4QFY2016 Result Update | Textile

May 27, 2016

Garware Wall Ropes

BUY

CMP

`362

Performance Highlights

Target Price

`460

Quarterly Data

Investment Period

12 months

(` cr)

4QFY16

4QFY15

% yoy

3QFY16

% qoq

Revenue

188

197

(4.3)

186

1.5

Stock Info

EBITDA

28

23

25.2

25

15.8

Sector

Textiles

Margin (%)

15.1

11.5

356bp

13.2

186bp

Market Cap (` cr)

853

Adj. PAT

17

12

41.0

15

18.3

Source: Company, Angel Research

Net Debt (` cr)

-62

Beta

1.0

Garware Wall Ropes (GWRL)’ 4QFY2016 results outperformed our estimates on

52 Week High / Low

438/187

the bottom-line front. The company’s top-line for the quarter de-grew by

Avg. Daily Volume

4,788

~4% yoy. On the operating front, the company reported margin improvement,

Face Value (`)

10

primarily on account of lower raw material costs. Further, on the bottom-line front, the

BSE Sensex

26,654

company reported strong growth on account of a favorable operating performance.

Nifty

8,157

Volumes grew but price cut dragged the overall top-line: The company’s top-line

Reuters Code

GRWL.BO

de-grew by ~4% yoy to `188cr (below our estimate of `205cr). The revenue

Bloomberg Code

GWWR@IN

underperformance was mainly due to lower growth of 1% yoy to `153cr in the

Synthetic cordage segment and de-growth of ~22% yoy to `40cr in the Fibre &

Industrial products segment.

Shareholding Pattern (%)

Promoters

50.6

Strong operating performance boosts profitability: On the operating front, the

MF / Banks / Indian Fls

6.1

company reported margin improvement (up by 356bp yoy to 15.1%), primarily

FII / NRIs / OCBs

4.1

on account of lower raw material costs by 981bp yoy as a percentage of sales as

Indian Public / Others

39.2

prices of its key raw materials, ie high density polyethylene, polyethylene etc

declined during the quarter. The reported net profit grew by ~41% yoy to `17.3cr

(outperforming our estimate of

`12cr) on account of the strong operating

Abs. (%)

3m 1yr

3yr

performance.

Sensex

15.1

2.0

32.2

GWRL

29.2

(3.0)

713.5

Outlook and valuation: Going ahead, we expect GWRL to report a healthy top-

line in anticipation of strong domestic as well as export sales. On the domestic

3-year price chart

front, we expect demand to pick up with an expected growth in the agriculture

and fisheries segments in the country. Further, we expect the company to continue

500

450

reporting strong numbers on back of higher demand for aquaculture and sports

400

350

products globally and also with the company tapping new geographies. Hence,

300

250

we recommend a Buy rating on the stock with a target price of `460.

200

150

Key financials (Consolidated)

100

50

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

0

Net sales

784

828

898

997

% chg

14.0

5.5

8.5

11.1

Net profit

43

62

64

72

% chg

61.5

43.7

2.6

13.3

Source: Company, Angel Research

EBITDA margin (%)

10.4

12.7

11.9

11.7

EPS (`)

19.7

28.3

29.0

32.9

P/E (x)

18.3

12.7

12.4

11.0

P/BV (x)

2.5

2.1

1.8

1.6

RoE (%)

13.8

16.8

14.9

14.6

RoCE (%)

19.3

23.2

20.7

20.0

Amarjeet S Maurya

EV/Sales (x)

1.0

0.9

0.8

0.7

022-39357800 Ext: 6831

EV/EBITDA (x)

10.0

6.9

6.7

5.9

Source: Company, Angel Research, Note: CMP as of May 27, 2016

Please refer to important disclosures at the end of this report

1

Garware Wall Ropes | 4QFY2016 Result Update

Exhibit 1: Quarterly performance

Y/E March (` cr)

4QFY16

4QFY15

% yoy

3QFY16

% qoq

FY2016

FY2015

% chg

Net Sales

188

197

(4.3)

186

1.5

828

784

5.5

Consumption of RM

75

98

(23.2)

71

6.1

343

363

(5.6)

(% of Sales)

39.9

49.7

38.2

41.4

46.3

Staff Costs

25

16

55.8

23

8.2

93

84

10.2

(% of Sales)

13.2

8.1

12.4

11.2

10.7

Operating Expense

60

60

(0.8)

67

(10.9)

286

255

12.2

(% of Sales)

31.8

30.6

36.2

34.6

32.5

Total Expenditure

160

174

(8.2)

161

(0.7)

722

703

2.8

Operating Profit

28

23

25.2

25

15.8

105

81

29.4

OPM (%)

15.1

11.5

13.2

12.7

10.4

Interest

2

3

(39.3)

3

(29.7)

9

10

(14.8)

Depreciation

3

3

15.3

3

5.0

13

12

5.7

Other Income

1.2

0.4

193.0

1.2

(0.1)

3

2

102.3

PBT

24

17

43.4

20

23.1

87

61

43.9

(% of Sales)

12.9

8.6

10.6

10.5

7.7

Provision for Taxation

7

5

49.9

5

36.6

25

17

44.2

(% of PBT)

