4QFY2017 Result Update | Banking

April 24, 2017

HDFC Bank

ACCUMULATE

CMP

`1,533

Performance Highlights

Target Price

`1,650

Particulars (` cr)

4QFY17

3QFY17

% chg (qoq)

4QFY16

% chg (yoy)

Investment Period

12 Months

NII

9,055

8,309

9.0

7,453

21.5

Pre-prov. profit

7,279

6,609

10.1

5,735

26.9

Stock Info

PAT

3,990

3,865

3.2

3,374

18.3

Source: Company, Angel Research

Sector

Banks

Market Cap (` cr)

392,774

HDFC Bank reported a satisfactory set of results for the quarter. PAT growth

of 18% YoY was backed by renewed momentum in loan growth and

Beta

0.8

improvement in NIM QoQ,with stable asset quality.

52 Week High / Low

1538/1085

Advances growth picked up again during the quarter: After some moderation in

Avg. Daily Volume

136,732

credit growth in Q3, the banks business started picking up in Q4 with 19.4%

Face Value (`)

2

growth. Domestic loan book grew by 23.7%. In Q3 the bank’s loan book growth

BSE Sensex

29,656

had moderated to 13.4%. The slowdown in the loan growth in Q3 was due to

Nifty

9,218

repayment of overseas loans to the tune of $ 2 Bn linked to FCNR deposit. HDFC

bank’s ability to push business growth post domentisation shows the strength in

Reuters Code

HDBK.BO

its business model and we believe it will be able to deliver 18-20% CAGR in loan

Bloomberg Code

HDFCB@IN

book over FY17-19

CASA growth to helped in lower cost of funds and improved NIM during the

Shareholding Pattern (%)

quarter: Deposit growth was strong 17.8% with strong accretion to CASA

base which went up to 48% vs 45.3% QoQ. Strong growth in low cost

Promoters

21.2

deposit helped NIM further expanding to 4.3%. We expect some moderation

MF / Banks / Indian Fls

16.3

in NIM going ahead; however HDFC Bank will continue to have one of the

FII / NRIs / OCBs

53.1

best margins among Indian banks. Overall we expect deposit to report 17%

Indian Public / Others

9.5

CAGR over FY17-19.

No sign of stress in asset quality, a big postive: Asset quality of the bank

remained largely stable with GNPAs at 1.05% and NNPAs at 0.33%.The

Abs.(%)

3m 1yr

3yr

bank has highlighted that there was no divergence observed by RBI for FY16

Sensex

8.3

15.5

29.6

with respect to NPAs. While there was a rise in provisions, part of this can be

HDFCB

22.6

34.0

111.9

attributed to general growth in business and to the Rs 250 cr worth of NPA

which were due in Q3, but the bank had used the RBI’s dispensation and not

accounted that as NPA. However, from pure operational point of view the

3-year price chart

credit cost of HDFC Bank remains under control.

1,600

Outlook and valuation: After some moderation in business growth HDFC Bank is

1,400

back with strong momentum during the quarter. We believe strong internal

capital generation will drive 20% earnings CAGR over FY17-19, which will be

1,200

backed by stable NIM and moderating credit cost. At the current market price,

1,000

the bank is trading at 3.3x FY2019E ABV. We Maintain ACCUMULATE rating, on

800

the stock, with a target price of `1,650.

600

Key financials (standalone)

400

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

NII

27,592

33,139

40,298

45,762

% chg

23.6

20.1

21.6

13.6

Source: Company, Angel Research

Net profit

12,296

14,549

17,857

20,971

% chg

21.2

18.3

22.7

17.4

NIM (%)

4.5

4.5

4.5

4.4

EPS (`)

48.6

56.8

69.7

81.8

P/E (x)

31.5

27.0

22.0

18.7

P/ABV (x)

5.4

4.6

4.0

3.3

Siddharth Purohit

RoA (%)

1.9

1.9

1.9

1.9

022 - 3935 7800 Ext: 6872

RoE (%)

18.3

18.3

19.2

19.0

Source: Company, Angel Research; Note: CMP as of April 24, 2017

Please refer to important disclosures at the end of this report

1

HDFC Bank | 4QFY2017 Result Update

Exhibit 1: 4QFY2017 performance (standalone)

Particulars (` cr)

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

% QoQ

% YoY

Interest earned

14,041

14,773

15,411

15,997

16,516

17,070

17,606

18,114

2.9%

13.2%

- on Advances / Bills

10,447

10,948

11,483

11,949

12,471

12,901

13,176

13,507

2.5%

13.0%

- on investments

3,281

3,398

3,651

3,790

3,809

3,818

4,049

4,268

5.4%

12.6%

- on balance with RBI & others

78

175

60

49

40

140

187

165

-11.6%

237.8%

- on others

234

252

217

209

196

211

194

174

-10.2%

-16.9%

Interest Expended

7,652

8,092

8,343

8,543

8,735

9,076

9,297

9,059

-2.6%

6.0%

Net Interest Income

6,389

6,681

7,069

7,453

7,781

7,994

8,309

9,055

9.0%

21.5%

Other income

2,462

2,552

2,872

2,866

2,807

2,901

3,143

3,446

9.7%

20.3%

- Fee & commission income

1,713

1,869

2,005

2,172

1,978

2,104

2,207

2,523

14.3%

16.1%

- Treasury income

126

162

328

116

277

284

399

180

-54.7%

56.2%

- Forex & derivative income

348

320

277

283

315

295

297

357

20.0%

26.1%

Others

275

201

262

295

237

219

240

386

60.9%

30.8%

Operating income

8,851

9,233

9,941

10,319

10,588

10,895

11,452

12,501

9.2%

21.1%

Operating expenses

4,001

4,190

4,205

4,584

4,769

4,870

4,843

5,222

7.8%

13.9%

- Employee expenses

1,359

1,414

1,431

1,498

1,585

1,657

1,689

1,553

-8.1%

3.7%

- Other Opex

2,642

2,776

2,774

3,086

3,184

3,213

3,154

3,669

16.3%

18.9%

Pre-provision Profit

4,850

5,043

5,736

5,735

5,819

6,025

6,609

7,279

10.1%

26.9%

Provisions & Contingencies

728

681

654

662

867

749

716

1,262

76.3%

90.5%

PBT

4,122

4,362

5,082

5,072

4,952

5,276

5,893

6,018

2.1%

18.6%

Provision for Tax

1,426

1,492

1,725

1,698

1,714

1,820

2,028

2,028

0.0%

19.4%

PAT

2,696

2,869

3,357

3,374

3,239

3,455

3,865

3,990

3.2%

18.3%

Effective Tax Rate (%)

