2QFY2016 Result Update | Capital Goods

November 13, 2015

Bharat Earth Movers (BEML)

NEUTRAL

CMP

`1,093

Performance Highlights

Target Price

-

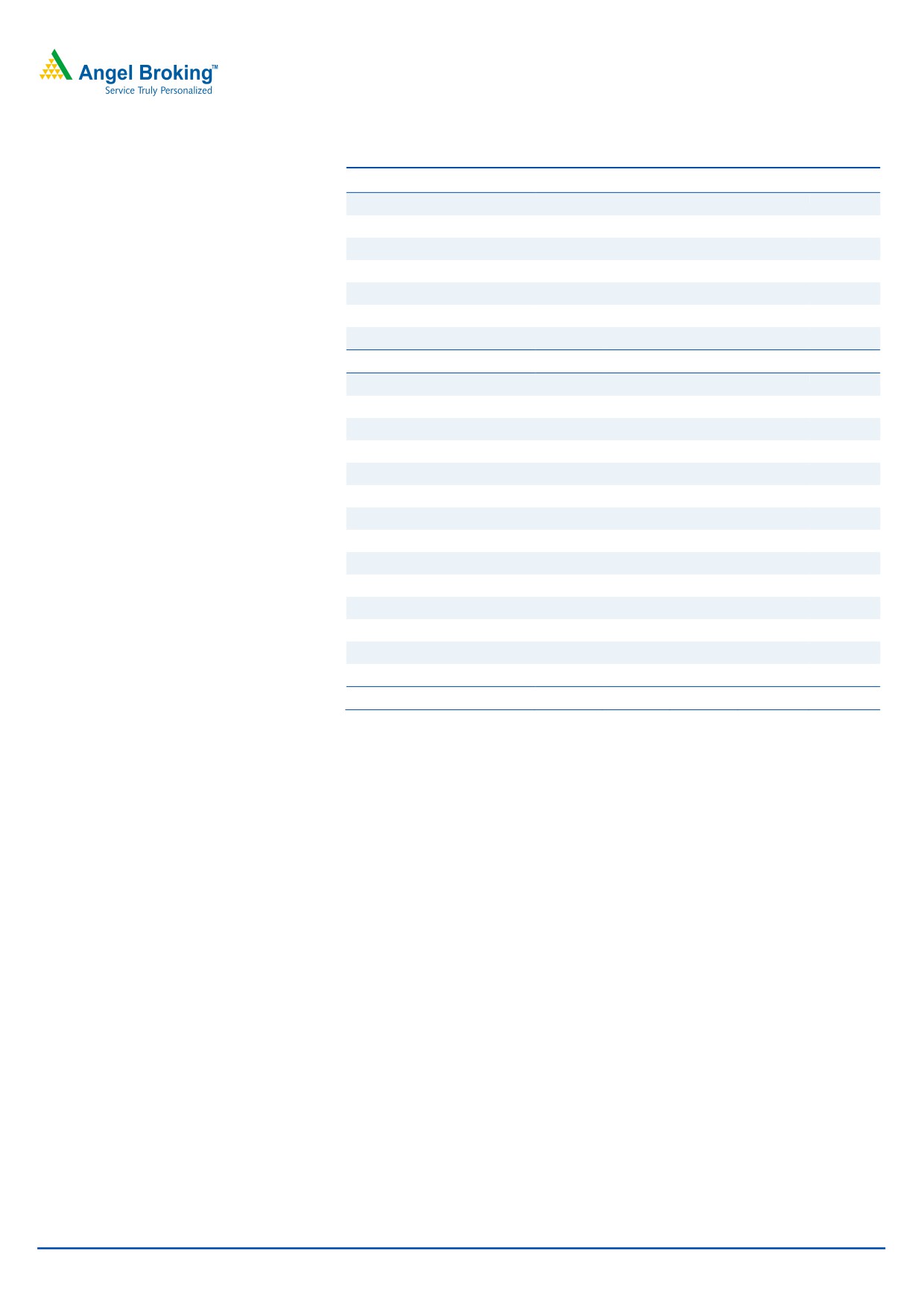

Quarterly highlights - Standalone

Investment Period

-

Y/E March (` cr)

2QFY16 1QFY16 2QFY15

% chg (yoy)

% chg (qoq)

Stock Info

Net sales

621

590

451

37.7

5.2

Sector

Capital Goods

EBITDA

(13)

(57)

(31)

nmf

nmf

Market Cap (` cr)

4,553

Reported PAT

(30)

(75)

(55)

nmf

nmf

Net debt (` cr)

448

Source: Company, Angel Research; Note: nmf- Not meaningful

Beta

1.1

BEML reported standalone sales of `621cr for 2QFY2016, up 37.7% yoy (ahead

52 Week High / Low

1,609/640

of our expectation of `599cr). At the EBITDA level, the company reported losses

Avg. Daily Volume

27,674

of `13cr, in-line with our expectation. The impact of losses at EBITDA level was

Face Value (`)

10

seen at the PAT level too, as the company reported a net loss of `30cr, against

BSE Sensex

25,611

our loss expectation of `12cr. Notably, the quantum of loss has narrowed down

Nifty

7,762

on a yoy basis.

Reuters Code

BEML.BO

BEML’s order book as of 2QFY2016 stands at ~`6,376cr, which gives revenue

Bloomberg Code

BEML@IN

visibility for over the next few quarters.

Valuation: During the quarter, BEML impressed us by reporting strong execution,

Shareholding Pattern (%)

mainly seen across the Construction & Mining Equipments segment. Also, BEML

Promoters

54.0

has reported a `1,771cr of order inflows, across all the 3 business segments.

MF / Banks / Indian Fls

17.8

Reported order inflows, emerging bid pipeline, indicate us that BEML should end

FII / NRIs / OCBs

7.4

FY2016E with strong order inflows of `2,900cr. A strong awarding environment

Indian Public / Others

20.8

should lead to improvement in the execution. Accordingly, we expect BEML to

report a

19.4% top-line CAGR during FY2015-17E. At the back-drop of

Abs. (%)

3m 1yr 3yr

improved execution and better absorption of fixed costs, we expect BEML to

Sensex

(1.0)

(8.7)

38.6

report a strong 529.2% PAT CAGR during FY2015-17E.

