3QFY2016 Result Update | Banking

March 3, 2016

Bank of Baroda

NEUTRAL

CMP

`145

Performance Highlights

Target Price

-

Particulars (` cr)

3QFY16 2QFY16

% chg (qoq) 3QFY15

% chg (yoy)

Investment Period

-

NII

2,705

3,244

(16.6)

3,286

(17.7)

Pre-prov. profit

1,704

2,337

(27.1)

2,339

(27.1)

Stock Info

PAT

(3,342)

124

(2,784.6)

334

(1,100.7)

Sector

Banking

Source: Company, Angel Research

Market Cap (` cr)

33,445

Beta

1.5

Bank of Baroda (BoB) took aggressive steps to clean up its balance sheet and

52 Week High / Low

216/109

recognized all the RBI identified weak accounts as NPA during the quarter

A vg. Daily Volume

1,00,08,585

(3QFY2016). Consequently the provisions went up substantially and the bank

Face Value (`)

2

reported a loss of `3,342cr.

BSE Sensex

24,243

Nifty

7,369

Substantial rise in provisions and decline in loan book resulted in loss at the net

Reuters Code

BOB.BO

level: During the quarter, the loan book declined by 2.4% yoy, while deposits grew

Bloomberg Code

BOB@IN

by 4.4% yoy. CASA deposits declined by 5.1% yoy and as a result the CASA ratio

declined to 24% vs 26.4% in 3QFY2015. Provisions went up 2.5x qoq and hence

Shareholding Pattern (%)

the bank reported a huge loss of `3,342cr compared to a PAT of `334cr in

Promoters

59.2

3QFY2015 and of `124.5cr in the sequential previous quarter. However, as the

bank has now recognized a large part of the troubled accounts and taken provisions

MF / Banks / Indian Fls

21.8

accordingly, we expect the profitability to improve from 1QFY2017 onwards.

FII / NRIs / OCBs

12.3

Indian Public / Others

6.7

Early recognition of stressed assets gives better clarity: BoB is the only bank in the

PSU space which has recognized all the AQR related accounts as NPAs. Further it

also has recognized certain stressed accounts as NPA during the quarter; as a

result the gross slippages went up substantially to `15,785cr. However, this gives

Abs. (%)

3m

1yr

3yr

better clarity on the asset quality of the bank. The Management doesn’t expect

Sensex

(7.2)

(17.7)

28.4

much pain in terms of asset quality, going ahead. The Gross NPA ratio went up

Bank of Baroda

(16.5)

(20.5)

2.6

substantially to 9.68% from 5.56% in 2QFY2016 (up 412bp qoq), while the Net

NPA ratio stood at 5.67% vs 3.08% in 2QFY2016. BoB has recognized a majority

3-years price chart

of its 5:25 and SDR accounts as NPAs; hence, most of the pain in terms of asset

250

quality now seems to be through for the bank.

200

Outlook and valuation: BoB is the only large PSU bank to have recognized all the

150

AQR accounts as NPA during the quarter. The Management’s intention to clean

up its balance sheet faster than others gives more clarity about the bank’s growth

100

prospects, going ahead. The bank is well capitalized with a CAR of 12.2% and

50

believes it will not need any fresh capital for the next 18-24 months. At the current

0

market price, the stock trades at a valuation of 0.9x FY2017E ABV. Although there

is more clarity on the bank’s asset quality now, in our view, the bank is trading at

a higher valuation multiple compared to its peers. Hence, we maintain our

Neutral view on the stock.

Source: Company, Angel Research

Key financials (Standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

Vaibhav Agrawal

NII

11,965

13,187

14,260

16,102

022 - 3935 7800 Ext: 6808

% chg

5.7

10.2

8.1

12.9

Net profit

4,541

3,398

(1,631)

2,886

% chg

1.3

(25.2)

(148.0)

(277.0)

Siddharth Purohit

NIM (%)

2.0

2.0

2.0

2.2

022 - 3935 7800 Ext: 6872

EPS (`)

21.1

15.3

(7.4)

13.0

P/E (x)

6.9

9.5

(19.7)

11.2

P/ABV (x)

0.9

0.9

1.2

0.9

Chintan Shah

RoA (%)

0.8

0.5

(0.2)

0.4

022 - 4000 3600 Ext: 6828

RoE (%)

13.4

9.0

7.3

10.7

Source: Company, Angel Research; Note: CMP as of March 2, 2016

Please refer to important disclosures at the end of this report

1

Bank of Baroda | 3QFY2016 Result Update

Exhibit 1: 3QFY2016 performance (Standalone)

Particulars (` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

FY2015

FY2014

% chg

Interest earned

10,614

11,156

(4.9)

10,718

(1.0)

42,964

38,940

10.3

- on Advances / Bills

7,169

7,712

(7.0)

7,715

(7.1)

30,803

27,878

10.5

- on investments

2,686

2,739

(2.0)

2,464

9.0

9,701

8,696

11.6

- on balance with RBI & others

353

291

21.3

367

(3.6)

1,550

1,534

1.0

- on others

406

414

(2.0)

172

135.1

910

832

9.4

Interest Expended

7,909

7,912

(0.0)

7,432

6.4

29,776

26,974

10.4

Net Interest Income

2,705

3,244

(16.6)

3,286

(17.7)

13,187

11,965

10.2

Other income

1,113

1,144

(2.7)

1,090

2.1

4,402

4,463

(1.4)

Other income excl. treasury

824

920

(10.4)

847

(2.7)

3,395

3,719

(8.7)

- CEB

339

361

(6.2)

373

(9.2)

1,482

1,437

3.1

- Treasury Income

289

224

28.9

244

18.6

1,007

744

35.4

- Recoveries from written off a/cs

24

79

(69.7)

36

(33.5)

189

563

(66.5)

- Others

461

479

(3.9)

437

5.4

1,724

1,718

0.4

Operating income

3,818

4,389

(13.0)

4,376

(12.8)

17,589

16,428

7.1

Operating expenses

2,114

2,051

3.1

2,037

3.8

7,674

7,075

8.5

- Employee expenses

1,155

1,044

10.6

1,120

3.1

4,261

4,140

2.9

- Other Opex

959

1,008

(4.8)

918

4.5

3,413

2,935

16.3

Pre-provision Profit

1,704

2,337

(27.1)

2,339

(27.1)

9,915

9,353

6.0

Provisions & Contingencies

6,165

1,892

225.9

1,262

388.4

4,495

3,856

16.6

- Provisions for NPAs

6,474

1,844

251.1

1,150

463.0

3,997

2,968

34.7

- Provisions for Standard adv.