28.7

27.5

25.9

28.9

28.9

Minority Interest

Reported PAT

17

12

41.0

15

18.3

62

43

43.7

PATM

9.2

6.2

7.9

7.5

5.5

Source: Company, Angel Research

May 27, 2016

2

Garware Wall Ropes | 4QFY2016 Result Update

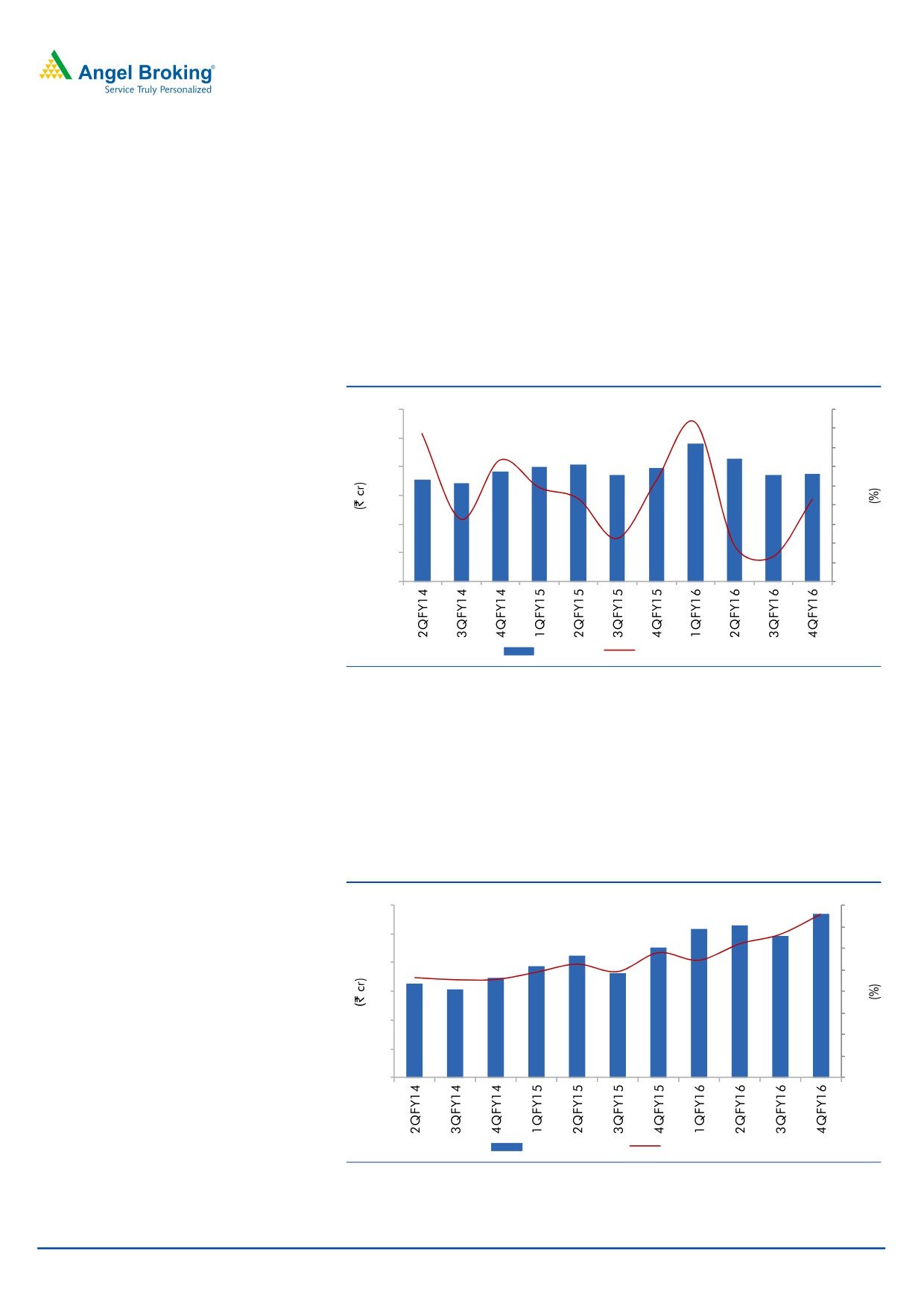

Volumes grew but price cut dragged overall top-line

The company’s top-line de-grew by ~4% yoy to `188cr (below our estimate of

`205cr). The revenue underperformance was mainly due to lower growth of 1%

yoy to `153cr in the Synthetic cordage segment and de-growth of ~22% yoy to

`40cr in the Fibre & Industrial products segment.

Going forward, we expect the company to report healthy numbers on back of

higher anticipated demand for aquaculture and sports products globally and also

with the company tapping new geographies.

