Initiating coverage | Capital Goods

December 17, 2015

Bharat Electronics

BUY

CMP

`1,206

Battlefield set

Victory likely

Target Price

`1,414

Bharat Electronics (BEL) is a PSU and a leader in the domestic defense electronics space,

Investment Period

12 Months

with major proportion of its revenue coming in from the Indian Navy and Army.

Defense spending at an inflexion point: After years of lull, government announced

Stock Info

15.4% yoy increase in Defense Capital Budget to `94,588cr. In our view, we are

Sector

Capital Goods

at an inflexion point where Indian Defense capex cycle, led by government

Market Cap (` cr)

28,944

spending is entering new era of growth. Our view strengthens on account of

following developments, (1) Defense sector getting high priority in government’s

Net debt (` cr)

(6,013)

‘Make in India’ campaign, with increased emphasis on the indigenization aspect,

Beta

1.1

(2) increase in FDI limits in defense from 26% to 49%, and (3) $47bn worth of

52 Week High / Low

1,386/869

projects cleared by Defense Acquisition Council (DAC) in last 19 months,

Avg. Daily Volume

292,634

indicating faster clearances in place. Also high expectations are being built from

Face Value (`)

10

soon to be released Defense Procurement Procedures (DPP). Current bid pipeline,

BSE Sensex

25,804

which could lead to strong award activity for next few years, along with above-

mentioned factors indicate that good times are ahead for Defense sector.

Nifty

7,844

Reuters Code

BAJE.BO

BEL to emerge as key beneficiary: At the backdrop of higher allocation made

towards defense capex with ~$47bn worth of projects cleared by DAC, we expect

Bloomberg Code

BHE@IN

good times ahead for defense players, including BEL. BEL in FY2015 had market

share of 37% in domestic defense electronics. On considering (1) bid-pipeline

dominated by Indian Airforce and Navy’s platform projects, which have high

Shareholding Pattern (%)

Defense Electronics components requirement, (2) BEL’s in-house R&D capabilities,

Promoters

75.0

(3) tie-up with Thales, France for product development, and (4) zero debt status with

MF / Banks / Indian Fls

14.7

potential for further improvement in working capital cycle, all point out that BEL should

FII / NRIs / OCBs

4.0

maintain its strong market positioning in Defense Electronics space. On a whole, we

Indian Public / Others

6.3

expect BEL to emerge as key beneficiary of the revival in Defense capex cycle.

Outlook & Valuation: At the current market price of `1,206/share, BEL is trading

at FY2016E and FY2017E P/E multiple of 22.3x and 19.6x, respectively. In the

Abs. (%)

3m 1yr 3yr

last 5 years, BEL’s stock has traded at 1-year forward P/E multiple of 14.0x. We

Sensex

(5.7)

(4.9)

33.3

expect BEL to report a 12.4% top-line and 13.7% bottom-line CAGR during

FY2015-18E; a similar growth rate is expected to be maintained beyond FY2017E

BEL

1.6

29.9

208.7

as well. We expect BEL to trade at a premium to its historical valuations on

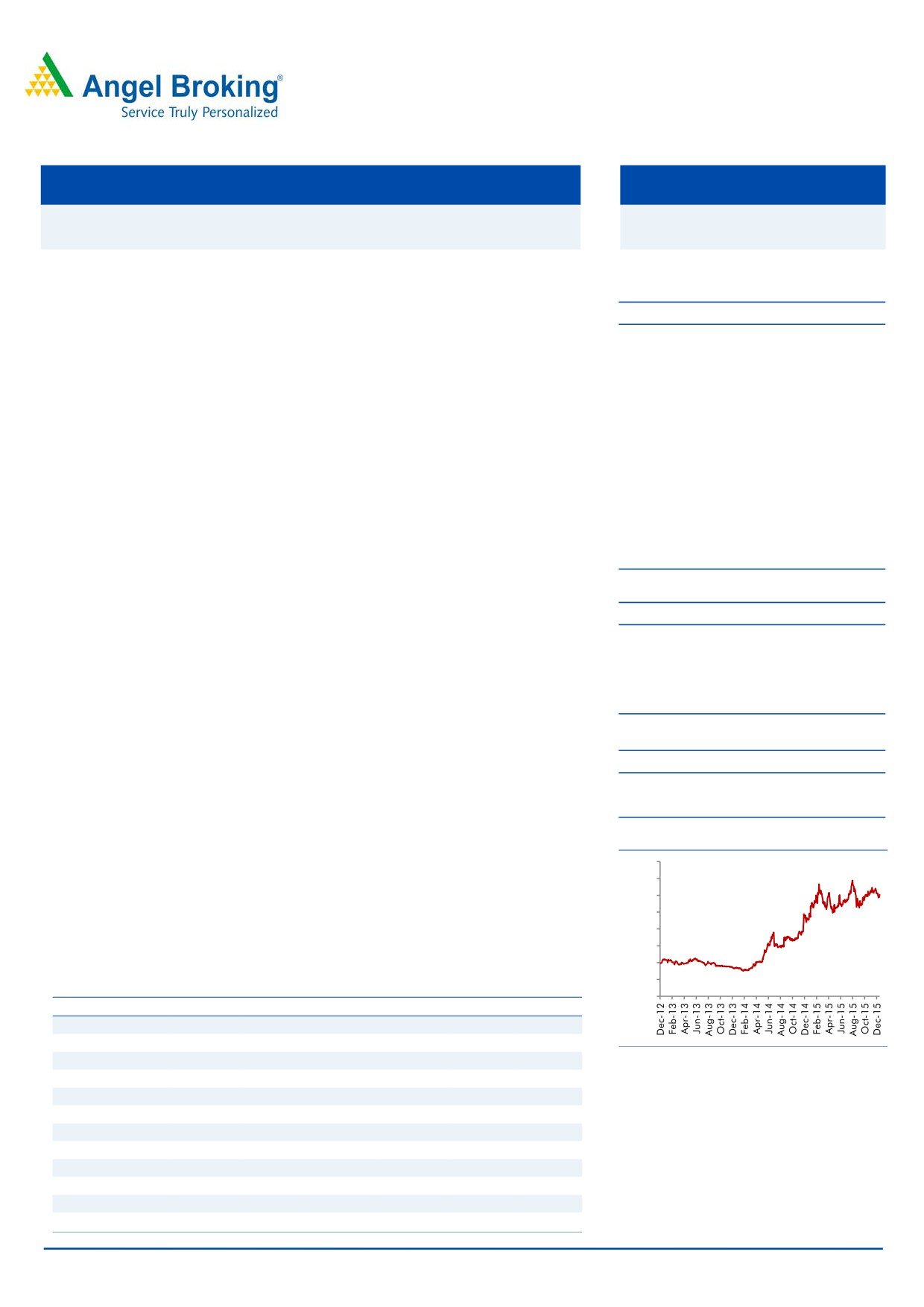

3-Year Daily price chart

account of the uptick in investment cycle, which indicates strong long-term growth

prospects. The current low competitive intensity and the contention of it justifiably

1,600

1,400

commanding a scarcity premium, being the largest listed defense player, make

1,200

the stock all the more attractive. Considering the long-term growth prospects,

1,000

which should stretch beyond FY2017E, we assign a 1-year forward P/E multiple of

800

23.0x to arrive at price target of `1,414/share. Given the 17% upside from the

600

current levels, we initiate coverage on the stock with a BUY rating.

400

200

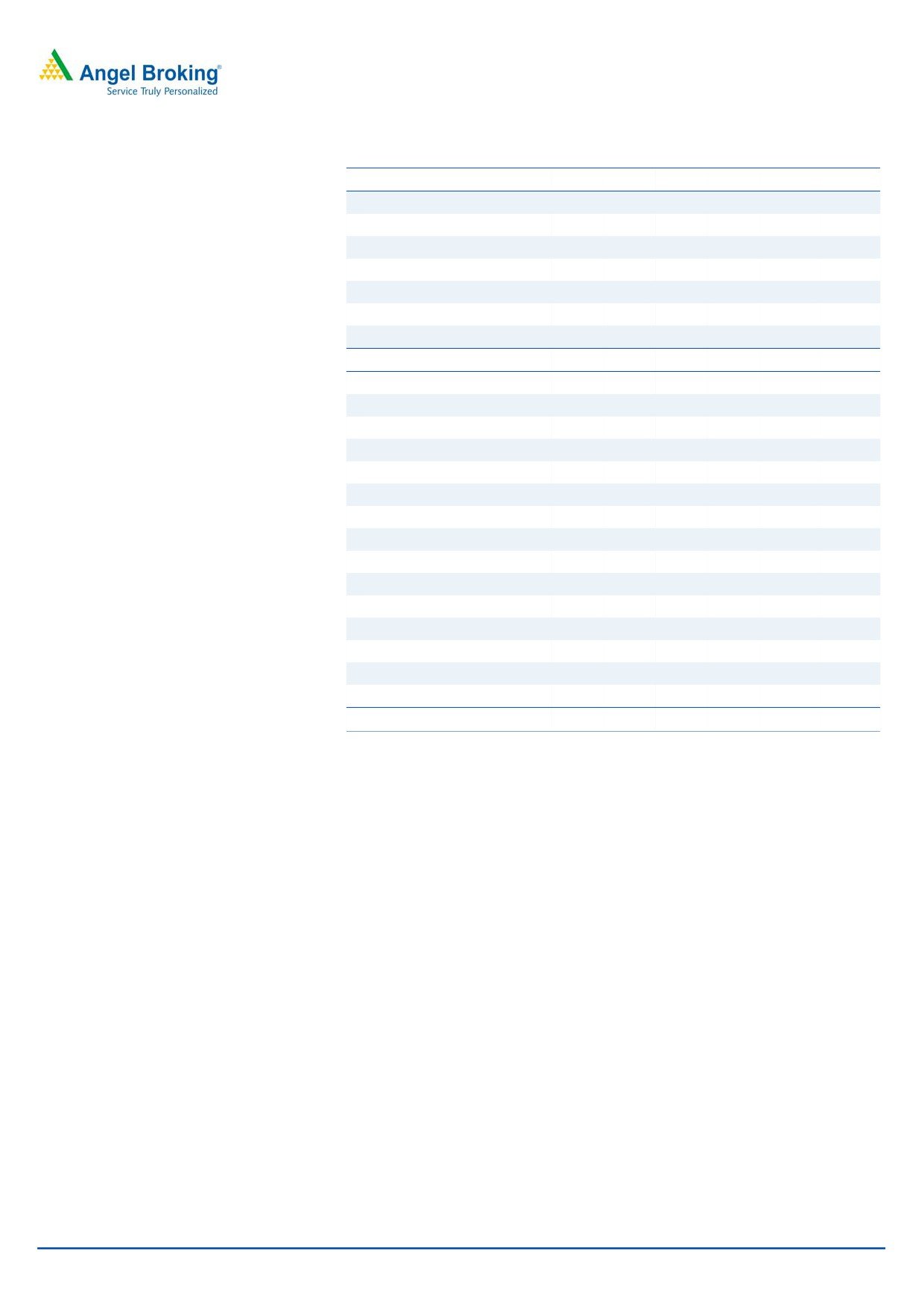

Key Financials

0

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

FY18E

Net Sales

6,273

6,518

7,093

7,737

8,634

10,064

% chg

6.1

3.9

8.8

9.1

11.6

16.6

Source: Company, Angel Research

Net Profit

906

952

1,197

1,296

1,475

1,760

% chg

7.0

5.0

25.8

8.2

13.9

19.3

EBITDA (%)

