IPO Note | Consumer Durable

Sep 5, 2017

Dixon Technologies Ltd

SUBSCRIBE

sue Open: Sep 6, 2017

Is

The trajectory of strong client base continues

Issue Close: Sep 8, 2017

Dixon Technologies (India) Ltd (DTIL) is the largest home grown design-focused

and solutions company engaged in manufacturing products in the consumer

Issue Details

durables, lighting and mobile phone segments in India. The company

manufactures electronics products for Panasonic, Philips Lighting India, Haier

Face Value: `10

Appliances, Gionee, Surya Roshni, Reliance Retail, Intex Technologies, Mitashi.

Present Eq. Paid up Capital: `11cr

Leading market position, strong customer relations to propel growth: DTIL is

Offer for Sale: **0.30cr Shares

the leading player in most of the verticals in which it operates and it enjoys

market leadership in manufacturing in India. DTIL is focused on expanding its

Fresh issue: `60cr

product basket, strengthening existing customer relationships and increasing

customer base. Strong relationship would help the company to expand

Post Eq. Paid up Capital: `11.3cr

market share, develop new products and enter newer market.

Original Design Manufacturer (ODM) & Reverse Logistics (RL) segments to

Issue size (amount): *`597cr -**600 cr

improve blended margin: EBITDA margin of DTIL has improved by 130bps

over the last 4 years, primarily due to the growing contribution from ODM

business (improved by 800bps), which has better margins than original

Price Band: `1760-1766

equipment manufacturing(OEM). Considering the management’s ability and

Lot Size: 8 shares and in multiple

execution skills, we believe that margin improvement would continue further.

thereafter

Moreover, many bigger brands in home appliance segment are expected to

Post-issue implied mkt. cap: *`1993cr -

collaborate with DTIL. Further, the company is also focusing on RL, which has

**`2000cr

higher margin and is growing fast over last 3 years.

Sufficient capacity and expansion into CCTV & DVR: DTIL manufactures and

Promoters holding Pre-Issue: 46%

assembles high growth products and has enough operating leverage, as its

Promoters holding Post-Issue: 35%

utilization levels remain comfortable (40-60%). This, we believe, is a near

term lever to improve the operating margins. Dixon is also setting up a new

*Calculated on lower price band

capacity of CCD televisions, which will commission in September 2017 and

** Calculated on upper price band

will add a new revenue stream in its business.

Healthy financials and return ratio: DTIL has reported healthy top-line of

Book Building

33.8% CAGR and bottom-line of 78.3% CAGR over FY2013-17. Further, the

QIBs

50% of issue

company had negligible debt (D/E-0.22), low working capital requirement

and reported ROE and ROCE of 25.5% and 33.3% for FY17.

Non-Institutional

15% of issue

Outlook & Valuation: DTIL would continue to report higher revenue and

improvement in margins owing to its presence in high growth segments,

Retail

35% of issue

experienced management and growing share of ODM segment. Despite the

company operating on thin margins, it has registered return on capital of a

whopping 33.3% in FY2017. Further, it has been generating positive cash

Post Issue Shareholding Patter

flow from operations over the last 5 years and negligible debt post IPO. At the

Promoters

35%

upper end of the price band, the pre issue P/E multiples works out be 38.5x

of FY2017 EPS, on P/B, it is valued at 9.8x of FY2017 book value. We

Others

65%

recommend ‘SUBSCRIBE’ on the issue for a mid-to-long term period.

Key Financial

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

Net Sales

1,094

1,201

1,389

2,457

% chg

43

10

16

77

Net Profit

14

12

43

50

% chg

171

(12)

259

18

EBITDA (%)

2

3

4

4

EPS (Rs)

12

11

39

46

P/E (x)

144

164

46

39

P/BV (x)

26

23

16

10

Jaikishan J Parmar

RoE (%)

18

14

35

25

RoCE (%)

13

15

25

33

+022 39357600, Extn: 6810

EV/EBITDA

80

64

35

22

Source: RHP, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Please refer to important disclosures at the end of this report

1

Dixon Technologies Limited | IPO Note

Company background

Dixon Technologies (India) Limited (DTIL) was incorporated as ‘Weston Utilities

Limited’ at Alwar, Rajasthan on January 15, 1993 under the Companies Act, 1956

as a public limited company. The company was converted to a public limited

company pursuant to a resolution of the shareholders on April 18, 2017 and a

fresh certificate was issued by the RoC on May 2, 2017 in the name of “Dixon

Technologies (India) Limited”.

