IPO Note | Pharmaceutical

December 7, 2015

Dr Lal PathLab

AVOID

Issue Open: December 8, 2015

IPO Note - Valuation not compelling

Issue Close: December 10, 2015

Dr Lal PathLabs is one of the largest companies in the Indian diagnostic industry,

Face Value: `10

having a market share of 12.0% amongst diagnostic chains. It’s one of the fastest

Present Eq. Paid up Capital: `82.6cr

growing companies in the space with strong profitability.

Offer Sale:1.16cr Shares

Dominant player in the industry: The company, according to our estimates, is the

Post Eq. Paid up Capital: `82.6cr

second largest player with an estimated ~12% market share in the organised

Market Lot: 20 Shares

diagnostic chains. It has grown at a CAGR of 20.7% over FY2013-15, primarily

driven by volumes which grew 16.7% during the period, while the rest was on

Issue (amount): `624-638cr

back of pricing power. Thus, given the company’s dominance in its industry and

Price Band: `540-555

its cash flows (~`148cr cash on the books of the company as of FY2015), we

believe that the company can easily leverage growth in the diagnostic healthcare

Post-issue implied mkt. cap `4460cr*- 4543cr**

services industry in India, which will grow by a CAGR of 16-17% till FY2018.

Note:*at Lower price band and **Upper price band

Strong financials: The company has strong business fundamentals, which are

reflected in its financials. It has exhibited a strong 20.7% CAGR on the sales front

Book Building

over FY2013-15, predominately led by volumes and partially on the back of

QIBs

50%

pricing power. On the profitability front, the company has maintained healthy and

Non-Institutional

15%

steady margins in the range of

22-25%. The same has been driven by

improvement in operating efficiency, including prudent management of costs and

Retail

35%

expenses and lower capital expenditure due to use of a “reagent rental” model.

Outlook and Valuation: The company is valued at a P/E multiple of 43.5x-44.3x

Post Issue Shareholding Pattern(%)

its FY2016E EPS at the lower and upper end of the price band respectively,

Promoters Group

58.7

assuming industry led growth. On P/BV basis, the company trades at 10.3x-10.5x

MF/Banks/Indian

FY2016E, which factors in a higher-than-industry growth and continuance of the

FIs/FIIs/Public & Others

41.3

current profitability of the business, which the company has been maintaining

over the past few years. However, though we believe that the company can

sustain the profitability trend and is fundamentally strong, we believe that the

valuations demanded through the IPO factor in the company’s business

fundamentals as well as the scarcity premium with it being the only

listed company in the space. Hence, we recommend an “Avoid” on the issue.

Investors could consider waiting for a possible correction in the stock price post the

listing of the IPO.