(373)

(79)

369.7

141

(364.5)

548

535

2.4

- Provisions for Investments

30

112

(73.2)

(50)

(159.8)

(149)

199

(175.2)

- Other Provisions

34

15

119.3

22

55.5

(51)

353

(114.4)

PBT

(4,460)

445

(1,101.6)

1,077

(514.2)

5,421

5,497

(1.4)

Provision for Tax

(1,118)

321

(448.6)

743

(250.6)

2,022

956

111.5

PAT

(3,342)

124

(2,784.6)

334

(1,100.7)

3,398

4,541

(25.2)

Effective Tax Rate (%)

25.1

72.0

(4697)bp

69.0

(4391)bp

37.3

17.4

1991bp

Source: Company, Angel Research

March 3, 2016

2

Bank of Baroda | 3QFY2016 Result Update

Exhibit 2: 3QFY2016 performance analysis (Standalone)

Particulars

3QFY16 2QFY16 % chg (qoq) 3QFY15 % chg (yoy)

Balance sheet

Advances (` cr)

3,84,272

4,14,900

(7.4)

3,93,631

(2.4)

Deposits (` cr)

5,89,687

6,12,458

(3.7)

5,64,600

4.4

Credit-to-Deposit Ratio (%)

65.2

67.7

(258)bp

69.7

(455)bp

Current deposits (` cr)

31,463

42,532

(26.0)

46,297

(32.0)

Saving deposits (` cr)

1,10,060

1,11,582

(1.4)

1,02,844

7.0

CASA deposits (` cr)

1,41,523

1,54,114

(8.2)

1,49,141

(5.1)

Global CASA ratio (%)

24.0

25.2

(116)bp

26.4

(242)bp

Domestic CASA ratio (%)

30.0

32.0

(198)bp

32.4

(245)bp

CAR (%)*

13.0

12.5

44bp

12.4

53bp

Tier 1 CAR (%)*

9.9

9.4

48bp

9.1

80bp

Profitability Ratios (%)

Dom. Cost of deposits

6.8

6.9

(14)bp

7.1

(35)bp

Dom. Yield on advances

9.6

10.4

(87)bp

11.0

(144)bp

Dom. Yield on investments

7.5

7.8

(25)bp

8.1

(62)bp

Dom. Reported NIM

2.1

2.7

(58)bp

2.9

(81)bp

Cost-to-income ratio

55.4

46.7

862bp

46.6

881bp

Asset quality

Gross NPAs (` cr)

38,934

23,710

64.2

15,453

152.0

Gross NPAs (%)

9.7

5.6

412bp

3.9

583bp

Net NPAs (` cr)

21,806

12,798

70.4

8,291

163.0

Net NPAs (%)

5.7

3.1

259bp

2.1

356bp

PCR incl. tech. w/offs (%)

52.7

58.2

(553)bp

62.4

(967)bp

Annualized slippage ratio (%)

14.8

6.5

824bp

3.1

1164bp

NPA prov. to avg. assets (%)

3.7

1.1

266bp

0.7

302bp

Source: Company, Angel Research * Basel III not comparable

Substantial rise in provisions and decline in loan book resulted in

loss at the net level

During the quarter, the loan book declined by 2.4% yoy, while deposits grew by

4.4% yoy. CASA deposits declined by 5.1% yoy and as a result the CASA ratio

declined to 24% vs 26.4% in 3QFY2015. Global NIM dipped by 66bp qoq, largely

due to high reversal of interest owing to NPA recognition. The NII declined by

17.7% yoy due to decline in loan book and large reversal of interest. Provisions

went up 2.5x qoq and hence the bank reported a huge loss of `3,342cr compared

to a PAT of `334cr in 3QFY2015 and of `124.5cr in the sequential previous

quarter. However, as the bank has now recognized a large part of the troubled

accounts and taken provisions accordingly, we expect the profitability to improve

from 4QFY2016 onwards.

