Initiating Coverage | Housing Finance

January 27, 2017

Can Fin Homes

BUY

CMP

`1,728

Favorably placed for sustainable growth

Target Price

`2,128

Can Fin Homes Ltd (Can Fin) is a south based (74% of business) housing finance

Investment Period

12 Months

company with 43.53% shareholdings owned by Canara Bank. Can Fin has maintained

a low-risk profile loan book, predominantly focused on salaried class.

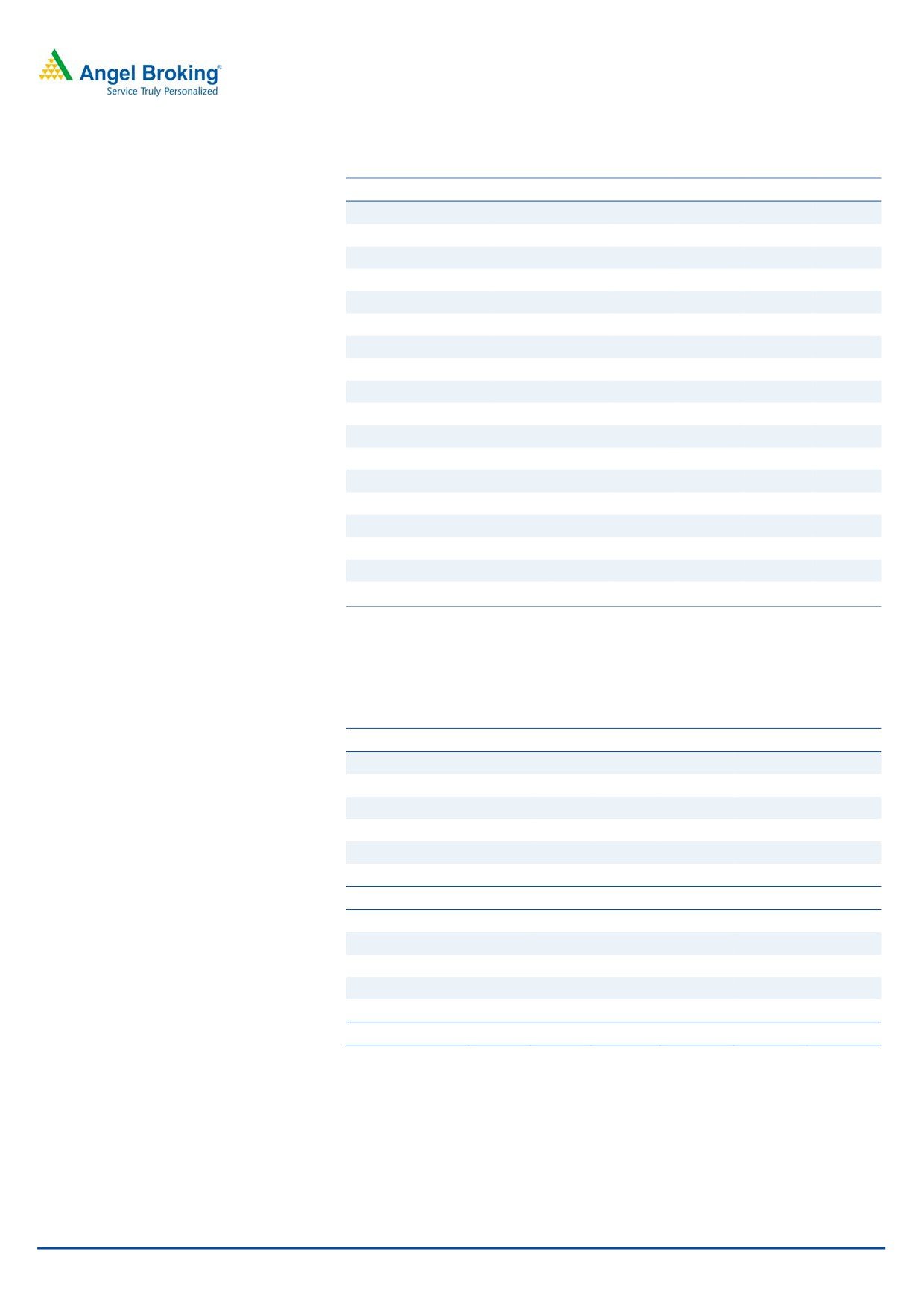

Stock Info

Growth momentum to continue: Over the last 4 years Can Fin has reported

Sector

Housing Finance

phenomenal 41.6% CAGR in loan book. Considering the lower interest rates and

Market Cap (` cr)

4,539

the government’s interest subvention scheme, we believe that the company’s

Beta

1.2

growth momentum would continue and it would record a CAGR of 26% in loan

book over FY2016-19E. Moreover, well capitalized balance sheet, with Capital

52 Week High / Low

1887/841

Adequacy Ratio (CAR) of 18.76% would support the growth trajectory. The management

Avg. Daily Volume

7,825

is targeting a loan book of `35,000cr by March 2020.

Face Value (`)

10

Retail oriented book with a focus on salaried class: Can Fin’s Loan book

BSE Sensex

27,708

comprises of 88% Housing finance, 6% of LAP (50% is to salaried class), builder

Nifty

8,603

loans constitute only 0.16% and the remaining consists of others such as staff,

Reuters Code

CNFH.BO

loan for sites & top up. According to the recent quarter result, it was witnessed

Bloomberg Code

CANF@IN

that Can Fin was not much affected due to demonetization, as loans are largely

offered to the first time home buyers in the salaried class and for the projects

nearing completion. .

Shareholding Pattern (%)

Favorable borrowing & changing asset mix to support NIM: Can Fin has reduced

Promoters

44.1

its dependence on bank borrowing and increased borrowing from debt market

MF / Banks / Indian Fls

18.1

instruments such as CP & NCD (48% in 3QFY2017 v/s. 5% in FY2014), which

FII / NRIs / OCBs

3.8

resulted into lower cost of fund (8.32% in 3QFY2017 from 9.70% in FY2013).

Indian Public / Others

34.0

Further, Can Fin is focusing on the high yielding Non-housing / Non-Salaried

loans in calibrated manner, which should be margin accretive.

Impressive asset quality: Can Fin has been able to improve its asset quality

Abs.(%)

3m 1yr 3yr

(GNPA) from 1.06% in FY2011 to 0.24% in 3QFY2017. With 100% provisioning of

Sensex

(2.9)

11.0

26.9

NPA it has been able to maintain nil NPA consistently for last six years. Its NPAs are

Canfin Homes

(5.0)

67.2

992.7

consistently 0% for the last six years implying 100% coverage ratio.

Outlook & Valuation: We expect Can Fin to deliver RoE of more than 20% on a

sustained basis from FY2017 onwards (FY2017-23.6%, FY2018E-24.1%, and

3-year price chart

FY2019E-25.6%) on the back of higher growth, NIM expansion and stable credit

2,000

cost. Additionally, cost optimization should also add to return ratio. At the current

1,800

1,600

market price, the stock is trading at 2.85x its FY2019E BV of `608. We recommend

1,400

a BUY rating on the stock with a target price of `2,128 (3.5x FY2019E BV).

