1QFY2017 Result Update | Pharmaceutical

August 17, 2016

Dishman Pharmaceuticals

SELL

CMP

`170

Performance Highlights

Target Price

`45

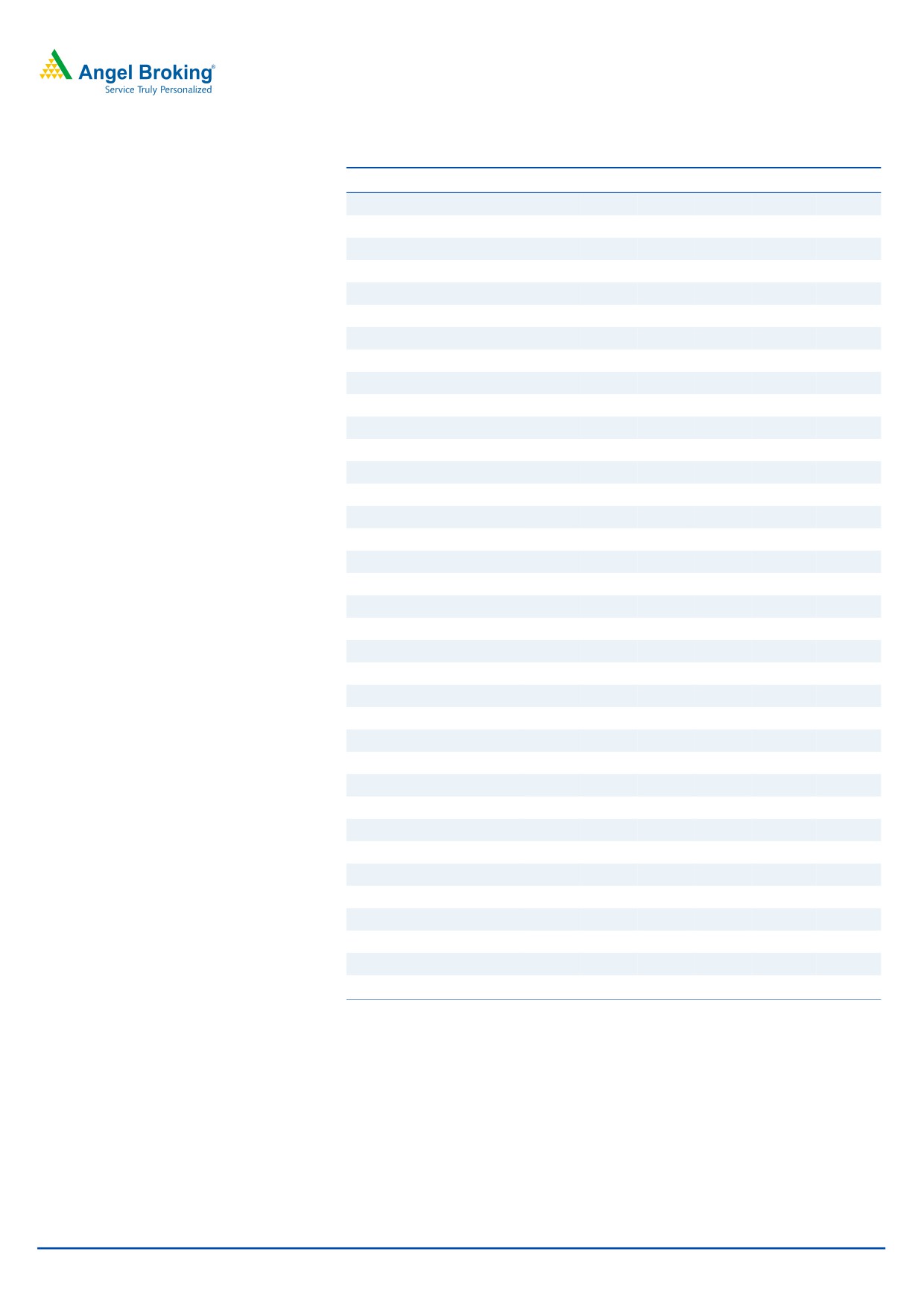

Y/E March (` cr)

1QFY2017 4QFY2016

% chg qoq 1QFY2016

% chg yoy

Investment Period

-

Net sales

366

406

(9.8)

400

(8.5)

Other income

17

29

(43.8)

5

257.2

Stock Info

Operating profit

93

88

5.1

104

(10.8)

Sector

Pharmaceutical

Interest

22

20

9.7

32

(29.5)

Market Cap (` cr)

2,746

Net profit/(loss)

46

50

(8.9)

40

13.7

Net Debt (` cr)

845

Source: Company, Angel Research

Beta

1.3

52 Week High / Low

210 / 87

The company posted better than expected results for 1QFY2017 with sales at

Avg. Daily Volume

307,512

`366cr V/s `350cr expected and V/s `400cr in 1QFY2016, a yoy de-growth of

Face Value (`)

2

8.5%. CRAMS (`258cr) posted a growth of 2.3% yoy and the Market Molecules

BSE Sensex

28,065

other segment (`108cr) posted de-growth of 26.9% yoy. On the operating front,

Nifty

8,643

the EBITDA margin came in at 25.3% V/s 20.9% expected and V/s 25.4% in

Reuters Code

DISH.BO

1QFY2016. Thus, the Adj. net profit came in at `46cr V/s `32cr expected and V/s

`40cr in 1QFY2016, a yoy growth of 13.7%. We recommend a SELL.

