IPO Note | Financials

Oct 10, 2017

General Insurance Corporation of India

SUBSCRIBE

sue Open: Oct 11, 2017

Is

Issue Close: Oct 13, 2017

General Insurance Corporation of India (GIC Re) is the largest reinsurer company

in terms of gross premium (GP) accepted, having a market share of 60% in India.

GIC Re provides reinsurance across key business lines including fire (property),

Issue Details

marine, motor, engineering, agriculture, aviation, health, liability & credit, etc.

Face Value: `5

Leader in Indian reinsurance industry: GIC Re is the largest reinsurer company in

Present Eq. Paid up Capital: `430cr

India with 60% market share in terms of GP accepted (12th largest global and 3rd

largest Asian reinsurer). Over the last 15 years, industry GP has grown at 15%

Offer for Sale: **10.75cr Shares

and expected to grow at 20% for the next 5-10 years on the back of government

Fresh issue: `1569cr

initiatives, growth in distribution network and increased awareness.

Diversified portfolio leading to better yield: As on 1QFY2018, GIC Re had an

Post Eq. Paid up Capital: `439cr

investment book worth `41,930cr carrying value (`73,903cr Market value) on

Issue size (amount): *`10,662cr -

which company has been able to generate yield of 12.3% for FY2017. For

**11,372cr

FY2013/FY2014/FY2015/FY2016 it has managed to generate yield of

Price Band: `855-912

11.9%/12.1%/14.1%/12.9% respectively. As on Q1FY18, the company’s fixed

income debt securities, equities and money market instruments accounted for

Lot Size: 16 shares and in multiple

thereafter

61.49%, 20.21% and 17.12% respectively.

Post-issue implied mkt. cap:

