1

Please refer to important disclosures at the end of this report

1

1

Computer Age Management Services Ltd (CAMS) is India’s largest registrar and

transfer agent (RTA) of mutual funds with an aggregate market share of

approximately 70% based on mutual fund average assets under management

(AAUM) managed by its clients and fastest growing RTA for last 5 years. CAMS is

responsible for entire back end work of its mutual fund clients i.e. from account

creation to processing to redemption and also provides statutory statements,

transaction origination, operations, investor & distributor services, risk

management services and compliance services. For all the above service, CAMS

charges fees of 0.036% (FY20) on AUM managed by its clients. All 41 mutual

funds outsource back end/operational work to RTA.

Huge growth potential in Mutual Fund AUM to support CAMS’ revenue: Over the

past five years (FY15-20), equity AUM for the Indian MF industry has increased

2.7x from `3.24 lakh cr to `9 lakh cr. Further, overall AUM has nearly jumped

2.4x from `11.48 lakh cr to `27.14 lakh cr over the same period. There is a huge

growth potential for MF industry as the penetration of mutual funds is low in India

with an AUM/GDP ratio of 12% as of Dec 2019 vs. that of developed countries at

>50%. Lower attraction in real estate by investors due to subdued returns coupled

with lower inflation will direct investors from physical assets to financial savings,

resulting in MF AUM to grow at a healthy rate. Given that CAMS’ 87% revenue is

linked to AUM growth, MF industry growth is positive for CAMS.

Leadership position in MF RTA business and foray in new growing business:

CAMS is the largest RTA of mutual funds with an aggregate market share of 70%.

Its mutual fund clients include four of the five largest mutual funds as well as nine

of the 15 largest mutual funds based on AAUM during July 2020. Most of the

bank-led top mutual funds are CAMS’ clients. Leveraging on current domain

expertise, processes, and infrastructure, CAMS has also started to cater to AIFs,

insurance companies, banks and NBFCs.

Healthy financials to support higher dividend payout: Revenue has grown at a

steady CAGR of 13% over FY15-20.Its leadership position has helped to report a

healthy EBIDTA margin of 41% for FY20. Return on equity (ROE) for FY20 was

34% and the last 3 years average ROE was 31.3%. For FY20, CAMS has

registered dividend payout of 41%. Considering the ability to generate strong

cash flow from operations, we expect the company would continue to pay a

generous dividend to shareholders.

Outlook & Valuation: At the upper end of the IPO price band, it is offered at

34.6x its FY20 EPS and 11x its FY20 book value, demanding `6,000cr market

cap, which we believe is reasonable. Given CAMS’ leadership position, huge

growth potential of MF industry, strong return ratios, asset-light business and

higher dividend payout ratio, we are positive on this IPO and rate it as

SUBSCRIBE.

