2QFY2016 Result Update | IT

January 27, 2016

HCL Technologies

BUY

CMP

`840

Performance Highlights

Target Price

`1,038

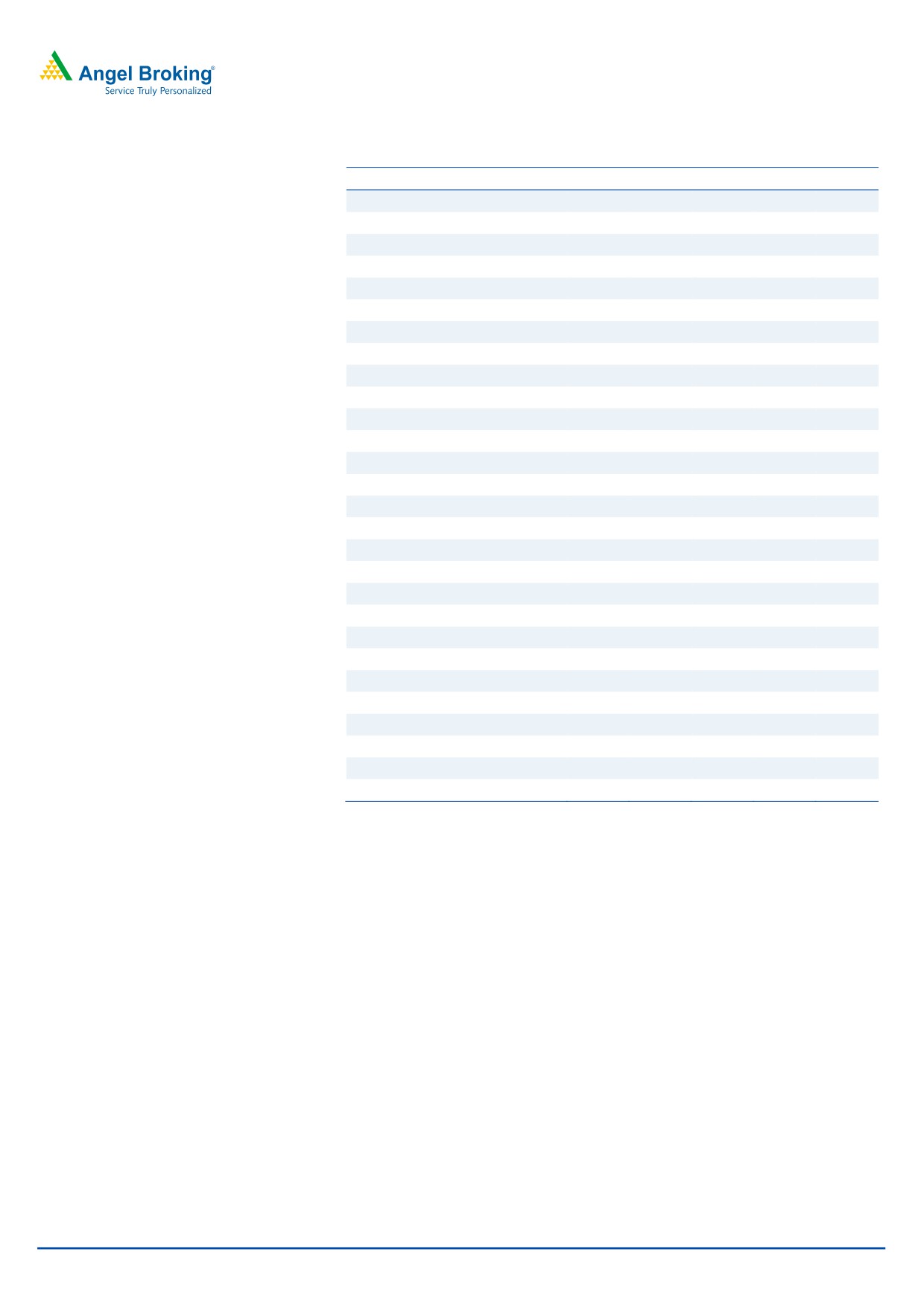

(` cr) - Consl.

2QFY16 1QFY16

% chg (qoq) 2QFY15

% chg (yoy)

Investment Period

12 Months

Net revenue

10,341

10,097

2.4

9,283

11.4

EBIT

2,072

1,979

4.7

2,210

(6.2)

Stock Info

Adj. EBIT margin (%)

20.0

20.6

56bps

23.8

(377)bps

Sector

IT

PAT

1,920

1,823

5.3

1,915

0.3

Market Cap (` cr)

118,376

Source: Company, Angel Research

Net Debt (` cr)

(10,553)

HCL Technologies (HCL Tech) reported better-than-expected results for

Beta

0.6

2QFY2016. It posted a sales growth of 1.4% qoq to US$1,566mn V/s an

52 Week High / Low

1,058/798

expected US$1,568mn. In constant currency (CC) terms, revenue grew 2.1% qoq.

Avg. Daily Volume

175,777

On the operating front, the EBITDA margin came in at 21.5% (V/s an expected

Face Value (`)

2

20.9%) an uptick of 58bp qoq. Consequently, the PAT came in at `1,920cr (V/s

BSE Sensex

24,486

an expected `1,739cr), a growth of 5.3% qoq. On back of a strong order book,

Nifty

7,436

the company expects 2HFY2016 to be better than 1HFY2016. We maintain our

Reuters Code

HCLT.BO

Buy recommendation on the stock with a price target of `1,038.

Bloomberg Code

HCLT@IN

Quarterly highlights: The company has reported better-than-expected results for

the quarter. It posted a sales growth of 1.4% qoq to US$1,566mn V/s an

expected US$1,568mn. In constant currency (CC) terms, revenue grew 2.1% qoq.

Shareholding Pattern (%)

In CC terms, the key geography which drove sales was Americas, which grew

Promoters

60.6

5.5% qoq; while Europe and ROW posted a dip of 2.4% qoq and 3.4% qoq,

MF / Banks / Indian Fls

7.5

respectively. On the operating front, the EBITDA margin came in at 21.5% (V/s an

FII / NRIs / OCBs

28.8

expected 20.9%) an uptick of 58bp qoq. Consequently, the PAT came in at

Indian Public / Others

3.1

`1,920cr (V/s an expected `1,739cr), a growth of 5.3% qoq. On the productivity

front, the blended utilization came in at 84.7% V/s 83.6% in 1QFY2016, while the

attrition rate came in at 6.4% V/s 7.1% in 1QFY2016.

Abs.(%)

3m 1yr

3yr

Sensex

(10.9)

(16.4)

21.8

Outlook and valuation: We expect HCL Tech to post a USD and INR revenue

HCL Tech

(1.6)

2.1

147.0

CAGR of 13.0% and 13.2%, respectively, over FY2015-17E. On back of strong

order book and given the attractive valuations, we recommend a Buy on the

stock.