March 3, 2016

3

Bank of Baroda | 3QFY2016 Result Update

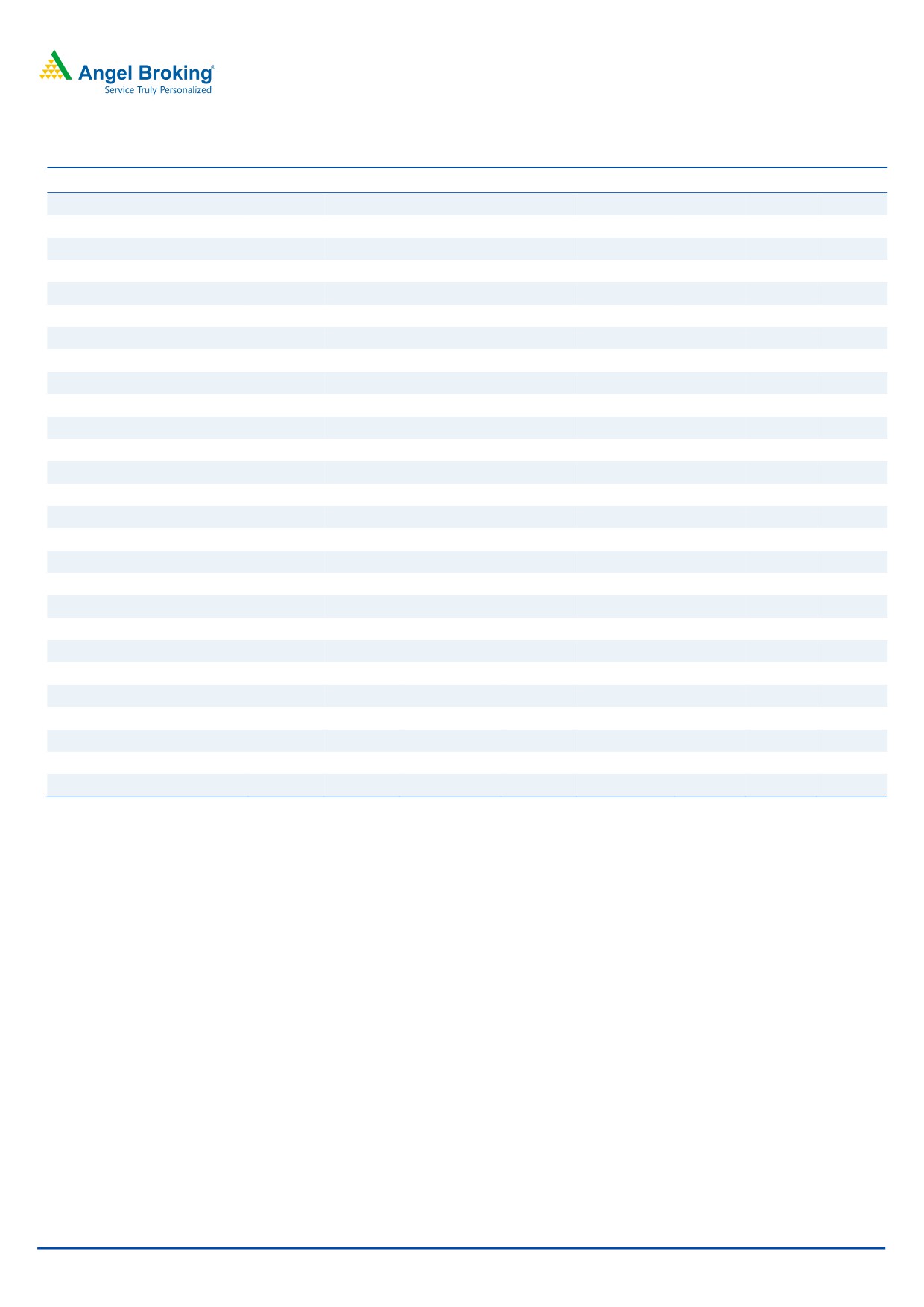

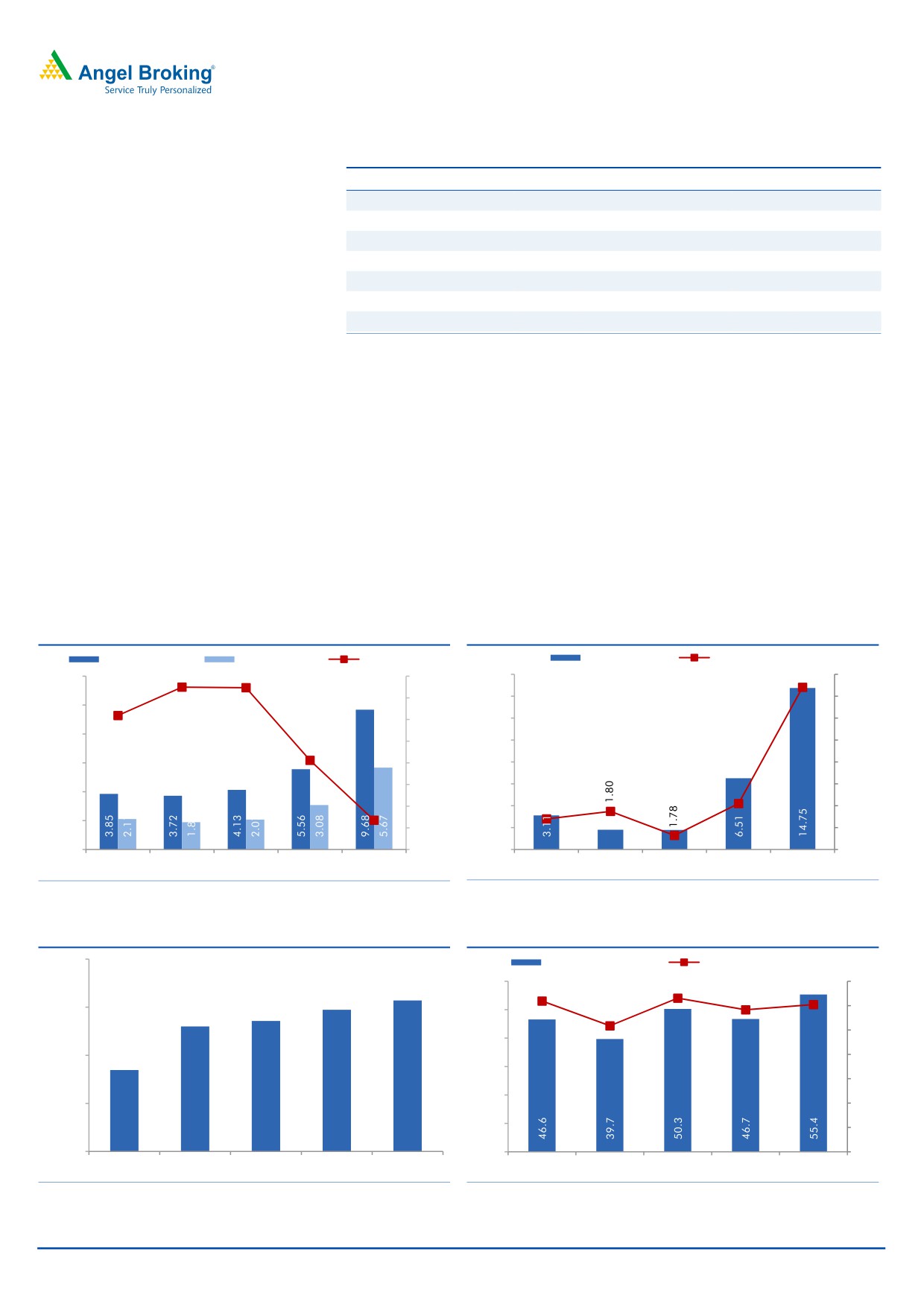

Exhibit 3: Advances decline

Exhibit 4: Domestic CASA ratio tumbles qoq

Adv. yoy chg (%)

Dep. yoy chg (%)

CDR (%, RHS)

Domestic CASA ratio

CASA yoy growth (%, RHS)

34.00

13.6

15.0

14.0

71.0

12.7

12.9

69.7

11.9

12.0

69.3

70.0

68.9

33.00

12.0

10.0

69.0

67.7

32.00

9.0

8.0

68.0

6.0

67.0

31.00

6.0

4.0

65.2

66.0

30.00

3.0

2.0

65.0

29.00

(0.2)

-

-

64.0

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

(2.0)

63.0

28.00

(3.0)

(4.0)