1,200

1,000

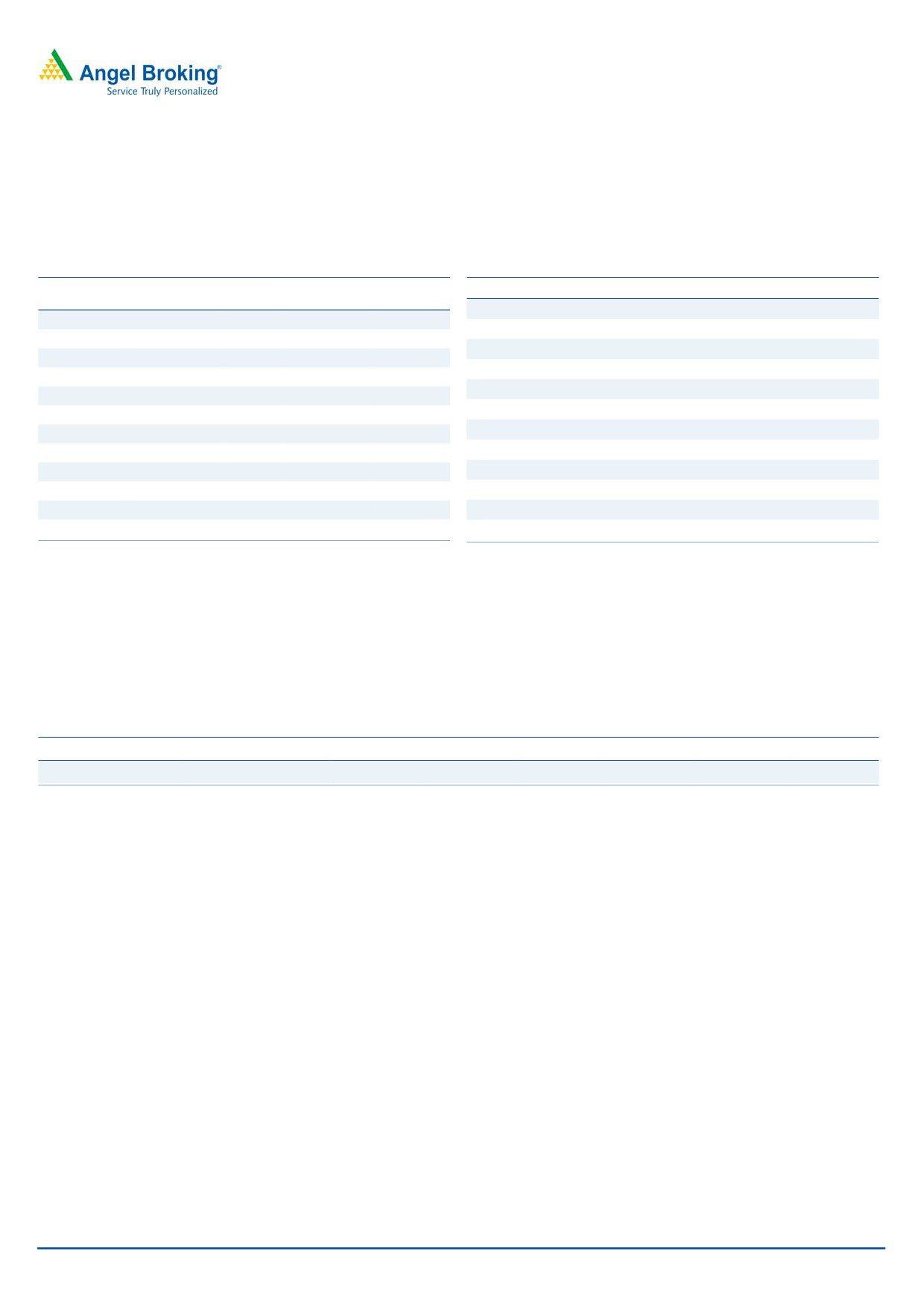

Key Financials (Standalone)

800

600

FY14

FY15

FY16

FY17E

FY18E

FY19E

400

200

NII

136.1

179.6

309.0

420.3

525.7

665.1

0

% Chg

41.1

31.9

72.1

36.0

25.1

26.5

Net Profit

75.7

86.2

157.1

230.3

287.1

375.2

% Chg

41.0

13.9

82.2

46.6

24.6

30.7

Source: Company, Angel Research

NIM (%)

2.7

2.5

3.2

3.5

3.5

3.5

EPS (`)

37.0

32.4

59.0

86.5

107.8

141.0

P/E (x)

46.8

53.13

29.13

20

16

12.3

P/BV (x)

7.8

6.0

5.2

4.3

3.5

2.8

Jaikishan J Parmar

RoA (%)

1.5

1.2

1.6

1.9

1.9

2.0

022 39357600, Extn: 6810

RoE (%)

17.9

14.1

19.0

23.6

24.1

25.6

Source: Company, Angel Research; Note: CMP as of January 25, 2017

Please refer to important disclosures at the end of this report

1

Can Fin Homes | Initiating Coverage

Multiple drivers for loan growth

The company’s loan book has grown at a CAGR of 39%/41.6%/37.3% in the last

Affordable housing segment - principle

3/4/5 years. This growth is without any deliberate policy by the government. We

growth driver

believe that the recent changes in Pradhan Mantri Awas Yojana (PMAY) and other

initiatives, stringent policy and regulation by government are likely to raise

demand for houses & eventually the demand for home loans. The management is

targeting a loan book of `35,000cr by March 2020.

