IPO Note | Financials

Nov 6, 2017

HDFC Standard Life Insurance Company Ltd

SUBSCRIBE

sue Open: Nov 7, 2017

Is

Issue Close: Nov 9, 2017

HDFC Standard Life Insurance Co Ltd (HDFC Life) started as a JV between HDFC

Ltd, India’s largest Housing Finance Company and Standard Life Aberdeen Plc.

HDFC Life is the country's third-largest private sector life insurance company with

Issue Details

16.5% share of total private sector premiums in FY2017. Based on the new

Face Value: `10

business premium (NBP), it ranked second with a market share of 17.2%. It had

robust NBP margin of 22% for FY2017 vis-à-vis 10-19% of peers.

Present Eq. Paid up Capital: `2,005cr

Trusted brand name and diversified distribution network major catalysts: HDFC

Offer for Sale: **29.98cr Shares

Life has pan India presence with 414 branches. Its bancassurance partners grew

Fresh issue: --

from 31 in FY2015 to 125 as on 2QFY2018 and top 15 bancassurance partners

had over 11,200 branches across India as on 2QFY2018. NBP has been growing

Post Eq. Paid up Capital: `2,005cr

at healthy CAGR of 17.8% over FY2013-17 (SBI Life’s & ICICI Pru’s NPB grew at

9.2 & 9.1% respectively over same period). Market share of HDFC Life in NBP has

Issue size (amount): *`8,245cr -**8,695cr

improved by 547bps to 17.2% over FY2012-17 (PVT insurer).

Healthy financials & highest VNB margin - a positive: Over FY2015-17, overall

Price Band: `275 - `290

total premium grew at CAGR of 14.5% to ₹19,445cr. It has reported healthy ROE

Lot Size: 50 shares and in multiple

of 23% and Operating Return on Embedded Value of 21.7% for FY2017.

thereafter

Moreover, it has also improved VNB (Value of New Business) margin by 350bps

Post-issue implied mkt. cap: *`55,247cr -

**`58,260cr

to 22% over FY2015-17, which is highest in the industry (ICICI Pru -10%, SBI Life

15.4%). We believe, owing to healthy VNB margin has kept the company self-

Promoters holding Pre-Issue: 100%

sustained, and hence, it would not require diluting capital very often.

Promoters holding Post-Issue: 85%

Balanced business mix makes HDFC Life’s business more predictable: HDFC Life

*Calculated on lower price band

has a well balanced portfolio (ULIP - 35.2%, Non-participating - 50.4% and

Participating - 14.3%) on NBP basis for FY2017 (ULIP contribution for SBI life and

** Calculated on upper price band

ICICI Pru is 50.5% and 79.1% respectively). Experienced management has

Book Building

categorically developed this mix, which will help to reduce volatility in business

QIBs

50% of issue

and impact on the embedded value (EV) and VNB.

Outlook & Valuation: At the upper band of `290 the issue is valued at 4.2x of

Non-Institutional

15% of issue

2QFY2018 embedded value (EV) of `14,011cr, bit higher than close listed player

Retail

35% of issue

SBI Life and ICICI Pru which is trading at 3.6x and 3.3x of 2QFY2018 EV

respectively. However, we believe slight premium is justifiable, considering,

consistent growth across premium categories, improving dividend payout over last

Post Issue Shareholding Pattern

4 years, strong parentage, trusted brand name, highest VNB margin (22% for

Promoters

85%

FY2017) and well balanced business mix. Based on the above positive factors we

Others

15%

assign SUBSCRIBE rating to the issue.

