3QFY2016 Result Update | Capital

Goods

8 February 2016

Elecon Engineering Company

NEUTRAL

CMP

`61

Performance Highlights

Target Price

-

Standalone

Investment Period

-

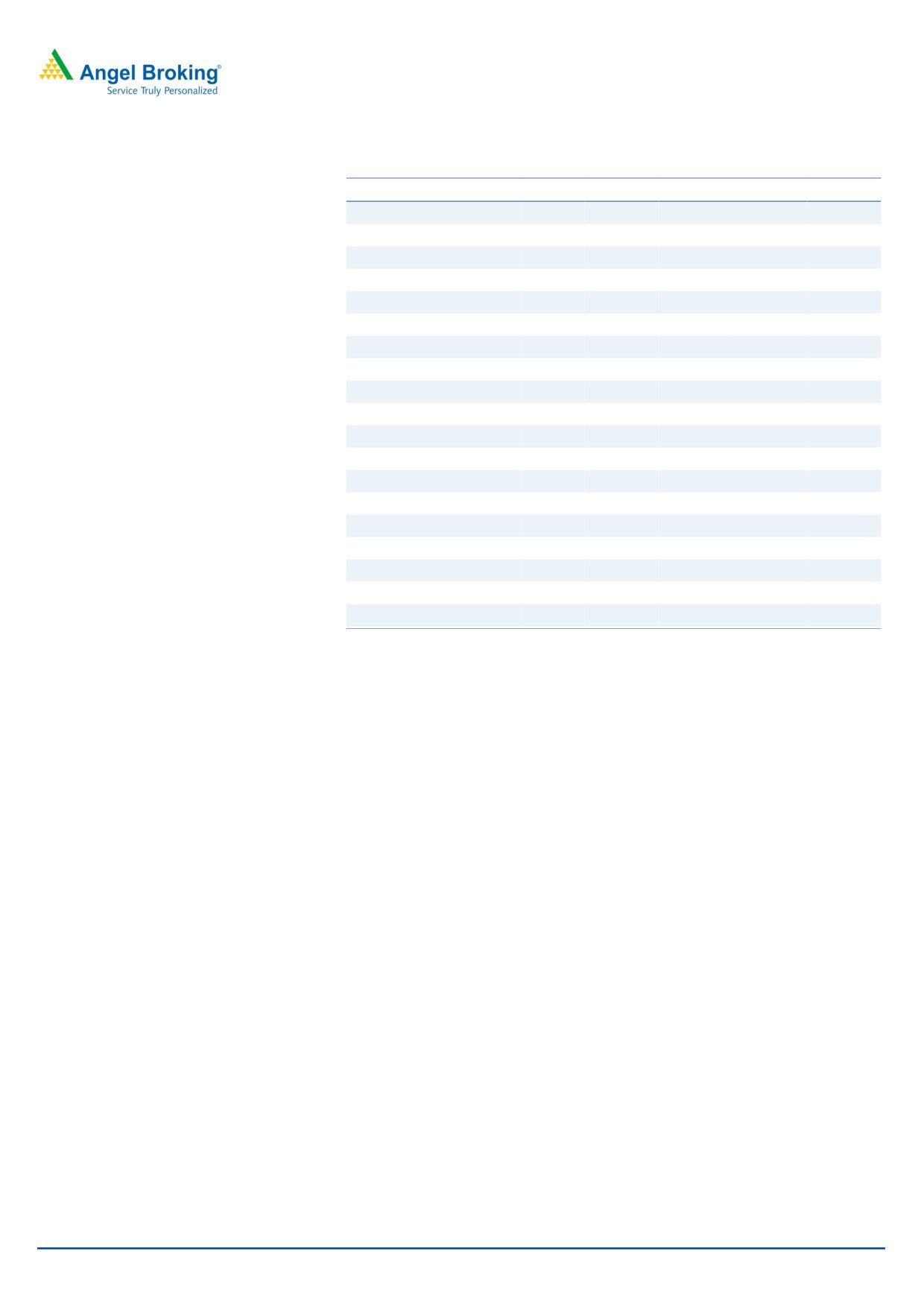

Y/E March (` cr)

3QFY2016

3QFY2015

% chg (yoy) 2QFY2016

% chg (qoq)

Net Sales

120

113

6.0

111

8.0

Stock Info

EBITDA

19

28

(32.7)

28

(32.8)

Sector

Capital Goods

EBIDTA margin(%)

15.5

24.4

(891)bp

24.9

(939)bp

Adjusted PAT

2

6

(66.3)

7

(68.4)

Market Cap (` cr)

666

Source: Company, Angel Research

Beta

1.7

For 3QFY2016, Elecon Engineering reported a disappointing set of numbers on

52 Week High / Low

97/48

both the standalone and consolidated basis. The standalone top-line grew by

Avg. Daily Volume

2,76,052

6.0% yoy to `120cr while the EBITDA margin declined by 891bp yoy mainly on

Face Value (`)

2

account of unfavorable revenue mix involving bulk of the shipments of low

BSE Sensex

24,287

margins. The consolidated top-line grew by 10.6% on a yoy basis to `330cr

mainly led by the overseas business and growth in the Material Handling Business

Nifty

7,387

(MHE) business. But the EBITDA margin deteriorated sharply by 872bp yoy to

Reuters Code

ELCN.BO

2.8%, mainly owing to a spike in raw material cost and other expenses. The

Bloomberg Code

ELCN@IN

company has reported higher other income on its standalone business related to

profits from sale of land amounting to

~`22cr, adjusting for which, the

standalone bottom-line declined by 66.3% yoy to `2cr. On the consolidated basis,

Shareholding Pattern (%)

the bottom-line after adjusting for the above mentioned exceptional gains and

Promoters

57.3

minority interest reported a loss of `11cr.

MF / Banks / Indian Fls

7.3

Recovery in capex taking longer than expected, long term prospects intact: The

performance of the MHE business of the company has remained under pressure

FII / NRIs / OCBs

0.9

on account of delay in capex in the core sectors and due to slower execution at

Indian Public / Others

34.5

customer level. On the other hand, the PTE business which had been holding its

ground has faced some pressure in the current year. Although the recovery in

capex in core sectors has been slower than expected, the long term prospects for

Abs. (%)

3m 1yr

3yr

the MHE business remain intact. Additionally, the underperforming European

Sensex

(7.0)

(4.1)

24.0

subsidiary is undergoing restructuring and it has been PAT positive for the past

Elecon Engg

(19.9)

(5.8)

54.1

three quarters (PAT of `7cr in 9MFY2016). We expect the subsidiary to contribute

more meaningfully in the longer run.

