IPO Note | Financial Services

April 4, 2016

Equitas Holdings Limited

SUBSCRIBE

Issue Open: April 5, 2016

IPO Note

Issue Close: April 7, 2016

Equitas Holdings (Equitas) is a diversified financial services player with presence

across microfinance, vehicle & MSE finance and housing finance. With a humble

Issue Details

start in 2007, it has emerged as the fifth largest micro finance player in a short

Face Value: `10

period of time. Equitas is amongst the ten players to have received a small

Present Eq. Paid up Capital: `269.9cr

finance bank license from the Reserve Bank of India (RBI). The company has a

presence in 11 states through 539 branches, is backed by a strong Management

Fresh Issue**: 6.55cr Shares amounting to `720crs

team and with it being the second IPO in the micro finance segment, we expect

Offer for sale: 13.2cr Shares amounting to `1,456.7crs

strong subscription responses to the issue.

Post Eq. Paid up Capital: `335.4crs

Expect a smooth transition towards being a Small Finance bank: The proposed

small finance bank (SFB) will have access to low cost funds, ie below the current

Market Lot: 135 Shares

~12% rate via deposits. However, there will be initial expenses to be incurred

Fresh Issue (amount): `720cr

while transitioning to be a SFB as new processes will have to be implemented

along with maintenance of CRR and SLR. Meeting 75% Priority Sector Lending

Price Band: `109-110

(PSL) target will not be a challenge for Equitas as its entire portfolio qualifies for

Post-issue implied mkt. cap `3,662*- 3,689cr**

PSL and hence the migration from NBFC to SFB should be smooth. With leverage

of only 4x, we believe there would be enough scalability without further dilutions.

Note:*at Lower price band and **Upper price band

Scalable business model with presence across growing verticals: Equitas’

microfinance business has grown at a CAGR of 45% over FY2012-9MFY2016 to

Book Building

`2,935cr. There is a huge untapped opportunity in this segment as microfinance

is targeted to the lower income segment which often lacks access to formal

QIBs

50%

financing sources. With a loan portfolio of only ~`43,300cr for the industry and

Non-Institutional

15%

given the government’s focus on financial inclusion together with better clarity on

Retail

35%

regulatory aspects, the microfinance industry is positioned for healthy growth going

ahead. Within five years of operations Equitas’ used vehicle & MSE financing business

has scaled up to an AUM to `2,341cr, growing at a CAGR of 125% over FY12-15.

Pre Issue Shareholding Pattern(%)

Reducing dependence on microfinance: Equitas has successfully diversified its

Foreign Residents

92.6

business; the share of microfinance in terms of its total AUM has declined to 53%

in 9MFY2016 from 100% in FY2011, while that of vehicle finance and MSE has

Others

7.4

risen to 42.5% from nil over the same period. Despite aggressive growth, it has

been able to maintain strong asset quality with the GNPA at

0.2% for

Microfinance and 2.6% for vehicle & MSE finance as of Dec-15. Its NIM of 11.1%

and 12.5% respectively for the two aforementioned segments should help mitigate

against any serious deterioration in asset quality, going forward.

Outlook Valuation: At the upper band of the offer price `110 the issue is priced at

1.8x its diluted BV of `60 (pre-dilution 2.3x). The company has decent ROE and

ROA of 13% and 3.1%. Though post conversion to a SFB the return ratios might

be compressed, while we expect the same to scale up subsequently. We believe

the issue is attractively priced looking at the growth options the company offers in

the long run. We recommend SUBSCRIBE to the issue.

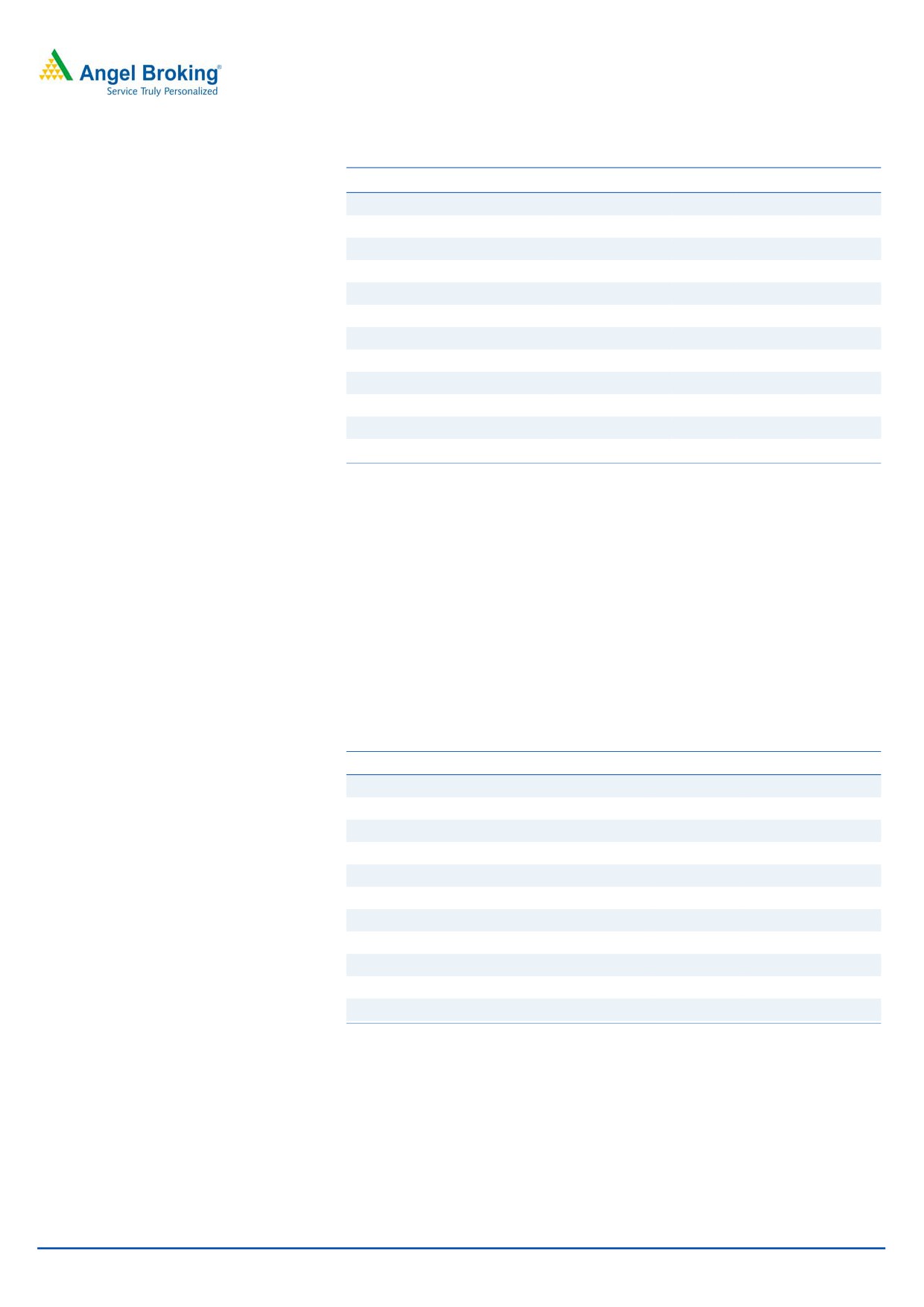

Key Financials

Y/E March (`cr)

FY2012

FY2013

FY2014

FY2015

9MFY2016

NII

125.3

155.3

259.6

401.3

423.3

% chg

-

23.9

67.2

54.6

-

Siddharth Purohit

Net profit

(2.7)

31.9

74.3

107.0

120.4

+91 22 39357800 Ext: 6872

% chg

-

-

133.0

43.9

-

NIM (%)

14.5

12.7

12.4

12.1

11.6

Book Value (`)

68.0

81.7

102.1

43.5

48.0

P/ABV (x)

1.6

1.3

1.1

2.5

1.8

Chintan Shah

RoA (%)

(0.7)

2.3

3.2

3.0

3.0

+91 22 4000 3600 Ext: 6828

RoE (%)

(2.4)

8.5

12.2

11.2

13.1

Source: Company, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Please refer to important disclosures at the end of this report

1

Equitas Holdings | IPO Note

Company background

Equitas is a diversified financial services player with strong presence across

microfinance, vehicle finance, MSE finance, and housing finance segments.

