3QFY2016 Result Update | Banking

January 27, 2016

HDFC Bank

BUY

CMP

`1,040

Performance Highlights

Target Price

`1,262

Particulars (` cr)

3QFY16 2QFY16

% chg (qoq) 3QFY15

% chg (yoy)

Investment Period

12 Months

NII

7,069

6,681

5.8

5,700

24.0

Pre-prov. profit

5,736

5,043

13.7

4,779

20.0

Stock Info

PAT

3,357

2,869

17.0

2,795

20.1

Sector

Banking

Source: Company, Angel Research

Market Cap (` cr)

2,62,230

HDFC Bank continued its trend of delivering consistent earnings performances.

Beta

0.9

For 3QFY2016, it registered a net profit growth of 20.1% yoy, which is in line with

52 Week High / Low

1,127/944

Avg. Daily Volume

13,17,817

our expectation.

Face Value (`)

2

Advances grow strongly; Asset quality top-notch

BSE Sensex

24,486

During 3QFY2016, the loan book grew at a rapid pace, ie by 25.7% yoy. Retail

Nifty

7,436

growth picked further traction; the growth in the retail book was at 30.4% yoy,

Reuters Code

HDBK.BO

Bloomberg Code

HDFCB@IN

which took the total contribution of retail as a proportion of total advances book

to 49%. Corporate credit growth rate, at 20.7% yoy, stood well above that of the

industry.

Shareholding Pattern (%)

Current and Savings account deposits continued with their momentum, registering

Promoters

21.5

a spurt of 29.7% yoy and 20.6% yoy respectively leading to a qoq push in the

MF / Banks / Indian Fls

43.6

CASA ratio to 40.0%. Fixed deposits grew at 28.5% yoy, faster than the growth in

FII / NRIs / OCBs

18.7

the total CASA deposits (at 23.7% yoy).

Indian Public / Others

16.2

The bank’s non-interest income (excluding treasury) grew by 12.1% yoy, while fee

income grew at 11.0% yoy. The NIM came in as a surprise at 4.29%.

The asset quality continued to remain healthy with the Gross NPA rate at 0.97%,

Abs. (%)

3m 1yr

3yr

increasing marginally by 6bp qoq in a challenging macro environment. The Net

Sensex

(10.5)

(16.4)

21.8

NPA ratio stood at 0.29% as against 0.25% in 2QFY2016. The Provision

HDFC Bank

(5.5)

(0.3)

56.5

Coverage Ratio (PCR) stood at 70.4% vs 72.9% in the sequential previous quarter.

Outlook and valuation: Credit and deposit growth beat the industry growth rate,

3-year price chart

driven by strong retail business, healthy CASA and continued network expansion.

1,200

This provides strong visibility for a robust 20% earnings trajectory, coupled with

1,000

high quality of earnings. This in our view justifies a premium valuation multiple. At

800

the current market price, the bank is trading at

3.1x FY2017E ABV. We

600

recommend a Buy rating on the stock, with a target price of `1,262.

400

200

Key financials (standalone)

0

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

NII

18,483

22,396

27,415

33,929

% chg

16.9

21.2

22.4

23.8

Source: Company, Angel Research

Net profit

8,478

10,216

12,363

15,302

% chg

26.0

20.5

21.0

23.8

NIM (%)

4.4

4.3

4.3

4.3

EPS (`)

35.3

40.8

49.3

61.0

Vaibhav Agrawal

P/E (x)

29.4

25.5

21.1

17.0

022 - 3935 7800 Ext: 6808

P/ABV (x)

5.7

4.2

3.6

3.1

RoA (%)

1.9

1.9

1.9

1.9

Chintan Shah

RoE (%)

21.3

19.4

18.5

19.7

022 - 4000 3600 Ext: 6828

Source: Company, Angel Research; Note: CMP as of January 25, 2016

Please refer to important disclosures at the end of this report

1

HDFC Bank | 3QFY2016 Result Update

Exhibit 1: 3QFY2016 performance (standalone)