Outlook and Valuation: The impending improvement in the economic scenario

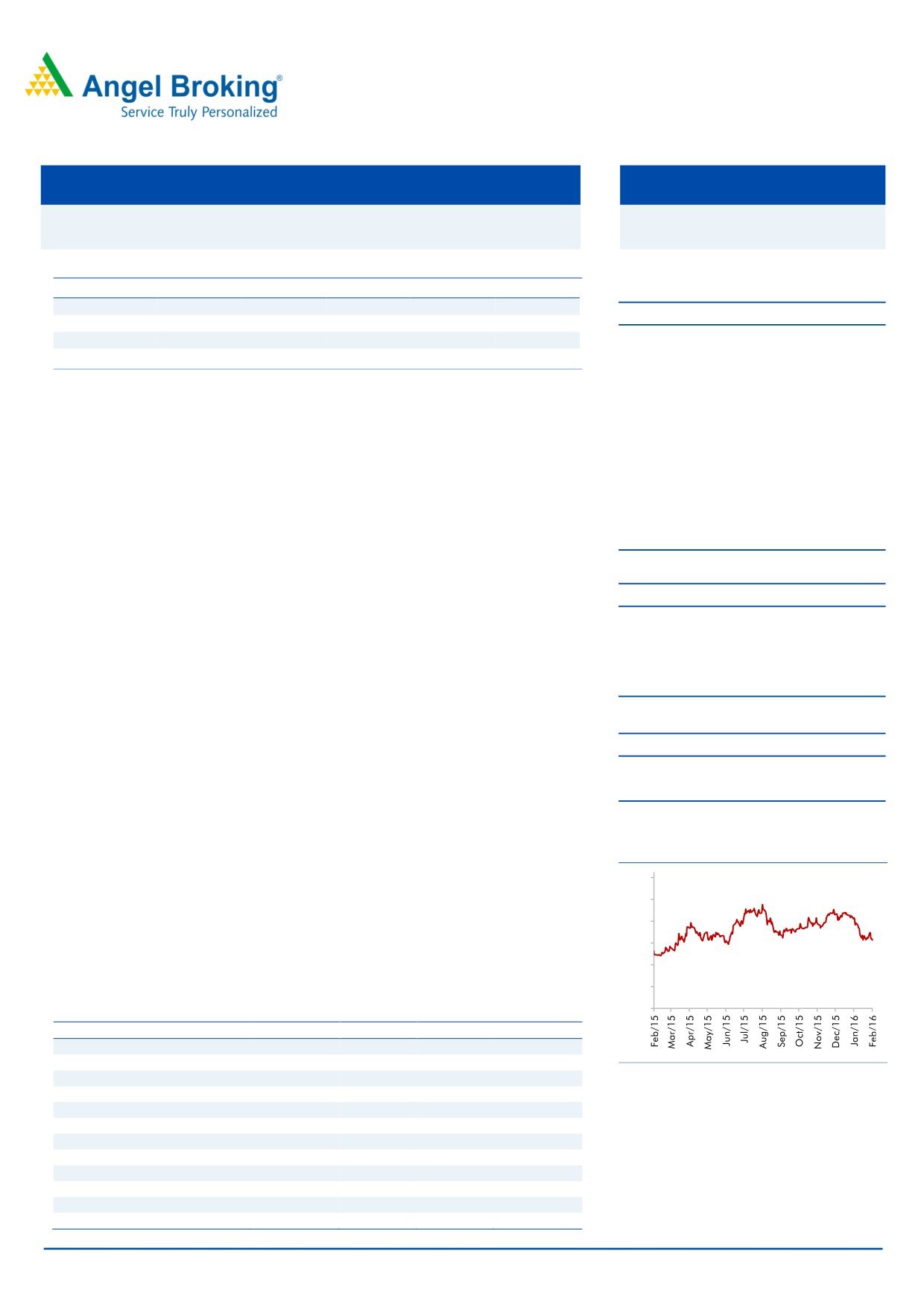

3-year daily price chart

and the resultant capex is expected to drive up demand for the MHE business.

Also its PTE business stands to benefit for the same reason. However, owing to

120

near term issues like slow pace of execution at customers ends and delay in capex

100

in core sectors have been impacting the overall business of the company. We are

80

accounting for a modest 5.6% revenue CAGR over FY2015-17E to `1,482cr and

60

we expect net profit after minority interest to be at `42cr in FY2017E. At the

40

current market price, the stock is trading at 15.7 its FY2017E earnings. We have

a Neutral view on the stock.

20

-

Key Financials (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

Net Sales

1,293

1,329

1,359

1,482

% chg

(15.3)

2.8

2.3

9.0

Source: Company, Angel Research

Adj. Net Profit

15

16

9

42

% chg

(54.1)

9.8

(46.5)

384.7

EBITDA (%)

11.7

12.8

10.3

13.6

EPS (`)

1.4

1.5

0.8

3.9

P/E (x)

44.7

40.7

76.1

15.7

P/BV (x)

1.3

1.2

1.2

1.2

RoE (%)

2.8

3.1

1.6

7.8

Milan Desai

RoCE (%)

6.3

7.4

5.8

10.5

022 4000 3600

EV/Sales (x)

1.0

0.9

0.9

0.8

EV/EBITDA (x)

8.6

7.1

8.3

5.8

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Elecon Engineering | 3QFY2016 Result Update