In 1993, they commenced manufacturing of consumer electronics such as color

televisions and in 2007, manufacturing of LCD TVs and subsequently progressed

into manufacturing of LED TVs in 2010. They entered the lighting products

segment in 2008 with the manufacturing of CFL products and gradually increased

their product portfolio to LED products in

2016. In

2010, DTIL started

manufacturing semi-automatic washing machines. They also started providing

reverse logistics services in 2008. The most recent segment that DTIL has entered

into is the manufacturing of mobile phones through a JV. They have continuously

diversified their product portfolio to keep pace with changing consumer trends and

development in technology.

In 2008, IBEF I and IBEF, whose investments are advised and managed by MOPE

Investment Advisors Pvt Ltd., subsidiary of Motilal Oswal Financial Services Ltd,

invested in the company. IBEF I and IBEF currently hold 13.16% and 10.52% of the

pre-Offer Equity Share capital of the company respectively.

Exhibit 1: Long term business relationship with customers

% of total FY17 revenue

Duration of relationship

Top five customers

Products purchased

attributable to such

with the Company, not

customer (%)

less than

Consumer Electronics

22.4

Panasonic India

Home Appliances

1.6

4 years

Reverse Logistics

0.01

Mobile Phones

14.4

Philips lighting

Lighting

20.2

8 years

Gionee

Mobile Phones

16.6

1 Year

Intex Technologies

Consumer Electronics/Home Appliances/Reverse Logistics

4.4

2 Years

Reliance Retail Ltd

Consumer Electronics/Reverse Logistics

3.3

1 Year

Source: RHP, Angel Research

Sep 5, 2017

2

Dixon Technologies Limited | IPO Note

Issue Details

This IPO is a mix of OFS and issue of fresh shares. Issue would constitute fresh

issue worth of `60cr and OFS worth of `539cr. OFS largely would offer exit to IBEF

I and IBEF, whose investments are advised and managed by MOPE Investment

Advisors Pvt Ltd., subsidiary of Motilal Oswal Financial Services Ltd, invested in the

company. IBEF I and IBEF currently hold 13.16% and 10.52% of the pre-Offer

Equity Share capital of the company respectively.

Exhibit 2: Pre and Post-IPO shareholding pattern

No of shares (Pre-issue)

% No of shares (Post-issue)

%

Promoter

50,75,040

46%

39,62,879

35%

Public

5910278

54%

73,62,190

65%

1,09,85,318 100%

1,13,25,069

100%

Source: RHP, Angel Research; Note: Calculated on upper price band

Objects of the offer

Repayment/pre-payment, in full or in part, of certain borrowings availed by

the company (`22cr)

Setting up a unit for manufacturing of LED TVs at the Tirupati Facility (`7.6cr)

Finance the enhancement of backward integration capabilities in the lighting

products vertical at the Dehradun I Facility (`8.9cr)

Up gradation of the information technology infrastructure of the company

(`10.6cr)

General Corporate purpose

Key Management Personnel

Sunil Vachani is the Executive Chairman of the company. He is also the Promoter

of the company and has been associated with it since inception. He has over two

decades of experience in the EMS industry. He has been awarded as “Man of

Electronics” by CEAMA in 2015. He also acts as Vice President for Consumer

Electronics and Appliances Manufacturer Association.

Atul B. Lall is the Managing Director of the company. He has been associated with

the company since inception. He is responsible for the company’s overall business

operations. He has more than 25 years of experience in the EMS industry.

Ramesh Chandra Chopra is a Non-Executive Independent Director of the

company. He superannuated as Scientist 'G’-Group Coordinator from the

Department of Information Technology (presently known at MeitY) and has over 32

years of experience in the electronics industry.

Sep 5, 2017

3

Dixon Technologies Limited | IPO Note

Investment Rationale

Leading market position, strong customer relations to propel growth

DTIL is the leading player in most of the verticals in which it operates and it enjoys

market leadership in manufacturing in India. DTIL is focused on expanding its

product basket, strengthening existing customer relationships and increasing

customer base. Strong relationship would help the company to expand market

share, develop new products and enter newer market.

