4QFY2016 Result Update | Pharmaceutical

June 10, 2016

Cipla

NEUTRAL

CMP

`469

Performance Highlights

Target Price

-

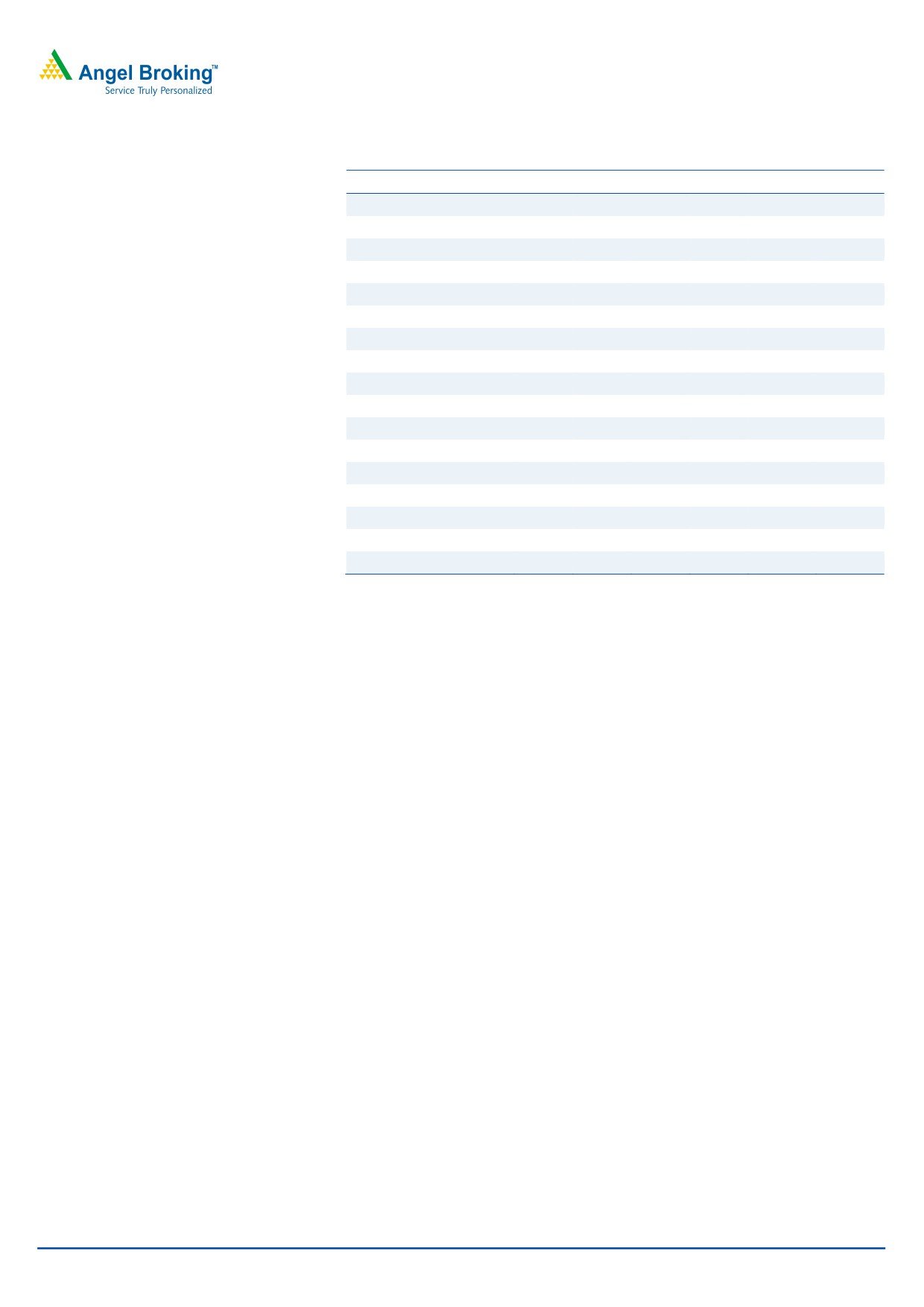

Y/E March (` cr)

4QFY2016 3QFY2016

% chg qoq 4QFY2015

% chg yoy

Investment Period

-

Net sales

3,207

3,027

5.9

2,981

7.6

Other income

115

159

(27.7)

173

(33.8)

Stock Info

Gross profit

142

1,783

(92.0)

1,822

(92.2)

Operating profit

159

364

(56.3)

396

(59.8)

Sector

Pharmaceutical

Adj. Net profit

81

343

(76.4)

260

(68.9)

Market Cap (` cr)

37,662

Source: Company, Angel Research

Net Debt (` cr)

563

Beta

0.8

Cipla’s results for 4QFY2016 have come much below our expectations. Sales

52 Week High / Low

748/458

came in at `3,207cr V/s `3,274cr expected, a yoy growth of 7.6%. The sales

Avg. Daily Volume

156,993

growth was driven by domestic formulations (`1,258cr), as expected, which grew

15.9% yoy, while exports posted a yoy growth of 7.4%. On the operating front,

Face Value (`)

2

the EBDITA came in at 5.0% V/s 13.3% in 4QFY2015 and against 13.8%

BSE Sensex

27,010

expected. The reported EBDITA margins include a lot of one-offs, adjusting for

Nifty

8,266

which the OPM was at 15.8%. The net profit thus came in at `81cr V/s `399cr

Reuters Code

CIPL.BO

expected and V/s `260cr in 4QFY2015, a yoy de-growth of 68.9%. We remain

Bloomberg Code

CIPLA@IN

Neutral on the stock.

Results much lower than expectations: Sales for the quarter came in at `3,207cr

Shareholding Pattern (%)

V/s `3,274cr expected, a yoy growth of 7.6%. The sales growth was driven by

Promoters

36.8

domestic formulations (`1,258cr), as expected, which grew 15.9% yoy, while

MF / Banks / Indian Fls

19.0

exports posted a yoy growth of 7.4%. Exports of formulations increased 3.2% to

FII / NRIs / OCBs

25.1

`1,744cr during 4QFY2016, while exports of APIs were flat at `204cr during

Indian Public / Others

19.1

4QFY2016. On the operating front, the EBDITA came in at 5.0% V/s 13.3% in

4QFY2015 and against 13.8% expected. The decline was mainly owing to a dip

in gross profit margins, which came in at 55.8% V/s 61.1% in 4QFY2015. The

Abs. (%)

3m 1yr

3yr

reported EBDITA margins include a lot of one-offs, adjusting for which, the OPM

Sensex

9.6

0.9

39.0

was 15.8%. The net profit thus came in at `81cr V/s `399cr expected and V/s

Cipla

(13.0)

(24.8)

25.8

`260cr in 4QFY2015, a yoy dip of 68.9%.