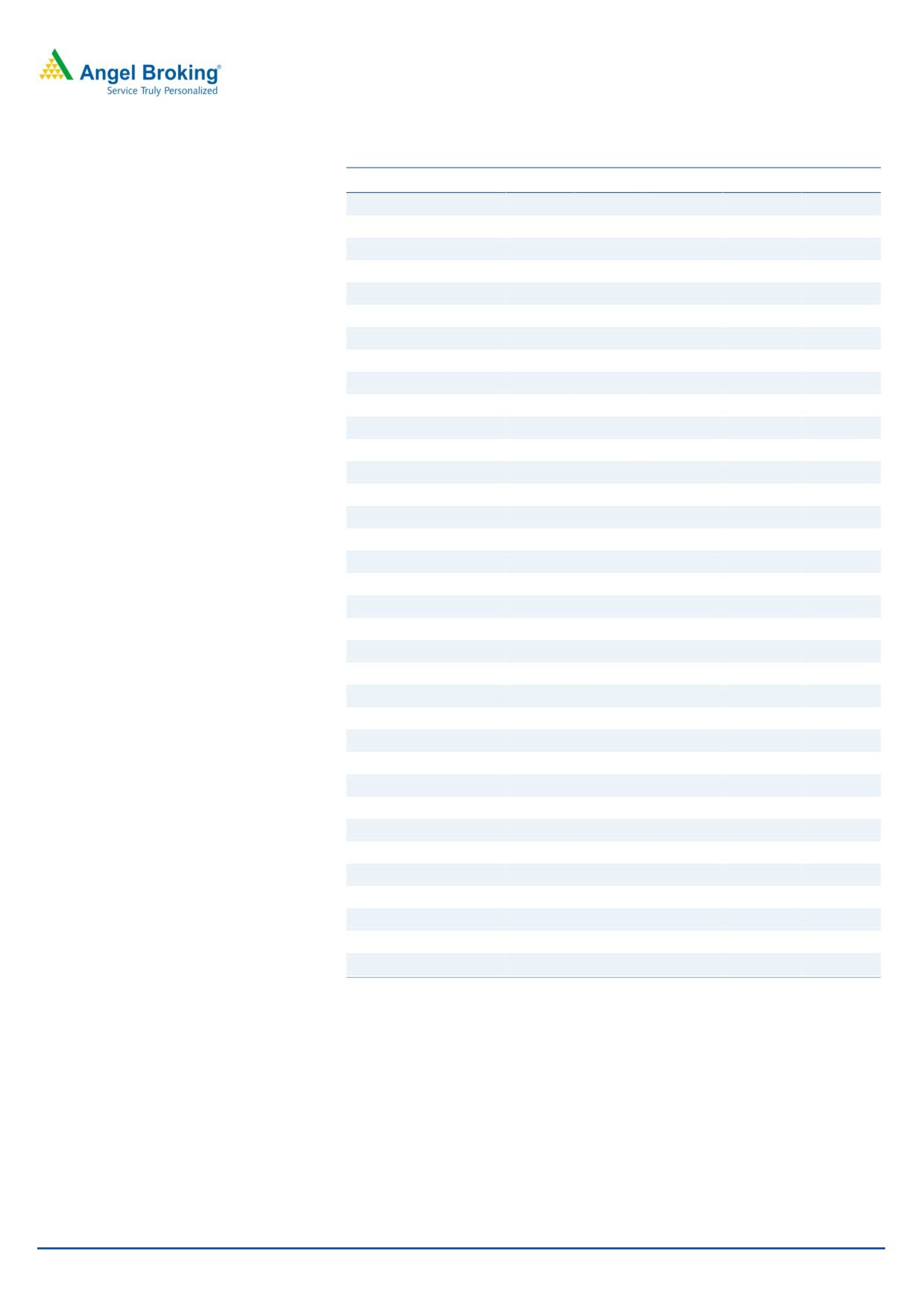

Exhibit 1: 3QFY2016 Standalone performance

Y/E March (` cr)

3QFY16

3QFY15

yoy chg (%)

2QFY16

qoq chg (%)

9MFY16

9MFY15

% chg

Net Sales

120

113

6.0

111

8.0

329

327

0.6

Net raw material

64

60

8.4

49

31.9

160

181

(11.5)

(% of Sales)

53.6

52.4

118bp

43.9

972bp

48.7

55.3

(667)bp

Staff Costs

12

10

21.9

14

(12.8)

36

29

24.3

(% of Sales)

10.0

8.7

131bp

12.4

(238)bp

10.8

8.8

206bp

Other Expenses

25

16

53.0

21

19.8

64

53

21.0

(% of Sales)

20.9

14.5

642bp

18.9

205bp

19.5

16.2

327bp

Total Expenditure

102

86

18.5

84

21.5

260

263

(1.0)

Operating Profit

19

28

(32.7)

28

(32.8)

69

64

7.4

OPM

15.5

24.4

(891)bp

24.9

(939)bp

21.0

19.7

133bp

Interest

9

7

23.3

9

1.5

26

22

18.6

Depreciation

12

12

(1.6)

12

0.8

35

37

(3.9)

Other Income

25.6

1.3

1812.5

3.2

689.2

31

10

226.6

PBT

23

10

144.0

10

129.0

39

15

12.6

(% of Sales)

19.3

8.4

9.1

11.9

4.7

Tax

6

3

3

11

5

(% of PBT)

26

32

32

29

32

Reported PAT

17

6

164.0

7

147.9

28

10

165.3

Extraordinary item

15

-

-

15

0

Adj. PAT

2

6

(66.3)

7

(68.4)

13

10

21.7

PATM

1.8

5.7

6.2

3.8

3.2

Source: Company, Angel Research

Exhibit 2: Actual vs. Estimate (Standalone 3QFY2016)

Particulars (` cr)

Actual

Estimate

Variation (%)

Total Income

120

122

(1.5)

EBIDTA

19

30

(37.7)

EBIDTA margin (%)

15.5

24.5

(900)bp

Adjusted PAT

2

9

(75.5)

Source: Company, Angel Research

Numbers disappoint on EBITDA and bottom-line front

For 3QFY2016, Elecon Engineering reported a disappointing set of numbers on

almost all fronts. The standalone top-line grew by 6.0% yoy to `120cr while the

standalone EBITDA margin declined by

891bp yoy mainly on account of

unfavorable revenue mix involving bulk of the shipments of low margins. The

consolidated top-line grew by 10.6% on a yoy basis to `330cr mainly led by the

overseas business and ~9% yoy growth in the MHE business. However, the

consolidated EBITDA margins deteriorated sharply by 872bp yoy to 2.8% mainly

on the back of spike in raw material cost and other expenses. The MHE business

like its competition is facing rough times owing to a tough operating environment

and has reported a loss at the EBITDA level.

The company has reported a higher other income on its standalone business

related to profits from sale of land amounting to ~`22cr, adjusting for which, the

standalone bottom-line declined by 66.3% yoy to `2cr. On the consolidated basis,

8 February 2016

2

Elecon Engineering | 3QFY2016 Result Update

the bottom-line after adjusting for the above mentioned exceptional gains and

minority interest reported a loss of `11cr against a net loss of `6cr in 3QFY2015.

The numbers were mostly below our estimates owing to a poor mix. Raw material

costs caused major variance in the actual numbers to our estimates.

Con-call Takeaways

The Management much like the past quarter has maintained its view that the

near term scenario remains subdued as customers are facing challenges in

terms of execution.

The margin drop at the standalone level was owing to higher share of low

margin orders and lower contribution from sale of spares. The spares which

used to contribute ~20-25% in prior quarters were much lower.

The international subsidiary has remained positive and has posted a PAT of

`7.1cr for 9MFY2016.

Tech-Pro situation remains unchanged. The consolidated receivables stood at

`775cr (~`608cr for MHE division, ~`60cr for Benzlers and ~`105cr for

standalone).

The MHE order book stood at `990cr while the Benzlers Group’s order book

stood at ~`60cr.

Consolidated debt stood at ~`600cr.

The other income was higher on account of sale of land to the promoter(s)

who were leasing the land from the company. The proceeds were ~`25cr for

which the company reported gains of ~`22cr.

Investment Argument

Capex in core sectors yet to pick up, long term prospects intact

The MHE business of the company has been undergoing a rough phase with

slower execution and lack of uptick in orders owing to a poor operating

environment. The performance has remained under pressure as pick-up in capex

in core sectors is taking longer than expected. However, the outlook remains intact

for the MHE business on account of imminent improvement in capex in power,

mining and port sectors. Further, the declining interest rate scenario should

improve liquidity in the market that has hampered execution at the client level.

Considering the near term muted outlook, we expect the MHE business’ top-line to

post a revenue CAGR of 3.7% over FY2015-17E to `556cr.