62.0

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research

Source: Company, Angel Research

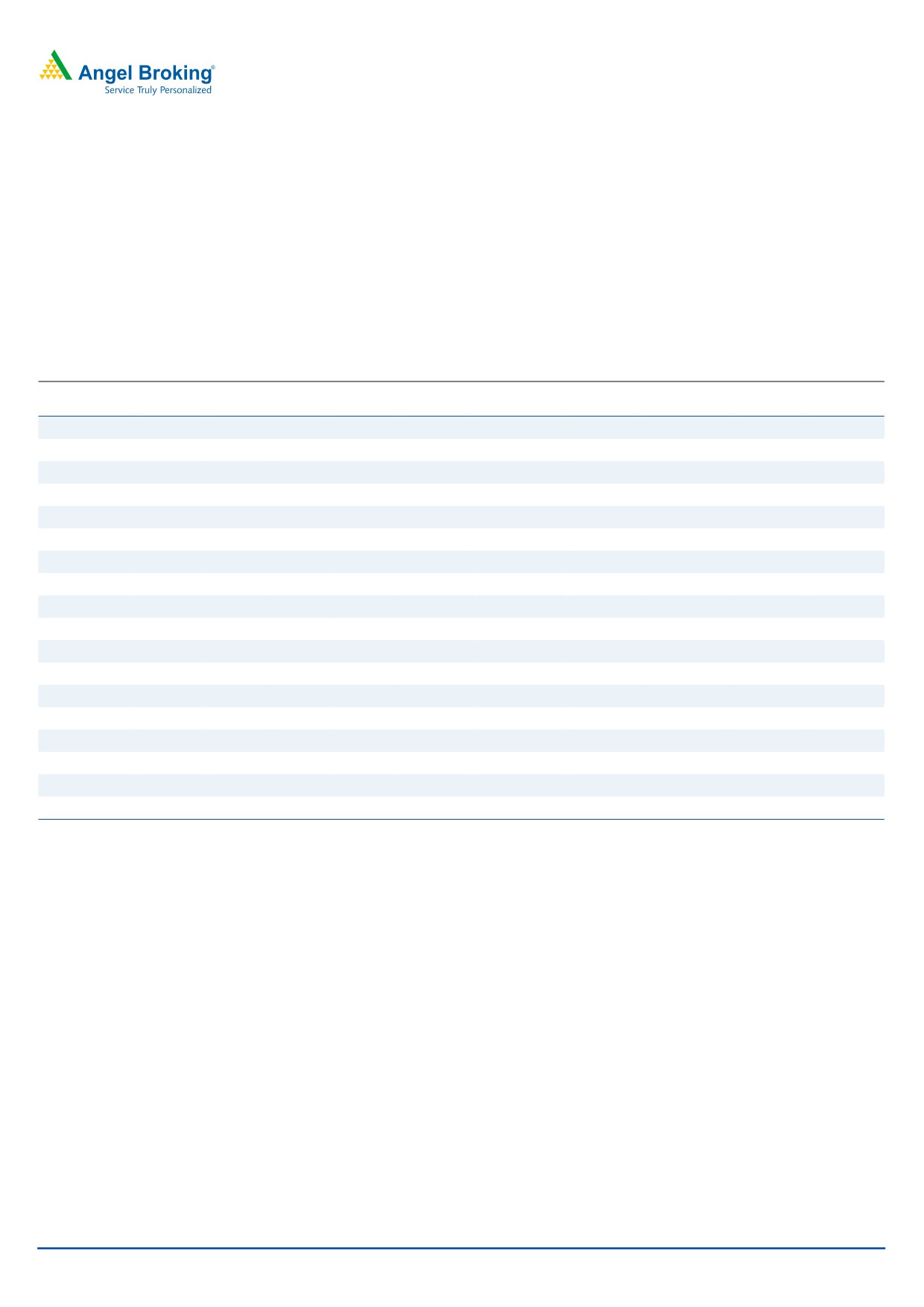

NIM dips qoq as well as yoy

During the quarter, global NIM dipped by 36bp qoq, domestic NIM declined by

58bp qoq, while the international NIM rose by 2bp qoq. The NIM dip was led by

an 87bp yoy fall in yield on earning assets as well as elevated slippages. In

addition, a reduction in the bank’s base rate during the beginning of the quarter

also levied pressure on the global and domestic NIM of the bank.

