1QFY2017 Result Update | Cons. Durables

August 16, 2016

Bajaj Electricals

ACCUMULATE

CMP

`245

Performance highlights

Target Price

`277

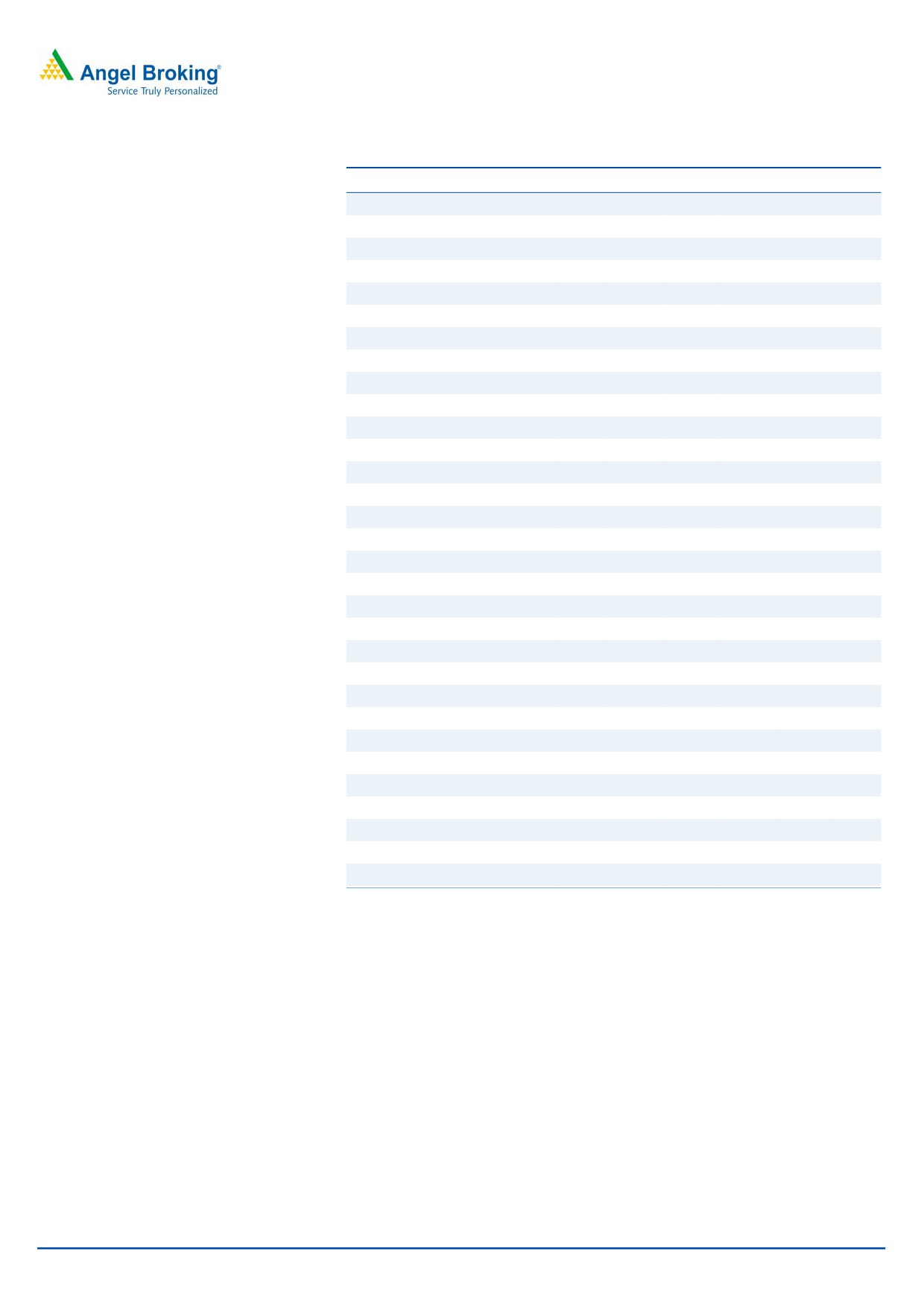

Y/E March (` cr)

1QFY17

1QFY16

% yoy

4QFY16

% qoq

Investment Period

12 months

Net sales

952

996

(4.5)

1,357

(29.9)

EBITDA

56

55

2.0

74

(24.2)

Stock Info

EBITDA Margin (%)

5.9

5.6

37

5.5

44

Sector

Consumer durables

Adjusted PAT

22

20

12.2

35

(36.3)

Market Cap (` cr)

2,566

Source: Company, Angel Research

Net Debt

93.4

For 1QFY2017, Bajaj Electricals (BEL)’ top-line and bottom-line have come in

Beta

1.0

below our estimates. The top-line growth was dampened by the poor

52 Week High / Low

280 / 155

performance of the Consumer durables and E&P segments. However, on the

Avg. Daily Volume

251,779

bottom-line front, the company reported a modest growth due to slight

Face Value (`)

2

improvement in the operating performance and lower interest cost, depreciation

BSE Sensex

28,152

cost and taxes.