34.6

34.2

33.9

33.5

34.6

34.5

34.4

33.7

Source: Company, Angel Research

April 24, 2017

2

HDFC Bank | 4QFY2017 Result Update

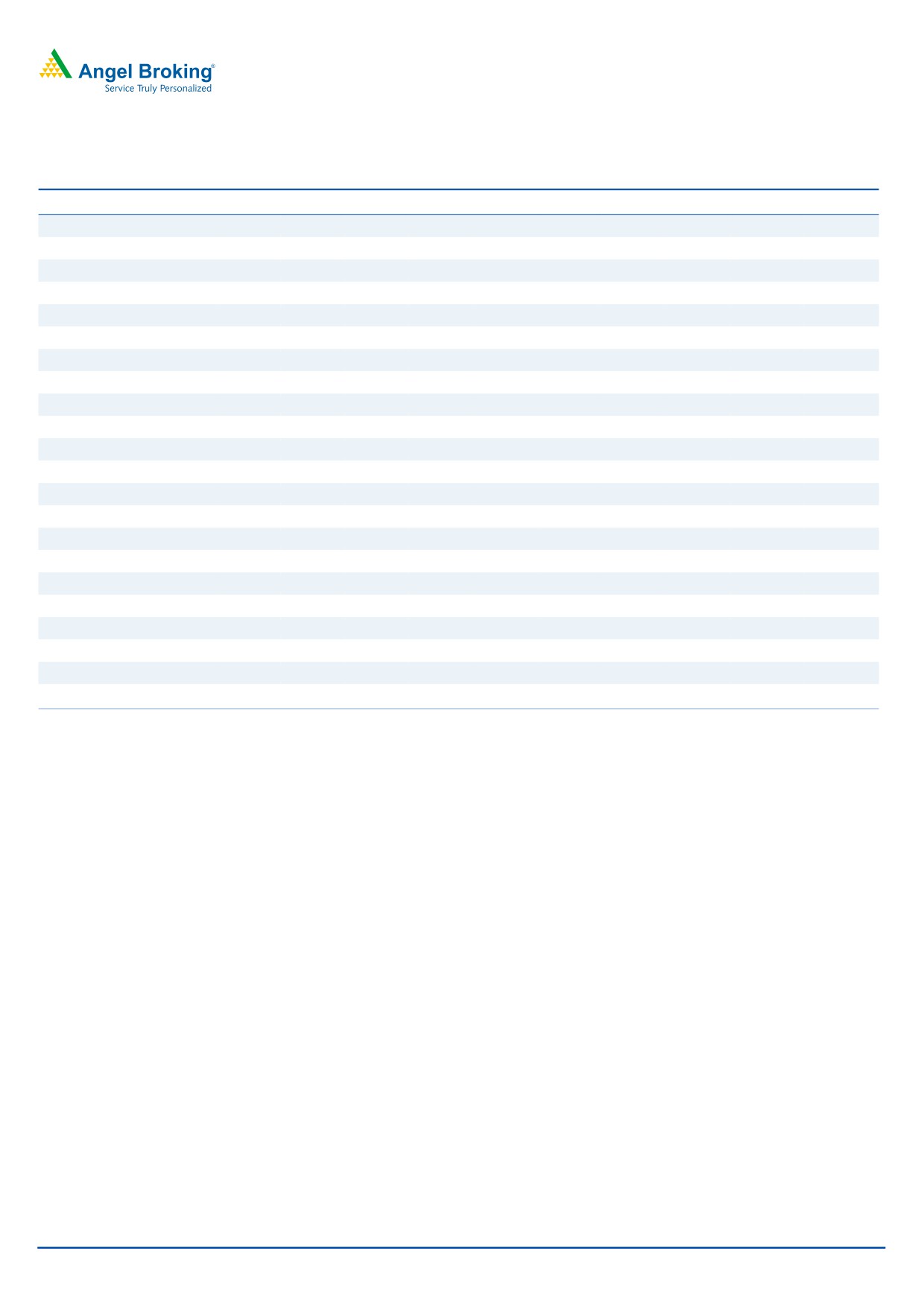

Advances growth picked up again during the quarter: After some moderation in

credit growth in Q3, the banks business started picking up in Q4FY17 with 19.4%

YoY growth, which was backed by 22.1% growth in retail loan book. Within the

retail loan book auto segment reported a healthy growth of 22.4% and personal

loans segment where HDFC bank has a strong market share grew by 34% YoY.

Credit cards another area of focus for the bank also had a healthy growth of

26.7%. Domestic loan book grew by 23.7%. In Q3 the bank’s loan book growth

had moderated to 13.4%, where in the domestic loan book had grown by 17.5%.

