2QFY2016 Result update | Power Cables

November 17, 2015

Finolex Cables

NEUTRAL

CMP

`258

Performance Highlights

Target Price

-

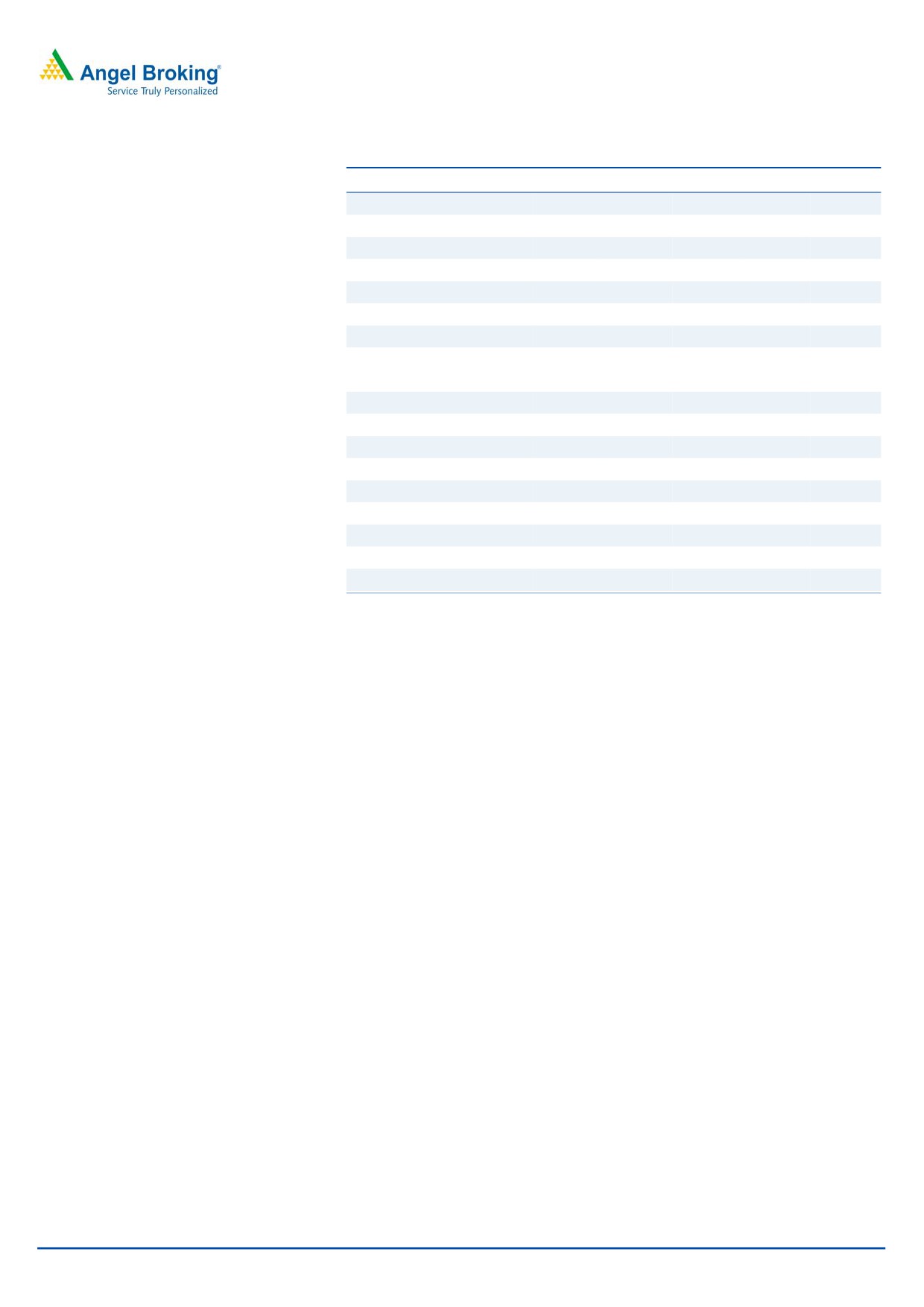

Y/E March (` cr)

2QFY16 2QFY15

% chg (yoy) 1QFY16

% chg (qoq)

Investment Period

-

Total operating income

605

637

(4.9)

588

2.9

EBITDA

75

80

(5.9)

73

3.4

Stock Info

EBITDA Margin (%)

12.5

12.6

(12)bp

12.4

6bp

Adj. PAT

65

79

(17.8)

48

35.2

Sector

Cables-Power

Source: Company, Angel Research

Market Cap (` cr)

3,953

Finolex Cables (FCL) has reported its 2QFY2016 numbers which are below our

Net Debt

(581.4)

estimates. The top-line declined by 4.9% yoy to `605cr. The decline is on

Beta

0.7

account of lower commodity prices which were passed on, resulting in lower

52 Week High / Low

306 / 215

realizations. The raw material cost declined by 178bp yoy to 72.1% of sales but

Avg. Daily Volume

37,448

the same was negated by 59bp yoy increase in employee cost to 4.3% of sales

and 131bp yoy increase in other expenses to 11.1% of sales. This resulted in

Face Value (`)

2

the EBITDA margin contracting by 12bp yoy to 12.5%. Other income during the

BSE Sensex

25,760

quarter declined by 24.4% yoy to `28cr. As a result, the net profit declined by

Nifty

7,807

17.8% yoy to `65cr against `79cr in the same quarter of the previous year.

Reuters Code

FNXC.BO

Revival in capex cycle to drive growth: The growth of the company is closely

Bloomberg Code

FNXC.IN

related to revival in the capex cycle of the industries catered to. The company

has evolved into an electrical equipment company from a wire and cables

Shareholding Pattern (%)

company by enhancing its product portfolio with entry into new product

segments. This is expected to drive earning of the company in the coming

Promoters

35.9

years. With the government’s increased focus on industrial and infrastructure

MF / Banks / Indian Fls

14.9

sectors, FCL is well placed to reap benefits of the same. However, in the near

FII / NRIs / OCBs

7.5

term the outlook is subdued with no visible signs of pick-up.

Indian Public / Others

41.7

Higher tax rate to dent profitability, recommend Neutral: We expect the

company’s top-line and EBITDA to post a 8.5% and 15.2% CAGR over

Abs.(%)

3m 1yr

3yr

FY2015-17E to `2,883cr and `345cr respectively with EBITDA margin at

Sensex

(7.6)

(8.6)