Bloomberg Code

DISH@IN

Results better than expected on all fronts: Company posted better than expected

results for 1QFY2017 with sales at `366cr V/s `350cr expected and V/s `400cr

Shareholding Pattern (%)

in 1QFY2016, a yoy de-growth of 8.5%. CRAMS (`258cr) posted a growth of

Promoters

61.4

2.3% yoy and Market Molecules (`108cr) posted de-growth of 26.9% yoy. Within

MF / Banks / Indian Fls

6.4

CRAMS, Carbogen Amcis (`202.3cr) posted a yoy growth of 14.3%, CRAMS India

FII / NRIs / OCBs

19.9

(`42.1cr) posted de-growth of 37.0% and CRAMS UK (`13.5cr) posted a yoy

Indian Public / Others

12.3

growth of 62.4%. Market Molecules declined on back of Vitamin D (`62.6cr; a

yoy de-growth of 28.4%), while the other segment (`45.7cr) posted a yoy de-

growth of 24.8%. On the operating front, the EBITDA margin came in at 25.3%

Abs. (%)

3m 1yr 3yr

V/s 20.9% expected and V/s 25.4% in 1QFY2016. Thus, the Adj. net profit came

Sensex

9.4

(0.0)

50.9

in at `46cr V/s `32cr expected and V/s `40cr in 1QFY2016, a yoy growth of

Dishman

(1.9)

(12.9)

44.5

13.7%

Outlook and valuation: We expect Dishman’s net sales and net profit to grow at a

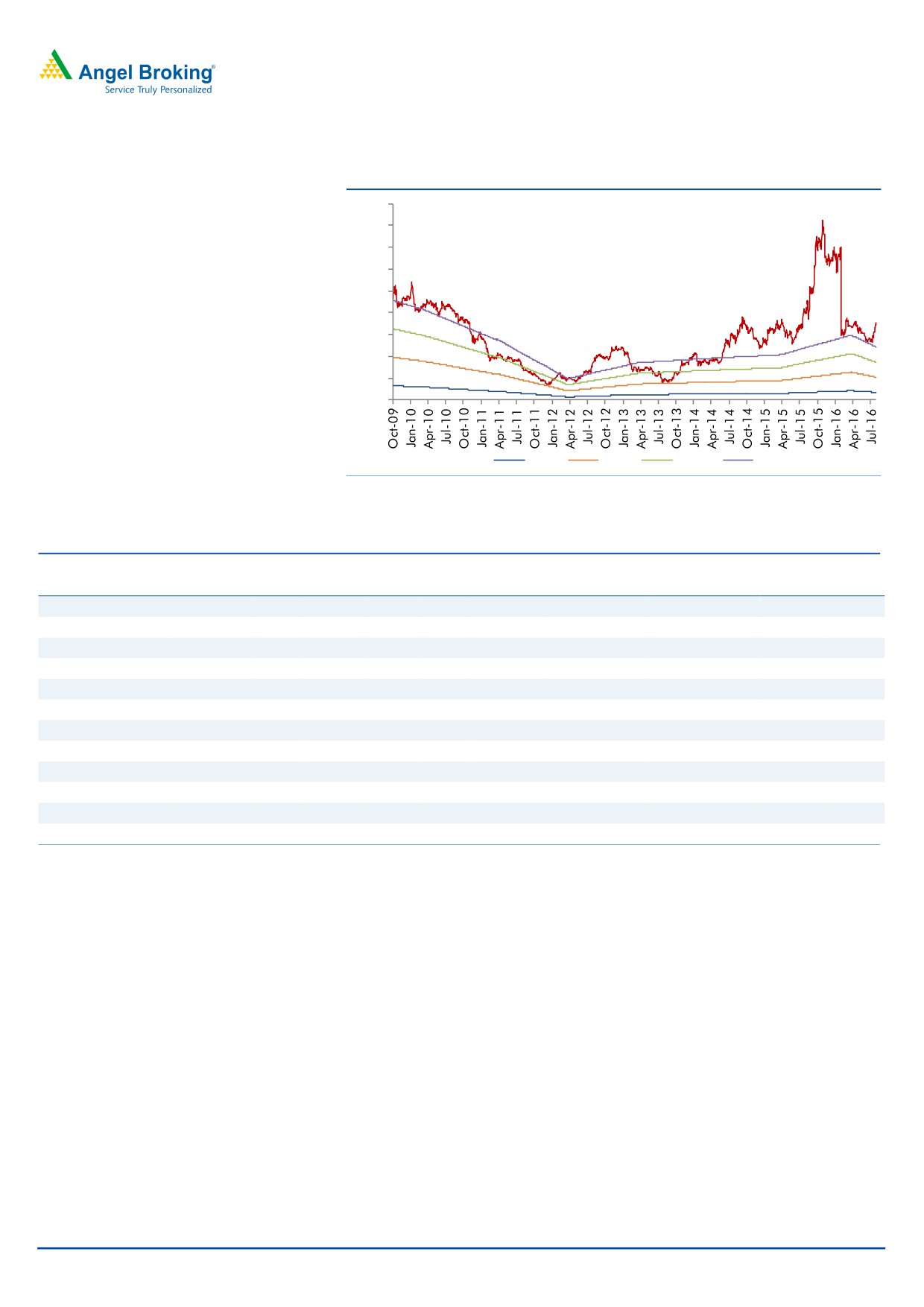

3-year price chart

CAGR of 10.0% and 3.1%, respectively, over FY2016-18E. At current levels,

450

400

Dishman is trading at 15.1x its FY2018E earnings. We believe the current

350

valuations are expensive, given the restrained growth and low profitability; hence,

300

we maintain our SELL rating on the stock.

