Company Update | Pharmaceuticals

July 3, 2018

Aurobindo Pharmaceuticals

BUY

Aurobindo Pharmaceuticals is an India-based leading global generic

CMP

`619

company. It’s predominately formulations export company, with USA &

Target Price

`770

Europe contributing

~70% of sales (FY2018). Amongst the Indian

Investment Period

12 Months

Pharmaceutical companies, we believe that Aurobindo Pharmaceuticals is

well placed to face the challenging generic markets, given its focus on

S tock Info

S ector

P harmaceuticals

achieving growth through productivity.

Market Cap (` cr)

35,286

Well placed for challenging times in USA: Aurobindo has a robust pipeline

Net Debt (` c r)

3,277

Beta

1.1

(has filed 478 ANDA’s; second highest amongst Indian companies) & is

52 W eek High / L ow

809/527

investing to enhance its foray into complex generic (mainly injectables,

A vg. Daily V olume

54,388

Face Value (`)

1

ophthalmic etc.) & biosimilar, which will drive its next leg of growth. In the

BSE Sensex

35,038

Nifty

10,589

current price competitive market, company is well placed; given it’s vertically

R euters Code

AR BN.BO

integrated with 70% of raw material requirements being meet through

B loomberg Code

AR BN.IN

internally. In addition, almost no single product of the company contributes

S hareholding P attern (% )

than 3% of sales; unlike others peers, who have high product concentration.

P romoters

51.9

MF / Banks / Indian Fls

15.6

This is also evident from the performance of the company in USA in FY2018.

F II / NR Is / OCB s

18.6

Company expects pricing pressure to stabilize at +/- 5% yoy over the medium

Indian P ublic / Others

13.9

term. The company expects to launch ~30-40 products in the US, over the

Abs .(% )

3m

1y r

3y r

next six months, which will aid growth in the US business. Overall USA will

Sensex

6.3

13.6

26.0

Aurobindo P harma

8.1

(10.2)

(15.9)

grow at 12.7% CAGR over FY2018-20E.

Europe to grow steady, while ARV could provide extra boost: Europe, which is

another key region for the company, is expected to post CAGR of 12.0%

during FY2018-20E, while ROW is expected to post a CAGR of 20% during

same period. However, growth during the period would be more

predominate in the ARV segment, where company has confirmed tenders of

US$80-100mn to be executed over next two years.