Nifty

8,672

Top-line de-grew 5% yoy: The top-line de-grew by ~5% YoY to `952cr (below our

Reuters Code

BJEL.BO

estimate of `1,188cr), mainly due to de-growth of 8% YoY in the Consumer

Bloomberg Code

BJE.IN

Durables segment to `548cr and lower growth of ~1% YoY in the E&P segment to

`414cr.

Shareholding Pattern (%)

Despite revenue de-growth, PAT grew ~12%: On the operating front, the company

Promoters

63.6

reported a mild margin improvement (OPM up by 37bp YoY to 5.9%), primarily

on account of lower raw material costs during the quarter. The reported net profit

MF / Banks / Indian Fls

5.9

grew by ~12% YoY to `22cr, again underperforming our estimate of `27cr, on

FII / NRIs / OCBs

9.5

account of lower sales growth.

Indian Public / Others

21.0

Outlook and valuation: On expectation of timely execution of new projects in the

E&P segment and with the Lighting and Consumer Durables segments expected to

Abs.(%)

3m 1yr 3yr

benefit from an improvement in consumer sentiments going forward, we expect

Sensex

9.2

2.3

48.6

the company’s top-line to grow at a CAGR of ~12% to `5,805cr and bottom-line

BEL

9.3

(4.8)

58.8

to grow at a CAGR of 24% to `147cr over FY2016-FY2018E. We retain our

Accumulate rating on the stock with a revised target price of `277.

Key financials

3-Year Daily Price Chart

400

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

350

Net Sales

4,258

4,612

5,099

5,805

300

250

% chg

5.7

8.3

10.6

13.8

200

Net Profit

(14)

96

115

147

150

100

% chg

(14.0)

95.6

114.8

147.2

50

0

EBITDA Margin (%)

2.1

5.6

5.6

5.9

EPS (`)

(1.4)

9.5

11.4

14.6

P/E (x)

(177.3)

25.9

21.5

16.8

Source: Company, Angel Research

P/BV (x)

3.6

3.2

2.9

2.6

RoE (%)

6.2

12.5

13.4

15.1

RoCE (%)

10.6

23.7

23.9

26.2

Amarjeet S maurya

EV/Sales (x)

0.7

0.6

0.5

0.4

+91 22 3935 7800 Ext: 6831

EV/EBITDA (x)

