Please refer to important disclosures at the end of this

report

1

Incorporated in 2007, Ethos Limited is India's

one of the largest luxury and

premium watch retail player having 13% share of the total retail sales in

premium and luxury segment and a share of 20% in exclusively luxury

segment in FY2020. KDDL Ltd is the parent company of Ethos Ltd and i

s

already listed on exchanges. The company

offers sizeable portfolio of 50

premium and Luxury watch brands. Ethos Ltd

sells its products through online

platforms and

50 physical retails stores in 17 cities in India in a Multi store

format.

Positives: (a) M

arket leader in Luxury watch segment in India, and it also leads

the Luxury Omnichannel market in India (b)

Strategically located and well

invested store network (c) Strong and long-

standing relationships with luxury

watch brands (d) Founder-

led company supported by a professional

management team.

Investment concerns: (a) Increase in competition (b) Slowdown in the

economy

could impact the overall revenue of the company.

Outlook & Valuation: In terms of valuations, the post-

issue TTM P/E works out

to 96.2x (at the upper end of the issue price band), which is high considering

Company’s historical top-line & bottom-

line negative CAGR of ~7% and ~24%

respectively over FY19-21. However, Ethos has

a healthy market share in total

retail sales in the premium and luxury segment. Further Ethos has strong brands

and a wide range of products but we believe that these positives are captured in

the valuations commanded by the company. Thus, we have a NEUTRA

L rating

on the issue.

