2QFY2016 Result Update | Banking

November 20, 2015

Canara Bank

NEUTRAL

CMP

`270

Performance Highlights

Target Price

-

Particulars (` cr)

2QFY16 1QFY16

% chg (qoq) 2QFY15

% chg (yoy)

Investment Period

-

NII

2,647

2,517

5.2

2,368

11.8

Pre-prov. profit

1,944

2,004

(3.0)

1,626

19.6

Stock Info

PAT

529

479

10.4

627

(15.6)

Sector

Banking

Source: Company, Angel Research

Market Cap (` cr)

14,634

Beta

1.5

In its 2QFY2016 results, Canara Bank reported a decline in PAT by 15.6% yoy,

52 Week High / Low

478/251

mainly due to higher provisions and surge in operating expenses.

Avg. Daily Volume

5,47,261

Loan book grows at a slow pace; NIM rises qoq

Face Value (`)

10

During 2QFY2016, the bank’s loan book grew by 3.9% yoy with retail loan book

BSE Sensex

25,483

growing at a faster pace at 14.3% yoy. The C-D ratio came down to 66.6% from

Nifty

7,732

67.4% in 2QFY2015. Deposits growth was muted at 5.2% yoy with CASA deposits

Reuters Code

CNBK.NS

showing momentum, which grew by 11.5% yoy. As a result, the domestic CASA

Bloomberg Code

CBK@IN

ratio for the bank rose by 178bp yoy to 25.5% as of 2QFY2016. The Reported

Global NIM rose sequentially from 2.21% in 1QFY2016 to 2.24% in the current

Shareholding Pattern (%)

quarter which aided NII growth of 11.8% for the quarter. The Management

Promoters

66.3

expects to reach 2.35% NIM by the end of this fiscal year. During 2QFY2016, the

MF / Banks / Indian Fls

19.5

non-interest income (excluding treasury) was subdued with a yoy growth of 4.4%

FII / NRIs / OCBs

7.5

yoy largely aided by recoveries from written off accounts. Treasury income, at

Indian Public / Others

6.7

`295cr, more than doubled for the quarter on a yoy basis (`144cr in 2QFY2015).

On the asset quality front, slippages came at `2,202cr (annualized slippage rate

Abs. (%)

3m

1yr

3yr

of 2.7% as compared to 3.1% in 1QFY2016). Recoveries and upgrades were

Sensex

(8.4)

(9.5)

39.0

lower at `1,261cr as compared to `2,478cr in 1QFY2016. As a result, the Gross

CBK

(21.3)

(33.3)

(36.7)

NPA ratio went up to 4.27% as compared to 3.98% in 1QFY2016, whereas the

Net NPA increased to 2.90% from 2.74% in 1QFY2016. Additionally, the bank

3-year price chart

restructured advances worth

`600cr during the quarter taking the book to

600

`29,026cr as on 2QFY2016. The Provision coverage ratio improved to 59.81%

500

from 58.68% in 2QFY2015.

400

Outlook and valuation: Canara Bank has been reporting subdued growth in its

300

profitability over the past several quarters. It has a larger exposure to various

200

stress sectors in the economy as compared to its peers. At the current market

100

price, the stock trades at 0.4x FY2017E ABV. We maintain our Neutral view on

0

the stock.

Key financials (Standalone)

Source: Company, Angel Research

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

NII

8,944

9,664

10,645

11,893

% chg

13.5

8.0

10.2

11.7

Net profit

2,438

2,669

2,212

3,346

% chg

(15.1)

9.5

(17.1)

51.2

Vaibhav Agrawal

NIM (%)

2.1

1.9

2.0

2.1

022 - 3935 7800 Ext: 6808

EPS (`)

52.9

56.2

46.6

70.4

P/E (x)

5.1

4.8

5.8

3.8

P/ABV (x)

0.6

0.5

0.5

0.4

Chintan Shah

RoA (%)

0.5

0.5

0.4

0.6

022 - 4000 3600 Ext: 6828

RoE (%)

10.4

10.5

8.0

11.2

Source: Company, Angel Research; Note: CMP as of November18, 2015.

Please refer to important disclosures at the end of this report

1

Canara Bank | 2QFY2016 Result Update

Exhibit 1: 2QFY2016 performance (Standalone)

Particulars (` cr)

2QFY16

1QFY16

% chg (qoq)

2QFY15

% chg (yoy)

FY2015

FY2014

FY2013

Interest earned

11,268

11,140

1.1

10,894

3.4

43,750

39,548

34,078

- on Advances / Bills

8,126

8,101

0.3

8,005

1.5

32,066

28,457

24,380

- on investments

2,943

2,850

3.3

2,681

9.8

10,924

10,251

9,112

- on balance with RBI & others

199

189

5.1

208

(4.5)

760

731

585

Interest Expended

8,621

8,623

(0.0)

8,526

1.1

34,086

30,603

26,199

Net Interest Income

2,647

2,517

5.2

2,368

11.8

9,663

8,944

7,879

Other income

1,210

1,113

8.8

1,021

18.5

4,550

3,933

3,153

Other income excl. treasury

915

915

0.1

877

4.4

3,505

3,269

2,477

- Fee Income

222

214

3.7

224

(0.9)

928

940

797

- Treasury Income

295

198

49.0

144

104.4

1,045

664

676

- Recov. from written off a/cs

161

210

(23.3)

90

78.9

371

425

303

- Others

532

491

8.4

563

(5.4)

2,206

1,904

1,377

Operating income

3,857

3,629

6.3

3,389

13.8

14,214

12,877

11,032

Operating expenses

1,913

1,626

17.6

1,764

8.5

7,264

6,081

5,142

- Employee expenses

1,108

1,059

4.6

1,036

7.0

4,274

3,672

3,254

- Other Opex

805

567

41.9

728

10.6

2,989

2,409

1,888

Pre-provision Profit

1,944

2,004

(3.0)