The slowdown in the loan growth in Q3 was due to repayment of overseas loans to

the tune of $ 2 Bn linked to FCNR deposit. HDFC bank’s ability to push business

growth post domentisation shows the strength in its business model and we believe

it will be able to deliver 18-20% CAGR in loan book over FY17-19

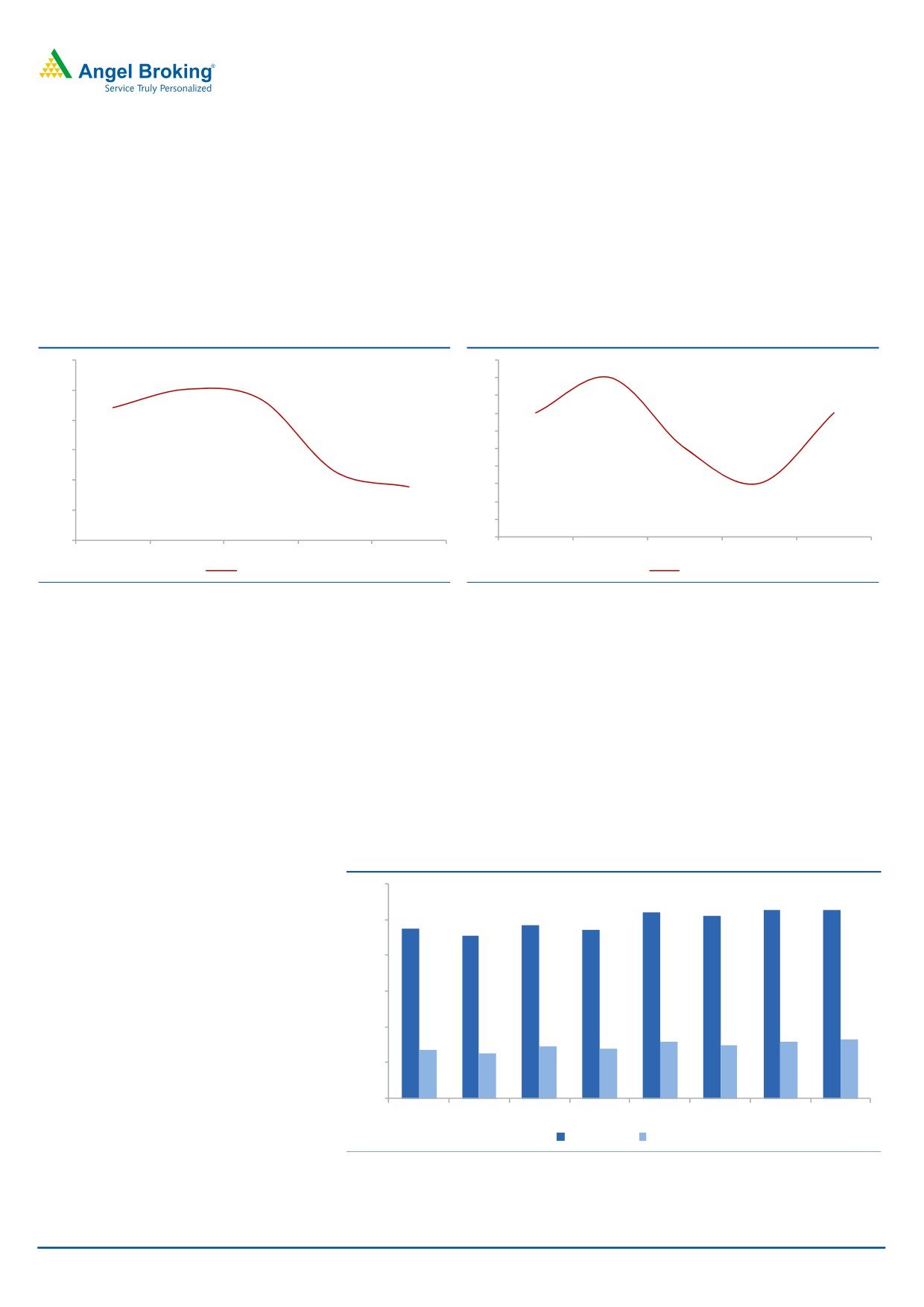

Exhibit 2: Advances growth picked up again (` cr)

Exhibit 3: Retail continues to drive the growth (%)

5,80,000

60

55

53

54

53

51

5,60,000

49

47

47

50

46

45

5,40,000

40

5,20,000

5,00,000

30

4,80,000

20

4,60,000

4,40,000

10

4,20,000

0

4,00,000

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Retail

Wholesale

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 4: Break Up Of Domestic Retail Book

Break Up Of Domestic Retail Bank ( Rs Cr)