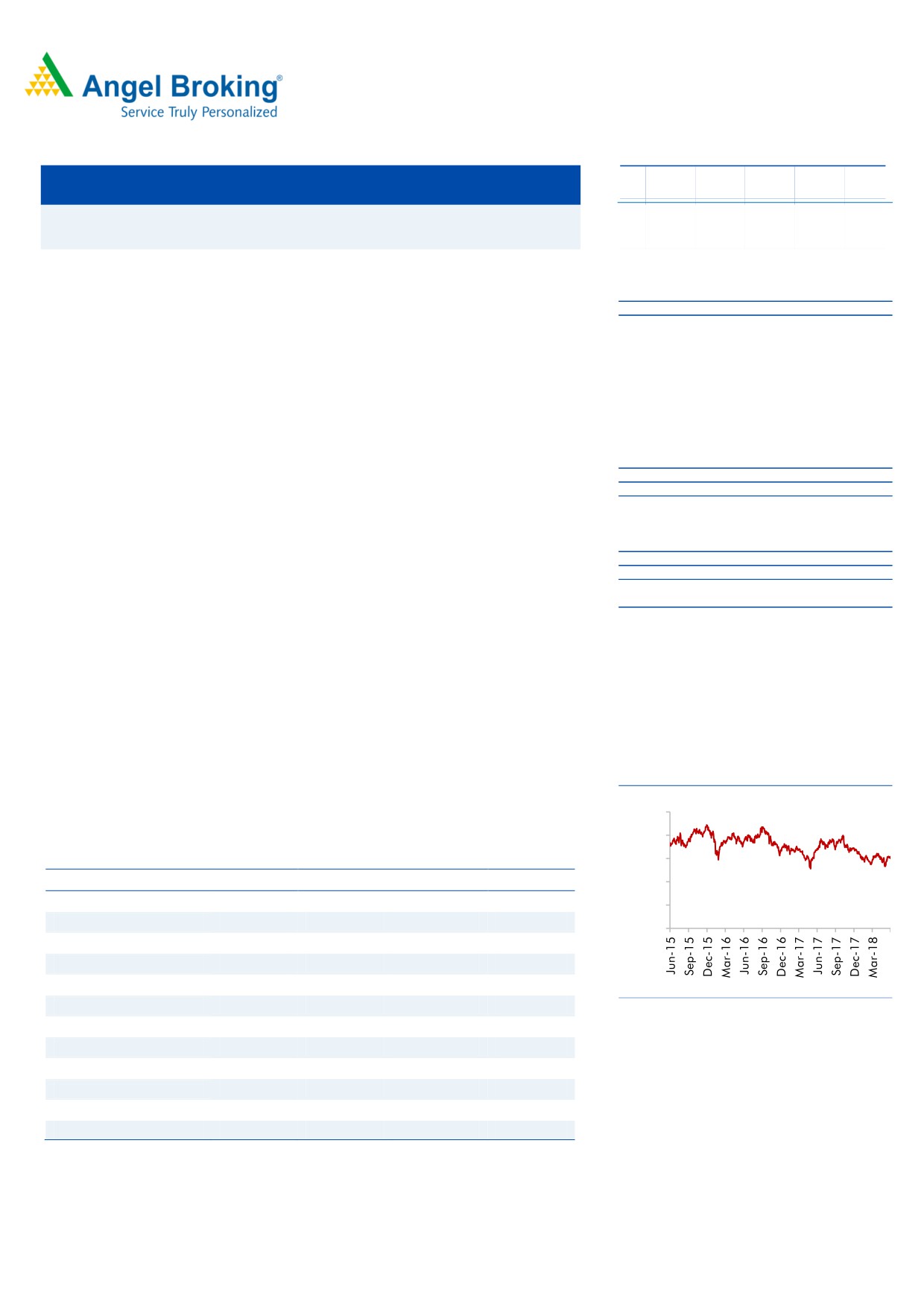

Outlook and Valuation: We expect Aurobindo to report net revenue CAGR of

3-year price chart

~13% & net profit to grow at ~5% CAGR during FY2018-20E, due to

increased R&D expenditure. However, valuations of the company are cheap

1000

V/s its peers and own fair multiples of 17-18x. We recommend BUY rating.

800

Key Financials

600

Y/E March (` cr)

FY2017

FY2018 FY2019E FY2020E

400

Net sales

14,845

16,233

18,871

20,646

200

% chg

8.3

9.4

16.3

9.4

0

Adj. Net profit

2,302

2,423

2,685

2,650

% chg

13.7

5.3

10.8

(1.3)

EBITDA margin (%)

21.5

21.6

21.0

19.2

EPS (`)

39.4

41.5

46.0

45.4

Source: Company, Angel Research

P/E (x)

15.4

14.6

13.2

13.4

P/BV (x)

3.8

3.0

2.5

2.2

RoE (%)

27.6

23.0

20.9

17.4

RoCE (%)

23.1

20.6

19.6

17.8

EV/Sales (x)

2.6

2.4

2.0

1.8

EV/EBITDA (x)