Particulars (` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

FY2015

FY2014

% chg

Interest earned

15,411

14,773

4.3

12,396

24.3

48,470

41,136

17.8

- on Advances / Bills

11,483

10,948

4.9

9,543

20.3

37,181

31,687

17.3

- on investments

3,651

3,398

7.5

2,696

35.5

10,277

9,037

13.7

- on balance with RBI & others

60

175

(66.0)

138

(56.9)

517

356

45.3

- on others

217

252

(13.9)

19

1,034.5

495

56

787.0

Interest Expended

8,343

8,092

3.1

6,696

24.6

26,074

22,653

15.1

Net Interest Income

7,069

6,681

5.8

5,700

24.0

22,396

18,483

21.2

Other income

2,872

2,552

12.6

2,535

13.3

8,996

7,920

13.6

Other income excl. treasury

2,544

2,389

6.5

2,269

12.1

8,415

7,809

7.8

- Fee & commission income

2,005

1,869

7.3

1,807

11.0

6,584

5,735

14.8

- Treasury income

328

162

101.9

266

23.5

582

110

426.9

- Forex & derivative income

277

320

(13.2)

253

9.5

1,028

1,401

(26.6)

Operating income

9,941

9,233

7.7

8,235

20.7

31,392

26,402

18.9

Operating expenses

4,205

4,190

0.4

3,456

21.7

13,988

12,042

16.2

- Employee expenses

1,431

1,414

1.2

1,133

26.4

4,751

4,179

13.7

- Other Opex

2,774

2,776

(0.1)

2,324

19.4

9,237

7,863

17.5

Pre-provision Profit

5,736

5,043

13.7

4,779

20.0

17,404

14,360

21.2

Provisions & Contingencies

654

681

(4.0)

560

16.7

2,076

1,588

30.7

PBT

5,082

4,362

16.5

4,218

20.5

15,329

12,772

20.0

Provision for Tax

1,725

1,492

15.6

1,424

21.2

5,113

4,294

19.1

PAT

3,357

2,869

17.0

2,795

20.1

10,216

8,478

20.5

Effective Tax Rate (%)

33.9

34.2

(26)bp

33.8

20bp

33.4

33.6

(26)bp

Source: Company, Angel Research

January 27, 2016

2

HDFC Bank | 3QFY2016 Result Update

Exhibit 2: 3QFY2016 performance analysis

Particulars

3QFY16

2QFY16

% chg (qoq) 3QFY15

% chg (yoy)

Balance sheet

Advances (` cr)

4,36,364

4,18,541

4.3

3,47,088

25.7

Deposits (` cr)

5,23,997

5,06,909

3.4

4,14,128

26.5

Credit-to-Deposit Ratio (%)

83.3

82.6

71bp

83.8

(54)bp

Current deposits (` cr)

74,044

69,811

6.1

57,105

29.7

Saving deposits (` cr)

1,35,432

1,31,522

3.0

1,12,284

20.6

CASA deposits (` cr)

2,09,476

2,01,333

4.0

1,69,389

23.7

CASA ratio (%)

40.0

39.7

26bp

40.9

(93)bp

CAR (%)

15.9

15.5

40bp

15.7

20bp

Tier 1 CAR (%)

13.2

12.8

40bp

12.0

123bp

Profitability Ratios (%)

Reported NIM

4.3

4.2

10bp

4.4

(10)bp

Cost-to-income ratio

42.3

45.4

(308)bp

42.0

33bp

Asset quality

Gross NPAs (` cr)

4,255

3,828

11.2

3,468

22.7

Gross NPAs (%)

0.97

0.91

6bp

1.0

(2)bp

Net NPAs (` cr)

1,261

1,038

21.5

904

39.5

Net NPAs (%)

0.3

0.3

4bp

0.3

3bp

Provision Coverage Ratio (%)

70.4

72.9

(252)bp

73.9

(357)bp

Source: Company, Angel Research

Advances growth above industry

During 3QFY2016, the loan book grew at a rapid pace, ie by 25.7% yoy. Retail

growth picked further traction; the growth in the retail book was at 30.4% yoy,

which took the total contribution of retail as a proportion of total advances book to

49%. Corporate credit growth rate, at 20.7% yoy, stood well above that of the

industry.