Outlook and valuation: We expect the company to post a 16.3% CAGR in

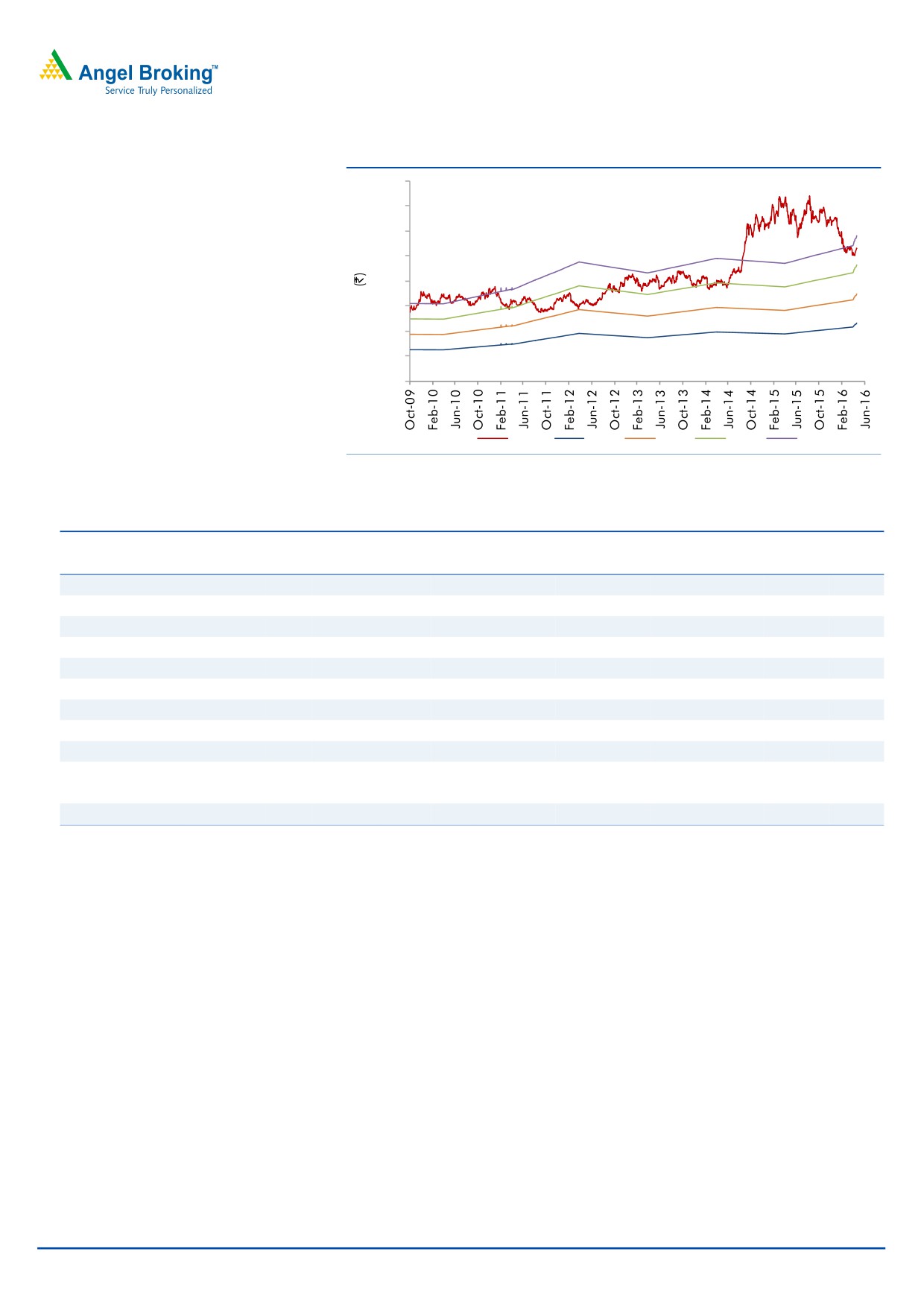

3-Year Daily Price Chart

net sales to `18,089cr and EPS to record a 20.4% CAGR to `27.2 over

800

700

FY2016-18E. We recommend our neutral stance on the stock owing to the

600

company’s poor return ratios.

500

Key financials (Consolidated)

400

300

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

200

Net sales

11,681

13,372

15,378

18,089

100

% chg

19.8

14.5

15.0

17.6

0

Adj. Net profit

1,578

1,506

1,736

2,185

% chg

13.6

-4.5

15.3

25.9

EPS (`)

19.6

18.8

21.6

27.2

Source: Company, Angel Research

EBITDA margin (%)

17.7

16.4

17.4

18.4

P/E (x)

23.8

24.9

21.6

17.2

RoE (%)

15.1

13.3

13.7

15.2

RoCE (%)

12.9

10.7

11.1

13.5

P/BV (x)

3.5

3.2

2.8

2.4

Sarabjit Kour Nangra

EV/Sales (x)

3.3

3.1

2.7

2.2

+91 22 3935 7600 Ext: 6806

EV/EBITDA (x)