8 February 2016

3

Elecon Engineering | 3QFY2016 Result Update

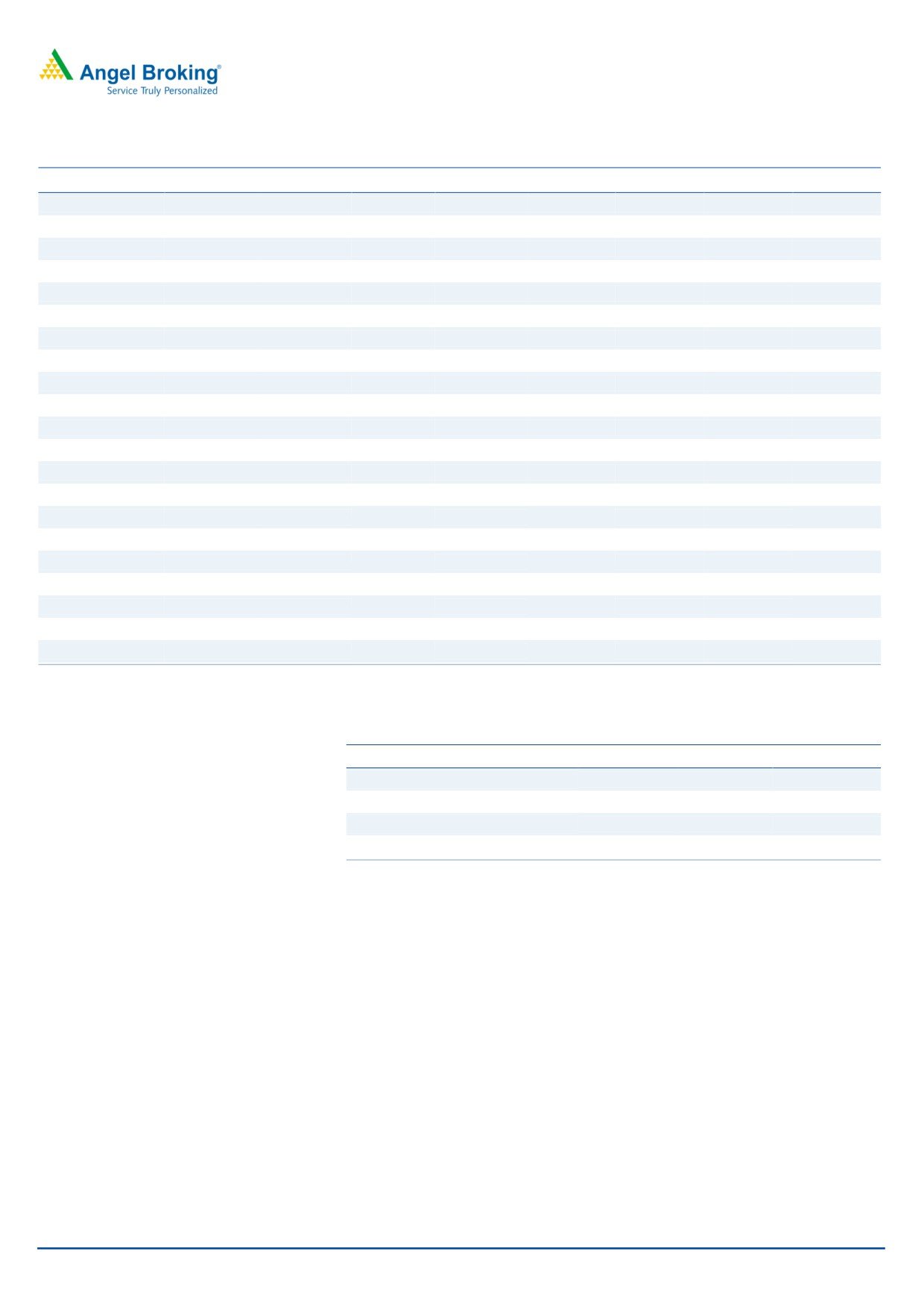

Exhibit 3: MHE Revenues and Growth trend

Exhibit 4: Standalone PTE Revenue and Growth trend

900

MHE Revenue (LHS)

MHE Growth (RHS)

PTE Revenue (LHS)

Growth (RHS)

620

15

20.0

800

18.0

600

9.9

10

15.0

8.0

700

8.4

580

5

10.0

3.7

600

560

0.4

2.5

-

5.0

3.1

500

-

540

(5)

(0.8)

400

(5.0)

520

(10)

300

(10.0)

500

(15)

(15.8)

200

(15.0)

480

(20)

(16.4)

100

(20.0)

460

(25)

(24.4)

-

(25.0)

440

(30)

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Source: Company, Angel Research

Source: Company, Angel Research

The standalone PTE business which was holding its ground till now has come

under pressure owing to the above mentioned reasons. The order book remains

healthy at `252cr providing revenue visibility. The utilization levels remain low at

40-45% which should improve once the capex cycle turns around. Going forward,

we expect the standalone business to post a CAGR of 5.2% over FY2015-17E to

`557cr. Owing to operating leverage coming into play, we expect the EBITDA

margin to improve from the present levels of ~21.0% (9MFY2016) to 23.6% in

FY2017E.

Exhibit 5: Standalone EBITDA & EBITDA Margins

Exhibit 6: Standalone PAT and PAT Margins

EBITDA (LHS)

EBITDA Margins (RHS)

PAT (LHS)

PAT Margins (RHS)

140

25.0

45

8.0

23.6

40

7.1

7.0

120

22.6

21.2

20.0

20.0

35

6.6

6.6

6.0

100

17.3

30

5.4

5.0

15.0

80

25

4.0

60

20

10.0

3.0

15

2.8

40

2.0

10

5.0

20

5

1.0

-

-

-

-

FY2013

FY2014

FY2015

FY2016E

FY2017E

FY2013

FY2014

FY2015

FY2016E

FY2017E

Source: Company, Angel Research

Source: Company, Angel Research

Benzlers-Radicon restructuring to have a meaningful impact in

the long run

Elecon Engineering is in the process of restructuring its operations in Europe, which

is more likely to be along the lines of shifting of some production to India to

develop higher quality products that meet European standards at a lower cost. The

company will shift a major portion of production to India in the longer run. This

along with other cost cutting measures undertaken by the Management and with a

gradual recovery in Europe, should lead the subsidiary to have a meaningful

contribution over the longer term. At present the EBITDA margin for Benzlers-

Radicon is more likely to continue to be at 7-8%, which although would improve to

~10% over the longer run. The subsidiary has turned PAT positive so far in the

year reporting a PAT of ~`7cr in 9MFY2016.

8 February 2016

4

Elecon Engineering | 3QFY2016 Result Update

Consolidated Financials

Exhibit 7: Revenue Assumptions

(` cr)

FY2015

FY2016E

FY2017E

Revenue

Elecon EPC (MHE)

