

Source: Company, Angel Research

Net profit to post a 25.4% CAGR over FY2016-18E

Depreciation expense is expected to increase FY2017E onwards as the Pipes

business capex will get capitalized in FY2017E. Also on account of higher losses in

the subsidiary, the consolidated tax rate is higher in FY2016. We expect the tax

rate to retract to 35% on the subsidiary trimming its losses. As a result, we expect

the bottom-line to post a CAGR 25.4% over FY2016-18E to `140cr.

Exhibit 8: Lower interest cost to lead PAT northwards

220

5.6

6

200

5.0

4.3

5

180

4.3

160

3.8

4

140

120

3

100

1.8

80

2

60

40

1

20

66

34

85

89

111

140

0

0

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

PAT (LHS)

PAT margin (RHS)

Source: Company, Angel Research

May 27, 2016

6

HSIL | 4QFY2016 Result Update

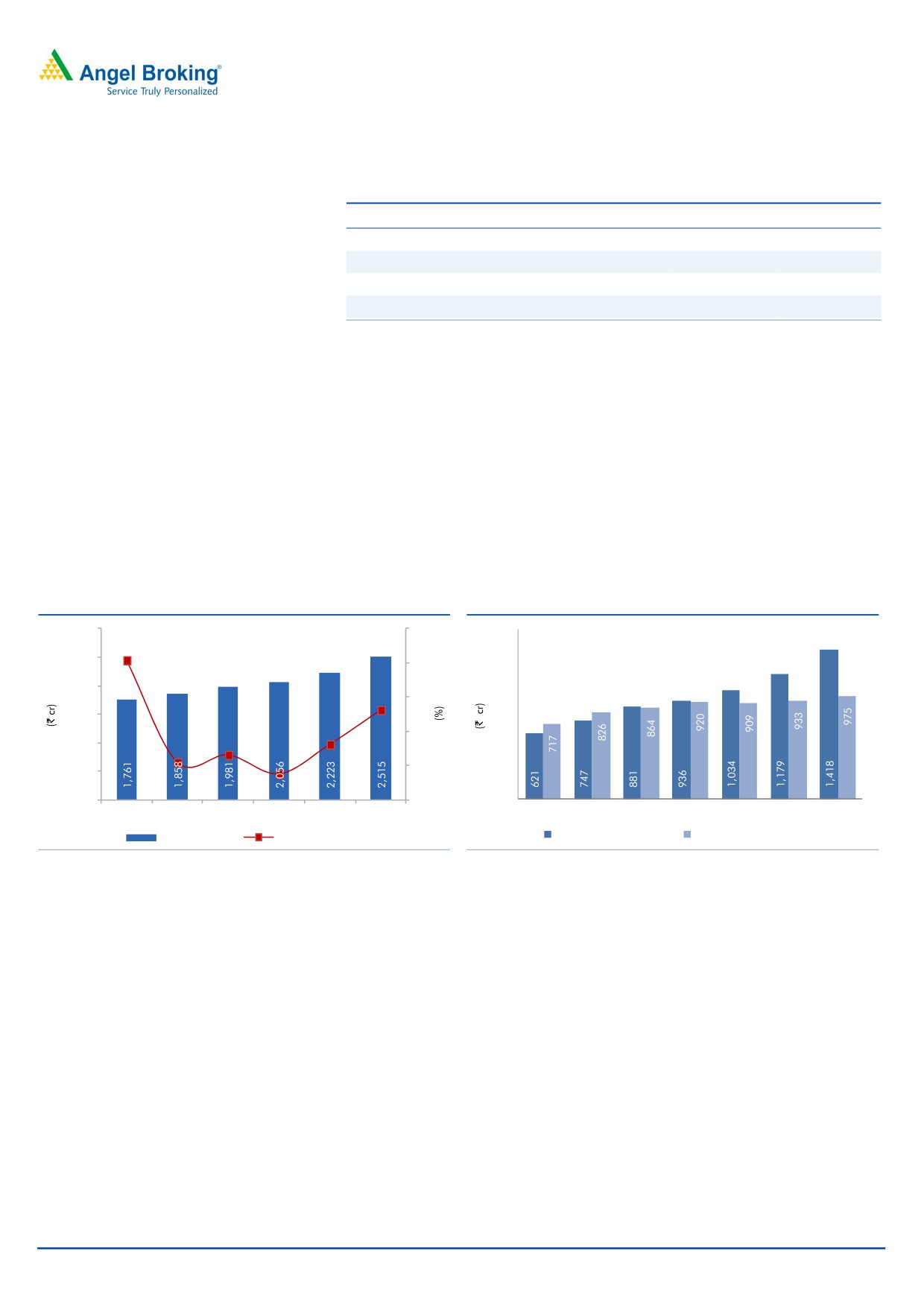

Outlook and Valuation

We has revised downwards our estimates for FY2017 for both Building and

Packaging products segments but expect FY2018E to be better on account of

contribution from newer businesses as well as pick up in volumes. Further,

favorable pricing for the core Building products business should also aid the

company in delivering better numbers.

At the current market price, the stock trades at 15.0x its FY2018E earnings. We

have an Accumulate rating on the stock with a target price of `310.