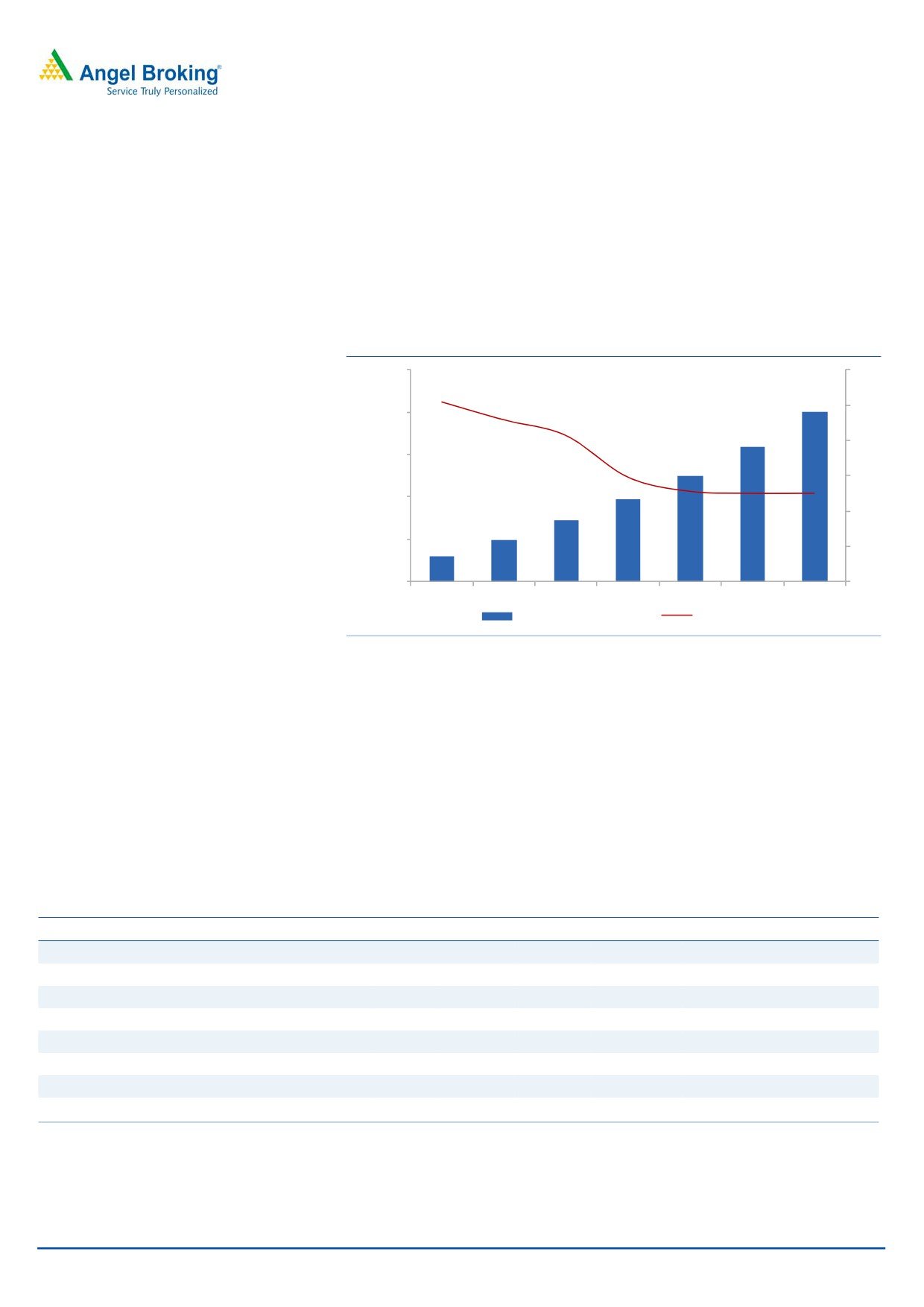

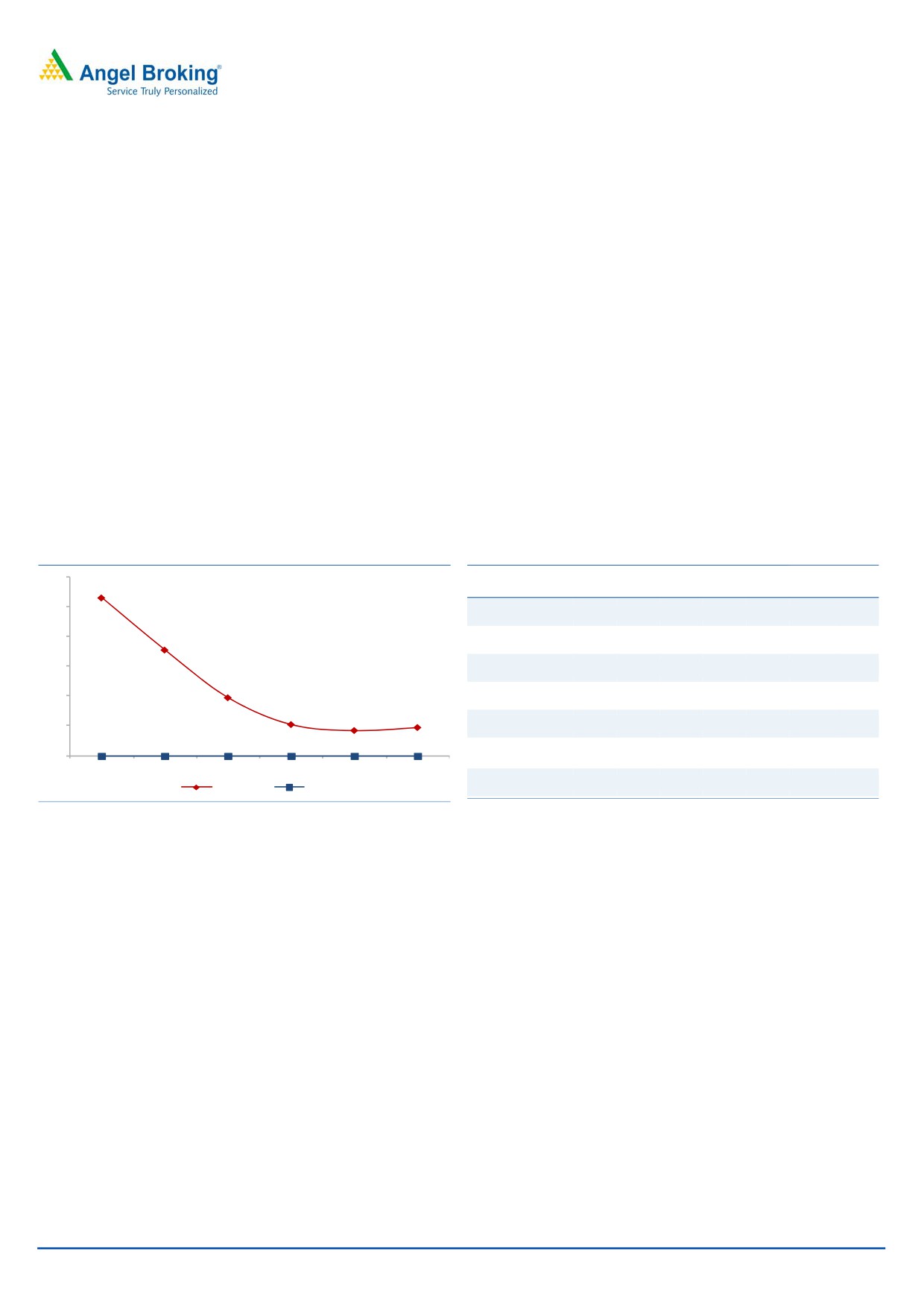

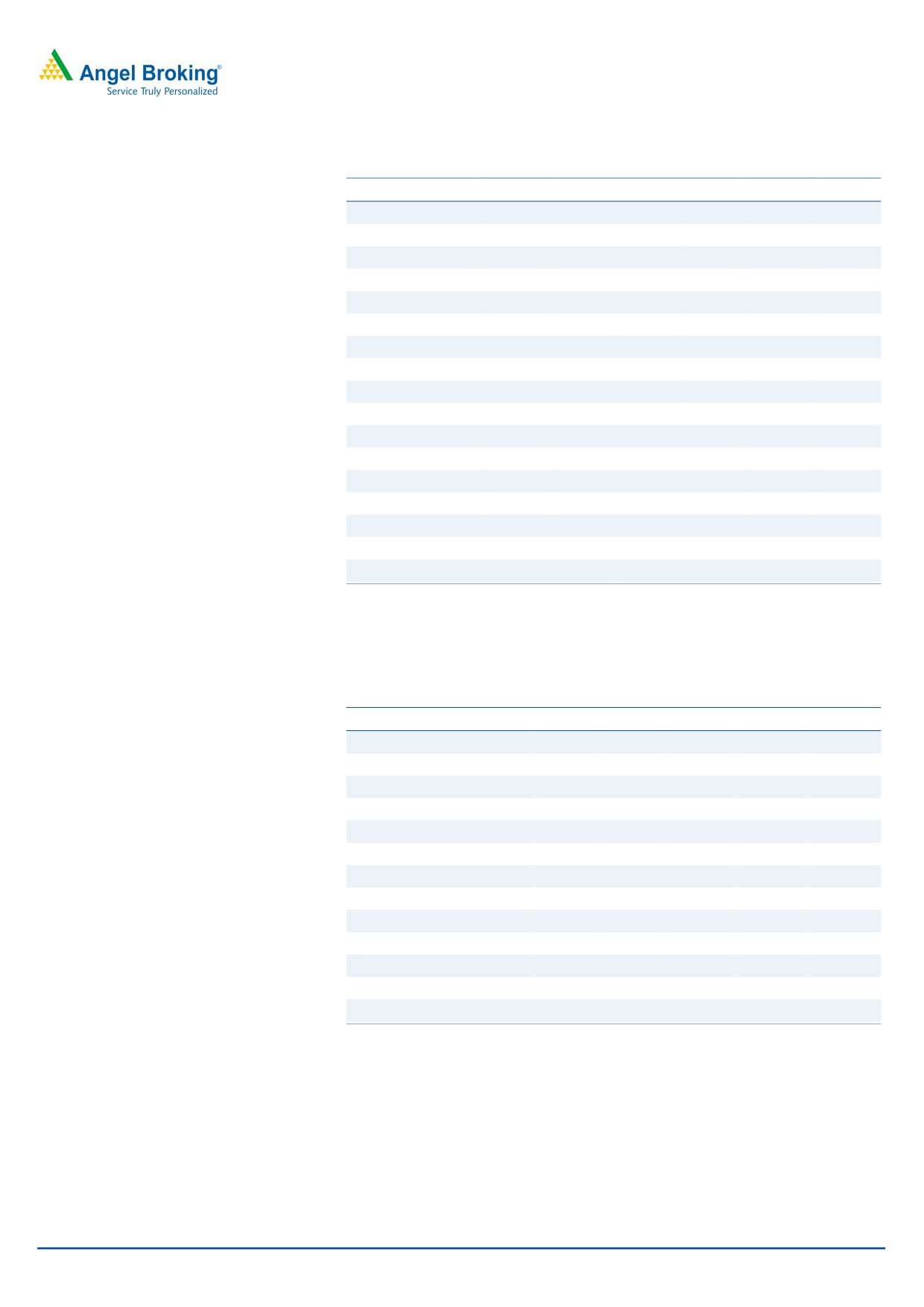

Exhibit 1: Loan Book growth Trend

26,000

60

51

50

21,000

46

41

40

16,000

30

30

11,000

26

25

25

20

6,000

10

1,000

-

FY13

FY14

FY15

FY16

FY17E

FY18E

FY19E

Loan Book (` in cr)