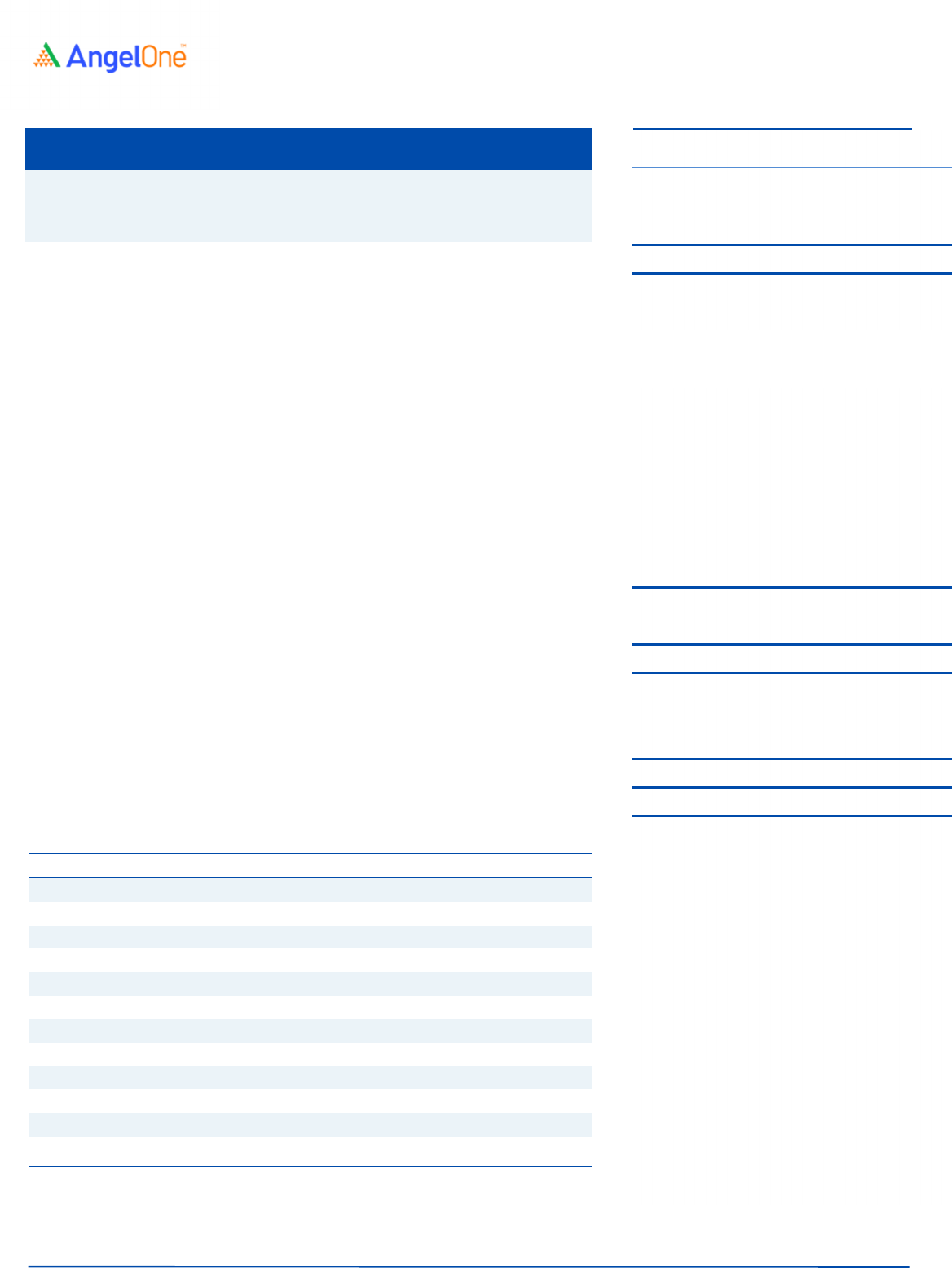

Key Financials

Y/E March (` cr) FY2019

FY2020

FY2021 9MFY22

Net Sales

444

458

387

419

% chg

3.2

(15.6)

Net Profit

10

(1)

6

16

% chg

(113.5)

533.7 -

OPM (%)

7.0

4.1

2.2

5.4

EPS (`)

5.3

(0.7)

3.1

8.5

P/E (x)

166.7

NA

284.9

-

P/BV (x)

12.6

11.0

10.6

-

RoE (%)

7.6

(0.7)

3.6

-

RoCE (%)

11.1

5.8

2.8

-

EV/Sales (x)

4.0

4.0

4.6

-

EV/EBITDA (x)

31.6

35.1

44.5

-

Angel Research; Note: Valuation ratios based on post-issue shares and at `878 per share.

NEUTRAL

Issue Open: May 18, 2022

Issue Close: May 20, 2022

Offer for Sale: 0.11cr share

Fresh Issue: `375cr

QIBs 50%

Non-Institutional 15%

Retail 35%

Promoters 61.7%

Public 38.4%

Issue Details

Face Value: `10

Present Eq. Paid up Capital:

`19cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `23cr

Issue size (amount): `472.3cr

Price Band: `836-878

Lot Size: 17 shares

Post-issue mkt.cap: `1,970*– 2,050cr**

Promoter holding Pre-Issue: 81.0%

Promoter holding Post-Issue: 61.7%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Amarjeet S Maurya

Amarjeet.maurya@angelbroking.com

+022 4000 3600, Extn: 6810

Ethos Limited IPO

IPO Note |

Retail

May 16

, 2022

Ethos Limited | IPO Note

May

1

6

,

2

022

2

Company background

Incorporated in 2007, Ethos Limited is India's one of the largest luxury and

premium watch retail player having 13% share of the total retail sales in

premium and luxury segment and a share of 20% in exclusively luxury segment

in FY2020. The company delivers premium luxury watches through websites,

social media platforms and physical stores. Ethos Limited operates on an

omnichannel model and allows customers to order products either offline or

online and have the flexibility of buying products at one store and returning at

another or browsing product catalogues and placing orders online with

doorstep delivery.

The company's watch portfolio has 50 premium brands including Omega, IWC

Schaffhausen, Jaeger LeCoultre, Panerai, Bvlgari, H. Moser & Cie, Rado,

Longines, Baume & Mercier, Oris SA, Corum, Carl F. Bucherer, Tissot, Raymond

Weil, Louis Moinet and Balmain.

The company has 50 physical retail stores in 17 cities in India including New

Delhi Mumbai, Bengaluru, Hyderabad, Chennai, Kolkata, Chandigarh,

Ahmedabad, Jaipur, Lucknow, Gurgaon, Guwahati, Ludhiana, Nagpur, Noida,

Pune and Thane. Ethos Limited has 7,000 different premium watches and

30,000 watches in stock at any given time. As of December 31, 2021, the

company's website had 21,844,216 visitor sessions.

Issue details

Ethos is raising ~₹97cr through OFS and ₹375cr through Fresh Issue

in the

price band of ₹836-₹878per share.