BEML

(7.3)

50.2

292.7

On the whole, we are optimistic that the company would report strong earnings

going forward, given the improving award activity environment across all

3

business segments, BEML has a strong market positioning. We continue to

3-Year Daily Price Chart

maintain our NEUTRAL rating on the stock.

2,000

1,500

Key financials (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

1,000

Net Sales

2,809

2,912

2,809

3,404

4,006

500

% chg

3.0

3.7

(3.5)

21.2

17.7

0

Net Profit

(80)

5

7

151

268

% chg

NA

NA

44.8

2128.7

77.7

EBITDA (%)

(1.6)

3.9

2.5

6.8

8.9

Source: Company, Angel Research

EPS (`)

(19.2)

1.1

1.6

36.2

64.3

P/E (x)

nmf

nmf

nmf

30.2

17.0

P/BV (x)

2.2

2.2

2.2

2.1

1.9

RoE (%)

(4.3)

0.4

0.3

7.0

11.6

RoCE (%)

(2.8)

1.8

0.6

6.2

10.1

Yellapu Santosh

EV/Sales (x)

2.1

1.9

1.8

1.4

1.2

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

nmf

48.1

71.5

21.0

12.9

Source: Company, Angel Research; Note: nmf- Not Meaningful; CMP as of November 13, 2015

Please refer to important disclosures at the end of this report

1

BEML | 2QFY2016 Result Update

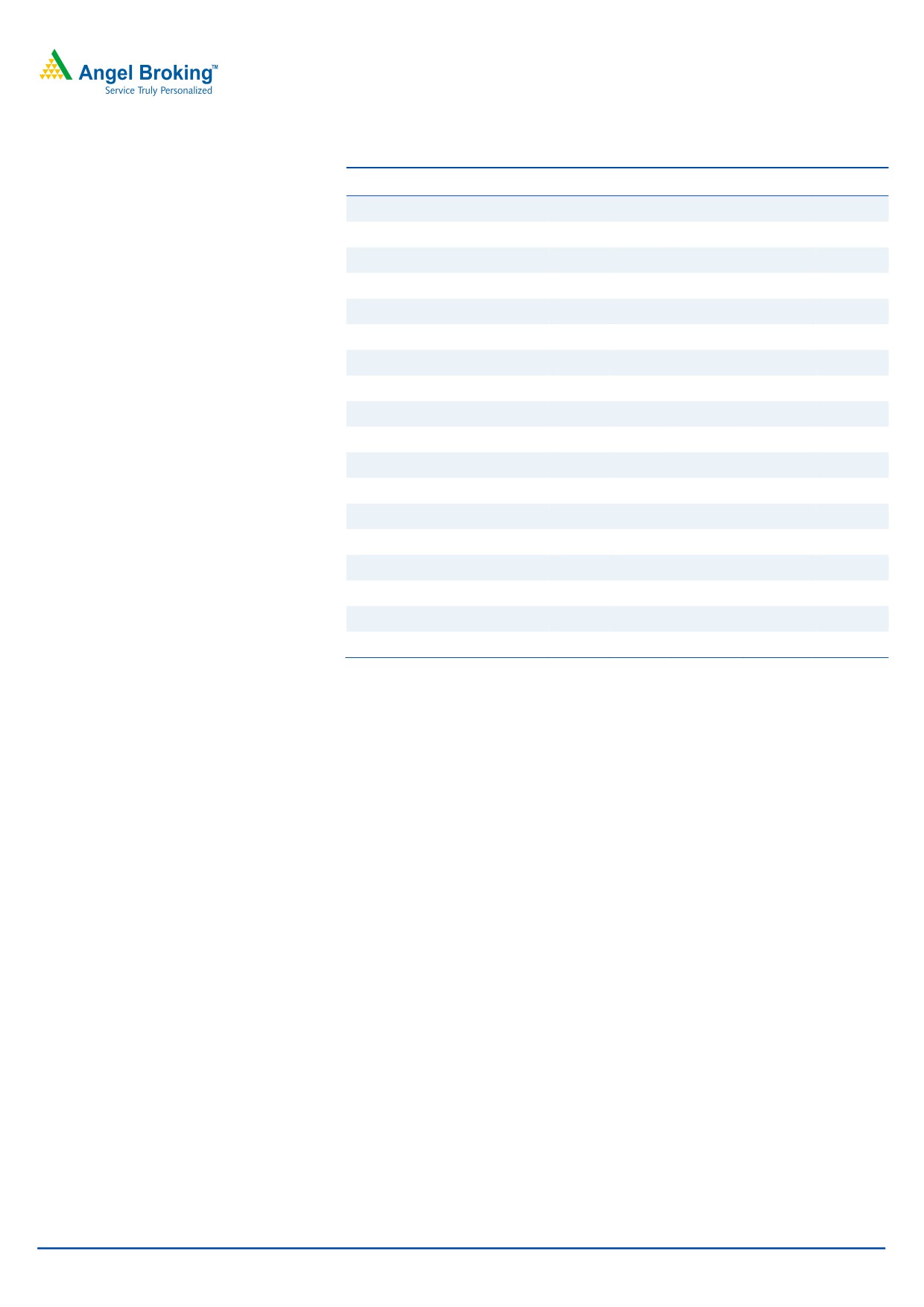

Exhibit 1: Quarterly Performance (Standalone)

Particulars (` cr)

2QFY16

1QFY16

% chg (qoq)

2QFY15

% chg (yoy)

1HFY16

1HFY15

% chg

Net Sales

621

590

5.2

451

37.7

1,211

953

27.1

Total Expenditure

635

648

(2.0)

482

31.6

1,282

1,051

22.0

Cost of materials consumed

337

373

(9.6)

215

56.7

710

530

33.9

Purchases of stock-in-trade

0

0

nmf

0

nmf

0

0

nmf

Employee benefits Expense

193

196

(1.7)

187

3.0

389

378

2.9

Other Expenses

105

79

33.1

80

30.9

184

144

28.1

EBITDA

(13)

(57)

nmf

(31)

nmf

(71)

(98)

nmf

EBIDTA %

(2.2)

(9.7)

(6.9)

(5.8)

(10.3)

Depreciation

13

13

(2.3)

13

(5.2)

25

26

(1.2)

EBIT

(26)

