Initiating Coverage | Hotels

September 9, 2015

The Byke Hospitality

BUY

CMP

`153

Appealing business model in a growing industry segment

Target Price

`181

The Byke Hospitality Ltd (Byke) is an India based hospitality services company. The company

Investment Period

12 Months

operates under two business segments - 1) managing hotels and 2) room chartering.

Investment Arguments

Stock Info

Asset light business model: Byke has 11 properties as of now, of which, 9 properties

Sector

Hotels

are on a long term lease of over 10-15 years. In the last 5 to 6 years, the company

Market Cap (` cr)

613

has increased its number of rooms from 102 to 697 (as in 1QFY2016). Going

forward, the company has strong expansion plans through the lease model, which will

Net Debt (` cr)

10

enable it to grow at a faster pace with minimal capex requirement.

Beta

0.9

Expansion on the cards: Currently, the company operates 697 rooms, including both

52 Week High / Low

180 / 147

owned and leased, across 11 properties. The company is now planning to add 8 more

Avg. Daily Volume

1,15,983

properties, which would lead to an addition of ~450-500 rooms over the next two

Face Value (`)

10

years. Such expansion would be based on the lease model (for 10-20 years), thus not

BSE Sensex

25,318

requiring any significant capex. The company plans to increase the number of

properties from 11 to 50 within 5 years, following the asset light expansion plan.

Nifty

7,688

Reuters Code

TBKH.BO

Presence in vegetarian budget hotels (mid-size) segment: Byke has presence in the

vegetarian budget hotel segment at popular leisure destinations such as Goa,

Bloomberg Code

BYKE@IN

Matheran, Jaipur, Manali, Shimla, Puri and Mumbai while it has plans to expand

across other destinations like Kerala, Lonavala, Chandigarh, Mahabaleshwar etc. In our

view, the vegetarian budget hotels at leisure destinations in domestic market is a huge

Shareholding Pattern (%)

opportunity. Also in absence of track records, non-branded (single hotel players) hotels face

Promoters

44.0

issues in running their businesses. Byke, a branded vegetarian budget hotel follows a

MF / Banks / Indian Fls

10.2

differentiated market penetration strategy. It leases hotels and address the challenges on back

FII / NRIs / OCBs

0.3

of their management experience; strong track record, marketing and distribution network,

which further leads to higher occupancy, thereby maximizing the company’s profitability.

Indian Public / Others

45.6

Strong growth in chartering business to drive overall revenue: Under the room

chartering business Byke books third-party hotel rooms, mainly during peak seasons,

Abs. (%)

3m 1yr

3yr

at strategically identified cultural and religious destinations on bulk basis and lets them

Sensex

(4.5)

42.4

42.6

out to tourists. In the chartering segment, the company has a strong track record, with its

Byke

(2.2)

(4.8)

84.6

revenue having grown by 3.5x (`90cr in FY2015) in the last three years. Going forward

we expect strong growth momentum in this segment due to the huge industry size.

Outlook and Valuation: Given the company’s proven track records and taking into

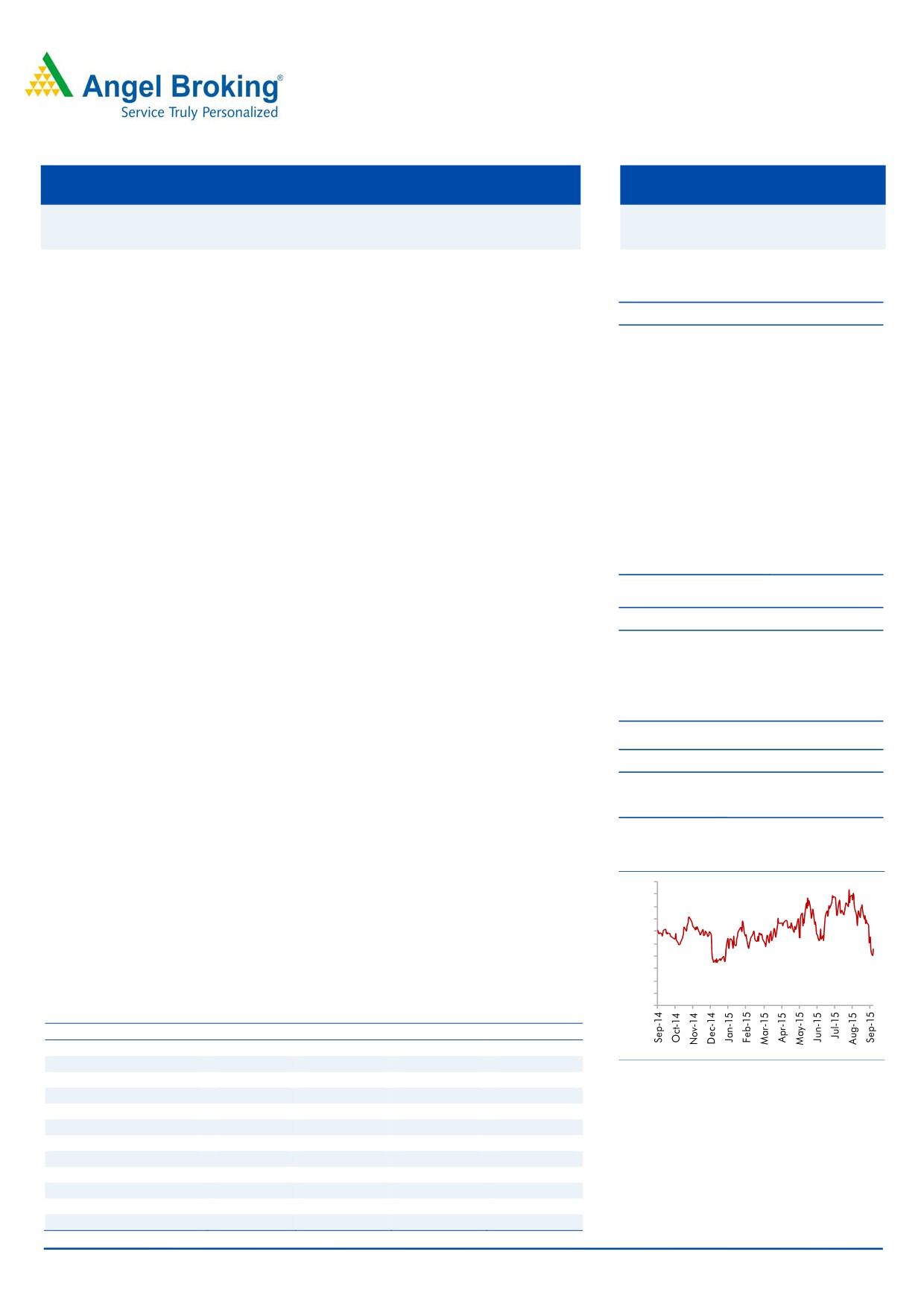

3 years - share price chart

consideration its strong expansion plans, we expect the company to report strong top-

180

line and bottom-line CAGR of ~28% and ~29% respectively, over FY2015-18E.