517

513

556

Elecon Standalone

503

516

557

Radicon Benzlers (PTE) & Others

384

408

453

Less: Inter Company

76

78

84

Consolidated

1,329

1,359

1,482

Source: Company, Angel Research

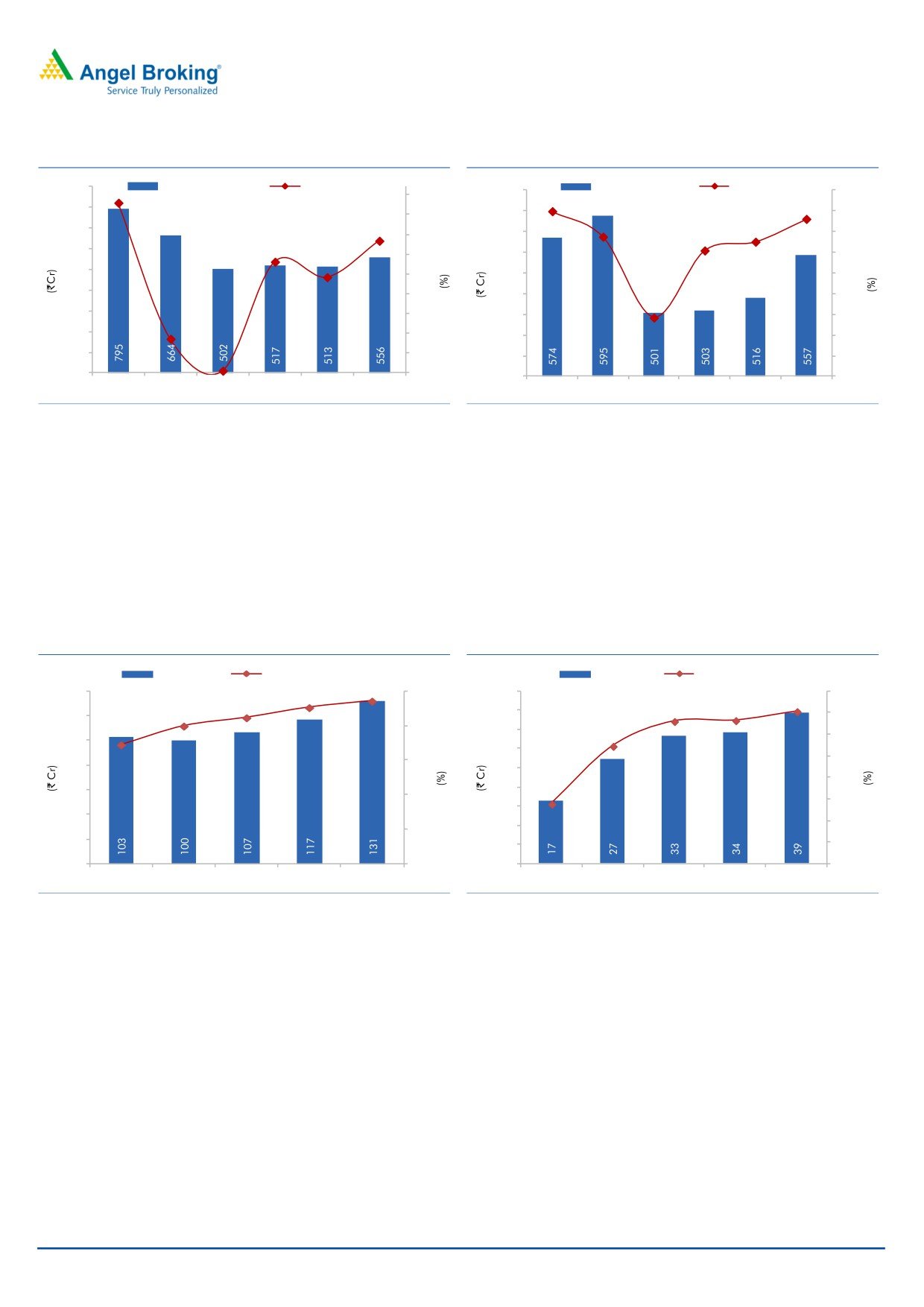

Recovery in Capex across industry to improve top-line

We have scaled down our expectation in the near term as the recovery at the

ground level is taking longer than expected. However, we expect the recovery to

gather steam only after FY2016E (2HFY2017E). We have built in a revenue CAGR

of 5.6% over FY2015-17E to `1,482cr.

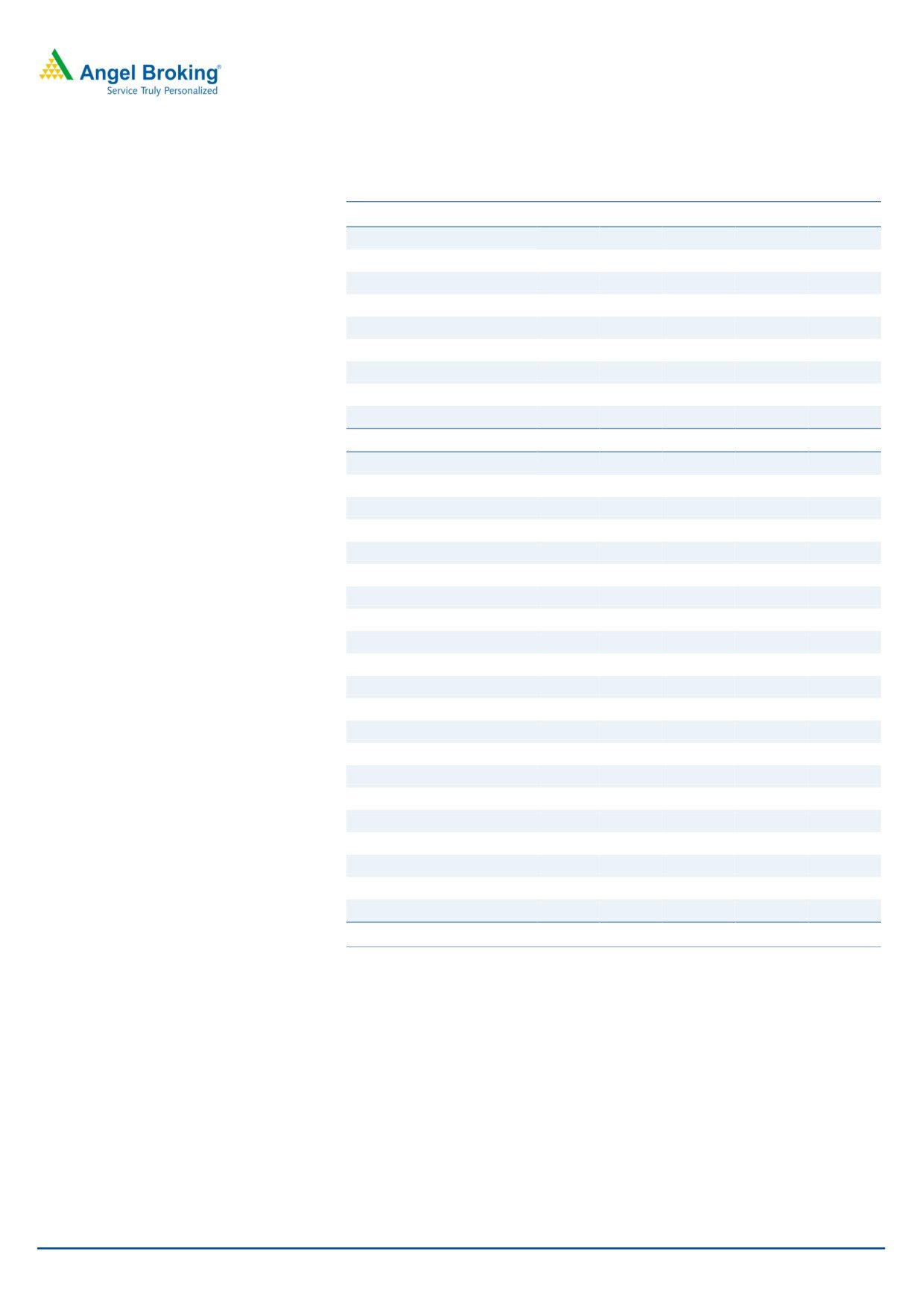

Exhibit 8: Revenues to improve on revival in capex

Exhibit 9: EBITDA Margin to witness improvement

Revenue (LHS)

Revenue Growth (RHS)

250

EBITDA (LHS)

EBITDA Margins (RHS)

16.0

1,550

15.0

13.6

13.

