IPO Note | Retail

March 4, 2017

Avenue Supermarts Limited

SUBSCRIBE

sue Open: March 08, 2017

Is

A retailer with a growth appetite

Issue Close: March 10, 2017

Avenue Supermarts Ltd (ASL), founded in 2002, is the owner of well established

supermarket chain D-Mart. ASL is amongst the largest and the most profitable

Food & Grocery retailer in India. It offers wide range of Food and non-food

Issue Details

products. ASL operates total 118 stores in 9 states and 1 Union Territory.

Face Value: `10

Market sentiment moving in favour of organized sector to aid growth: The Indian

Present Eq. Paid up Capital: `562cr

Retail industry is valued at US$616bn and is mainly dominated by the

unorganized sector (accounting for 91% share). Industry reports indicate that the

Fresh issue: `1,870 cr

Retail sector is expected to grow at a CAGR of ~12% over FY2016-20E to

Post Eq. Paid up Capital: `624cr

~US$960bn, within which, the organized segment is expected to grow at a faster pace

than the unorganized segment. The share of organized players is expected to improve

Issue size (amount): `1,870cr

from 9% to ~12% in FY2020E, thus benefitting organised players like D-Mart.

Price Band: `295-299

Steady footprint expansion: ASL has increased its store count from 45 in FY2011

to 118 in 9MFY2017 with total retail business area of ~3.9mn sq. ft in 45 cities.

Lot Size: 50 shares and in multiple

thereafter

Further, the company has plans to increase total retail space by 2.1mn sq. ft by

2020, which will support its growth.

Post-issue implied mkt. cap: *`1,8410cr -

**`1,8660cr

Huge potential for growth in F&G: In the modern retail, Food & Grocery (F&G)

has lower penetration compared to other categories like apparel & accessories,

Promoters holding Pre-Issue: 91.4%

footwear, jewellery & watches, consumer electronics, etc. Going forward, we

Promoters holding Post-Issue: 82.2%

expect the penetration in this category to improve, which will benefit the organised

*Calculated on lower price band

players like D-Mart.

** Calculated on upper price band

Track record of healthy financial performance: ASL has reported revenue CAGR

of ~40% over FY2012-16 on the back of (1) same store growth and (2)

Book Building

expansion of its business by adding new stores. On the bottom-line front, the

company has reported CAGR of ~52% over FY2012-16 due to good business

QIBs

50% of issue

and gradual improvement in the operating margins. Return on equity has also

Non-Institutional

15% of issue

improved from 9% in FY2012 to 32% in FY2016.

Retail

35% of issue

Outlook and Valuation: At the upper end of the price band, the pre-issue P/E

works out to be 32.5x its annualised 9MFY2017 earnings, which is lower

compared to P/E multiple of its peers i.e. Trent - 73.9x, Shoppers Stop - 123.8x

Post Issue Shareholding Pattern

and Future Retail 36.5x. Better RoE profile, promoter’s strong background,

strategically located stores, intense focus on maintaining lower costs and strong

Promoters

82.2%

brand perception are the compelling factors indicating that ASL is a long term story

Others

17.8%

that will unfold going ahead. Thus, we recommend a SUBSCRIBE on this issue.

Key Financials

Y/E March (` cr)

FY2014

FY2015

FY2016

9MHFY17

Net Sales

4,686

6,439

8,588

8,784

% chg

40.3

37.4

33.4

-

Net Profit

161

212

319

387

% chg

71.9

31.2

50.6

OPM (%)

7.3

7.1

7.7

8.8

EPS (`)

2.9

3.8

5.7

6.9

P/E (x)

104.0

79.3

52.7

-

P/BV (x)

17.6

14.0

11.1

-

RoE (%)

25.6

27.0

32.4

-

RoCE (%)

19.4

19.3

22.1

-

Amarjeet S Maurya

EV/Sales (x)

3.7

2.7

2.1

-

+91 22 39357800 Ext: 6831

EV/EBITDA (x)

50.4

38.1

26.8

-

Source: Company, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Please refer to important disclosures at the end of this report

1

Avenue Supermarts | IPO Note

Company background

Incorporated in 2002, Avenue Supermarts Limited (ASL) is a Mumbai based

supermarket chain under the name of D-Mart. Company is among the largest and

the most profitable F&G retailers in India. Company offers a wide range of

products with a focus on the Foods, Non-Foods (FMCG) and General Merchandise

& Apparel product categories.

Company has 118 stores with total retail business area of 3.59mn sq. ft in

45 cities spread across 9 states and 1 Union Territory in India. Company also

operates distribution centres and packing centres which form the backbone of the

supply chain to support its retail store network. Company has 21 distribution

centres and six packing centres in Maharashtra, Gujarat, Telangana and

Karnataka.