10.6

14.1

16.6

16.8

17.2

17.6

EPS (`)

38

40

50

54

61

73

P/E (x)

31.8

30.4

24.2

22.3

19.6

16.4

P/BV (x)

4.5

4.0

3.6

3.2

2.8

2.5

RoE (%)

30.3

20.1

36.8

39.3

45.6

51.8

RoCE (%)

26.6

23.9

30.7

28.5

29.0

30.5

Yellapu Santosh

EV/Sales (x)

3.8

3.8

3.3

2.9

2.5

2.0

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

35.6

26.4

19.5

17.0

14.2

11.2

Source: Company, Angel Research; CMP as of December 17, 2015

Please refer to important disclosures at the end of this report

1

Initiating coverage | BEL

Investment Rationale

Defense Sector spending at an inflexion point

India’s Defence spend during FY2010-11 to FY2014-15 has risen at 9.6% CAGR

to `222,370cr. Notably, Capital expenditure has grown at a slower pace of 7.2%

CAGR during the same period (Average of Defense capex during FY2011-12 to

FY2015-16 (budgeted), accounts for 38% of the total Defense spends; lower than

developed nations spending).

In our view, we are at an inflexion point where the Indian Defense capex cycle is

entering a new era, with government spending cycle expected to see long-term

uptrend. Our view strengthens on account of following recent developments,

(1) Defense sector getting high priority in government’s ‘Make in India’ campaign,

where higher emphasis has been laid on the indigenization aspect, (2) increase in

Defense sector FDI limit from 26% to 49%, and (3) faster clearance processes put

into place (in 19 months after the NDA-led government having come into power,

~$47bn worth of projects have been cleared by Defense Acquisition Council

(DAC)). Amidst high expectations new Defense Procurement Procedures (DPP) are

expected to be announced soon.

The table below (“DAC cleared projects under various stages of awarding [on

page no. 3]) highlights that ~`244,089cr worth of Defense projects are at

awarding stages, and Defense companies like BEL could emerge as the biggest

beneficiaries of any such revival in the awarding activity.

Recent Defense Acquisition Council (DAC) clearances and positive Defense Ministry

announcements, indicate strong emerging bid pipeline for next few years, which in

our view are multi-thousand crore opportunity. Given that Defense projects take

longer time to materialize and are executed over 2-3 year periods, capex

commitments for given year also capture part payments for equipments purchased

earlier, thereby leaving lower budgeted spending towards purchase of new

equipments. Accordingly, we can see some short-term delays in awarding activity,

but long-term capex spending cycle is on an uptrend.