Exhibit 3: Time-line of product evolution

1994

Color TV

2007

LCD TV

2008

CFL Lighting, Reverse Logistics

2010

LED TV, Washing Machine

2016

Mobile Phones

2017

CCTV, Digital Video Recorder

Source: RHP, Angel Research

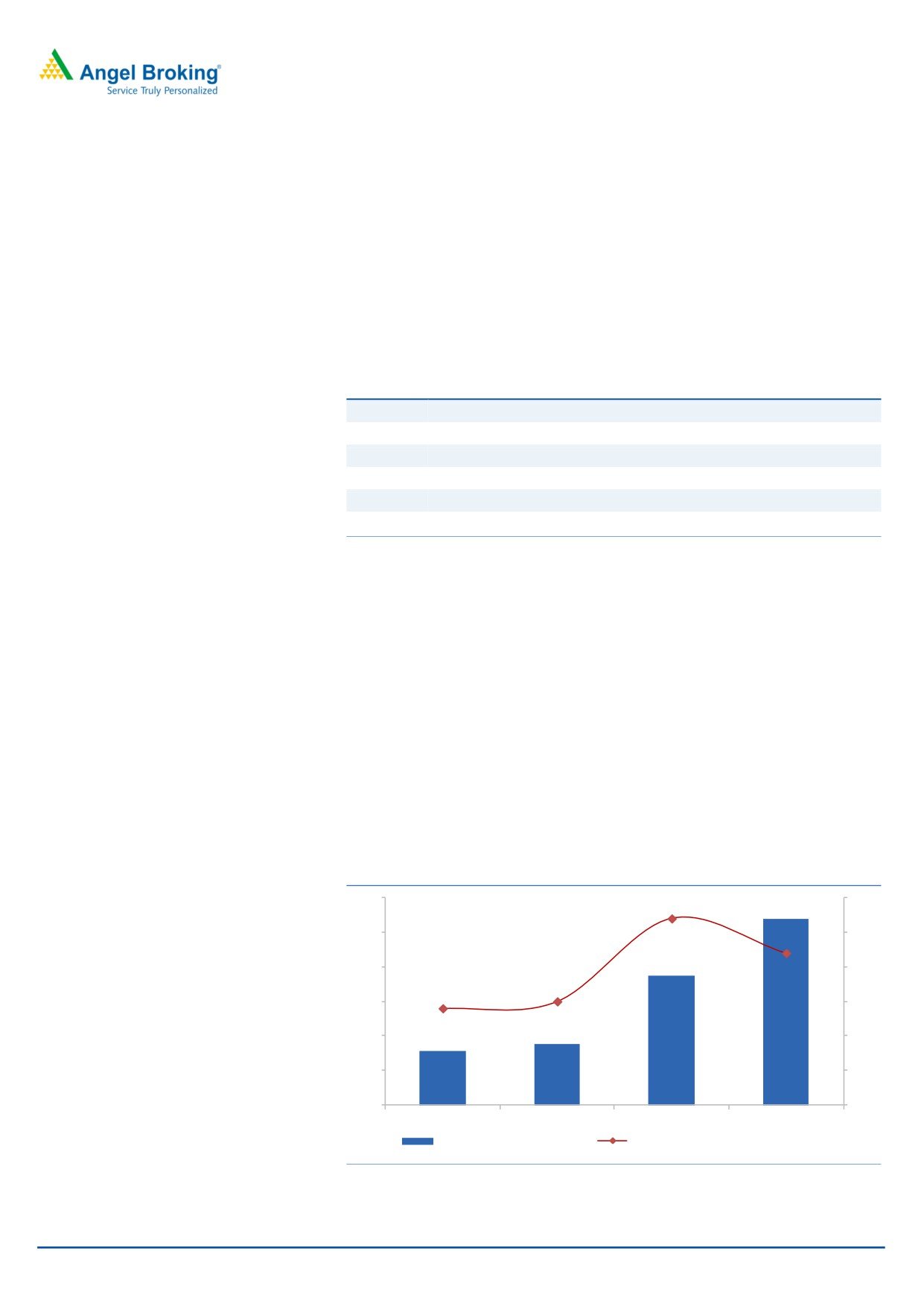

Original Design Manufacturer (ODM) & Reverse Logistics (RL) segments to improve

blended margin

EBITDA margin of DTIL has improved by 130bps over the last 4 years, primarily

due to the growing contribution from ODM business (improved by 800bps), which

has better margins than original equipment manufacturing(OEM). Considering the

management’s ability and execution skills, we believe that margin improvement

would continue further. Moreover, many bigger brands in home appliance

segment are expected to collaborate with DTIL. Further, the company is also

focusing on RL, which has higher margin and is growing fast over last 3 years.