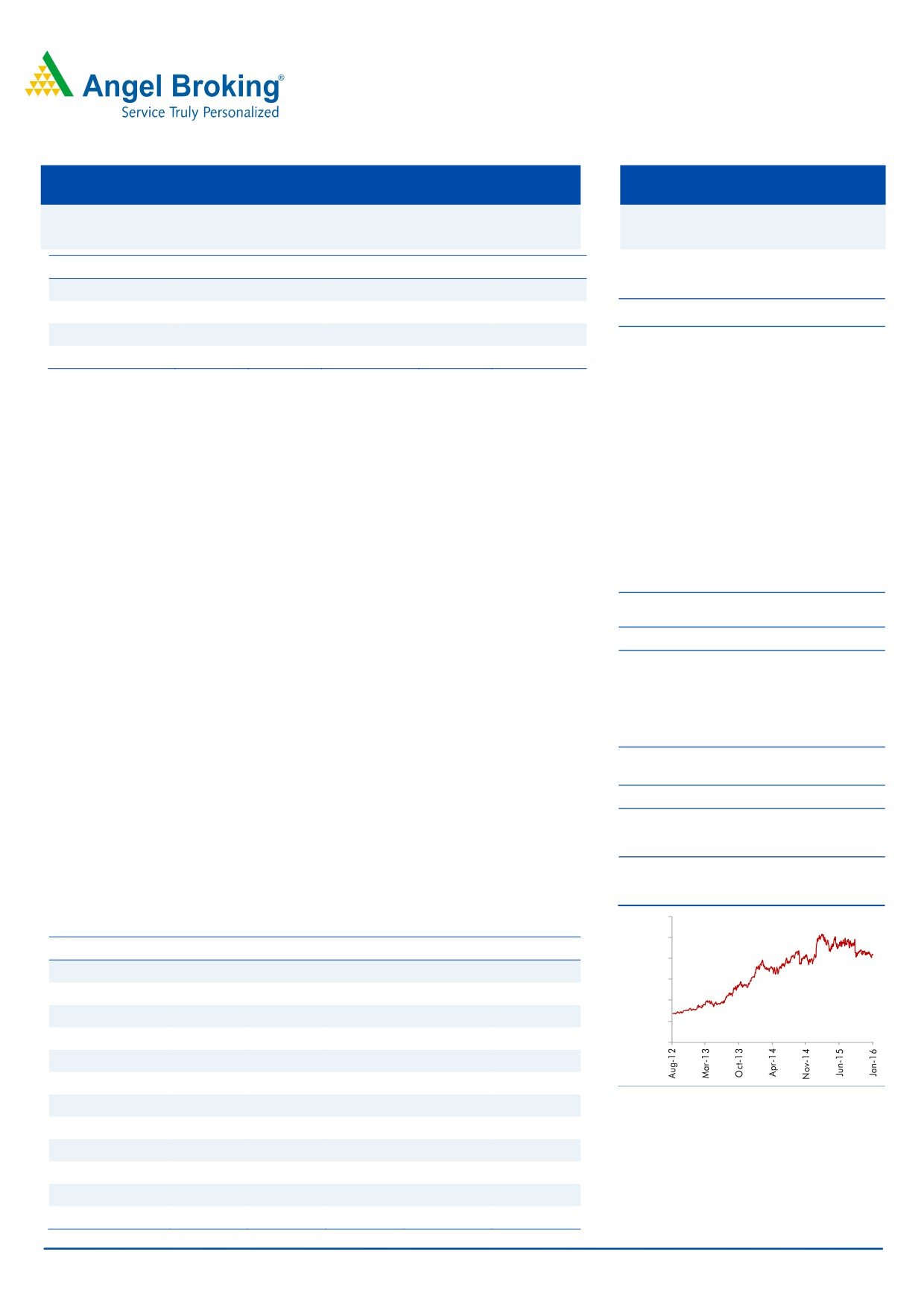

3-year price chart

1,200.0

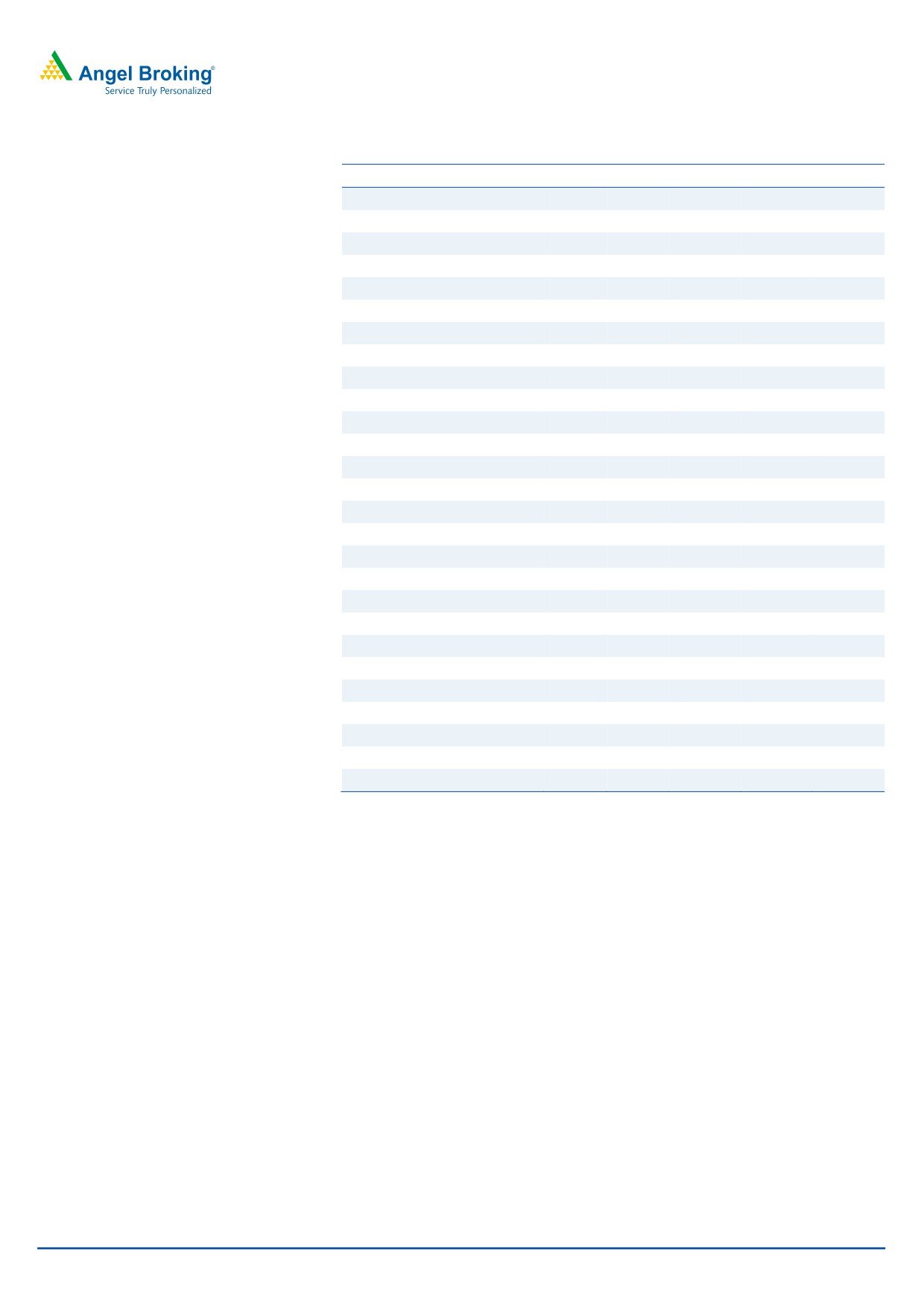

Key financials (Consolidated, US GAAP)

