IPO Note | Defence

Mar 09, 2018

Bharat Dynamics Ltd

SUBSCRIBE

sue Open: Mar 13, 2018

Is

Issue Close: Mar 15, 2018

Incorporated in 1970, Bharat Dynamics Limited (BDL), a Government of India

(GOI) Enterprise under the Ministry of Defense (MOD) was established in

Hyderabad to be a manufacturing base for guided missiles and allied defense

Issue Details

equipment. BDL, a Miniratna Category-I Public Sector Unit (PSU), is amongst the

Face Value: `10

few industries in the world having capabilities to produce state-of-the-art guided

weapon systems.

Present Eq. Paid up Capital: `183.2cr

Healthy order book indicates strong revenue visibility: BDL current order book

Fresh issue: Nil

stands at `10,543cr, comprising the Akash Weapon System, LR SAM, MR SAM,

INVAR (3 UBK 20) ATGM and the Konkurs-M ATGM. This puts the revenue visibility

Post Eq. Paid up Capital: `183.2cr

for next two years at 2.2x (on FY17 revenues of `4,832cr). Going forward, the

strong order book will further help the BDL to boost its top-line.

Issue size (amount): `961cr

Offering wide Range of Products: BDL is one of the leading defence PSUs in India,

engaged in the manufacture of Surface to Air missiles, Anti Tank Guided Missiles,

Price Band: `413-428

under water weapons, launchers, counter measures and test equipment.

Lot Size: 35 shares and in multiple

Additionally, BDL is also involved in the business of refurbishment and life

thereafter

extension of missiles manufactured. BDL is co-development partner with the DRDO

Post-issue implied mkt. cap: *`7570cr -

for the next generation of ATGMs & SAMs, and capable of catering to India’s

**`7844cr

emerging guided missile and torpedo requirement.

Promoters holding Pre-Issue: 100.0%

BDL to benefit from Make in India initiative: The government’s new thrust towards

Promoters holding Post-Issue: 87.75%

Make in India seeks to fast-track defence procurements with indigenous

*Calculated on lower price band

manufacturing being given the highest priority. This would benefit the defence

players like BDL.

** Calculated on upper price band

Outlook & Valuation: In terms of valuations, the pre-issue P/E works out to 22.7x

Book Building

1HFY2018 annualized earnings (at the upper end of the issue price band), which is

QIBs

50% of issue

lower compared to BDL’s peers like Bharat Electron and Apollo Micro System

(trading at 33.6x and 40.7x of its 1HFY2018 annualized earnings respectively).

Non-Institutional

15% of issue

Further, BDL has a strong order book and revenue visibility, coupled with superior

Retail

35% of issue

return ratios compared to peers. Hence, considering the above positive factors

including growth in the defence industry, we recommend SUBSCRIBE on the issue.