18.6

18.8

15.3

12.0

Source: Company, Angel Research; Note: CMP as of June 7, 2016

Please refer to important disclosures at the end of this report

1

Cipla | 4QFY2016 Result Update

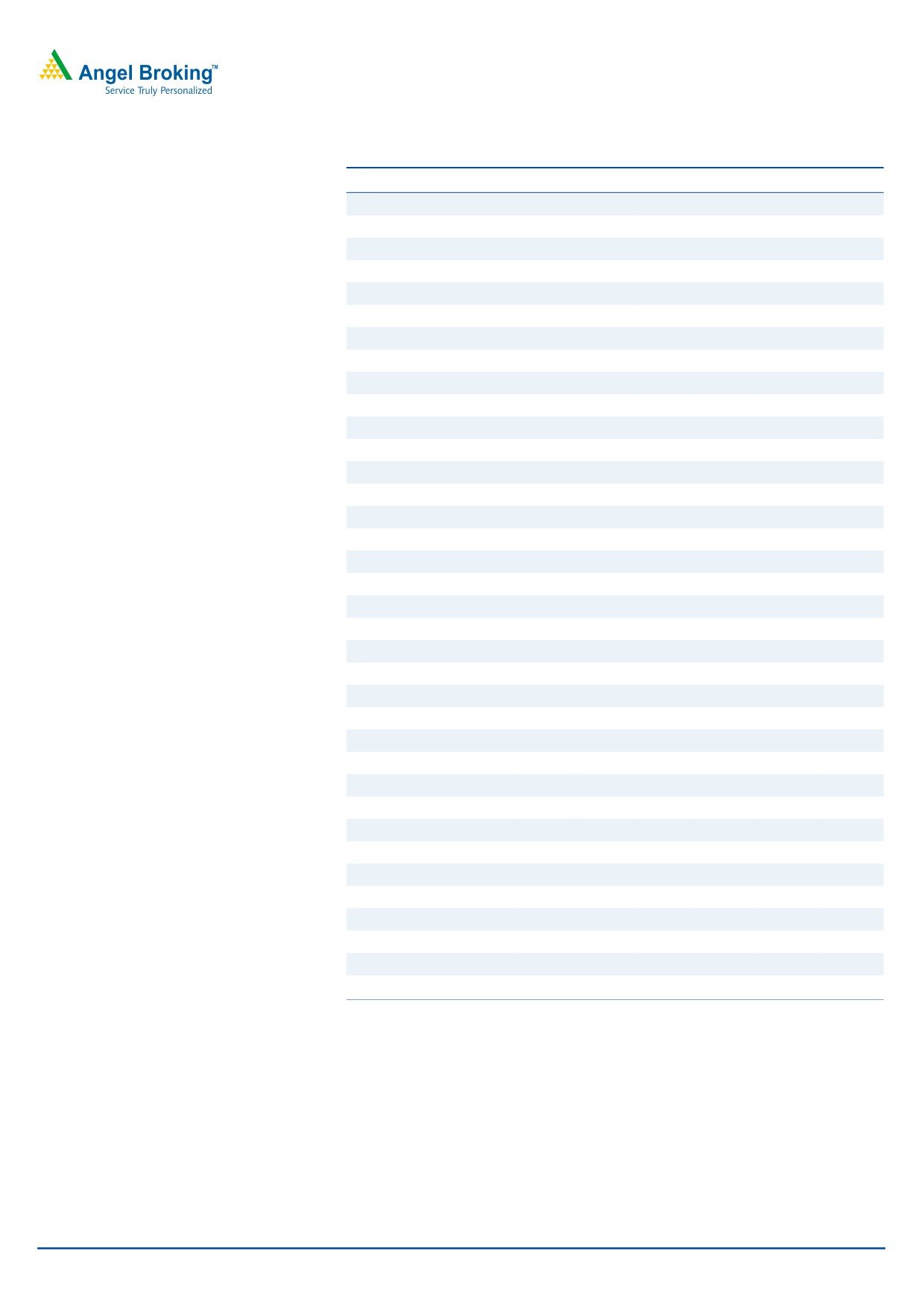

Exhibit 1: 4QFY2016 ( Consolidated) performance

Y/E March (` cr)

4QFY2016

3QFY2016

% chg QoQ

4QFY2015

% chg yoy FY2016 FY2015

% chg yoy

Net sales

3,207

3,027

5.9

2,981

7.6

13,372

10,882

22.9

Other income

114.6

158.6

(27.7)

173.2

(33.8)

514.7

628.6

(18.1)

Total income

3,321

3,186

4.3

3,154

5.3

13,887

11,511

20.6

Gross profit

142

1783

(92.0)

1822

(92.2)

8254

6728

22.7

Gross margin

4.4

58.9

61.1

61.7

61.8

Operating profit

159

364

(56.3)

396

(59.8)

2195

1699

29.2

OPM (%)

5.0

12.0

13.3

16.4

15.6

Interest

36.8

23.0

60.2

43.4

(15.2)

161

168

(4.0)

Depreciation

141

137

2.9

136

4.2

542

505

7.3

PBT

96

363

(73.6)

390

(75.5)

2007

1654

21.3

Provision for taxation

-4

12

(132.6)

103

(103.8)

440

400

9.9

PAT before extra-ordinary item

99

351

(71.6)

287

(65.3)

1567

1254

25.0

Share of Profit /( loss ) of asso.

(13)

(10)

27

(61)

(73)

Extra-ordinary items/(income)

0

0

0

0

0

PAT after extra-ordinary item

81

343

(76.4)

260

(68.9)

1506

1181

27.5

Adj. PAT

81

343

(76.4)

260

(68.9)

1506

1181

27.5

EPS (`)

1.0

4.3

3.2

18.8

14.7

Source: Company, Angel Research

Exhibit 2: 4QFY2016 - Actual vs. Angel estimates

(` cr)

Actual

Estimates

Variance

Net sales

3,207

3,274

(2.1)

Other income

115

106

8.0

Operating profit

159

451

(64.7)

Tax

(4)

12

-

Net profit

81

399

(79.8)

