IPO Note | Capital Goods

September 20, 2016

HPL Electric & Power Limited

NEUTRAL

Issue Open: September 22, 2016

IPO Note - Weak on profitability, low on ROE

Issue Close: September 26, 2016

HPL Electric & Power Private Limited (HPL) is a New Delhi based company

Issue Details

engaged in manufacturing of energy meters, switchgears, lighting equipments

and wires and cables. Company operates seven manufacturing facilities located

Face Value: `10

in Haryana and Himachal Pradesh. HPL has pan-India presence and its

Present Eq. Paid up Capital: `46.4cr

distribution network includes

2,400 authorized dealers/distributors, selling

Fresh Issue: `2.06*- 1.78cr**

products to 15,000 retailers. As per its FY16 numbers, Metering contributes 47%

Offer for sale:-NA

of the total revenues whereas switchgears (15%), Lighting equipment (24%) and

Post Eq. Paid up Capital: `64.3cr

Wires and cables (14%) form the rest of the business mix. B2C sales represent

44% of the total sales and B2B sales represent remaining 56% sales.

Market Lot: 70 Shares

Major business has seen slower growth in last three years: HPL’s three business

Issue (amount): `361cr

segments (Meters, Switchgears and wires and cables) contribute 3/4th of the total

Price Band: `175-202

revenues. In the last three years revenues from these segments have remained

Post-issue implied mkt. cap `1,174cr*-

1,299cr**

flat. Company holds meaningful market share in Meters and Switchgears, despite

Note:*at Lower price band and **Upper price band

which it has not been able to generate higher revenues. Its fourth segment

Lighting has been a consistent performer due to its exposure to LED lamps

however it has low contribution in revenues.

Book Building

High working capital requirements: HPL has high working capital requirements

QIBs

50%

than its peers. Company derives bulk of its revenues from the debt ridden power

Non-Institutional

15%

utilities which is the cause of the problem. Over last few years, working capital

Retail

35%

have deteriorated with working capital cycle stretching from 140 days in FY13 to

160 days in FY16. Company is hopeful of ease in the working capital once Ujwal

Post Issue Shareholding Pattern(%)

DISCOM Assurance Yojana (UDAY) is fully implemented. We remain uncertain

over the time line of ease in its working capital.

Promoters Group

72.1

Public

27.9

Lower ROE than peers: HPL has been a low ROE business compared to its peers.

Higher working capital cycle, increased depreciation due to increased capacity

and high debt has impacted its profitability and ROE. Company will have to

significantly improve operating performance in near future to maintain current

ROE levels. With the further equity dilution, we don’t see significant jump in the

ROE profile.

Existing litigation against HPL by Havells India: Two of promoter companies of

HPL use name Havells in their name. HPL and Havells India Limited have been

engaged in the litigation over the use of name ‘Havell’s’ in the corporate name.

HPL has clarified that its promoters and promoter group companies are not

associated with Havells India limited in any manner.

Outlook & Valuation: On the valuation front, at the upper end of the price band,

the pre-issue P/E works out to 25.6x of its FY2016 earnings which is lower

compared to its peers. However this discount is justified considering its

significantly low ROE, stretched working capital and low profitability compared to

Shrikant Akolkar

its peers. Considering past financial performance and poor visibility on future

+91 22 4000 3600 Ext: 6846

growth, we rate this issue as NEUTRAL.

Please refer to important disclosures at the end of this report

1

HPL Electric & Power | IPO Note

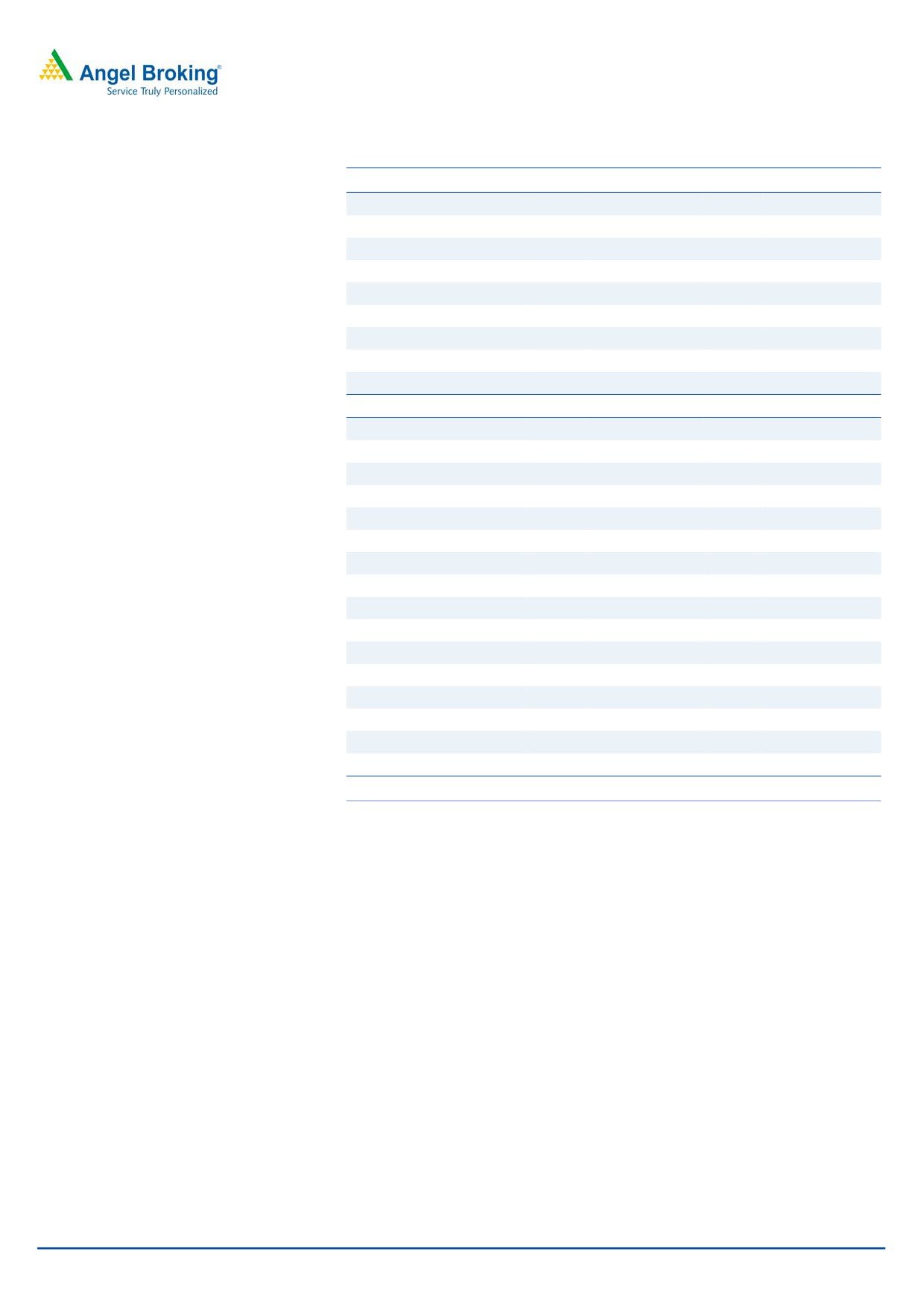

Key Financial

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016

Net Sales

724

916

1,016

1,052

1,121

% chg

-

26.4

11.0

3.5

6.6

Net Profit

28

31

28

35

37

% chg

-

10.7

(9.7)