40.7

12.0% in FY2017E. However, benefit of low material cost and interest outgo is

Finolex

2.1

4.0

420.5

expected to be offset by higher tax rate which will dent profitability. As a result,

the bottom-line is expected to post a modest CAGR of 4.3% for the same

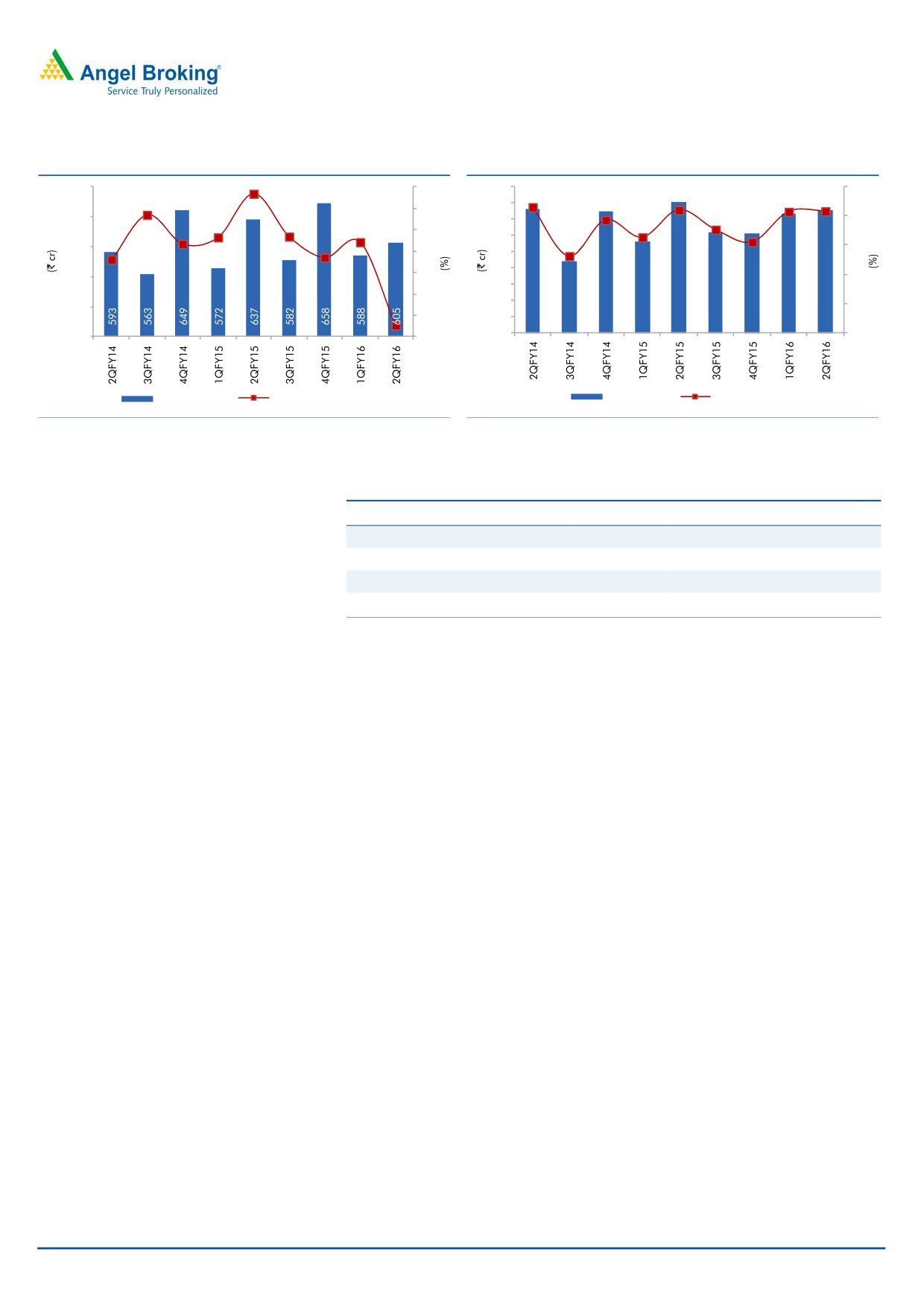

3-Year Daily Price Chart

period to `217cr. We recommend a Neutral rating on the stock as it trades at

fair valuations of 18.2x its FY2017E earnings.

350

300

Key Financials

250

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

200

Net Sales

2,271

2,359

2,449

2,520

2,883

150

% chg

10.0

3.9

3.8

2.9

14.4

100

50

Net Profit

145

208

199

194

217

-

% chg

47.9

43.0

(4.0)

(2.8)

12.1

EBITDA Margin (%)

10.1

10.5

10.6

12.2

12.0

FDEPS (`)

9.5

13.6

13.0

12.7

14.2

P/E (x)

27.2

19.0

19.8

20.4

18.2

Source: Company, Angel Research

P/BV (x)

4.3

3.6

3.1

2.8

2.5

RoE (%)

15.7

18.8

15.8

13.6

13.5

RoCE (%)

23.5

25.4

27.6

33.7

34.0

Milan Desai

EV/Sales (x)

1.7

1.5

1.4

1.3

1.1

+91 22 4000 3600 Ext: 6846

EV/EBITDA (x)

