Company Update | Banking

October 6, 2016

Axis Bank

BUY

CMP

`536

Axis to continue business growth

Target Price

`630

Despite slow down in the industry, Axis Bank continues to deliver strong business

Investment Period

12 Months

growth: Axis Bank has been able to outpace the industry growth delivering 19%

CAGR in loan book over FY12-16. The key driving force has been the retail

Stock Info

business (39% CAGR), whose share has gone up to 41% from 21% during the

Sector

Banking

same period. The management has been reiterating its stand on pick up in retail

loans, which is visible from the 24.3% growth during Q1FY17. Corporate loans

Market Cap (` cr)

1,28,019

also witnessed strong growth during Q1FY17 by 21%. Hence, we believe the

Beta

1.4

bank has potential to deliver 20% CAGR in loan for next 2-3 years & sharp

52 Week High / Low

638 /367

moderation in growth is unlikely.

Avg. Daily Volume

879,954

Asset quality woes restricted to the watch list: Axis bank came out with a watch

Face Value (`)

2

list of `22,628cr worth of loans at the end of Q4FY16, estimating 60% of that

could fall into NPA over the next 2 years with a bias towards higher slippages in

BSE Sensex

28,221

FY17. Accordingly, the bank saw slippages of `3,638cr in Q1FY17, reducing the

Nifty

8,744

watch list amount by 10.3%. Almost 74% of the slippages (`2,680cr) came from

Reuters Code

AXBK.BO

the watch list, while slippages from non watch list corporate book accounted for

Bloomberg Code

AXSB@IN

6% of the gross slippages.

Balance 20% slippages came from Non Corporate book. As expected, large part

of the slippages came from the corporate loans within the watch list. While, it is a

Shareholding Pattern (%)

known fact that in absolute terms there would be a rise in NPA and their ratio

will go up. However, there is low probability of negative surprise from the non

Promoters

29.7

watch list accounts turning into large scale NPAs.

MF / Banks / Indian Fls

14.2

We expect RoE to bounce back in FY18: Axis Bank has maintained RoE of 16-

FII / NRIs / OCBs

48.1

17% over the last 3 years. Their ability to contain credit cost and higher traction

in fee income were the driving forces behind the strong RoE. However, the

Indian Public / Others

8.0

management has already come out with a watch list and has given a higher

credit cost guidance of 125-150 bps for FY17 vs 92 bps/ 83 bps/110 bps in

FY14/FY15/16, respectively. This indicates that bottom-line will be under

Abs. (%)

3m

1yr

3yr

pressure. While, FY17 will see RoE falling to 13.6% vs 16.8% in FY16, we expect

Sensex

3.9

8.1

42.3

the same to bounce back to 16.5% by FY18. Ability to grow retail loans would be

Axis Bank

0.2

4.6

150.5

one of the keys for maintaining strong RoE & we believe the bank will be able to

sustain RoE of 16-17% in the medium term.