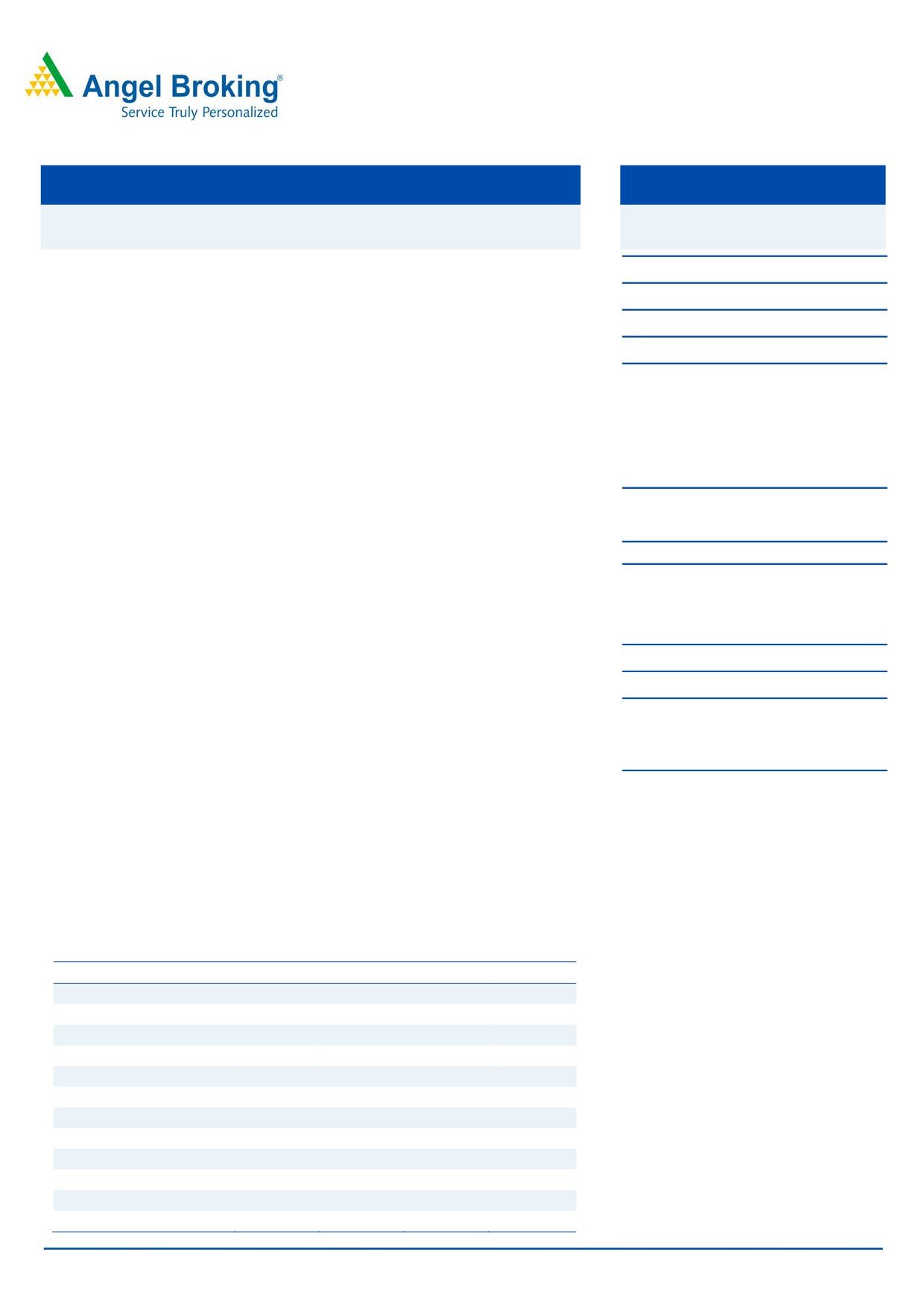

Key Financials

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

Net Sales

452

558

660

792

% chg

32.0

23.5

18.2

20.0

Net Profit

55

80

94

103

% chg

23.5

45.3

17.4

8.9

EPS (`)

6.7

9.7

11.4

12.4

EBITDA Margin (%)

21.6

24.8

23.6

21.7

P/E (x)

82.3

56.6

48.2

44.3

RoE (%)

39.9

40.8

32.9

26.5

RoCE (%)

51.2

52.1

40.2

34.9

P/BV (x)

27.6

19.3

13.1

10.5

Sarabjit Kour Nangra

EV/Sales (x)

9.9

7.9

6.5

5.4

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

45.9

31.7

27.4

24.7

Source: Company, Angel Research; Note :Valuations at upper price band and Equity post IPO

Please refer to important disclosures at the end of this report

1

Dr Lal Pathlab | IPO Note

Company background

Dr Lal PathLabs is a provider of diagnostic and related healthcare tests and

services, primarily in India. It includes (a) routine clinical laboratory tests, (b)

specialized tests, and (c) preventive tests. The business is based on the ‘Hub and

Spoke’ model, whereby, specimens are collected across multiple locations within

regions for delivery to predesignated clinical labs. The company has one national

reference laboratory in New Delhi, 172 other clinical laboratories, 1,554 patient

service centers and 7,000 pick-up points. Out of 172 clinical laboratories, 166 are

owned and 6 are not owned, but operated under the brand of Dr Lal Path. Dr Lal

PathLabs’ 1,475 patient service centers are under the franchise model.