19.1

9.9

8.9

7.4

Source: Company, Angel Research; Note: CMP as of August 16, 2016

Please refer to important disclosures at the end of this report

1

Bajaj Electricals | 1QFY2017 Result Update

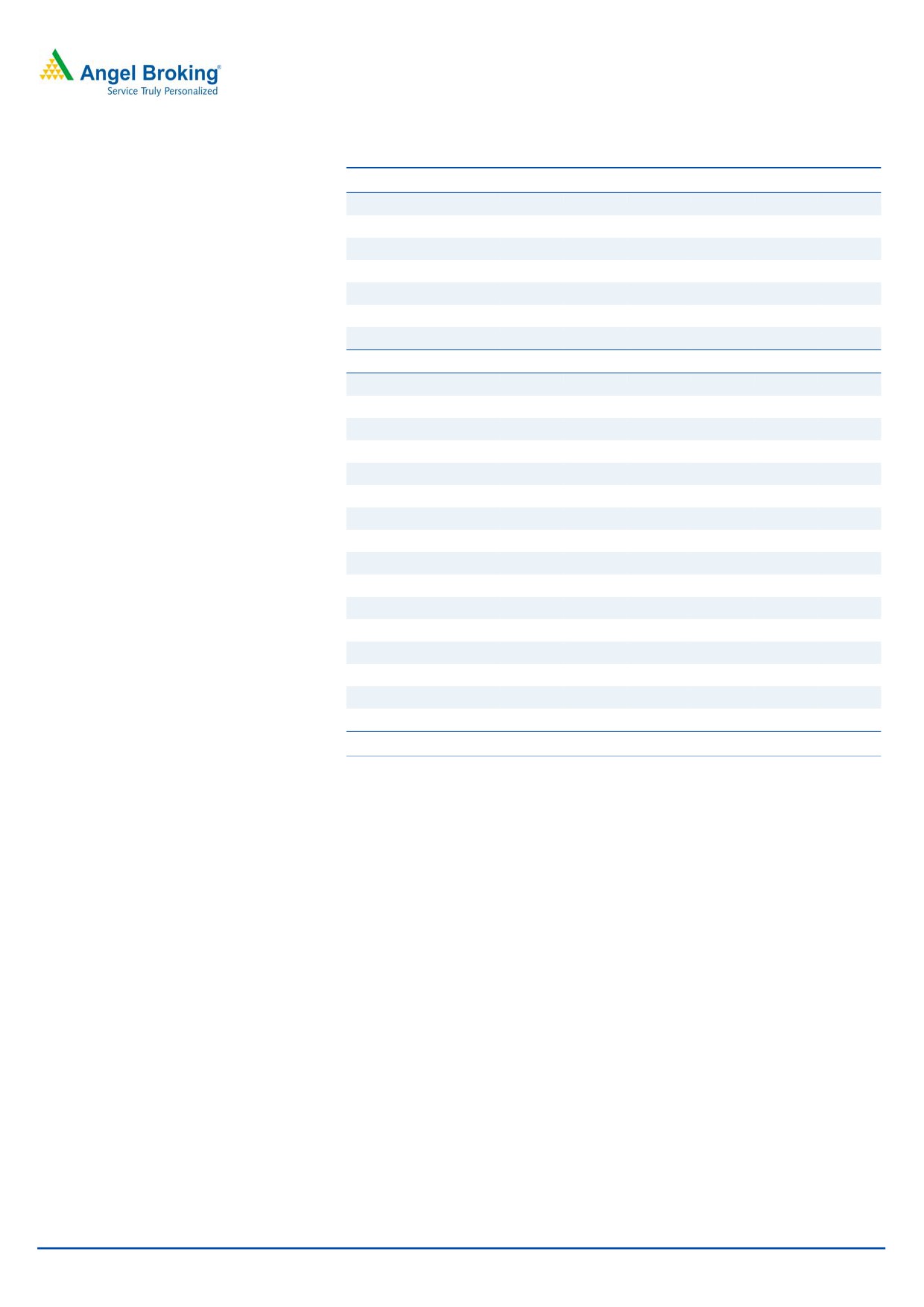

Exhibit 1: 1QFY2017 performance highlights

Y/E March (` cr)

1QFY17

1QFY16

% yoy

4QFY16

% qoq

FY2016

FY2015

% chg

Net Sales

952

996

(4.5)

1,357

(29.9)

4,612

4,263

8.2

Consumption of RM

628

716

(12.3)

829

(24.2)

3,082

3,060

0.7

(% of Sales)

66.0

71.9

61.1

66.8

71.8

Staff Costs

79

58

36.2

81

(2.5)

284

226

25.4

(% of Sales)

8.3

5.8

5.9

6.2

5.3

Other Expenses

189

167

13.1

374

(49.4)

987.16

888.34

11.1

(% of Sales)

19.8

16.8

27.5

21.4

20.8

Total Expenditure

895

941

(4.9)

1,283

(30.2)

4,353

4,174

4.3

Operating Profit

56

55

2.0

74

(24.2)

259

88

193.6

OPM

5.9

5.6

5.5

5.6

2.1

Interest

23

25

(10.3)

22

3.3

101

104

(2.9)

Depreciation

7

7

(4.7)

7

(3.2)

27

29

(6.2)

Other Income

10

12

(17.5)

8

25.7

23

24

(5.9)

PBT (excl. Ext Items)

37

35

5.6

53

(31.0)

154

(21)

(837.7)

Ext (Income)/Expense

PBT (incl. Ext Items)

37

35

5.6

53

(31.0)

154

(21)

(837.7)

(% of Sales)

3.9

3.5

3.9

3.3

(0.5)

Provision for Taxation

14

14

19

58

(7)

(944.0)

(% of PBT)

37.7

41.2

34.8

38

33

Reported PAT

23

20

11.9

35

(34.1)

96

(14)

(785.4)

PATM

2.4

2.1

2.6

2.1

(0.3)

Minority Interest After NP

Extra-ordinary Items

1

1

Reported PAT

22

20.0

12.2

35

(36.3)

96

(14)

(785.4)

Equity shares (cr)

10

10

10

10

10

FDEPS (`)

2.2

2.0

12.2

3.4

(36.3)

9.5

(1.4)

(785.4)

