Initiating Coverage| HFC

April 5, 2016

Dewan Housing Finance Corporation

BUY

CMP

`189

Parallel play on “Housing for All”

Target Price

`270

Dewan Housing Finance Corporation Ltd (DHFL) is the third largest housing

Investment Period

12 Months

finance company in India with a market share of ~4%. With a focus on the low

and medium income (LMI) consumer segment, the company has increased its

Stock Info

presence in tier-II & III cities where the growth opportunity is immense. With strong asset

Sector

HFC

quality and healthy return ratios, the company is all set to witness its next leg of growth.

Market Cap (` cr)

5,547

DHFL is the 3rd largest private sector housing finance company with a scalable

Beta

1.5

business model: Given the present declining interest rate scenario, the housing

52 Week High / Low

268 / 141

finance industry is likely to emerge stronger. After delivering 39% AUM CAGR

Avg. Daily Volume

1,29,241

over FY2010-15, we expect DHFL to grow at a CAGR of 20% over FY2015-18, as

demand for housing in the middle & low income group is expected to pick up,

Face Value (`)

10

which is the focus area for the company. Backed by stable asset quality and firm

BSE Sensex

24,884

margins, DHFL has reported a 32% CAGR in PAT over FY2010-15 and we expect

Nifty

7,603

the same to grow by 21.3% (CAGR) over FY2015-18.

Reuters Code

DWNH.BO

Seasoned and granular loan book with stable asset quality: DHFL is a pioneer in

Bloomberg Code

DEWH.IN

the home loan business with nearly three decades of experience and has achieved

strong underwriting skills. Individual borrowers account for 75%, while the high

yielding loan against property (LAP) and projects loans account for 16% and 8% of

Shareholding Pattern (%)

advances, respectively. The company has increased its average ticket size from `0.59mn

Promoters

34.9

in FY2011 to `1.2mn by FY2015, while it has brought down its loan-to-value (LTV) from

MF / Banks / Indian Fls

2.0

61.8% to 46.9% during the same period. Despite strong loan growth, the GNPAs and

FII / NRIs / OCBs

35.9

NNPAs of the company are likely to be at ~1.05% and 0.71%, respectively, for FY2016.

We don’t expect any major deterioration in the asset quality going ahead.

Indian Public / Others

27.2

Lower cost of funds will help maintain NIM: After its rating having got upgraded

to AAA from AA+ earlier by CARE the incremental cost of funds for the company

has come down and is likely to continue to remain favorable. Nearly 70% of the

Abs.(%)

3m 1yr

3yr

bank borrowings are due for maturity over the next three years and swapping a

Sensex

(2.7)

(12.7)

34.9

part of that with non-convertible debentures (NCDs), where it has ~100bp cost

DHFL

(17.8)

(18.9)

137.0

benefit, will help DHFL in maintaining its NIM at ~2.86%.