1,000.0

Y/E June (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

800.0

Net sales

25,770

32,908

37,061

42,038

47,503

600.0

% chg

22.5

27.7

12.6

13.4

13.0

400.0

Net profit

4,082

6,190

7,253

7,216

8,142

200.0

% chg

61.6

51.6

17.2

(0.5)

12.8

0 .0

EBITDA margin (%)

22.6

26.2

23.5

21.2

21.5

EPS (`)

28.9

43.9

51.4

51.1

57.7

Source: Company, Angel Research

P/E (x)

29.0

19.1

16.3

16.4

14.6

P/BV (x)

8.3

5.9

4.8

3.5

2.7

RoE (%)

28.6

30.8

29.3

21.5

18.8

RoCE (%)

22.3

25.8

23.1

17.6

16.3

Sarabjit kour Nangra

EV/Sales (x)

4.4

3.3

2.9

2.3

1.9

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

19.6

12.7

12.3

11.0

8.7

Source: Company, Angel Research; Note: CMP as of January 25, 2016

Please refer to important disclosures at the end of this report

1

HCL Technologies | 2QFY2016 Result Update

Exhibit 1: 2QFY2016 performance (Consolidated, US GAAP)

Y/E June (` cr)

2QFY16

1QFY16

% chg (qoq)

2QFY15

% chg (yoy)

1HFY16

1HFY15

% chg(yoy)

Net revenue

10,341

10,097

2.4

9,283

11.4

20,438

18,018

13.4

Cost of revenue

6,768

6,623

2.2

5,849

15.7

13,391

11,371

17.8

Gross profit

3,573

3,474

2.8

3,434

4.0

7,047

6,647

6.0

SG&A expense

1,348

1,360

(0.9)

1,115

20.9

2,708

2,136

26.8

EBITDA

2,225

2,114

5.3

2,319

(4.1)

4,339

4,511

(3.8)

Dep. and amortization

153

135

13.3

109

40.4

288

213

35.2

EBIT

2,072

1,979

4.7

2,210

(6.2)

4,051

4,298

(5.7)

Other income

355

241

47.3

216

64.4

596

559

PBT

2,427

2,220

9.3

2,426

0.0

4,647

4,857

(4.3)

Income tax

508

494

2.8

510

(0.4)

1,002

1,029

(2.6)

PAT

1,920

1,726

11.2

1,915

0.3

3,646

3,828

(4.8)

Forex gain/(loss)

0

0

-

-

-

(38)

-

Adjusted PAT

1,920

1,823

5.3

1,915

0.3

3,646

3,788

(3.7)

EPS

13.6

12.9

5.4

13.6

0.3

25.8

27.0

(4.2)

Gross margin (%)

34.6

34.4

15bp

37.0

(244)bp

34.5

36.9

(241)bp

EBITDA margin (%)

21.5

20.9

58bp

25.0

(346)bp

21.2

25.0

(381)bp

EBIT margin (%)

20.0

19.6

44bp

23.8

(377)bp

19.8

23.9

(403)bp

PAT margin (%)

18.6

18.1

51bp

20.6

(206)bp

17.8

21.0

(318)bp

Source: Company, Angel Research

Exhibit 2: 2QFY2016 - Actual vs Angel estimates

(` cr)

Actual

Estimate

Variation (%)

Net revenue

10,341

10,331

0.1

EBITDA margin (%)

21.5

20.5

102bps

PAT

1,920

1,739

10.4

Source: Company, Angel Research

Inline sales growth

The company has reported better-than-expected results for the quarter. It posted a

sales growth of 1.4% qoq to US$1,566mn V/s an expected US$1,568mn. In

constant currency (CC) terms, revenue grew 2.1% qoq. In rupee terms, revenues

came in at `10,341cr (V/s an expected `10,331cr), a growth of 2.4% qoq.

In CC terms, the key geography that drove sales was Americas, which grew 5.5%

qoq; while Europe and ROW posted a dip of

2.4% qoq and

3.4% qoq,

respectively. Among services, all posted robust growth with the exception of

Engineering and R&D Services which dipped by 1.5% qoq CC; Application

Services, Infrastructure Services and Business Services posted a qoq CC growth of

2.0%, 3.4% and 8.0%, respectively.

Among verticals, Manufacturing and Life sciences & Healthcare were soft; the

former posted a dip of 1.3% qoq CC while the latter posted a flat growth of 0.3%

qoq CC. Other verticals like Financial Services, Public Services, Retail & CPG and

Telecommunications & Media posted a qoq CC growth of 1.9%, 8.4%, 10.3% and

3.4%, respectively.

January 27, 2016

2

HCL Technologies | 2QFY2016 Result Update

Strong client addition continued for the company in CY2015: US$50Mn+ clients

were up by 3, US$30mn+ clients were up by 5, and US$20mn+ clients were up

by 5. Continuing its momentum of deal wins, HCL Tech booked business in excess

of USD 1bn in TCV during the quarter, including 8 transformational deals. The

broad-based business wins, across service lines and industry verticals were driven

by the company’s next-generation offerings. Thus, on back of strong order book,

the company expects 2HFY2016 to be better than 1HFY2016.

