3QFY2016 Result Update | HFC

January 29, 2016

HDFC

NEUTRAL

CMP

`1,148

Performance Highlights

Target Price

-

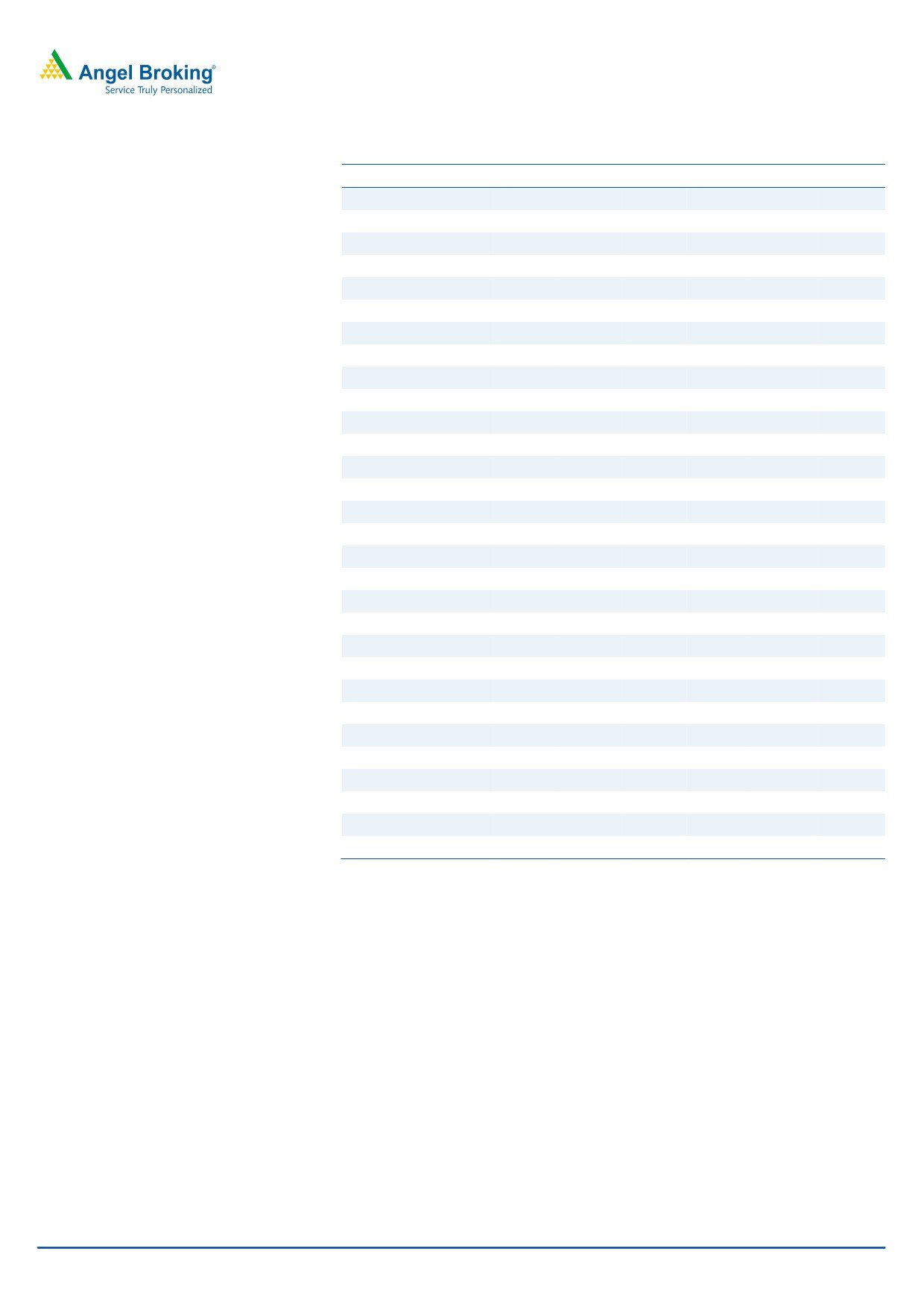

Particulars (` cr)

3QFY16 2QFY16

% chg (qoq) 3QFY15

% chg (yoy)

Investment Period

-

NII

2,254

2,076

8.6

2,068

9.0

Pre-prov. profit

2,259

2,376

(4.9)