Zone-wise, about 73-74% of sales are from North India and 12.6% are from East

India. West India and South India contribute lower proportions of ~8.5% and 5.6%

of total sales, respectively.

Issue details

Through the IPO, Dr Lal PathLabs proposes to offer 1.16cr equity shares for sale

by Promoter and Investors. The Promoter is offering upto 0.41cr shares and

Investors are offering upto 0.75cr shares through an offer for sale. Since it is an

offer for sale, the company will not receive any proceeds from sale of shares.

Exhibit 1: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

52,616,200

63.7

48,486,200

58.7

Others

29,983,800

36.3

34,113,800

41.3

Total

82,600,000

100.0

82,600,000

100.0

Source: Company, Angel Research

Industry

The domestic diagnostic market is highly fragmented and has a current size of US$

~US$5.7bn. The industry is expected to grow at a CAGR of

16-17% to

~US$9.2bn by FY2018 as per CRISIL estimates.

Diagnostic centres in India can be classified as hospital-based, diagnostic chains,

and standalone centres. Standalone centres form a majority share of

48%,

followed by hospital based at 37%. Thus, diagnostic chains control ~15% of the

market. The absence of stringent regulations and low entry barriers has led to

evolution of standalone centres, while hospitals tend to have their own pathology

labs. Within diagnostic chains, large pan-India chains form 35-40% and regional

chains forms 60-65%.

Specialized tests require expensive infrastructure and economy of scale and this

has led to formation of diagnostic chains in India through the “Hub and Spoke”

model. The fragmented nature of industry indicates low pricing power of service

providers in the near term.

December 7, 2015

2

Dr Lal Pathlab | IPO Note

The key drivers for the industry are - increase in evidence-based treatments, huge

demand-supply gap, increase in health insurance coverage, need for greater

health coverage as population and life expectancy increase, rising income levels

making quality healthcare services more affordable, and growing demand for

lifestyle diseases-related healthcare services.

Key investment rational

Dominant player in the industry

The company has built a national network comprising a national reference

laboratory in New Delhi, 172 clinical laboratories, 1,554 patient service centres

and over 7,059 pick-up points (data as of 1HFY2016-end). The company’s

network has wide coverage across India, including in metropolitan areas of New

Delhi, Mumbai, Bengaluru, Chennai, Hyderabad, and Kolkata.

The company, according to our estimates, is the second largest player with an

estimated ~12% market share in the organised diagnostic centres space. It has

grown at a CAGR of 20.7% over FY2013-15, primarily driven by volumes which

grew 16.7% during the period, while the rest was on back of pricing power. Thus,

given the company’s dominance in its industry and its cash flows (~`148cr cash

on the books of the company as of FY2015), we believe that the company can

easily leverage growth in the diagnostic healthcare services industry in India.

Currently, the company has presence in North India (which accounts for 72% of

revenue) and intends to grow through enhancing presence in Eastern and Central

India by setting up another reference laboratory and opening additional clinical

laboratories associated with the reference laboratory. The company also plans to

grow inorganically through acquisitions and strategic partnerships with key

franchises and hospitals.

Strong financials

The company has strong business fundamentals, which are reflected in the

financials of the company. It has exhibited a strong 20.7% CAGR on the sales

front, predominately led by volumes and with some pricing power. On the

profitability front, the company has maintained healthy and steady margins in the

range of 22-25%. This has been driven by improvements in operating efficiency,

including prudent management of costs and expenses and lower capital

expenditure due to use of the “reagent rental” model. Thus, healthy operating

margins along with high asset turnover has led the company to post significantly

higher ROIC (in the range of 45-63%) in the past, leading to high operating ROE

of 47-63%. Given the opportunity and low capital intensive nature of the business

(through the franchise model), the company is a good free cash flow generating

one in the healthcare space.