11.9

11.1

9.6

9.3

Sarabjit Kour Nangra

Source: Company, Angel Research Note: CMP as of July 02, 2018

022-39357800 Ext: 6806

Please refer to important disclosures at the end of this report

1

Aurobindo Pharmaceuticals

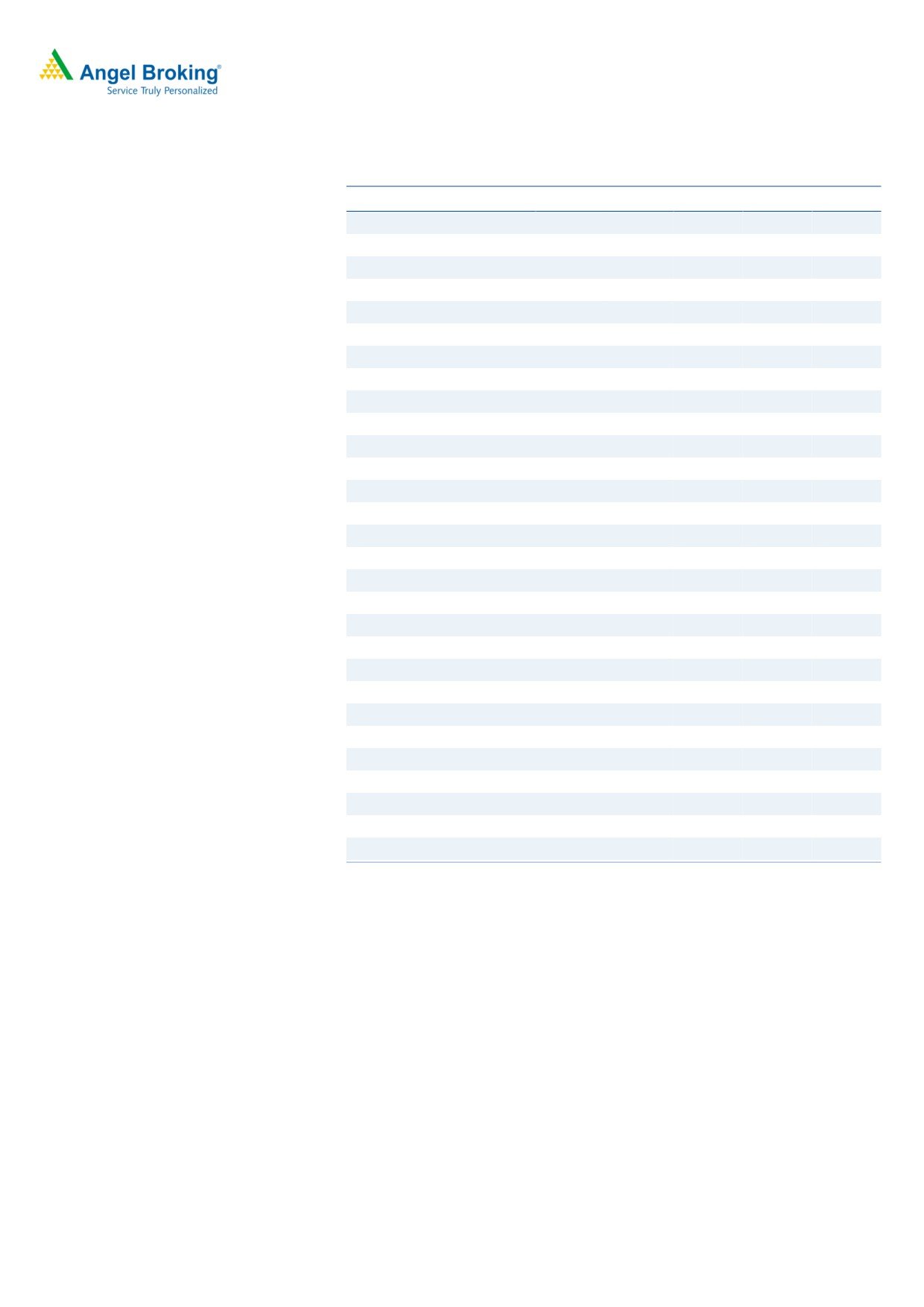

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E FY2020E

Total operating income

13,955

15,090

16,500

19,138

20,913

% chg

15.1

8.1

9.3

16.0

9.3

Total Expenditure

10,931

11,656

12,728

14,917

16,674

Net Raw Materials

6,162

6,434

6,753

7,737

8,362

Other Mfg costs

1,371

1,484

1,623

1,887

2,065

Personnel

1,543

1,768

2,131

2,450

2,818

Other

1,386

1,426

1,555

1,710

1,881

R&D

470

543

667

1,132

1,548

EBITDA

2,779

3,189

3,505

3,954

3,972

% chg

11.8

14.8

9.9

12.8

0.5

(% of Net Sales)

20.3

21.5

21.6

21.0

19.2

Depreciation& Amortisation

392

428

558

672

756

EBIT

2,386

2,762

2,947

3,282

3,216

% chg

10.8

15.7

6.7

11.4

(2.0)

(% of Net Sales)

17.4

18.6

18.2

17.4

15.6

Interest & other Charges

93

67

78

75

55

Other Income

205

121

105

105

105

(% of PBT)

7.5

4.0

3.2

2.9

3.0

Share in profit of Associates

-

-

-

-

-

Recurring PBT

2,744

3,061

3,241

3,579

3,533

% chg

23.2

11.5

5.9

10.4

(1.3)

Extraordinary Expense/(Inc.)