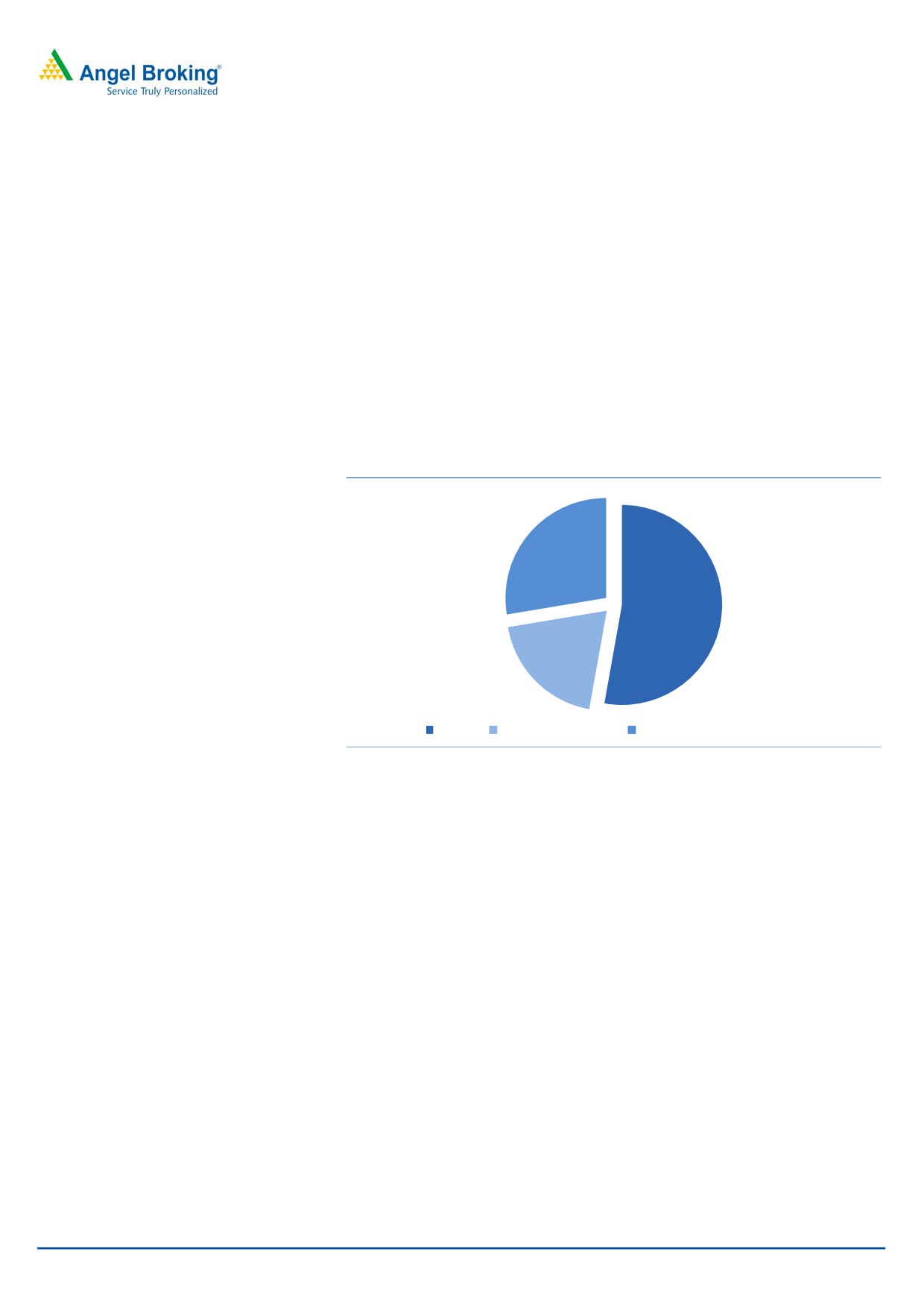

Exhibit 1: Revenue Mix (9MFY2017)

27.6%

52.8%

19.6%

Foods

Non-Foods (FMCG)

General Merchandise & Apparel

Source: Company, Angel Research

March 4, 2017

2

Avenue Supermarts | IPO Note

Issue details

The company is raising `1,870cr through a fresh issue of equity shares in the price

band of `295-299. The fresh issue will constitute ~10% of the post-issue paid-up

equity share capital of the company, assuming the issue is subscribed at the upper

end of the price band.

Exhibit 2: Pre and Post-IPO shareholding pattern

No. of shares (Pre-issue)

(%) No. of shares (Post-issue)

(%)

Promoters

51,30,25,392

91

51,30,25,392

82

Others

4,85,17,288

9

11,10,59,094

18

56,15,42,680

100

62,40,84,486

100

Source: RHP, Angel Research; Note: Calculated on upper price band

Objects of the offer

Repayment or prepayment of a portion of loans and redemption/ earlier

redemption of NCDs availed by Company - `1,080cr

Construction and purchase of fit outs for new stores - `367cr

General corporate purpose

March 4, 2017

3

Avenue Supermarts | IPO Note

Investment Rationale

Market sentiment moving in favour of organized sector to aid

growth

The Indian Retail industry is currently valued at US$616bn and is mainly

dominated by the unorganized sector (accounting for 91% share). Industry reports

indicate that the Retail sector is expected to grow at a CAGR of 12% over FY2016-

20E to ~US$960bn, within which, the organized segment is expected to grow at a

faster pace than the unorganized segment. The share of organized players is

expected to improve from 9% to ~12% in FY2020E, thus benefitting organised

players like D-Mart.

