2QFY2019 Result Update | HFC

Dec 12, 2018

Dewan Housing Finance Ltd

BUY

CMP

`205

Performance Highlights

Target Price

`300

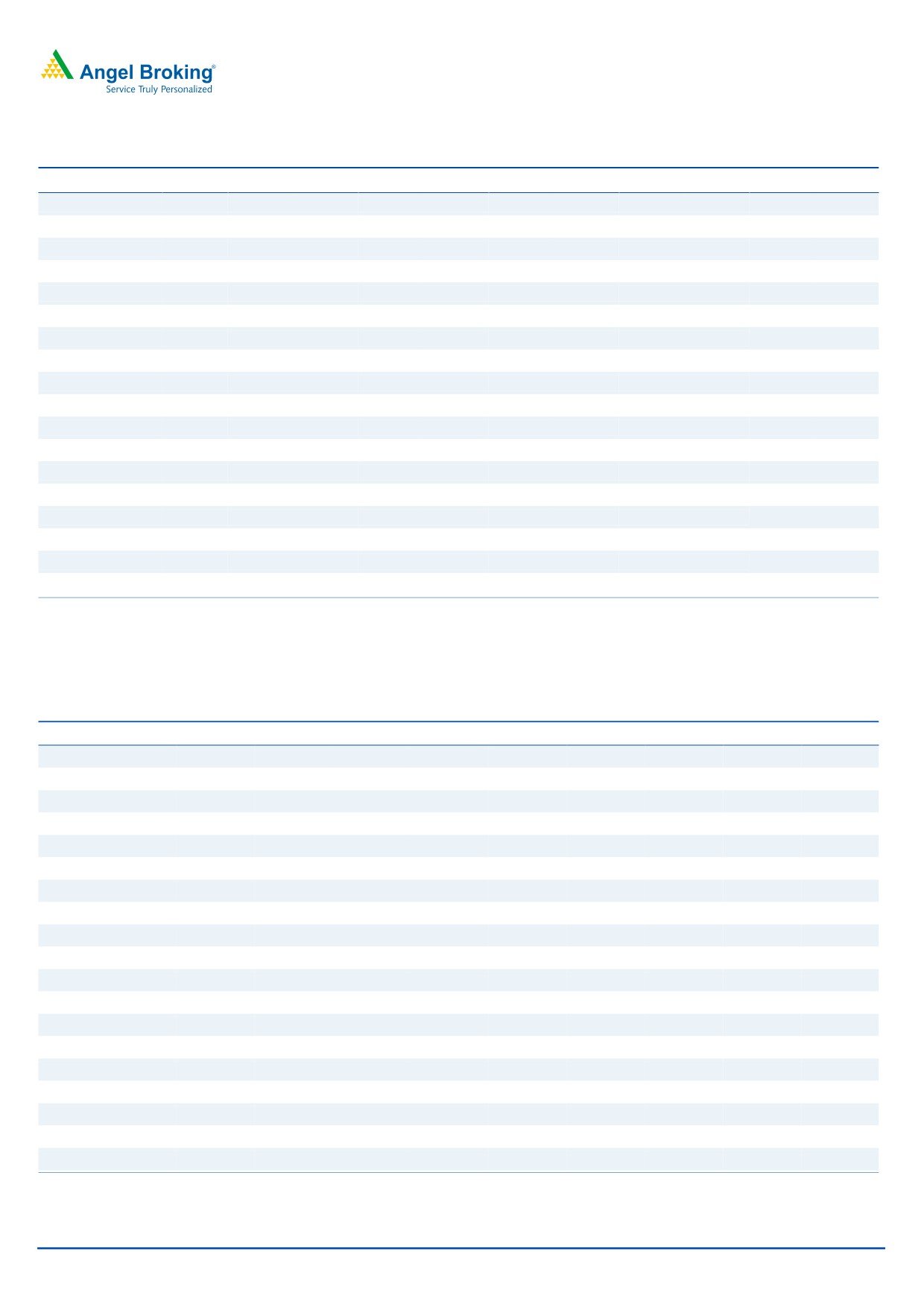

Particulars (` cr)