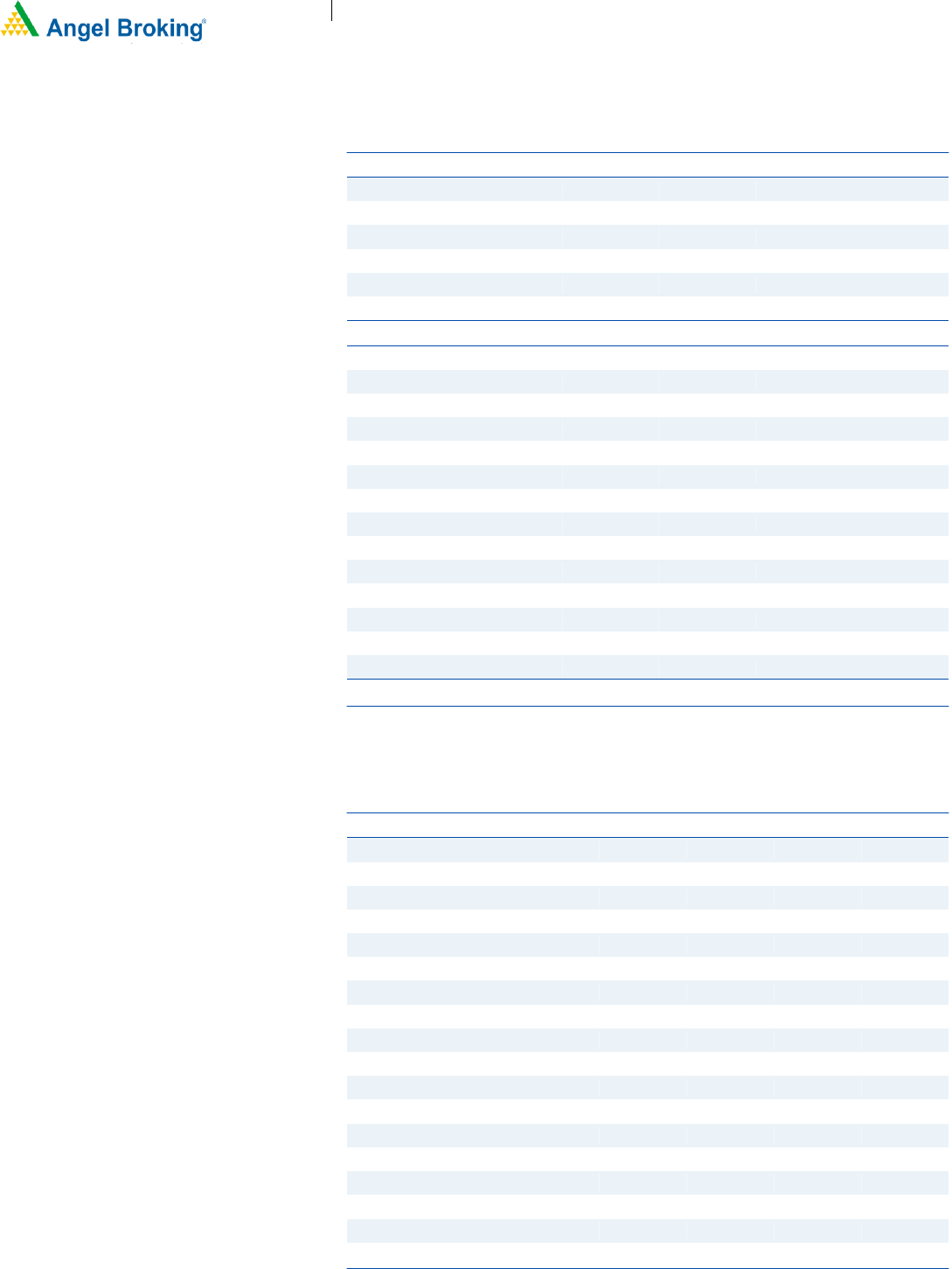

Key Financials

Y/E March (` cr)

FY2018

FY2019

FY2020

1FY21

Net Sales

642

694

700

149

% chg

8

1

-

Net Profit

146

131

173

41

% chg

(11)

33

-

EBITDA (%)

40

35

41

35

EPS (`)

30

27

36

-

P/E (x)

41

46

35

-

ROE (%)

32

29

32

-

Note - Valuation done on pre IPO financials

SUBSCRIBE

Issue Open: Sep 21, 2020

Issue Close: Sep 23, 2020

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 44%

Others 57%

Fresh issue: -

Issu e Details

Face Value: `10

Present Eq. Paid up Capital: `48.8cr

Offer for Sale: **1.82cr Shares

Post Issu e Sh areh oldin g Pattern

Post Eq. Paid up Capital: `48.8cr

Issue size (amount): *`2,240cr -

**2,242 cr

Price Band: `1,229-1,230

Lot Size: 12 shares and in multiples

thereafter.

Post-issue implied mkt. cap: *`5,996cr

- **`6,001cr

Promoters holding Pre-Issue: 43.50%

Promoters holding Post-Issue: 43.50%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Jaikishan J Parmar

Research Analyst

+022 39357600, Extn: 6810

Jaikishan.parmar@angelbroking.com

Computer Age Management Services Limited

IPO Note | Financials

Sep 19, 2020

2

Computer Age Management Services Limited I PO Note

Sep 19,2020

2

Company Background

Promoted by Great Terrain Investment Ltd (Affiliate of Warburg Pincus), Computer

Age Management Services Limited (CAMS) was incorporated on May 25, 1988.