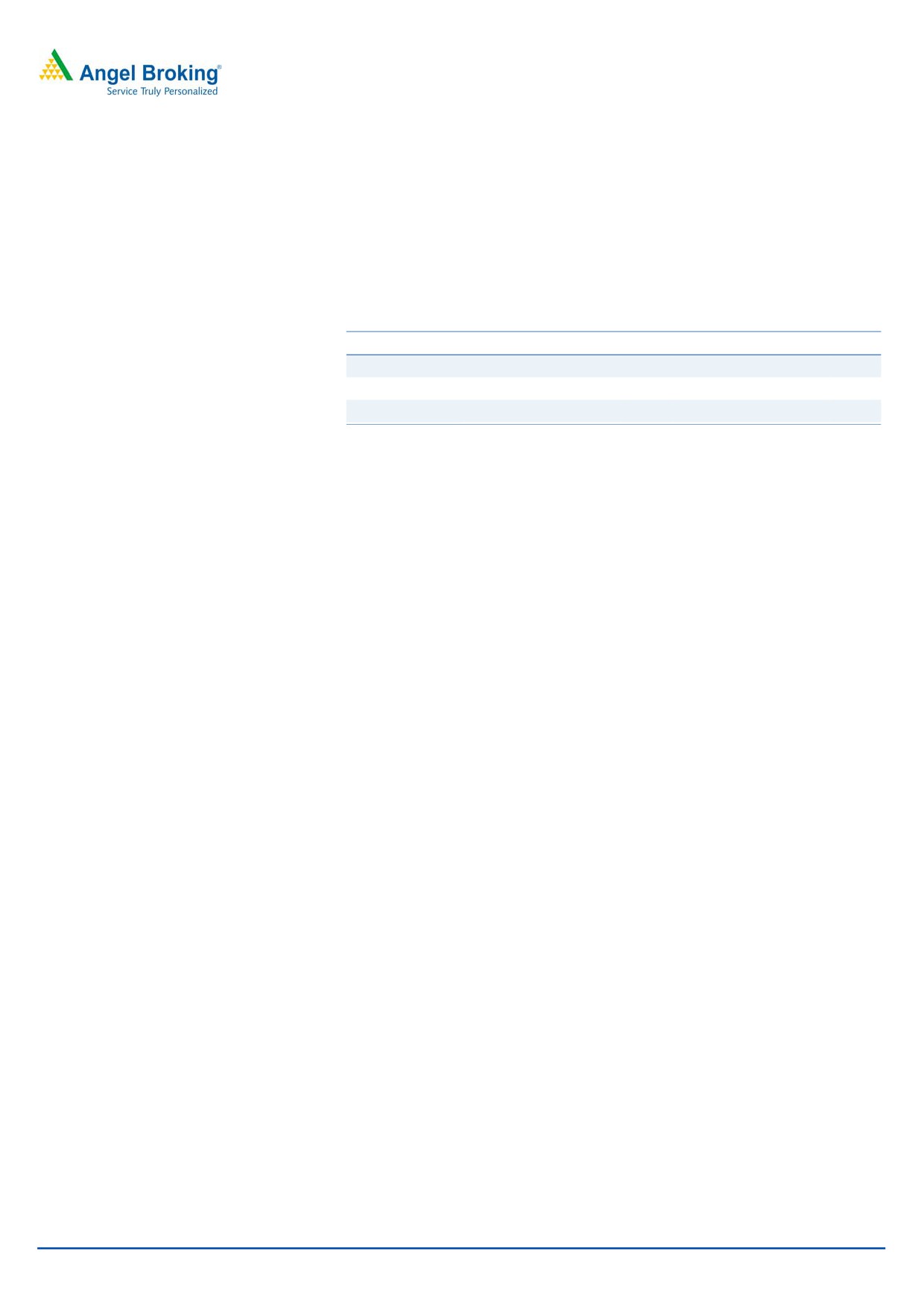

Exhibit 3: Market trend moving toward organised segment

1,200

960

1,000

800

616

600

386

400

200

115

55

27

0

FY2012

FY2016

FY2020

Overall Retail

Organized Brick & Mortar Retail

Source: Company, Angel Research

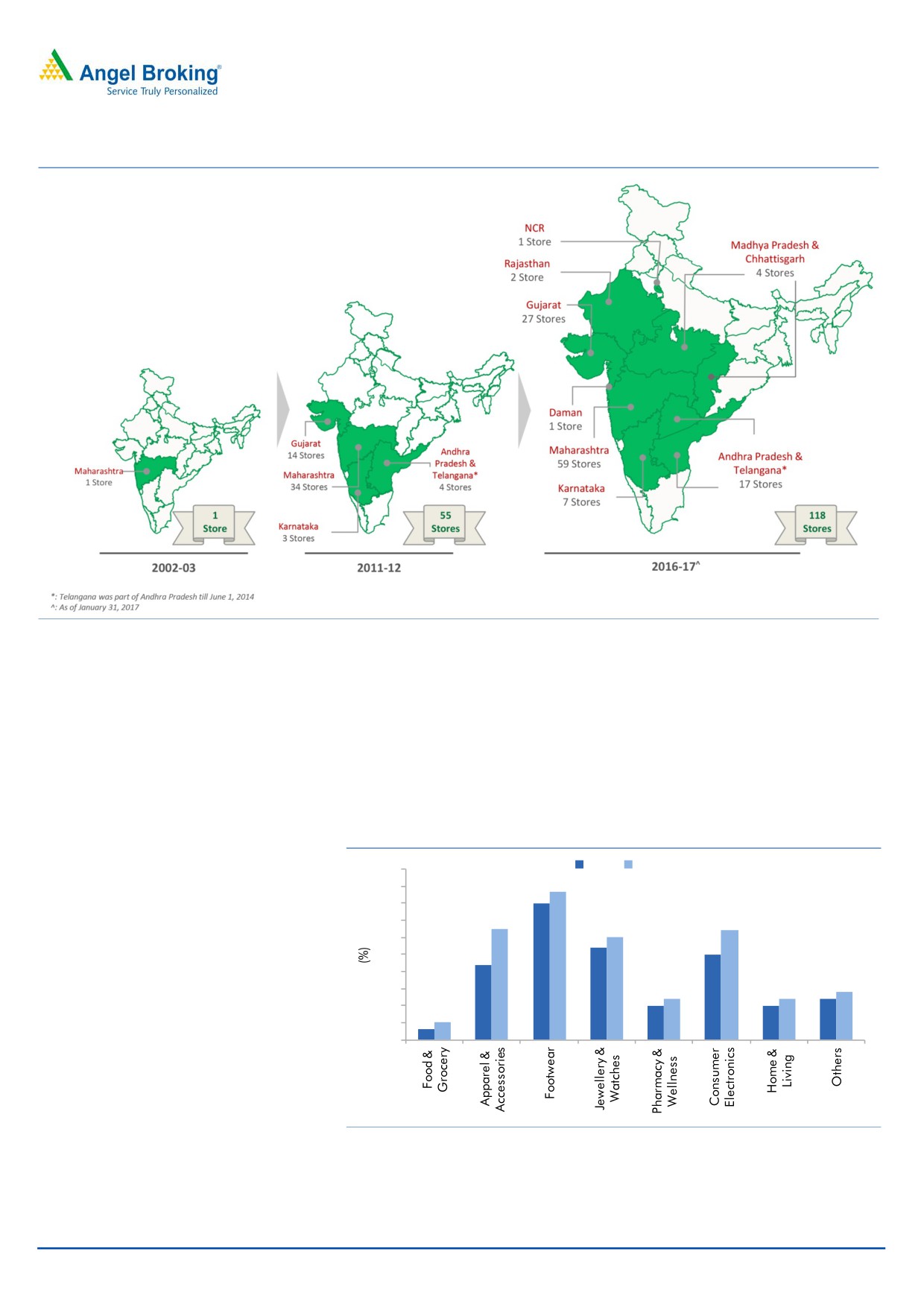

Steady footprint expansion

ASL has increased its store count from 45 in FY2011 to 118 in 9MFY2017, which

is around 3.9mn sq. ft total retail business area in 45 cities spread across 9 states

and 1 Union Territory. Further, the company has expansion plans to increase their

retail space by 2.1mn sq. ft by 2020. Company operates stores in locations where

it has the maximum growth possibility. It’s strategies such as (1) Medium sized

stores instead of large format stores, (2) standalone stores than stores in malls,

(3) maximum owned stores than leased stores, (4) focus on urban + rural than

only urban, and (5) maintaining profits at the store level, have proved to be very

successful for ASL. Company has indicated that it will continue to operate the same

strategy for the new stores as well, which gives a strong sense that it will maintain

the growth trajectory going ahead.