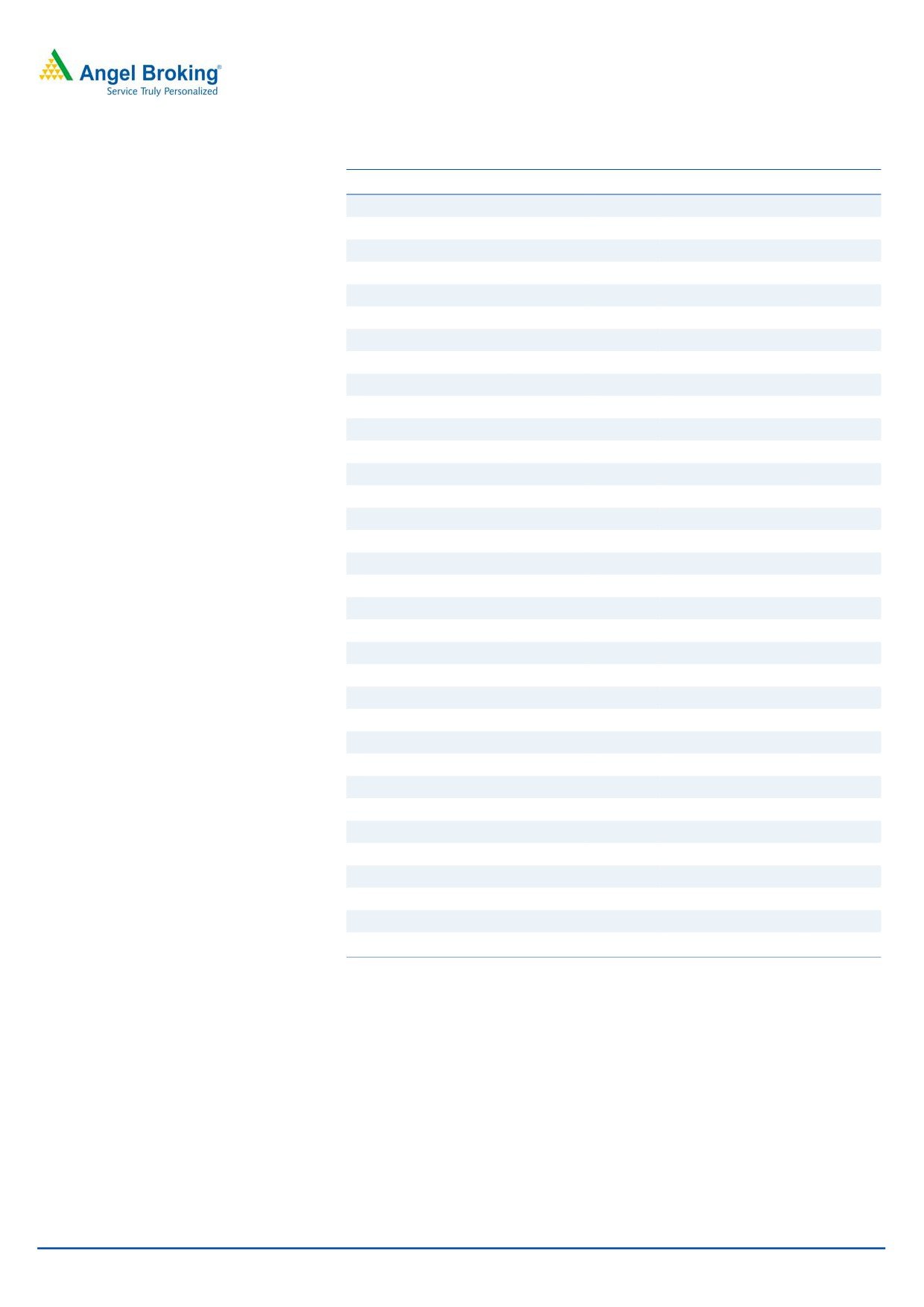

Exhibit 9: One-year forward PE band

500

450

400

350

300

250

200

150

100

50

-

Price

6x

12x

18x

24x

Source: Company, Angel Research,

Risk factors

Unorganized sanitaryware manufacturers pose a threat since they enjoy the

benefit of nil excise duty and sales tax. Hence, their products are ~70%

cheaper than the organized sector’s products. The increase in excise duty from

8% to 12% has made products from organized players more expensive.

Low-cost imports from China.

Any drastic change in government policy related to housing construction and

imports among others is bound to impact the industry.

Raw material cost- Any increase in the price of brass, the main raw material

for faucets, may dent the company’s EBITDA margin. Rise in the cost of raw

materials such as soda ash could dent operational margins.

Continued slowdown in the housing segment will cease growth, as in India the

major demand for sanitaryware is fresh demand.

External Commercial Borrowings (ECBs) formed a significant portion of total

borrowing of the company. Weakness in INR against the USD owing to global

macro economic slowdown and imminent interest rate hike in the US will

impact the performance of the company and work against our estimates.

May 27, 2016

7

HSIL | 4QFY2016 Result Update

Profit and Loss (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Total operating income

1,858

1,981

2,056

2,223

2,515

% chg

5.5

6.6

3.8

8.1

13.1

Net Raw Materials

648

732

763

829

922

% chg

19.3

13.0

4.3

8.7

11.3

Power and Fuel

377

280

231

253

289

% chg

(6.6)

(25.7)

(17.5)

9.6

14.1

Personnel

188

216

251

271

307

% chg

3.4

14.6

16.2

8.1

13.1

Other

392

421

496

518

586

% chg

4.8

7.3