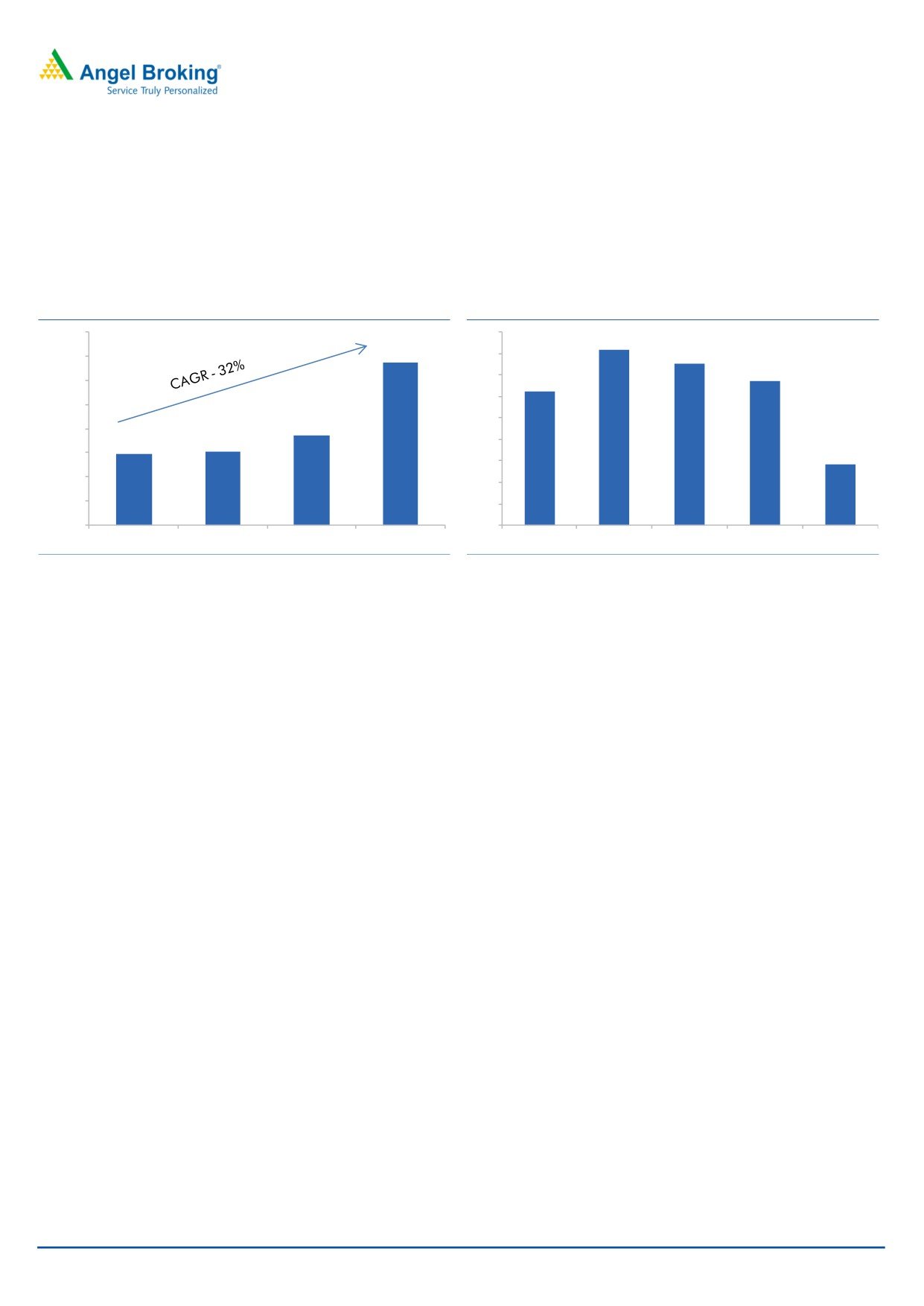

Strong financials with improved combined ratio: GP over last 4/3 years has

*`75,001cr - **`80,001cr

grown at healthy CAGR of 22%/32% respectively. On the bottom-line front, the

Promoters holding Pre-Issue: 100%

company has reported CAGR of ~12% over FY2013-16. Return on equity (ROE)

Promoters holding Post-Issue: 0%

for FY2017 was 16% and last 4 years average ROE was 17%. The combined ratio

has declined from 106.5% in FY2013 to 99.7% in FY2017 due to an increase in

*Calculated on lower price band

Agriculture GP.

** Calculated on upper price band

Outlook & Valuation: At the upper end of the IPO price band it is offered at 25x

Book Building

its FY2017 EPS and 4x its FY2017 book value (Pre-IPO). The agriculture GP has

QIBs

50% of issue

grown aggressively over the last 3 years largely due to the initiatives taken by the

Government and it contributed 29% of GP in FY2017 (4% in FY2014). However,

Non-Institutional

15% of issue

the financials of the company may get affected adversely if India witnesses bad

Retail

35% of issue

monsoon or successive poor monsoon seasons, drought, flooding or other

catastrophic events impacting the Indian agriculture industry. Nonetheless,

positives such as leadership position, well managed investment book, robust

Post Issue Shareholding Patter

balance sheet and reasonable valuations provide comfort, hence, we recommend

Promoters

86%

SUBSCRIBE on this Issue.

Others

14%

Key Financials

Y/E March (` cr)

FY14

FY15

FY16

FY17

Premium earned (net)

13,616

13,595

15,338

26,375

% chg

(0.2)

13

72

Net Profit

2,433

2,891

2,823

3,141

% chg

18.8

(2)

11

EPS

28

34

33

37

Book Value

159

186

214

232

P/E

32

27

28

25

P/BV

6

5

4

4

Jaikishan J Parmar

Combined Ratio (%)

108.9

108.9

107.0

100.2

+022 39357600, Extn: 6810

ROE (%)

18

18

15

16

Source: RHP, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Please refer to important disclosures at the end of this report

1

General Insurance Corporation of India Ltd | IPO Note

Company Background

GIC Re is the largest reinsurance company in India (owned by Government of

India) in terms of Gross Premium accepted in FY2017; this is for approximately

60% of the premiums ceded by Indian insurers to reinsurers during Fiscal 2017. It

is also an international reinsurer and underwrote business from 161 countries as

on June 30, 2017. According to CRISIL Research, GIC Re was ranked 12th largest

global reinsurer in 2016 and the 3rd largest Asian reinsurer in 2015, in terms of

gross premiums accepted.

GIC Re provides reinsurance across key business lines including fire (property),

marine, motor, engineering, agriculture, aviation/space, health, liability, credit &

finance and life insurance. Through their more than 44 years of experience in, and

commitment to, providing reinsurance products and services, the company has

become a trusted brand for insurance and reinsurance customers in India and

overseas.