250

200

Key financials (Consolidated)

150

100

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

50

Net sales

1,575

1,562

1,718

1,890

0

% chg

14.7

(0.8)

10.0

10.0

Net profit

119.8

171.0

154.0

181.7

% chg

9.6

42.8

(9.9)

18.0

Source: Company, Angel Research

EPS (`)

7.4

10.6

9.5

11.3

EBITDA margin (%)

19.9

24.1

22.7

22.8

P/E (x)

22.9

16.1

17.8

15.1

RoE (%)

9.9

12.7

10.1

10.9

RoCE (%)

7.2

11.2

9.4

10.3

P/BV (x)

2.2

1.9

1.7

1.6

Sarabjit Kour Nangra

EV/Sales (x)

1.4

1.4

2.0

1.7

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

6.9

5.7

8.9

7.7

Source: Company, Angel Research; Note: CMP as of August 16, 2016

Please refer to important disclosures at the end of this report

1

Dishman Pharmaceuticals | 1QFY2017 Result Update

Exhibit 1: 1QFY2017 performance (Consolidated)

Y/E March (` cr)

1QFY2017

4QFY2016

% chg QoQ 1QFY2016

% chg YoY

FY2016

FY2015

% chg

Net sales

366

406

(9.8)

400

(8.5)

1,562

1,560

0.1

Other income

17

29

(43.8)

5

257.2

61

101

(39.9)

Total income

382

435

(12.1)

405

(5.5)

1,623

1,661

(2.3)

Gross profit

312

330

(5.6)

318

(1.9)

1,226

1,025

19.6

Gross margins

85.2

81.4

79.4

78.5

65.7

Operating profit

93

88

5.1

104

(10.8)

376

299

25.8

OPM (%)

25.3

21.7

26.0

24.1

19.2

Interest

22

20

9.7

32

(29.5)

94

90

4.9

Dep & amortisation

28

30

(4.7)

26

9.8

109

151

(27.8)

PBT

58

67

(13.3)

51

14.8

233

159

46.8

Provision for taxation

13

17

(26.6)

12

8.7

62

39

59.9

Reported net profit

46

50

(8.6)

40

13.7

171

120

42.5

Less : Exceptional items

-

-

-

-

-

-

Minority interest

0

0

0

-

0

PAT after exceptional items

46

50

(8.9)

40

13.7

171

120

42.8

Adj. PAT

46

50

(8.9)

40

13.7

171

120

42.8

EPS (`)

5.6

6.2

5.0

21.2

14.8

Source: Company, Angel Research

Exhibit 2: 1QFY2017 - Actual Vs Angel estimates

(` cr)

Actual

Estimates

Variation

Net sales

382

350

9.3

Other income

17

29

(43.8)

Operating profit

46

84

(46.1)

Interest

22

21

9.6

Tax

13

17

(26.8)

Net profit

46

32

44.0

Source: Company, Angel Research

Revenue above expectation: Sales came in at `366cr V/s `350cr expected and V/s

`400cr in 1QFY2016, a yoy de-growth of 8.5%. CRAMS (`258cr) posted a growth

of 2.3% yoy and Market Molecules (`108cr) posted de-growth of 26.9% yoy.

Within CRAMS, Carbogen Amcis (`202.3cr) posted a yoy growth of 14.3%, CRAMS

India (`42.1cr) posted de-growth of 37.0% and CRAMS UK (`13.5cr) posted a yoy

growth of 62.4%. Market Molecules declined on back of Vitamin D (`62.6cr; a yoy

de-growth of 28.4%), while the other Marketable Molecules segment (`45.7cr)

posted a yoy de-growth of 24.8%.

CRAMS-India’s revenues declined by 37.0% yoy as the corresponding quarter last

year had a higher base due to spill over of few commercial orders for a specific

customer from 4QFY2015 to 1QFY2016 and higher supply requirement of the

customer in 1QFY2016. The orders received in FY2017 are to be supplied over the

next three quarters.

Carbogen Amcis’ revenues were higher by 14.3% yoy due to higher share of high

margin commercial orders as against development orders. Vitamin D revenues

declined 28.4% yoy as the company discontinued supply of certain lower margin

orders to China and continued to consolidate its focus on high margin Vitamin D

analogues and cholesterol business.