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

% YoY

% QoQ

Auto

57,281

59,561

64,429

65,545

70,099

22.4%

6.9%

Personal Loans

37,704

41,059

45,024

46,826

50,545

34.1%

7.9%

Home Loans

31,860

33,605

33,574

35,423

38,379

20.5%

8.3%

Business Banking

61,089

60,444

65,794

63,582

71,188

16.5%

12.0%

Kisan Gold Card

22,934

22,403

24,881

23,888

26,742

16.6%

11.9%

Credit Cards

20,520

21,255

21,336

23,673

25,995

26.7%

9.8%

CV/CE

30,935

31,461

33,561

34,526

37,937

22.6%

9.9%

Others

14,644

15,151

16,276

16,190

17,803

21.6%

10.0%

Two Wheelers

6,383

6,614

7,118

7,107

7,345

15.1%

3.3%

Gold Loans

4,586

4,876

5,093

4,818

4,925

7.4%

2.2%

Loan Against Securities

1,897

1,886

2,052

2,249

2,798

47.5%

24.4%

Total

2,89,833

2,98,315

3,19,138

3,23,827

3,53,756

22.1%

9.2%

Source: Company, Angel Research

April 24, 2017

3

HDFC Bank | 4QFY2017 Result Update

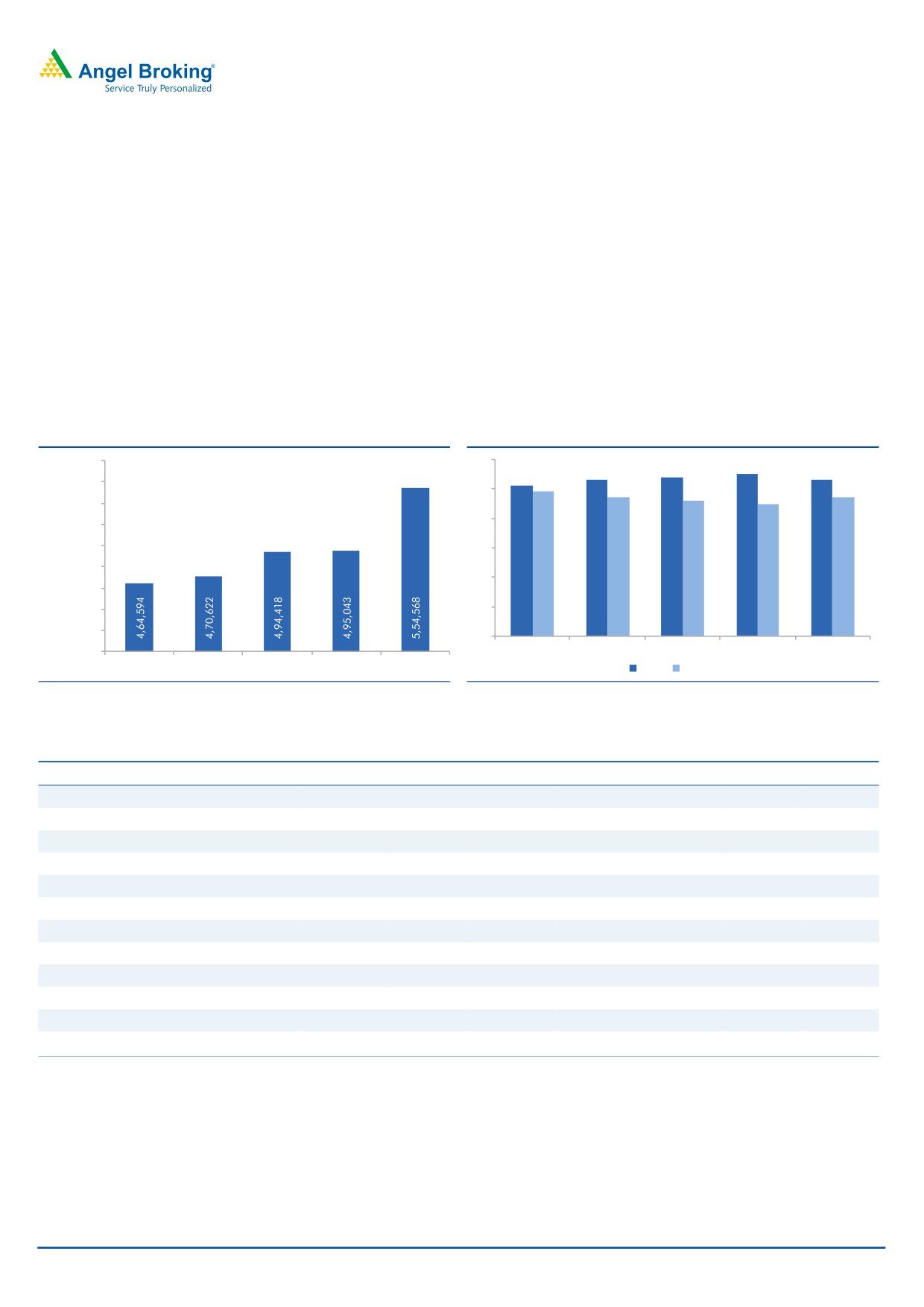

Deposit growth too was strong during the quarter: Deposit growth was strong

17.8% with strong accretion to CASA base which went up to 48% vs 45.3% QoQ.

In absolute terms CASA addition was `21,280 cr growing by 30.8% YoY,7% QoQ.

Strong growth in low cost deposit helped NIM further expanding to 4.3% up 20

bps QoQ. We expect some moderation in NIM going ahead; however HDFC Bank

will continue to have one of the best margins among Indian banks. Overall we

expect deposit to report 17% CAGR over FY17-19.