1,626

19.6

6,950

6,796

5,890

Provisions & Contingencies

1,212

1,360

(10.8)

814

49.0

3,453

3,733

2,218

- Provisions for NPAs

979

1,314

(25.5)

912

7.3

3,771

2,135

1,861

- Provisions for Investments

64

133

(51.9)

(22)

(390.9)

(658)

692

(370)

- Other Provisions

169

(87)

(294.0)

(76)

(321.9)

340

906

727

PBT

732

644

13.7

812

(9.9)

3,497

3,063

3,672

Provision for Tax

203

165

23.0

185

9.7

795

625

800

PAT

529

479

10.4

627

(15.6)

2,702

2,438

2,872

Effective Tax Rate (%)

27.7

25.6

210bp

22.8

494bp

22.7

20.4

21.8

Source: Company, Angel Research

November 20, 2015

2

Canara Bank | 2QFY2016 Result Update

Exhibit 2: 2QFY2016 performance analysis (Standalone)

Particulars

2QFY16 1QFY16

% chg (qoq)

2QFY15

% chg (yoy)

Balance sheet

Advances (` cr)

3,23,077

3,24,063

(0.3)

3,10,860

3.9

Deposits (` cr)

4,85,206

4,71,877

2.8

4,61,193

5.2

Credit-to-Deposit Ratio (%)

66.6

68.7

(209)bp

67.4

(82)bp

Current deposits (` cr)

19,257

17,534

9.8

17,743

8.5

Saving deposits (` cr)

96,745

92,149

5.0

86,287

12.1

CASA deposits (` cr)

1,16,002

1,09,683

5.8

1,04,030

11.5

Calculated CASA ratio (%)

23.91

23.2

66bp

22.56

135bp

CAR (%)

11.04

10.8

29bp

10.19

85bp

Tier 1 CAR (%)

8.63

8.3

35bp

7.41

122bp

Profitability Ratios (%)

Cost of deposits

7.07

7.12

(5)bp

7.40

(33)bp

Yield on advances

10.18

10.22

(4)bp

10.69

(51)bp

Yield on investments

7.95

7.97

(2)bp

8.04

(9)bp

Yield on funds

8.30

8.28

2bp

8.77

(47)bp

Cost of funds

6.39

6.41

(2)bp

6.82

(43)bp

Reported NIMs

2.24

2.21

3bp

2.24

0bp

Cost-to-income ratio

49.59

44.80

480bp

52.04

(244)bp

Asset quality

Gross NPAs (` cr)

14,021

13,081

7.2

9,164

53.0

Gross NPAs (%)

4.27

3.98

29bp

2.92

135bp

Net NPAs (` cr)

9,383

8,888

5.6

7,170

30.9

Net NPAs (%)

2.90

2.74

16bp

2.31

59bp

PCR incl. tech. w/offs (%)

59.81

59.02

79bp

58.68

113bp

Slippage ratio (%)

2.67

3.05

(39)bp

4.22

(155)bp

NPA to avg. assets (%)