Valuation

The company is valued at a P/E multiple of 43.5x-44.3x its FY2016E EPS at the

lower and upper end of the price band respectively, assuming industry led growth.

On P/BV basis, the company trades at 10.3x-10.5x FY2016E, which factors in a

December 7, 2015

3

Dr Lal Pathlab | IPO Note

higher-than-industry growth and continuance of the current profitability of the

business, which the company has been maintaining over the past few years.

However, though we believe that the company can sustain the profitability trend

and is fundamentally strong, we believe that the valuations demanded through the

IPO factor in the company’s business fundamentals as well as the scarcity premium

with it being the only listed company in the space. Hence, we recommend an

“Avoid” on the issue. Investors could consider waiting for a possible correction in the

stock price post the listing of the IPO.

Risks for the company

Highly fragmented market with intense local competition (standalone centers

make for 48% of the industry).

Training and retention of critical staff such as lab technicians, who are

employed at labs and collections centres.

December 7, 2015

4

Dr Lal Pathlab | IPO Note

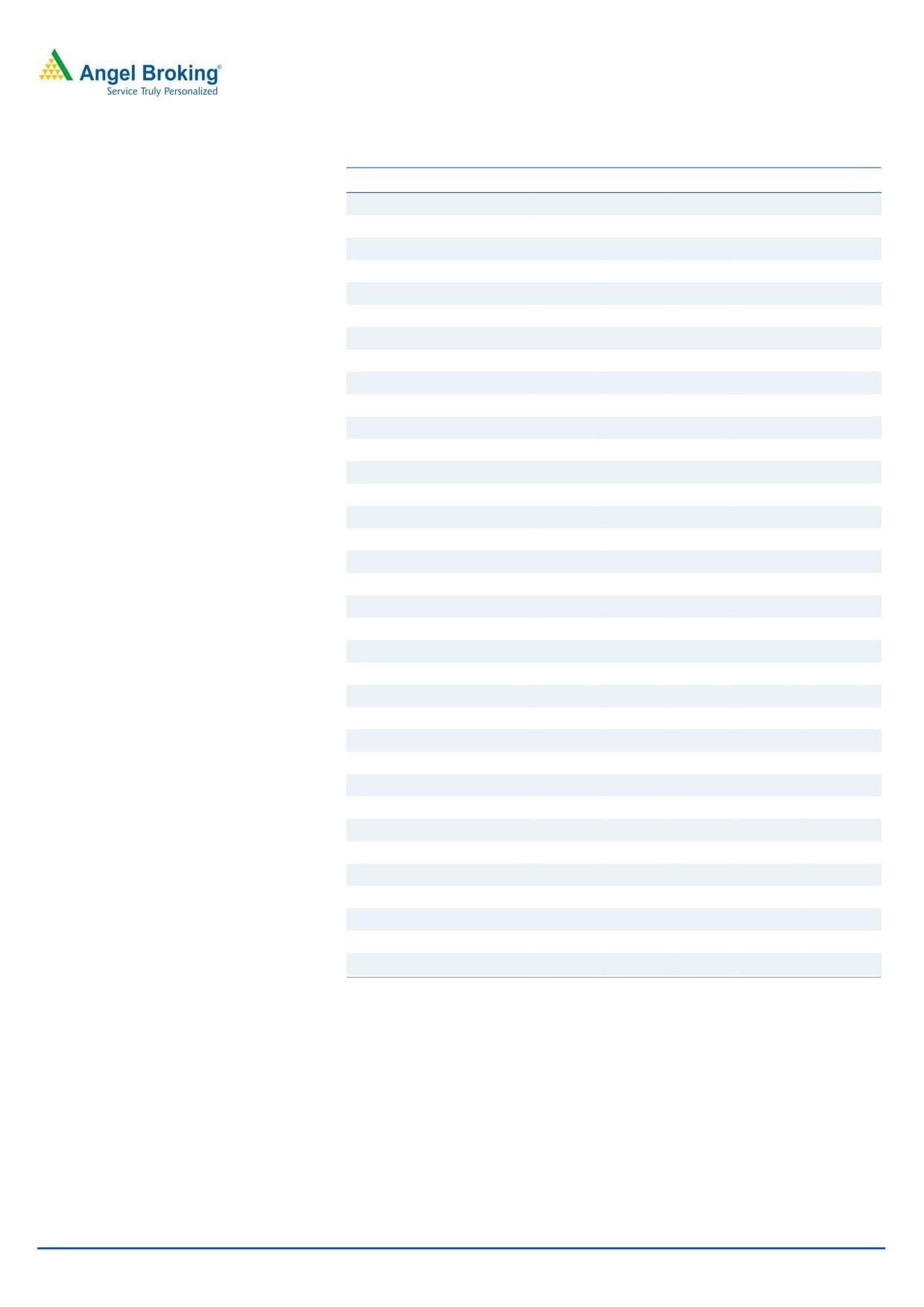

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

