2QFY2016 Result Update | Cons. Durables

November 3, 2015

Blue Star

NEUTRAL

CMP

`380

Performance Highlights

Target Price

-

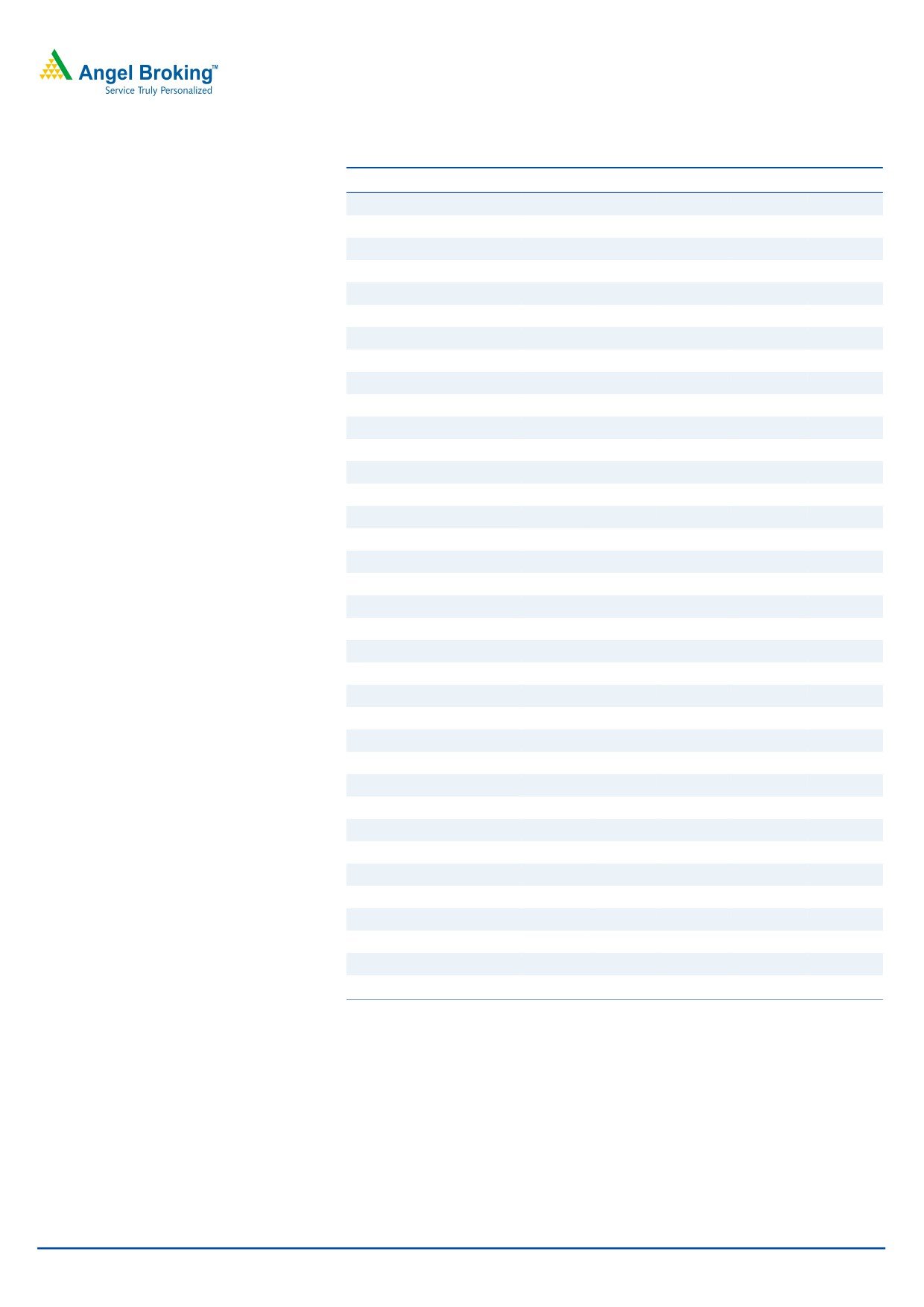

Y/E March (` cr)

2QFY2016 2QFY2015

% chg (yoy) 1QFY2016

% chg (qoq)

Investment Period

-

Net Sales

717

642

11.6

909

(21.1)

EBITDA

27

26

3.9

66

(58.9)

Stock Info

EBITDA margin (%)

3.8

4.0

(28)bp

7.2

(347)bp

PAT

7

9

(24.3)

39

(82.5)

Sector

Cons. Durable

Source: Company, Angel Research (Standalone)

Market Cap (` cr)

3,418

Net Debt

317

Blue Star reported an in-line set of numbers for 2QFY2016, posting an 11.6% yoy

Beta

0.7

increase in top-line to `717cr. On the operational front, net raw material cost as

52 Week High / Low

395 / 274

a percentage of sales increased by 330bp yoy to 70.2%. However, this was offset

Avg. Daily Volume

12,053

by a 102bp yoy and 199bp yoy decline in Employee and Other expenses to 8.9%

Face Value (`)

2

and 17.1% of sales, respectively. The EBITDA margin for the quarter declined by

BSE Sensex

26,559

28bp yoy to 3.8%. On account of higher depreciation and after adjusting for

Nifty

8,051

exceptional items (VRS related expenses of `13cr), the net profit declined by

Reuters Code

BLUS.BO

24.3% yoy to `7cr.

Bloomberg Code

BLSTR IN

Improvement in macro scenario to support growth: The Cooling

Products division has been the key performer for the company and is expected to

Shareholding Pattern (%)

carry the baton till the Electro Mechanical Projects and Packaged Air-conditioning

Promoters

39.5

Systems (EMPPAC) division recovers on the back of an expected improvement in

MF / Banks / Indian Fls

21.1

the macro scenario. Slow order finalization and execution has impacted the

EMPPAC division’s performance, which however is likely to rebound as the market

FII / NRIs / OCBs

6.8

condition improves. The company has been brisk in adding orders after clearing

Indian Public / Others

32.7

out legacy orders. As for the Cooling Products business, the company has been

growing at a rapid pace in the room air conditioners (RAC) segment and thereby

enhancing its market share. The company expects its market share to increase to

Abs.(%)

3m 1yr 3yr

10.5% from the current 10.0%, in the near term.