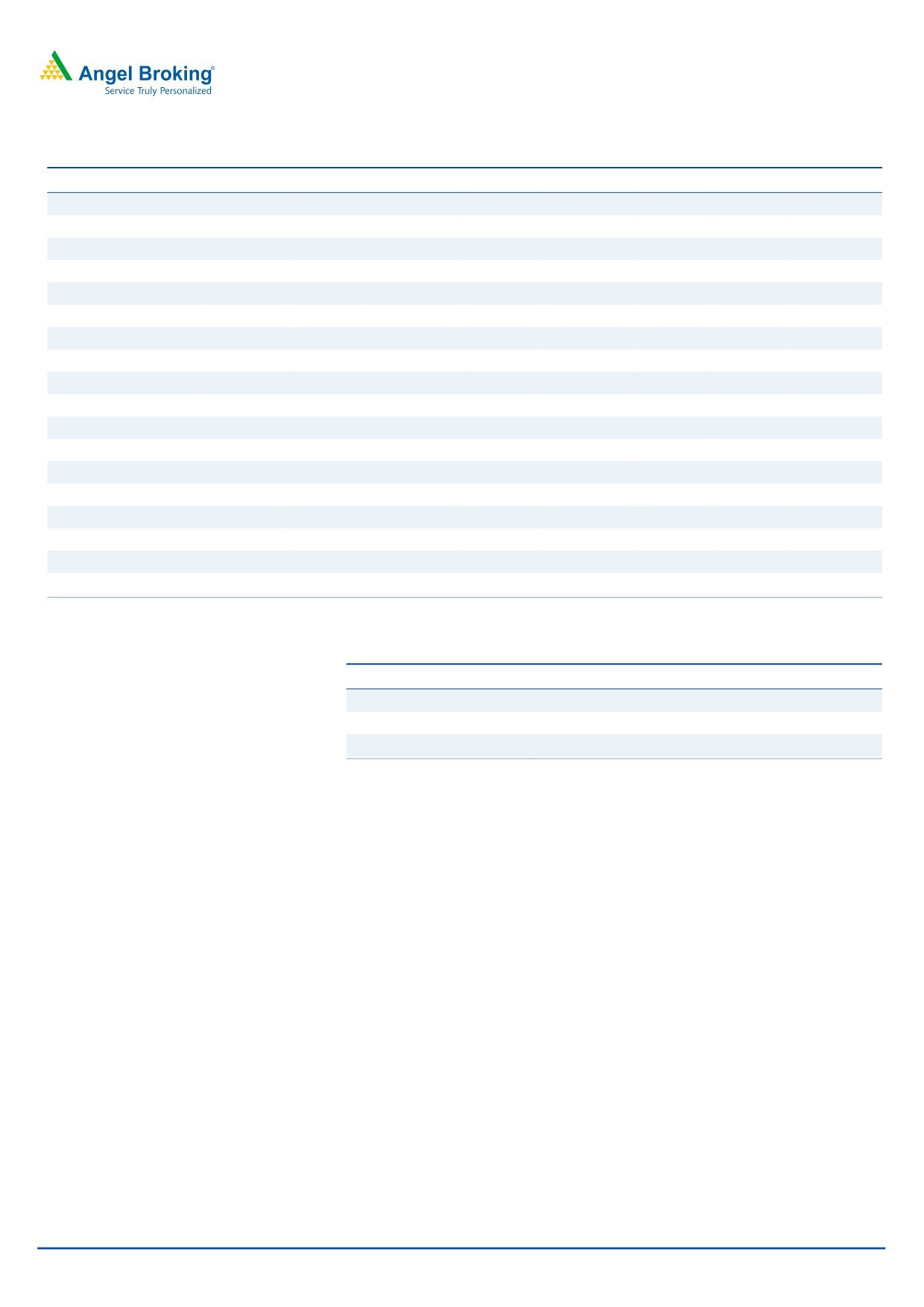

Exhibit 3: Revenue growth trend (USD terms)

1,700

5

4.0

4

1,600

4

1,500

3.1

3

1,400

3

2

1,300

2

1,200

1.4

1

1,100

0.5

1

1,491

1,491

1,538

1,545

1,566

1,000

0.0

0

2QFY15

3QFY15

4QFY15

1QFY2016

2QFY2016

Revenue (USD)

qoq growth (%)

Source: Company, Angel Research

In terms of services, the Engineering & R&D services (which constitute 18.6% of

sales) posted a de-grew 1.5% qoq CC growth, while Application services (which

constitute 40.4% of sales) grew by 2.0% qoq in CC terms. Infrastructure services,

another important segment of the company, which contributes by around 18.6% to

overall sales, posted a growth of 3.4% qoq. Business services, which constituted

5.5% of sales, grew 8.0% qoq on CC basis.

Exhibit 4: Revenue growth trend (Service wise)

% of revenue

% growth CC (qoq)

% growth (yoy)

Application services

40.4

2.0

6.4

Infrastructure services

18.6

3.4

16.4

Business services

5.5

8.0

23.9

Engineering and R&D services

18.6

(1.5)

23.0

Source: Company, Angel Research

Industry segment wise, the company’s Financial Services vertical (contributed

25.9% to revenue) posted a 1.9% qoq growth in CC terms. The Manufacturing

vertical (contributed 31.5% to revenue) posted a 1.3% qoq de-growth in CC terms.

Public services; Life sciences & Healthcare; and Telecommunication, Media,

Publishing & Entertainment reported a qoq growth of 8.4%, 0.3%, and 3.4%, all in

CC terms, respectively. Retail & CPG (contributed 9.5% to revenue) on the other

hand reported a growth of 10.3% qoq in revenue in CC terms, during the quarter.

January 27, 2016

3

HCL Technologies | 2QFY2016 Result Update

Exhibit 5: Revenue growth trend (Industry wise)

% of revenue

% growth (CC qoq)

% growth (yoy)

Financial services

25.9

1.9

10.1

Manufacturing

31.5

(1.3)

12.3

Life sciences & Healthcare

12.2

0.3

27.7

Public Services

10.6

8.4

17.8

Retail & CPG

9.5

10.3

12.6

Telecom, MPE

9.7

3.4

23.6

Source: Company, Angel Research

Among geographies, in CC terms, Americas grew by 5.5% qoq, Europe de-grew

by 2.4% qoq, while RoW de-grew by 3.4% qoq on a sequential basis.