Current and Savings account deposits continued with their momentum, registering

a spurt of 29.7% yoy and 20.6% yoy respectively leading to a qoq push in the

CASA ratio to 40.0%. Fixed deposits grew at 28.5% yoy, faster than the growth in

the total CASA deposits (at 23.7% yoy).

Home loan advances rose by 42.3% yoy, witnessing the highest growth among

retail advances, followed by personal loans which grew by 41.4% yoy. The spurt in

home loan advances was mainly due to some pick-up in housing demand and

also on account of the bank taking a higher proportion of loan origination on its

own books from HDFC.

January 27, 2016

3

HDFC Bank | 3QFY2016 Result Update

Exhibit 3: Home loans/Personal loans aid Retail loan book growth

Particulars (` cr)

3QFY16

2QFY16

% chg (qoq) 3QFY15

% chg (yoy)

% to total

Auto Loans

49,755

46,009

8.1

40,014

24.3

23.2

CVCE

14,950

14,799

1.0

13,212

13.2

7.0

Two Wheelers

5,213

4,730

10.2

3,959

31.7

2.4

Personal Loans

35,071

31,881

10.0

24,804

41.4

16.3

Business Banking

26,936

27,288

(1.3)

21,340

26.2

12.5

Loans Against Secu.

1,129

1,078

4.7

1,194

(5.4)

0.5

Credit Cards

19,689

18,000

9.4

15,364

28.2

9.2

Home loans

28,419

28,483

(0.2)

19,977

42.3

13.2

Others

33,710

32,187

4.7

24,970

35.0

15.7

Retail Advances

2,14,872

2,04,455

5.1

1,64,834

30.4

100.0

Source: Company, Angel Research

NIM fairly strong at 4.3%: Non-interest income growth slows

down

The bank’s non-interest income (excluding treasury) grew by 12.1% yoy, while fee

income grew at 11.0% yoy. The NIM came in as a surprise at 4.29%.

Exhibit 4: Advances growth above industry

Exhibit 5: Reported NIM at 4.3%

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

(%)

(%)

4.7

30.0

4.5

4.40

4.40

4.34

4.30

22.5

4.3

4.20

4.1

15.0

3.9

7.5

3.7

-

3.5

Advances

Deposits

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 6: CASA ratio increases marginally qoq

Exhibit 7: Trends in CASA growth

(%)

CASA growth (%)

SA growth (%)

30.0

45.0

44.0

23.7

40.9

40.0

20.0

39.6

39.7

15.6

40.0

20.6

10.0

12.0

35.0

-

30.0

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research, Note: *adjusting for FCNR (B) deposits

Source: Company, Angel Research

January 27, 2016

4

HDFC Bank | 3QFY2016 Result Update

Exhibit 8: Capital adequacy remains healthy

Exhibit 9: Branch expansion continues

Tier-I CAR (%)

Tier-II CAR (%)

Branches

ATMs (RHS)

20.0

4,500

11,843

13,500

16.8

11,962

11,686

15.7

15.7

15.9

11,473

11,256

15.5

4,000

12,000

15.0

3.1

3,500

2.9

2.7

2.7

3.7

10,500

3,000

2,500

9,000

10.0

2,000

7,500

13.7

12.8

12.8

13.2

12.0

1,500

5.0

6,000

1,000

4,500

500

-

-

3,000

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research Note *as per Basel III **including profits

Source: Company, Angel Research

Fee growth was sluggish on some slowdown in TPD fees owing to a change in the

mix of products and due to some regulatory changes like commission up-fronting.

Also, certain fees were waived off as a festive season incentive to customers, which

also impacted fee growth. Despite slow growth in other income, the cost to income

ratio was at 43.7%.