Sensex

(5.5)

(4.7)

41.6

Outlook and valuation: We expect Blue Star to report a CAGR of 14.3% in

BLUESTAR

1.1

12.2

88.0

its revenue over FY2015-17E to `4,157cr. The EBITDA margin is expected to

expand by 256bp over FY2015-17E to 6.0% due to better margin orders.

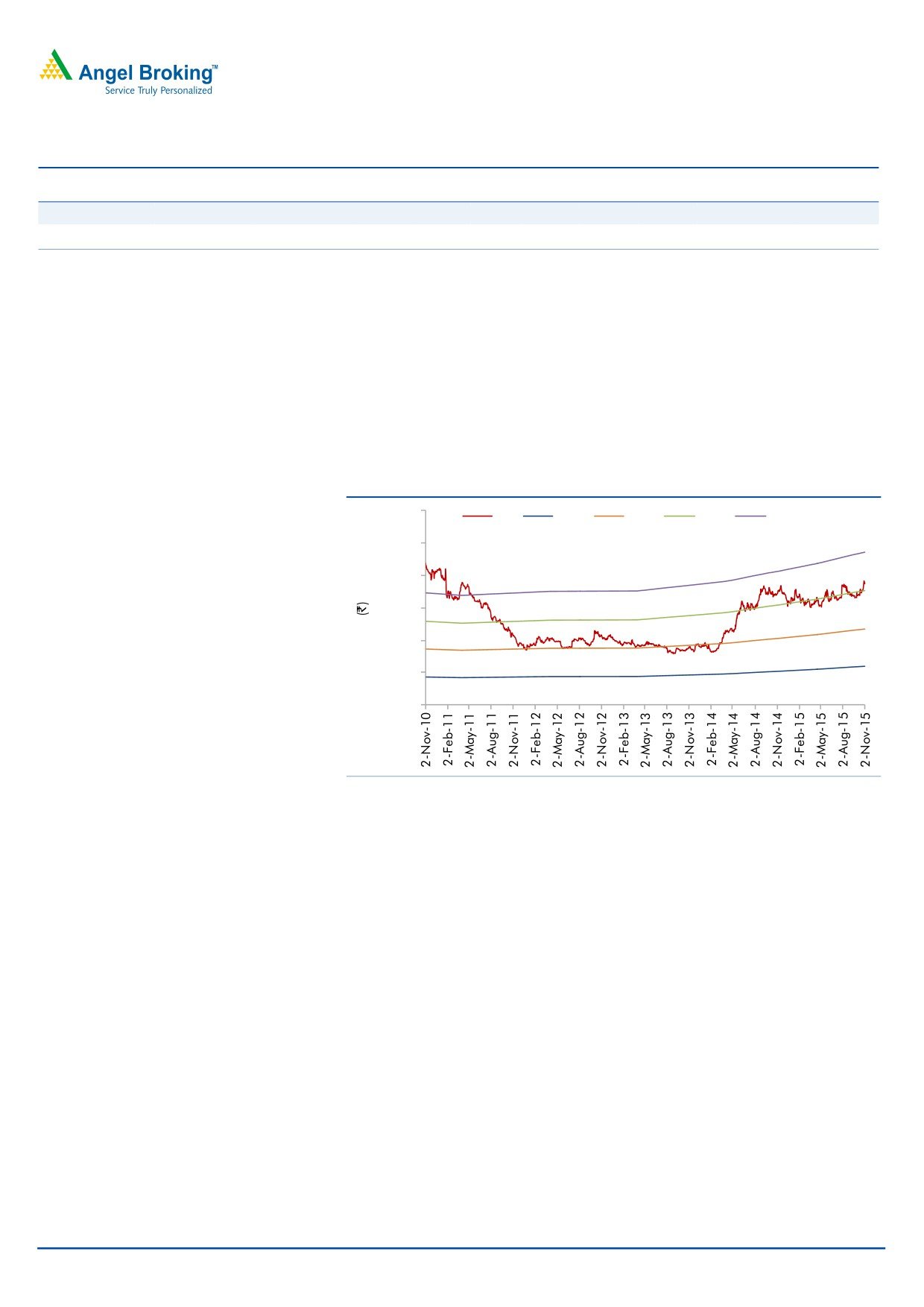

3 Year Price Chart

Consequently, the net profit is expected to be at `130cr in FY2017E as compared

600

to an adjusted net profit of `42cr in FY2015. At the current market price, the stock

is trading at EV/sales of 0.9x for FY2017E and 26.3x its FY2017 earnings. We

500

have not accounted for the merger of Blue Star Infotech into the company as the

400

same is subject to respective shareholders’ and High Court’s approval and as we

300

await more information about the deal from the company. Currently we have a

200

Neutral rating on the stock.