2QFY19

1QFY19

% chg (qoq)

2QFY18

% chg (yoy)

Investment Period

12 Months

NII

831

824

0.9

576

44.3

Pre-prov. profit

766

728

5.2

505

51.6

PAT

439

435

1.0

288

52.3

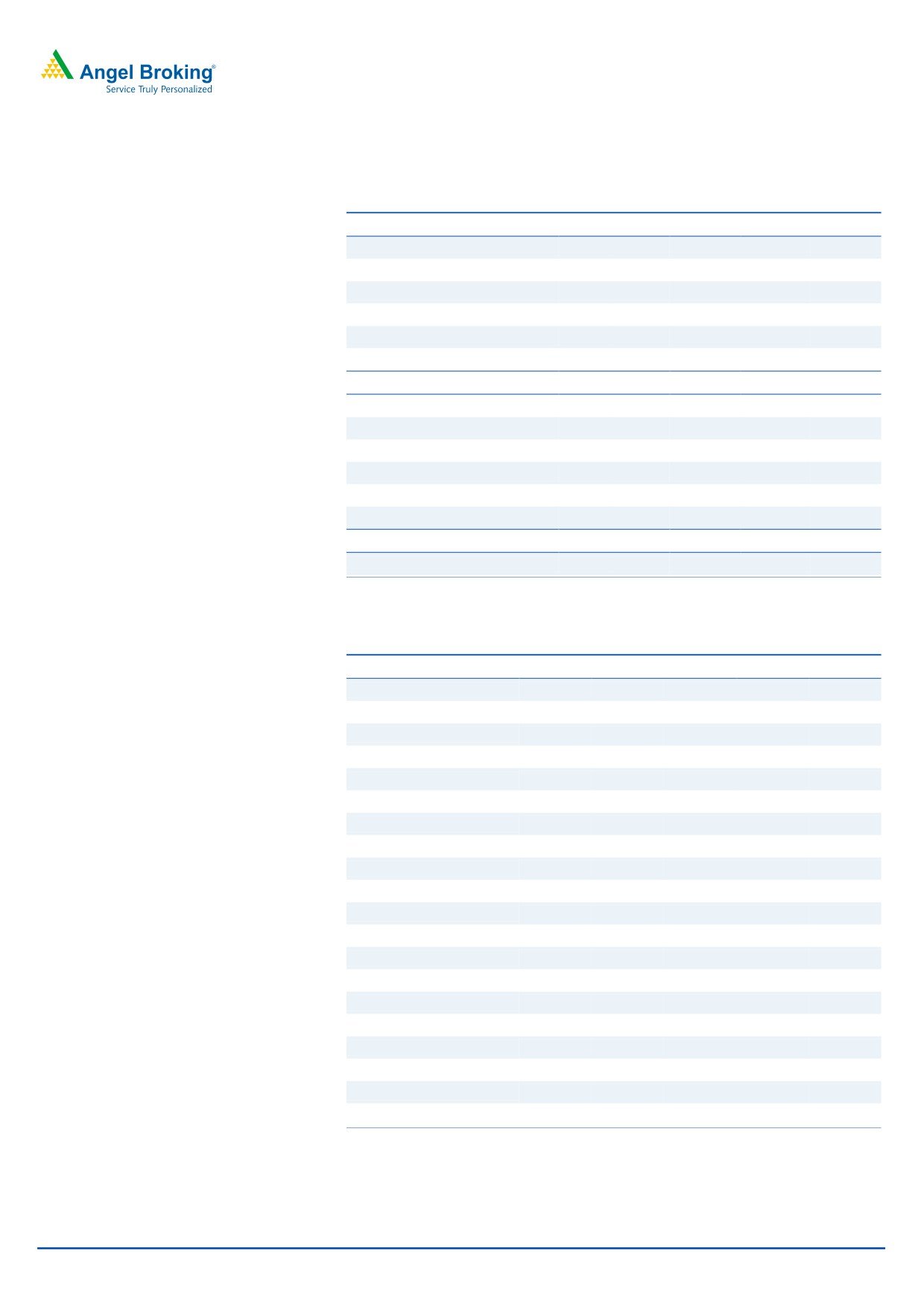

Stock Info

Source: Company, Angel Research

Sector

HFC

Dewan Housing Finance (DHFL) posted steady operating performance yet again in

Market Cap (` cr)

6,314

2QFY18, however, liquidity issues began at the end of the quarter. DHFL’s

Beta

2.3

business grew in the quarter with a 35% yoy rise in loan book to `1,10,100cr.

52 Week High / Low

690/176

Further, in-line with the loan book, AUMs also increased by 38% yoy in the

Avg. Daily Volume

18,70,500

quarter. At the bottom-line, the company’s net profit grew by 52%, aided by steady

Face Value (`)

10

growth of 44% in net interest income, surge in other income and a reduction in

BSE Sensex

35,673

Nifty

10,694

cost with respect to income, which decreased by 80bps to 24.3%.

Reuters Code

DWNH.NS

Asset quality intact despite higher advances; however liquidity issues to impact

Bloomberg Code

DEWH.IN

growth: During 2QFY19, the company’s AUM grew by 24%, 70%, 56% and 101%

in home loans, LAP, corporate loan and SME loans respectively. Asset quality

Shareholding Pattern (%)

remained strong (GNPA - 0.96%) despite the company’s loan growth being

aggressive. The borrowings increased by 26% yoy, while the calculated cost of

Promoters

39.2

funds increased by 26bps to 9.07%. The mix in borrowing remained largely

MF / Banks / Indian Fls

9.5

unchanged with banks accounting for 42% of total borrowings, followed by capital

FII / NRIs / OCBs

20.5

markets (40%) and others (18%).

Indian Public / Others

16.3

Current liquidity issue has led the company to recalibrate business strategy. Here

on, management will focus more on retail lending and reduce project finance

from current 17% to 5% in next 4 quarters. The rising cost of funds and stiff

Abs. (%)

3m 1yr

3yr

competition would restrict it to pass on cost and will lead to compression in

Sensex

3.5

8.3

39.7

spread. We expect AUM growth to moderate for next 2 quarters considering

DHFL

(68.9)

(66.6)

(8.2)

current liquidity tightness. We will continue to closely monitor developments on

funding availability and performance of LAP/project finance book.