Post Issue Shareholding Patter

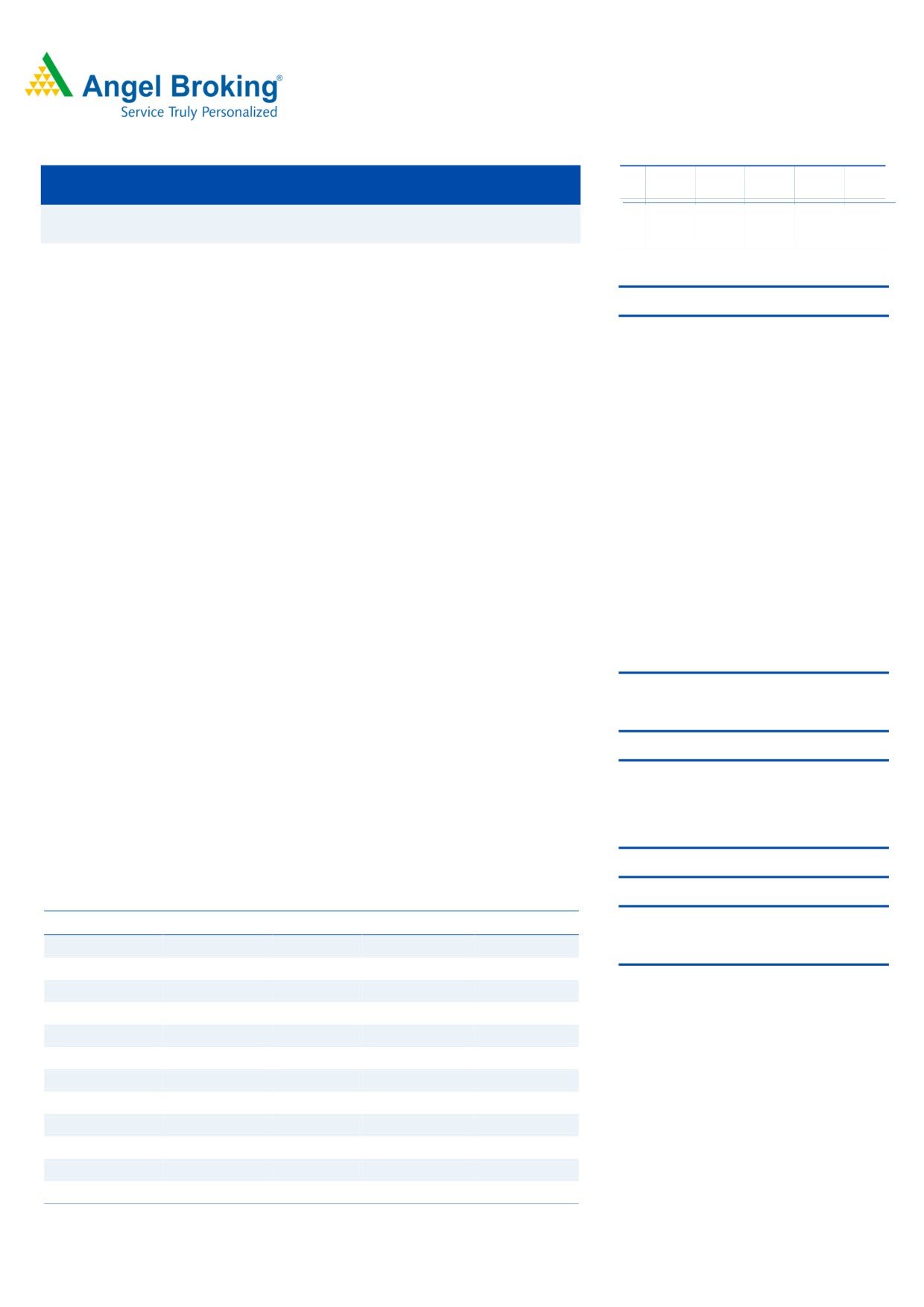

Key Financials

Y/E March (` cr)

FY2015

FY2016

FY2017

1HFY18

Promoters

87.7%

Net Sales

2,841

4,079

4,833

1,806

Others

12.3%

% chg

-

43.6

18.5

-

Net Profit

444

562

490

173

% chg

-

26.7

(12.8)

-

OPM (%)

9.7

12.6

11.8

13.6

EPS (`)

24.2

30.7

26.8

9.4

P/E (x)

17.7

14.0

16.0

-

P/BV (x)

4.7

4.2

3.5

-

Amarjeet S Maurya

RoE (%)

26.8

30.4

22.2

-

+022 39357600, Extn: 6831

RoCE (%)

12.6

24.8

22.9

-

EV/Sales (x)

1.5

1.1

1.3

-

EV/EBITDA (x)