18.0

4.4

13.1

Total Expenditure

1,605

1,648

1,741

1,871

2,104

EBITDA

253

333

315

352

410

% chg

(2.1)

31.3

(5.2)

11.6

16.8

(% of Net Sales)

13.6

16.8

15.3

15.8

16.3

Depreciation& Amortisation

110

125

120

127

145

EBIT

143

207

195

225

266

% chg

(13.5)

44.9

(6.0)

15.4

18.2

(% of Net Sales)

7.7

10.5

9.5

10.1

10.6

Interest & other Charges

72

78

41

49

56

Other Income

4

4

4

3

5

(% of Net Sales)

0.2

0.2

0.2

0.1

0.2

Recurring PBT

71

130

154

176

210

% chg

(25.7)

82.0

18.3

14.4

19.5

PBT (reported)

75

134

157

179

215

Tax

41

48

68

68

75

(% of PBT)

54.8

36.0

43.4

38.0

35.0

PAT (reported)

34

85

89

111

140

Extraordinary Expense/(Inc.)

0

0

0

0

0

ADJ. PAT

34

85

89

111

140

% chg

(48.8)

151.5

4.2

24.5

26.2

(% of Net Sales)

1.8

4.3

4.3

5.0

5.6

Basic EPS (`)

5.1

11.8

12.3

15.3

19.4

Fully Diluted EPS (`)

5.1

11.8

12.3

15.3

19.4

% chg

(48.8)

129.7

4.2

24.5

26.2

May 27, 2016

8

HSIL | 4QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

FY2018E

SOURCES OF FUNDS

Equity Share Capital

13

14

14

14

14

Reserves& Surplus

1,015

1,308

1,363

1,440

1,536

Shareholders’ Funds

1,028

1,323

1,378

1,454

1,551

Total Loans

1,133

786

627

756

767

Other Long Term Liabilities

15

18

20

20

20

Long Term Provisions

5

5

9

9

9

Deferred Tax (Net)

115

105

101

101

101

Total Liabilities

2,297

2,237

2,135

2,340

2,447

APPLICATION OF FUNDS

Gross Block

2,018

2,211

2,266

2,449

2,622

Less: Acc. Depreciation

537

654

774

901

1,045

Net Block

1,481

1,557

1,492

1,549

1,577

Capital Work-in-Progress

119

34

57

100

50

Goodwill

38

31

27

23

19

Investments

11

11

11

11

11

Long Term Loans and adv.