Exhibit 10: Non-interest income (excl. treasury)

Particulars (` cr)

3QFY16 2QFY16

% chg (qoq) 3QFY15

% chg (yoy)

Fees & Commission

2,005

1,869

7.3

1,807

11.0

Treasury Income

328

162

101.9

266

23.5

Forex Income & Others

277

320

(13.2)

253

9.5

Other

262

201

30.5

210

25.1

Other income

2,872

2,552

12.6

2,535

13.3

Other income excl. treasury

2,544

2,389

6.5

2,269

12.1

Source: Company, Angel Research

Asset quality remains top-notch

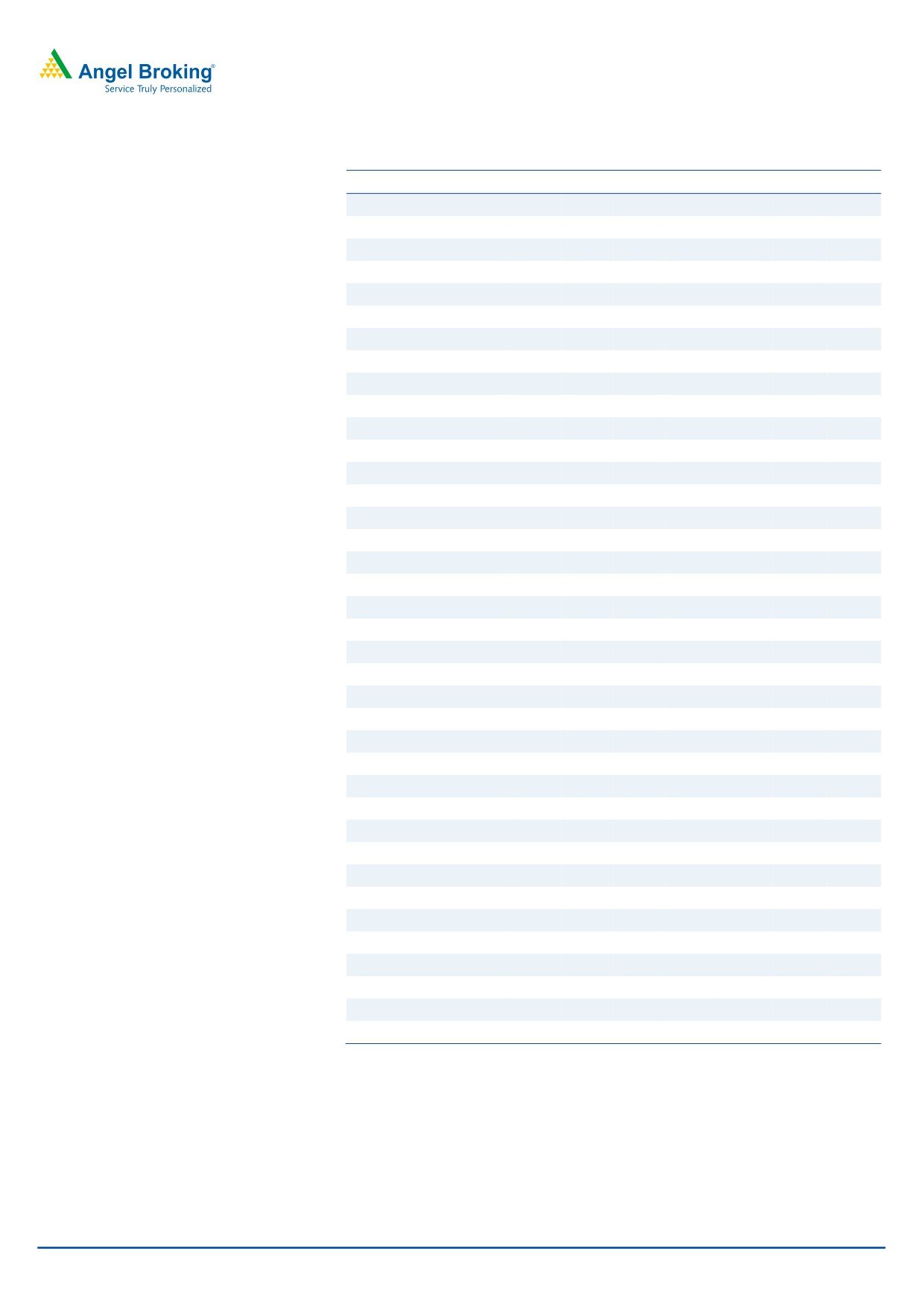

The asset quality continued to remain healthy with the Gross NPA rate at 0.97%,

increasing marginally by 6bp qoq in a challenging macro environment. The Net

NPA ratio stood at 0.29% as against 0.25% in 2QFY2016. The Provision Coverage

Ratio (PCR) stood at 70.4% vs 72.9% in the sequential previous quarter.

Total restructured loans were stable at 0.1% of gross advances as of December 31,

2015 (as against 0.1% as of December 31, 2014). Also, currently the bank does

not have any SDR asset or 5/25 refinancing.

January 27, 2016

5

HDFC Bank | 3QFY2016 Result Update

Exhibit 11: Asset quality remains top-notch

Gross NPAs (%)

Net NPAs (%)

PCR (Calc, %, RHS)

1.2

80.0

73.9

73.9

72.9

0.9

71.9

70.4

0.6

70.0

0.3

0.0

60.0

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research

January 27, 2016

6

HDFC Bank | 3QFY2016 Result Update

Outlook & Valuation

We believe HDFC Bank is among the most competitive banks in the sector, with an

A-list Management at the helm of affairs, which has one of the best track records

in the industry. We believe the bank is well positioned for high qualitative growth,

with strong CAR, and top-notch asset quality. The bank’s credit and deposit growth

for the quarter under review was above industry (driven by strong retail business),

and enjoys healthy CASA. The bank is continuously expanding its branch network.