March 4, 2017

4

Avenue Supermarts | IPO Note

Exhibit 4: Expanding footprint

Source: Company, Angel Research

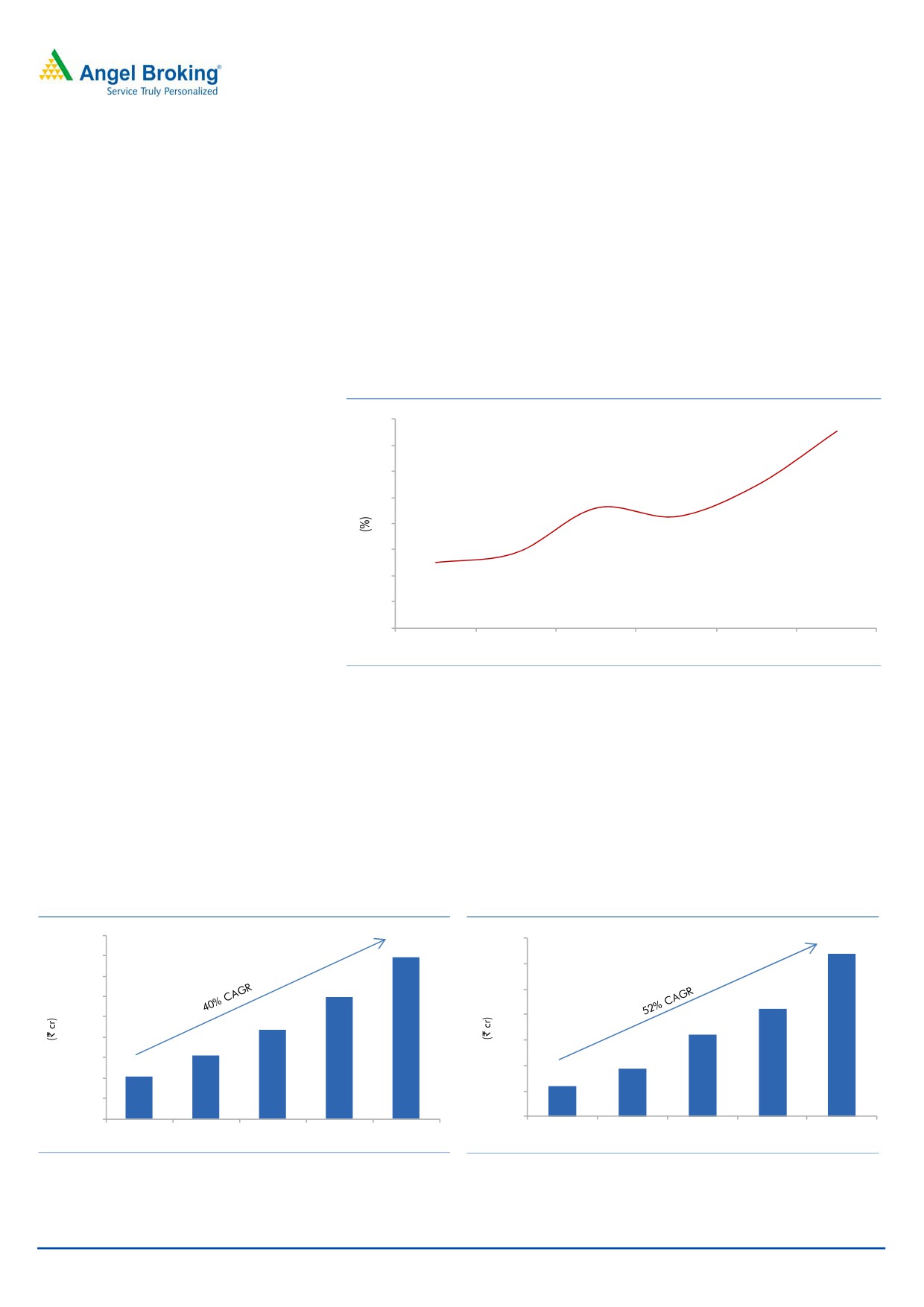

Low penetration provides huge potential for growth in F&G

Currently in the modern retail, Food & Grocery (F&G) has lower penetration

compared to other categories like apparel & accessories, footwear, jewellery &

watches, consumer electronics, etc. Going forward, we expect the penetration in

this category to improve, which in turn will prove beneficial for the big organised

players like D-Marts.