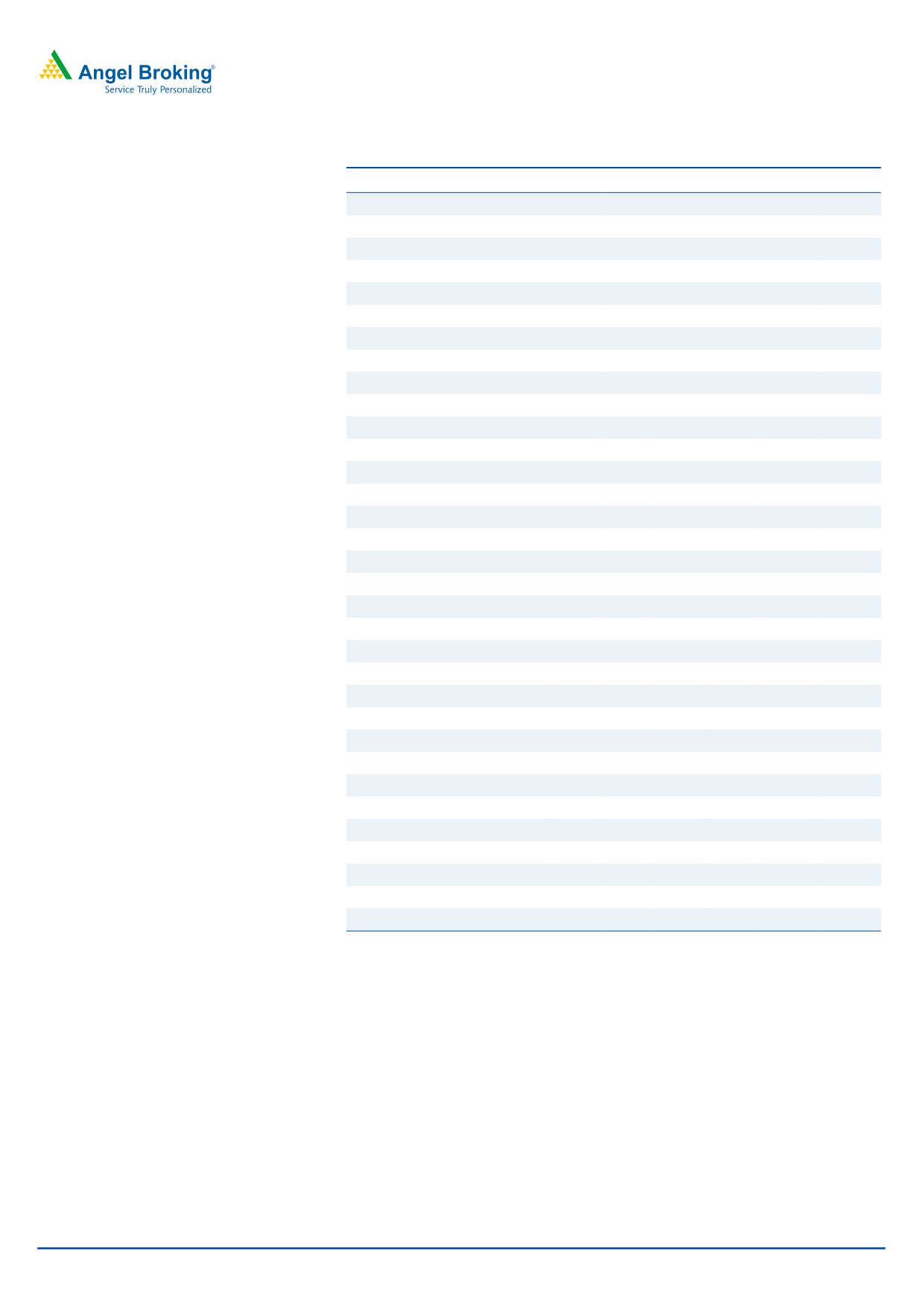

Exhibit 2: Top-line growth trend

25

300

20

250

15

200

10

5

150

-

100

(5)

(10)

50

(15)

0

(20)

Net sales

QoQ growth (%)