Key Financials

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Premium Income

11,446

11,976

14,762

16,179

19,275

% chg

5

23

10

19

PAT

447

725

786

817

887

% chg

62

8

4

9

AUM

67,047

74,247

91,742

Embedded Value

8,888

10,233

12,471

ROE

21

34

31

26

23

PE

130

80

74

71

66

Jaikishan J Parmar

P/BV

27

27

23

19

15

+022 39357600, Extn: 6810

P/EV

6.6

5.7

4.7

Source: RHP, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Please refer to important disclosures at the end of this report

1

HDFC Standard Life Insurance Company Ltd | IPO Note

Company background

HDFC Life was established in the year 2000 as a joint venture between HDFC, one

of India's leading housing finance, institutions, and Standard Life Aberdeen Plc,

one of the world's largest investment companies, initially through wholly owned

subsidiary The Standard Life Assurance Company and now through wholly owned

subsidiary Standard Life Mauritius. HDFC held 61.21% stake and Standard Life

Mauritius 34.75% as on the date of the Red Herring Prospectus.

The total net worth was `4460cr and the solvency ratio of 200.5% end September

2017 was above the regulatory minimum requirement of 150%. Total assets under

management (AUM) were `99,530cr and Indian embedded value `14,010cr as

on 2QFY2018.