100

Key financials (Consolidated)

0

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

Net Sales

2,934

3,182

3,624

4,157

% chg

0.4

8.4

13.9

14.7

Net Profit

66

42

87

130

% chg

68.3

(35.6)

104.2

50.3

EBITDA (%)

4.6

3.4

5.3

6.0

EPS (`)

8.2

6.0

8.2

14.5

P/E (x)

51.9

80.6

39.5

26.3

P/BV (x)

7.1

7.5

7.2

6.2

RoE (%)

15.0

9.1

18.6

25.4

RoIC (%)

12.4

8.8

19.9

25.1

Milan Desai

EV/Sales (x)

1.3

1.2

1.0

0.9

+91 22 3935 7800 Ext: 6846

EV/EBITDA (x)

28.5

34.3

19.7

15.0

Source: Company, Angel Research; Note: CMP as of November 02, 2015

Please refer to important disclosures at the end of this report

1

Blue Star | 2QFY2016 Result Update

Exhibit 1: 2QFY2016 performance highlights

Y/E March (` cr)

2QFY2016

2QFY2015

yoy chg (%)

1QFY2016

qoq chg (%)

1HFY16

1HFY15

% chg

Net Sales

717

642

11.6

909

(21.1)

1,625

1,480

9.8

Net raw material

503

430

17.1

639

(21.3)

1142

1014

12.7

(% of Sales)

70.2

66.9

70.4

70.3

68.5

Staff Costs

64

64

0.1

61

5.3

125

125

(0.1)

(% of Sales)

8.9

9.9

6.7

7.7

8.4

Other Expenses

123

123

(0.0)

143

(14.1)

266

260

2.0

(% of Sales)

17.1

19.1

15.7

16.3

17.6

Total Expenditure

690

616

11.9

843

(18.2)

1,533

1,399

9.6

Operating Profit

27

26

3.9

66

(58.9)

93

81

14.5

OPM

3.8

4.0

7.2

5.7

5.5

Interest

9

11

(11.9)

8

12.3

18

22

(18.6)

Depreciation

12

9

26.4

9

27.4

21

19

11.1

Other Income

2

3

(29.1)

0

347.7

2

4

(45.2)

Exceptional Item

(16)

-

-

(16)

-

PBT

(8)

9

(184.7)

49

(115.7)

41

45

12.6

(% of Sales)

(1.1)

1.4

5.4

2.5

3.1

Tax

(2)

0

10

8

5

(% of PBT)

25

0

20

19

11

Reported PAT

(6)

9

(164.0)

39

(114.8)

33

40

(17.0)

Extraordinary Item

13

-

-

13

0

Adjusted PAT

7

9

(24.3)

39

46

40

14.6

PATM

1.0

1.4

4.3

2.8

2.7

Source: Company, Angel Research

Exhibit 2: Actual vs. Angel Estimates

(` cr)

Actual

Estimate

% Variation

Net Sales

717

714

0.4

EBITDA

27

23.3

15.7

EBIDTA margin

3.8

3.3

50bp

Adjusted PAT

7

4

53.7

Source: Company, Angel Research

Top-line improves, margins disappoint

For 2QFY2016, Blue Star reported numbers that were broadly in line with our

estimates. The standalone top-line for the quarter reported an 11.6% yoy increase

to `717cr. This is in-line with our estimate of `714cr. The raw material cost as a

percentage of sales increased by 330bp yoy to 70.2% but this was offset by a

102bp yoy and 199bp yoy decline in Employee and Other expenses to 8.9% and

17.1% of sales, respectively. The EBITDA margin contracted by 28bp yoy to 3.8%,

but still, is higher than our estimate of 3.3%. The raw cost increased on account of

i) Rupee depreciation, ii) excess RAC inventory build-up and iii) change in mix in

the service business with a higher contribution from the relatively lower margin

segments. On account of higher depreciation and after adjusting for exceptional

items (VRS related expenses of `13cr), the net profit declined by 24.3% yoy to `7cr.

Still, the net profit has come in higher than our estimate of `4cr.

November 3, 2015

2

Blue Star | 2QFY2016 Result Update

Segment-wise performance

Exhibit 3: Segment-wise performance (Standalone)

Y/E March (` cr)

2QFY2016 2QFY2015 % chg (yoy) 1QFY2016 % chg (qoq)

Total Revenue

A) EMPPAC

459

399

14.8

327

40.2

B) Cooling Products

246

206

19.1

556

(55.9)

C) PEIS

12

37

(66.0)

25

(50.7)

Total

717

642

11.6

909

(21.1)

Less: Inter-Segmental Rev.

-

-

-

Net Sales

717

642

11.6

909

(21.1)

Segmental Profit

A) EMPPAC

26

29

(9.0)

9

199.9

B) Cooling Products

14

14

(0.1)

79

(82.3)

C) PEIS

2

8

(74.4)

5

(56.4)

Segmental Margin (%)

A) EMPPAC

5.7

7.2

(150)bp

2.7

305bp

B) Cooling Products

5.7

6.8

(110)bp

14.2

(850)bp

C) PEIS

17.2

22.8

(566)bp

19.4

(224)bp

Source: Company, Angel Research

EMPPAC margins contract: The segment’s revenue (accounting for 64% of total

revenue) grew by 14.8% yoy to `459cr in 2QFY2016. The EBIT margin witnessed a

decline of 150bp yoy to 5.7% for the quarter as compared to 7.2% in 2QFY2015

on account of slow project execution, which in turn slowed down the pace of

billing. There has been almost no movement in the closure of legacy jobs over the

past quarter, which stood at ~`30cr spread across 20-25 jobs.

Cooling Products segment’s strong run continues: Despite 2Q traditionally tending

to be a lean quarter for the segment, the segment’s top-line grew by 19.1% yoy to

`246cr. The segment once again has managed to outgrow the industry, which as

per Management has grown by ~9.0% in value terms during the quarter. The EBIT

margin for the quarter declined by 110bp yoy to 5.7% as negative currency

movement impacted raw material cost, and lower realization owing to excess

inventory buildup in the industry put pressure on the pricing.

The Cooling Products segment continues to be strong while the EMPAAC segment

continues to weather the storm. The company has significantly increased its

distribution network to 2,250 dealers as compared to 1,950 dealers in the same

period last year to further grow its business.

Top-line disappoints but margin improves for PEIS segment: The Professional

Electronics and Industrial Systems (PEIS) segment’s revenue decreased by 66.6%

yoy to `12cr. Margins for the business declined by 566bp yoy to 17.2%. However,

these numbers are not comparable on a yoy basis as the PEIS business was

transferred into Blue Star’s wholly owned subsidiary effective April 01, 2015. There

were some orders that were booked under the standalone business which the

company will continue to execute. The quantum of such orders will decline, going

forward as all the new orders are now being booked with the subsidiary.