Source: Company, Angel Research

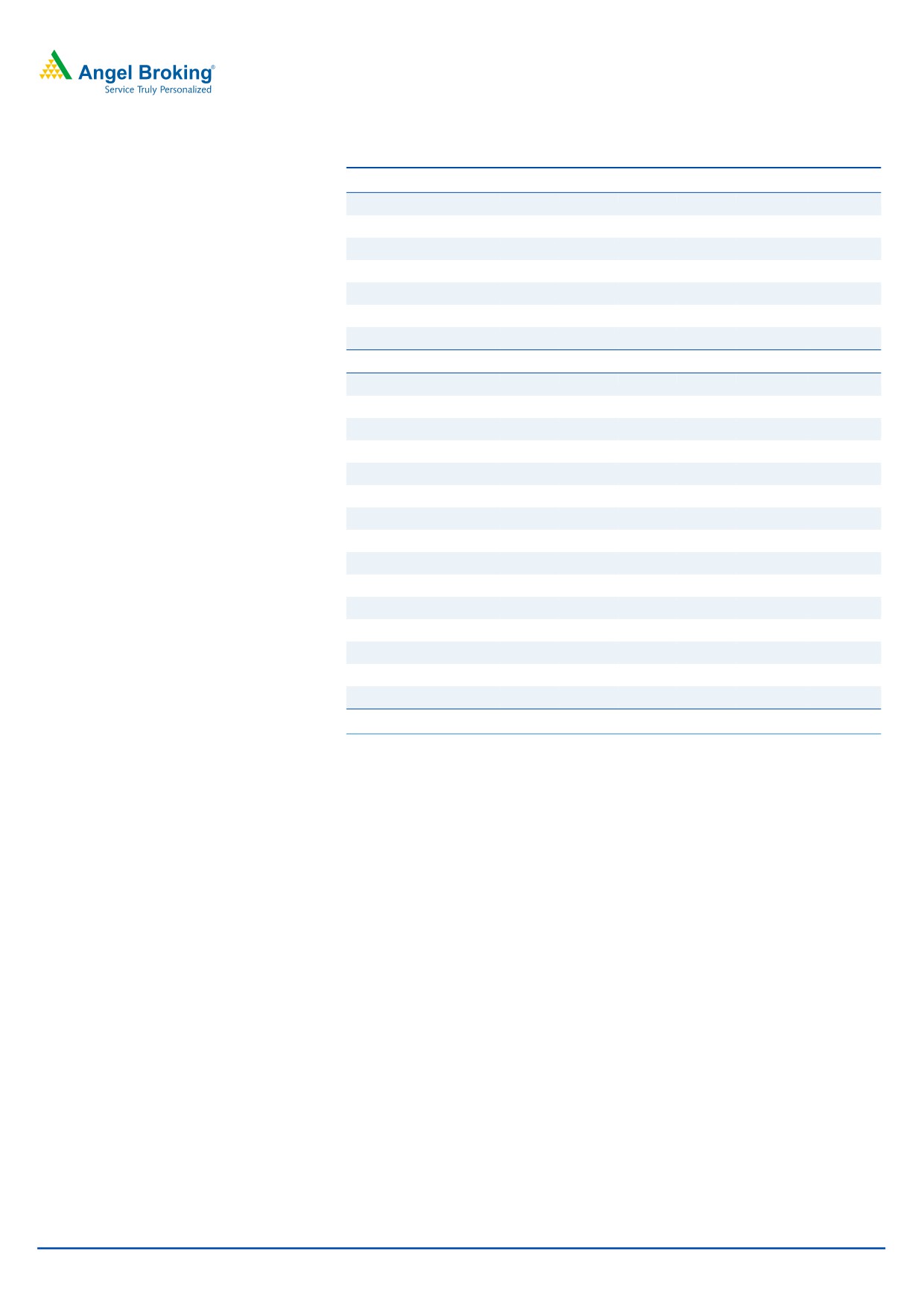

Operating margin expansion due to falling material prices

On the operating front, the company reported margin improvement (up by 356bp

yoy to 15.1%), primarily on account of lower raw material costs by 981bp yoy as a

percentage of sales as prices of its key raw materials, ie high density polyethylene,

polyethylene etc declined during the quarter.

Exhibit 3: Operating profit and margin trend

30

16

14

25

12

20

10

15

8

6

10

4

5

2

0

0

Operating Profit

Margin (%)

