2QFY2016 Result Update | Mining

November 16, 2015

Coal India

ACCUMULATE

CMP

`338

Performance Highlights

Target Price

`380

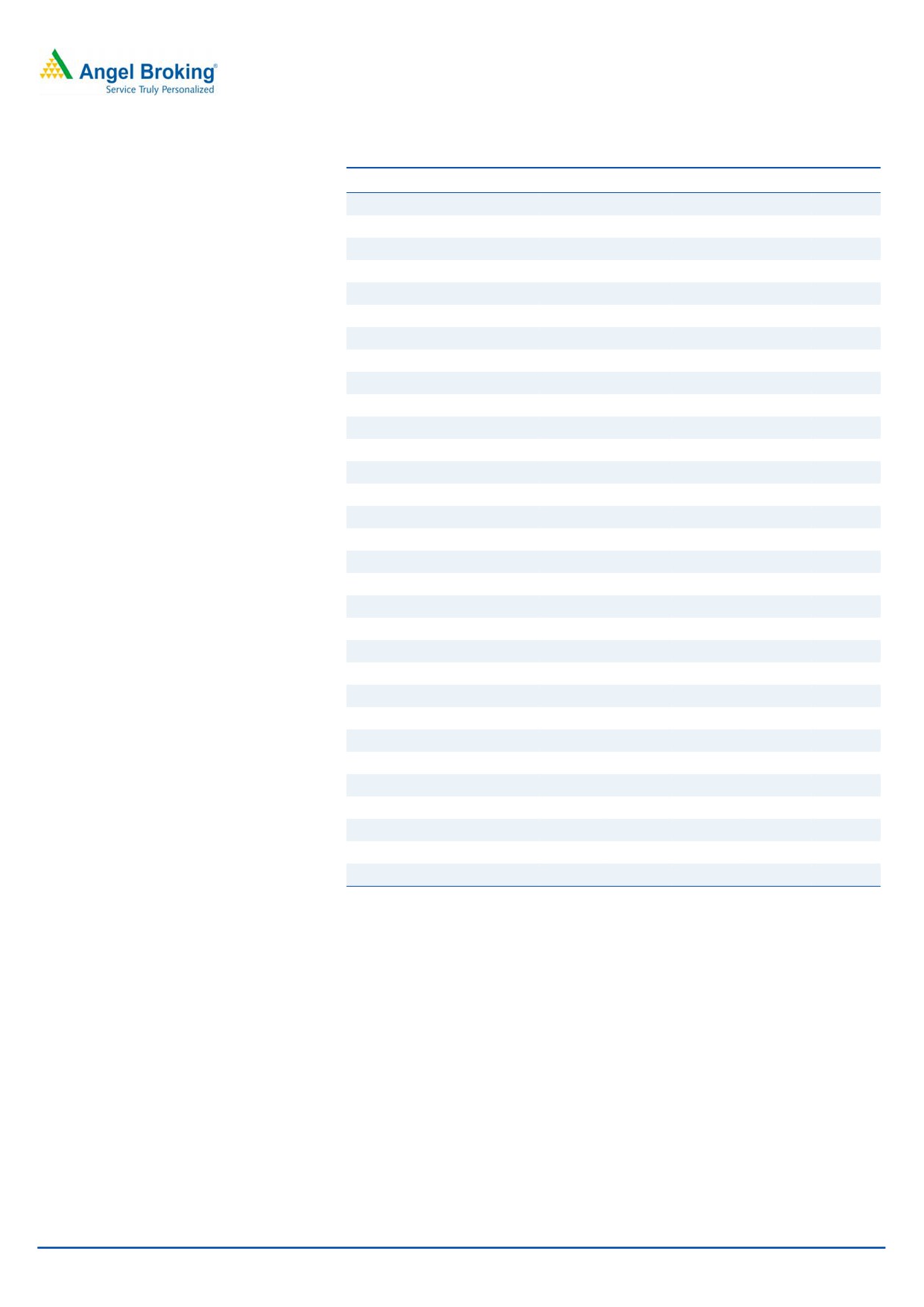

(` cr)

2QFY16

2QFY15

% yoy

1QFY16

% qoq

Investment Period

12 months

Net Sales

16,958

15,678

8.2

18,956

(10.5)

Stock Info

EBITDA

3,008

2,556

17.7

4,944

(39.2)

Sector

Mining

% margin

17.2

15.8

139bp

25.3

(813bp)

Market Cap (` cr)

2,13,272

Net Profit

2,519

2,188

15.2

3,787

(33)

Net Debt (` cr)

(49,805)

Source: Company, Angel Research

Beta

0.7

For 2QFY2016, Coal India (CIL) reported a strong 8% yoy increase in revenue to

52 Week High / Low

447/301

`16,958cr, in line with our estimate of `16,833cr. Off-take volumes were

Avg. Daily Volume

46,02,127

marginally ahead of our expectations at 121.8MT (our estimate was of 119.1MT).

Face Value (`)

10

Off-take was higher in the FSA segment with e-auction and washeries’ volumes in

BSE Sensex

25,611

line with expectations. FSA realizations were in line with expectations at `1,294/T.

Nifty

7,762

However, e-auction realizations came in much lower than expected at `1,788.

Reuters Code

COAL.BO

Blended realization/tonne came in lower than our expectation at `1,392 (1.5%

Bloomberg Code

COAL@IN

lower than our estimate of `1,414), led by the sharply lower e-auction realisation.