NHB’s move to reduce risk weightage will help further leveraging: The National

Housing Bank (NHB) has recently revised LTV to as high as 90% for home loans

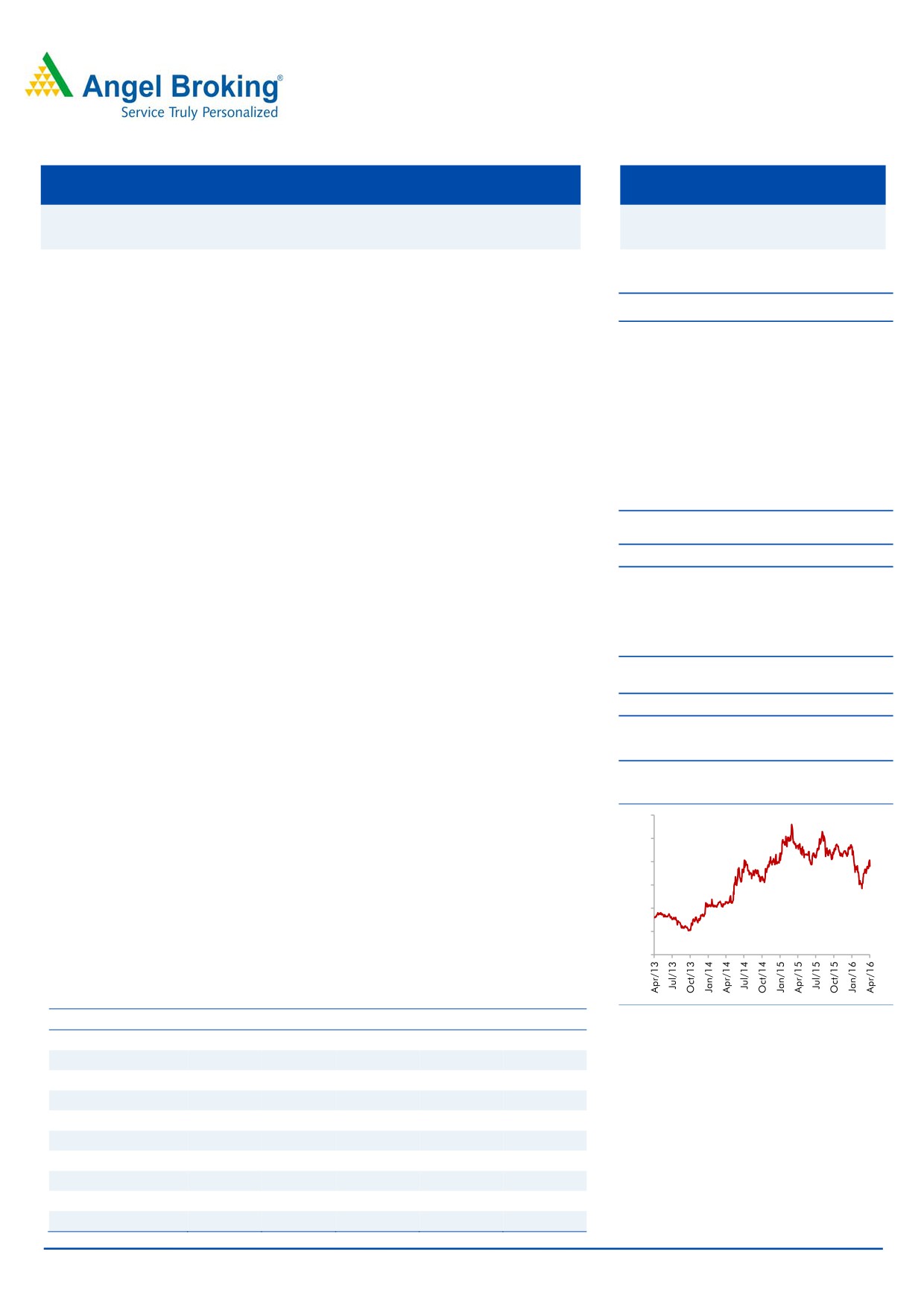

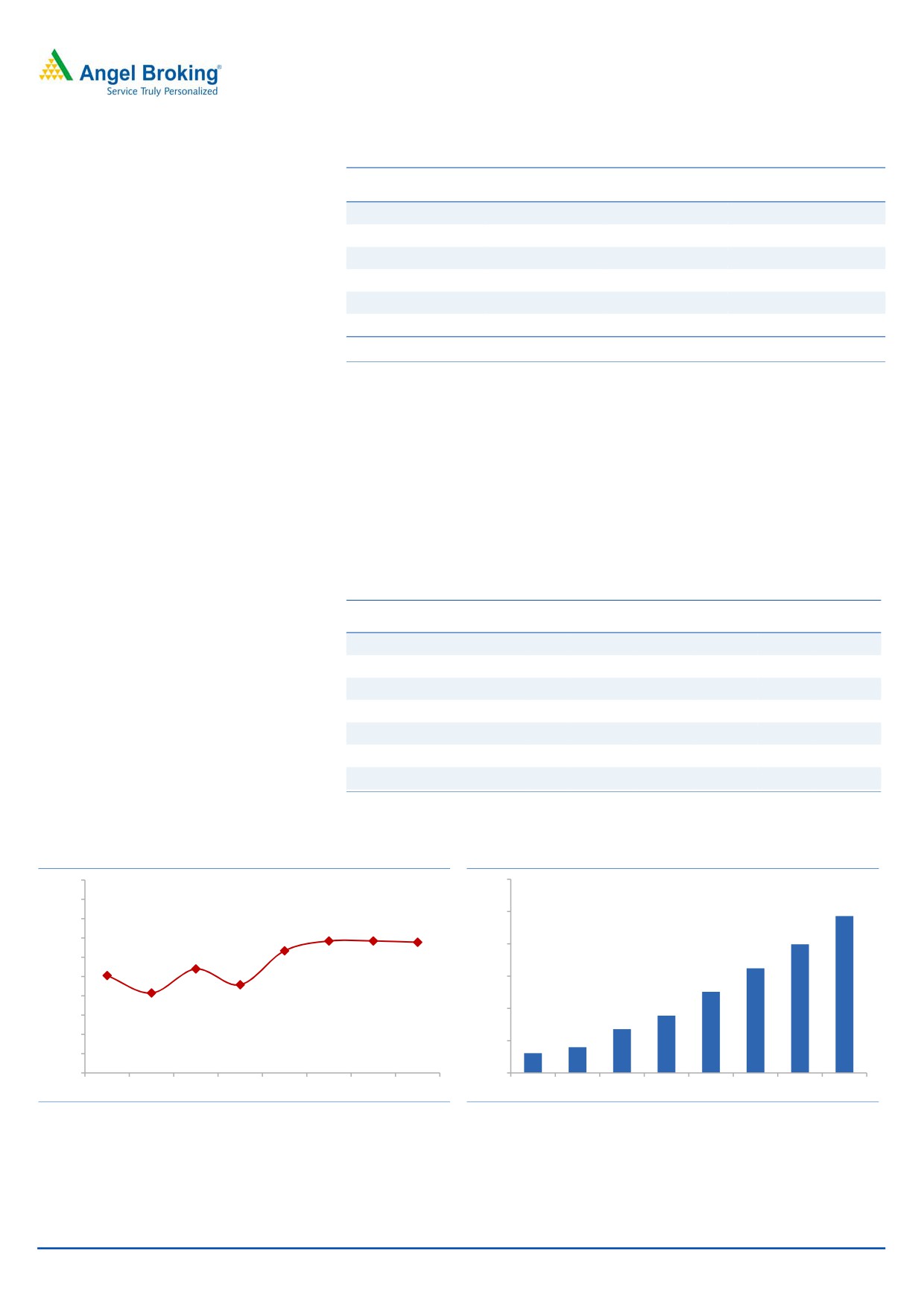

3-Year Daily Price Chart

upto `30lakh against `20lakh earlier and reduced the risk weightage on the

300

same to 35% vs 50% earlier. This move will give a fillip to the affordable home

250

segments. DHFL being a key player in this segment will be able to growth its

200

balance sheet by further increasing its leverage, with lower incremental capital

requirement. Further the promoters have subscribed warrants worth `500cr,

150

which will improve the CAR (which currently stands at 16.4%).

100

Outlook and valuation: We expect the company to post a healthy loan book

50

CAGR of 20% over FY2015-18E, which is likely to translate in an earnings CAGR

-

of 21.3%, over the same period. The stock currently trades at 0.8x FY2018E ABV.

We recommend a Buy on the stock, with a target price of `270.

Key Financials (Standalone)

Source: Company, Angel Research

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

FY2018E

NII

888

1,256

1,621

1,993

2,431

% chg

30.9

41.5

29.0

22.9

22.0

Net profit

527

620

757

898

1,107

% chg

14.8

17.8

22.0

18.7

23.2

NIM (%)

2.4

2.8

2.9

2.9

2.7

Siddharth Purohit

EPS (`)

20.5

21.3

25.9

30.8

35.4

022 - 3935 7800 Ext: 6872

P/E (x)

8.6

8.3

6.8

5.8

5.0

P/ABV (x)

1.4

1.2

1.0

0.9

0.8

Chintan Shah

RoA (%)

1.3

1.3

1.2

1.2

1.1

022 - 4000 3600 Ext: 6828

RoE (%)