Credit and deposit growth beat the industry growth rate, driven by strong retail

business, healthy CASA and continued network expansion. This provides strong

visibility for a robust 20% earnings trajectory, coupled with high quality of

earnings. This in our view justifies a premium valuation multiple. At the current

market price, the bank is trading at 3.1x FY2017E ABV. We recommend a Buy

rating on the stock, with a target price of `1,262.

Exhibit 12: Recommendation summary

CMP

Tgt. Price

Upside

FY2017E

FY2017E

FY2017E

FY15-17E

FY2017E

FY2017E

Company

Reco.

(`)

(`)

(%)

P/ABV (x)

Tgt. P/ABV (x)

P/E (x)

EPS CAGR (%)

RoA (%)

RoE (%)

HDFCBk

Buy

1,040

1,262

21.4

3.1

3.8

17.0

22.4

1.9

19.7

ICICIBk*

Buy

236

304

28.7

1.6

1.7

9.7

13.4

1.6

14.7

YesBk

Buy

677

825

21.8

1.8

2.2

9.7

20.5

1.6

19.6

AxisBk

Buy

420

531

26.4

1.7

2.2

9.7

18.4

1.8

18.9

SBI*

Buy

183

237

29.3

0.9

1.0

7.5

17.8

0.7

12.7

FedBk

Neutral

47

-

-

0.9

0.9

8.5

(2.9)

0.9

10.8

SIB

Neutral

18

-

-

0.7

0.7

5.6

21.6

0.7

11.6

BOB

Neutral

130

-

-

0.7

0.7

6.1

17.5

0.6

10.6

PNB

Neutral

92

-

-

0.4

0.4

3.4

28.5

0.7

12.0

BOI

Neutral

100

-

-

0.3

0.7

3.0

14.0

0.3

7.6

IndBk

Neutral

93

-

-

0.3

0.3

3.1

19.4

0.6

8.6

Vijaya Bank

Neutral

32

-

-

0.4

0.3

4.8

14.1

0.4

8.8

OBC

Neutral

108

-

-

0.2

0.3

2.4

65.5

0.5

9.4

Allahabad BankNeutral

53

-

-

0.2

0.2

1.9

56.2

0.6

11.9

UnionBk

Neutral

119

-

-

0.3

0.3

3.0

18.1

0.6

11.4

CanBk

Neutral

184

-

-

0.3

0.2

2.6

12.0

0.6

11.2

IDBI#

Neutral

59

-

-

0.4

0.5

4.2

61.6

0.6

9.3

DenaBk

Neutral

36

-

-

0.3

0.4

3.5

45.6

0.4

7.9

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), #Without adjusting for SASF