Blended realisation declined 2% yoy, while off-take increased 10.2% yoy, resulting

in an 8.2% increase in net sales. The EBITDA, at `3,008cr, came in 3.2% lower

Shareholding Pattern (%)

than our estimate, resulting in a 140bp improvement in EBITDA margin to 17.2%,

Promoters

79.7

marginally lower than our estimate of 17.9%. Net profit at `2,544cr was slightly

MF / Banks / Indian Fls

8.4

ahead of our estimate of `2,445cr.

FII / NRIs / OCBs

9.0

Indian Public / Others

2.9

Outlook and valuation

We reduce our consolidated FY2016 and FY2017 EPS estimates by 12% and 9%,

respectively, in view of the lower than expected realizations and increased

Abs. (%)

3m 1yr

3yr

operating expenses. We expect CIL’s production to increase by 7.1% to 530MT in

Sensex

(7.0)

(8.3)

37.6

FY2016 (538MT earlier) and 572MT in FY2017 (575 MT earlier). We expect e-

CIL

(10.5)

(2.8)

(2.4)

auction realization to remain under pressure led by weakness in global

commodity prices and increased availability of coal in FY2016. We value Coal

3-year price chart

India at 8x FY2017E Adj. EBITDA to arrive at a revised target price of `380 (`400

500

earlier) and retain our Accumulate rating on the stock.

450

Key financials (Consolidated)

400

Y/E March (` Cr)

FY2013

FY2014E

FY2015E

FY2016E

FY2017E

350

Net Sales

68,303

68,810

72,015

76,167

84,130

300

% chg

9.4

0.7

4.7

5.8

10.5

250

Net Profit

17,350

15,110

13,722

14,161

16,314

200

% chg

17.4

(12.9)

(9.2)

3.2

15.2

FDEPS (`)

27.5

23.9

21.7

22.4

25.8

OPM (%)

26.5

23.2

21.1

19.9

22.3

Source: Company, Angel Research

P/E (x)

12.3

14.1

15.5

15.1

13.1

P/BV (x)

4.4

5.0

5.3

5.4

5.3

RoE (%)

39.0

33.2

33.1

35.5

41.0

RoCE (%)

22.0

17.1

15.9

15.3

18.6

Rahul Dholam

EV/Sales (x)

1.8

2.3

2.2

2.1

1.9

Tel: 022- 3935 7800 Ext: 6847

EV/Adj. EBITDA (x)