Source: Company, Angel Research

Exhibit 2: Segment-wise performance

Y/E Mar (` cr)

1QFY17

1QFY16

% yoy

4QFY16

% qoq

Total Revenue

A) Lighting

548

593

(7.6)

327

67.7

B) E&P

414

412

0.5

486

(14.8)

EBIT

A) Lighting

23

12

100.3

21

12.9

B) E&P

19

38

(50.1)

27

(30.2)

EBIT Margin (%)

A) Lighting

7.2

4.2

7.5

B) E&P

3.4

6.9

5.0

Source: Company, Angel Research

August 16, 2016

2

Bajaj Electricals | 1QFY2017 Result Update

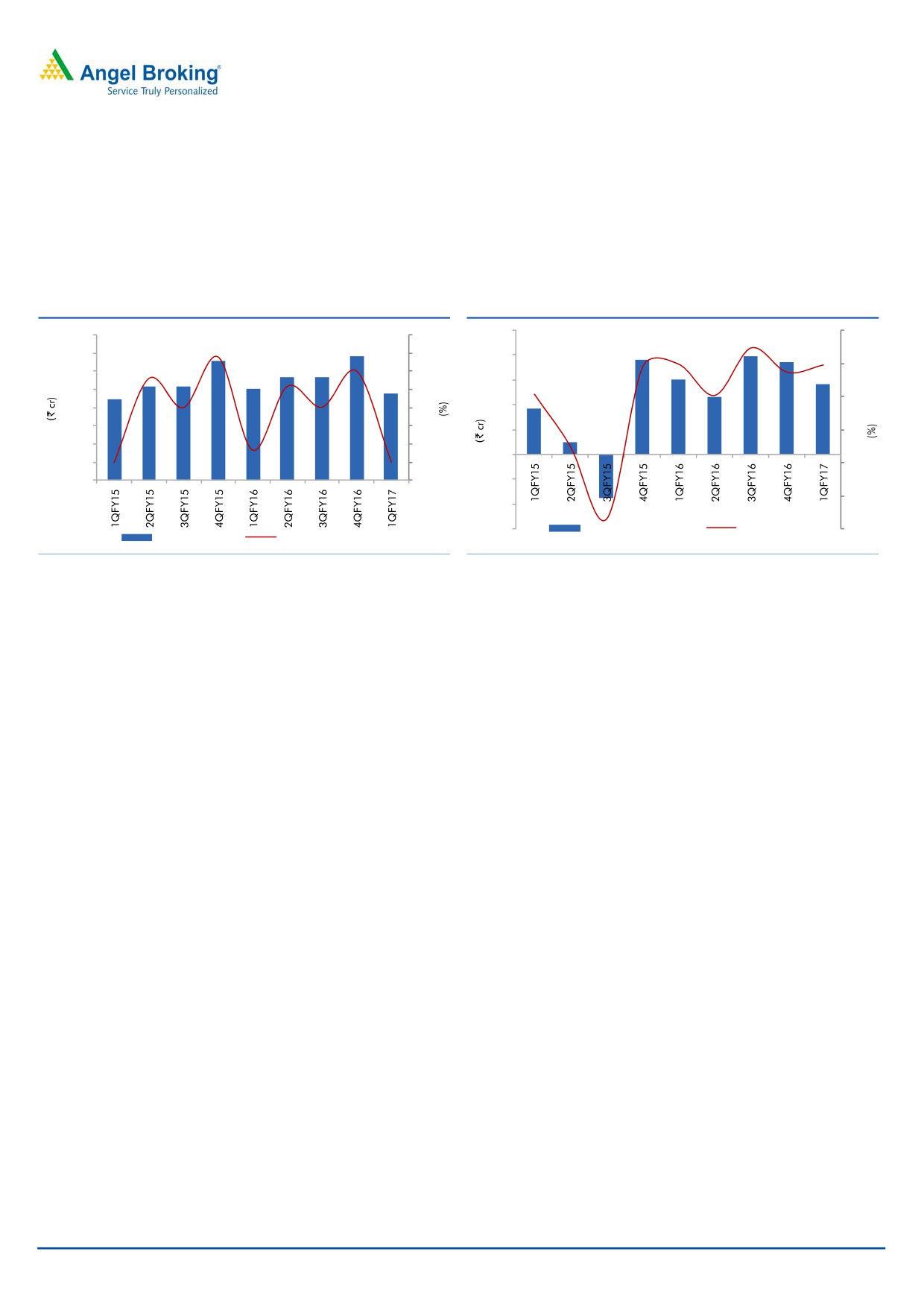

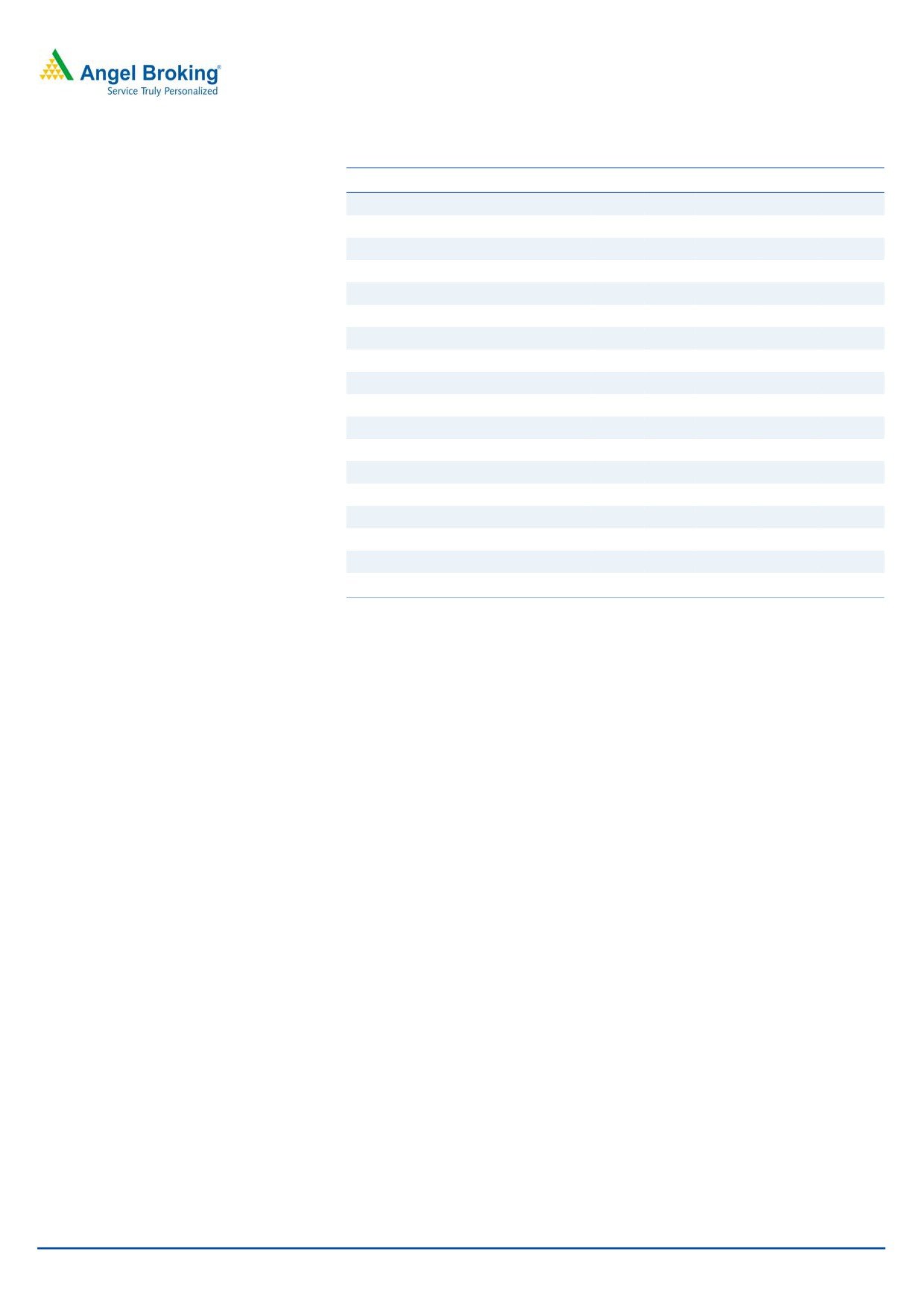

Poor performance of Consumer durables segment dragged

the overall top-line growth

The top-line de-grew by ~5% YoY to `952cr (below our estimate of `1,188cr),

mainly due to de-growth of 8% YoY in the Consumer durables segment to `548cr

and lower growth of ~1% YoY in the E&P segment to `414cr.