August 17, 2016

2

Dishman Pharmaceuticals | 1QFY2017 Result Update

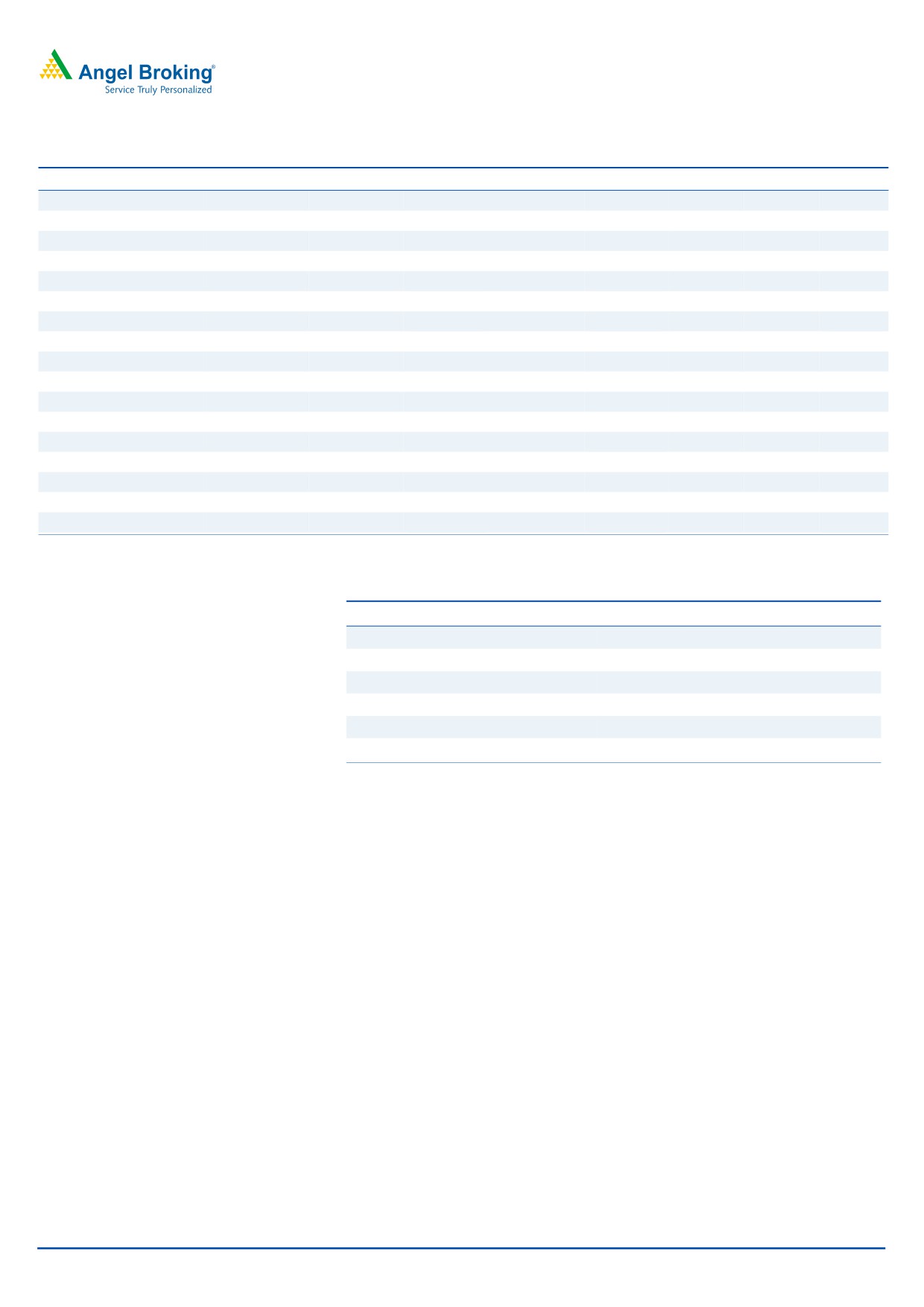

Exhibit 3: Sales trend

410

406

400

400

390

382

380

374

370

366

360

350

340

1QFY2016

2QFY2016

3QFY2016

4QFY2016

1QFY2017

Source: Company, Angel Research

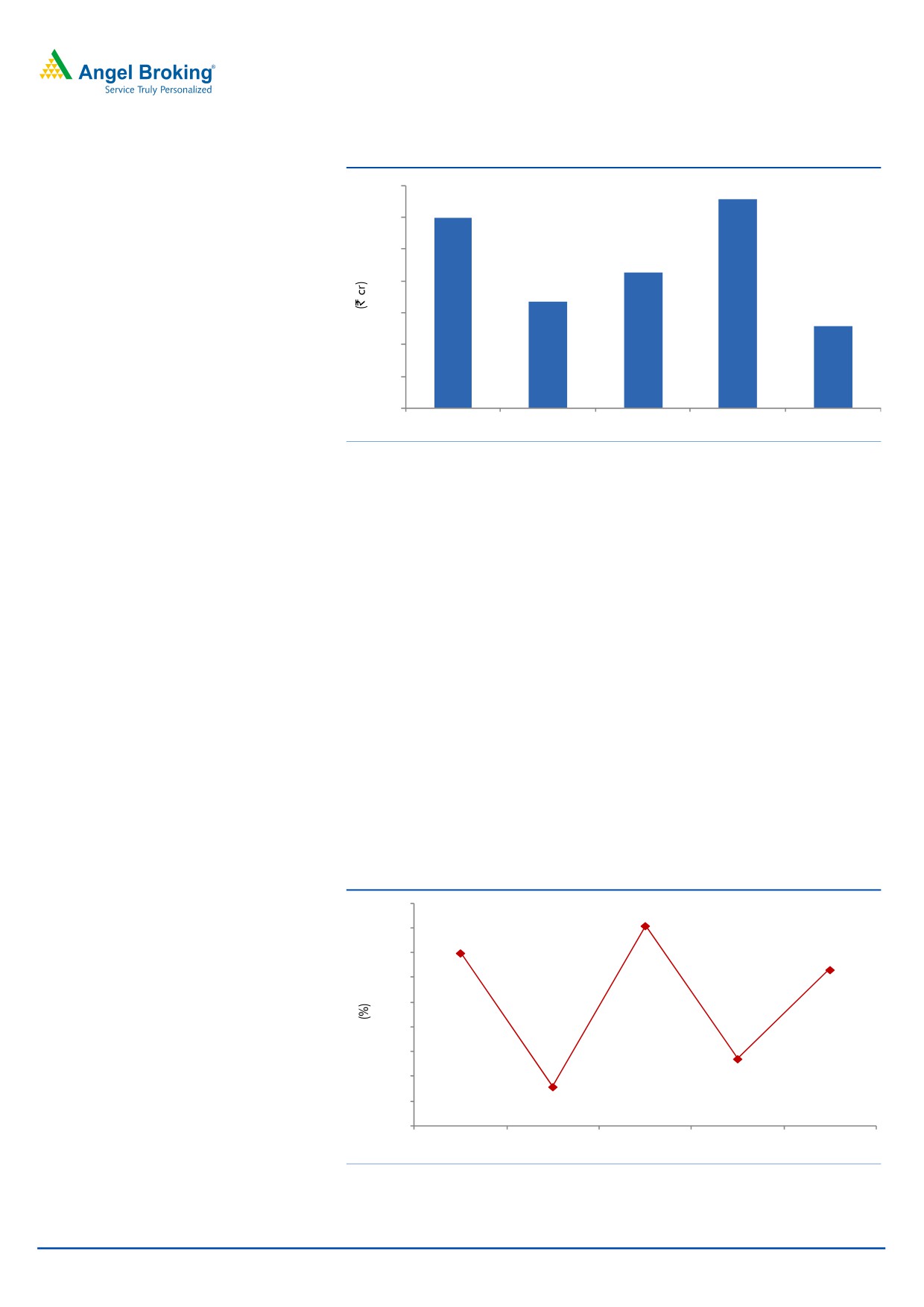

OPM above expectation: On the operating front, EBITDA margin came in at 25.3%

V/s 20.9% expected V/s 25.4% in 1QFY2016. The GPM came in at 85.2% V/s

81.3% expected and V/s 79.4% in 1QFY2016. Margin improvement was on the

back of an improved sales mix.

CRAMS - Carbogen Amcis posted an OPM of 19.9% in 1QFY2017 V/s 17.2% in

1QFY2016, CRAMS - India posted an OPM of 56.5% in 1QFY2017 V/s 49.5% in

1QFY2016 and CRAMS - UK posted an OPM of 24.2% in 1QFY2017 V/s 16.9%

in 1QFY2016. In Market Molecules segment, Vitamin D posted an OPM of 34.0%

in 1QFY2017 V/s 30.5% in 1QFY2016.

CRAMS - Carbogen Amcis’ OPM improved by ~220bp due to higher revenue

contribution from the high margin “commercial production” work. CRAMS India’s

OPM improved by ~700bp due to execution of high margin commercial and

development orders, process improvement and a better product mix. In Vitamin D,

the focus is on high value products like certain Vitamin D analogues and direct

selling of cholesterol medications to end customers. Further the segment also

benefitted from bulk purchase of raw materials at lower prices.

Exhibit 4: OPM trend (%)