Outlook and valuation: Declaring the watch list gave the much required clarity

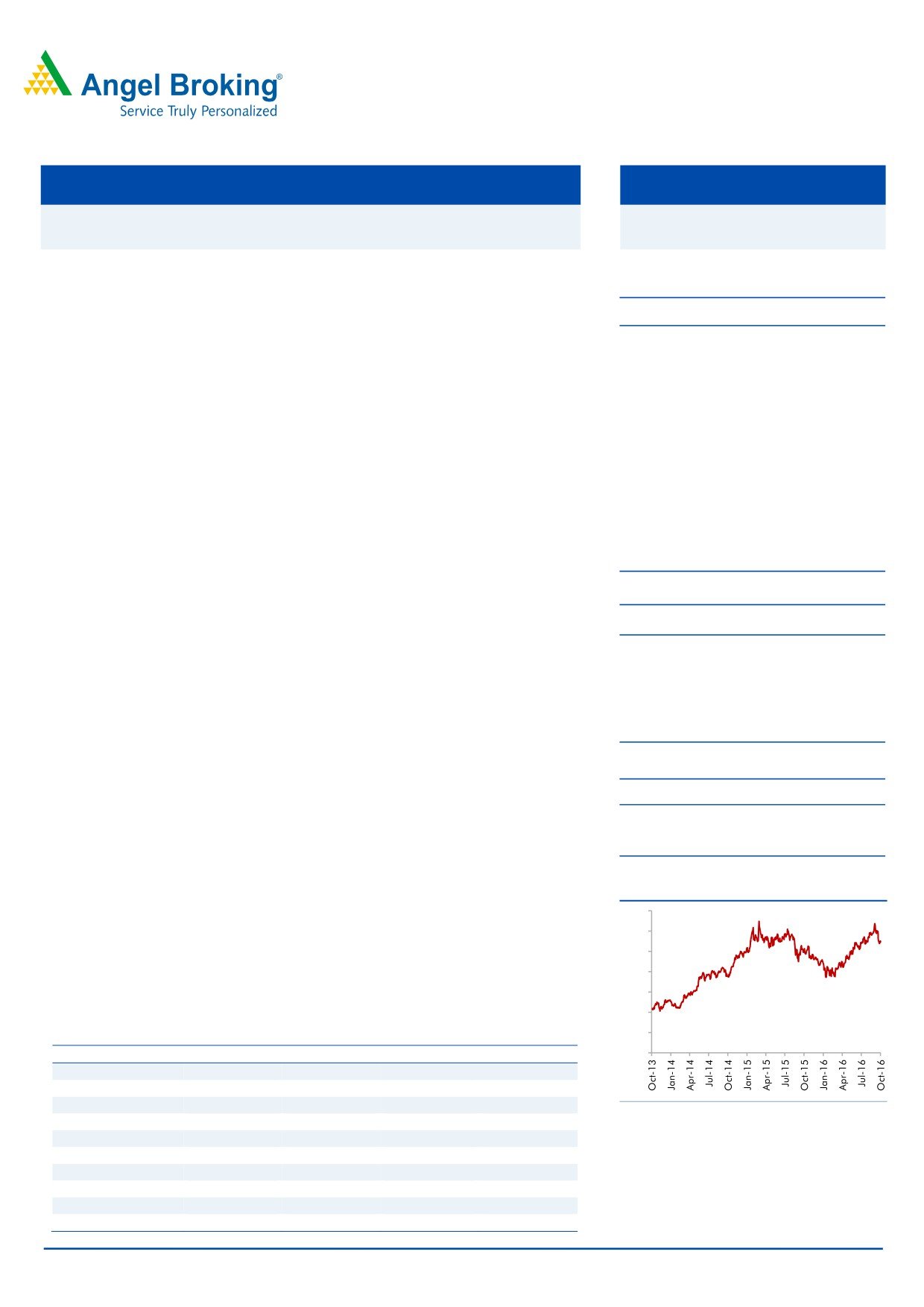

3-year price chart

on the book for the Bank. While credit cost will remain high and in turn RoE will

700

be under pressure for FY17; once the cleaning up process is over, we can expect

600

RoE rebounding and Axis Bank can be a re-rating candidate. At the current

500

levels, the stock trades at 2x its FY18E Adj BV of `268. Thus, we believe the

400

current corrections in the stock gives long term investors an opportunity to enter

300

the stock. We upgrade the stock to a BUY with a target price of `630.