Exhibit 1: Segmental Business

FY15

FY16

FY17

Outside

Outside

Outside

Business Segment

India

Total

India

Total

India

Total

India

India

India

Fire (Property)

11.0%

20.1%

31.1%

11.4%

23.7%

35.1%

8.0%

16.3%

24.3%

Marine

2.7%

4.6%

7.3%

2.0%

3.5%

5.5%

1.3%

2.1%

3.4%

Miscellaneous

Motor

19.8%

5.5%

25.2%

17.8%

6.4%

24.2%

15.2%

4.4%

19.6%

Engineering

2.9%

2.3%

5.2%

2.6%

2.2%

4.8%

1.3%

1.3%

2.6%

Agriculture

4.0%

0.2%

4.2%

6.8%

0.2%

7.0%

28.4%

0.5%

28.9%

Aviation

1.0%

3.5%

4.5%

0.1%

2.4%

2.5%

0.3%

1.7%

2.0%

Health

8.6%

5.2%

13.8%

8.9%

4.6%

13.5%

9.5%

2.9%

12.4%

Liability

0.6%

0.2%

0.8%

0.5%

0.3%

0.8%

0.5%

0.2%

0.7%

Credit

0.9%

0.1%

1.0%

0.9%

0.1%

1.0%

0.6%

0.1%

0.6%

Others (1)

4.4%

1.5%

5.9%

3.0%

1.4%

4.4%

3.5%

1.0%

4.5%

Life

0.9%

0.3%

1.1%

1.0%

0.3%

1.3%

1.1%

0.0%

1.1%

Total

56.7%

43.3%

100.0%

55.0%

45.0%

100.0%

69.5%

30.5%

100.0%

Source: RHP

Oct 10, 2017

2

General Insurance Corporation of India Ltd | IPO Note

Issue details

State owned GIC Re is a mix of Offer for sale and fresh issue. The issue would

constitute fresh issue worth of `1,569cr and Offer for sale worth of `9,804cr. The

national reinsurer will dilute 14.22% of its post-offer paid-up equity share capital.

Of this, the government will dilute 12.26% stake and the balance 1.96% by the

Corporation itself.

Note: A discount of `45 per equity share would be offered to employees and retail

individual bidders.

Exhibit 2: Pre and Post-IPO shareholding pattern

No of shares

No of shares

%

%

(Pre-issue)

(Post-issue)

Promoter

86,00,00,000 100

75,25,00,000

86

Investor/Public

12,47,00,000

14

Total

86,00,00,000 100

87,72,00,000

100

Source: RHP, Note: Calculated on upper price band

Objects of the offer

Augmenting the capital base of the Corporation to support the growth of

business and to maintain current solvency levels

General corporate purposes, subject to applicable law

Key Management Personnel

Alice G Vaidyan is the Chairman-cum-Managing Director. She holds a post

graduate degree in English language and literature from University of Kerala. She

has trained in “Strategy: Building and Sustaining Competitive Advantage” at

Harvard Business School, Boston, USA and is a fellow of the Insurance Institute of

India. She has over 30 years of experience in the Indian insurance and reinsurance

industry.

Vimal Chand Jain, is the Chief Financial Officer. He holds a bachelor’s degree of

commerce from University of Rajasthan, certificate of membership from the

Institute of Chartered Accountants of India, and is a fellow of the Insurance Institute

of India. He has been associated with GIC Re since October 2012. Previously, he

worked with New India Assurance Company Limited.