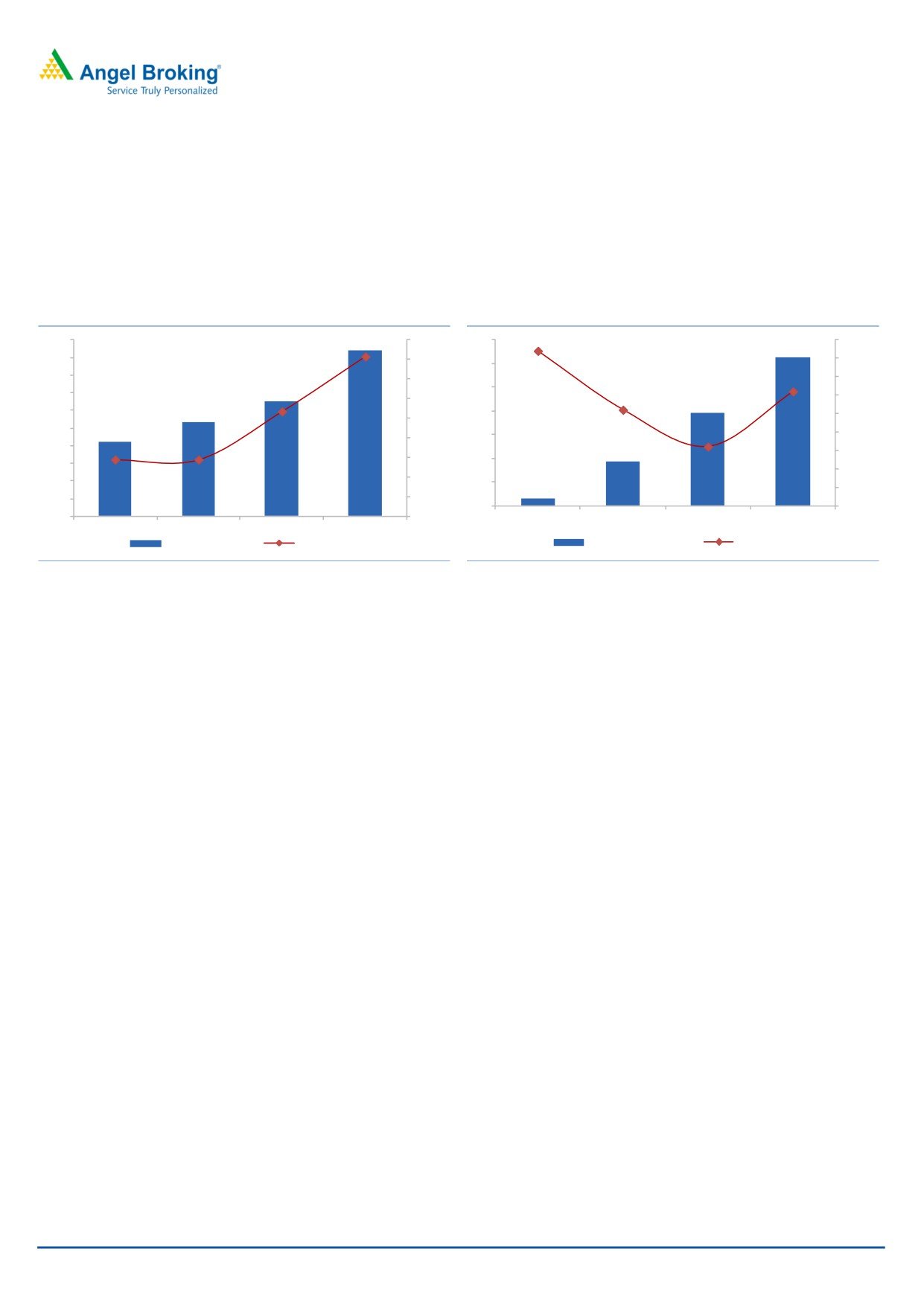

Exhibit 4: Increasing ODM share in overall business

600

27%

30%

500

22%

25%

400

20%

15%

14%

300

15%

200

10%

100

5%

155.8

176.8

373.4

537.4

0

0%

FY14

FY15

FY16

FY17

ODM Revenue (` in cr)