Growth YoY (%)

Source: Company, Angel Research

Until 2011, Can Fin Homes was reporting moderate loan growth (~9% CAGR

over 2002-2011). However, since 2011 it has grown its advances at a CAGR of

39%/41.6%/37.3% in the last 3/4/5 year. In order to achieve such a phenomenal

growth, Can Fin has added 79 branches and 50 satellite offices in last five years

(currently 120 offices and 50 satellite offices). For further growth, the management

has a vision to reach the loan book size of `35,000cr by March 2020 with high

asset quality. This implies that its loan book could grow by healthy ~35% CAGR till

2020. We estimate Can Fin’s loan book to grow at a CAGR of 25% over FY2016-

FY2019E.

Exhibit 2: Comparative Loan book growth of peers

` in cr

FY11

FY12

FY13

FY14

FY15

FY16

CAGR 5 (%)

CAGR 4 (%)

CAGR 3 (%)

LIC Hsg

51,400

63,080

77,812

91,341

1,08,361

1,25,173

19.5

18.7

17.2

DHFL

19,740

28,805

42,163

58,810

78,632

1,02,834

39.1

37.5

34.6

India Bulls Hsg

19,800

27,500

34,400

41,200

52,200

68,700

28.3

25.7

25.9

PNB Hsg

2,899

3,800

5,400

8,600

14,400

25,600

54.6

61.1

68.0

Gruh Fin

3,176

4,077

5,447

7,020

8,926

11,115

28.5

28.5

26.8

Can Fin Hom

2,205

2,673

4,030

5,874

8,302

10,753

37.3

41.6

38.7

Repco

2,079

2,804

3,545

4,662

6,013

7,691

29.9

28.7

29.5

GIC Housing

3,416

3,872

4,539

5,313

6,598

7,912

18.3

19.6

20.3

Source: Company, Angel Research

January 27, 2017

2

Can Fin Homes | Initiating Coverage

Government’s drive - affordable housing for all

Since the general election of 2014, NDA had campaigned and promised to roll

out low cost housing programs (Affordable house/House for all), which would

benefit the large population of India, especially the economically weaker sections.

After taking office, NDA had granted infrastructure status to the affordable housing

segment in the 2014-15 Budget, which enabled lower borrowing costs for

developers.

Affordable house/House for all was one of the core promises made during the

election campaigns. The government launched the Pradhan Mantri Awas Yojana in

2015, with the aim of building 2 crore houses over a seven year period till 2022.

The scheme provided for an upfront subsidy for low cost housing along with a

6.5% interest rate subsidy for loans up to ` 6 lakh.

The Government plans to implement the project via four modes:

Slum Redevelopment

Affordable Housing through credit linked Subsidy

Affordable Housing in partnership

Subsidy for beneficiary led individual house construction or enhancement

Exhibit 3: The Pradhan Mantri Awas Yojna older schemes

Beneficiary

Dwelling Area

Eligibility Criteria

EWS ( Economically

30 Sq Meters

Having an annual income upto ` 3 Lakhs

Weaker Section)

LIG ( Low Income Group)

60 Sq Meters

Having Annual Income Upto `3-6 lakhs

Source: Company, Angel Research

Under this scheme, loan up to `6 lakh is provided to the beneficiary at a

subsidized interest rate of 6.5% for a tenure of 15 years. The maximum interest

subsidy is `2.2 lakh. The scheme was officially launched in 2015; it subsumed an

earlier scheme called the Rajiv Awas Yojana.

Exhibit 4: Progress of PM Awas Yojana between 2014 - 2016

House Involved

12,27,088

House gronded for construction

2,21,373

House Completed

48,236

Source: Company, Angel Research

As per the vision of ‘Housing for All by 2022’, the government has been aiming to

supply affordable homes to majority of the population. In addition to that, the Real

Estate Regulatory Act that has been passed by both the houses at the end of this

financial year has also brought forward the scope for development of the sector. In

the upcoming years, certain long term goals and initiatives of the government are

likely to raise demand for houses, thereby eventually raising the demand for home

loans.

Can Fin Homes, FY2016 Annual Report

January 27, 2017

3

Can Fin Homes | Initiating Coverage

The actual number of PMAY doesn’t commensurate with the big bang promise

made by present government. Primary reason for the muted response/activity

could be the loan limit of ` 6 lakh, which may be inadequate for meeting the cost

involved for building house. The average ticket size for affordable house in tier 2 &

3 Cities is `10-15 lakhs, much higher than the earlier cap of ` 6 lakh for interest

subvention on housing loans.

This can be validated from the recent data provided by National Housing Board

(NHB) progress of housing report released last year. Out of the total outstanding

individual housing loans of ` 4.40 lakh crore given by 26 PSBs in 2014-15, 65%

were given to people taking loans up to ` 25 lakh.

PM Modi’s new scheme for subsidized home loans could trigger

a growth for the sector

In his address to the nation, Honorable Prime Minister, Mr. Narendra Modi,

announced some benefits which could make affordable housing more realistic.

Under the new scheme, there would be two more slabs i.e. home loans upto `9

lakh taken in 2017 will receive an interest subvention of 4%, while loans upto `12

lakh taken in 2017 will receive an interest subvention of 3%. This scheme will run

along with the existing scheme under which loans upto `6 lakh are provided to the

EWS/LIG segment at a subsidized interest rate of 6.5%. More details on the

eligibility of the home loans under this scheme are still awaited.

Exhibit 5: New schemes announced by Govt.

New schemes announced by Govt.

Subsidy

Eligibility

Loan Amount Upto

`2 lakhs

3%

For Rural

`9 lakhs

4%

For Urban

`12 lakhs

3%

For Urban

Source: Company, Angel Research

The government’s scheme is likely to provide big boost to demand for affordable

housing, mostly in the peripheral area of Tier - 2 cities, as maximum affordable

houses are priced anywhere between `15 lakhs to `30 lakhs. The newly launched

scheme effectively narrows down the gap between rent and EMI, hence, it is

tremendously positive for housing loan demand.

Exhibit 6: Avg ticket Size FY2016

Company

` Lakhs

Can Fin Hom

17.4

LIC Hsg

21.0

DHFL

18.0

India Bulls Hsg

25.0

PNB Hsg

32.0

Gruh Fin

6.4

Repco

13.0

Source: Company, Angel Research

January 27, 2017

4

Can Fin Homes | Initiating Coverage

Various initiatives, schemes and policies to support sector growth

Smart Cities: GOI has in place a developmental plan covering 100 cities between

2016 to 2020, which will include improvement, city renewal, city extension

(Source: Ministry of Urban Development (Government of India) - Smart City

Mission Transform-nation - Mission Statement & Guidelines).

Housing for all by 2022: GOI had launched the program in June 2015, with the

aim of providing 20 million new housing units in 500 towns and cities over the

next seven years, recently changed to incorporate faster implementation.

Sebi relaxes debt fund exposure limit for housing finance companies: Debt

mutual funds can invest an additional 10% in housing finance companies above

the 25 percent sectoral limit. SEBI had earlier allowed a 5 percent additional limit

for housing finance companies.