Oct 10, 2017

3

General Insurance Corporation of India Ltd | IPO Note

Investment Rationale

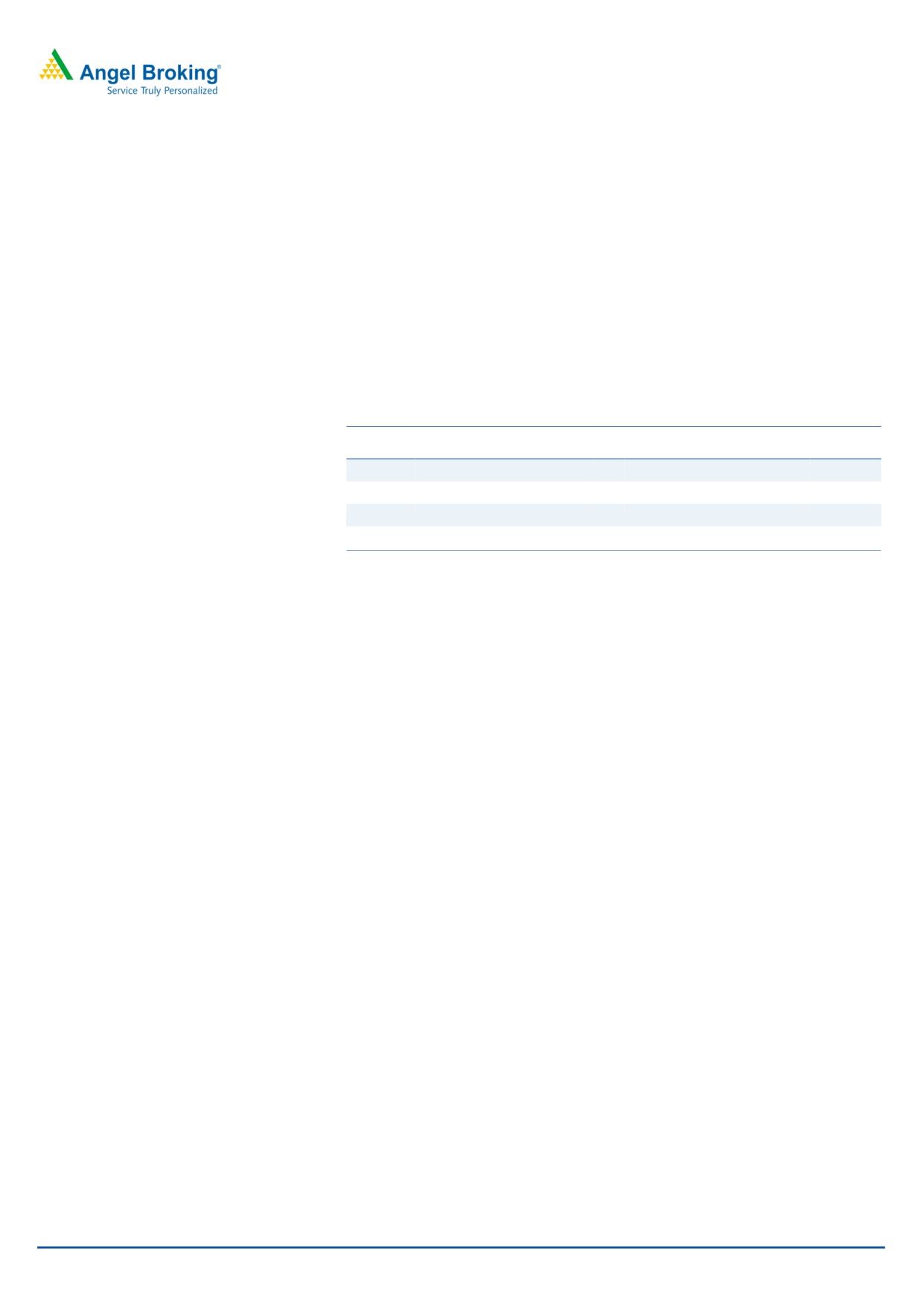

Leader in Indian reinsurance industry: GIC Re is the largest reinsurance company

in India with 60% market share in terms of GP accepted. It is also the 12th largest

global and 3rd largest Asian reinsurer. Over last 15 years industry GP has grown

at 15% and is expected to grow at 20% for the next 5-10 years on the back of

government initiatives, growth in distribution network and increased awareness.

Penetration level in India (Premiums as % of GDP) is very low (0.77%) compared to

2.8% world average. We expect that an increase in awareness of general

insurance would continue to support reinsurance business at a healthy rate.

Exhibit 3: Non-Life insurance penetration as of 2016

5%

5%

Premium as % of GDP

4%

4%

3%

3%

2%

2%

1%

1%

0%

Source: RHP

According to CRISIL Research, size of the Indian reinsurance market was estimated

to be approximately ₹388 billion in Fiscal 2017. The reinsurance market in India

grew at a healthy 15% CAGR in the ten fiscal years ending FY2017. In Fiscal

2017, premiums ceded to reinsurers increased by 73%, as non-life insurance

premiums grew by 32% on-year and retention ratios declined close to 9%. The

sharp jump in non-life premiums in Fiscal 2017 was driven by a four-fold increase

in crop insurance premiums. Even after excluding crop insurance, premium growth

in Fiscal 2017 remained healthy at 18%.