5.7

8.2

8.4

9.2

7.5

Source: Company, Angel Research: Note CMP as of November 13, 2015

Please refer to important disclosures at the end of this report

1

Coal India | 2QFY2016 Result Update

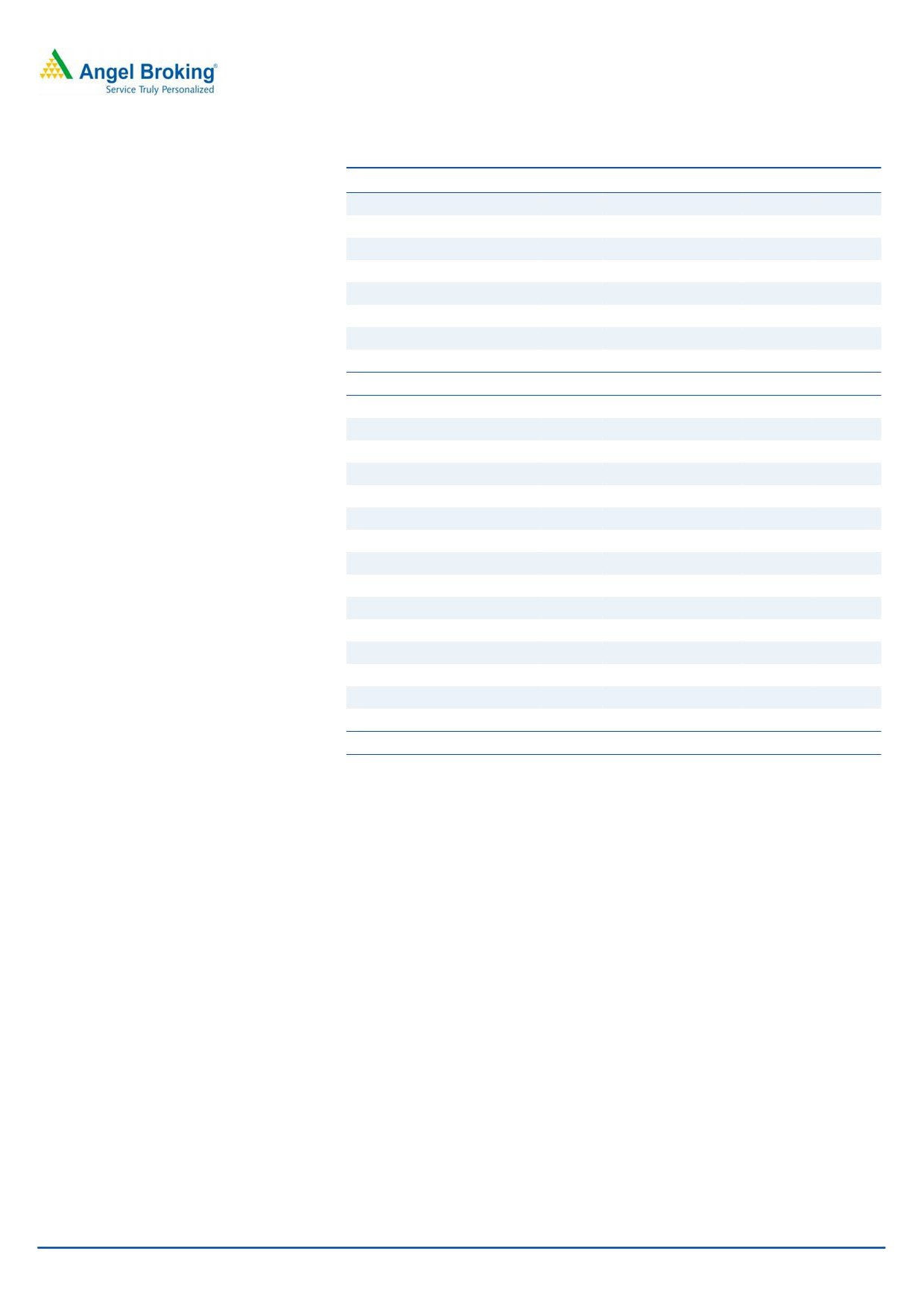

Exhibit 1: 2QFY2016 performance (Consolidated)

Y/E March (` cr)

2QFY16

2QFY15

% yoy

1QFY16

% qoq

FY2015

FY2014

% yoy

Net sales

16,958

15,678

8.2

18,956

(10.5)

72,015

68,810

4.7

Other operating income

532

486

9.4

562

(5.3)

2,105

1,798

17.1

Total Income

17,490

16,164

8.2

19,518

(10.4)

74,120

70,608

5.0

Raw material expenses

2,356

2,423

(2.8)

2,180

8.1

6,726

7,115

(5.5)

(% of Net Sales)

13.9

15.5

11.5

9.3

10.3

Staff cost

7,530

7,287

3.3

7,185

4.8

29,859

27,769

7.5

(% of Net Sales)

44.4

46.5

37.9

41.5

40.4

Power & Fuel

654

585

11.7

588

11.1

2,347

2,282

2.9

(% of Net Sales)

3.9

3.7

3.1

3.3

3.3

Social Overhead

186

129

44.7

177

5.1

405

735

(44.8)

(% of Net Sales)

1.1

0.8

0.9

0.6

1.1

Contractual Expenses

2,254

1,626

38.6

2,490

(9.5)

8,513

6,828

24.7

(% of Net Sales)

13.3

10.4

13.1

11.8

9.9

Other Expenses

1,501

1,558

(3.6)

1,953

(23.1)

8,935

8,118

10.1

(% of Net Sales)

8.9

9.9

10.3

12.4

11.8

Total expenditure

14,481

13,608

6.4

14,574

(0.6)

56,785

52,847

7.5

(% of Net Sales)

85.4

86.8

76.9

78.9

76.8

EBIDTA

3,008

2,556

17.7

4,944

(39.2)

17,335

17,761

(2.4)

EBITDA margin (%)

17.2

15.8

25.3

23.4

25.2

Interest

2

1

42.1

4

(62.3)

7

58

(87.4)

Depreciation

586

536

9.3

558

5.2

2,320

1,996

16.2

Other income

1,431

1,536

(6.8)

1,447

(1.1)

6,571

7,172

(8.4)

Exceptional items

25

5

414.6

(23)

(209.6)

5

1

254.6

Profit before tax

3,877

3,559

8.9

5,807

(33.2)

21,584

22,880

(5.7)

Margin (%)

22.2

22.0

29.8

29.1

32.4

Tax

1,333

1,367

(2.5)

2,043

(34.8)

7,857

7,768

1.2

% of PBT

34.4

38.4

35.2

36.4

34.0

Rep. Net income

2,544

2,192

16.0

3,764

(32.4)

13,727

15,112

(9.2)

Margin (%)

14.5

13.6

19.3

18.5

21.4

Adjusted net income

2,519

2,188

15.2

3,787

(33.5)

1,37,217

1,51,103

(9.2)

Source: Company, Angel Research

Exhibit 2: Consolidated - 2QFY2016 Actual vs Angel estimates

(` cr)

Actual

Estimates

Variation (%)

Net Sales

16,958

16,833

0.7

EBITDA

3,008

3,106

(3.2)

EBITDA margin (%)

17.2

17.9

(65bp)

Adjusted PAT

2,519

2,445

3.0

Source: Company, Angel Research

November 16, 2015

2

Coal India | 2QFY2016 Result Update

Result highlights

Higher E-auction volumes offset by lower realisation

Coal India’s total revenue increased 8.2% yoy to `16,958cr, in line with our

estimate of `16,833cr. While production was slightly below our estimate at

108.2MT for the quarter (vs. our estimate of 110.6MT), off-take volumes were

marginally ahead of our expectations at 121.8MT (our estimate was of 119.1MT).

Off-take was higher in the FSA segment with e-auction and washeries volumes in

line with expectations. FSA realizations were in line with expectations at `1,294/T.

However, e-auction realizations came in much lower than expected at `1,788. This

was partially offset by better than expected washeries realizations of `2,328.