Gross sales

342

452

558

660

792

Less: Excise duty

-

-

-

-

-

Net sales

342

452

558

660

792

Other operating income

0.8

2.8

2.2

2.9

2.0

Total operating income

343

455

560

663

794

% chg

44.2

32.5

23.3

18.3

19.8

Total expenditure

256

354

419

504

620

Net raw materials

76

97

118

139

167

Personnel

54

94

102

134

161

Other

126

163

200

230

292

EBITDA

87

98

139

156

172

% chg

12.9

41.9

12.5

10.2

(% of Net Sales)

25.3

21.6

24.8

23.6

21.7

Depreciation& amortisation

20

20

27

28

28

Interest & other charges

3

0

0

0

0

Other income

1

1

6

9

9

(% of PBT)

2

1

5

7

6

Share in profit of Associates

-

-

-

-

-

Recurring PBT

66

80

117

140

152

% chg

Extraordinary expense/(Inc.)

-

-

-

-

-

PBT (reported)

66

80

117

140

152

Tax

21

25

38

45

49

(% of PBT)

32.0

30.6

32.7

32.0

32.0

PAT (reported)

45

56

81

95

104

Add: Share of earnings of asso.

-

-

-

-

-

Less: Minority interest (MI)

1

1

1

1

1

Prior period items

-

-

-

-

-

PAT after MI (reported)

45

55

80

94

103

ADJ. PAT

45

55

80

94

103

% chg

53.5

23.5

45.3

17.4

8.9

(% of Net Sales)

13.1

12.2

14.4

14.3

13.0

Basic EPS (`)

5.4

6.7

9.7

11.4

12.4

Fully Diluted EPS (`)