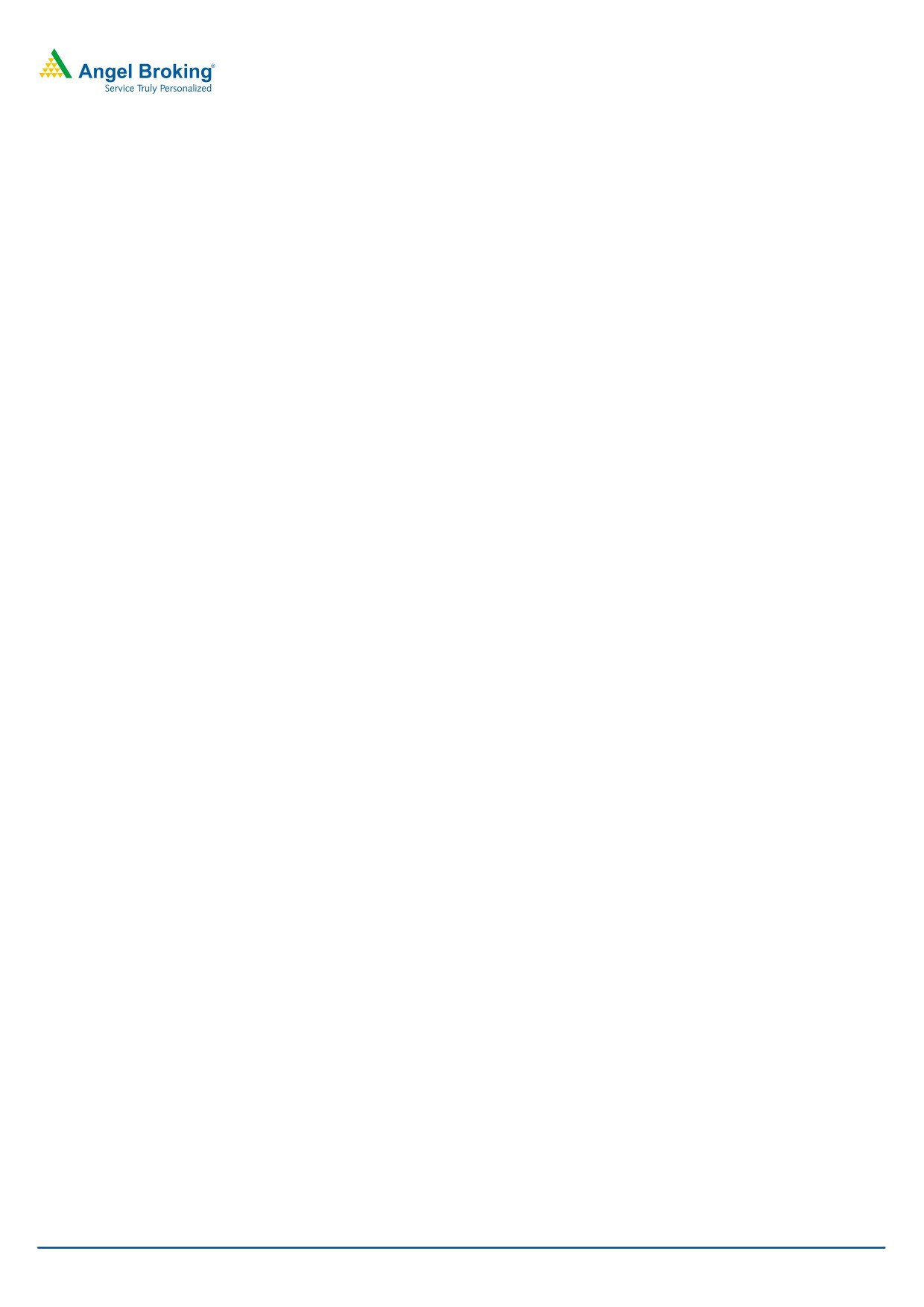

Exhibit 5: Deposit growth trend (` cr)

Exhibit 6: CASA ratio jumped sharply QoQ again (%)

6,60,000

60.0

6,40,000

48.0

50.0

45.4

6,20,000

43.2

39.9

40.4

6,00,000

40.0

5,80,000

30.0

5,60,000

5,40,000

20.0

5,20,000

10.0

5,00,000

4,80,000

0.0

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Source: Company, Angel Research,

Source: Company, Angel Research

Other income for the bank also picked up during the quarter growing by 20.3%

YoY. Fee income grew by 16.1% YoY and formed 73% of the non operating

income. However, treasury income was lower QoQ. NPA recovery witnessed

improvement QoQ.

Exhibit 7: Other Income Bifurcation

Other Income (` Cr)