16.3

14.6

13.0

10.8

9.2

Source: Company, Angel Research; Note: CMP as of November 16, 2015

Please refer to important disclosures at the end of this report

1

Finolex Cables | 2QFY2016 Result update

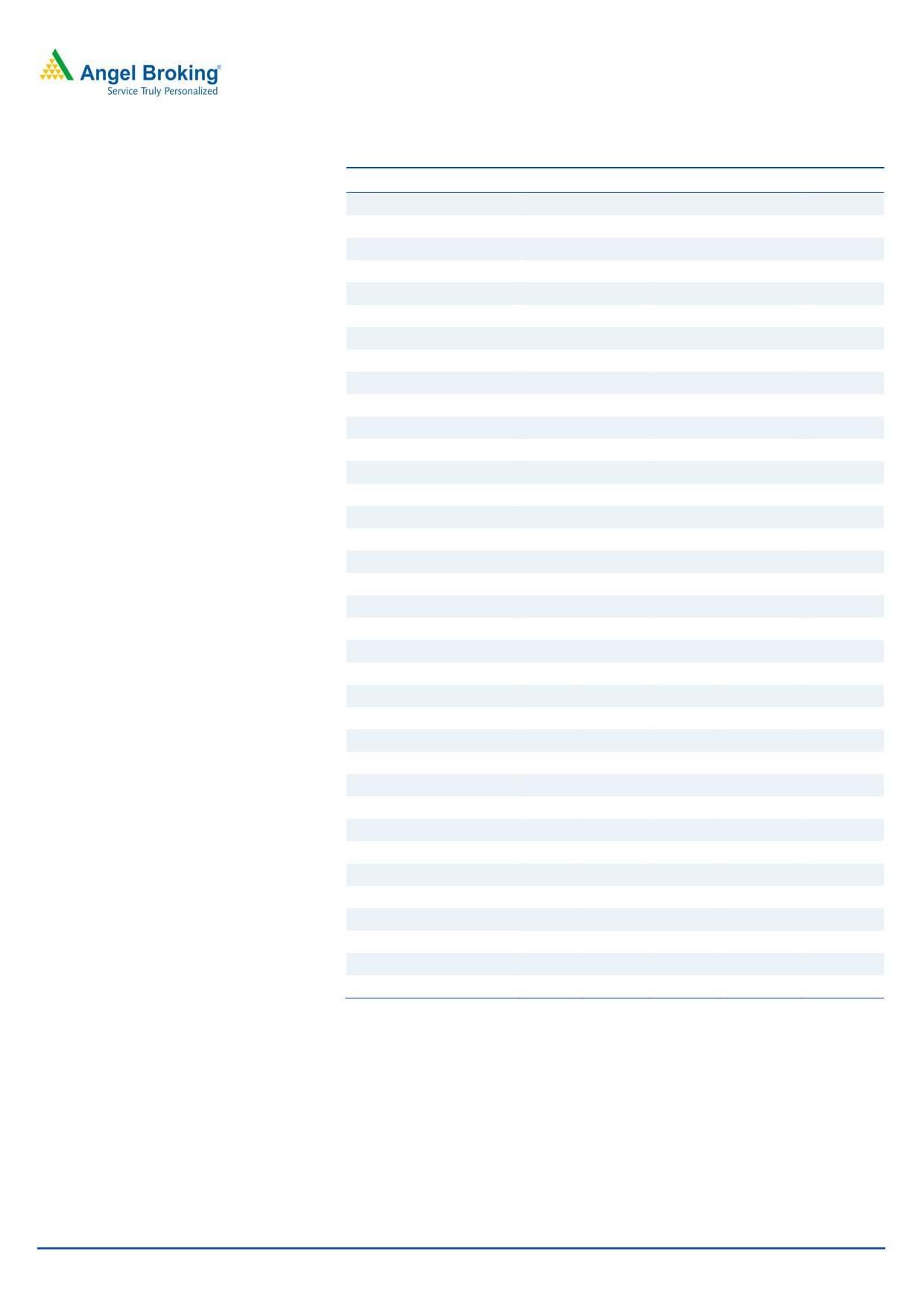

Exhibit 1: 2QFY2016 performance highlights

Y/E March (` cr)

2QFY16

2QFY15

% chg (yoy) 1QFY16

% chg (qoq) 1HFY16 1HFY15

% chg

Total operating income

605

637

(4.9)

588

2.9

1,194

1,209

(1.3)

Net raw material

436

470

(7.2)

423

3.1

860

899

(4.4)

(% of Sales)

72.1

73.9

(178)bp

71.9

15bp

72.0

74.4

(238)bp

Employee cost

26

24

10.2

25

3.9

51

46

10.8

(% of Sales)

4.3

3.7

59bp

4.3

4bp

4.3

3.8

47bp

Other Expenses

67

63

7.8

67

0.7

134

127

5.7

(% of Sales)

11.1

9.8

131bp

11.4

(25)bp

11.3

10.5

74bp

Total expenditure

530

557

(4.8)

515

2.8

1,045

1,073

(2.6)

EBITDA

75

80

(5.9)

73

3.4

148

136

9.0

EBITDA Margin (%)

12.5

12.6

(12)bp

12.4

6bp

12.4

11.3

10bp

Interest

3

3

(19.8)

3

(14.8)

6

7

(12.4)

Depreciation

13

14

(6.5)

13

0.8

26

28

(6.1)

Other income

28

37

(24.4)

9

227.5

37

45

(18.0)

PBT

88

100

(12.2)

65

34.1

153

146

4.6

(% of Sales)

14.5

15.7

11.1

12.8

12.1

Tax

23

21

8.9

17

31.0

40

33

22.9

(% of PBT)

25.9

20.9

26.5

26.2

22.3

Reported PAT

65

79

(17.8)

48

35.2

113

114

(0.6)

Exceptional items

0

0

0

0

0

Adjusted PAT

65

79

(17.8)

48

35.2

113

114

(0.6)

PATM (%)

10.7

12.4

8.2

9.5

9.4

Source: Company, Angel Research

Performance below expectations

FCL’s 2QFY2016 numbers have come in below our estimates. The top-line

declined by 4.9% yoy to `605cr, which is below our estimate of `691cr. The

decline is on account of lower commodity prices, which were passed on, resulting

in lower realizations. In terms of volume growth, Electrical Cables posted modest

growth numbers while Communication Cables posted a more than 20% yoy

growth. The raw material cost declined by 178bp yoy to 72.1% of sales but the

same was negated by 59bp yoy increase in employee cost to 4.3% of sales and

131bp yoy increase in other expenses to 11.1% of sales. This resulted in the

EBITDA margin contracting by 12bp yoy to 12.5%. Other income during the

quarter declined by 24.4% yoy to `28cr, but the same is in-line with our estimate

of `27cr. As a result, the net profit declined by 17.8% yoy to `65cr as against

`79cr in the same quarter of the previous year.

November 17, 2015

2

Finolex Cables | 2QFY2016 Result update

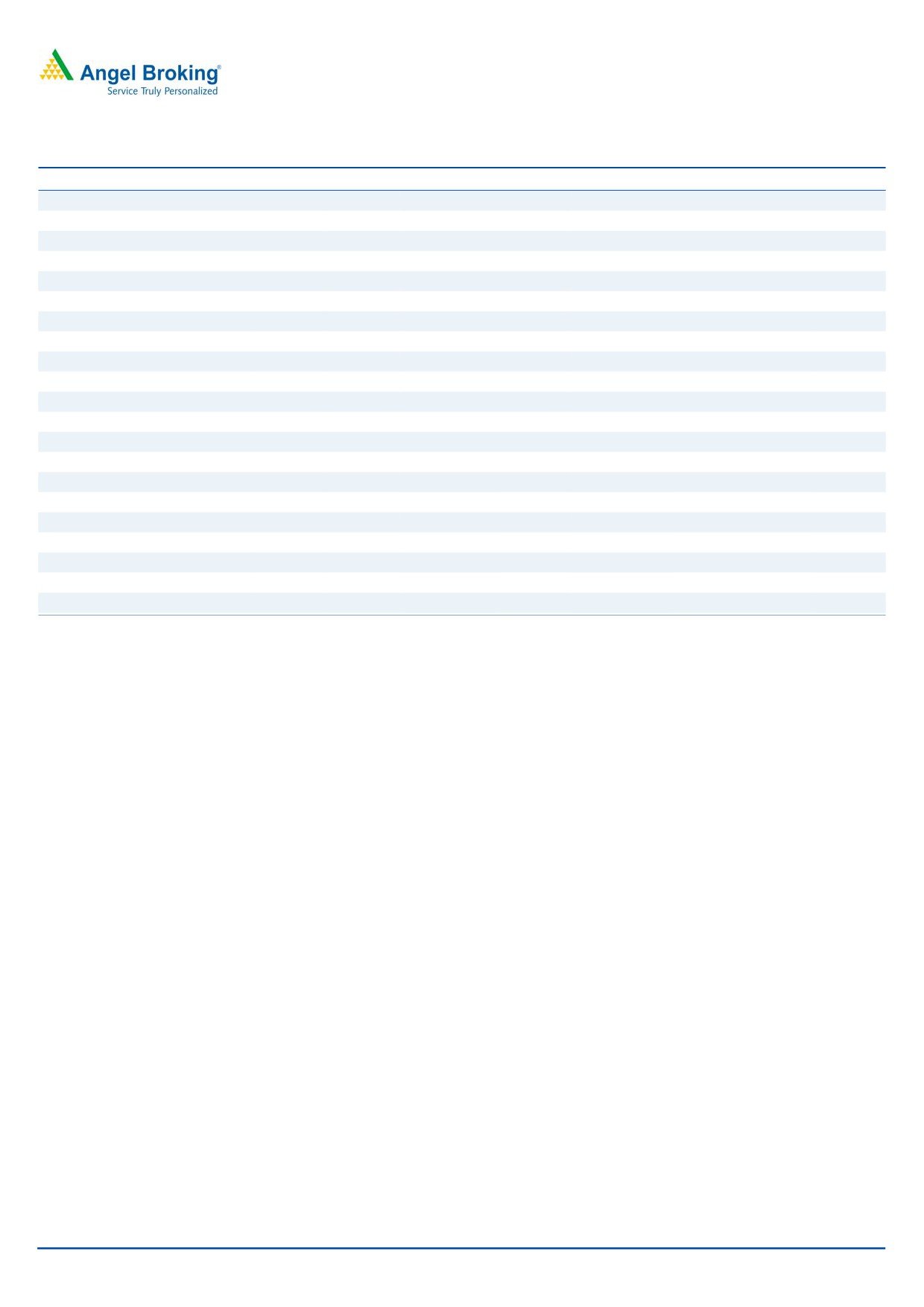

Exhibit 2: Revenue growth continues to disappoint

Exhibit 3: EBIDTA margins declines further

680

2.7

7.4

8

90

15

5.4

12.9

12.6

12.4

12.5

(4.9)

