3QFY2016 Result Update | FMCG

January 20, 2016

Asian Paints

NEUTRAL

CMP

`845

Performance Highlights

Target Price

-

Quarterly Data

Investment Period

-

(` cr)

3QFY16

3QFY15

% yoy

2QFY16

% qoq

Revenue

4,160

3,653

13.9

3,779

10.1

Stock Info

EBITDA

748

585

27.9

621

20.5

Sector

FMCG

Margin (%)

18.0

16.0

(197bp)

16.4

(156bp)

Market Cap (` cr)

81,071

Adj. PAT

499

368

35.4

399

25.0

Net Debt (` cr)

-1,374

Source: Company, Angel Research

Beta

0.8

52 Week High / Low

925 / 693

Asian Paints’ posted a healthy performance for 3QFY2014, both on the top-line

Avg. Daily Volume

91,960

as well as the bottom-line front. For the quarter, the company’s top-line grew by

Face Value (`)

1

13.9% yoy to `4,160cr while the reported Adj.PAT grew ~35% yoy to `499cr.

BSE Sensex

24,480

Key highlights: For 3QFY2016, Asian Paints’ consolidated top-line posted a

Nifty

7,435

double-digit growth of 13.9% yoy to `4,160cr on the back of healthy festival

Reuters Code

ASPN.BO

season demand. However, heavy rainfall in south India did impact its sales

Bloomberg Code

APNT@IN

performance. The company’s protective and powder coatings business did well

with the segment benefitting from lower material prices. Its international business

posted healthy growth, particularly in the Middle East and Bangladesh. However

Shareholding Pattern (%)

as per the Management, the domestic demand environment continues to be

Promoters

52.8

challenging.

MF / Banks / Indian Fls

15.3

On the operating profit front, the company reported a growth of 27.9% yoy due to

FII / NRIs / OCBs

18.8

healthy sales growth and lower material prices. The operating profit margin was

Indian Public / Others

13.1

up by 197bp yoy to 18.0% due to easing material prices and employee costs as a

percentage of sales. During the quarter, the company reported an adjusted net

profit of 35.4% yoy to `499cr.

Abs. (%)

3m 1yr 3yr

Sensex

(11.6)

(5.9)

20.7

Outlook and valuation: We expect Asian Paints to post a ~10.2% and ~11.9%

CAGR in its top-line and bottom-line respectively, over FY2015-18E. At the current

Asian Paints

2.5

0.2

96.1

market price, the stock is trading at 40.9x FY2018E earnings. We maintain our

Neutral view on the stock.

3-year price chart

Key financials (Consolidated)

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

1000

900

Net sales

14,183

15,403

17,128

18,978

800

% chg

11.6

8.6

11.2

10.8

700

Adj. Net profit

1,414

1,705

1,835

1,984

600

500

% chg

15.4

20.6

7.6

8.1

400

EBITDA margin (%)

15.6

17.4

16.8

16.4

300

EPS (`)

14.7

17.8

19.1

20.7

P/E (x)

57.3

47.5

44.2

40.9

Source: Company, Angel Research

P/BV (x)

17.1

16.3

15.4

14.5

RoE (%)

29.4

34.3

34.8

35.5

RoCE (%)

37.6

44.3

45.1

46.2

EV/Sales (x)

5.6

5.2

4.6

4.2

Amarjeet S Maurya

022-39357800 Ext: 6831

EV/EBITDA (x)