Real Estate (Regulatory & Development) Act, 2016: This is expected to bring

sea changes in the otherwise unregulated industry. Primary fears in the mind of

house buyers are delayed possession, incomplete paperwork and poor quality of

construction. Hence, many cases are running against builders in consumer courts

and eventually the buyer has to suffer in terms of long waiting for judgment. Also,

the builders used to sell flats before construction actually happened and they used

the same money to buy other plot/project. However, under the Act, builders have

to deposit 70 per cent of the collected amount in an escrow account to ensure that

money is not diverted from one project to another.

January 27, 2017

5

Can Fin Homes | Initiating Coverage

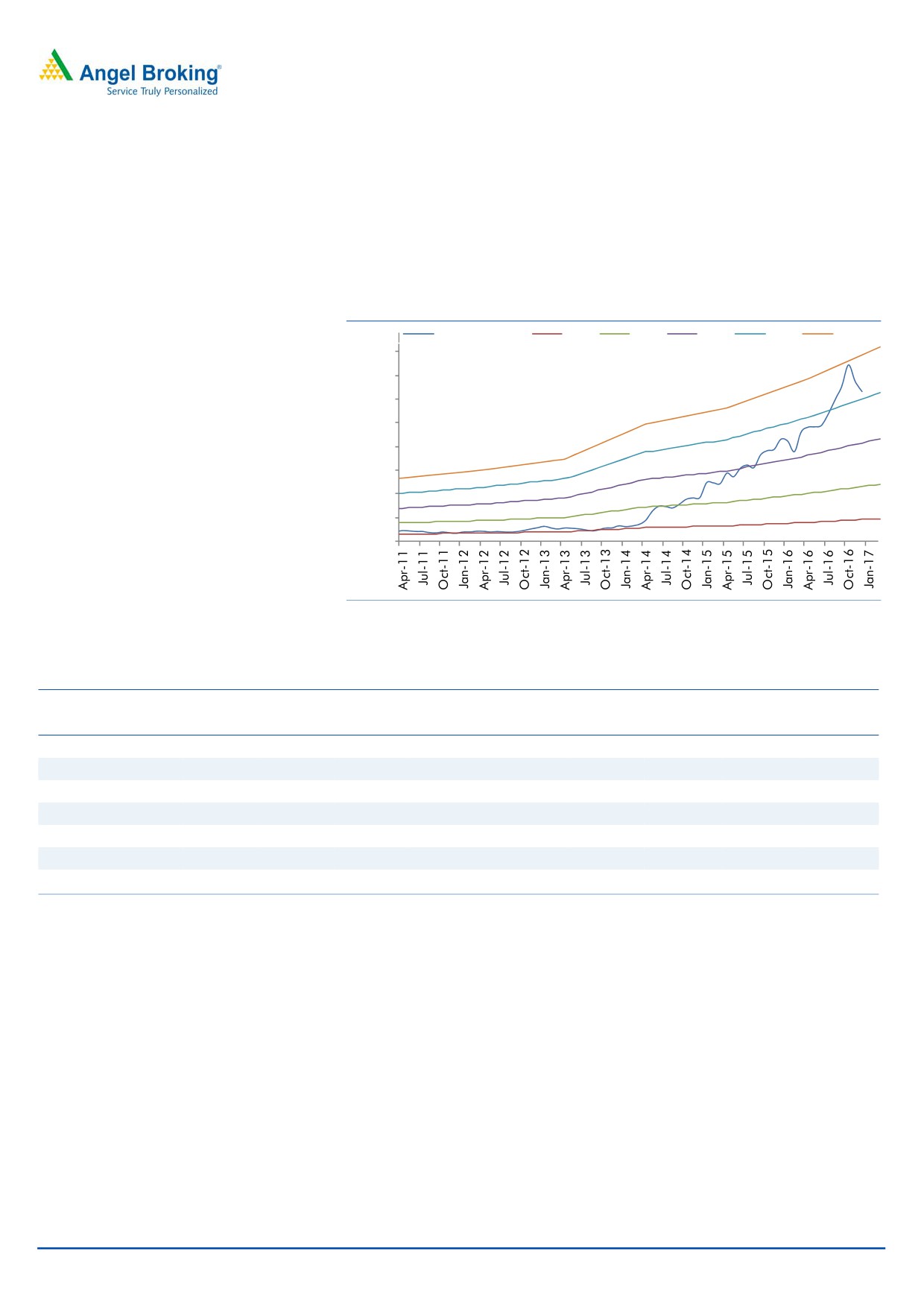

Favorable borrowing mix to support NIM

Well diversified resource mix supports

Can Fin has reduced its reliance on bank borrowing (20% in 3QFY2017 v/s. 68%

profitability

in FY2012) and increased borrowing from debt market instruments such as

Commercial Papers (CP) & Non-Convertible Debentures (NCD), which thereby

resulted in lower cost of funds i.e. 8.55% in 2QFY2017 from 9.70% in FY2013.

Can Fin Homes continues to enjoy AAA rating for borrowings/ NCD and A+ for

CP issuance. We believe Can Fin would continue to receive capital and funding

support from Canara Bank, and hence, ratings would remain the highest (AAA).

Eventually, this would help its plan to increase reliance on money market

instrument and would reduce the borrowing cost and improve margins.

Exhibit 7: Borrowing Mix Trend of CanFin Homes (%)

Borrowing Mix

FY10

FY11

FY12

FY13

FY14

FY15

FY16

Q1FY17

Q2FY17

Q3FY17

Deposit

11

8

6

5

3

3

2

3

2

2

NHB

28

29

26

51

48

44

37

34

32

30

Banks

61

63

68

44

44

31

27

19

18

20

NCD, CP

-

-

-

-

5

22

34

44

48

48

Source: Company, Angel Research

Exhibit 8: Comparative Source of borrowing (%)