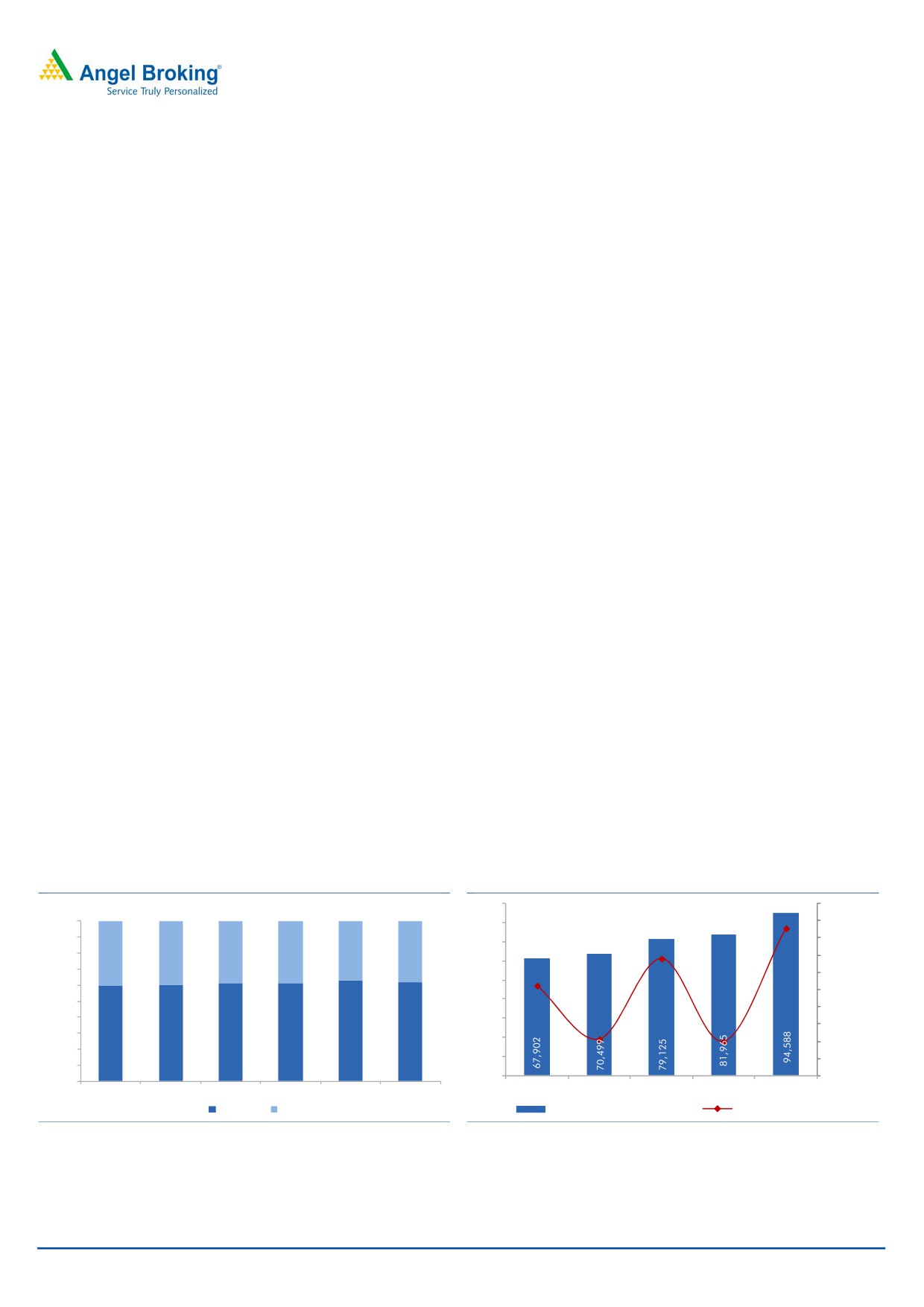

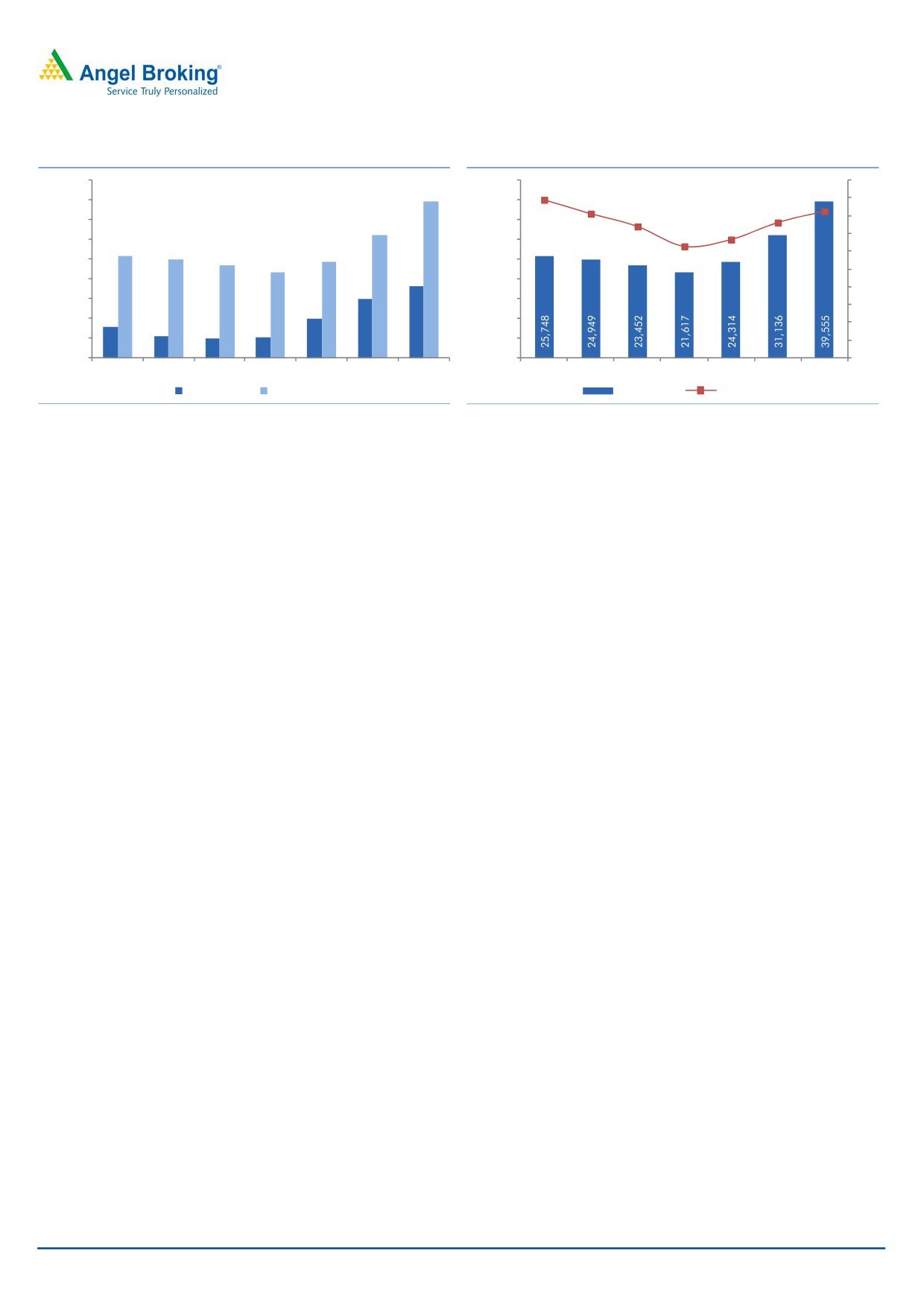

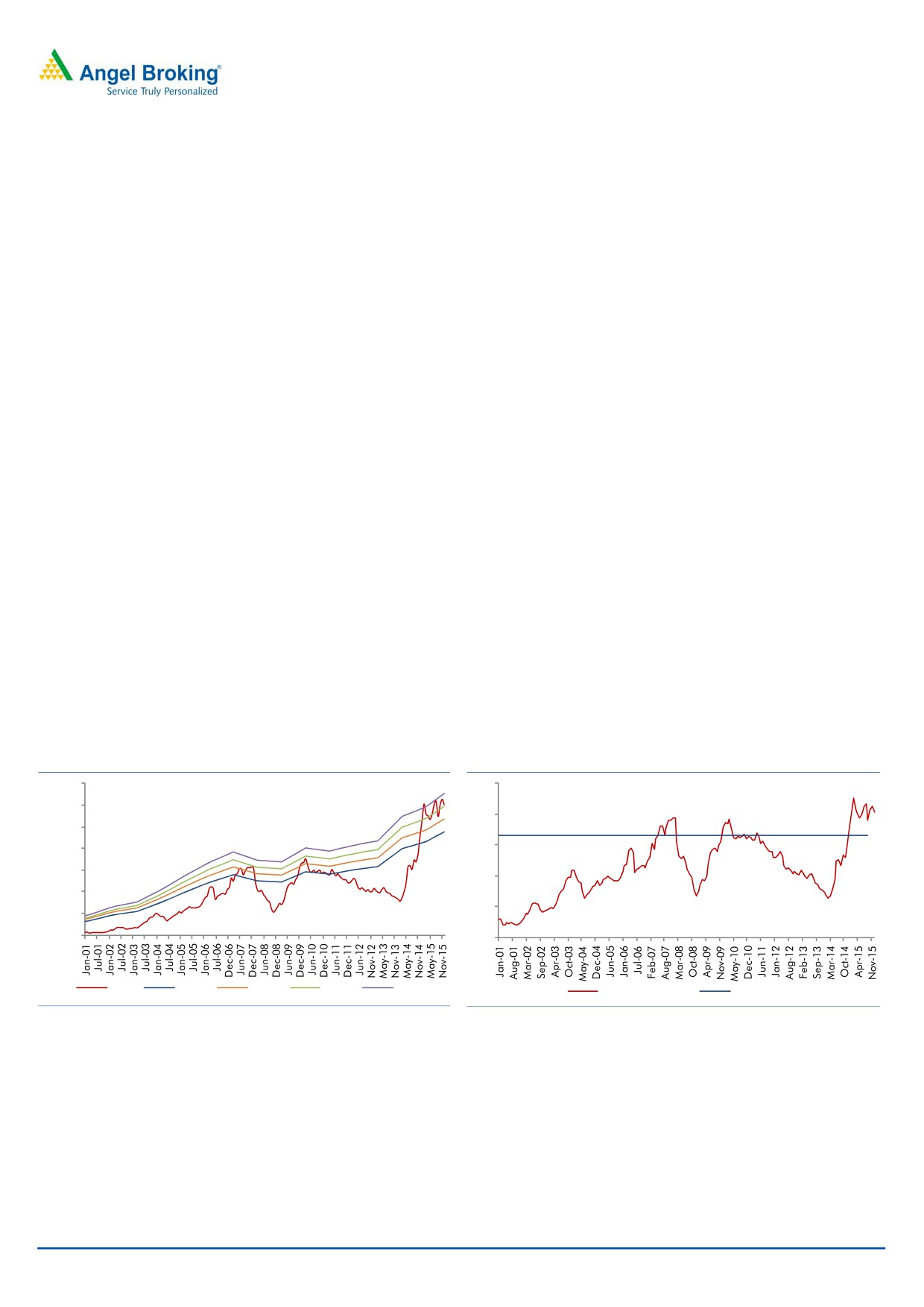

Exhibit 1: Defense Expenditure break-up...

Exhibit 2: Defence Cap. Exp Budget

154,117

170,913

181,776

203,499

222,370

246,727

18

100,000

15.4

100%

16

90,000

90%

80,000

14

80%

40

40

39

39

37

38

70,000

12

12.2

70%

60,000

10

60%

9.4

50,000

50%

8

40,000

40%

6

30,000

30%

60

60

61

61

63

62

4

3.8

3.6

20,000

20%

2

10,000

10%

0

0

0%

FY2011-12 FY2012-13 FY2013-14 FY2014-15 FY2015-16

FY2010-11 FY2011-12 FY2012-13 FY2013-14 FY2014-15 FY2015-16

Revenue

Capital

Defense Cap. Budget (` cr)

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

December 17, 2015

2

Initiating coverage | BEL

Exhibit 3: DAC cleared projects under various stages of awarding

Sl.

Approx.

Orders in the pipeline

Comments

No.

value (` cr)

1

30 Weapon Locating Radars (Swati)

1,605

Cleared by DAC; to be awarded soon

2

2 French Airbus A-330 Aircrafts

5,100

Cleared by DAC; Radars mounted on the Aircraft would be made by DRDO

3

Ground based Mobile Electronic

NA

Cleared by DAC; BEL is the only domestic company to have worked on such

Intelligence System

project earlier; project to be awarded soon

4

36 Rafale Fighter Jets

60,000

Cleared by DAC; Govt. to soon sign agreement with French Govt. on this deal;

1 fighter Jet to be supplied within 3 years of signing the deal

5

8 Chetak Utility Helicopters

322

Cleared by DAC; To be ordered to HAL

6

4 Air Traffic Control (ATC) Radars

228

Cleared by DAC; to be awarded to BEL sooner

(at Avantipur, Bhita, Panagarh and Purnia)

7

Handheld Thermal Imager with Laser

4,000

Cleared by DAC; to be awarded to BEL sooner

Range Finders

8

Upgrade 428 L70 and Zu 23mm guns for

16,900

Cleared by DAC; BEL and Punj Lloyd cleared technical evaluation round;

the Army (Acceptance of Necessity)

Already executing `575cr project from Indian Army; final bid to be opened

sooner

9

4 P81 Aircrafts

4,380

Cleared by DAC;

10

Upgrade of Weapon and Sensor suite of

2,900

Cleared by DAC;

Delhi and Talwar Class Ships

11

4 large Survey Vessels for the Navy

2,324

Cleared by DAC; RFP to be announced sooner

12

Integrated Submarine Sonar - USHUS

NA

Cleared by DAC; BEL has the capabilities as it has earlier worked on such

projects earlier

13

7 Akash-2 Surface-to-Air Squadrons (14

4,790

Cleared by DAC; BEL being the lead vendor and integrator for IAF will be given

units) for Indian Airforce

the main contract under 'repeat order'; BEL manufactures surveillance radar,

tracking radar, flight control centre, support systems and integrates the

software; We expect BEL's share of the project to be ~`850cr

14

6 P 75I Submarine (Diesel Engine)

64,000

Cleared by DAC; 8-member panel has inspected all the facilities; RFP to be

soon invited; L&T, Mazgaon Dock and Pipavav Defense are strong contenders;

BEL and DRDO could get small chunk of API/ Sonar related works, given the

proximity to 5 shipyards identified by the 8-member panel

15

48 Mi 17 V-5 Choppers for Indian Airforce

6,966

DAC having negotiations with Russian entity

16

110 Naval Utility Helicopters

5,000

Cleared by DAC; 94 of the 110 are to be made in India; Companies other

than BEL could emerge as the key beneficiaries as 11 JV's/ companies have

shown interest

17

600 Unmanned Aerial Vehicles (UAVs)

NA

Director General of Infantry has already issued a Request for Information (RFI),

to be followed by Request for Proposals (RFPs); 4 Foreign players (along with

India JV partners) have participated in the RFI; BEL already is working on UAVs

and is one of the JV bidders at the RFI stage;

18

10 metre Short Span Bridges (Vehicle

490

Cleared by DAC; DRDO to benefit from this project

Mounted)

19

Mobile Integrated Electronic Warfare

1,682

Cleared by DAC; BEL has already sold ~`2,000cr worth of Electronic Warfare

System, Samyukta

Systems to Indian Army over the years; Developed Samyukta along with DRDO;

Expected to win this project as 'repeat order'; Could see competition from Tata

Power SED

20

P-7 Heavy Drop Platform (used for Military

402

Cleared by DAC;

Logistics)

21

Battlefield Management Systems

50,000

This order at very early stages; Awarding would happen only in FY2017

22

Tactical Communication Systems

13,000

This order at very early stages; Awarding would happen only in FY2017

244,089

Source: Media Articles, Company, Angel Research

Government machinery as well as media in various stances, have highlighted that

various types of Defense Equipments currently used are either outdated or are

obsolete. Government has taken due note of this and started addressing them

one-by-one. Government in its recent budget allocated 15.4% yoy increase in

Defense capital expenditure to `94,588cr.

December 17, 2015

3

Initiating coverage | BEL

In addition to higher budgetary allocation, government has laid increased

emphasis on domestic indigenization. The current bid pipeline focuses on domestic

indigenization up to the extent of 75% of project value.

Higher budgetary allocation towards Defense sector (in the back-drop of ageing/

obsolete Defense Equipments), when coupled with government’s thrust towards

indigenization, strengthen our view that we are at inflexion point of multi-year

increase in government spending towards Defense capex cycle. Based on order

pipeline and projects cleared by DAC (Defense minister highlighted that ~$35bn

worth of projects would get cleared in FY2016), we estimate strong uptick in the

domestic Defense capex cycle for next 2-3 years, post FY2016E.

Market share currently stands at ~37%….

Defense Electronics market, where BEL enjoys strong market positioning was

gradually opened for private sector participation in FY2006-07. L&T, Astra

Microwave, and Tata Power SED are the key domestic players in this space, which

have their own manufacturing facilities. Even though the sector has been open for

private sector participation, given the limited competition in Defense industry, BEL

has reported its market share in the 37-57% range during FY2011-15.