5.4

6.7

9.7

11.4

12.4

% chg

53.5

23.5

45.3

17.4

8.9

Note: *EPS calculation is based on Post IPO outstanding shares

December 7, 2015

5

Dr Lal Pathlab | IPO Note

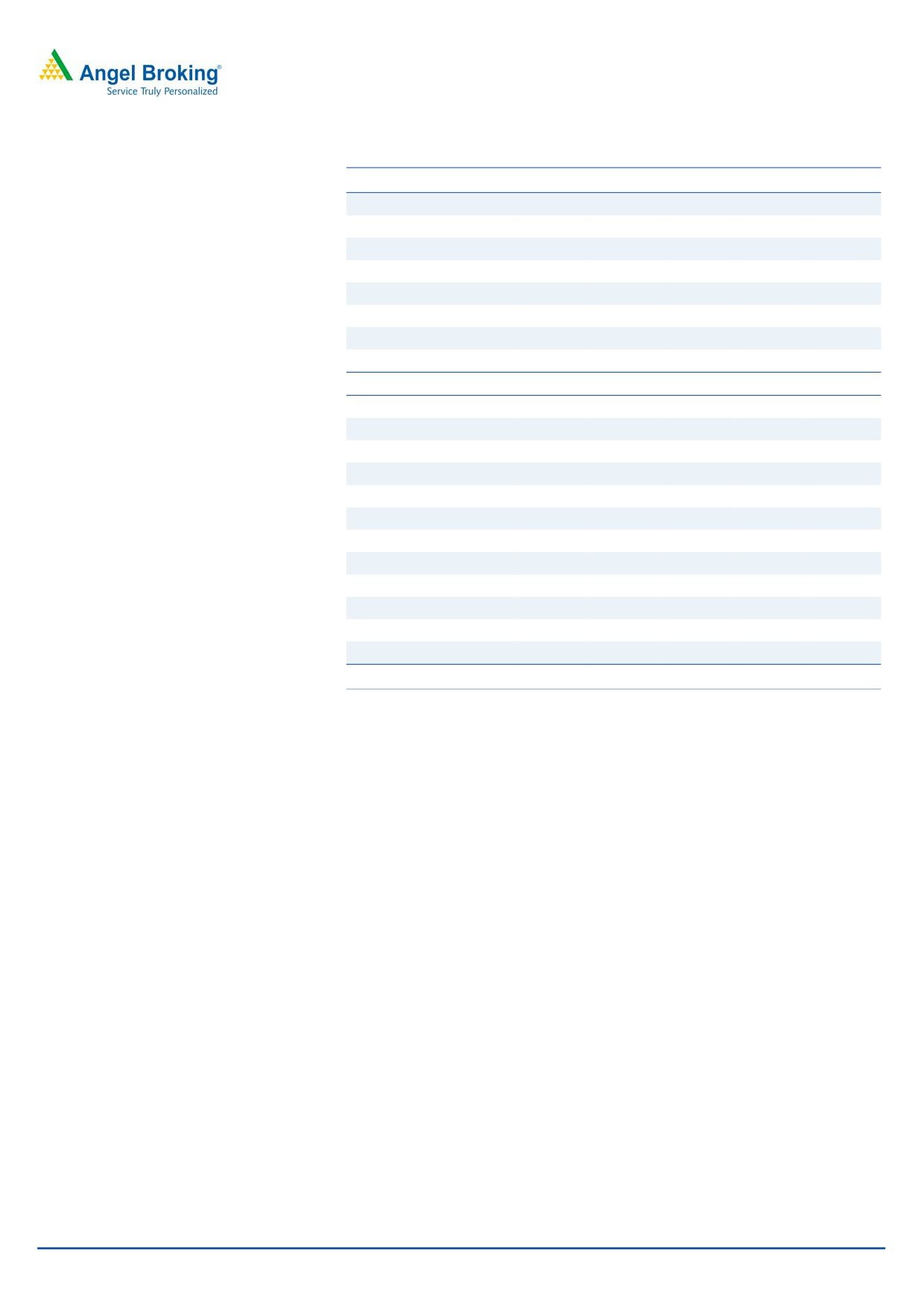

Consolidated Balance Sheet

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

SOURCES OF FUNDS

Equity share capital

5.1

5.0

80.3

81.3

82.6

Preference Capital

-

-

-

-

-

Reserves & surplus

110

157

151

260

352

Shareholders funds

115

162

231

341

435

Minority Interest

1.1

1.6

1.8

2.3

2.3

Total loans

-

0

1

-

-

Deferred tax liability

(3)

(13)

(20)

(25)

(25)

Total liabilities

114

151

214

318

411

APPLICATION OF FUNDS

Net block

86

94

98

109

119

Capital work-in-progress

23

33

42

42

42

Goodwill

6

1

0

1

1

Investments

4.8

54.8

8.6

37.9

37.9

Current assets

55

74

183

261

371

Cash

13

22

106

148

182

Loans & advances

16

21

24

41

103

Other

25

32

53

72

86

Current liabilities

60

105

117

132

158

Net current assets

(5)

(31)