36.1

29.7

27.7

25.6

Source: Company, Angel Research; Note: CMP as of January 19, 2016

Please refer to important disclosures at the end of this report

1

Asian Paints | 3QFY2016 Result Update

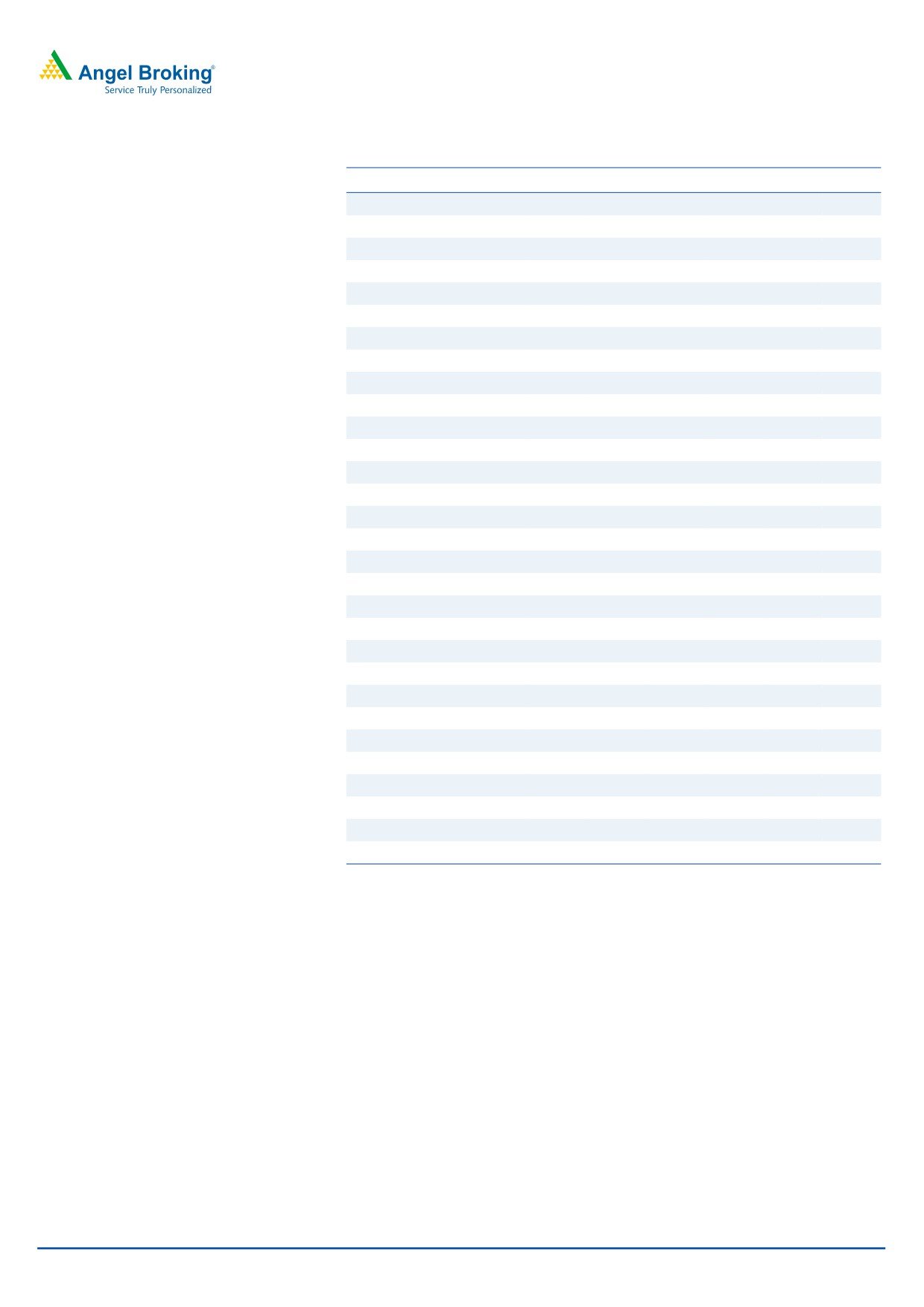

Exhibit 1: Consolidated quarterly performance

Y/E March (` cr)

3QFY16

3QFY15

% yoy

2QFY15

% qoq

9MFY16

9MFY15

% chg

Net Sales

4,160

3,653

13.9

3,779

10.1

11,563

10,648

8.6

Consumption of RM

2,200

2,052

7.2

2,032

8.3

6,179

6,030

2.5

(% of Sales)

52.9

56.2

53.8

53.4

56.6

Staff Costs

247

232

6.5

247

0.1

741

691

7.3

(% of Sales)

5.9

6.3

6.5

6.4

6.5

Other Expenses

965

784

23.0

880

9.6

2,591

2,277

13.8

(% of Sales)

23.2

21.5

23.3

22.4

21.4

Total Expenditure

3,412

3,068

11.2

3,159

8.0

9,510

8,997

5.7

Operating Profit

748

585

27.9

621

20.5

2,052

1,650

24.4

OPM

18.0

16.0

16.4

17.8

15.5

Interest

8

10

(22.2)

9

(17.5)

26

25

4.8

Depreciation

73

67

7.7

71

2.3

213

199

7.0

Other Income

36

31

17.3

58

(37.8)

167

128

30.2

PBT (excl. Ext Items)

704

538

30.7

598

17.7

1,981

1,555

27.4

Ext (Income)/Expense

-

-

-

-

-

-

-

-

PBT (incl. Ext Items)

704

538

30.7

598

17.7

1,981

1,555

27.4

(% of Sales)

16.9

14.7

15.8

17.1

14.6

Provision for Taxation

229

167

184

624

480

30.0

(% of PBT)

32.5

31.0

30.7

31

31

Reported PAT

475

372

27.8

415

14.6

1,357

1,075

26.2

PATM

11.4

10.2

11.0

11.7

10.1

Minority Interest After NP

11.7

3.5

15.6

39.5

21.2

Extra-ordinary Items

(35)

-

-

-

--

-

-

-

Reported PAT

499

368

35.4

399

25.0

1,317

1,054

25.0

Equity shares (cr)

96

96

96

96

96

FDEPS (`)