ODM conribution as % of revenue

Source: RHP, Company, Angel Research

Sep 5, 2017

4

Dixon Technologies Limited | IPO Note

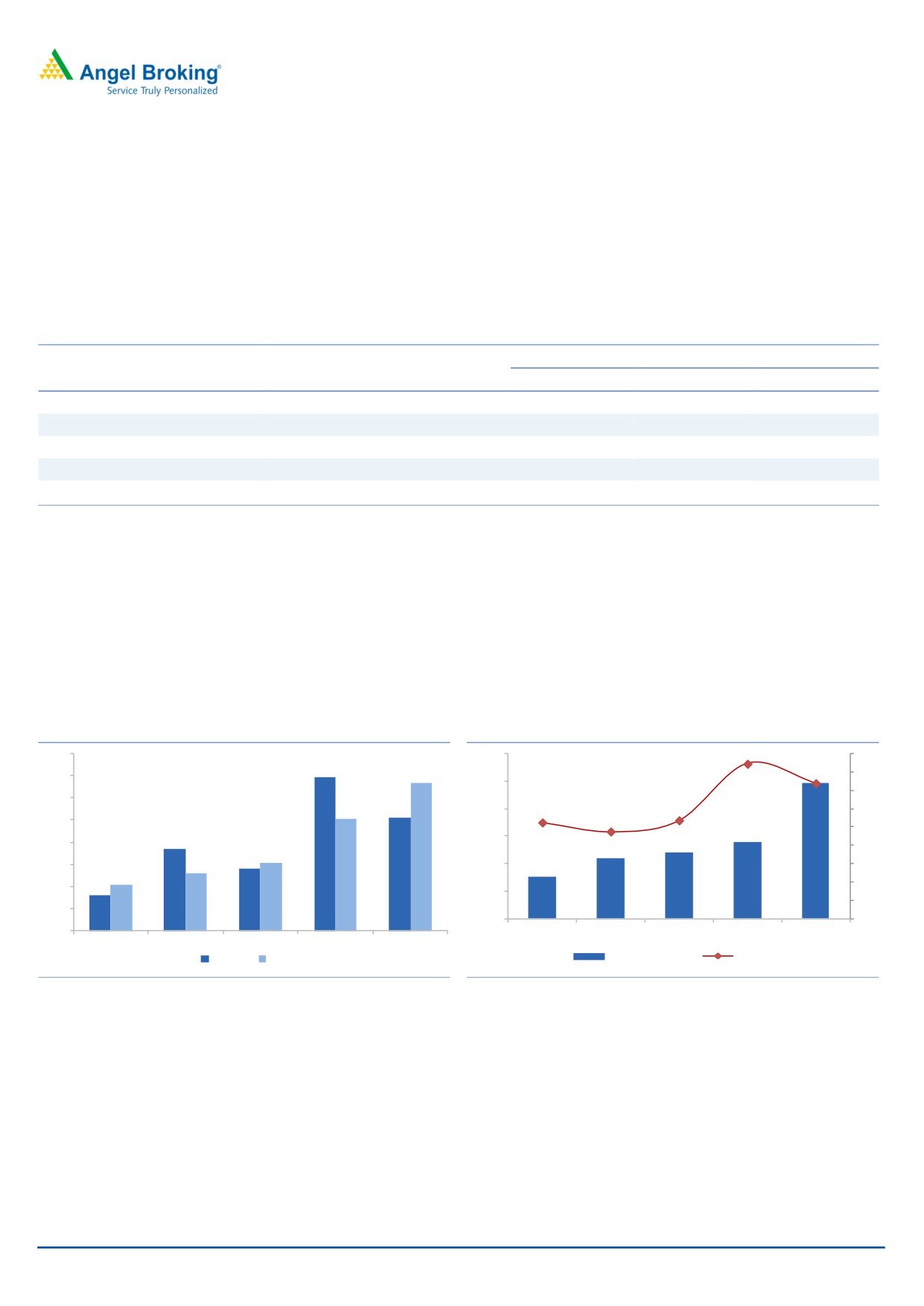

Over the last 4 years, the revenue trend of home appliance ODM business has

witnessed a surge and the EBITDA margin has improved by improved 1100bps

(Exhibit 5). In Home appliance, Dixon manufactures semi washing machine for

Panasonic, Haier and Intex. Considering the management’s experience and ability

to develop new products, we believe that bigger brands would also collaborate

with Dixon.

Exhibit 5: Home Appliance revenue & EBITDA trend

Exhibit 6: Reverse Logistic revenue & EBITDA trend

200

16.3%

18.0%

70

21.0%

180

16.0%

20.5%

60

20.7%

160

19.6%

14.0%

20.0%

50

140

10.7%

19.1%

19.5%

12.0%

120

40

19.0%

10.0%

100

18.1%

18.5%

8.0%

30

80

5.8%

5.8%

18.0%

6.0%

20

60

17.5%

40

4.0%

10

17.0%

2.8

18.4

39.1

62.7

20

85

2.0%

107

131

188

0

16.5%

0

0.0%

FY14

FY15

FY16

FY17

FY14

FY15

FY16

FY17

Revenure (` cr)

EBITDA

Revenure (` cr)

EBITDA

Source: Company, Angel Research

Source: Company, Angel Research

DTIL commenced the reverse logistics vertical in the year 2008 with a view to

complement their portfolio offerings and provide end-to-end solutions in the

industry they operate. This is extension of their existing skill set of manufacturing

electronics, and DTIL has been able to acquire new customers in this vertical as

well as expand the scope of their offerings to the existing customers.