2,109

7.1

Stock Info

PAT

1,521

1,605

(5.2)

1,425

6.7

Sector

HFC

Source: Company, Angel Research

Market Cap (` cr)

181,270

HDFC posted a modest 6.7% yoy increase in PAT for 3QFY2016, which is

Beta

1.3

marginally lower than our expectation. The NII for the quarter grew 9.0% yoy,

52 Week High / Low

1,399/1,093

which again is slightly lower than our expectation, due to moderate growth in

Avg. Daily Volume

2,403,329

advances. The company witnessed a pick-up in non-individual loans and hence

Face Value (`)

2

had to take extra provisions during the quarter. Further it booked lower treasury

BSE Sensex

24,470

gains yoy, hence the PAT came in marginally lower than our expectation.

Nifty

7,425

Growth in loan book remained moderate: For 3QFY2016, HDFC’s loan book

Reuters Code

HDFC.BO

grew by 12.8% yoy, with loans to the individual segment growing by 14.2% yoy

Bloomberg Code

HDFC@IN

(by 23% after adding back loans sold in the preceding 12 months). Non-

individual loans also picked up during the quarter. Incremental growth in the loan

book came on the back of growth in individual loans as well as non-individual

Shareholding Pattern (%)

segments. Individual loans inched up marginally, accounting for 70% of the book.

Promoters

0.0

MF / Banks / Indian Fls

9.8

NIM declines: The spread stood largely stable at 2.31% as compared to 2.32% in

FII / NRIs / OCBs

78.6

the quarter ended September 2015, while the NIM contracted by 8bp to 3.85%

Indian Public / Others

11.6

from 3.93% in 3QFY2015. Softening interest rates and in turn yield will keep the

NIM under pressure in the near term. Overall, we expect the loan book to grow at

a CAGR of 15.0% and the NII to grow at a CAGR of 11.6% over FY2015-17E.

Abs. (%)

3m

1yr

3yr

Sensex

(9.5)

(17.2)

21.7

Asset quality fairly stable: HDFC continued to keep its asset quality under check,

with GNPAs as a % of total loans rising marginally by 3bp/1bp yoy/qoq to

HDFC

(9.3)

(14.6)

43.2

0.72%. The company continues to maintain a 100% Provision Coverage Ratio

and carries extra provision to the tune of `230cr on its book.

3-year price chart

1,400

Outlook and valuation: HDFC posted a moderate set of numbers for the quarter

1,200

despite a sluggish economic environment. Overall, we expect HDFC to post a PAT

CAGR of 11.2% over FY2015-17E. Currently, HDFC’s core business (after

1,000

adjusting

`482/share towards the value of its subsidiaries) trades at

3.6x

800

FY2017E ABV. We maintain our Neutral rating on the stock.

600

Key financials (standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

NII*

6,666

7,631

8,341

9,502

Source: Company, Angel Research

% chg

12.5

14.5

9.3

13.9

Vaibhav Agrawal

Net profit

5,440

5,990

6,466

7,407

022 - 3935 7800 Ext: 6808

% chg

12.2

10.1

8.0

14.5

NIM (%)

3.4

3.4

3.3

3.3

Siddharth Purohit

EPS (`)

34.9

38.0

41.1

47.0

022 - 3935 7800 Ext: 6872

P/E (x)

32.9

30.2

28.0

24.4

P/ABV (x)

6.4

5.8

5.3

4.8

RoA (%)

2.5

2.4

2.3

2.3

Chintan Shah

022 - 4000 3600 Ext: 6828

RoE (%)

20.5

20.3

19.9

20.8

Source: Company, Angel Research; Note: * Core NII; CMP as of January 28, 2015.

Please refer to important disclosures at the end of this report

1

HDFC | 3QFY2016 Result Update

Exhibit 1: Quarterly performance (standalone)

Particulars (` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

FY2015

FY2014

% chg

Income from operations

7,124

6,994

1.9

6,656

7.0

26,272

23,338

12.6

Interest expensed

4,869

4,918

(1.0)

4,588

6.1

17,975

16,029

12.1

NII

2,254

2,076

8.6

2,068

9.0

8,297

7,309

13.5

Non-interest income

204

487

(58.0)

227

(10.0)

1,199

859

39.6

Operating income

2,459

2,563

(4.1)

2,295

7.1

9,496

8,168

16.3

Operating expenses

200

187

6.9

185

8.0

707

628

12.5

Pre-prov. profit

2,259

2,376

(4.9)

2,109

7.1

8,789

7,540

16.6

Provisions & cont.