Exhibit 4: Market share of GIC Re in India

70%

60%

60%

47%

50%

45%

43%

40%

40%

36%

30%

20%

10%

0%

FY12

FY13

FY14

FY15

FY16

FY17

Source: RHP

Oct 10, 2017

4

General Insurance Corporation of India Ltd | IPO Note

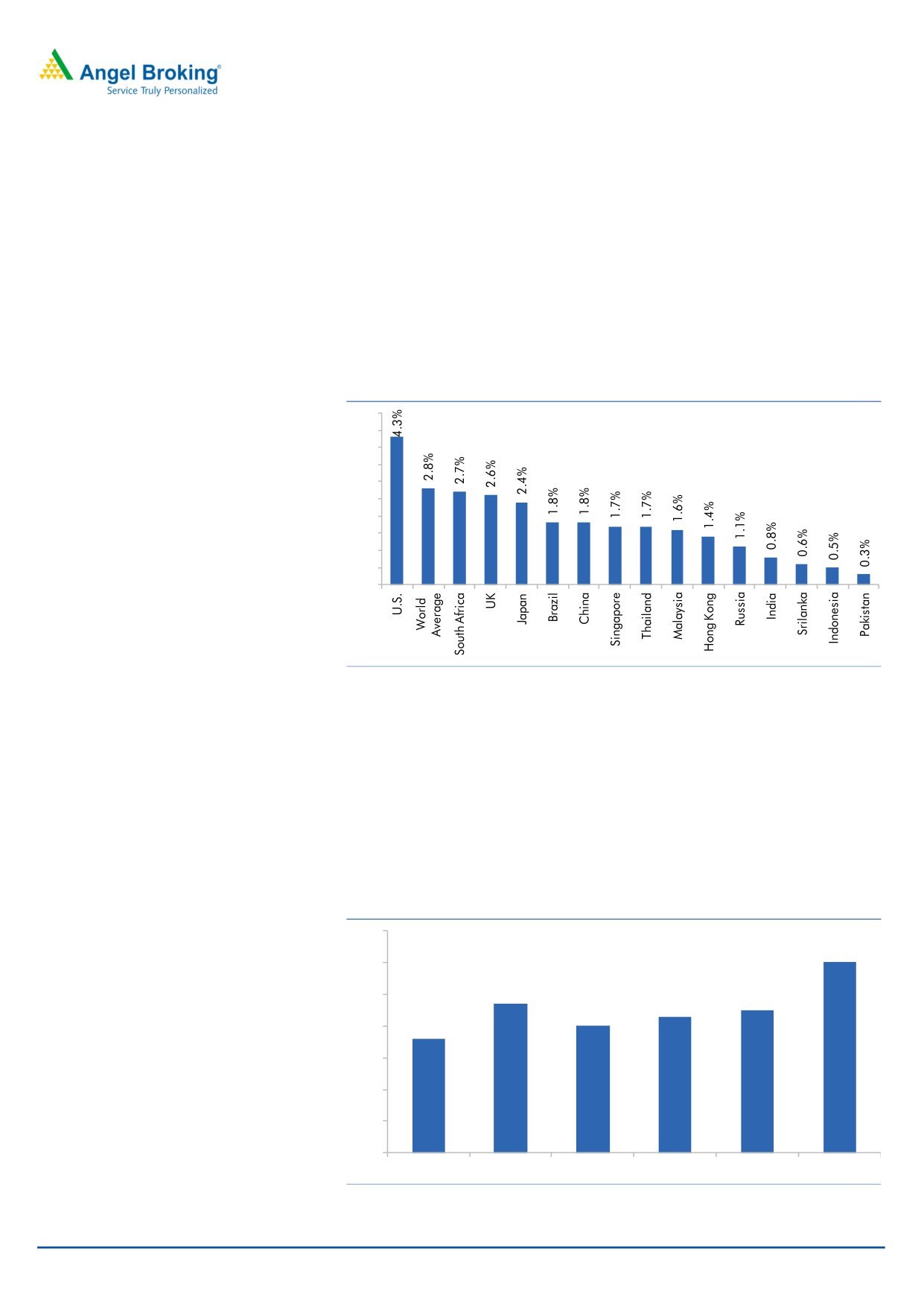

Diversified portfolio leading to better yields: As on 1QFY2018, GIC Re had an

investment book worth `41,930cr carrying value (`73,903cr Market value) on

which company has been able to generate yield of 12.3% for FY2017. For

FY2013/FY2014/FY2015/FY2016 it has managed to generate yield of

11.9%/12.1%/14.1%/12.9% respectively. As on Q1FY18, the company’s fixed

income debt securities, equities and money market instruments accounted for

61.49%, 20.21% and 17.12% respectively.