200

100

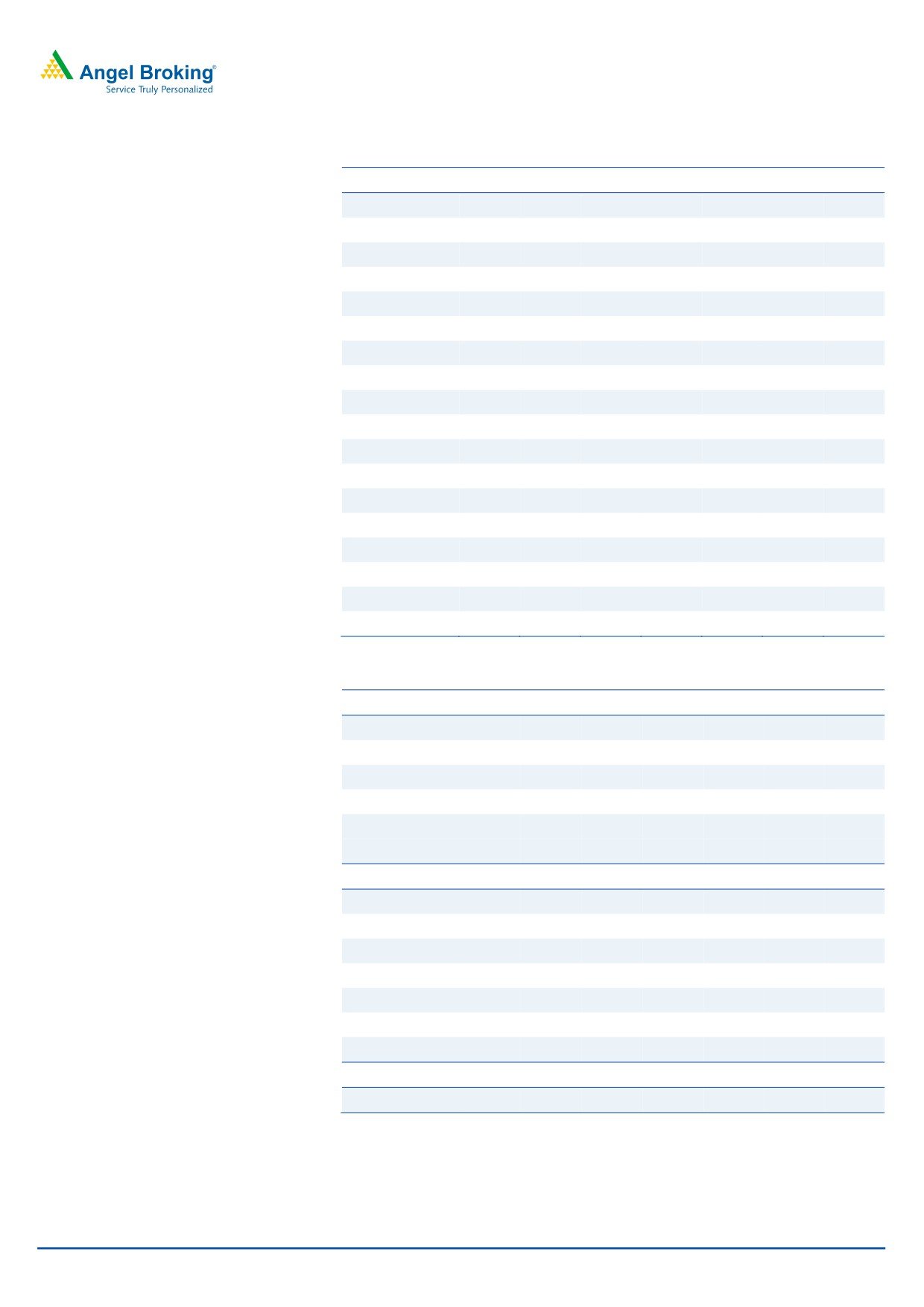

Key financials (Standalone)

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

-

NII

14,224

16,833

19,077

22,035

% chg

19.0

18.3

13.3

15.5

Net profit

7,358

8,224

7,723

10,669

Source: Company, Angel Research

% chg

18.3

11.8

-6.1

38.2

NIM (%)

3.5

3.6

3.5

3.4

EPS (`)

31.0

34.5

32.3

44.6

P/E (x)

17.7

15.9

17.0

12.3

P/ABV (x)

2.6

2.4

2.1

1.9

Siddharth Purohit

RoA (%)

1.7

1.7

1.3

1.6

022 - 3935 7800 Ext: 6828

RoE (%)

17.9

16.8

13.6

16.5

Source: Company, Angel Research; Note: CMP as of October 5, 2016

Please refer to important disclosures at the end of this report

1

Axis Bank | Company Update

Should we expect moderation in growth?

Axis Bank has been able to outpace the industry growth and has delivered 19%

CAGR in loan book over FY12-16. The key driving force behind the growth has

been the retail business, which had delivered a staggering 39% CAGR over the

same period. Axis has been able to increase the share of retail loans from 22% to

41% during the same period. It seems there is further scope for the bank to

increase its share of retail loans.

In the last 4 years, the management has aggressively expanded the retail credit

book and that too without compromising in the asset quality. During Q1FY17,

slippages ratio in the retail loan book stood at 0.7% compared to 4.2% overall

slippages and 7.5% corporate slippages. The management has been reiterating

that retail will continue to grow stronger and retail loans grew by 24.3% during

Q1FY17. On the other hand, even the corporate loan book has witnessed strong

growth during Q1FY17 by 21%. Hence, we believe the bank has enough potential

to deliver 20% CAGR for next 2-3 years and sharp moderation in the business

growth is very unlikely.