68

52

30.8

45

51.1

165

100

65.0

PBT

2,191

2,324

(5.7)

2,064

6.1

8,624

7,440

15.9

Prov. for taxes

670

719

(6.8)

639

4.9

2,634

2,000

31.7

PAT

1,521

1,605

(5.2)

1,425

6.7

5,990

5,440

10.1

EPS (`)

96.2

10.2

846.2

9.1

961.3

38.0

34.9

9.1

Cost-to-income ratio (%)

8.1

7.3

83bp

8.1

7bp

7.4

7.7

Effective tax rate (%)

30.6

30.9

31.0

30.5

26.9

Source: Company, Angel Research

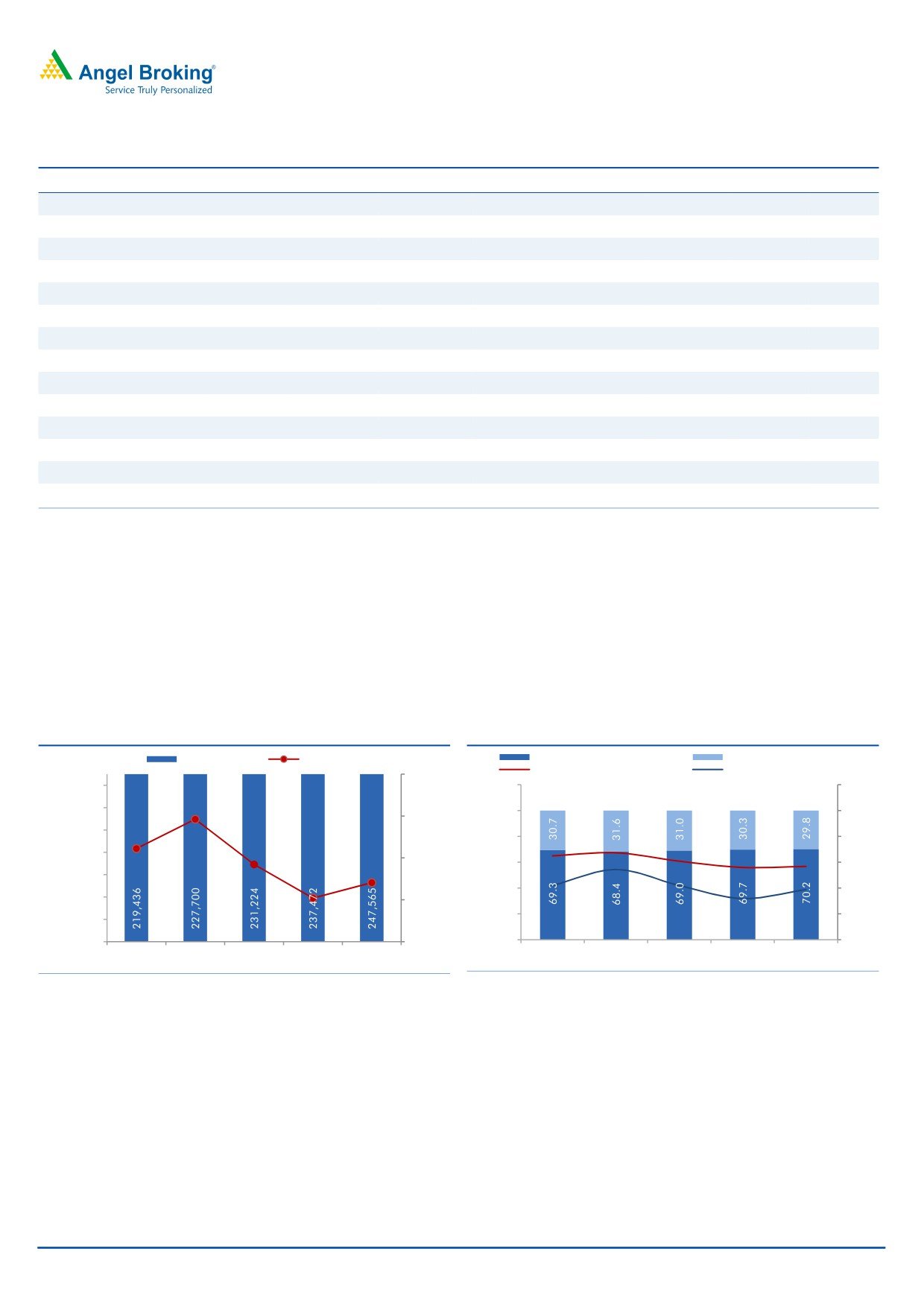

Growth in Loan book remained moderate

For 3QFY2016, HDFC’s loan book grew by 12.8% yoy, with loans to the individual

segment growing by 14.2% yoy (by 23% after adding back loans sold in the

preceding 12 months). Non-individual loans also picked up during the quarter.

Incremental growth in the loan book came on the back of growth in individual

loans as well as non-individual segments. Individual loans inched up marginally,

accounting for 70% of the book.

Exhibit 2: Loan book grows at a moderate pace

Exhibit 3: Individual loans grew at 14% yoy

Advances (`cr)

Growth (yoy, %)