55

32

45

49

55

Other Non-current asset

2

1

0

1

1

Current Assets

968

965

950

1,045

1,225

Cash

60

25

20

33

89

Loans & Advances

42

50

49

53

59

Inventory

444

474

490

522

584

Debtors

419

414

390

435

492

Other current assets

2

2

2

2

2

Current liabilities

377

394

447

436

490

Net Current Assets

590

571

503

609

735

Misc. Exp. not written off

-

-

-

-

-

Total Assets

2,297

2,237

2,135

2,340

2,447

May 27, 2016

9

HSIL | 4QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016E FY2017E FY2018E

Profit before tax

75

134

157

179

215

Depreciation

110

125

120

127

145

Change in Working Capital

(52)

(16)

62

(92)

(71)

Direct taxes paid

(41)

(48)

(68)

(68)

(75)

Others

(4)

(4)

(4)

(3)

(5)

Cash Flow from Operations

88

191

268

142

208

(Inc.)/Dec. in Fixed Assets

(171)

(100)

(74)

(223)

(119)

(Inc.)/Dec. in Investments

(0)

(0)

0

-

-

(Incr)/Decr In LT loans & adv.

(1)

23

(12)

(4)

(6)

Others

4

4

4

3

5

Cash Flow from Investing

(169)

(73)

(82)

(223)

(120)

Issue of Equity

-

1

-

-

-

Inc./(Dec.) in loans

99

(345)

(151)

129

11

Dividend Paid (Incl. Tax)

(23)

(30)

(35)

(35)

(43)

Others

(17)

221

(5)

-

-

Cash Flow from Financing

59

(153)

(191)

95

(33)

Inc./(Dec.) in Cash

(22)

(35)

(5)

14

55

Opening Cash balances

82

60

25

20

33

Closing Cash balances

60

25

20

33

89

May 27, 2016

10

HSIL | 4QFY2016 Result Update

Key ratios (Consolidated)

Y/E March

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

61.7

24.5

23.5

18.9

15.0

P/CEPS

14.5

10.0

10.0

8.8

7.4

P/BV

2.0

1.6

1.5

1.4

1.4

EV/Net sales

1.7

1.4

1.3

1.3

1.1

EV/EBITDA

9.0

6.8

7.2

6.5

5.5

EV / Total Assets

1.4

1.3

1.3

1.2

1.1

Per Share Data (`)

EPS (Basic)

5.1

11.8

12.3

15.3

19.4

EPS (fully diluted)

5.1

11.8

12.3

15.3

19.4

Cash EPS

21.8

29.1

28.9

32.8

39.3

DPS

3.0

3.5

4.0

4.0

5.0

Book Value

155.7

183.0

190.6

201.1

214.5

DuPont Analysis

EBIT margin

7.7

10.5

9.5

10.1

10.6

Tax retention ratio

0.5

0.6

0.6

0.6

0.7

Asset turnover (x)

0.9

0.9

1.0

1.1

1.1

ROIC (Post-tax)

3.2

6.3

5.3

6.7

7.8

Cost of Debt (Post Tax)

3.0

5.2

3.3

4.4

4.8

Leverage (x)

1.0

0.6

0.4

0.5

0.4

Operating ROE

3.4

7.0

6.2

7.8

9.1

Returns (%)

ROCE (Pre-tax)

6.4

9.2

8.9

10.1

11.1

Angel ROIC (Pre-tax)

7.1

9.9

9.4

10.7

11.9

ROE

3.3

7.3

6.6

7.8

9.3

Turnover ratios (x)

Asset TO (Gross Block)

1.0

0.9

0.9

0.9

1.0

Inventory / Net sales (days)

84

85

86

83

80

Receivables (days)

79

77

71

71

71

Payables (days)

86

85

88

85

85

WC cycle (ex-cash) (days)

99

99

91

87

89

Solvency ratios (x)

Net debt to equity

1.0

0.6

0.4

0.5

0.4

Net debt to EBITDA

4.2

2.3

1.9

2.0

1.6

Int. Coverage (EBIT/ Int.)

2.0

2.7

4.7

4.6

4.8

May 27, 2016

11

HSIL | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitian Stock Exchange of India Limited. It is also registered as a Depository Participant

with CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial

interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months. Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in

market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

HSIL

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

May 27, 2016

12