(70)

nmf

(44)

nmf

(96)

(124)

nmf

Interest and Financial Charges

12

12

(1.5)

18

(37.0)

23

40

(41.5)

Other Income

7

7

2.5

8

(2.9)

14

13

9.5

PBT before Exceptional Items

(30)

(75)

nmf

(55)

nmf

(105)

(151)

nmf

Exceptional Items

0

0

0

0

0

PBT after Exceptional Items

(30)

(75)

nmf

(55)

nmf

(105)

(151)

nmf

Tax

0

0

nmf

0

nmf

0

0

nmf

% of PBT

0.0

0.0

0.0

0.0

0.0

PAT

(30)

(75)

nmf

(55)

nmf

(105.1)

(150.7)

nmf

PAT %

(4.9)

(12.7)

(12.2)

(8.7)

(15.8)

Dil. EPS (after extra-ord. Items)

(7.24)

(17.98)

nmf

(13.24)

nmf

(25.22)

(36.18)

nmf

Source: Company, Angel Research; Note: nmf- Not meaningful

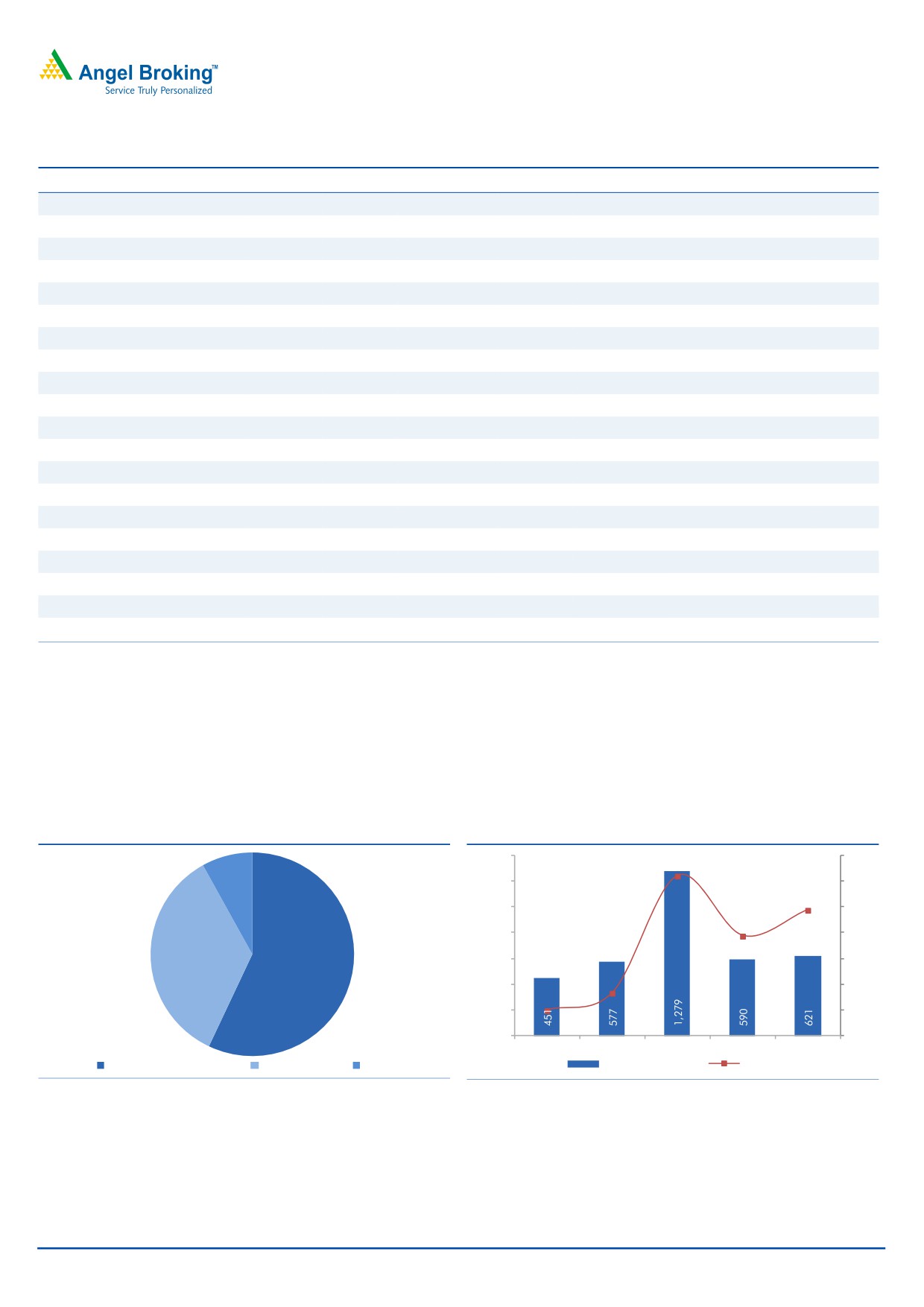

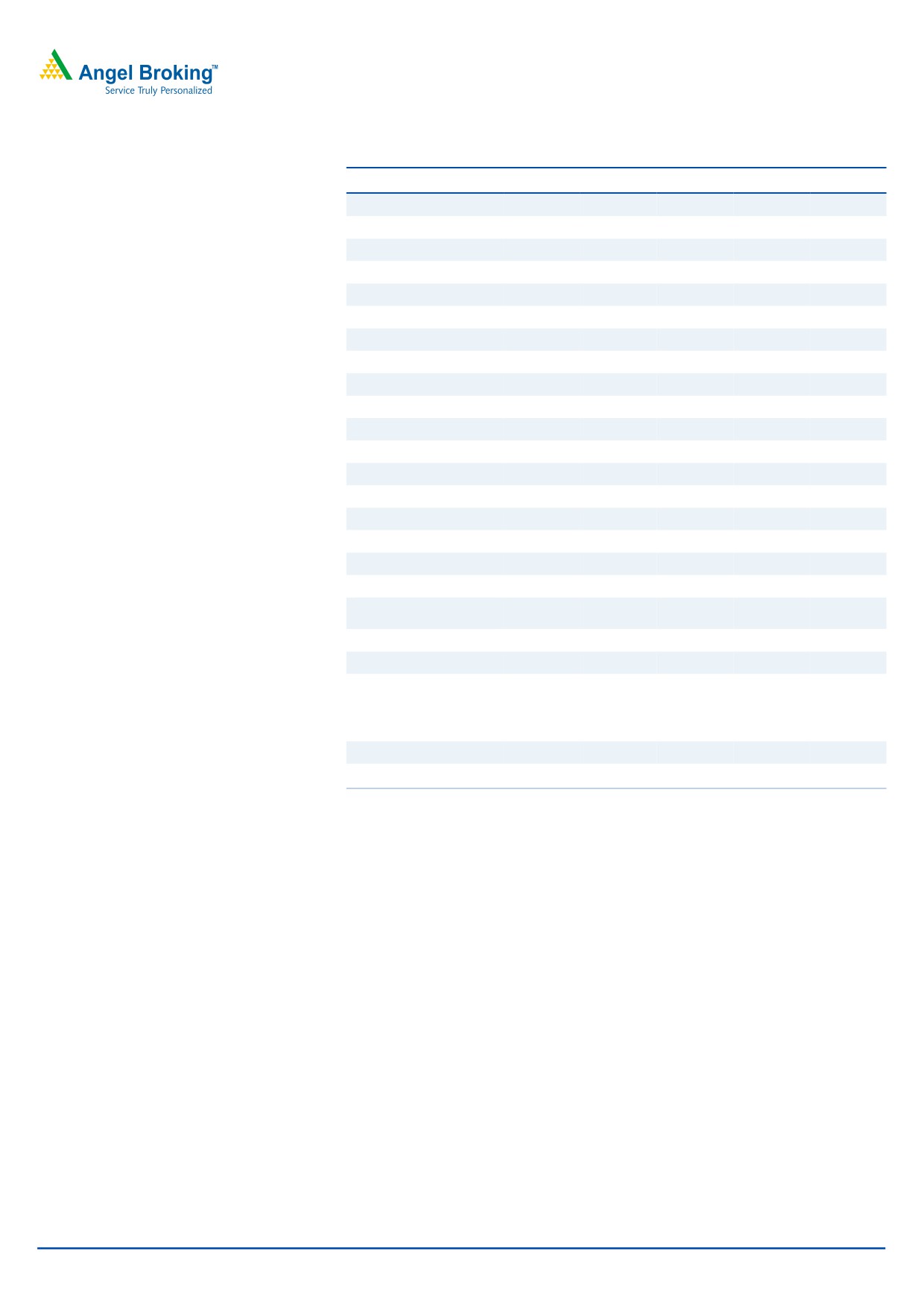

Revenues increase 37.7% yoy

BEML reported sales of `621cr in 2QFY2016, ahead of our expectation of `599cr.

The Reported top-line numbers reflect 37.7% yoy growth. Construction & Mining

Equipments segment accounted for a major 57% of the quarter’s revenues at

`316cr.

Exhibit 2: Segment-wise 2QFY2016 Revenue split

Exhibit 3: Quarterly revenue trend

1,400

80.0

64.1

8%

1,200

60.0

37.7

1,000

40.0

17.7

800

20.0

(26.4)

35%

600

0.0

(39.9)

57%

400

(20.0)

200

(40.0)

(0)

(60.0)

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Const. & Mining Equip.

Rail & Metro

Defense

Revenues (` in cr)