6

80

11.6

640

10.6

12

2.8

70

1.2

3.3

3.4

9.8

9.3

4

60

1.4

7.9

600

9

2

50

40

560

0

6

30

(2)

20

3

520

(4)

10

76

44

75

56

80

62

61

73

75

480

(6)

0

0

Revenue (LHS)

Revenue growth yoy (RHS)

EBITDA (LHS)

EBITDA Margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 4: Actual vs Angel’s Estimates for 2QFY2016

Particulars

Actual (` cr)

Estimate (` cr)

% Variation

Total Income (` cr)

605

691

(12.4)

EBITDA (`cr)

75

96

(21.2)

EBITDA Margin (%)

12.5

13.9

(139)bp

Adjusted PAT (` cr)

65

80

(19.0)

Source: Company, Angel Research

Segment-wise performance

For 2QFY2016, revenue from the Electrical cables (EC) segment declined by

10% yoy to `491cr. This was owing to lower realization as the company had to

pass on the benefit of lower copper prices to the customers. EBIT for the segment

declined by 13.4% yoy and came in at `70cr, while the EBIT margin contracted by

55bp yoy to 14.2%.

The Communication cables (CC) segment revenue grew by 113.1% yoy to `110cr.

EBIT increased by 668.3% yoy to `13cr, resulting in margin expanding by

824bp yoy to 11.4%.

The revenue from Continuous Copper Rods (CCR) segment declined by 91.0% yoy

to `4cr during the quarter. The EBIT margins came in at 14.0% vs. 3.5% in

2QFY2015. The segment’s contribution has been declining gradually since the

company is reducing its exposure to third parties owing to thin margins and

production is mainly for captive purpose.

November 17, 2015

3

Finolex Cables | 2QFY2016 Result update

Exhibit 5: Segment-wise performance

Y/E March (` cr)

2QFY16

2QFY15

% chg (yoy) 1QFY16

% chg (qoq)

Total Revenue

A) Electrical Cables

491

546

(10.0)

502

(2.2)

B) Communications Cables

110

52

113.1

63

75.8

C) Copper Rods

4

39

(91.0)

23

(84.8)

D) Others

15

72

(79.7)

8

72.1

Total Net sales

605

637

(4.9)

588

2.9

EBIT

A) Electrical Cables

70

80

(13.4)

81

(14.0)

B) Communications Cables

13

2

668.3

6

127.4

C) Copper Rods

0

1

(64.2)

0

345.5

D) Others

7

20

(61.9)

(18)

(141.0)

Total EBIT

90

103

(12.4)

68

31.9

EBIT Margin (%)

A) Electrical Cables

14.2

14.7

(55)bp

16.1

(195)bp

B) Communications Cables

11.4

3.2

824bp

8.8

259bp

C) Copper Rods

14.0

3.5

1,046bp

0.5

1,352bp

D) Others

51.2

27.3

2,392bp

(215.3)

26,658bp

Source: Company, Angel Research

November 17, 2015

4

Finolex Cables | 2QFY2016 Result update

Investment arguments

Capex plans to complement revival in user industry

FCL serves varied user industries through its EC segment with contribution from the

construction sector being the largest followed by industrial, automotive, power and

agriculture sectors. The construction sector growth appears to be coming in from

Tier 2 and Tier 3 cities rather than being restricted to larger cities. With the

government determined on developing a robust and stable infrastructure and

industrial activity expected to pick-up, potential demand outlook for the company’s

offering looks encouraging.

FCL has executed its capex plans which have lead to higher capacity at its existing

plants coupled with technological upgradation. In the CC segment, the company

has been awarded a tender of `200cr by the National Optical Fibre Network

(NOFN) backbone project and in order to service the tender, FCL has expanded its

capacity at Urse and Goa from 8,000 km-a-month to 10,000 km-a-month.

Organic growth and diversifying portfolio to drive earnings

FCL has a wide range of products in its offering, ranging within speaker wires, to

T5 tube lights and fittings in the lighting division. Further, FCL forayed into

manufacturing of electrical products like electric motors and transformers with a

separate dealer network for these products. The company has been expanding its

presence in north and central India by gradually adding dealers and distributors.

The company also has set up a new switchgear division that will initially make

miniature circuit breakers. Given its wide distribution network and strong brand

recall, we expect the company to take advantage of the same which will lead to

higher earnings growth going ahead. Further, with an expansion of its product

portfolio, FCL intends to change its legacy image of being a cable and wire

manufacturer to a ‘manufacturer of electrical products’.

Changing sales mix to boost margins

The company has expanded its product portfolio which includes high margin

products which will improve realizations and margins. Further, FCL is gradually

reducing its exposure to the copper rod segment as the surplus production was

used for third party sales which have low margins. The company has increased its

focus on creating brand awareness across product lines through increased

advertisement expense and increasing distribution reach.

Healthy balance sheet

The company has been successful in its debt reduction plans and has been utilizing

internal accruals to reduce debt. This will lead to saving in interest expense going

ahead which will improve its profit. The cash generation from operating activities

continues to be strong. The working capital days reduced to 34 days in FY2015,

led by lower trade receivables days and higher payable days.