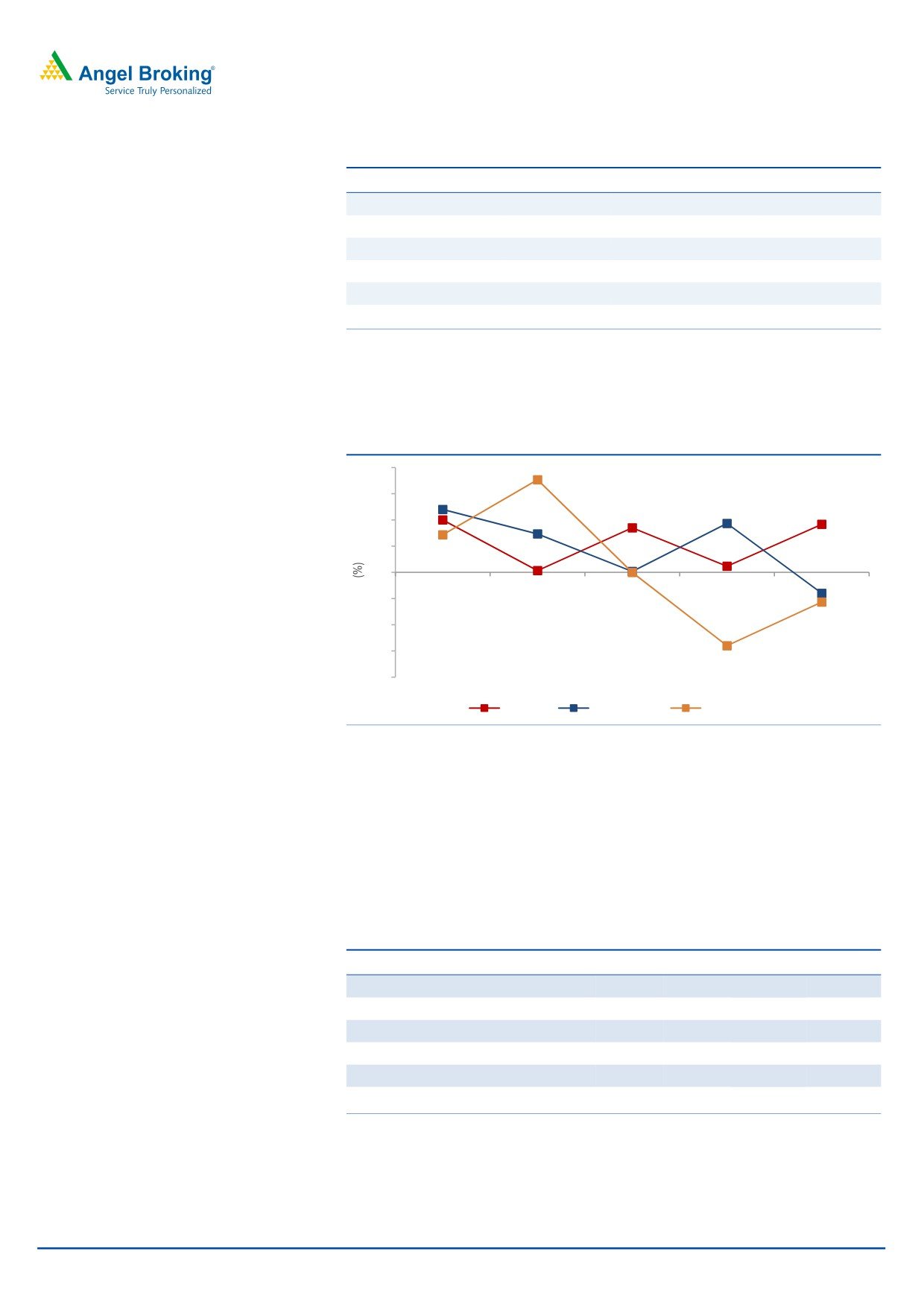

Exhibit 6: Revenue growth trend (Geography wise in CC terms)

12

10.6

9

7.2

5.1

6

4.4

5.5

6.0

3

5.6

4.3

0.1

0.7

0

(2.4)

0.2

(0.0)

(3)

(3.4)

(6)

(8.4)

(9)

(12)

2QFY15

3QFY15

4QFY15

1QFY2016

2QFY2016

US

Europe

Rest of the world

Source: Company, Angel Research

Hiring and utilization

During the quarter, the overall headcount of HCL Tech decreased by 7,889 to

1,03,696 employees. Gross addition during the quarter was of 6,234 employees.

The attrition rate in IT Services inched up to 16.7% vs 16.3% in 1QFY2016. The

blended utilization level of the company inched up to 84.7% V/s 83.6% in

1QFY2016.

Exhibit 7: Hiring trend

Particulars

2QFY15 3QFY15 4QFY15 1QFY16 2QFY16

Technical

91,595

95,190

97,135

96,541

94,652

Support

8,645

8,994

8,972

9,030

9,044

Total employee base

1,00,240

1,04,184

1,06,107

105,571

103,696

Gross addition

11,734

11,041

9,448

7,889

6,234

Net addition

4,718

3,944

1,923

(1559)

(1875)

Attrition - IT services (LTM) - %

16.4

16.2

16.5

16.3

16.7

Source: Company, Angel Research

January 27, 2016

4

HCL Technologies | 2QFY2016 Result Update

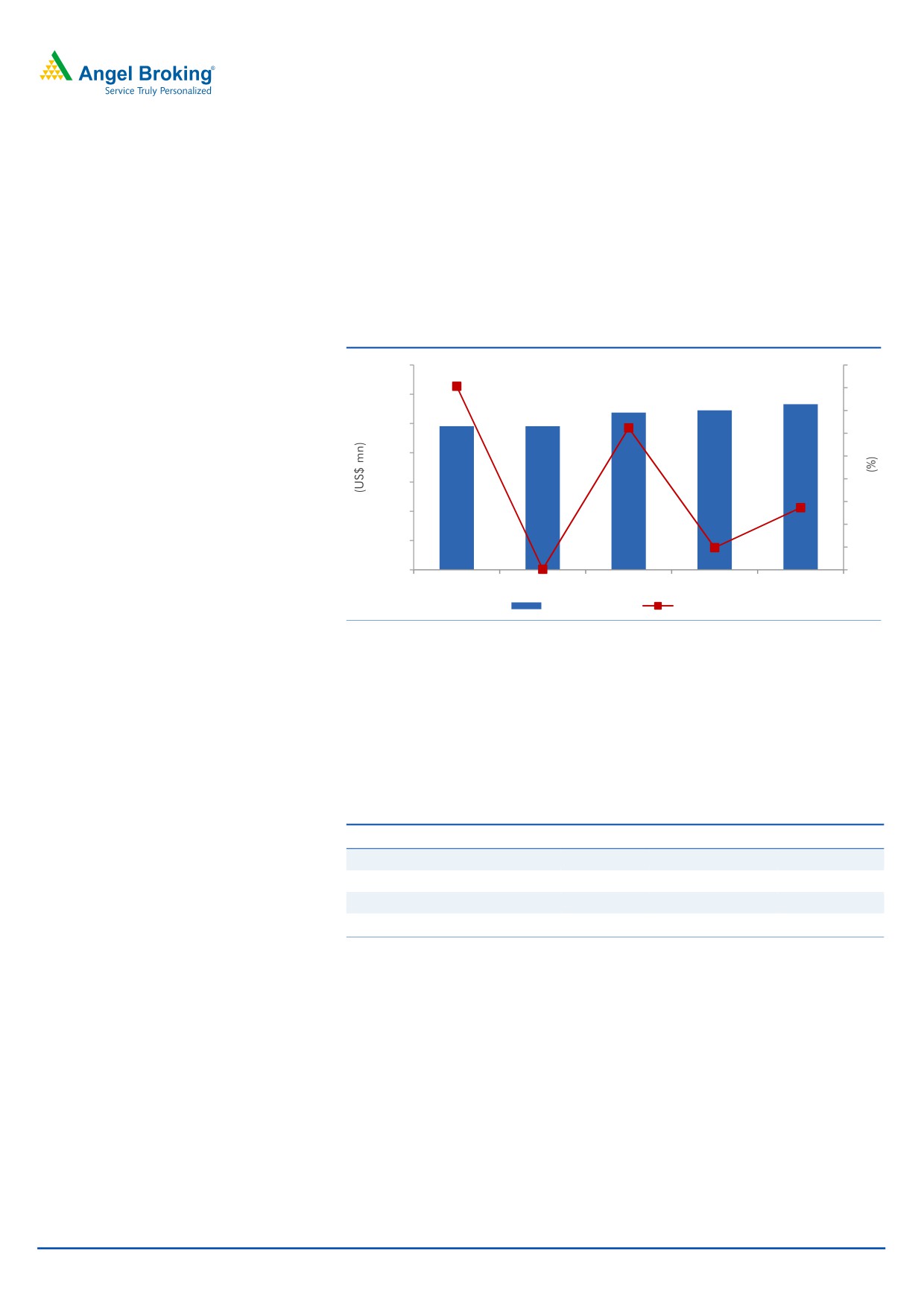

Operating margins above expectation

On the operating front, the EBITDA margin came in at 21.5% (V/s an expected

20.9%) an uptick of 58bps qoq. The Adj. EBIT margin came in at 20.0% V/s 20.6%

in 1QFY2016, a dip of 60bp qoq. While business continuity costs in Chennai were

headwinds in addition to partial wage hikes, these were however offset by

depreciation of the INR and sequential decline in the headcount.