Source: Company, Angel Research

May 27, 2016

3

Garware Wall Ropes | 4QFY2016 Result Update

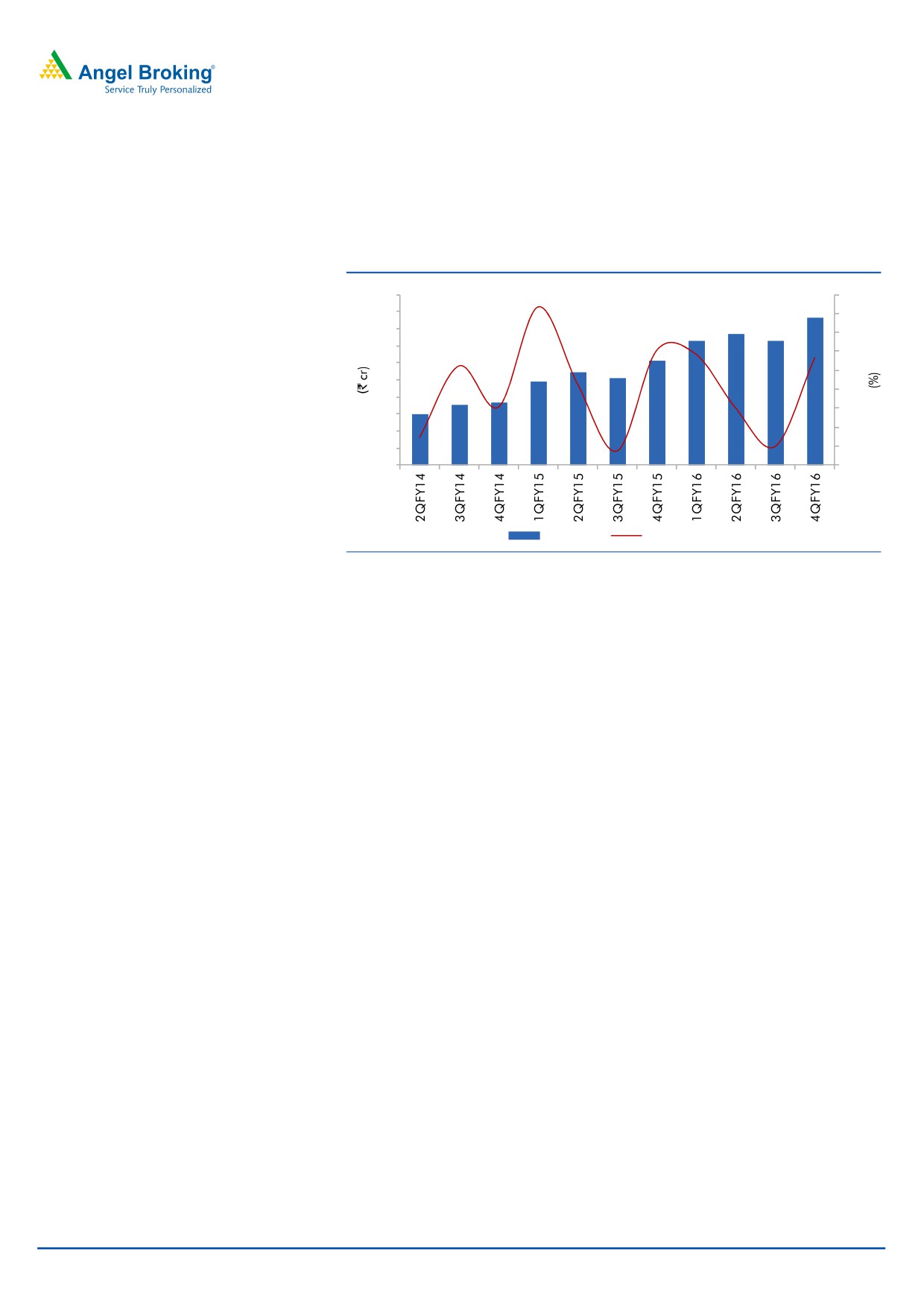

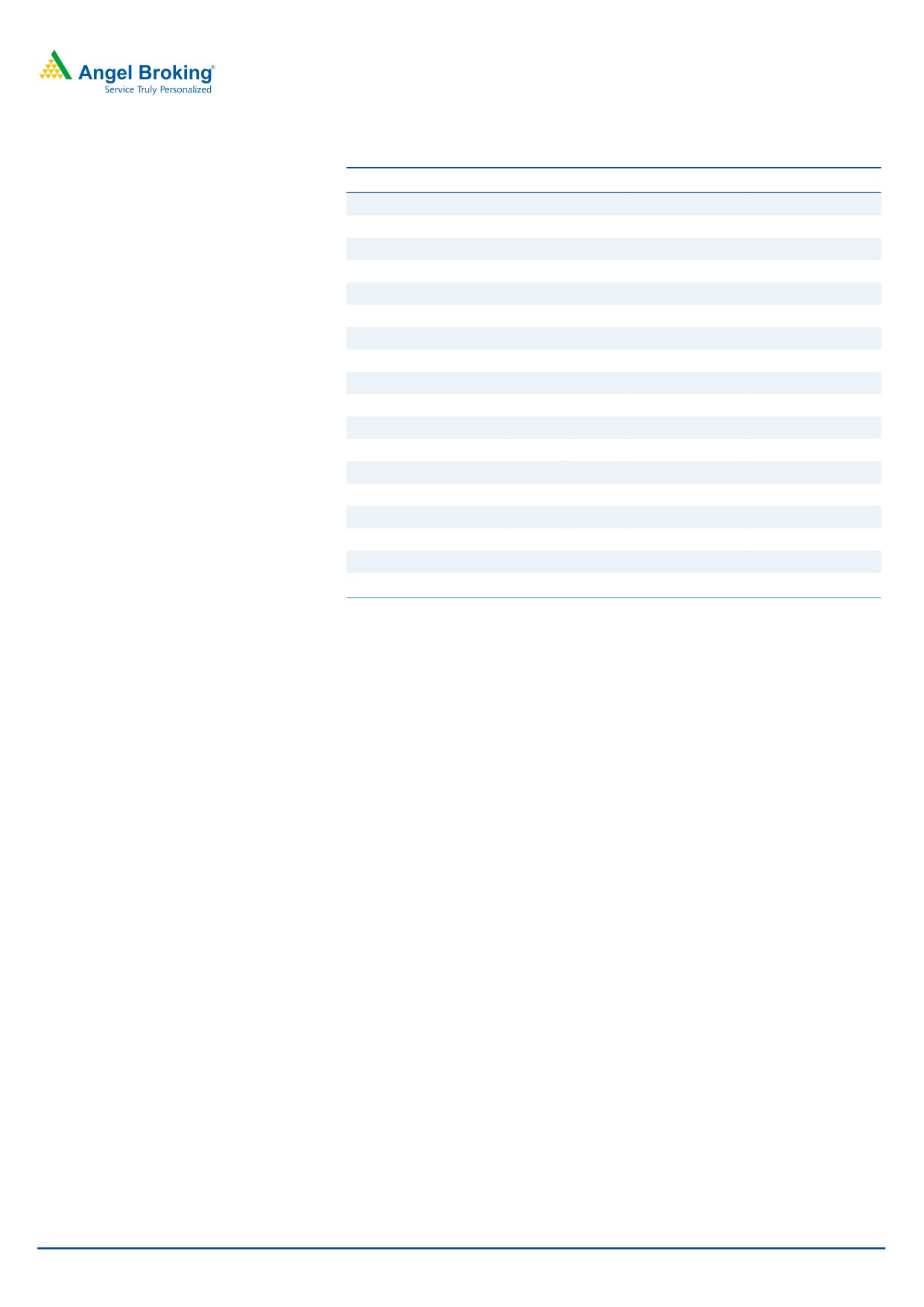

PAT grew ~41% yoy

The reported net profit grew by ~41% yoy to `17.3cr (outperforming our estimate

of `12cr) on account of the strong operating performance.

Exhibit 4: Net Profit and growth trend

20

35

18

30

16

25

14

20

12

15

10

10

8

5

6

-

4

2

(5)

0

(10)

Net Profit

QoQ growth (%)

Source: Company, Angel Research

May 27, 2016

4

Garware Wall Ropes | 4QFY2016 Result Update

Investment rationale

Higher exports to accelerate top-line growth

We expect GWRL to report a healthy top-line CAGR of ~10% over FY2016-18E,

on the back of higher growth in exports. Over the last seven years, the company

has reported a CAGR of ~16% in export sales to `412cr (for FY2016). The

percentage of exports to total sales has increased from 32.5% to 50% over the

same period. Exports predominately comprise of fishing and aquaculture offerings

and of sports goods. Going forward, we expect the company to continue to report

strong numbers on the export front on back of higher demand for aquaculture and

sports products globally. The company has export presence in 72 countries, mainly

in the US, Canada and across Europe. It is now planning to strengthen its presence

in Africa through agricultural offerings. Thus, we expect the company to report

export sales CAGR of ~13% over FY2016-18E. The Management is targeting to

increase export business’ contribution to about 65% of turnover in the next couple

of years.