November 17, 2015

5

Finolex Cables | 2QFY2016 Result update

Financials

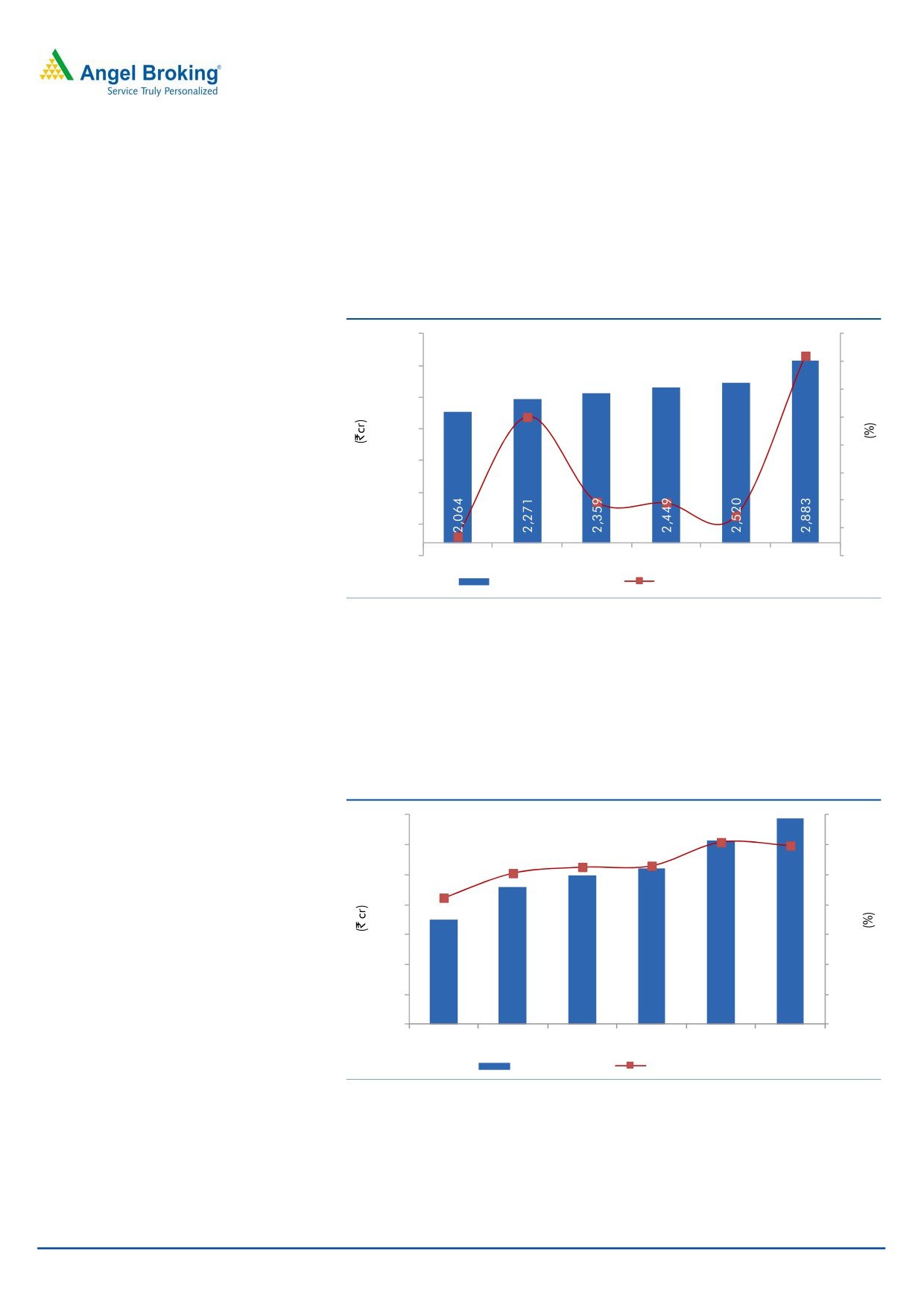

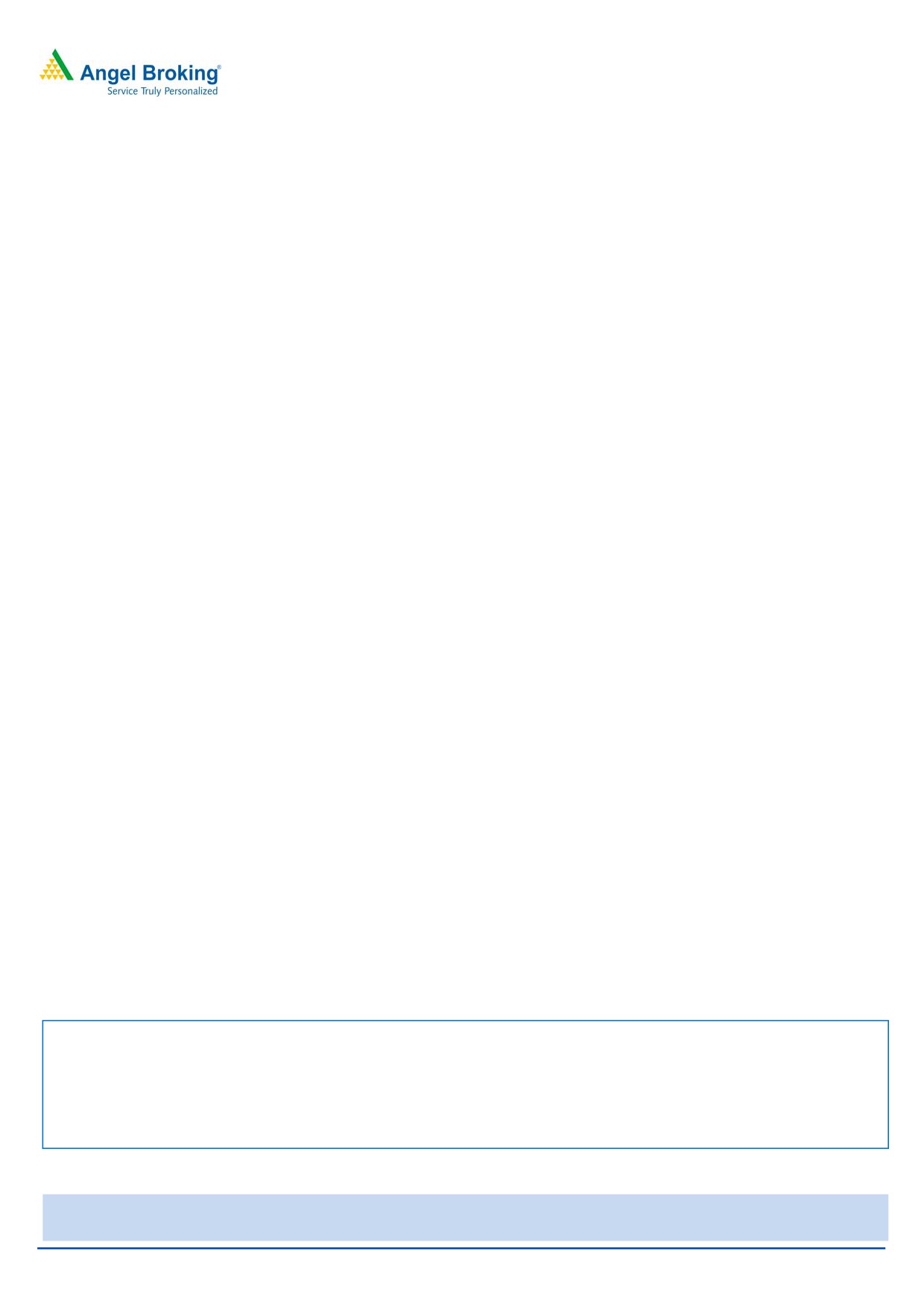

Net sales to grow at CAGR of 8.5% over FY2015-17E

The net sales for the company are expected to be driven by high single digit

volume growth. We expect the net sales to grow at a CAGR of 8.5% over FY2015-

FY2017E to `2,883cr.