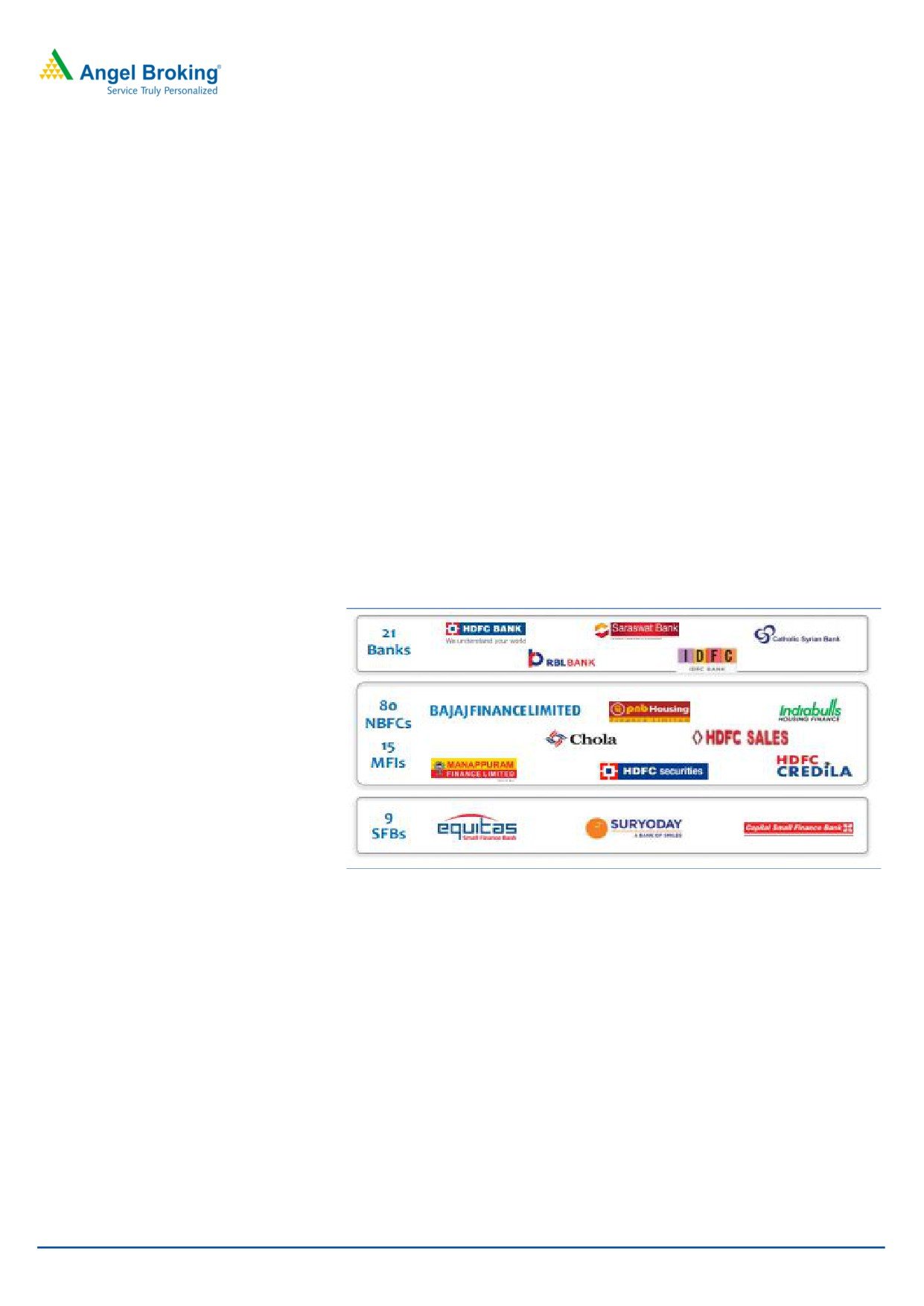

The bancassurance partners include banks, non-banking financial companies,

micro-finance institutions and small finance banks in India. The number of major

bancassurance partners stood at

125 as on 2QFY2018. The top

15

bancassurance partners had over 11,200 branches across India. There were

66,372 individual agents as on 2QFY2018, comprising 6.8% of all private agents

in the Indian life insurance industry.

The pan-India presence comprises 414 branches and spokes across India,

supported by a dedicated workforce of 16,544 full-time employees.

A wholly-owned subsidiary, HDFC Pension, was set up in 2012 to operate the

pension fund business under the National Pension System (NPS). HDFC Pension

had approximately `1162.98cr of AUM from customers enrolled under the NPS as

on 2QFY2018. HDFC Pension is the second-largest private pension fund

management company in India by AUM and subscribers in FY2017.

Exhibit 1: Contribution of distribution channels to total NBP

FY12

FY13

FY14

FY15

FY16

FY17

Bancassurance

55%

47%

50%

54%

51%

54%

Individual agents

12%

10%

10%

8%

8%

6%

Direct

28%

39%

37%

37%

40%

38%

Brokers and others

4%

4%

3%

2%

2%

2%

Total

100%

100%

100%

100%

100%

100%

Source: RHP

Nov 6, 2017

2

HDFC Standard Life Insurance Company Ltd | IPO Note

Issue details

The company is raising `8,245-`8,695cr through a offer for sale of equity shares

in the price band of `275-290. The promoters, HDFC Ltd and Standard Life will

dilute 9.52% and 5.4% respectively in their joint venture HDFC Life. Currently,

HDFC owns 61.21% in the joint venture, which will come down to 51.69%, while

Standard Life's 34.75% shareholding will come down to 29.35% post the IPO.

The offer for sale would constitute 19.82% of the post-issue paid-up equity share

capital of the HDFC Life.

As much as 0.11% of the issue is reserved for eligible HDFC Life employees,

0.04% for eligible HDFC employees and 1.49% for HDFC shareholders.

Exhibit 2: Pre and Post-IPO shareholding pattern

Particular

Pre-Issue

Post-Issue

No. of shares

%

No. of shares

%

Promoter group

2,00,89,73,222

100

1,70,91,45,404

85

Other

29,98,27,818

15

Total

2,00,89,73,222

100

2,00,89,73,222

100

Source: RHP, Angel Research; Note: Calculated on upper price band

Objects of the offer

To achieve benefits of listing equity shares on stock exchanges and to carry out

the offer for sale.

Listing of equity shares will enhance HDFC Life’s brand name and provide

liquidity to existing shareholders. The listing will also provide a public market

for the equity shares in India.

Key Management Personnel

Mr. Amitabh Chaudhry is the Managing Director and Chief Executive Officer of the

Company and he has been with the Company since January 18, 2010. Mr.

Chaudhry holds a bachelor’s degree in engineering (electronics and electrical

branch) from Birla Institute of Technology and Science, Pilani and post graduate

diploma in management from Indian Institute of Management, Ahmedabad. He

has also been associated with CLSA (formerly Credit Lyonnais Securities, Asia).

Ms. Vibha Padalkar is an Executive Director and Chief Financial Officer of the

Company and she has been with the Company since August 4, 2008. Ms.