5.2

3.8

35.4

4.2

25.0

13.7

11.0

25.0

Source: Company, Angel Research

January 20, 2016

2

Asian Paints | 3QFY2016 Result Update

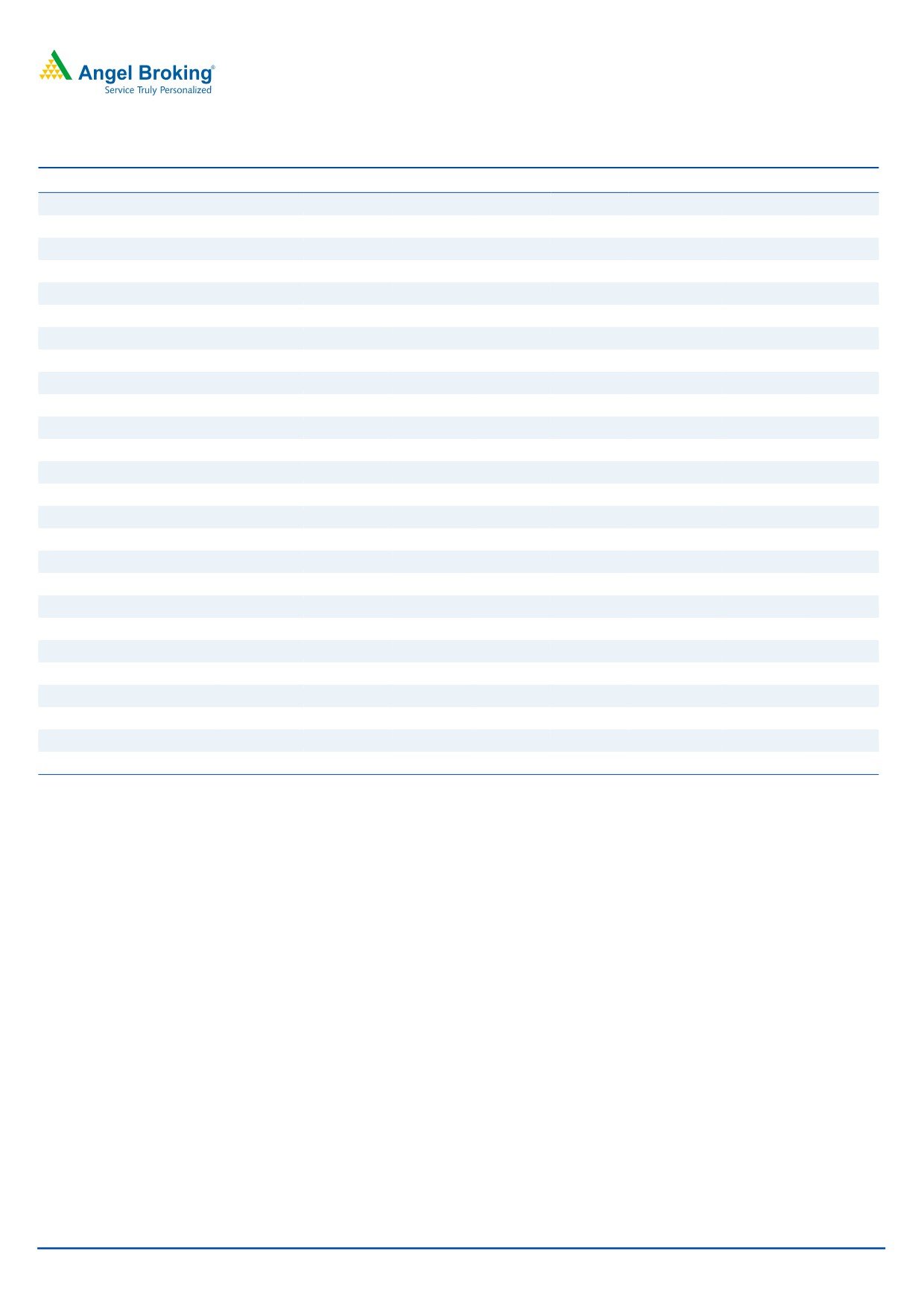

Healthy top-line growth

For 3QFY2016, Asian Paints’ consolidated top-line posted a double-digit growth

of 13.9% yoy to `4,160cr on the back of healthy festival season demand.

However, heavy rainfall in south India did impact its sales performance. The

company’s protective and powder coatings business did well with the segment

benefitting from lower material prices. Its international business posted healthy

growth, particularly in the Middle East and Bangladesh. However as per the

Management, the domestic demand environment continues to be challenging.

