IPO Note | FMCG

October 12, 2015

Coffee Day Enterprises

NEUTRAL

Issue Open: October 14, 2015

IPO Note - Valuation expensive

Issue Close: October 16, 2015

Coffee Day Enterprises Ltd (CDEL) owns the coffee chain - Café Coffee Day, and is

Issue Details

the largest coffee retail company in India. The company also has diversified

business interests through its subsidiaries across segments like logistics, financial

Face Value: `10

services, hospitality, and technology parks.

Present Eq. Paid up Capital: `170.9cr

Strong brand equity with a substantial market presence: The company has strong

Fresh Issue**:3.5cr Shares

brand equity through its retail coffee chain - Café Coffee Day, which was ranked

Post Eq. Paid up Capital: `206.0cr

second in the Most Trusted Brands in the food service retail category in India by

The Economic Times, BE Survey, 2014. Café Coffee Day outlets enjoy wide

Market Lot: 45 Shares

preference and loyalty among the youth in the country, ie people in the age profile

Fresh Issue (amount): `1,150cr

of less than 35 years. Considering that this age group constituted ~65% of the

overall population of India as of FY2013 (source: Technopak, March 2015), the

Price Band: `316-328

company is in an advantageous position to leverage its business. Over the years,

Post-issue implied mkt. cap `6,510cr*-

the company has been successfully able to create a strong brand on its own

6,757cr**

without any international tie-ups. Its market share in terms of number of chained

Note:*at Lower price band and **Upper price band

café outlets as of December 31, 2014, stood at ~46%.

Strong pan-India coffee retail network targeting multiple consumption points and

Book Building

customer segments: Since the opening of the first outlet in 1996 in Bengaluru, the

QIBs

50%

Café Coffee Day network has expanded to 1,538 outlets, covering over 219 cities.

In addition, the company has 561 Coffee Day Xpress kiosks across 12 cities and

Non-Institutional

15%

412 fresh & ground (F&G) outlets across five states in India (as of June 30, 2015).

Retail

35%

The company also has 30,916 vending machines (as of June 30, 2015) which

serve corporate and institutional clients all over India. Through multiple

consumption points, the company covers high street malls, petrol stations,

Post Issue Shareholding Pattern(%)

highways, airports, hospitals, educational institutions and tourist attractions.

Promoters Group

52.6

Outlook and Valuation: CDEL, on a consolidated basis, has reported ~30% CAGR in

MF/Banks/Indian

revenue over FY2010-15 to `2,479cr. On the EBITDA front, the company reported a

FIs/FIIs/Public & Others

47.4

~26% CAGR over the same period. However, on account of higher depreciation and

interest costs, the company incurred a consolidated net loss of ~`87cr in FY2015.

CDEL has diversified across other businesses, which however have failed to deliver

impressive financial performances so far.

Considering negligible profits/reported losses of subsidiaries and the complex

holding structure of the company, we are of the view that the IPO is priced at a

slightly higher valuation. Thus, we recommend a NEUTRAL on the issue. Investors

having conviction in the long term growth prospects of the company and wanting

to tap this perceived opportunity could consider waiting for a possible correction in

the stock price post the listing of the IPO.

Key Financials

Y/E March (` cr)

FY2013

FY2014

FY2015

1QFY16

Net Sales

2,100

2,287

2,479

623

Net Profit/(Loss)

(21)

(77)

(87)

(20)

OPM (%)

14.3

13.9

15.1

16.4

P/BV (x)

6.0

7.0

7.3

-

RoCE (%)

2.8

1.7

2.7

-

Amarjeet S Maurya

EV/Sales (x)

2.9

2.8

2.5

-

+91 22 3935 7800 Ext: 6831

EV/EBITDA (x)

20.0

20.4

16.4

-

Source: Company, Angel Research; Note: *The above numbers are considering subscription at the

upper end of the price band

Please refer to important disclosures at the end of this report

1

Coffee Day Enterprises | IPO Note

Company background

Coffee Day Enterprises Ltd (CDEL) is the parent company of the coffee chain -

Cafe Coffee Day. It is the largest coffee retail company in India and in operation

since 1996. It owns a network of 1,538 cafe outlets, spread across 219 cities in

India. In addition to having the largest chain of cafes in India, the company

operate a highly optimized and vertically integrated coffee business which ranges

from procuring, processing and roasting of coffee beans to retailing of coffee

products across various formats. The company is one of the largest exporters of

Indian coffee beans, primarily to Europe, Japan and the Middle East.