Lower raw material prices and higher export contribution to

enhance margins

In the last six years, despite of volatility in raw material prices, the company has

maintained its operating margin in the range of 10-11%. In FY2016, the company

witnessed an improvement in its operating margin by 235bp. Going forward, we

believe that the company would be able to increase its margins owing to (a) easing

raw material prices including that of high density polyethylene, polyethylene, nylon

etc. which are crude based raw materials, and (b) higher contribution of exports

which is a high margin business.

Continuous debt repayment and improving return ratios

The company is continuously generating higher cash flows, which has resulted in

debt reduction and improvement in its ROE. The company has been consistently

repaying debt over the past five years, resulting in debt having come down from

~`140cr in FY2012 to `30cr in FY2016. Going forward, we believe the company

will continue repaying debt with strong cash flows, which in turn will lead to

reduction in interest cost (interest cost has reduced from ~`17cr in FY2012 to

~`9cr in FY2016). A lower interest expense in turn will lead to higher profitability

for the company. Further, the company’s ROE has improved from 9.6% in FY2012

to 16.8% in FY2016.

May 27, 2016

5

Garware Wall Ropes | 4QFY2016 Result Update

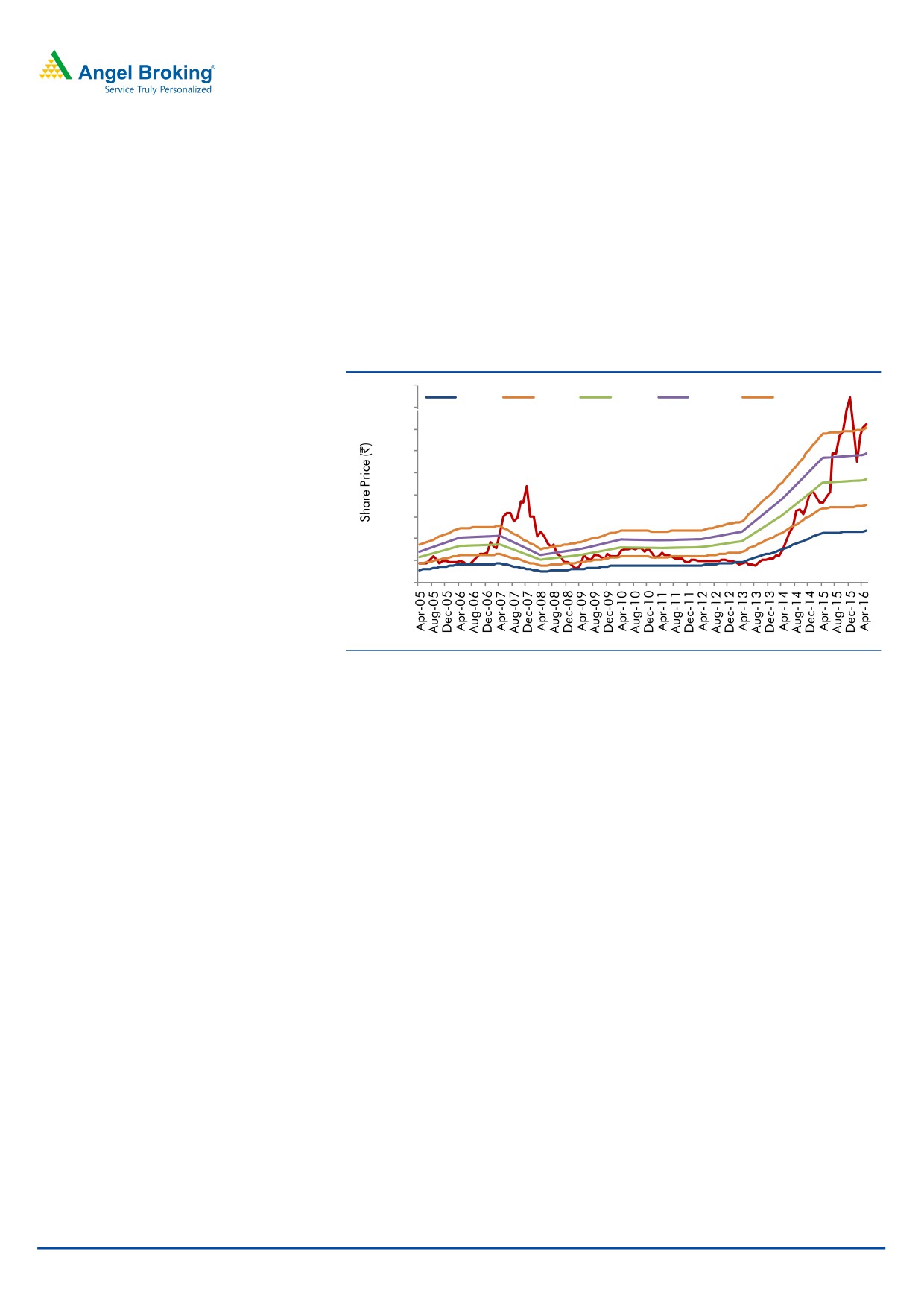

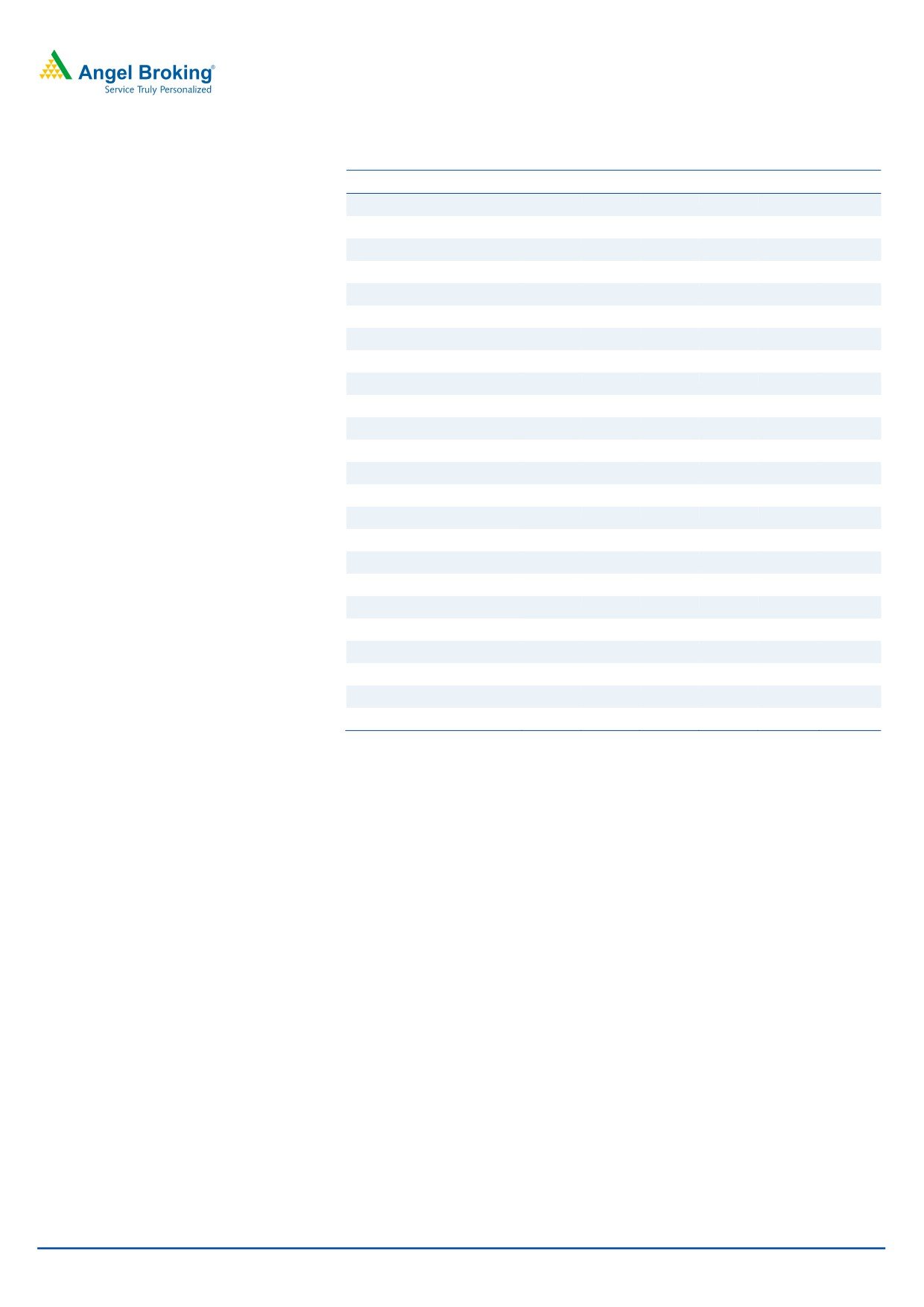

Outlook and valuation

Going ahead, we expect GWRL to report a healthy top-line in anticipation of

strong domestic as well as export sales. On the domestic front, we expect demand

to pick up with an expected growth in the agriculture and fisheries segments in the

country. Further, we expect the company to continue reporting strong numbers on

back of higher demand for aquaculture and sports products globally and also with