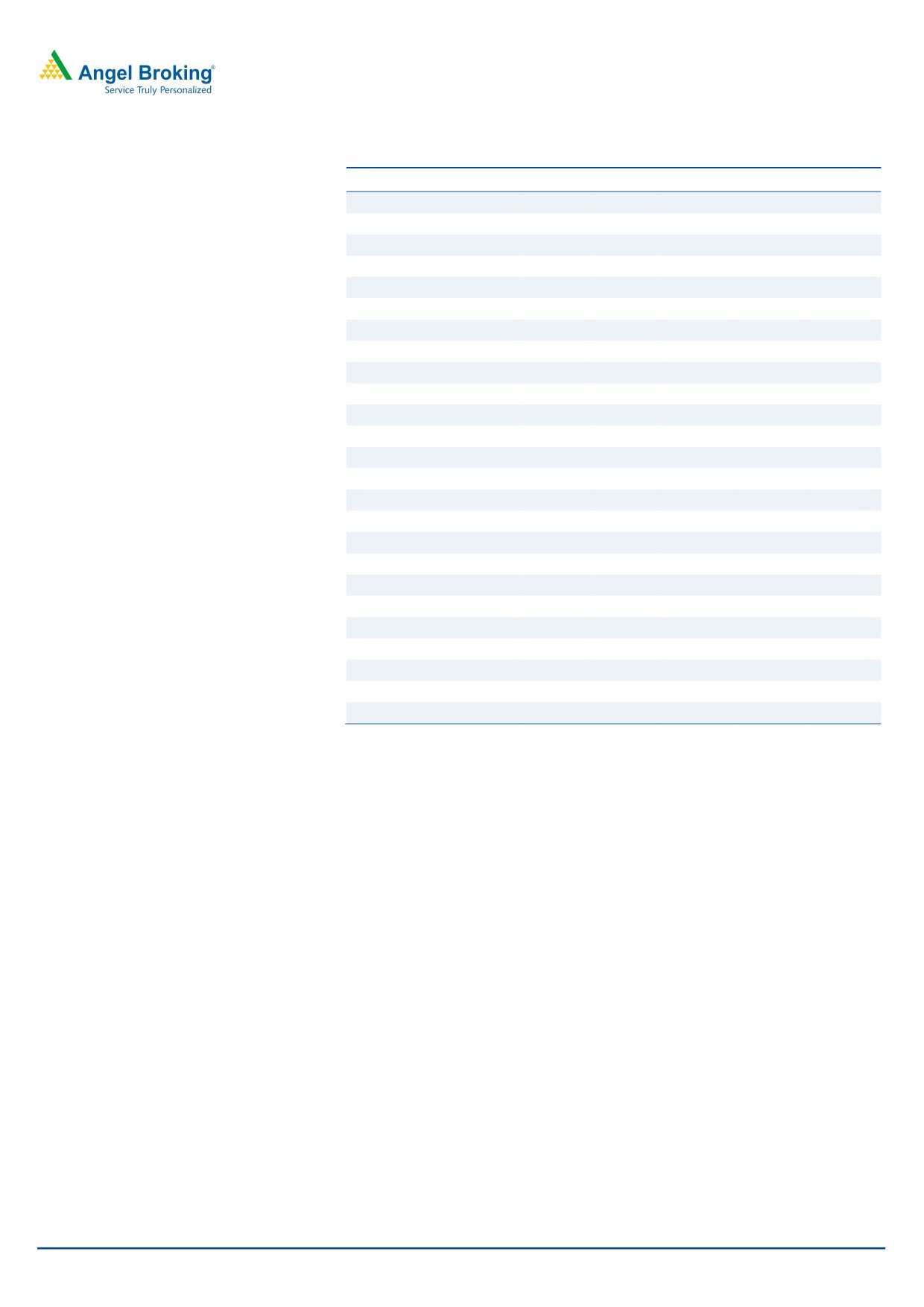

Exhibit 5: Yield on advances decline qoq...

Exhibit 6: ...causing Domestic NIM to drop by 58bp qoq

(%)

Yield on advances

(%)

Reported NIM - Domestic

3.50

12.5

2.92

2.89

3.00

2.76

2.69

11.5

2.50

11.01

2.11

10.56

10.64

2.00

10.44

10.5

1.50

9.57

1.00

9.5

0.50

8.5

0.00

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research

Source: Company, Angel Research

Subdued non-interest income

During 3QFY2016, the bank’s non-interest income (excluding treasury) de-grew by

2.8% yoy led by decline in fee income and recoveries. However, treasury income

partially supported the overall fee income.

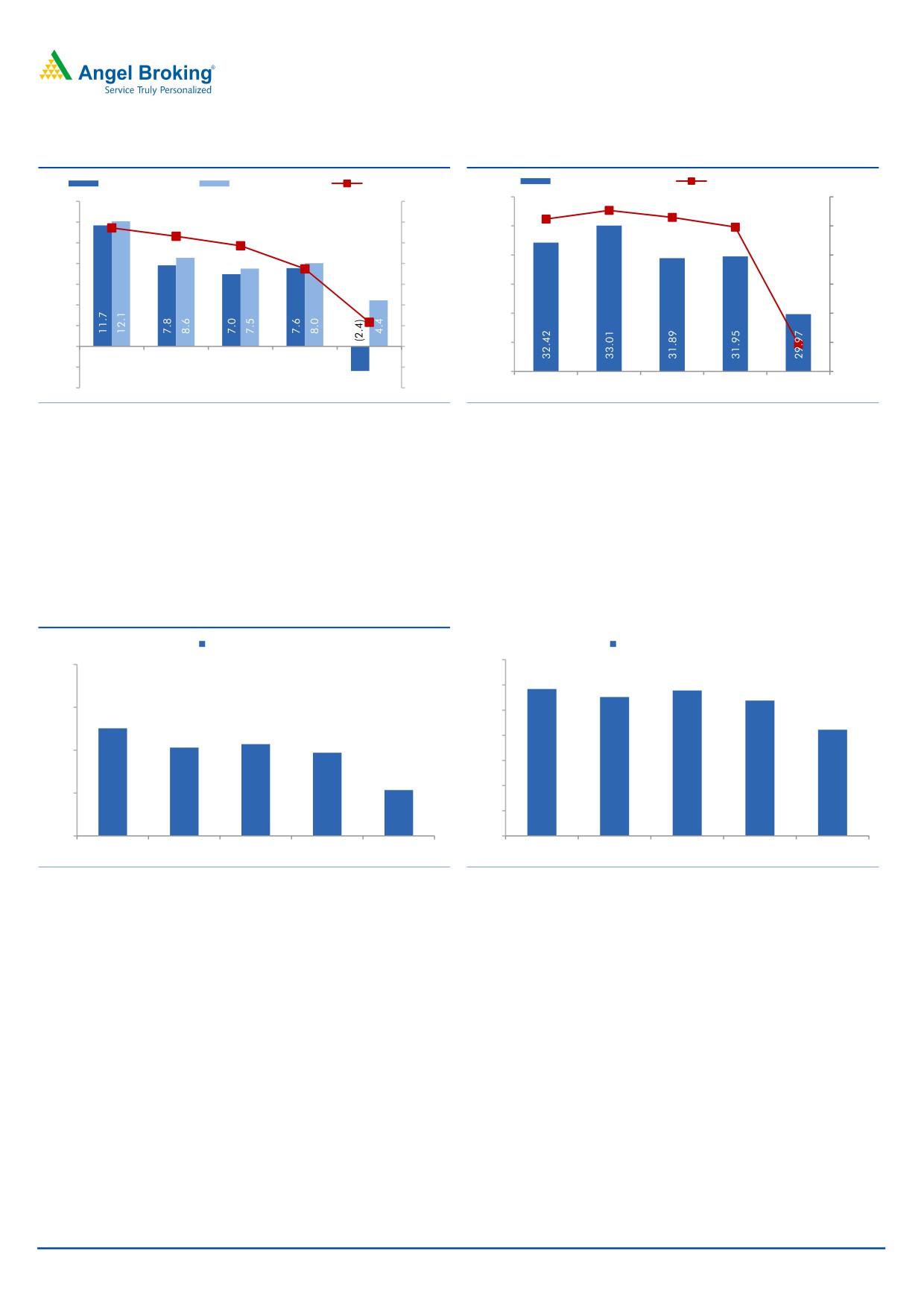

Moderate growth in operating expenses

Operating expenses grew by 3.8% yoy led by a rise of 3.1% yoy in employee

expenses as well as a 4.5% yoy rise in other expenses. The bank opened 65 new

branches during the quarter, taking the total number of branches to 5,271. The

Cost to income ratio stood at 55.4% for the quarter as against 46.6% in

3QFY2015.