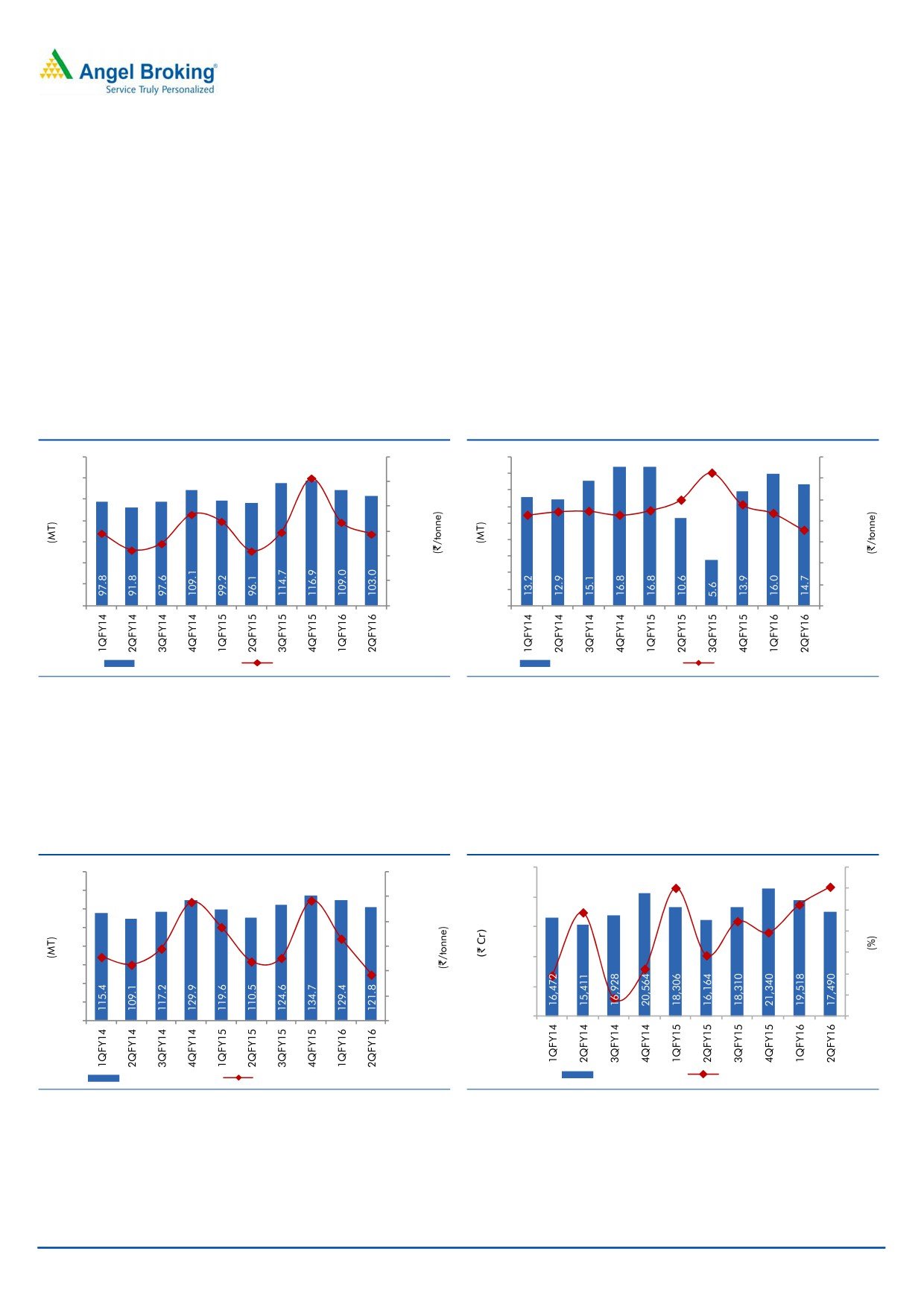

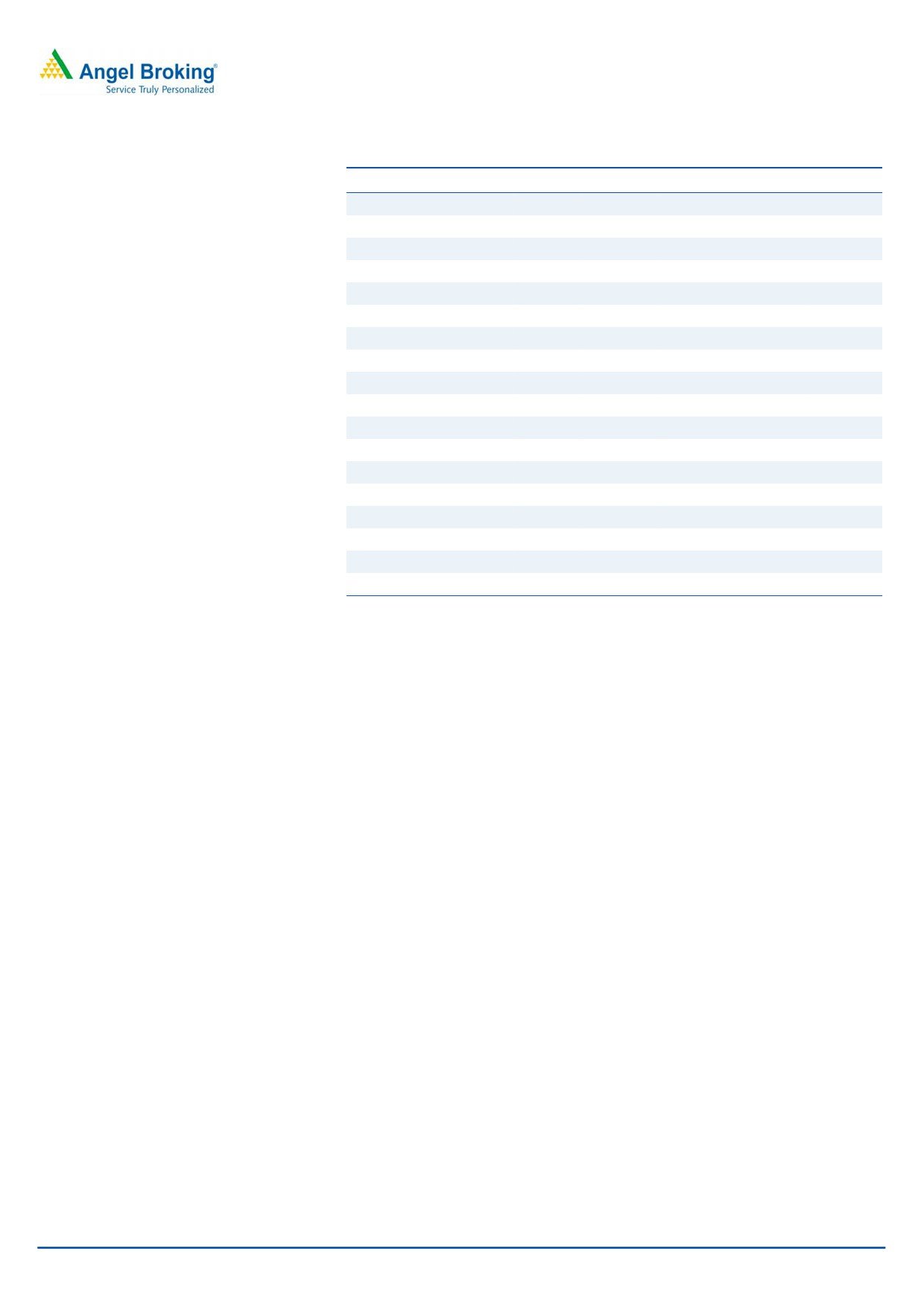

Exhibit 3: FSA volumes stable, realisation declines

Exhibit 4: E-auction volume in line with expectations

140

1,450

18

3,500

16

120

1,400

3,000

14

100

2,500

1,350

12

80

10

2,000

1,300

60

8

1,500

1,250

6

40

1,000

4

20

1,200

500

2

0

1,150

0

-

FSA Volumes (MT)

Realisation (`/tonne)

E-auction Volumes (MT)

Realisation (`/tonne)

Source: Company, Angel Research

Source: Company, Angel Research

Blended realization/tonne came in lower than our expectation at `1,392 (1.5%

lower than our estimate of `1,414), led by the sharply lower e-auction realisation.

Blended realisation declined 2% yoy, while off-take increased 10.2% yoy, resulting

in an 8.2% increase in net sales.

Exhibit 5: Off-take volume stable, realisation declines

Exhibit 6: Revenue growth picks up to 8.2%

25,000

10

160

1,600

140

8

1,550

20,000

120

6

1,500

100

15,000

4

80

1,450

10,000

2

60

1,400

0

40

5,000

1,350

-2

20

0

1,300

0

-4

Total Volumes (MT)

Blended Realisation (`/tonne)

Revenue (` cr)

yoy change (%)