0.72

0.99

(27)bp

0.79

(7)bp

Source: Company, Angel Research

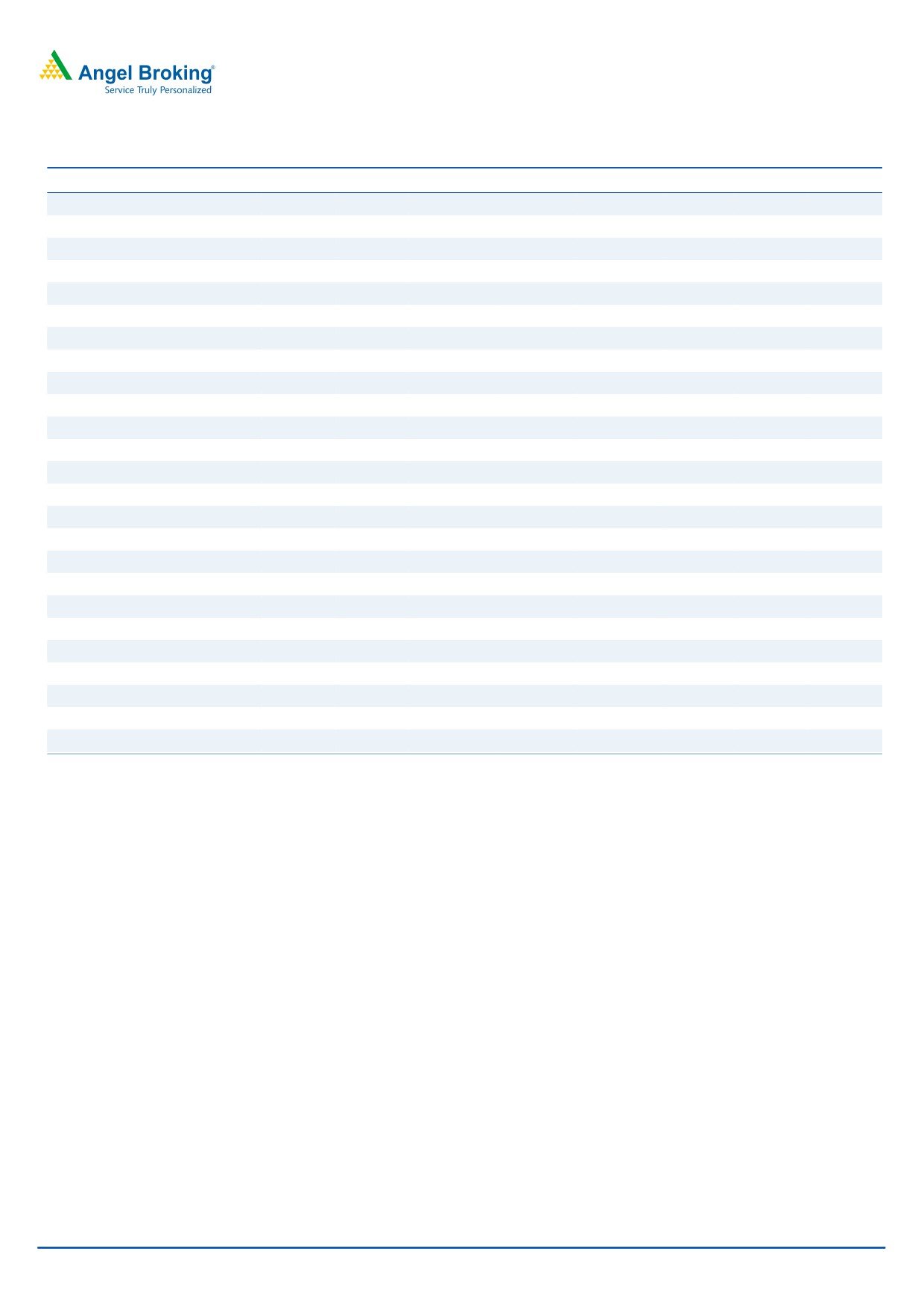

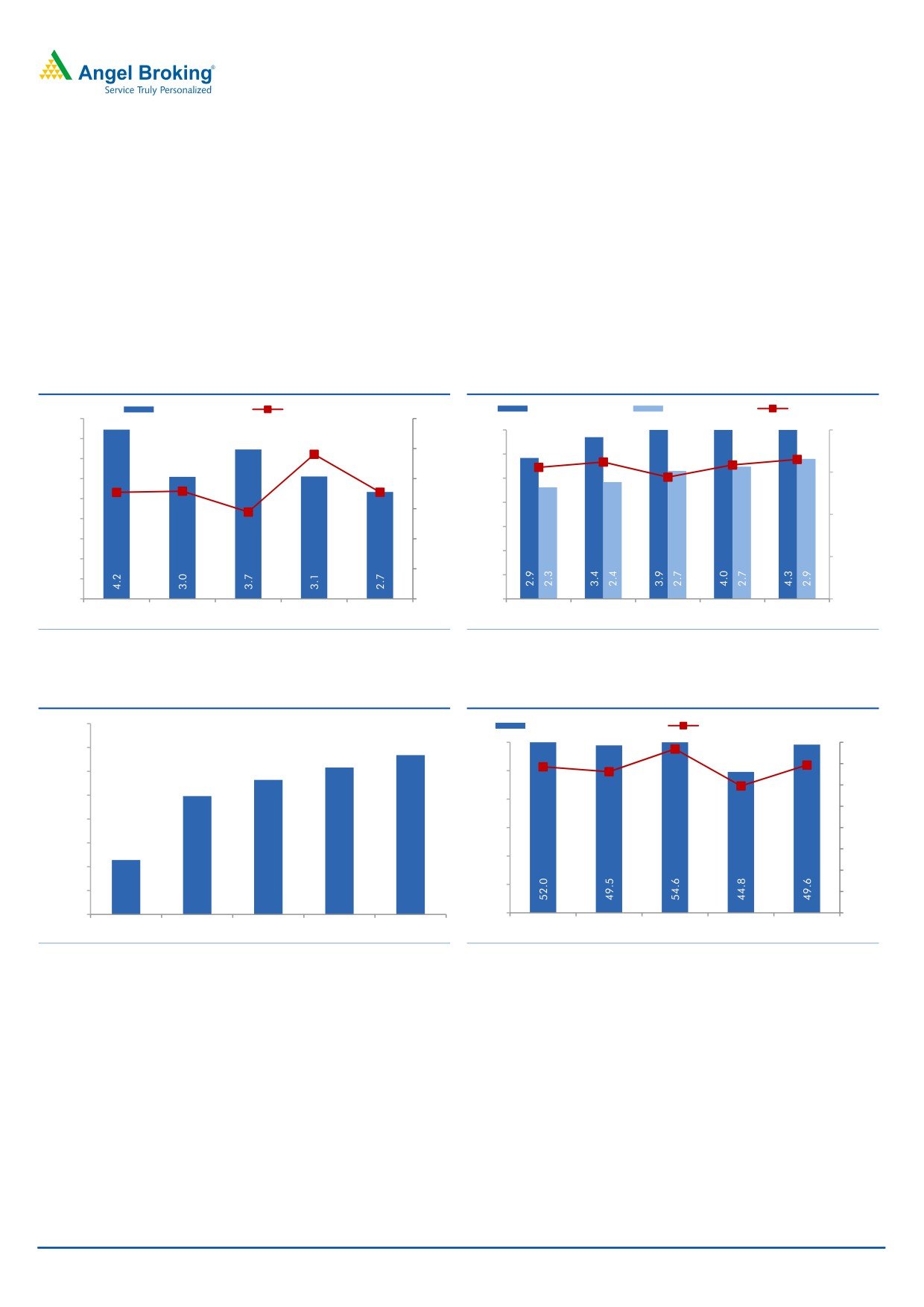

Loan book grows at a slow pace; NIM rises qoq

During 2QFY2015, the bank’s loan book grew by 3.9% yoy with retail loan book

growing at a faster pace at 14.3% yoy. The C-D ratio came down to 66.6% from

67.4% in 2QFY2015. Deposits growth was muted at 5.2% yoy with CASA deposits

showing momentum (which grew by 11.5% yoy). As a result, the domestic CASA

ratio for the bank rose by 178bp yoy to 25.5% as of 2QFY2016.