66

129

213

Mis. Exp. not written off

(1.0)

(0.5)

(1.0)

-

-

Total assets

114

151

214

318

411

December 7, 2015

6

Dr Lal Pathlab | IPO Note

Consolidated Cash Flow Statement

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

Profit before tax

66

80

117

140

152

Depreciation

20

20

27

28

28

(Inc)/Dec in Working Capital

(0)

(36)

77

104

7

Less: Other income

-

-

-

-

-

Direct taxes paid

21

25

38

45

49

Cash Flow from Operations

65

40

183

228

139

(Inc.)/Dec.in Fixed Assets

(24)

(21)

(20)

(32)

(32)

(Inc.)/Dec. in Investments

-

-

-

-

-

Other income

-

-

-

-

-

Cash Flow from Investing

(24)

(21)

(20)

(32)

(32)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(18)

0

1

(1)

-

Dividend Paid (Incl. Tax)

(3)

(15)

(10)

(10)

(10)

Others

(30)

3

(71)

(141)

(63)

Cash Flow from Financing

(50)

(12)

(80)

(152)

(73)

Inc./(Dec.) in Cash

(9)

8

84

43

34

Opening Cash balances

23

13

22

106

148

Closing Cash balances

13

22

106

148

182

December 7, 2015

7

Dr Lal Pathlab | IPO Note

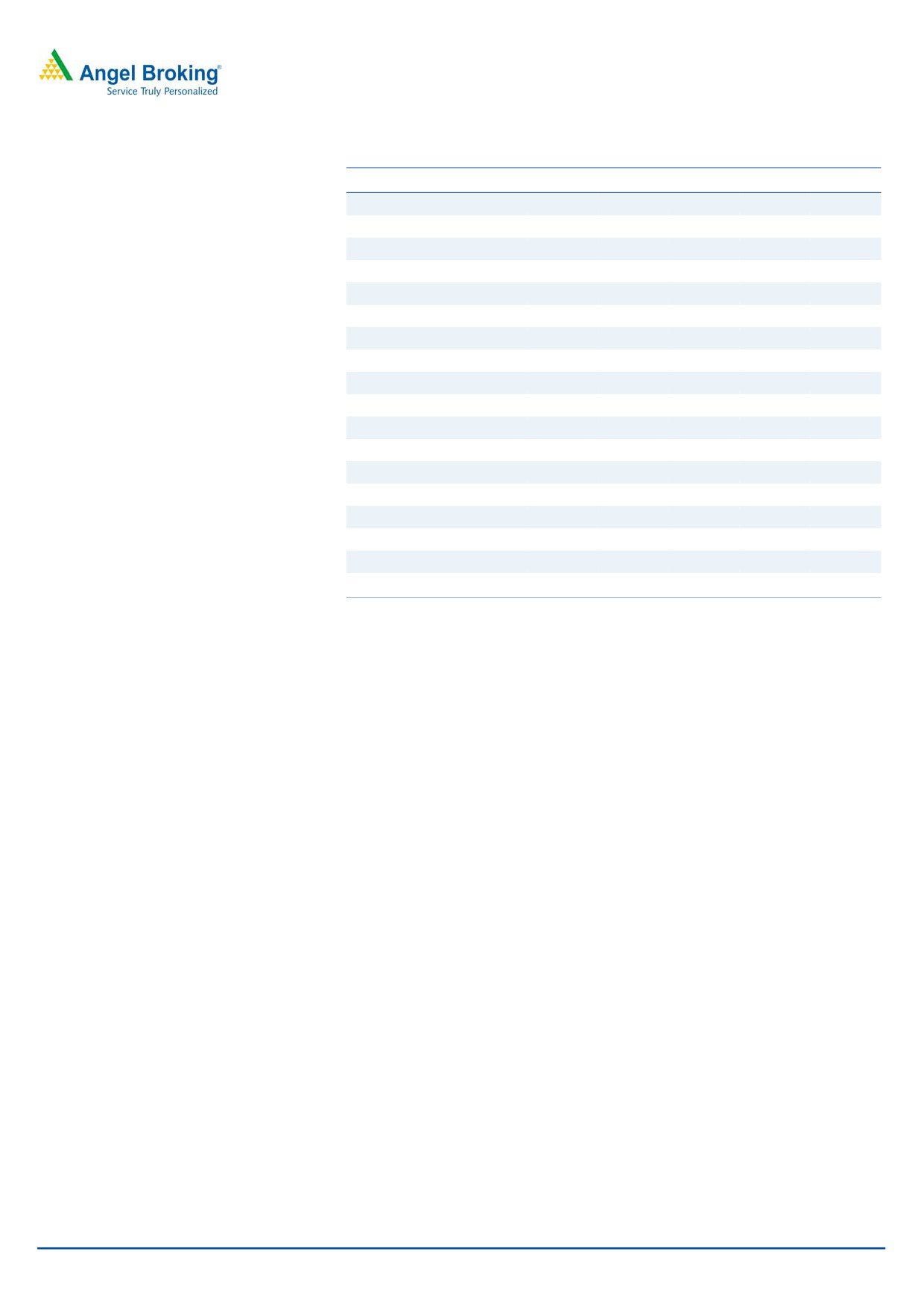

Key Ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

Valuation Ratio (x)

P/E (on FDEPS)

101.6

82.3

56.6

48.2

44.3

P/CEPS

70.4

60.1

42.2

37.1

34.7

P/BV

38.8

27.6

19.3

13.1

10.5

Dividend yield (%)

0.2

0.1

0.1

0.3

0.3

EV/Sales

13.1

9.9

7.9

6.5

5.4

EV/EBITDA

52.0

45.9

31.7

27.4

24.7

