Quick take | Footwear

June 18, 2018

Bata India

BUY

Better brands for better growth

CMP

`779

Target Price

`896

Bata India Ltd (BIL) is the largest footwear retailer in India, offering footwear,

Investment Period

12 Months

accessories and bags across brands like Bata, Hush Puppies, Naturalizer, Power, etc.

BIL’s ~70% revenue is derived from Men & Kids segment and balance from women’s

segment. BIL has over 1,400 Bata retail stores across India.

Stock Info

Sector

Footwear

Shift in trend towards the organized sector to propel growth: The Indian footwear

Market Cap (` cr)

10,276

industry is valued at `50,000-55,000, which is expected to grow at a CAGR of ~15%

Net Debt (` cr)

(2,575)

going ahead. One third of the industry is mainly dominated by the unorganized

Beta

0.9

52 Week High / Lo

833/511

sector. However, organized segment is expected to grow at a faster pace compared to

Avg. Daily Volume

40,298

the unorganized segment on the back of increase in household income and rising

Face Value (`)

5

BSE Sensex

35,626

brand consciousness amongst Indian consumers. This would be beneficial for branded

Nifty

10,816

players like Bata India.

Reuters Code

BATA.BO

Bloomberg Code

BATA.IN

Strong retail stores expansion plan to boost growth: Currently, the company has 1,400

retail stores, which includes owned and franchise model (mainly presence in metro

Shareholding Pattern (%)

cities). Further, over the last 3 years, the company has added 135 stores (net

Promoters

53.0

MF / Banks / Indian Fls

17.5

addition). Going forward, the company has plans to open 500 stores (already

FII / NRIs / OCBs

6.2

identified 435 cities) mainly in tier-II and tier-III cities over the next 4-5 years. We

Indian Public / Others

23.4

believe Bata is brand for masses, and this is a growth driving factor going ahead.

Abs.(%)

3m 1yr

3yr

New launches and higher ad spends to boost women’s segment: Currently, women’s

Sensex

2.3

17.7

51.7

M&M

9.6

44.3

34.0

footwear segment accounts for ~30% of Bata sales, which the company is targeting to

increase to ~40% over the 3 years. We believe that the company would achieve

strong growth going ahead mainly because of (a) Indian women footwear industry is

growing faster (20%+ growth p.a.), (b) new launches of products (recently launched

950+), and (c) increasing ad spends from 1% to 2.5-3%.

Higher sales of premium products to aid margins: Currently, BIL’s 40% sales come

from premium products like Hush Puppies, Power, Marie Clarie, etc. BIL has plans to

3-year price chart

increase premium product sales from current level of total revenue over next two

years.

900

800

Outlook and Valuation: We expect BIL to report net revenue CAGR of ~16% to

700

600

~`3,555cr over FY2018-20E mainly due increasing brand consciousness amongst

500

Indian consumers, new product launches, higher number of stores addition in tier - II

400

and III cities and focus on women’s segment (high growth segment). Further, on the

300

200

bottom-line front, we expect CAGR of ~19% to `311cr over the same period on the

100

back of margin improvement (increasing premium product sales). Thus, we initiate

0

coverage on Bata India with BUY recommendation and Target Price of `896.

Key Financials

Source: Company, Angel Research

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

Net sales

2,474

2,634

3,063

3,555

% chg

2.1

6.5

16.3

16.0

Adj. Net profit

173

221

265

311

% chg

3.9

27.7

20.2

17.3

EBITDA margin (%)

10.4

13.3

13.5

13.7

EPS (`)

13.4

17.2

20.6

24.2

Amarjeet S Maurya

P/E (x)

58.0

45.4

37.8

32.2

022-39357800 Ext: 6831

P/BV (x)

7.6

6.7

5.9

5.1

RoE (%)

13.0

14.8

15.6

16.0

RoCE (%)

14.5

19.5

20.3

21.0

EV/Sales (x)

3.8

3.6

3.0

2.6

EV/EBITDA (x)

36.9

26.8

22.4

18.8

Source: Company, Angel Research Note: CMP as of June 15, 2018

Please refer to important disclosures at the end of this report

1

Bata India Ltd

Key investment arguments

Shift in trend towards the organized sector to propel growth: The Indian

footwear industry is valued at `50,000-55,000 and is mainly dominated by

the unorganized sector (accounting for

65-67% share). Industry reports

indicate that the footwear sector is expected to grow at a CAGR of ~15%

going ahead, within which, the organized segment is expected to grow at a

faster pace compared to the unorganized segment. Bata is in a sweet spot

owing to the increase in household income, shifting consumer behavior from

saving to spending, rising brand consciousness amongst Indian consumers

and penetration in tier - II and III cities by footwear companies. The share of

organized players is expected to improve from current levels, which would be

beneficial for branded players like Bata India.