Exhibit 3: Historical top-line trend

Exhibit 4: Historical operating performance trend

100

8

1,600

40

1,400

30

80

6

1,200

20

60

1,000

10

4

800

0

40

600

(10)

20

2

400

(20)

0

200

(30)

0

0

(40)

(20)

(2)

(40)

(60)

Operating Profit (LHS)

Margin (RHS)

(4)

Net Sales (LHS)

qoq growth (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Despite revenue de-growth, PAT grew ~12% yoy

On the operating front, the company reported a mild margin improvement (OPM

up by 37bp YoY to 5.9%), primarily on account of lower raw material costs during

the quarter. The reported net profit grew by ~12% YoY to `22cr, underperforming

our estimate of `27cr, on account of lower sales growth

August 16, 2016

3

Bajaj Electricals | 1QFY2017 Result Update

Investment Rationale

Strong brands, leading market position and successful

implementation of replenishment strategy - the key drivers

BEL has a strong brand positioning and a well-spread distribution network in

comparison to its peers. It has collaborated with known global brands in each of

its segments which has enabled it to grow at a robust pace over the years. The

company has a leading position in consumer durables, ie in mixers, water heaters,

fans, toasters, OTG and mixers.

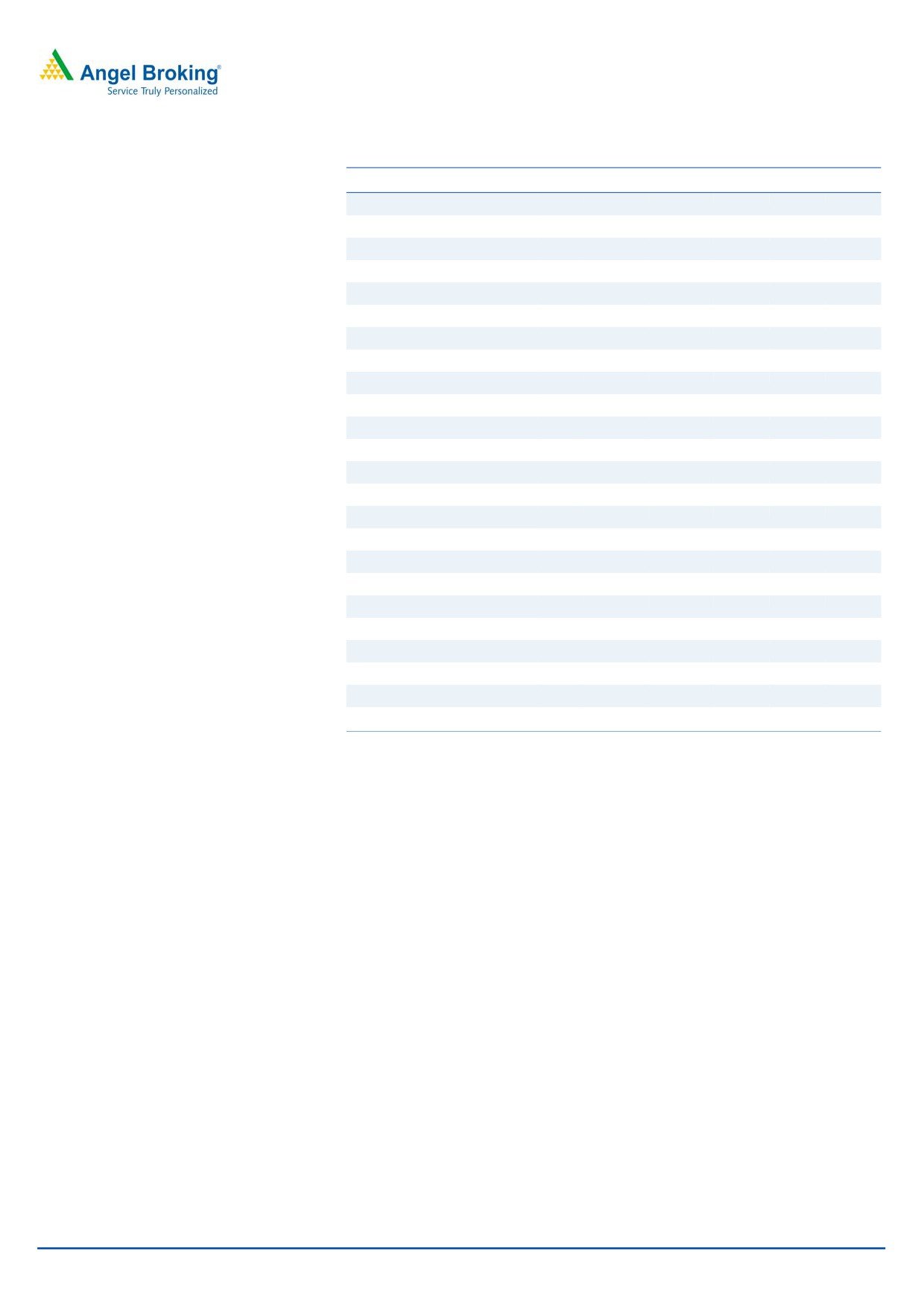

Exhibit 5: Strong brand associations

Products

Brand

Luminaries

Trilux Lenze (Germany)