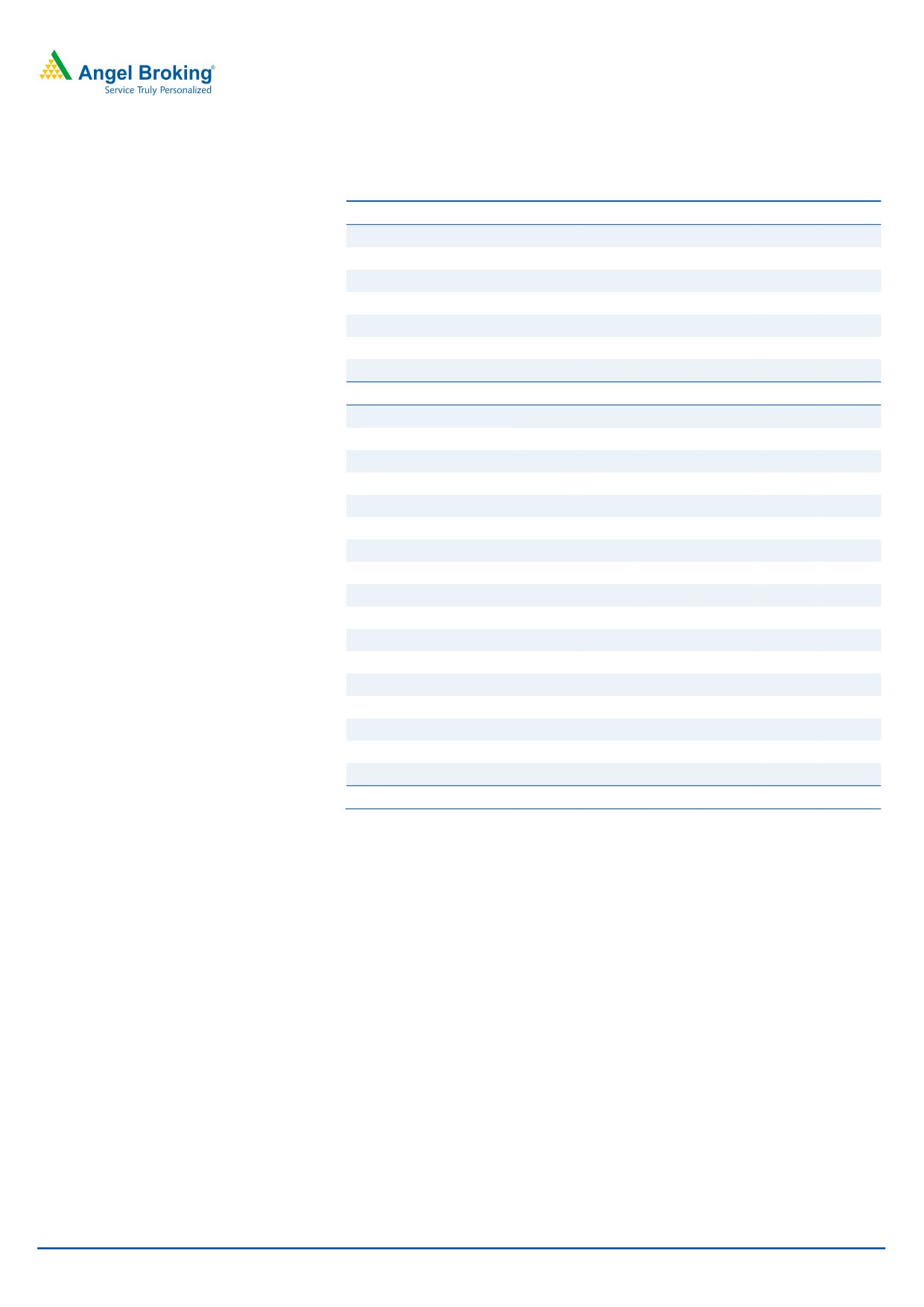

Exhibit 2: Top-line growth trend

4,500

14

4,000

12

3,500

10

8

3,000

6

2,500

4

2,000

2

1,500

-

1,000

(2)

500

(4)

0

(6)

Net Sales

QoQ growth (%)