March 3, 2016

4

Bank of Baroda | 3QFY2016 Result Update

Exhibit 7: Other income growth led by higher treasury gains

Particulars (` cr)

3QFY16

2QFY16

% chg (qoq) 3QFY15

% chg (yoy)

CEB

339

361

(6.2)

373

(9.2)

Treasury

289

224

28.9

244

18.6

Forex

241

253

(4.6)

253

(4.7)

Recoveries

24

79

(69.7)

36

(33.5)

Others

219

227

(3.4)

185

18.7

Other income

1,112

1,144

(2.8)

1,090

2.0

Other income excl. treasury

823

920

(10.5)

847

(2.8)

Source: Company, Angel Research

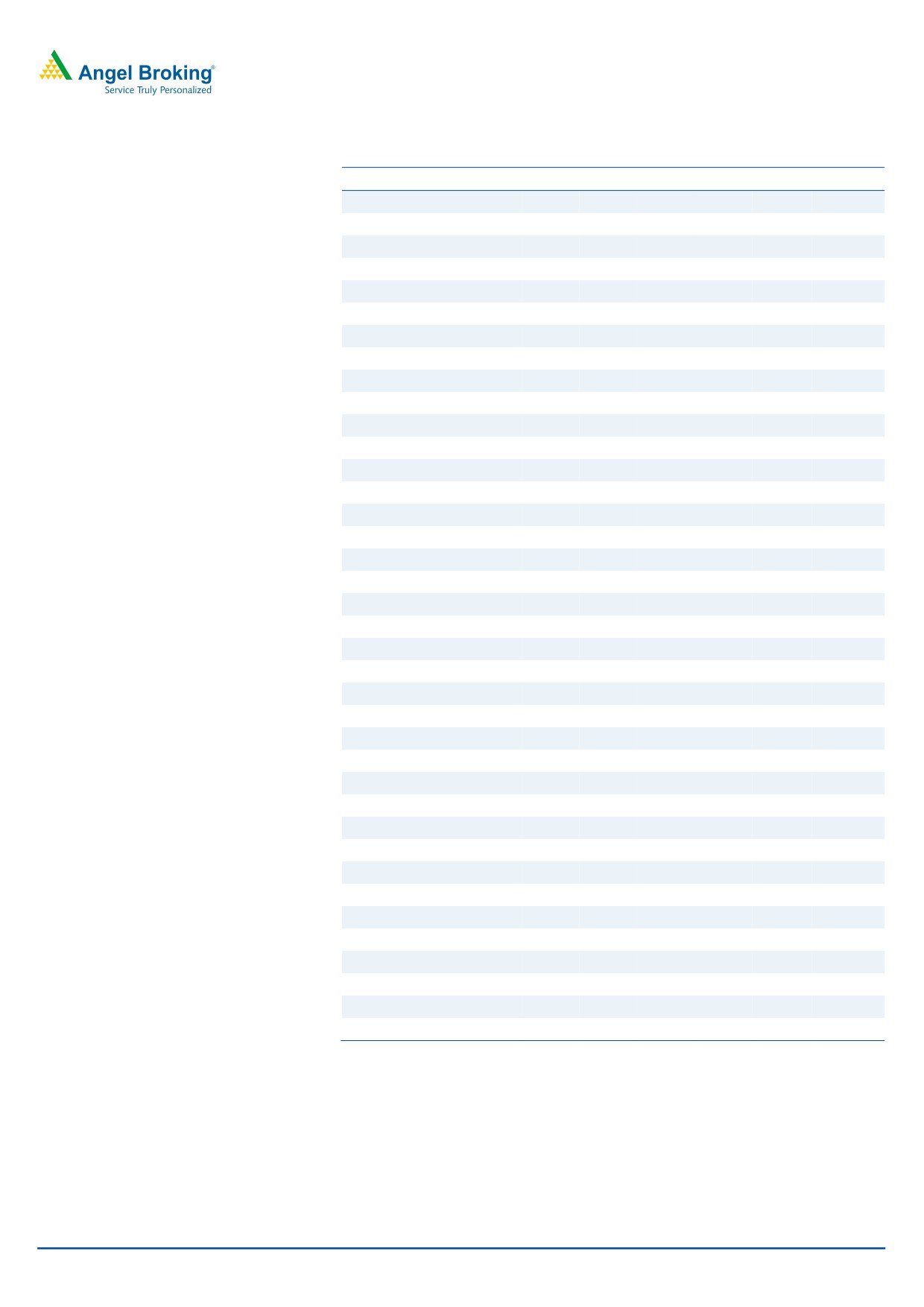

Early recognition of stressed assets gives better clarity

BoB is the only bank in the PSU space which has recognized all the AQR related

accounts as NPAs. Further it also has recognized certain stressed accounts as NPA

during the quarter; as a result the gross slippages went up substantially to

`15,785cr. However, this gives better clarity on the asset quality of the bank. The

Management doesn’t expect much pain in terms of asset quality, going ahead. The

Gross NPA ratio went up substantially to 9.68% from 5.56% in 2QFY2016 (up

412bp qoq), while the Net NPA ratio stood at 5.67% vs 3.08% in 2QFY2016. BoB

has recognized a majority of its 5:25 and SDR accounts as NPAs; hence, most of

the pain in terms of asset quality now seems to be through for the bank.

Exhibit 8: NPA ratios rises sharply

Exhibit 9: Slippages elevated at 14.8%

Gross NPAs (%)

Net NPAs (%)

PCR (%, RHS)

Slippages (%)

Credit cost (%, RHS)