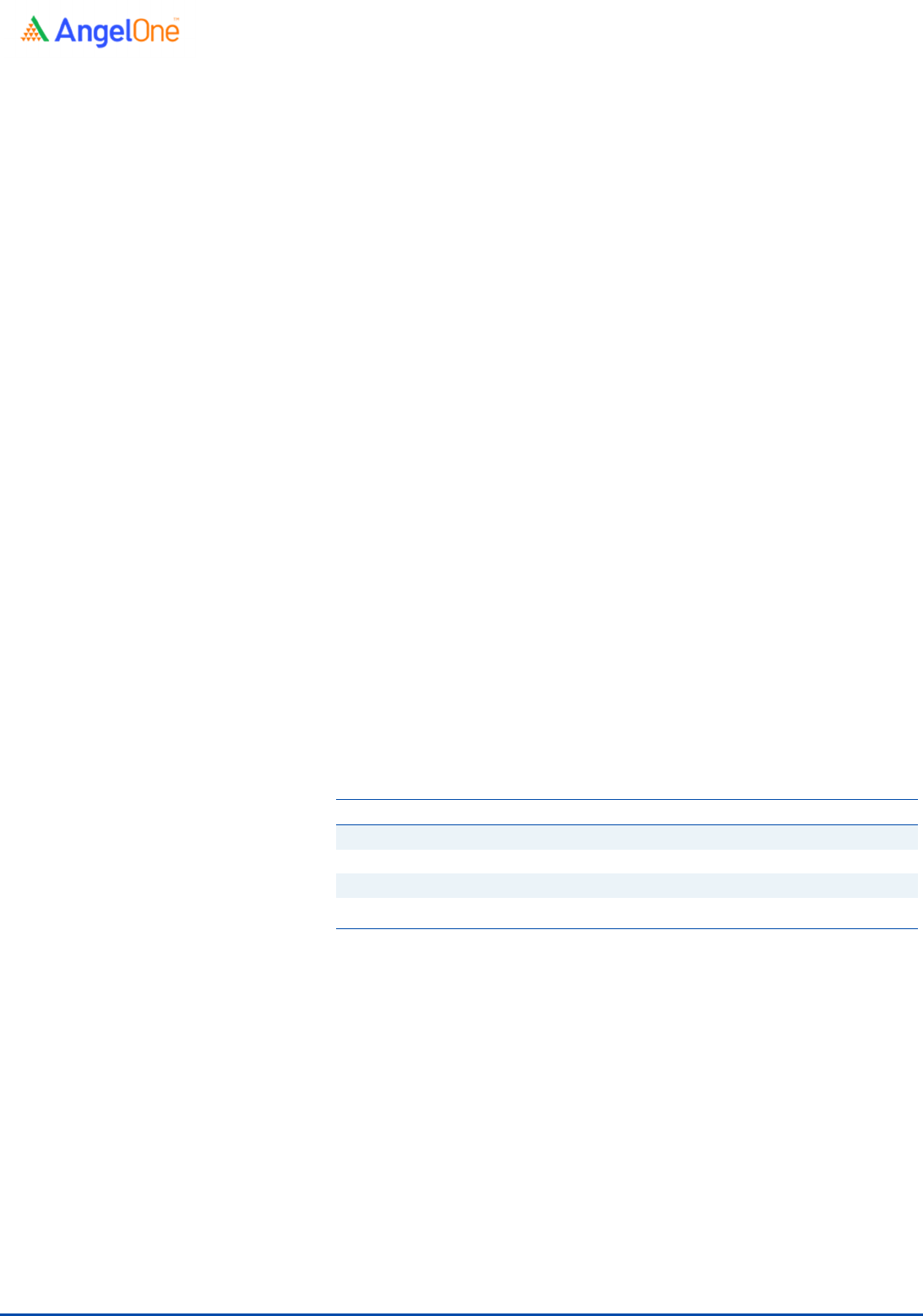

Exhibit 1: Pre and post IPO shareholding pattern

No of shares (Pre-issue) % (Post-issue) %

Promoter 1,54,56,412 81.0% 1,43,95,912 61.7%

Public 36,21,751 19.0% 89,53,322 38.3%

Total 1,90,78,163 100.00% 2,33,49,234 100.00%

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the Offer

Repayment or pre-payment, in full or in part, of all or certain borrowings

availed by the Company (~₹30cr).