22.0

5.8

OPM (%)

10.9

11.3

9.5

10.8

11.3

EPS (`)

6.3

6.8

6.1

7.5

7.9

P/E (x)

32.0

29.7

33.1

27.1

25.6

P/BV (x)

3.8

3.3

3.0

2.9

2.6

RoE (%)

11.8

11.1

9.2

10.9

10.3

RoCE (%)

13.5

15.8

13.0

13.5

13.3

EV/Sales (x)

1.7

1.4

1.3

1.4

1.4

EV/EBITDA (x)

14.6

11.1

12.2

10.9

10.6

Source: Company, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares

and at upper end of the price band

Company background

HPL Electric & Power Private Limited (HPL) is a New Delhi based company engaged

in manufacturing of energy meters, switchgears, lighting equipments and wires

and cables. It was founded as HPL-Socomec Private Limited in 1991 as a joint

venture between Socomec and Havells Electronics Private Limited (now Havells

India limited). The current promoter and promoter group holds 99.92% shares of

the company. In 2010, its name was changed to HPL Electric & Power Private

Limited.

Company operates seven manufacturing facilities located in Haryana and

Himachal. HPL has pan-India presence and its distribution network includes 2,400

authorized dealers or distributors selling products to 15,000 retailers. In addition,

company supplies products to Power Utilities, which primarily includes supply of

meters to electricity boards and power distribution companies. HPL also sells its

products to developers of residential and commercial building projects, original

equipment manufacturers and to industrial customers through a mix of direct sales

and through authorized dealer network. It also has two in-house research and

development centers in Haryana.

As per its FY16 numbers, meters contribute 47% of the total revenues whereas

switchgears (15%), Lighting equipment (24%) and Wires and cables (14%) form the

rest of the business mix. B2C sales represent 44% of the total sales and B2B sales

represent remaining 56% sales.

September 20, 2016

2

HPL Electric & Power | IPO Note

Issue details

The company is raising `361cr through fresh issue (1.78cr share) of equity shares

in the price band of `175-202. The fresh issue will constitute ~28% of the post-

issue paid-up equity share capital of the company assuming the issue is subscribed

at the upper end of the price band.

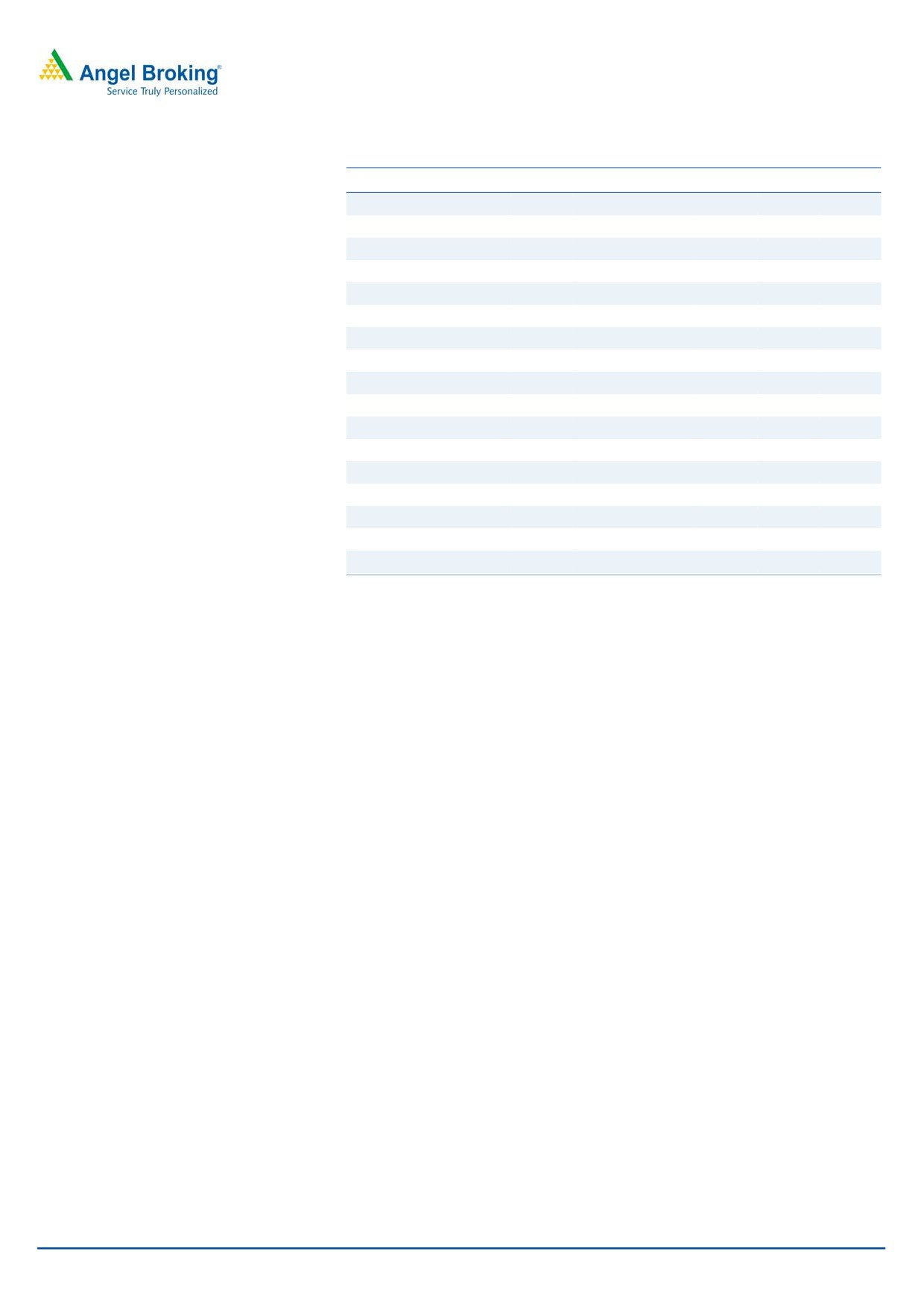

Exhibit 1: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

46,391,699

99.9%

46,391,699

72.1%

Others

37,500

0.1%

17,908,787

27.9%

Total

46,429,199

100.0%

64,300,486

100.0%

Source: Company, Angel Research

Objects of the offer

~`130cr will be used for repayment/prepayment of certain indebtedness

~`180cr will be used for funding working capital requirements

The balance will be used for general corporate purposes.