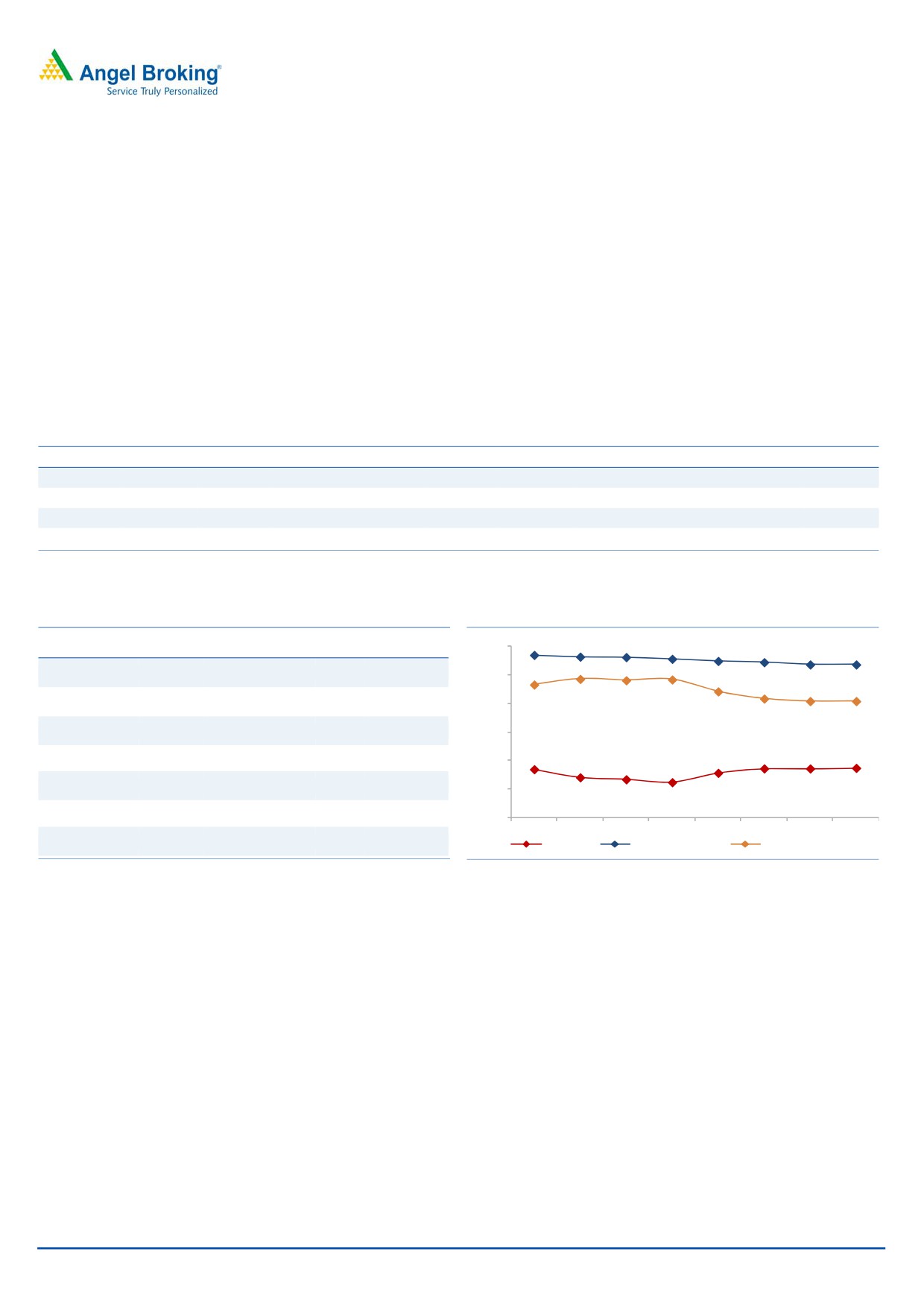

Exhibit 9: NIM Trend (%)

FY16

Banks

NCD NHB CP FD &Others

11.4

11.2

11.2

11.1

10.9

12.0

10.9

10.7

10.7

Can Fin Hom

27

23

37

11

2

10.0

9.7

9.6

9.7

LIC Hsg

13

77

2.7

1

6.3

8.0

9.3

8.8

8.3

8.2

8.2

DHFL

53

33

2

-

12

6.0

3.4

3.5

3.5

3.5

India Bulls Hsg

49

38

-

-

13

4.0

2.8

3.2

2.7

2.5

PNB Hsg

6

38

8

20

28

2.0

Gruh Fin

38

-

39

-

23

-

FY12

FY13

FY14

FY15

FY16

FY17E FY18E FY19E

Repco

72

6

14

-

8

NIM Trend

Yield on Loan Book

Cost Of Borrowing

Source: Company, Angel Research

Source: Company, Angel Research

Can Fin Homes has been able to borrow from money market at

an average 1% premium to G-Sec yield

Due to demonetization, banks have been flooded with low cost deposits (CASA),

Well diversified funding mix, shift

therefore the cost of funds for the banks has declined drastically. Hence, post

toward money market instrument (NCD

demonetization, banks have reduced their lending rates vary aggressively. This

& CP)

would intensify competition in housing finance market, however, it is not a big

cause of concern for Can Fin due to - (1) historically, Can Fin used to charge 50 -

75bps higher than banks despite this it has able to deliver stellar CAGR of 41% in

last 4 years. Recently, Can Fin has revised its loan rate to 8.85% from 9.5%. Thus,

the average difference now is ~40 bps between lower interests charged by banks

and other housing finance companies compared to Can Fin Homes (Exhibit-10);

(2) Can Fin Homes has been able to raise NCD/debt from money market on an

average 1% higher than 10-Year G-sec Yield (Exhibit -10). We believe that in

future also it would be able to borrow at similar attractive rates owing to support

January 27, 2017

6

Can Fin Homes | Initiating Coverage

and majority ownership of Canara Bank and maintain top grade asset quality;

(3) Can Fin Homes had 20% of its total borrowing from banks in 3QFY2017, out

of which certain portion is floating. Therefore, the reducing MCLR rates of the bank

would help Can Fin Homes to reduce its cost of funding.

Exhibit 10: Competitive borrowing

Exhibit 11: Equally competitive lending rate

10 Year

Prem Over

HFC

Floating Interest Rate (%)

Issue Date

Maturity

Coupon

G Sec Yield

G-Sec

CanFIn Homes

8.85

13-01-2014

13-01-2017

10.05

8.71

1.34

SBI

8.6

03-12-2014

03-12-2024

8.94

7.97

0.97

PNB

8.45

06-02-2015

06-02-2018

8.80

7.70

1.10

HDFC LTD

8.65

28-05-2015

28-06-2018

8.70

7.65

1.05

Axis Bank

8.85

02-07-2015

02-07-2018

8.80

7.81

0.99

ICICI Bank

8.65

08-10-2015

08-10-2018

8.44

7.54

0.90

LIC Hsg

8.5

07-01-2016

06-04-2019

8.60

7.74

0.86

17-02-2016

17-05-2019

8.85

7.79

1.06

DHFL

8.6

22-04-2016

22-03-2019

8.37

7.46

0.91

India Bulls Hsg

8.65

27-05-2016

27-08-2019

8.55

7.47

1.08

PNB Hsg

8.9

16-09-2016

16-12-2019

7.85

6.87

0.98

Gruh Fin

9.75

15-11-2016

15-11-2021

7.77

6.53

1.24

Repco

9.6

Source: Company, Angel Research

Source: Company, Angel Research

Scope to increase higher yielding book: Can Fin’s focus has always been on

relatively low risk salaried home loans segment (78% in 2QFY2017). However, the

management now intends to increase focus on building a high yielding non-

housing portfolio. The share of non-housing loan has increased from 3% in

FY2012 to 12% by the end of 3QFY2017.

Exhibit 12: LAP as % of Total Loan Book

Particular

Can Fin Hom

LIC Hsg

DHFL India Bulls Hsg

PNB Hsg

Gruh Fin

Repco

LAP Loan (%)

4

9

16

37

26

11

20

Source: Company, Angel Research

Can Fin Homes has been able to position itself very well owing to its predominant

Growing non-housing (higher yielding)

focus on the salaried class, and primarily to first home buyers and near-

Portfolio

completion projects. However, with lower exposure to LAP, loans to builders and

under construction projects, the company would be able to increase business in

higher yielding assets going ahead. We believe, on the whole, portfolio

vulnerability would not increase due to rising share of relatively riskier segments (LAP,

self-employed, non-housing loans). Nevertheless, the strong monitoring and control

processes, borrowers’ own equity in the properties, lower LTV in LAP portfolio (50%) and a

large proportion of self-occupied properties could reduce the impact of the concerns on

asset quality to some extent.

We believe, going ahead, transparency into the sector would improve owning to

crack down on black money (improved accountability of income, thereby, would

help to improve non-salaried portfolio), implementation of Real Estate Regulatory

Authority (RERA; improved level of transparency) and Amendment Bill (The Benami

Transaction (Prohibition) Amendment Act).

Considering, Can Fin’s existing low risk portfolio and management’s incremental

focus on non-housing, non-salaried and higher yielding asset would fetch in

higher return ratio and growth going ahead.

January 27, 2017

7

Can Fin Homes | Initiating Coverage

Robust loan growth with impressive asset quality and

sufficient CAR

Can Fin Homes has aggressively expanded its loan book (41% CAGR over

Best-in-class asset quality maintained

FY2012-16). Regardless of this, asset quality (GNPA) has improved from 1.06% in

FY2011 to 0.24%in 3QFY2017. Its NPAs have consistently remained 0% for the

last six years, implying 100% coverage ratio. Also, the capital adequacy ratio

(18.76%) is at a comfortable level backing their growth prospects. Going forward,

we believe that loan growth momentum would continue, supported by the

government’s push for housing for all by 2022 and stringent steps taken to bring

transparency and lower interest rates.