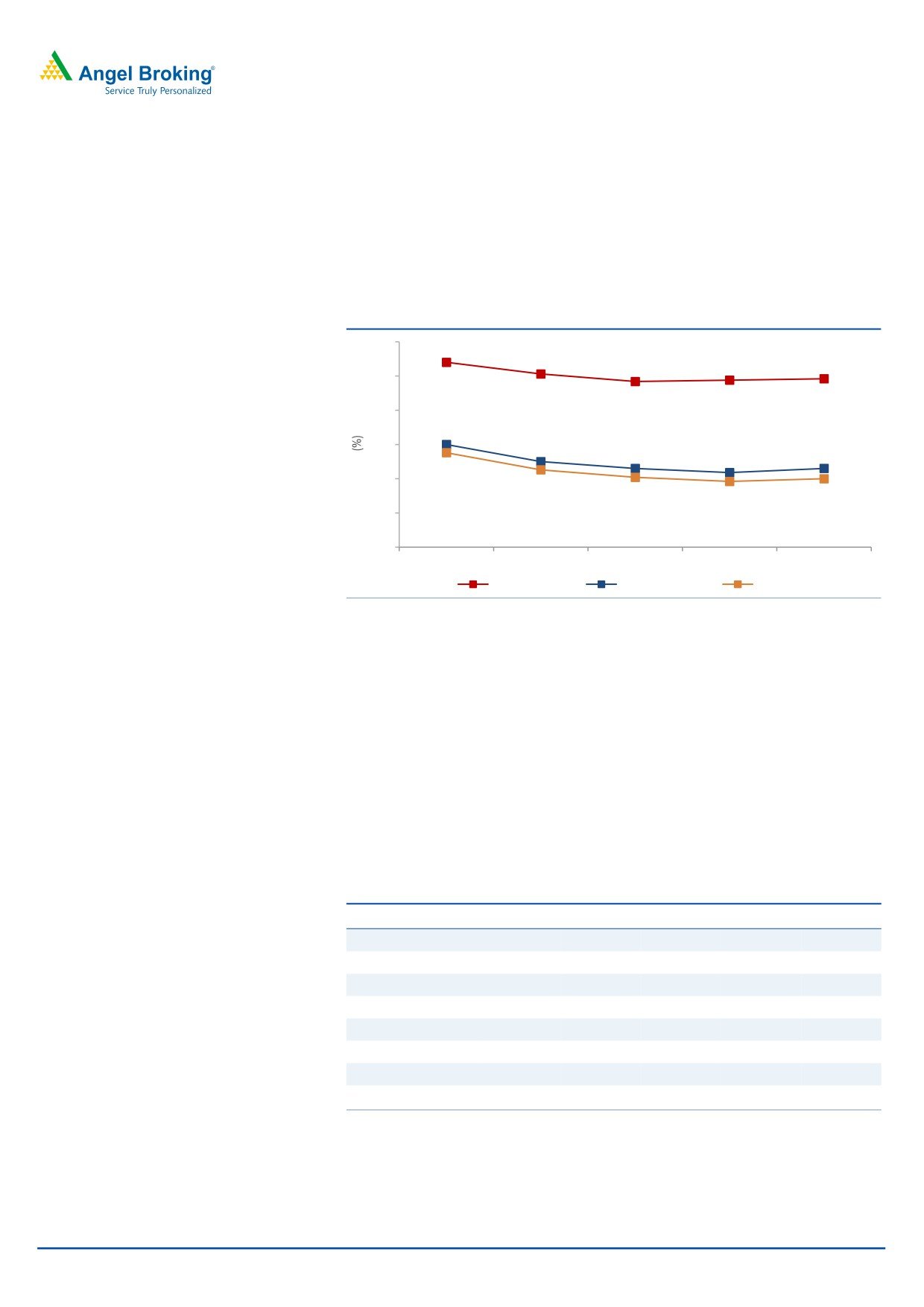

Exhibit 8: Margin profile

40

37.0

35.3

34.2

34.4

34.6

35

30

25.0

25

22.5

21.5

21.5

20.9

23.8

20

21.3

20.2

19.6

20.0

15

10

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Gross margin

EBITDA margin

EBIT margin

Source: Company, Angel Research

Client pyramid

Strong client addition continued for the company in CY2015: US$50Mn+ clients

were up by 3, US$30mn+ clients were up by 5, and US$20mn+ clients were up

by 5. Continuing its momentum of deal wins, HCL Tech booked business in excess

of USD 1bn in TCV during the quarter, including 8 transformational deals.

The broad-based business wins, across service lines and industry verticals were

driven by the company’s next-generation offerings. Thus, on back of strong order

book, the company expects 2HFY2016 to be better than 1HFY2016.

Exhibit 9: Client pyramid

Particulars

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

US$1mn-5mn

245

262

265

262

267

US$5mn-10mn

84

84

87

91

87

US$10mn-20mn

52

50

51

58

66

US$20mn-30mn

32

35

33

32

32

US$30mn-40mn

15

16

17

19

16

US$40mn-50mn

6

5

6

6

4

US$50mn-100mn

9

10

10

11

12

US$100mn plus

7

7

7

7

7

Source: Company, Angel Research

January 27, 2016

5

HCL Technologies | 2QFY2016 Result Update

Investment arguments

Robust outlook: The Management indicated that the deal pipeline across other

service lines also remains healthy and the same has been partly demonstrated in

the company’s last one year performance. Verticals such as financial services,

public services, life sciences & healthcare along with retail & CPG have proved to

be the company’s growth drivers. Geography wise, continental Europe has proved

to be a strong spender vis-à-vis its peers. We expect HCL Tech to post a USD and

INR revenue CAGR of 13.0% and 13.2%, respectively, over FY2015-17E and

remain watchful of the company’s performance in the core software services

business.

