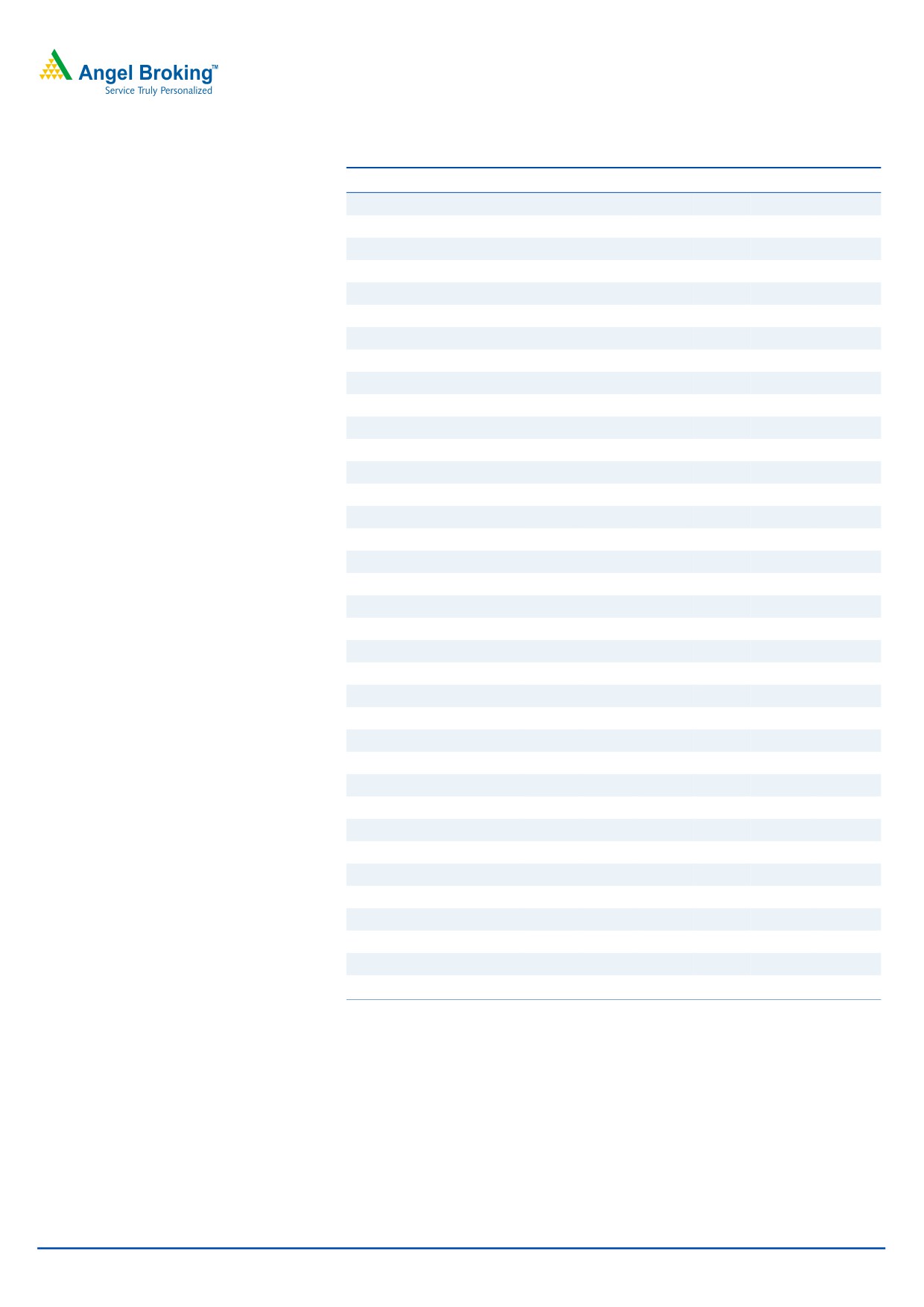

3QFY2016 Result Update | Pharmaceutical

February 24, 2016

Cadila Healthcare

ACCUMULATE

CMP

`330

Performance Highlights

Target Price

`352

Investment Period

12 Months

Y/E March (` cr)

3QFY2016 2QFY2016

% chg (qoq) 3QFY2015

% chg (yoy)

Net sales

2,342

2,374

(1.3)

2,160

8.4

Other income

112

109

2.5

40

180.7

Stock Info

Gross profit

1542

1567

(1.6)

1400

10.1

Sector

Pharmaceutical

Operating profit

492

536

(8.3)

417

17.9

Market Cap (` cr)

33,748

Adj. Net profit

390

391

(0.4)

278

40.0

Net debt (` cr)

1,817

Source: Company, Angel Research

Beta

0.8

52 Week High / Low

454 / 296

For 3QFY2016, Cadila Healthcare (Cadila) posted a robust performance on the

Avg. Daily Volume

95,007

net profit front while sales came in lower than expected. Sales came in at

`2,342cr (V/s `2,600cr expected), growing by 8.4% yoy. On the operating front,

Face Value (`)

1

the OPM came in at 21.0% V/s 21.4% expected and V/s 19.3% in 3QFY2015.

BSE Sensex

23,410

The expansion in the OPM was driven by expansion in the GPM to 65.9% V/s

Nifty

7,110

64.8% in 3QFY2015 and almost flat growth in staff and other expenditure. R&D

Reuters Code

CADI.BO

expenditure during the quarter came in at 10.1% V/s 8.7% of sales in 3QFY2015.

Bloomberg Code

CDH@IN

The net profit came in at `389cr V/s `353cr expected and V/s `282cr in

3QFY2015, a yoy growth of 38.2%. The Adj. net profit came in at `390cr V/s

`278cr in 3QFY2015, a yoy growth of 40.0%. We maintain our Accumulate on

Shareholding Pattern (%)

the stock.

Promoters

74.8

MF / Banks / Indian Fls

9.7

Results better than expected at the net profit level: For 3QFY2016, sales came in

FII / NRIs / OCBs

9.6

at `2,342cr (V/s `2,600cr expected), growing by 8.4% yoy. On the operating

Indian Public / Others

6.0

front, the OPM came in at 21.0% V/s 21.4% expected and V/s 19.3% in

3QFY2015. The expansion in the OPM was driven by expansion in the GPM to

65.9% V/s 64.8% in 3QFY2015 and almost flat growth in staff and other

Abs.(%)

3m 1yr 3yr

expenditure. R&D expenditure during the quarter came in at 10.1% V/s 8.7% of

Sensex

(9.3)

(19.2)

21.2

sales in 3QFY2015. The net profit came in at `389cr V/s `353cr expected and

Cadila

(22.2)

6.8

112.5

V/s `282cr in 3QFY2015, a yoy growth of 38.2%. The Adj. net profit came in at

`390cr V/s `278cr in 3QFY2015, a yoy growth of 40.0%.