175

170

Moreover, the company is asset light, has negligible debt, and has been posting

165

healthy return ratios, which make its balance sheet all the more attractive. At the

160

155

current market price, the stock trades at a P/E of 14.3x its FY2018E EPS. We initiate

150

coverage on the stock with a Buy recommendation and target price of `181 (17x

145

140

FY2018E EPS), indicating an upside of ~19% in the stock price from the present levels.

135

130

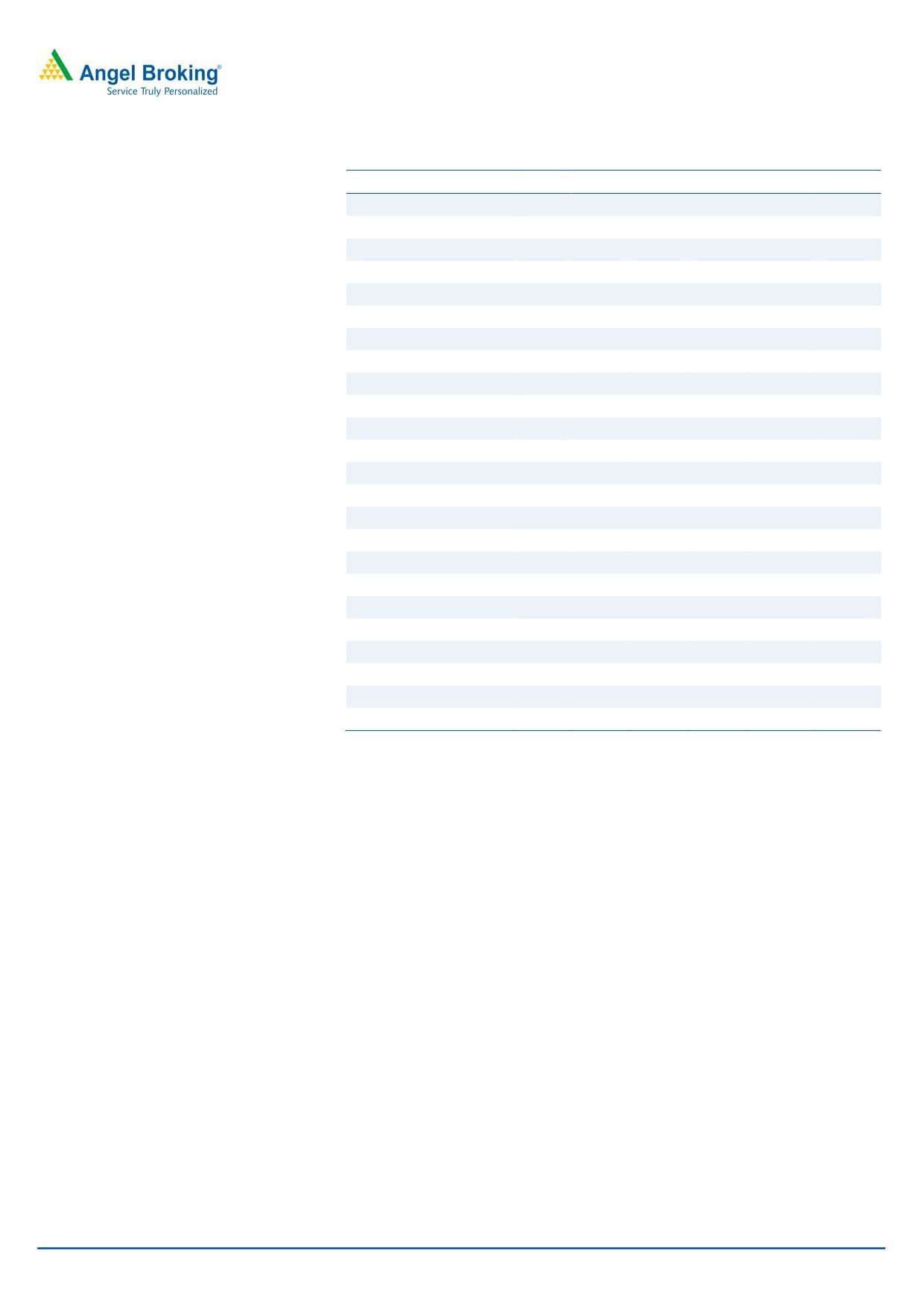

Key financials

Y/E March (` cr)

FY2015

FY2016E

FY2017E

FY2018E

Net sales

181

222

287

384

% chg

16.5

22.2

29.4

33.7

Source: Company, Angel Research

Net profit

20

23

30

43

% chg

26.2

12.8

34.0

41.3

EBITDA margin (%)

20.5

20.5

20.5

20.5

EPS (`)

5.0

5.6

7.6

10.7

P/E (x)

30.6

27.1

20.3

14.3

P/BV (x)

6.1

5.1

4.2

3.4

RoE (%)

20.0

18.8

20.7

23.5

RoCE (%)

24.1

26.2

29.3

33.4

Amarjeet S Maurya

EV/Sales (x)

3.4

2.8

2.2

1.6

022-39357800 Ext: 6831

EV/EBITDA (x)

16.7

13.6

10.5

7.8

Source: Company, Angel Research, Note: CMP as of September 8, 2015

Please refer to important disclosures at the end of this report

1

The Byke Hospitality | Hotels

Investment Arguments

Expansion on the cards

Byke is a fast growing hospitality services company, currently operating hotels (own

+ leased) at popular holiday destinations such as Goa, Matheran, Mandawa,

Jaipur, Manali, Shimla, Puri and Mumbai. Its average occupancy level stands at

around 70%.