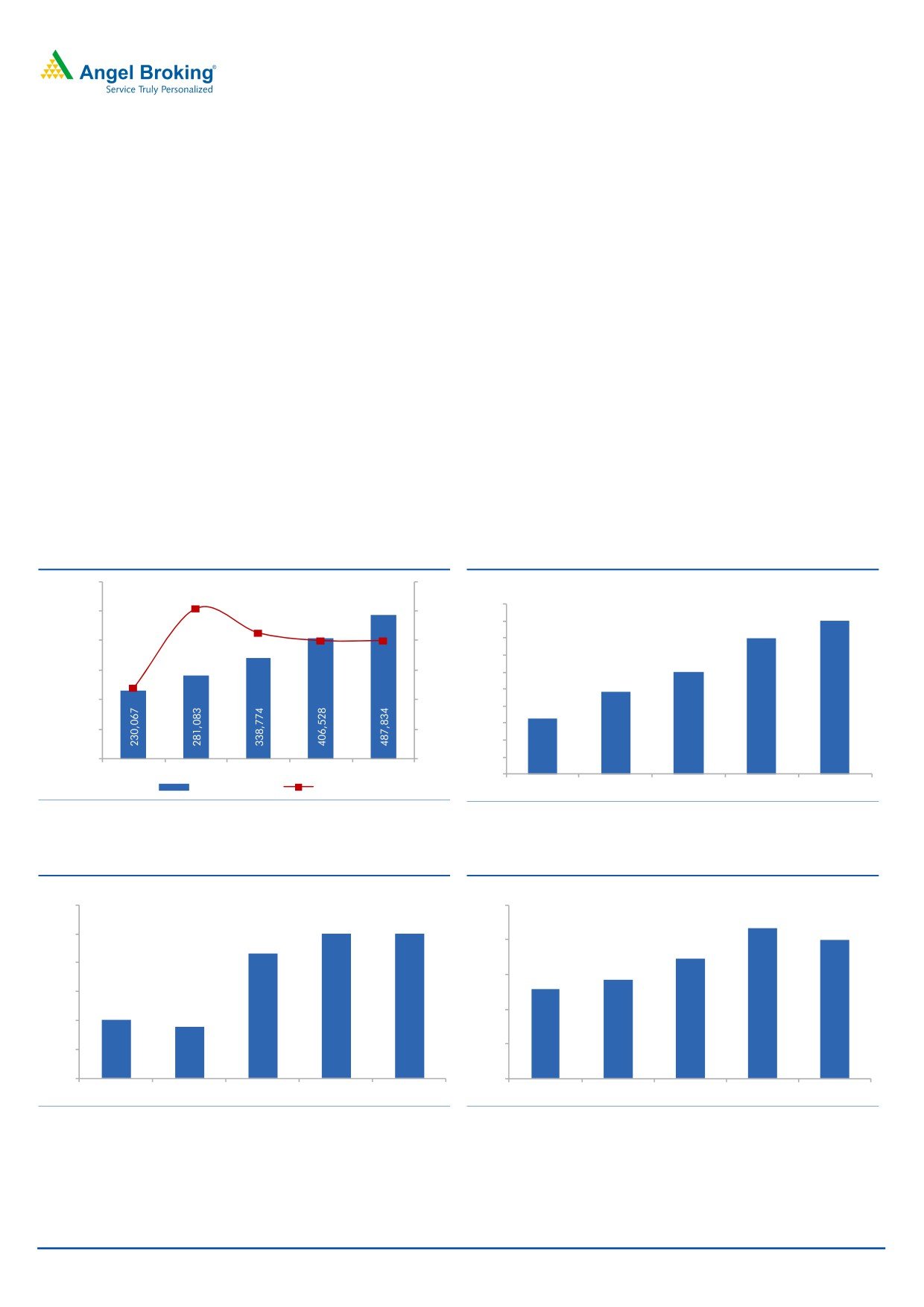

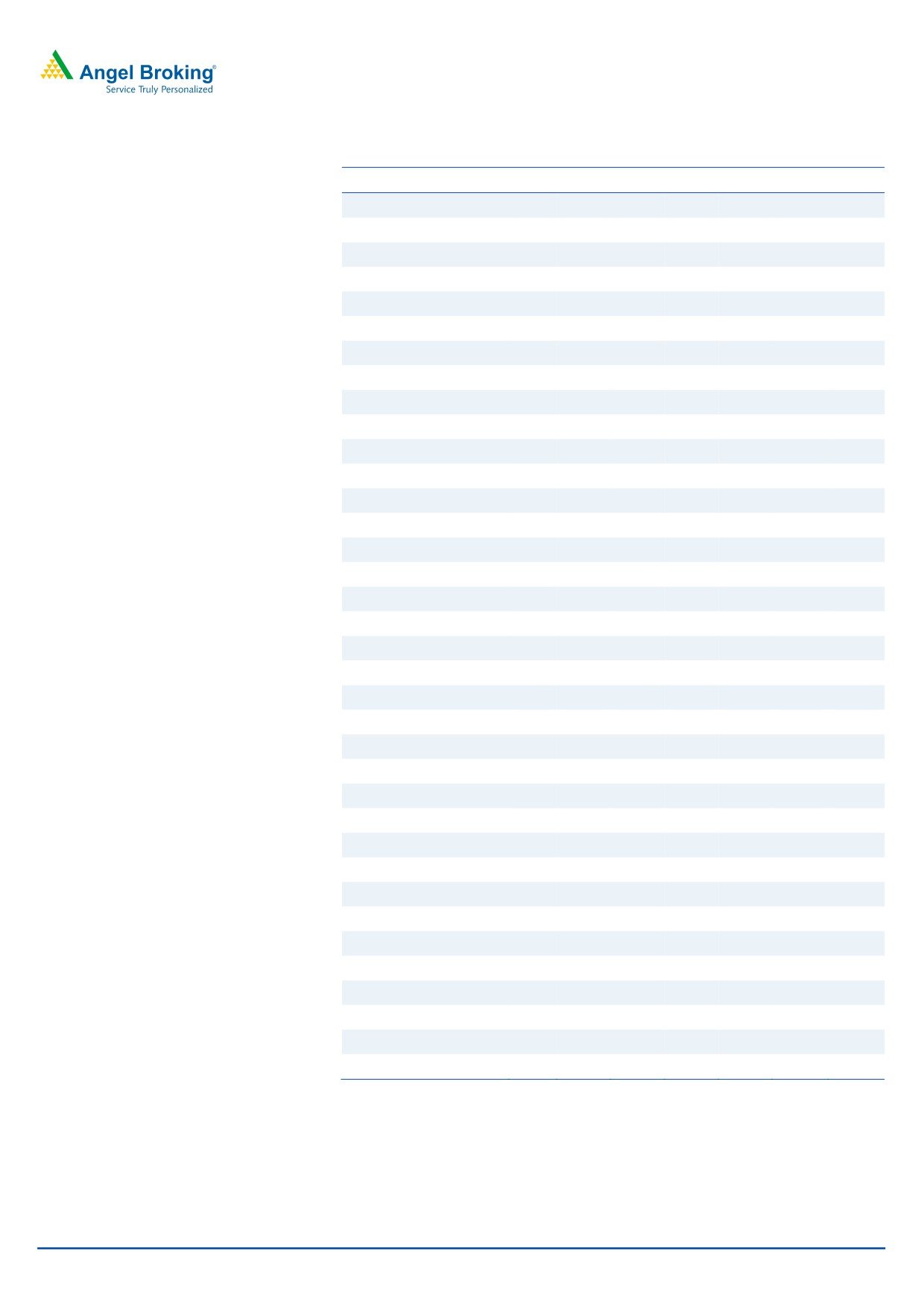

Exhibit 1: Loan Book growth %

Exhibit 2: Retail Loan Book %

600,000

24.0

(%)