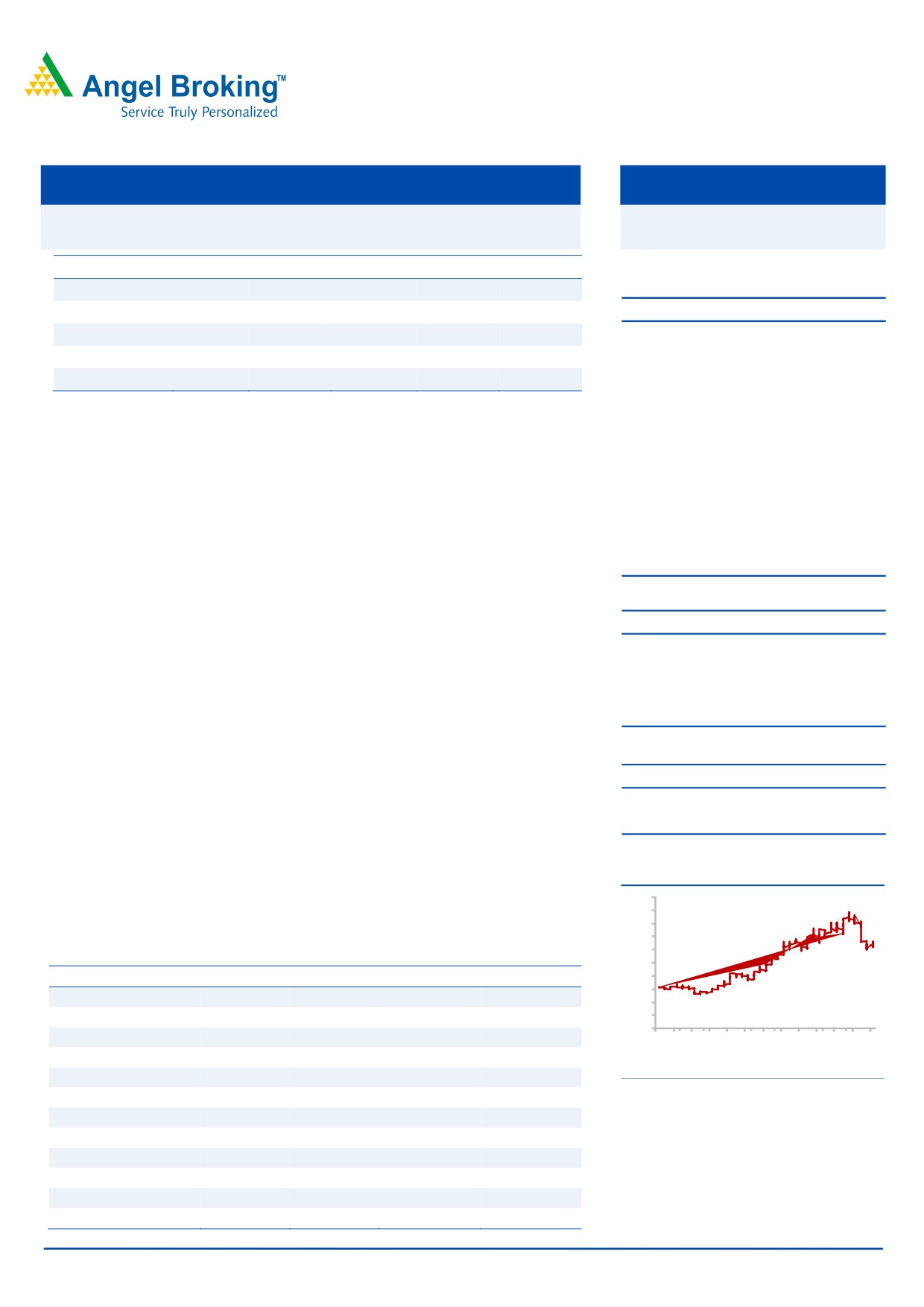

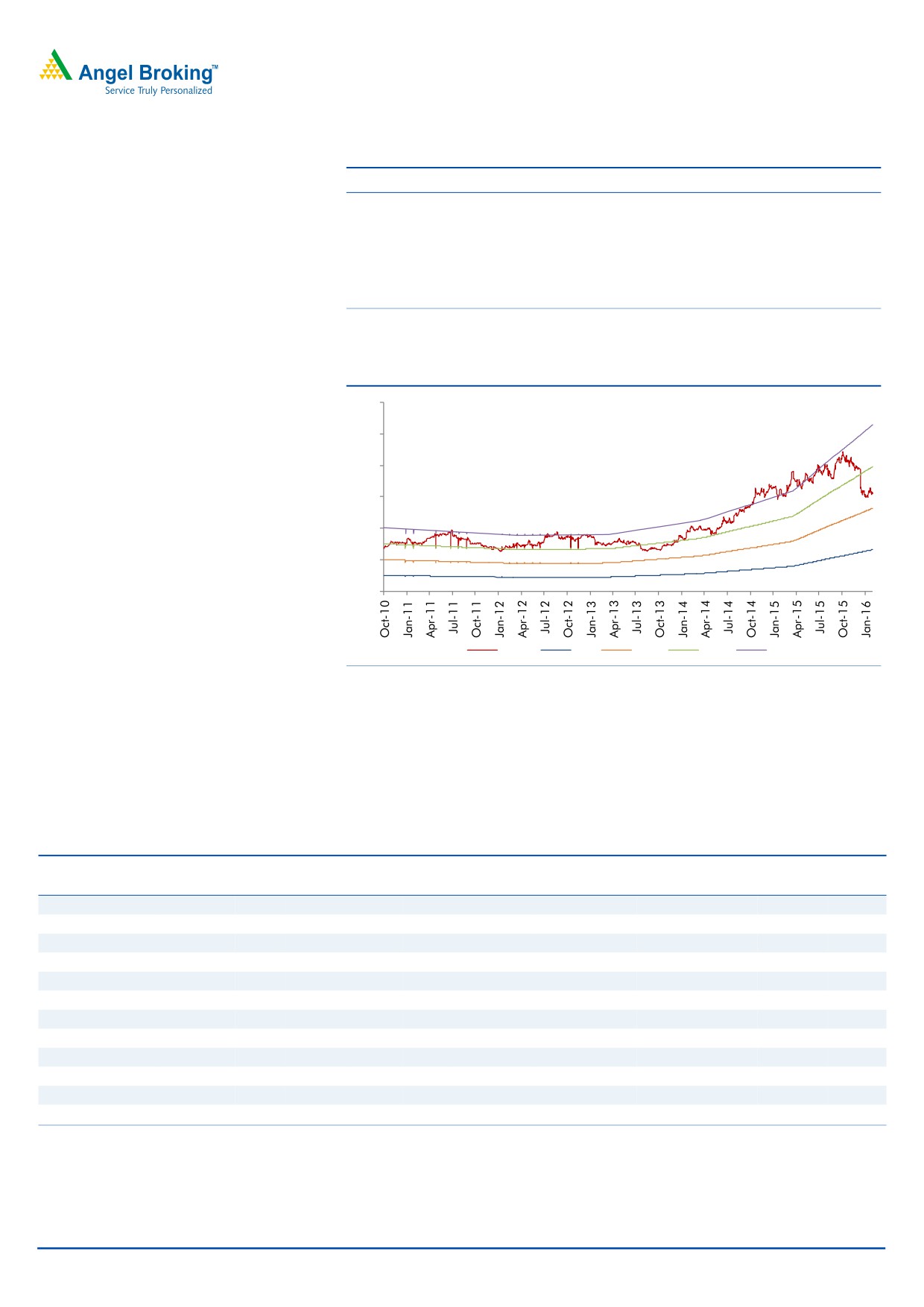

3-Year Daily Price Chart

Outlook and valuation: We expect Cadila’s net sales to post an 18.0% CAGR to

500

`11,840cr and EPS to report a 24.6% CAGR to `17.6 over FY2015-17E. We

450

400

maintain our Accumulate rating on the stock.

350

300

Key financials (Consolidated)

250

Y E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

200

150

Net sales

7,060

8,497

10,224

11,840

100

50

% chg

14.7

20.4

20.3

15.8

0

Net profit

819

1,159

1,496

1,800

3

3

3

3

4

4

4

4

5

5

5

5

6

1

1

1

1

1

1

1

1

1

1

1

1

1

b

y

g

v

b

y

g

v

b

y

g

v

b

% chg

25.0

41.5

29.1

20.3

e

a

u

o

e

a

u

o

e

a

u

o

e

F

M

A

N

F

M

A

N

F

M

A

N

F

EPS

8.0

11.3

14.6

17.6

Source: Company, Angel Research

EBITDA margin (%)

14.7

18.8

21.0

22.0

P/E (x)

53.1

37.5

29.1

24.1

RoE (%)

25.3

30.1

30.8

29.0

RoCE (%)

13.8

20.2

24.5

25.2

P/BV (x)

2.5

10.2

8.0

6.2

Sarabjit Kour Nangra

EV/Sales (x)

1.4

5.2

4.3

3.6

+91 22 39357600 Ext: 6806

EV/EBITDA (x)

9.7

27.8

20.2

16.3

Source: Company, Angel Research; Note: CMP as of February 23, 2016

Please refer to important disclosures at the end of this report

1

Cadila Healthcare |3QFY2016 Result Update