Street Lights

CREE Lighting (USA), Disano (Italy)

Building management systems

Delta Controls (Canada)

LED

Rudd (US)

Appliances

Morphy Richards (UK), Nardi (Italy)

Fans

Disney (USA), Media (China)

Fire alarm system

Securiton (Switzerland)

Source: Company

BEL has revamped its product portfolio by discarding the non-performing products

and introducing new products with better quality in addition to introduction of

premium range products across categories. Though in the near term, there might

be some pressure in terms of demand due to slackness in the market, but the

outlook is positive post FY2017 as is being expected by most industry players. With

per capita income on the rise for the urban population, discretionary spends are

expected to increase, which will drive growth for the Consumer durables segment.

Its high-end products also have a growing acceptance with consistent performance

from brands like Morphy Richards.

Further, the government’s ambitious plan to build smart cities will require smart

lighting solutions and this will resultantly drive growth for the company’s Lighting

segment considering its well established position. Also, increasing focus on the LED

division would ensure that decline in CFL due to switch of consumer preference

would be addressed appropriately.

August 16, 2016

4

Bajaj Electricals | 1QFY2017 Result Update

Outlook and Valuation

On expectation of timely execution of new projects in the E&P segment and with

the Lighting and Consumer Durables segments expected to benefit from an

improvement in consumer sentiments going forward, we expect the company’s

top-line to grow at a CAGR of ~12% to `5,805cr and bottom-line to grow at a

CAGR of 24% to `147cr over FY2016-FY2018E. We retain our Accumulate rating

on the stock with a revised target price of `277.

Company Background

BEL is a diversified company with interests in Lighting, Luminaries, Appliances,

Fans, and Engineering & Projects. It has a strong network of more than 1,000

distributors and 5,000 dealers.

Key Concerns

Currency fluctuation: BEL has a substantial part of its products imported from

various associate foreign brands which pose a risk of currency fluctuation,

thereby impacting profitability.

Inflation: Inflationary pressure would resist volume pick up.

August 16, 2016

5

Bajaj Electricals | 1QFY2017 Result Update

Profit and loss statement

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Total operating income

3,377

4,030

4,258

4,612

5,099

5,805

% chg

9.0

19.3

5.7

8.3

10.6

13.8

Total Expenditure

3,223

3,884

4,113

4,353

4,811

5,462

Cost of Materials

2,655

2,959

3,082

3,082

3,466

3,958

Personnel

167

186

226

284

331

406

Others Expenses

401

739

804

987

1,014

1,098

EBITDA

154

145

146

259

288

343

% chg

(44.7)

(5.5)

0.0

78.2

11.0

19.3

(% of Net Sales)

4.6

3.6

3.4

5.6

5.6

5.9

Depreciation& Amortisation

14

25

29

27

34

37

EBIT

140

121

117

232

253

306

% chg

(47.5)

(13.5)

(3.5)

99.3

9.1

20.8

(% of Net Sales)

4.1

3.0

2.7

5.0

5.0

5.3

Interest & other Charges

69

78

105

101

105

110

Other Income

42

15

24

23

23

23

(% of PBT)

37.0

26.3

68.0

14.9

13.4

10.5

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

112

58

36

154

171

219

% chg

(48.4)

(48.6)

(38.0)

330.1

11.6

27.9

Prior Period & Extraord. Exp./(Inc.)

-

-

-

-

-

-

PBT (reported)

112

58

36

154

171

219

Tax

18

(1)

(7)

58

57

72

(% of PBT)

15.8

(1.1)

(19.2)

37.7

33.0

33.1

PAT (reported)

94

58

43

96

115

147

Add: Share of earnings of asso.