Source: Company, Angel Research

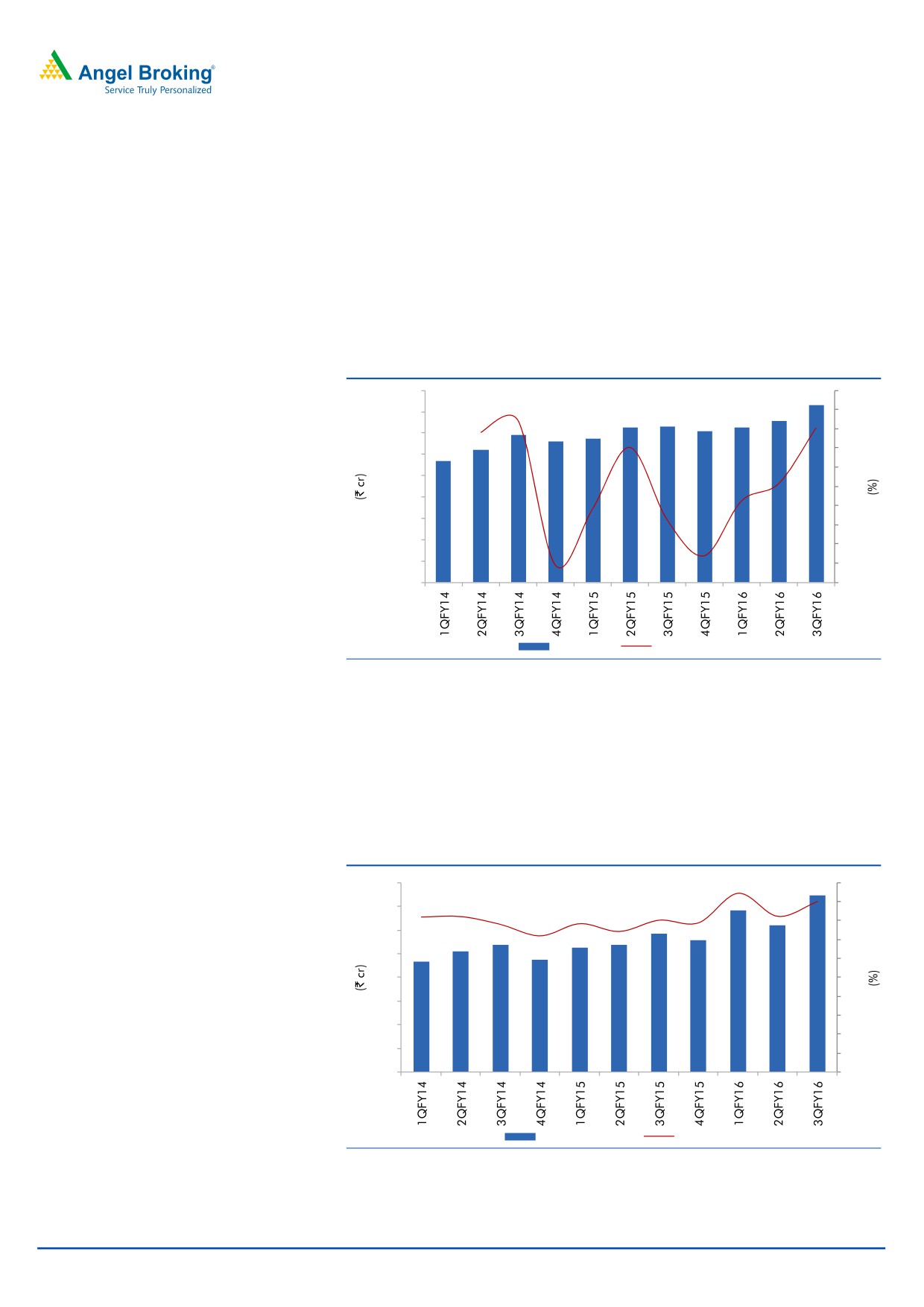

Operating margin up due to lower material prices

On the operating profit front, the company reported a growth of 27.9% yoy due to

healthy sales growth and lower material prices. The operating profit margin was

up by 197bp yoy to 18.0% due to easing material prices and employee costs as a

percentage of sales.

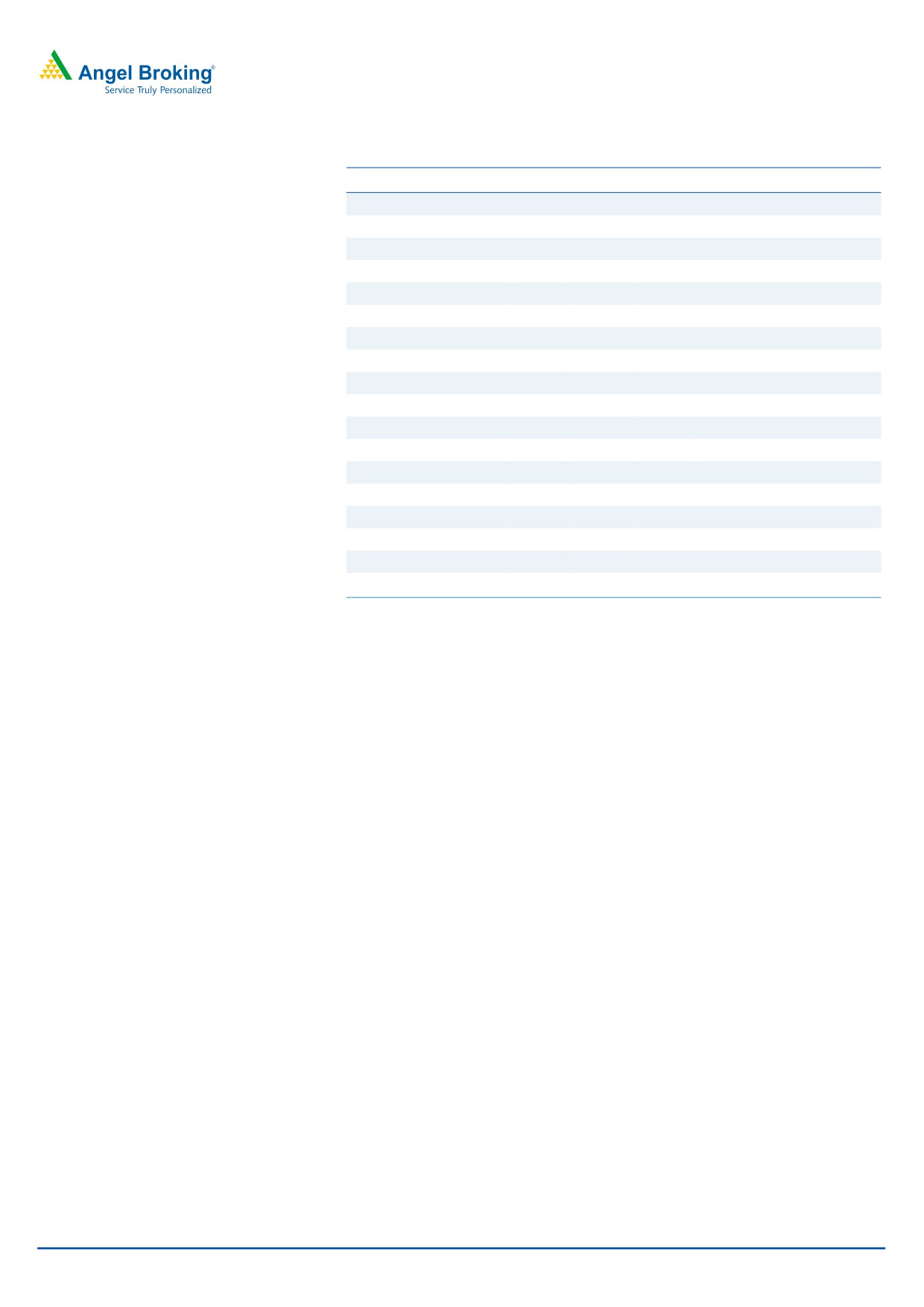

Exhibit 3: Operating profit and margin trend

800

20

18

700

16

600

14

500

12

400

10

8

300

6

200

4

100

2

0

0

Operating Profit

Margin (%)