-

-

-

-

-

PBT (reported)

2,744

3,061

3,241

3,579

3,533

Tax

720.7

759.6

818.3

894.8

883.3

(% of PBT)

26.3

24.8

25.2

25.0

25.0

PAT (reported)

2,024

2,301

2,423

2,684

2,650

PAT after MI (reported)

2,025

2,302

2,423

2,685

2,650

Basic EPS (Rs)

34.6

39.3

41.4

45.9

45.3

% chg

25.1

13.7

5.3

10.8

(1.3)

July 3, 2018

2

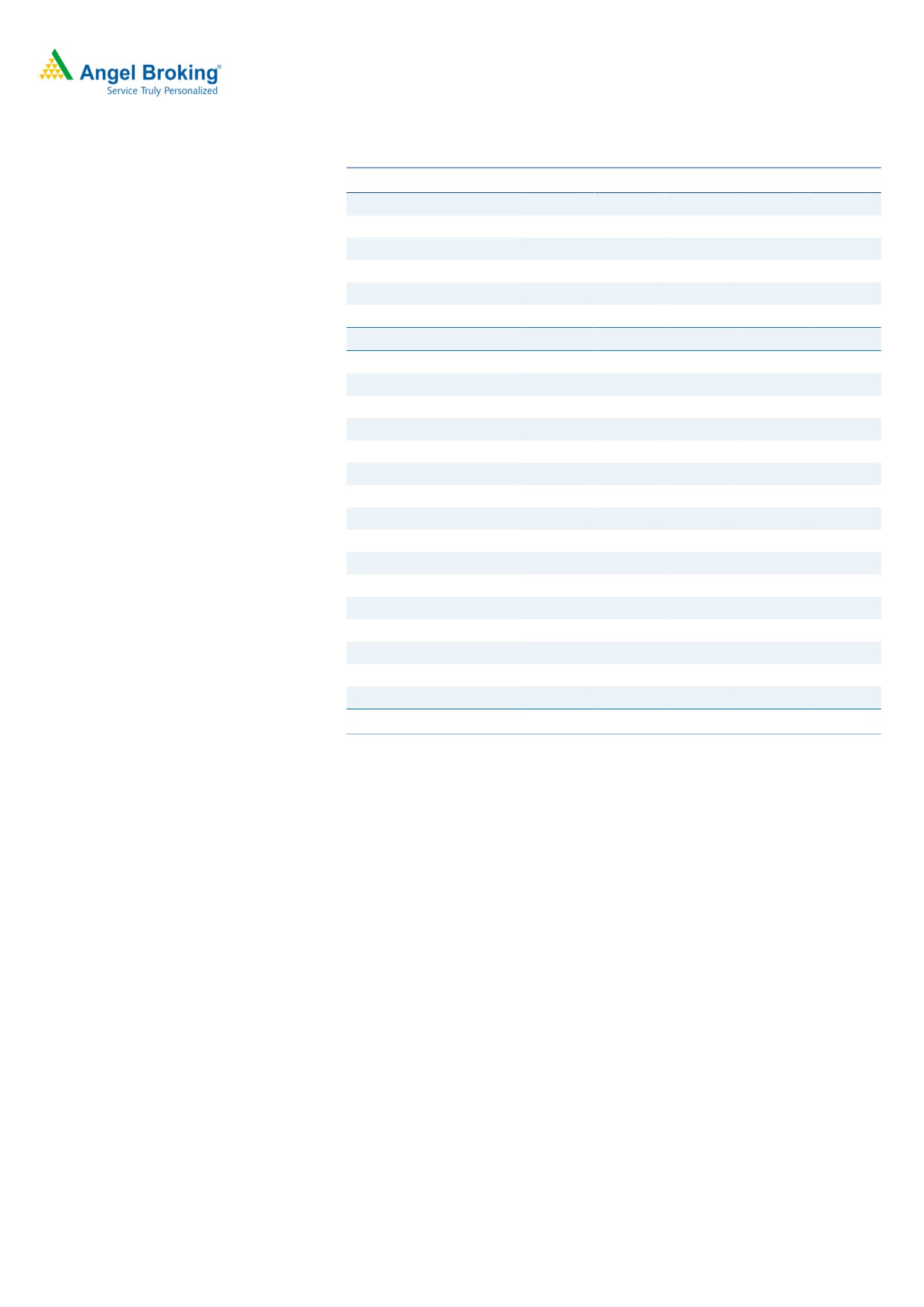

Aurobindo Pharmaceuticals

Consolidated Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018 FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