November 3, 2015

3

Blue Star | 2QFY2016 Result Update

Conference Call Highlights

The EBITDA margin decline was owing to drop in gross margins across all

segments mainly due to combination of negative currency movement, excess

inventory buildup that put pressure on realizations, and change in business

mix in the service business. The expectations are that the currency movement

will be more or less stable, while the inventory issue has been resolved and the

mix should also get regularized by the end of the year.

The EMPPAC business’ performance was impacted by sluggish execution

along with a higher cost structure. The improvement in the top-line is on the

back of the company hitting the market more proactively after being vigilant in

the recent past. The recently launched inverter based VRF - IV Plus, is receiving

a good response from the market. The company is planning towards

introducing Inverter VRF IV + in a select export markets as well. Inverter VRFs

are more profitable than any of the company’s products businesses. The

overall market for the EMPPAC segment is yet to revive.

Order inflow has improved for Segment I- which has grown by 67% yoy to

`561cr. The segment’s order book stood at `1,55cr, representing a growth of

7% on yoy basis. The cash flow situation has improved for the market in

general. The drop in interest rates should aid order inflow.

In the Electro Mechanical Projects business, there was improvement in order

inflow from select markets in segments such as healthcare, malls, power and

metro. Integrated MEP gained more traction in segments like hospitality,

healthcare and malls. The new business margins have returned to north of

12% with favorable terms and conditions.

The company’s market share in the RAC business has improved to 10.0%. The

company is targeting a market share of 10.5% in the near term and ~12%

over the next 2-3 years. Blue Star’s Inverter ACs are growing faster than the

market. The Management pointed that going forward, inverter ACs will

account for close to 35-50% of the total RACs, citing examples of China and

Japan. The share of Inverter ACs for the industry is 10% of total sales while

that of Blue Star is at 15% of its total AC sales.

PEIS - The negative currency movement impacted the budgets of its clients

(institutions/government/PSUs; as they are in USD terms). With stable currency

and revised budgets, the business should improve. The inquiry levels have

been stronger across clients and the company expects things to return to

normalcy by 4QFY2016.

Merger with Blue Star Infotech Ltd

Blue Star group entity Blue Star Infotech Ltd (BSIL) announced the sale of its IT

business to Infogain Inc on September 29, 2015. As per the deal the aggregate

consideration for the sale of the IT business of BSIL and its subsidiaries in UK, USA

and Singapore is `181cr. BSIL will retain its real estate business, a certain amount

of cash, and tax receivables which have a fair value of `97cr. Following the sale,

which is subject to shareholders’ approval, BSIL is proposed to be merged with

Blue Star Ltd with effect from April 1, 2015. The cash and cash equivalents portion

amounts to `25cr and the market value of the real estate property is `70cr which is

November 3, 2015

4

Blue Star | 2QFY2016 Result Update

leased out to 3rd party generating annual rental of `6cr. The proceeds from the

BSIL IT division sale will be used to set up a factory for RACs - A) Phase One -

investment of `75cr, work for which will start in CY2016 and be operational by

end of FY2017 and Phase Two - investment of `75cr starting in CY2017 and will

be operational by end of FY2018. B) Investment in Services business, marketing

expenses and building up its international business.

As per the scheme, shareholders of BSIL will be issued equity shares in Blue Star as

per the share swap ratio of 7 shares of face value of `2 each in Blue Star Ltd for

10 shares of face value of `10 each held in BSIL.

Note: We have not accounted for the merger of BSIL with Blue Star as the same is

contingent upon approval from respective shareholders and the High Court.

Although the top-line is expected to remain unaffected, there will be equity dilution

of ~5-6% post the merger. We will incorporate the changes as further details are

revealed and when the merger materializes.

Joint Venture in MEP contracting business

The company has entered into a Joint Venture in MEP contracting business with W.

J. Towell & Co. LLC, Oman, by acquiring 51% stake in Oman Electro Mechanical

Contracting Co LLC (OEMC), which is 100% step down subsidiary of W. J. Towell.

Joint venture entity Blue Star Oman Electro-Mechanical Company LLC will offer

Mechanical, Electrical and Plumbing (MEP) contracting services in Oman. OEMC is

a MEP contracting company. Blue star will take over management aspect in the JV

which has an order book of `150cr. Blue Star intends to scale the business up to

`500cr over the next few years. This move is more in line with the company’s plan

to grow the MEP business along with the products business internationally.

November 3, 2015

5

Blue Star | 2QFY2016 Result Update

Investment Rationale

Improvement in macro scenario to support growth

The EMPPAC division of Blue Star contributed ~54% of total revenues in FY2015.

The division mainly caters to industrial/institution clients like IT/ITeS, retail

(including malls and multiplexes), healthcare, hospitality, infrastructure, etc. The

order execution and finalization has remained sluggish, thereby affecting the

segment. With slow recovery in various client industries and improvement in

environment post interest rate cuts, we expect the segment to recover and be a key

contributor to the company’s overall top-line.

Quality order execution to support EBITDA margin expansion

The company continues to be selective in terms of order booking which has hurt its

margins in the past. So far, the delay in execution of high-margin projects, coupled

with delayed closure of low margin jobs, has resulted in snail-paced expansion of

the EBITDA margin. The order book as on 30 September 2015 stands at `1,604cr

with almost no movement in the legacy jobs over the past quarter which stood at

~`30cr spread across 20-25 jobs. The Management is hopeful about clearing

them out in 2HFY2016.

Cooling Products division to be the backbone

The superior performance of the division is mainly on the back of the high growth

seen in the RAC segment which is growing faster than the overall RAC market. The

Cooling Products segment’s share as a percentage of total revenue has increased

from 23.4% in FY2009 to ~42% in FY2015. We expect the division to be a key

contributor as there is significant potential to capitalize on the underpenetrated

RAC market in India. Blue Star can add to its current market share as it has good

channel coverage and it has been selectively expanding the channel network in tier

3, 4 and 5 cities.