Exhibit 5: Investment Performance

Exhibit 6: Composition of the Indian Investment Assets

14.5%

14.1%

2%

14.0%

15%

Equity

21%

13.5%

12.9%

Central Govt. Sec

13.0%

State Govt. Sce

12.5%

12.3%

12.1%

11.9%

Bond

12.0%

29%

21%

Money Market

11.5%

Others

11.0%

10.5%

12%

FY13

FY14

FY15

FY16

FY17

Source: RHP

Source: RHP

Exhibit 7: Investment Income and Yield Without Unrealized Gains

(` in Cr)

2013

2014

2015

2016

2017

Investment

Yield

Investment Yield

Investment Yield Investment Yield

Investment Yield

Income

Income

Income

Income

Income

Equity

1,344 21%

1,508 22%

2,202 31%

2,046 27%

2,202 28%

Fixed Income Securities

... Central Govt Securities

412

8%

495

8%

548

8%

611

8%

661

8%

…State Govt Securities

210

8%

244

8%

292

9%

341

8%

391

9%

…Other Approved Securities

42

8%

37

8%

35

8%

31

7%

28

8%

...Debentures and Bonds

558

9%

696

9%

784

9%

867

9%

965

9%

...Money Market Instruments

268 10%

288

9%

268

9%

239

8%

223

5%

Loans

45

9%

49 11%

39 10%

39 10%

35 10%

Venture Capital Funds

4

3%

5

3%

8

5%

0

0%

10

6%

Preference Shares

5

5%

0

2%

-0

-5%

1

8%

0

6%

Total Investments

2,889 12%

3,321 12%

4,176 14%

4,175 13%

4,516 12%

Source:RHP

Oct 10, 2017

5

General Insurance Corporation of India Ltd | IPO Note

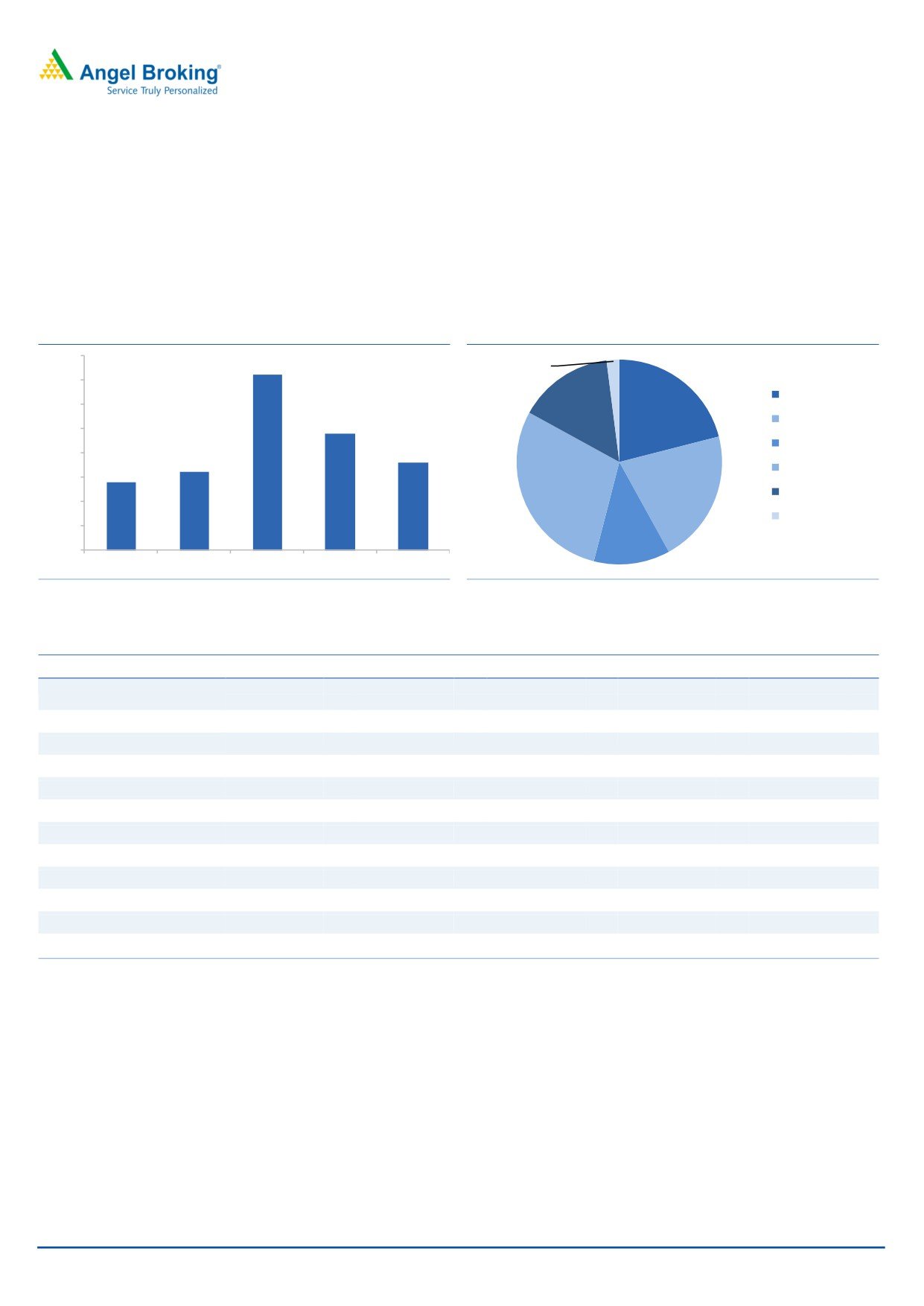

Strong financials with improved combined ratio: GP over last 4/3 years has grown

at healthy CAGR of 22%/32% respectively. On the bottom-line front, the company

has reported CAGR of ~12% over FY2013-16. Return on equity (ROE) for FY2017

was 16% and last 4 years average ROE is 17%. The combined ratio has declined

from 106.5% in FY2013 to 99.7% in FY2017 due to an increase in Agriculture GP.

Exhibit 8: Gross Premium growth trend (` in cr)

Exhibit 9: Combined Ratio Trend (%)

112

40,000

110.3

33,741

109

35,000

110

107.4

30,000

108

106.5

106

25,000

104

18,534

20,000

14,680

15,270

102

15,000

99.7

100

10,000

98

5,000

96

0

94

FY14

FY15

FY16

FY17

FY13

FY14

FY15

FY16

FY17

Source: RHP

Source: RHP

Company’s future strategy

Expand and leverage leadership position in domestic reinsurance industry

Expand the presence internationally and grow overseas business

Focus on improving profitability through reduction in combined ratio