Padalkar is qualified as member of the Institute of Chartered Accountants of

England and Wales in 1992. She is also a member of the Institute of Chartered

Accountants of India. Prior to her appointment with the Company, she has worked

in varied sectors such as Business Process Outsourcing (WNS Global Services),

FMCG (Colgate Palmolive (India) Limited) and Big 4 audit firms (Lovelock & Lewes

(part of PricewaterhouseCoopers).

Nov 6, 2017

3

HDFC Standard Life Insurance Company Ltd | IPO Note

Investment Rationale

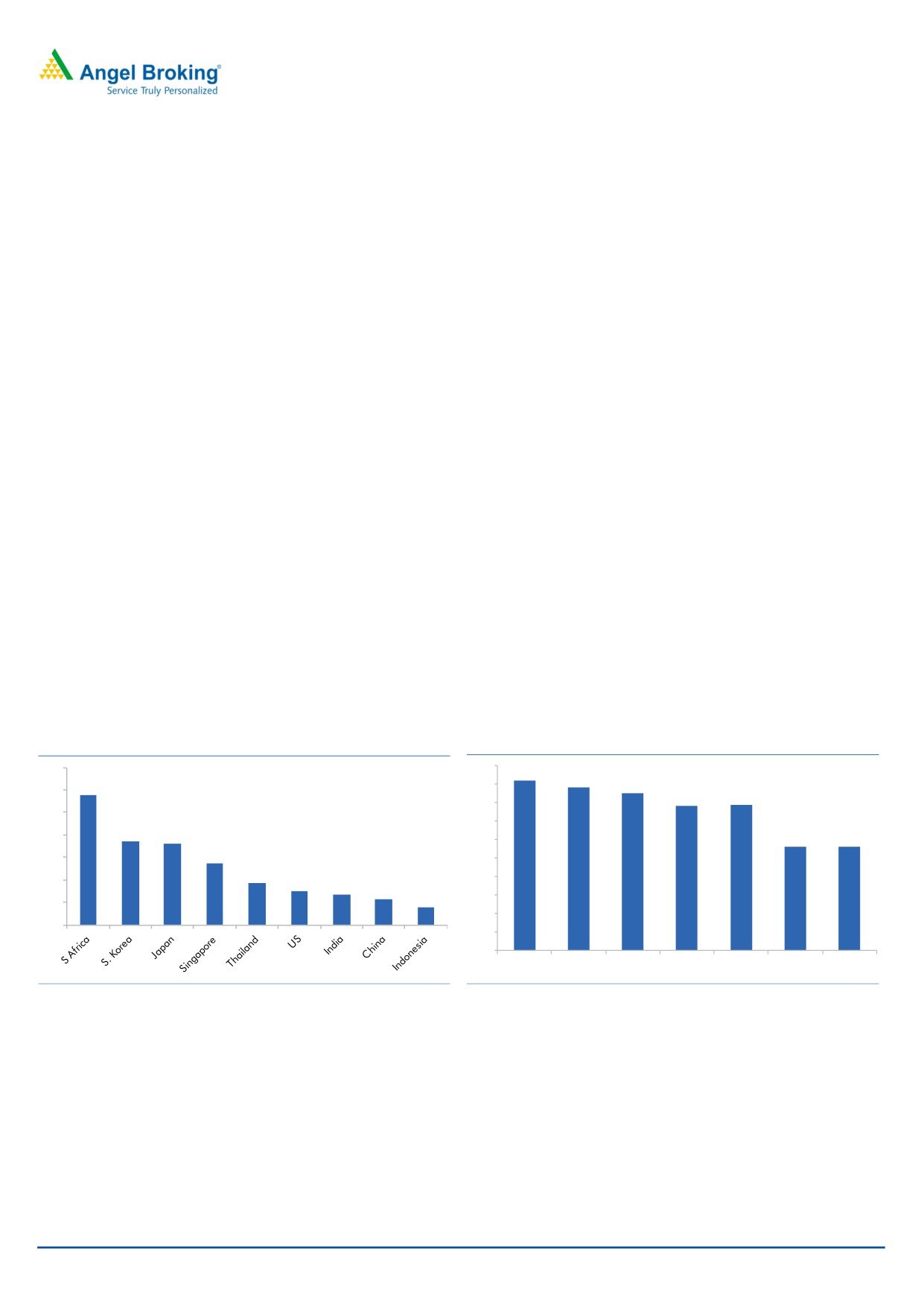

Life insurance industry is well poised for long term growth

The size of Indian life insurance industry stood `4.2tn on a total premium basis in

