4QFY2016 Result Update | Tyres

February 9, 2016

Goodyear India

BUY

CMP

`487

Performance Highlights

Target Price

`582

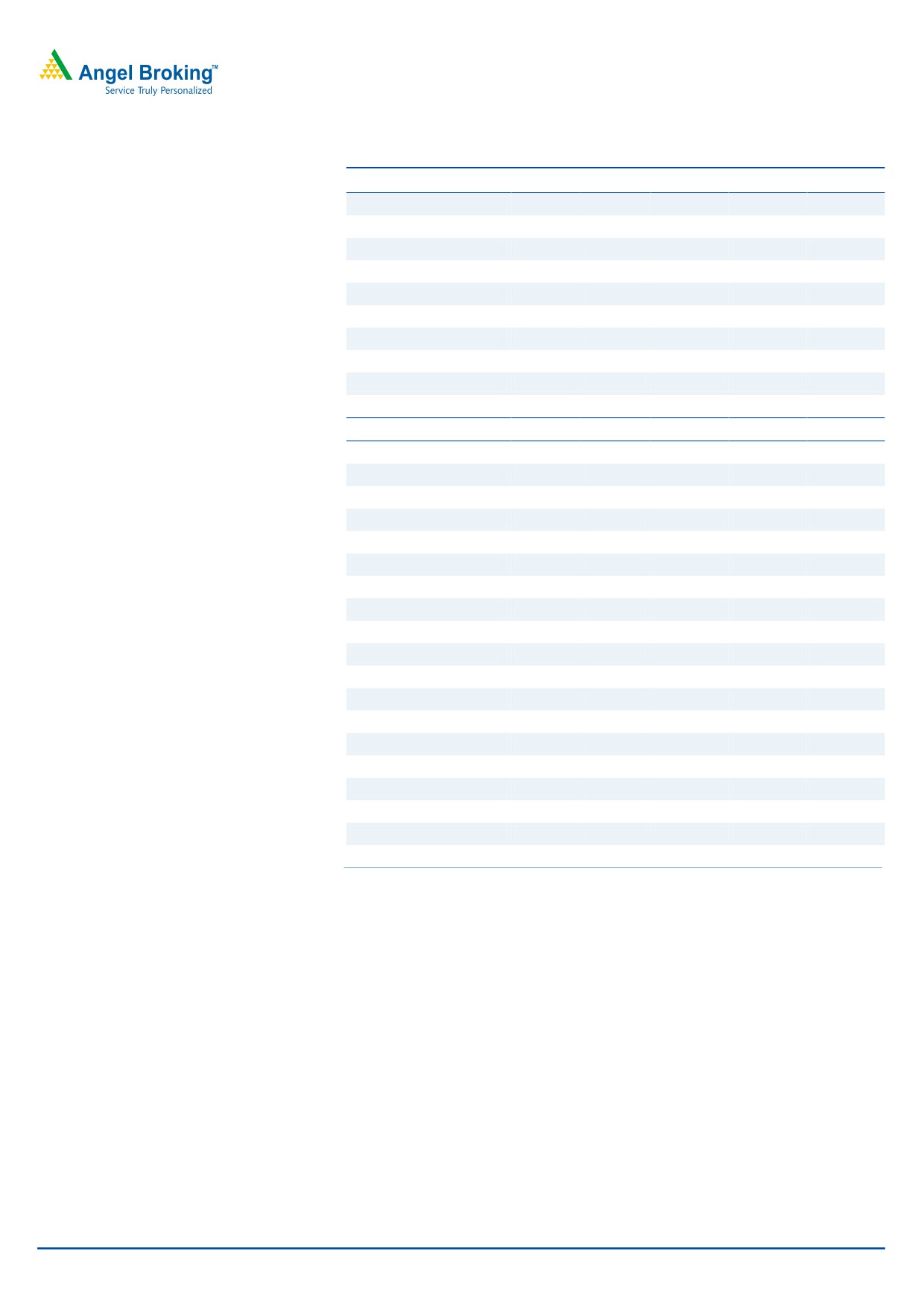

Y/E December (` cr)

4QFY2016

4QCY2014*

% chg (yoy)

3QFY2016

% chg (qoq)

Investment Period

12 Months

Net sales

366

360

1.7

382

(4.1)

EBITDA

39

30

27.7

46

(15.5)

EBITDA margin (%)

10.5

8.4

214bp

11.9

(142)bp

Stock Info

Adjusted PAT

26

19

37.5

29

(10.1)

Sector

Tyres

Source: Company, Angel Research; Note: *reporting changed from CY to FY starting Jan 2015

Market Cap (` cr)

1,124

Note- Goodyear India is shifting from calendar year reporting to financial year

Net Debt

(365)

reporting. Hence FY2016 will consist of five quarters.

Beta

0.8

52 Week High / Low

674 / 470

For 4QFY2016, Goodyear India (GIL)’s numbers have come in lower than our

Avg. Daily Volume

14,951

estimates. The top-line reported a marginal growth of 1.7% yoy to `366cr.

Face Value (`)

10

However, the company performed well on the operational front, reporting an

EBITDA margin expansion of 214bp yoy to 10.5% while its EBITDA grew by

BSE Sensex

24,021

27.7% yoy to `39cr. On the back of lower operating expenses and higher other

Nifty

7,298

income, which grew by 43.7% yoy to `10cr, the net profit grew by 37.5% yoy to

Reuters Code

GDYR.BO

`26cr.

Bloomberg Code

GDYR IN

Expansion drive to lead to recovery in top-line: GIL has laid out plans to

significantly grow its presence in the passenger car segment in India over the next

Shareholding Pattern (%)

five years. The company aspires to be one of the top players in the mid to

premium and SUV segments of passenger cars. It is also evaluating an entry into

Promoters

74.0

newer segments; in order to reach its goal, the company is weighing organic as

MF / Banks / Indian Fls

7.6

well as inorganic growth options to expand in India. We believe that this

FII / NRIs / OCBs

0.9

increased focus on growing its presence in the passenger car segment as well

Indian Public / Others

17.5

entry into newer segments will lower the impact of poor performance of the

tractor industry.

Strong balance sheet with high RoIC: GIL is a debt free-cash rich company with

Abs. (%)

3m 1yr 3yr

RoIC estimated at ~68% for FY2017. The company’s cash and equivalents are

expected to be at `515cr by FY2017-end, which amount to ~46% of the current

Sensex

(8.0)

(14.9)

23.4

market cap. More importantly, GIL is one of the cheapest MNCs available to

GOODYEAR

(13.5)

(14.5)

56.2

invest in, in the similar market cap range.