EV / Total Assets

39.6

29.7

20.6

13.4

10.3

Per Share Data (`)

EPS (Basic)

5.4

6.7

9.7

11.4

12.4

EPS (fully diluted)

5.4

6.7

9.7

11.4

12.4

Cash EPS

7.8

9.2

13.0

14.8

15.8

DPS

1.1

0.6

0.7

1.5

1.5

Book Value

14.2

19.9

28.5

42.0

52.6

Dupont Analysis

EBIT margin

19.5

17.1

19.9

19.4

18.2

Tax retention ratio

68.0

69.4

67.3

68.0

68.0

Asset turnover (x)

3.4

4.0

4.7

4.8

4.0

ROIC (Post-tax)

45.4

47.1

63.4

62.9

49.0

Cost of Debt (Post Tax)

0.0

138.8

20.7

60.4

54.4

Leverage (x)

0.5

0.0

0.0

0.0

0.0

Operating ROE

67.4

47.1

63.4

62.9

49.0

Returns (%)

ROCE (Pre-tax)

58.7

51.2

52.1

40.2

34.9

Angel ROIC (Pre-tax)

93.9

92.3

137.0

132.2

91.4

ROE

38.8

39.9

40.8

32.9

26.5

Turnover ratios (x)

Asset Turnover (Net Block)

4.0

5.1

5.8

6.4

7.0

Inventory / Sales (days)

6.0

5.4

6.2

6.8

6.9

Receivables (days)

14.9

13.4

14.1

14.7

13.5

Payables (days)

30.9

25.6

26.1

23.4

10.6

WCcycle (ex-cash) (days)

(19.5)

(28.2)

(29.9)

(16.2)

2.7

Solvency ratios (x)

Net debt to equity

(0.1)

(0.1)

(0.5)

(0.4)

(0.4)

Net debt to EBITDA

(0.2)

(0.2)

(0.8)

(1.0)

(1.1)

Interest Coverage (EBIT / Interest)

26.7

193.2

556.6

319.4

359.4

Note:*EPS and other valuation parameters is based on post IPO outstanding shares at upper price

band

December 7, 2015

8

Dr Lal Pathlab | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

December 7, 2015

9