Exhibit 1: 3QFY2016 performance (Consolidated)

Y/E March (` cr)

3QFY2016

2QFY2016

% chg (qoq) 3QFY2015

% chg (yoy) 9MFY2016 9MFY2015

% chg

Net Sales

2,342

2,374

(1.3)

2,160

8.4

7,094

6,250

13.5

Other Income

112

109

2.5

40

180.7

365

143

155.0

Total Income

2,454

2,483

(1.2)

2,199

11.6

7,459

6,393

16.7

Gross profit

1542

1567

(1.6)

1400

10.1

4640

3849

20.5

Gross margin (%)

65.9

66.0

64.8

65.4

61.6

Operating profit

492

536

(8.3)

417

17.9

1504

1139

32.0

Operating Margin (%)

21.0

22.6

19.3

21.2

18.2

Financial Cost

13

13

(0.5)

16

(22.4)

39

52

(25.8)

Depreciation

77

73

5.1

71

8.9

224

212

5.6

PBT

515

560

(8.1)

370

39.0

1606

1018

57.7

Tax

115

158

(27.3)

79

45.3

445

189

135.6

Adj. PAT before Extra-ordinary item

400

402

(0.6)

291

37.3

1161

829

40.0

Exceptional loss/(gain)

0

0

(5)

(3)

(5)

Minority

9

10

(7.2)

14

27

31

Reported PAT

390

391

(0.3)

282

38.2

1134

800

41.7

Adj. PAT

390

391

(0.4)

278

40.0

1136

796

42.8

EPS (`)

3.8

3.8

2.7

11.1

7.8

Source: Company, Angel Research

Exhibit 2: 3QFY2016 - Actual vs. Angel estimates

(` cr)

Actual

Estimates

Variance

Net Sales

2,342

2,600

(9.9)

Operating profit

492

556

(11.5)

Tax

115

143

(19.5)