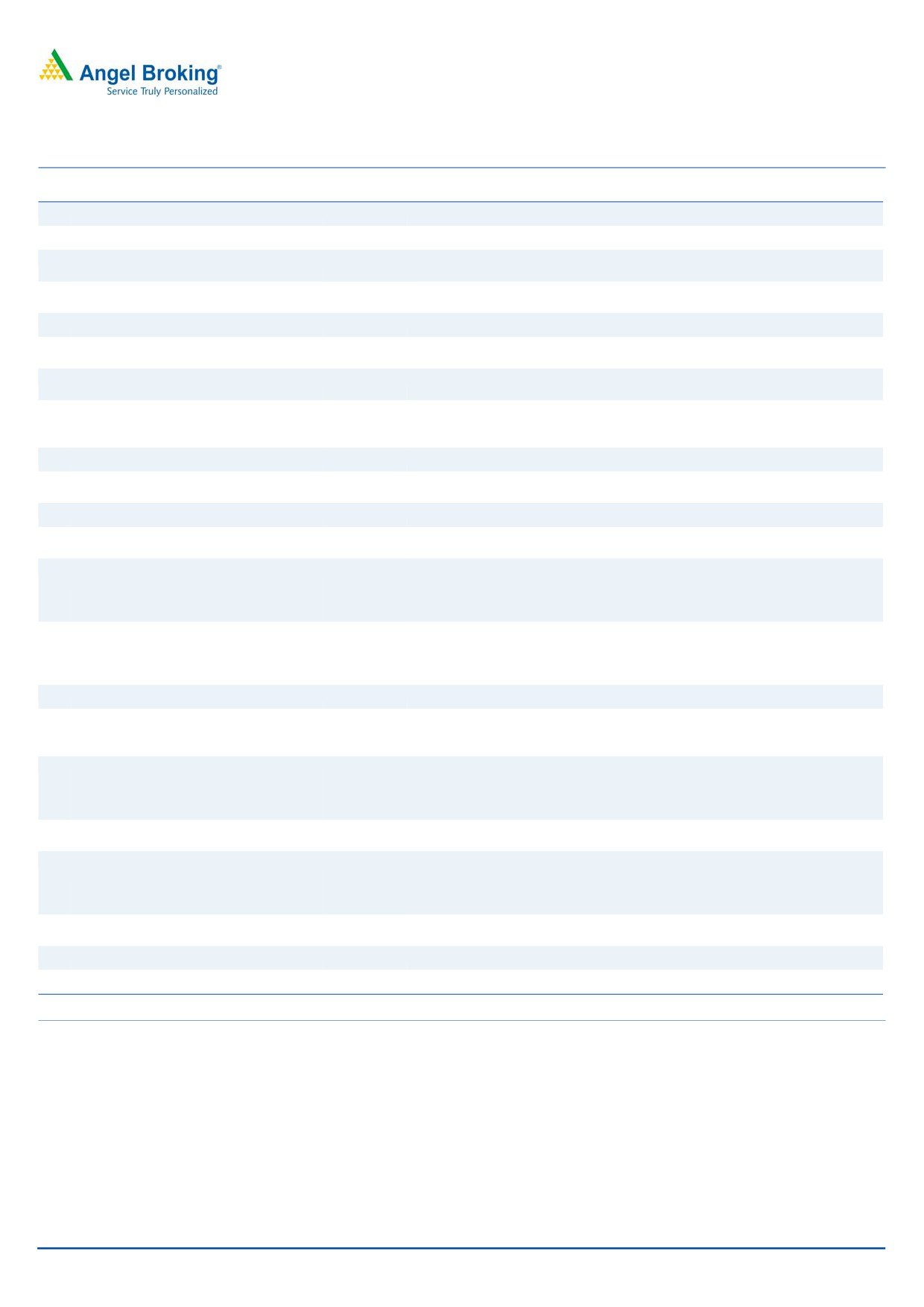

Exhibit 4: Defense Electronic Production & BEL market share

18,000

56.8

56.6

60

16,000

48.5

50

14,000

12,000

37.0

40

36.8

10,000

30

8,000

6,000

20

4,000

10

2,000

0

0

FY11

FY12

FY13

FY14

FY15

Defense Electronics Production (` cr)

BEL's Market Share (%)

Source: Dept. of Electronics & Information Technology, Angel Research

With government’s increasing Defense sector capex allocation, new private players

entered the Defense space using JV route and tying-up with foreign players. Most

of the JV’s that have shaped in the recent past have been formed with a focus on

win ‘platform’-based orders from emerging opportunities. Given that BEL focuses

only on Defense Electronics space, which is less crowded, we do not see any major

loss of market share for the company, going forward.

December 17, 2015

4

Initiating coverage | BEL

Exhibit 5: Recent Joint Ventures formed

JV Details

Segment

L&T (74%) & EADS (26%)

Defense Electronics Equipment

L&T (74%) & Thales (26%)

Avoinics

BEL (74%) & Thales (26%)

Civilian & Defense Radars

Axis Aerospace & Tech. (74%) &

Avoinics

Rosoboronexport (26%)

Mahindra & Mahindra (74%) &

Radar, Surveillance & Communication Systems

Telephonics (26%)

Source: Angel Research

Notably, 5 JV’s have been formed in Defense Electronics space, Avionics and

Radars and Surveillance space, the areas where BEL operates. Within areas where

BEL operates, management highlighted that they are facing more competitive

intensity across communications and night vision space than the traditional Radars

and Defense Electronics space. Further, management clarified that 80-90% of

contracts are won on nomination-basis. Considering all above-mentioned points,

BELs strong execution track record, when coupled with multi-fold growth in the bid

pipeline, we are optimistic that the emerging competition would not eat much in to

the growth prospects of BEL, for the next few years.

Order Inflows set to explode…

BEL during FY2013-15 has reported average yearly Order Inflows to the tune of

~`5,000cr. The huge order inflows seen during FY2011-12 is on account of large

order wins for Akash Missiles. Based on our interaction with BEL management, BEL

is optimistic of winning projects north of `10,000cr in FY2016E itself. These are the

projects where DAC has given the clearances, and BEL is either well placed to win

them or get repeat orders for works done earlier.

Following table below highlights that, projects over `6,000cr are likely to be

awarded to BEL in next few months:

Exhibit 6: Near-term potential Order Inflows for BEL

Approx.

Sl. No.

Orders in the pipeline

value (` cr)

1

30 Weapon Locating Radars (Swati)

1,605

2

Ground based Mobile Electronic Intelligence System

NA

3

4 Air Traffic Control (ATC) Radars

228

4

Handheld Thermal Imager with Laser Range Finders

4,000

5

Integrated Submarine Sonar - USHUS

NA

6

7 Akash-2 Surface-to-Air Squadrons for Indian Airforce

850

Total Value of projects in the pipeline

6,683

Source: Company, Angel Research

Our above estimates do factor works from the `4,790cr, 7 Akash-2 Surface-to-Air

Squadrons (14 units) project, where BEL’s scope of work in our view could be north

of ~`850cr. DAC has already cleared this project.

December 17, 2015

5

Initiating coverage | BEL

Exhibit 7: Order Inflow & Order Book movement

Exhibit 8: Order Book split to grow 1.8x by FY2018E

45,000

45,000

4.5

5.0

39,555

4.1

4.1

40,000

40,000

4.5

3.8

3.7

4.0

35,000

31,136

35,000

3.3

3.1

3.5

30,000

30,000

25,748

24,949

24,314

23,452

3.0

25,000

21,617

25,000

2.5

18,000

20,000

20,000

15,000

2.0

15,000

15,000

10,000

1.5

7,940

10,000

10,000

5,352

4,839

5,060

1.0

5,000

5,000

0.5

0

0

0.0

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E FY2018E

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Order Inflows

Order Book

Order Book

OB/LTM sales (x)

Source: Company, Angel Research

Source: Company, Angel Research

Again management has maintained optimism that they are strong contenders for

the `50,000/13,000cr Battlefield Management System/ Tactical Communication

System projects, which could be awarded in FY2017E.

On a whole, the strong bid pipeline and faster clearance process comforts us that

Order Inflow scenario would improve sharply from here-on and companies like

BEL should emerge as key beneficiaries. Accordingly, we expect BEL to report

~`10,000/15,000cr worth of new orders during FY2016/2017E.

Defense order wins do not translate to immediate execution, as BEL has to get

approval for Bulk Production Clearance (BPC) from its clients before it can go for

commercial production. Hence, management had given a conservative revenue

growth guidance of 8-10% for next few years. We have maintained our revenue

growth estimate of 9.1%/11.6% for FY2016/17E, respectively. Our FY2017E

revenue growth estimate is slightly ahead of management guidance, as we are

optimistic that as execution cycle improves management would revise-up it’s

revenue growth guidance for FY2017E.

As of 2QFY2016-end, BEL is sitting on an order book (OB) of `21,648cr (~3.1x

OB/LTM revenues). We expect OB of the company to grow 1.8x during FY2015-

18E to `39,555cr by FY2018-end.

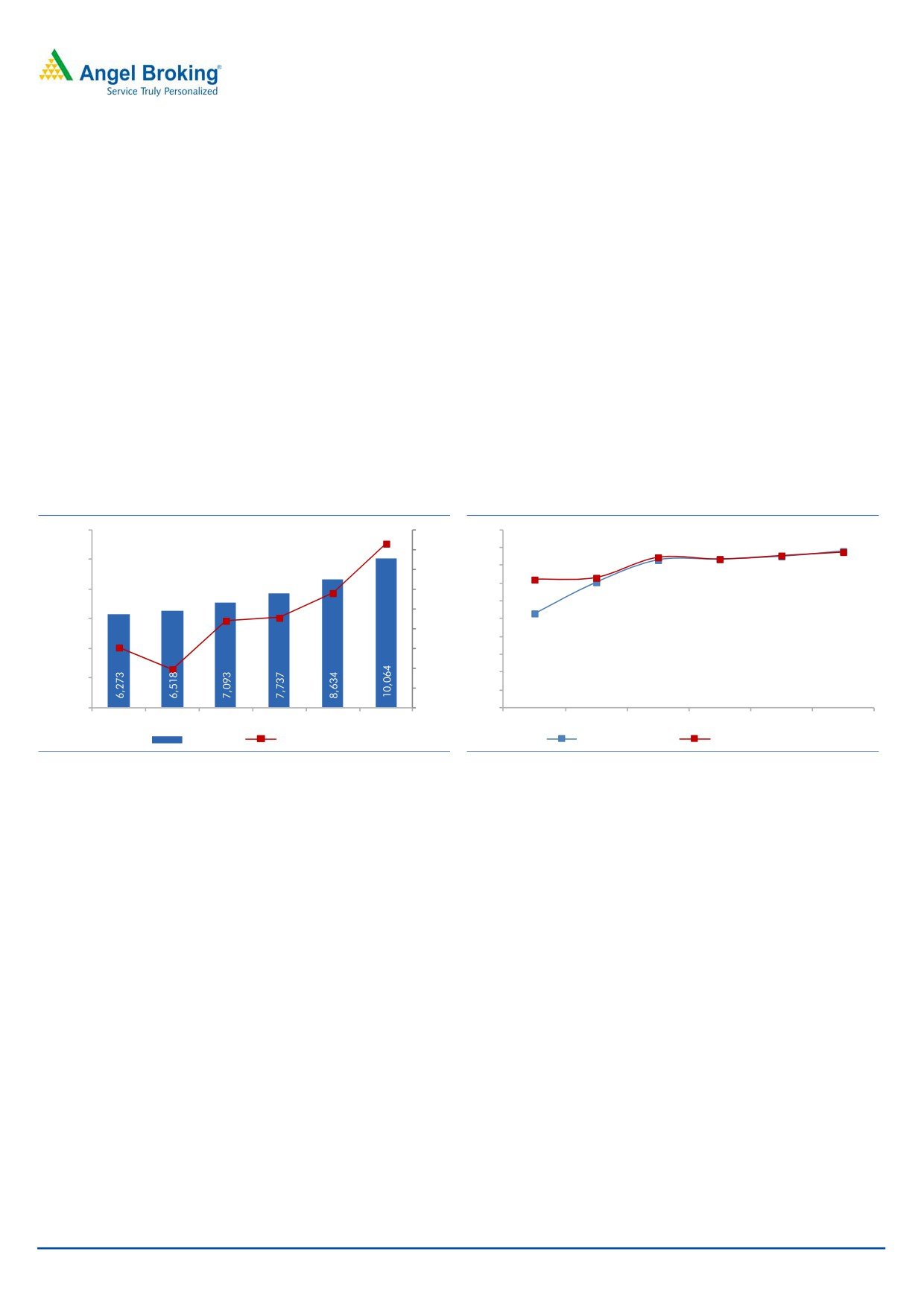

12.4% revenue and 13.7% PAT CAGR during FY2015-18E…

Given that BEL has to get BPC before starting commercial production of Defense

Equipments from its client, despite almost doubling of the Order Inflows, we expect