Source: Company, Angel Research

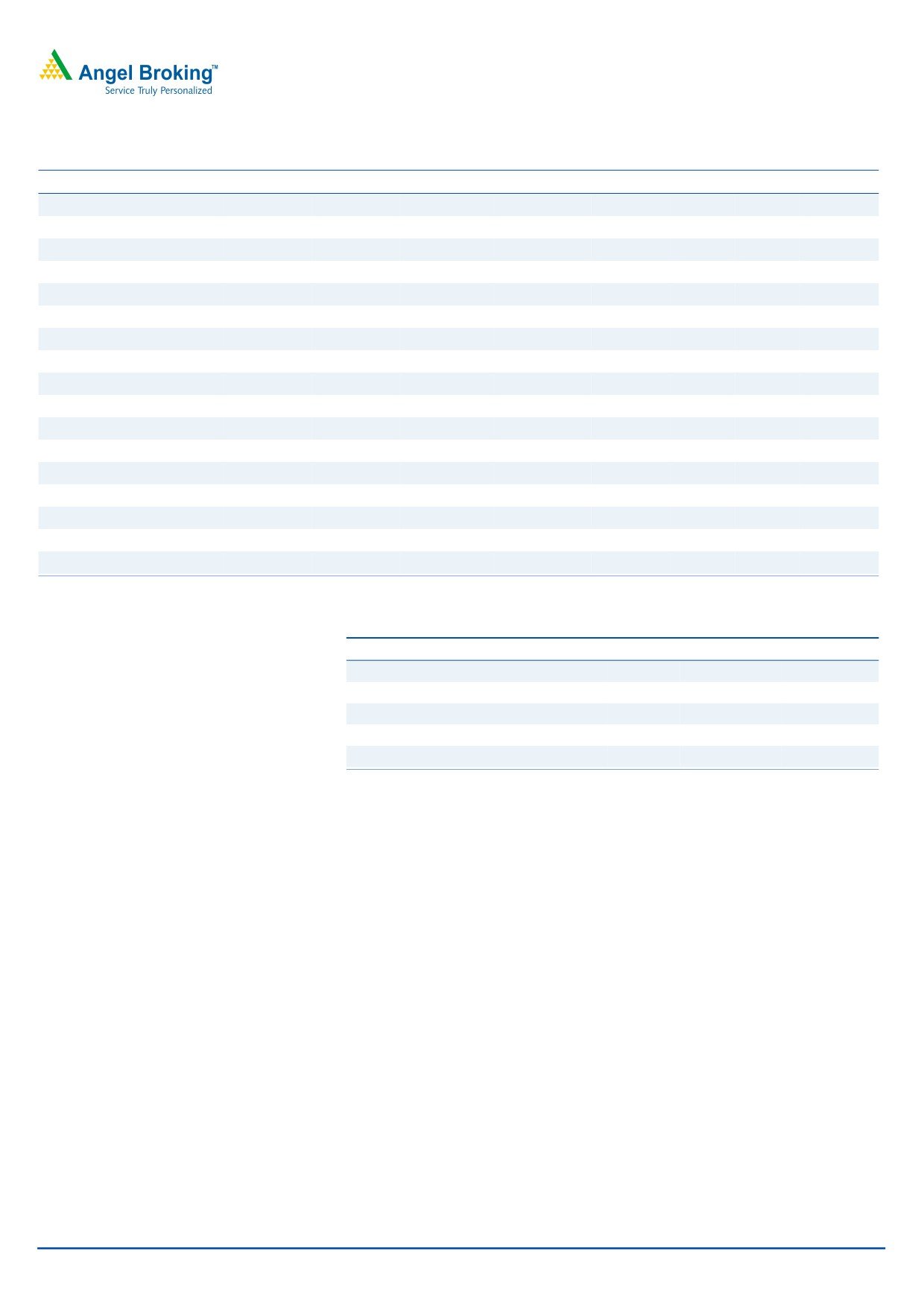

Top-line growth tad lower than expectation

For 4QFY2016, Cipla posted a yoy growth of 7.6% in sales of `3,207cr (V/s

`3,274cr expected). The sales growth was as expected driven by domestic

formulations (`1,258cr), which posted a yoy growth of 15.9%, while exports posted

a yoy growth of 7.4%. Exports of formulations increased 3.2% to `1,744cr during

4QFY2016, while exports of APIs were flat at `204cr during 4QFY2016.

For FY2016, domestic sales grew 9.0% yoy to `5,184cr (40% of overall sales), with

the branded segment posting a 13.0% yoy growth and accounting for 81% of the

overall domestic formulation sales. In the Indian market, the company is ranked

third, with a market share of 5.3%.

Exports at `8,261cr posted a yoy growth of 36.4%. USA (US$321mn), which was

15% of sales (including the acquisition), posted a yoy growth of 117%. The

company completed the acquisition of InvaGen Pharmaceuticals Inc., while Exelan

Pharmaceuticals Inc’s integration of operations is under way. In terms of filings, the

company has filed 168 ANDAs with around 90 approved and 78 tentatively

approved/pending approval.

June 10, 2016

2

Cipla | 4QFY2016 Result Update

South Africa’s (ZAR3,272mn) contribution at ~11.5% of overall sales in FY2016,

registered a growth of ~25% over last year. The company has a market share of

~5% in the private market and is the 3rd largest generics player in South Africa.

Also, the company posted a 60% yoy growth in tender sales vs last year.

International business’ (US$523mn) posted an overall sales growth of ~14% in

FY2016 over last year and contributed by ~25% to overall sales. It posted a robust

growth of ~25% in front-end markets vs last year, despite a war situation in

Yemen and currency devaluation in several emerging markets. It has a market

leadership in Uganda, Sri Lanka, Yemen, and North Africa. There has been a

resurgence in partnership-led markets (B2B) with 8% yoy growth vs last year.

The Europe business contributed ~4% to overall sales. There was a growth of 30%

in FY2016 sales vs last year, driven by strong performance across B2B and DTM

segments. It launched Fluticasone Salmeterol, Mometasone, Fluticasone,

Ipratropium Salbutamol respules and Ipratropium MDI across multiple markets in

FY2016. The company witnessed new launches in 4QFY2016 for Fluticasone

Salmeterol (Netherlands), Mometasone (Austria, Portugal), Fluticasone (Germany,

Hungary, and Spain), Ipratropium Salbutamol respules (Belgium). It received an

approval for Salmeterol Fluticasone in Italy in 4QFY2016.