November 3, 2015

6

Blue Star | 2QFY2016 Result Update

Financials

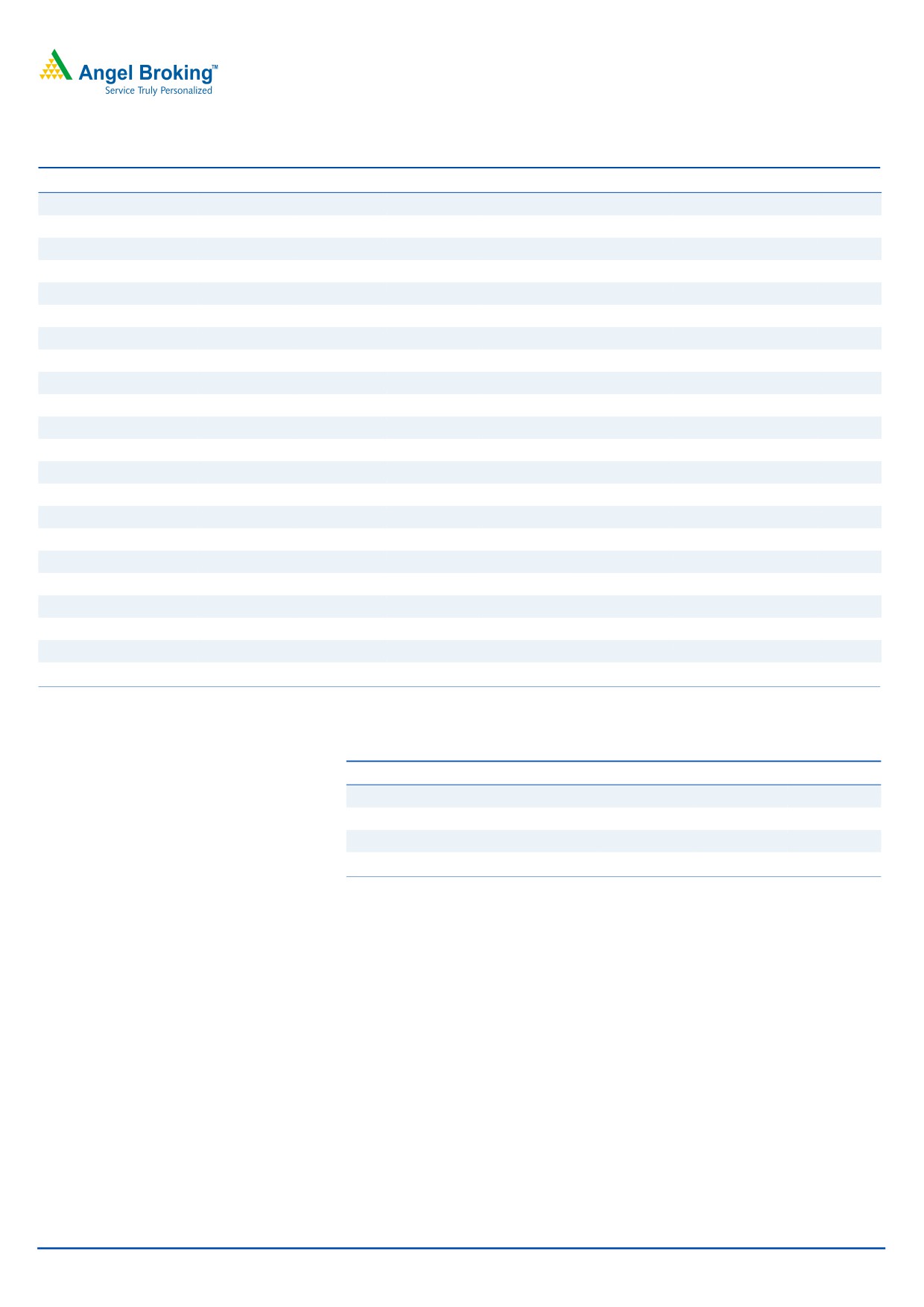

Improvement in revenue growth

We expect the revenue to grow gradually at 14.3% CAGR over FY2015-17E to

`4,157cr. We believe with gradual recovery in macro-economic conditions and

strong footing of its Cooling Products business, revenue would grow by 13.9% and

14.7% in FY2016E and FY2017E respectively.

Exhibit 4: Revenue growth estimates

4,500

20

18.0

4,000

13.9

14.715

3,500

8.4

10

3,000

5

2,500

3.7

0.4

2,000

0

1,500

(5.4)

(5)

1,000

500

(10)

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Revenue (LHS)

Revenue growth (RHS)