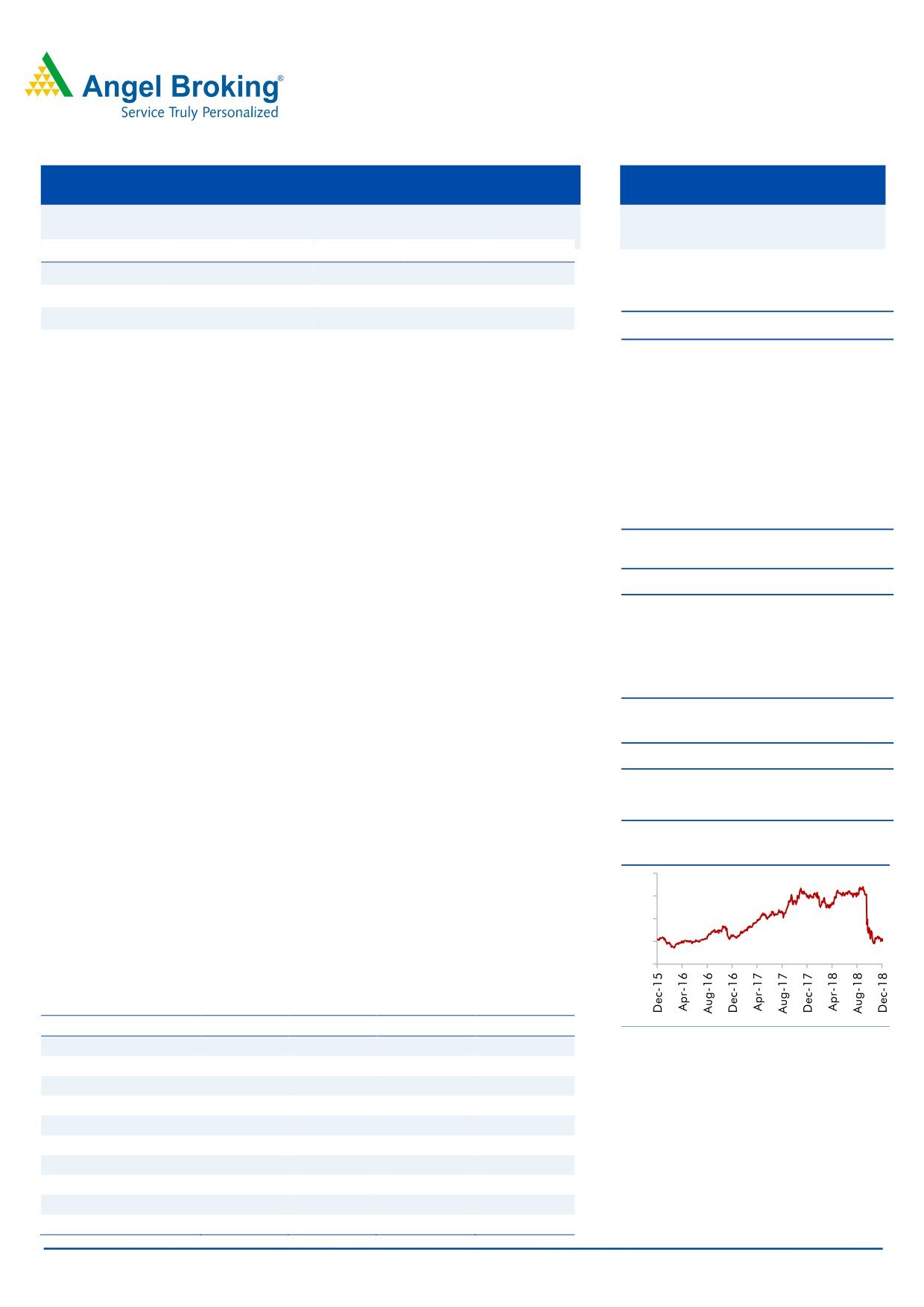

3-year price chart

Outlook & Valuation: Current liquidity issue would completely reset midterm

800

growth path and return ratios. We expect loan book to slowdown significantly over

600

FY18-20, driven by rising cost of funds. Considering, the above parameters, we

400

have moderated our loan growth expectations for the company from 30% to 5%

200

for FY2019E. We maintain our BUY on the stock, with our target price of `300.