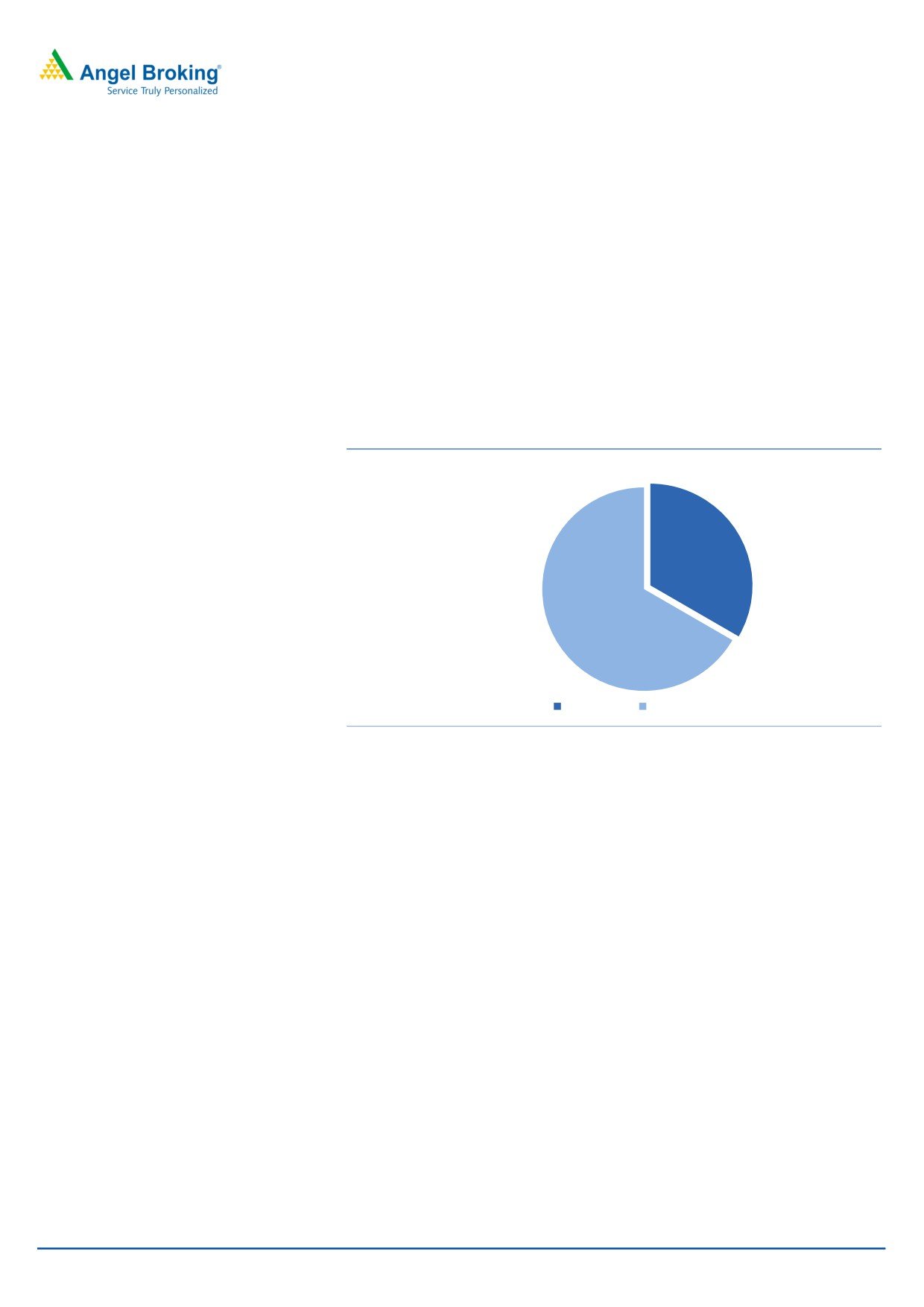

Exhibit 1: Huge untapped opportunity for organised players

33%

67%

Organised

Unorganised

Source: Company, Angel Research

Strong retail store expansion plan to boost further growth: Currently, the company

has 1,400 retail stores, which includes owned and franchise model (mainly present

in metro cities). Further, over the last 3 years, the company has added 135 stores