Source: Company, Angel Research

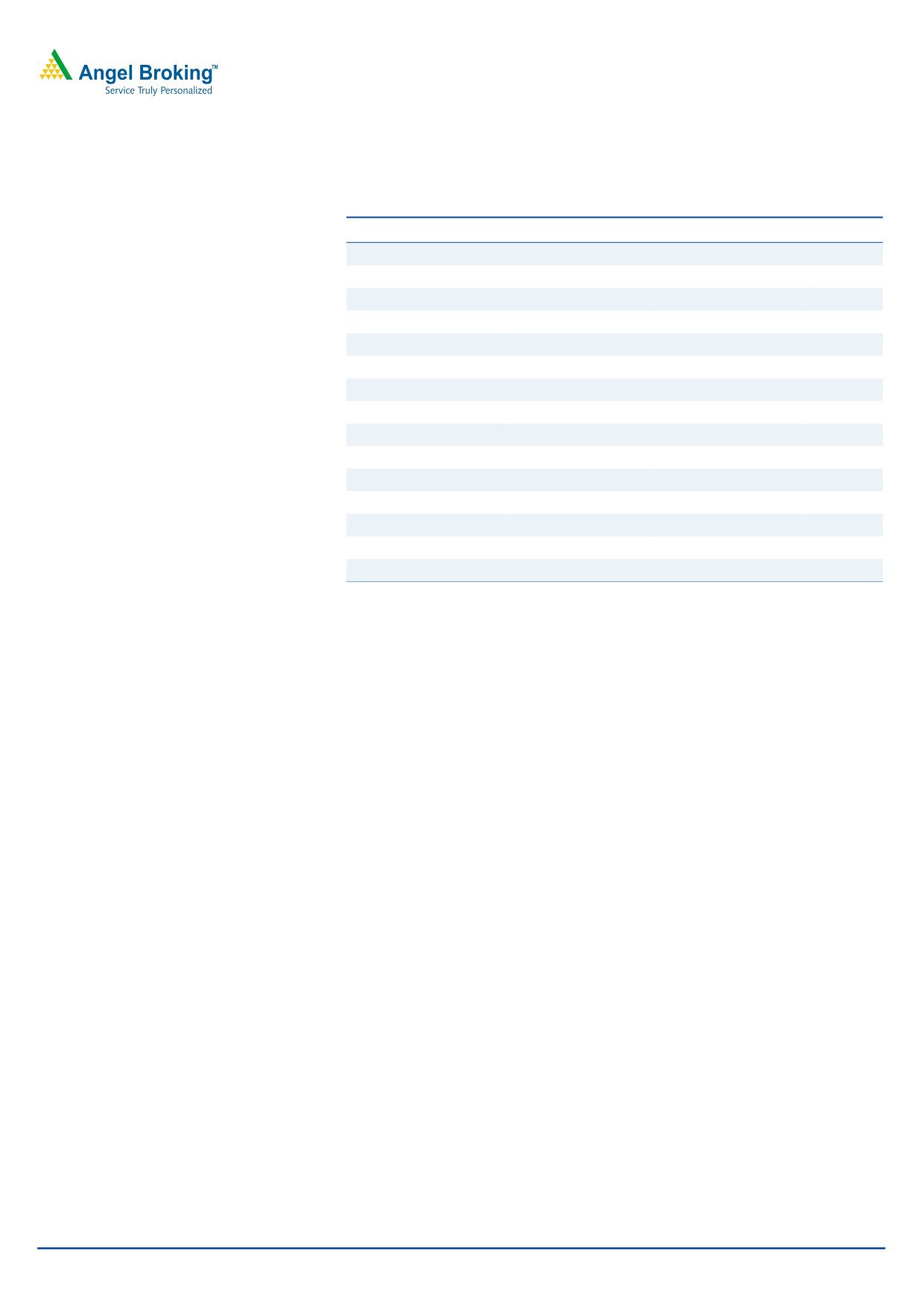

EBITDA margin to improve

We expect the EMPPAC segment’s performance to improve mainly in anticipation

of a macroeconomic turnaround and with low/no margin orders coming off the

books this year. We expect the EBITDA margin to improve from 3.4% in FY2015 to

5.3% in FY2016E and 6.0% in FY2017E. Consequently, the net profit is expected

to be at `87cr in FY2016E and `130cr in FY2017E.

Exhibit 5: EBITDA margin to improve

Exhibit 6: PAT expected to improve

300

10

150

3.1

4

8.6

2.4

250

2.2

3

8

100

1.3

2

200

6.0

6

1.3

1

5.3

50

150

4.6

0

4

39

66

42

87

130

3.4

(1)

100

3.1

0

2

(105)

(2)

50

(3)

(50)

0

0

(3.7)

(4)

(0.8)

-50

(2)

(100)

(5)

FY2011

FY2012

FY2013

FY2014 FY2015 FY2016E FY2017E

FY2012

FY2013

FY2014 FY2015 FY2016E FY2017E

EBITDA (LHS)

EBITDA margin (RHS)

PAT (LHS)