DTIL currently offers repair and refurbishment services for STBs and repair of

mobile phones, LCD and LED TVs, LED panels, home theatres, printers, etc. The

reverse logistics vertical provides high return on capital employed and has a higher

potential for growth. As per a Frost & Sullivan Report, average return rates in

reverse logistics of electronic items are - mobile phones (9%), set top box (16%),

FPD TV (8%), washing machines (8%), and computer peripherals (10%).

Currently DTIL focuses only on B2B reverse logistics and does not have consumer

facing service centers which is in-line with their strategy of building relationships

with brand owners and OEMs.

Sep 5, 2017

5

Dixon Technologies Limited | IPO Note

Sufficient capacity and expansion into CCTV & DVR: DTIL manufactures and

assembles high growth products and has enough operating leverage as its

utilization levels remain comfortable (40-60%). This, we believe is a near term

lever to improve the operating margins. Dixon is also setting up a new capacity of

CCD televisions, which will commission in September 2017 and will add a new

revenue stream in its business.

Exhibit 7: Capacity Utilisation rate

Capacity Utilized

Aggregate annual installed

Key Products / Vertical

capacity as on 31.12.2017

Fiscal 2017

Fiscal 2016

Fiscal 2015

LED TVs

12,00,000

62.60%

48.09%

51.76%

Lighting Products

26,04,00,000

53.48%

54.00%

59.28%

Washing Machines

5,50,000

68.12%

52.86%

45.33%

Mobile Phones

1,00,80,000

34.31%

7.32%

Reverse Logistics

36,60,000

37.49%

61.09%

52.17%

Source: Company, Angel Research

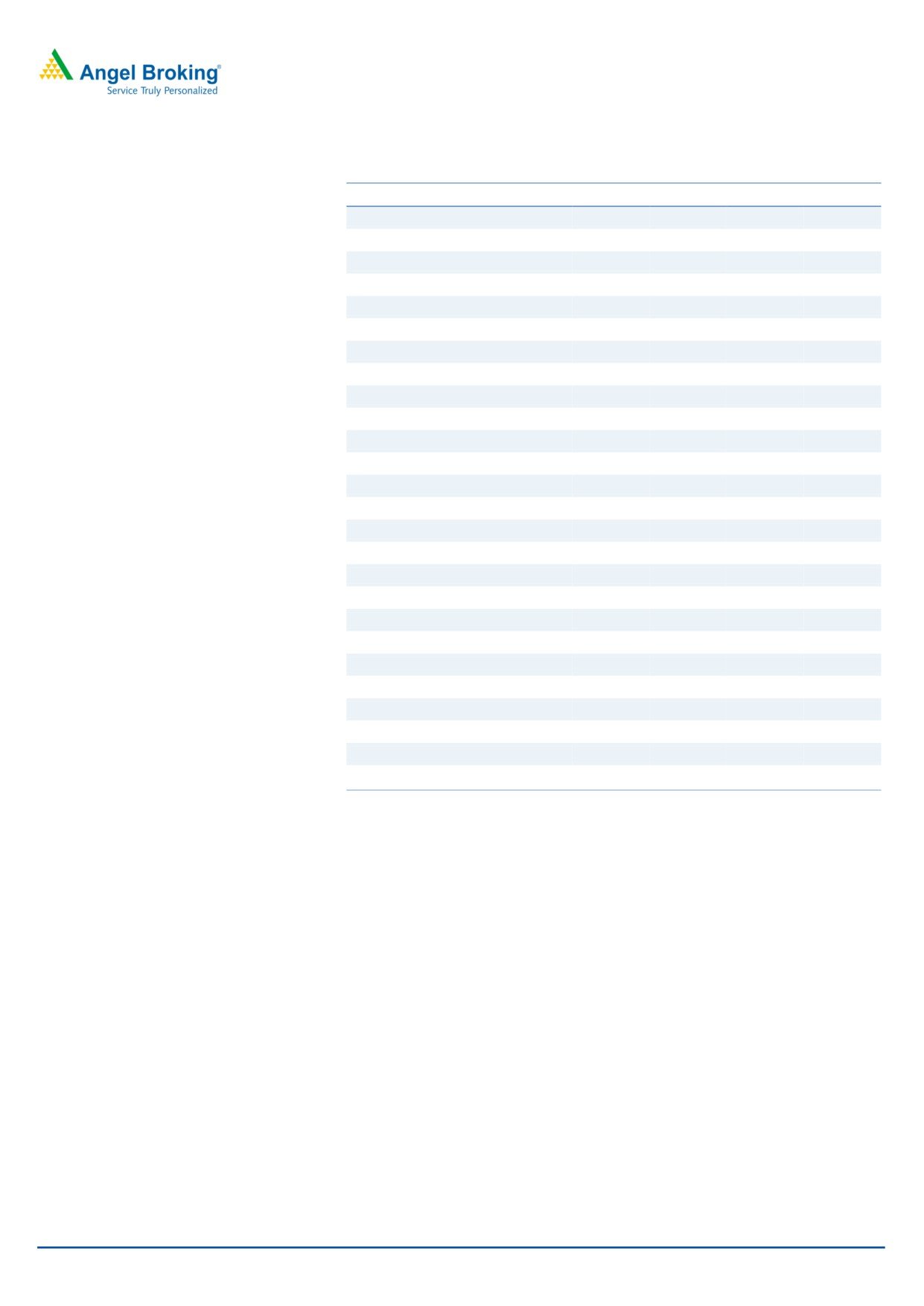

Healthy financials and return ratio: DTIL has reported healthy top-line of 33.8%

CAGR and bottom-line of 78.3% CAGR over FY2013-17. Further, the company

had negligible debt (D/E-0.22) in FY2017 and low requirement of working capital.

For FY2017 the company has reported ROE and ROCE of 25.5% and 33.3%

respectively.

Exhibit 8: Return ratios improving

Exhibit 9: Revenue and EBITDA margin trend

40

3000

4.5

3.7

4.0

35

2500

4.2

3.5

30

2.6

2.7

2000

3.0

2.4

25

2.5

1500

20

2.0

15

1000

1.5

1.0

10

500

0.5

5

767

1094

1201

1389

2457

8

10

18

13

14

15

35

25

25

33

0

0.0

-

FY13

FY14

FY15

FY16

FY17

FY13

FY14

FY15

FY16

FY17

ROE (%) ROCE (%)

Revenue (` cr)

EBITDA (%)

Source: Company, Angel Research

Source: Company, Angel Research

Sep 5, 2017

6

Dixon Technologies Limited | IPO Note

Outlook and Valuation