28.0

27.1

27.0

26.0

26.0

25.3

25.0

24.0

23.0

21.7

22.0

20.6

21.0

20.0

19.0

1QFY2016

2QFY2016

3QFY2016

4QFY2016

1QFY2017

Source: Company, Angel Research

August 17, 2016

3

Dishman Pharmaceuticals | 1QFY2017 Result Update

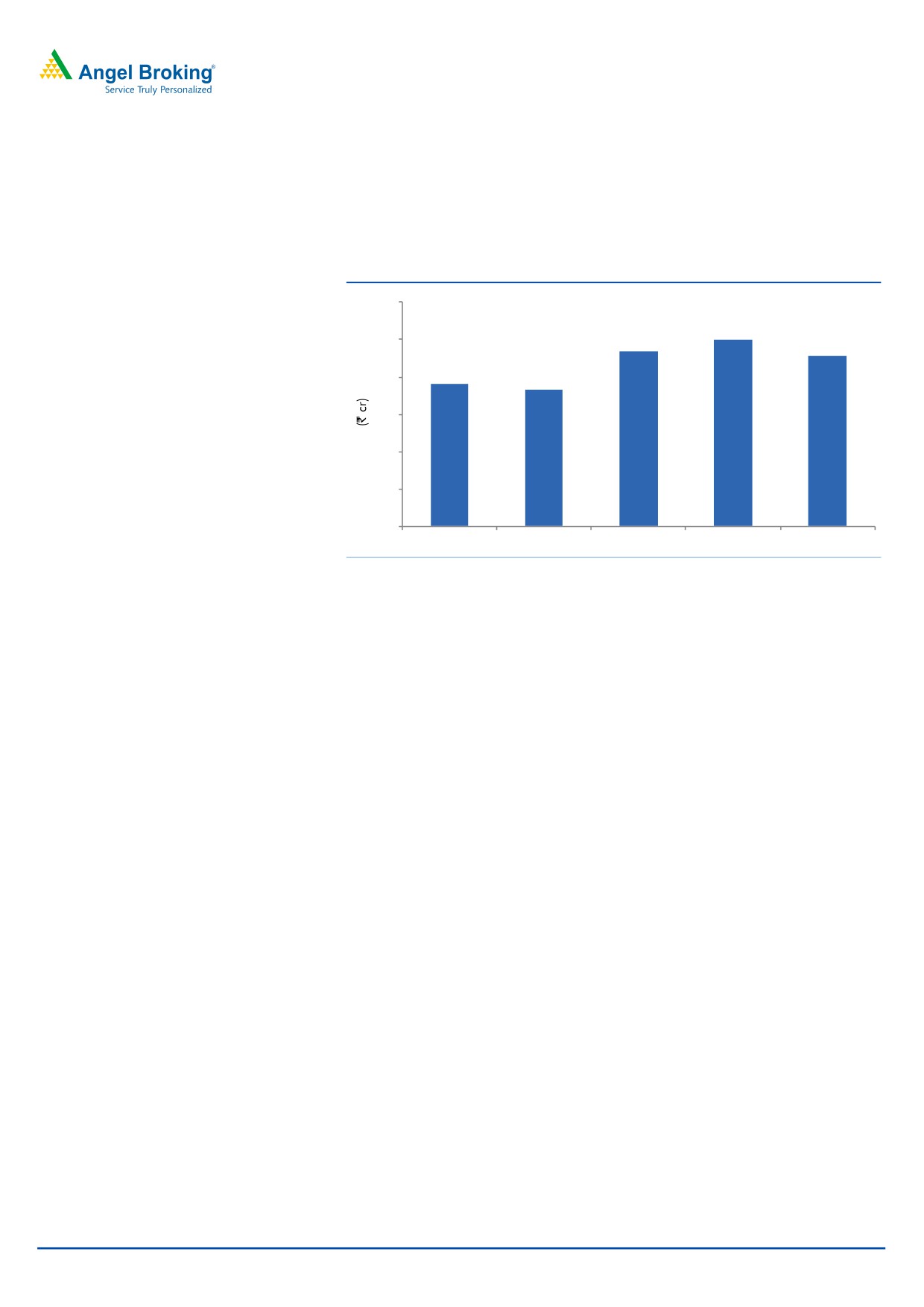

Net profit higher than expectation: Thus, the Adj. net profit came in at `45.5cr V/s

`32cr expected and V/s `41cr in 1QFY2016, a yoy growth of 13.7%. Apart from

the OPM expansion, the other income came in at `17cr V/s `5cr during the

corresponding period of last year.

Exhibit 5: Net profit trend

60

50

50

47

46

38

40

37

30

20

10

0

1QFY2016

2QFY2016

3QFY2016

4QFY2016

1QFY2017

Source: Company, Angel Research

Investment arguments

Focus on profitability: Dishman has been incurring a capex of around

~`100cr on an annual basis over the last couple of years. With the major

capex out, the company is now focused on improving the overall profitability

of the business. The same is evident in the improvement in OPM from 16.4%

in FY2011 to 23.3% in FY2014, thereby improving the overall profitability of

the company. The RoCE of the company improved from 5.5% in FY2011 to

10.2% in FY2014. Going forward, with focus on profitability, the company has

reduced its capex plans (~`30-50cr in FY2015) and lays focus on sweating its

assets and restructuring the business, which will lead to improvement in

profitability over the medium term. We expect the ROCE to improve to 10.9%

in FY2017E from 7.7% in FY2012.

CRAMS stabilizing: CRAMS, which contributes by around 65.1% to the overall

business has stabilised over the last two years, after a lull, posting a robust

growth of 14% in FY2012-14. As of March 2015, Carbogen Amcis has a

budgeted total order book of over `673cr for FY2016 and a part of the same

is in hands. In its Oncology Hippo Unit 9, the Management expects to book

more incremental revenues, where EBITDA margins are high at 40-50%. As

regards the Vitamin-D business, the Management expects to scale it up to

`300cr with a 20% EBITDA margin.

Outlook and valuation

We expect Dishman’s net sales and net profit top post a CAGR of 10.0% and 3.1%

respectively over FY2016-18E. At current levels, Dishman is trading at 15.1x its

FY2018E earnings. We believe the current valuations are expensive, given the

restrained growth and low ROE. We maintain SELL, with a price target of `45.