CAMS is a technology-driven financial infrastructure and services provider to

mutual funds and other financial institutions with over 2 decades of experience.

CAMS is India’s largest registrar and transfer agent of mutual funds with an

aggregate market share of 70% based on mutual fund average assets under

management (AAUM) managed by its clients and serviced by them during

November 2019.

Its mutual fund clients include 4 of the 5 largest mutual funds as well as 9 of the

15 largest mutual funds based on AAUM during July 2020.

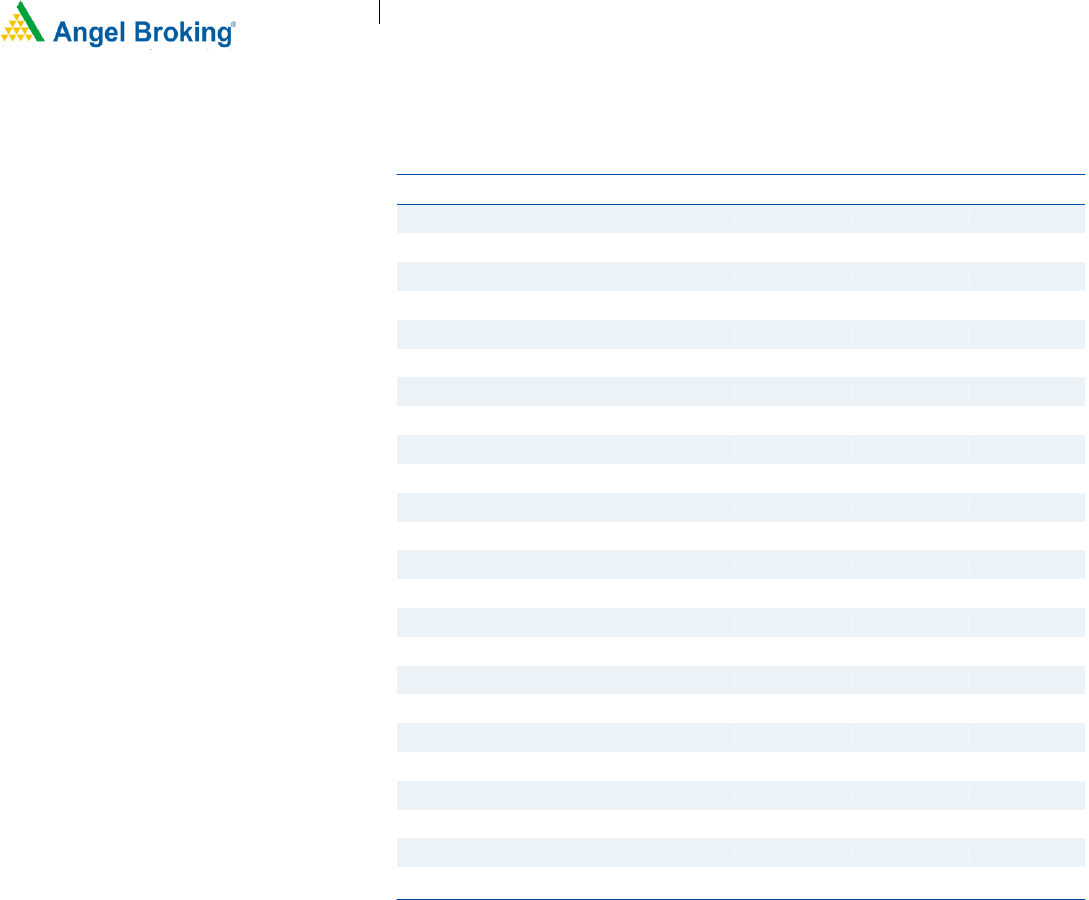

Exhibit 1: Key Performance Indicators

Particular

FY16

FY17

FY18

FY19

FY20

Q1FY21

Total AAUM of the mutual funds serviced (` in Cr)