Net profit

390

353

10.3

Source: Company, Angel Research

Revenue up 8.4% yoy; marginally lower than our expectation

For 3QFY2016, the company posted sales of `2,342cr (V/s `2,600cr expected), a

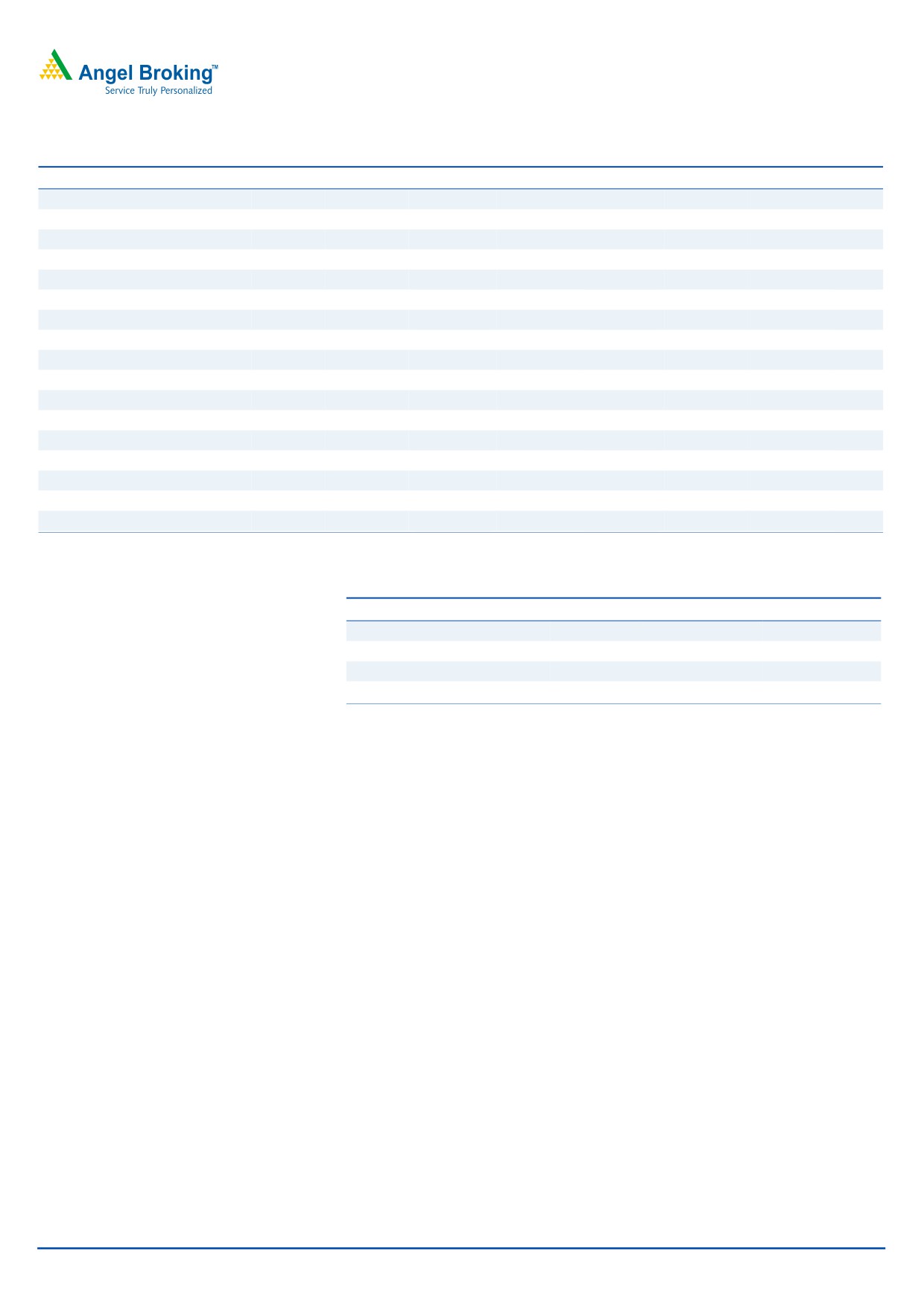

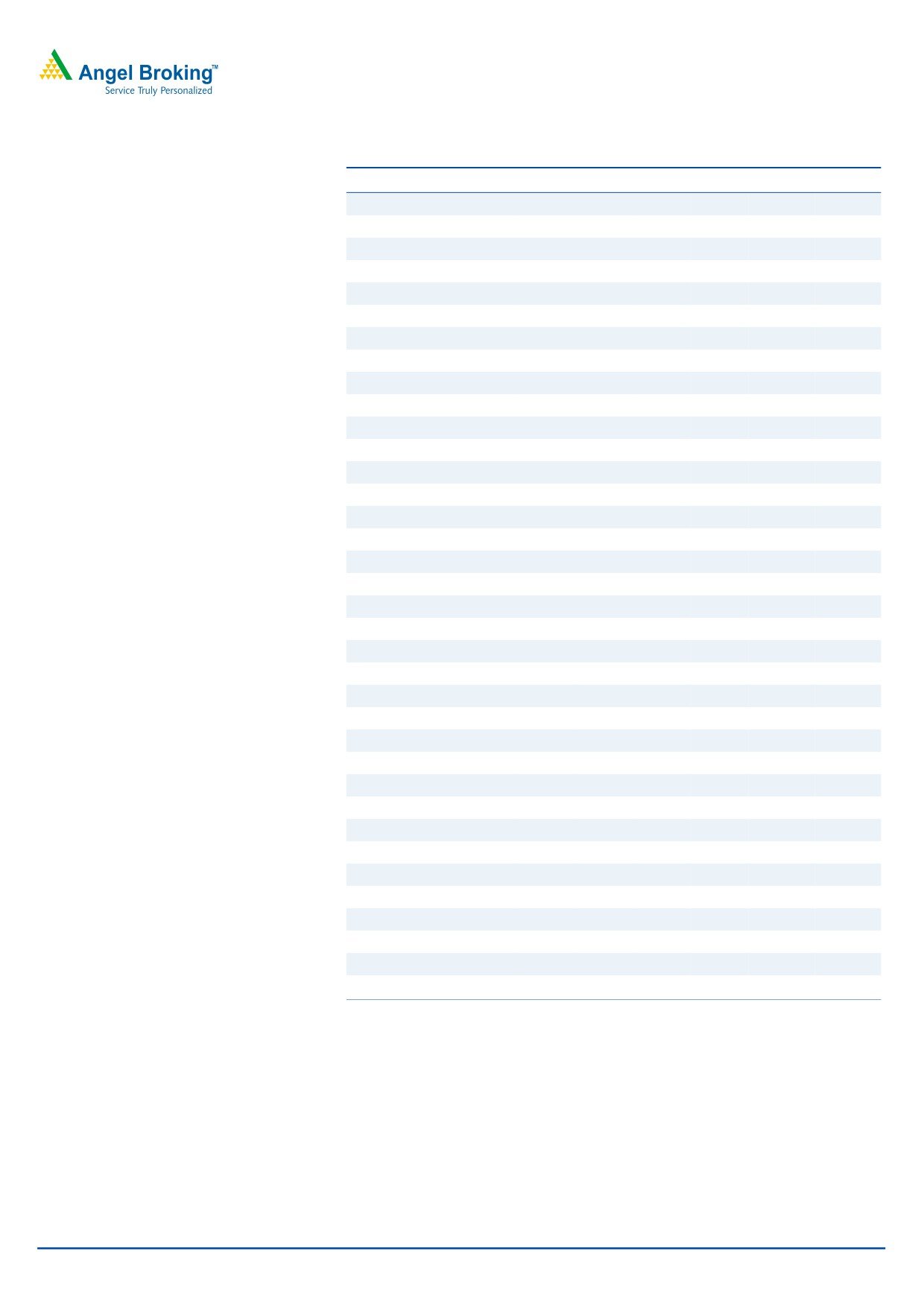

growth of 8.4% yoy. Exports (`1,398.8cr) posted a 10.6% yoy growth during the

quarter while domestic markets (`993.2cr) posted a 6.4% yoy growth.

In exports the key market US (`1071.7cr) posted a yoy growth of 19.6%, while the

other key market Europe (`76.2cr) posted a dip of 10.0%; JVs and alliances

(`100.2cr) posted a dip of 17.7% yoy. In domestic markets, the Indian formulation

markets posted a yoy growth of 11.0%.