6 14.0

1,500

200

10.0

9.0

12.8

12.0

11.7

1,450

5.0

10.0

150

10.3

1,400

2.8

2.3

-

8.0

1,350

(5.0)

100

(5.4)

6.0

1,300

(10.0)

4.0

1,250

50

(15.0)

2.0

1,200

(15.3)

1,150

(20.0)

-

-

FY2013

FY2014

FY2015

FY2016E FY2017E

FY2013

FY2014

FY2015

FY2016E

FY2017E

Source: Company, Angel Research

Source: Company, Angel Research

EBITDA margin to expand

Post the decline in profitability in 3QFY2016, we expect the EBITDA margin to

decline to 10.3% in FY2016E and recover to 13.6% in FY2017E. Adjusting for

minority interest, the company’s net profit is expected to be at `42cr for FY2017E.

8 February 2016

5

Elecon Engineering | 3QFY2016 Result Update

Exhibit 10: PAT trajectory

45

PAT (LHS)

PAT Margins (RHS)

3.5

40

3.0

2.9

35

2.5

30

2.1

25

2.0

20

1.5

15

1.2

1.2

1.0

10

0.6

0.5

5

-

-

FY2013

FY2014

FY2015

FY2016E

FY2017E

Source: Company, Angel Research

Outlook and Valuation

The impending improvement in the economic scenario and the resultant capex is

expected to drive up demand for the MHE business. Also its PTE business stands to

benefit for the same reason. However, owing to near term issues like slow pace of

execution at customer’s end and delay in capex in core sectors has been impacting

the overall business of the company. We are accounting for a modest 5.6%

revenue CAGR over FY2015-17E to `1,482cr and we expect the net profit after

minority interest to be at `42cr in FY2017E. At the current market price, the stock is

trading at 15.7x its FY2017E earnings. We have a Neutral view on the stock.

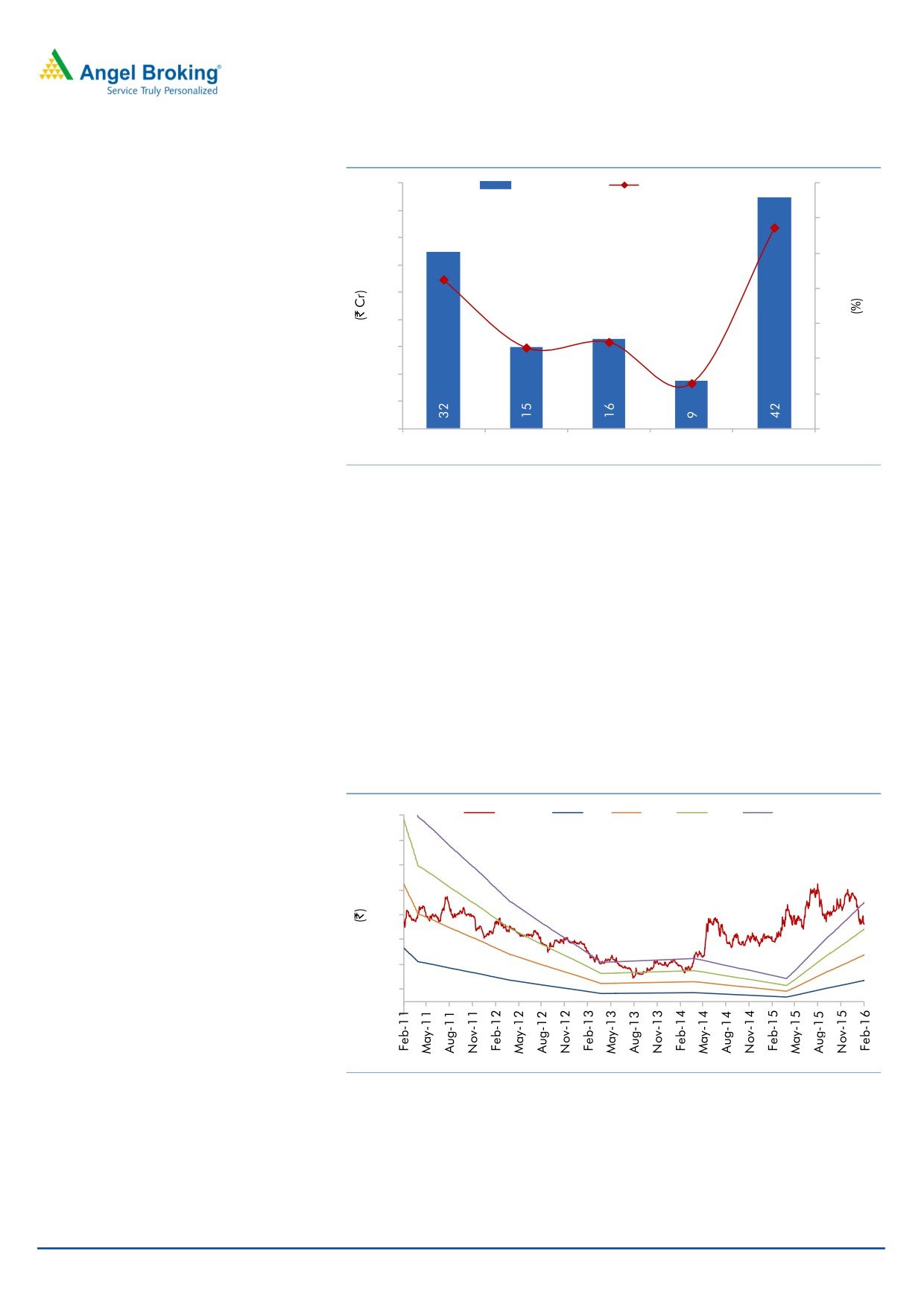

Exhibit 11: One-year forward P/E band

150

Price (`)

5x

11x

17x

23x

130

110

90

70

50

30

10

(10)

Source: Company, Angel Research

8 February 2016

6

Elecon Engineering | 3QFY2016 Result Update

Key Risks

Competition - Competition from other smaller players who bid at lower margins

will have a negative impact on the company’s business growth.

Failure of revival in capex - Both the main businesses of Elecon Engineering

benefit indirectly from improvement in infrastructure as well as capex in core

sectors. Contraction in capex will have a negative impact on the business.

Higher exposure to Coal Handling - The company’s MHE business derives most of

its revenues (60-70%) from the coal handling segment for power projects. Further

delay in allocation of blocks, environmental clearances, land acquisition and other

policy related issues will have a negative impact on the business.

Foreign Exchange - The Benzlers-Radicon group has transferred some lines of

production (~30% of subsidiary’s turnover) from Sweden to India. It plans on

scaling it up to ~60-80% in a gradual manner. Depreciating Euro against the INR

will have a negative impact on the margins of the subsidiary.

Company Background

Established in 1951, Elecon Engineering pioneered breakthrough innovations in

the manufacture of MHE and power transmission solutions and is one of the

largest manufacturers of MHE and industrial gears in Asia. The company has

expanded its skills and expertise to execute EPC contracts and has transformed into

a fully integrated EPC company executing several projects in India. The company’s

acquisition of Benzlers - Radicon from David Brown Gear Systems Group in 2010

adds to the expertise in manufacturing customized gearboxes for steel mills, high

speed turbines, and satellites for Indian Space Research Program and Naval

aircraft carriers.