Grow the life reinsurance and other business lines in India and overseas

markets

Oct 10, 2017

6

General Insurance Corporation of India Ltd | IPO Note

Outlook & Valuation:

At the upper end of the IPO price band it is offered at 25x its FY2017 EPS and 4x

its FY2017 book value (Pre-IPO). The agriculture GP has grown aggressively over

the last 3 years largely due to the initiatives taken by the Government and it

contributed 29% of GP in FY2017 (4% in FY2014). However, the financials of the

company may get affected adversely if India witnesses bad monsoon or successive

poor monsoon seasons, drought, flooding or other catastrophic events impacting

the Indian agriculture industry. Nonetheless, positives such as leadership position,

well managed investment book, robust balance sheet and reasonable valuations

provide comfort, hence, we recommend SUBSCRIBE on this Issue.

Key Risks

Underwriting risk

The success of GIC Re depends upon the ability to accurately assess the risks

associated with the businesses that it reinsures. If actual losses exceed

estimated loss reserves, then net income and capital position will be reduced.

Hampered agricultural industry

The financials of GIC Re may get adversely affected, if India witnesses a bad

monsoon or successive poor monsoon seasons, drought, flooding or other

disastrous events which could hamper the Indian agricultural industry.

Catastrophic losses

Events such as windstorms, hurricanes, tsunamis, earthquakes, floods,

hailstorms, tornadoes, severe winter, fire, drought, explosions and other

natural and man-made disasters, are some incidents whose severity is highly

unpredictable. These catastrophic events pose a risk for GIC Re.

Oct 10, 2017

7

General Insurance Corporation of India Ltd | IPO Note

Income Statement

Y/E March (` cr)

FY14

FY15

FY16

FY17

Operating Profit/(Loss)

(a) Fire Insurance

14

1,318

732

637

(b) Marine Insurance

451

(122)

407

210

(c) Miscellaneous Insurance

1,131

326

381

1,404

(d) Life Insurance

7

39

70

(110)

Operating Profit from Insurance

1,603

1,561

1,590

2,142

% chg

(3)

2

35

Income from Investments

(a) Interest, Dividend & Rent - Gross

673

747

893

1,020

(b) Profit on sale of Investments

310

555

544

619

Less: Loss of sale of Investment

-

-

-

-

Other Income:

110

235

243

18

Profit on Exchange

101

-

83

0

Profit on sale of Assets (Net)