BEL to report 12.4% revenue CAGR over FY2015-18E, majorly supported by

execution of projects in their Order Book, esp. the Akash Missile project.

Few large ticket projects, including the ~`6,500cr Akash Missiles project (won in

FY2011-12) got delayed. Recent successful tests by the Indian Air Force (IAF) and

receipt of BPC, gives better execution visibility of this project, now. Already `630cr

of revenues have been booked from this project YTDFY2016.

We expect BEL to report 12.4% revenue CAGR during FY2015-18E to `10,064cr

(ahead of management’s conservative 8-10% revenue growth outlook for next few

years).

December 17, 2015

6

Initiating coverage | BEL

Even though BEL has evolved as Systems Integrator over last few years, by focusing

more on R&D and increasing its focus on out-sourcing the non-core activities, we

sense that their 2 major cost heads, employee costs and raw material costs, would

continue to grow slightly behind revenue growth, thereby leaving some scope for

EBITDA margin expansion from here-on.

We estimate raw material cost assumption, in-line with management commentary,

that raw material costs is very much dependent on the product mix and it should

remain in 55-60% range of revenues. On the employee’s side, BEL every year has

added 200-350 staff in last few years, mainly engineers/ scientists. At the same

time BEL has reduced its staff strength from 11,545 employees in FY2010 to 9,703

employees in FY2015. We expect employee expenses as % of sales to decline from

18.1% in FY2015 to 15.5% by FY2018E.

On a whole, we expect PAT margins to expand from 16.9% in FY2015 to 17.5%

by FY2018E.

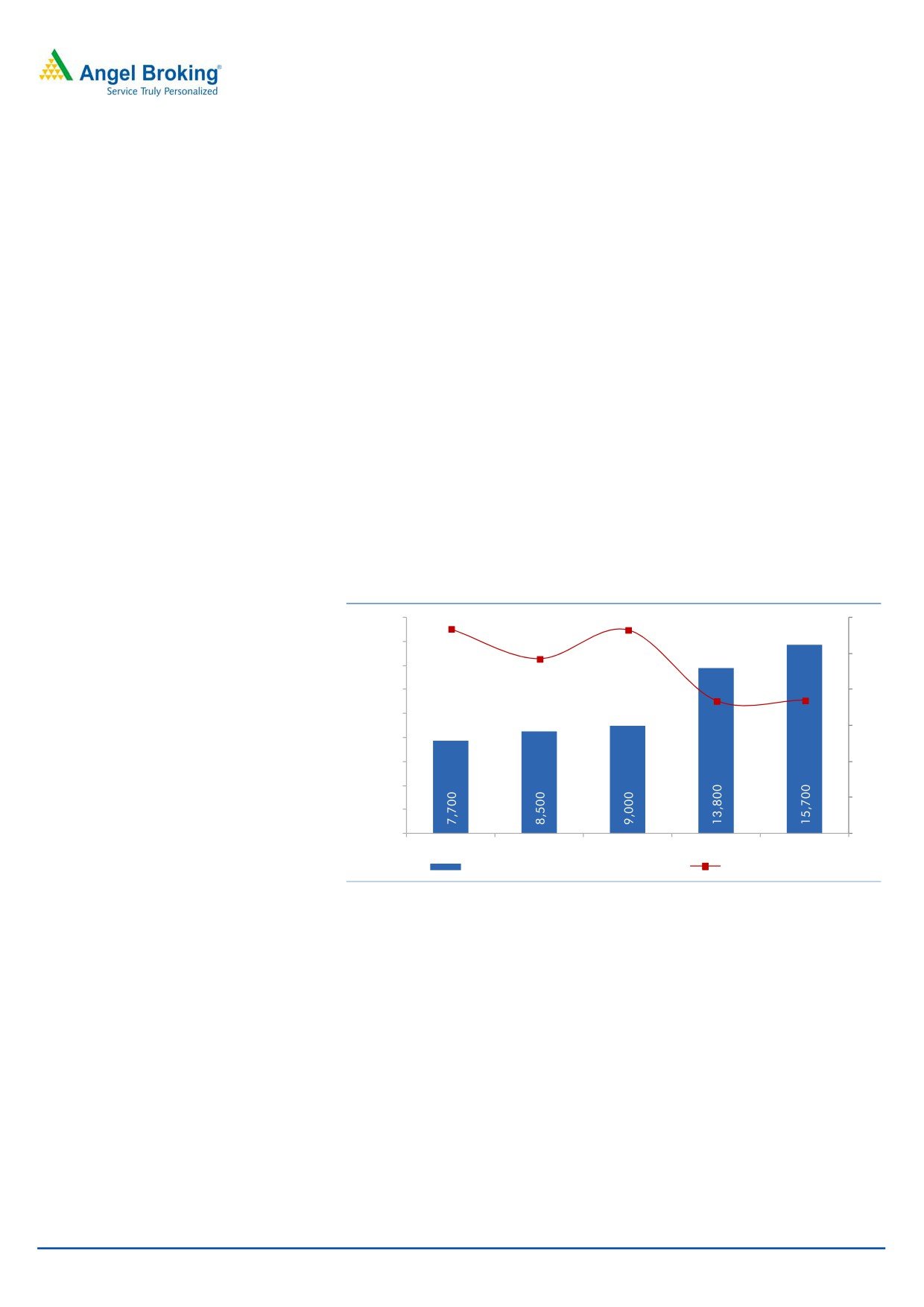

Exhibit 9: Revenue growth on uptrend...

Exhibit 10: EBITDA & PAT Margins (%) to expand...

12,000

16.6

18.0

20

17.1

16.9

17.5

16.7

16.0

18

10,000

14.6

11.6

16

14.4

17.6

14.0

17.0

16.6

16.7

14

8,000

12.0

8.8

14.1

9.1

12

10.0

6,000

10

6.1

8.0

10.6

8

4,000

6.0

3.9

6

4.0

4

2,000

2.0

2

0

0.0

0

FY13

FY14

FY15

FY16E

FY17E

FY18E

FY13

FY14

FY15

FY16E

FY17E

FY18E

Net Sales

yoy growth (%)

EBITDA Margin (%)

PAT Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

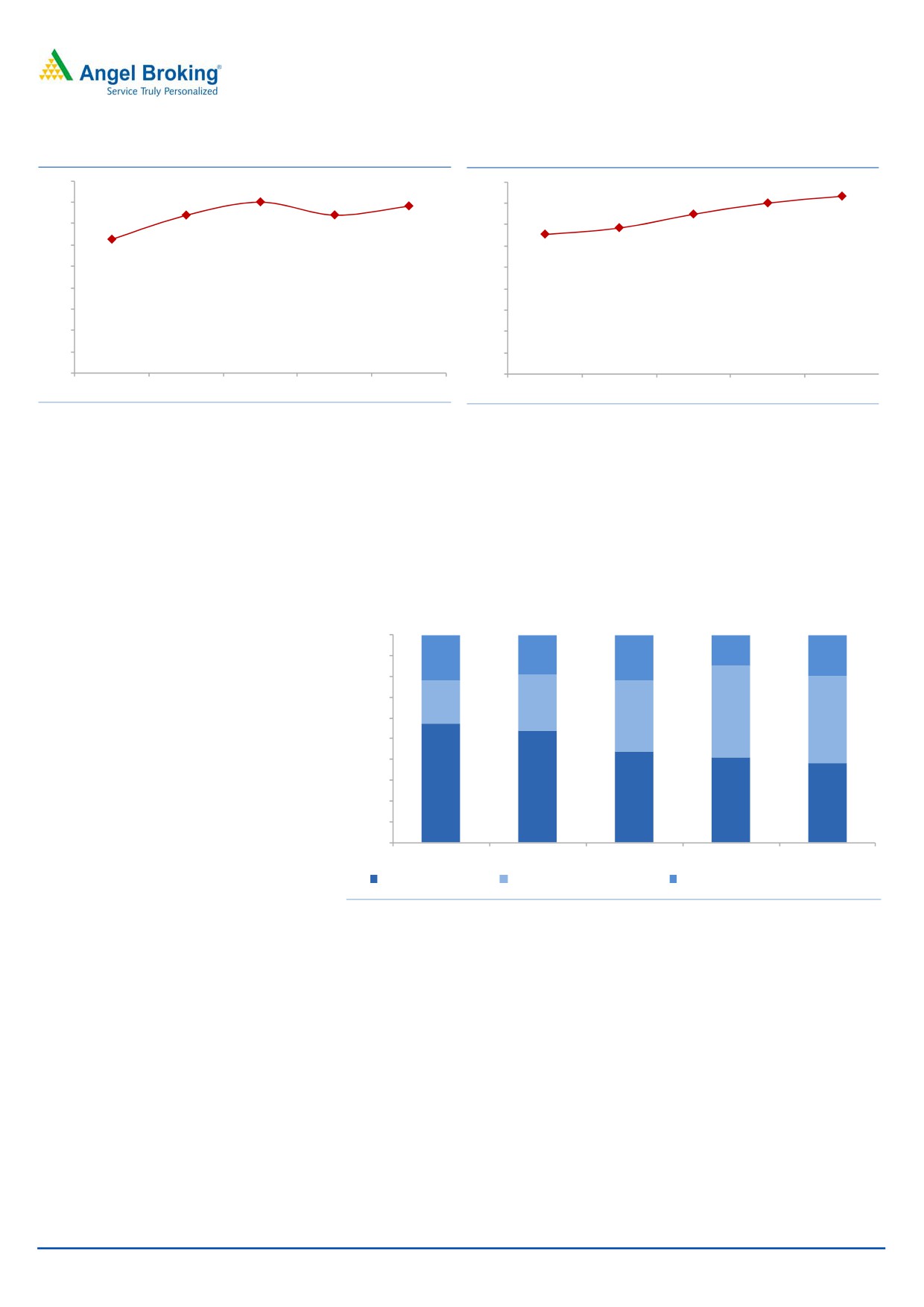

BEL to continue increasing its focus on R&D activities….