DTIL would continue to report higher revenue and improvement in margins owing

to its presence in high growth segments, experienced management and growing

share of ODM segment. Despite the company operating on thin margins, it has

registered return on capital of a whopping 33.3% in FY2017. Further, it has been

generating positive cash flow from operations over the last 5 years and negligible

debt post IPO. At the upper end of the price band, the pre issue P/E multiples

works out be 38.5x of FY2017 EPS, on P/B, it is valued at 9.8x of FY2017 book

value. We recommend ‘SUBSCRIBE’ on the issue for a mid-to-long term period.

Key risks

Client concentration

The company is dependent on certain customers who have contributed to a

substantial portion of its total revenues. In the aggregate, top five customers

accounted for 82.93%, 79.43%, 73.28%, 76.95% and 79.67% of revenue from

operations (net) for the years ending March 31, 2017, 2016, 2015, 2014 and

2013 respectively. Being dependent on specific clients holds a risk to revenue flow.

No clarity on renewal agreement with existing customers

The company enters into agreements with customers for specific products. The

agreement is generally valid for one to three years, and is renewed on a regular

basis if both the parties decide to do so. There is always an uncertainty regarding

the renewal of the agreement.

Changing preferences, advancement in technology

The markets in which company’s customers compete are characterized by

consumers and their rapidly changing preferences, advancement in technology

and other related factors including lower manufacturing costs. Hence, the

company may be affected by any disruptions in the industry.

Sep 5, 2017

7

Dixon Technologies Limited | IPO Note

Exhibit 10: Consolidated Income Statement

Y/E March (` cr)

FY14

FY15

FY16

FY17

Total operating income

1,094

1,201

1,389

2,457

% chg

43

10

16

77

Total Expenditure

1,068

1,169

1,331

2,366

Raw Material

996

1,084

1,212

2,180

Personnel

32

37

55

64

Others Expenses

39

48

63

122

EBITDA

26

32

59

91

% chg

29

24

82

55

(% of Net Sales)

2

3

4

4

Depreciation& Amortisation

5

7

8

11

EBIT

21

25

50

80

% chg

34

23

99

59

(% of Net Sales)

2

2

4

3

Interest & other Charges

11

10

13

13

Other Income

3

2

2

2

(% of Sales)

0

0

0

0

Extraordinary Items

-

-

-

-

Share in profit of Associates

-

-

-

-

Recurring PBT

13

17

39

69

% chg

153

35

125

77

Tax

4

4

8

18

PAT (reported)