September 20, 2016

3

HPL Electric & Power | IPO Note

Investment rationale

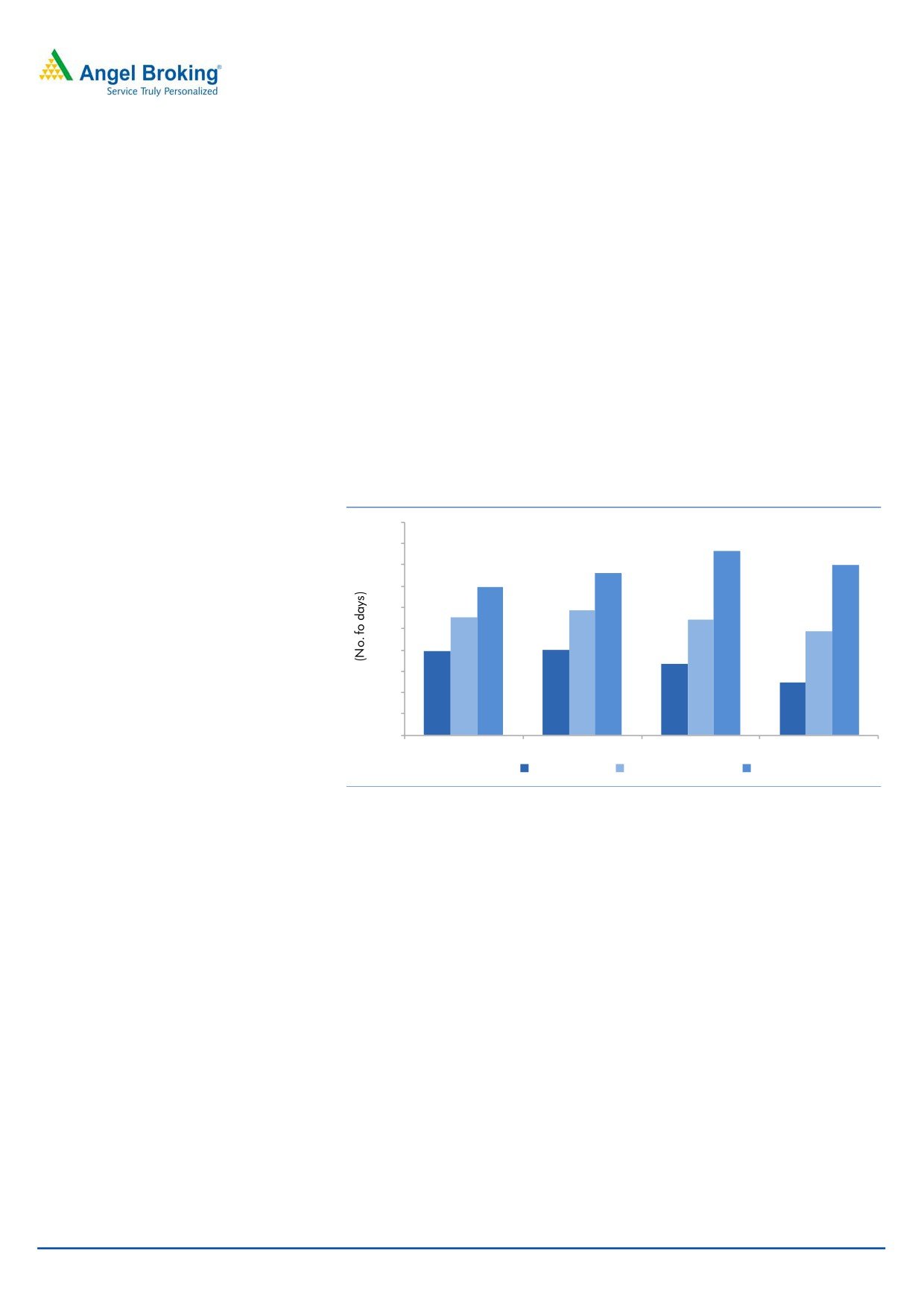

Major business has seen slower growth in last three years

Majority of HPL’s business has grown at slower rate in last three years. More than

half of its business comes from Meters and Switchgears segment (62% of gross

sales in FY16). Both the segments have witnessed weak revenue growth in the last

three years. Despite the company having ~20% market share in Electricity Energy

Meters, it has witnessed low CAGR of 5% in Meters revenue between FY14-FY16.

The Smart Cities Mission project announced by the central government is expected

to be the fortune changer for Meters market; however that is only expected after

2022 when the civil work for the smart cities will be near the completion and hence

we do not expect any immediate impact on this industry.

The switchgears segment, has witnessed CAGR of -11.3% in the gross revenues

between FY14-FY16. In the switchgears segment, company competes with the

bigger companies such as L&T, Schneider Electric ABB Limited, Havells Industries

Limited, etc. While company claims to have 5% market share in this segment,

strong decline in revenues from switchgears suggest that company is facing huge

competition or the market is not growing fast enough to accommodate all players.

Company claims that it’s Wires and cables business segment is a 100% B2C

business but it has a very low operating margin profile (4.4% EBIT margins in

FY16). This business has remained flat in the last three years growing from

`169.3cr in FY14 to `173.5cr in FY16. Overall nearly 3/4th of HPL’s business has

seen slow growth for last three years affecting its operating performance.