Ind. loans as % to Total

Non Ind. loans as % to Total

Ind. Loan growth (%) -RHS

Non Ind. loan growth (%) -RHS

18.0

190,000

120.0

30.0

15.8

170,000

100.0

25.0

16.0

150,000

14.4

80.0

20.0

13.7

130,000

12.1

14.0

12.8

60.0

15.0

110,000

40.0

10.0

90,000

12.0

20.0

5.0

70,000

50,000

10.0

-

-

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research

Source: Company, Angel Research

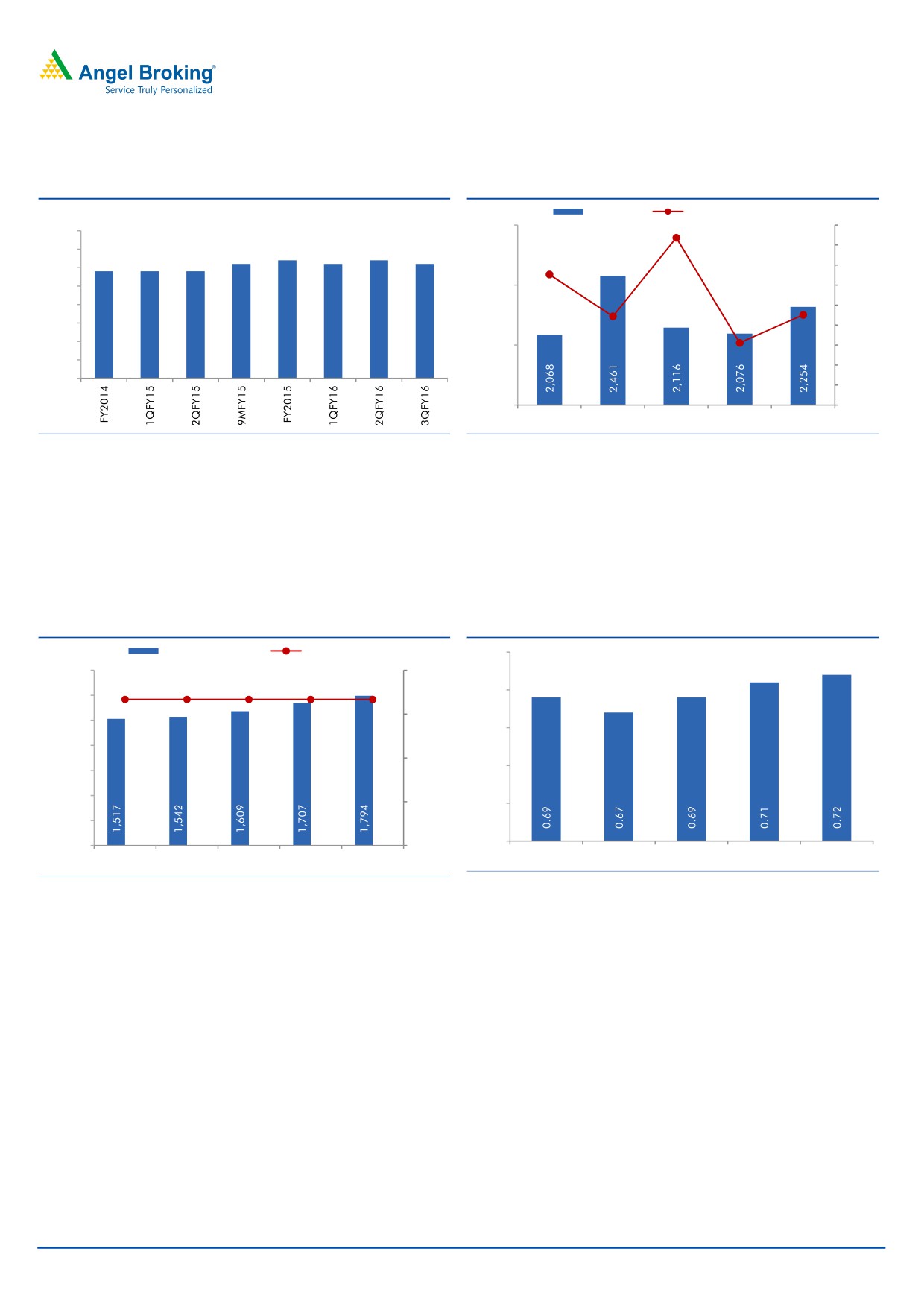

NIM declines yoy

The spread stood largely stable at 2.31% as compared to 2.32% in the quarter

ended September 2015, while the NIM contracted by 8bp to 3.85% from 3.93% in

3QFY2015. Softening interest rates and in turn yield will keep the NIM under

pressure in the near term. Overall, we expect the loan book to grow at a CAGR of

15.0% and the NII to grow at a CAGR of 11.6% over FY2015-17E.

January 29, 2016

2

HDFC | 3QFY2016 Result Update

Exhibit 4: Spreads strong at 2.31% for 3QFY2016

Exhibit 5: NII growth trend

NII (`cr)

Growth yoy (%, RHS)

(%)