August 17, 2016

4

Dishman Pharmaceuticals | 1QFY2017 Result Update

Exhibit 6: One-year forward PE

450

400

350

300

250

200

150

100

50

-

2x

6x

10x

14x

Source: Company, Angel Research

Exhibit 7: Recommendation summary

Company

Reco

CMP Tgt. price Upside

FY2018E

FY16-18E

FY2018E

(`)

(`)

% PE (x) EV/Sales (x) EV/EBITDA (x) CAGR in EPS (%) RoCE (%) RoE (%)

Alembic Pharma

Neutral

647

-

-

21.3

2.8

13.3

(10.8)

27.5

25.3

Aurobindo Pharma Buy

735

877

19.3

15.5

2.6

10.8

18.1

22.5

26.1

Cadila Healthcare

Accumulate

364

400

9.9

18.2

2.7

12.4

15.8

24.3

26.6

Cipla

Reduce

554

490

(11.5)

20.4

2.6

14.0

20.4

13.5

15.2

Dr Reddy's

Neutral

3,008

-

-

19.1

2.8

11.2

6.9

18.1

17.1

Dishman Pharma

Sell

170

45

(73.6)

15.1

1.8

7.7

3.1

10.3

10.9

GSK Pharma*

Neutral

3,049

-

-

51.3

6.6

35.1

15.9

35.8

31.8

Indoco Remedies

Sell

306

225

(26.5)

19.6

2.3

12.5

31.5

19.1

19.2

Ipca labs

Buy

517

613

18.6

26.2

1.8

11.9

36.5

8.8

9.4

Lupin

Accumulate

1,590

1,809

13.8

22.9

3.8

14.1

17.2

24.4

20.9

Sanofi India

Neutral

4,343

-

-

25.7

3.2

18.5

21.2

24.9

28.4

Sun Pharma

Buy

783

944

20.6

23.9

4.8

15.5

22.0

33.1

18.9

Source: Company, Angel Research; Note: *December year ending

Background

Dishman commenced business in

1983 as a QUAT (Speciality Chemicals)

company and has since emerged to be a global leader in the segment. Since

1997, Dishman has diversified its interests towards the CRAMS segment. The

company has now established itself as a respected and preferred outsourcing

partner to various pharma majors, offering a portfolio of development, scale-up

and manufacturing services. The company caters to the customers' needs ranging

from chemical development to commercial manufacture and supply of APIs.

Dishman has large scale manufacturing facilities in India and China.

August 17, 2016

5

Dishman Pharmaceuticals | 1QFY2017 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Gross sales

1,273

1,387

1,582

1,577

1,735

1,909

Less: Excise duty

6

14

7

16

17

19

Net sales

1,268

1,373

1,575

1,562

1,718

1,890

Other operating income

5

12

44

34

34

34

Total operating income

1,272

1,385

1,619

1,596

1,752

1,924

% chg

13.2

8.9

16.9

(1.4)

9.8

9.8

Total expenditure

982

1,053

1,262

1,186

1,328

1,459

Net raw materials

376

373

535

336

464

510

Other mfg costs

95

103

77

117

129

142

Personnel

351

412

423

535

526

577

Other

161

164

227

197

210

230

EBITDA

285

320

314

376

390

430

% chg

28.7

12.2

(2.1)

19.9

3.7

10.4

(% of Net Sales)

22.5

23.3

19.9

24.1

22.7

22.8

Depreciation & amortisation

84

109

151

109

153

156

EBIT

202

212

163

267

237

274

% chg

38.8

5.0

(23.0)

63.9

(11.2)

15.6

(% of Net Sales)

15.9

15.4

10.3

17.1

13.8

14.5

Interest & other charges

79

92

90

94

93

93

Other Income

15

25

42

27

27

27

(% of PBT)

10.8

15.8

26.5

11.4

12.9

11.0

Share in profit of associates

-

-

-

-

-

-

Recurring PBT

143

156

159

233

205

242

% chg

61.4

9.5

1.8

46.6

(12.0)

18.0

Extraordinary expense/(Inc.)

(2.4)

0.2

PBT (reported)

145

156

159

233

205

242

Tax

45.0

47.1

39.4

62.4

51.3

60.6

(% of PBT)

31.0

30.1

24.8

26.7

25.0

25.0

PAT (reported)

100

109

120

171

154

182

Add: Share of earnings of asso.

0

0

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

-

Prior period items

-

-

-

-

-

-

PAT after MI (reported)

100

109

120

171

154

182

ADJ. PAT

99

109

120

171

154

182

% chg

73.1

10.7

9.6

42.8

(9.9)

18.0

(% of Net Sales)

7.9

8.0

7.6

10.9

9.0

9.6

Basic EPS (`)

6.1

6.8

7.4

10.6

9.5

11.3

Fully Diluted EPS (`)

6.1

6.8

7.4

10.6

9.5

11.3

% chg

73.1

10.7

9.6

42.8

(9.9)

18.0

August 17, 2016

6

Dishman Pharmaceuticals | 1QFY2017 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity share capital

16

16

16

16

32

32

Share application money

4

4

-

-

-

-

Reserves & surplus

1,026

1,161

1,222

1,435

1,555

1,717

Shareholders funds

1,046

1,181

1,238

1,452

1,587

1,750

Minority interest

-

-

-

0

-

-

Total loans

800

880

836

841

841

841

Other Long Term Liabilities

10

0

73

-

-

-

Long Term Provisions

43

64

97

81

81

81

Deferred tax liability

58

68

63

77

77

77

Total liabilities

1,956

2,193

2,307

2,451

2,586

2,749

APPLICATION OF FUNDS

Gross block

1,686

1,946

2,019

2,158

2,208

2,258

Less: Acc. depreciation

524

688

813

923

1,075

1,232

Net block

1,162

1,258

1,206

1,235

1,133

1,026

Capital work-in-progress

97

79

142

142

142

142

Goodwill

211

247

235

253

253

253

Long-Term Loans and Adv.