Exhibit 5: Modern Retail Penetration Category wise

2016

2020

50

43.5

45

40

40

32.5

32

35

30

30

27

25

25

22

20

14

15

12

12

12

10

10

10

5

3

5

0

Source: Company, Angel Research

March 4, 2017

5

Avenue Supermarts | IPO Note

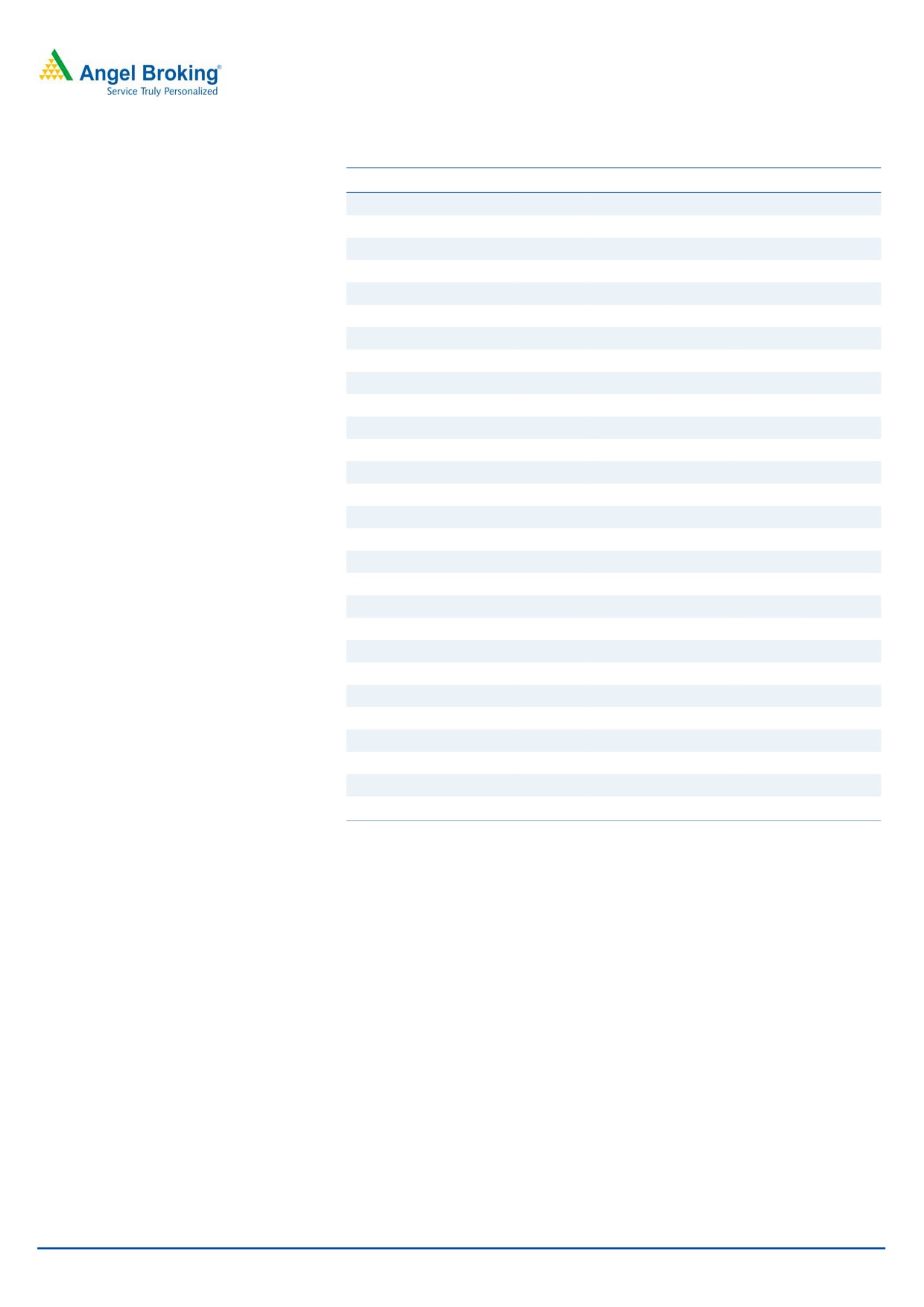

Consistently improving margins in a low margin industry

While growing its business, company has not compromised on its profitability,

which can be seen in its healthy operating profit margins over FY2012-16. While it

continues to attract consumers by keeping low prices every day, it also maintains

lower operating costs every day, which shows that management is involved in the

day to day operations and maintains a strong discipline in costs. While margins

are not likely to go up from the current levels, focus on strong operational

efficiency is likely to keep margins at the current levels, which we think is a

comfortable level.