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

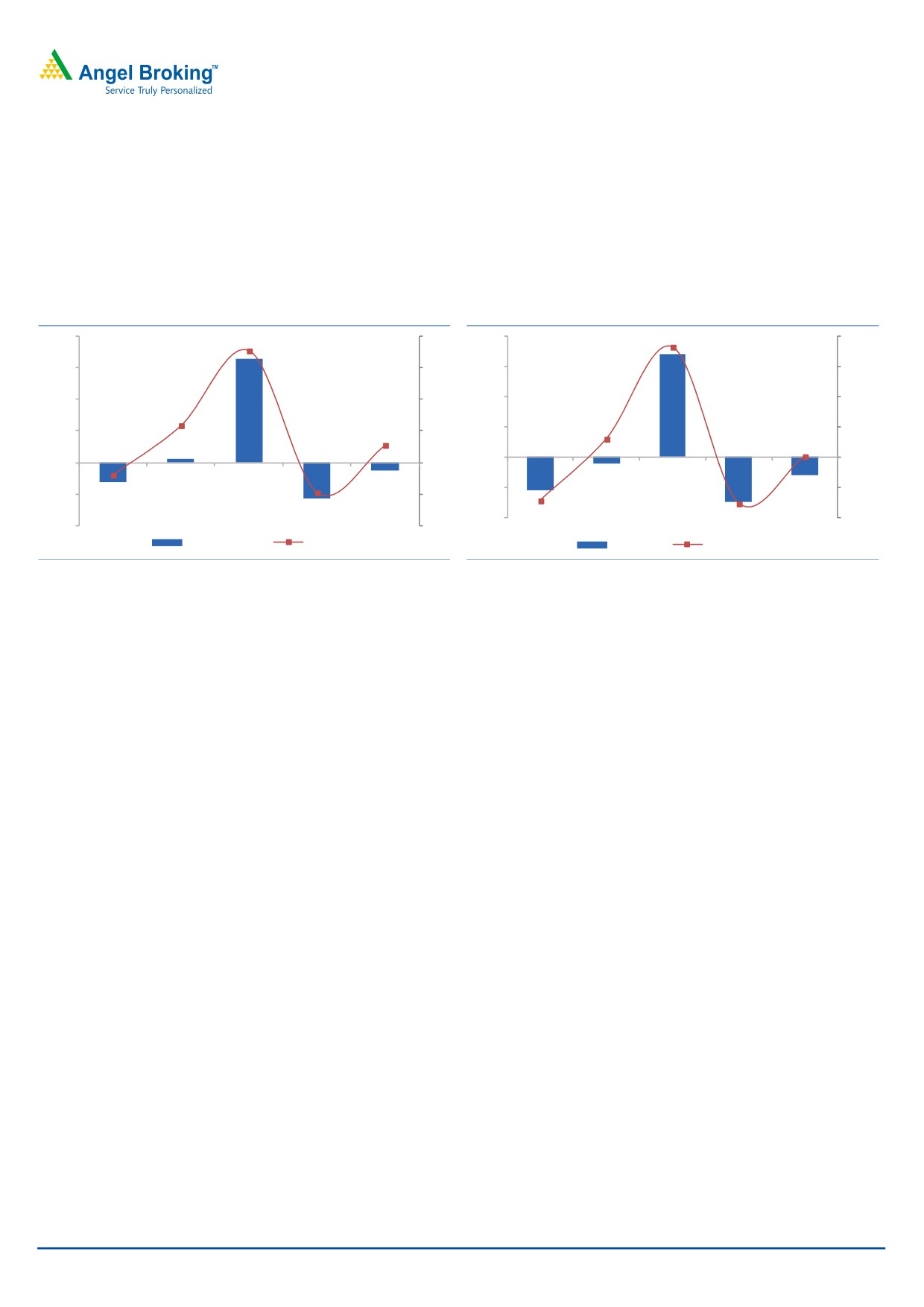

Reports EBITDA level losses on a yoy basis

BEML reported an EBITDA level loss of `13cr in 2QFY2016, which is almost in-line

with our EBITDA level loss expectations. The positive emerging has been due to

narrowing down of EBITDA level loss on a yoy basis. EBITDA losses narrowed

November 13, 2015

2

BEML | 2QFY2016 Result Update

down from a year ago level of `31cr. A lower increase in employee and other

expenses which grew 3.0% and 30.9% yoy respectively (compared to revenue

growth on yoy basis), led to narrowing down of the EBITDA level loss for BEML.

In our view, higher revenue booking seen across the high margin Construction &

Mining Equipment segment led to narrow down of the EBITDA level loss on a yoy

basis.

Exhibit 4: EBITDA loss narrows down on yoy basis

Exhibit 5: PAT loss too narrows down on yoy basis

200

163

15

200

169

15.0

13.2

12.7

150

10

150

10.0

100

5

100

5.0

0.9

50

0.0

50

0

(2.0)

5

(2.2)

(4.9)

(6.9)

0

(5.0)

0

(5)

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

(50)

(10.0)

(50)

(10)

(11)

(30)

(9.7)

(13)

(12.2)

(31)

(12.7)

(57)

(100)

(55)

(15.0)

(75)

(100)

(15)

EBITDA (` in cr)

EBITDA Margin (%)

PAT (` in cr)

PAT Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

PAT level losses also narrow down on yoy basis

In-line with EBITDA level losses, BEML reported a PAT level loss of `30cr for the

quarter, again below our loss expectation of `12cr. Notably, the quantum of loss

has narrowed down on a yoy basis from `55cr in 2QFY2015. Narrow down of

EBITDA losses coupled with 37% decline in yoy interest expenses to `12cr

(indicating benefits of lower interest rate cycle) led to a narrow down of the PAT

level loss.