February 24, 2016

2

Cadila Healthcare |3QFY2016 Result Update

Exhibit 3: Sales trend in the US and Europe

1,200

1,072

1,120

1,004

1,040

979

985

960

896

880

800

720

640

560

480

400

320

240

160

85

84

74

65

76

80

0

3QFY2015

4QFY2015

1QFY2016

2QFY2016

3QFY2016

US

Europe

Source: Company, Angel Research

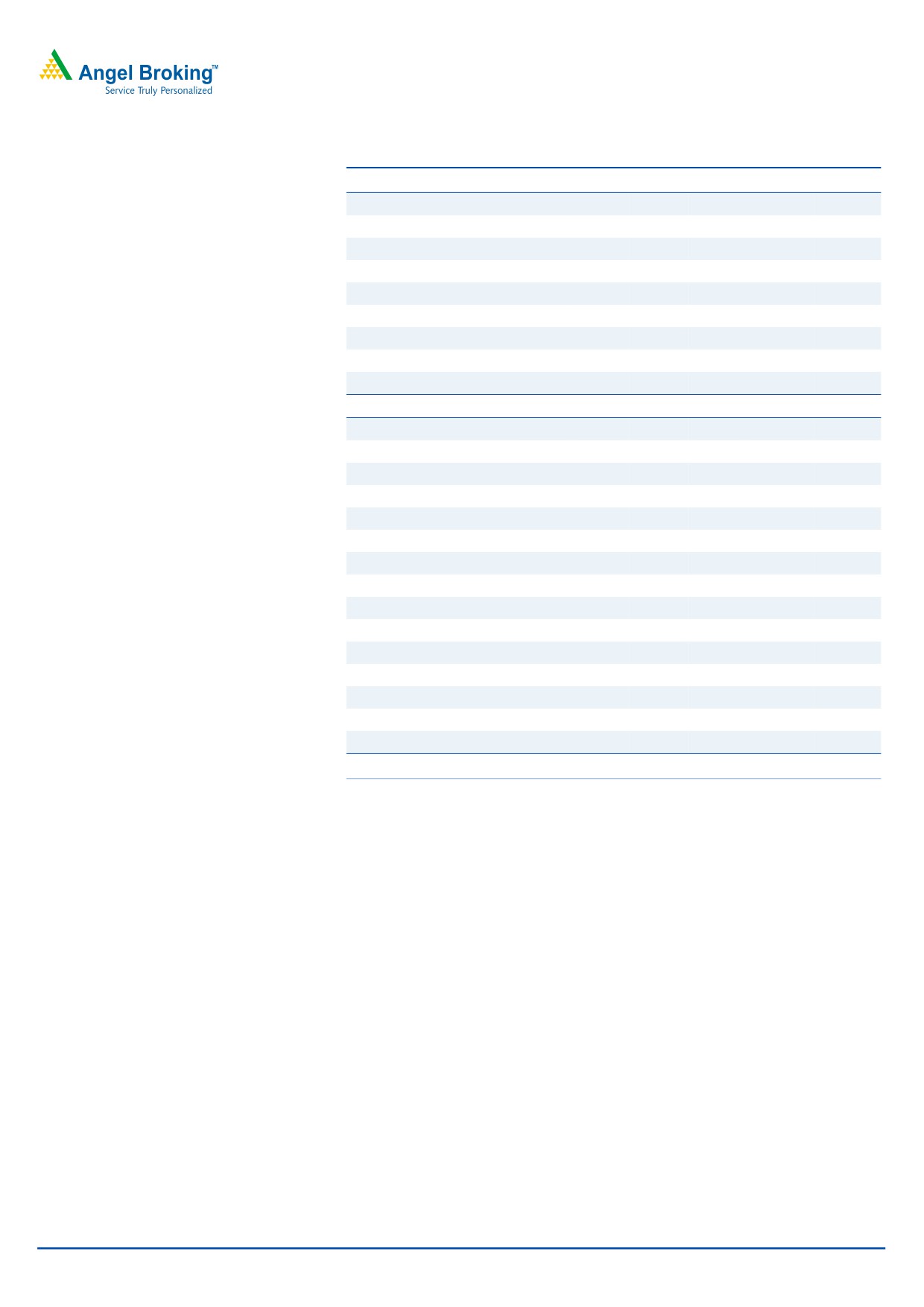

The growth in the domestic market (42% of sales) was 6.4% yoy mainly led by

formulations (`713cr) which grew by 11.1% yoy. API (`83.8cr) on the other hand

de-grew by 12.6% yoy, while Wellness (`117.8cr) grew by 3.3% yoy. Animal

Health and others (`78.5cr) de-grew by 3.8% yoy.

Exhibit 4: Sales trend in Domestic Formulation and Consumer Wellness Divisions

800

742

751

713

680

700

642

600

500

400

300

200

114

111

111

112

118

100

0

3QFY2015

4QFY2015

1QFY2016

2QFY2016

3QFY2016

Domestic Formulation

Consumer division

Source: Company, Angel Research

On the CRAMS front, the company generated sales of `100cr (vs `121.7cr in

3QFY2015), reporting a de-growth of 17.7% yoy.