(net addition). Going forward, the company has plans to open 500 stores (already

identified 435 cities) mainly in tier-II and tier-III cities over the next 4-5 years.

Opening of stores in the small cities, where the company does not have significant

presence, provides growth opportunity for BIL. Moreover, besides the new stores,

the company is also redesigning most of the existing stores with specific focus on

particular categories like sports, women, youth and even school shoes. We believe,

Bata is a brand for masses and this is a growth driving factor for the company.

Moreover, BIL has adopted the right strategy for expansion, which would aid the

overall growth for the company.

June 18, 2018

2

Bata India Ltd

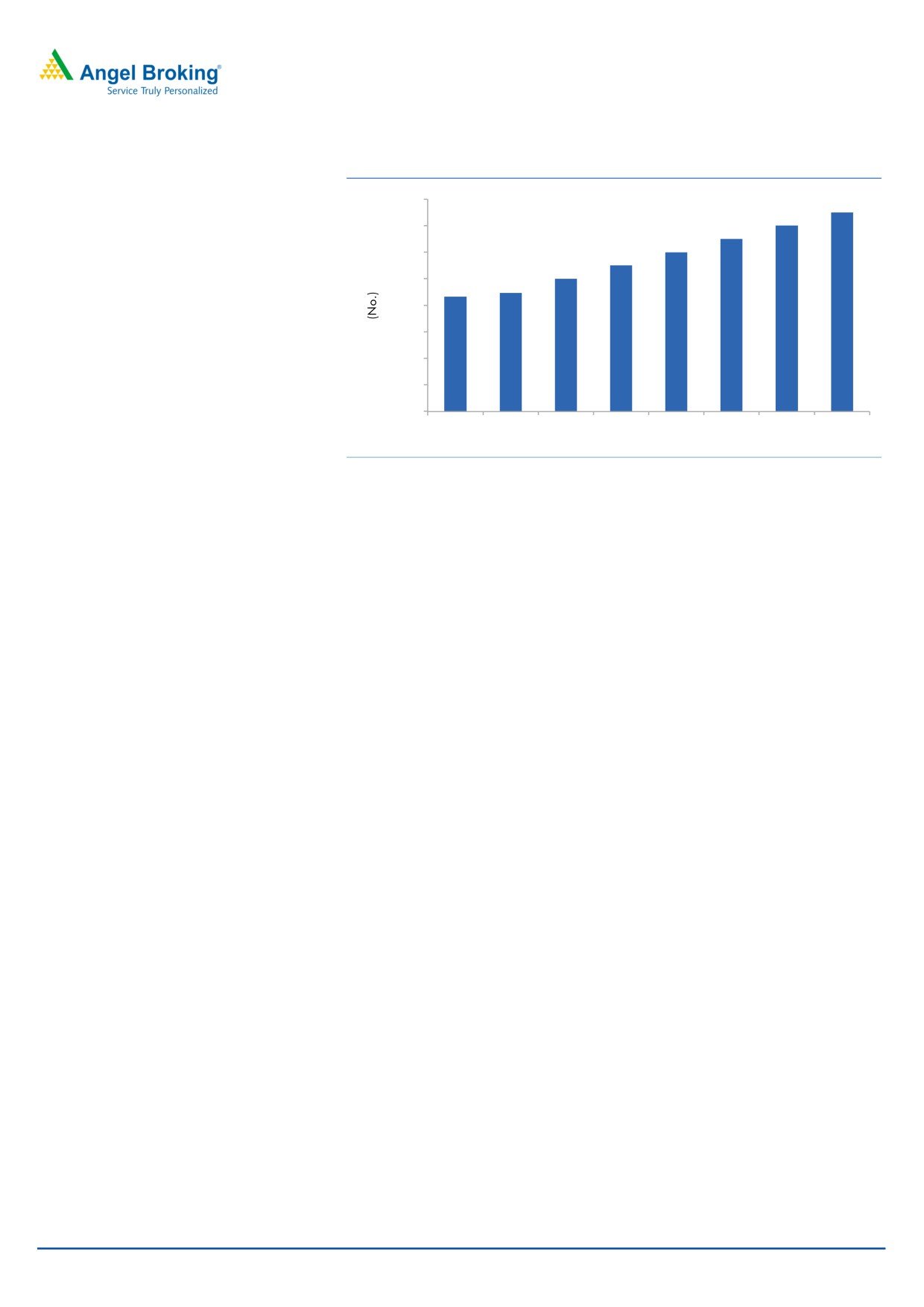

Exhibit 2: Number of store additions

2,000

1,900

1,800

1,800

1,700

1,600

1,600

1,500

1,400

1,400

1,265

1,293

1,200

1,000

800

600

400

FY2016

FY2017

FY2018

FY2019E FY2020E FY2021E FY2022E FY2023E

Source: Company, Angel Research

New launches and higher ad spend to boost women’s segment: Currently,

women’s footwear segment accounts for ~30% of Bata’s sales, which the company

is targeting to increase to ~40% over the next 3 years. We believe that the

company would achieve strong growth going ahead mainly because of (a) Indian

women’s footwear industry is growing faster than overall footwear industry, which

registers 20%+ growth every year, (b) new product launches (recently launched

950+ products largely in women’s collection), and (c) increasing ad spends from

1% to 2.5-3% and also associating with brand ambassadors from Bollywood - Kriti

Sanon and Cricket

- Smriti Mandhana to support the launch of its new

internationally designed Red Label & Power collections.