Incorporated in 2007 and headquartered in Chennai, Equitas operates across 11

states through 539 branches. Equitas, through its subsidiary Equitas Micro Finance

Ltd (EMFL) is the fifth largest microfinance company in India (on gross loan

portfolio basis). Equitas has also received in-principle approval from the RBI to set

up a SFB in October 2015.

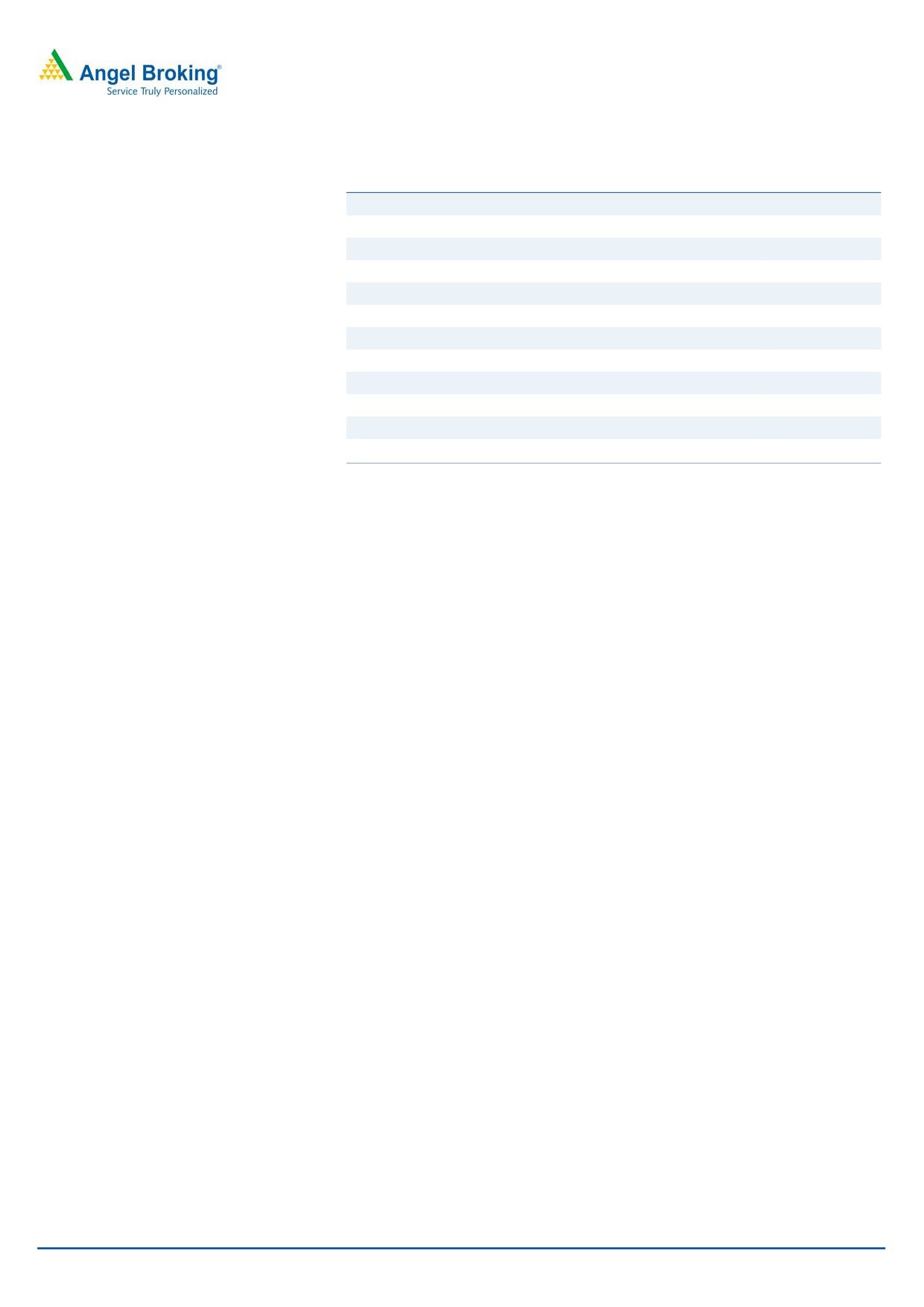

Exhibit 1: Key Businesses - Segment-wise data (As on 31Dec 2015)

Micro

Vehicle

MSE

Affordable

Particulars

Finance

Finance

Finance

Housing

AUM `Cr

2,935

1,406

934

229

% of Total AUM

53.3%

25.5%

17.0%

4.2%

Micro Housing-

`2.4 Lakhs

` 2,000-

Ticket Size

`3.8 Lakhs

` 2.1 Lakhs

`35,000

Affordable

Housing `10.6

Lakhs

No of Loan Accounts

2.78 mn

52,274

45,992

4,022

CAR %

21.02%

31.45%

NA

32.11%

Source: Company, Angel Research

Regulatory aspect of Small Finance Bank:

Exhibit 2: Regulatory aspect of Small Finance Bank (SFB)

Key Regulations

Company’s Plan of Action

With MFI’s average ticket size of `9,364 and that of vehicle finance and

50% of a SFB’s loan portfolio should constitute of loans not

MSE at `3.8lakhs and `2.1 lakhs respectively, the proposed SFB will be

exceeding `25 lakhs.

meet the guidelines.

As per FDI rule SFB can have maximum 49% share holding by

The proposed IPO will reduce the foreign investors holding from 93% to

foreign stake holders.

35%.

SFBs need to operate 25% of their branches in unbanked rural

Existing branches of the company can be converted as SFB branches.

areas.

CRR & SLR to be maintained as per RBI norms.

SFB needs to have 75% of its loans under the priority sector.

Maximum exposure to single entity and group to be capped at 10%

Will be complied as per the guidelines by the RBI.

& 15% of net worth respectively.

SFBs are not permitted to set up any subsidiary.

Minimum CAR of 15% of its RWA, with Tier of 7.5%.

With the proposed IPO, capital not to be a concern.

Source: Company, Angel Research

Key Management Personnel:

P. N. Vasudevan, Managing Director. (worked with Cholamandalam Investment

and Finance Company Limited for about two decades)

S. Bhaskar, CFO, joined the Equitas Group in

2007. (worked with

Cholamandalam Investment and Finance Company Limited for about two

decades)

H.K.N. Raghavan, CEO of EMFL, joined the Equitas Group in 2008.

V. S. Murthy, CEO of Equitas Finance Ltd (EFL), joined the Equitas Group in 2010.

April 4, 2016

2

Equitas Holdings | IPO Note

Issue details

The company is raising `720cr through fresh issue of equity shares in the price

band of `109-110. The fresh issue will constitute 19.5% of the post-issue paid-up

equity share capital of the company assuming the issue is subscribed at the upper

end of the price band. Along with the fresh issue of equity shares, there is also an

Offer for Sale (OFS) of 13.2cr equity shares from the existing shareholders.

Exhibit 3: Offer Details

Amount (in crs.)

Offer Details

No. of equity shares

(at the upper price band)

Fresh Issue

6.5

720

Offer for Sale

13.2

1,457

Total Offering

19.8

2,177

Source: Company, Angel Research

The top 10 shareholders of the company are as follows:

Exhibit 4: Top10 Shareholders

No. of Equity Shares

Name of the Shareholder

Shareholding %

(in crs)

International Finance Corporation

3.9

14.3

CDC Group plc

2.7

9.9

India Financial Inclusion Fund

2.6

9.7

Lumen Investments Holdings Limited

2.3

8.4

Creation Investments Equitas Holdings, LLC

1.8

6.7

Credit Access Asia N.V

1.8

6.5

MVH S.p.A.