2,800

16.7

18.0

2.40

2.32

2.32

16.0

2.35

2.31

2.31

2.31

13.1

2.29

2.29

2.29

2.30

14.0

2.25

2,400

12.0

2.20

8.9

9.0

10.0

2.15

8.0

6.2

2.10

2,000

6.0

2.05

4.0

2.00

2.0

1,600

-

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research

Source: Company, Angel Research

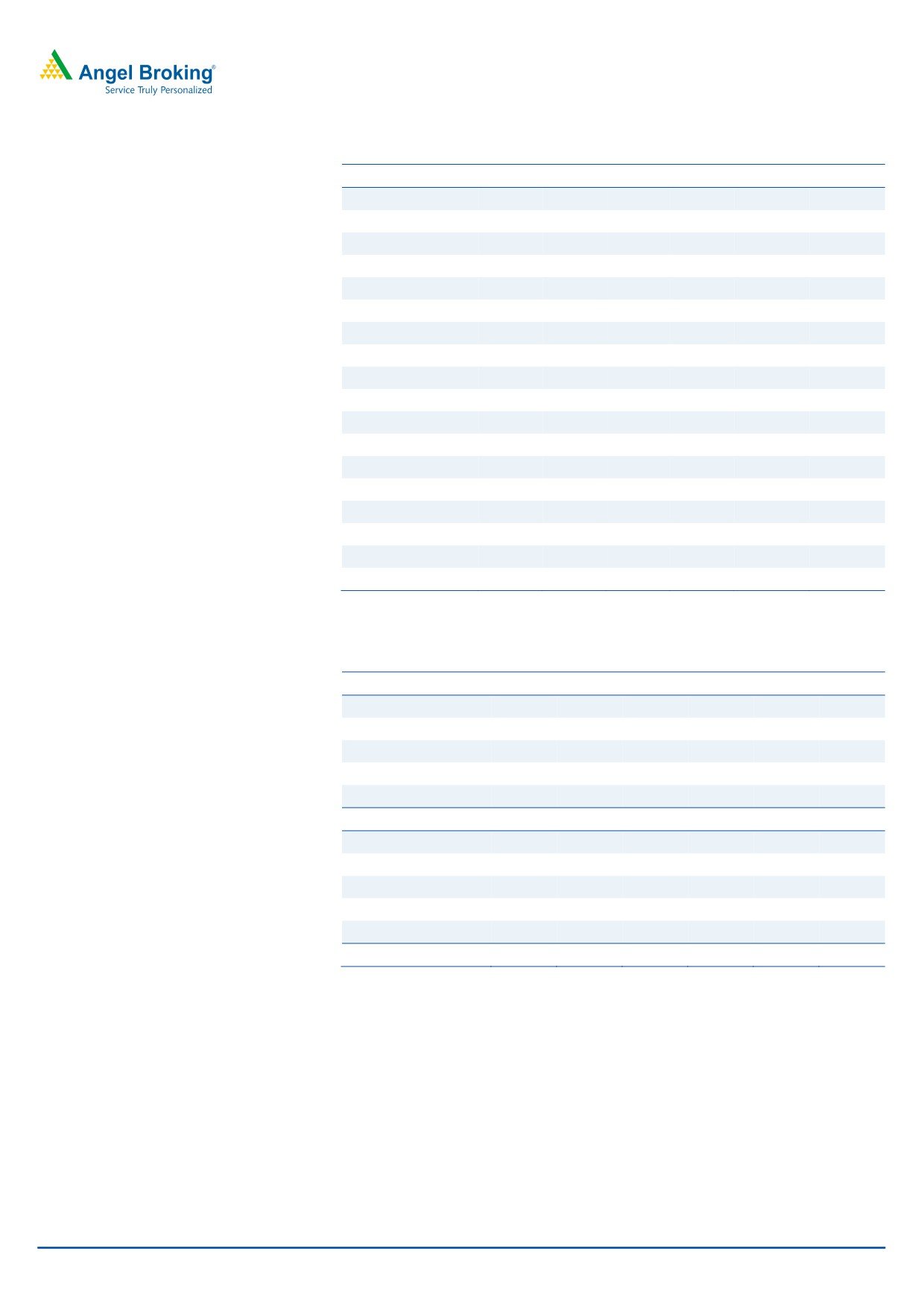

Asset quality fairly stable

HDFC continued to keep its asset quality under check, with GNPAs as a % of total

loans rising marginally by 3bp/1bp yoy/qoq to 0.72%. The company continues to

maintain a 100% Provision Coverage Ratio and carries extra provision to the tune

of `230cr on its book.

Exhibit 4: NPA coverage remains at 100%

Exhibit 5: Gross NPA ratio remains stable

Gross NPA (`cr)

PCR (%, RHS)

0.75

Gross NPA % (3 months)

2,100

120.0

100.0

100.0

100.0

100.0

100.0

0.70

1,800

90.0

1,500

0.65

1,200

60.0

0.60

900

600

30.0

0.55

300

0.50

-

-

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research

Source: Company, Angel Research

Outlook and valuation

HDFC posted a moderate set of numbers for the quarter despite a sluggish

economic environment. Overall, we expect HDFC to post a PAT CAGR of 11.2%

over FY2015-17E. Currently, HDFC’s core business (after adjusting `482/share

towards the value of its subsidiaries) trades at 3.6x FY2017E ABV. We maintain our

Neutral rating on the stock.

January 29, 2016

3