14

12

43

50

% chg

171

(12)

259

18

(% of Net Sales)

1

1

3

2

Basic & Fully Diluted EPS (Rs)

12

11

39

46

% chg

171

(12)

259

18

Sep 5, 2017

8

Dixon Technologies Limited | IPO Note

Exhibit 11: Consolidated Balance Sheet

Y/E March (` cr)

FY14

FY15

FY16

FY17

SOURCES OF FUNDS

Equity Share Capital

3.1

3.1

3.1

11.0

Reserves& Surplus

70.5

81.7

119.7

186.7

Shareholders Funds

73.6

84.8

122.8

197.7

Minority Interest

2.1

3.0

-

-

Total Loans

86.9

79.9

77.1

42.9

Other Liab & Prov

7.4

7.9

9.6

14.2

Total Liabilities

169.9

175.6

209.4

254.8

APPLICATION OF FUNDS

Net Block

84.2

97.0

123.6

139.1

Capital Work-in-Progress

-

-

-

-

Investments

6.3

6.0

0.1

-

Current Assets

184.2

204.7

271.3

636.7

Inventories

93.3

113.0

136.3

282.2

Sundry Debtors

46.4

54.4

87.6

279.3

Cash

4.6

6.9

7.5

15.3

Loans & Advances

38.0

29.4

39.4

58.6

Other Assets

1.9

1.0

0.6

1.2

Current liabilities

121.3

148.8

207.8

544.3

Net Current Assets

62.9

55.9

63.5

92.4

Other Non Current Asset

16.5

16.6

22.2

23.2

Total Assets

169.9

175.6

209.4

254.8

Sep 5, 2017

9

Dixon Technologies Limited | IPO Note

Exhibit 12: Consolidated Cash Flow Statement

Y/E March (`cr)

FY14

FY15

FY16

FY17

Profit before tax

18.2

17.3

50.6

68.8

Depreciation

5.3

6.9

8.4

10.6

Change in Working Capital

(19.6)

14.5

(10.7)

(23.5)

Interest / Dividend (Net)

(0.8)

(0.9)

(0.9)

(1.2)

Direct taxes paid

2.5

(4.1)

(8.7)

(15.5)

Others

(4.8)

(10.8)

(3.5)

(15.3)

Cash Flow from Operations

10.4

44.5

42.3

54.6

(Inc.)/ Dec. in Fixed Assets

(8.5)

(22.1)

(27.0)

(39.1)

(Inc.)/ Dec. in Investments

-

0.5

17.6

0.1

Cash Flow from Investing

1.2

(22.3)

(21.6)

(43.1)

Issue of Equity

-

-

-

43.6

Inc./(Dec.) in loans

(0.8)

(11.3)

(2.7)

4.6

Others

12.0

11.0

17.4

58.6

Cash Flow from Financing

(12.8)

(22.3)

(20.1)

(10.4)

Inc./(Dec.) in Cash

(1.1)

(0.0)

0.6

1.0

Opening Cash balances

2.2

1.1

1.1

1.7

Closing Cash balances

1.1

1.1

1.7

2.7

Exhibit 13: Key Ratios

Y/E March

FY14

FY15

FY16

FY17

Valuation Ratio (x)

P/E (on FDEPS)

143.6

163.6

45.6

38.5

P/CEPS

130.7

148.9

41.5

35.1

P/BV

26.4

22.9

15.8

9.8

Dividend yield (%)

0.0

0.0

0.2

0.3

EV/Sales

1.9

1.7

1.5

0.8

EV/EBITDA

80.0

64.3

35.1

22.3

EV / Total Assets

12.2

11.8

9.8

8.0

Per Share Data (Rs)

EPS (Basic)

12.3

10.8

38.7

45.9

EPS (fully diluted)

12.3

10.8

38.7

45.9

Cash EPS

13.5

11.9

42.6

50.4

DPS

0.3

0.3

3.5

6.0

Book Value

67.0

77.2

111.8

180.0

Returns (%)

ROCE

12.9

15.4

25.1

33.3

Angel ROIC (Pre-tax)

13.0

15.6

26.3

33.7

ROE

18.4

14.0

34.7

25.5

Turnover ratios (x)

Asset Turnover (Gross Block)

9.3

9.0

8.9

13.0

Inventory / Sales (days)

31

34

36

42

Receivables (days)

15

17

23

41

Payables (days)

33

41

49

75

Working capital cycle (days)

14

10

10

8

Sep 5, 2017

10

Dixon Technologies Limited | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Sep 5, 2017

11