1.7

6.3

Nederlandse Financierings - Maatschappij

1.5

5.5

voor Ontwikkelingslanden N. V. (FMO)

DEG - Deutsche Investitions-

1.5

5.4

Entwicklungsgesellschaft mbH

Sequoia Capital India Investments III

1.3

4.8

Total

20.9

77.5

Source: Company, Angel Research

Objects of the offer

Investment in certain subsidiaries of the company, namely, EFL, EMFL and

Equitas Housing Finance Ltd (EHFL), to augment their capital base to meet

their future capital requirements arising out of growth in business. The amount

to be invested in these subsidiaries is `616cr.

The balance will be used for general corporate purposes.

In addition, the proceeds from the Offer for Sale portion of the total issue

proceeds, which may be a major portion of the total issue proceeds, would

accrue to the selling shareholders and will not be available for utilization by

the company for its requirements.

April 4, 2016

3

Equitas Holdings | IPO Note

Investment rationale

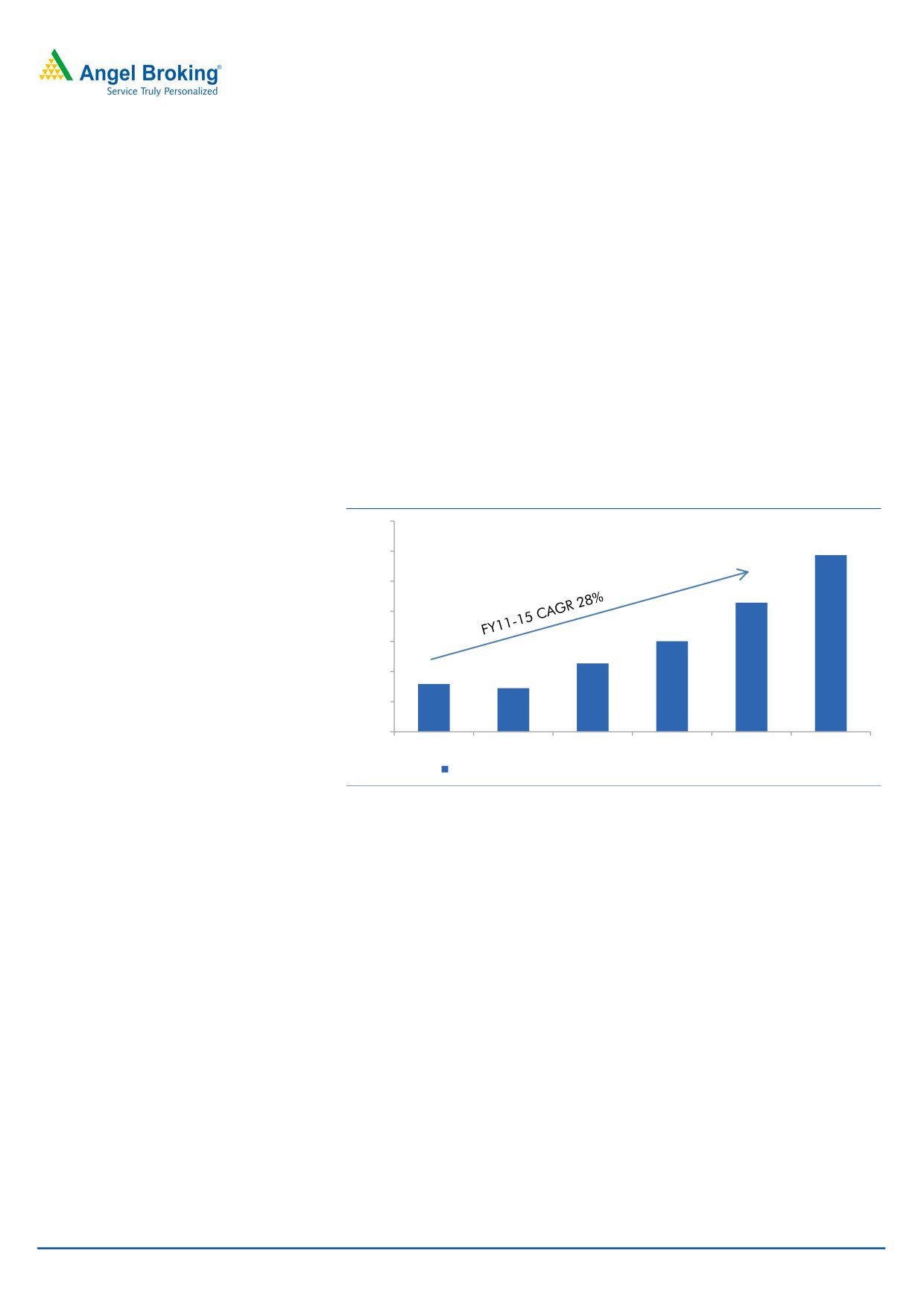

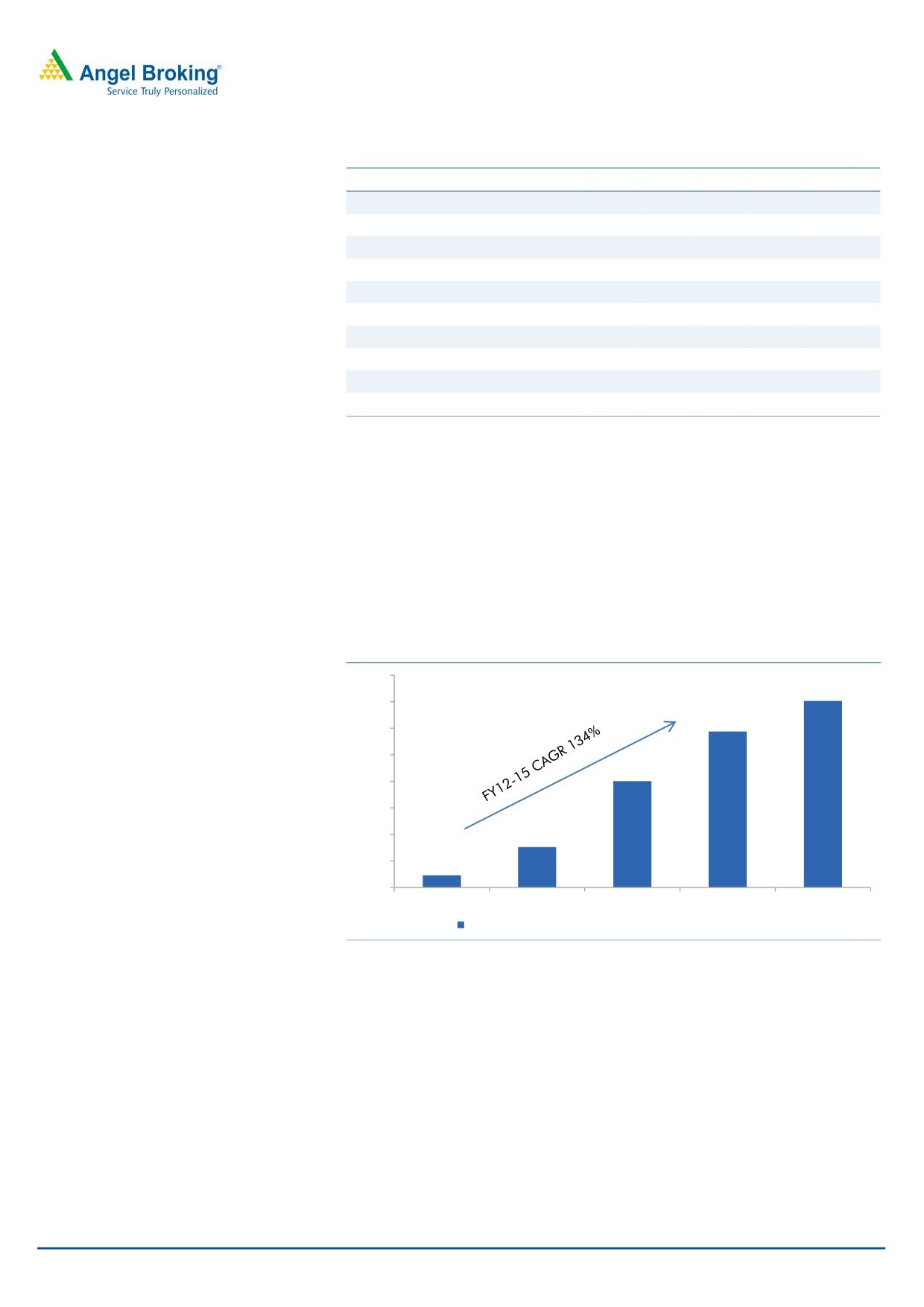

Micro finance business has huge scalability: Equitas’ microfinance business has

grown at a CAGR of 42% over FY2012-9MFY2016 to `2,935cr. There is a huge

untapped opportunity in this segment as microfinance is targeted to the lower

income segment which often lacks access to formal financing sources. Ideally the

ticket size of the loans range from `2,000-`35,000 (average ticket size of `9,634)

and more than 90% of the borrowers are female, who access loans via group

borrowings (Self Help Group) for very small businesses. Sharing the group liability

has resulted in maintaining credit discipline and hence the delinquency in this type

of business has been very low despite it being an unsecured form of loan. EMIs are

collected on 14 days or 28 days basis, which reduces the risk of any bad loans.