BEL is one of the exceptions to general perception that Public Sector Undertakings

(PSU’s) in India do not focus on technology upgrades. R&D spends as % of BEL’s

standalone sales increased from sub-5% levels in FY2007 (3.6%) to 7.8% by

FY2015. Same time, mix of Scientist/ Engineers to total employees increased from

29.6% in FY2010 to 41.7% in FY2015.

December 17, 2015

7

Initiating coverage | BEL

Exhibit 11: R&D spend as % of Standalone Sales...

Exhibit 12: Scientist/Engineers as % of Employees...

9.0

45.0

8.0

40.0

41.7

8.0

40.1

7.0

7.8

35.0

7.4

7.4

37.5

6.0

30.0

34.3

32.8

6.3

5.0

25.0

4.0

20.0

3.0

15.0

2.0

10.0

1.0

5.0

0.0

0.0

FY11

FY12

FY13

FY14

FY15

FY11

FY12

FY13

FY14

FY15

Source: Company, Angel Research

Source: Company, Angel Research

Higher in-house R&D spends, strong tie-ups with National Laboratories (including

Defense Research and Development Organization) and increased in-house

dependency on Scientists/ Engineers has helped BEL lower its revenue dependency

on foreign transfer of technology (ToTs) agreements. This can be seen from the

below table that revenues derived from technology acquired through foreign ToTs

has been stable at ~20% levels.

Exhibit 13: Higher contribution from indigenously developed products..

100

15

90

22

19

22

20

80

70

21

27

44

60

34

42

50

40

30

57

54

20

44

41

38

10

0

FY11

FY12

FY13

FY14

FY15

BEL developed prod.

Ass. with DRDO & Nat. Labs

Tech. acquired through foreign ToTs

Source: Company, Angel Research

This strategy of maintaining lower dependency on foreign ToTs, should avoid any

major volatility in earnings of the company. BEL management has maintained that

it would continue to pursue its strategy of increasing its focus on R&D and

outsource the non-core works. Management highlighted that they intend to set-up

a new R&D centre in Bangalore and further increase their R&D spends as % of

sales to ~10%, going forward.

Higher R&D spends in our view, would bridge the gaps in their current product

offerings and make them more efficient to the private players product offerings.

To continue capex to strengthen their product offerings…

BEL during FY2012-2015 has spent on an average of `300cr yearly towards the

capex. With improved visibility on the defense investment cycle, and government

December 17, 2015

8

Initiating coverage | BEL

increasingly emphasizing on upgrading the Defense technologies, BEL

acknowledging their product gaps (at the technology level), identified the need to

strongly further pursue the capex. Accordingly, the company has announced to

pursue `400-500cr of yearly capex for the next 3-5 years.

Exhibit 14: Capex pipeline for the next few years

Capex details

Location, State

Comments

To be set-up across 950 acres of land; proposed capex to the

New Missile Integration Range

Anantapur, A.P.

tune of `500cr; would take at least 3 years for operations to

commence;

Spread across 14 acres, this facility has started operations in

Test bed for Missile Systems

Bangalore, Karnataka

Sep-2015

BEL is supporting Atlas Elektronik on supply of 6 Sonars (as

part of contract, technology would be transferred to BEL);

Sonar Transducer Integration & Testing Facility

Bangalore, Karnataka

Expect ramp-up in capex towards this facility from FY2017

onwards;

Bangalore, Karnataka &

Additional Near Field Test Range (NFTRs)

Ghaziabad, U.P.

Manufacture Zinc Sulphide (ZnS) Domes

Highly Accelerated Life Test & Stress Screening

Facility

Tactical Communication System (TCS) Test Bed

Battlefield Management System (BMS) Test Bed

Robotic Welding Facility

50MW Solar Power Plant

Wind Energy Power Plant

Source: Company, Angel Research

Test bed for Missile Systems, Bangalore commenced operations in Sep-2015.

Whereas, Sonar Integration & Testing facility, Bangalore and Missile Integration

Range facility, Anantapur would not commence operations before FY2017E.

With roll-out of these modernization as well as expansion projects, we expect BEL

to strengthen its product portfolio in the long-run, which in turn should help them

support their key domestic client requirements. This on whole should lead to better

revenue growth visibility in the long-run.

Strong BS, Adj. RoE’s to expand to ~52% by FY2018E...

BEL is a cash rich company, sitting on net cash (adj. for debt, consol.) of `6,103cr.

Noticeably, this cash rich position is despite the point that debtors and inventory

position of BEL has deteriorated over the last few years. Management attributed

payment delays and bureaucratic functioning, as key reasons for working capital

cycle deterioration.

In our view, stretch in working capital cycle is also attributable to BEL’s transition

from being pure play products supplier to Systems Integrator (material costs

increased sharply owing to high proportion of bought-out items for a project).

BEL in our view has reached later stages of the transition process from being a

products developer to Systems Integrator. Our view stems from the point that (1)

BEL works with ~800 indigenous vendors in the domestic markets, and (2) intends

to further increase its R&D spends to 10% going forward. These pointers put BEL as

India’s largest Systems Integrator in the Defense space.

December 17, 2015

9

Initiating coverage | BEL

In the back-drop of higher budgetary allocation towards Defense capex, strong

bid-pipeline emerging, where BEL should see strong order inflow growth, roll-out

of new simplified Defense Procurement Procedure (DPP) in next few months,

comfort us that BEL’s Working Capital cycle should gradually improve, going

forward.

Considering uptick in earnings growth, improvement in working capital cycle, we

expect BEL to report improvement in its Adj. Return on Equity (RoE) levels from

20.1% in FY2014 to 51.8% by FY2018E. On a whole, BEL should continue to

report expansion in its Adj. RoEs during FY2016-18E.

BEL management has announced that it is pursuing yearly capex of ~`400-500cr

for next 3-5 years. We expect BEL to generate over `1,100cr of yearly cash flow

from operations, which should support their yearly capex plans of `400-500cr.

Going forward, we do not see BEL depending on debt to pursue its proposed

capex.

December 17, 2015

10

Initiating coverage | BEL

About the Company

Bharat Electronics Ltd. (BEL) is Bangalore based public sector undertaking (PSU)

established in 1954 under the control of Ministry of Defence (MoD) to cater to

specialised electronic needs of the Indian Defense. BEL, a Nava-Ratna company

over the years has grown to be multi-segment, multi-technology company servicing

a diverse range of clients across India and in the international markets.

Business Segments

BEL operates across 8 business segments, with ~20-30% of their current Order

Book contribution coming-in from their largest business segment- Radars, Sonars

& Weapons Systems.

Exhibit 15: Business Segments

Radars, Sonars & Weapon Systems

Communication

Electronic Warfare

Network Centric Systems

Anti Submarine Warfare

Electro-Optics

Tank Electronics

Civilian Products (such as EVM machines

Source: Company, Angel Research

Details of Manufacturing Plants

To-date BEL has set-up 9 manufacturing plants across Bangalore (headquarters),

Chennai, Machilipatnam (post take-over of Andhra Scientific Company in 1983),

Hyderabad, Pune, Navi Mumbai, Panchkula, Kotdwara, and Ghaziabad, which

are into manufacture of entire range of Defense products offered by the company.

Exhibit 16: Details of Manufacturing facilities

Production Facilities

Production details

(since)

Military Communication Equipment, Network Centric Systems,

Military Radars, Naval Systems, Electronic Warfare (Air-force),

Avionics, Weapon Management System, Telecom and

Bangalore (1966)

Broadcast System, Components, Coastal Surveillance System,

Electronic Voting Machines, Solar Products, Traffic Signals,

Security Systems, Microwave Super Components

Tank Electronics, Gun Upgrades, Multi-purpose Advanced

Chennai

Stabilized systems

Machilipatnam (1983) Electro-Optics (Night Vision Devices)

Hyderabad

Electronic Warfare Systems

Pune (1981)

X-ray Tubes, Batteries, Laser Products

Navi Mumbai

Shelters, Masks

Panchkula

Military Communication Equipment, Encryption Products

Kotdwara

Telecommunication Systems, Military Communication Systems

Network Centric Systems, Radars, Satcom (Defense),

Ghaziabad

Microwave components

Source: Company AR’s, Angel Research

December 17, 2015

11

Initiating coverage | BEL

Valuation

BEL in our view is expected to emerge as the key beneficiary of (1) increase in the

long-term defence spending and (2) government’s indigenization push (as can be

seen from their Make-in-India drive). Also, these positives when coupled the strong

market positioning within the niche area where BEL operates comforts us that good

days are ahead for BEL stock. We expect BEL to report doubling of the order

inflows to `10,000cr in FY2016E and to further accentuate to `15,000cr in

FY2017E. Accordingly, the OB of the company would increase from `21,648cr

(OB/TTM sales ratio of 3.1x) to `39,555cr (OB/TTM sales ratio of 4.1x). Despite

the strong ordering trends, given that longer time taken to get bulk production

clearances from the clients, management has given conservative 8-10% top-line

growth for next few years. We are optimistic, that BEL management would revise

upwards the revenue growth numbers as defense processes get more streamlined

and visibility on the execution front improves.