15.2

9.0

10.7

-

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end

of the price band

Please refer to important disclosures at the end of this report

1

Bharat Dynamics Limited | IPO Note

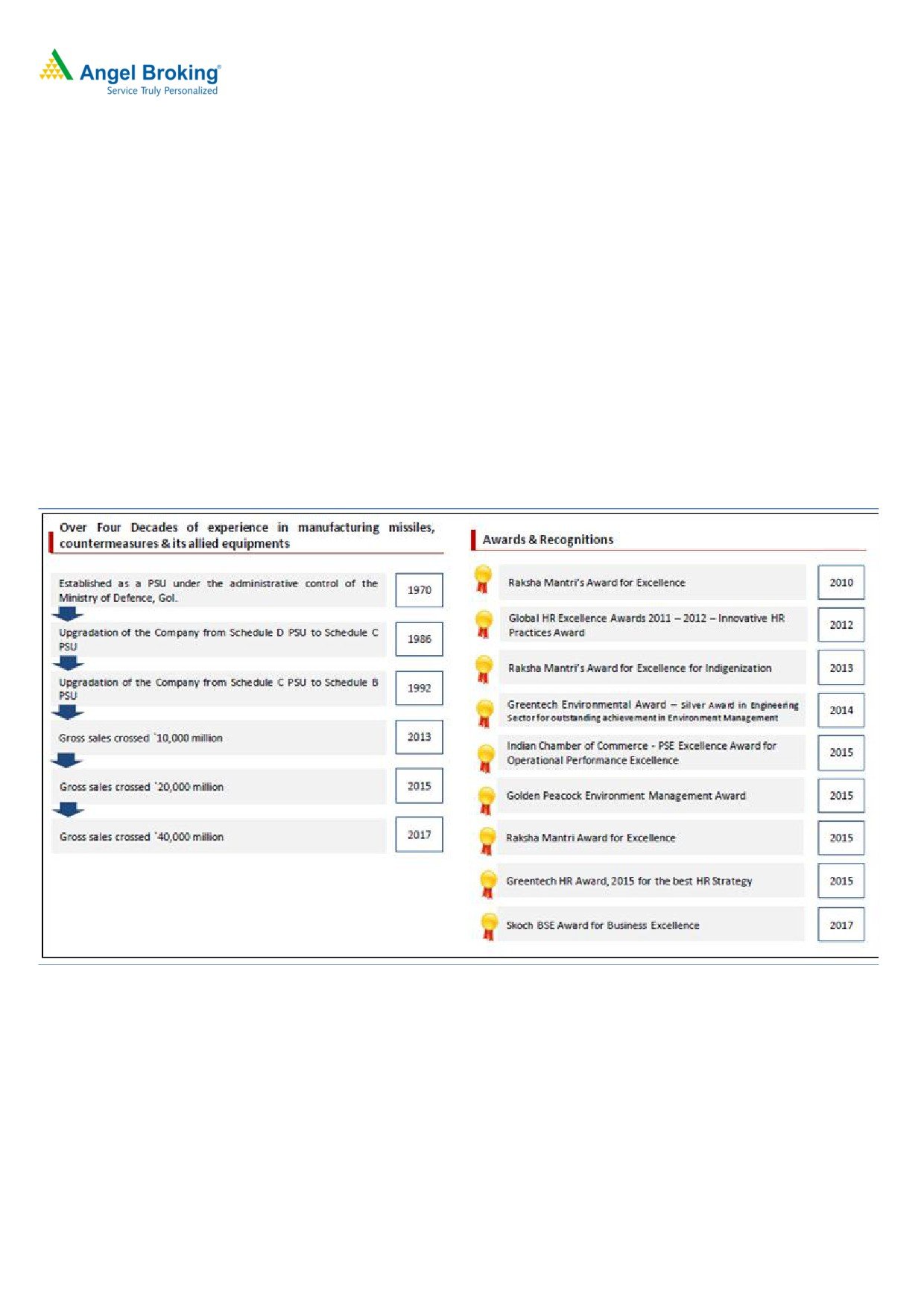

Company background

Incorporated in 1970, Bharat Dynamics Limited (BDL), a GOI Enterprise under the

MOD was established in Hyderabad to be a manufacturing base for guided

missiles and allied defence equipment. Nurtured by a pool of talented engineers

drawn from DRDO and aerospace industries, BDL began its journey by producing

the 1st Generation Anti -Tank Guided Missile (ATGM) - the French SS11B1. On

successful completion of the SS11B1 project, BDL embarked on production of 2nd

generation ATGMs - the French MILAN-2 and Russian Konkurs. Currently BDL has

been working closely with both the end-user and the OEMs in the upgradation of

ATGMs to the class of tandem warhead ATGMs. The lead taken by the Nation to

develop indigenous, sophisticated and contemporary missiles through the

Integrated Guided Missile Development Program (IGMDP), gave BDL an

opportunity to be closely involved in the program, wherein it was identified as the

Prime Production Agency.