Funding working capital requirements (~₹235cr).

Financing the capital expenditure for establishing new stores and

renovation of certain existing stores (~₹33cr) as well as upgradation of

enterprise resource planning software (~₹2cr).

General corporate purpose

Ethos Limited | IPO Note

May

1

6

,

2

022

3

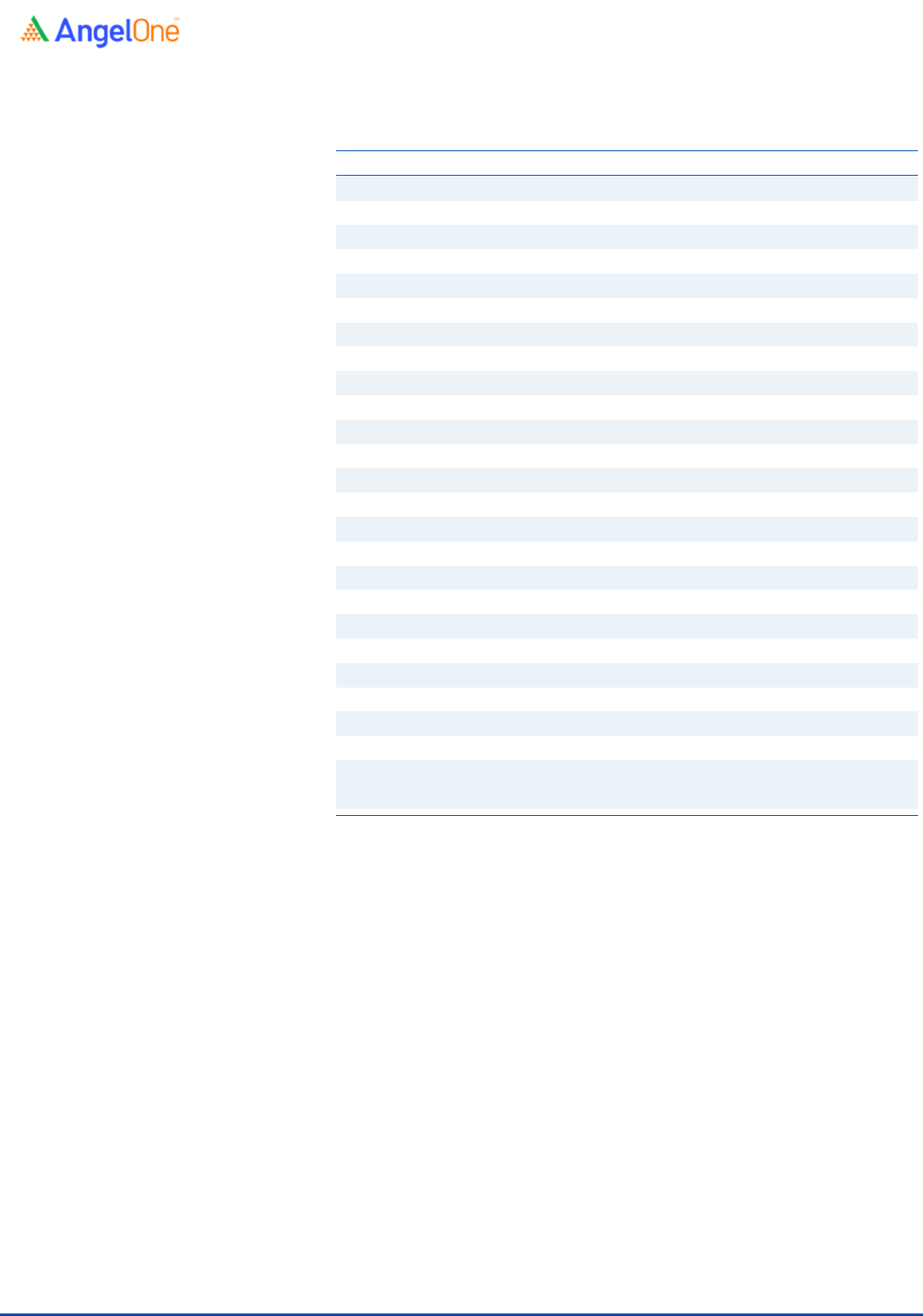

Exhibit 2: Consolidated Profit & Loss Statement

Y/E March (` cr) FY2019 FY2020 FY2021

Net Sales

444

458

387

% chg

3.2

(15.6)