22.2

45.0

500,000

22.0

44.0

20.5

20.0

44.0

43.0

400,000

20.0

43.0

20.0

42.0

41.0

300,000

16.8

18.0

41.0

39.8

40.0

200,000

16.0

39.0

38.3

38.0

100,000

14.0

37.0

-

12.0

36.0

FY14

FY15

FY16

FY17E

FY18E

35.0

Advances (` cr)

% Growth

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 3: CASA %

Exhibit 4: CASA Growth remains strong

(%)

(%)

49.0

25.0

21.7

48.0

48.0

20.0

48.0

47.3

20.0

17.3

47.0

14.2

15.0

12.8

46.0

45.0

10.0

44.8

45.0

5.0

44.0

43.0

0.0

FY14

FY15

FY16

FY17E

FY18E

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research

Source: Company, Angel Research

October 6, 2016

2

Axis Bank | Company Update

Can asset quality further deteriorate for Axis Bank?

The bank came out with strong disclosure at the end of Q4FY16 in which, the

management outlined that ~`22,628cr worth of loans were under stress and

estimated ~60% could fall into NPA over the next eight quarters. Further, large

part of the incremental NPA from this account are likely to come up in FY17 itself.

Accordingly, the bank saw slippages of `3,638cr during Q1FY17. The watch list

amount was reduced by 10.3% post slippages from that account.

A close watch into the slippages shows that `2,680cr i.e 74% of the total slippages

came from the watch list itself, while slippages from non watch list corporate book

accounted for 6% of the gross slippages. The balance 20% slippages came from

Non Corporate book. This indicates that, as expected, large part of the slippages

is in fact coming in from the corporate segment within the watch list. While, it is a

known fact that in absolute terms there would be a rise in NPA and the NPA ratios

will go up. However, there is low probability of negative surprises from the non

watch list accounts turning into large scale NPAs.