Source: Company, Angel Research

Source: Company, Angel Research

November 16, 2015

3

Coal India | 2QFY2016 Result Update

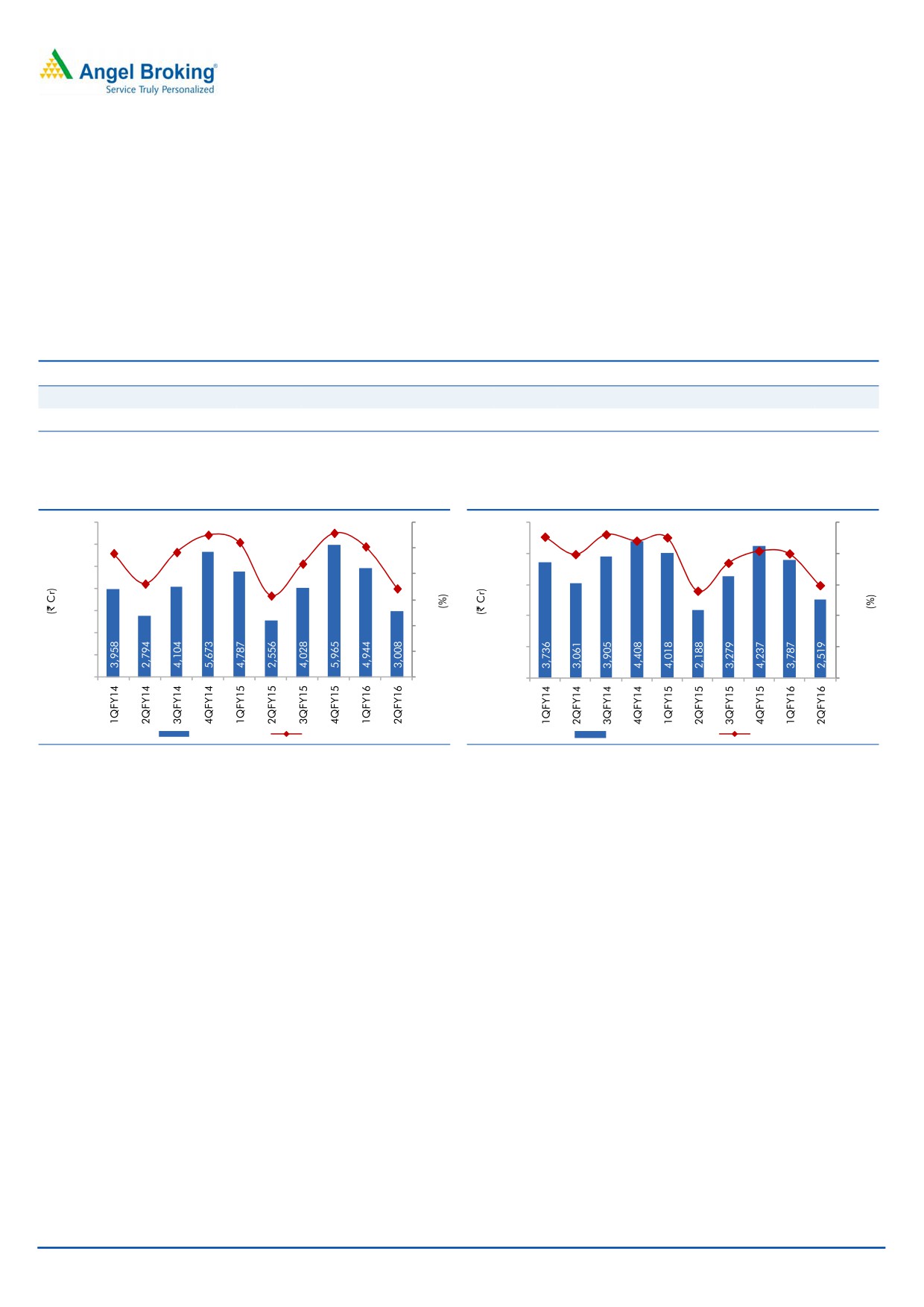

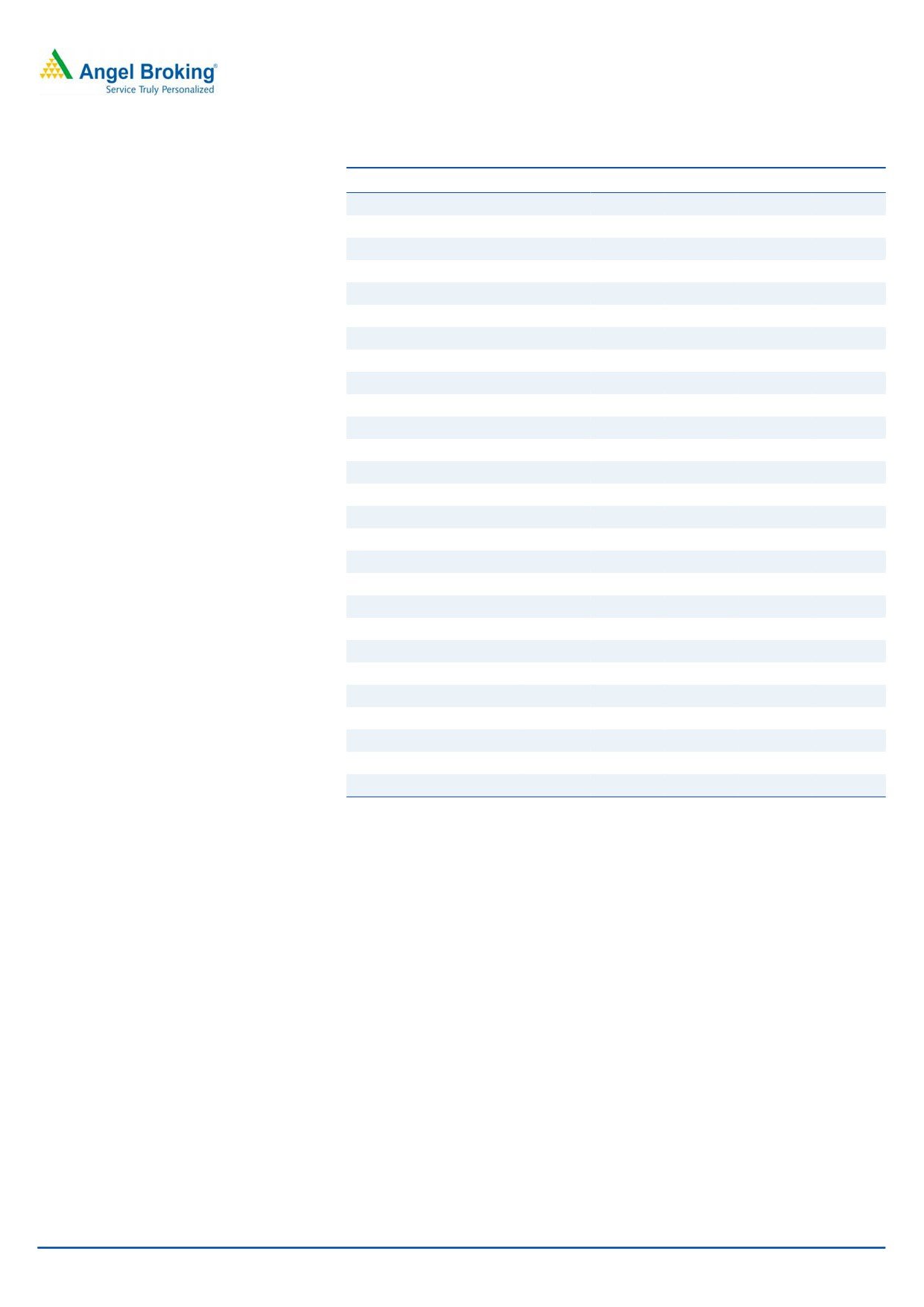

Higher expenses offset by lower material costs

Higher staff and other expenses offset lower than expected material and

overburden expenses resulting in an EBITDA of `3,008cr, as against our estimate

of `3,106cr. EBITDA margin improved 140bp to 17.2%, but was marginally lower

than our estimate of 17.9%. The Net profit at `2,544cr was slightly ahead of our

expectations (our estimate was of `2,445cr) led by lower than expected tax

expenses and marginally higher than expected other income.