Total Expenditure

387

406

347

Raw Material

315

329

282

Personnel

33

33

29

Other Expenses

38

44

36

EBITDA

57

52

40

% chg (9.0) (23.0)

(% of Net Sales)

12.8

11.3

10.3

Depreciation& Amortization

26

33

31

EBIT

31

19

8

% chg (39.4) (55.4)

(% of Net Sales)

7.0

4.1

2.2

Interest & other Charges

16

20

17

Other Income

2

3

17

(% of PBT)

9.5

136.1

208.1

Recurring PBT

16

2

8

% chg (85.9)

243.2

Tax

7

3

2

(% of PBT)

40.0

143.1

29.0

PAT before P/L of JV

10

(1)

6

% chg (110.1) (665.2)

Share in profit of Joint Venture - (0)

0

PAT

10

(1)

6

Basic EPS (Rs)

5.3

(0.7)

3.1

Fully Diluted EPS (Rs)

5.3

(0.7)

3.1

Source: Company, Angel Research

Ethos Limited | IPO Note

May

1

6

,

2

022

4

Consolidated Balance Sheet

Y/E March (` cr) FY2019 FY2020 FY2021

SOURCES OF FUNDS

Equity Share Capital

17

18

18

Reserves& Surplus

114

132

137

Shareholders’ Funds

130

150

156

Total Loans

149

174

140

Other Liabilities

2

2

2

Total Liabilities

281

326

298

APPLICATION OF FUNDS

Net Block

90

125

111

Capital Work-in-Progress

5

1

4

Investments -

1

1

Current Assets

252

276

257

Inventories

206

219

198

Sundry Debtors

9

9

12

Cash

9

11

21

Loans & Advances

0

0

0

Other Assets

28

37

26

Current liabilities

88

96

94

Net Current Assets

164

180

163

Deferred Tax Asset

8

8

9

Other Assets

14

12

12

Total Assets

281

326

298

Source: Company, Angel Research

Ethos Limited | IPO Note

May

1

6

,

2

022

5

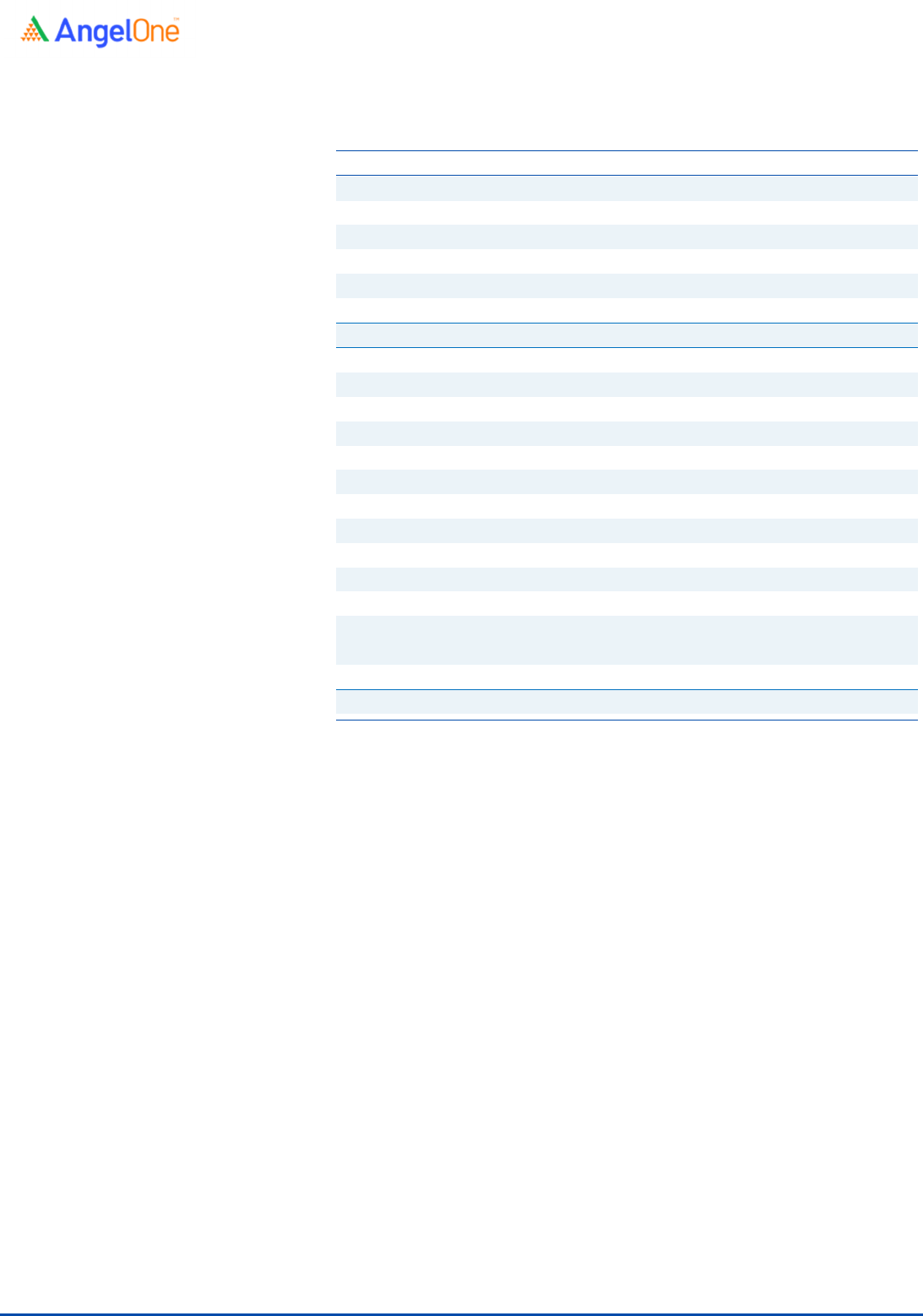

Exhibit 3: Consolidated Cash Flow Statement

Y/E March (` cr) FY2019 FY2020

FY2021

Profit before tax 16 2

8

Depreciation 26 33

31

Change in Working Capital -51 -12

26

Interest / Dividend (Net) 15 18

16

Direct taxes paid -7 -6

-3

Others -1 1