Higher sales of premium products to aid margin: Currently, BIL’s 40% sales is

derived from premium products like Hush Puppies, Power, Marie Clarie, etc. The

company has plans to increase premium product sales from current level of total

revenue over the next two years. We believe that BIL would be able to achieve

strong growth in premium products on the back new collection launched, higher

number of stores additions and strong marketing spends, which would improve the

overall margin of the company going ahead.

June 18, 2018

3

Bata India Ltd

Outlook & Valuation: We expect BIL to report net revenue CAGR of ~16% to

~`3,555cr over FY2018-20E mainly due increasing brand consciousness amongst

Indian consumers, new product launches, higher number of stores addition in tier

- II and III cities and focus on women’s segment (high growth segment). Further,

on the bottom-line front, we expect CAGR of ~19% to `311cr over the same

period on the back of margin improvement (increasing premium product sales).

Thus, we Initiate Coverage on Bata India with BUY recommendation and Target

Price of `896.

Downside risks to our estimates

Strong store expansion from competitors like Khadim, Relaxo could impact the

company’s sales growth

Slowdown in economy could hurt the overall profitability of the company

Company Background

BATA India Ltd (BIL) is the largest footwear retailer in India, offering footwear,

accessories and bags across brands like Bata, Hush Puppies, Naturalizer, Power,

Marie Claire, Weinbrenner, North Star, Scholl, Bata Comfit and Bubblegummers

to name a few. Currently, the company’s ~70% revenue is derived from Men &

Kids footwear segment and balance from women’s segment. Its retails in over

1,290 Bata stores on bata.in and has thousands of multi-brand footwear dealer

stores pan-India.