In addition to the coffee business, the company operates select other businesses

that are aimed at leveraging India's growth potential, namely, development of

IT- ITES technology parks, logistics, financial services, and hospitality.

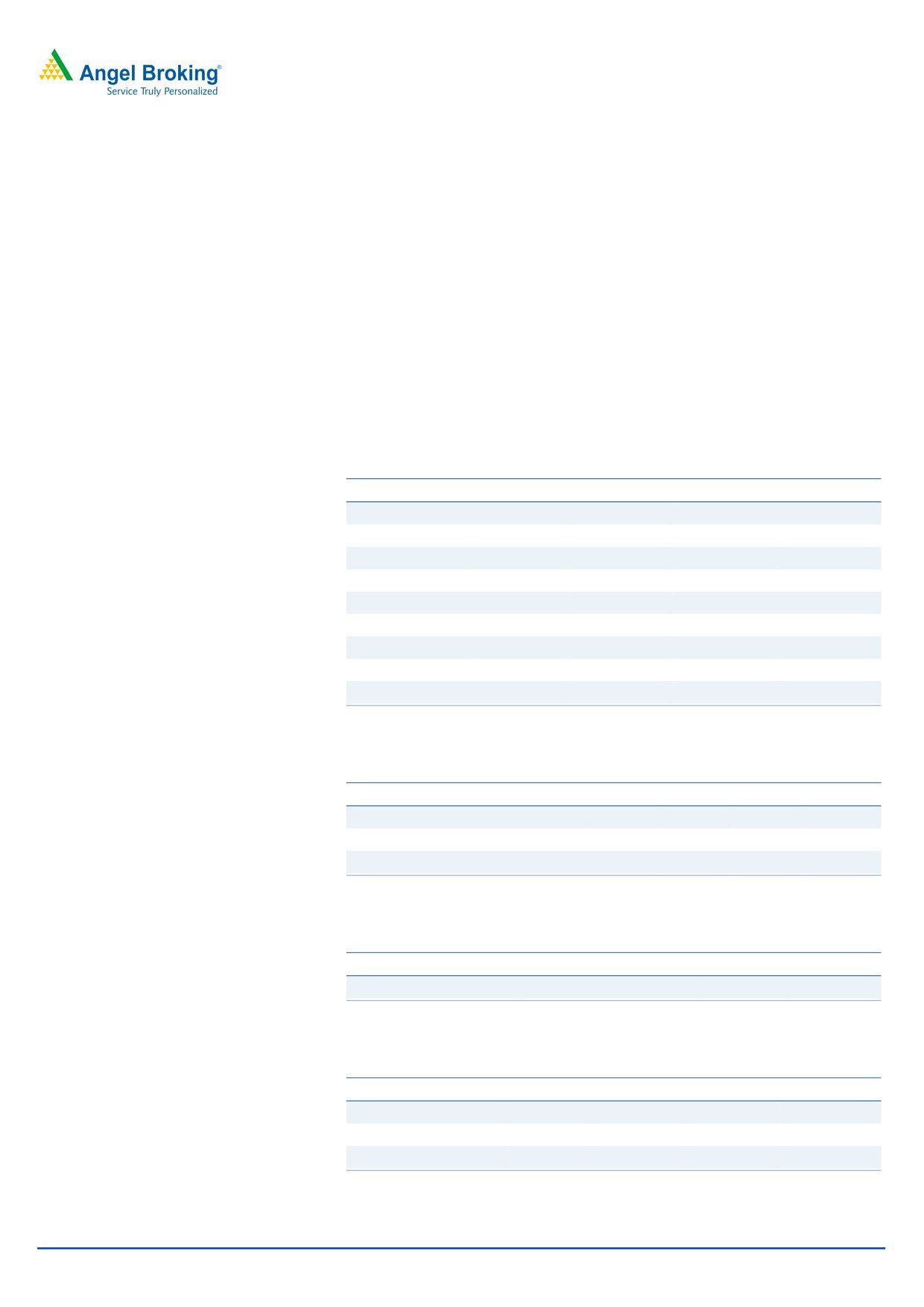

Exhibit 1: Café Network outlets across various cities in India

City in India

FY2013

FY2014

FY2015

1QFY16

Bengaluru

207

220

201

200

Chennai

84

92

94

95

Hyderabad

76

78

74

76

Kolkata

67

77

83

85

Mumbai

187

202

202

204

New Delhi*

208

225

207

211

Pune

74

78

75

74

Others

551

596

582

593

Total

1,454

1,568

1,518

1,538

Source: Company, Angel Research

Exhibit 2: Number of kiosks outlets in India

FY2013

FY2014

FY2015

1QFY16

Company Owned and operated

844

873

546

528

Franchised

75

72

33

33

Total

919

945

579

561

Source: Company, Angel Research

Exhibit 3: Vending machines placed at client premises

FY2013

FY2014

FY2015

1QFY16

Placed at clients premises

21,594

25,561

29,760

30,916

Source: Company, Angel Research

Exhibit 4: Revenue Mix of Café Network outlets

FY2013

FY2014

FY2015

1QFY16

Food

36.7%

36.5%

36.0%

32.7%

Beverages

56.5%

57.5%

59.1%

60.7%

Merchandise

6.8%

6.0%

4.9%

6.7%

Source: Company, Angel Research

October 12, 2015

2

Coffee Day Enterprises | IPO Note

Issue details

The company is raising money through an IPO via the book building process

aggregating to `1,150cr. Shares could be subscribed to in the price band of

`316-328 (face value of shares: `10/- each). The fresh issue of shares will

constitute ~17% (at the upper end of the price band) of the post-issue paid-up

equity share capital of the company.