The Reported Global NIM rose sequentially from 2.21% in 1QFY2016 to 2.24% in

the current quarter which aided NII growth of 11.8% for the quarter. The

Management expects to reach 2.35% NIM by the end of this fiscal year.

November 20, 2015

3

Canara Bank | 2QFY2016 Result Update

Exhibit 3: Loan book growth slows

Exhibit 4: Calculated CASA falls sequentially and yoy

Adv. yoy chg (%)

Dep. yoy chg (%)

CDR (%, RHS)

Calculated CASA ratio

CASA yoy growth (%, RHS)

24.5

15.0

69.7

20.0

70.0

68.7

11.5

18.0

69.5

24.0

11.2

11.5

16.0

69.0

9.2

9.9

14.0

68.5

23.5

10.0

12.0

67.4

67.5

68.0

23.0

10.0

67.5

8.0

66.6

67.0

22.5

5.0

6.0

66.5

4.0

66.0

22.0

2.0

65.5

-

65.0

21.5

-

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Source: Company, Angel Research

Source: Company, Angel Research

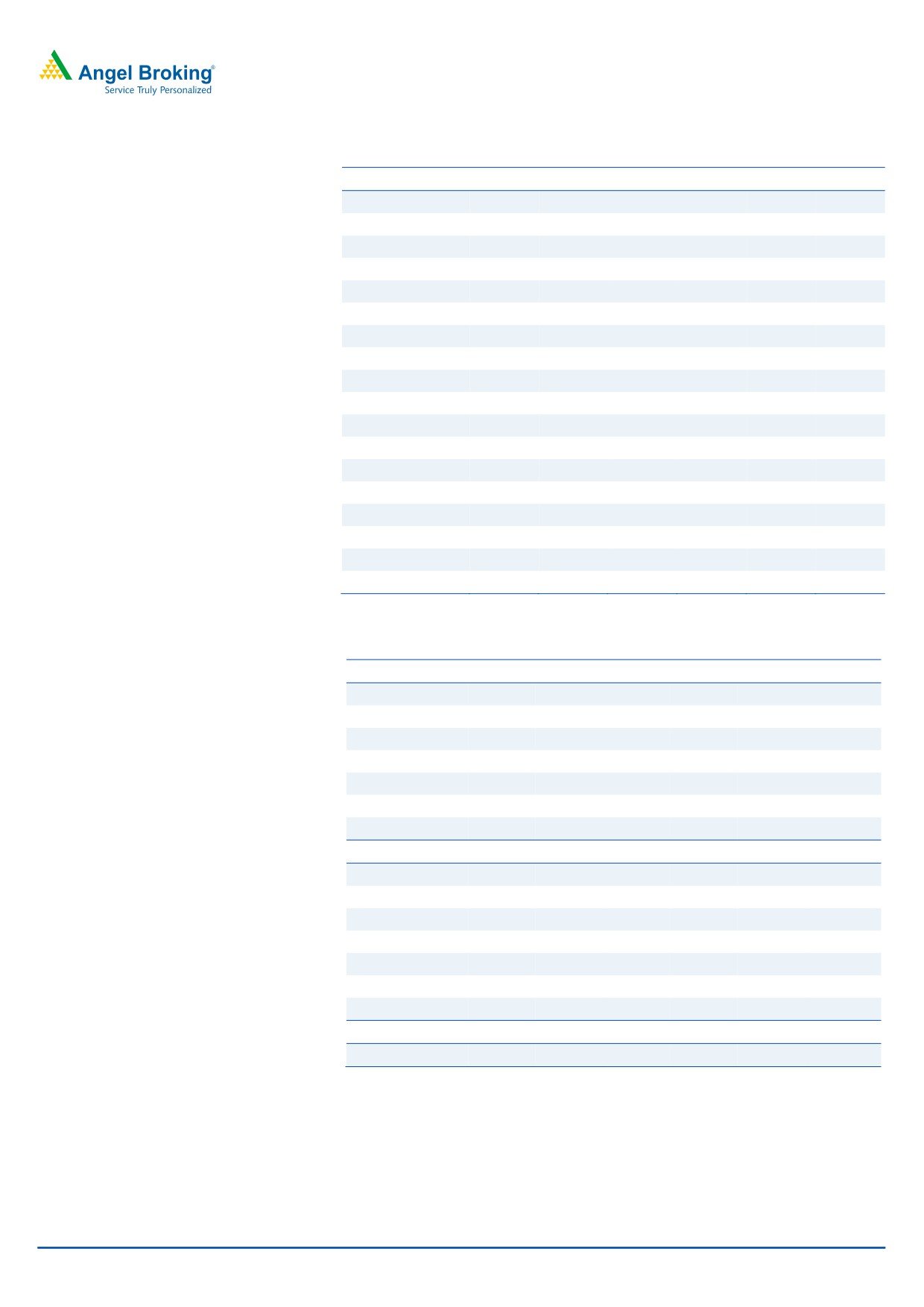

Exhibit 5: YoA falls qoq and yoy

Exhibit 6: NIM rises 3bp qoq

(%)

(%)

11.5

2.26

2.25

2.25

11

10.76

10.75

2.24

2.24

2.24

10.69

2.24

10.5

10.22

10.18

2.23

2.22

10

2.21

2.21

9.5

2.2

9

2.19

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Source: Company, Angel Research

Source: Company, Angel Research

Subdued growth in non-interest income

During 2QFY2016, the non-interest income (excluding treasury) was subdued with

a yoy growth of 4.4% largely aided by recoveries from written off accounts.

Treasury income doubled for the quarter at `295cr as against `144cr for the

corresponding quarter of the previous fiscal.