June 18, 2018

4

Bata India Ltd

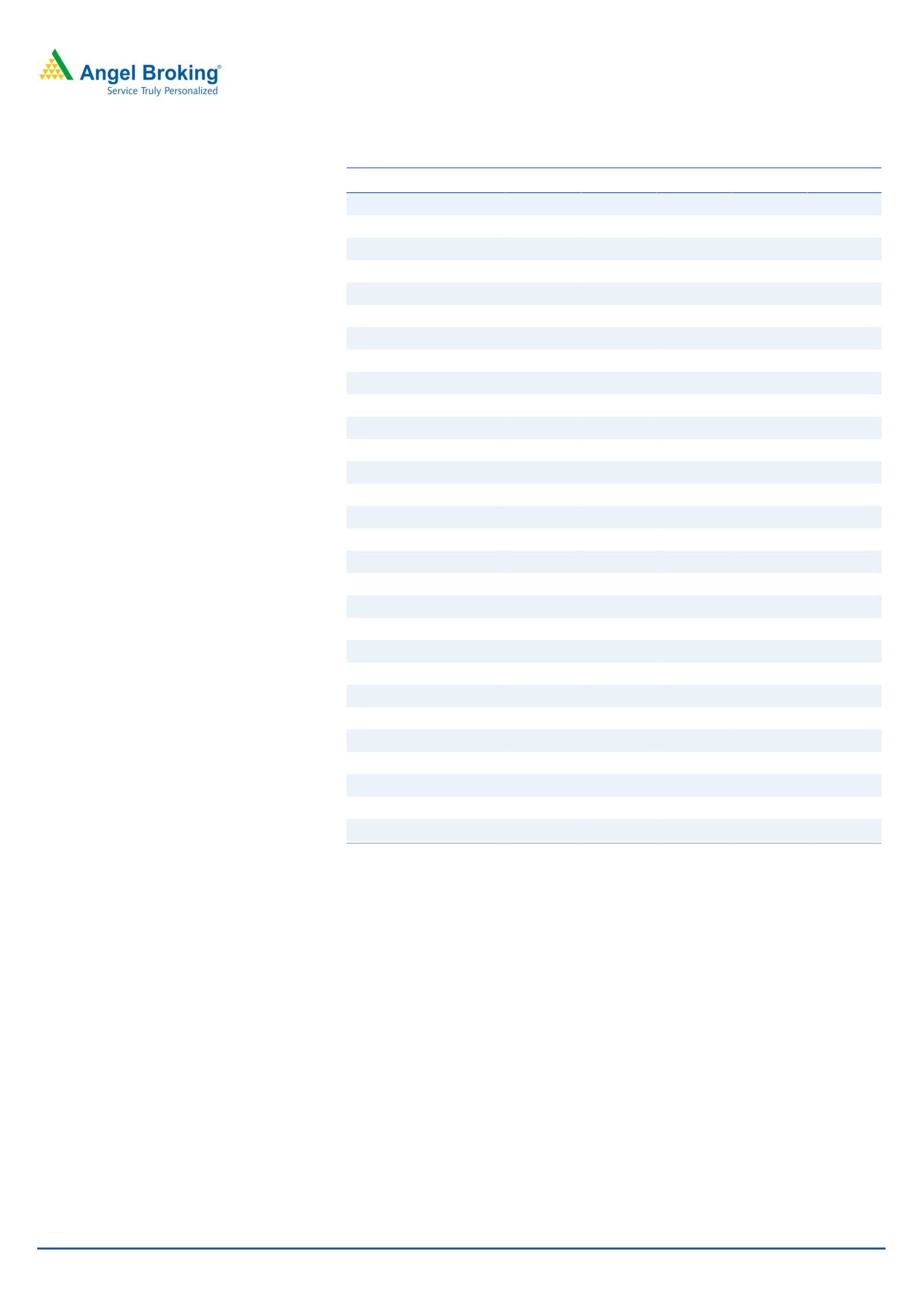

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E

FY2020E

Net Sales

2,423

2,474

2,634

3,063

3,555

% chg

(10.1)

2.1

6.5

16.3

16.0

Total Expenditure

2,147

2,217

2,283

2,650

3,068

Raw Material

1,152

1,158

1,202

1,403

1,635

Personnel

261

273

296

349

412

Selling & Adm

345

356

362

460

533

Others Expenses

389

430

423

438

487

EBITDA

276

257

351

414

487

% chg

(17.3)

(6.8)

36.8

17.7

17.8

(% of Net Sales)

11.4

10.4

13.3

13.5

13.7

Depreciation& Amortisation

79

65

60

69

79

EBIT

197

192

291

345

408

% chg

(22.5)

(2.6)

51.6

18.6

18.4

(% of Net Sales)

8.1

7.8

11.0

11.3

11.5

Interest & other Charges

2

4

4

4

4

Other Income

101

46

50

55

60

(% of PBT)

34.2

19.7

14.9

13.9

12.9

Recurring PBT

297

234

337

396

464

% chg

(9.8)

(21.1)

44.1

17.4

17.3

Tax

79

75

117

131

153

(% of PBT)

26.7

32.0

34.6

33.0

33.0

PAT (reported)