15.5

15.1

15.3

15.9

16.4

Source: Company, Angel Research; Note: CMP as of April 5, 2016

Please refer to important disclosures at the end of this report

1

Dewan Housing Finance | Initiating Coverage

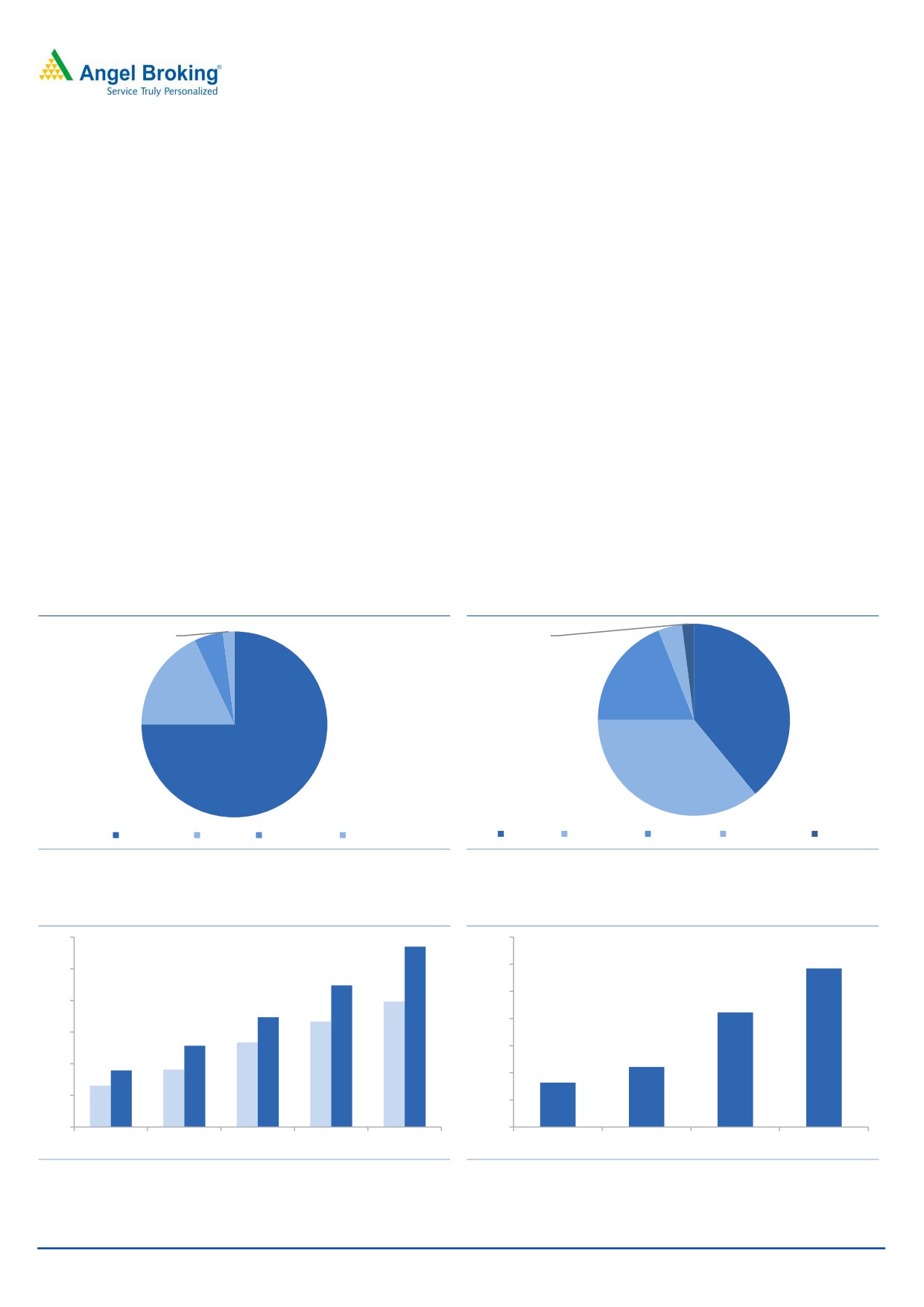

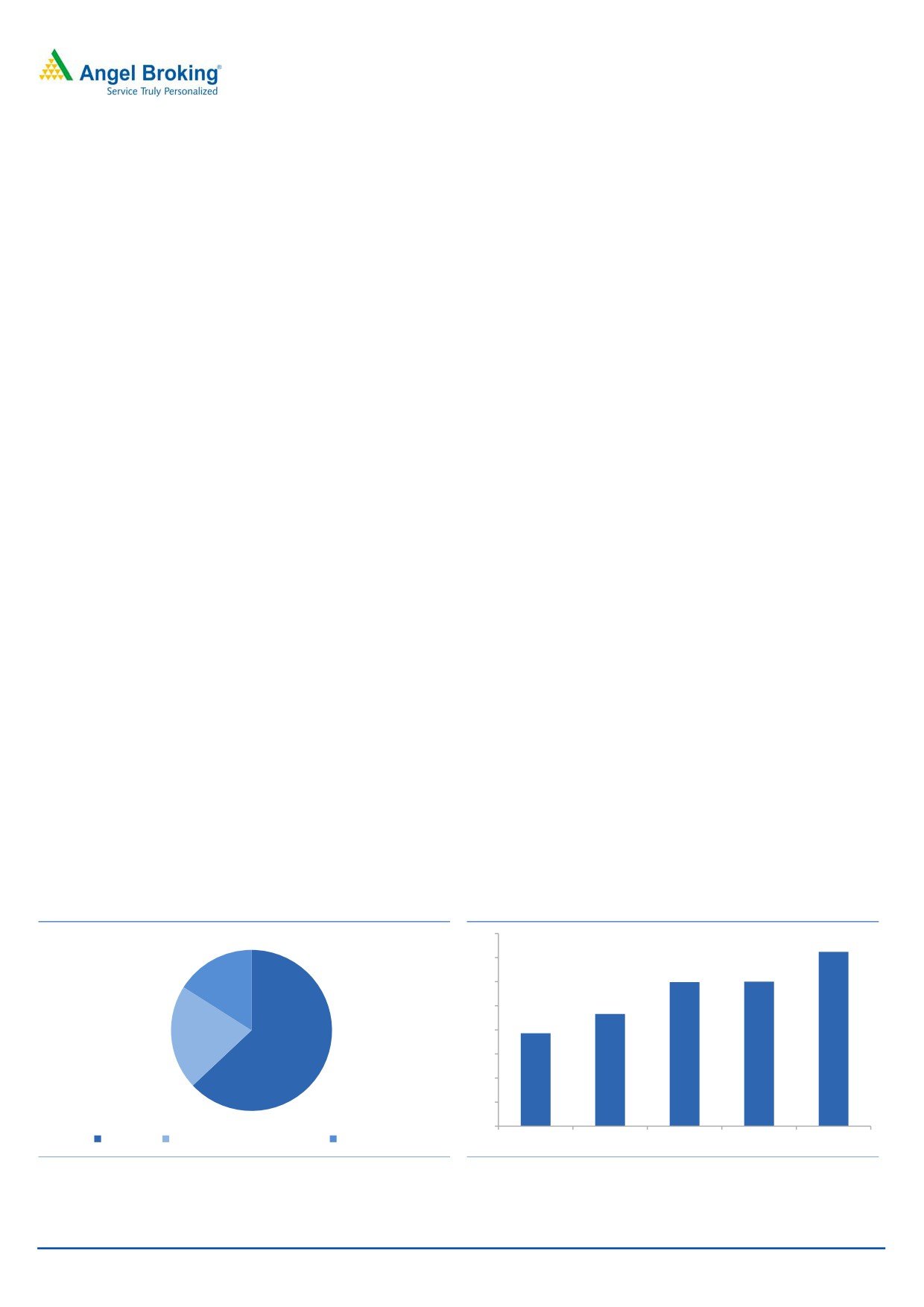

Seasoned and granular loan book gaining further strength: DHFL has a diversified

loan book, with individual borrowers accounting for 75% of the advances. Within

the retail loan book, 60% of the advances are towards purchase of flats, 13% is

accounted by the self construction segment, while the high yielding LAP and

projects loans account for 16% and 8%, respectively. Loans to the individual

segment normally carry a low risk of default as has been historically witnessed.

Loans to builders are generally perceived to be risky; still, DHFL has so far been

able to manage this loan portfolio with minimum NPAs.

Based on customer profile the company’s loan book is well diversified with ~60%

of it accounted by service holders, within which ~18% is towards government

employees while the balance is accounted by private sector employee. In order to

diversify its client base DHFL over the last few years has increased advances to the

self-employed segment which now accounts for 34% of the loan book compared to

19% in FY2011. The company is also engaged in funding the construction of

educational institutes which accounts for 4% of the loan book. Further, the

company has recently forayed into lending to the SME segment, which accounts for

2% of the total loan portfolio. The company doesn’t intend to go aggressive on

MSE loans although it believes that the segment has strong growth prospects and

the potential to offer attractive yields.

Exhibit 1: Retail Oriented loan book growing strong

Exhibit 2: Diversified customer profile

2%

2%

4%

5%

19%

18%

39%

75%

36%

Home Loans LAP/LRD Project Loans

Others

Company Self Employed Govt Others Educational Inst Others

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 3: Strong growth in sanctions & disbursements

Exhibit 4: Securitized portfolio ( In Rs cr)

300

285

7,000

5,845

6,000

250

224

198

5,000

200

4,225

173

167

4,000

150

129

134

3,000

90

91

2,215

100

65

2,000

1,638

50

1,000

0

0

FY11

FY12

FY13

FY14

FY15

FY12

FY13

FY14

FY15

Source: Company, Angel Research

Source: Company, Angel Research

April 5, 2016

2

Dewan Housing Finance | Initiating Coverage

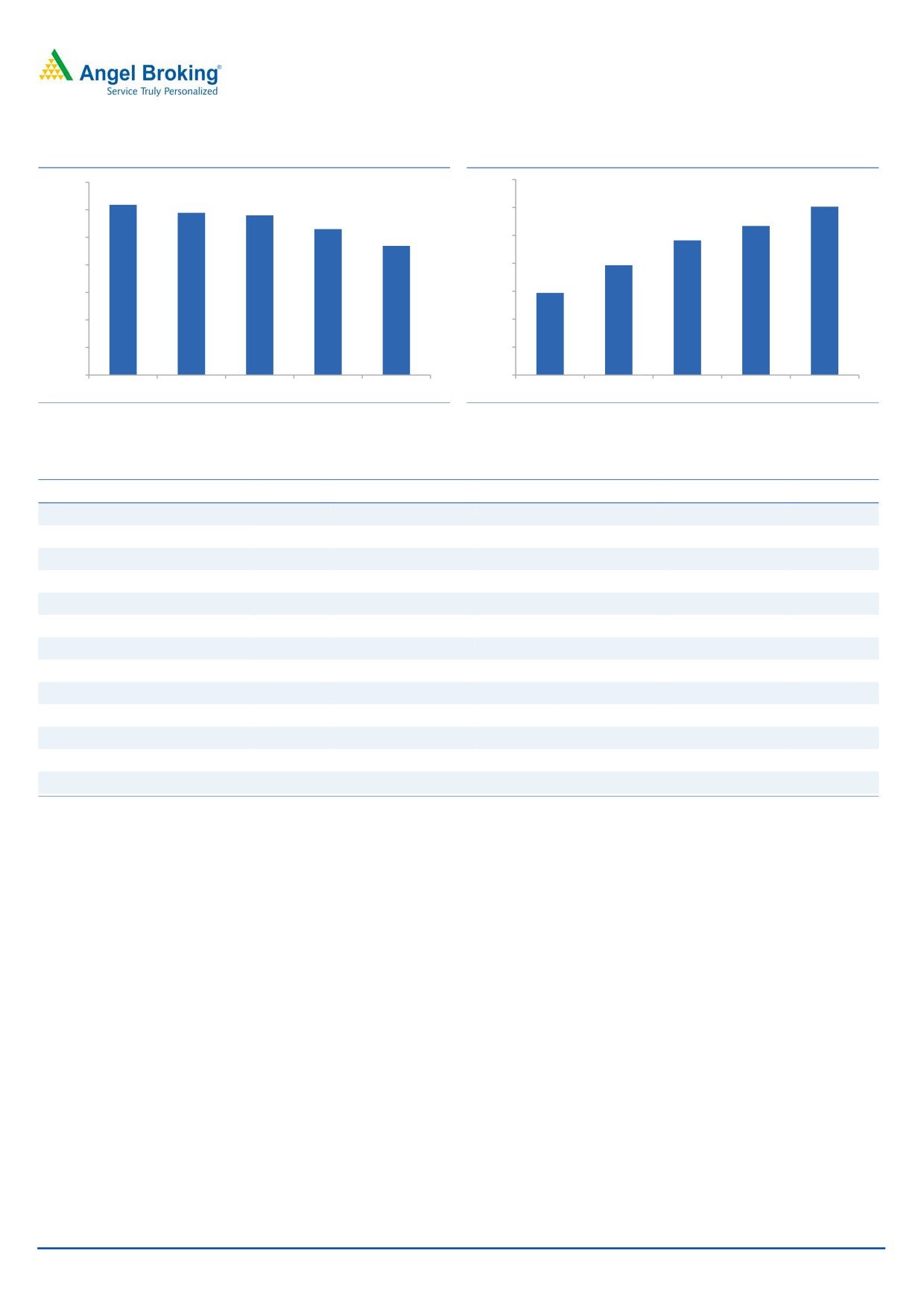

Increase in average ticket size with a simultaneous reduction in LTV: The company

has increased its average ticket size from `0.59mn in FY2011 to `1.2mn by

FY2015, while on the other hand it has brought down its blended LTV from 61.8%

to 46.9% during the same period. Lower LTV reduces the incremental risk in case

of a default while simultaneously increasing the average ticket size helps in

meeting business growth. Both the moves are certainly a positive for the long term

growth of the company.

DHFL also maintains a decent income to installment ratio of 39%, in line with the

industry, which is a key indicator of borrowers’ repayment capability. Increase in

average ticket size can largely be attributed to inflation in real-estate prices. The

incremental average ticket size of the company in the home loan segment has

risen to ~`18 lakhs, which again is in line with the industry. While in the LAP

segment, the average ticket size stands at `25 lakhs and the incremental ticket size

is at `28 lakhs.

In the builder loan segment DHFL normally lends to mid and small sized builders.

Ideally the loans are given for entire projects and not just for working capital. This

ensures enough security as it gets the first charge on the receivables from the

proceeds in case of liquidation. The average ticket size for builder loans remains at

`20cr and the incremental ticket size is at ~`30cr.