Exhibit 7: ‘Recoveries’ aids strong growth in Oth. income excl. Treasury

Particulars (` cr)

2QFY2016 1QFY2016 % chg (qoq) 2QFY2015 % chg (yoy)

Fee Income

222

214

3.7

224

(0.9)

Treasury

295

198

49.0

144

104.4

Recoveries

161

210

(23.3)

90

78.9

Others

532

491

8.4

563

(5.4)

Other income

1,210

1,113

8.8

1,021

18.5

Other income excl. treasury

915

915

0.1

877

4.4

Source: Company, Angel Research

November 20, 2015

4

Canara Bank | 2QFY2016 Result Update

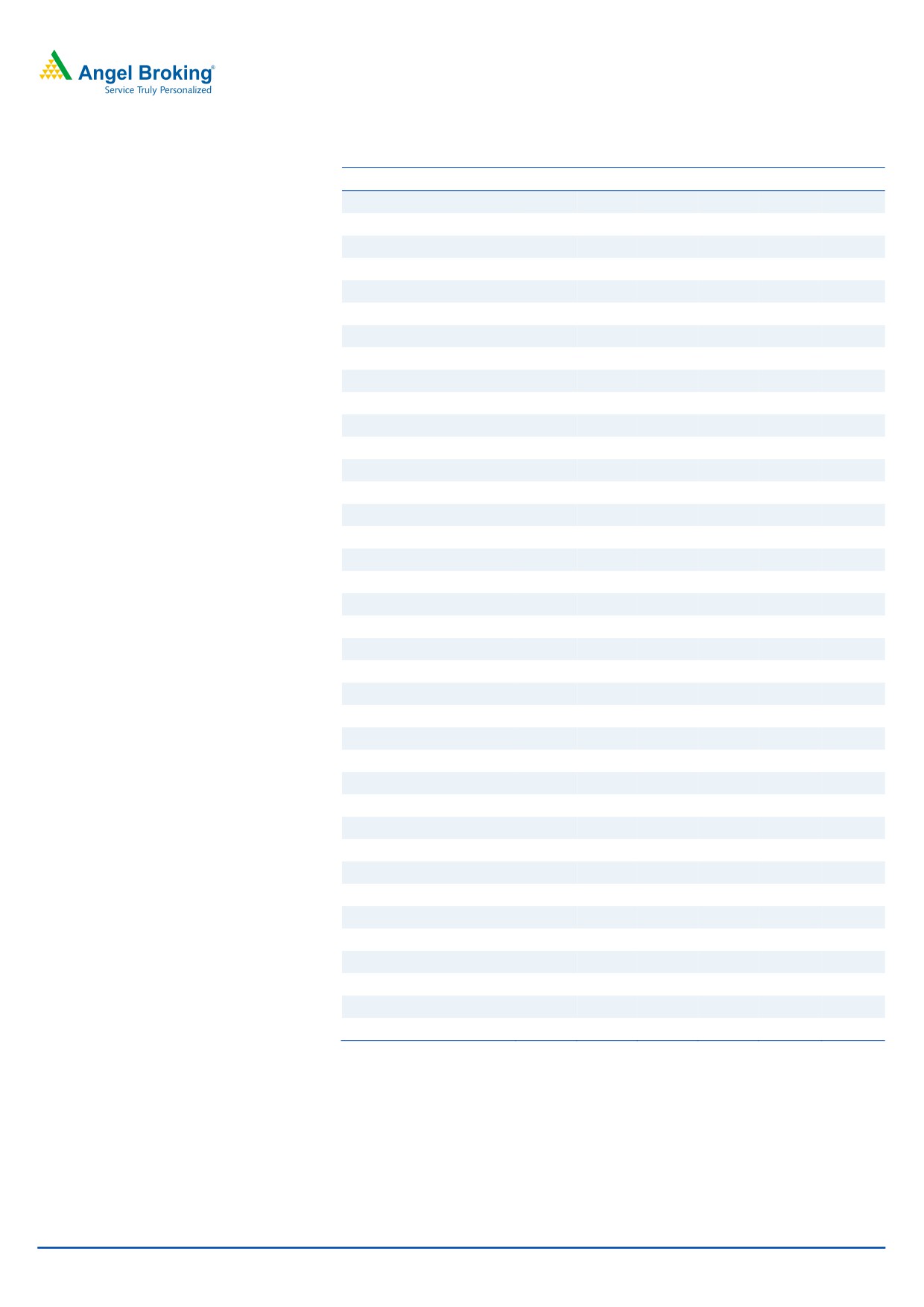

Asset quality pressures continue with surge in NPA ratios

On the asset quality front, slippages came in at `2,202cr (annualized slippage rate

of 2.7% as compared to 3.1% in 1QFY2016). Recoveries and upgrades were lower

at `1,261cr as compared to `2,478cr in 1QFY2016. As a result, the Gross NPA

ratio went up to 4.27% as compared to 3.98% in 1QFY2016, whereas the Net

NPA increased to 2.90% from 2.74% in 1QFY2016. Additionally, the bank

restructured advances worth

`600cr during the quarter taking the book to

`29,026cr as on 2QFY2016. The Provision Coverage Ratio improved to 59.81%

from 58.68% in 2QFY2015

Exhibit 8: Slippages remain moderate in 2QFY2016

Exhibit 9: NPA ratios increases sequentially

Slippages (%)

Credit cost (%, RHS)

Gross NPAs (%)

Net NPAs (%)

PCR (%, RHS)

4.50

1.2

3.5

64.0

4.00

1.0

59.8

1.0

59.4

59.0

3.0

58.7

3.50

57.3

0.7

0.7

0.7

58.0

3.00

0.8

2.5

2.50

0.6

2.0

0.6

52.0

2.00

1.5

1.50

0.4

1.0

1.00

46.0

0.2

0.5

0.50

-

-

-

40.0

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Source: Company, Angel Research