HDFC | 3QFY2016 Result Update

Company Background

HDFC is India's leading housing finance company, with a balance sheet size of

around `2.6lakh cr. The company's primary business is to provide loans for the

purchase or construction of residential houses. HDFC's distribution network spans

392 outlets, covering more than 2,400 towns and cities across India. HDFC also

has representative offices in London, Dubai and Singapore and service associates

in Kuwait, Oman, Qatar, Abu Dhabi and Saudi Arabia to cater to NRIs. From its

origins as a specialized mortgage company, HDFC has grown into a financial

conglomerate with market leading group companies in banking, asset

management and insurance verticals.

January 29, 2016

4

HDFC | 3QFY2016 Result Update

Income statement (standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

NII*

4,998

5,927

6,666

7,631

8,341

9,502

- YoY Growth (%)

17.7

18.6

12.5

14.5

9.3

13.9

Other Income

1,199

1,329

1,503

1,865

2,017

2,350

- YoY Growth (%)

12.0

10.8

13.0

24.1

8.1

16.5

Operating Income

6,198

7,257

8,168

9,496

10,358

11,852

- YoY Growth (%)

16.5

17.1

12.6

16.3

9.1

14.4

Operating Expenses

452

539

628

707

795

898

- YoY Growth (%)

18.6

19.3

16.5

12.5

12.5

13.0

Pre - Provision Profit

5,746

6,718

7,540

8,789

9,563

10,954

- YoY Growth (%)

16.4

16.9

12.2

16.6

8.8

14.5

Prov. & Cont.