PAT margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

November 3, 2015

7

Blue Star | 2QFY2016 Result Update

Exhibit 7: Relative valuation

Net Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/EBITDA

EV/Sales

Year end

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

Blue Star*

FY2017E

4,157

6.0

130

14.5

25.4

26.3

6.2

15.0

0.9

Voltas

FY2017E

6,413

8.9

463

14.1

18.0

20.2

3.4

15.4

1.3

Source: Angel Research, Bloomberg

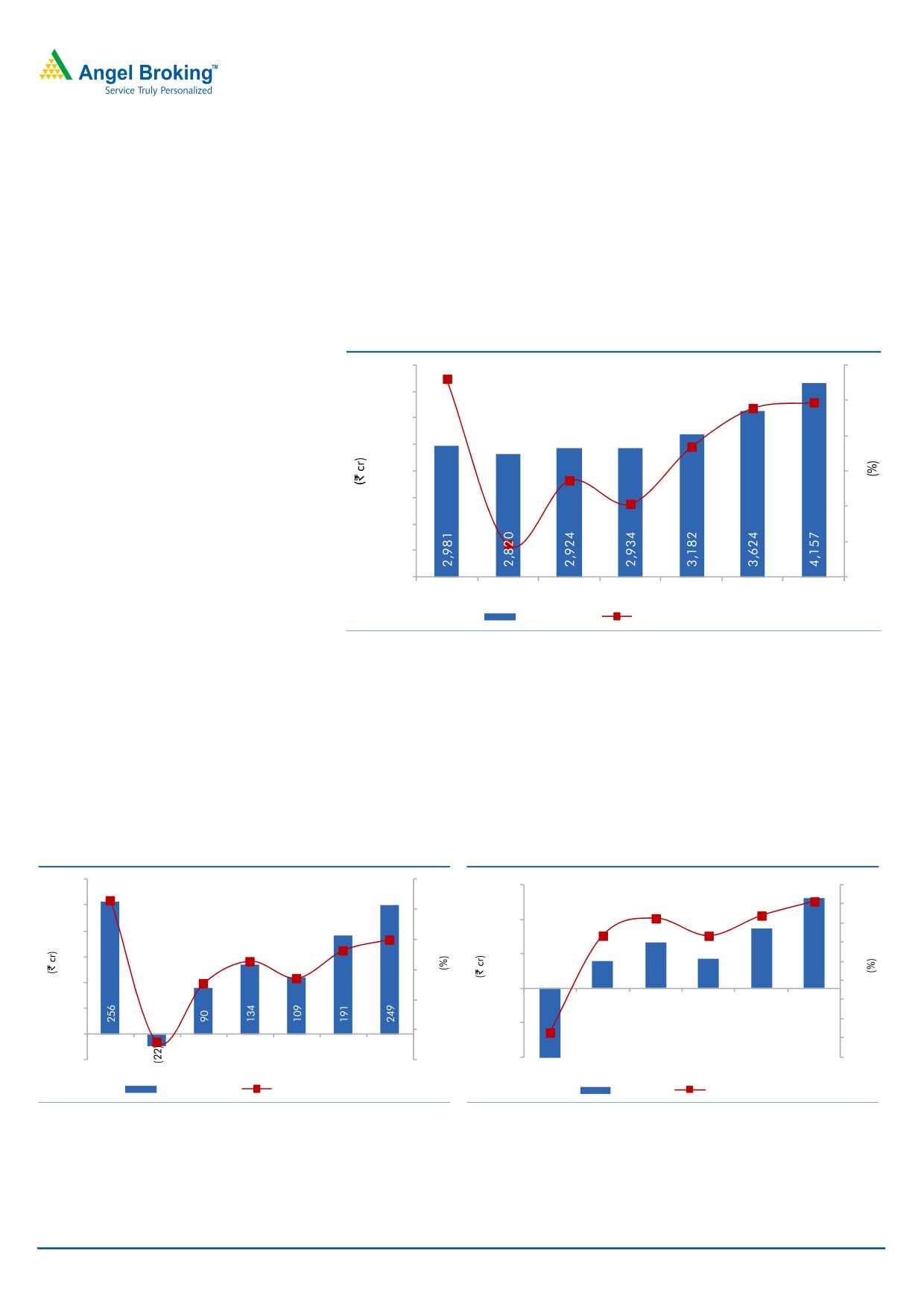

Outlook and valuation

We expect Blue Star to report a CAGR of 14.3% in its revenue over FY2015-17E to

`4,157cr. The EBITDA margin is expected to expand by 256bp over FY2015-17E

to 6.0% due to better margin orders. Consequently, the net profit is expected to be

at `130cr in FY2017E as compared to adjusted net profit of `42cr in FY2015. At

the current market price, the stock is trading at EV/sales of 0.9x for FY2017E and

26.3x its FY2017 earnings. Currently we have a Neutral rating on the stock.

Exhibit 8: One year forward EV/sales band

6,000

EV

0.3x

0.6x

0.9x

1.2x

5,000

4,000

3,000

2,000

1,000

-

Source: Company, Angel Research

Key concerns

Slowdown in investment cycle may impact the order inflow, thus impacting

revenue. It may also force the Management to compromise on its strategy of

avoiding low margin projects.

Slowdown in consumer segments like IT/ITES, healthcare, hospitality and

infrastructure is also expected to impact the company’s growth.

Foreign exchange fluctuations have a direct impact on the profit of the

Cooling Products division since commercial refrigerators are imported. Further

depreciation in the local currency may impact the profits of Blue Star.

November 3, 2015

8

Blue Star | 2QFY2016 Result Update

Company Background

Blue Star is India's largest central air-conditioning company with a network of

32 offices, seven manufacturing facilities, over

2,000 dealers and around

2,500 employees. The company’s operations could be classified under three main

segments:

EMPPACS: This segment comprises central and packaged air-conditioning

(involving design, engineering, manufacturing, installation, commissioning and

support of large central air conditioning plants, packaged air conditioners and

ducted split air conditioners) as well as electrical projects and plumbing and fire

fighting projects. In addition, the company promotes after-sales service as a

business, by offering several value added services in the areas of upgrades and

enhancements, air management, water management, energy management and

LEED consultancy for Green Buildings.

Cooling Products: Blue Star offers a wide range of contemporary window and split

air conditioners. The company also manufactures and markets a comprehensive

range of commercial refrigeration products and services that cater to the industrial,

commercial and hospitality sectors.

PEIS: This division has been the exclusive distributor in India for many

internationally renowned manufacturers of hi-tech professional electronic

equipment and services, as well as industrial products and systems.

November 3, 2015

9

Blue Star | 2QFY2016 Result Update

Profit and loss statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Gross sales

2,924

2,934

3,182

3,624

4,157

Less: Excise duty

-

-

-

-

-

Net Sales

2,924

2,934

3,182

3,624

4,157

Total operating income

2,924

2,934

3,182

3,624

4,157

% chg

3.7

0.4

8.4

13.9

14.7

Net Raw Materials

2,184

2,087

2,214

2,534

2,920

Personnel

230

248

267

278

306

Other

420

466

591

621

683

Total Expenditure

2,834

2,801

3,073

3,433

3,908

EBITDA

90

134

109

191

249

% chg

(0.3)

(1.2)

9.7

11.7

13.8

(% of Net Sales)

3.1

4.6

3.4

5.3

6.0

Depreciation& Amortisation

33

38

43

45

47

EBIT

57

96

66

146

202

% chg

-

67.9

(31.2)

38.3

(% of Net Sales)

2.0

3.3

2.1

4.0

4.9

Interest (incl. forex loss)

53

54

49

45

43

Other Income

36

35

31

13

15

(% of Net Sales)

1.2

1.2

1.0

0.4

0.4

Exceptional Items

-

-

(5.7)

(15.8)

-

PBT

41

76

43

99

174

% chg

-

87.1

(44.0)

131.2

76.0

Tax

3

2

(8)

25

43

(% of PBT)

6.3

2.9

(18.5)

25.0

25.0

PAT (reported)

38

74

51

74

130

Extraordinary (Expense)/Inc.