Source: Company, Angel Research; Note: PCR including tech. write-offs

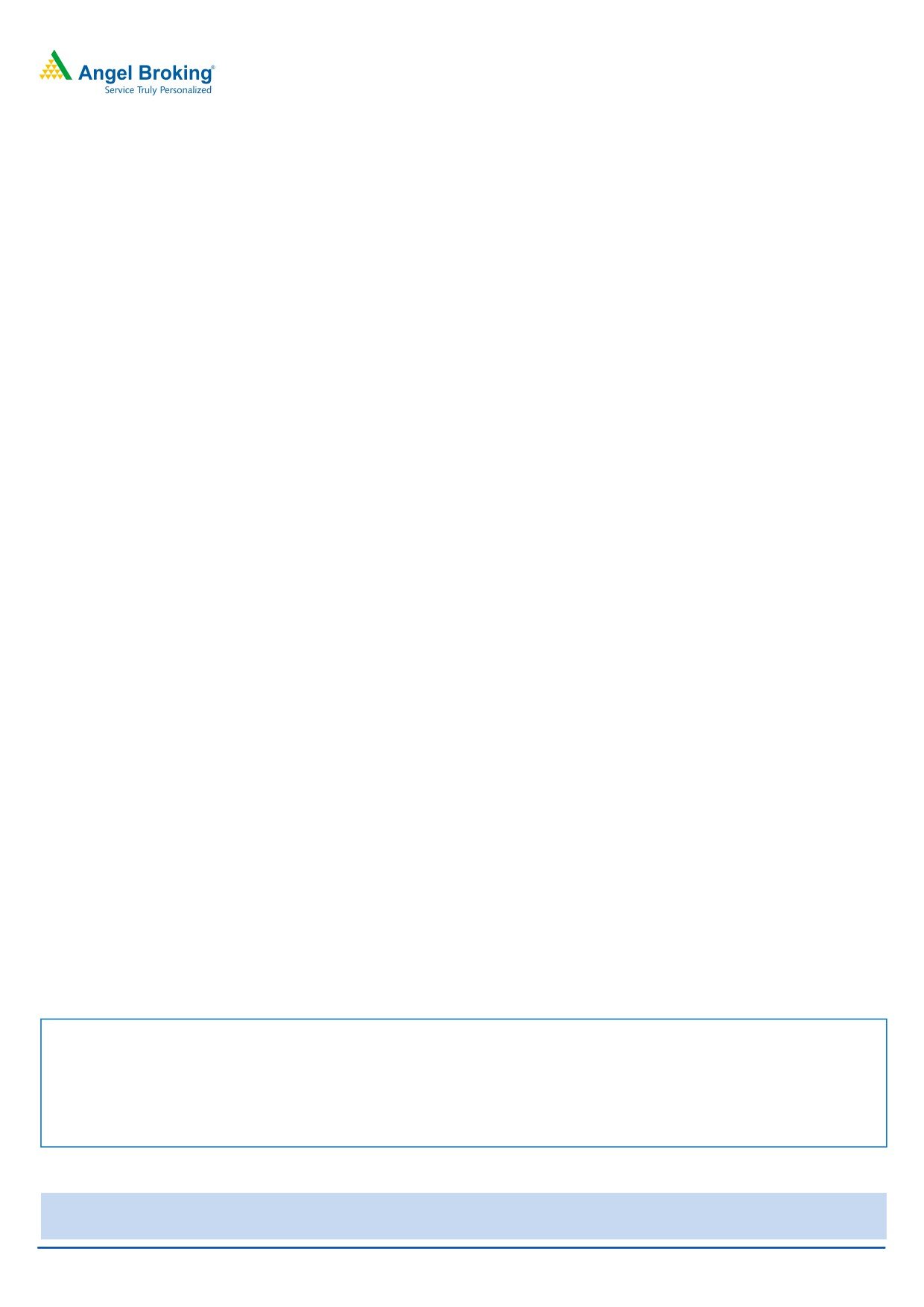

Exhibit 10: Branch expansion slows down qoq

Exhibit 11: Cost to income ratio declines qoq

5,800

Cost-to-income ratio (%)

Opex to average assets (%, RHS)

5,734

50.0

1.6

5,750

1.5

5,708

1.4

5,682

1.4

1.4

5,700

45.0

1.3

5,648

1.2

1.2

5,650

40.0

1.0

5,600

35.0

0.8

5,550

5,514

0.6

30.0

5,500

0.4

25.0

5,450

0.2

5,400

20.0

-

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Source: Company, Angel Research