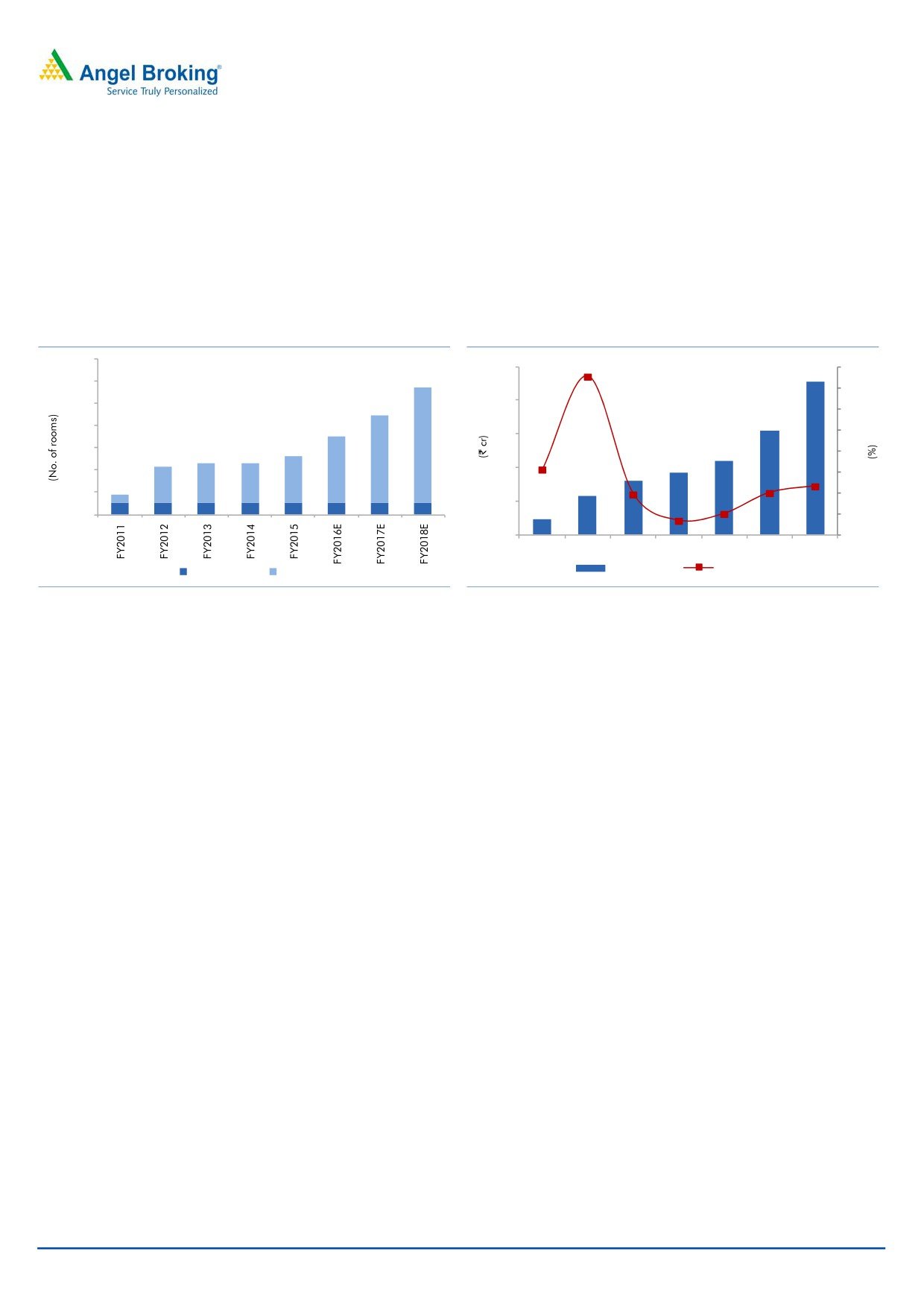

Exhibit 1: Projected growth in hotel rooms

Exhibit 2: Revenue growth from hotel business

1,400

151.1

250

228

160

1,200

140

1,000

200

120

155

800

100

150

1,042

111

600

62.7

80

792

92

400

595

100

81

46.7

60

40.3

323

363

363

417

58

200

40

80

50

20.4

23

13.9

102

102

102

102

102

102

102

102

39.0

0

20

0

0

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Owned rooms

Leased rooms

Net Revenue

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

Byke is now planning to add 8 more

Currently, the company operates 697 rooms, including both owned and leased,

properties, which would lead to an

across 11 properties. The company is now planning to add 8 more properties,

addition of ~450-500 rooms over the

which would lead to an addition of ~450-500 rooms over the next two years. In

next two years

FY2016, the company would be adding 3 properties; ie in Lonavala, Chandigarh,

and Mahabaleshwar, which will lead to an addition of 197 rooms. Further

expansion in addition to the aforementioned is expected to happen in FY2017,

with the tentative locations being Dalhousie, Jodhpur, Udaipur, Darjeeling and

Gangtok; these properties are expected to be fully operational by FY2018. Such

expansion would be based on the lease model (for 10-20 years), thus not

requiring any significant capex. In this segment, we expect the company to report a

top-line CAGR of ~35% over FY2015-18E to `288cr. Moreover, the company

plans to increase the number of properties from 10 to 50 within 5 years under the

asset light expansion plan.

September 9, 2015

2

The Byke Hospitality | Hotels

Exhibit 3: Hotel portfolio of Byke

Name of hotel

Location

Rooms

Type

The Byke Heritage

Matheran (Maharashtra)

80

Owned

The Byke- Sunflower

North Goa

22

Owned

The Byke - Redwood

Matheran (Maharashtra)

25

Leased

The Byke - Old Anchor

South Goa

240

Leased

The Byke- Hidden Paradise North Goa

40

Leased

The Byke - Neelkanth

Manali (Himachal Pradesh)

40

Leased

The Byke- Grassfield

Jaipur (Rajasthan)

54

Leased

The Byke Suraj Plaza

Thane (Mumbai)

122

Leased

Operational in FY16

Shimla & Puri

75

Leased

Upcoming Hotel in FY17

Lonavala

Leased

Upcoming Hotel in FY17

Chandigarh

Leased

Upcoming Hotel in FY17

mahabaleshwar

Leased

Source: Company, Angel Research

Strong growth in chartering business to drive overall revenue

The chartering model has helped Byke

The company also operates in the chartering business segment. In this segment, it

strengthen its pan-India presence, with

books third-party hotel rooms at strategically identified cultural and religious tourist

it letting out rooms across 50 cities in

destinations during peak seasons, on bulk basis, and lets them out to tourists. It

India, following the model

thus capitalises on the diverse peak seasons across the country and offers

unparalleled choice to guests through its strong marketing network. This model has

helped Byke strengthen its pan-India presence with it letting out rooms across 50

cities in India, following the model.