Exhibit 6: Strong operating margin improvement

9

9

8

8

7

7

6

6

5

FY2012

FY2013

FY2014

FY2015

FY2016

9MFY17

Source: Company, Angel Research

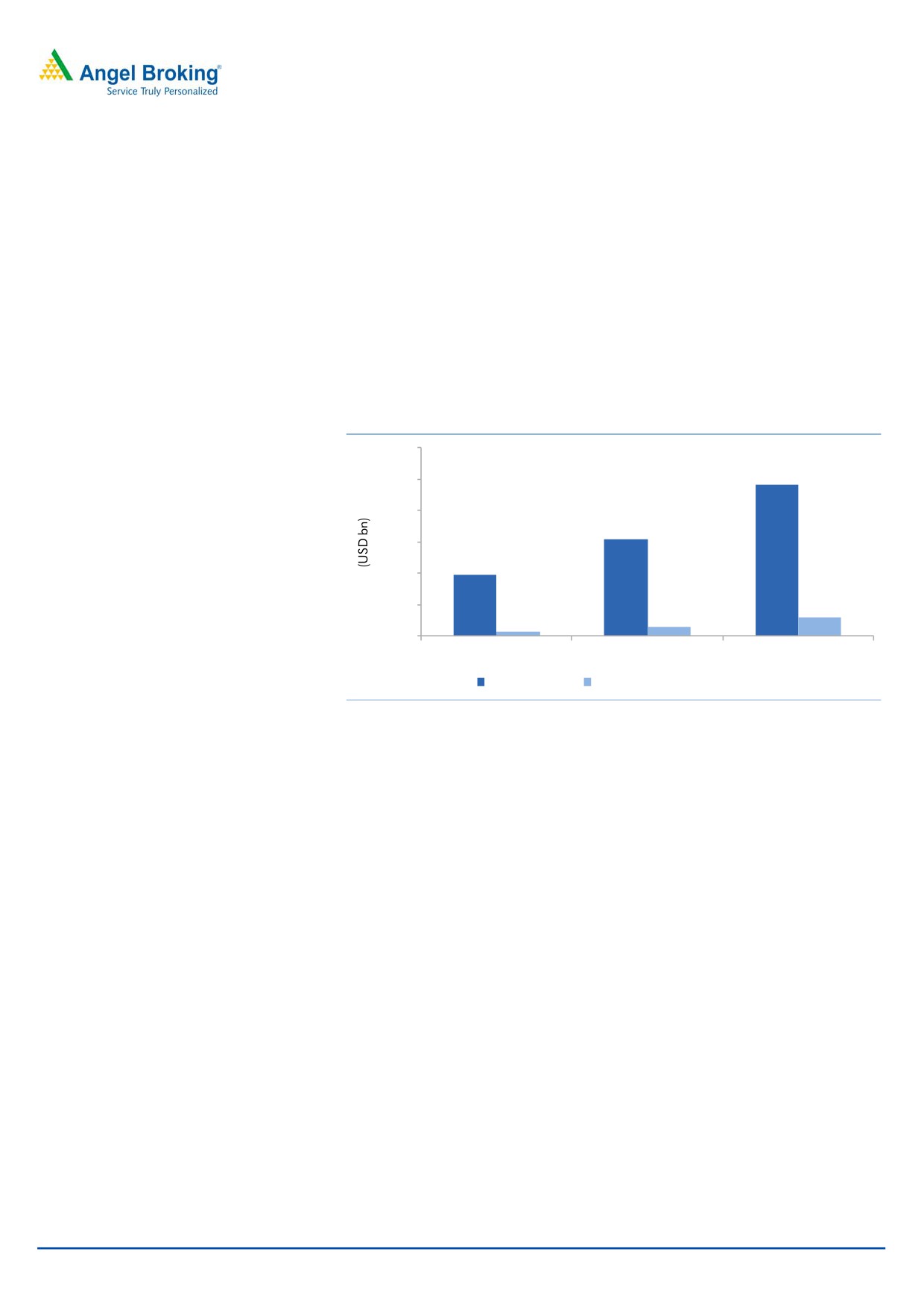

Track record of healthy financial performance

The company has reported revenue CAGR of ~40% over FY2012-16 on the back

of strong growth in number of stores and also growth in existing stores. On the

bottom-line front, the company has reported CAGR of ~52% over FY2012-16 on

the back strong revenue growth and gradual improvement n operating margins.

Further, the company has also improved its ROE from 9% in FY2012 to 32% in

FY2016.

Exhibit 7: Historical revenue trend

Exhibit 8: Historical PAT trend

9,000

350

7,925

319

8,000

300

7,000

5,980

250

6,000

212

5,000

4,345

200

161

4,000

3,126

150

3,000

94

2,071

100

60

2,000

50

1,000

-

0

FY2012

FY2013

FY2014

FY2015

FY2016

FY2012

FY2013

FY2014

FY2015

FY2016

Source: Company, Angel Research

Source: Company, Angel Research

March 4, 2017

6

Avenue Supermarts | IPO Note

Outlook and Valuation

At the upper end of the price band, the pre-issue P/E works out to be 32.5x its

annualised 9MFY2017 earnings, which is lower compared to P/E multiple of its

peerss i.e. Trent - 73.9x, Shoppers Stop - 123.8x and Future Retail 36.5x. Better

RoE profile, promoter’s strong background, strategically located stores, intense

focus on maintaining lower costs and strong brand perception are the compelling

factors indicating that ASL is a long term story that will unfold going ahead. Thus,

we recommend a SUBSCRIBE on this issue.