FY2017. The total premium grew at 17% CAGR over FY2001-17. In terms of total

premium, the Indian life insurance industry is the 10th largest market in the world

and the fifth largest in Asia based on Swiss Re, sigma No 3/2017 report

The penetration of life insurance in India remains low at 2.7% of GDP as of 2016,

compared to 3.7% in Thailand, 7.4% in South Korea and 5.5% in Singapore in

2016. Insurance density at USD 47 in 2016 also remains low, compared with

other developed and emerging countries.

We expect healthy growth for the industry going ahead owing to 1) Low

penetration of insurance in India, 2) Focus on financial inclusion, 3) Increasing

insurable population, 4) significant protection gap, 5) Rise in healthcare spending.

As per Swiss Re Institute sigma No 3/2017 report, the protection gap for India

stood at $8.5 trillion as of FY2017, which was much higher compared to its Asian

counterparts. The protection margin (measured as ratio between protection gap

and protection needs, as per Swiss Re Institute) for India at 92% was highest

among all the countries in Asia Pacific, as per the report. This means that for $100

of insurance protection requirement, only $8 was actually insured as of FY2014.

This indicates the absence of inadequacy of pure protection coverage (term

insurance) for a large part of the population.

Exhibit 3: Premium as % of GDP - 2016

Exhibit 4: Protection margin across key Asian countries (%)

14

100

92

88

11.5

90

85

12

78

79

80

10

70

7.4

7.2

8

56

56

60

5.5

6

50

3.7

3

40

2.7

4

2.3

1.6

30

2

20

0

10

0

India

China South Korea Thailand Indonesia

Japan

Singapore

Source: RHP

Source: RHP,FY14

Nov 6, 2017

4

HDFC Standard Life Insurance Company Ltd | IPO Note

Trusted brand name and diversified distribution network major catalysts: HDFC life

has pan India presence with 414 branches. Bancassurance remained most

significant distribution channel, generating 50.4%, 53.5%, 50.7% and 54.1% of

total new business premiums for FY2015, FY2016, FY2017 and 1QFY2018,

respectively. HDFC Life has longstanding successful relationships with its

bancassurance partners through corporate agency or master policyholder

arrangements. The oldest bancassurance partner relationship was established in

2002. Its bancassurance partners grew from 31 in FY2015 to 125 as on

2QFY2018 and top 15 bancassurance partners had over 11,200 branches across

India as on 2QFY2018. NBP has been growing at healthy CAGR of 17.8% over

FY2013-17 (SBI Life’s & ICICI Pru’s NPB grew at 9.2 & 9.1% over same period

respectively). Market share of HDFC Life in NBP has improved by 547bps to 17.2%

over FY2012-17 (PVT Insurer).

HDFC group is known as an investor for clear corporate governance, professional

management and value creation for long term. These all positive/brand aspect of

the HDFC group would help HDFC Life to garner higher market share into new

business premium.

Exhibit 5: Select bancassurance partners

Source: RHP

Nov 6, 2017

5

HDFC Standard Life Insurance Company Ltd | IPO Note

Healthy financials & highest VNB margin - a positive: Over FY2015-17, overall

total premium grew at CAGR of 14.5% to ₹19,445cr. It has reported healthy ROE

of 23% and Operating Return on Embedded Value of 21.7% for FY2017.

Moreover, it has also improved VNB (Value of New Business) margin by 350bps to

22% over FY2015-17, which is highest in the industry (ICICI Pru -10%, SBI Life

15.4%). We believe, owing to healthy VNB margin has kept the company self-

sustained, and hence, it would not require diluting capital very often.