Company Background

HDFC Bank is the second-largest private sector bank in India with a pan-India

network of over 4,200 branches and nearly 11,800 ATMs. The bank is promoted

and 21.6% owned by HDFC, India's largest housing Finance Company. HDFC

Bank has been at the forefront of modern retail banking in India. The bank has

pioneered the transaction banking model in India, which has enabled it to garner

substantial CASA deposits as well as fee income, while the focus on retail lending

(which forms ~49% of total loans) has further helped the bank in consistently

maintaining above-industry margins.

January 27, 2016

7

HDFC Bank | 3QFY2016 Result Update

Income statement

Y/E March (` cr)

FY11

FY12

FY13

FY14

FY15

FY16E

FY17E

Net Interest Income

10,543

12,885

15,811

18,483

22,396

27,415

33,929

- YoY Growth (%)

25.7

22.2

22.7

16.9

21.2

22.4

23.8

Other Income

4,335

5,784

6,853

7,920

8,996

10,894

13,373

- YoY Growth (%)

8.8

33.4

18.5

15.6

13.6

21.1

22.8

Operating Income

14,878

18,668

22,664

26,402

31,392

38,309

47,302

- YoY Growth (%)

20.3

25.5

21.4

16.5

18.9

22.0

23.5

Operating Expenses

7,153

9,278

11,236

12,042

13,988

17,087

21,103

- YoY Growth (%)

20.4

29.7

21.1

7.2

16.2

22.2

23.5

Pre - Provision Profit

7,725

9,391

11,428

14,360

17,404

21,222

26,199

- YoY Growth (%)

20.2

21.6

21.7

25.7

21.2

21.9

23.5

Prov. & Cont.

1,907

1,877

1,677

1,588

2,076

2,315

2,799

- YoY Growth (%)

(10.9)

(1.5)

(10.7)

(5.3)

30.7

11.5

20.9

Profit Before Tax

5,819

7,513

9,751

12,772

15,329

18,906

23,400

- YoY Growth (%)

35.7

29.1

29.8

31.0

20.0

23.3

23.8

Prov. for Taxation

1,892

2,346

3,024

4,294

5,113

6,543

8,098

- as a % of PBT

32.5

31.2

31.0

33.6

33.4

34.6

34.6

PAT

3,926

5,167

6,726

8,478

10,216

12,363

15,302

- YoY Growth (%)

33.2

31.6

30.2

26.0

20.5

21.0

23.8

Balance sheet

Y/E March (` cr)

FY11

FY12

FY13

FY14

FY15

FY16E

FY17E

Share Capital

465

469

476

480

501

501

501

Reserves & Surplus

24,914

29,455

35,738

42,999

61,508

71,087

82,930

Deposits

2,08,586

2,46,706

2,96,247

3,67,337

4,50,796

5,63,495

7,04,368

- Growth (%)

24.6

18.3

20.1

24.0

22.7

25.0

25.0

Borrowings

7,447

13,250

16,963

23,395

29,571

36,354

44,864

Tier 2 Capital

6,947

10,597

16,044

16,044

15,642.80

15,252

14,870

Other Liab. & Prov.