Healthy pipeline: In terms of order flow in FY2015, HCL Tech has signed 58

transformational engagements during FY2014-15 with US$5bn+ of TCV. These

bookings saw significant momentum driven by Next-gen ITO, Engineering Services

Outsourcing, Digital, and Modern Apps deals, each of which had a component of

new technology constructs like Digitalization, Cloud etc. These engagements

reflected a broad-based spread across verticals, service lines and geographies. We

believe that sustaining the run-rate of large deal wins is a healthy sign and should

translate into better revenue visibility for the company in FY2016.

Continuing its momentum of deal wins, HCL Tech booked business in excess of

USD 1 bn in TCV in 2QFY2016, including 8 transformational deals. The broad-

based business wins, across service lines and industry verticals were driven by the

company’s next-generation offerings. Thus, on back of strong order book, the

company expects 2HFY2016 to be better than 1HFY2016.

Outlook and valuation

On the operating front, HCL Tech’s EBIT margin has been around 22.3% in

FY2015, a dip of 185bp over the previous financial year. Going ahead, the

Management expects EBIT margins to sustain at 21-22%, driven by moving work

offshore and efficiency-led gains. We expect the EBIT and PAT to post a 7.7% and

6.0% CAGR, respectively, over FY2015-17E. At the current market price, the stock

is trading at 16.4x FY2016E and 14.6x FY2017E EPS. We recommend a Buy on

the stock with a price target of `1,038.

January 27, 2016

6

HCL Technologies | 2QFY2016 Result Update

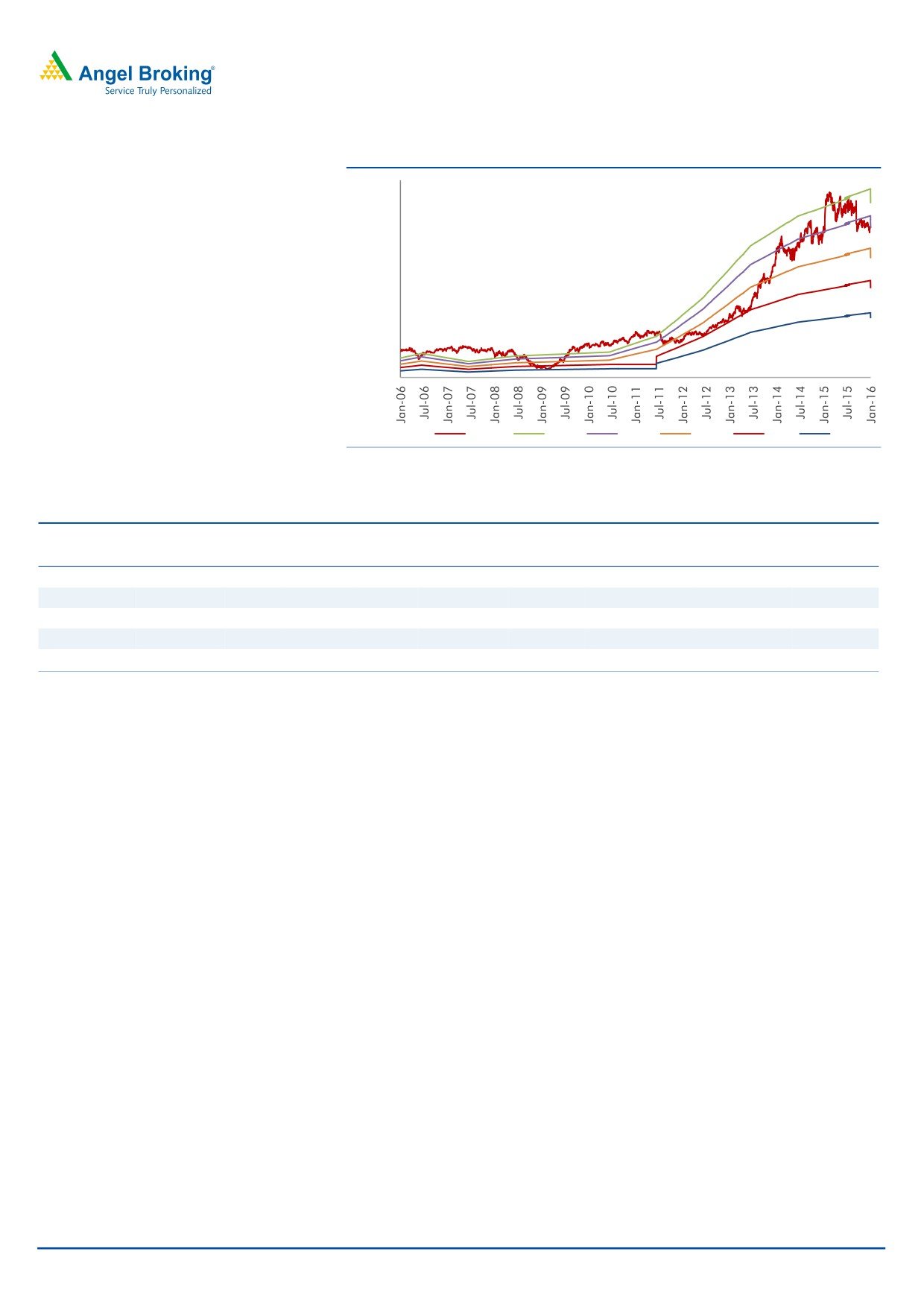

Exhibit 10: One-year forward PE (x) chart

1000.0

800.0

600.0

400.0

200.0

0.0

Price

18x

15x

12x

9x

6x

Source: Company, Angel Research

Exhibit 11: Recommendation summary

Company

Reco

CMP Tgt Price Upside

FY2017E FY2017E

FY2015-17E

FY2017E

FY2017E

(`)

(`)

(%)

EBITDA (%)

P/E (x)

EPS CAGR (%)

EV/Sales (x)

RoE (%)

HCL Tech

Buy

840

1,038

23.6

21.5

14.6

6.0

1.9

18.8

Infosys

Buy

1,138

1,306

18.4

27.5

17.3

10.6

2.9

20.1

TCS

Buy

2,306

3,168

23.8

28.5

16.7

11.8

3.3

38.9

Tech Mahindra Buy

514

646

25.6

17.0

16.1

8.0

1.4

18.6

Wipro

Buy

547

719

31.5

23.8

12.9

9.7

1.8

17.9

Source: Company, Angel Research

Company Background

HCL Tech is India's fifth largest IT services company, with over

1,00,000

employees catering to more than 450 clients. The company's service offerings

include Enterprise Application Services (EAS), Custom Applications, Engineering

and Research and Development (ERD) and Infrastructure Management Services

(IMS). In December 2008, HCL Tech acquired UK-based SAP consulting company -

Axon, which now contributes ~10% to its consolidated revenue.

January 27, 2016

7

HCL Technologies | 2QFY2016 Result Update

Profit and loss statement (Consolidated, US GAAP)

Y/E June (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Net sales

25,770

32,908

37,061

42,038

47,503

Cost of revenues

16,511

20,209

23,798

27,829

31,447

Gross profit

9,259

12,699

13,263

14,209

16,056

% of net sales

35.9

38.6

35.8

33.8

33.8

SG&A expenses

3,437

4,070

4,563

5,288

5,843

% of net sales

13.3

12.4

12.3

12.6

12.3

EBITDA

5,822

8,629

8,700

8,920

10,213

% of net sales

22.6

26.2

23.5

21.2

21.5

Depreciation and amort.