Outlook and valuation: We expect the company’s top-line to be at `1,800cr and

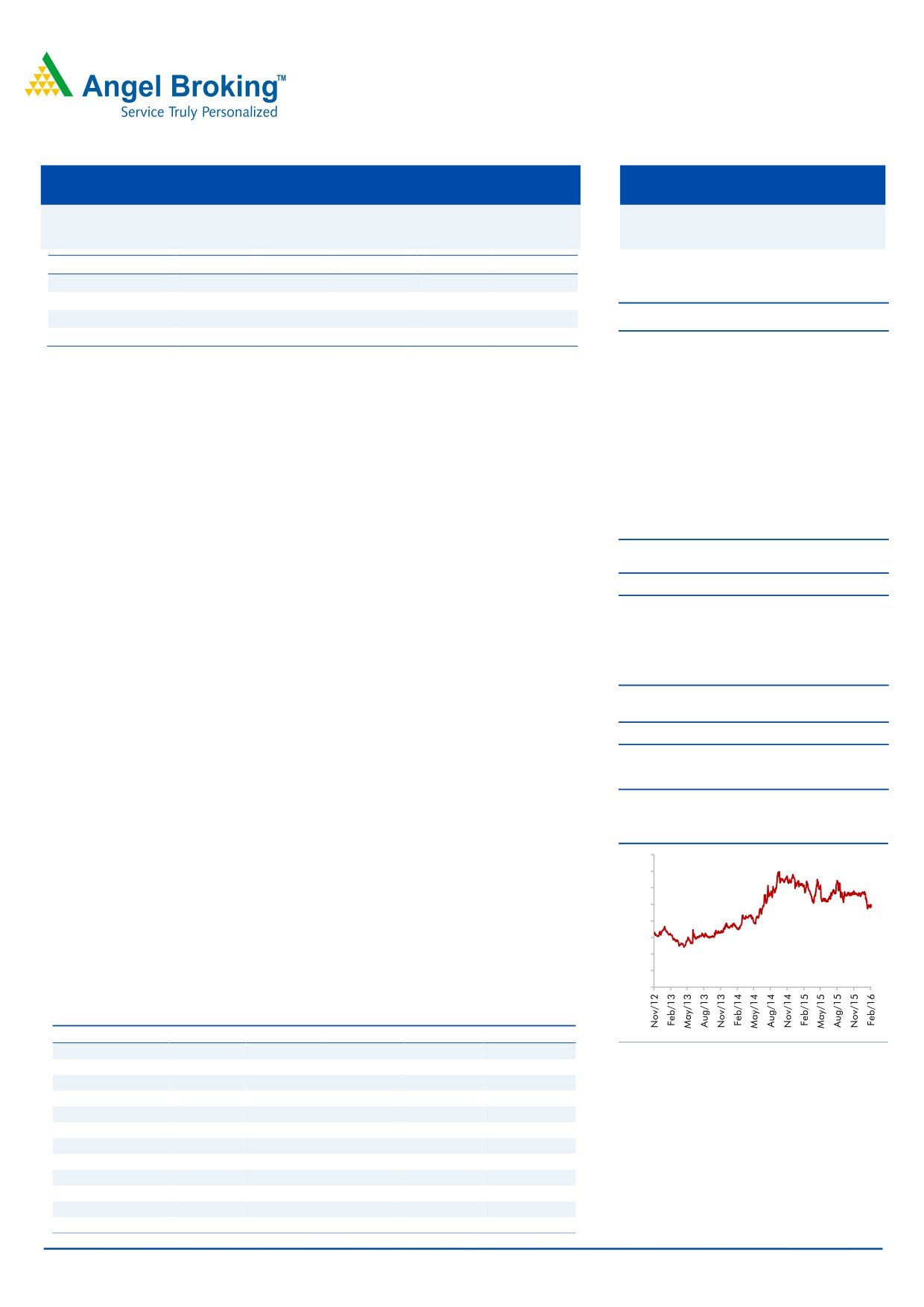

3-year Daily Price Chart

`1,600cr in FY2016E and FY2017E respectively. Raw material cost is expected to

remain stable over FY2016E-17E resulting in EBITDA margin of 11.7% in

800

700

FY2016E and 11.5% in FY2017E. Consequently, we estimate the net profit to be

600

at `122cr in FY2017E. At the current market price, the stock is trading at a PE of

500

9.2x its FY2017E earnings. On a TTM basis, GIL is one of the cheapest MNCs

400

available as it trades at a PE of 11.0x while other MNCs (having market cap in

300

the range of `1,000cr-`5,000cr) trade above the 20.0x mark (with a median of

200

27.7x). We maintain our Buy rating on the stock and assign a target price of `582

100

based on a target PE of 11.0x for FY2017E.

-

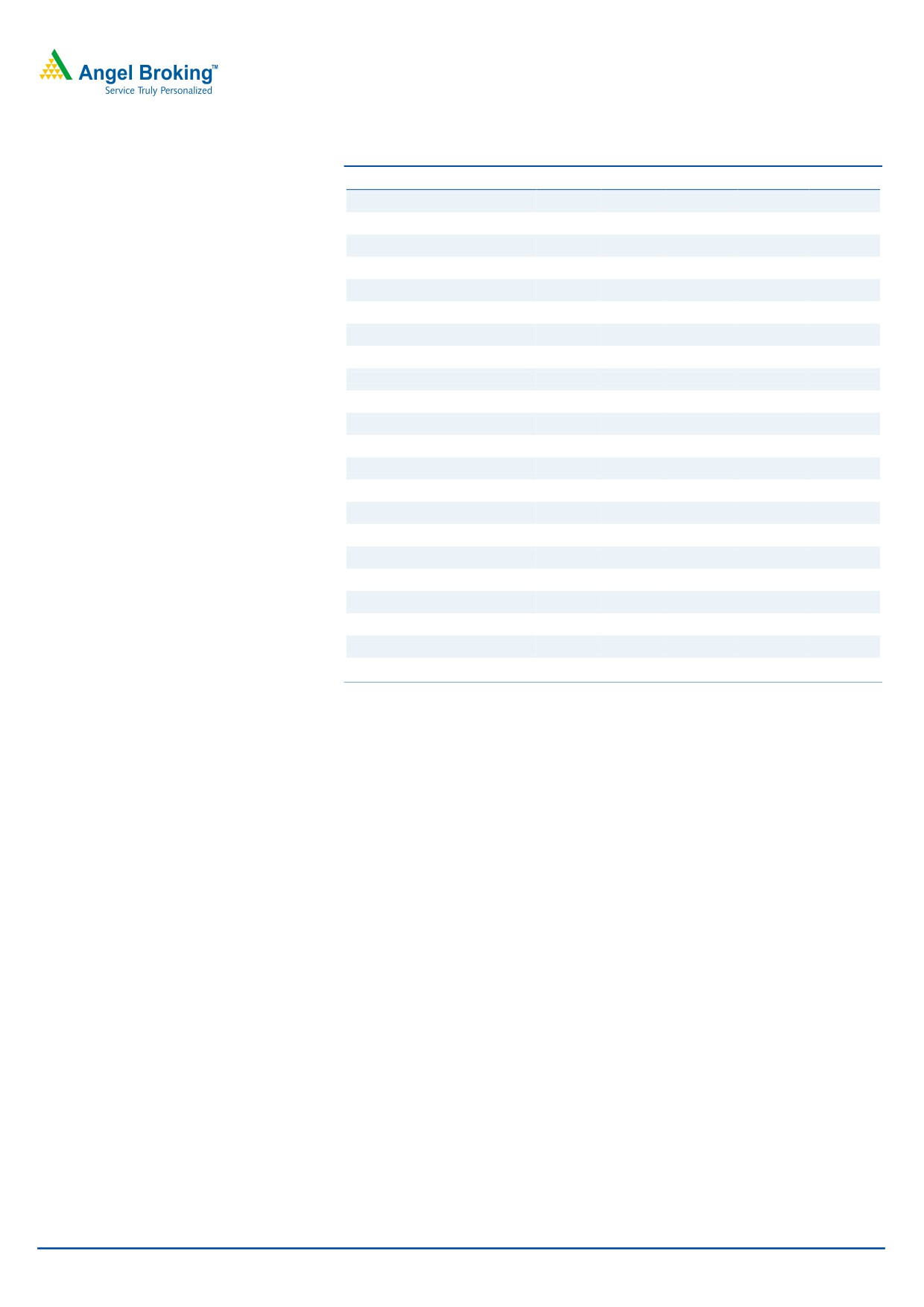

Key Financials

Y/E Mar (` cr)

CY2012

CY2013

CY2014

FY2016E*

FY2017E

Net Sales

1,481

1,569

1,579

1,800

1,600

Source: Company, Angel Research

% chg

(2.1)

5.9

0.7

14.0

(11.1)

Net Profit

57

94

101

135

122

% chg

(13.4)

66.3

7.6

33.8

(9.9)

EBITDA (%)

6.1

8.9

9.7

11.7

11.5

EPS (`)

24.5

40.8

43.9

58.7

52.9

P/E (x)

19.9

12.0

11.1

8.3

9.2

P/BV (x)

3.2

2.7

2.3

1.9

1.6

RoE (%)

16.9

24.2

22.0

24.6

18.7

RoIC (%)