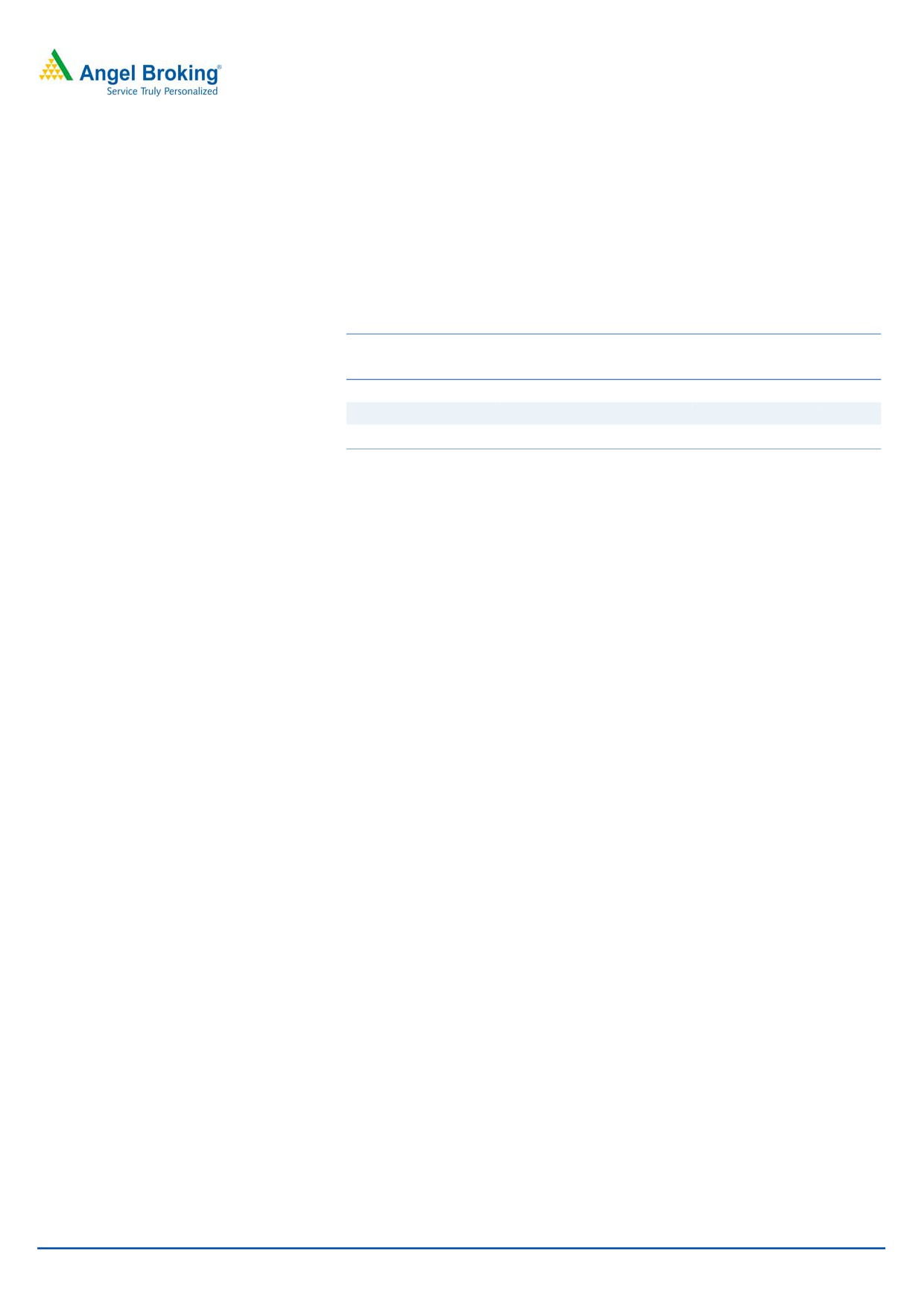

Exhibit 5: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

1082,67,296

63.3

1082,67,296

52.6

Others

626,73,448

36.7

977,34,424

47.4

Total

1709,40,744

100.0

2060,01,720

100.0

Source: Company, Angel Research

Objects of the offer and proposed utilization of IPO proceeds

Setting-up of new Cafe Network outlets and Coffee Day Xpress kiosks: ~`88cr

Manufacturing and assembling of vending machines: ~`97cr

Refurbishment of existing Cafe Network outlets and vending machines:

~`61cr

Setting-up of a new coffee roasting plant facility, along with integrated coffee

packing facility and tea packing facility: ~`42cr

Repayment of loans of the company and subsidiaries: ~`633cr

The balance amount would be utilized towards general corporate purposes

October 12, 2015

3

Coffee Day Enterprises | IPO Note

Key investment rational

Strong brand equity with a substantial market presence

The company has strong brand equity through its retail coffee chain - Café Coffee

Day, which was ranked second in the Most Trusted Brands in the food service retail

category in India by The Economic Times, BE Survey, 2014. Café Coffee Day

outlets enjoy wide preference and loyalty among the youth in the country, ie

among people in the age profile of less than 35 years. Considering that this age

group constituted ~65% of the overall population of India as of FY2013 (source:

Technopak, March 2015), the company is in an advantageous position to leverage

its business. Over the years, the company has been successfully able to create a

strong brand on its own without any international tie-ups. Its market share in terms

of number of chained café outlets as of December 31, 2014, stood at ~46%.

Strong pan-India coffee retail network targeting multiple

consumption points and customer segments

Since the opening of the first outlet in 1996 in Bengaluru, the Café Coffee Day

network has expanded to 1,538 outlets, covering over 219 cities. In addition, the

company has 561 Coffee Day Xpress kiosks across 12 cities and 412 fresh &

ground (F&G) outlets across five states in India (as of June 30, 2015). The

company also has 30,916 vending machines (as of June 30, 2015) which serve

corporate and institutional clients all over India. Through multiple consumption

points, the company covers high street malls, petrol stations, highways, airports,

hospitals, educational institutions and tourist attractions.