Exhibit 4: Projected room sales

7,00,000

5,93,728

6,00,000

5,16,286

5,00,000

4,48,944

3,73,250

4,00,000

3,45,000

3,00,000

2,01,355

2,00,000

1,23,758

1,00,000

0

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Source: Company, Angel Research

September 9, 2015

3

The Byke Hospitality | Hotels

Exhibit 5: Revenue growth in Chartering business

Exhibit 6: Average realisation per room

180

90

3,000

12

156

2,404

2,627

74.8

2,550

160

80

2,476

65.6

132

2,500

10

140

70

2,131

2,174

2,093

111

10.6

120

60

2,000

8

100

90

50

34.2

75

1,500

6

80

40

60

43

23.9

30

1,000

3.0

3.0

3.0

4

19.6

18.5

18.5

2.3

2.0

40

26

20

1.8

500

2

20

10

0

0

0

0

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

FY2012

FY2013

FY2014

FY2015 FY2016E FY2017E FY2018E

Revenue

yoy growth (%)

ARR

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

In the chartering segment, we expect

In the chartering segment, the company has a strong track record, with its revenue

the company to report a CAGR of

having grown by 3.5x (`90cr in FY2015) in the last three years. Going forward we

~20% over FY2015-18E, to `156cr

expect strong growth momentum in this segment due to the huge industry size; as

per the company’s Management, the current size of the budget hotel segment is

around `50,000cr. We expect the company to report a CAGR of ~20% over

FY2015-18E, to `156cr.

Strong marketing network supports utilization

Byke has one of the widest sales and

The company has one of the widest sales and marketing network, reaching out to

marketing networks, reaching out to the

the target audience through its 27 owned sales offices and 219 active agents. The

target audience through its 27 owned

company is also having a unique third party marketing tie-up through which the

sales offices and 219 active agents

Byke brand is present across 53 cities in the country.

Exhibit 7: Strong marketing network

Exhibit 8: “The Byke” Presence

250

219

208

200

182

150

134

89

100

48

53

41

50

32

22

0

FY2012

FY2013

FY2014

FY2015

1QFY16

No. of Cities

No. of Agents

Source: Company, Angel Research

Source: Company, Angel Research

A strong network enables the company to avail to higher utilization rates of rooms

in the owned + leased model as well as the chartering business.

September 9, 2015

4

The Byke Hospitality | Hotels

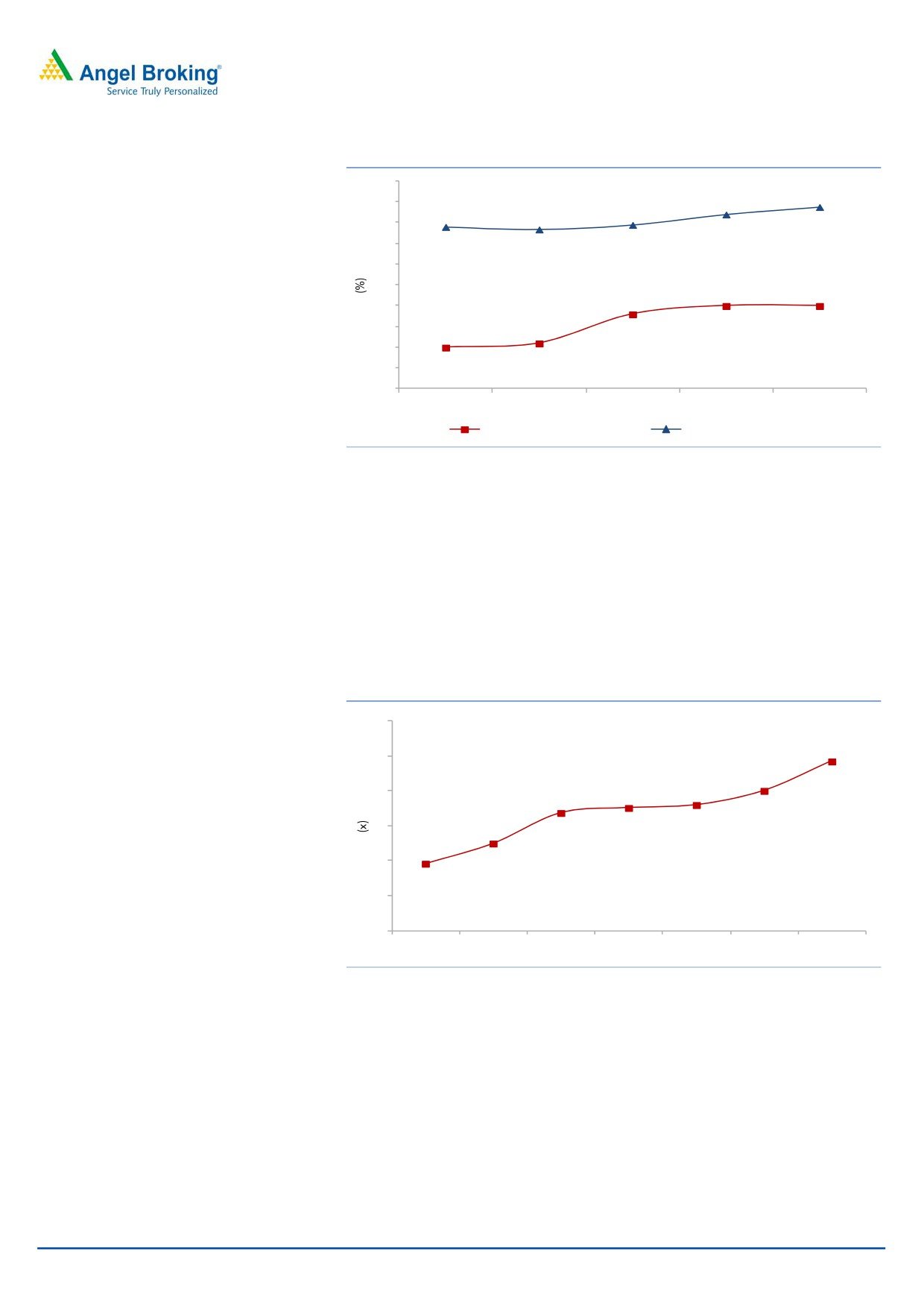

Exhibit 9: Higher utilisation in hotel segments

100

94

92

95

89

89

88

90

85

80

75

70

70

68

70

65

61

60

60

55

50

FY2011

FY2012

FY2013

FY2014

FY2015

Owned + leased business

Chartering business

Source: Company, Angel Research

Asset light business model

As of now, the company has

11

As of now, the company has 11 properties out of which 9 properties are on long

properties, of which, 9 properties are

term lease based over 10-15 years. In the last 5 to 6 years, the company has

on a long term lease over 10-15 years

increased its number of rooms from 102 to 697 as in 1QFY2016. During the

period, the company has added 595 rooms, all of which are based on the lease

model. Further, the company has strong expansion plans through the lease model,

which will also enable it to grow at a faster pace with minimal capex requirement.