Exhibit 3: Sales Trend

3,000

2,500

2,000

1,500

1,000

500

0

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Domestic

Export

Source: Company

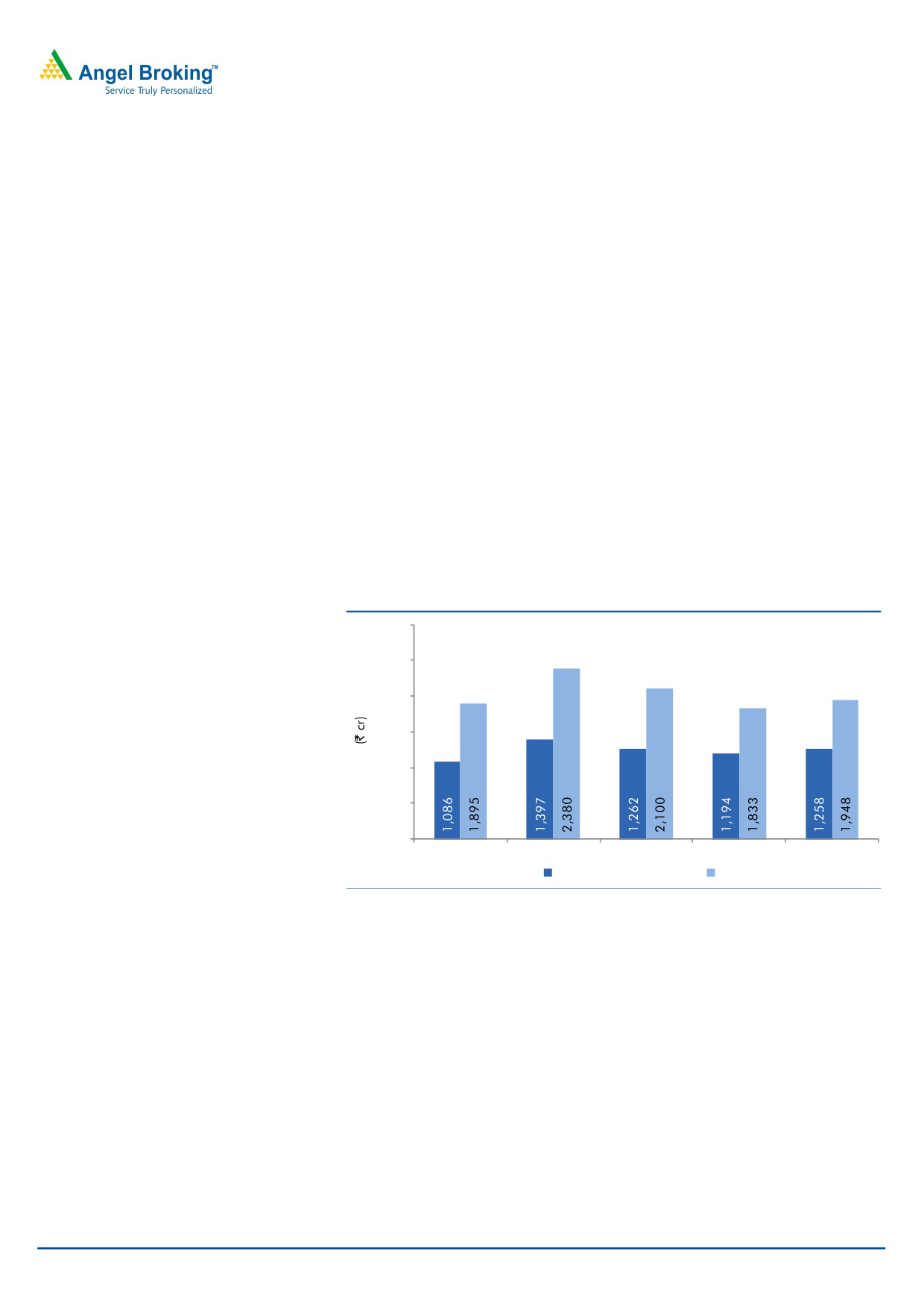

Operating profit margin much lower than expected

On the operating front, the EBDITA came in at 5.0% V/s 13.3% in 4QFY2015 and

against 13.8% expected, mainly owing to a dip in gross profit margins, which

came in at 55.8% V/s 61.1% in 4QFY2015. The reported EBDITA margins include

a lot of one-offs, adjusting for which the OPM was 15.8%.

June 10, 2016

3

Cipla | 4QFY2016 Result Update

Exhibit 4: OPM Trend

30.0

25.0

25.5

20.0

20.8

15.0

13.3

12.0

10.0

5.0

5.0

0.0

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Source: Company

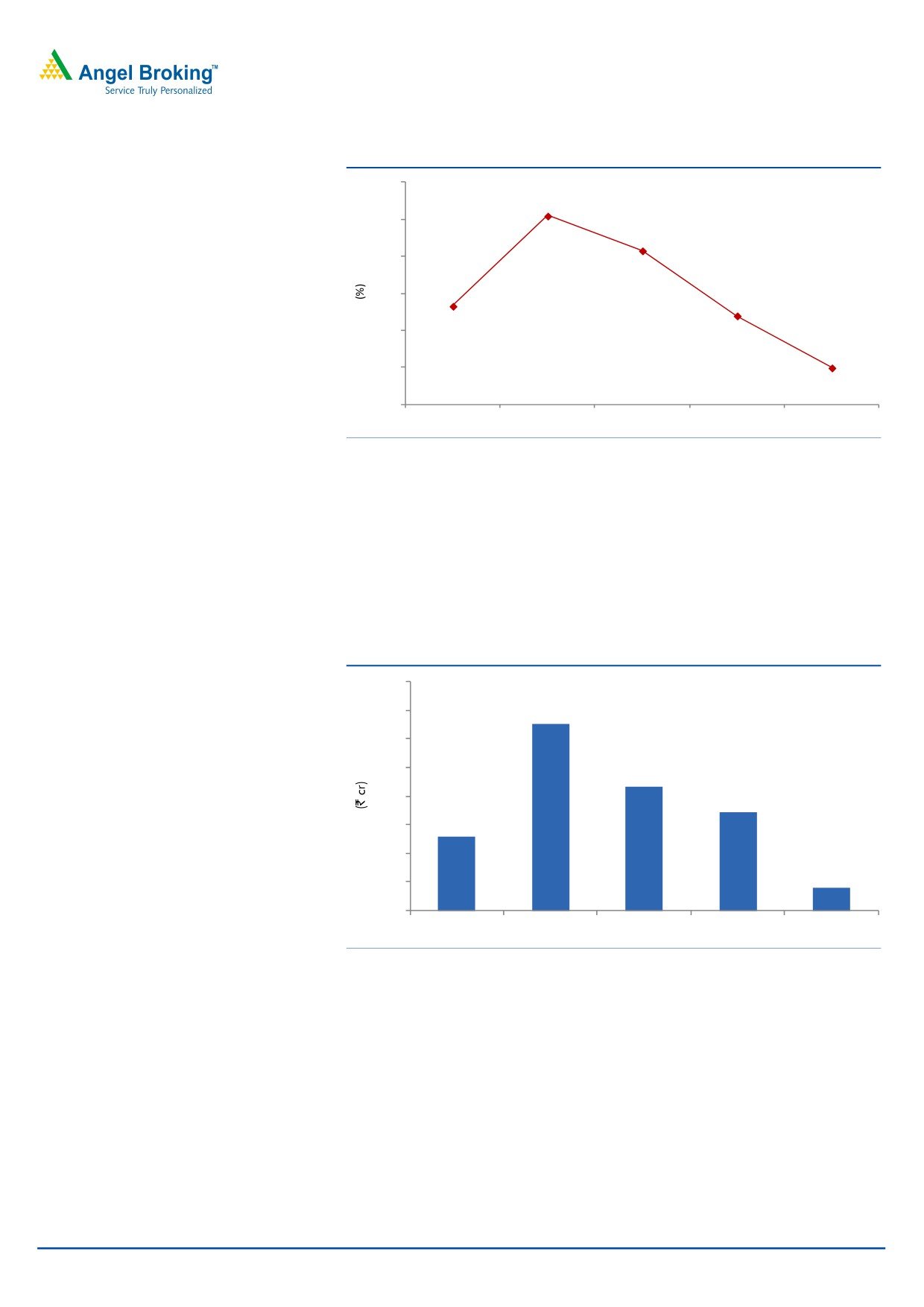

Net profit lower than expectation

On back of much lower than expected OPM, the net profit came in at `81cr V/s

`399cr expected and V/s `260cr in 4QFY2015, a yoy de-growth of 68.9%. Also,

the other income during the quarter was `115cr V/s `173cr in 4QFY2015, a yoy

dip of 33.8%.

Exhibit 5: Net Profit Trend

800

651

700

600

500

431

400

343

300

260

200

80

100

0

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Source: Company

Concall takeaways

R&D as % of sales is expected to be ~8% in FY2017, as against ~6.5% in

FY2016.

In USA, the company expects to file 20-25 ANDAs in FY2017.

Impact of DPCO and Fixed Dosage Combinations ban on domestic market

expected to be ~2-3% for FY2017.

June 10, 2016

4

Cipla | 4QFY2016 Result Update

Recommendation rationale

Export segment to be the growth driver: Cipla exports to more than 180 countries,

with growth coming through marketing alliances and distribution tie-ups in various

markets. Exports contributed 60% to the total turnover in FY2016, with Africa, US

and Latin America constituting more than ~60% of total exports. In the US, Cipla

has a strong product pipeline of 168 ANDAs, out of which, 90 are approved.

Another long term growth driver for the company is the launch of the CFC-free

inhalers in the regulated markets. CFC-free inhalers in Europe and US address a

potential market size of more than US$3bn.