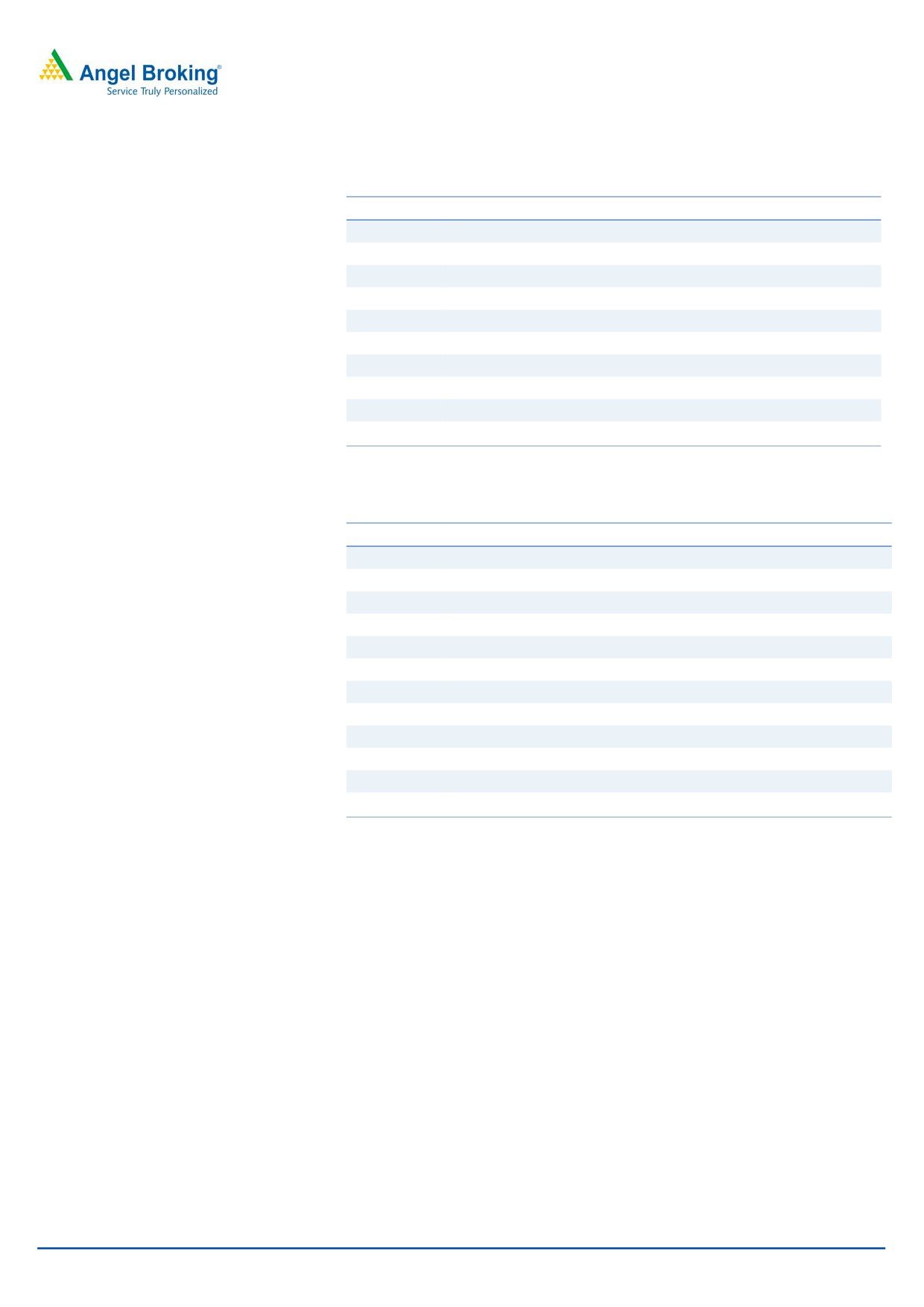

At the current market price of `1,206/share, BEL stock is trading at FY2016E and

FY2017E P/E multiple of 22.3x and 19.6x, respectively. Historically, in the last 5

years, BEL’s stock has traded at a 1-year forward P/E multiple of 14.0x.

We expect BEL to report 12.4% top-line and 13.7% bottom-line CAGR during

FY2015-18E, with such strong growth expected to sustain beyond FY2017 as well.

We expect BEL to trade at premium to its historical valuations on account of the

uptick in the investment cycle, which indicates strong long-term growth outlook

with lesser competitive business threat and scarcity premium it enjoys being the

largest listed defense player. Considering the long-term growth prospects, which

should stretch beyond FY2017E, we have assigned 1-year forward P/E multiple of

23.0x.

Exhibit 17: 1-year forward P/E multiple band (x)

Exhibit 18: 1-year forward Avg. P/E band (x)

1,400

25

1,200

20

Avg. 1-year fwd. P/E- 14x

1,000

15

800

600

10

400

5

200

0

0

Price

16.0x

18.0x

20.0x

22.0x

1-yr Fwd PE (x)

Avg. P/E

Source: Angel Research

Source: Angel Research

Our target multiple of 23.0x captures, (1) strong business uptick in FY2016/17E,

which is expected to last for few years, (2) strong market positioning amidst

increasing competitive intensity, (3) debt free company with adj. RoE expansion

potential (to expand to 51.8% by FY2018E). On assigning 23.0x P/E multiple to

our FY2017E EPS estimate of `61/share, we arrive at price target of `1,414/share.

Given the 17% upside from current levels, we initiate coverage on BEL stock with

Buy rating.

December 17, 2015

12

Initiating coverage | BEL

ANNEXURE

Exhibit 19: Major Orders executed in FY2015

Sl. No.

Particulars of Orders executed

1

Akash Weapon System

2

Passive Night Vision Devices

3

3D Tactical Control Radar

4

Missile Warning System

5

Schilka Gun Tank Upgrade

6

Laser Range Finder

7

Hull Mounted Sonar

8

Shipborne EW System (Sanket)

9

Fire Control Systems

10

Electronic Voting Systems

Source: Company

Exhibit 20: Major Projects planned during FY2016

Sl. No.

Particulars of Orders executed

1

Akash Missile System

2

3D Tactical Control Radar

3

Low level Light Weight Radar

4

Handheld Thermal Imagers

5

Schilka Gun Tank Upgrade

6

L70 Gun Upgrade

7

New Generation Hull Mounted Sonar

8

Gigabyte Ethernet based Ship Data Network

9

Combat Management System

10

Shipborne Electronic Warfare System

12

Fire Control Systems

13

Electronic Voting Systems

Source: Company

December 17, 2015

13

Initiating coverage | BEL

Risks to our Estimates

To increase indigenization in the defense sector, Government of India (GoI)

increased the FDI limit in Defense sector to 49% in Jul-2014. Till now, recent

developments/ announcements have failed to attract any major international

defense players in to India. With more positive announcements expected and

fast growing bid pipeline, international defense giants could be compelled to

forge partnership with domestic players at the time of bidding. This could

possibly lead to loss of market share for BEL, which we have not incorporated

in to our assumptions.

Last few years have seen sluggish ordering activity from the Defense sector.

Even though Defense sector in the last few months has seen positive

announcements, any further delays in the awarding activity, could act as risk

to our estimates.

Management highlighted that it is working on improvising some areas of the

technology part, which are a gap currently. BEL’s management’s inability to

form tie-ups with international MNC’s or absorb the technology from foreign

vendors could impact its financials, going forward.

Defense is a highly technology focused sector. BEL would have to continuously

spend on R&D to regularly upgrade its product profile. Any shift away from the

R&D could make their products unattractive (vs the peers), resulting in loss of

market share and further delaying the execution.

Any government announcement to de-list the products manufactured by BEL

could open up the competition and further impact their market positioning

within the domestic markets, which again acts as a risk to our market share

assumptions and threatens our earnings growth estimates.

Defense Ministry has been asked by government to set-up 300MW of power

plants. In line with this broader goal, BEL has decided to set-up 50MW of solar

power plant. This is an area of unrelated business entry for BEL (even though

BEL claims that it makes voltaic modules amongst other parts).

December 17, 2015

14

Initiating coverage | BEL

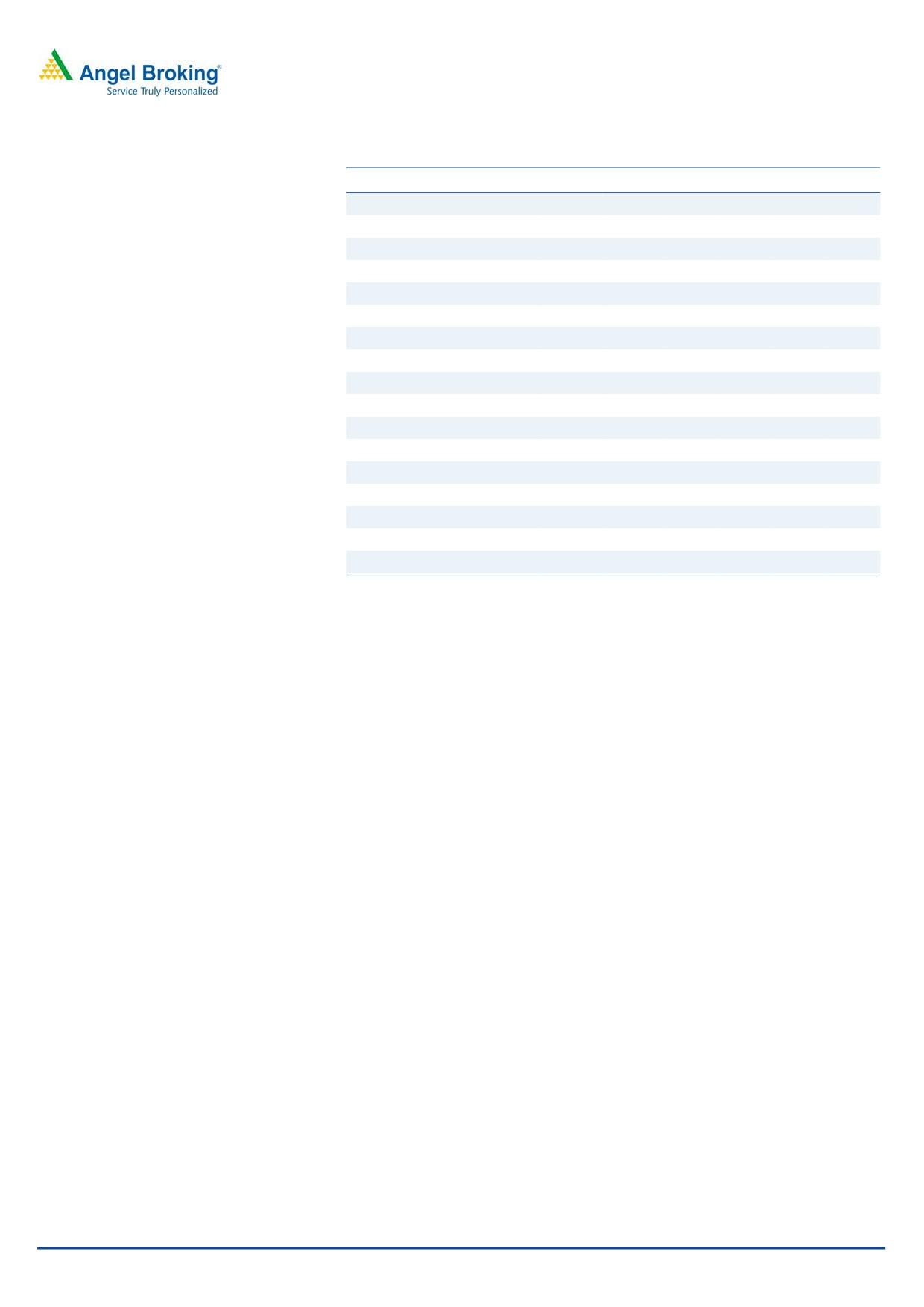

Profit and Loss Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

FY18E

Net Sales

6,273

6,518

7,093

7,737

8,634

10,064

% Chg

6.1

3.9

8.8

9.1

11.6

16.6

Total Expenditure

5,610

5,596

5,918

6,440

7,153

8,289

Raw Materials Consumed

3,156

3,344

3,495

3,870

4,384

5,141

Purchase of stock-in-trade

760

444

440

467

515

580

Employee benefits Expense

1,125

1,046

1,281

1,343

1,406

1,564

Other Expenses

569

762

702

760

847

1,004

EBITDA

663

922

1,175

1,297

1,481

1,775

% Chg

4.3

39.1

27.4

10.4

14.2

19.8

EBIDTA %

10.6

14.1

16.6

16.8

17.2

17.6

Depreciation

136

150

166

193

216

239

EBIT

526

772

1,008

1,104

1,265

1,537

% Chg

3.2

46.6

30.6

9.4

14.6

21.4

Interest and Financial Charges

1

4

3

3

3

3

Other Income

625

437

507

544

611

709

EBT before Excep. & prior-period items

1,151

1,205

1,513

1,645

1,874

2,242

Exceptional Items & Prior period Items

(9)