Exhibit 10: Net Sales/Gross Block trend

3

2.4

3

2.0

2

1.8

1.8

1.7

2

1.2

1.0

1

1

0

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Source: Company, Angel Research

September 9, 2015

5

The Byke Hospitality | Hotels

Financial outlook

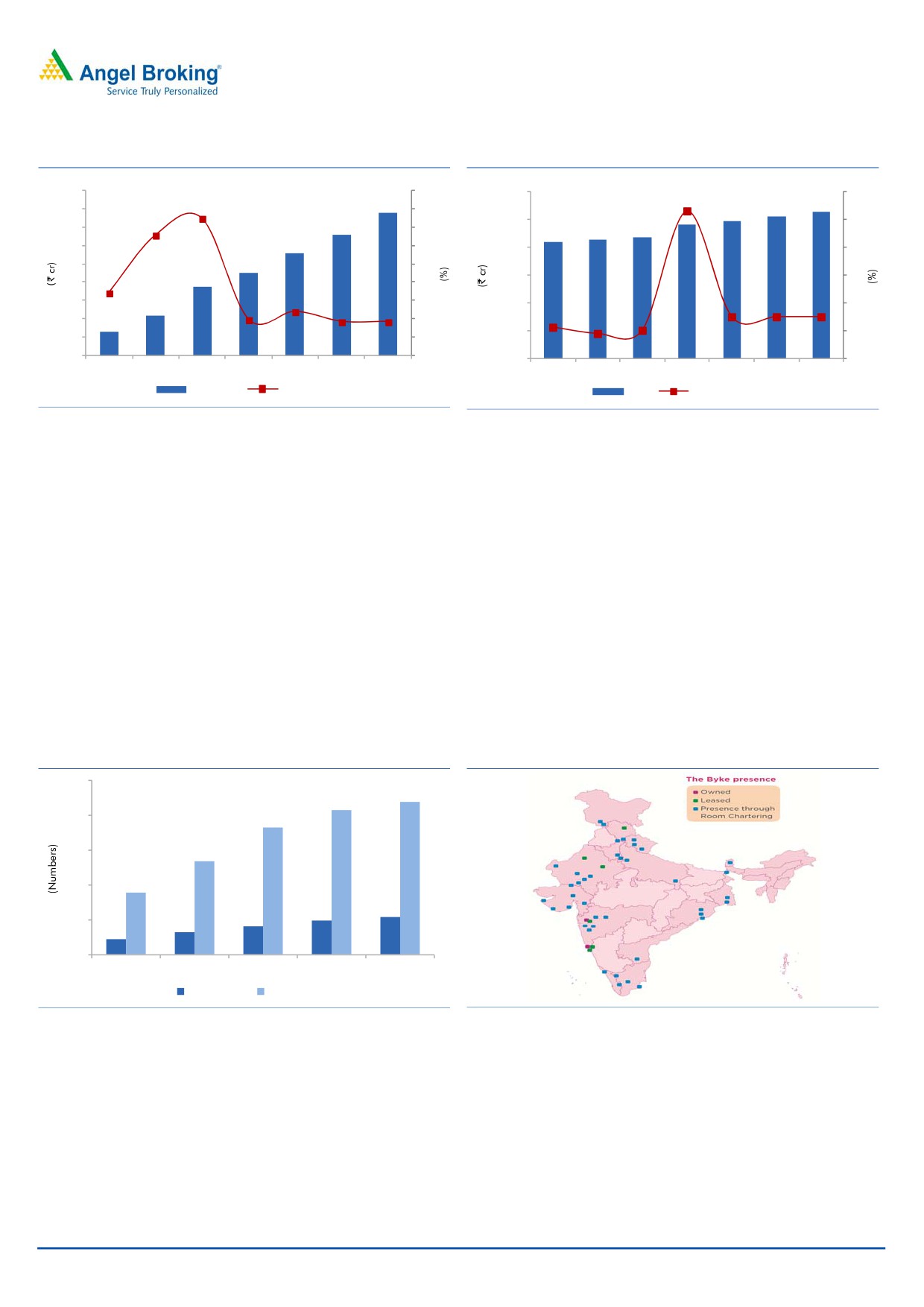

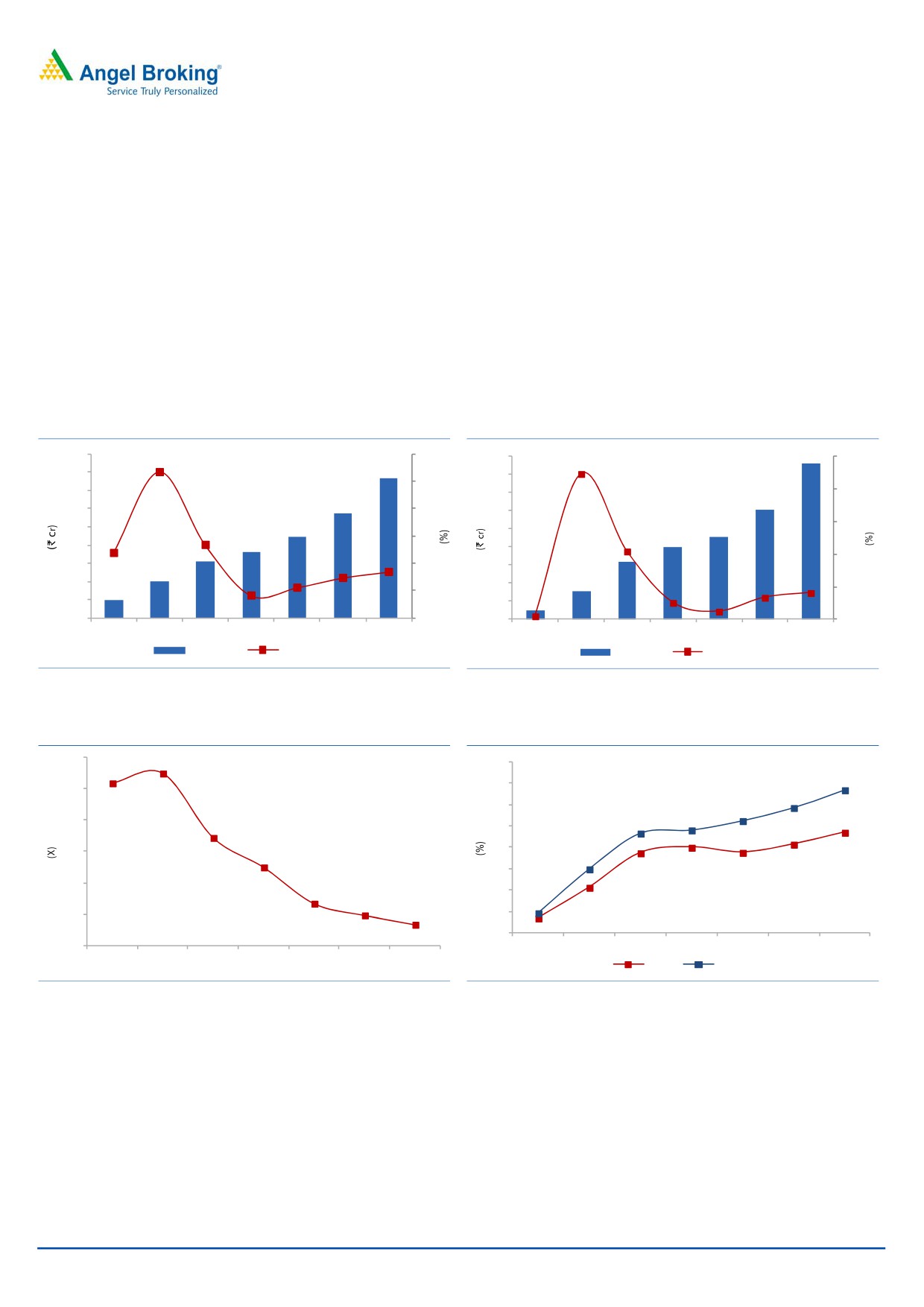

Going ahead, we expect Byke to report

Going ahead, we expect Byke to report a top-line CAGR of ~28% over FY2015-

a top-line CAGR of ~28% over FY2015-

18E to ~`384cr owing to strong growth in the hotel business. The growth would

18E to ~`384cr

come on the back of robust expansion of number of rooms at popular destination.

Further, we expect the chartering business to contribute to the company’s growth

as well, aided by a strong marketing network.

On the bottom-line front, we expect the

On the bottom-line front, we expect the company to report a 29% CAGR over

company to report a 29% CAGR over

FY2015-18E on account of healthy top-line growth and operating margin.

FY2015-18E

Moreover, the company is asset light, has negligible debt, and is able to post a

healthy return ratio, which makes its balance sheet all the more attractive.

Exhibit 11: Projected Net Sales growth trend

Exhibit 12: Projected Net Profit growth trend

450

106.7

120

45

223.3

43

250

384

400

40

100

350

35

200

287

30

300

80

30

250

222

23

150

53.5

25

47.6

60

20

181