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

% YoY

% QoQ

Fees Income

2,172

1,978

2,104

2,207

2,523

16.1%

14.3%

Forex

283

315

295

297

357

26.1%

20.0%

Profit on sale of investments

116

277

284

399

180

56.2%

-54.7%

NPA Recovery

295

237

219

240

386

30.8%

60.9%

Other Income

2,866

2,807

2,901

3,143

3,446

20.3%

9.7%

Fee Income as % of Other Income

76%

70%

73%

70%

73%

Source: Company, Angel Research

April 24, 2017

4

HDFC Bank | 4QFY2017 Result Update

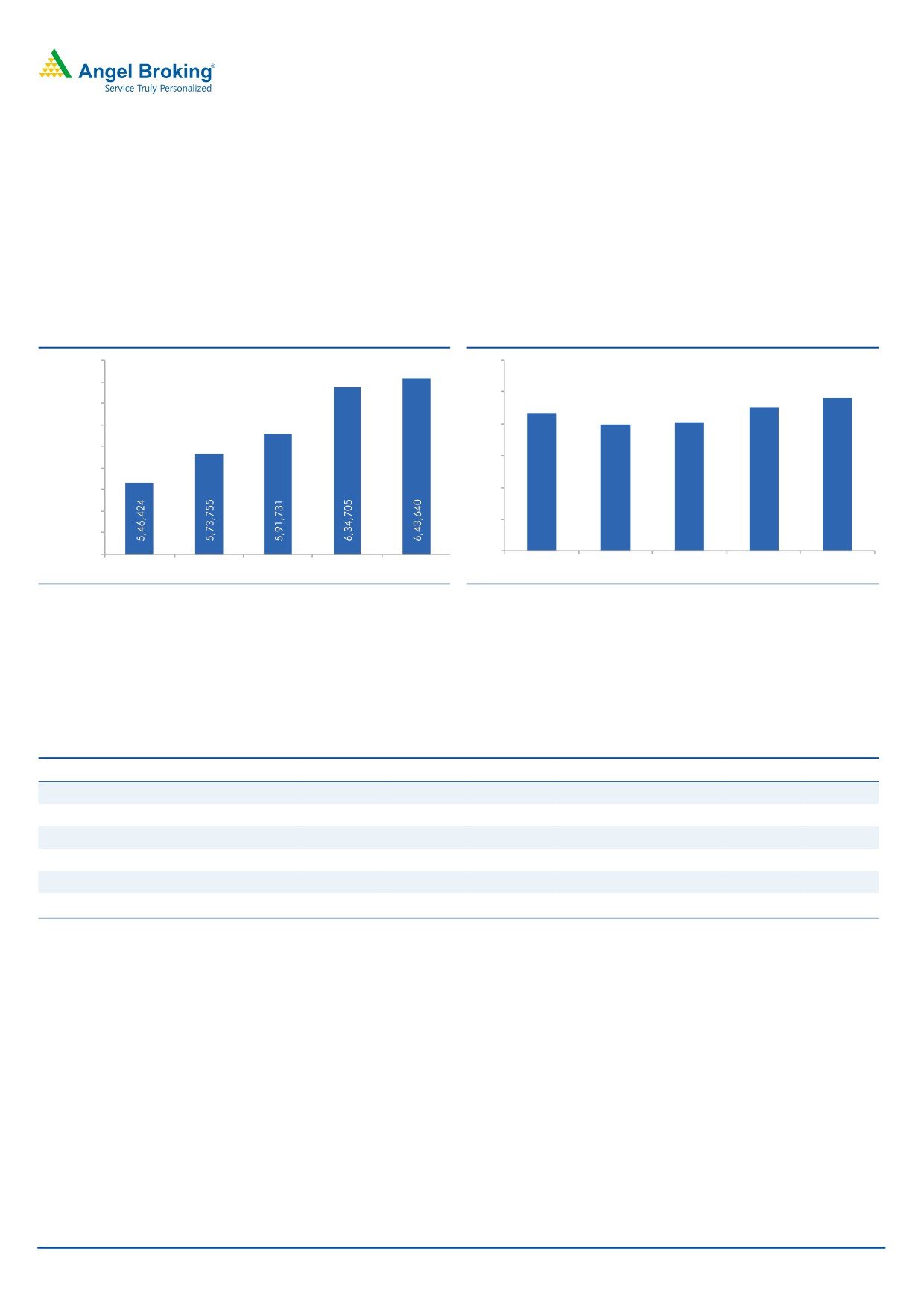

CASA growth to help in lower cost of funds and stable NIM going ahead: During

the quarter HDFC bank witnessed sharp surge in its low cost deposit base and

CASA ratio went up by 270 bps QoQ to 48% and this has helped in lower cost of

funds and improvement in NIM. On a sequential basis NIM has expanded from

4.10% to 4.3%. While NIM may not significantly improve from here on, HDFC is

likely to continue to have a strong retail book for many years to come and this

should help it enjoy similar NIM in the coming years.