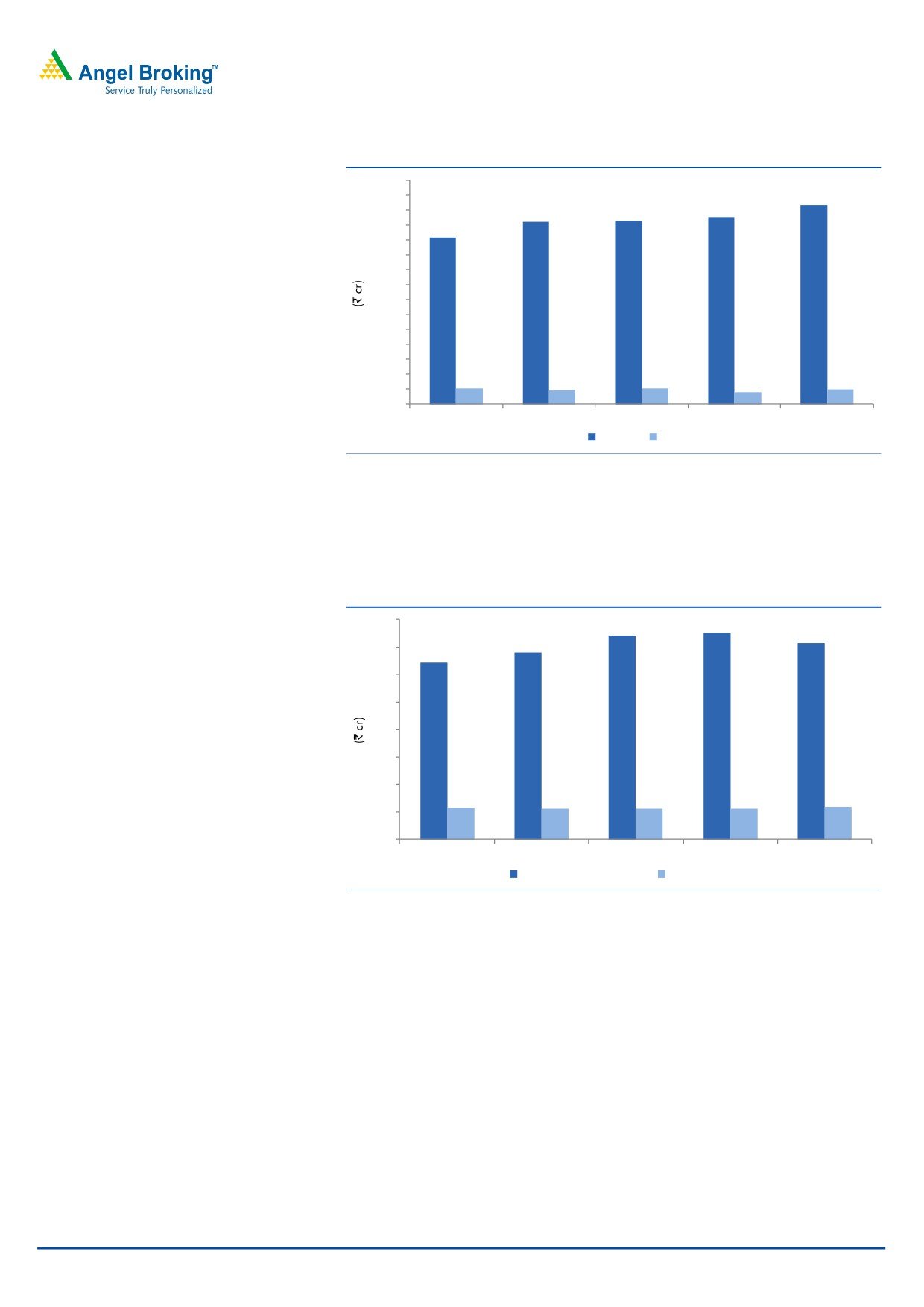

OPM in line with expectations

On the operating front, the OPM came in at 21.0% V/s 21.4% expected and V/s

19.3% in 3QFY2015. The expansion in the OPM was driven by expansion in the

GPM to 65.9% V/s 64.8% in 3QFY2015 and almost flat growth in staff and other

expenditure. R&D expenditure during the quarter came in at 10.1% V/s 8.7% of

sales in 3QFY2015.

February 24, 2016

3

Cadila Healthcare |3QFY2016 Result Update

Exhibit 5: OPM trend

23.0

22.5

22.6

22.0

21.5

21.0

21.0

20.5

20.0

20.2

20.1

19.5

19.0

19.3

18.5

3QFY2015

4QFY2015

1QFY2016

2QFY2016

3QFY2016

Source: Company, Angel Research

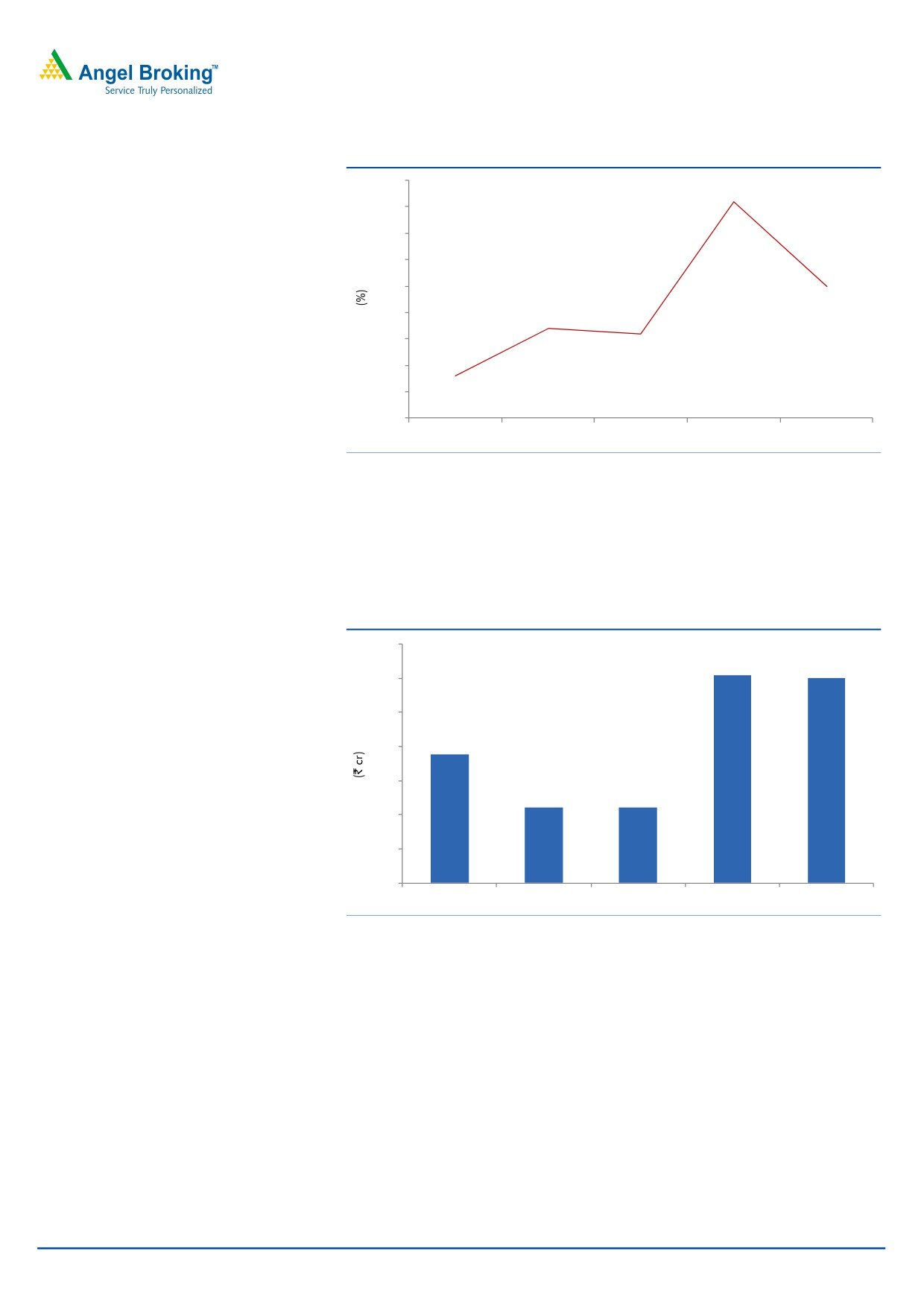

Net profit up 40.0% yoy: During the quarter, the company posted a other income

of `112cr V/s `39.9cr in 3QFY2015. This aided the net profit to come in at `389cr

(V/s `353cr expected) V/s `282cr in 3QFY2015, yoy growth of 38.2%. The Adj.

net profit came in at `390cr V/s `278cr in 3QFY2015, a yoy growth of 40.0%.

Exhibit 6: Adjusted Net profit trend

400

391

390

390

380

368

370

360

352

352

350

340

330

3QFY2015

4QFY2015

1QFY2016

2QFY2016

3QFY2016

Source: Company, Angel Research

Concall takeaways

Margin improvement during the quarter was primarily driven by higher US

and JV sales.