217

159

221

265

311

Extraordinary Items

51

(14)

-

-

-

ADJ. PAT

166

173

221

265

311

% chg

(20.5)

3.9

27.7

20.2

17.3

(% of Net Sales)

6.9

7.0

8.4

8.7

8.8

Basic EPS (`)

12.9

13.4

17.2

20.6

24.2

Fully Diluted EPS (`)

12.9

13.4

17.2

20.6

24.2

% chg

(20.5)

3.9

27.7

20.2

17.3

June 18, 2018

5

Bata India Ltd

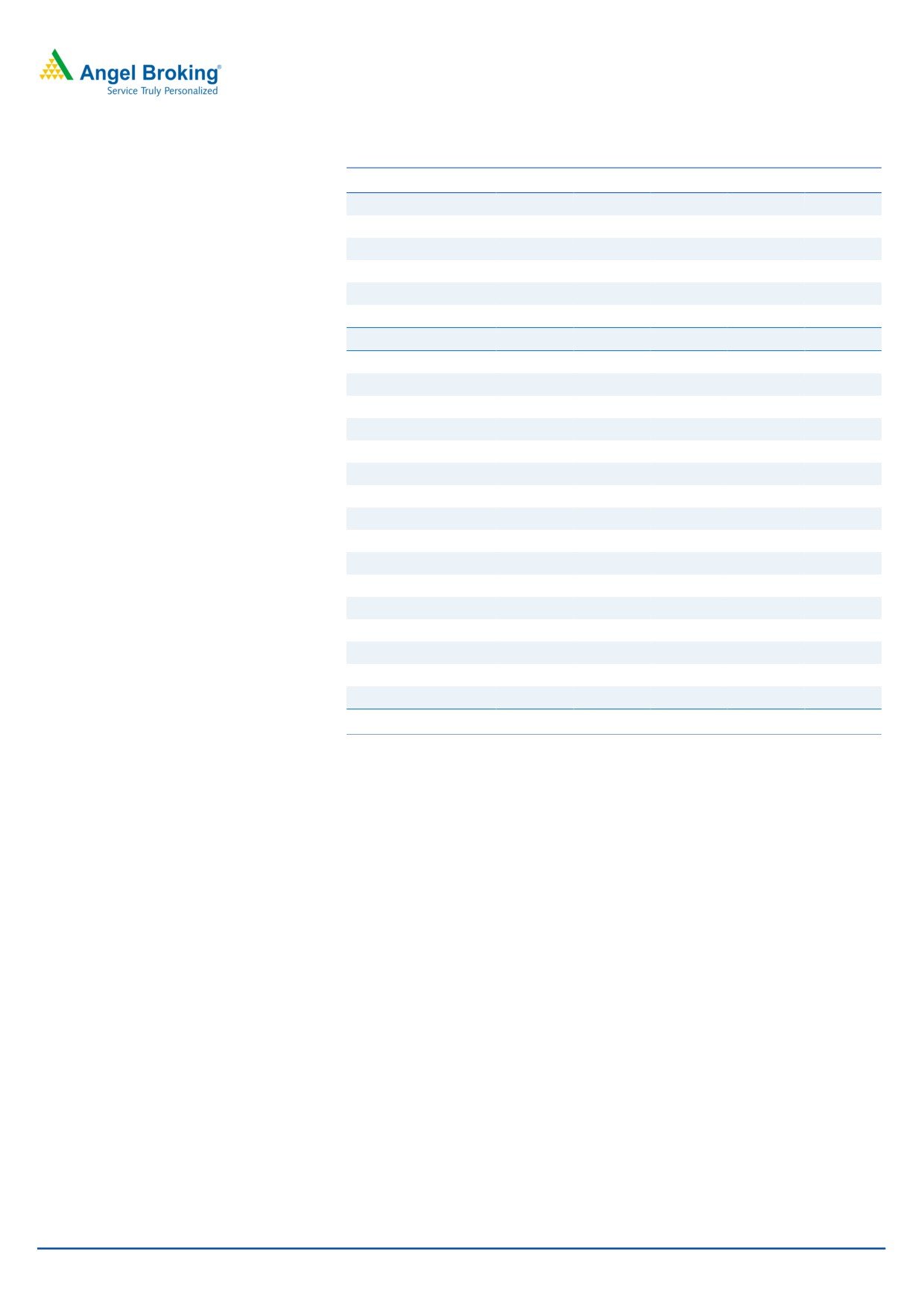

Consolidated Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

64

64

64

64

64

Reserves& Surplus

1,157

1,260

1,429

1,636

1,883

Shareholders Funds

1,221

1,324

1,493

1,701

1,948

Total Loans

-

-

-

-

-

Deferred Tax Liability

-

-

-

-

-

Total Liabilities

1,221

1,324

1,493

1,784

2,036

APPLICATION OF FUNDS

Gross Block

382

406

508

578

678

Less: Acc. Depreciation

78

138

199

267

346

Net Block

304

268

309

311

332

Capital Work-in-Progress

19

30

-

-

-

Investments

-

-

-

84

88

Current Assets

1,321

1,525

1,680

1,970

2,300

Inventories

685

714

765

898

1,052

Sundry Debtors

71

69

89

109

136

Cash

342

522

591

675

763

Loans & Advances

59

57

61

80

100

Other Assets

163

163

174

208

249

Current liabilities

512

599

597

681

785

Net Current Assets

809

926

1,084

1,289

1,515

Deferred Tax Asset

89

100

100

100

100

Mis. Exp. not written off

-

-

-

-

-

Total Assets

1,221

1,324

1,493

1,784

2,036

June 18, 2018

6

Bata India Ltd

Consolidated Cashflow Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Profit before tax

297

234

337

396

464

Depreciation

79

65

60

69

79

Change in Working Capital

(41)

53

(88)

(122)

(137)

Interest / Dividend (Net)

(24)

(40)

4

4

4

Direct taxes paid

(108)

(65)

(117)

(131)

(153)

Others

1

10

0

0

0

Cash Flow from Operations

204