Other business segments

Logistics

The company’s subsidiary, Sical Logistics (SLL), in which it holds 53% stake, is one

of the leading logistic service providers with experience of over five decades. The

subsidiary is listed on the BSE and the NSE and has a market cap of around

`937cr. SLL’s surface logistics business encompasses pan-India transportation over

railways and roads, combined with value-added services viz. container freight

station facilities, warehousing, custom clearances and documentation, and

specialized cargo handling facilities.

Financial Services

CDEL holds 85% stake in Way 2 Wealth Securities Pvt Ltd. The subsidiary has

presence in the retail investment advisory business, and provides retail broking,

portfolio management services and wealth management services to its customers.

Hospitality

CDEL owns and operates three luxury resorts in the state of Karnataka. In addition,

it holds a minority stake in and manages a luxury resort in Andaman and Nicobar

islands.

October 12, 2015

4

Coffee Day Enterprises | IPO Note

Technology Parks

CDEL’s wholly owned subsidiary - Tanglin Development Ltd is engaged in the

development and management of technology parks and related infrastructure,

offering bespoke infrastructure facilities for ITITES enterprises. The company has

two technology parks, one in Bengaluru (Global Village) spread over an area of

114 acres (clear title of 91 acres) and another in Mangalore (Tech Bay) spread

over 21 acres. In Bengaluru, the company has developed and leased 2.8mn sq ft

and can further develop approximately 12.3mn sq ft of built-up office space. While

in Mangalore, it has developed and leased 0.3mn sq ft of space and can further

develop 1.8mn sq ft of office space.

Investments

The company also has investments in certain IT-ITES and other technology

companies such as Mindtree, Ittiam, Magnasoft, and Global Edge. It holds 16.8%

equity in Mindtree Solutions, which is listed on the BSE and the NSE.

October 12, 2015

5

Coffee Day Enterprises | IPO Note

Valuation

Coffee Day Enterprises Ltd (CDEL) is the parent company of the coffee chain -

Cafe Coffee Day, and is the largest coffee retail company in India. It owns a

network of 1,538 coffee outlets across 219 cities in India. In addition to the coffee

business, the company operates in areas aimed to leverage on India's growth

potential, namely, development of IT- ITES technology parks, logistics, financial

services and hospitality.

CDEL, on a consolidated basis, has reported ~30% CAGR in revenue over FY2010-15

to `2,479cr. On the EBITDA front, the company reported a ~26% CAGR over the

same period. However, on account of higher depreciation and interest costs, the

company incurred a consolidated net loss of ~`87cr in FY2015. CDEL has diversified

across other businesses, which however have failed to deliver impressive financial

performances so far.

Considering negligible profits/reported losses of subsidiaries and the complex

holding structure of the company, we are of the view that the IPO is priced at a

slightly higher valuation. Thus, we recommend a NEUTRAL on the issue. Investors

having conviction in the long term growth prospects of the company and wanting

to tap this perceived opportunity could consider waiting for a possible correction in

the stock price post the listing of the IPO.

Risks to upside

(a) Faster execution in terms of opening new retail outlets.

(b) Subsidiary companies turning profitable sooner than expected.

October 12, 2015

6

Coffee Day Enterprises | IPO Note

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

1QFY16

Total operating income

2,100

2,287

2,479

623

% chg

8.9

8.4

-

Total Expenditure

1,800

1,968

2,104

521

Raw Materials

606

575

645

164

Cost of integrated logistic services

602

689

673

120

Cost of traded commodities sold

11

47

13

0

Personnel Expenses

205

226

254

77

Others Expenses

376

431

519

160

EBITDA

300

319

375

102

% chg

6.5

17.6

-

(% of Net Sales)

14.3

13.9

15.1

16.4

Depreciation& Amortisation

203

249

266

67

EBIT

97

70

110

35

% chg

(27.4)

55.7

-

(% of Net Sales)

4.6

3.1

4.4

5.7

Interest & other Charges

210

278

326

83

Other Income

50

66

69

12

Recurring PBT

(64)

(142)

(147)

(36)

% chg

122.0

4.0

-

Prior Period & Extraordinary Exp./(Inc.)