the company tapping new geographies. Hence, we recommend a Buy rating on

the stock with a target price of `460.

Exhibit 5: One-year forward P/E band

450

4.0 X

6.0 X

8.0 X

10.0 X

12.0 X

400

350

300

250

200

150

100

50

0

Source: Company, Angel Research

Company Background

Garware Wall Ropes Ltd (GWRL) is an ISO 9001:2008 certified company.

Established in 1976, the company is a leading player in technical textiles,

specializing in providing customized solutions to the cordage and infrastructure

industry worldwide. The company is a global player and known for its innovation

in the field of fisheries, aquaculture, shipping, sports, agriculture, coated fabrics

and geosynthetics. GWRL’s products are manufactured in its state-of-art facilities at

Wai and Pune (both in Maharashtra, India) and are marketed in more than

75 countries worldwide.

May 27, 2016

6

Garware Wall Ropes | 4QFY2016 Result Update

Profit & Loss Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Total operating income

604

688

784

828

898

997

% chg

4.0

13.9

14.0

5.5

8.5

11.1

Total Expenditure

541

622

703

722

791

881

Cost of Materials

263

316

363

343

407

452

Personnel Expenses

81

64

84

93

102

116

Others Expenses

197

242

255

286

282

313

EBITDA

63

65

81

105

107

117

% chg

(1.1)

3.9

24.6

29.6

1.4

9.2

(% of Net Sales)

10.4

9.5

10.4

12.7

11.9

11.7

Depreciation& Amortisation

16

14

12

13

14

15

EBIT

47

51

69

92

92

102

% chg

(2.2)

9.4

35.5

33.9

0.1

9.8

(% of Net Sales)

7.7

7.4

8.8

11.2

10.3

10.2

Interest & other Charges

14

13

10

9

6

4

Other Income

1

1

2

3

3

4

(% of PBT)

4.1

2.6

3.0

4.0

3.4

3.9

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

33

39

61

87

89

101

% chg

4.2

17.0

54.9

43.9

2.7

13.3

Prior Period & Extraord. Exps./(Inc.)