65.1

95.4

94.6

89.9

68.0

Milan Desai

EV/Sales (x)

0.6

0.5

0.5

0.4

0.4

+91- 22- 4000 3600 Ext: 6846

EV/EBITDA (x)

9.8

5.8

4.9

3.4

3.3

Source: Company, Angel Research; Note: *reporting changed from CY to FY starting January 2015

Please refer to important disclosures at the end of this report

1

Goodyear | 4QFY2016 Result Update

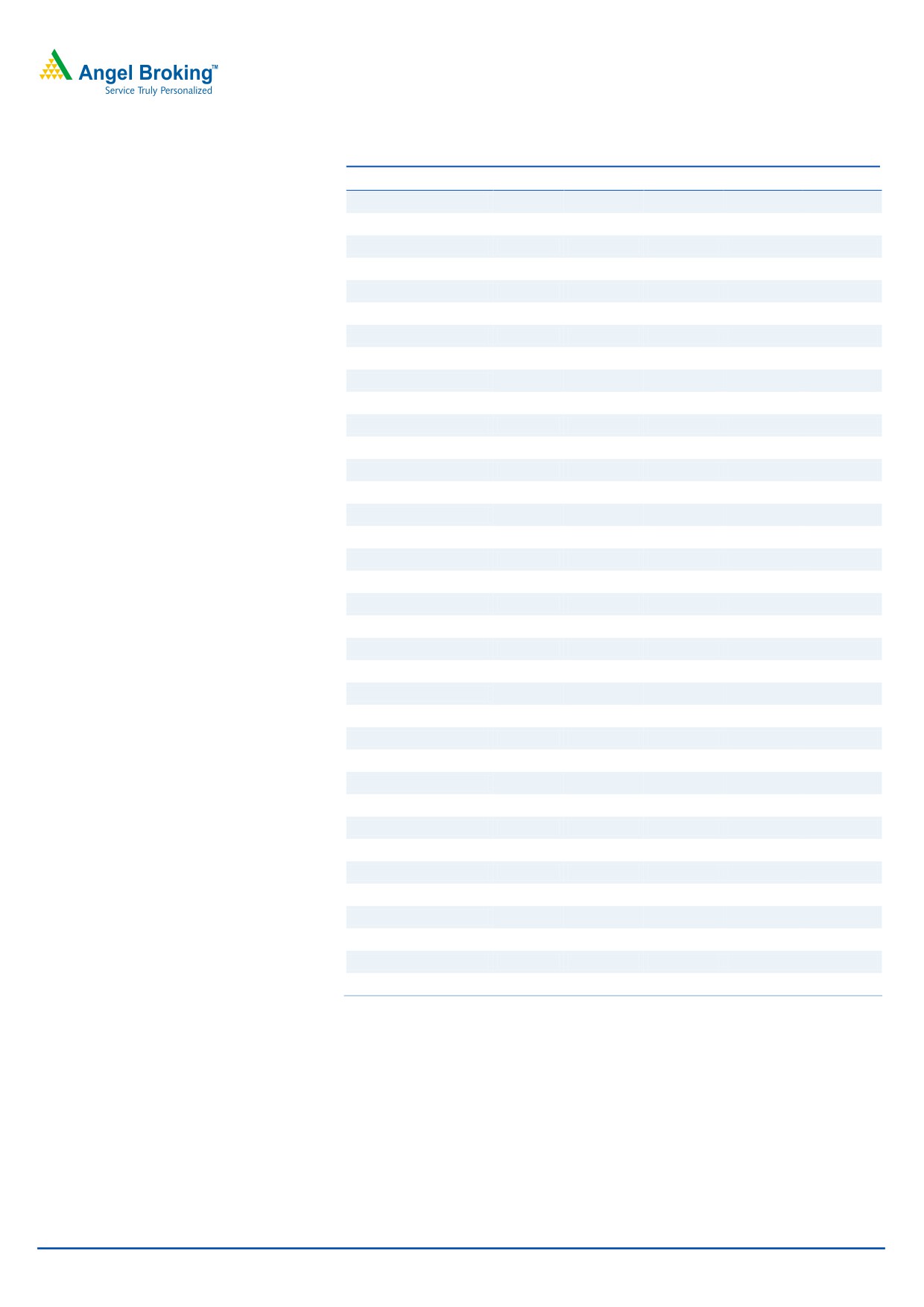

Exhibit 1: 4QFY2016 performance

Y/E December (` cr)

4QFY16

4QCY14*

yoy chg (%)

3QFY16

qoq chg (%)

CY2015*

CY2014*

% chg

Net Sales

366

360

1.7

382

(4.1)

1,455

1,579

(7.8)

Net raw material

243

239

1.4

242

0.3

935

1,094

(14.6)

(% of Sales)

66.3

66.5

(20)bp

63.4

289bp

64.2

69.3

(508)bp

Staff Costs

29

31

(5.4)

30

(1.5)

111

99

12.3

(% of Sales)

7.9

8.5

(59)bp

7.7

20bp

7.6

6.3

137bp

Other Expenses

56

60

(6.6)

64

(13.6)

240

232

3.3

(% of Sales)

15.2

16.6

(135)bp

16.9

(167)bp

16.5

14.7

177bp

Total Expenditure

328

330

(0.7)

336

(2.5)

1,286

1,426

(9.8)

EBITDA

39

30

27.7

46

(15.5)

170

154

10.5

EBITDA margin (%)

10.5

8.4

214bp

11.9

(142)bp

11.7

9.7

194bp

Interest

1

1

(5.8)

1

(5.8)

3

3

(23.6)

Depreciation

8

8

(0.1)

8

(1.3)

32

29

13.2

Other Income

10

7

43.7

7.3

36.8

29

32

(7.5)

PBT

40

29

39.8

44

(9.5)

164

154

12.6

(% of Sales)

11.0

8.0

11.6

11.3

9.7

Tax

14

10

15

57

52

(% of PBT)

35.0

34.0

34.6

34.8

34.0

Reported PAT

26

19

37.5

29

(10.1)

107

101

5.8

PATM

7.1

5.3

7.6

7.4

6.4

Equity capital (cr)

23

23

23

23

23

EPS (`)

11

8

37.5

13

(10.1)

46

44

5.8

Source: Company, Angel Research; *reporting changed from CY to FY starting January 2015

Exhibit 2: Actual vs. Angel estimates (4QFY2016)

Actual (` cr)

Estimate (` cr)

Var (%)

Total Income

366

397

(7.8)

EBIDTA

39

49

(21.6)

EBIDTA margin (%)

10.5

12.4

(184)bp

Adjusted PAT

26

33

(20.8)

Source: Company, Angel Research

Revenue and margin below expectations

GIL’s numbers for 4QFY2016 have come in below our estimates. The top-line

witnessed a marginal growth of 1.7% yoy to `366cr, which is below our estimate

of `397. Sales continue to be impacted on account of softness in demand for farm

tyres owing to erratic rainfall and only a moderate increase in MSPs. The demand

from OEMs has been unimpressive as tractor sales have reported marginal growth

rates for Oct-Dec 2015 period, that too on a lower base. The operational

performance improved on a yoy basis led by a 135bp yoy decline in other

expenses as a percentage of sales to 15.2% while raw material cost and employee

expense as a percentage of sales also declined marginally on a yoy basis. As a

result, the EBITDA grew by 27.7% yoy to `39cr and the EBITDA margin improved

by 214bp yoy to 10.5%. On the back of lower operating expenses and higher

other income, which grew by 43.7% yoy to `10cr, the net profit grew by 37.5% yoy

to `26cr against our estimate of `33cr.