Exhibit 1: Journey of the company

Source: Company, Angel Research

Mar 09, 2018

2

Bharat Dynamics Limited | IPO Note

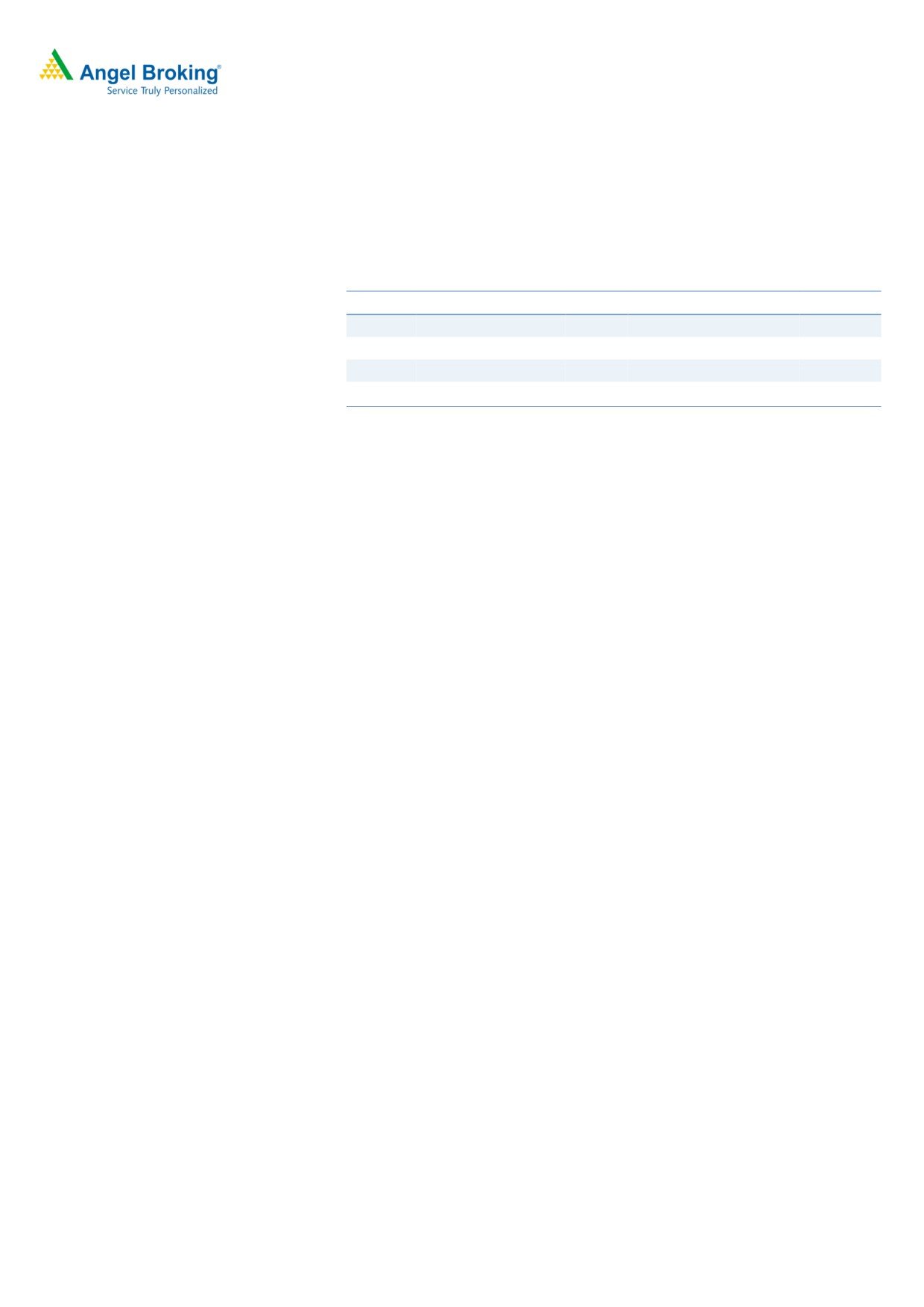

Issue details

BDL is raising ~`961cr through offer for sale of equity shares in the price band of

`413-428. The company will dilute 12.3% (at upper price band) of its post-offer

paid-up equity share capital.

Exhibit 2: Pre and Post IPO shareholding pattern

No of shares (Pre-issue)

% No of shares (Post-issue)

%

Promoters

18,32,81,250

100.0%

16,08,29,297

87.7%

Others

-

-

2,24,51,953

12.3%

18,32,81,250

100.0%

18,32,81,250

100.0%

Source: Source: RHP, Note: Calculated on upper price band

Note: A discount of `10 per equity share is offered to Retail Investors & Employees.

Objectives of the Offer

Company’s objectives of the offer are:

to achieve the benefits of listing the Equity Shares on the Stock Exchanges.

general corporate purposes

Outlook & Valuation

In terms of valuations, the pre-issue P/E works out to 22.7x 1HFY2018 annualized

earnings (at the upper end of the issue price band), which is lower compared to

BLD’s peers like Bharat Electron and Apollo Micro System (trading at 33.6x and

40.7x its 1HFY2018 annualized earnings respectively). Further, BDL has a strong

order book and revenue visibility, coupled with superior return ratios compared to