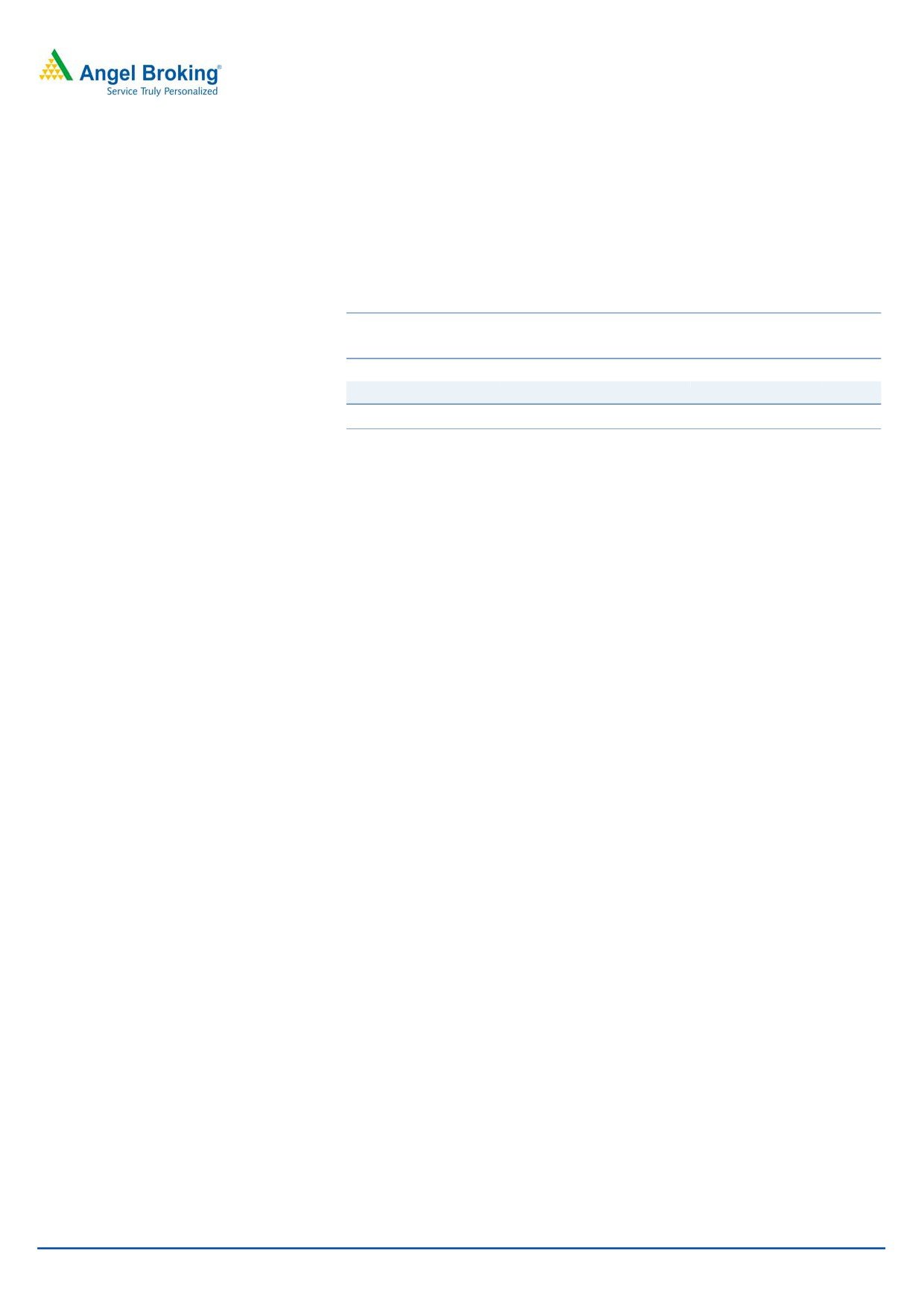

Exhibit 2: HPL’s revenue mix

Exhibit 3: Performance of major business FY2014-16

(%)

14%

5

6

5

4

24%

2

0

(2)

(4)

(6)

47%

(8)

15%

(10)

(12)

(11)

(14)

Meters

Switchgears

Lighting equipment

Wires and cables

Meters

Switchgears

Wires and cables

Source: Company, Angel Research

Source: Company, Angel Research

Lighting segment at bright spot

HPL’s Lighting segment contributed 24% of its revenues in FY16 and has seen a

CAGR of 29.3% between FY14-FY16. This is the only segment of HPL which has

been consistent in growth. HPL manufactures wide range of LED lamps (including

down-lighters), luminaires and CFLs. Strong growth drivers for LED specially has

been main reason that HPL’s lighting segment has been witnessing strong growth.

Indian LED lighting market is further expected to grow at a CAGR of 62% between

2016 and 2020. HPL holds 5% market share in LED lamps and hence we remain

positive over the growth of this segment. This positive impact however would be

offset by its lower revenue contribution in overall revenue mix.

September 20, 2016

4

HPL Electric & Power | IPO Note

High working capital requirements

HPL’s working capital cycle is a certainly an issue considering it takes more than

150 days to convert working capital in actual revenues. Working capital turnover

which stood at 2.8x in FY11 deteriorated to 2.1x in FY16 indicating high working

capital requirement. Receivables have seen a sharp increase as sizable proportion

of its revenues (45% in FY16) comes from debt ridden power utilities which have

been plagued by poor operating performances for several years. HPL believes that

Ujwal DISCOM Assurance Yojana (UDAY), announced by central government in

November-2015, is expected to ease it’s the working capital conditions. The UDAY

scheme is in early stages of implementation and earlier reforms in the power

sector have not been highly successful to improve the performance of state

electricity boards. Nearly half portion of the IPOL proceeds is allocated to fund the

working capital so company has understood its pain area however there is no

timeline when HPL will see ease in working capital.