Key risks

Increase in penetration of e-commerce

Increase in penetration of e-commerce in retails could affect the company’s

profitability

Increase in competition

Due to low entry barrier in business, the company could face increased

competition, which would impact the company’s profitability

March 4, 2017

7

Avenue Supermarts | IPO Note

Consolidated Income Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

9MFY17

Total operating income

3,341

4,686

6,439

8,588

8,784

% chg

51.3

40.3

37.4

33.4

-

Total Expenditure

3,126

4,345

5,980

7,925

8,014

Raw Material

2,857

3,984

5,487

7,308

7,416

Personnel

69

87

134

149

138

Others Expenses

200

273

359

468

461

EBITDA

215

342

459

663

770

% chg

55.8

59.0

34.3

44.6

-

(% of Net Sales)

6.4

7.3

7.1

7.7

8.8

Depreciation& Amortisation

46

57

82

98

92

EBIT

169

285

377

565

678

% chg

68.3

68.3

32.5

49.7

-

(% of Net Sales)

5.1

6.1

5.9

6.6

7.7

Interest & other Charges

43

56

72

91

91

Other Income

14

16

18

18

19

(% of PBT)

10.1

6.5

5.6

3.7

3.2

Share in profit of Associates

-

-

-

-

-

Recurring PBT

141

245

323

492

606

% chg

59.9

73.8

32.0

52.2

Tax

47

83

111

172

213

PAT (reported)

94

161

212

321

393

% chg

55.1

72.3

31.6

50.9

-

(% of Net Sales)

2.8

3.4

3.3

3.7

4.5

Adj.

0.2

(0.1)

(0.7)

(1.7)

(5.4)

PAT after adj.

94

161

212

319

387

(% of Net Sales)

2.8

3.4

3.3

3.7

4.4

Basic & Fully Diluted EPS (`)

1.7

2.9

3.8

5.7

6.9

% chg

55.4

71.9

31.2

50.6

-

March 4, 2017

8

Avenue Supermarts | IPO Note

Consolidated Balance Sheet

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

9MFY17

SOURCES OF FUNDS

Equity Share Capital

544

547

562

562

562

Reserves& Surplus

245

409

638

956

1,344

Shareholders Funds

790

956

1,199

1,518

1,905

Minority Interest

0

0

0

0

0

Total Loans

434

511

757

1,038

1,242

Deferred Tax Liability

20

27

31

40

48

Total Liabilities

1,243

1,494

1,987

2,596

3,195

APPLICATION OF FUNDS

Net Block

925

1,172

1,528

2,094

2,330

Capital Work-in-Progress

118

89

98

82

206

Investments

16

16

15

27

59

Current Assets

433

532

713

896

1,173

Inventories

276

378

540

672

848

Sundry Debtors

13

10

7

8

41

Cash

62

55

38

35

49

Loans & Advances

82

88

128

180

234

Other Assets

0

0

0

1

1

Current liabilities

249

314

368

502

573

Net Current Assets

185

218

346

394

601

Mis. Exp. not written off

-

-

-

-

-

Total Assets

1,243

1,494

1,987

2,596

3,195

March 4, 2017

9

Avenue Supermarts | IPO Note

Consolidated Cash Flow Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

9MFY17

Profit before tax

141

245

323

493

607

Depreciation

46

57

82

98

92

Change in Working Capital

(65)

(83)

(152)

(69)

(219)

Interest / Dividend (Net)

43

56

72

91

91

Direct taxes paid

37

75

100

164

185

Others

(74)

(152)

(202)

(330)

(376)

Cash Flow from Operations

127

198

222

447

378

(Inc.)/ Dec. in Fixed Assets

(239)

(272)

(477)

(648)

(466)

(Inc.)/ Dec. in Investments

9

2

4

(10)

(31)

Cash Flow from Investing

(231)

(270)

(474)

(658)

(497)

Issue of Equity

14

5

33

0

0

Inc./(Dec.) in loans

103

60

201

208

132

Others

0

1

0

1

1

Cash Flow from Financing

118

65

234

208

133

Inc./(Dec.) in Cash

14

(7)

(17)

(3)

14

Opening Cash balances

48

61

55

37

34

Closing Cash balances

61

55

37

34

48

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016

Valuation Ratio (x)

P/E (on FDEPS)

178.9

104.0

79.3

52.7

P/CEPS

120.4

76.9

57.1

40.1

P/BV

21.3

17.6

14.0

11.1

EV/Sales

5.1

3.7

2.7

2.1

EV/EBITDA

79.7

50.4

38.1

26.8

EV / Total Assets

13.8

11.5

8.8

6.8

Per Share Data (`)

EPS (Basic)

1.7

2.9

3.8

5.7

EPS (fully diluted)

1.7

2.9

3.8

5.7

Cash EPS

2.5

3.9

5.2

7.5

Book Value

14.1

17.0

21.4

27.0

Returns (%)

ROCE

13.8

19.4

19.3

22.1

Angel ROIC (Pre-tax)

14.8

20.4

19.8

22.7

ROE

17.8

25.6

27.0

32.4

Turnover ratios (x)

Inventory / Sales (days)

30

29

31

29

Receivables (days)

10

10

7

8

WC cycle (ex-cash) (days)

21

21

24

21

Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

March 4, 2017

10

Avenue Supermarts | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

March 4, 2017

11