Exhibit 6: Net Sales growth trend

3,300

16

14.4

14

2,800

12

2,300

10.0

10

1,800

8

1,300

6

800

3.9

3.8

4

2.9

300

2

1.4

(200)

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

0

Net sales (LHS)

Net sales growth (RHS)

Source: Company, Angel Research

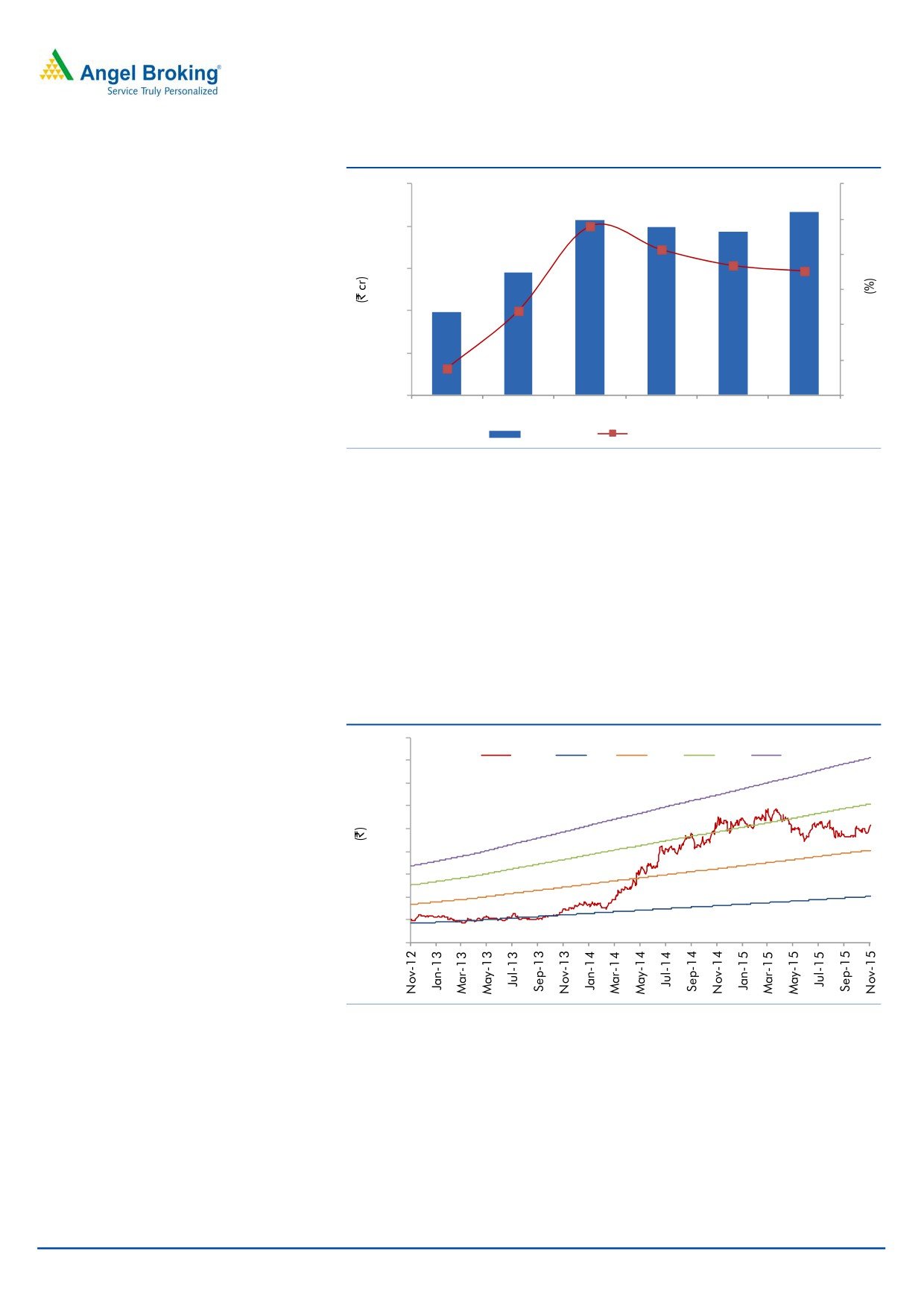

EBITDA to post CAGR of 15.2% over FY2015-17E

FCL’s EBITDA, on back of decent top-line growth and improved operational

efficiency, is expected to grow at a CAGR of 15.2% over FY2015-17E. The EBITDA

is expected to rise from `260cr in FY2015 to `345cr in FY2017E and EBITDA

margins are expected to be at 12.0% in FY2017E.

Exhibit 7: EBIDTA and EBIDTA margin trend

350

12.0

14

12.2

300

12

10.5

10.6

10.1

8.5

250

10

200

8

150

6

100

4

50

2

175

230

248

260

307

345

-

0

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

EBITDA (LHS)

EBITDA margin (RHS)

Source: Company, Angel Research

PAT to register modest CAGR of 4.3%

Despite decent top-line growth coupled with better operating performance the net

profit growth is expected to grow at a modest CAGR of 4.3%, largely owing to

higher tax rate.

November 17, 2015

6

Finolex Cables | 2QFY2016 Result update

Exhibit 8: PAT and PAT margin trend

250

10

9

8.8

200

8.1

8

150

7.7

7.5

7

100

6.4

6

50

5

4.8

98

145

208

199

194

217

-

4

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

PAT (LHS)

PAT margin (RHS)