12.00

65.0

66.0

16.00

3.70

4.00

64.9

62.4

64.0

14.00

3.50

10.00

62.0

12.00

3.00

8.00

60.0

10.00

2.50

58.2

6.00

58.0

8.00

2.00

56.0

6.00

1.50

4.00

52.7

0.70

1.05

54.0

4.00

1.00

2.00

52.0

2.00

0.87

0.50

0.32

-

50.0

-

-

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research

Source: Company, Angel Research

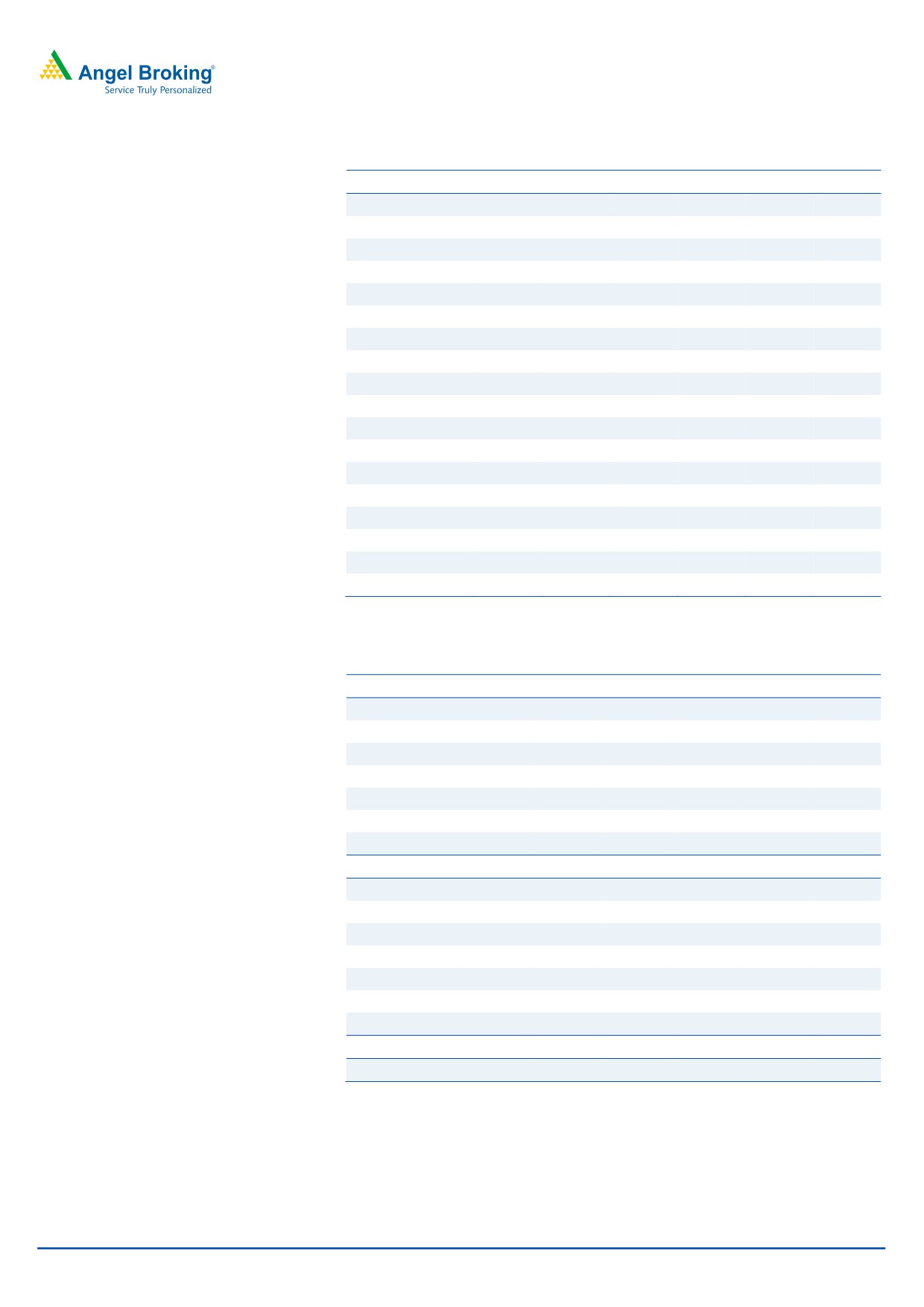

Exhibit 10: Moderate pace of Branch expansion

Exhibit 11: Cost to income ratio rises sequentially

5,400

Cost-to-income ratio (%)

Opex to average assets (%, RHS)

60.0

1.2

1.3

1.4

5,271

1.2

1.2

5,242

5,250

5,207

50.0

1.0

1.2

5,190

1.0

40.0

5,100

5,054

0.8

30.0

0.6

20.0

4,950

0.4

10.0

0.2

4,800

-

0.0

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Source: Company, Angel Research

Source: Company, Angel Research

March 3, 2016

5

Bank of Baroda | 3QFY2016 Result Update

Outlook and valuation: BoB is the only large PSU bank to have recognized all the

AQR accounts as NPA during the quarter. The Management’s intention to clean up

its balance sheet faster than others gives more clarity about the bank’s growth

prospects, going ahead. The bank is well capitalized with a CAR of 12.2% and

believes it will not need any fresh capital for the next 18-24 months. At the current

market price, the stock trades at a valuation of 0.9x FY2017E ABV. Although there

is more clarity on the bank’s asset quality now, in our view, the bank is trading at a

higher valuation multiple compared to its peers. Hence, we maintain our Neutral

view on the stock.

Exhibit 12: Recommendation summary

CMP

Tgt. Price

Upside

FY2017E

FY2017E Tgt.

FY2017E

FY15-17E EPS

FY2017E

FY2017E

Company

Reco.

(`)

(`)

(%)

P/ABV (x)

P/ABV (x)

P/E (x)

CAGR (%)

RoA (%)

RoE (%)

HDFCBk

Buy

1,008

1,262

25.2

3.0

3.8

16.5

22.4

1.9

19.7

ICICIBk*

Buy

220

254

15.2

1.5

1.3

9.0

13.5

1.6

14.7

YesBk

Neutral

754

-

-

2.0

2.0

10.8

20.5

1.6

19.6

AxisBk

Buy

407

494

21.3

1.6

2.0

9.4

18.4

1.8

18.9

SBI*

Neutral

181

-

-

1.0

0.7

8.7

8.3

0.6

11.2

FedBk

Neutral

50

-

-

0.9

0.9

9.0

(2.9)

0.9

10.8

SIB

Neutral

17

-

-

0.6

0.6

5.3

21.6

0.7

11.6

BOB

Neutral

145

-

-

0.9

0.9

11.2

(7.9)

0.4

7.3

PNB

Neutral

79

-

-

0.5

0.5

3.6

14.4

0.6

10.0

BOI

Neutral

93

-

-

0.2

0.8

2.8

14.0

0.3

7.6

IndBk

Neutral

84

-

-

0.2

0.2

2.8

19.4

0.6

8.6

Vijaya Bank

Neutral

33

-

-

0.4

0.4

4.9

14.1

0.4

8.8

OBC

Neutral

85

-

-

0.2

0.3

1.9

65.5

0.5

9.4

Allahabad BankNeutral

49

-

-

0.2

0.2

1.8

56.2

0.6

11.9

UnionBk

Neutral

121

-

-

0.4

0.3

3.1

18.1

0.6

11.4

CanBk

Neutral

177

-

-

0.3

0.2

2.5

12.0

0.6

11.2

IDBI#

Neutral

64

-

-

0.4

0.5

4.5

61.6

0.6

9.3

DenaBk

Neutral

27

-

-

0.2

0.3

2.7

45.6

0.4

7.9

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), #Without adjusting for SASF

Company Background

Bank of Baroda (BoB) is the second-largest public sector bank in India with a

balance sheet size of ~`7.0lakh cr. The bank has a network of 5,271 domestic

branches and more than 8,600 ATMs, mainly in western India (accounts for ~40%

of total branch network). The bank has a strong presence overseas, with more than

32% of its advances coming from overseas branches.