0

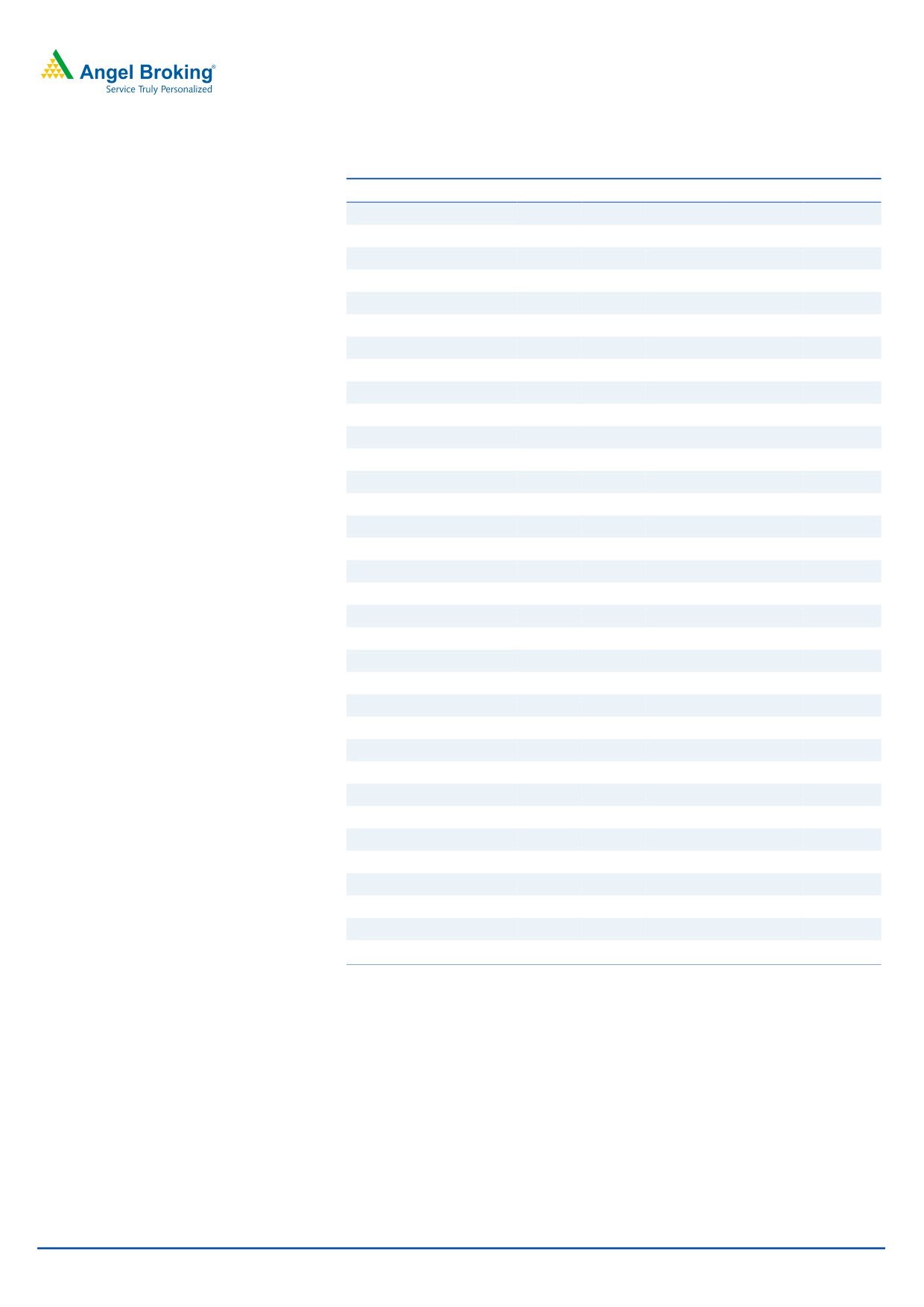

Key financials (Standalone)

Y/E March (` cr)

FY2017

FY2018E

FY2019E

FY2020E

Source: Company, Angel Research

NII

1,859

2,460

2,674

2,691

% chg

26%

32%

9%

1%

Net profit

927

1,174

1,078

1,073

% chg

27%

27%

-8%

-1%

NIM (%)

2.4

2.5

2.4

2.3

EPS (`)

30

37

34

34

P/E (x)

7

5

6

6

Jaikishan Parmar

P/ABV (x)

0.8

0.8

0.6

0.6

022 - 39357600 Ext: 6810

RoA (%)

1.2

1.2

1.0

1.0

RoE (%)

14

14

11

10

Source: Company, Angel Research; Note: CMP as of Dec 12, 2018

Please refer to important disclosures at the end of this report

1