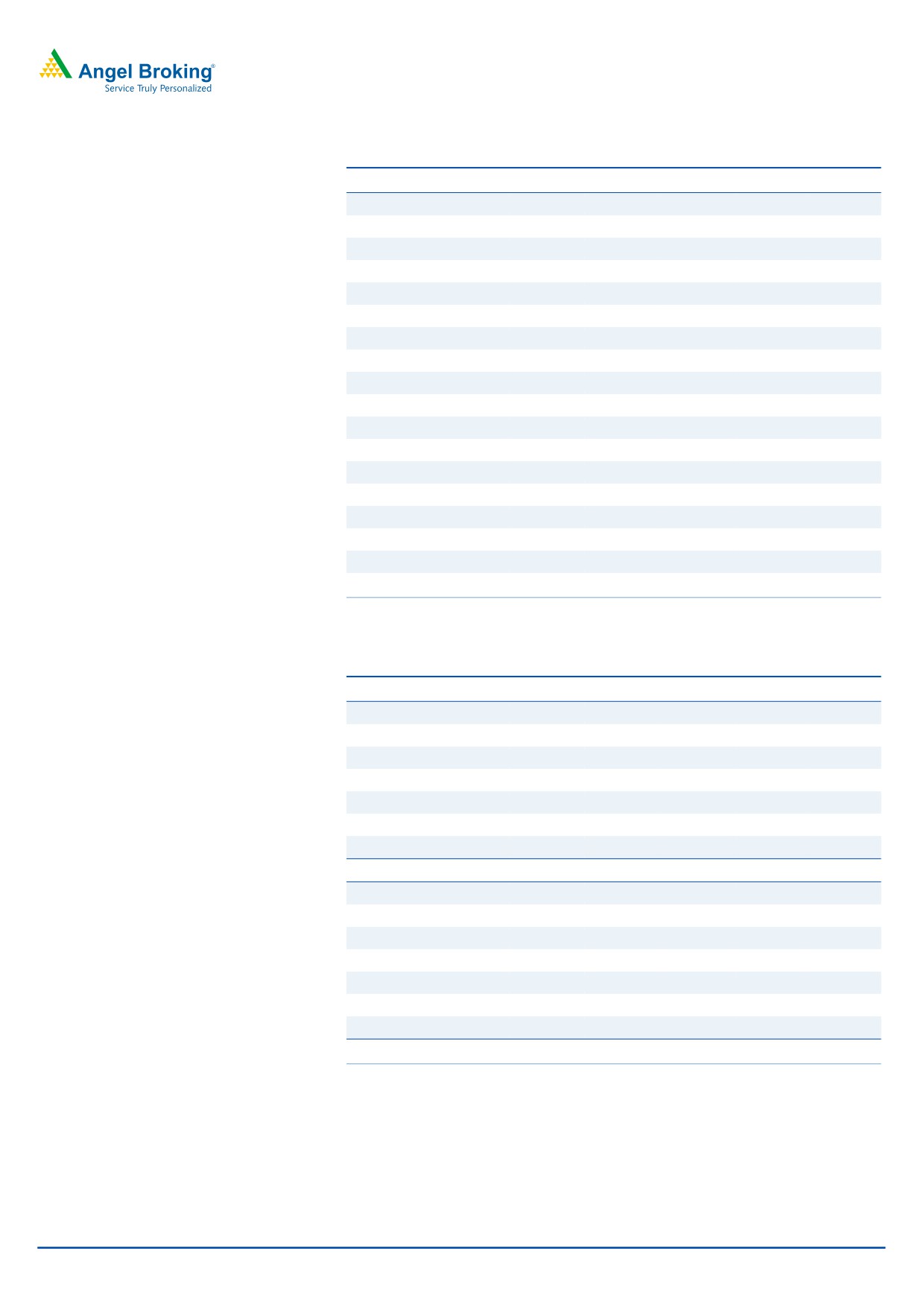

Exhibit 8: Cost/ Income remains under control

Exhibit 9: NIM got a further push

46.0

4.5

4.40

45.0

4.4

44.7

45.0

44.4

4.4

4.30

4.30

4.3

44.0

4.3

4.20

43.0

4.2

42.3

4.2

4.10

41.8

42.0

4.1

4.1

41.0

4.0

40.0

4.0

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Cost / Income

%

NIM %

Source: Company, Angel Research

Source: Company, Angel Research

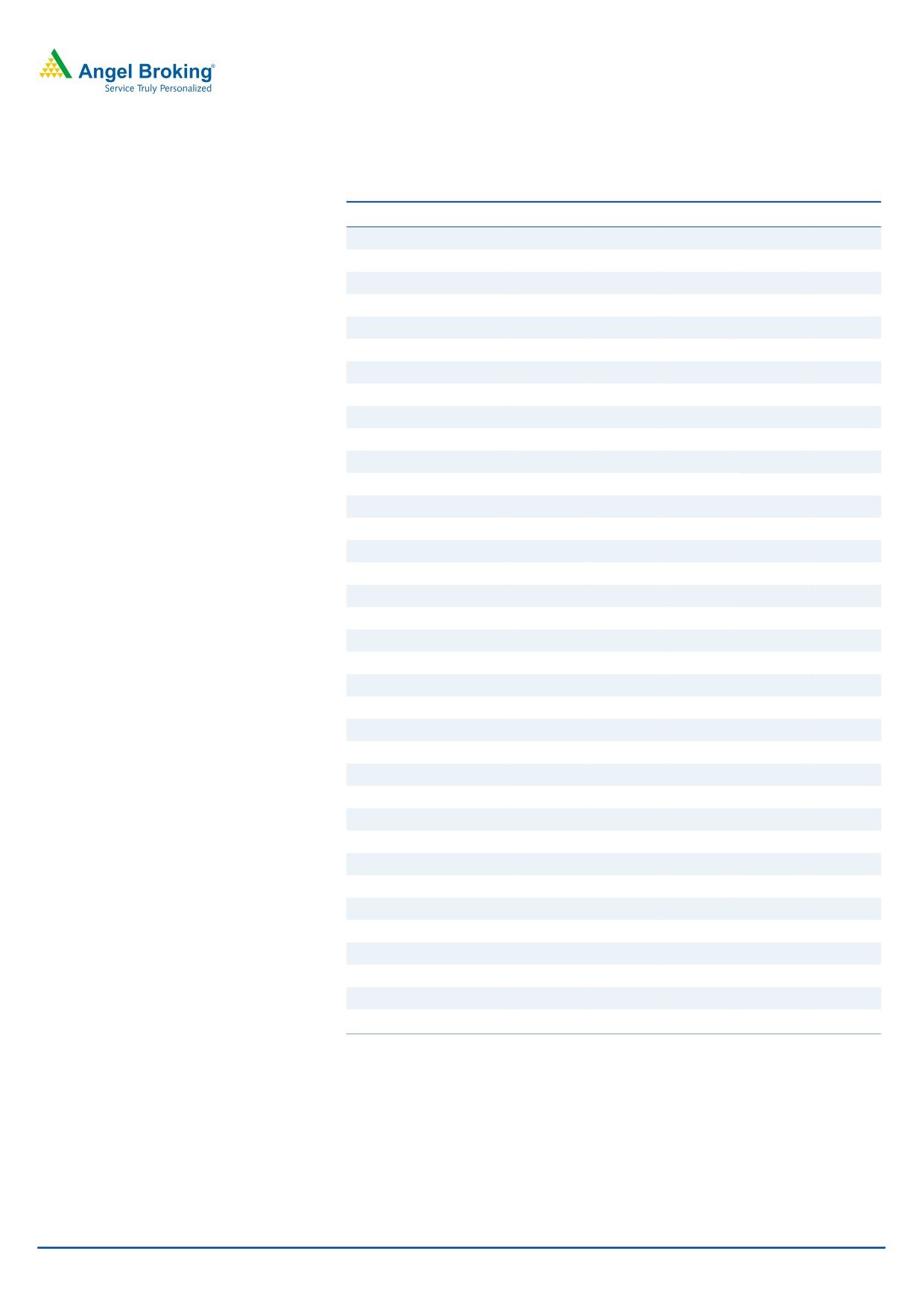

No sign of stress on asset quality: Asset quality of the bank remained largely

stable with GNPAs at 1.05% and NNPAs at 0.33%.The bank has highlighted

that there was no divergence observed by RBI for FY16 with respect to NPAs.

While there was a rise in provisions part of this can be attributed to general

growth in business and to the `250 cr worth of NPA which were due in Q3,

but the bank had used the RBI’s dispensation and not accounted that as NPA.

However, from pure operational point of view the credit cost of HDFC Bank

remains under control. We have factored in credit cost of 60 bps for FY18 and

FY19 in our model. HDFC Banks historical track record and ability to sail

through economic down turn without compromising on its credit quality gives

us comfort that credit cost will not materially rise in the near term.

Exhibit 10: GNPAs & NNPAs trend

1.20

1.04

1.05

1.05

1.02

0.95

0.97

1.00

0.91

0.94

0.80

0.60

0.40

0.32

0.32

0.33

0.29

0.30

0.27

0.28

0.25

0.20

0.00

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

GNPAs (%) NNPAs (%)

Source: Company, Angel Research

April 24, 2017

5

HDFC Bank | 4QFY2017 Result Update

Outlook & Valuation

After some moderation in business growth HDFC Bank is back with strong

momentum during the quarter. We believe strong internal capital generation will

drive 20% earnings CAGR over FY17-19, which will be backed by stable NIM and

moderating credit cost. HDFC Bank has always traded at a premium to other

banks in India, because of its best in class asset quality, superior NIM and

sustainable growth. We believe the bank will continue to attract premium

valuations going ahead as well. At the current market price, the bank is trading at

3.3x FY2019E ABV. We Maintain ACCUMULATE rating, on the stock, with a target

price of `1,650.