February 9, 2016

2

Goodyear | 4QFY2016 Result Update

Investment rationale

Focus to be among the leading players in passenger car segment

GIL is targeting towards becoming one of the top players in the passenger car tyre

segment in the next five years. The company is focusing on increasing its presence

in both the OEM and the aftermarket segments. It will be launching new products

and widening its product portfolio in the mid to premium and SUV segments of

passenger vehicles. To reach its goal, the company is weighing both organic as

well as inorganic growth options to expand in the segment. The Management has

indicated that apart from farm and passenger car tyres, it is looking at entering

into newer segments and ramping up newer launches to grow in India. The

company benefits from strong R&D capability of its parent Goodyear Tire & Rubber

Company (USA), which helps it in launching technologically superior products for

the Indian markets. The passenger vehicle segment has been the sole bright spot

in the Indian Auto Industry (non-MHCV) posting a growth rate of ~11% YTD in

FY2016. We believe that this increased focus on growing its presence in the

passenger car segment will lower the impact of poor performance of the tractor

industry.

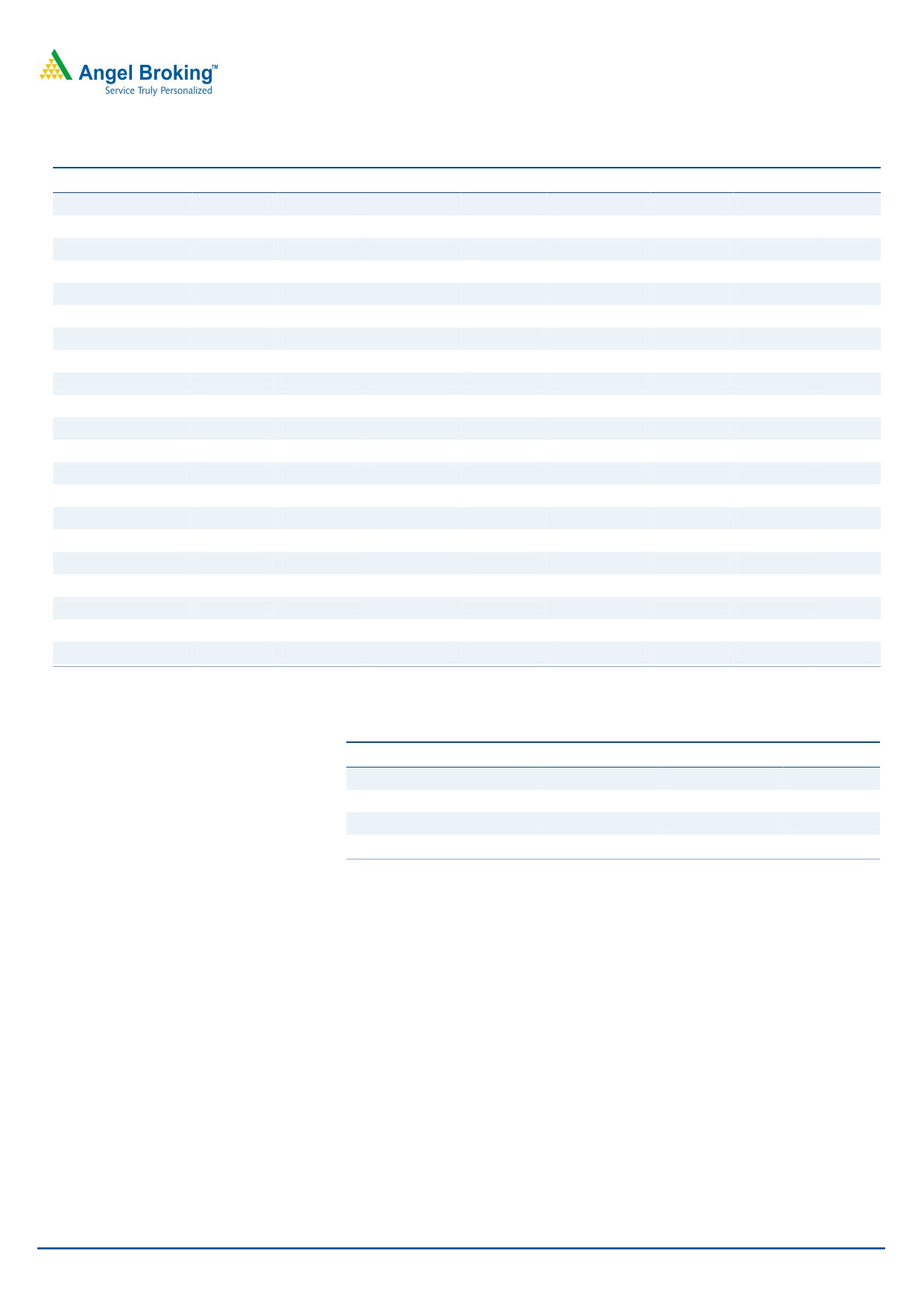

Strong balance sheet with high RoIC; valuations remain

attractive!

GIL is a debt free-cash rich company with RoIC estimated at ~68% for FY2017.

The company’s cash and equivalents are expected to be at

`515cr by

FY2017-end, which amount to ~46% of the current market cap. GIL remains

among the cheapest MNCs available among those with a market cap in the range

of `1,000cr-`5,000cr. On a TTM basis, GIL trades at a P/E of 11.0x vis-à-vis

median TTM PE of ~27.7x for other MNCs. Thus, GIL is available at an attractive

valuation considering the fact that all other MNCs are trading above the 20.0x

mark.