59

59

59

59

59

Reserves& Surplus

7,229

9,313

11,622

13,993

16,333

Shareholders Funds

7,287

9,372

11,680

14,051

16,391

Total Loans

4,415

3,084

4,483

3,000

2,500

Deferred Tax Liability

(182)

(118)

76

76

76

Total Liabilities

11,546

12,362

16,297

17,129

18,969

APPLICATION OF FUNDS

Gross Block

Less: Acc. Depreciation

6,093

7,625

8,998

10,198

11,398

Net Block

2,186

2,614

3,172

3,844

4,600

Capital Work-in-Progress

3,907

5,011

5,826

6,354

6,799

Investments

310

310

310

310

310

Current Assets

812

971

1,968

1,968

1,968

Inventories

123

246

312

312

312

Sundry Debtors

269

338

343

343.32

399.12

Cash

10,294

9,206

12,188

13,247

15,096

Loans & Advances

834

513

1,262

547

1,202

Other Assets

831

409

10

10

10

Current liabilities

8,629

8,284

10,916

12,690

13,884

Net Current Assets

4,168

3,720

4,649

5,405

5,913

Deferred Tax Asset

6,127

5,487

7,539

7,842

9,182

Mis. Exp. not written off

-

-

-

-

-

Total Assets

11,546

12,362

16,297

17,129

18,969

July 3, 2018

3

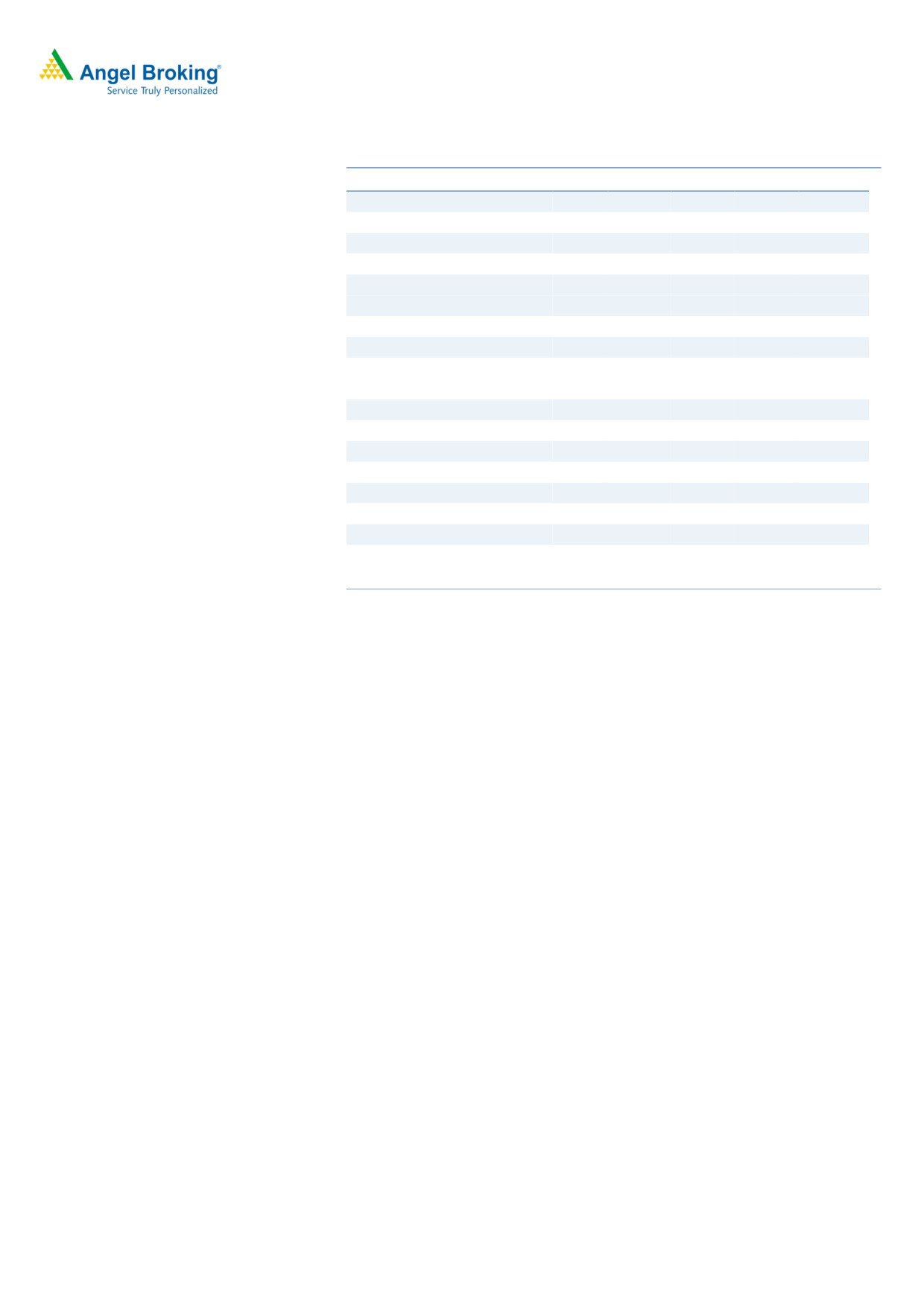

Aurobindo Pharmaceuticals

Consolidated Cashflow Statement

Y/E March (` cr)

FY2016 FY2017 FY2018 FY2019E FY2020E

Profit before tax

2,744

3,061

3,241

3,579

3,533

Depreciation

392

428

558

672

756

Change in Working Capital

(1,333)

388

(1,298)

(1,018)

(629)

Interest / Dividend (Net)

205

121

105

105

105

Direct taxes paid

(721)

(760)

(818)

(895)

(883)

Cash Flow from Operations

877

2,996

1,577

2,233

2,671

(Inc.)/ Dec. in Fixed Assets

3

(1,532)

(1,374)

(1,200)

(1,200)

(Inc.)/ Dec. in Investments

103

123

66

-

-

Other Income

205

121

105

105

105

Cash Flow from Investing