Company Background

HDFC Bank is the second-largest private sector bank in India with a pan-India

network of over 4,715 branches and nearly 12,260 ATMs. HDFC has been a

leader in the retail lending space in India and has consistently outpaced the

industry growth rate. Huge and increasing branch network has enabled the bank

in gaining a strong market share in the retail loans in India. This has also ensured

a higher share of low cost deposits (CASA) for the bank. The management has

time and again reiterated that in the retail loan space it will continue to have

strong market share in the coming years as well.

April 24, 2017

6

HDFC Bank | 4QFY2017 Result Update

Income Statement ( Standalone)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Net Interest Income

22,329

27,592

33,139

40,298

45,762

- YoY Growth (%)

20.8

23.6

20.1

21.6

13.6

Other Income

8,996

10,752

12,296

14,476

16,957

- YoY Growth (%)

13.6

19.5

14.4

17.7

17.1

Operating Income

31,326

38,343

45,435

54,773

62,719

- YoY Growth (%)

18.6

22.4

18.5

20.6

14.5

Operating Expenses

13,988

16,980

19,703

24,173

27,038

- YoY Growth (%)

16.2

21.4

16.0

22.7

11.9

Pre - Provision Profit

17,338

21,364

25,732

30,600

35,680

- YoY Growth (%)

20.7

23.2

20.4

18.9

16.6

Prov. & Cont.

2,076

2,726

3,593

3,948

4,381

- YoY Growth (%)

30.7

31.3

31.8

9.9

11.0

Profit Before Tax

15,262

18,638

22,139

26,652

31,299

- YoY Growth (%)

19.5

22.1

18.8

20.4

17.4

Prov. for Taxation

5,113

6,342

7,589

8,795

10,329

- as a % of PBT

33.5

34.0

34.3

33.0

33.0

PAT

10,150

12,296

14,549

17,857

20,971

- YoY Growth (%)

19.7

21.2

18.3

22.7

17.4

Balance Sheet ( Standalone)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Share Capital

501

506

513

513

513

Reserves & Surplus

61,508

72,172

85,502

99,311

1,20,282

Net Worth

62,009

72,678

86,014

99,824

1,20,794

Deposits

4,50,796

5,46,424

6,43,640

7,52,967

8,74,876

- Growth (%)

22.7

21.2

17.8

17.0

16.2

Borrowings

45,214

53,018

74,029

82,826

96,236

Other Liab & Prov.

32,484

36,725

56,709

60,237

69,990

Total Liabilities

5,90,503

7,08,846

8,60,392

9,95,855

11,61,897

Cash balances

27,510

30,058

37,897

43,672

48,118

Bank balances

8,821

8,861

11,055

12,800

13,998

Investments

1,51,642

1,63,886

2,14,463

2,48,479

2,88,709

Advances

3,65,495

4,64,594

5,54,568

6,61,303

7,73,631

- Growth (%)

20.6

27.1

19.4

19.2

17.0

Fixed Assets

3,122

3,343

3,627

4,668

5,424

Other Assets

33,913

38,104

38,782

24,932

32,017

Total Assets

5,90,503

7,08,846

8,60,392

9,95,855

11,61,897

April 24, 2017

7

HDFC Bank | 4QFY2017 Result Update

Ratio Analysis ( Standalone)

Y/E March

FY15

FY16

FY17

FY18E

FY19E

Profitability Ratios (%)

NIMs

4.4

4.5

4.5

4.5

4.4

Cost to Income Ratio

44.7

44.3

43.4

44.1

43.1

RoA

1.9

1.9

1.9

1.9

1.9

RoE

19.2

18.3

18.3

19.2

19.0

B/S ratios (%)

CASA Ratio

44.0

43.2

48.0

45.0

45.0

Credit/Deposit Ratio

81.1

85.0

86.2

87.8

88.4

CAR

16.8

15.5

14.7

15.4

15.6

- Tier I

13.7

13.2

12.9

13.7

14.2

Asset Quality (%)

Gross NPAs

0.9

0.9

1.0

1.1

1.1

Net NPAs

0.2

0.3

0.3

0.3

0.3

Slippages

1.6

1.6

1.5

1.5

1.0

Loan Loss Prov./Avg. Assets

0.6

0.6

0.6

0.6

0.6

Provision Coverage

74

70

74

69

69

Per Share Data (`)

EPS

40.5

48.6

56.8

69.7

81.8

ABVPS

247

287

336

390

471

DPS

8.0

9.5

11.5

13.5

13.5

Valuation Ratios

PER (x)

37.9

31.5

27.0

22.0

18.7

P/ABVPS (x)

6.3

5.4

4.6

4.0

3.3

Dividend Yield

0.6

0.7

0.8

1.0

1.0

DuPont Analysis (%)

NII

4.1

4.2

4.2

4.3

4.2

Non Interest Income

1.7

1.7

1.6

1.6

1.6

Total Revenues

5.8

5.9

5.8

5.9

5.8

Operating Cost

2.6

2.6

2.5

2.6

2.5

PPP

3.2

3.3

3.3

3.3

3.3

Total Provisions

0.4

0.4

0.5

0.4

0.4

PreTax Profit

2.8

2.9

2.8

2.9

2.9

Tax

0.9

1.0

1.0

0.9

1.0

ROA

1.9

1.9

1.9

1.9

1.9

Leverage

10.3

9.6

9.9

10.0

9.8

RoE (%)

19.2

18.3

18.3

19.2

19.0

April 24, 2017

8

HDFC Bank | 4QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

HDFC Bank

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

April 24, 2017

9