104.8

200

20

156

33.7

100

150

29.4

40

15

101

22.2

16

16.5

8

41.3

100

10

34.0

49

26.2

50

20

2

12.8

50

5

5.7

0

0

0

0

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Net Sales

yoy growth (%)

Net Profit

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 13: Debt/Equity trend

Exhibit 14: ROE and ROCE trend

0.3

40

0.3

0.3

33.4

35

0.3

29.3

30

26.2

23.3

24.1

0.2

25

0.2

20

23.5

0.2

15.0

20.0

20.7

0.1

15

18.7

18.8

0.1

10

4.8

0.1

0.0

10.7

0.1

5

0.0

0

3.6

0.0

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

ROE

ROCE

Source: Company, Angel Research

Source: Company, Angel Research

September 9, 2015

6

The Byke Hospitality | Hotels

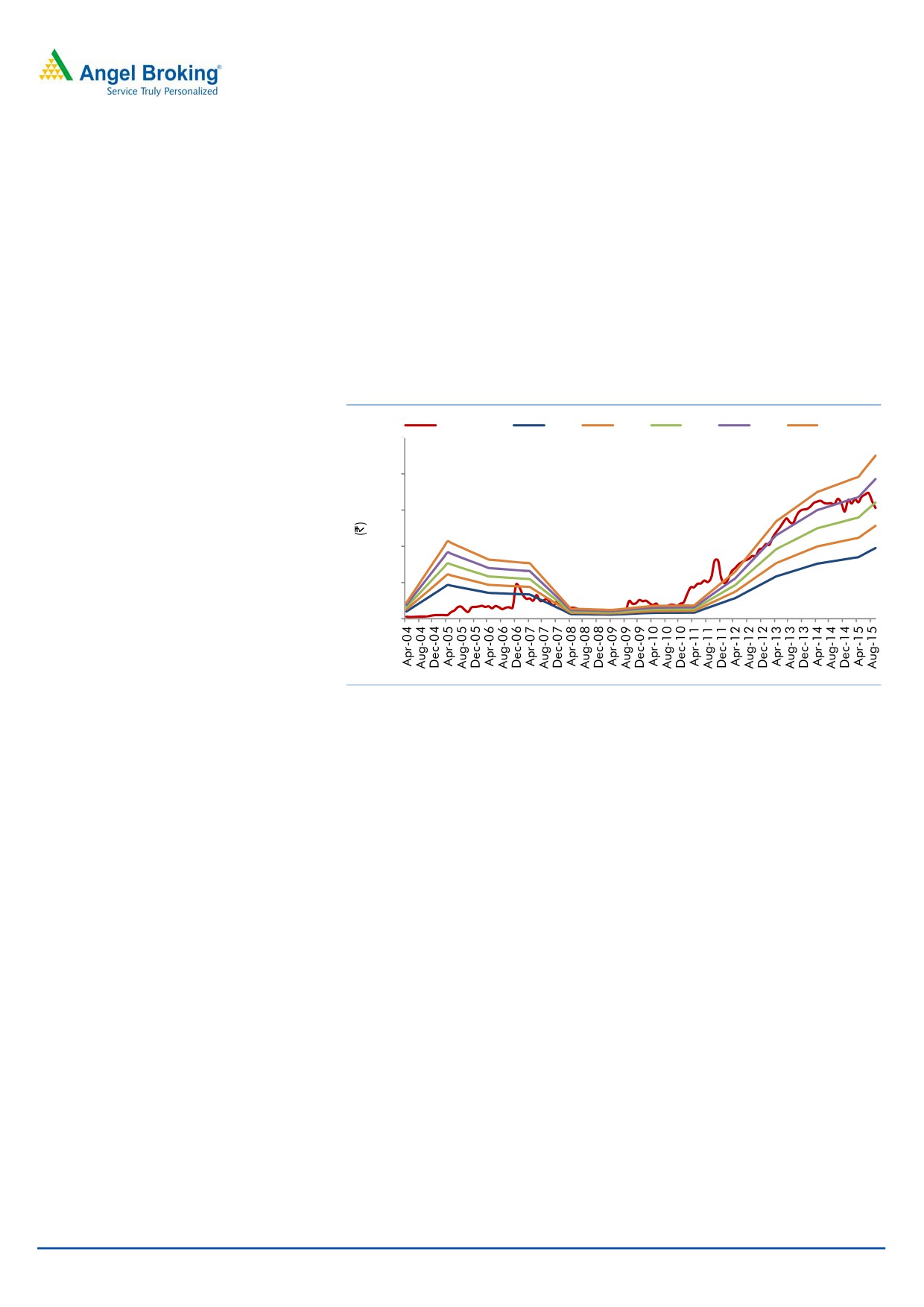

Outlook and Valuation

Given the company’s proven track records and taking into consideration its strong

expansion plans, we expect the company to report strong top-line and bottom-line

CAGR of ~28% and ~29% respectively, over FY2015-18E. Moreover, the

company is asset light, has negligible debt, and has been posting healthy return

ratios, which make its balance sheet all the more attractive. At the current market

price, the stock trades at a P/E of 14.3x its FY2018E EPS. We initiate coverage on

the stock with a Buy recommendation and target price of `181 (17x FY2018E EPS),

indicating an upside of ~19% in the stock price from the present levels.