Exhibit 3: On TTM PE basis, GIL is cheapest amongst MNCs

45

41

38

40

35

35

31

28

28

30

23

24

24

25

18

20

15

11

10

5

0

Source: Company, Angel Research

February 9, 2016

3

Goodyear | 4QFY2016 Result Update

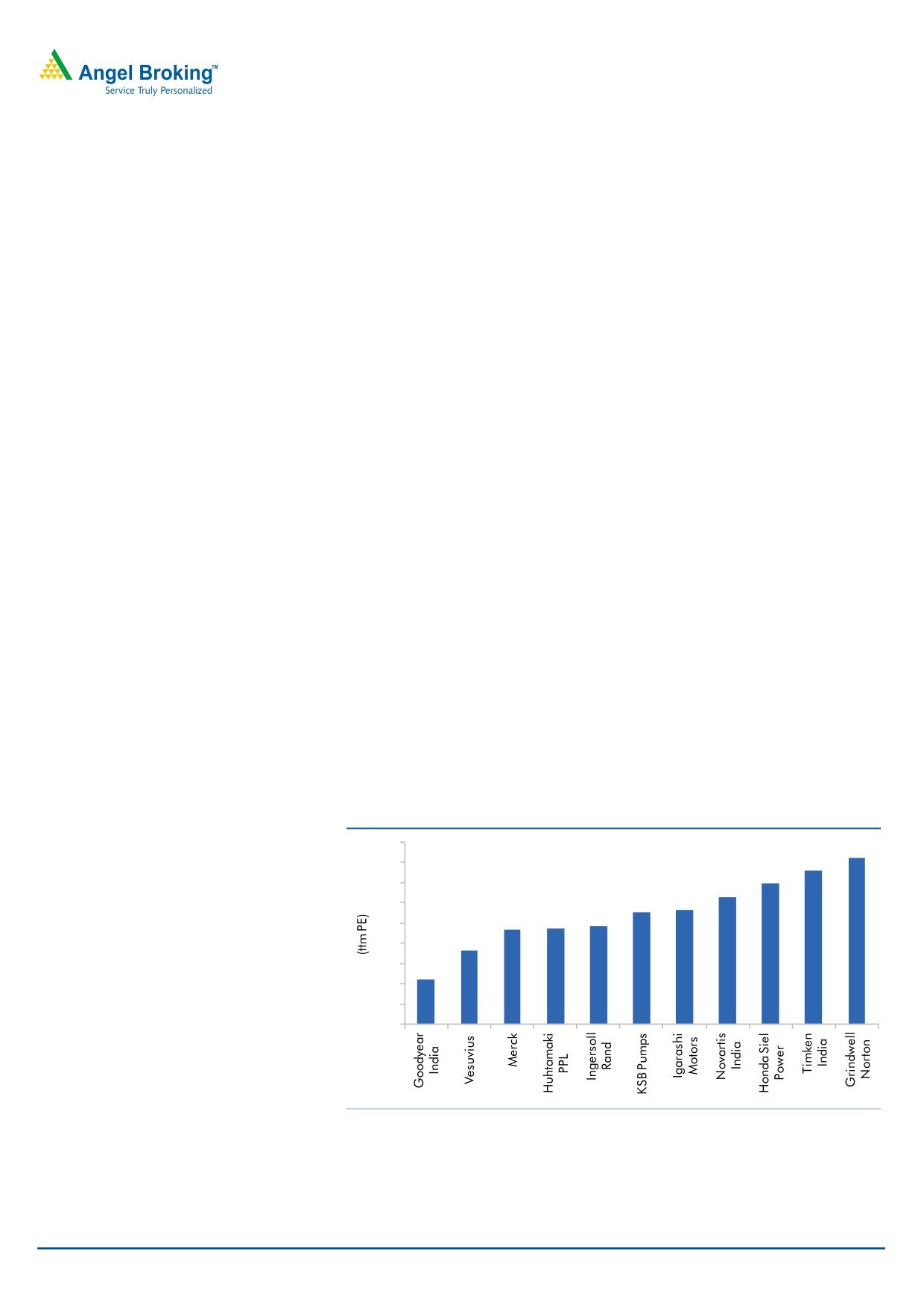

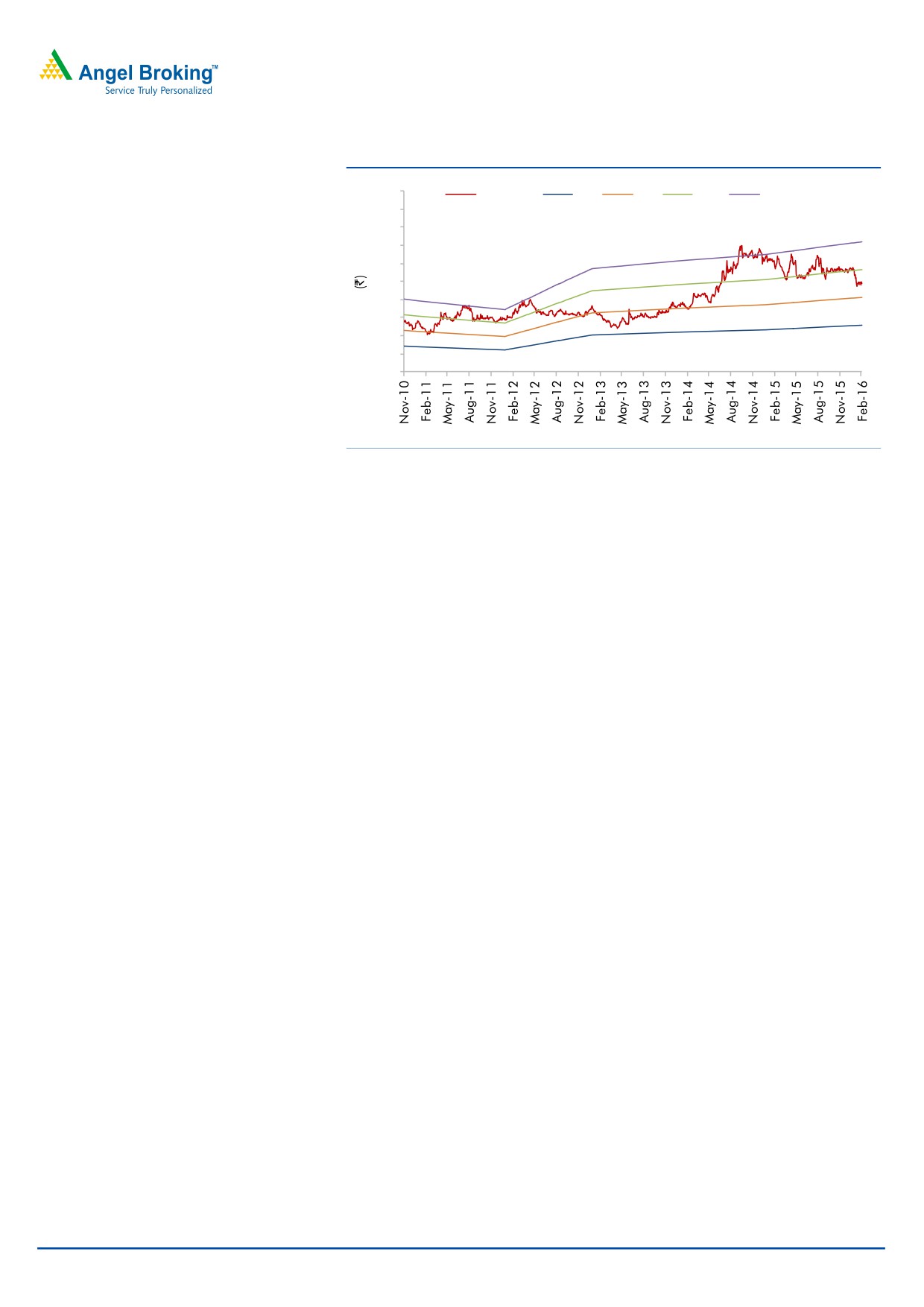

Stable rubber prices to help in sustaining margins

Natural Rubber (NR) continues to show weakness as domestic NR prices further

slipped by ~10.0% yoy and ~8.0% qoq to `109/kg in 3QFY2016. Global prices

during the period have declined by ~17.0% yoy and ~14.0% qoq suggesting the

higher global inventory is likely to keep prices at lower levels. With lower raw

material price environment prevailing, we expect GIL to maintain its margin in the

near future.