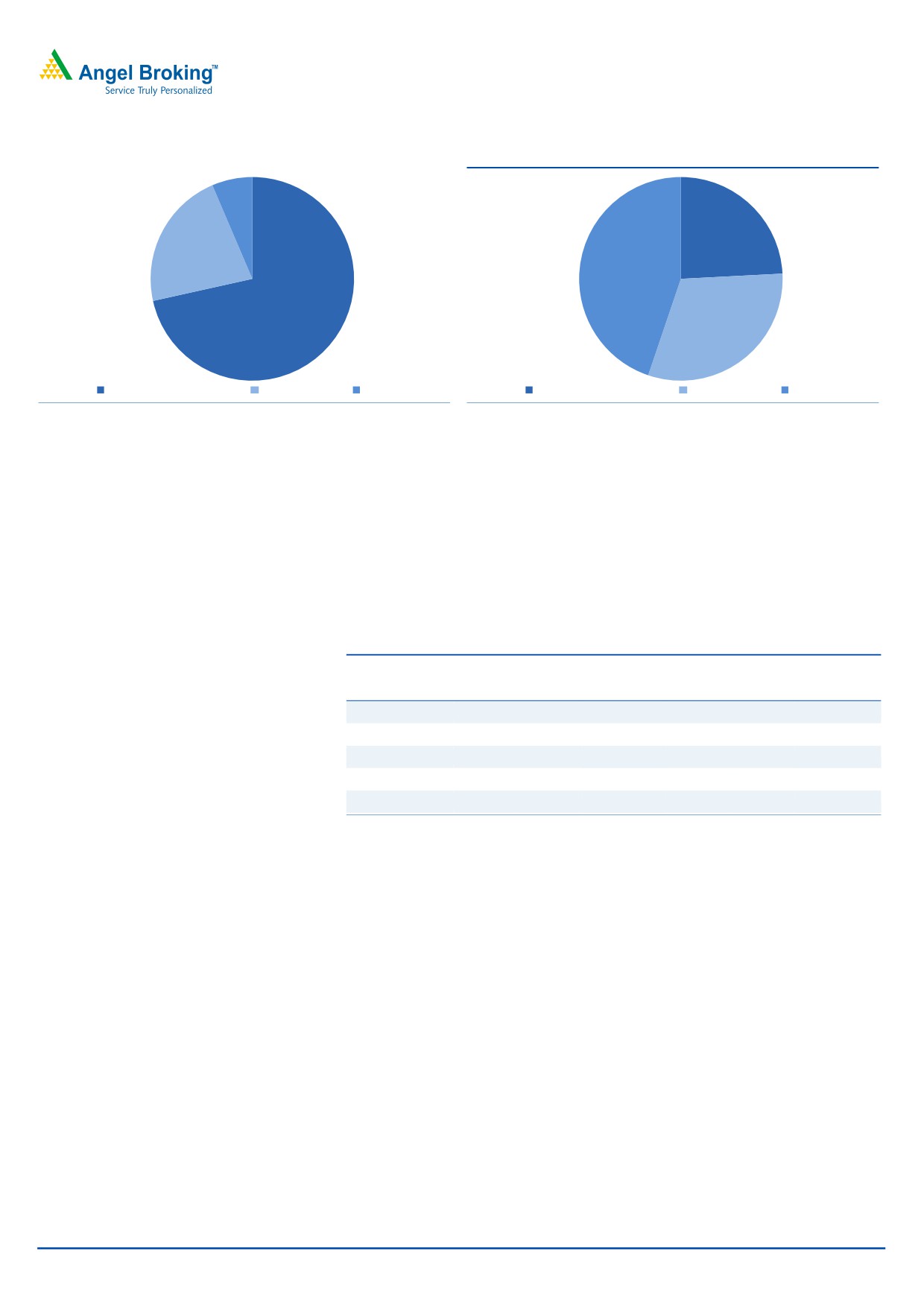

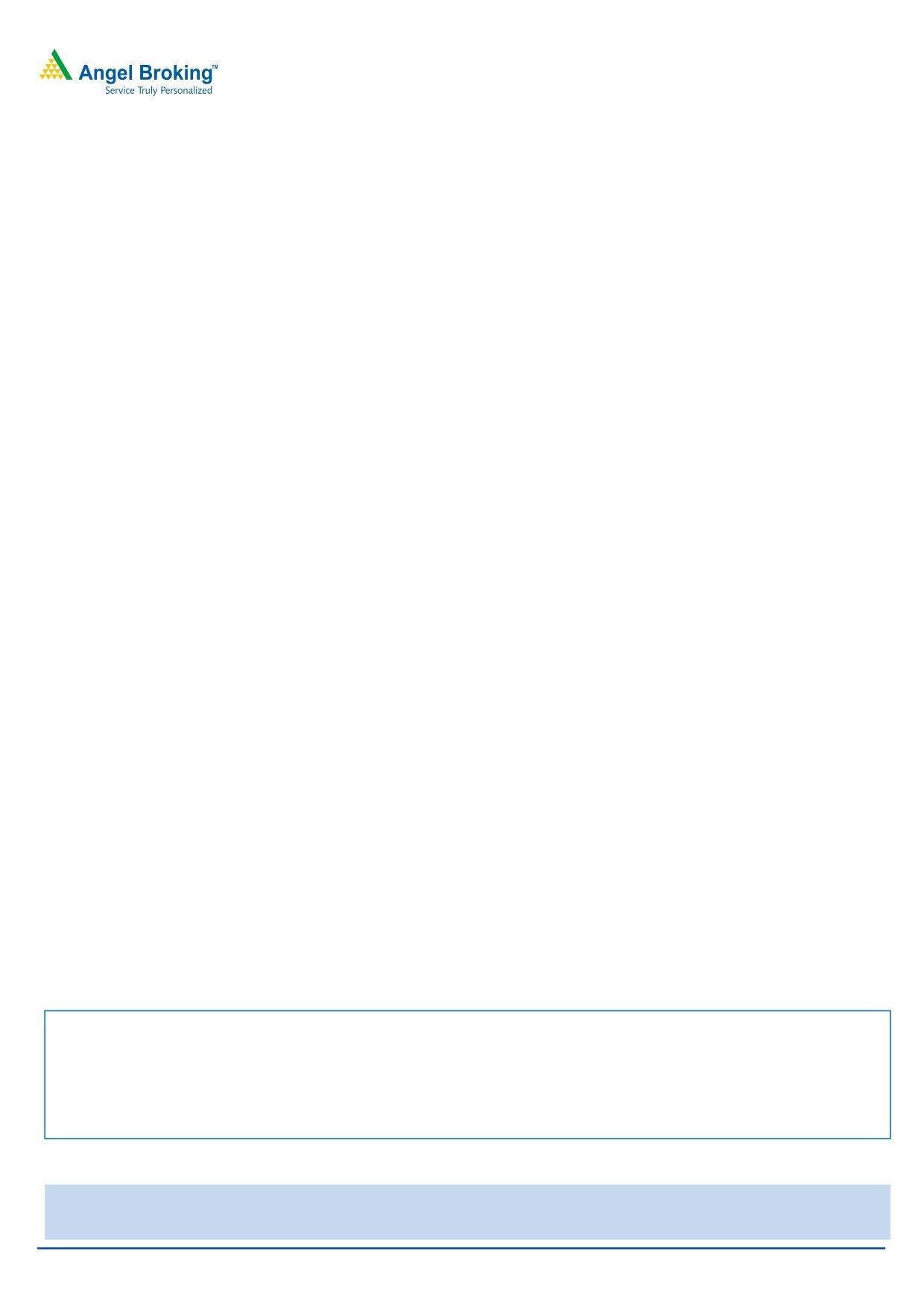

Reports `410cr of Order Inflows for 2QFY2016

BEML in 2QFY2016 reported `410cr of order inflows, mainly led by Construction

& Mining Equipments segment (again within the segment, order wins were mainly

from the domestic market). This segment accounted for 72% of the 2QFY2016

order inflows.

To-date, the Construction & Mining Equipments segment has reported `720cr of

order inflows during 1HFY2016E, mainly from Coal India (CIL). At the backdrop of

CIL’s capex outlook, we expect BEML to benefit from an uptick in the awarding

activity.

In 1HFY2016, on a whole, the company has reported `1,771cr of order inflows,

across all the 3 business segments (vs our FY2016E expectation of `2,900cr).

November 13, 2015

3

BEML | 2QFY2016 Result Update

Exhibit 6: Order Inflows driven by Const. & Mining seg.

Exhibit 7: Order Book gives better revenue visibility

6%

24%

22%

45%

72%

31%

Const. & Mining Equip.

Rail & Metro

Defense

Const. & Mining Equip.

Rail & Metro

Defense

Source: Company, Angel Research

Source: Company, Angel Research

Post the recent order wins, the order book as of 2QFY2016-end stood at `6,376cr.

Order book / last twelve month (LTM) sales ratio at 2QFY2016-end stood at 2.1x.

The current order book gives revenue visibility for the next few quarters.

Revision of Estimates

Considering better than expected revenues reported for 1HFY2016, we are

revising our FY2016E Revenue, EBITDA and PAT estimates.

Exhibit 8: Revised Earnings Estimates

FY2016E

FY2017E

Old

New

Chg. (%)

Old

New

Chg. (%)

Net Sales

3,277

3,404

3.9%

4,006

4,006

0.0%

EBITDA

196

233

18.9%

357

357

0.0%

EBITDA %

6.0

6.8

8.9

8.9

PAT

122

151

23.8%

268

268

0.0%

PAT %

3.7

4.4

6.7

6.7

Source: Company, Angel Research

Valuation

During the quarter, BEML impressed us by reporting strong execution across the

Construction & Mining Equipment segment.