Source: Company, Angel Research

November 20, 2015

5

Canara Bank | 2QFY2016 Result Update

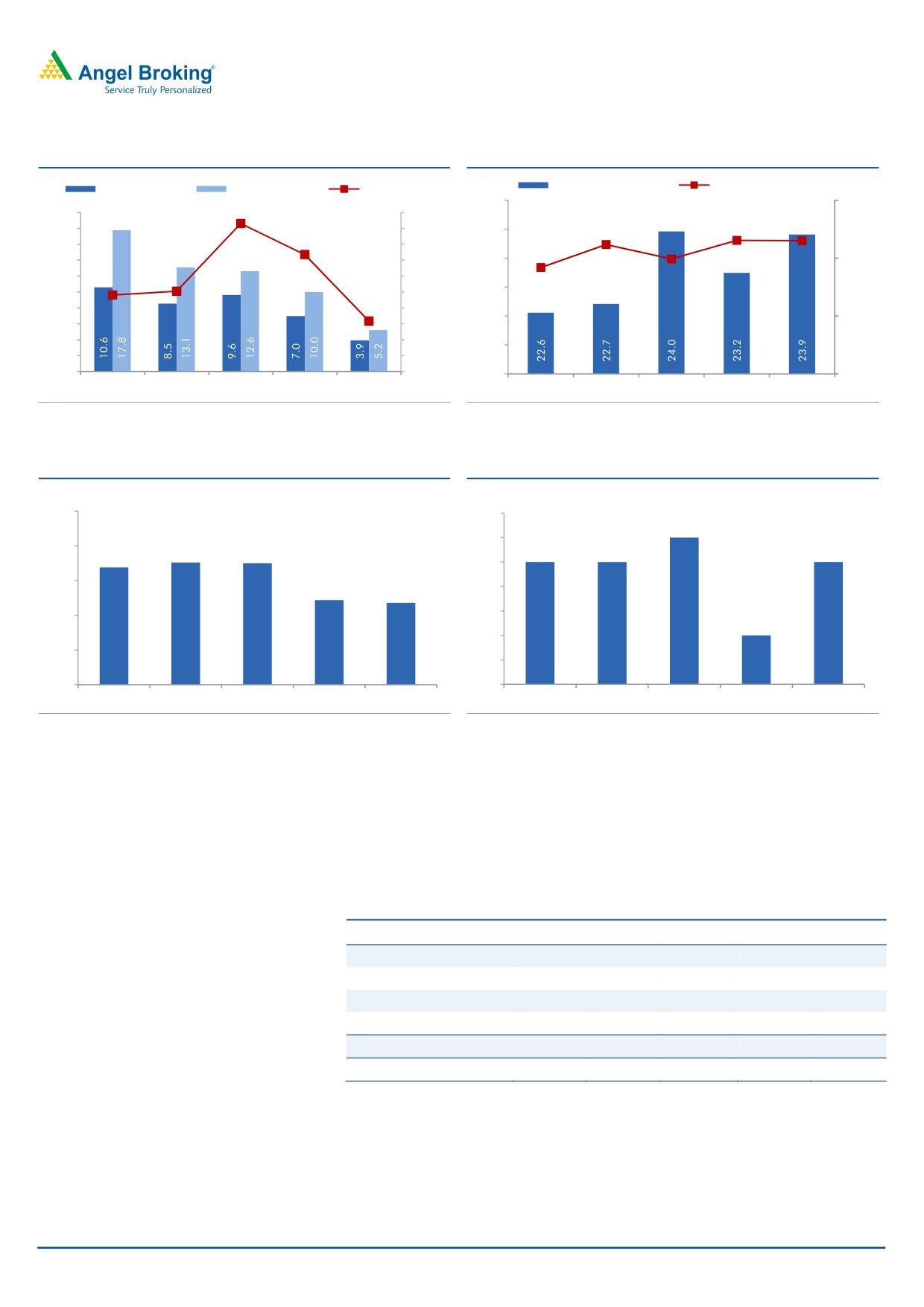

Outlook and valuation

Canara Bank has been reporting subdued growth in its profitability over the past

several quarters. Canara Bank has larger exposure to the various stress sectors in

the economy as compared to its peers. At the current market price, the stock trades

at 0.4x FY2017E ABV. We maintain our Neutral view on the stock.

Exhibit 12: Recommendation summary

CMP

Tgt. Price

Upside

FY2017E

FY2017E

FY2017E

FY15-17E

FY2017E

FY2017E

Company

Reco.

(`)

(`)

(%)

P/ABV (x)

Tgt. P/ABV (x)

P/E (x)

EPS CAGR (%)

RoA (%)

RoE (%)

HDFCBk

Buy

1,048

1,262

20.4

3.2

3.8

17.2

22.4

1.9

19.7

ICICIBk*

Buy

260

354

36.1

1.8

2.0

10.7

13.4

1.6

14.7

YesBk

Buy

723

921

27.3

1.9

2.4

10.4

20.5

1.6

19.6

AxisBk

Buy

464

630

35.8

1.9

2.6

10.7

18.4

1.8

18.9

SBI*

Buy

241

283

17.4

1.2

1.2

9.9

17.8

0.7

12.7

FedBk

Neutral

55

-

-

1.0

1.0

8.9

3.1

1.0

11.9

SIB

Neutral

20

-

-

0.7

0.8

6.1

21.6

0.7

11.6

BOB

Neutral

168

-

-

0.9

0.9

8.0

17.5

0.6

10.6

PNB

Neutral

136

-

-

0.6

0.6

5.0

28.5

0.7

12.0

BOI

Neutral

129

-

-

0.3

0.8

3.9

14.0

0.3

7.6

IndBk

Neutral

126

-

-

0.4

0.3

4.2

19.4

0.6

8.6

Vijaya Bank

Neutral

34

-

-

0.5

0.5

5.1

14.1

0.4

8.8

OBC

Neutral

146

-

-

0.3

0.5

3.2

65.5

0.5

9.4

Allahabad Bank Neutral

74

-

-

0.3

0.3

2.7

56.2

0.6

11.9

UnionBk

Neutral

160

-

-

0.5

0.4

4.1

18.1

0.6

11.4

CanBk

Neutral

270

-

-

0.4

0.3

3.8

12.0

0.6

11.2

AllBk

Neutral

74

-

-

0.3

0.4

2.7

56.2

0.6

11.9

IDBI#

Neutral

83

-

-

0.5

0.6

5.8

61.6

0.6

9.3

DenaBk

Neutral

41

-

-

0.3

0.4

4.1

45.6

0.4

7.9

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), #Without adjusting for SASF

Company Background

Canara Bank is a south India based PSU bank (fifth largest bank in India), with a

balance sheet size of around `5.3lakh cr. The bank has a reasonably large

pan-India presence with a network of 5500+ branches. The bank also has over

7,095 ATMs across the country.