During the quarter, the company strengthened its foothold in the US through the

acquisition of InvaGen Pharma and Exelan Pharma. The companies added a

pipeline of ~70 ANDAs, of which 40 are approved (32 marketed) and 30

awaiting approval. The company is likely to add over USD250mn in FY2017. The

deal is expected to conclude by December 2015. It will also provide manufacturing

capabilities in the US. Overall, we expect the company’s exports to grow at a

CAGR of 19.1% during FY2016-18E.

Increasing penetration in the domestic market: Cipla is one of the largest players

in the domestic formulation market, with a market share of around

5.3%.

Domestic formulations contributed 40% to the company’s total turnover in FY2016.

The company is the market leader in key therapeutic areas such as respiratory

care, anti-viral and urological. Cipla’s distribution network in India consists of a

field force of around 7,000-8,000 employees. The company plans to increase its

focus on domestic markets with new therapies such as oncology and neuro-

psychiatry in the offing. The company plans to focus on growing its market share

and sales by increasing penetration in the Indian market, especially in rural areas,

and plans to expand its product portfolio by launching biosimilars, particularly

relating to the oncology, anti-asthmatic and anti-arthritis categories. Overall we

expect the company’s domestic formulation business to post a CAGR of 14.0%

over FY2016-18E.

Valuation: We expect the company to post a 16.3% CAGR in net sales to

`18,089cr and EPS to record a 21.7% CAGR to `27.8 over FY2016-18E. The

growth in the top-line would be driven by domestic formulation sales and exports.

We maintain our Neutral stance on the stock.

Exhibit 6: Key assumptions

Key assumptions

FY2017E

FY2018E

Domestic growth (%)

13.0

15.0

Exports growth (%)

19.1

19.2

Growth in employee expenses (%)

15.0

15.0

Operating margins (excl tech. know-how fees) (%)

17.4

18.4

Source: Company, Angel Research

June 10, 2016

5

Cipla | 4QFY2016 Result Update

Exhibit 7: One-year forward PE band

800

700

600

500

400

300

200

100

-

Price

10x

15x

20x

25x

Source: Company, Angel Research

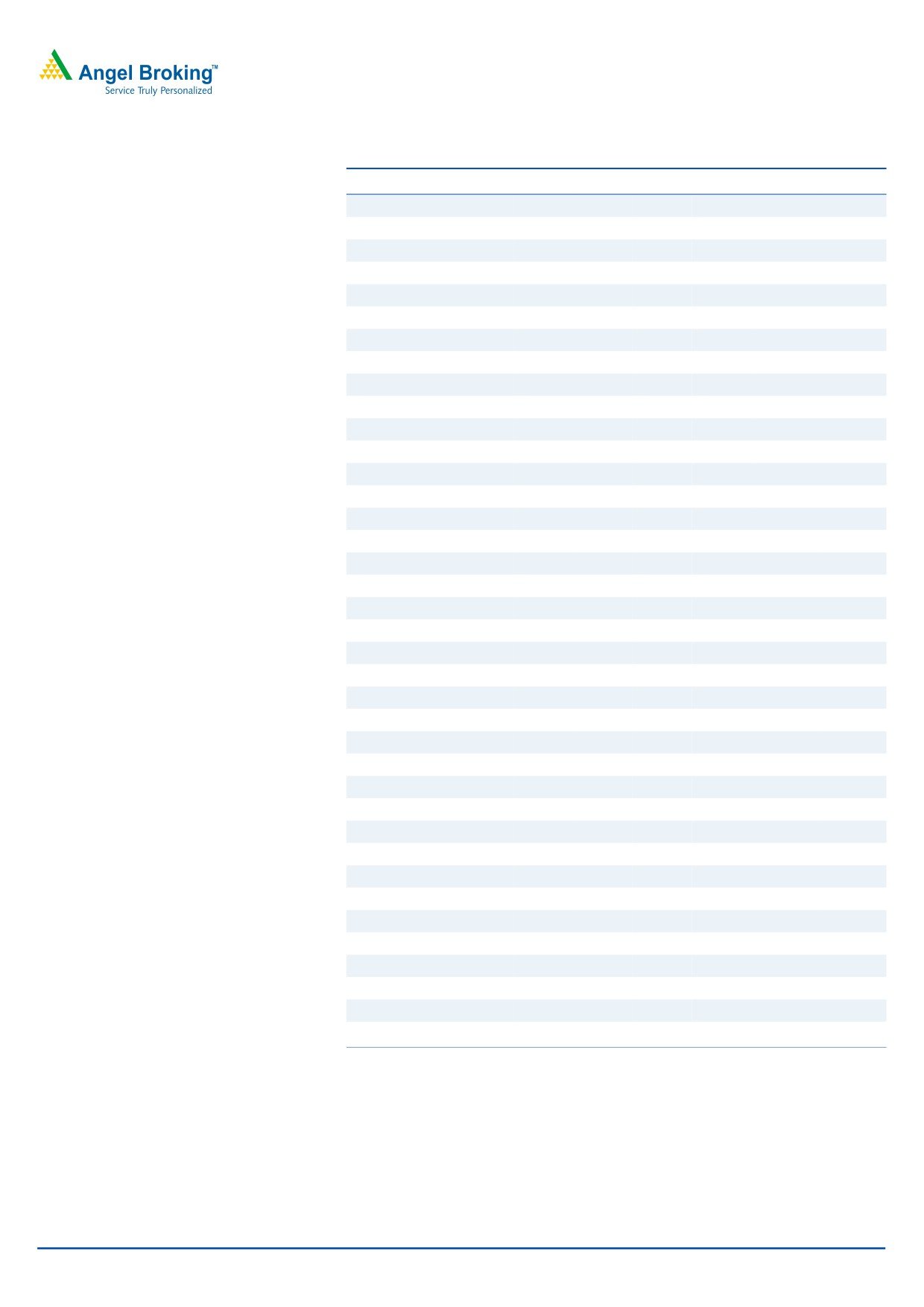

Exhibit 8: Recommendation Summary

Company

Reco

CMP Tgt. price Upside

FY2017E

FY15-17E

FY2017E

(`)

(`)

% PE (x) EV/Sales (x) EV/EBITDA (x)

CAGR in EPS (%)

RoCE (%) RoE (%)

Alembic Pharma

Neutral

557

-

-

29.8

3.0

18.2

11.4

22.0

20.1

Aurobindo Pharma Accumulate

773

768

10.8

20.1

3.1

14.5

11.4

21.4

27.7

Cadila Healthcare Buy

320

400

25.0

18.7

2.9

13.2

22.9

24.2

28.8

Cipla

Neutral

469

-

-

21.6

2.7

15.3

4.9

11.1

13.7

Dr Reddy's

Accumulate

3,158

3,476

10.1

20.7

3.0

12.3

6.8

19.2

18.7

Dishman Pharma Neutral

152

-

-

15.2

1.6

7.7

15.9

9.4

11.0

GSK Pharma

Neutral

3,515

-

-

58.4

8.1

43.0

0.0

33.0

29.9

Indoco Remedies

Neutral

282

-

-

20.7

2.2

12.4

23.0

19.7

19.7

Ipca labs

Buy

431

750

74.0

15.4

1.6

8.8

17.9

11.8

14.9

Lupin

Buy

1,435

1,809

26.1

24.7

4.1

15.6

13.1

29.6

24.7

Sanofi India*

Accumulate

4,300

4,738

10.2

28.0

3.9

22.3

34.2

21.0

25.6

Sun Pharma

Buy

739

950

28.6

26.4

5.4

17.9

10.5

17.7

18.7

Source: Company, Angel Research; Note: * December year ending

June 10, 2016

6

Cipla | 4QFY2016 Result Update

Company Background

Cipla is a leading pharmaceutical company in India with a strong presence in

both, the export and domestic markets. On the exports front, where it follows the

partnership model, it has 5,700 product registrations in around 180 countries.