With a loan portfolio of only ~`43,300cr for the industry and the government’s

focus on financial inclusion together with better clarity on regulatory aspects, the

microfinance industry can look forward for healthy growth ahead.

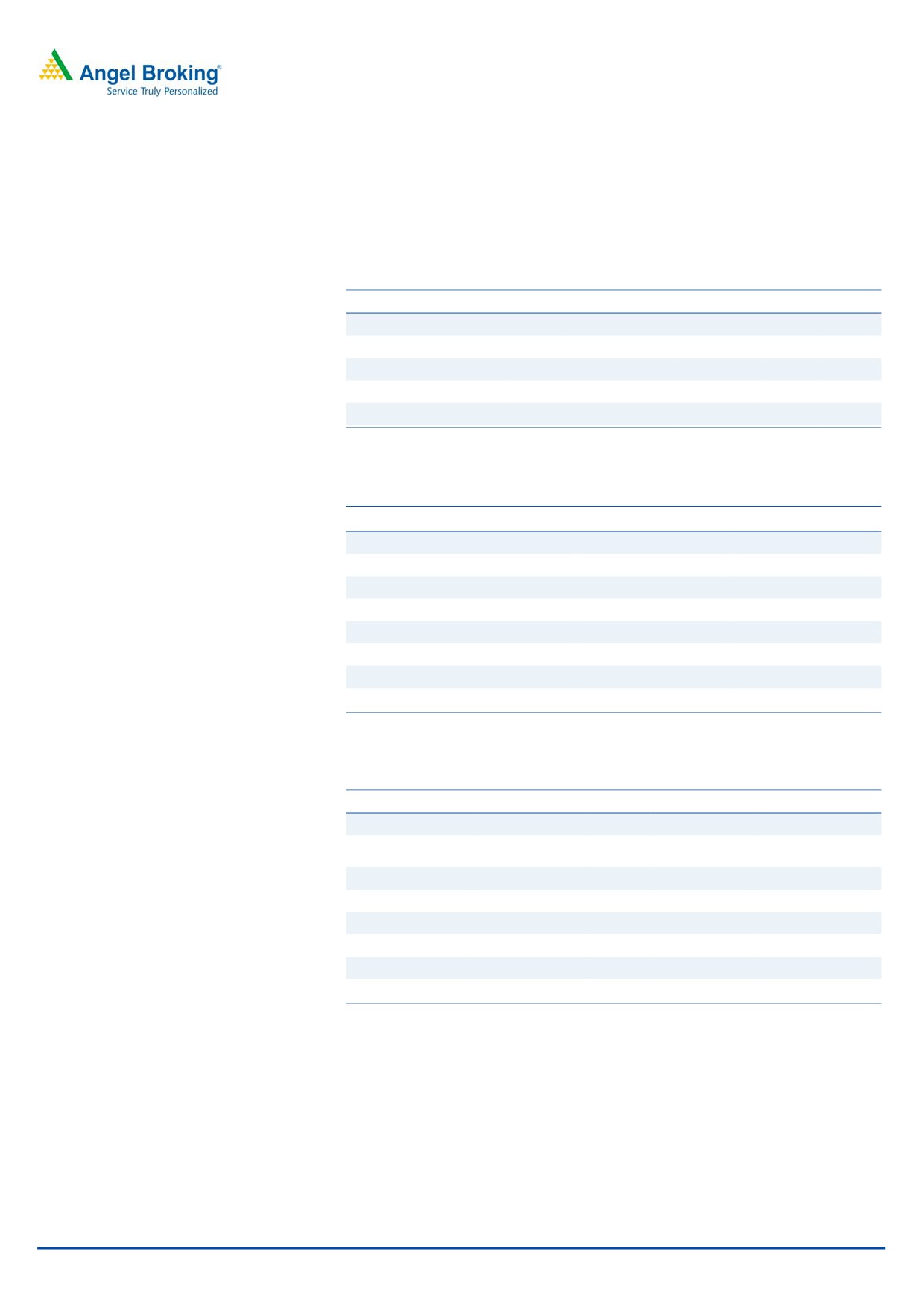

Exhibit 5: Micro Finance AUM CAGR%

3,500

2,935

3,000

2,500

2,144

2,000

1,503

1,500

1,135

1,000

794

724

500

0

FY11

FY12

FY13

FY14

FY15

9MFY16

Assets Under Management (AUM) (`crs) - Micro Finance

Source: Company, Angel Research

Despite being a late entrant, Equitas has been able to scale up its operations very

fast and now ranks fifth in terms of gross loan portfolio within the microfinance

industry. Despite being perceived to be a risky segment, the company has

managed its loan portfolio quite strong with Gross NPAs of 0.17% and Net NPAs

at 0.10% at the end of 9MFY2016. Based on its historical trend, we believe the

company has developed robust processes for monitoring and collections and

hence any substantial deterioration in asset quality is unexpected. Backed by scale

of operations it has been able to reduce its operating expenses to 7.6% of sales in

9MFY2016 from 13.7% in FY2012. Though the ROA has come off from its peak of

4.3%, it still continues to be healthy at 2.9%, while ROE and NIM have been steady

at 19.1% and 11.1% respectively.

April 4, 2016

4

Equitas Holdings | IPO Note

Exhibit 6: Microfinance Business - Key Parameters

(` In Cr)

FY12

FY13

FY14

FY15

9MFY16

AUM

724

1,135

1,503

2,144

2,935

% Growth

(8.8)

56.7

32.5

42.6

36.9

NII

113

115

161

215

212

% Growth

(0.3)

0.0

0.4

0.3

(0.0)

NIM %

14.9

12.3

12.2

11.8

11.1

Operating Expenses/ Average AUM

12.5

9.5

7.8

7.6

7.6

ROA %

2.0

2.5

4.3

3.8

2.9

ROE %

7.2

12.0

20.0

19.8

19.1

Gross NPA/ On Book AUM(%)

1.3

0.0

0.1

0.1

0.2

Net NPA/ On Book AUM (%)

0.1

0.0

0.0

0.0

0.1

Source: Company, Angel Research

Diversifying into used vehicle finance and MSE financing a positive move: The

company earlier diversified into used vehicle & MSE financing and within 5 years it

has been able to scale up its AUM to `2,341cr, growing at a CAGR of 125% over

FY12-15. The segment now forms 43% of the company’s overall AUM. With

average ticket size of `3.8 lakhs the primary target customers are first time buyers

of used vehicles and the Management believes its experience in handling the

unsecured loan portfolio will help in further scaling up the vehicle & MSE portfolio.

Exhibit 7: Strong AUM growth under Vehicle Finance

1,600

1,406

1,400

1,175

1,200

1,000

801

800

600

400

305

200

92

0

FY12

FY13

FY14

FY15

9MFY16

Assets Under Management (AUM) (`crs) - Vehicle Finance

Source: Company, Angel Research

There are large players in the used vehicle financing business. However, the

company believes it has enough scope to penetrate the hinterland of the country

where a formal system of financing in this segment is still missing and borrowers

have to depend on high cost funds from local players.