The asset quality indicators remain comfortable, Gross NPAs at 0.24% & NPA at

0.01% as on 3QFY2017. We do not feel that the overall portfolio vulnerability

would increase due to the rising share of relatively riskier segments (LAP, self-

employed, non-housing loans). Nevertheless, the strong monitoring and control

processes, borrowers’ own equity in the properties and a large proportion of self-

occupied properties would continue to abate asset quality concerns.

Exhibit 13: GNPA & NPA Trend

Exhibit 14: Comparative Asset Quality, GNPA (%)

1.2

Q1

Q2

1.06

HFC

FY12

FY13

FY14

FY15

FY16

FY17

FY17

1

Can Fin Hom

0.71

0.39

0.21

0.17

0.19

0.24

0.25

0.8

0.71

LIC Hsg

0.42

0.61

0.67

0.46

0.45

0.59

0.57

0.6

DHFL

0.76

0.76

0.78

0.95

0.93

0.98

0.96

0.39

0.4

India Bulls Hsg

0.79

0.79

0.83

0.85

0.84

0.84

0.83

0.21

0.17

0.19

0.2

PNB Hsg

1.04

0.56

0.32

0.20

0.20

0.22

0.26

0

0

0

0

0

0

0

Gruh Fin

0.52

0.32

0.27

0.28

0.32

0.56

0.62

FY11

FY12

FY13

FY14

FY15

FY16

GNPA (%)

NPA (%)

Repco

1.40

1.50

1.50

1.30

1.30

2.20

2.37

Source: Company, Angel Research

Source: Company, Angel Research

Adequate capitalization; supported

by

In 3QFY2017, capital adequacy ratio for Can Fin remained comfortable (18.76%).

internal capital generation

The relaxation in the risk weightage for certain categories of home loans has

enabled most Housing Finance Companies to show a better capital adequacy

ratio. However, for Can Fin in addition to this relaxation, best in class asset quality

has also helped to report higher internal capital generation, which eventually

helped to report better CAR.

January 27, 2017

8

Can Fin Homes | Initiating Coverage

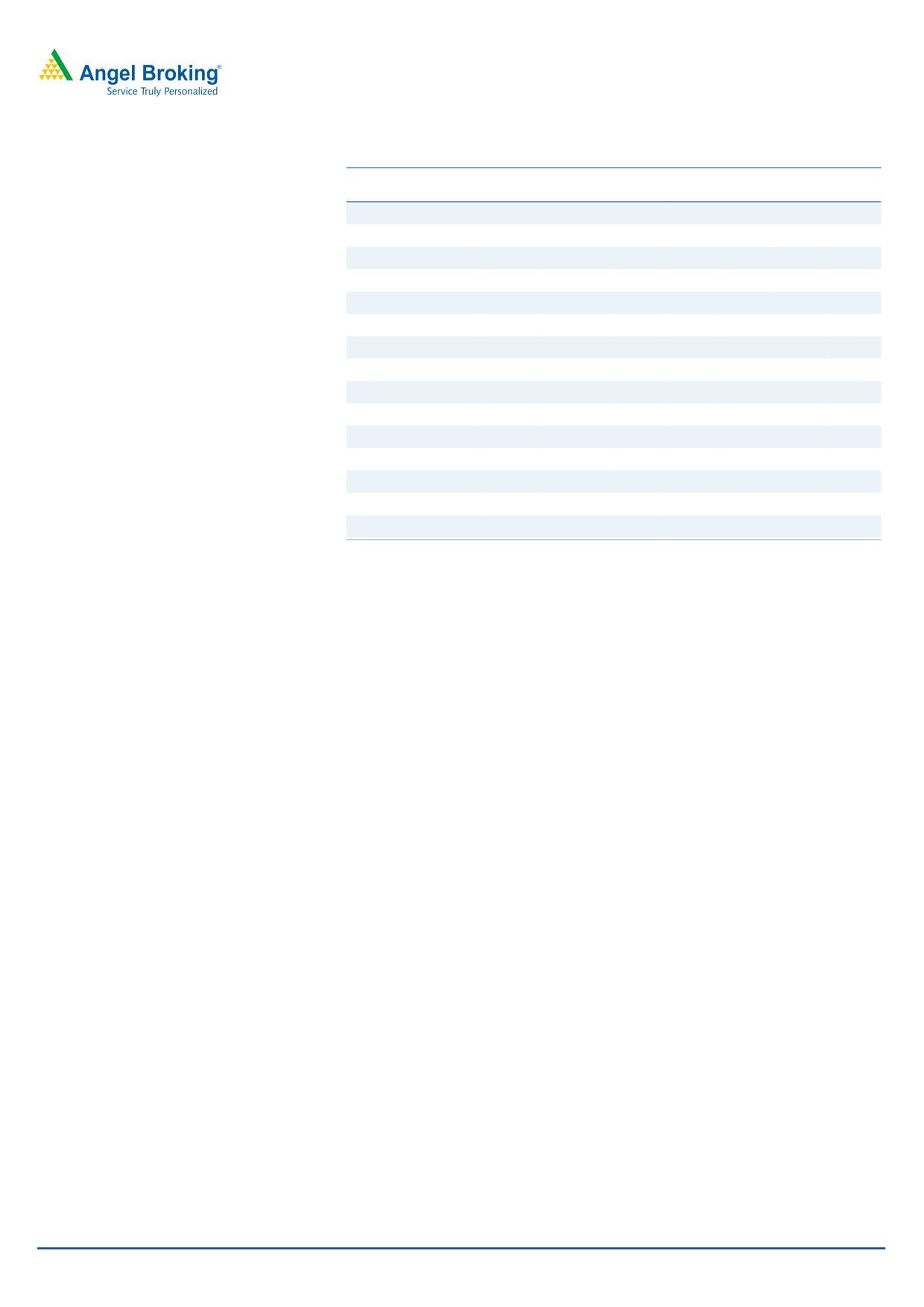

Outlook & Valuation: We expect CanFin to deliver ROE of more than 20% on a

sustained basis from FY2017 onwards (FY2017-23.6%, FY2018E-24.1%, and

FY2019E-25.6%) on the back of higher growth, NIM expansion and stable credit

cost. Additionally, cost optimization should also add to return ratio. At the current

market price, the stock is trading at

2.85x its FY2019E BV of

`608. We

recommend a BUY on the stock with a target price of `2,128 (3.5x FY2019E BV).

Exhibit 15: One year forward P/BV

Close -Unit Curr

0.5 X

1.3 X

2.3 X

3.3 X

4.3 X

2,000

1,750

1,500

1,250

1,000

750

500

250

0

Source: Company, Angel Research

Exhibit 16: Comparative Valuation & Return ration

P/BV

RoE%

RoA%

FY17E

FY18E

FY19E

FY17E

FY18E

FY19E

FY17E

FY18E

FY19E

Can Fin Home

4.3

3.5

2.8

23.6

24.1

25.6

1.9

1.9

2.0

LIC Hsg Fin

2.5

2.1

1.8

19.5

19.1

19.6

1.4

1.4

1.4

DHFL

1.5

1.3

1.1

16.9

17.5

17.8

1.2

1.3

1.3

Indiabulls Hsg Fin

2.7

2.4

2.1

25.6

27.7

29.5

3.3

3.2

3.1

GRUH Finance

12.0

9.7

8.2

29.9

29.8

31.3

2.3

2.3

2.3

Repco Home Fin

3.6

3.0

2.6

17.6

18.6

18.8

2.1

2.1

2.1

PNB Hsg Fin

2.5

2.2

1.9

14.9

14.9

18.7

1.6

1.7

1.8

Source: Company, Angel Research, Note: CMP as of January 24, 2017, * other bank Consensus taken from Bloomberg,