Cipla is a market leader in the domestic formulation market with ~5.3% market

share. The company is likely to continue on the growth trajectory owing to its entry

into the inhalers market in the EU and potential new long-term manufacturing

contracts with Global Innovators.

June 10, 2016

7

Cipla | 4QFY2016 Result Update

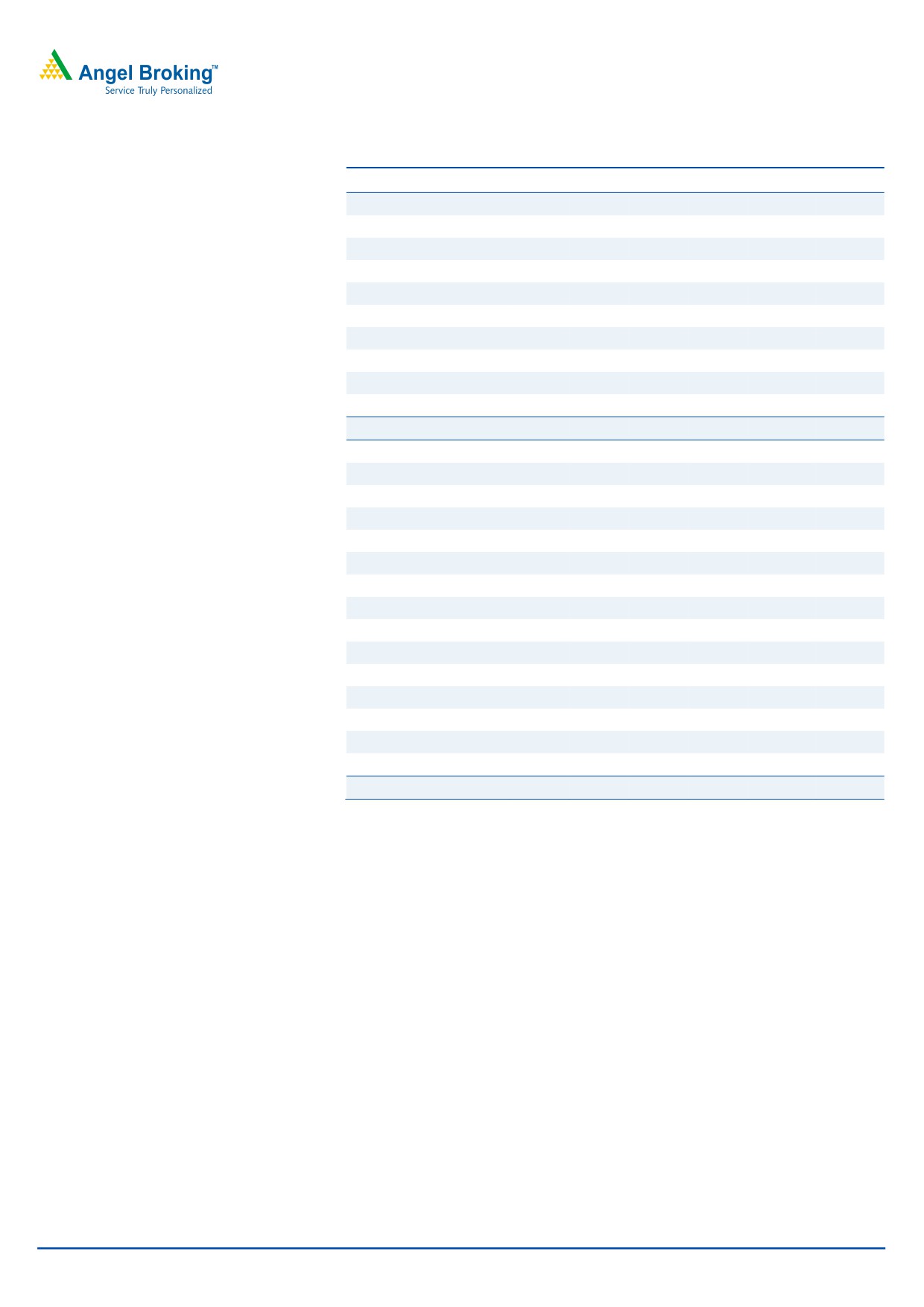

Profit & loss statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Gross sales

8,196

9,902

11,861

13,587

15,615

18,368

Less: Excise duty

108.7

149.3

179.7

215.0

236.6

278.3

Net sales

8,087

9,753

11,681

13,372

15,378

18,089

Other operating income

193

348

348

306

306

306

Total operating income

8,279

10,100

12,029

13,678

15,684

18,395

% chg

17.9

22.0

19.1

13.7

14.7

17.3

Total expenditure

6,081

7,967

9,612

11,177

12,704

14,760

Net raw materials

2,953

3,875

4,556

5,118

5,736

6,747

Other mfg costs

641

827

993

1,142

1,313

1,510

Personnel

1,036

1,543

2,083

2,447

2,814

3,236

Other

1,451

1,722

1,981

2,470

2,841

3,267

EBITDA

2,005

1,786

2,069

2,195

2,675

3,329

% chg

35.0

(11.0)

15.9

6.1

21.8

24.5

(% of Net Sales)

24.8

18.3

17.7

16.4

17.4

18.4

Depreciation & amort.

330

373

457

542

676

732

EBIT

1,675

1,413

1,613

1,654

1,999

2,597

% chg

42.7

(15.6)

14.1

2.5

20.9

30.0

(% of Net Sales)

20.7

14.5

13.8

12.4

13.0

14.4

Interest & other charges

34

146

85

161

161

161

Other Income

235

266

266

209

209

209

(% of PBT)

11.4

14.1

12.4

10.4

8.9

7.1

Recurring PBT

2,069

1,881

2,141

2,007

2,352

2,951

% chg

39.3

(9.1)

13.8

(6.3)

17.2

25.5

Extraordinary exp./(Inc.)