28,993

37,432

34,864

41,344

32,484

40,401

49,750

Total Liabilities

2,77,353

3,37,910

4,00,332

4,91,600

5,90,503

7,27,090

8,97,284

Cash Balances

25,101

14,991

14,627

25,346

27,511

28,175

35,218

Bank Balances

4,568

5,947

12,653

14,238

8,821

14,542

17,946

Investments

70,929

97,483

1,11,614

1,20,951

1,66,460

2,03,919

2,48,657

Advances

1,59,983

1,95,420

2,39,721

3,03,000

3,65,495

4,53,214

5,61,985

- Growth (%)

27.1

22.2

22.7

26.4

20.6

24.0

24.0

Fixed Assets

2,171

2,347

2,703

3,028

3,122

3,728

4,463

Other Assets

14,601

21,722

19,014

25,036

19,095

23,512

29,015

Total Assets

2,77,353

3,37,910

4,00,332

4,91,600

5,90,503

7,27,090

8,97,284

- Growth (%)

24.7

21.8

18.5

22.8

20.1

23.1

23.4

January 27, 2016

8

HDFC Bank | 3QFY2016 Result Update

Ratio Analysis (standalone)

Y/E March

FY11

FY12

FY13 FY14

FY15

FY16E

FY17E

Profitability ratios (%)

NIMs

4.4

4.5

4.6

4.4

4.3

4.3

4.3

Cost to Income Ratio

48.1

49.7

49.6

45.6

44.6

44.6

44.6

RoA

1.6

1.7

1.8

1.9

1.9

1.9

1.9

RoE

16.7

18.7

20.3

21.3

19.4

18.5

19.7

B/S ratios (%)

CASA Ratio

52.7

48.4

47.4

44.8

44.0

42.6

41.9

Credit/Deposit Ratio

76.7

79.2

80.9

82.5

81.1

80.4

79.8

CAR

16.2

16.5

16.8

16.1

17.1

15.6

14.3

- Tier I

12.2

11.6

11.1

11.8

13.6

12.8

12.0

Asset Quality (%)

Gross NPAs

1.0

1.0

1.0

1.0

0.9

0.8

0.7

Net NPAs

0.2

0.2

0.2

0.3

0.2

0.2

0.2

Slippages

1.1

1.0

1.0

2.0

1.9

1.7

1.7

Loan Loss Prov. /Avg. Assets

0.3

0.4

0.3

0.4

0.4

0.3

0.3

Provision Coverage

82.5

82.3

79.3

73.6

73.9

73.4

70.3

Per Share Data (`)

EPS

16.9

22.0

28.3

35.3

40.8

49.3

61.0

ABVPS (75% cover.)

109.1

127.5

152.2

181.0

247.2

285.4

332.2

DPS

3.3

4.3

5.5

6.9

6.9

9.5

11.8

Valuation Ratios

PER (x)

61.6

47.2

36.8

29.4

25.5

21.1

17.0

P/ABVPS (x)

9.5

8.2

6.8

5.7

4.2

3.6

3.1

Dividend Yield

0.3

0.4

0.5

0.7

0.7

0.9

1.1

DuPont Analysis

NII

4.2

4.2

4.3

4.1

4.1

4.2

4.2

(-) Prov. Exp.

0.8

0.6

0.5

0.4

0.4

0.4

0.3

Adj. NII

3.5

3.6

3.8

3.8

3.8

3.8

3.8

Treasury

(0.0)

(0.0)

0.0

0.0

0.1

0.1

0.1

Int. Sens. Inc.

3.4

3.5

3.9

3.8

3.9

3.9

3.9

Other Inc.

1.8

1.9

1.8

1.8

1.5

1.5

1.5

Op. Inc.

5.2

5.5

5.7

5.6

5.4

5.5

5.5

Opex

2.9

3.0

3.0

2.7

2.6

2.6

2.6

PBT

2.3

2.4

2.6

2.9

2.8

2.9

2.9

Taxes

0.8

0.8

0.8

1.0

0.9

1.0

1.0

RoA

1.6

1.7

1.8

1.9

1.9

1.9

1.9

Leverage

10.7

11.1

11.2

11.2

10.3

9.9

10.5

RoE

16.7

18.7

20.3

21.3

19.4

18.5

19.7

Note: FY2013 onwards ratios reflect revised accounting practices

January 27, 2016

9

HDFC Bank | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

HDFC Bank

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 27, 2016

10