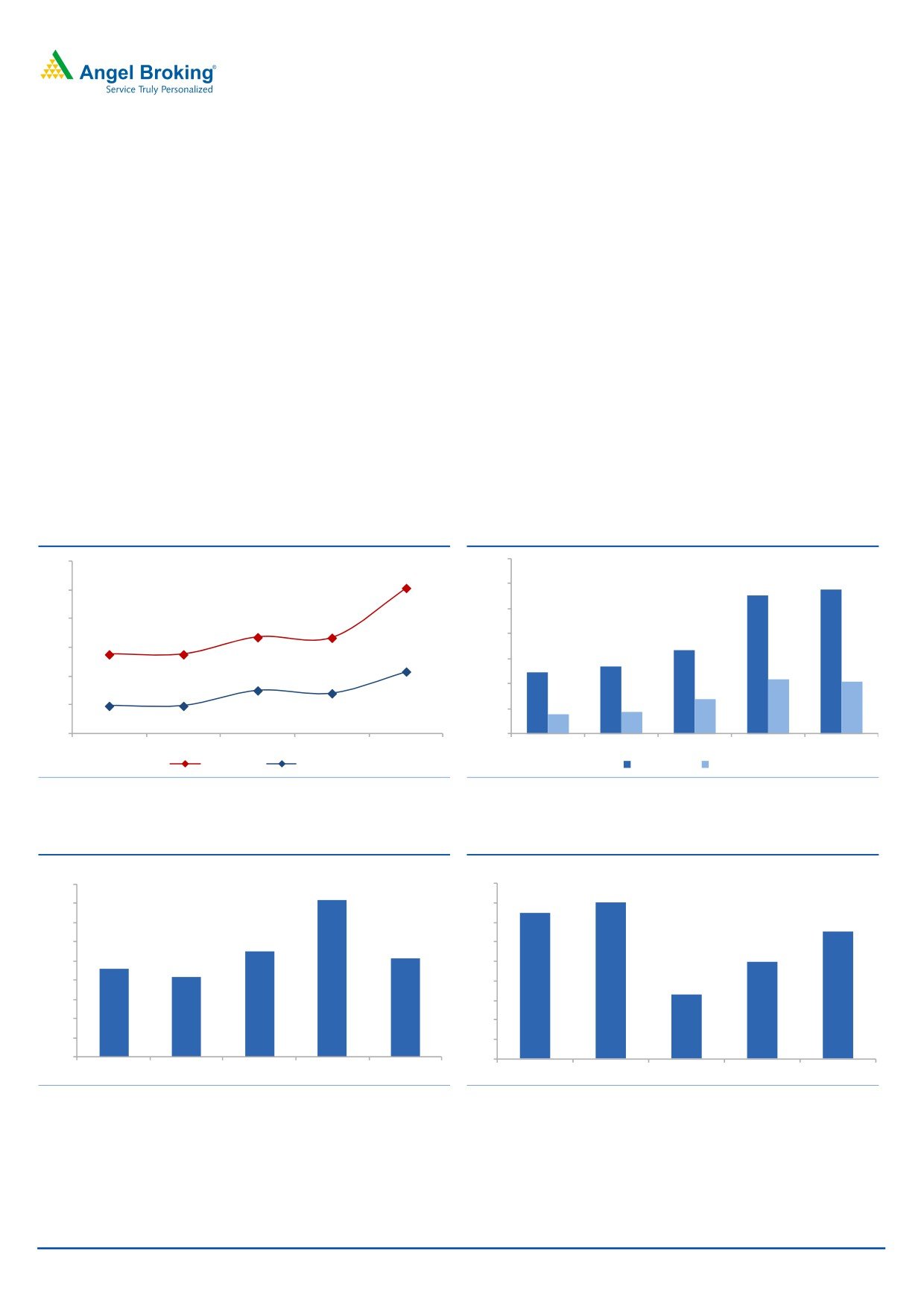

Exhibit 5: GNPAs & NNPAs Ratio Quarterly trend

Exhibit 6: GNPAs & NNPAs Ratio yearly trend

3.50

3.0

2.54

2.87

3.00

2.75

2.5

2.50

2.0

1.68

1.67

2.00

1.38

1.38

1.67

1.5

1.08

1.34

1.50

1.22

1.08

1.03

1.0

0.75

0.70

1.00

0.70

0.48

0.48

0.40

0.44

0.5

0.50

0.0

-

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

FY14

FY15

FY16

FY17E

FY18E

GNPAs (%)

NNPAs (%)

GNPAs (%)

NNPAs (%)

Source: Company, Angel Research;

Source: Company, Angel Research

Exhibit 7: Credit Cost %

Exhibit 8: PCR %

(%)

(%)

1.80

1.64

70

68

1.60

68

67

1.40

66

65

1.20

1.10

64

1.03

62

0.92

1.00

0.83

62

0.80

60

59

0.60

58

0.40

56

0.20

54

0.00

52

FY14

FY15

FY16

FY17E

FY18E

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research

Source: Company, Angel Research

October 6, 2016

3

Axis Bank | Company Update

How sustainable is the RoE?

Axis Bank has maintained RoE of 16-17% over the last three years. Their ability to

contain credit cost and higher traction in fee income were the driving forces behind

the strong RoE. However, the management has already come out with a watch list

and has given a higher credit cost guidance of 125-150 bps for FY17 vs 92 bps/

83 bps/110 bps in FY14/FY15/16, respectively. This indicates that bottom-line will

be under pressure. However, we have factored in a credit cost of 164 bps for FY17

and 103 bps for FY18. While, FY17 will see RoE falling to 13.6% vs 16.8% in

FY16, we expect the same to bounce back to 16.5% by FY18 end. Ability to sustain

the retail loans would be one of the keys for maintaining strong RoE and we

believe the bank will be able to sustain RoE of 16-17% in the medium term.