(26.7)

-

-

-

-

-

PBT (reported)

2,095

1,881

2,141

2,007

2,352

2,951

Tax

544.3

463.4

535.3

439.6

588.0

737.7

(% of PBT)

26.0

24.6

25.0

21.9

25.0

25.0

PAT (reported)

1,551

1,417

1,606

1,567

1,764

2,213

Add: Share of earnings of asso.

(6)

(12)

(12)

(12)

(11)

(10)

Less: Minority interest (MI)

-

16

16

49

17

18

Prior period items

-

-

-

-

-

-

PAT after MI (reported)

1,545

1,388

1,578

1,506

1,736

2,185

ADJ. PAT

1,524

1,388

1,578

1,506

1,736

2,185

% chg

30.0

(8.9)

13.6

(4.5)

15.3

25.9

(% of Net Sales)

19.1

14.2

13.5

11.3

11.3

12.1

Basic EPS (`)

19.0

17.3

19.6

18.8

21.6

27.2

Fully Diluted EPS (`)

19.0

17.3

19.6

18.8

21.6

27.2

% chg

30.0

(8.9)

13.6

(4.5)

15.3

25.9

June 10, 2016

8

Cipla | 4QFY2016 Result Update

Balance sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity share capital

161

161

161

161

161

161

Preference Capital

-

-

-

-

-

-

Reserves & surplus

8,858

9,890

10,629

11,697

13,245

15,241

Shareholders funds

9,019

10,050

10,801

11,857

13,405

15,402

Minority interest

-

50

180

270

270

270

Total loans

966.9

1,247.9

1,701.8

5,191.4

4,000.0

4,000.0

Other long term liabilities

30.0

32.6

32.6

32.6

32.6

32.6

Long Term Provisions

50.4

77.4

168.4

154.9

154.9

154.9

Deferred tax liability

280.5

309.0

284.6

366.4

366.4

366.4

Total liabilities

10,347

11,767

13,169

17,872

18,229

20,226

APPLICATION OF FUNDS

Gross block

5,318

6,183

6,868

8,100

8,800

9,500

Less: acc. depreciation

1,708

2,180

2,634

3,176

3,852

4,584

Net block

3,610

4,003

4,234

4,924

4,948

4,916

Capital work-in-progress

378

442

442

442

442

442

Goodwill

-

2,493

2,735

5,713

5,713

5,713

Investments

2,532

709

640

757

757

757

Long Term Loans and Adv.

363

301

419

715

475

559

Current assets

4,775

5,340

7,201

8,262

8,508

10,914

Cash

143

175

564

871

358

1,327

Loans & advances

573

596

701

958

923

1,085

Others

4,058

4,569

5,936

6,432

7,228

8,502

Current liabilities

1,311

1,634

2,501

2,939

2,614

3,075

Net current assets

3,464

3,706

4,700

5,322

5,894

7,839

Mis. Exp. not written off

-

112

-

-

-

-

Total assets

10,347

11,767

13,169

17,872

18,229

20,226

June 10, 2016

9

Cipla | 4QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

Profit before tax

2,095

1,881

2,141

2,007

2,352

2,951

Depreciation

330

373

457

542

676

732

(Inc)/Dec in Working Capital

(667)

(149)

(722)

(611)

(846)

(1,060)

Direct taxes paid

518

431

537

632

-

-

Cash Flow from Operations

1,241

1,673

1,339

1,306

2,182

2,623

(Inc.)/Dec.in Fixed Assets

(698)

(930)

(684)

(1,232)

(700)

(700)

(Inc.)/Dec. in Investments

(1,263)

1,824

69

(117)

-

-

Other income

-

-

-

-

-

-

Cash Flow from Investing

(1,961)

894

(616)

(1,349)

(700)

(700)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

957

311

545

3,476

(1,191)

-

Dividend Paid (Incl. Tax)

(188)

(188)

(188)

(188)

(188)

(188)

Others

4

(2,658)

(692)

(2,938)

410

(766)

Cash Flow from Financing

773

(2,535)

(335)

350

(969)

(954)

Inc./(Dec.) in Cash

53

32

389

307

513

969

Opening Cash balances

90

143

175

564

871

358

Closing Cash balances

143

175

564

871

358

1,327

June 10, 2016

10

Cipla | 4QFY2016 Result Update

Key Ratio

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

24.6

27.0

23.8

24.9

21.6

17.2

P/CEPS

20.0

21.3

18.5

18.3

15.6

12.9

P/BV

4.2

3.7

3.5

3.2

2.8

2.4

Dividend yield (%)

0.4

0.4

0.4

0.4

0.4

0.4

EV/Sales

4.7

3.9

3.3

3.1

2.7

2.2

EV/EBITDA

19.0

21.5

18.6

18.8

15.3

12.0

EV / Total Assets

3.7

3.3

2.9

2.3

2.2

2.0

Per Share Data (`)

EPS (Basic)

19.0

17.3

19.6

18.8

21.6

27.2

EPS (fully diluted)

19.0

17.3

19.6

18.8

21.6

27.2

Cash EPS

23.4

21.9

25.3

25.5

30.0

36.3

DPS

2.0

2.0

2.0

2.0

2.0

2.0

Book Value

112.3

125.2

134.5

147.7

166.9

191.8

Dupont Analysis

EBIT margin

20.7

14.5

13.8

12.4

13.0

14.4

Tax retention ratio

74.0

75.4

75.0

78.1

75.0

75.0

Asset turnover (x)

0.9

0.9

1.0

0.9

0.9

1.0

ROIC (Post-tax)

14.0

10.1

10.3

8.9

8.8

10.8

Cost of Debt (Post Tax)

5.0

9.9

4.3

3.7

2.6

3.0

Leverage (x)

0.0

0.1

0.0

0.0

1.0

2.0

Operating ROE

14.4

10.1

10.3

8.9

14.9

26.3

Returns (%)

ROCE (Pre-tax)

18.3

12.8

12.9

10.7

11.1

13.5

Angel ROIC (Pre-tax)

19.3

15.3

17.8

16.3

17.7

21.2

ROE

18.3

14.6

15.1

13.3

13.7

15.2

Turnover ratios (x)

Asset Turnover (Gross Block)

1.7

1.8

1.8

1.8

1.9

2.0

Inventory / Sales (days)

93

95

96

101

87

95

Receivables (days)

71

60

74

58

67

73

Payables (days)

46

41

55

74

43

44

WC cycle (ex-cash) (days)

131

124

116

115

116

120

Solvency ratios (x)

Net debt to equity

0.1

0.1

0.1

0.4

0.3

0.2

Net debt to EBITDA

0.4

0.6

0.5

2.0

1.4

0.8

Interest Coverage (EBIT/Int.)

-

-

-

-

-

-

June 10, 2016

11

Cipla | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Cipla

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

June 10, 2016

12