674

753

451

551

651

% of net sales

2.6

2.3

1.2

1.3

1.4

EBIT

5,148

7,876

8,249

8,369

9,562

% of net sales

20.0

23.9

22.3

19.9

20.1

Other income, net

177

492

912

930

930

Profit before tax

5,325

8,369

9,161

9,299

10,492

Provision for tax

1,222

1,629

1,908

2,083

2,350

% of PBT

22.9

19.5

20.8

22.4

22.4

PAT

4,104

6,739

7,253

7,216

8,142

Share from equity invest.

-

-

-

-

-

Forex loss

(21)

(549)

-

-

-

ESOP charges

73

25

103

102

102

Reported net profit

4,082

6,190

7,253

7,216

8,142

Fully diluted EPS (`)

28.9

43.9

51.4

51.1

57.7

January 27, 2016

8

HCL Technologies | 2QFY2016 Result Update

Balance sheet (Consolidated, US GAAP)

Y/E June (` cr)

FY2013 FY2014 FY2015 FY2016E FY2017E

Cash and cash equivalent

732

1,021

1,352

3,982

8,370

Account receivables, net

4,464

5,684

6,563

7,260

8,204

Unbilled receivables

1,713

2,024

2,923

2,522

2,850

Deposit with banks

3,615

8,370

9,670

14,670

19,670

Deposit (one year with HDFC ltd)

-

-

-

-

-

Invest. securities, available for sale

634

609

767

2,250

2,250

Other current assets

1,907

2,125

2,338

2,638

2,938

Total current assets

13,065

19,833

23,613

33,323

44,282

Property and equipment, net

2,728

3,147

3,820

4,120

4,420

Intangible assets, net

4,958

5,149

5,204

5,204

5,204

Deposits with HDFC Ltd.

-

-

-

-

-

Fixed deposits with banks

-

-

-

-

-

Investment securities HTM

50

-

8

8

8

Investment in equity investee

8

16

-

16

16

Other assets

2,239

2,346

3,066

4,780

4,780

Total assets

23,048

30,490

35,711

47,450

58,710

Current liabilities

6,542

8,197

9,232

11,285

12,752

Borrowings

696

751

469

469

469

Other liabilities

1,515

1,462

1,259

2,077

2,077

Total liabilities

8,753

10,409

10,960

13,831

15,298

Minority interest

-

-

-

-

-

Total stockholder equity

14,295

20,081

24,751

33,619

43,412

Total liab. and stock holder equity

23,048

30,490

35,711

47,450

58,710

January 27, 2016

9

HCL Technologies | 2QFY2016 Result Update

Cash flow statement (Consolidated, US GAAP)

Y/E June (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Pre tax profit from operations

5,021

7,797

7,253

7,216

8,142

Depreciation

674

733

451

551

651

Expenses (deffered)/written off/others

(21)

(584)

(168)

(48)

(48)

Pre tax cash from operations

5,673

7,946

7,536

7,719

8,745

Other income/prior period ad

305

572

912

930

930

Net cash from operations

5,978

8,518

8,448

8,649

9,675

Tax

(1,222)

(1,547)

(1,908)

(2,083)

(2,350)

Cash profits

4,756

6,971

6,540

6,566

7,325

(Inc)/dec in current assets

(1,219)

(1,749)

(1,991)

(596)

(1,572)

Inc/(dec) in current liabilties

1,603

1,654

1,035

2,053

1,467

Net trade working capital

384

(95)

(956)

1,456

(105)

Cashflow from operating activities

5,140

6,875

5,584

8,023

7,220

(Inc)/dec in fixed assets

(878)

(1,094)

(674)

(300)

(300)

(Inc)/dec in intangibles

(65)

(248)

(55)

-

-

(Inc)/dec in investments

(2,135)

(4,688)

(1,458)

(6,483)

(5,000)

(Inc)/dec in minority interest

-

-

-

-

-

Inc/(dec) in non current liabilities

181

(54)

(203)

818

-

(Inc)/dec in non current assets

(434)

(107)

(214)

(300)

(300)

Cashflow from investing activities

(3,330)

(6,191)

(2,602)

(6,265)

(5,600)

Inc/(dec) in debt

(1,226)

55

-

-

-

Inc/(dec) in equity/premium

-

-

-

-

-

ESOP charges

(73)

(25)

(103)

(103)

(103)

Dividends

(850)

(296)

(1,651)

(1,651)

(1,651)

Others

405

(129)

(208)

1,225

3,947

Cashflow from financing activities

(1,745)

(396)

(1,962)

(529)

2,193

Cash generated/(utilised)

65

289

331

2,630

4,388

Cash at start of the year

667

732

1,021

1,352

3,982

Cash at end of the year

732

1,021

1,352

3,982

8,370

January 27, 2016

10

HCL Technologies | 2QFY2016 Result Update

Key ratios

Y/E June

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation ratio (x)

P/E (on FDEPS)

29.0

19.1

16.3

16.4

14.6

P/CEPS

24.9

17.1

15.4

15.3

13.5

P/BVPS

8.3

5.9

4.8

3.5

2.7

Dividend yield (%)

1.2

1.7

1.7

1.4

1.4

EV/Sales

4.4

3.3

2.9

2.3

1.9

EV/EBITDA

19.6

12.7

12.3

11.0

8.7

EV/Total assets

5.0

3.6

3.0

2.1

1.5

Per share data (`)

EPS (Fully diluted)

28.9

43.9

51.4

51.1

57.7

Cash EPS

33.7

49.2

54.6

55.0

62.3

Dividend

10.0

14.0

14.0

12.0

12.0

Book value

101

142

175

238

308

Dupont analysis

Tax retention ratio (PAT/PBT)

0.8

0.8

0.8

0.8

0.8

Cost of debt (PBT/EBIT)

1.0

1.1

1.1

1.1

1.1

EBIT margin (EBIT/Sales)

0.2

0.2

0.2

0.2

0.2

Asset turnover ratio (Sales/Assets)

1.1

1.1

1.0

0.9

0.8

Leverage ratio (Assets/Equity)

1.6

1.5

1.4

1.4

1.4

Operating ROE

28.7

33.6

29.3

21.5

18.8

Return ratios (%)

RoCE (pre-tax)

22.3

25.8

23.1

17.6

16.3

Angel RoIC

28.6

38.4

34.5

31.5

33.7

RoE

28.6

30.8

29.3

21.5

18.8

Turnover ratios (x)

Asset turnover (fixed assets)

2.7

3.2

3.3

3.2

3.3

Receivables days

59

71

68

67

67

January 27, 2016

11

HCL Technologies | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

HCL Technologies

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 27, 2016

12