January 27, 2017

9

Can Fin Homes | Initiating Coverage

Exhibit 17: Comparative DuPont Analysis for FY16

Can Fin

LIC

India

PNB

Gruh

DHFL

Repco

Home Housing

Bulls

HSG

Fin

Interest Income

10.9

10.1

11.4

11.6

10.4

11.9

12.3

Interest expenses

7.8

7.7

9.0

7.4

7.6

7.8

7.9

Net Interest margin

3.1

2.4

2.4

4.2

2.8

4.1

4.4

Fees & Other Income

0.4

0.2

0.6

2.0

0.6

0.5

0.4

Total Income

3.6

2.6

3.0

6.1

3.4

4.5

4.8

Employee Exp

0.3

0.1

0.4

0.6

0.3

0.4

0.6

Other exp

0.4

0.3

0.5

0.3

0.7

0.4

0.3

Opex

0.7

0.4

0.9

0.9

1.0

0.8

0.9

PPP

2.9

2.2

2.1

5.3

2.4

3.7

3.9

Provision

0.2

0.1

0.3

0.6

0.3

0.2

0.6

PBT

2.7

2.1

1.8

4.7

2.1

3.5

3.3

Tax

1.0

0.7

0.6

1.2

0.7

1.1

1.2

RoA

1.6

1.4

1.2

3.5

1.3

2.4

2.2

Leverage

11.6

14.3

12.7

7.7

13.1

13.3

7.8

RoE (%)

19.0

19.6

15.1

27.0

17.6

31.5

17.0

Source: Company, Angel Research

January 27, 2017

10

Can Fin Homes | Initiating Coverage

Key Risk

Precipitous correction and prolonged down cycle of real estate price: Steep price

correction in real estate market could heighten the risk of deteriorating asset

quality.

Recent management change: Till June

2016, Mr Illango was running the

company’s show very effectively and under him Can Fin Homes performed very

well. Any drastic changes by new MD could be a cause of concern.

Loan mix gets riskier aggressively in the wake of growth: Till now Can Fin Homes

has smartly built and maintained a low-risk profile loan book. But in wake of

growth, aggressive and less compliant lending to riskier assets (LAP, non-salaried

and builder loans) could pose issues for the company.

Company Background

Can Fin Homes Ltd is a south based (74% of business) finance company with

“69.74% collection of installments

43.53% shareholding owned by Canara Bank. Since inception, Can Fin has

done through Electronic Clearing

smartly built and maintained a low-risk profile loan book. Housing finance holds a

System (ECS)”

giant share of the total loan book at ~88%. The remaining 12% which is into non-

CanFin Homes, FY16 Annual Report

housing, of that less than 50% is to salaried class. Can Fin has been lending

predominantly to the salaried class, and primarily to first buyers and near

completion projects. The management’s goal is to augment the loan book to

`13,500cr by the end of FY2017E and `35,000cr by March 2020E.

Key management Personnel

SHRI K.N. PRITHVIRAJ, Chairman - Shri K.N. Prithviraj was appointed as Director

on June 4, 2014. He is an independent and non-executive Chairman of the

Company. He has over 45 years of experience in the banking industry.

SHRI SARADA KUMAR HOTA, Managing Director - Shri Sarada Kumar Hota has

been appointed as the Managing Director of Can Fin Homes Ltd. w.e.f May 19,

2016. Prior to his posting to the Company, he was the Deputy General Manager

and Circle Head of Nagpur and Jaipur Circles of Canara Bank for 3 years

followed by a brief stint at the Recovery Wing of the Bank at Head Office.

January 27, 2017

11

Can Fin Homes | Initiating Coverage

Income statement (standalone)

Y/E March ( `cr)

FY14

FY15

FY16

FY17E

FY18E

FY19E

NII

136

180

309

420

526

665

- YoY Growth (%)

41

32

72

36

25

27

Other Income

21

29

39

44

61

76

- YoY Growth (%)

50

39

34

14

37

25

Operating Income

155

207

340

465

586

741

- YoY Growth (%)

42

33

64

37

26

26

Operating Expenses

44

55

67

79

107

133

- YoY Growth (%)

21

25

21

18

36

25

Pre - Provision Profit

111

152

273

386

480

608

- YoY Growth (%)

52

36

80

41

24

27

Prov. & Cont.

4

14

19

24

38

48

- YoY Growth (%)

-

221

36

21

62

25

Profit Before Tax

107

137

254

363

442

560

- YoY Growth (%)

43

29

85

43

22

27

Prov. for Taxation

31

51

97

132

155

185

- as a % of PBT

29

37

38

37

35

33

PAT

76

86

157

230

287

375

- YoY Growth (%)

41

14

82

47

25

31

Balance Sheet (standalone)

Y/E March ( `cr)

FY14

FY15

FY16

FY17E

FY18E

FY19E

Share Capital

20

27

27

27

27

27

Reserve & Surplus

432

745

851

1,043

1,281

1,592

Networth

452

771

878

1,069

1,308

1,619

Borrowing

5,269

7,375

9,478

12,108

15,014

18,693

- YoY Growth (%)

49

40

29

28

24

25

Other Liab. & Prov.

191

188

438

371

614

858

Total Liabilities

5,912

8,334

10,795

13,549

16,936

21,170

Investment

15

15

15

19

24

30

Advance

5,874

8,302

10,753

13,500

16,875

21,094

- YoY Growth (%)

46

41

30

26

25

25

Fixed Asset

8

9

9

13

16

20

Other Assets

14

8

18

17

21

26

Total Asset

5,912

8,334

10,795

13,549

16,937

21,170

January 27, 2017

12

Can Fin Homes | Initiating Coverage

Ratio analysis (standalone)

Profitability Ratio (%)

FY14

FY15

FY16

FY17E

FY18E

FY19E

NIMs

2.7

2.5

3.2

3.5

3.5

3.5

Cost to Asset

0.9

0.8

0.7

0.6

0.7

0.7

Cost to Income

28.3

26.6

19.6

16.9

18.2

18.0

RoA

1.5

1.2

1.6

1.9

1.9

2.0

ROE

17.9

14.1

19.0

23.6

24.1

25.6

Asset Quality (%)

Gross NPAs

0.2

0.2

0.2

0.2

0.3

0.3

Net NPAs

0.0

0.0

0.0

0.0

0.0

0.0

Credit Cost

0.1

0.2

0.2

0.2

0.3

0.3

Per Share Data (`)

EPS

37

32

59

87

108

141

BV

221

290

330

402

491

608

DPS

7

7

10

15

18

24

Valuation Ratios

PER (x)

47

53

29

20

16

12

P/BV

7.8

6.0

5.2

4.3

3.5

2.8

Dividend Yield (%)

0.4

0.4

0.6

0.9

1.1

1.4

DuPont Analysis

FY14

FY15

FY16

FY17E

FY18E

FY19E

Interest Income

11.2

11.1

10.9

10.8

10.7

10.7

Interest expenses

8.5

8.6

7.8

7.4

7.3

7.2

Net Interest Income

2.7

2.5

3.1

3.5

3.4

3.5

Fees & Other Income

0.4

0.4

0.4

0.4

0.4

0.4

Total Income

3.1

2.9

3.5

3.8

3.8

3.9

Opex

0.9

0.8

0.7

0.6

0.7

0.7

PPP

2.2

2.1

2.9

3.2

3.1

3.2

Provision

0.1

0.2

0.2

0.2

0.3

0.3

PBT

2.1

1.9

2.6

3.0

2.9

2.9

Tax

0.6

0.7

1.0

1.1

1.0

1.0

RoA

1.5

1.2

1.6

1.9

1.9

2.0

Leverage

11.8

11.6

11.6

12.5

12.8

13.0

RoE (%)

17.9

14.0

19.0

23.6

24.1

25.6

January 27, 2017

13

Can Fin Homes | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Can Fin Homes

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 27, 2017

14