Exhibit 5: Segmental Ticket Size (Average & Incremental)

Category

Incremental

Average

Home Loan

`18 lakhs

`12 lakhs

LAP

`28 lakhs

`25 lakhs

Builder Loan

`30cr

`20cr

Source: Company, Angel Research

Exhibit 6: Segmental LTV

80

70

70

60

60

50

50

50

40

30

20

10

0

Home Loans

LAP

Projects

SME

Source: Company, Angel Research

April 5, 2016

3

Dewan Housing Finance | Initiating Coverage

Exhibit 7: Decreasing LTV (Blended)

Exhibit 8: Average Ticket Size (In Rs mn)

70.0%

1.40

61.8%

1.20

58.9%

58.0%

60.0%

1.20

53.0%

1.07

0.96

46.9%

1.00

50.0%

0.79

40.0%

0.80

0.59

30.0%

0.60

20.0%

0.40

10.0%

0.20

0.0%

-

FY11

FY12

FY13

FY14

FY15

FY11

FY12

FY13

FY14

FY15

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 9: Comparative data

Name of the Company

DHFL

India Bulls Housing

REPCO

LIC Housing

Can Fin Homes

HDFC Ltd

Loan Bifurcation

Retail

74

76

81

91

84

69

Non Retail

26

24

19

9

16

31

Of Which

LAP

16

0

19

6

0

0

Developer

6

0

0

3

0

30

Average Ticket Size

Housing Loan ( Rs Lakhs)

12

25

12

18.2

17.3

25

Non Housing Loan

25

73

12.8

LTV %

LTV %

49.1

71

62

50-60

63

65

LTV

Instalment to Income Ratio

39.2

NA

50

30-40

50

0

Source: Company, Angel Research

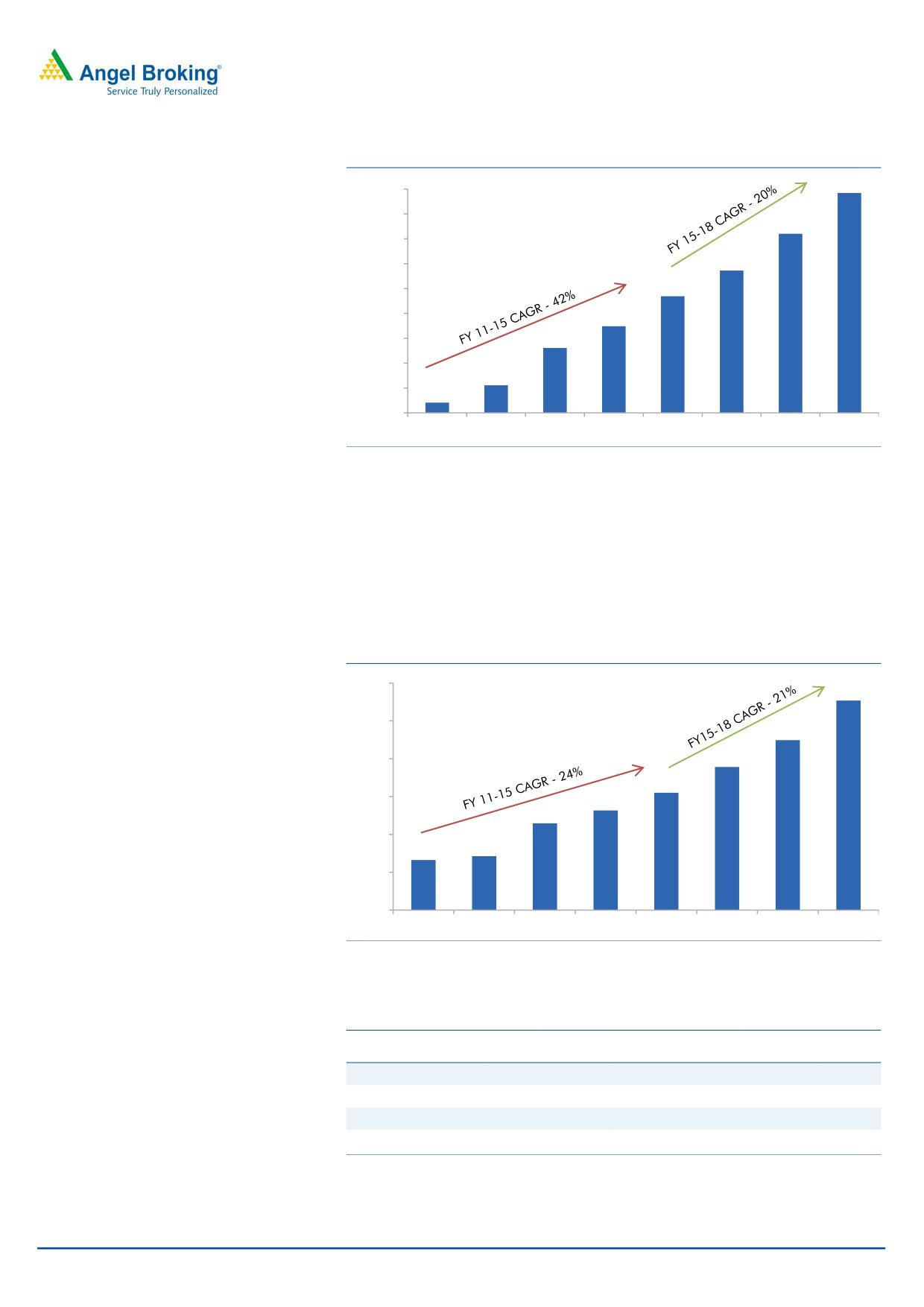

Company expected to report AUM CAGR of 20% and PAT CAGR of 21.3% over

FY2015-18: DHFL has delivered 39% AUM CAGR over FY2010-15, backed by

increasing geographical penetration and higher incremental average ticket size of

its loans. The company has been able to increase the average ticket size of its loan

portfolio on a continuous basis. The incremental average ticket size, at `17 lakhs,

is ~40% higher than the average ticket size of `12 lakhs for FY2015. In our view,

this higher incremental loan size together with widening market share would

propel growth for the company going ahead.

We expect the company to deliver AUM CAGR of 20% over FY2015-18, as

demand for housing in the middle and low income group is expected to pick up,

on the back of lower interest rates and the governments thrust on affordable

housing.

April 5, 2016

4

Dewan Housing Finance | Initiating Coverage

Exhibit 10: AUM trend ( In Rs Cr )

98,411

100,000

90,000

82,009

80,000

67,221

70,000

56,884

60,000

50,000

44,822

36,117

40,000

30,000

21,095

20,000

14,111

10,000

FY11

FY12

FY13

FY14

FY15

FY16E

FY17E

FY18E

Source: Company, Angel Research

DHFL has maintained healthy asset quality with Gross NPA at 0.99% in FY2015

and decent margins in the range of 2.70% to 2.89% in FY2015 (2.87% in

9MFY2016). As a result it has been able to achieve a 32% CAGR in PAT over

FY2010-15. We do not expect any material change in the asset quality and

margins and hence expect the company to deliver 21.3% growth in PAT over

FY2015-18.

Exhibit 11: PAT growth likely to remain strong

1,200

1,107

1,000

898

757

800

620

600

527

459

400

265

285

200

0

FY11

FY12

FY13

FY14

FY15

FY16E

FY17E

FY18E

Source: Company, Angel Research

Exhibit 12: Comparative AUM of HFCs

India Bulls

Can

HDFC

(` Cr)

DHFL

REPCO LIC Housing

Housing

Fin Homes

Ltd

AUM (31 Dec 2015)

65,962

62,265

7,154

1,17,396

9,895

2,48,097

5 Yr AUM CAGR %

42.1%

36.5%

33.8%

23.3%

34.5%

15.3%

AUM March 2010

9,804

11,023

1,400

38,081

1,887

1,11,763

AUM March 2015

56,884

52,235

6,013

1,08,361

8,302

2,27,700

Source: Company, Angel Research

April 5, 2016

5

Dewan Housing Finance | Initiating Coverage

Increased sourcing of funds from capital markets will help reduce cost of funds:

The company intends to reduce its dependence on bank borrowings and rely more

on capital markets for meeting its funding requirements, which is cost effective and

the same has resulted in lower cost of funds at 10.28% in FY2015 vs 10.85% in

FY2012. During the same period, the share of bank borrowings came down to

58% from 70%, while the share of capital market borrowings went up to 28% from

18%. For 9MFY2016 the cost of funds has further come down to 9.60% vs 10.33%

in the corresponding period of the previous year and the share of funding from

capital markets has increased to 32%.

We believe there is enough headroom for the company to reduce its cost of funds

by migrating from bank loans to other instruments like NCDs as ~`22,000cr

worth of bank loans are due for maturity in the next three years, while some part of

it could be migrated towards other instruments of borrowings.

Exhibit 13: Funding Mix

Cost of Funds

FY10

FY11

FY12

FY13

FY14

9MFY16

Banks & FIs

10.01%

11.41%

11.02%

11.00%

10.81%

10.16%

NHB

7.58%

7.63%

7.99%

8.04%

7.93%

7.59%

Capital Markets

9.72%

9.92%

10.06%

9.84%

9.49%

9.00%

Multilateral Agencies

9.27%

9.79%

10.03%

10.73%

8.56%

8.21%

Fixed Deposits

9.49%

10.04%

10.59%

10.56%

10.34%

9.65%

WACB (Day end)

9.73%

10.85%

10.63%

10.59%

10.28%

9.60%

Source: Company, Angel Research

The company also enjoys AAA rating, the highest financial rating by CARE, which

helps the company in availing to lower cost of funds. We expect the company to be

able to further cut down on its cost of funds with the RBI on a rate cutting spree.