Standalone business - The Power Transmission business of the company is the

largest gear manufacturing company in Asia. Its market share currently stands at

~30% with customer presence across India and countries like Australia, Africa,

South East Asia, Middle East, and Europe. As on FY2014, the standalone revenues

accounted for ~39% of its overall sales.

Elecon EPC Projects Ltd - Elecon EPC Projects became a 60.48% subsidiary of

the company with the balance held by the Promoter family. It was formed to

manage the core MHE business of the company and today it is the third largest

MHE company in India with products and solutions for various industrial sectors in

India. Its FY2014 revenues accounted for ~39% of Elecon Engineering’s overall

sales.

8 February 2016

7

Elecon Engineering | 3QFY2016 Result Update

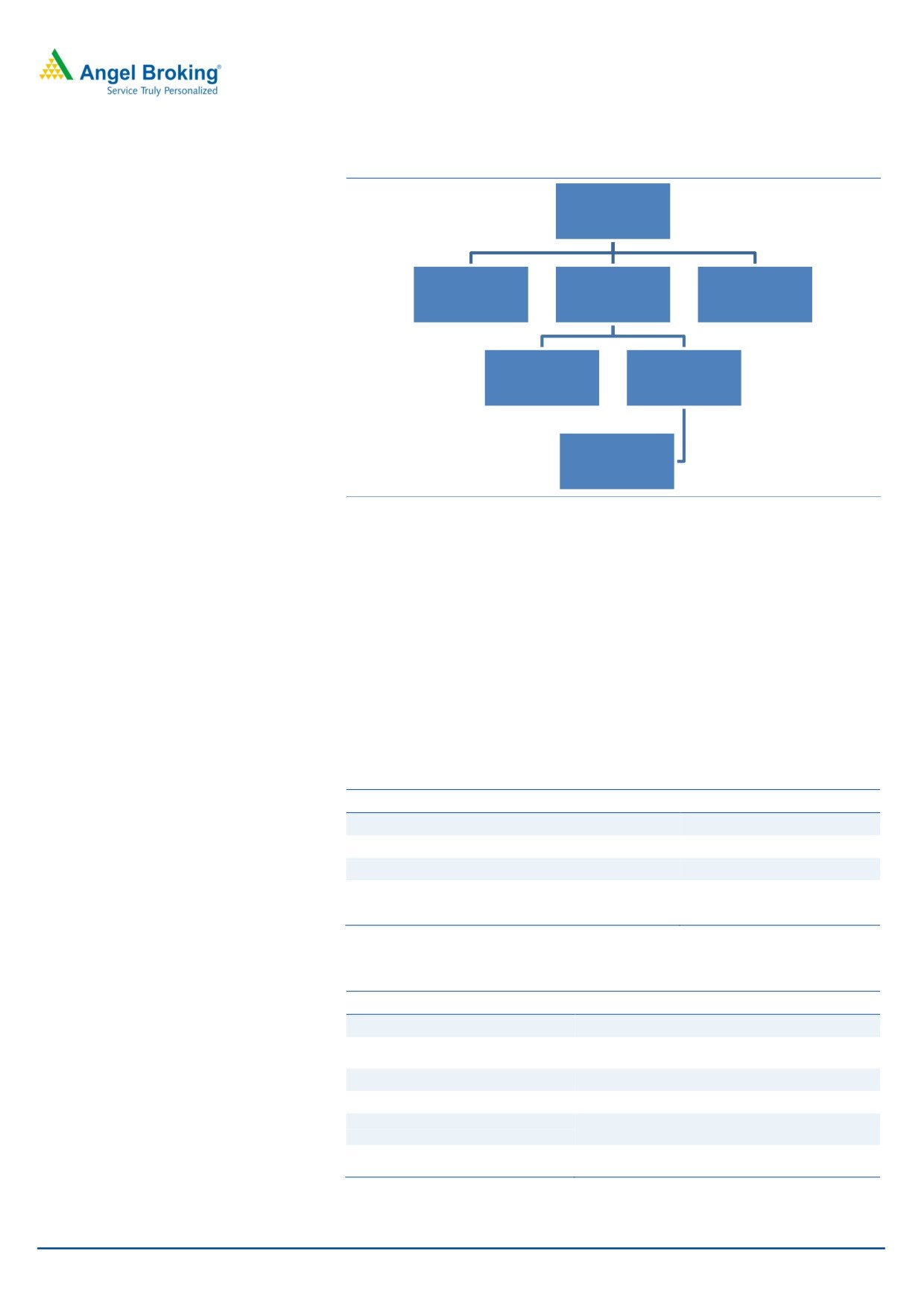

Exhibit 12: Business Structure

Elecon Engineering

Co. Ltd

Elecon Transmission

Elecon EPC Projects

Standalone (PTE)

Inernational Ltd (PTE)

(MHE)

100%

60.48%

AB Benzlers

Radicon UK

Radicon US

Source: Company, Angel Research

Benzler-Radicon Group - Elecon Engineering acquired Benzler-Radicon in

October 2010 from the UK based engineering company David Brown. Benzler-

Radicon have over 60 years of experience and have a reputation for being market

leaders in the design and manufacture of screw jacks, shaft mounted gearboxes

and industrial reducers.

Products

Its Power Transmission division involves design and manufacturing of the

following:

Power Transmission Solutions

Helical and Bevel Helical Gear boxes

Wind Mill Gear boxes

Planetary Gear boxes

Elevator Traction

Worm Gear boxes

Marine Gear boxes

Geared & Flexible Couplings

Loose Gear boxes

High Speed Gear boxes

Special Gear boxes

Its product range in the MHE segment includes design, engineering, manufacture,

supply, erection and commissioning of the following -

Material Handling Equipment

Wagon tipplers

Crawler-mounted trippers

Stationary and shiftable conveying systems for open

Bucket wheel stacker/reclaimers

cast lignite mines

Barrel-type blender reclaimers

Integrated coal handling plants for power stations

Fertilizer reclaiming scrapers

Fertilizer reclaiming scrapers

Limestone pre-homegenizing and

Underground mining conveyors

blending plants

Single and twin bucket wheel bridge-

Open-cast conveying systems

type reclaimers

8 February 2016

8

Elecon Engineering | 3QFY2016 Result Update

Profit and loss statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Total operating income

1,527

1,293

1,329

1,359

1,482

% chg

(5.4)

(15.3)

2.8

2.3

9.0

Net Raw Materials

807

624

677

715

742

% chg

(14.1)

(22.6)

8.4

5.6

3.8

Mfg. Exp. & Erection Charges

131

142

147

152

163

% chg

35.9

8.4

3.8

3.6

7.1

Personnel

185

174

143

151

161

% chg

27.9

(5.8)

(17.7)

5.3

7.0

Other

196

202

192

201

213

% chg

(12.4)

2.9

(4.8)

4.7

6.0

Total Expenditure

1,319

1,142

1,159

1,219

1,280

EBITDA

208

151

170

140

202

% chg

(0.2)

(27.5)

12.4

(17.4)

44.3

(% of Net Sales)

13.6

11.7

12.8

10.3

13.6

Depreciation& Amortisation

57

62

72

66

69

EBIT

151

89

98

74

133

% chg

(5.6)

(40.9)

9.9

(24.8)

80.2

(% of Net Sales)

9.9

6.9

7.4

5.4

9.0

Interest & other Charges

82

74

81

77

72

Other Income

7

15

17

37

17

(% of Net Sales)

0.5

1.2

1.3

2.7

1.1

Recurring PBT

69

15

17

(3)

61

% chg

(25.9)

(77.9)

12.9

(119.7)

-

Exceptional items

(27)

-

-

-

-

PBT (reported)

50

31

34

34

78

Tax

21

15

17

20

31

(% of PBT)

41.4

49.3

49.5

60.0

40.0

PAT (reported)

29

16

17

13

47

Minority Interest (after tax)

12

1

1

(10)

5

Profit/Loss of Associate Company

0

0

0

0

0

Net Profit after Minority Int.