-

-

-

-

PBT (reported)

(64)

(142)

(147)

(36)

Tax

10

(3)

12

4

(% of PBT)

(15.8)

2.5

(8.3)

(12.2)

PAT (reported)

(74)

(138)

(159)

(40)

Less: Minority interest (MI)

(7)

(14)

(18)

(2)

Add: Share in profit / (loss) of asso.

60

75

90

23

PAT after MI (reported)

(21)

(77)

(87)

(20)

October 12, 2015

7

Coffee Day Enterprises | IPO Note

Consolidated Balance Sheet Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

1QFY16

SOURCES OF FUNDS

Equity Share Capital

16

16

16

118

Reserves& Surplus

634

540

516

338

Shareholders Funds

650

556

532

456

Minority Interest

488

498

512

514

Total Loans

2,847

3,578

3,550

3,874

Deferred Tax Liability

30

27

29

26

Total Liabilities

4,015

4,659

4,622

4,870

APPLICATION OF FUNDS

Net Block

1,890

1,995

1,981

1,990

Capital Work-in-Progress

749

841

997

1,029

Goodwill

496

492

498

498

Investments

381

431

516

532

Current Assets

1,735

1,934

2,019

2,133

Inventories

162

175

126

110

Sundry Debtors

313

280

334

290

Cash

346

521

743

886

Loans & Advances

766

788

649

665

Other Assets

149

170

168

182

Current liabilities

1,238

1,036

1,392

1,315

Net Current Assets

497

899

628

819

Deferred Tax Asset

1

2

3

3

Mis. Exp. not written off

-

-

-

-

Total Assets

4,015

4,659

4,622

4,870

October 12, 2015

8

Coffee Day Enterprises | IPO Note

Consolidated Cash Flow Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

1QFY16

Profit before tax

(64)

(142)

(147)

(36)

Depreciation

203

249

266

67

Change in Working Capital

(50)

(2)

88

67

Interest / Dividend (Net)

170

245

285

75

Direct taxes paid

(47)

(17)

(21)

(10)

Others

(0)

(27)

1

1

Cash Flow from Operations

212

306

471

163

(Inc.)/ Dec. in Fixed Assets

(930)

(292)

(168)

35

(Inc.)/ Dec. in Investments

(52)

(50)

(85)

(16)

Cash Flow from Investing

(982)

(341)

(253)

20

Issue of Equity

101

-

100

-

Proceeds from / (redemption of)

-

-

-

(71)

preference shares

Inc./(Dec.) in loans

799

362

191

237

Dividend Paid (Incl. Tax)

(3)

(3)

-

-

Interest / Dividend (Net)

(198)

(272)

(303)

(79)

Cash Flow from Financing

700

87

(12)

87

Inc./(Dec.) in Cash

(70)

51

205

270

Opening Cash balances

277

207

258

463

Closing Cash balances

207

258

463

733

Key Ratios

Y/E March

FY2013

FY2014

FY2015

Valuation Ratio (x)

P/CEPS

30.1

35.1

36.5

P/BV

6.0

7.0

7.3

EV/Sales

2.9

2.8

2.5

EV/EBITDA

20.0

20.4

16.4

EV / Total Assets

1.1

1.1

1.0

Per Share Data (`)

Cash EPS

10.9

9.4

9.0

Book Value

55.0

47.1

45.1

Returns (%)

ROCE

2.8

1.7

2.7

Angel ROIC (Pre-tax)

3.5

2.2

3.9

October 12, 2015

9

Coffee Day Enterprises | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

October 12, 2015

10