793.15

1,029.36

1,375.85

1,584.12

1814.97

1743.33

Equity Oriented (` in Cr)

232.74

292.11

488.48

623.25

670.67

575.07

Number of transactions handled (in Cr)

11.52

15.18

25

31.29

32.84

7.59

Number of live folios (in Cr)

1.93

2.3

3.18

3.71

3.94

3.98

Number of total investor folios (in Cr)

4

4.4

5.48

6.36

7.09

7.18

Number of PAN accounts handled (in Cr)

0.72

0.87

1.24

1.48

1.59

1.6

Number of SIP transactions processed (in Cr)

6.32

8.39

13.22

19.17

23.75

5.85

Source: RHP

Key Management Personnel:

Anuj Kumar is the whole time Director and CEO of the company. He was

previously associated with Godrej & Boyce Mfg. Co. Ltd., Blow Plast Limited,

Escorts Finance Ltd, BillJunction Payments Ltd, IBM India Pvt. Ltd. and Concentrix

Daksh Services India Pvt. Ltd. He joined the company in March, 2016.

Somasundaram M. is the Chief Financial Officer of the company. He joined the

company on July 6, 2009.

Srikanth Tanikella is the Chief Operations Officer of the company. He joined the

company on December 18, 2014.

3

Computer Age Management Services Limited I PO Note

Sep 19,2020

3

Issue details

This IPO is purely on offer for sale and the issue is worth `2,242cr. Of this issue

worth `22cr, 1,82,500 shares are reserved for employees of CAMS.

NSE Investment, an arm of NSE, will be the only selling shareholder under the

IPO. Notably, the markets regulator in February had directed NSE to divest its

entire 37.5% stake in CAMS within a year.

Exhibit 2: Pre and Post-IPO shareholding pattern

Particular

No of shares

(Pre-issue)

%

No of shares

(Post-issue)

%

Promoter

2,12,24,000

44

2,12,24,000

44

Institution

2,75,62,800

56

93,16,200

19

Public (OFS)

1,82,46,600

37

Total

4,87,86,800

100

4,87,86,800

100

Source: RHP Note,: Calculated on upper price band

Exhibit 3: Pre-Offer Equity Share capital

Share Holder

No Of share

% Stake

Great Terrain

2,12,24,000

43.5

NSE Investments

1,82,85,000

37.5

HDFC

29,20,724

6.0

HDFC Bank

16,23,708

3.3

HDB Trust

15,55,444

3.2

Faering Capital India Evolving Fund II

12,41,430

2.5

Acsys

9,44,724

1.9

Faering Capital India Evolving Fund III

7,08,970

1.5

Other

2,82,800

0.6

Total

4,87,86,800

100

Source:RHP

Objects of the offer

The markets regulator in February had directed NSE to divest its entire 37.5%

stake in CAMS within a year.

To achieve the benefits of listing the Equity Shares on the Exchanges and to

carry out offer for sale of equity shares

Risk

87% of the revenue comes from Mutual fund industry, hence, degrowth in

AUM and decline in yield would impact the company’s financials.

Significant disruptions in CAMS’ information technology systems or breach of

data security could adversely affect business and reputation.

4

Computer Age Management Services Limited I PO Note

Sep 19,2020

4

Income Statement

Y/E March (` cr)

FY2018

FY2019

FY2020

Q1FY21

Net Sales

642

694

700

149

% chg

8.1

0.9

Total Expenditure

383

450

412

97

Personnel

226

275

258

65

Operating Exp

94

106

87

17

Others Expenses

63

70

68

16

EBITDA

258

244

287

51

% chg

(5.7)

17.9

(% of Net Sales)

40.3

35.1

41.1

34.6

Depreciation& Amortisation

40

50

49

11

EBIT

218

193

239

41

% chg

(11.5)

23.6

(% of Net Sales)