-15

Cash Flow from Operations -1 37

63

(Inc.)/ Dec. in Fixed Assets -13 -13

-9

(Inc.)/ Dec. in Investments 1 -1

-1

Interest Received 0 0

0

Cash Flow from Investing -12 -15

-10

Issue of Equity 29 21

0

Inc./(Dec.) in loans 0 -22

-29

Dividend Paid (Incl. Tax) 0 0

0

Interest / Dividend (Net) -16 -19

-16

Cash Flow from Financing 13 -20

-45

Inc./(Dec.) in Cash 0 2

8

Opening Cash balances 7 8

10

Closing Cash balances 8 10

18

Source: Company, Angel Research

Ethos Limited | IPO Note

May

1

6

,

2

022

6

Key Ratios

Y/E March FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

166.7

NA

284.9

P/CEPS

46.4

52.4

44.4

P/BV

12.6

11.0

10.6

EV/Sales

4.0

4.0

4.6

EV/EBITDA

31.6

35.1

44.5

EV / Total Assets

6.4

5.5

5.9

Per Share Data (Rs)

EPS (Basic) 5.3 -0.

7

3.1

EPS (fully diluted)

5.3

(0.7)

3.1

Cash EPS

18.9

16.8

19.8

Book Value

69.5

79.8

82.9

Returns (%)

ROCE

11.1

5.8

2.8

Angel ROIC (Pre-tax)

11.5

6.0

3.1

ROE

7.6

(0.7)

3.6

Turnover ratios (x)

Asset Turnover (Net Block)

4.9

3.7

3.5

Inventory / Sales (days)

169

174

187

Receivables (days)

7

7

12

Payables (days)

56

58

68

Working capital cycle (ex-cash) (days)

121

124

130

Source: Company, Angel Research

Ethos Limited | IPO Note

May

1

6

,

2

022

7

Research Team Tel: 022 - 40003600 E-mail: research@angelbroking.com Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with

SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates

has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in

this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking

or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel

or its associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection

with the research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.