-

12

12

(13)

-

Share of Profit of Associate

1

4

4

-

-

ADJ. PAT

39

66

42

87

130

% chg

-

68.3

(35.6)

104.2

50.3

(% of Net Sales)

1.3

2.2

1.3

2.4

3.1

Basic EPS (`)

4.3

7.3

4.7

9.6

14.5

Fully Diluted EPS (`)

4.3

7.3

4.7

9.6

14.5

% chg

(37.2)

168.3

64.4

204.2

150.3

November 3, 2015

10

Blue Star | 2QFY2016 Result Update

Balance sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity Share Capital

18

18

18

18

18

Pref. Share Capital

-

18

-

-

-

Reserves& Surplus

383

443

438

457

533

Shareholders’ Funds

401

479

456

475

551

Total Loans

422

494

398

390

382

Deferred Tax Liability

(0)

(1)

(17)

(17)

(17)

Other Long Term Liabilities

5

4

6

6

6

Total Liabilities

827

976

843

855

923

APPLICATION OF FUNDS

Gross Block

451

514

549

603

637

Less: Acc. Depreciation

238

269

304

349

396

Net Block

213

245

245

254

241

Capital Work-in-Progress

8

15

22

18

14

Goodwill

15

11

11

9

8

Investments

27

33

36

36

36

Long term Loans & adv

112

120

139

152

175

Other non-current assets

-

-

-

-

-

Current Assets

1,785

1,911

1,704

1,938

2,238

Cash

17

68

44

14

37

Loans & Advances

98

130

116

132

151

Inventory

510

466

479

541

615

Debtors

835

833

795

943

1,082

Other current assets

325

414

270

308

353

Current liabilities

1,332

1,359

1,315

1,552

1,788

Net Current Assets

453

552

389

386

450

Misc. Exp. not written off

-

-

-

-

-

Total Assets

827

976

843

855

923

November 3, 2015

11

Blue Star | 2QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016E FY2017E

Profit before tax

41

76

43

99

174

Depreciation

33

38

43

45

47

Change in Working Capital

(66)

(47)

139

(27)

(42)

Other income

(36)

(35)

(31)

(13)

(15)

Direct taxes paid

(3)

(2)

(7)

(25)

(43)

Others

57

37

28

-

-

Cash Flow from Operations

26

67

215

79

121

(Inc.)/Dec. in Fixed Assets

(12)

(71)

(43)

(47)

(29)

(Inc.)/Dec. in Investments

0

(6)

(3)

-

-

(Inc.)/Dec. In L.T loans and adv

(35)

(8)

(20)

(13)

(22)

Other income

36

35

31

13

15

Others

(9)

62

(14)

-

-

Cash Flow from Investing

(20)

11

(49)

(47)

(36)

Issue of Equity

(0)

18

(18)

0

-

Inc./(Dec.) in loans

55

73

(97)

(8)

(8)

(Dec.)/Inc. in long term provision

0

(1)

2

-

-

Forex difference on cash equivalent

0

-

-

-

-

Dividend Paid (Incl. Tax)

(32)

(42)

(54)

(54)

(54)

Others

(67)

(74)

(23)

-

-

Cash Flow from Financing

(44)

(26)

(190)

(62)

(62)

Inc./(Dec.) in Cash

(37)

52

(24)

(30)

22

Opening Cash balances

54

17

68

44

14

Closing Cash balances

17

68

44

14

37

November 3, 2015

12

Blue Star | 2QFY2016 Result Update

Key ratios

Y/E March

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

87.4

51.9

80.6

39.5

26.3

P/CEPS

47.2

33.0

39.9

25.9

19.3

P/BV

8.5

7.1

7.5

7.2

6.2

Dividend yield (%)

0.8

1.1

1.3

1.3

1.3

EV/Sales

1.3

1.3

1.2

1.0

0.9

EV/EBITDA

42.0

28.5

34.3

19.7

15.0

EV / Total Assets

4.6

3.9

4.4

4.4

4.0

Per Share Data (`)

EPS (Basic)

4.3

7.3

4.7

9.6

14.5

EPS (fully diluted)

4.3

7.3

4.7

9.6

14.5

Cash EPS

8.1

11.5

9.5

14.7

19.7

DPS

3.0

4.0

5.0

5.0

5.0

Book Value

44.6

53.2

50.7

52.9

61.3

DuPont Analysis

EBIT margin

2.0

3.3

2.1

4.0

4.9

Tax retention ratio

0.9

1.0

1.2

0.8

0.8

Asset turnover (x)

4.3

3.8

4.3

5.0

5.2

ROIC (Post-tax)

7.9

12.1

10.4

15.0

18.8

Cost of Debt (Post Tax)

0.1

0.1

0.2

0.1

0.1

Leverage (x)

0.8

0.9

0.8

0.7

0.6

Operating ROE

14.4

22.6

18.2

25.4

30.8

Returns (%)

ROCE (Pre-tax)

7.2

10.6

7.2

17.2

22.7

Angel ROIC (Pre-tax)

8.4

12.4

8.8

19.9

25.1

ROE

9.8

15.0

9.1

18.6

25.4

Turnover ratios (x)

Asset Turnover (Gross Block)

6.8

6.1

6.0

6.3

6.7

Inventory / Sales (days)

60

61

54

51

51

Receivables (days)

100

104

93

95

95

Payables (days)

171

175

159

165

167

WC cycle (ex-cash) (days)

50

57

47

36

34

Solvency ratios (x)

Net debt to equity

0.8

0.9

0.8

0.7

0.6

Net debt to EBITDA

4.2

2.9

2.9

1.8

1.2

Interest Coverage (EBIT / Int.)

1.1

1.8

1.4

3.3

4.7

November 3, 2015

13

Blue Star | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Blue Star

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 3, 2015

14