Currently, the company has transferred 11 products from Moraiya facility to

Ahmedabad based SEZ facility from its existing product portfolio. It is also in

the process of site transferring 4 more key products from future pipeline that

includes - Asacol HD and Prevacid ODT.

Currently, Moraiya facility supplies 60% of total US sales. In terms of pending

product approvals, Cadila Healthcare has filed 74 products from Moraiya

facility which includes 40% of total oral solid filings. Cadila Healthcare expects

February 24, 2016

4

Cadila Healthcare |3QFY2016 Result Update

the remediation measures at Moraiya facility to get completed over the next 3-

6 months. The Management highlighted that a re-inspection by USFDA might

be required for full resolution. Meanwhile the company has successfully

completed site transfer of 9 existing products and has already initiated site

transfers for four key upcoming launches (including Asacol HD, Toprol XL,

Prevacid ODT, etc).

R&D expenditure is expected to remain at 7-8% of sales in FY2016.

Tax rate as a % of PBT is expected to be around 20% in FY2017.

The Management has guided for higher capex in FY2017 with construction of

few greenfield and brownfield facilities.

Recommendation rationale

Strong domestic portfolio: Cadila is the fifth largest player in the domestic market,

with sales of about `2,677cr in FY2015; the domestic market contributes ~44% to

its top-line. The company enjoys a leadership position in the CVS, GI, women

healthcare and respiratory segments, and has a sales force of 4,500 executives.

The company, on an aggressive front, launched more than 75 new products in

FY2014. During FY2009-14, the company reported a ~13% CAGR in its top-line

in the domestic formulation business.

Further, the company has a strong consumer division through its stake in Zydus

Wellness, which has premium brands such as Sugarfree, Everyuth and Nutralite,

under its umbrella. This segment which contributes ~5.9% of sales, registered a

growth of 3.1% yoy during FY2015.

Going forward, the company expects the segment to grow at an above-industry

rate on the back of new product launches and field force expansion. In FY2014,

sales were lower; however, FY2015 witnessed a rebound. During FY2015-17E, we

expect the domestic segment to grow at a CAGR of 15.0%.

Exports on a strong footing: Cadila has a two-fold focus on exports, wherein it is

targeting developed as well as emerging markets, which contributed around 50%

to its FY2015 top-line. The company has established a formidable presence in the

developed markets of US, Europe (France and Spain) and Japan. In the US, the

company achieved critical scale of `3,393cr on the sales front in FY2015. The

growth in exports to the US along with other regions like Europe would be driven

by new product launches, going forward. Overall, exports are expected to post a

CAGR of 20.0% over FY2015-17E.

Outlook and valuation

We expect Cadila’s net sales to post an 18.0% CAGR to `11,840cr and EPS to

report a 24.6% CAGR to `17.6 over FY2015-17E. We maintain our Accumulate

rating on the stock.

February 24, 2016

5

Cadila Healthcare |3QFY2016 Result Update

Exhibit 7: Key Assumptions

Key assumptions

FY2016E

FY2017E

Domestic growth (%)

15.0

17.0

Exports growth (%)

20.0

20.0

Growth in employee expenses (%)

24.1

15.8

Operating margins (excl tech. know-how fees) (%)

21.0

22.0

Capex (` cr)

650

650

Source: Company, Angel Research

Exhibit 8: One-year forward PE band

600

500

400

300

200

100

0

Price

7x

14x

21x

28x

Source: Company

Company background: Cadila Healthcare‘s operations range across API,

formulations, animal health products and cosmeceuticals. The group has global

operations spread across USA, Europe, Japan, Brazil, South Africa and 25 other

emerging markets. Having already achieved the US$1bn sales mark in 2011, the

company believes to be a research-driven pharmaceutical company by 2020.

Exhibit 9: Recommendation Summary

Company

Reco

CMP Tgt. price Upside

FY2017E

FY15-17E

FY2017E

(`)

(`)

% PE (x) EV/Sales (x) EV/EBITDA (x)

CAGR in EPS (%) RoCE (%) RoE (%)

Alembic Pharma

Neutral

618

-

-

21.5

3.0

15.3

38.2

31.3

31.2

Aurobindo Pharma Buy

655

856

30.7

15.3

2.5

10.9

15.6

23.5

30.2

Cadila Healthcare Accumulate

330

352

6.8

18.7

2.8

12.8

24.6

25.2

29.0

Cipla

Buy

523

605

15.8

19.0

2.5

17.7

18.3

16.7

16.1

Dr Reddy's

Buy

3,075

3,933

27.8

17.2

2.6

11.1

17.2

19.1

20.4

Dishman Pharma

Neutral

295

-

-

14.8

1.6

7.5

15.9

9.4

11.0

GSK Pharma*

Neutral

3,217

-

-

47.1

8.2

37.2

6.6

33.7

34.3

Indoco Remedies

Neutral

251

-

-

18.5

2.0

11.1

23.0

19.7

19.7

Ipca labs

Buy

622

900

44.8

22.2

2.2

12.1

17.9

11.8

14.0

Lupin

Neutral

1,777

-

-

26.0

4.5

16.6

13.1

29.6

24.7

Sanofi India*

Neutral

4,304

-

-

28.4

3.7

17.7

33.1

27.9

25.5

Sun Pharma

Accumulate

871

950

9.1

32.4

5.8

18.7

8.4

15.8

16.6

Source: Company, Angel Research; Note: *December year ending

February 24, 2016

6

Cadila Healthcare |3QFY2016 Result Update

Profit & Loss statement (Consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Gross sales

5,181

6,285

7,208

8,658

10,417

12,063

Less: Excise duty

91

129

148

161

193

223

Net sales

5,090

6,155

7,060

8,497

10,224

11,840

Other operating income

173

203

164

154

154

154

Total operating income

5,263

6,358

7,224

8,651

10,379

11,994

% chg

13.7

20.8

13.6

19.8

20.0

15.6

Total expenditure

4,179

5,232

6,024

6,896

8,073

9,229

Net raw materials

1,679

2,320

2,714

3,197

3,681

4,262

Other mfg costs

320

387

443

534

642

744

Personnel

751

903

1,071

1,209

1,500

1,737

Other

1,429

1,622

1,796

2,107

2,249

2,486

EBITDA

911

923

1,036

1,601

2,152

2,610

% chg

5.8

1.4

12.3

54.6

34.4

21.3

(% of Net Sales)

17.9

15.0

14.7

18.8

21.0

22.0

Depreciation& amortisation

158

183

201

287

304

373

EBIT

753

740

835

1,314

1,848

2,237

% chg

2.6

(1.7)

12.8

57.4

40.6

21.1

(% of Net Sales)

14.8

12.0

11.8

15.5

18.1

18.9

Interest & other charges

185

169

90

68

93

93

Other income

53

37

51

55

55

55

(% of PBT)

7

5

5

4

3

2

Recurring PBT

794

811

959

1,456

1,964

2,353

% chg

(5.7)

2.1

18.3

51.8

34.9

19.8

Extraordinary expense/(Inc.)