Cuts in the repo rate will reduce the borrowing cost via NCDs, which is a focus

area for the company. Over the next three years the company intends to reduce

the share of bank borrowings in total capital to 45% from the current ~55% and

replace the same via low cost funds raised from the capital markets, primarily

through NCDs.

Exhibit 14: Composition of Funding

FY 2011

FY 2015

FY 2018E

13%

0%

4%

50%

28%

38%

9%

8%

3%

58%

8%

74%

3%

4%

0%

Banks & Fls

NHB

Multilateral Agencies

Fixed Deposits

Capital Markets

Source: Company, Angel Research

April 5, 2016

6

Dewan Housing Finance | Initiating Coverage

Exhibit 15: Maturity profile of borrowings and loans

Borrowings

Market

Housing &

` (In crs)

from Banks

Borrowings

Property Loans

Upto 1 yr

4,574

6,237

2,158

Upto 3 yrs

22,219

13,026

12,901

Upto 5 yrs

28,022

14,962

18,277

Upto 7 yrs

31,285

16,227

26,549

Upto 10 yrs

31,343

16,434

50,852

Above 10 yrs

-

-

-

Total

31,483

17,438

51,040

Source: Company, Angel Research

NIM likely to stabilize going ahead: DHFL’s NIM has improved on the back of

lower cost of funds through higher incremental funding from low cost NCDs.

However, with housing finance being a very competitive business, we don’t expect

substantial improvement in the NIM and expect the same to cross 3% any time

soon. We believe the company would intend to pass on any cost benefit to its

borrowers and try to gain market share instead of purely focusing on improving its

NIM.

Exhibit 16: Comparative Return Ratios

India Bulls

LIC

Can Fin

HDFC

Name of the Company

DHFL

REPCO

Housing

Housing

Homes

Ltd

ROE % ( 9m FY16 Annualised)

19.3

27

16.1

19.2

16.9

18

ROA % ( 9m FY16 Annualised)

1.6

3.6

2.2

1.52

1.6

2.4

NIM % ( (9mFY16)

2.9

NA

4.4

2.6

3.2

3.9

Cost/ Income

26.3

19.2

21.3

16.3

18.2

7.6

Yield On Assets %

12.6

12.6

12.6

10.8

11.2

11.1

Cost of Funds %

9.6

9.4

9.6

9.2

9.0

8.6

Spread %

3.0

3.2

3.0

2.1

2.2

2.6

Source: Company, Angel Research

Exhibit 17: NIM likely to remain healthy

Exhibit 18: NII growth trend

3.5%

3,000

3.3%

2,431

2,500

3.1%

2.9%

2.9%

2.9%

2.8%

1,993

2.9%

2,000

2.6%

1,621

2.7%

2.5%

2.4%

2.5%

2.3%

1,500

1,256

2.3%

888

1,000

2.1%

678

1.9%

399

500

307

1.7%

1.5%

0

FY11

FY12

FY13

FY14

FY15

FY16E FY17E FY18E

FY11

FY12

FY13

FY14

FY15

FY16E FY17E FY18E

Source: Company, Angel Research

Source: Company, Angel Research

April 5, 2016

7

Dewan Housing Finance | Initiating Coverage

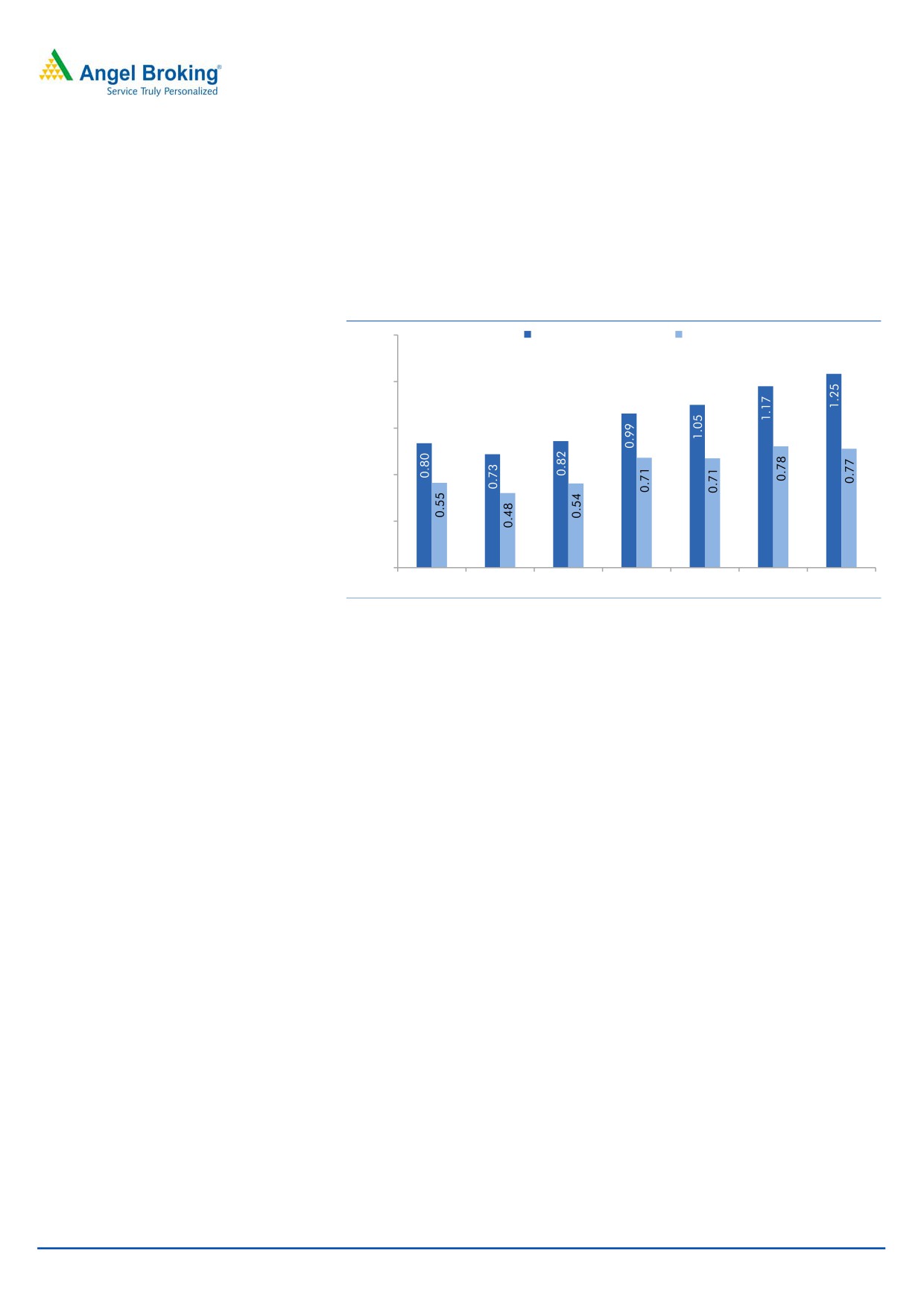

Asset quality stable and expected to continue to be stable: Housing finance

companies have so far maintained very good asset quality across the board.

Despite a sharp slowdown in the economy this is one sector which is witnessing

decent and qualitative growth. Despite high growth rates the asset quality of DHFL

continues to be decent with Gross NPA at 1.05% and Net NPA at 0.71%. We don’t

expect any deterioration in the asset quality in the near term.

Exhibit 19: Gross & Net NPA Ratio

1.50

Gross NPA (%)

Net NPA (%)

1.20

0.90

0.60

0.30

-0.00

FY12

FY13

FY14

FY15

FY16

FY17

FY18

Source: Company, Angel Research

ROE likely to see marginal uptick: Housing finance companies across the board

have witnessed a decline in ROEs in the last three years. Similarly, DHFL has also

undergone a fall in ROE to ~15.3% in FY2016E. However, we expect the reported

ROE to improve to 16.4% by FY2018E from 15.1% in FY2015. The company had

raised zero coupon bonds worth

`3,119cr, of which

~`1,200cr has been

deployed for investments which are not yield generating. These have been used

towards land & building, which show as WIP in the balance sheet. Adjusting for the

implied interest rate on the zero coupon bonds, the ROE of the company should

come down by 80bp/69bp/57bp in FY2016/FY2017/FY2018 to 14.5% / 15.2% /

15.8% respectively.