April 4, 2016

5

Equitas Holdings | IPO Note

Exhibit 8: Vehicle Finance & MSE Business - Key Parameters

Vehicle Finance & MSE Business (` Cr)

FY12

FY13

FY14

FY15

9MFY16

AUM Combined

92

305

889

1,686

2,341

% Growth

232.1

191.9

89.7

38.8

Vehicle

92

305

801

1,175

1,406

% Growth

232.1

163.2

46.7

19.6

MSE

0

0

87

511

936

% Growth

NA

NA

484.5

83.1

NII

4

28

72

158

189

% Growth

696.3

157.4

119.9

19.3

NIM %

3.8

14.1

12.1

12.3

12.5

Operating Expenses/ Average AUM %

18.2

15.7

8.5

7.7

6.8

ROA %

(22.3)

1.1

2.6

2.7

3.6

ROE %

(46.5)

3.2

7.1

7.5

12.1

Gross NPA/ N Book AUM (%)

0.5

1.0

1.6

2.0

2.6

Net NPA/ On Book AUM (%)

0.4

0.7

1.4

1.5

2.0

Source: Company, Angel Research

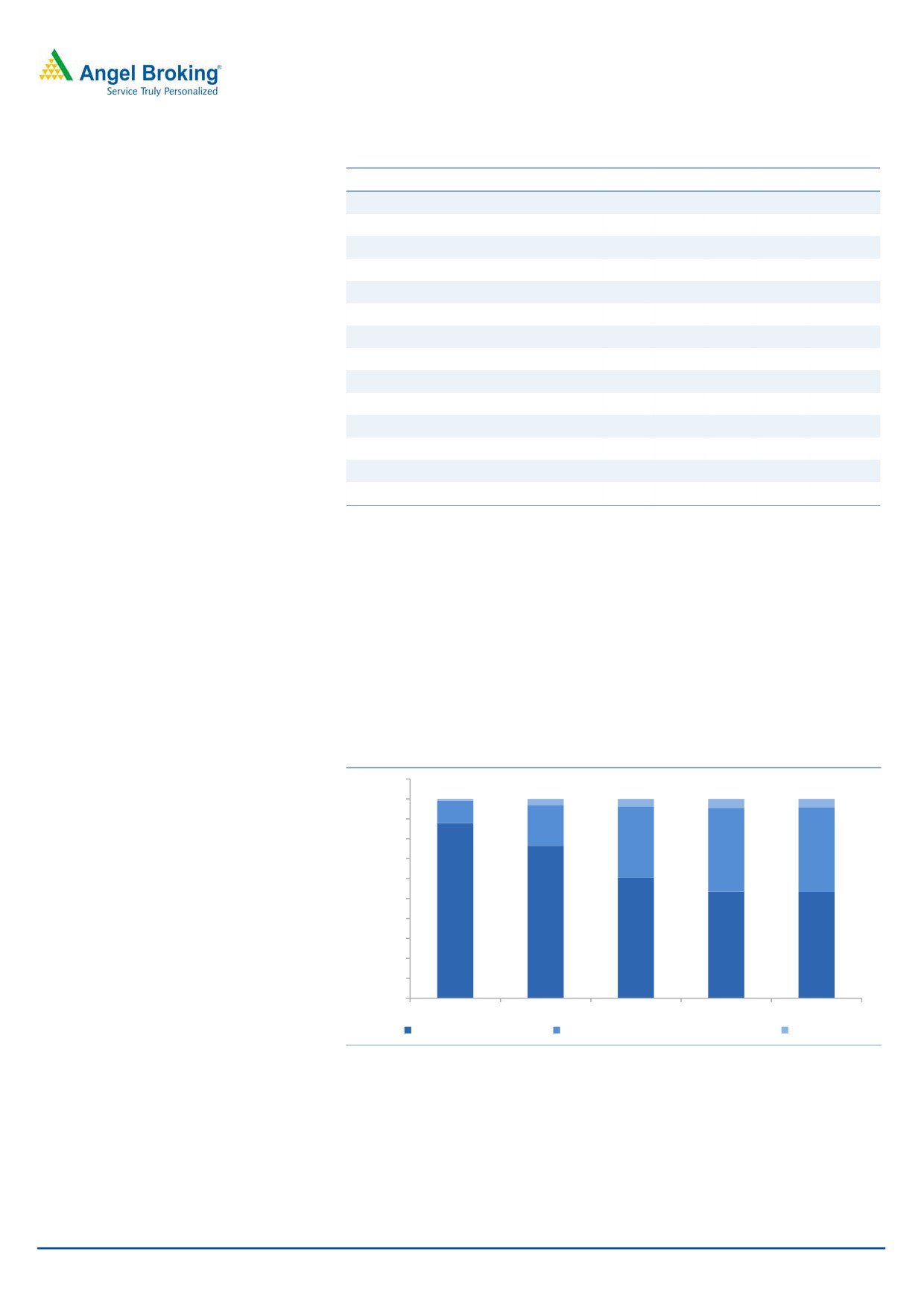

Reducing dependence on microfinance: Equitas has successfully diversified its

business; accordingly the share of microfinance in the total AUM has declined to

53% in 9MFY2016 from 100% in FY2011, while that of vehicle finance and MSE

finance has risen to 42.5% from nil over the same period. The company also

started Home Loans business in 2011, however intends to grow the same slow and

steady as the initial delinquencies in the same has been high. Contribution of

Home Loans continues to be very small at 4% of the AUM, and the management

doesn’t intend to scale it up fast in the near term.