1

1

0

0

0

EBT

1,142

1,206

1,513

1,645

1,874

2,242

Tax Expenses

236

254

316

349

398

482

% of PBT

20.7

21.1

20.9

21.2

21.2

21.5

PAT before Minority Interest

906

952

1,197

1,296

1,476

1,760

Minority Interest

0

0

(0)

0

0

1

PAT

906

951

1,197

1,296

1,475

1,760

% Chg

7.0

5.0

25.8

8.2

13.9

19.3

PAT %

14.4

14.6

16.9

16.7

17.1

17.5

Diluted EPS

114

119

150

54

61

73

% Chg

7.6

4.4

25.8

8.2

13.9

19.3

December 17, 2015

15

Initiating coverage | BEL

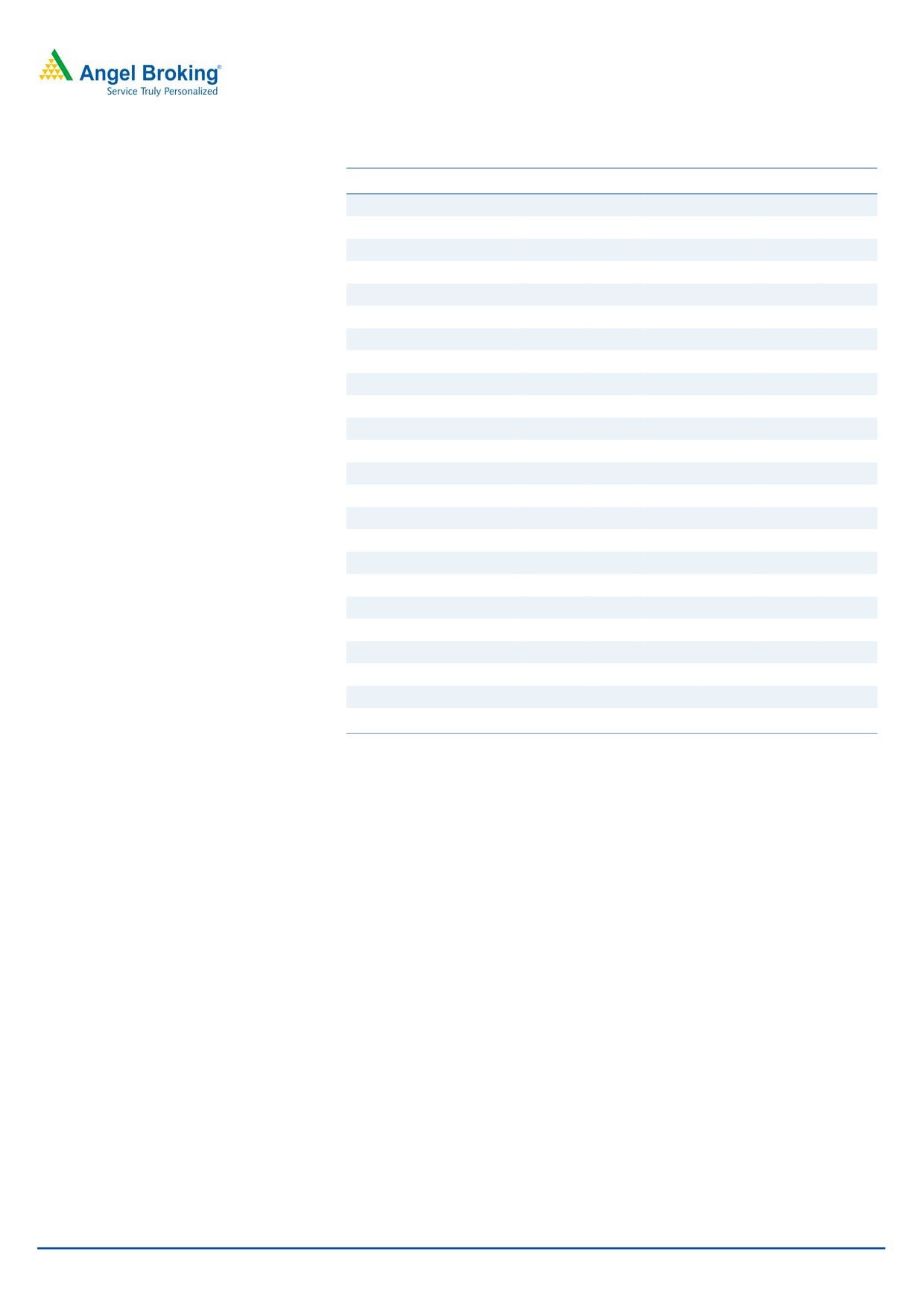

Balance Sheet

Y/E March (` cr)

FY13 FY14 FY15 FY16E FY17E FY18E

Sources of Funds

Equity Capital

80

80

80

240

240

240

Reserves & Surplus

6,407

7,140

8,037

8,852

9,975

11,348

Networth

6,487

7,220

8,117

9,092

10,215

11,588

Total Debt

0

0

25

0

0

0

Minority Int. & Govt. Grants

163

224

207

203

202

202

Other Long-term Liab. & Prov.

386

365

435

441

476

483

Total Liabilities

7,037

7,809

8,784

9,736

10,893

12,273

Application of Funds

Gross Block

2,106

2,366

2,894

3,276

3,681

4,104

Accumulated Depreciation

1,506

1,671

1,821

2,014

2,230

2,469

Net Block

600

695

1,073

1,262

1,451

1,635

Capital WIP & Intan. Assets Dev.

328

458

140

110

105

100

Investments

0

0

0

0

0

0

Current Assets

Inventories

3,255

3,340

3,424

3,664

3,864

4,244

Sundry Debtors

3,364

4,156

3,805

4,146

4,707

5,476

Cash and Bank Balance

5,331

4,605

6,038

6,901

7,938

9,042

Loans & Advances

1,378

1,190

684

750

800

780

Other Current Asset

81

69

54

55

57

59

Current Liabilities

7,814

7,166

6,941

7,663

8,547

9,589

Net Current Assets

5,594

6,192

7,064

7,852

8,818

10,012

Other Assets

515

464

506

512

520

525

Total Assets

7,037

7,809

8,784

9,736

10,893

12,273

December 17, 2015

16

Initiating coverage | BEL

Cash Flow Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16E FY17E FY18E

Profit before tax

1,147

1,206

1,513

1,645

1,874

2,242

Dep. & Other Non-cash Chrg.

(338)

(336)

(163)

(266)

(218)

(225)

Change in Working Capital

(2,104)

(1,237)

436

75

71

(90)

Interest & Financial Charges

1

4

3

3

3

3

Direct taxes paid

(245)

(206)

(356)

(349)

(398)

(482)

Cash Flow from Operations

(1,540)

(569)

1,434

1,108

1,332

1,448

(Inc)/ Dec in Fixed Assets

(353)

(369)

(225)

(351)

(400)

(418)

(Inc)/ Dec in Inv. & Oth. Adj.

2,106

1,128

(614)

302

238

142

Cash Flow from Investing

1,753

759

(839)

(49)

(162)

(277)

Issue/ (Buy Back) of Equity

0

0

0

0

0

0

Inc./ (Dec.) in Borrowings

0

(0)

25

(25)

0

0

Dividend Paid (Incl. Tax)

(157)

(209)

(220)

(301)

(331)

(364)

Interest Expenses & Oth. Adj.

(1)

(4)

(14)

(3)

(3)

(3)

Cash Flow from Financing

(157)

(213)

(209)

(329)

(334)

(367)

Inc./(Dec.) in Cash

56

(23)

386

730

837

804

Opening Cash balances

1,752

1,809

1,786

2,171

2,901

3,738

Closing Cash balances

1,809

1,786

2,171

2,901

3,738

4,542

December 17, 2015

17

Initiating coverage | BEL

Key Ratios

Y/E March

FY13

FY14

FY15

FY16E FY17E FY18E

Valuation Ratio (x)

P/E (on FDEPS)

31.8

30.4

24.2

22.3

19.6

16.4

P/CEPS

27.6

26.3

21.2

19.4

17.1

14.5

Dividend yield (%)

1.6

1.6

1.2

1.1

1.0

0.9

EV/Sales

3.8

3.8

3.3

2.9

2.5

2.0

EV/EBITDA

35.6

26.4

19.5

17.0

14.2

11.2

EV / Total Assets

3.4

3.1

2.6

2.3

1.9

1.6

Per Share Data (`)

EPS (fully diluted)

38

40

50

54

61

73

Cash EPS

44

46

57

62

70

83

DPS

7.4

7.8

9.7

10.7

11.8

13.0

Book Value

270

301

338

379

426

483

Returns (%)

RoCE (Pre-tax)

26.6

23.9

30.7

28.5

29.0

30.5

Angel RoIC (Pre-tax)

35.8

35.0

36.4

41.4

45.4

51.4

RoE

30.3

20.1

36.8

39.3

45.6

51.8

Turnover ratios (x)

Asset Turnover (Gr. Block) (x)

2.9

2.8

2.6

2.4

2.4

2.5

Inventory / Sales (days)

178

190

179

172

163

150

Receivables (days)

180

217

211

193

192

189

Payables (days)

541

489

435

414

414

399

WC (days)

(183)

(82)

(45)

(50)

(59)

(61)

Leverage Ratios (x)

D/E ratio (x)

0.0

0.0

0.0

0.0

0.0

0.0

December 17, 2015

18

Initiating coverage | BEL

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

BEL

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

December 17, 2015

19