Source: Company, Angel Research

January 20, 2016

3

Asian Paints | 3QFY2016 Result Update

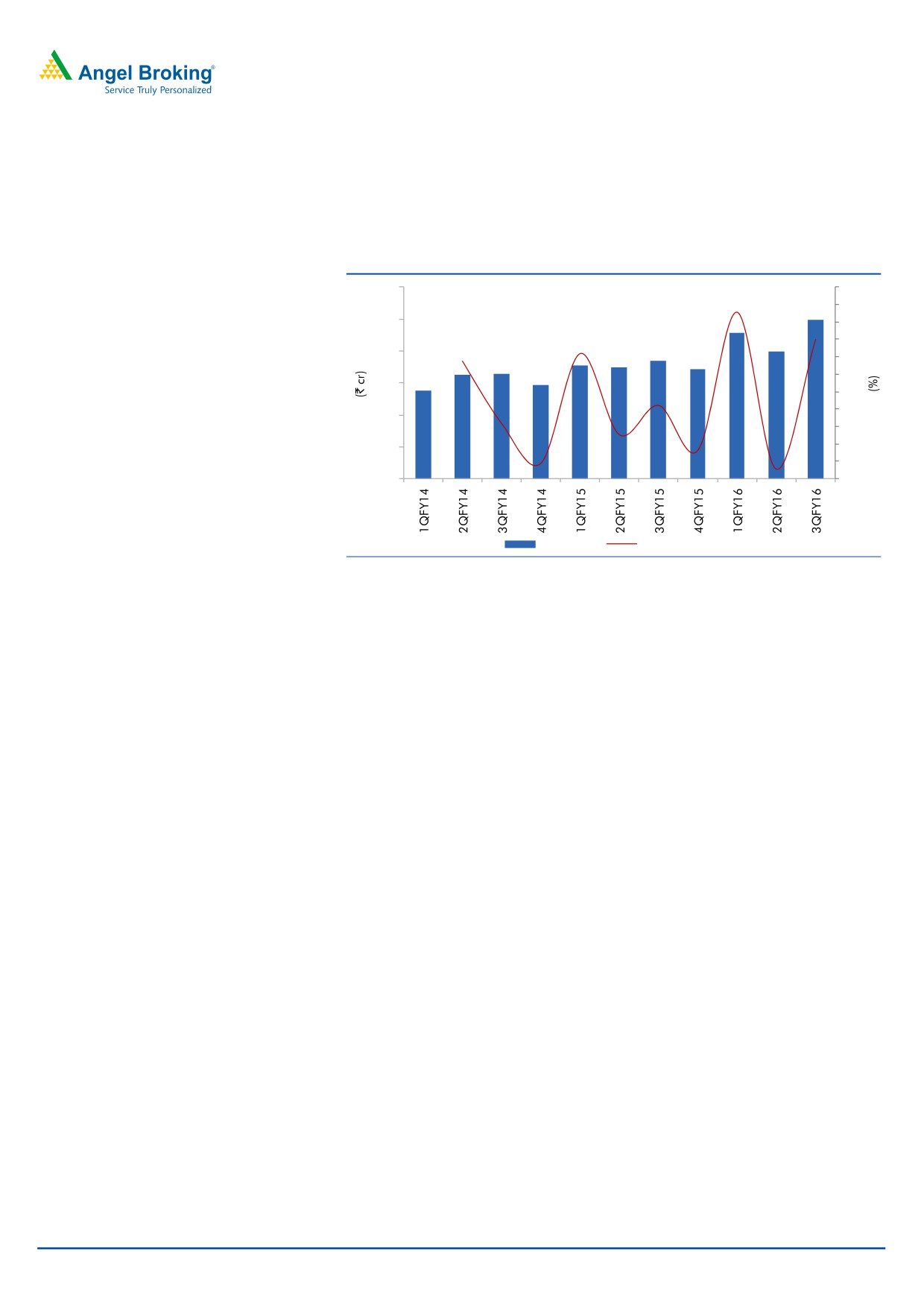

Adjusted PAT grew ~35.4% yoy

During the quarter, the company reported an adjusted net profit of 35.4% yoy to

`499cr.