April 5, 2016

8

Dewan Housing Finance | Initiating Coverage

Exhibit 20: Comparative DuPont of HFCs

Year End FY15

DHFL HDFC LICHFL IndiabullsHsg CanFin

GICHFL

Interest Earned

11.6

11.1

10.1

12.1

11.1

11.7

Provisions

0.2

0.1

0

0.6

-0.2

0.2

Risk Adjusted Interest Earned

11.4

11

10.1

11.5

11.3

11.5

Interest Expended

9

7.8

8

7.8

8.6

8.3

Risk adjusted NII

2.3

3.2

2.1

3.7

2.7

3.2

Other Inc.

0.5

0.5

0.2

2.3

0.4

0.3

Op. Inc.

2.9

3.7

2.4

6

3.1

3.5

Op. Exp

1

0.3

0.4

1.1

0.7

0.9

Op Profit

1.9

3.4

2

4.9

2.4

2.5

PBT

1.9

3.4

2

4.9

2.4

2.5

Taxes

0.7

1.1

0.7

1.1

0.7

0.7

RoA

1.3

2.3

1.3

3.8

1.7

1.8

Leverage

12

11.2

13.6

8.2

11.6

9.6

RoE

15.1

25.7

18.1

31.0

19.7

17.8

Source: Company, Angel Research

*HDFC not adjusted for subsidiary income

Exhibit 21: Dupont Reported Vs Comparative (DHFL)

Reported

Adjusted

Dupont Reported vs

Adjusted for ZCB

FY16E FY17E FY18E

FY2016E FY2017E

FY2018E

NII

2.6

2.7

2.6

2.5

2.6

2.6

(-) Prov. Exp.

0.3

0.4

0.3

0.3

0.3

0.3

Adj NII

2.3

2.3

2.3

2.2

2.2

2.2

Int. Sens. Inc.

2.3

2.3

2.3

2.2

2.2

2.2

Other Inc.

0.4

0.4

0.3

0.4

0.4

0.3

Op. Inc.

2.8

2.7

2.6

2.7

2.6

2.6

Opex

0.9

0.9

0.8

0.9

0.9

0.8

PBT

1.9

1.8

1.8

1.7

1.7

1.74

Taxes

0.6

0.6

0.6

0.6

0.6

0.6

ROA

1.2

1.2

1.2

1.1

1.1

1.1

Leverage

12.4

13.3

13.7

12.6

13.5

13.8

ROE

15.3

15.9

16.4

14.5

15.2

15.8

Source: Company, Angel Research

April 5, 2016

9

Dewan Housing Finance | Initiating Coverage

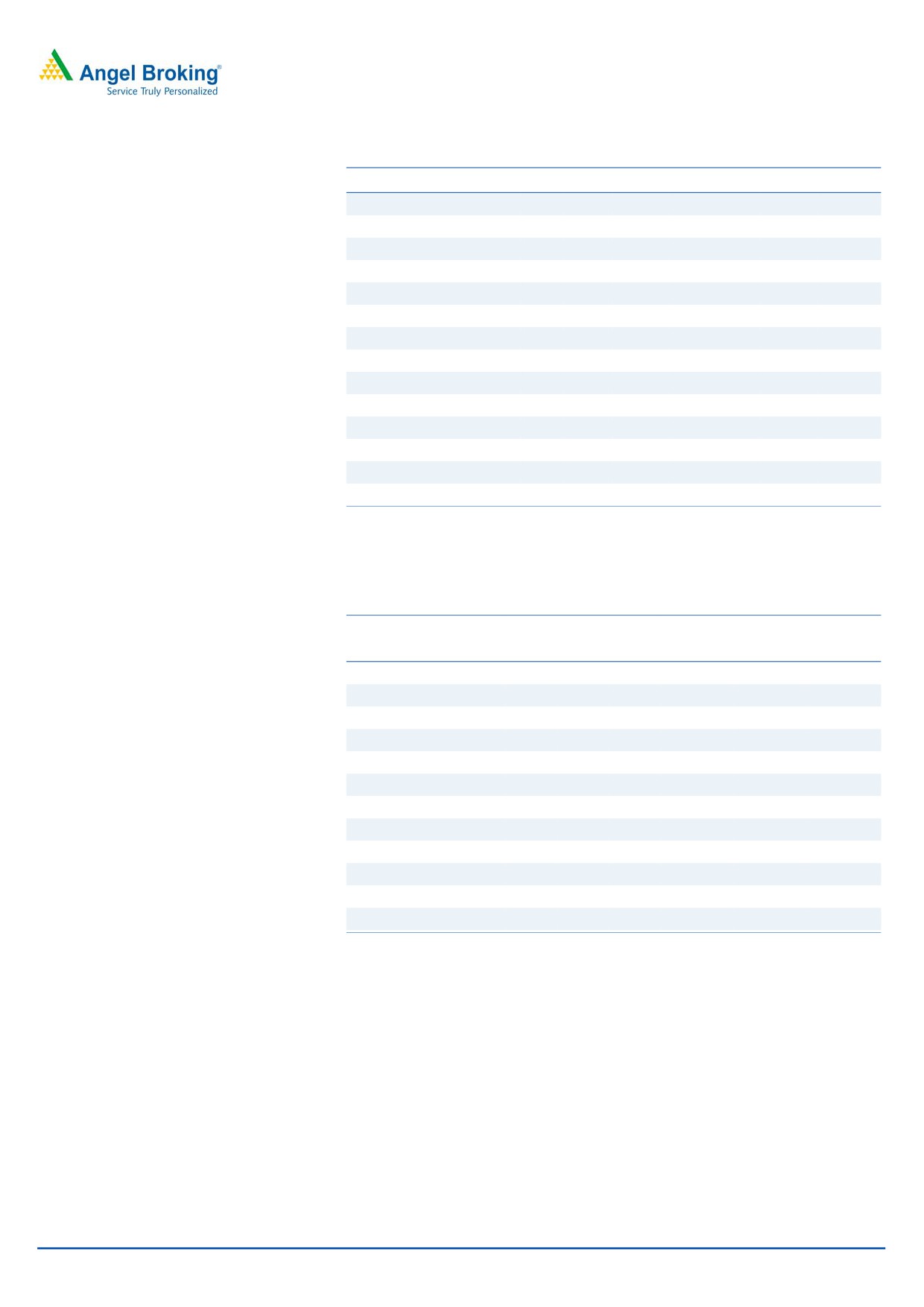

NHB’s move to reduce risk weightage for affordable housing will help further

leveraging: The company’s current leverage (Total Assets/Net worth) stands at

~12x and we see scope for further leveraging after the NHB’s relaxation on risk

weightage on the affordable housing segment. Recently the regulator allowed LTV

upto 90% for home loans upto `30 lakhs as against `20 lakhs earlier. The capital

adequacy of the company is at 16.4% with tier-I CAR of 12.6% for 9MFY2016. The

company has already got some benefit in capital due to the relaxation.

Incrementally we believe this comes as a big relief for players like DHFL which are

primarily engaged in lending to the middle and low income group, which is driving

the demand for the affordable housing segment. Housing finance companies are

required to maintain a CAR of 12%. Looking at the current growth rate it seems the

company will have to raise funds in the next 18 months to maintain the current

capital adequacy. The promoters have issued 2.12cr warrant to themselves worth

`500cr to be converted at a price of `235.5/share. This will help the company in

meeting its capital requirement. However, we believe the company will have to

raise further capital in FY2018 to boost CAR and reduce the high leverage.

Exhibit 22: Capital Adequacy Ratio

25.0%

19.4%

20.0%

17.4%

17.2%

16.5%

16.6%

15.8%

15.0%

14.4%

15.0%

10.0%

5.0%

0.0%

FY11

FY12

FY13

FY14

FY15

FY16E

FY17E

FY18E

Source: Company, Angel Research

Exhibit 23: Exhibit 22: Comparative Analysis

Name of the

India Bulls

LIC

Can Fin HDFC

DHFL

REPCO

Company

Housing

Housing

Homes

Ltd

CAR %

16.4

21.6

24.0

15.5

21.1

17.7

Tier I

12.6

18.8

NA

12.5

19.5

14.2

Gross NPAs% (9M FY16)

1.0

0.8

1.3

0.6

0.3

0.6

Net NPAs% ( 9M FY16)

0.7

0.4

0.5

0.3

0.0

0.0

Source: Company, Angel Research

April 5, 2016

10

Dewan Housing Finance | Initiating Coverage

Outlook and valuation

On a conservative side, we have factored in interest cost on the entire `1,200cr on

Zero Coupon Bond in the P&L. We feel the effect of the same on the ROE for FY17

will be ~69bp at 15.2% against our calculated ROE of 15.9%. The prevalent

benign interest rate scenario will help DHFL in reducing its cost of funds and this

we believe will help in sustaining the ROE at the current level in the long run. The

centre’s and NHB’s move to reduce risk weight on the affordable home loans

segment will allow housing finance companies to incase their leverage and this will

act as an additional growth driver.

The stock is trading at 0.8x FY2018E Adj BV which is lower than its 10-year

historical median P/ABV multiple of 1.07x while its 10-year historical range has

been 0.88x -1.39x. We expect the company to post a healthy loan book CAGR of

20% over FY2015-18E, which is likely to reflect in earnings CAGR of 21.3%, over

the same period. The stock currently trades at 0.8x FY2018E ABV. We recommend

Buy on the stock, with a target price of `270.