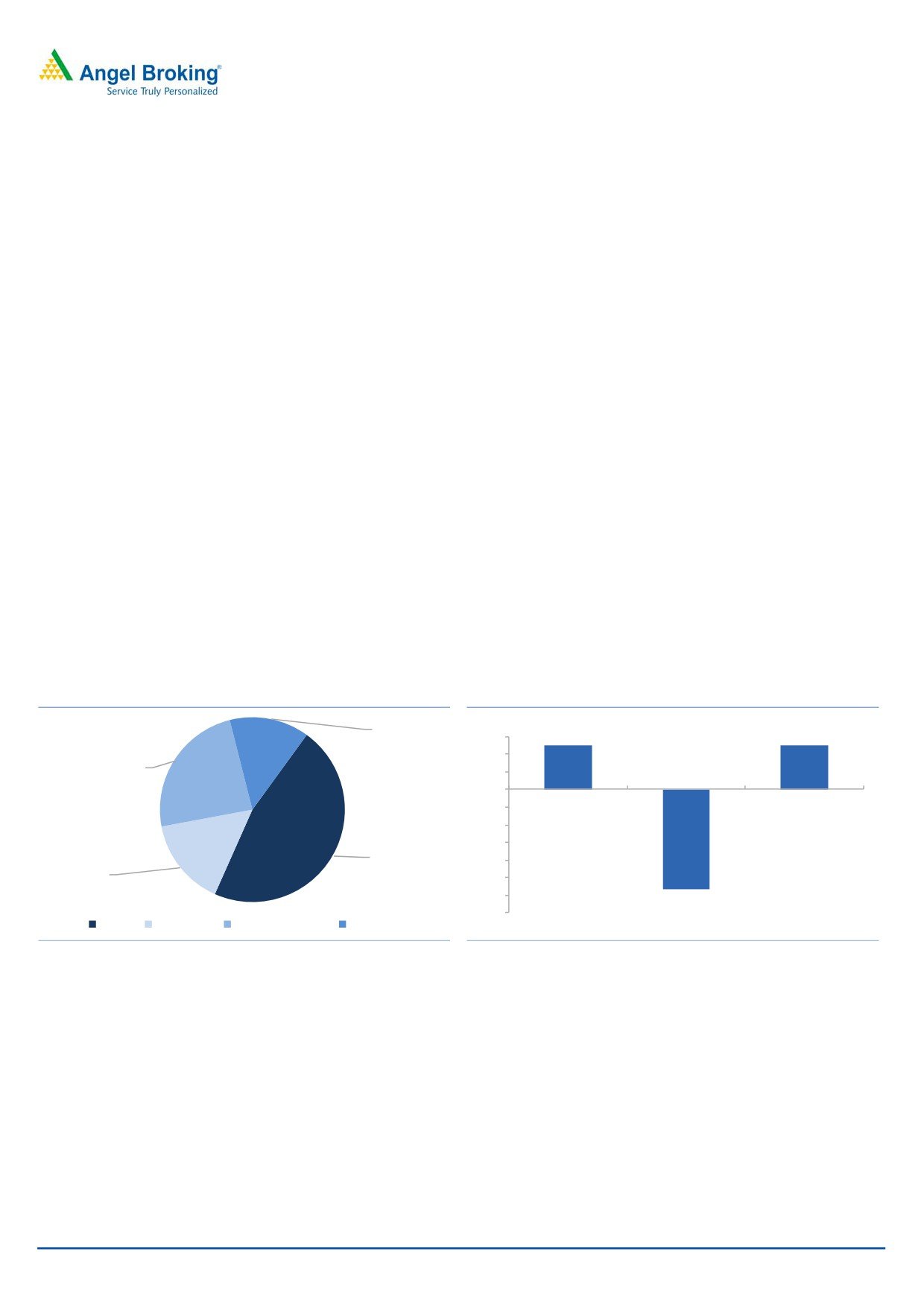

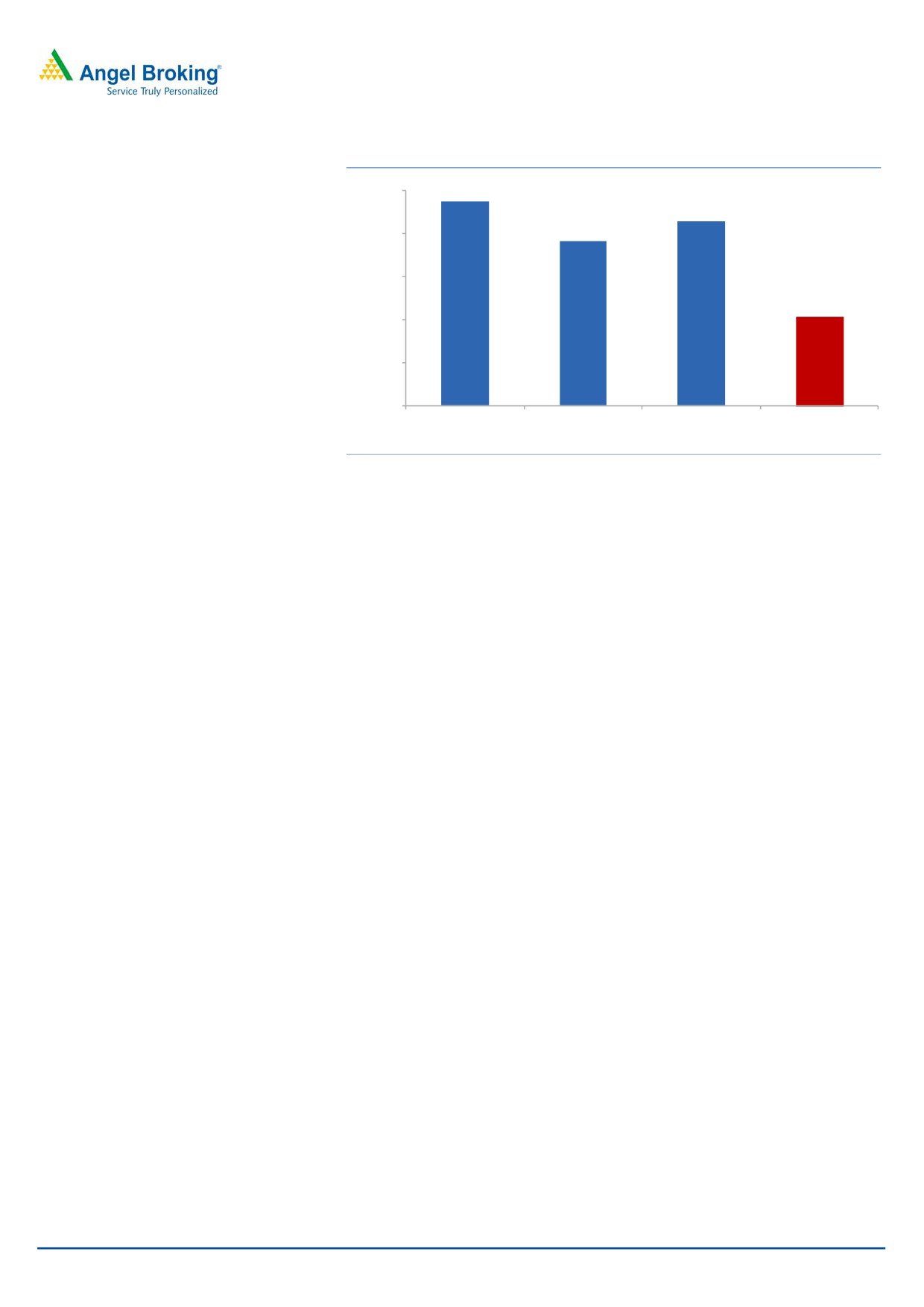

Exhibit 4: Higher working capital cycle than peers

200

173

180

160

152

160

140

140

118

111

109

120

98

100

79

80

80

67

60

49

40

20

0

FY2013

FY2014

FY2015

FY2016

Havells India

V-Guard Industries

HPL

Source: Company, Angel Research

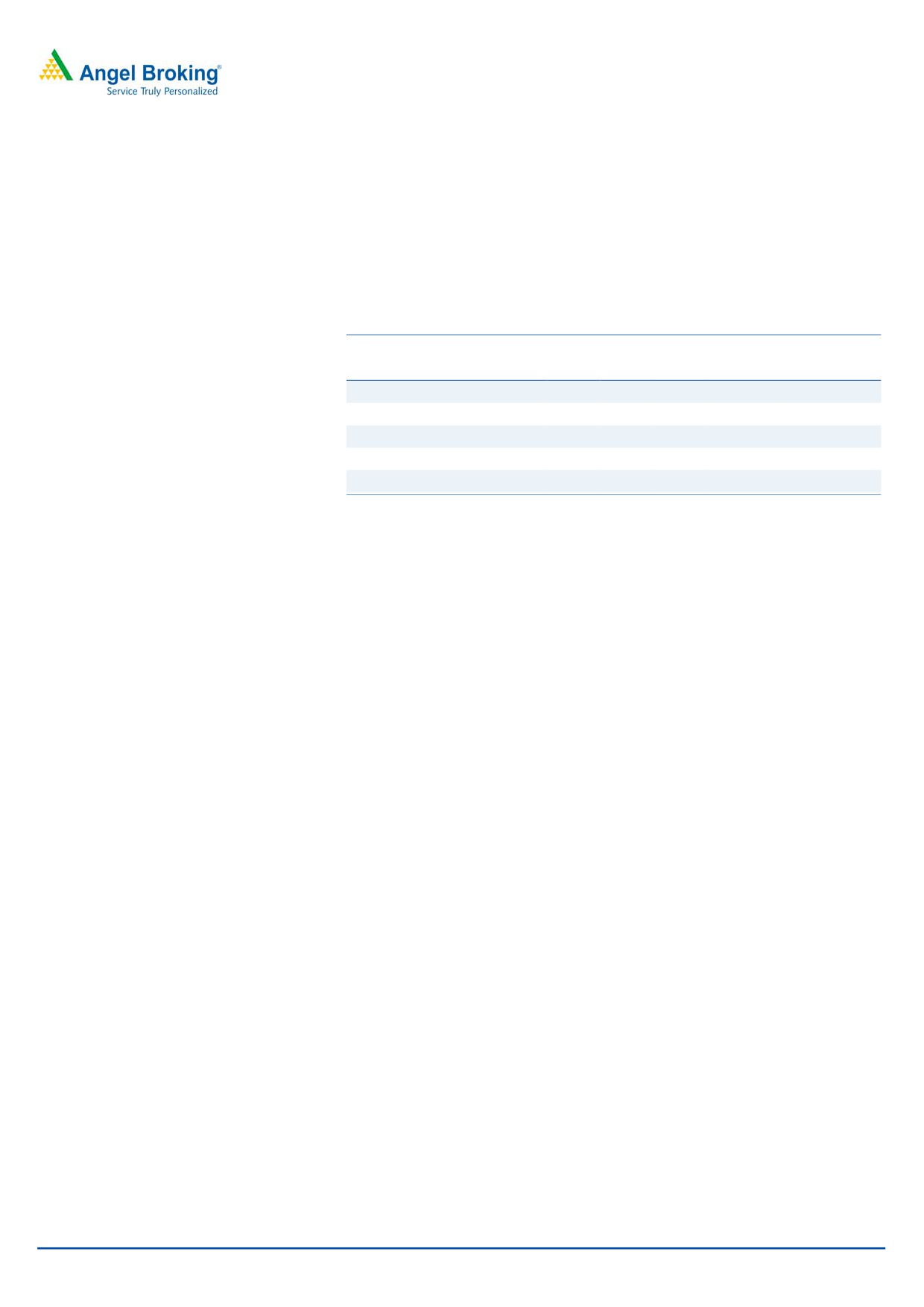

Lower ROE than peers

HPL has been a low ROE business for many years which is due to its weak working

capital, high debt and rise in depreciation due to the recent capacity additions.

HPL’s ROE of 17% in FY11 has been declining and stood 10.3% in FY16. During

this period, HPL’s debt has increased 2.73x from ` 220cr to ` 601cr. Its interest

cost has also remained at elevated levers which has reduced its net profit margins

from 6.6% in FY11 to 3.3% in FY16 despite having EBITDA margins between 12%

to 13%.

The company has lower ROE compared to its peers such as Havells India (23%), V-

Guard Industries (23%), Finolex Cables (19%), etc. The company is expected to

repay `130cr of the IPO proceeds which will help it to improve the net margins;

however the 28% dilution is also expected to offset this impact and hence leaving

the ROE unchanged.