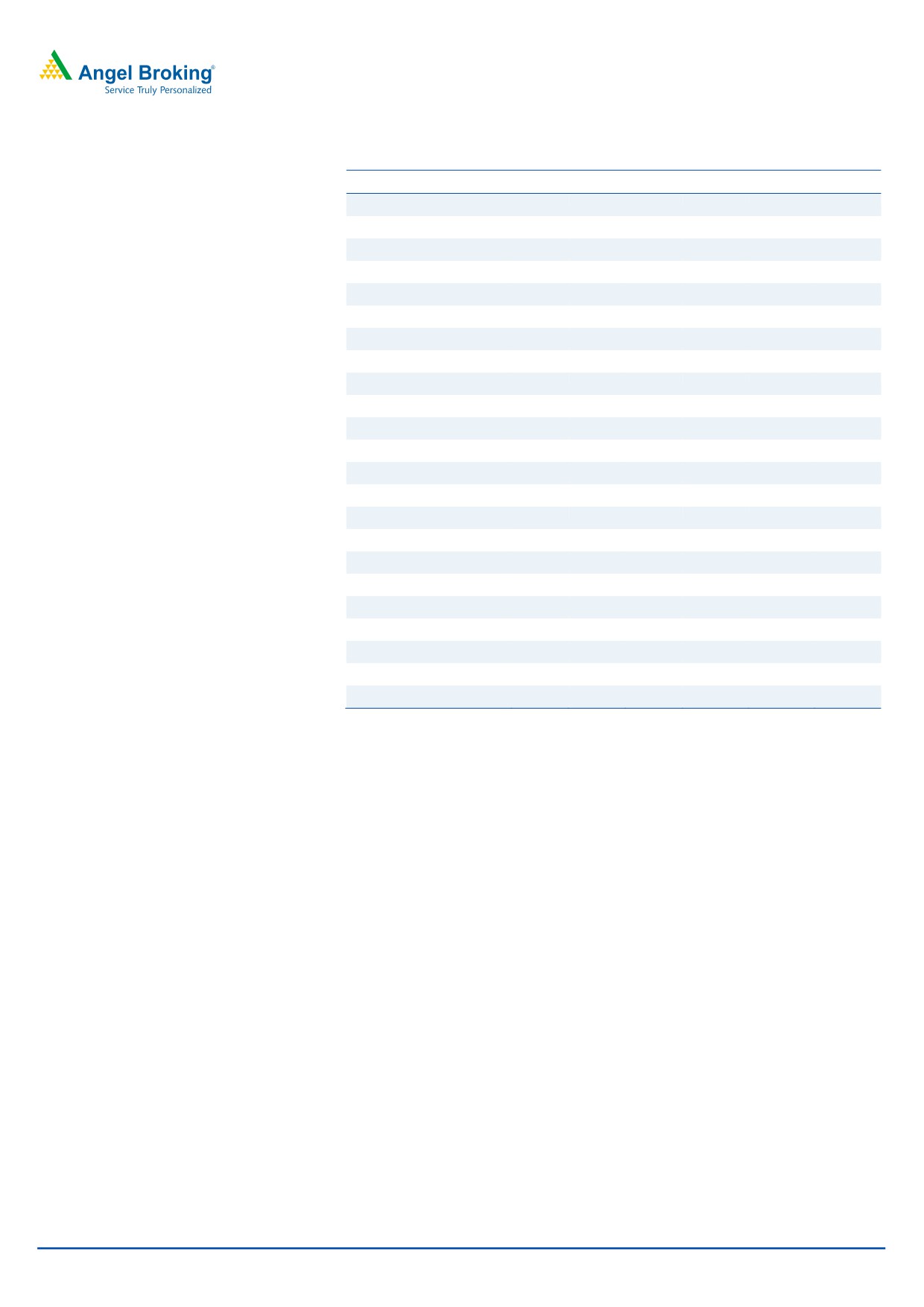

Exhibit 4: Net Profit and growth trend

600

40

35

500

30

25

400

20

15

300

10

5

200

-

100

(5)

(10)

0

(15)

Net Profit

QOQ growth (%)

Source: Company, Angel Research

January 20, 2016

4

Asian Paints | 3QFY2016 Result Update

Investment rationale

Market leadership in India

Asian Paints is the largest paint company in India with a leadership position in the

decorative paint segment with market share in excess of 50%. The overall weak

demand environment in the economy has been impacting the domestic decorative

paint market in the recent past. We believe that with gradual recovery in the

economy, coupled with increased focus of the government on infrastructure

spending, Asian Paints stands to benefit owing to its vast dealer network and

strong brand equity.

Stable raw material price to aid margin

Since raw materials are crude derivatives, lower crude prices are positive for paint

companies. We believe that with oil prices likely to be stable at current levels in the

near term, Asian Paints’ margins are likely to expand.

Outlook and valuation

We expect Asian Paints to post a ~10.2% and ~11.9% CAGR in its top-line and

bottom-line respectively, over FY2015-18E. At the current market price, the stock is

trading at 40.9x FY2018E earnings. We maintain our Neutral view on the stock.

Company background

Asian Paints is India's largest paint company, with a market share of ~50%. The

company is mainly present in the decorative segment, which contributes over 75%

of its sales. The company features among the top 10 decorative paint players

globally. It has a large distribution network of over 25,000 dealers and 27,000

'Colour World' outlets across India. The company's international revenue comes

from countries in the Caribbean, Middle East, South Pacific and Asian regions.