peers. Hence, considering the above positive factors including growth in the

defence industry, we recommend SUBSCRIBE on the issue.

Key Risks

Delay in order inflow or execution of current order book can impact both

the top-line and bottom-line.

Increase in competition from other players can impact the business of

BDL.

Mar 09, 2018

3

Bharat Dynamics Limited | IPO Note

Income Statement

Y/E March (` cr)

FY2015

FY2016

FY2017

1HFY18

Total operating income

2,841

4,079

4,833

1,806

% chg

-

43.6

18.5

-

Total Expenditure

2,566

3,566

4,265

1,561

Raw Material

2,000

2,818

3,222

1,132

Personnel

312

326

448

222

Others Expenses

253

421

594

206

EBITDA

275

513

568

245

% chg

-

86.7

10.7

-

(% of Net Sales)

9.7

12.6

11.8

13.6

Depreciation& Amortization

67

53

62

30

EBIT

208

460

506

215

% chg

-

120.9

10.0

-

(% of Net Sales)

7.3

11.3

10.5

11.9

Interest & other Charges

3

4

4

2

Other Income

439

385

230

75

(% of PBT)

68.2

45.7

31.4

26.0

Share in profit of Associates

-

-

-

-

Recurring PBT

644

841

732

288

% chg

-

30.6

(13.0)

-

Tax

200

279

242

115

(% of PBT)

31.1

33.2

33.0

40.1

PAT (reported)

444

562

490

173

% chg

-

26.7

(12.8)

-

(% of Net Sales)

15.6

13.8

10.1

9.6

Basic EPS (`)

24.2

30.7

26.8

9.4

Fully Diluted EPS (`)