Exhibit 6: FY2017 VNB margin

Exhibit 7: Return Ratios - HDFC Life

HDFC

FY15

FY16

FY17

22.0%

life

VNB (` cr)

590

740

920

Max Life

18.8%

VNB margin (%)

18.5

19.9

22

SBI Life

15.4%

ROEV (%)

22.9

20.7

21.7

ROE (%)

31

26

23

ICICI Pru

10.1%

Dividend Payout (%)

21

26

30

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

Source: Company, Angel Research

Source: Company, Angel Research

Balanced business mix makes HDFC Life’s business more predictable: HDFC Life

has a well balanced portfolio (ULIP - 35.2%, Non-participating - 50.4% and

Participating - 14.3%) on NBP basis for FY2017 (ULIP contribution for SBI life and

ICICI Pru is 50.5% and 79.1% respectively). Experienced management has

categorically developed this mix, which will help to reduce volatility in business and

impact on the embedded value (EV) and VNB.

Exhibit 8: Product Mix - New Business Premium (FY2017) (%)

HDFC Life

ICICI Pru

SBI Life

Linked

35.2

79.1

50.5

Non-Linked

Participating

14.3

7.9

10.8

Non - Participating

50.4

13.0

38.7

Source:

Nov 6, 2017

6

HDFC Standard Life Insurance Company Ltd | IPO Note

Outlook & Valuation: At the upper band of `290 the issue is valued at 4.2x of

2QFY2018 embedded value (EV) of `14,011cr, bit higher than close listed player

SBI Life and ICICI Pru which is trading at 3.6x and 3.3x of 2QFY2018 EV

respectively. However, we believe slight premium is justifiable, considering,

consistent growth across premium categories, improving dividend payout over last

4 years, strong parentage, trusted brand name, highest VNB margin (22% for

FY2017) and well balanced business mix. Based on the above positive factors we

assign SUBSCRIBE rating to the issue.

Exhibit 9: Relative Comparison

HDFC Life

SBI Life

ICICI Pru

Total Premium

19,460

21,020

22,350

APE

4,188

6,727

6,625

NBP (Cr)

8,700

10,150

7,860

Persistency

13 months

81

81

86

61 months

57

67

56

NBP 5 yr CAGR

18

9

9

ROEV

21

23

17

VNB Margin %)

22

15

10

P/EV

4.2

3.6

3.3

Source: RHP, Company, EV-Embedded Value, Valuation as on 3/11/17

Key risks

Any termination of or adverse change in bancassurance arrangements

In FY2015, FY2016 and FY2017, the bancassurance channel contributed 50.4%,

53.5%, 50.7%, respectively, to New Business Premium from individual products. If

there is any adverse change in this channel, it may impact the profitability of the

company.

Abrupt change in interest rates

The profitability of certain insurance products and return on investment are

particularly sensitive to interest rate fluctuations. As of Q2FY18, 58.2% of the

company’s investments were in debt securities. Changes in prevailing interest rates

could reduce the investment returns and spread and thus materially and adversely

affect the business and investment returns, financial condition and results of

operations

Nov 6, 2017

7

HDFC Standard Life Insurance Company Ltd | IPO Note

Income Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Premiums earned - Net

11,446

11,976 14,762 16,179

19,275

% chg

5

23

10

19

Income from Investments

2,543

5,073 12,249

1,791

11,141

Other Income

28

241

79

97

139

Total Income (A)

14,016

17,291 27,091 18,066

30,554

Total Expenditure (B)

2,042

2,108

2,382

2,937

3,552

% chg

3

13

23

21

Commission

647

514

623

702

792

% chg

(21)

21

13

13

Operating Exp - Insurance

1,216

1,281

1,489

1,872

2,385

Provision for Doubtful Debts

179

313

270

363

374

Liabilities against life policies (C )

11,336

14,753

23,886 14,170

26,055

Benefits Paid (Net)