Exhibit 24: One-year forward P/B band

350

300

250

200

150

100

50

0

Price (`)

0.5x

0.75x

1x

1.25x

1.5x

Source: Company, Angel Research

Exhibit 25: Comparative Analysis:

Parameters (` Cr)

DHFL India Bulls Housing

REPCO LIC Housing

Can Fin Homes

HDFC Ltd

5 Yr PAT CAGR %

32.8

44.0

22.9

19.2

17.1

16.2

PAT March 2010

151

307

44

662

39

2,826

PAT March 2015

621

1,901

123

1,591

86

5,990

CAR %

16.4

21.6

24.0

15.5

21.1

17.7

Borrowings (March 2015)

48,881

45,556

5,104

83,217

6,941

1,30,860

Net worth (March 2015)

4,636

6,492

812

7,818

772

30,970

Leverage

10.5

7.0

6.3

10.6

9.0

4.2

Gross NPAs% (9M FY16)

1.1

0.8

1.3

0.6

0.3

0.6

Net NPAs% ( 9M FY16)

0.7

0.4

0.9

0.3

0.0

0.0

Cost/ Assets

0.9

1.4

0.9

0.3

0.7

0.3

CMP

189

613

626

467

1,152

1,103

P/ BV

1.1

2.5

4.2

2.6

3.6

4.9

Source: Company, Angel Research

April 5, 2016

11

Dewan Housing Finance | Initiating Coverage

Key Risk & Concern:

The company has ~ `3,119cr of Zero Coupon Bonds on its balance sheet, out of

which `800cr has been earmarked for the construction of corporate office in

Mumbai. The amount currently doesn’t earn interest. However, post maturity of the

bond we believe the company will have to pay interest on it as it will have to be

replaced with fresh debt, which so far was not being accounted in the P&L account.

In the absence of any income generation from the above investments, we believe it

will be RoE dilutive for the company.

Company Background

DHFL—a leading housing finance company in India

Dewan Housing was established in 1984 by late Shri Rajesh Kumar Wadhawan.

DHFL is a dominant player in niche markets (tier II & III cities) with strong foothold

in the limited competition low and middle income (LMI) segment. After the

acquisition and merger of First Blue Home Finance, DHFL also now caters to the

middle and upper middle income group. The company operates in the mortgage

financing business where the growth and asset quality have remained healthy over

the past few years.

The company has emerged as a one-stop-shop for its customers’ financial needs,

extending beyond home loans. The company has a presence in the education

loans, life insurance, and mutual funds segments through Avanse Education Loans,

DHFL Pramerica Life Insurance and DHFL Pramerica Asset Managers Pvt Ltd,

respectively.

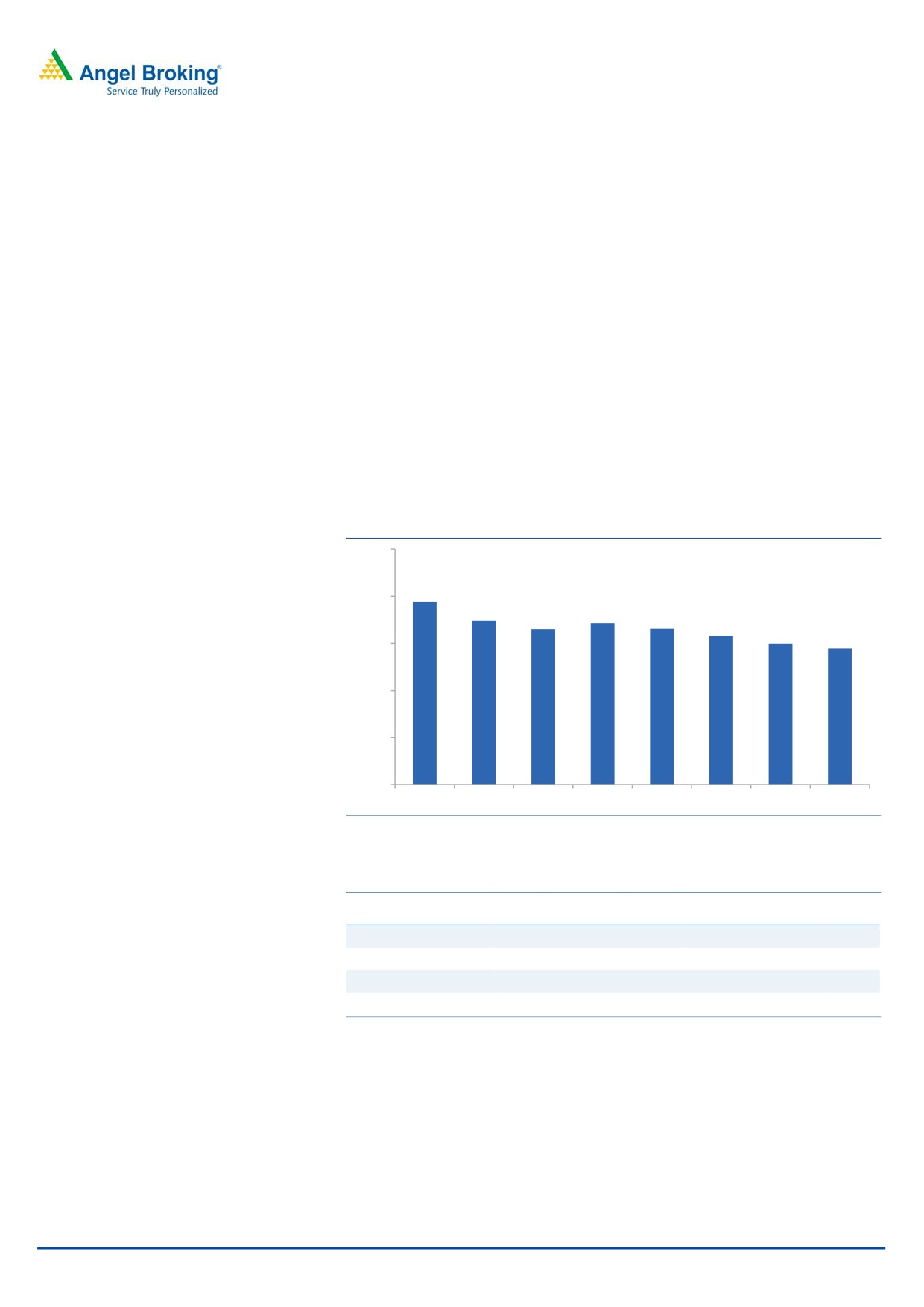

It is India’s third largest private sector housing finance company with an AUM of

`65,962cr as on 31st December, 2015. The company has a well diversified loan

book with housing loans accounting for the largest share at 77%, followed by LAP

(16%), project loans (5%) and loans to SME (2%) (as of 31st December, 2015).

DHFL currently has a strong distribution network with pan-India presence and

2 international representative offices in the UK and the UAE. It operates via a large

distribution network of 362 company operated centers across India and 357

locations through alliance partners with the distribution network focused primarily

on tier II and tier III locations.

Exhibit 26: Geographical Presence

Exhibit 27: Strong Branch Expansion

400

362

350

299

300

16%

300

233

250

193

200

21%

63%

150

100

50

0

West

North, Eastern, Central

South

2011

2012

2013

2014

2015

Source: Company, Angel Research

Source: Company, Angel Research

April 5, 2016

12

Dewan Housing Finance | Initiating Coverage

Key Management Personnel

Mr Kapil Wadhawan (CMD): Mr Wadhawan is an MBA from Edith Cowan

University (Australia). He was appointed as the MD in 2000 and as CMD in 2009.

He has been one of the driving forces behind the group when the AUM surged

from ~`5,000cr to ~`50,000cr over 6 years.

Mr Harshil Mehta (CEO): Mr Mehta was the MD & CEO of Aadhar Housing

Finance since the company’s inception in 2011 till January 2015. He then

assumed office of the CEO at DHFL.

Mr GP Kohli, (Independent Director): Mr Kohli was the former MD of LIC and has

extensive experience in the field of insurance, housing, HRD and IT.

Mr V.K Chopra (Independent Director): Mr Chopra was former CMD, Corporation

Bank & SIDBI. He was also the former executive director of Oriental Bank of

Commerce and former whole time member of SEBI.