3

-

17

10

-

-

PBT (reported)

794

811

942

1,445

1,964

2,353

Tax

113.0

119.5

106.0

259.4

432.1

517.7

(% of PBT)

14.2

14.7

11.3

17.9

22.0

22.0

PAT (reported)

681

692

836

1,186

1,532

1,836

Less: Minority interest (MI)

28.6

36.4

32.6

35.5

35.5

35.5

PAT after MI (reported)

653

655

804

1,151

1,496

1,800

ADJ. PAT

650

655

819

1,159

1,496

1,800

% chg

(8.6)

0.8

25.0

41.5

29.1

20.3

(% of Net Sales)

12.8

10.6

11.4

13.5

14.6

15.2

Adj.Basic EPS (`)

6.3

6.4

8.0

11.3

14.6

17.6

Adj. Fully Diluted EPS (`)

6.3

6.4

8.0

11.3

14.6

17.6

% chg

(8.6)

0.8

25.0

41.5

29.1

20.3

February 24, 2016

7

Cadila Healthcare |3QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity share capital

102

102

102

102

102

102

Reserves & Surplus

2,471

2,938

3,337

4,149

5,358

6,871

Shareholders funds

2,574

3,040

3,439

4,252

5,460

6,973

Minority interest

90

119

144

169

204

240

Total loans

2,289

2,681

2,265

2,334

2,334

2,334

Other Long Term Liabilities

43

47

55

43

44

45

Long Term Provisions

79

64

76

110

77

78

Deferred tax liability

119

100

96

59

120

121

Total liabilities

5,193

6,053

6,075

6,966

8,118

9,667

APPLICATION OF FUNDS

Gross block

3,008

4,104

3,756

4,353

5,003

5,653

Less: Acc. depreciation

1,175

1,358

1,540

1,827

2,132

2,504

Net block

1,833

2,746

2,214

2,526

2,871

3,148

Capital Work-in-Progress

484

248

892

892

892

892

Goodwill

1,015

862

908

733

733

733

Investments

24

21

87

154

154

154

Long Term Loans and Adv.

263

411

495

637

595

716

Current assets

2,760

3,191

3,391

4,105

5,642

7,230

Cash

467

582

549

670

1,684

2,699

Loans & advances

275

279

341

334

335

336

Other

2,019

2,330

2,501

3,102

3,623

4,195

Current liabilities

1,186

1,426

1,912

2,081

2,768

3,206

Net Current assets

1,574

1,765

1,480

2,024

2,873

4,024

Mis. Exp. not written off

-

-

-

-

-

-

Total assets

5,193

6,053

6,075

6,966

8,118

9,667

February 24, 2016

8

Cadila Healthcare |3QFY2016 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015 FY2016E FY2017E

Profit before tax

794

811

942

1,445

1,964

2,353

Depreciation

158

183

201

287

304

373

(Inc)/Dec in Working Capital

(427)

(223)

168

(565)

207

(257)

Less: Other income

53

37

51

55

55

55

Direct taxes paid

113

119

106

259

432

518

Cash Flow from Operations

359

614

1,154

853

1,988

1,896

(Inc.)/Dec.in Fixed Assets

(743)

(860)

(296)

(597)

(650)

(650)

(Inc.)/Dec. in Investments

(4)

3

(65)

(68)

-

-

Other income

53

37

51

55

55

55

Cash Flow from Investing

(694)

(820)

(310)

(609)

(595)

(595)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

1,238

382

(397)

91

(33)

2

Dividend Paid (Incl. Tax)

(175)

(175)

(216)

(287)

(287)

(287)

Others

(557)

115

(264)

74

(60)

(1)

Cash Flow from Financing

506

322

(877)

(122)

(380)

(286)

Inc./(Dec.) in Cash

171

116

(33)

121

1,013

1,015

Opening Cash balances

295

467

582

549

670

1,684

Closing Cash balances

467

582

549

670

1,684

2,699

February 24, 2016

9

Cadila Healthcare |3QFY2016 Result Update

Key Ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

51.9

51.5

41.2

29.1

22.6

18.7

P/CEPS

41.7

40.2

33.0

23.3

18.7

15.5

P/BV

13.1

11.1

9.8

7.9

6.2

4.8

Dividend yield (%)

2.3

2.3

2.3

2.3

2.3

2.3

EV/Sales

1.7

1.4

1.1

4.1

3.3

2.8

EV/EBITDA

9.2

9.2

7.8

21.8

15.7

12.5

EV / Total Assets

1.6

1.4

1.3

5.0

4.2

3.4

Per Share Data (`)

EPS (Basic)

6.3

6.4

8.0

11.3

14.6

17.6

EPS (fully diluted)

6.3

6.4

8.0

11.3

14.6

17.6

Cash EPS

7.9

8.2

10.0

14.2

17.6

21.3

DPS

7.5

7.5

7.5

7.5

7.5

7.5

Book Value

25.1

29.7

33.6

41.5

53.3

68.1

Dupont Analysis

EBIT margin

14.8

12.0

11.8

15.5

18.1

18.9

Tax retention ratio

85.8

85.3

88.7

82.1

78.0

78.0

Asset turnover (x)

1.3

1.2

1.3

1.5

1.6

1.8

ROIC (Post-tax)

16.8

12.8

13.8

18.6

23.0

26.4

Cost of Debt (Post Tax)

9.4

5.8

3.2

2.4

3.1

3.1

Leverage (x)

0.5

0.7

0.6

0.4

0.3

0.0

Operating ROE

20.8

17.7

20.1

25.8

28.1

27.2

Returns (%)

ROCE (Pre-tax)

17.3

13.2

13.8

20.2

24.5

25.2

Angel ROIC (Pre-tax)

27.2

19.5

20.6

31.3

39.0

44.1

ROE

27.4

23.3

25.3

30.1

30.8

29.0

Turnover ratios (x)

Asset Turnover (Gross Block)

2.0

1.8

1.8

2.1

2.2

2.3

Inventory / Sales (days)

66

66

69

61

71

79

Receivables (days)

57

54

57

57

58

64

Payables (days)

49

42

55

46

53

53

WC (ex-cash) (days)

64

66

53

48

45

38

Solvency ratios (x)

Net debt to equity

0.7

0.7

0.5

0.4

0.1

(0.1)

Net debt to EBITDA

2.0

2.3

1.7

1.0

0.3

(0.1)

Interest Coverage (EBIT / Int.)

4.1

4.4

9.3

19.4

19.8

24.0

February 24, 2016

10

Cadila Healthcare |3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Cadila Healthcare

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

February 24, 2016

11