Exhibit 4: International vs. Domestic rubber price trend

230

Domestic Price

International Price

210

190

170

150

130

110

91

90

85

70

50

Source: Angel Research

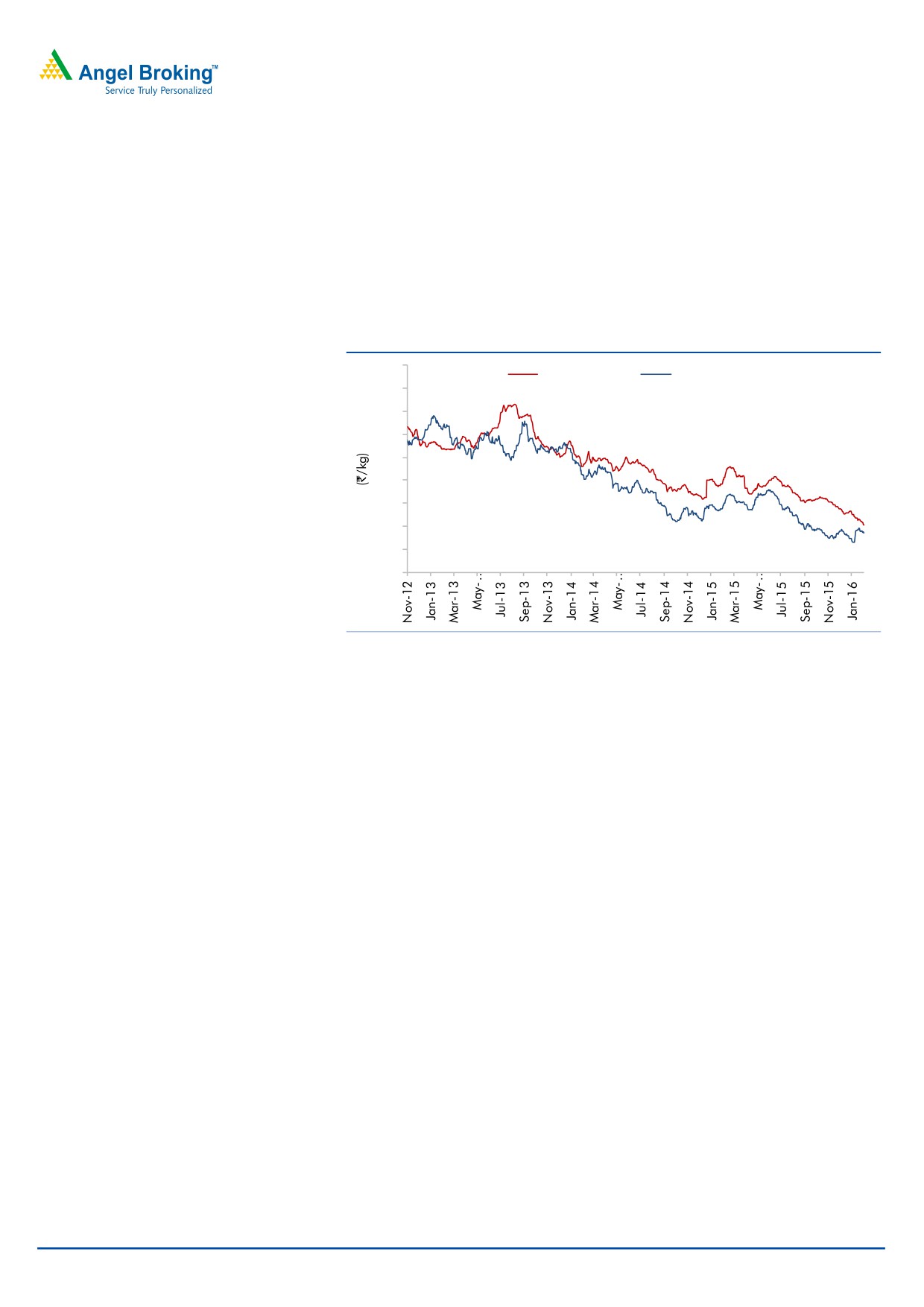

Tractor demand outlook muted in the near term, long term

prospects remain intact

GIL is a market leader in the tractor tyre industry. The tractor industry has

witnessed a sharp decline in volumes over the past few years due to below average

monsoon, unseasonal rains and moderate increase in MSPs that has hurt rural

sentiments. However, expectation of a normal monsoon and increase in MSPs are

likely to prove as triggers for the overall tractor industry. Industry reports suggest

that the tractor industry is expected to post a CAGR of ~6% over the next five years

owing to factors mentioned above as well as factors such as shortage of labor

which is driving a trend towards farm mechanization.

February 9, 2016

4

Goodyear | 4QFY2016 Result Update

Exhibit 5: M&M Domestic tractor sales trend

80,000

30.0

18.3

20.0

70,000

10.0

60,000

4.0

0.3

-

50,000

(17.8)

(10.0)

(20.0)

40,000

(24.5)

(26.7)

(30.0)

30,000

(40.0)

(50.0)

20,000

(60.0)

(66.0)

10,000

(70.0)

-

(80.0)

1QFY15 2QFY15 3QFY15 4QFY15 1QFY16 2QFY16 3QFY16

M&M DomesticTractor Sales (LHS)

yoy growth % (RHS)

Source: Company, Angel Research

Financials

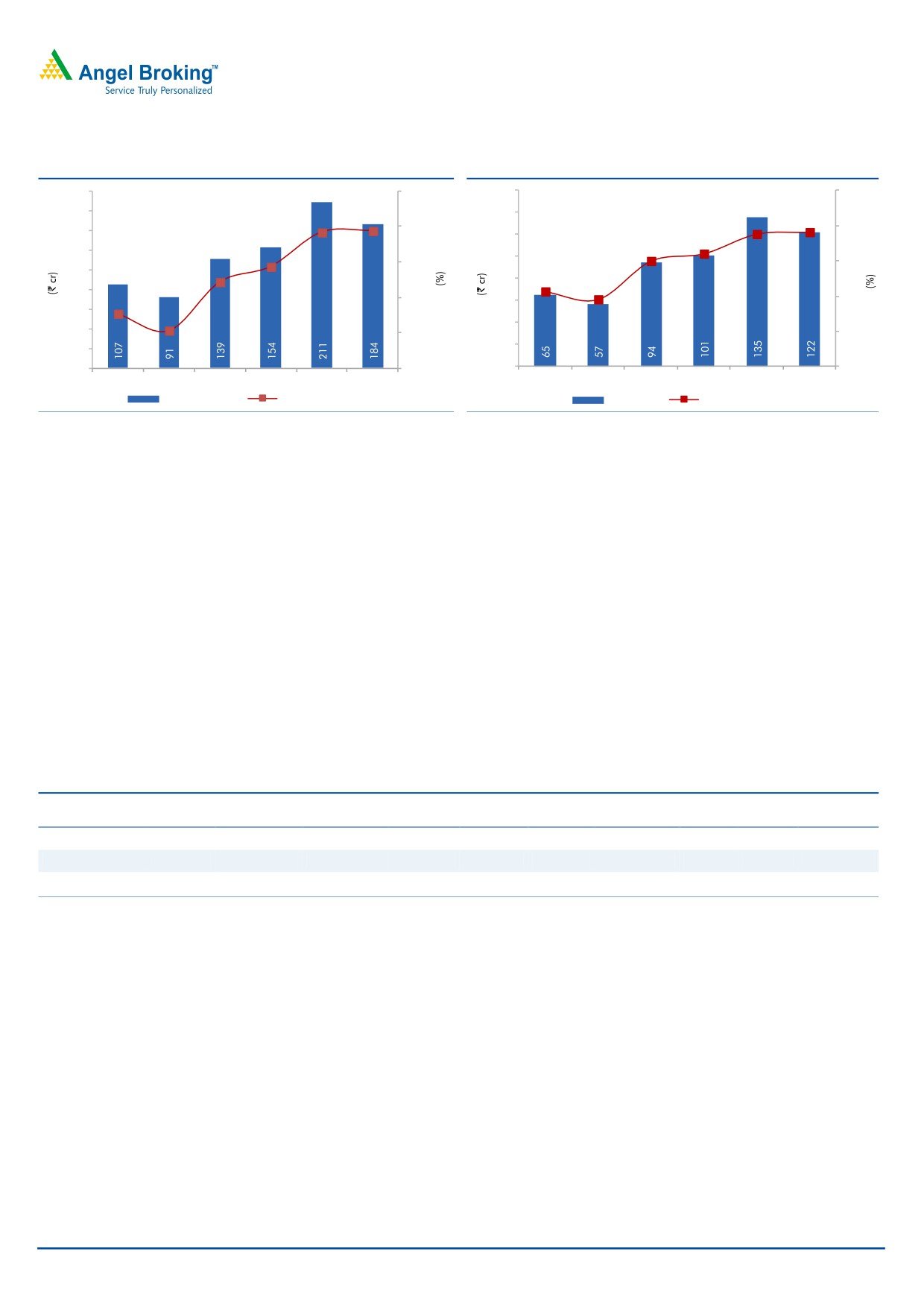

Although the near term outlook remains subdued owing to poor tractor sales, we

expect stable improvement in the company’s performance over FY2016E-17E

citing recovery in tractor sales, Management’s drive to expands its presence in the

passenger vehicle segment and entry into newer segments. We expect GIL’s

revenue to be at `1,800cr and `1,600cr in FY2016E and FY2017E, respectively.