24.2

30.7

26.8

9.4

% chg

-

26.7

(12.8)

-

Source: Company, Angel Research

Mar 09, 2018

4

Bharat Dynamics Limited | IPO Note

Exhibit 3: Balance Sheet

Y/E March (` cr)

FY2015

FY2016

FY2017

1HFY18

SOURCES OF FUNDS

Equity Share Capital

115

98

122

92

Reserves& Surplus

1,538

1,753

2,090

1,539

Shareholders’ Funds

1,653

1,851

2,212

1,631

Total Loans

-

-

-

-

Deferred Tax Liability

-

18

-

-

Total Liabilities

1,653

1,870

2,212

1,631

APPLICATION OF FUNDS

Net Block

525

698

767

760

Capital Work-in-Progress

135

125

130

176

Investments

3

3

3

4

Current Assets

7,689

8,738

7,546

7,148

Inventories

1,476

2,058

2,251

2,159

Sundry Debtors

335

145

356

130

Cash

3,669

3,242

1,738

1,311

Loans & Advances

6

6

6

6

Other Assets

2,204

3,286

3,194

3,541

Current liabilities

6,759

7,771

6,388

6,654

Net Current Assets

930

967

1,158

493

Deferred Tax Asset

60

77

155

197

Total Assets

1,653

1,870

2,212

1,631

Source: Company, Angel Research

Mar 09, 2018

5

Bharat Dynamics Limited | IPO Note

Exhibit 4: Cash Flow Statement

Y/E March (` cr)

FY2015

FY2016

FY2017

1HFY18

Profit before tax

644

841

732

288

Depreciation

67

53

62

30

Change in Working Capital

(747)

(61)

(506)

754

Interest / Dividend (Net)

3

4

4

2

Direct taxes paid

(220)

(278)

(335)

(148)

Others

(347)

(275)

19

(50)

Cash Flow from Operations

(599)

284

(23)

876

(Inc.)/ Dec. in Fixed Assets

(291)

(216)

(136)

(70)

(Inc.)/ Dec. in Investments

354

365

139

65

Cash Flow from Investing

62

149

3

(4)

Issue of Equity

-

-

-

-

Inc./(Dec.) in loans

0

(199)

0

(451)

Dividend Paid (Incl. Tax)

(61)

(125)

(124)

(1)

Interest / Dividend (Net)

0

0

(42)

0

Cash Flow from Financing

(61)

(324)

(166)

(451)

Inc./(Dec.) in Cash

(598)

109

(186)