Exhibit 9: Portfolio Distribution

110.0%

100.0%

1.0%

3.0%

3.8%

4.5%

4.2%

11.1%

90.0%

20.5%

80.0%

35.8%

42.1%

42.5%

70.0%

60.0%

50.0%

87.9%

40.0%

76.5%

30.0%

60.5%

53.5%

53.3%

20.0%

10.0%

0.0%

FY12

FY13

FY14

FY15

9MFY16

Micro Finance Business

Vehicle Finance & MSE Business Rs Cr

Home Loans

Source: Company, Angel Research

April 4, 2016

6

Equitas Holdings | IPO Note

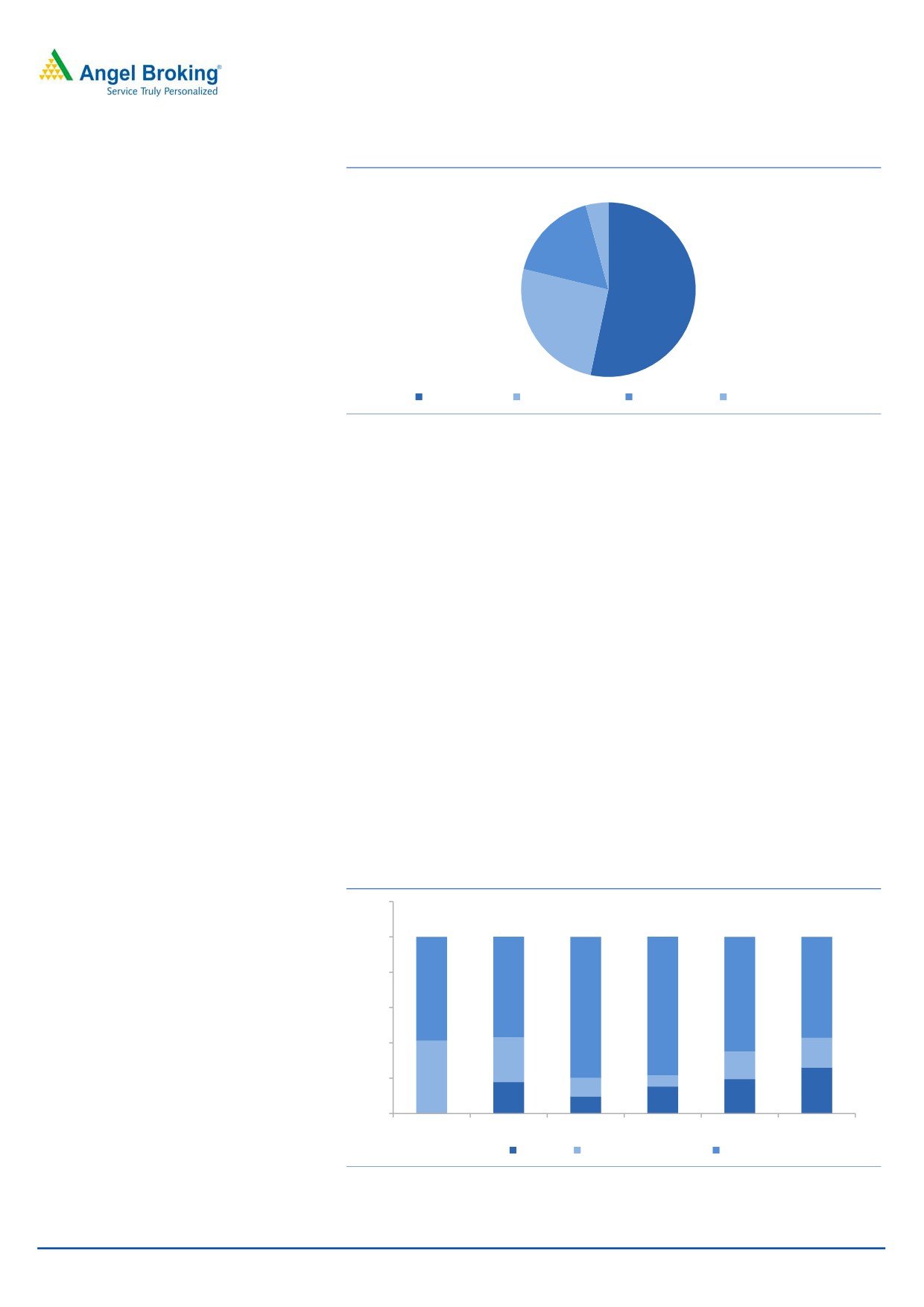

Exhibit 10: Latest Portfolio Mix (%)

4.2%

17.0%

53.3%

25.5%

Microfinance

Vehicle Finance

MSE finance

Housing finance

Source: Company, Angel Research

Expect smooth transition to a SFB: Equitas is amongst the ten players to have

received a SFB license from the RBI. Migrating to become an SFB from being a

NBFC has its own pros and cons. On the positive side the proposed SFB will have

access to low cost funds via deposits and even borrowing costs can be reduced

further via NCDs and CP/CDs. It can also start other retail loans at par with other

banks. While on the flip side there will be initial expenses associated with being a

bank as new processes will have to be implemented. Further, the SFB will have to

comply with CRR and SLR requirements. Meeting 75% Priority Sector Lending (PSL)

target will not be a challenge for Equitas as its entire portfolio qualifies for PSL and

hence the migration from NBFC to SFB should be smooth These will impact the

overall NIM and ROA during the initial 2-3 years. Having said that, we believe with

an experienced Management and already diversified loan portfolio, the migration

from NBFC to SFB would be smooth.

Borrowing Mix:

The Company has over the years tilted its borrowings mix more in favor of lending

from banks and reduced its exposure to Non Convertible Debentures. Upon

conversion of SFB, the bank will have more leeway of low cost funds in the form of

deposits and higher credibility will allow it to price its NCD’s at a competitive rate.

This will overall result in lower cost of funds going ahead.