34.0

27.9

34.1

Interest & other Charges

8

10

10

2

Other Income

16

18

22

15

(% of PBT)

7.2

9.0

8.7

Recurring PBT

227

201

251

53

% chg

(11.3)

24.8

Tax

80

70

77

12

(% of PBT)

35.4

34.8

30.8

23.4

PAT (reported)

146

131

173

41

(% of Net Sales)

22.8

18.9

24.8

27.5

Basic EPS (`)

30.0

26.8

35.6

8.2

5

Computer Age Management Services Limited I PO Note

Sep 19,2020

5

Balance Sheet

Y/E March (` cr)

FY2018

FY2019

FY2020

Q1FY21

SOURCES OF FUNDS

Equity Share Capital

49

49

49

48.8

Reserves& Surplus

402

401

491

479

Shareholders Funds

451

449

540

528

Financial Laibility

87

84

77

65

Provision

57

71

74

75

Total Liabilities

595

605

691

668

APPLICATION OF FUNDS

Net Block

177

168

154

136

Intangible assets

147

152

145

142

Investments

228

242

318

329

Current Assets

123

150

177

218

Inventories

-

-

-

-

Sundry Debtors

23

27

32

44

Cash

28

44

51

84

Loans & Advances

0.5

0.7

0.6

0.8

Other Assets

72

79

94

90

Current liabilities

103

132

112

168

Net Current Assets

20

18

65

50

Deferred Tax Asset

6

2

0

1

Other Asset

17

22

9

10

Total Assets

594

605

691

668

Cashflow Statement

Y/E March (`s cr)

FY2018

FY2019

FY2020

Q1FY21

Profit before tax

227

201

251

53

Depreciation

40

50

49

11

Change in Working Capital

(5)

19

(10)

(6)

Interest / Dividend (Net)

Direct taxes paid

(89)

(76)

(83)

(11)

Others

(11)

(8)

(5)

(9)

Cash Flow from Operations

162

187

201

39

(Inc.)/ Dec. in Fixed Assets

(43)

(35)

(15)

(1)

(Inc.)/ Dec. in Investments

24

4

(69)

3

Cash Flow from Investing

(19)

(31)

(84)

1

Issue of Equity

0

0

0

2

Inc./(Dec.) in loans

(14)

(16)

(18)

(5)

Dividend Paid (Incl. Tax)

(116)

(132)

(72)

(54)

Interest / Dividend (Net)

(8)

(10)

(9)

(2)

Cash Flow from Financing

(138)

(158)

(99)

(60)

Inc./(Dec.) in Cash

5

(3)

18

(20)

Opening Cash balances

3

7

5

23

Closing Cash balances

7

5

23

3

Source: Company

6

Computer Age Management Services Limited I PO Note

Sep 19,2020

6

Key Ratio

Y/E March

FY2018

FY2019

FY2020

Valuation Ratio (x)

P/E (on FDEPS)

41.0

45.8

34.6

P/CEPS

31.9

32.8

26.8

P/BV

13.3

13.4

11.1

Dividend yield (%)

1.9

2.2

1.2

EV/Sales

9.1

8.4

8.2

EV/EBITDA

22.6

23.8

19.9

EV / Total Assets

9.8

9.6

8.3

Per Share Data (`)

EPS (Basic)

30.0

26.8

35.6

EPS (fully diluted)

30.0

26.8

35.6

Cash EPS

38.2

37.2

45.5

DPS

23.9

27.1

14.7

Book Value

92.5

92.1

110.6

Returns (%)

ROCE

40.6

36.2

38.7

Angel ROIC (Pre-tax)

77.4

78.0

96.1

ROE

32.4

29.1

32.2

Turnover ratios (x)

Asset Turnover (Gross Block)

2.0

2.2

2.3

Inventory / Sales (days)

-

-

-

Receivables (days)

4

4

5

Payables (days)

19

18

19

Working capital cycle (ex-cash) (days)

(16)

(15)

(14)

Valuation done on upper price band

7

Computer Age Management Services Limited I PO Note

Sep 19,2020

7

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.