420

Opening Cash balances

722

124

233

46

Closing Cash balances

124

233

46

466

Source: Company, Angel Research

Mar 09, 2018

6

Bharat Dynamics Limited | IPO Note

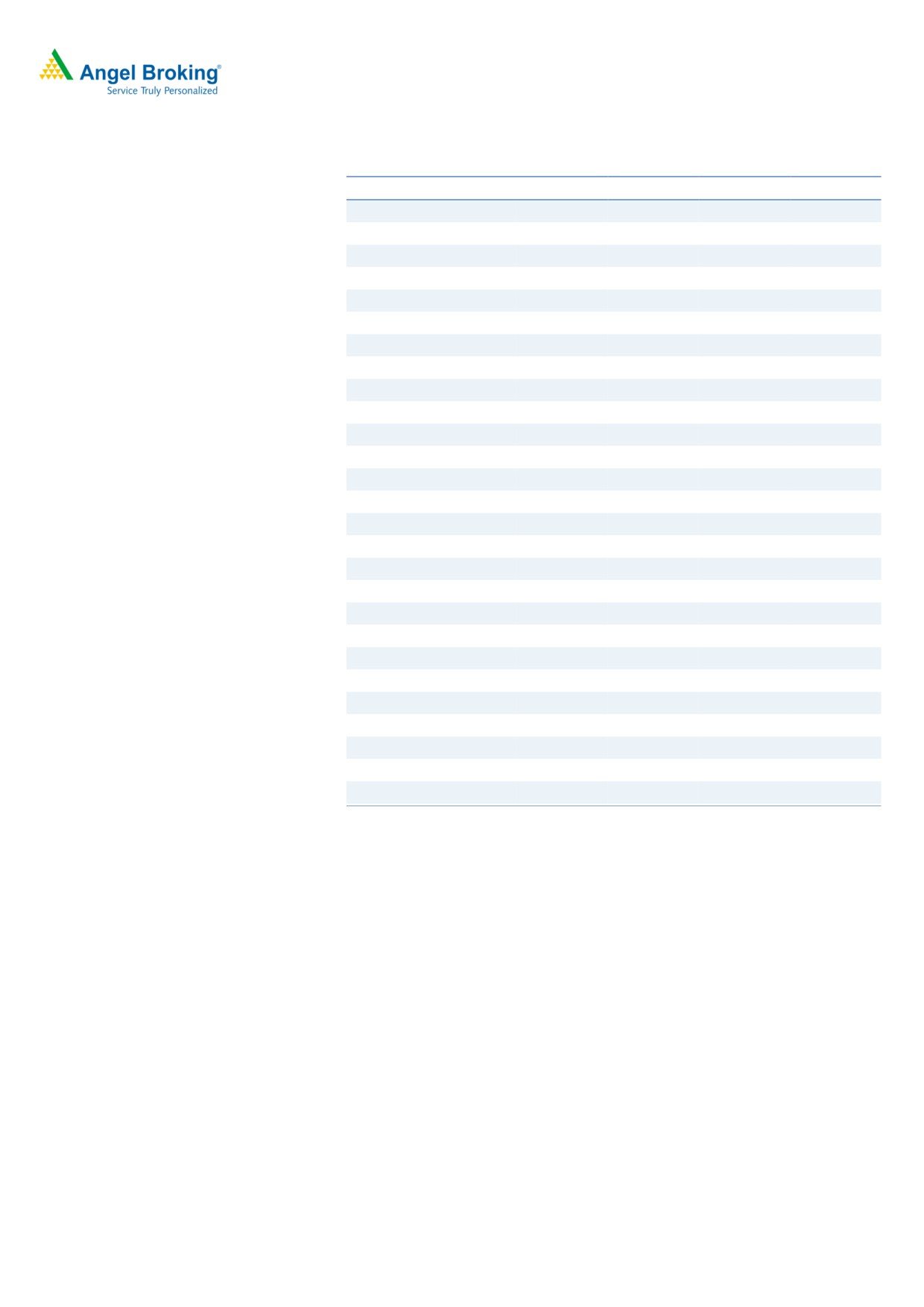

Exhibit 5: Key Ratios

Y/E March

FY2015

FY2016

FY2017

Valuation Ratio (x)

P/E (on FDEPS)

17.7

14.0

16.0

P/CEPS

15.4

12.7

14.2

P/BV

4.7

4.2

3.5

Dividend yield (%)

0.0

0.0

0.0

EV/Sales

1.5

1.1

1.3

EV/EBITDA

15.2

9.0

10.7

EV / Total Assets

2.5

2.5

2.8

Per Share Data (`)

EPS (Basic)

24.2

30.7

26.8

EPS (fully diluted)

24.2

30.7

26.8

Cash EPS

27.8

33.6

30.1

Book Value

90.2

101.0

120.7

Returns (%)

ROCE

12.6

24.8

22.9

Angel ROIC (Pre-tax)

(10.3)

(33.0)

107.3

ROE

26.8

30.4

22.2

Turnover ratios (x)

Inventory / Sales (days)

190

184

170

Receivables (days)

43

13

27

Payables (days)

66

120

113

Working capital cycle (ex-cash) (days)

167

77

84

Source: Company, Angel Research

Mar 09, 2018

7

Bharat Dynamics Limited | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Mar 09, 2018

8