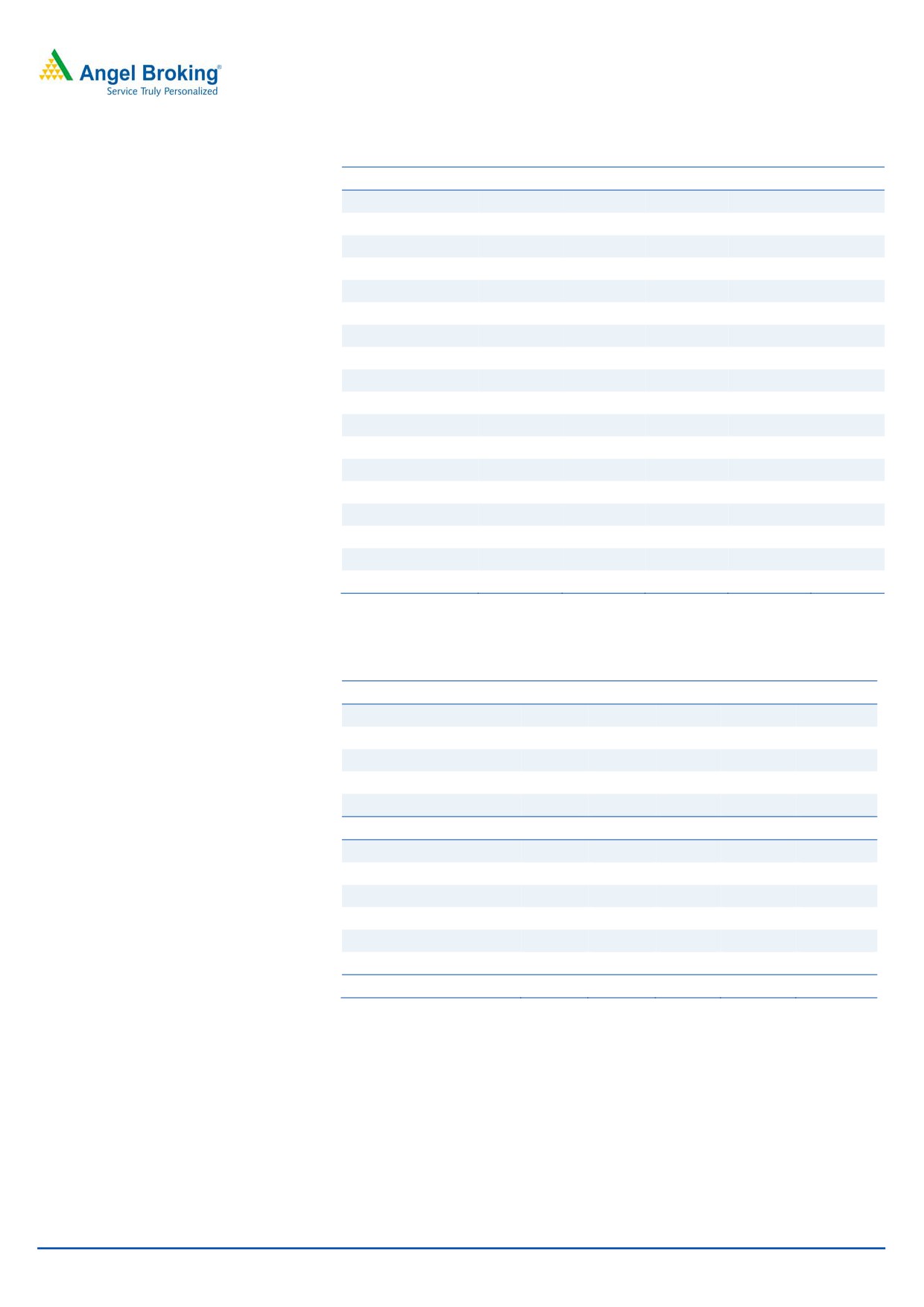

Exhibit 11: Borrowing Mix

120.0

100.0

80.0

58.8

57.0

57.2

64.9

60.0

79.9

78.5

40.0

16.7

25.3

15.6

20.0

41.2

6.3

10.4

26.1

17.8

15.3

19.5

9.7

0.0

0.0

FY2011

FY2012

FY2013

FY2014

FY2015

9MFY2016

NCD's

Financial Institutions

Banks

Source: Company, Angel Research

April 4, 2016

7

Equitas Holdings | IPO Note

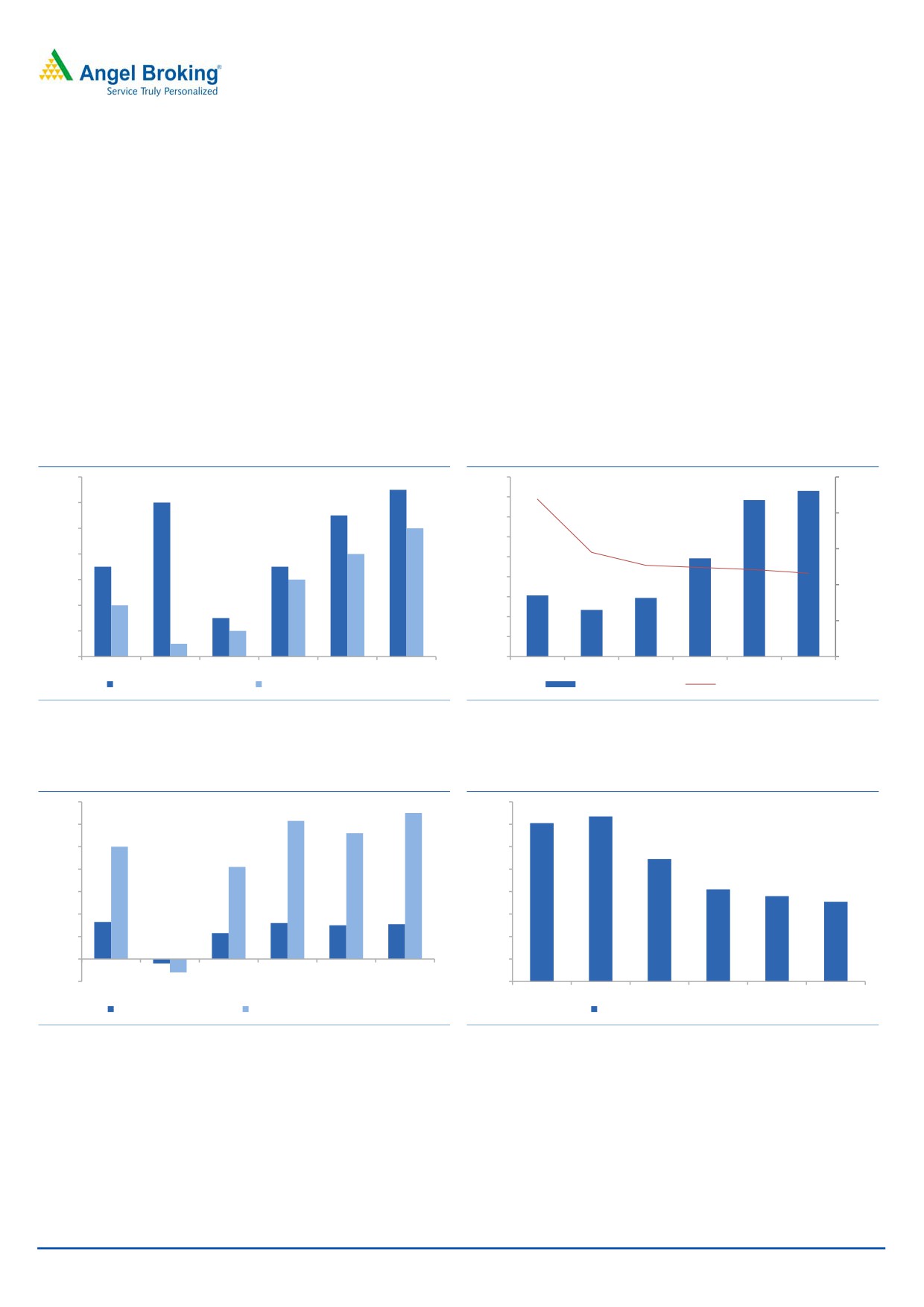

NIM’s and Asset Quality:

The company has managed its NPA level quite strong despite aggressive growth in

the last 4-5 years. Microfinance, though is an unsecured form of loan, the

company has achieved excellent track record of maintaining Gross NPA below

0.2% which is a commendable job.

However, in the vehicle finance business, Gross NPA is 2.6% which can be a cause

of concern if it escalates further. In the home loan business, Gross NPA has gone

upto 3% and hence management intends to go slow on expanding the same.

Net Interest Margins (NIM’s) for the company have been on a declining trend over

the past few years and we expect the same to decline further over the next few

quarters before it stabilises.

Exhibit 12: Gross & Net NPA (%)

Exhibit 13: NII & NIM

1.4%

4,500

25.0%

1.3%

21.9%

4,149

1.2%

3,921

4,000

1.2%

1.1%

1.0%

3,500

20.0%

1.0%

3,000

14.5%

0.8%

12.7%

12.4%

15.0%

0.8%

0.7%

0.7%

2,500

12.1%

11.6%

0.6%

0.6%

2,000

1,532

1,470

2,460

10.0%

0.4%

1,500

1,169

0.4%

0.3%

0.2%

1,000

5.0%

0.2%

0.1%

500

0.0%

0

0.0%

FY11

FY12

FY13

FY14

FY15

9MFY16

FY11

FY12

FY13

FY14

FY15

9MFY16

Gross NPA / On-Book AUM Net NPA / On-Book AUM

Net interest income

Net interest margin

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 14: Return rations are decent lower leverage

Exhibit 15: Operating expense/ Average AUM

allows scope for RoA & RoE expansions

14.0

13.0

16.0%

14.7%

12.3

14.1%

11.2

12.0

14.0%

10.0

10.0

12.0%

10.9%

8.2

8.0

10.0%

8.2%

7.6%

6.0

8.0%

7.1%

3.3

3.2

3.0

3.1

4.0

6.0%

2.3

2.0

4.0%

0.0

2.0%

(2.0)

(0.4)

(1.2)

0.0%

FY11

FY12

FY13

FY14

FY15

9MFY16

FY11

FY12

FY13

FY14

FY15

9MFY16

Return on average assets Return on average net worth

Operating expense/ Average AUM

Source: Company, Angel Research

Source: Company, Angel Research

April 4, 2016

8

Equitas Holdings | IPO Note

Exhibit 16: Consolidated Performance

FY12

FY13

FY14

FY15

9MFY16

AUM (Rs. crs)

824

1,484

2,486

4,010

5,505

% growth

3.8

80.1

67.5

61.3

37.3

On Book %

74.8

81.8

85.4

86.4

91.1

Off Book %

25.2

18.2

14.6

13.6

9.0

NIM %

14.5

12.7

12.4

12.1

11.6

ROA

(0.4)

2.3

3.2

3.0

3.1

ROE %

(1.2)

8.2

12.3

11.2

13.0

Cost/ Income %

88.3

71.8

55.0

53.6

52.4

Cost/ AUM %

14.7

10.9

8.2

7.6

7.1

Gross NPA/ On Book AUM (%)

1.2

0.3

0.7

1.1

1.3

Net NPA/ On Book AUM (%)

0.1

0.2

0.6

0.8

1.0

Leverage

3.2

3.6

3.8

3.8

4.5

Source: Company, Angel Research

Overview of Microfinance Industry:

The microfinance industry (MFI) witnessed rapid growth after 2001, after the RBI

granted priority sector status to bank loans advanced to MFIs. MFI had a problem

of high cost of funds and in order to tackle the problem the Union Budget 2016

announced setting up MUDRA Bank to refinance the microfinance sector. As a

result microfinance companies have better access to funds at lower costs and can

now scale up. Though there are ~60 microfinance companies in India, nearly 70%

of the gross loan portfolio is accounted by the top 10 players.