September 20, 2016

5

HPL Electric & Power | IPO Note

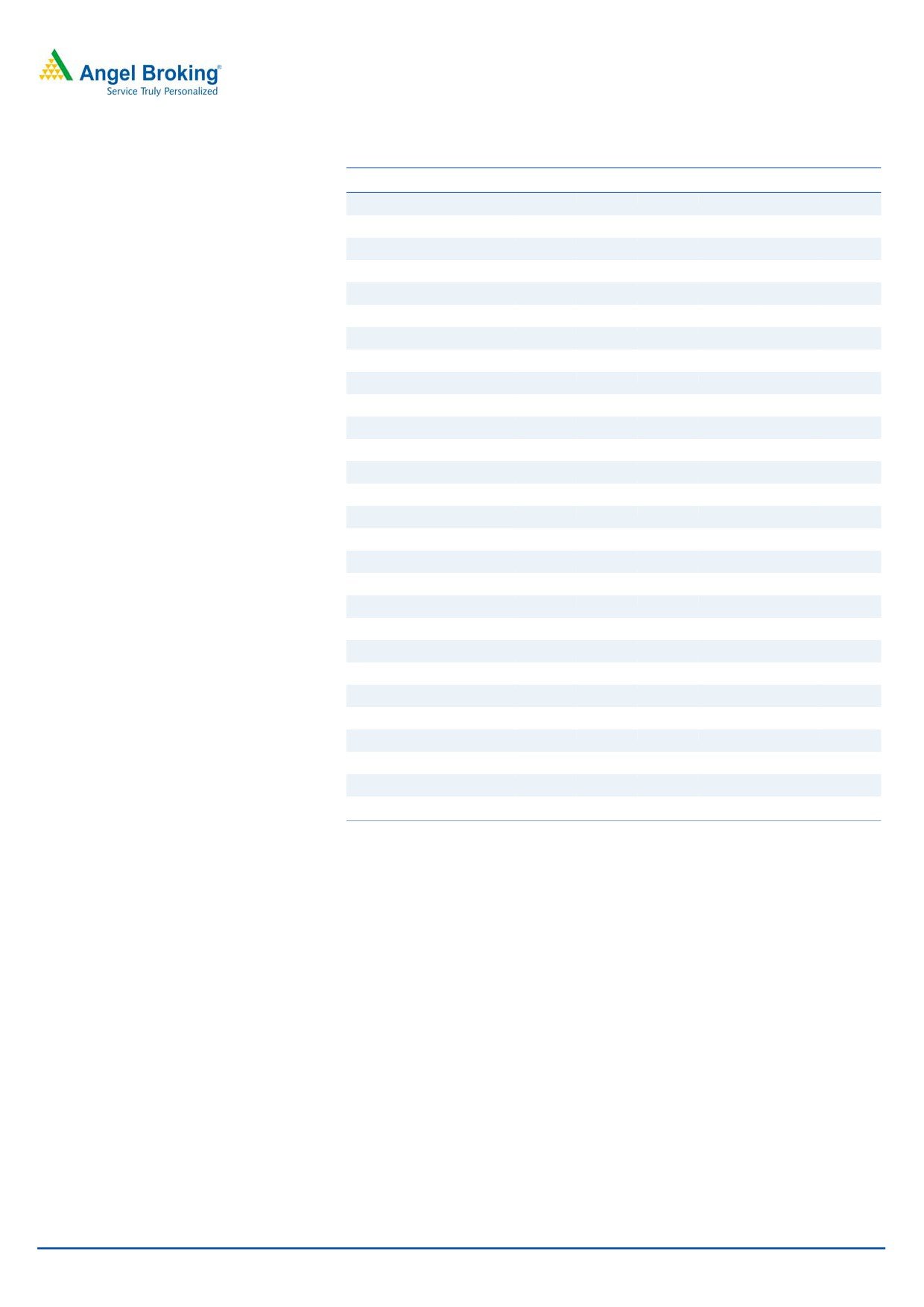

Exhibit 5: HPL has lower ROE compared to peers

23.7%

25.0%

21.4%

19.1%

20.0%

15.0%

10.3%

10.0%

5.0%

0.0%

V-Guard Industries

Finolex cables

Havells India

HPL

Consolidated

Source: Company, Angel Research

Existing litigation against HPL by Havells India

Among the promoters of HPL are two companies named Havell’s Private Limited

and Havells Electronics Private Limited. This is highly confusing due the similarity of

the name ‘Havells’ with Havells India Limited (HIL), which is a much larger

company listed on the bourses and also in the business of electrical consumer

durables. Due to this, HIL and Q.R.G. Enterprises have filed a litigation against

HPL refraining it from using word ‘Havell’s’ in its corporate name. HPL has

disclosed in the RHP that HPL and its promoters are not associated with Havells

India limited in any manner and they are two different companies.

September 20, 2016

6

HPL Electric & Power | IPO Note

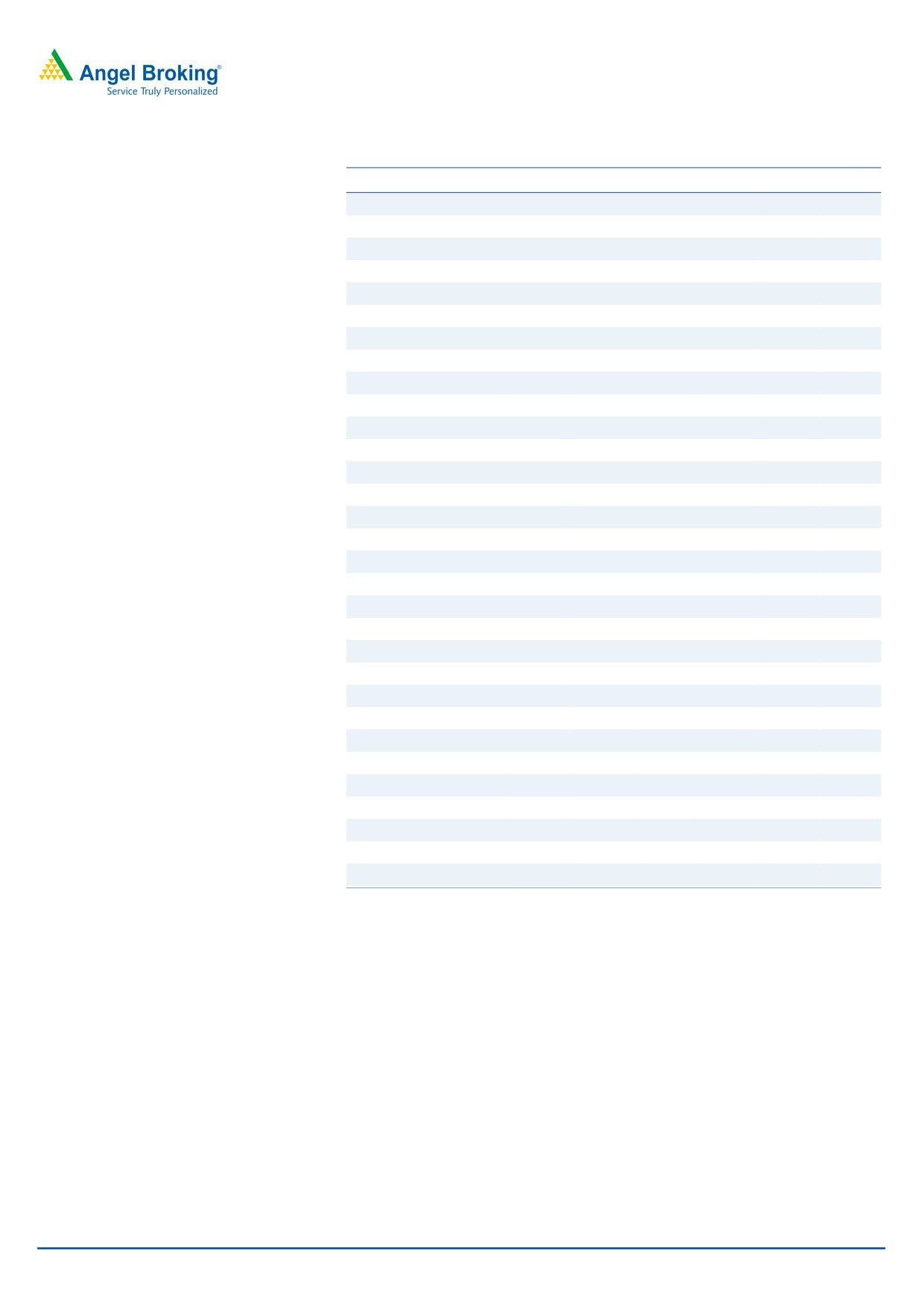

Outlook and Valuation

On the valuation front, at the upper end of the price band, the pre-issue P/E works

out to 25.6x of its FY2016 earnings which is lower compared to its peers. However

this discount is justified considering its low ROE, high working capital conditions

and low profitability compared to its peers. Considering past financial

performance and poor visibility on future growth, we rate this issue as NEUTRAL.

Exhibit 6: Comparative Valuation

FY2016

P/E

P/BV

ROE EV/Sales

EV/EBITDA

Pre issue valuation^

(x)

(x)

(%)

(x)

(x)

HPL Electric & Power Ltd.

25.6

2.6

10.3

1.3

9.8

Havells India Ltd.

42.6

9.7

24.4

4.2

21.1

V-Guard Industries

49.2

11.7

23.7

3.0

27.5

Finolex Cables

21.2

4.0

19.1

2.3

12.0

KEC International

16.2

2.0

12.6

0.6

8.1

Source: RHP, Note: ^based on price at upper band & pre-market cap

Upside risks

Strong traction in Lighting business: Strong growth in lighting business may alter

the business mix significantly which could lead to better operating performance.

Decline in working capital: Success UDAY could lead to ease in HPL’s working

capital which could improve its financial performance.