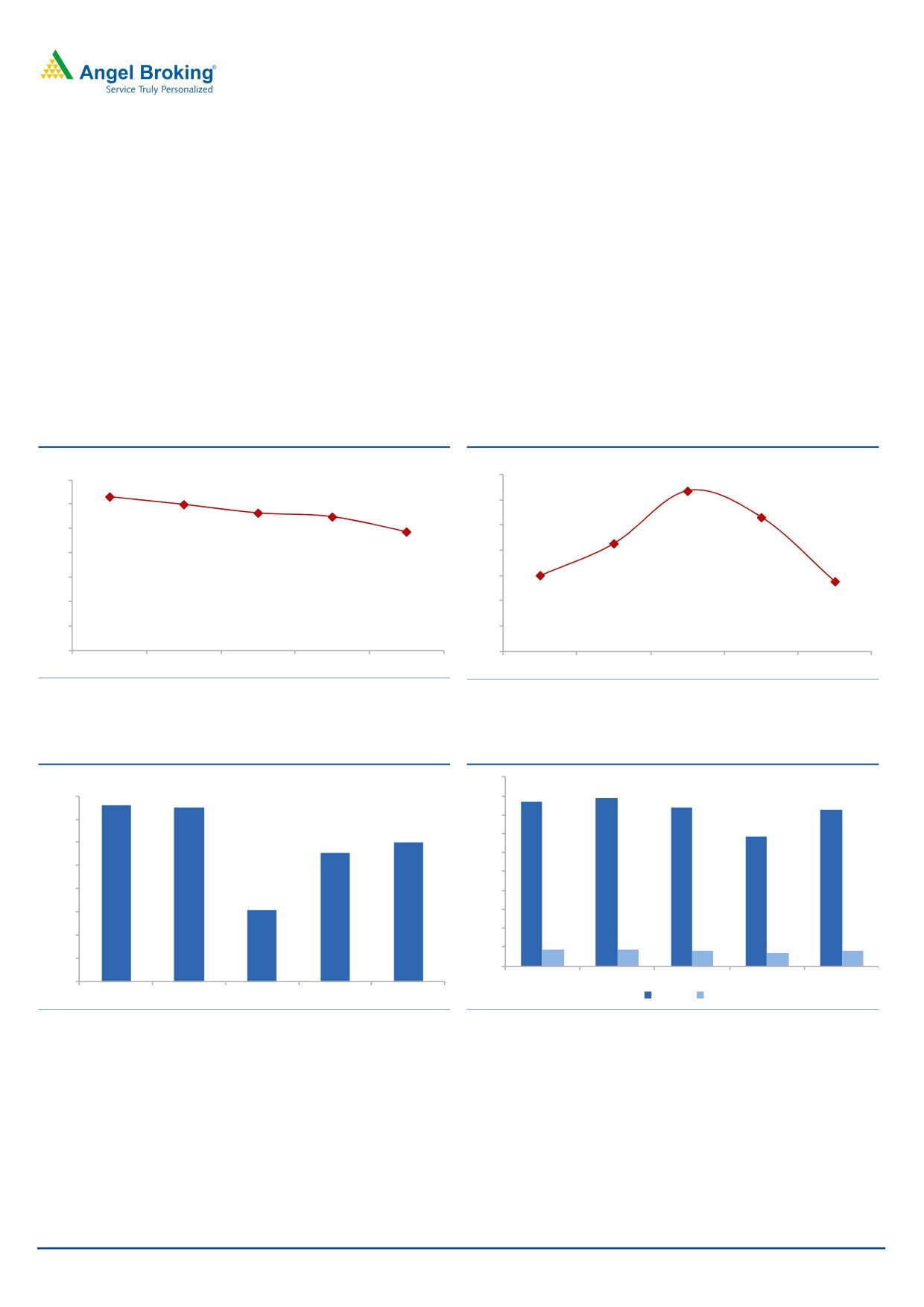

Exhibit 9: Cost Funds have declined

Exhibit 10: NIM Trend

(%)

(%)

3.6

6.3

3.6

5.8

3.6

6.0

5.8

3.5

5.3

5.6

5.5

3.5

4.8

5.2

3.5

3.5

4.3

3.4

3.4

3.8

3.4

3.4

3.3

3.3

2.8

3.3

FY14

FY15

FY16

FY17E

FY18E

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research;

Source: Company, Angel Research

Exhibit 11: Cost/ Income Ratio

Exhibit 12: ROE & ROA%

(%)

20.0

17.4

17.8

41.0

40.8

40.7

18.0

16.8

16.5

16.0

40.5

13.6

40.0

14.0

40.0

39.8

12.0

39.5

10.0

39.0

8.0

38.5

38.5

6.0

4.0

38.0

1.7

1.7

1.7

1.3

1.6

2.0

37.5

0.0

37.0

FY14

FY15

FY16

FY17E

FY18E

FY14

FY15

FY16

FY17E

FY18E

RoE (%) RoA (%)

Source: Company, Angel Research;

Source: Company, Angel Research

October 6, 2016

4

Axis Bank | Company Update

Is re-rating possible in the near term and how valuations look as

compared to peers?

Both Axis Bank and ICICI Bank came out with strong disclosures during Q4FY16

results. In absolute terms, both the banks have declared assets, which are sticky

and have potential to slip into NPA. However, the management of Axis Bank

estimated 60% of the `22,628 cr worth of loans, which are under watch list, could

fall into NPA category over the next eight quarters. While, the watch list was 13%

of the corporate assets, which seems high; it gave the much required clarity on the

book. Credit cost will remain high and in turn RoE will be under pressure for FY17;

but once the cleaning up process is over, we can expect RoE rebounding and Axis

Bank can be a re-rating candidate.

At the CMP, the stock trades at 2x its FY18E Adj BV of ` 268. We believe that the

current corrections in the stock give long term investors an opportunity to enter the

stock. We upgrade the stock to a BUY with a target price of `630.

Company Background

Axis Bank is India's third largest private sector bank, after ICICI and HDFC. The

bank is promoted by government institutions led by UTI (SUUTI currently holds 12%

stake in the bank). It has an extensive network of 3006 branches and 12,871

ATMs spread across 1,882 centers. The bank's strong growth has been backed by

robust retail branch expansion, strong corporate relationships and a wide range of

fee income products.

October 6, 2016

5

Axis Bank | Company Update

Income statement (Standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

Net Interest Income

8,018

9,666

11,952

14,224

16,833

19,077

22,035

- YoY Growth (%)

22.2

20.6

23.6

19.0

18.3

13.3

15.5

Other Income

5,420

6,551

7,405

8,365

9,371

11,149

12,884

- YoY Growth (%)

17.0

20.9

13.0

13.0

12.0

19.0

15.6

Operating Income

13,438

16,217

19,357

22,589

26,204

30,226

34,919

- YoY Growth (%)

20.0

20.7

19.4

16.7

16.0

15.3

15.5

Operating Expenses

6,007

6,914

7,901

9,204

10,101

12,018

13,963

- YoY Growth (%)

25.7

15.1

14.3

16.5

9.7

19.0

16.2

Pre - Provision Profit

7,431

9,303

11,456

13,385

16,104

18,209

20,956

- YoY Growth (%)

15.8

25.2

23.1

16.8

20.3

13.1

15.1

Prov. & Cont.