-

-

-

-

-

-

ADJ. PAT

94

58

43

96

115

147

% chg

32.9

(5.3)

(14.0)

95.6

114.8

147.2

(% of Net Sales)

2.8

1.4

1.0

2.1

2.3

2.5

Basic EPS (`)

3.3

(0.5)

(1.4)

9.5

11.4

14.6

Fully Diluted EPS (`)

3.3

(0.5)

(1.4)

9.5

11.4

14.6

% chg

(72.1)

(116.2)

162.7

(785.4)

20.1

28.2

August 16, 2016

6

Bajaj Electricals | 1QFY2017 Result Update

Balance sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

SOURCES OF FUNDS

Equity Share Capital

20

20

20

20

20

20

Reserves& Surplus

709

689

667

747

839

950

Shareholders Funds

729

709

687

767

859

970

Minority Interest

-

-

-

-

-

-

Total Loans

166

348

409

212

200

200

Deferred Tax Liability

17

16

13

13

13

13

Total Liabilities

914

1,077

1,111

992

1,072

1,183

APPLICATION OF FUNDS

Gross Block

326

372

432

472

512

552

Less: Acc. Depreciation

97

120

152

179

213

251

Net Block

229

252

280

293

299

301

Capital Work-in-Progress

6

3

3

3

3

3

Investments

30

67

59

59

59

59

Current Assets

1,887

2,341

2,441

2,333

2,447

2,661

Inventories

421

447

475

505

559

620

Sundry Debtors

938

1,235

1,290

1,365

1,509

1,654

Cash

50

54

38

59

63

68

Loans & Advances

142

137

167

55

112

87

Other Assets

336

467

471

349

204

232

Current liabilities

1,263

1,627

1,734

1,758

1,798

1,904

Net Current Assets

625

714

707

575

649

757

Deferred Tax Asset

25

42

62

62

62

62

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

914

1,077

1,111

992

1,072

1,183

August 16, 2016

7

Bajaj Electricals | 1QFY2017 Result Update

Cash Flow Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

FY18E

Profit before tax

69

(6)

(21)

154

171

220

Depreciation

14

25

29

27

34

37

Change in Working Capital

12

(130)

(42)

153

(70)

(103)

Interest / Dividend (Net)

66

73

100

101

105

110

Direct taxes paid

(40)

1

7

(58)

(57)

(72)

Others

19

31

15

-

-

-

Cash Flow from Operations

141

(7)

88

378

184

191

(Inc.)/ Dec. in Fixed Assets

14

(114)

(41)

(40)

(40)

(40)

(Inc.)/ Dec. in Investments

14

(38)

8

-

-

-

Cash Flow from Investing

(0)

(76)

(49)

(40)

(40)

(40)

Issue of Equity

1

4

13

-

-

-

Inc./(Dec.) in loans

-

-

-

(197)

(12)

-

Dividend Paid (Incl. Tax)

(28)

(20)

(15)

(15)

(23)

(37)

Interest / Dividend (Net)

(116)

106

(51)

(104)

(105)

(110)

Cash Flow from Financing

(142)

89

(53)

(316)

(140)

(147)

Inc./(Dec.) in Cash

(2)

6

(14)

21

4

5

Opening Cash balances

52

48

52

38

59

63

Closing Cash balances

50

54

38

59

63

68

August 16, 2016

8

Bajaj Electricals | 1QFY2017 Result Update

Key Ratios

Y/E March

FY13

FY14

FY15

FY16

FY17E FY18E

Valuation Ratio (x)

P/E (on FDEPS)

75.3

(465.8)

(177.3)

25.9

21.5

16.8

P/CEPS

37.7

127.2

164.0

20.1

16.6

13.4

P/BV

3.4

3.5

3.6

3.2

2.9

2.6

Dividend yield (%)

0.8

0.6

0.6

0.6

0.9

1.5

EV/Sales

0.8

0.7

0.7

0.6

0.5

0.4

EV/EBITDA

16.6

18.6

19.1

9.9

8.9

7.4

EV / Total Assets

1.2

1.0

1.0

0.9

0.9

0.8

Per Share Data (`)

EPS (Basic)

3.3

(0.5)

(1.4)

9.5

11.4

14.6

EPS (fully diluted)

3.3

(0.5)

(1.4)

9.5

11.4

14.6

Cash EPS

6.5

1.9

1.5

12.2

14.8

18.3

DPS

2.0

1.5

1.5

1.5

2.3

3.6

Book Value

72.2

70.2

68.1

76.0

85.1

96.1

Returns (%)

ROCE

15.6

11.4

10.6

23.7

23.9

26.2

Angel ROIC (Pre-tax)

17.1

12.9

11.7

27.0

27.0

29.4

ROE

12.9

8.2

6.2

12.5

13.4

15.1

Turnover ratios (x)

Asset Turnover (Gross Block)

10.4

10.8

9.9

9.8

10.0

10.5

Inventory / Sales (days)

46

40

41

40

40

39

Receivables (days)

101

112

111

108

108

104

Payables (days)

49

50

49

50

51

52

WC cycle (ex-cash) (days)

98

103

102

98

97

91

August 16, 2016

9

Bajaj Electricals | 1QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Bajaj Electricals

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

August 16, 2016

10