-

(0)

-

-

Sundry Balances Written Back (Net)

-

-

-

-

Interest on Income-tax Refund

5

233

-

17

Motor Pool Service changes

3

-

-

-

(Provision) / Doubtful Debts written back

-

-

157

-

Miscellaneous Receipts

0

2

2

1

Total Income

2,696

3,098

3,269

3,799

% chg

15

6

16

Provision for Doubtful Loans & Investment

125

3

42

29

Provision for Doubtful Debts

-

108

-

231

Amortisation of premium on Investments

20

18

19

19

Diminution in the value of investments written off

111

59

136

56

Other Expenses :

-

-

-

-

Expenses relating to Investments

1

1

1

2

Loss on Exchange

-

29

-

24

(Profit)/Loss on sale of Assets (Net)

(0)

-

(0)

0

Sundry Balances Written off (Net)

-

-

-

-

Interest Motor Pool & Others

137

32

1

6

IPO Expenses

-

-

-

-

Total (B)

394

268

248

382

Profit Before Tax

2,302

2,831

3,021

3,417

Provisions for Taxation

(17)

29

332

412

as a % of PBT

-

1

11

12

Profit After Tax

2,319

2,801

2,690

3,004

Share of Profit in Associate Companies

114

90

134

136

Profit for the year

2,433

2,891

2,823

3,141

% chg

19

(2)

11

EPS

28

34

33

37

Source:RHP

Oct 10, 2017

8

General Insurance Corporation of India Ltd | IPO Note

Balance Sheet

Y/E March (` cr)

FY14

FY15

FY16

FY17

SOURCES OF FUNDS

Share Capital

430

430

430

430

Reserves and Surplus

13,224

15,594

17,988

19,539

Net Worth

13,654

16,024

18,418

19,969

- Growth (%)

17

15

8

Borrowings

-

-

-

-

Deferred Tax Liability

-

-

-

-

Fair Value Change Account

20,532

28,148

23,457

30,037

Total

34,186

44,172

41,875

50,006

APPLICATION OF FUNDS

Investments

46,679

56,758

55,686

66,212

- Growth (%)

22

(2)

19

Loans

424

394

366

322

Fixed Assets

118

143

176

169

Goodwill on Consolidation

-

38

38

38

Deferred Tax Asset

24

9

11

16

Current Assets:

-

-

-

-

Cash and Bank Balances

8,264

7,749

9,779

12,231

Advances and Other Assets

8,486

9,826

10,047

18,090

Current Assets

16,750

17,575

19,827

30,322

Current Liabilities

22,433

22,774

25,072

33,809

Provisions

7,376

7,971

9,156

13,264

Sub-Total (B)

29,809

30,745

34,228

47,074

Net Current Assets

(13,059)

(13,169)

(14,402)

(16,752)

Miscellaneous Expenditure

-

-

-

-

Total

34,186

44,172

41,875

50,006

- Growth (%)

29

(5)

19

Contingent Liabilities

3,036

3,086

2,766

3,317

Source: RHP

Oct 10, 2017

9

General Insurance Corporation of India Ltd | IPO Note

Key Ratio

Y/E March (` cr)

FY14

FY15

FY16

FY17

Valuation Ratio

P/E

32

27

28

25

P/B

5.7

4.9

4.3

3.9

Profitability ratios (%)

ROE

18

18

15

16

ROA

7.1

6.5

6.7

6.3

Yield in Investment

12.1

14.1

12.9

12.3

Per Share Data (`)

EPS

28

34

33

37

BV

159

186

214

232

Operating Ratio (%)

Solvency Ratio

2.9

3.3

3.8

2.4

Claim Ratio

88.9

87.6

84.5

81.6

Commission Ratio

20.1

21.3

17.7

Combined Ratio (CONSOL) (%)

108.9

108.9

107.0

100.2

- Fire

-

93.2

101.2

103.7

- Marine

-

129.5

91.2

101.6

- Motor

-

124.4

113.3

114.0

- Engineering

-

89.9

59.5

69.7

- Agriculture

-

112.9

169.5

92.2

- Aviation

-

102.8

90.9

109.2

- Health

-

132.7

113.8

110.3

- Liability

-

13.3

63.2

70.9

- Credit

-

118.0

184.7

31.3

- Life

-

81.9

77.7

148.4

Oct 10, 2017

10

General Insurance Corporation of India Ltd | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Oct 10, 2017

11