Positive emerging from the 1HFY2016 performance is that BEML has won orders

to the tune of `720cr from the Construction & Mining Equipment segment alone.

BEML has emerged as L1 for over `600cr of order from the Kolkata Metro, which

in our view should be slow-moving in nature. On a whole, we expect BEML to see

increased traction from the awarding activity across all the 3 business segments.

We are optimistic that the company would report strong earnings going forward.

Our view stems on the back of BEML's strong market positioning across business

segments and improving award activity environment across segments. At the back-

drop of increased order book, we expect BEML to report better execution trends,

which should further lead to turn-around in profits, going forward. We continue to

maintain our NEUTRAL rating on the stock.

November 13, 2015

4

BEML | 2QFY2016 Result Update

Investment arguments

Order book set to expand…

As of 2QFY2016-end, BEML is sitting on an order book of `6,376cr, which gives

revenue visibility for over the next few quarters. Further, if we look into order book

details, a major chunk of it is from the Defense segment (45% of total order book),

followed by Rail & Metro segment (31% of total order book), and Mining segment

(24% of total order book).

The government’s increased thrust towards Mining, Defense and Metro amongst

other verticals, when coupled with BEML’s strong market positioning across the

segments, strengthens our view that BEML should report 25% CAGR in its order

inflow during FY2015-17E (expect BEML to report `6,100cr of order wins during

FY2016-17E).

Expect strong 19% top-line CAGR during FY2015-17E…

At the backdrop of strong revival in the order inflow environment (across all the

three business segments), we expect BEML to ramp-up its execution, going

forward. We expect BEML to report strong growth across two of its business

segments, ie Rail & Metro and Defense, which have been under pressure in the last

2-3 years. The government’s thrust towards Metro development and expansion

across 15+cities will create huge demand for Rolling stock, which in turn should

benefit BEML the most, with it being one of the low cost Metro coach

manufacturers. We expect the Rail & Metro segment of the company to report 18%

top-line CAGR during FY2015-17E to `1,371cr. Further, with the removal of ban

on Tatra trucks, growth prospects for BEML’s Defense segment look strong. We

expect the Defense segment to report 105% top-line CAGR during FY2015-17E to

`678cr. Our view of strong growth in the Defense segment is owing to (1) higher

budgetary

allocation

made towards the Defense sector and

(2) considering that BEML is the single supplier of Tatra trucks to Indian defense.

Also, their MCE segment is expected to report a 9% top-line CAGR during

FY2015-17E to `1,919cr. Growth across the MCE division would be driven by

strong new equipment demand and replacement demand emanating from CIL,

SAIL and NMDC’s capex cycle (as all of them are pursuing strong capex).

Strong execution to fuel the much required turnaround…

Higher fixed cost base across business segments and almost stagnated revenue

base has put BEML in a tough spot. BEML reported negative EBITDA margin in

FY2013

(-1.6%), 1HFY2015

(-10.3%) and 1HFY2016

(-5.9%); margins for

1HFY2015 are the worst in the company’s recent history. But on the back of

stronger execution, 2HFY2015 witnessed a turn-around. With losses on a yoy basis

narrowing down in 1HFY2016, we expect strong EBITDA numbers for 2HFY2016E.

Further, if we look into segment-wise details, the Defense segment reported

margins in red during FY2015 (reflecting weak execution). Also, Mining Equipment

and Rail & Metro segments witnessed margin contraction on account of a higher

fixed cost base.

November 13, 2015

5

BEML | 2QFY2016 Result Update

Led by revival across business segments (as highlighted above), we expect BEML to

report a strong 19.4% top-line CAGR during FY2015-17E to `4,006cr. BEML at

FY2015-end had 10,328 employees. Considering revenue growth potential during

FY2016-17E, when coupled with (1) ~800 employees retiring during the same

period, (2) control over admin. and marketing expenses, (3) cost control initiatives

at the shop floor level, and (4) next pay commission hike coming in to effect from

Jan-2018 only, we are of the view that BEML would be well positioned to absorb

fixed costs, which in turn should translate into margin expansion. We expect BEML

to extend its FY2015 EBITDA level turnaround to FY2016 (at 6.8%) and further

expand margins during FY2017E (to 8.9%).

With EBITDA level turnaround already seen, we expect the entire benefits to flow

down to PAT level. This, when coupled with ease in working capital cycle and lower

interest rate cycle, should help BEML report PAT level margin expansion. On the

whole, we expect PAT margins to improve from 0.2% in FY2015 to 6.7% in

FY2017 (reflecting sharp PAT growth from `7cr in FY2015 to `268cr in FY2017E.

Working Capital cycle to ease going forward…

BEML is well geared to capitalize on the emerging opportunities across its business

segments. Slowdown in the capex cycle across business segments had taken a toll

on the company’s growth prospects. Anticipation of sharp demand from MCE

segment led BEML build higher inventories, which contributed majorly to the stretch

in the Net Working Capital (NWC) cycle.

However, with early indications of capex cycle revival across Mining sector, mainly

led by Coal India, we are optimistic that BEML should be able to further lower its

NWC days (from 282 days in FY2012 to 126 days in FY2017E).

Ease in the NWC cycle of BEML, in our view would lead to decline in the overall

debt levels of the company. As a result, the debt of BEML would decline from

`592cr (as of FY2015-end) to `317cr by FY2017E. Simultaneously, the Net D/E

ratio would decline from 0.2x as of FY2015-end to 0.0x by FY2017-end.

November 13, 2015

6

BEML | 2QFY2016 Result Update

Risks & Concerns

Delays in MCE and Metro capex cycle recovery from here-on could be a big

risk to our estimates.

Significant loss of market share vs. our assumption of slight loss of market

share across the MCE segment could be a risk to our assumptions.

Any sharp appreciation in the Rupee (INR) could make MCE segment imports

competitive, which again could be a risk to our market share assumptions and

be a threat to our earnings growth estimates.

Company background

BEML is a Mini-Ratna Category-1 public sector undertaking (PSU) under the control

of Ministry of Defence (MoD), operating in three distinct business segments

namely, Mining & Construction Equipment, Defence, and Rail & Metro.