Source: Company, Angel Research

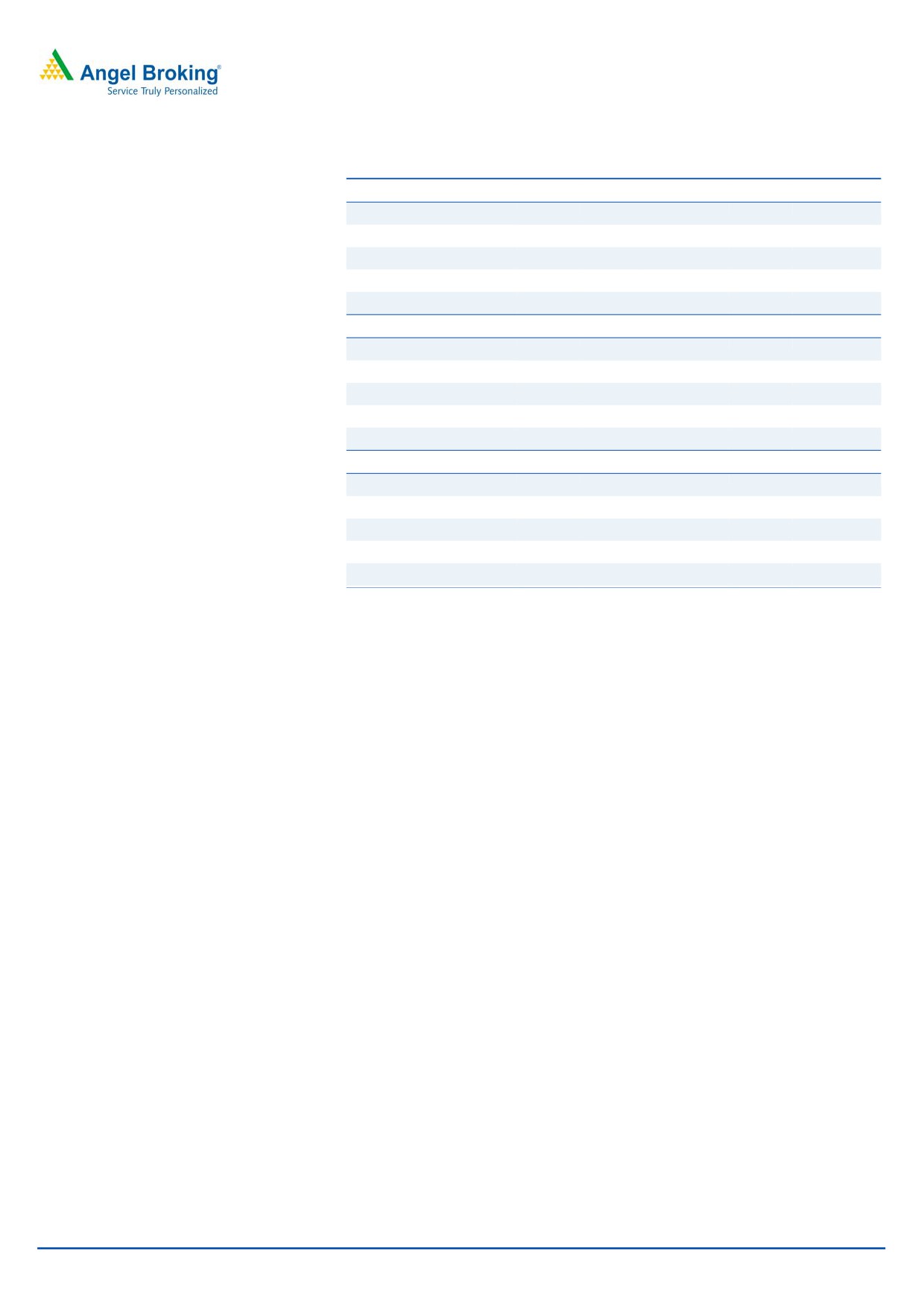

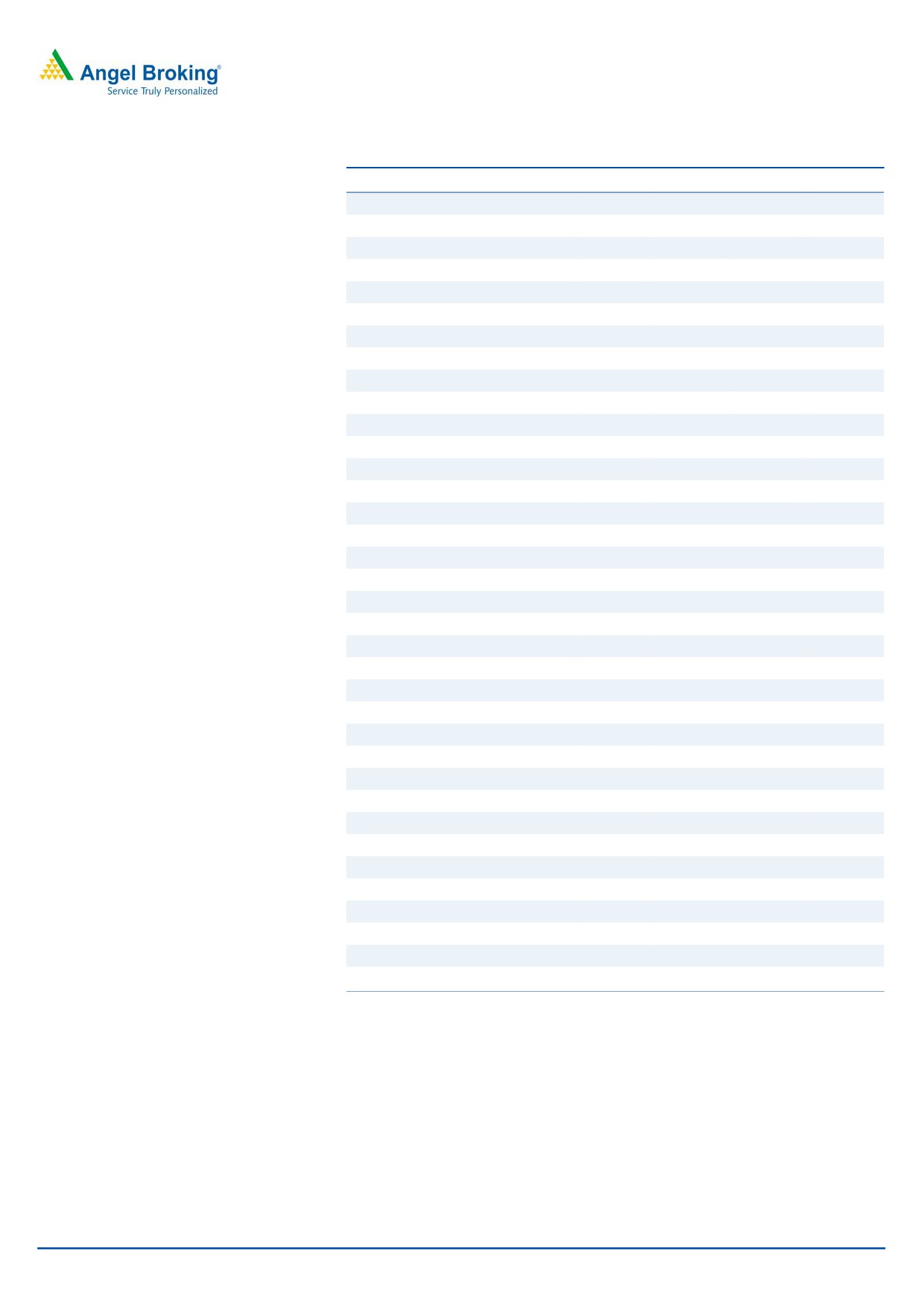

Outlook and Valuation

We expect the company’s top-line and EBITDA to post an 8.5% and 15.2% CAGR

over FY2015-17E to `2,883cr and `345cr respectively with EBITDA margin at

12.0% in FY2017E. However, benefit of low material cost and interest outgo is

expected to be offset by higher tax rate which will dent profitability. As a result, the

bottom-line is expected to post a modest CAGR of 4.3% for the same period to

`217cr. We recommend a Neutral rating on the stock as it trades at fair valuations

of 18.2x PE on FY2017E.

Exhibit 9: One-year forward PE

450

Price

5x

10x

15x

20x

400

350

300

250

200

150

100

50

-

Source: Company, Angel Research

November 17, 2015

7

Finolex Cables | 2QFY2016 Result update

Concerns

Competition from the unorganized sector is a concern since the products

available from them are relatively cheaper and they thus cannibalize into

market volumes.

Fluctuation in the price of copper, which is an essential raw material (~80% of

total raw material), is a key concern as it would directly impact operational

efficiency. Although prices have fallen recently, volatility in commodity markets

persists.

Slowdown in the user industry could hurt the company’s volumes.

Company background

FCL is India’s largest and leading manufacturer of electrical and communication

cables. Its wire and cable products are used in applications such as automobile,

lightning, cable TV, telephone and computers to industrial applications. The

company mainly operates through

4 divisions;

1) Electrical cables,

2) Communication cables, 3) Continuous Cast Copper rods and 4) Others-

comprising switches, compact fluorescent lamps manufactured and LED based

lamps through its facilities set up at Roorkee, Goa, and Pune (at Pimpri, Urse).