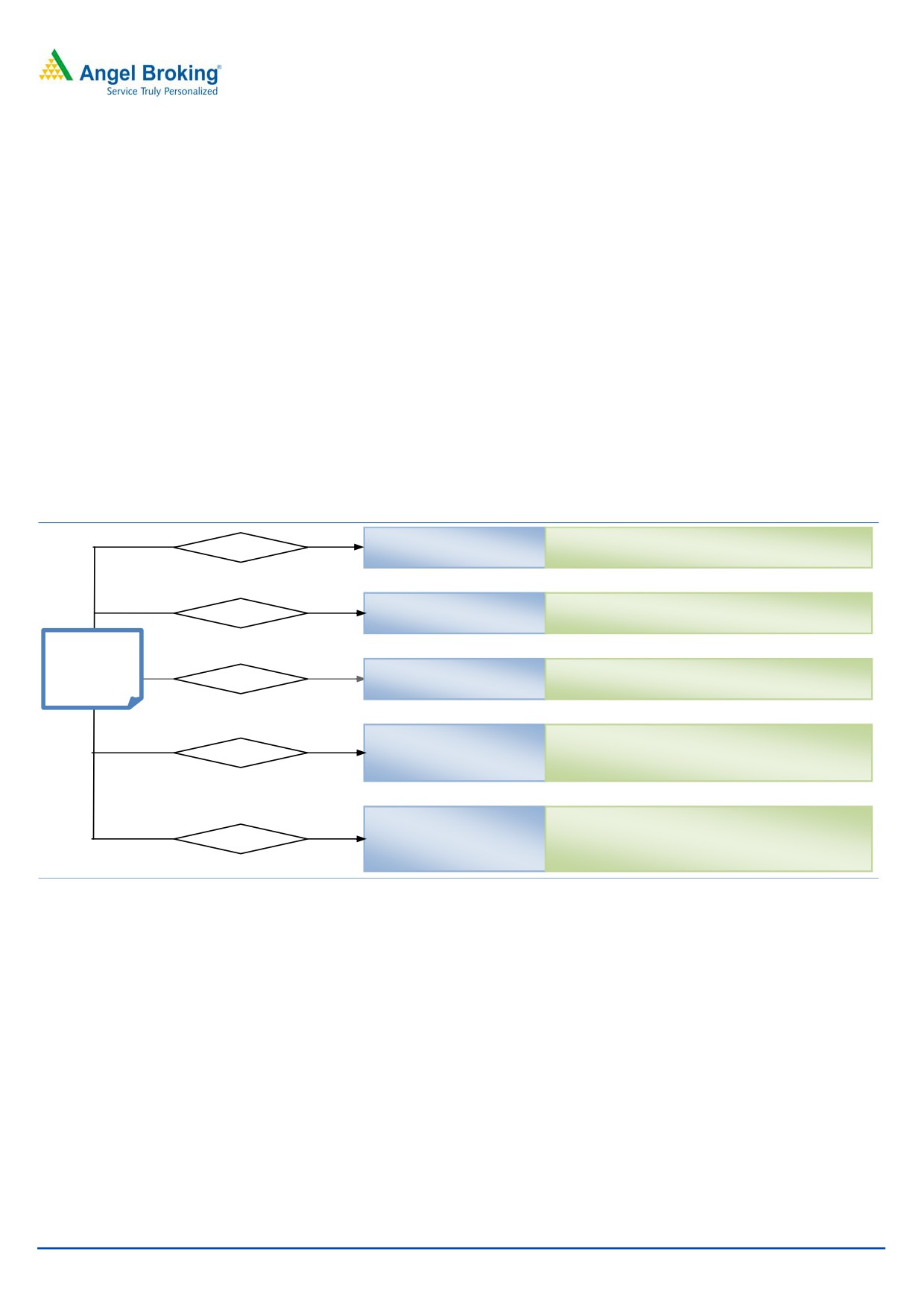

Exhibit 28: Company Structure - Associates & Joint Ventures (JV’s)

DHFL Vysya Housing

-Mainly caters to the LMI segment in

9.47%

Finance

south India

Aadhar Housing

-Caters to LIG & EWS segment, majorly

14.90%

in a developing stage

Finance

DHFL

AUM:

Avanse Education

-Provides education loans across 8

48.39%

`660 bn

Loans1

major markets

DHFL Pramerica Life

-Provides life insurance

50.00%

Insurance

-JV with Prudential Financial (owning

26% stake)

DHFL Pramerica

-Provides asset management

50.00%

Asset Managers

-JV with Prudential Financial which

Private Limited

owns 50% stake

Source: Company, Angel Research

April 5, 2016

13

Dewan Housing Finance | Initiating Coverage

Industry Overview

The new government’s aim of providing housing for all by 2022 has the potential

to create demand for 60mn new affordable housing units in the next 8 years.

Strengthening its focus on housing for all, the government has allowed additional

interest deduction of `50,000 for loans upto `35 lakhs, with property cost not

exceeding `50 lakhs.

These additional deductions will give a fillip to the mid-end housing segment in

both urban and semi-urban areas and housing finance companies are likely to see

accelerated growth in loan demand on this account. DHFL having a wide presence

in the tier II and tier III cities with a focus on mid and low income group segment is

likely to be a key beneficiary of the above efforts of the government.

Exhibit 29: Housing Industry Data

Urban Housing

Rural Housing

Category

Shortage (in mn)

% to Total Category

Shortage (in mn)

% to Total

Economically Weaker Section

10.55

56.2

Below Poverty Line

39.3

90

Lower Income Group

7.41

39.5

Above Poverty Line

4.37

10

Middle Income Group

0.82

4.37

Total

18.78

100

43.67

100

Source: Company, Angel Research

April 5, 2016

14

Dewan Housing Finance | Initiating Coverage

Income statement (standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

FY2018E

NII

888

1,256

1,621

1,993

2,431

- YoY Growth (%)

30.9

41.5

29.0

22.9

22.0

Other Income

296

265

271

284

304

- YoY Growth (%)

5.8

(10.5)

2.1

5.0

7.0

Operating Income

1,184

1,522

1,892

2,277

2,735

- YoY Growth (%)

23.6

28.5

24.3

20.3

20.1

Operating Expenses

384

480

560

649

744

- YoY Growth (%)

26.2

25.2

16.6

15.8

14.7

Pre - Provision Profit

801

1,041

1,332

1,628

1,991

- YoY Growth (%)

22.4

30.1

27.9

22.2

22.3

Prov. & Cont.

66

99

184

264

310

- YoY Growth (%)

47.7

48.7

85.8

44.1

17.4

Profit Before Tax

734

943

1,149

1,364

1,681

- YoY Growth (%)

20.5

28.4

21.8

18.7

23.2

Prov. for Taxation

206

322

392

466

574

- as a % of PBT

28.1

34.1

34.1

34.1

34.1

PAT

527

620

757

898

1,107

- YoY Growth (%)

14.8

17.8

22.0

18.7

23.2

Balance sheet (standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Share Capital

128

146

292

292

313

Reserve & Surplus

3,447

4,490

4,983

5,741

7,154

Loan Funds

33,890

40,526

49,800

61,730

76,519

- Growth (%)

23.5

19.6

22.9

24.0

24.0

Other Liab. & Prov.

6,465

9,557

12,776

15,015

17,819

Total Liabilities

43,930

54,718

67,851

82,778

1,01,805

Investments

721

1,006

1,248

1,522

4,076

Advances

38,651

48,789

60,499

73,808

88,570

- Growth (%)

19.3

26.2

24.0

22.0

20.0

Fixed Assets

988

985

1,221

1,490

1,832

Other Assets

3,569

3,938

4,883

5,958

7,327

Total Assets

43,930

54,718

67,851

82,778

1,01,805

April 5, 2016

15

Dewan Housing Finance | Initiating Coverage

Ratio analysis (standalone)

Y/E March

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Profitability ratios (%)

NIMs

2.4

2.8

2.9

2.9

2.9

Cost to Income Ratio

32.4

31.6

29.6

28.5

27.2

RoA

1.3

1.3

1.2

1.2

1.2

RoE

15.5

15.1

15.3

15.9

16.4

Asset Quality (%)

Gross NPAs

0.8

1.0

1.1

1.2

1.3

Net NPAs

0.5

0.7

0.7

0.8

0.8

Provision Coverage

33.5

28.7

32.8

33.1

38.6

Per Share Data (`)

EPS

20.5

21.3

25.9

30.8

35.4

ABVPS (75% cover.)

129.0

143.7

171.2

193.8

225.1

DPS

1.6

1.1

0.7

0.8

0.9

Valuation Ratios

PER (x)

8.6

8.3

6.8

5.8

5.0

P/ABVPS (x)

1.4

1.2

1.0

0.9

0.8

Dividend Yield

0.9

0.6

0.4

0.5

0.5

DuPont Analysis

NII

2.2

2.5

2.6

2.6

2.6

(-) Prov. Exp.

0.2

0.2

0.3

0.4

0.3

Adj. NII

2.1

2.3

2.3

2.3

2.3

Treasury

0.0

0.0

0.0

0.0

0.0

Int. Sens. Inc.

2.1

2.4

2.3

2.3

2.3

Other Inc.

0.7

0.5

0.4

0.4

0.3

Op. Inc.

2.8

2.9

2.8

2.7

2.6

Opex

1.0

1.0

0.9

0.9

0.8

PBT

1.8

1.9

1.9

1.8

1.8

Taxes

0.5

0.7

0.6

0.6

0.6

RoA

1.3

1.3

1.2

1.2

1.2

Leverage

11.7

12.0

12.4

13.3

13.7

RoE

15.5

15.1

15.3

15.9

16.4

April 5, 2016

16

Dewan Housing Finance | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Dewan Housing Finance Corporation

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

April 5, 2016

17