November 20, 2015

6

Canara Bank | 2QFY2016 Result Update

Income statement (Standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Net Interest Income

7,689

7,879

8,944

9,664

10,645

11,893

- YoY Growth (%)

(0.1)

2.5

13.5

8.0

10.2

11.7

Other Income

2,928

3,153

3,933

4,550

4,796

5,052

- YoY Growth (%)

4.1

7.7

24.7

15.7

5.4

5.3

Operating Income

10,617

11,032

12,877

14,214

15,441

16,945

- YoY Growth (%)

1.0

3.9

16.7

10.4

8.6

9.7

Operating Expenses

4,674

5,142

6,081

7,264

7,627

8,042

- YoY Growth (%)

5.8

10.0

18.3

19.4

5.0

5.4

Pre - Provision Profit

5,943

5,890

6,796

6,950

7,814

8,903

- YoY Growth (%)

(2.4)

(0.9)

15.4

2.3

12.4

13.9

Prov. & Cont.

1,860

2,218

3,733

3,497

4,721

4,055

- YoY Growth (%)

74.6

19.2

68.3

(6.3)

35.0

(14.1)

Profit Before Tax

4,083

3,672

3,063

3,454

3,094

4,849

- YoY Growth (%)

(18.8)

(10.1)

(16.6)

12.8

(10.4)

56.7

Prov. for Taxation

800

800

625

785

882

1,503

- as a % of PBT

19.6

21.8

20.4

22.7

28.5

31.0

PAT

3,283

2,872

2,438

2,669

2,212

3,346

- YoY Growth (%)

(18.5)

(12.5)

(15.1)

9.5

(17.1)

51.2

Balance sheet (Standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Share Capital

443

443

461

475

475

475

Reserve & Surplus

22,247

24,435

29,159

31,906

33,646

36,268

Deposits

3,27,054

3,55,856

4,20,723

4,73,840

5,02,271

5,42,452

- Growth (%)

11.5

8.8

18.2

12.6

6.0

8.0

Borrowings

6,558

11,573

15,955

14,678

15,516

16,700

Tier 2 Capital

8,967

8,711

11,276

10,994

10,719

10,451

Other Liab. & Prov.

8,891

11,325

14,348

16,108

16,693

17,161

Total Liabilities

3,74,160

4,12,343

4,91,922

5,48,001

5,79,320

6,23,508

Cash Balances

17,795

15,406

22,154

21,972

25,114

27,123

Bank Balances

10,384

19,309

22,675

26,669

26,069

24,940

Investments

1,02,057

1,21,133

1,26,828

1,45,346

1,49,871

1,52,648

Advances

2,32,490

2,42,177

3,01,067

3,30,036

3,53,138

3,91,983

- Growth (%)

10.0

4.2

24.3

9.6

7.0

11.0

Fixed Assets

2,858

2,863

6,642

6,950

7,126

7,440

Other Assets

8,576

11,456

12,556

17,028

18,002

19,375

Total Assets

3,74,160

4,12,343

4,91,922

5,48,001

5,79,320

6,23,508

- Growth (%)

11.4

10.2

19.3

11.4

5.7

7.6

November 20, 2015

7

Canara Bank | 2QFY2016 Result Update

Ratio analysis (Standalone)

Y/E March

FY12

FY13

FY14

FY15

FY16E

FY17E

Profitability ratios (%)

NIMs

2.2

2.1

2.1

1.9

2.0

2.1

Cost to Income Ratio

44.0

46.6

47.2

51.1

49.4

47.5

RoA

0.9

0.7

0.5

0.5

0.4

0.6

RoE

17.0

13.2

10.4

10.5

8.0

11.2

B/S ratios (%)

CASA Ratio

24.3

24.2

24.5

24.0

25.3

26.7

Credit/Deposit Ratio

71.1

68.1

71.6

69.7

70.3

72.3

CAR

13.8

12.4

11.1

10.7

10.6

10.5

- Tier I

10.4

9.8

8.0

8.0

8.0

8.1

Asset Quality (%)

Gross NPAs

1.7

2.6

2.5

3.9

5.3

5.5

Net NPAs

1.5

2.2

2.0

2.6

2.9

2.5

Slippages

2.2

2.5

3.5

3.6

3.5

3.0

Loan Loss Prov. /Avg. Assets

0.4

0.5

0.5

0.7

0.8

0.6

Provision Coverage

67.6

61.4

60.1

60.0

62.5

67.5

Per Share Data (`)

EPS

74.1

64.8

52.9

56.2

46.6

70.4

ABVPS (75% cover.)

448.1

473.6

474.3

496.7

530.7

610.7

DPS

11.0

13.0

11.0

8.6

8.5

13.0

Valuation Ratios

PER (x)

3.6

4.2

5.1

4.8

5.8

3.8

P/ABVPS (x)

0.6

0.6

0.6

0.5

0.5

0.4

Dividend Yield

4.1

4.8

4.1

3.2

3.2

4.8

DuPont Analysis

NII

2.2

2.0

2.0

1.9

1.9

2.0

(-) Prov. Exp.

0.5

0.6

0.8

0.7

0.8

0.7

Adj. NII

1.6

1.4

1.2

1.2

1.1

1.3

Treasury

0.1

0.2

0.1

0.2

0.2

0.2

Int. Sens. Inc.

1.7

1.6

1.3

1.4

1.2

1.5

Other Inc.

0.7

0.6

0.7

0.7

0.7

0.7

Op. Inc.

2.5

2.2

2.0

2.1

1.9

2.1

Opex

1.3

1.3

1.3

1.4

1.4

1.3

PBT

1.1

0.9

0.7

0.7

0.5

0.8

Taxes

0.2

0.2

0.1

0.2

0.2

0.2

RoA

0.9

0.7

0.5

0.5

0.4

0.6

Leverage

18.4

18.1

19.3

20.4

20.3

20.1

RoE

17.0

13.2

10.4

10.5

8.0

11.2

November 20, 2015

8

Canara Bank | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Canara Bank

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 20, 2015

9