Exhibit 15: One year PE forward chart

Share Price

15x

20x

25x

30x

35x

250

200

150

100

50

0

Source: Company, Angel Research

Downside risks to our estimates include 1) increase in competition from online

companies like oyorooms.com could impact Byke’s growth in the long term,

(2) slower pace in room addition could impact the company’s earnings,

(3)

slowdown in Indian economy could impact spending in this segment.

September 9, 2015

7

The Byke Hospitality | Hotels

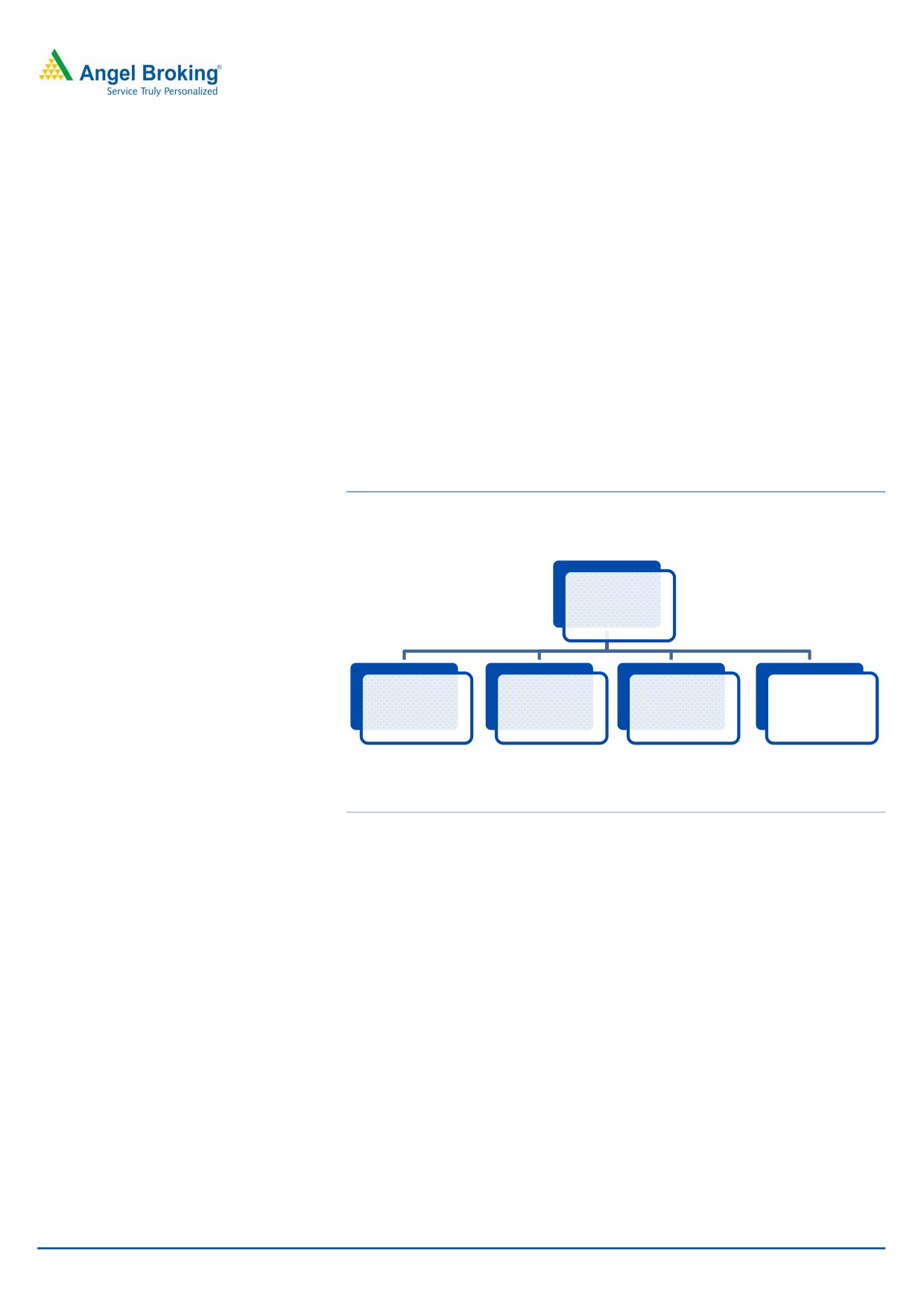

Company Background

Byke Hospitality Ltd (Byke) is an India based hospitality services company. The

company has two business segments - 1) managing properties/hotels and 2) room

chartering. The company operates 11 resorts across Maharashtra, Rajasthan, Goa

and Himachal Pradesh (Manali) with a total bouquet of 697 rooms. It operates

primarily on a lease based model. While 2 of the 11 resorts are owned, the

remaining 9 are on an operating lease of 10-15 years. Under the room chartering

business, the company manages room inventory at various locations. The

company books third-party hotel rooms at strategically identified cultural and

religious tourist destinations during peak seasons, on a bulk basis, and lets them

out to tourists. It is also under the process of developing a travel portal -

tripdeal.com - which will facilitate travel and room booking online and help bolster

Byke’s room chartering business.