1,143

1,750

2,107

2,329

3,710

6,652

5,031

- YoY Growth (%)

(10.7)

53.1

20.4

10.5

59.3

79.3

(24.4)

Profit Before Tax

6,288

7,553

9,349

11,057

12,394

11,557

15,924

- YoY Growth (%)

22.4

20.1

23.8

18.3

12.1

(6.8)

37.8

Prov. for Taxation

2,046

2,373

3,131

3,699

4,170

3,834

5,255

- as a % of PBT

32.5

31.4

33.5

33.5

33.6%

33.2%

33.0%

PAT

4,242

5,179

6,218

7,358

8,224

7,723

10,669

- YoY Growth (%)

25.2

22.1

20.0

18.3

11.8

(6.1)

38.2

Balance sheet (Standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

Share Capital

413

468

470

474

477

477

478

Reserve & Surplus

22,395

32,640

37,751

43,463

52,688

59,635

68,704

Deposits

2,20,104

2,52,614

2,80,945

3,22,442

357,968

429,561

515,473

- Growth (%)

16.3

14.8

11.2

14.8

11.0

20.0

20.0

Borrowings

23,498

31,412

37,886

64,872

99,226

118,129

141,755

Other Liab. & Prov.

8,643

10,888

13,789

15,795

15,109

18,042

23,196

Total Liabilities

2,85,628

3,40,561

3,83,245

4,61,932

525,468

625,845

749,607

Cash Balances

10,703

14,792

17,041

19,819

22,361

21,478

25,774

Bank Balances

3,231

5,643

11,197

16,280

10,964

17,182

20,619

Investments

93,192

1,13,738

1,13,548

1,32,343

122,006

146,051

175,261

Advances

1,69,760

1,96,966

2,30,067

2,81,083

338,774

406,528

487,834

- Growth (%)

19.2

16.0

16.8

22.2

20.5

20.0

20.0

Fixed Assets

2,259

2,356

2,410

2,514

3,523

4,162

4,962

Other Assets

6,483

7,067

8,981

9,893

27,839

30,442

35,157

Total Assets

2,85,628

3,40,561

3,83,245

4,61,932

525,468

625,845

749,607

- Growth (%)

17.7

19.2

12.5

20.5

13.8

19.1

19.8

October 6, 2016

6

Axis Bank | Company Update

Ratio analysis (Standalone)

Y/E March

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

Profitability ratios (%)

NIMs

3.1

3.2

3.4

3.5

3.6

3.5

3.4

Cost to Income Ratio

44.7

42.6

40.8

40.7

38.5

39.8

40.0

RoA

1.6

1.7

1.7

1.7

1.7

1.3

1.6

RoE

20.3

18.5

17.4

17.9

16.8

13.6

16.5

B/S ratios (%)

CASA Ratio

41.5

44.4

45.0

44.8

47.3

48.0

48.0

Credit/Deposit Ratio

77.1

78.0

81.9

87.2

94.6

94.6

94.6

CAR

13.7

17.0

16.3

16.0

15.4

14.8

13.9

- Tier I

9.4

12.2

12.8

12.2

12.6

12.2

11.7

Asset Quality (%)

Gross NPAs

1.1

1.2

1.4

1.4

1.7

2.8

2.9

Net NPAs

0.3

0.4

0.4

0.5

0.7

1.1

1.0

Slippages

1.3

1.2

1.3

1.2

2.5

1.6

0.8

Loan Loss Prov. /Avg. Assets

0.3

0.4

0.4

0.5

1.1

1.6

1.0

Provision Coverage

73.8

70.6

77.2

68.0

58.6

62.0

65.0

Per Share Data (`)

EPS

20.5

22.1

26.5

31.0

34.5

32.3

44.6

ABVPS

110.3

141.0

161.7

184.1

212.5

233.5

268.4

DPS

3.2

3.6

4.0

5.9

5.0

6.0

6.5

Valuation Ratios

PER (x)

19.9

18.5

15.4

13.2

15.9

17.0

12.3

P/ABVPS (x)

3.7

2.9

2.5

2.2

2.4

2.1

1.9

Dividend Yield

0.8

0.9

1.0

1.4

0.9

1.1

1.2

DuPont Analysis

NII

3.0

3.1

3.3

3.4

3.4

3.3

3.2

(-) Prov. Exp.

0.4

0.6

0.6

0.6

0.8

1.2

0.7

Adj. NII

2.6

2.5

2.7

2.8

2.7

2.2

2.5

Other Inc.

2.0

1.9

2.0

1.7

1.9

1.9

1.9

Op. Inc.

4.7

4.6

4.8

4.8

4.6

4.1

4.3

Opex

2.3

2.2

2.2

2.2

2.0

2.1

2.0

PBT

2.4

2.4

2.6

2.6

2.5

2.0

2.3

Taxes

0.8

0.8

0.9

0.9

0.8

0.7

0.8

RoA

1.6

1.7

1.7

1.7

1.7

1.3

1.6

Leverage

12.6

11.2

10.1

10.3

10.1

10.2

10.6

RoE

20.3

18.5

17.4

17.9

16.8

13.6

16.5

October 6, 2016

7

Axis Bank | Company Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Axis Bank

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

October 6, 2016

8