Exhibit 7: Quarterly performance trend

1Q14

2Q14

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

Realisation (`/tonne)

1,428

1,412

1,445

1,539

1,488

1,419

1,426

1,542

1,465

1,392

EBITDA (`/tonne)

343

256

350

393

358

187

279

401

339

203

Source: Company, Angel Research

Exhibit 8: EBITDA margin improves 140bp yoy

Exhibit 9: Net profit improves 15% yoy

7,000

30

5,000

25

27.6

26.2

28.0

25.3

22.7

23.1

22.0

22.6

24.0

24.2

19.9

20.4

20.0

6,000

22.0

25

18.5

4,000

20

5,000

18.1

14.9

17.2

20

14.0

15.8

4,000

3,000

15

15

3,000

2,000

10

10

2,000

1,000

5

1,000

5

0

0

0

0

EBITDA (` cr)

Margin (%)

Net Profit (` cr)

Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

November 16, 2015

4

Coal India | 2QFY2016 Result Update

Investment arguments

Strong production growth to drive revenues

Coal India’s production increased ~7% yoy in FY2015 to 494MT, as against a

muted growth of 2.3% in FY2014. Off-take growth also picked up to 3.8% yoy in

FY2015 as against 1.4% in FY2014. According to the Coal Ministry, with rising

demand for power, demand for coal is estimated to increase to 1.6bn tonne by the

year FY2020. CIL has already finalised plans to achieve targeted production of

925MT by FY2020 and is planning to increase production to 1bn tonne. The target

production implies a ~13% CAGR growth in production over FY2015-20. We

believe the production growth target is a bit too optimistic and expect CIL’s

production to grow at a CAGR of ~8%.

Operating efficiencies and low realisations to help improve margins

CIL’s net realisation is significantly lower than the landed price of imported coal,

providing enough cushion against any decline in international coal prices. The gap

also provides ample scope for CIL to pass on any cost escalations. The increasing

share of washed coal will also help improve realizations. Further, technological

and infrastructural enhancements, coupled with operating efficiencies from rising

production will help to keep production costs low.

November 16, 2015

5

Coal India | 2QFY2016 Result Update

Outlook and valuation

We reduce our consolidated FY2016 and FY2017 EPS estimates by 12% and 9%,

respectively, in view of the lower than expected realizations and increased

operating expenses. We expect CIL’s production to increase by 7.1% to 530MT in

FY2016 (538MT earlier) and 572MT in FY2017 (575MT earlier). We expect e-

auction realization to remain under pressure led by weakness in global commodity

prices and increased availability of coal in FY2016.

We value Coal India at 8x FY2017E Adj. EBITDA to arrive at a target price of `380

(`400 earlier) and retain our Accumulate rating on the stock.

Exhibit 10: Valuation

EV/EBITDA

(` cr)

FY2017E Adj. EBITDA

23,545

Multiple (x)

8.0

Total EV

1,89,299

Net Cash

50,375

Minority Interest

66

Equity Value

2,39,609

Target price (`)

380

Source: Angel Research

Company background

Incorporated in 1973, Coal India Ltd (CIL) is a ‘Maharatna’ company under the

Ministry of Coal, Government of India and is the single largest coal producing

company in the world with reserves of 65bn tonne. CIL accounts for ~80% of

India's overall coal production and commands ~74% of the Indian coal market.

The company produced 494MT and dispatched 489MT of raw coal in FY2015. At

the end of FY2015, CIL had 430 mines (227 underground, 175 opencast and 28

mixed mines) and 15 coal washeries (12 coking coal and 3 non-coking coal).

November 16, 2015

6

Coal India | 2QFY2016 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Net Sales

68,303

68,810

72,015

76,167

84,130

% chg

9.4

0.7

4.7

5.8

10.5

Total Expenditure

50,219

52,847

56,785

61,034

65,369

Raw Material Expenses

6,556

7,115

6,726

8,656

9,618

Personnel

27,321

27,769

29,859

30,944

32,881

Power & Fuel Cost

2,333

2,282

2,347

2,551

2,817

Other Expenses

14,009

15,681

17,853

18,884

20,053

EBITDA

18,084

15,963

15,230

15,133

18,761

% chg

15.4

(11.7)

(4.6)

(0.6)

24.0

(% of Net Sales)

26.5

23.2

21.1

19.9

22.3

Depreciation

1,813

1,996

2,320

2,479

2,708

EBIT

16,271

13,967

12,910

12,654

16,053

% chg

18.8

(14.2)

(7.6)

(2.0)

26.9

(% of Net Sales)

23.8

20.3

17.9

16.6

19.1

Interest & other Charges

45

58

7

9

10

Other Income

8,747

8,969

8,676

8,584

8,413

(% of PBT)

35.0

39.2

40.2

40.4

34.4

Recurring PBT

24,972

22,878

21,579

21,230

24,456

% chg

17.9

(8.4)

(5.7)

(1.6)

15.2

Extraordinary Inc/(Expense)

7

1

5

2

0

PBT (reported)

24,979

22,880

21,584

21,232

24,456

Tax

7,623

7,768

7,857

7,069

8,143

(% of PBT)

30.5

34.0

36.4

33.3

33.3

PAT (reported)

17,356

15,112

13,727

14,163

16,314

Add: Share of earnings of asso.