Having commenced operations in 1964, with the transfer of Railway Coach

Manufacturing facilities from Hindustan Aeronautics Ltd, BEML has over the years

diversified into manufacturing various types of mining and construction

equipments, Metro coaches and specialised defence vehicles/ products.

November 13, 2015

7

BEML | 2QFY2016 Result Update

Profit and Loss Statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Net Sales

2,809

2,912

2,809

3,404

4,006

% Chg

3.0

3.7

(3.5)

21.2

17.7

Total Expenditure

2,854

2,798

2,739

3,172

3,649

Cost of Raw Materials Con.

1,645

1,711

1,583

1,918

2,311

Purchase of Stock-in-trade

9

3

0

1

0

Employee benefits Expense

739

717

769

787

805

Other Expenses

460

367

387

465

532

EBITDA

(45)

113

70

233

357

% Chg

(136.4)

(352.6)

(38.2)

233.0

53.5

EBIDTA %

(1.6)

3.9

2.5

6.8

8.9

Depreciation

50

54

52

55

59

EBIT

(95)

60

18

178

298

% Chg

(220.0)

(162.7)

(70.2)

902.2

67.6

Interest & Financial Charges

141

110

71

51

34

Other Income

104

63

60

66

79

PBT

(132)

13

7

193

343

Exceptional Items

10

16

0

0

0

Prior Period Adjustments

0

(19)

0

0

0

Tax

(42)

4

0

42

75

% of PBT

nmf

35.2

2.2

22.0

22.0

PAT

(80)

5

7

151

268

% Chg

NA

NA

44.8

2128.7

77.7

PAT %

(2.8)

0.2

0.2

4.4

6.7

Basic EPS

(19.2)

1.1

1.6

36.2

64.3

Diluted EPS

(19.2)

1.1

1.6

36.2

64.3

% Chg

NA

NA

44.8

2128.7

77.7

November 13, 2015

8

BEML | 2QFY2016 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Sources of Funds

Equity Capital

42

42

42

42

42

Reserves Total

2,038

2,038

2,035

2,159

2,380

Networth

2,080

2,080

2,077

2,201

2,422

Total Debt

1,214

905

592

528

317

Other Long-term Liabilities

406

379

317

337

355

Long-term Provisions

149

136

164

184

199

Total Liabilities

3,850

3,500

3,150

3,250

3,293

Application of Funds

Gross Block

1,184

1,201

1,253

1,316

1,385

Accumulated Depreciation

653

702

754

809

868

Net Block

531

499

499

507

518

Capital WIP & Intan. under Dev.

142

173

162

145

144

Investments

4

4

3

3

3

Deferred Tax Assets (net)

105

100

101

101

101

Inventories

2,456

2,152

1,921

1,995

1,959

Sundry Debtors

862

977

992

1,025

1,088

Cash and Bank Balance

77

16

144

201

270

Loans & Advances

603

532

400

413

448

Current Liabilities

1,366

1,261

1,441

1,570

1,678

Net Current Assets

2,632

2,417

2,017

2,065

2,087

Other Assets

436

308

368

429

440

Total Assets

3,850

3,500

3,150

3,250

3,293

November 13, 2015

9

BEML | 2QFY2016 Result Update

Cash Flow Statement

Y/E March (` cr)

FY13

FY14

FY15P

FY16E

FY17E

Profit before tax

(122)

9

7

193

343

Depreciation

53

55

52

55

59

Other Adjustments

96

(35)

(28)

(18)

(18)

Change in Working Capital

(275)

282

434

(12)

69

Interest & Financial Charges

141

110

71

51

34

Direct taxes paid

(31)

(26)

(0)

(42)

(75)

Cash Flow from Operations

(138)

394

535

226

411

(Inc)/ Dec in Fixed Assets

(170)

(53)

(42)

(45)

(69)

(Inc)/ Dec in Invest. & Int. received

38

25

22

18

18

Cash Flow from Investing

(132)

(28)

(20)

(27)

(51)

Inc./ (Dec.) in Borrowings

303

(306)

(312)

(64)

(211)

Issue/ (Buy Back) of Equity

0

0

0

0

0

Dividend Paid (Incl. Tax)

(24)

(12)

(5)

(26)

(47)

Finance Cost

(124)

(109)

(71)

(51)

(34)

Cash Flow from Financing

155

(427)

(388)

(142)

(292)

Inc./(Dec.) in Cash

(116)

(61)

128

57

68

Opening Cash balances

192

77

16

144

201

Closing Cash balances

77

16

144

201

270

November 13, 2015

10

BEML | 2QFY2016 Result Update

Ratio Analysis (x)

Y/E March

FY13

FY14

FY15

FY16E

FY17E

Valuation Ratio (x)

P/E (on FDEPS)

nmf

nmf

nmf

30.2

17.0

P/CEPS

nmf

78.2

77.3

22.2

13.9

Dividend yield (%)

0.2

0.1

0.1

0.5

0.9

EV/Sales

2.1

1.9

1.8

1.4

1.2

EV/EBITDA

nmf

48.1

71.5

21.0

12.9

EV / Total Assets

1.5

1.6

1.6

1.5

1.4

Per Share Data (`)

EPS (Basic)

(19.2)

1.1

1.6

36.2

64.3

EPS (fully diluted)

(19.2)

1.1

1.6

36.2

64.3

Cash EPS

(7.1)

14.0

14.1

49.3

78.4

DPS

2.5

1.0

1.0

5.4

9.6

Book Value

499.5

499.4

498.7

528.5

581.5

Returns (%)

RoCE (Pre-tax)

(2.8)

1.8

0.6

6.2

10.1

Angel RoIC (Pre-tax)

(2.9)

2.0

0.7

6.5

10.9

RoE

(4.3)

0.4

0.3

7.0

11.6

Turnover ratios (x)

Asset Turnover (Gross

2.4

2.4

2.3

2.7

3.0

Block) (x)

Inventory / Sales (days)

321

292

268

216

180

Receivables (days)

123

117

129

111

100

Payables (days)

175

166

178

170

154

NWC days

269

242

220

157

126

Leverage Ratios (x)

D/E ratio (x)

0.5

0.4

0.2

0.1

0.0

Int. Coverage Ratio (x)

nmf

0.5

0.3

3.5

8.8

Note: nmf- Not Meaningful

November 13, 2015

11

BEML | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

BEML

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

November 13, 2015

12