Exhibit 17: Top10 MFI’s in India

Top MFIs, gross loan portfolio (Rs. cr)

Q3FY16

Market Share (%)

Janalakshmi

8,096

19.1

SKS

6,177

14.5

Ujjivan

4,088

9.6

Satin

2,538

6.0

Equitas

2,320

5.5

Grameen Koota

1811

4.3

L & T Finance

1700

4.0

ESAF

1495

3.5

Spandana

1221

2.9

Grama Vidiyal

1147

2.7

Total of Top 10

30,593

72.0

Source: MFIN

April 4, 2016

9

Equitas Holdings | IPO Note

Exhibit 18: State-wise distribution of gross loan portfolio of the industry

State-wise distribution of gross loan portfolio

Q3FY16

Tamil Nadu

16.1%

Karnataka

13.8%

Maharashtra

11.9%

Uttar Pradesh

10.9%

Madhya Pradesh

7.8%

Odisha

6.1%

West Bengal

5.8%

Bihar

5.4%

Kerela

4.4%

Gujarat

3.7%

Others

14.1%

Total

100.0%

Source: MFIN

Other key observations:

Equitas is the first IPO in the proposed SFB segment. With current FII holding at

93%, participation of FIIs in the current IPO has not been allowed. Post IPO, the

foreign holding will come down to 35% and hence we expect value buyers to come

forward looking at the growth prospects the company offers in the long run.

Valuation

At the upper band of the offer price `110 the issue is priced at 1.8x its diluted BV

of `60 (pre-dilution 2.3x). The company has decent ROE and ROA of 13% and

3.1%. Though post conversion to a SFB the return ratios might be compressed,

while we expect the same to scale up subsequently. We believe the issue is

attractively priced looking at the growth options the company offers in the long

run. We recommend SUBSCRIBE to the issue.

April 4, 2016

10

Equitas Holdings | IPO Note

Comparative table

Within the listed space, we believe SKS Microfinance is the best comparable

company, while on others parameters we have tried to make a comparison with

other listed NBFCs as well.

Exhibit 19: Comparative - Micro Finance

Equitas

SKS Micro Fin

Janlakshmi

Ujjivan

Satin

Gross Loan Portfolio (crs)

2,935

6,177

8,096

4,088

2,538

Avg loan o/s per client

9,634

14,857

21,146

15,739

15,873

Branches

377

1,167

338

469

364

Employees

4,255

11,086

7,978

7,786

3,419

Clients (lakhs)

24.1

41.6

38.3

26.0

16.0

Source: MFIN

Exhibit 20: Comparative - Micro Finance

Equitas

SKS Micro Fin

NIM %

11.1%

10.5%

ROA%

2.9%

4.5%

ROE %

19.1%

25.0%

CAR %

21.0%

23.9%

GNPAs %

0.2%

0.1%

NNPAs%

0.1%

0.1%

P/BV

2.3x

4.2x

Leverage

4.0x

4.5x

Source: Company, Angel Research

Exhibit 21: Comparative - Vehicle Finance

Consolidated

Equitas

STFC Chola Sundaram Fin

Magma FinCorp

AUM Rs Crs

5,505

66,538

28,004

17,499

18,521

AUM CAGR

69.5%

13.7%

23.6%

6.4%

13.8%

3 yr (FY12-15)

NIM

11.6%

7.1%

8.5%

6.0

7.2%

GNPAs%

1.3%

4.3%

3.3%

2.1%

7.3%

NNPAs%

1.0%

0.9%

1.8%

1.1%

5.7%

Leverage

2.9

6.6

7.5%

5.6%

6.7%

ROA%

3.1%

2.2%

3.2%

2.3%

1.4%

ROE%

13.0%

14.2%

16.7%

13.8%

9.1%

Source: Company, Angel Research

April 4, 2016

11

Equitas Holdings | IPO Note

Risks

High concentration to a single state: Equitas derives ~63% of its AUM from Tamil

Nadu alone. Any change in socio political situation and natural calamity can

impact the economic condition of the borrowers and in turn impact the credit

quality of the company.

Ability to scale up its operations fast: The company is raising `720cr through fresh

issuance of shares, amounting to 56% of the existing net worth. Inability to scale

up its operations will result in ROE dilution in the near term.

Ability to meet deposit targets post SFB conversion: Post conversion to a SFB,

Equitas will be allowed to raise deposits from customers. Ability to raise deposits

from its existing client base will be limited looking at the average income profile of

the said borrowers. It might have to offer higher rates vis-a-vis other banks which

might have a negative impact on the NIM.

April 4, 2016

12

Equitas Holdings | IPO Note

Income statement

Y/E March (`cr)

FY2012

FY2013

FY2014

FY2015 9MFY2016

NII

125.3

155.3

259.6

401.3

423.3

- YoY Growth (%)

-

23.9

67.2

54.6

-

Other Income

9.1

20.2

34.4

59.9

63.1

- YoY Growth (%)

-

121.9

70.0

74.1

-

Operating Income

134.4

175.5

294.0

461.2

486.4

- YoY Growth (%)

-

30.6

67.5

56.9

-

Operating Expenses

118.7

126.0

161.8

247.2

254.7

- YoY Growth (%)

20.3

6.2

28.4

52.8

-

Pre - Provision Profit

15.8

49.6

132.2

214.0

231.7

- YoY Growth (%)

-

214.1

166.9

61.8

-

Prov. & Cont.

5.0

8.9

18.4

50.4

44.5

- YoY Growth (%)

-

78.5

106.5

174.1

-

Profit Before Tax

11.7

39.8

113.8

163.6

187.2

- YoY Growth (%)

-

240.8

186.3

43.7

-

Prov. for Taxation

14.4

7.9

39.5

56.6

66.9

- as a % of PBT

-

-

402.4

43.3

-

PAT

(2.7)

31.9

74.3

107.0

120.4

- YoY Growth (%)

-

-

133.0

43.9

-

Balance sheet

Y/E March (`cr)

FY2012 FY2013 FY2014

FY2015 9MFY2016

Share Capital

44.4

57.8

73.0

269.0

271.1

Reserve & Surplus

257.8

414.2

669.0

901.8

1,023.4

Loan Funds

563.8

1,274.4

1,849.2

3,032.2

4,154.9

- Growth (%)

-

126.0

45.1

64.0

37.0

Other Liab.& Prov.

94.8

107.6

160.4

261.9

347.3

Total Liabilities

960.8

1,853.9

2,751.6

4,464.9

5,796.7

Cash and Cash Equivalents

184.5

446.0

414.7

557.4

280.1

Investments

0.2

7.6

3.6

175.7

176.5

Advances

667.2

1,270.7

2,168.8

3,505.7

5,076.8

- Growth (%)

0.6

90.4

70.7

61.6

44.8

Fixed Assets

25.6

24.2

27.8

47.3

51.5

Other Assets

83.3

105.6

136.7

178.8

211.7

Total Assets

960.8

1,853.9

2,751.6

4,464.9

5,796.7

April 4, 2016

13

Equitas Holdings | IPO Note

Ratio analysis

Y/E March

FY2012

FY2013

FY2014

FY2015

9MFY2016

Profitability ratios (%)

NIMs

14.5

12.7

12.4

12.1

11.6

RoA

(0.7)

2.3

3.2

3.0

3.0

RoE

(2.4)

8.5

12.2

11.2

13.1

Asset Quality (%)

Gross NPAs

1.2

0.3

0.7

1.1

1.3

Net NPAs

0.1

0.2

0.6

0.8

1.0

Per Share Data (`)

EPS

(0.3)

2.1

4.0

4.5

4.5

BVPS

68.0

81.7

102.1

43.5

48.0

Valuation Ratios

PER (x)

(181.3)

19.9

10.7

27.6

24.6

P/ABVPS (x)

1.6

1.3

1.1

2.5

2.3

Dividend Yield (%)

0.0

0.0

0.0

0.0

0.0

DuPont Analysis

NII

26.1

11.0

11.3

11.1

10.3

(-) Prov. Exp.

1.0

0.6

0.8

1.4

1.0

Adj. NII

25.0

10.4

10.5

9.7

9.3

Other Inc.

1.9

1.4

1.5

1.7

1.5

Op. Inc.

26.9

11.8

12.0

11.4

10.9

Opex

24.7

9.0

7.0

6.9

6.2

PBT

2.2

2.9

4.9

4.5

4.6

Taxes

3.0

0.6

1.7

1.6

1.6

RoA

(0.7)

2.3

3.2

3.0

3.0

Leverage

3.2

3.6

3.8

3.8

4.4

RoE

(2.4)

8.5

12.2

11.2

13.1

April 4, 2016

14

Equitas Holdings | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

April 4, 2016

15