3,903

4,662

8,162

8,177

9,842

Interim Bonuses Paid

3

5

10

8

15

Terminal Bonuses Paid

16

28

62

57

143

Change in valuation of liab in respect of LP*

7,415

10,058

15,653

5,928

16,055

SURPLUS/ (DEFICIT) (D) = (A) - (B) - (C)

638

430

822

960

948

% chg

(33)

91

17

(1)

APPROPRIATIONS

Transfer to Shareholders' Account

390

765

671

718

786

Transfer to Other Reserves

-

-

-

-

-

Funds for future Appr - Prov for lapsed policy

(30)

(218)

(38)

(49)

-

Balance being Funds for Future Appropriations

218

(118)

190

290

161

Transfer to Balance

60

-

-

-

-

TOTAL (D)

638

430

822

960

948

Shareholder Accounts

390

765

671

718

786

Income from Investment

interest, Dividend & Rent - Gross

48

100

151

166

187

Other Investment Income

23

16

53

5

44

Other Income

-

-

0

11

0

Total Income

461

881

874

900

1,017

% chg

91

(1)

3

13

Operating Expenditure

10

239

70

67

108

Profit / (Loss) Before Tax

451

643

805

833

909

Tax

4

(83)

19

17

22

PAT

447

725

786

817

887

% chg

62

8

4

9

EPS

2.2

3.6

3.9

4.1

4.4

% chg

62

8

4

9

Nov 6, 2017

8

HDFC Standard Life Insurance Company Ltd | IPO Note

Exhibit 10: Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Source Of Fund

Share capital

1,995

1,995

1,995

1,995

1,998

Reserves

186

168

546

1,108

1,828

Shareholders’ funds

2,181

2,163

2,541

3,103

3,826

Borrowing

-

-

-

-

-

Policyholders fund

Policyholders liabilities

10,077

14,371

19,340

24,454

32,781

Provisions for linked liabilities

27,795

32,736

42,140

42,754

50,806

Funds for discontinued policies

538

1,472

2,780

2,973

2,994

Funds for future appropriation

649

313

464

705

867

Total liabilities

41,240

51,054

67,266

73,990

91,274

Application of Fund

INVESTMENTS:

Shareholders'

856

1,614

2,195

2,554

3,231

Policyholders'

11,215

14,706

19,908

25,863

34,692

Assets held to cover Linked Liabilities

28,333

34,207

44,920

45,727

53,800

LOANS

78

48

126

93

48

FIXED ASSETS

282

290

352

347

353

CURRENT ASSETS:

1,154

1,411

1,807

1,960

2,972

Cash and Bank Balances

464

445

573

727

797

Advances and Other Assets

690

966

1,234

1,233

2,174

CURRENT LIABILITIES

1,493

1,428

2,009

2,513

3,775

PROVISIONS

29

27

33

42

47

NET CURRENT ASSETS (C) = (A - B)

(368)

(45)

(235)

(594)

(850)

Miscellaneous Expenditure

844

235

-

-

-

TOTAL

41,240

51,054

67,266

73,990

91,274

% Growth YoY

24

32

10

23

Nov 6, 2017

9

HDFC Standard Life Insurance Company Ltd | IPO Note

Exhibit 11: Key Ratio

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Per Share Data (`)

EPS

2.2

3.6

3.9

4.1

4.4

BV

11

11

13

15

19

IEV

8,888

10,233

12,471

Valuation Ratio

PE (x)

130

80

74

71

66

P/BV (x)

27

27

23

19

15

P/EV (x)

7

6

5

ROE (%)

21

34

31

26

23

Solvency Ratio (%)

217

194

196

198

192

Opex Ratio (%)

Operation Exp

5.7

4.3

4.2

4.3

4.1

Commission

10.6

10.7

10.1

11.6

12.4

Total Cost

16

15

14

16

16

Persistency Ratio

13

73.3

78.9

80.9

25

64.0

67.5

73.3

37

65.1

60.1

63.9

49

64.2

63.4

58.3

61

39.8

50.0

56.8

Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Nov 6, 2017

10

HDFC Standard Life Insurance Company Ltd | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Nov 6, 2017

11