311

(1,288)

(1,203)

(1,095)

(1,095)

Issue of Equity

Inc./(Dec.) in loans

552

(1,331)

1,398

(1,483)

(500)

Dividend Paid (Incl. Tax)

(171)

(171)

(171)

(314)

(310)

Interest / Dividend (Net)

(1,204)

(527)

(854)

(56)

(111)

Cash Flow from Financing

(823)

(2,030)

373

(1,853)

(921)

Inc./(Dec.) in Cash

365

(321)

748

(715)

655

Opening Cash balances

469

834

513

1,262

547

Closing Cash balances

834

513

1,262

547

1.202

July 3, 2018

4

Aurobindo Pharmaceuticals

Key Ratios

Y/E March

FY2016 FY2017 FY2018 FY2019E FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

17.5

15.4

14.6

13.2

13.4

P/CEPS

14.7

13.0

11.9

10.6

10.4

P/BV

4.9

3.8

3.0

2.5

2.2

Dividend yield (%)

0.4

0.4

0.4

0.8

0.7

EV/Sales

2.9

2.6

2.4

2.0

1.8

EV/EBITDA

14.1

11.9

11.1

9.6

9.3

EV / Total Assets

3.4

3.1

2.4

2.2

1.9

Per Share Data (`)

EPS (Basic)

34.6

39.3

41.4

45.9

45.3

EPS (fully diluted)

34.6

39.3

41.4

45.9

45.3

Cash EPS

41.3

46.6

50.9

57.4

58.2

DPS

2.5

2.5

2.5

4.6

4.5

Book Value

124.5

160.1

199.6

240.1

280.1

Returns (%)

ROCE

22.9

23.1

20.6

19.6

17.8

Angel ROIC (Pre-tax)

26.5

27.4

25.3

24.3

21.6

ROE

32.5

27.6

23.0

20.9

17.4

Turnover ratios (x)

Asset Turnover (Gross Block)

2.3

2.2

2.0

2.0

1.9

Inventory / Sales (days)

100

101

113

106

110

Receivables (days)

107

89

65

65

65

Payables (days)

126

119

114

113

110

Working capital cycle (ex-cash) (days)

124

124

124

129

133

Source: Company, Angel Research

July 3, 2018

5

Aurobindo Pharmaceuticals

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Aurobindo Pharmaceuticals

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

July 3, 2018

6