18

15

16

24

42

& P/L Asso.Co.

Extraordinary Expense/(Inc.)

(14)

0

-

15

-

ADJ. PAT

32

15

16

9

42

% chg

(46.0)

(54.1)

9.8

(46.5)

384.7

(% of Net Sales)

2.1

1.2

1.2

0.6

2.9

Basic EPS (`)

3.5

1.4

1.5

0.8

3.9

Fully Diluted EPS (`)

3.5

1.4

1.5

0.8

3.9

% chg

(46.0)

(60.8)

9.8

(46.5)

384.7

Dividend

11

11

12

13

20

Retained Earning

16

3

3

-2

23

8 February 2016

9

Elecon Engineering | 3QFY2016 Result Update

Balance sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015E

FY2016E

FY2017E

SOURCES OF FUNDS

Equity Share Capital

22

22

22

22

22

Reserves& Surplus

516

510

514

511

535

Shareholders’ Funds

538

532

536

533

556

Minority Interest

34

35

36

26

31

Total Loans

697

633

552

552

530

Other Long Term Liabilities

128

139

113

113

113

Long Term Provisions

5

3

3

3

3

Deferred Tax Liability

44

43

36

36

36

Total Liabilities

1,446

1,386

1,276

1,263

1,269

APPLICATION OF FUNDS

Gross Block

904

908

895

922

949

Less: Acc. Depreciation

360

400

455

522

591

Less: Impairment

-

-

-

-

-

Net Block

544

508

440

400

358

Capital Work-in-Progress

10

7

4

4

4

Lease adjustment

-

-

-

-

-

Goodwill

81

87

84

82

79

Investments

13

14

15

15

15

Long Term Loans and advances

11

19

17

17

17

Other Non-current asset

39

65

54

54

54

Current Assets

1,425

1,357

1,351

1,389

1,474

Cash

32

22

32

61

47

Loans & Advances

155

115

109

111

121

Inventory

393

358

346

354

386

Debtors

838

853

858

857

913

Other current assets

8

9

6

6

6

Current liabilities

679

675

692

702

736

Net Current Assets

746

682

659

688

738

Misc. Exp. not written off

-

-

-

-

-

Deferred Tax Assets

3

3

3

3

3

Total Assets

1,446

1,386

1,276

1,263

1,269

8 February 2016

10

Elecon Engineering | 3QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015E FY2016E FY2017E

Profit before tax

50

31

34

34

78

Depreciation

57

62

72

66

69

Change in Working Capital

(171)

55

32

1

(64)

Direct taxes paid

(21)

(15)

(24)

(20)

(31)

Others

(7)

(15)

(17)

(37)

(17)

Cash Flow from Operations

(92)

116

97

43

35

(Inc.)/Dec. in Fixed Assets

(120)

(1)

20

(25)

(25)

(Inc.)/Dec. in Investments

1

(2)

(1)

-

-

(Incr)/Decr In LT loans & adv.

32

(34)

13

-

-

Others

7

15

17

37

17

Cash Flow from Investing

(80)

(22)

49

12

(8)

Issue of Equity

3

-

-

-

-

Inc./(Dec.) in loans

32

(64)

(82)

(10)

(17)

Dividend Paid (Incl. Tax)

(14)

(12)

(14)

(16)

(24)

Others

163

(28)

(40)

-

-

Cash Flow from Financing

185

(104)

(137)

(26)

(41)

Inc./(Dec.) in Cash

13

(9)

9

29

(14)

Opening Cash balances

19

32

22

32

61

Closing Cash balances

32

22

32

61

47

8 February 2016

11

Elecon Engineering | 3QFY2016 Result Update

Key ratios (Consolidated)

Y/E March

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

20.5

44.7

40.7

76.1

15.7

P/CEPS

7.4

8.7

7.6

8.9

6.0

P/BV

1.2

1.3

1.2

1.2

1.2

EV/Net sales

0.9

1.0

0.9

0.9

0.8

EV/EBITDA

6.5

8.6

7.1

8.3

5.8

EV / Total Assets

0.9

0.9

0.9

0.9

0.9

Per Share Data (`)

EPS (Basic)

3.5

1.4

1.5

0.8

3.9

EPS (fully diluted)

3.5

1.4

0.0

0.0

0.3

Cash EPS

9.6

7.0

8.1

6.9

10.2

DPS

1.2

1.0

1.1

1.2

1.8

Book Value

57.9

48.8

49.2

48.9

51.1

DuPont Analysis

EBIT margin

9.9

6.9

7.4

5.4

9.0

Tax retention ratio

0.6

0.5

0.5

0.4

0.6

Asset turnover (x)

1.3

1.0

1.1

1.2

1.3

ROIC (Post-tax)

7.4

3.5

4.1

2.6

7.2

Cost of Debt (Post Tax)

7.0

5.6

6.9

5.6

8.0

Leverage (x)

1.2

1.1

0.9

0.9

0.8

Operating ROE

7.9

1.2

1.5

0.0

6.5

Returns (%)

ROCE (Pre-tax)

11.3

6.3

7.4

5.8

10.5

Angel ROIC (Pre-tax)

12.7

7.0

8.2

6.6

12.0

ROE

6.5

2.8

3.1

1.6

7.8

Turnover ratios (x)

Asset TO (Gross Block)

1.8

1.4

1.5

1.5

1.6

Inventory / Net sales (days)

90

106

97

94

91

Receivables (days)

194

239

235

230

225

Payables (days)

189

216

215

210

210

WC cycle (ex-cash) (days)

150

194

177

168

162

Solvency ratios (x)

Net debt to equity

1.2

1.1

0.9

0.9

0.8

Net debt to EBITDA

3.1

4.0

3.0

3.4

2.3

Int. Coverage (EBIT/ Int.)

1.9

1.2

1.2

1.0

1.9

8 February 2016

12

Elecon Engineering | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel has received in-principal approval

from SEBI for registering as a Research Entity in terms of SEBI (Research Analyst) Regulations, 2014. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates

including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by

Analyst. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months. Angel/analyst has not served as an officer, director or employee of

company covered by Analyst and has not been engaged in market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Elecon Engineering

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15

8 February 2016

13