March 3, 2016

6

Bank of Baroda | 3QFY2016 Result Update

Income statement (Standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

NII

10,317

11,315

11,965

13,187

14,260

16,102

- YoY Growth (%)

17.2

9.7

5.7

10.2

8.1

12.9

Other Income

3,422

3,631

4,463

4,402

4,542

4,986

- YoY Growth (%)

21.8

6.1

22.9

(1.4)

3.2

9.8

Operating Income

13,739

14,946

16,428

17,589

18,802

21,088

- YoY Growth (%)

18.3

8.8

9.9

7.1

6.9

12.2

Operating Expenses

5,159

5,947

7,137

7,674

8,399

9,029

- YoY Growth (%)

11.4

15.3

20.0

7.5

9.4

7.5

Pre - Provision Profit

8,581

8,999

9,291

9,915

10,403

12,059

- YoY Growth (%)

22.9

4.9

3.2

6.7

4.9

15.9

Prov. & Cont.

2,555

4,168

3,794

4,495

12,897

7,646

- YoY Growth (%)

91.9

63.1

(9.0)

18.5

186.9

(40.7)

Profit Before Tax

6,026

4,831

5,497

5,421

(2,494)

4,413

- YoY Growth (%)

6.6

(19.8)

13.8

(1.4)

(146.0)

(277.0)

Prov. for Taxation

1,019

351

956

2,022

(863)

1,527

- as a % of PBT

16.9

7.3

17.4

37.3

34.6

34.6

PAT

5,007

4,481

4,541

3,398

(1,631)

2,886

- YoY Growth (%)

18.0

(10.5)

1.3

(25.2)

(148.0)

(277.0)

Balance sheet (Standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Share Capital

412

423

431

444

444

444

Reserves & Surplus

27,064

31,547

35,555

39,391

37,760

40,114

Deposits

3,84,871

4,73,883

5,68,894

6,17,560

6,17,560

6,91,667

- Growth (%)

26.0

23.1

20.0

8.6

-

12.0

Borrowings

14,171

17,178

25,411

23,709

23,702

26,454

Tier 2 Capital

9,402

9,402

11,402

11,555

11,266

10,984

Other Liab & Prov.

11,400

14,703

17,812

22,330

24,037

28,107

Total Liabilities

4,47,322

5,47,135

6,59,505

7,14,989

7,14,768

7,97,770

Cash balances

21,651

13,452

18,629

22,489

30,878

34,583

Bank balances

42,517

71,947

1,12,249

1,25,865

1,03,641

1,03,710

Investments

83,209

1,21,394

1,16,113

1,22,320

1,44,585

1,71,690

Advances

2,87,377

3,28,186

3,97,006

4,28,065

4,19,504

4,69,844

- Growth (%)

25.7

14.2

21.0

7.8

(2.0)

12.0

Fixed Assets

2,342

2,453

2,734

2,875

2,788

3,018

Other Assets

10,225

9,704

12,774

13,376

13,372

14,924

Total Assets

4,47,322

5,47,135

6,59,505

7,14,989

7,14,768

7,97,770

- Growth (%)

24.8

22.3

20.5

8.4

(0.0)

11.6

March 3, 2016

7

Bank of Baroda | 3QFY2016 Result Update

Ratio analysis (Standalone)

Y/E March

FY12

FY13

FY14

FY15

FY16E

FY17E

Profitability ratios (%)

NIMs

2.6

2.3

2.0

2.0

2.0

2.2

Cost to Income Ratio

37.5

39.8

43.4

43.6

44.7

42.8

RoA

1.2

0.9

0.8

0.5

(0.2)

0.4

RoE

20.6

15.1

13.4

9.0

(4.2)

7.3

B/S ratios (%)

CASA Ratio

26.9

25.3

25.7

26.4

29.6

30.1

Credit/Deposit Ratio

74.7

69.3

69.8

69.3

67.9

67.9

CAR

14.7

12.1

12.3

12.4

11.9

11.2

- Tier I

10.8

9.2

9.3

9.5

9.1

8.6

Asset Quality (%)

Gross NPAs

1.5

2.4

2.9

3.7

9.9

9.2

Net NPAs

0.5

1.3

1.5

1.9

5.4

3.7

Slippages

1.5

2.4

2.1

2.1

7.0

3.0

Loan Loss Prov. /Avg. Assets

0.4

0.6

0.5

0.6

1.8

1.0

Provision Coverage

80.1

68.2

65.5

62.5

53.0

65.0

Per Share Data (`)

EPS

24.3

21.2

21.1

15.3

(7.4)

13.0

ABVPS (75% cover.)

133.3

147.1

159.4

167.5

124.9

160.4

DPS

17.0

21.5

25.2

18.3

0.0

12.0

Valuation Ratios

PER (x)

6.0

6.8

6.9

9.5

(19.7)

11.2

P/ABVPS (x)

1.1

1.0

0.9

0.9

1.2

0.9

Dividend Yield

11.7

14.8

17.3

12.6

0.0

8.3

DuPont Analysis

NII

2.6

2.3

2.0

1.9

2.0

2.1

(-) Prov. Exp.

0.6

0.8

0.6

0.7

1.8

1.0

Adj. NII

1.9

1.4

1.4

1.3

0.2

1.1

Treasury

0.2

0.1

0.1

0.1

0.2

0.2

Int. Sens. Inc.

2.1

1.6

1.5

1.4

0.4

1.3

Other Inc.

0.7

0.6

0.6

0.5

0.5

0.5

Op. Inc.

2.8

2.2

2.1

1.9

0.8

1.8

Opex

1.3

1.2

1.2

1.1

1.2

1.2

PBT

1.5

1.0

0.9

0.8

(0.3)

0.6

Taxes

0.3

0.1

0.2

0.3

(0.1)

0.2

RoA

1.2

0.9

0.8

0.5

(0.2)

0.4

Leverage

16.6

16.7

17.8

18.1

18.3

19.2

RoE

20.6

15.1

13.4

9.0

(4.2)

7.3

March 3, 2016

8

Bank of Baroda | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Bank of Baroda

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

March 3, 2016

9