-

-

-

-

-

-

PBT (reported)

33

39

61

87

89

101

Tax

9

12

17

25

26

29

(% of PBT)

26.1

31.8

28.9

28.9

29.0

29.0

PAT (reported)

25

27

43

62

64

72

Add: Share of earnings of asso.

-

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

-

PAT after MI (reported)

25

27

43

62

64

72

ADJ. PAT

25

27

43

62

64

72

% chg

2.7

8.1

61.5

43.7

2.6

13.3

(% of Net Sales)

4.1

3.9

5.5

7.5

7.1

7.2

Basic EPS (`)

11.3

12.2

19.7

28.3

29.0

32.9

Fully Diluted EPS (`)

11.3

12.2

19.7

28.3

29.0

32.9

% chg

2.7

8.1

61.5

43.7

2.6

13.3

May 27, 2016

7

Garware Wall Ropes | 4QFY2016 Result Update

Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

SOURCES OF FUNDS

Equity Share Capital

24

22

22

22

22

22

Reserves& Surplus

243

254

291

347

405

471

Shareholders Funds

267

276

313

369

426

492

Minority Interest

-

-

-

-

-

-

Total Loans

110

71

45

30

20

15

Deferred Tax Liability

19

21

21

21

21

21

Total Liabilities

397

368

379

420

468

529

APPLICATION OF FUNDS

Gross Block

339

351

371

391

411

431

Less: Acc. Depreciation

185

198

211

224

238

253

Net Block

154

153

160

167

173

178

Capital Work-in-Progress

0

7

7

7

7

7

Investments

9

9

9

9

9

9

Current Assets

399

430

519

615

674

779

Inventories

122

127

137

127

140

158

Sundry Debtors

140

143

182

199

216

240

Cash

20

9

11

83

86

101

Loans & Advances

104

138

175

191

213

249

Other Assets

13

13

13

15

18

30

Current liabilities

167

232

318

380

396

445

Net Current Assets

232

198

201

235

277

333

Deferred Tax Asset

1

1

1

1

1

1

Total Assets

397

368

379

420

468

529

May 27, 2016

8

Garware Wall Ropes | 4QFY2016 Result Update

Cashflow Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Profit before tax

33

39

61

87

89

101

Depreciation

16

14

12

13

14

15

Change in Working Capital

(21)

19

(1)

38

(39)

(42)

Interest / Dividend (Net)

13

15

10

9

6

4

Direct taxes paid

(8)

(5)

(17)

(25)

(26)

(29)

Others

(0)

-

-

-

-

-

Cash Flow from Operations

34

82

64

121

45

50

(Inc.)/ Dec. in Fixed Assets

1

(20)

(20)

(20)

(20)

(20)

(Inc.)/ Dec. in Investments

(0)

(0)

0

-

-

-

Cash Flow from Investing

2

(20)

(20)

(20)

(20)

(20)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

(17)

(51)

(27)

(15)

(10)

(5)

Dividend Paid (Incl. Tax)

(7)

(7)

(6)

(6)

(6)

(6)

Interest / Dividend (Net)

(15)

(16)

(10)

(9)

(6)

(4)

Cash Flow from Financing

(39)

(74)

(43)

(29)

(22)

(15)

Inc./(Dec.) in Cash

(3)

(11)

2

72

3

15

Opening Cash balances

24

20

9

11

83

86

Closing Cash balances

20

9

11

83

86

101

May 27, 2016

9

Garware Wall Ropes | 4QFY2016 Result Update

Key Ratios

Y/E March

FY12

FY13

FY14

FY15

FY16E FY17E

Valuation Ratio (x)

P/E (on FDEPS)

31.9

29.5

18.3

12.7

12.4

11.0

P/CEPS

19.2

19.2

14.2

10.5

10.1

9.0

P/BV

2.9

2.9

2.5

2.1

1.8

1.6

Dividend yield (%)

0.8

0.8

0.8

0.8

0.8

0.8

EV/Sales

1.4

1.2

1.0

0.9

0.8

0.7

EV/EBITDA

13.8

12.9

10.0

6.9

6.7

5.9

EV / Total Assets

1.5

1.4

1.2

0.9

0.8

0.7

Per Share Data (`)

EPS (Basic & fully diluted)

11.3

12.2

19.7

28.3

29.0

32.9

EPS (Adjusted)

11.3

12.2

19.7

28.3

29.0

32.9

Cash EPS

18.7

18.8

25.3

34.3

35.6

39.8

DPS

2.7

2.7

2.7

2.7

2.7

2.7

Book Value

122.1

126.1

143.0

168.6

194.9

225.1

Returns (%)

ROCE

12.3

14.7

19.3

23.2

20.7

20.0

Angel ROIC (Pre-tax)

13.4

15.5

20.4

30.1

26.3

25.5

ROE

9.2

9.7

13.8

16.8

14.9

14.6

Turnover ratios (x)

Asset Turnover (Gross Block)

1.8

2.0

2.1

2.1

2.2

2.3

Inventory / Sales (days)

74

67

64

56

57

58

Receivables (days)

85

76

85

88

88

88

Payables (days)

35

34

36

37

38

38

WC cycle (ex-cash) (days)

124

109

113

107

107

108

May 27, 2016

10

Garware Wall Ropes | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Garware Wall Ropes

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

May 27, 2016

11