80

145

100

165

175

213

- YoY Growth (%)

14.3

81.3

(31.0)

65.0

6.1

21.6

Profit Before Tax

5,666

6,573

7,440

8,624

9,388

10,741

- YoY Growth (%)

16.4

16.0

13.2

15.9

8.9

14.4

Prov. for Taxation

1,543

1,725

2,000

2,634

2,922

3,334

- as a % of PBT

27.2

26.2

26.9

30.5

31.1

31.0

PAT

4,123

4,848

5,440

5,990

6,466

7,407

- YoY Growth (%)

16.6

17.6

12.2

10.1

8.0

14.5

Note: *Core NII

Balance sheet (standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Share Capital

295

309

312

315

315

315

Reserve & Surplus

18,722

24,691

27,643

30,655

33,661

37,092

Loan Funds

1,39,128

1,58,828

1,84,298

2,08,694

2,33,413

2,76,726

- Growth (%)

20.9

14.2

16.0

13.2

11.8

18.6

Other Liabilities & Prov.

9,375

11,703

13,504

14,383

16,153

18,962

Total Liabilities

1,67,520

1,95,531

2,25,757

2,54,047

2,83,542

3,33,095

Investments

12,207

13,613

13,804

14,294

15,020

16,238

Advances

1,40,422

1,69,571

1,96,554

2,27,700

2,55,024

3,00,928

- Growth (%)

20.2

20.8

15.9

15.8

12.0

18.0

Fixed Assets

234

238

276

677

758

894

Other Assets

14,657

12,109

15,123

11,376

12,741

15,034

Total Assets

1,67,520

1,95,531

2,25,757

2,54,047

2,83,542

3,33,095

January 29, 2016

5

HDFC | 3QFY2016 Result Update

Ratio analysis (standalone)

Y/E March

FY12

FY13

FY14

FY15

FY16E

FY17E

Profitability ratios (%)

NIMs

3.6

3.6

3.4

3.4

3.3

3.3

Cost to Income Ratio

7.3

7.4

7.7

7.4

7.7

7.6

RoA

2.7

2.6

2.5

2.4

2.3

2.3

RoE

22.7

22.0

20.5

20.3

19.9

20.8

Asset Quality (%)

Gross NPAs

0.76

0.71

0.69

0.68

0.70

0.70

Net NPAs

-

-

-

-

-

-

Provision Coverage

100.0

100.0

100.0

100.0

100.0

100.0

Per Share Data (`)

EPS

27.9

31.4

34.9

38.0

41.1

47.0

ABVPS (75% cover.)

128.8

161.7

179.1

196.7

215.8

237.5

DPS

11.0

12.5

14.0

15.1

16.1

18.4

Valuation Ratios

PER (x)

41.1

36.6

32.9

30.2

28.0

24.4

P/ABVPS (x)

8.9

7.1

6.4

5.8

5.3

4.8

DuPont Analysis#

NII

3.4

3.4

3.3

3.3

3.2

3.2

(-) Prov. Exp.

0.1

0.1

0.0

0.1

0.1

0.1

Adj. NII

3.4

3.3

3.2

3.2

3.1

3.1

Treasury

0.2

0.2

0.1

0.2

0.1

0.1

Int. Sens. Inc.

3.6

3.5

3.4

3.4

3.3

3.2

Other Inc.

0.5

0.4

0.5

0.4

0.5

0.5

Op. Inc.

4.1

3.9

3.8

3.9

3.7

3.7

Opex

0.3

0.3

0.3

0.3

0.3

0.3

PBT

3.8

3.6

3.5

3.6

3.4

3.4

Taxes

1.1

1.0

1.0

1.1

1.1

1.1

RoA

2.7

2.6

2.5

2.4

2.3

2.3

Leverage

14.4

12.6

11.1

10.9

10.8

10.9

RoE

39.3

33.2

28.1

26.3

24.7

24.9

Note: # Core RoEs excluding income and investments in subsidiaries

January 29, 2016

6

HDFC | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

HDFC

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 29, 2016

7