Exhibit 16: Segment wise revenue break-up of Byke

Total Revenue

(`182cr )

Rooms

Resort Room

Food &

Chartering

Others (13%)

Bookings (25%)

Beverage (12%)

(49%)

Source: Company, Angel Research

September 9, 2015

8

The Byke Hospitality | Hotels

Exhibit 17: The Byke- Sunflower (Goa)

Exhibit 18: The Byke - Old Anchor (Goa)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 19: The Byke- Hidden Paradise (Goa)

Exhibit 20: The Byke Heritage (Matheran)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 21: The Byke - Redwood (Matheran)

Exhibit 22: The Byke - Neelkanth (Manali)

Source: Company, Angel Research

Source: Company, Angel Research

September 9, 2015

9

The Byke Hospitality | Hotels

Exhibit 23: The Byke- Grassfield (Jaipur)

Exhibit 24: The Byke Suraj Plaza (Thane - Mumbai)

Source: Company, Angel Research

Source: Company, Angel Research

September 9, 2015

10

The Byke Hospitality | Hotels

Profit & Loss Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Total operating income

101

156

181

222

287

384

% chg

106.7

53.5

16.5

22.2

29.4

33.7

Total Expenditure

83

127

144

176

228

305

Personnel Expenses

3

3

4

5

7

9

Others Expenses

81

124

140

171

221

296

EBITDA

18

29

37

45

59

79

% chg

251.2

58.2

30.4

22.1

29.4

33.7

(% of Net Sales)

17.8

18.3

20.5

20.5

20.5

20.5

Depreciation& Amortisation

4

5

10

12

14

16

EBIT

14

23

27

34

45

63

% chg

244.8

67.2

16.8

24.0

33.5

40.1

(% of Net Sales)

13.7

14.9

14.9

15.1

15.6

16.4

Interest & other Charges

2

2

2

1

1

1

Other Income

-

0

0

0

0

0

(% of PBT)

-

0.7

0.4

0.3

0.3

0.2

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

12

21

25

32

44

62

% chg

225.6

83.8

19.4

27.3

35.9

41.3

Prior Period & Extraord. Exp./(Inc.)

-

-

-

-

-

-

PBT (reported)

12

21

25

32

44

62

Tax

4

5

5

10

14

19

(% of PBT)

32.9

25.2

21.0

30.0

31.0

31.0

PAT (reported)

8

16

20

23

30

43

Add: Share of earnings of asso.

-

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

-

PAT after MI (reported)

8

16

20

23

30

43

ADJ. PAT

8

16

20

23

30

43

% chg

223.3

104.8

26.2

12.8

34.0

41.3

(% of Net Sales)

7.7

10.2

11.1

10.2

10.6

11.2

Basic EPS (`)

1.9

4.0

5.0

5.6

7.6

10.7

Fully Diluted EPS (`)

1.9

4.0

5.0

5.6

7.6

10.7

% chg

223.3

104.8

26.2

12.8

34.0

41.3

September 9, 2015

11

The Byke Hospitality | Hotels

Balance Sheet

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

SOURCES OF FUNDS

Equity Share Capital

20

20

40

40

40

40

Reserves& Surplus

52

65

60

80

106

142

Shareholders Funds

72

85

100

120

146

182

Minority Interest

-

-

-

-

-

-

Total Loans

20

15

12

8

7

6

Deferred Tax Liability

4

6

5

5

5

5

Total Liabilities

96

105

117

133

158

193

APPLICATION OF FUNDS

Gross Block

81

92

103

123

143

158

Less: Acc. Depreciation

9

14

24

36

50

66

Net Block

73

78

79

87

93

92

Capital Work-in-Progress

3

4

2

2

2

2

Investments

-

-

-

-

-

-

Current Assets

38

43

55

69

96

146

Inventories

6

6

6

7

9

11

Sundry Debtors

12

11

14

18

24

33

Cash

1

2

2

2

3

6

Loans & Advances

13

19

31

40

57

89

Other Assets

5

6

2

2

3

8

Current liabilities

17

21

19

24

33

47

Net Current Assets

20

22

37

44

63

99

Deferred Tax Asset

0

1

-

-

-

-

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

96

105

117

133

158

193

September 9, 2015

12

The Byke Hospitality | Hotels

Cashflow Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Profit before tax

12

21

25

32

44

62

Depreciation

4

5

10

12

14

16

Change in Working Capital

(2)

(4)

(16)

(7)

(18)

(33)

Interest / Dividend (Net)

2

2

2

1

1

1

Direct taxes paid

(0)

(5)

(5)

(10)

(14)

(19)

Others

0

0

(0)

-

-

-

Cash Flow from Operations

16

20

16

28

28

26

(Inc.)/ Dec. in Fixed Assets

(15)

(9)

(9)

(20)

(20)

(15)

(Inc.)/ Dec. in Investments

-

-

-

-

-

-

Cash Flow from Investing

(15)

(9)

(9)

(20)

(20)

(15)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

2

(5)

(2)

(4)

(1)

(1)

Dividend Paid (Incl. Tax)

(2)

(2)

(4)

(3)

(4)

(7)

Interest / Dividend (Net)

(2)

(2)

(2)

(1)

(1)

(1)

Cash Flow from Financing

(2)

(10)

(7)

(9)

(6)

(9)

Inc./(Dec.) in Cash

(1)

1

0

(0)

1

3

Opening Cash balances

2

1

2

2

2

3

Closing Cash balances

1

2

2

2

3

6

September 9, 2015

13

The Byke Hospitality | Hotels

Key Ratios

Y/E March

FY2013

FY2014

FY2015 FY2016E FY2017E FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

79.1

38.6

30.6

27.1

20.3

14.3

P/CEPS

51.3

28.8

20.3

17.8

13.9

10.5

P/BV

8.5

7.2

6.1

5.1

4.2

3.4

Dividend yield (%)

0.3

0.5

0.3

0.4

0.7

1.1

EV/Sales

6.2

4.0

3.4

2.8

2.2

1.6

EV/EBITDA

35.0

21.9

16.7

13.6

10.5

7.8

EV / Total Assets

5.6

5.0

4.6

3.9

3.2

2.6

Per Share Data (`)

EPS (Basic)

1.9

4.0

5.0

5.6

7.6

10.7

EPS (fully diluted)

1.9

4.0

5.0

5.6

7.6

10.7

Cash EPS

3.0

5.3

7.5

8.6

11.0

14.6

DPS

0.5

0.8

0.5

0.7

1.1

1.7

Book Value

18.1

21.2

25.0

29.9

36.4

45.4

Returns (%)

ROCE

15.0

23.3

24.1

26.2

29.3

33.4

Angel ROIC (Pre-tax)

15.2

23.8

24.6

26.7

30.0

34.5

ROE

10.7

18.7

20.0

18.8

20.7

23.5

Turnover ratios (x)

Asset Turnover (Gross Block)

1.2

1.7

1.8

1.8

2.0

2.4

Inventory / Sales (days)

22

14

12

11

11

10

Receivables (days)

43

25

28

29

30

31

Payables (days)

33

15

13

14

14

14

WC cycle (ex-cash) (days)

32

24

27

26

27

27

September 9, 2015

14

The Byke Hospitality | Hotels

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

The Byke Hospitality

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

September 9, 2015

15