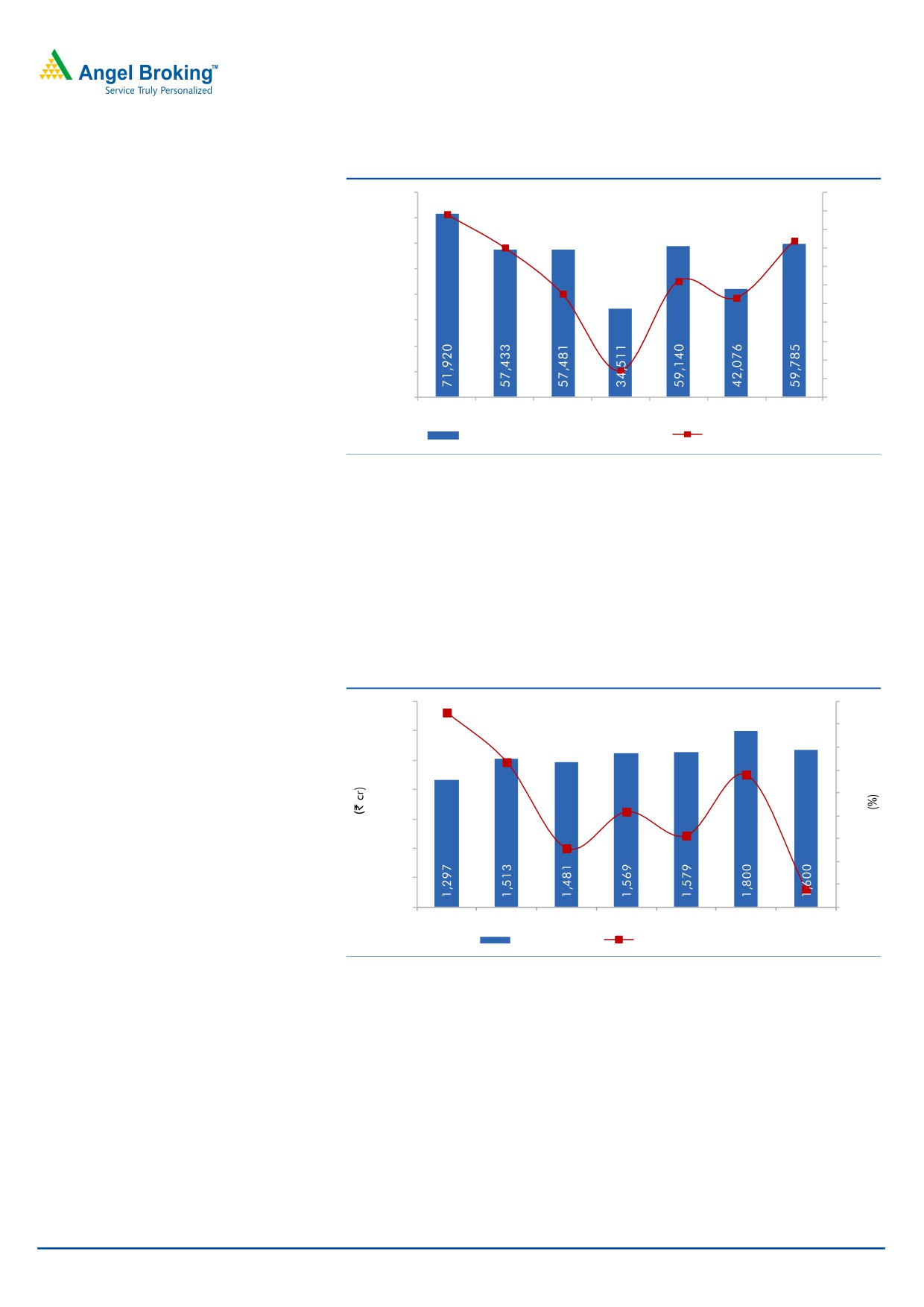

Exhibit 6: Top-line to recover

2,100

30

27.6

25

1,800

20

16.7

1,500

14.0

15

1,200

10

5.9

5

0.7

900

0

(2.1)

600

(5)

300

(11

.1)

(10)

0

(15)

CY2010

CY2011

CY2012

CY2013

CY2014 FY2016E* FY2017E

Revenue (LHS)

Revenue yoy growth (RHS)

Source: Company, Angel Research; *reporting changed from CY to FY starting January 2015

Domestic rubber prices have seen a declining trend since November 2011 from

the high of ~`200/kg to current levels of ~`90/kg while international prices are

trading close at ~`85/kg. We expect rubber prices to remain at lower levels and

report marginal increase if any over FY2016-17E.

February 9, 2016

5

Goodyear | 4QFY2016 Result Update

Exhibit 7: EBITDA and margin trend

Exhibit 8: PAT trend

225

14.0

160

10.0

200

140

7.5

7.6

11.7

11.

7

12.0

8.0

175

120

6.4

6.0

150

100

10.0

6.0

125

9.7

80

4.3

8.9

3.8

100

8.0

4.0

60

75

7.1

40

50

6.1

6.0

2.0

20

25

-

4.0

0

-

CY2011

CY2012

CY2013

CY2014

FY2016E* FY2017E

CY2011

CY2012

CY2013

CY2014

FY2016E* FY2017E

EBITDA (LHS)

EBITDA margin (RHS)

PAT (LHS)

PAT margin (RHS)

Source: Company, Angel Research; *reporting changed from CY to FY

Source: Company, Angel Research; *reporting changed from CY to FY

starting January 2015

starting January 2015

Led by recovery in volumes, coupled with raw material prices remaining at lower

levels, the net profit is expected to be at `135cr and at `122cr in FY2016E and

FY2017E, respectively.

Outlook and valuation

We have estimated the top-line to be at `1,800cr and `1,600cr in FY2016E (15

months) and FY2017E, respectively, while the net profit is expected to be at `135cr

and `122cr for the same period. At the current market price, GIL trades at a PE of

9.2x its FY2017E earnings (11.0x on TTM basis). GIL is among the cheapest stocks

available in the MNC space (with market cap in the range of `1,000cr-`1,500cr).

All other MNCs falling in a similar market cap range are trading above the 20.0x

mark on a TTM basis with median PE being 27.7x. We maintain our Buy

recommendation on the stock and assign a target price of `582 based on a target

PE of 11x its FY2017E EPS.

Exhibit 11: Relative valuation

Mcap

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/

Company

Year

(` cr)

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

Sales (x)

Apollo tyres

FY2017E

6,874

12,689

16.0

968

19.0

13.0

7.1

0.9

0.7

MRF

FY2017E

14,250

14,488

21.1

1,611

3,797.9

21.2

9.0

1.7

0.9

Goodyear

FY2017E

1,124

1,600

11.5

122

52.9

18.7

9.2

1.6

0.4

Source: Company, Angel Research, Bloomberg

GIL is fairly priced vis-à-vis its peers in the tyre industry in terms of PE and PBV

multiples considering its high ROE; but it is trading at a relatively lower valuation

of 0.4x EV/Sales multiple based on FY2017E earnings.

February 9, 2016

6

Goodyear | 4QFY2016 Result Update

Exhibit 9: One-year forward P/E band

1,000

Price (`)

5x

8x

11x

14

900

800

700

600

500

400

300

200

100

-

Source: Company, Angel Research

Risks

Volatile rubber prices: Rubber constitutes ~55% of the total raw-material cost in

the manufacture of tyres. Domestic rubber prices have declined from the level of

`200/kg in June 2012 to average levels of `121/kg in CY2015 and to `91/kg

currently. However, increase in rubber prices will have a negative impact on the

company’s EBITDA margin and consequently on its profit.

Concentrated product portfolio: GIL’s product portfolio is primarily

concentrated to tractor and passenger car tyres. Both these segments constitute

~98% of the total tonnage off-take of the company. Due to high dependency on

these segments, GIL is exposed to the risk of any slowdown in these segments.

Termination of off-take agreement: GIL is in an off-take agreement (on a

non-exclusive basis and can be terminated by either party with a four-month

notice) with Goodyear South Asia Tyres Pvt Ltd, from which it procures passenger

vehicle tyres. Considering that a significant percentage of GIL’s sales are backed

by this agreement, termination of the same may affect GIL’s sales considerably.

Hike in import duty of rubber: In the wake of falling domestic rubber prices, the

Central Government has increased the import duty on natural rubber to lower of

25% or `30/kg, from lower of 20% or `30/kg. Further upward revision in the

import duty will have an adverse impact on GIL’s profitability.

Company Background

GIL is a subsidiary of Goodyear Orient Company (Private) Ltd (a wholly owned

subsidiary of Goodyear Tire and Rubber Company, USA), which holds a 74% stake

in the company. The company majorly caters to the tractor tyre segment, where it

has a market share of ~22.0% in tractor front tyres and ~34.3% in tractor rear

tyres as of CY2012.