-

-

-

-

-

Less: Minority interest (MI)

-

0.0

0.1

0.1

0.1

Extraordinary (Expense)/Inc.

(0.0)

(0.0)

(0.0)

(0.0)

(0.0)

PAT after MI (reported)

17,356

15,112

13,727

14,163

16,314

Adjusted PAT

17,350

15,110

13,722

14,161

16,314

% chg

18.0

(12.9)

(9.2)

3.2

15.2

(% of Net Sales)

25.4

22.0

19.1

18.6

19.4

November 16, 2015

7

Coal India | 2QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

6,316

6,316

6,316

6,316

6,316

Reserves & Surplus

42,156

36,088

34,037

32,903

33,921

Shareholders Funds

48,472

42,404

40,353

39,220

40,237

Minority Interest

64

64

66

66

66

Total Loans

1,078

171

202

202

202

Other Long Term liabilities

3,137

3,529

3,999

4,230

4,672

Long term provisions

31,144

33,639

37,499

39,661

43,807

Total Liabilities

83,895

79,807

82,119

83,378

88,984

APPLICATION OF FUNDS

Gross Block

39,011

40,897

44,987

49,036

53,694

Less: Acc. Depreciation

25,545

26,302

28,622

31,101

33,809

Net Block

13,466

14,595

16,365

17,935

19,885

Capital Work-in-Progress

3,496

4,505

4,910

5,431

5,820

Goodwill

-

-

-

-

-

Investments

2,395

3,775

2,813

2,813

2,813

Other

1,256

1,756

2,641

2,794

3,086

Current Assets

87,429

77,639

78,767

78,938

84,070

Cash

62,236

52,390

50,007

48,413

50,577

Loans & Advances

4,920

6,596

8,827

9,336

10,312

Other

20,273

18,654

19,933

21,189

23,181

Current liabilities

26,401

24,435

25,337

26,492

28,651

Net Current Assets

61,028

53,204

53,430

52,446

55,420

Net deferred tax assets

2,255

1,972

1,960

1,960

1,960

Total Assets

83,895

79,807

82,119

83,378

88,984

November 16, 2015

8

Coal India | 2QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

24,979

22,880

21,584

21,232

24,456

Depreciation

1,839

1,996

2,320

2,479

2,708

Change in Working Capital

(6,839)

244

(2,609)

(609)

(810)

Others

(2,218)

(1,769)

1,916

2,249

4,306

Direct taxes paid

(8,652)

(8,826)

(7,857)

(7,069)

(8,143)

Cash Flow from Operations

9,109

14,525

15,354

18,282

22,518

(Inc.)/ Dec. in Fixed Assets

(2,454)

(4,116)

(4,494)

(4,570)

(5,048)

(Inc.)/ Dec. in Investments

4,195

(8,981)

2,031

-

-

Others

1,035

14,076

-

-

-

Cash Flow from Investing

2,776

979

(2,463)

(4,570)

(5,048)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(229)

(1,263)

30

-

-

Dividend Paid (Incl. Tax)

(7,907)

(24,243)

(15,296)

(15,296)

(15,296)

Others

284

156

(7)

(9)

(10)

Cash Flow from Financing

(7,852)

(25,350)

(15,273)

(15,305)

(15,306)

Inc./(Dec.) in Cash

4,033

(9,846)

(2,383)

(1,593)

2,164

Opening Cash balances

58,203

62,236

52,390

50,007

48,413

Closing Cash balances

62,236

52,390

50,007

48,413

50,577

November 16, 2015

9

Coal India | 2QFY2016 Result Update

Key ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

12.3

14.1

15.5

15.1

13.1

P/CEPS

11.1

12.5

13.3

12.8

11.2

P/BV

4.4

5.0

5.3

5.4

5.3

Dividend yield (%)

4.1

8.6

6.1

6.1

6.1

EV/Sales

1.8

2.3

2.2

2.1

1.9

EV/Adj. EBITDA

5.9

8.2

8.4

9.2

7.5

EV/Total Assets

1.5

2.0

2.0

1.9

1.8

Per Share Data (`)

EPS (Basic)

27.5

23.9

21.7

22.4

25.8

EPS (fully diluted)

27.5

23.9

21.7

22.4

25.8

Cash EPS

30.3

27.1

25.4

26.3

30.1

DPS

14.0

29.0

20.7

20.7

20.7

Book Value

76.7

67.1

63.9

62.1

63.7

Returns (%)

ROCE (Pre-tax)

22.0

17.1

15.9

15.3

18.6

ROE

39.0

33.2

33.1

35.5

41.0

Turnover ratios (x)

Asset Turnover (Gross Block)

1.8

1.7

1.6

1.6

1.6

Inventory (days)

41

38

40

40

40

Receivables (days)

56

44

43

43

43

Payables (days)

6

6

6

6

6

WC cycle (ex-cash) (days)

70

75

68

68

67

Solvency ratios (x)

Net debt to equity

(1.3)

(1.3)

(1.3)

(1.3)

(1.3)

Net debt to EBITDA

(2.9)

(3.5)

(3.5)

(3.4)

(2.8)

Interest Coverage (EBIT / Int.)

360.2

240.8

1,763.7

1,473.1

1,642.6

November 16, 2015

10

Coal India | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Coal India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

Yes

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 16, 2015

11