25

25

38

25

25

25

Investments

123

182

188

223

228

251

Current Assets

673

760

1,000

1,102

1,256

1,548

Cash

21

35

36

62

107

284

Loans & Advances

241

269

299

295

325

357

Other

581

457

665

744

825

907

Current liabilities

335

361

502

529

452

496

Net Current Assets

338

399

498

572

805

1,052

Non CA

-

2

-

-

-

-

Total Assets

1,956

2,193

2,307

2,451

2,586

2,749

August 17, 2016

7

Dishman Pharmaceuticals | 1QFY2017 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016 FY2017E FY2018E

Profit before tax

145

156

159

233

205

242

Depreciation

84

109

151

109

153

156

(Inc)/Dec in Working Capital

(178)

63

(103)

(84)

(192)

(93)

Less: Other income

15

25

42

27

27

27

Direct taxes paid

(45)

(47)

(39)

(62)

(51)

(61)

Cash Flow from Operations

144

179

180

181

182

183

(Inc.)/Dec.in Fixed Assets

(101)

(242)

(136)

(139)

(50)

(50)

(Inc.)/Dec. in Investments

-

-

-

-

-

-

Other income

15

25

42

27

27

27

Cash Flow from Investing

(85)

(217)

(94)

(112)

(23)

(23)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

(105)

92

62

(84)

-

-

Dividend Paid (Incl. Tax)

(11)

(11)

(19)

(19)

(19)

(19)

Others

54

312

-

-

-

-

Cash Flow from Financing

(62)

393

43

(103)

(19)

(19)

Inc./(Dec.) in Cash

(3)

354

129

(34)

140

141

Opening Cash balances

24

21

35

36

62

107

Closing Cash balances

21

35

36

62

107

284

August 17, 2016

8

Dishman Pharmaceuticals | 1QFY2017 Result Update

Key Ratio

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

27.8

25.1

22.9

16.1

17.8

15.1

P/CEPS

7.5

6.3

5.1

4.9

9.0

8.1

P/BV

2.6

2.3

2.2

1.9

1.7

1.6

Dividend yield (%)

0.7

0.6

1.2

1.2

1.2

1.2

EV/Sales

1.7

1.6

1.4

1.4

2.0

1.7

EV/EBITDA

7.5

6.9

6.9

5.7

8.9

7.7

EV / Total Assets

1.1

1.0

0.9

0.9

1.3

1.2

Per Share Data (`)

EPS (Basic)

6.1

6.8

7.4

10.6

9.5

11.3

EPS (fully diluted)

6.1

6.8

7.4

10.6

9.5

11.3

Cash EPS

22.8

27.0

33.5

34.7

19.0

20.9

DPS

1.2

1.0

2.0

2.0

2.0

2.0

Book Value

64.8

73.2

76.7

89.9

98.3

108.4

Dupont Analysis

EBIT margin

15.9

15.4

10.3

17.1

13.8

14.5

Tax retention ratio

69.0

69.9

75.2

73.3

75.0

75.0

Asset turnover (x)

0.7

0.7

0.7

0.7

0.7

0.8

ROIC (Post-tax)

7.3

7.3

5.7

8.6

7.5

8.5

Cost of Debt (Post Tax)

6.6

7.7

7.9

8.3

8.3

8.3

Leverage (x)

0.8

0.7

0.7

0.6

0.5

0.4

Operating ROE

7.8

7.0

4.2

8.8

7.1

8.6

Returns (%)

ROCE (Pre-tax)

10.4

10.2

7.2

11.2

9.4

10.3

Angel ROIC (Pre-tax)

13.9

12.2

8.7

13.7

11.6

13.2

ROE

10.0

9.8

9.9

12.7

10.1

10.9

Turnover ratios (x)

Asset Turnover (Gross Block)

0.9

0.8

0.8

0.8

0.8

0.9

Inventory / Sales (days)

99

100

106

106

123

138

Receivables (days)

47

20

21

42

25

28

Payables (days)

46

34

36

49

37

30

WC cycle (ex-cash) (days)

85

90

93

111

126

139

Solvency ratios (x)

Net debt to equity

0.7

0.7

0.6

0.5

0.5

0.3

Net debt to EBITDA

2.7

2.6

2.5

2.1

1.9

1.3

Interest Coverage (EBIT / Int.)

2.6

2.3

1.8

2.8

2.6

3.0

August 17, 2016

9

Dishman Pharmaceuticals | 1QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Dishman Pharmaceuticals

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

August 17, 2016

10