February 9, 2016

7

Goodyear | 4QFY2016 Result Update

Profit & Loss Statement

Y/E December (` cr)

CY2012

CY2013

CY2014

FY2016E*

FY2017E

Gross sales

1,613

1,706

1,709

1,953

1,735

Less: Excise duty

132

137

130

152

135

Net Sales

1,481

1,569

1,579

1,800

1,600

Other operating income

-

-

-

-

-

Total operating income

1,481

1,569

1,579

1,800

1,600

% chg

(2.1)

5.9

0.7

14.0

(11.1)

Net Raw Materials

1,102

1,116

1,094

1,157

1,034

Personnel

81

88

99

137

121

Other

207

226

232

295

262

Total Expenditure

1,391

1,430

1,426

1,590

1,416

EBITDA

91

139

154

211

184

% chg

(15.3)

53.2

10.5

37.3

(12.9)

(% of Net Sales)

6.1

8.9

9.7

11.7

11.5

Depreciation

24

25

29

40

35

EBIT

67

114

125

171

148

% chg

(23.7)

70.8

9.9

36.5

(13.1)

(% of Net Sales)

4.5

7.3

7.9

9.5

9.3

Interest & other charges

4

2

3

3

2

Other Income

22

30

32

38

39

(% of sales)

1.5

1.9

2.0

2.1

2.4

PBT

85

142

154

205

185

% chg

(12.1)

67.7

8.2

33.7

(9.9)

Tax

28

48

52

70

63

(% of PBT)

33.5

33.7

34.0

34.0

34.0

PAT (reported)

56

94

101

135

122

Extraordinary (Exp)/Inc.

(0)

-

-

-

-

ADJ. PAT

57

94

101

135

122

% chg

(13.4)

66.3

7.6

33.8

(9.9)

(% of Net Sales)

3.8

6.0

6.4

7.5

7.6

Basic EPS (`)

24.5

40.8

43.9

58.7

52.9

Fully Diluted EPS (`)

24.5

40.8

43.9

58.7

52.9

% chg

(12.4)

66.3

7.6

33.8

(9.9)

*reporting changed from CY to FY starting January 2015

February 9, 2016

8

Goodyear | 4QFY2016 Result Update

Balance Sheet

Y/E December (` cr)

CY2012

CY2013

CY2014E

FY2016E*

FY2017E

SOURCES OF FUNDS

Equity Share Capital

23

23

23

23

23

Preference Capital

-

-

-

-

-

Reserves& Surplus

331

400

474

581

676

Shareholders’ Funds

354

424

497

605

699

Minority Interest

-

-

-

-

-

Total Loans

-

-

-

-

-

Deferred Tax Liability

11

13

14

12

12

Other Long Term Liabilities

-

3

5

4

3

Long Term Provisions

19

20

21

23

21

Total Liabilities

384

459

536

644

735

APPLICATION OF FUNDS

Gross Block

398

430

481

541

595

Less: Acc. Depreciation

201

220

241

281

317

Net Block

198

210

240

260

279

Capital Work-in-Progress

17

32

17

10

10

Goodwill

-

-

-

-

-

Investments

-

-

-

-

-

Long Term Loans and adv.

19

17

19

15

15

Other non-current assets

0

0

1

1

1

Current Assets

507

600

617

678

788

Cash

238

317

365

408

515

Loans & Advances

6

10

6

11

10

Inventory

104

99

123

125

115

Debtors

154

165

112

127

141

Other Current Assets

4

9

10

8

8

Current liabilities

357

400

358

321

358

Net Current Assets

150

200

259

358

430

Misc. Exp. not written off

-

-

-

-

-

Total Assets

384

459

536

644

735

*reporting changed from CY to FY starting January 2015

February 9, 2016

9

Goodyear | 4QFY2016 Result Update

Cash Flow Statement

Y/E December (` cr)

CY2012

CY2013

CY2014E FY2016E* FY2017E

Profit before tax

85

142

154

205

185

Depreciation

24

25

29

40

35

Change in Working Capital

(40)

29

(11)

(56)

35

Other income

(22)

(30)

(32)

(38)

(39)

Direct taxes paid

(28)

(48)

(52)

(71)

(63)

Others

7

14

12

-

-

Cash Flow from Operations

26

131

99

81

154

(Inc.)/Dec. in Fixed Assets

(23)

(46)

(36)

(53)

(54)

(Inc.)/Dec. in Investments

-

-

-

-

-

(Incr)/Decr In L.T. loan and adv.

(4)

2

(2)

3

-

Other income

22

30

32

38

39

Others

(10)

(18)

(17)

-

-

Cash Flow from Investing

(14)

(32)

(24)

(12)

(15)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

-

-

2

(1)

(0)

Inc./(Dec.) in L.T. Pro. & Liab.

1

1

1

3

(3)

Dividend Paid (Incl. Tax)

(19)

(24)

(28)

(28)

(28)

Others

(5)

3

(2)

-

-

Cash Flow from Financing

(23)

(21)

(27)

(26)

(31)

Inc./(Dec.) in Cash

(11)

78

48

43

107

Opening Cash balances

249

238

317

365

408

Closing Cash balances

238

317

365

408

515

*reporting changed from CY to FY starting January 2015

February 9, 2016

10

Goodyear | 4QFY2016 Result Update

Key Ratios

Y/E December

CY2012

CY2013

CY2014E

CY2015E

CY2016E

Valuation Ratio (x)

P/E (on FDEPS)

19.9

12.0

11.1

8.3

9.2

P/CEPS

13.9

9.4

8.7

6.4

7.2

P/BV

3.2

2.7

2.3

1.9

1.6

Dividend yield (%)

1.4

1.8

2.1

2.1

2.1

EV/Sales

0.6

0.5

0.5

0.4

0.4

EV/EBITDA

9.8

5.8

4.9

3.4

3.3

EV / Total Assets

2.3

1.8

1.4

1.1

0.8

Per Share Data (`)

EPS (Basic)

24.5

40.8

43.9

58.7

52.9

EPS (fully diluted)

24.5

40.8

43.9

58.7

52.9

Cash EPS

35.0

51.7

56.3

76.1

68.2

DPS

7.0

9.0

10.0

10.0

10.0

Book Value

153.5

183.6

215.4

262.1

303.0

Dupont Analysis

EBIT margin

4.5

7.3

7.9

9.5

9.3

Tax retention ratio

0.7

0.7

0.7

0.7

0.7

Asset turnover (x)

14.5

13.1

11.9

9.5

7.3

ROIC (Post-tax)

43.4

63.2

62.4

59.3

44.9

Cost of Debt (Post Tax)

-

-

-

-

-

Leverage (x)

(0.7)

(0.7)

(0.7)

(0.7)

(0.7)

Operating ROE

14.2

16.0

16.6

19.3

11.8

Returns (%)

ROCE (Pre-tax)

18.3

27.0

25.1

29.0

21.5

Angel ROIC (Pre-tax)

65.1

95.4

94.6

89.9

68.0

ROE

16.9

24.2

22.0

24.6

18.7

Turnover ratios (x)

Asset Turnover

3.8

3.8

3.5

3.5

2.8

Inventory / Sales (days)

23

24

26

31

27

Receivables (days)

35

37

32

32

32

Payables (days)

118

124

126

126

126

WC (ex-cash) (days)

(27)

(24)

(26)

(20)

(15)

Solvency ratios (x)

Net debt to equity

(0.7)

(0.7)

(0.7)

(0.7)

(0.7)

Net debt to EBITDA

(2.6)

(2.3)

(2.4)

(1.9)

(2.8)

Interest Coverage

17.5

52.7

36.7

52.1

68.0

*reporting changed from CY to FY starting January 2015

February 9, 2016

11

Goodyear | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitian Stock Exchange of India Limited. It is also registered as a Depository Participant

with CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial

interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months. Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in

market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Goodyear India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

February 9, 2016

12