257

197

216

257

(Inc.)/ Dec. in Fixed Assets

(39)

(48)

(72)

(70)

(100)

(Inc.)/ Dec. in Investments

(75)

(181)

0

0

0

Cash Flow from Investing

(114)

(229)

(72)

(70)

(100)

Issue of Equity

0

0

0

0

0

Inc./(Dec.) in loans

0

0

0

0

0

Dividend Paid (Incl. Tax)

(42)

(45)

(51)

(58)

(64)

Interest / Dividend (Net)

85

197

(4)

(4)

(4)

Cash Flow from Financing

43

152

(56)

(62)

(68)

Inc./(Dec.) in Cash

132

180

69

84

88

Opening Cash balances

210

342

522

591

675

Closing Cash balances

342

522

591

675

763

June 18, 2018

7

Bata India Ltd

Key Ratios

Y/E March

FY2016

FY2017

FY2018E FY2019E FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

31.9

31.8

28.3

24.7

21.4

P/CEPS

23.9

19.8

19.3

17.2

15.3

P/BV

4.6

4.0

3.6

3.2

2.9

Dividend yield (%)

0.7

0.7

0.8

0.9

1.0

EV/Sales

2.2

1.9

1.8

1.5

1.3

EV/EBITDA

19.3

18.9

15.8

12.9

10.8

EV / Total Assets

3.3

2.8

2.6

2.3

2.0

Per Share Data (`)

EPS (Basic)

27.0

27.1

30.4

34.8

40.1

EPS (fully diluted)

27.0

27.1

30.4

34.8

40.1

Cash EPS

35.9

43.5

44.7

50.0

56.2

DPS

5.9

6.0

6.7

7.7

8.8

Book Value

188.5

215.8

239.5

266.7

298.0

Returns (%)

ROCE

14.0

10.5

11.6

13.3

14.3

Angel ROIC (Pre-tax)

37.4

33.6

33.7

37.5

41.0

ROE

14.3

12.5

12.7

13.1

13.5

Turnover ratios (x)

Asset Turnover (Gross Block)

3.0

2.9

3.0

3.2

3.5

Inventory / Sales (days)

24

22

24

25

26

Receivables (days)

22

24

26

28

30

Payables (days)

54

53

49

45

44

Working capital cycle (ex-cash) (days)

(7)

(7)

1

8

12

Source: Company, Angel Research

June 18, 2018

8

Bata India Ltd

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Bata India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

June 18, 2018

9