November 17, 2015

8

Finolex Cables | 2QFY2016 Result update

Profit and Loss statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Gross sales

2,424

2,510

2,575

2,669

3,057

Less: Excise duty

153

151

126

149

174

Net Sales

2,271

2,359

2,449

2,520

2,883

% chg

10.0

3.9

3.8

2.9

14.4

Net Raw Materials

1,689

1,766

1,824

1,822

2,097

% chg

7.7

4.5

3.3

(0.1)

15.1

Personnel

85

85

94

103

121

% chg

21.7

0.3

10.8

9.9

17.2

Other Mfg costs

112

116

101

115

123

% chg

-

(4.0)

12.7

(13.3)

(6.8)

Other

156

144

170

173

198

% chg

-

7.2

(18.0)

(1.5)

(14.4)

Total Expenditure

2,041

2,111

2,189

2,213

2,538

EBITDA

230

248

260

307

345

% chg

31.4

8.1

4.7

18.2

12.3

EBITDA Margin

10.1

10.5

10.6

12.2

12.0

Depreciation& Amort.

47

48

64

55

63

EBIT

183

200

196

252

282

% chg

35.3

9.1

(2.0)

28.5

11.9

(% of Net Sales)

8.1

8.5

8.0

10.0

9.8

Interest & other Charges

13

14

13

9

7

Other Income

24

48

58

47

49

(% of Net Sales)

1.1

2.0

2.4

1.9

1.7

Recurring PBT

170

185

183

243

275

% chg

55.3

9.2

(1.3)

32.6

13.4

Exceptional Expense/(Inc.)

23

(10)

(23)

-

-

PBT (reported)

171

244

264

289

324

Tax

26

36

64

95

107

(% of PBT)

15.0

14.9

24.4

33.0

33.0

PAT (reported)

145

208

199

194

217

ADJ. PAT

145

208

199

194

217

% chg

47.9

43.0

(4.0)

(2.8)

12.1

(% of Net Sales)

6.4

8.8

8.1

7.7

7.5

Basic EPS (`)

9.5

13.6

13.0

12.7

14.2

Fully Diluted EPS (`)

9.5

13.6

13.0

12.7

14.2

% chg

48.0

43.0

(4.0)

(2.8)

12.1

November 17, 2015

9

Finolex Cables | 2QFY2016 Result update

Balance sheet

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity Share Capital

31

31

31

31

31

Preference Capital

-

-

-

-

-

Reserves& Surplus

894

1,073

1,234

1,392

1,574

Shareholders’ Funds

924

1,103

1,265

1,423

1,604

Total Loans

162

127

51

46

28

Other Long term liability

58

5

5

5

5

Net Deferred tax liability

34

30

30

30

30

Total Liabilities

1,179

1,265

1,351

1,504

1,667

APPLICATION OF FUNDS

Gross Block

929

1,031

1,059

1,112

1,223

Less: Acc. Depreciation

487

535

599

654

717

Net Block

412

496

460

457

505

Capital Work-in-Progress

36

11

11

60

45

Goodwill

-

-

-

-

-

Long term Loans & Adv.

17

5

4

4

4

Investments

324

403

494

544

625

Other non-current assets

19

26

19

19

19

Current Assets

596

623

646

714

805

Cash

40

65

138

155

169

Loans & Advances

77

61

70

72

82

Inventory

330

352

319

351

398

Debtors

150

145

119

136

155

Other current assets

0

0

-

-

-

Current liabilities

225

299

282

294

337

Net Current Assets

372

324

363

420

468

Mis. Exp. not written off

-

-

-

-

-

Total Assets

1,179

1,265

1,351

1,504

1,667

November 17, 2015

10

Finolex Cables | 2QFY2016 Result update

Cash flow statement

Y/E March (` cr)

FY2013

FY2014 FY2015 FY2016E FY2017E

Profit before tax

171

244

264

289

324

Depreciation

47

48

64

55

63

(Inc.)/ Dec. in Working Capital

(53)

73

34

(40)

(34)

Less: Other income

(24)

(48)

(58)

(47)

(49)

Direct taxes paid

(26)

(36)

(64)

(95)

(107)

Cash Flow from Operations

114

280

239

163

197

(Inc.)/ Dec. in Fixed Assets

(88)

(77)

(28)

(102)

(96)

(Inc.)/ Dec. in Investments

(100)

(67)

(91)

(49)

(82)

Other income

24

48

58

47

49

Cash Flow from Investing

(164)

(96)

(60)

(105)

(129)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

33

(93)

(75)

(5)

(18)

Dividend Paid (Incl. Tax)

(21)

(29)

(32)

(36)

(36)

Others

28

(38)

1

-

-

Cash Flow from Financing

40

(160)

(106)

(41)

(54)

Inc./(Dec.) in Cash

(9)

25

74

17

14

Opening Cash balances

49

40

65

138

155

Closing Cash balances

40

65

138

155

169

November 17, 2015

11

Finolex Cables | 2QFY2016 Result update

Key ratios

Y/E March

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

27.2

19.0

19.8

20.4

18.2

P/CEPS

20.6

15.4

15.0

15.9

14.1

P/BV

4.3

3.6

3.1

2.8

2.5

Dividend yield (%)

0.5

0.6

0.7

0.8

0.8

EV/Sales

1.7

1.5

1.4

1.3

1.1

EV/EBITDA

16.3

14.6

13.0

10.8

9.2

EV / Total Assets

3.2

2.9

2.5

2.2

1.9

Per Share Data (`)

EPS (Basic)

9.5

13.6

13.0

12.7

14.2

EPS (fully diluted)

9.5

13.6

13.0

12.7

14.2

Cash EPS

12.6

16.8

17.2

16.3

18.3

DPS

1.2

1.6

1.8

2.0

2.0

Book Value

60.5

72.2

82.7

93.1

104.9

Dupont Analysis

EBIT margin

8.1

8.5

8.0

10.0

9.8

Tax retention ratio

0.9

0.9

0.8

0.7

0.7

Asset turnover (x)

2.9

3.0

3.5

3.4

3.5

ROIC (Post-tax)

20.0

21.6

20.9

22.6

22.8

Cost of Debt (Post Tax)

7.0

9.7

19.1

13.1

15.9

Leverage (x)

(0.2)

(0.3)

(0.5)

(0.5)

(0.5)

Operating ROE

17.1

17.9

20.0

18.2

19.5

Returns (%)

ROCE (Pre-tax)

15.5

15.8

14.5

16.7

16.9

Angel ROIC (Pre-tax)

23.5

25.4

27.6

33.7

34.0

ROE

15.7

18.8

15.8

13.6

13.5

Turnover ratios (x)

Asset Turnover (Gross Block)

2.4

2.3

2.3

2.3

2.4

Inventory / Sales (days)

49

53

50

48

47

Receivables (days)

21

23

20

20

20

Payables (days)

37

45

48

48

48

WC cycle (ex-cash) (days)

53

40

34

38

38

Solvency ratios (x)

Net debt to equity

(0.2)

(0.3)

(0.5)

(0.5)

(0.5)

Net debt to EBITDA

(0.9)

(1.4)

(2.2)

(2.1)

(2.2)

Interest Coverage (EBIT/Int.)

13.7

13.8

15.2

27.9

43.0

November 17, 2015

12

Finolex Cables | 2QFY2016 Result update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Finolex Cables

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 17, 2015

13