September 20, 2016

7

HPL Electric & Power | IPO Note

Profit & Loss Statement

Y/E March (` cr)

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

Total operating income

568

724

916

1,016

1,052

1,121

% chg

27.6

26.4

11.0

3.5

6.6

Total Expenditure

494

638

801

906

922

975

Raw Material Consumed

387

503

647

720

715

741

Personnel Expenses

34

48

54

58

68

107

Others Expenses

73

88

100

128

139

127

EBITDA

73

86

115

110

130

146

% chg

17.1

33.5

(4.0)

18.0

12.2

(% of Net Sales)

12.9

11.9

12.5

10.8

12.4

13.0

Depreciation& Amortisation

5

7

11

13

16

19

EBIT

68

79

103

97

114

127

% chg

16.0

30.5

(6.3)

17.5

11.2

(% of Net Sales)

12.0

10.9

11.3

9.5

10.8

11.3

Interest & other Charges

21

41

62

59

70

78

Recurring PBT

47

38

42

38

44

48

% chg

(19.7)

9.8

(9.7)

16.7

10.1

Extraordinary Expense/(Inc.)

-

-

-

-

-

-

PBT (reported)

47

38

42

38

44

48

Tax

10

10

10

9

9

12

(% of PBT)

21.3

25.2

24.7

24.7

21.2

24.3

PAT before MI

37

28

31

28

35

37

Minority Interest (after tax)

-

-

-

-

-

-

Profit/Loss of Associate Co.

-

-

-

-

-

-

PAT after MI(reported)

37

28

31

28

35

37

Exceptional Items

-

-

-

-

-

-

Reported PAT

37

28

31

28

35

37

% chg

(23.8)

10.7

(9.7)

22.0

5.8

(% of Net Sales)

6.6

3.9

3.4

2.8

3.3

3.3

Basic EPS (`)

8.0

6.1

6.8

6.1

7.5

7.9

Fully Diluted EPS (`)

8.0

6.1

6.8

6.1

7.5

7.9

% chg

(23.8)

10.7

(9.7)

22.0

5.8

September 20, 2016

8

HPL Electric & Power | IPO Note

Balance Sheet

Y/E March (` cr)

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

SOURCES OF FUNDS

Equity Share Capital

18

18

19

19

19

46

Reserves& Surplus

195

223

263

291

300

308

Shareholders Funds

213

241

282

310

318

354

Minority Interest

-

-

-

-

-

-

Total Loans

220

347

374

433

526

601

Other long term liabilities

6

8

16

17

18

14

Long-term provisions

1

1

1

1

2

3

Deferred Tax Liability

7

11

13

16

19

24

Total Liabilities

447

609

687

778

881

996

APPLICATION OF FUNDS

Gross Block

145

199

249

326

372

419

Less: Acc. Depreciation

18

25

36

49

65

84

Net Block

127

175

213

277

307

335

Intangible assets

-

-

0

-

-

-

Capital Work in Progress

72

66

53

29

-

3

Investments

15

15

15

15

15

54

Current Assets

351

511

627

663

819

948

Inventories

138

211

264

260

308

317

Sundry Debtors

144

217

269

328

401

512

Cash

30

47

52

46

54

52

Loans & Advances

38

35

41

27

54

65

Other Assets

0

1

1

1

1

2

Current liabilities

119

160

222

208

261

353

Net Current Assets

231

352

405

455

558

595

Long term loans and advances

1

1

1

1

1

9

Total Assets

447

609

687

778

881

996

September 20, 2016

9

HPL Electric & Power | IPO Note

Cash Flow Statement

Y/E March (` cr)

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

Profit before tax

47

38

42

38

44

48

Depreciation

5

7

11

13

16

19

Change in Working Capital

23

(91)

(39)

(53)

(89)

(31)

Interest / Dividend (Net)

20

38

58

55

66

74

Direct taxes paid

(10)

(8)

(9)

(7)

(11)

(8)

Cash Flow from Operations

85

(16)

63

46

27

103

(Inc.)/ Dec. in Fixed Assets

(78)

(48)

(37)

(54)

(43)

(50)

(Inc.)/ Dec. in Investments

1

3

4

4

4

(42)

Cash Flow from Investing

(77)

(45)

(33)

(49)

(39)

(92)

Issue of Equity

6.0

-

9.6

-

-

-

Inc./(Dec.) in loans

16.8

123.1

28.1

57.1

90.3

64.6

Dividend Paid (Incl. Tax)

(2.1)

(3.1)

(0.4)

(0.2)

(0.2)

(0.2)

Interest / Dividend (Net)

(21.0)

(41.3)

(61.7)

(59.3)

(69.9)

(78.2)

Cash Flow from Financing

(0)

79

(24)

(2)

20

(14)

Inc./(Dec.) in Cash

8

17

5

(6)

8

(3)

Opening Cash balances

22

30

47

52

46

54

Closing Cash balances

30

47

52

46

54

52

September 20, 2016

10

HPL Electric & Power | IPO Note

Key Ratio

Y/E March

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

Valuation Ratio (x)

P/E (on FDEPS)

25.2

33.0

29.9

33.1

27.1

25.6

P/CEPS

22.1

26.7

21.9

22.5

18.5

16.8

P/BV

4.4

3.9

3.3

3.0

2.9

2.6

Dividend yield (%)

0.2

0.3

0.0

0.0

0.0

0.0

EV/Sales

2.0

1.7

1.4

1.3

1.3

1.3

EV/EBITDA

15.2

14.2

10.8

11.9

10.7

9.8

EV / Total Assets

2.0

1.6

1.4

1.3

1.2

1.1

Per Share Data (`)

EPS (Basic)

8.0

6.1

6.8

6.1

7.5

7.9

EPS (fully diluted)

8.0

6.1

6.8

6.1

7.5

7.9

Cash EPS

9.1

7.6

9.2

9.0

10.9

12.1

DPS

0.4

0.6

0.1

0.0

0.0

0.0

Book Value

45.9

51.9

60.7

66.8

68.5

76.3

Returns (%)

ROCE

15.8

13.5

15.8

13.0

13.5

13.3

Angel ROIC (Pre-tax)

21.6

17.2

19.3

14.9

14.7

15.0

ROE

17.5

11.8

11.1

9.2

10.9

10.3

Turnover ratios (x)

Asset Turnover (Gross Block)

3.9

3.6

3.7

3.1

2.8

2.7

Inventory / Sales (days)

130

153

149

132

157

156

Receivables (days)

93

110

108

118

140

168

Payables (days)

97

107

117

98

125

164

WC cycle (ex-cash) (days)

127

156

140

152

173

160

Solvency ratios (x)

Net debt to equity

0.8

1.2

1.1

1.2

1.4

1.4

Net debt to EBITDA

2.4

3.3

2.7

3.4

3.5

3.4

Int. Coverage (EBIT / Int.)

3.3

1.9

1.7

1.6

1.6

1.6

September 20, 2016

11

HPL Electric & Power | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

September 20, 2016

12