January 20, 2016

5

Asian Paints | 3QFY2016 Result Update

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Total operating income

10,939

12,715

14,183

15,403

17,128

18,978

% chg

13.6

16.2

11.6

8.6

11.2

10.8

Total Expenditure

9,207

10,727

11,976

12,723

14,251

15,866

Raw Materials

6413

7341

7972

8287

9249

10248

Personnel Expenses

624

760

907

1,047

1,199

1,366

Others Expenses

2,170

2,626

3,096

3,389

3,803

4,251

EBITDA

1,732

1,988

2,208

2,680

2,878

3,112

% chg

14.8

14.8

11.1

21.4

7.4

8.2

(% of Net Sales)

15.8

15.6

15.6

17.4

16.8

16.4

Depreciation& Amortisation

155

246

266

291

313

336

EBIT

1,577

1,742

1,942

2,389

2,564

2,777

% chg

13.7

10.5

11.5

23.0

7.3

8.3

(% of Net Sales)

14.4

13.7

13.7

15.5

15.0

14.6

Interest & other Charges

37

42

35

36

38

40

Other Income

114

134

170

190

220

240

(% of PBT)

6.9

7.3

8.2

7.5

8.0

8.1

Share in profit of Associates

-

-

-

-

-

-

PBT (reported)

1,655

1,834

2,077

2,543

2,746

2,977

Tax

496

572

650

788

851

923

(% of PBT)

29.9

31.2

31.3

31.0

31.0

31.0

PAT (reported)

1,160

1,263

1,427

1,755

1,895

2,054

Less: Minority interest (MI)

46

44

32

50

60

70

PAT after MI (reported)

1,114

1,219

1,395

1,705

1,835

1,984

Prior Period & Extra. Exp./(Inc.)

-

(7)

(19)

-

-

-

ADJ. PAT

1,114

1,226

1,414

1,705

1,835

1,984

% chg

12.7

10.0

15.4

20.6

7.6

8.1

(% of Net Sales)

10.2

9.6

10.0

11.1

10.7

10.5

Basic & diluted EPS (`)

11.6

12.8

14.7

17.8

19.1

20.7

Adjusted EPS EPS (`)

11.6

12.8

14.7

17.8

19.1

20.7

% chg

12.7

10.0

15.4

20.6

7.6

8.1

January 20, 2016

6

Asian Paints | 3QFY2016 Result Update

Exhibit 5:

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016E FY2017E FY2018E

SOURCES OF FUNDS

Equity Share Capital

96

96

96

96

96

96

Reserves& Surplus

3,288

3,943

4,646

4,880

5,174

5,491

Shareholders Funds

3,384

4,039

4,742

4,976

5,270

5,587

Minority Interest

161

246

264

264

264

264

Total Loans

251

249

418

420

420

420

Deferred Tax Liability

195

231

247

247

247

247

Total Liabilities

3,991

4,765

5,671

5,906

6,200

6,517

APPLICATION OF FUNDS

Gross Block

3,429

3,804

4,112

4,442

4,772

5,102

Less: Acc. Depreciation

979

1,223

1,438

1,728

2,042

2,377

Less:Impairment of Assets

9

19

15

15

15

15

Net Block

2,441

2,562

2,660

2,699

2,716

2,710

Capital Work-in-Progress

59

72

196

196

196

196

Investments

296

1,424

1,588

1,588

1,588

1,588

Current Assets

3,989

4,019

4,468

5,104

5,875

6,652

Inventories

1,830

2,070

2,259

2,532

2,909

3,380

Sundry Debtors

981

1,110

1,180

1,350

1,596

1,768

Cash

737

229

204

266

308

328

Loans & Advances

313

454

511

616

685

759

Other Assets

128

156

315

339

377

418

Current liabilities

2,834

3,353

3,308

3,747

4,241

4,696

Net Current Assets

1,155

665

1,160

1,357

1,633

1,957

Deferred Tax Asset

41

43

67

67

67

67

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

3,991

4,765

5,671

5,906

6,200

6,517

January 20, 2016

7

Asian Paints | 3QFY2016 Result Update

Consolidated Cashflow Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Profit before tax

1,655

1,834

2,077

2,543

2,746

2,977

Depreciation

155

256

268

291

313

336

Change in Working Capital

(159)

(159)

(168)

(450)

(135)

(235)

Interest / Dividend (Net)

(7)

(10)

(37)

(47)

36

38

Direct taxes paid

(438)

(480)

(633)

(788)

(851)

(923)

Others

(19)

(39)

(320)

398

(99)

(66)

Cash Flow from Operations

1,187

1,402

1,188

1,947

2,011

2,127

(Inc.)/ Dec. in Fixed Assets

(522)

542

(301)

(343)

(344)

(345)

(Inc.)/ Dec. in Investments

59

(1,128)

(164)

-

-

-

Cash Flow from Investing

(463)

(586)

(465)

(343)

(344)

(345)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

(102)

(37)

153

2

-

-

Dividend Paid (Incl. Tax)

(4,000)

(2,811)

(3,245)

(1,432)

(1,541)

(1,667)

Interest / Dividend (Net)

3,490

1,525

1,648

(112)

(84)

(95)

Cash Flow from Financing

(611)

(1,324)

(1,445)

(1,542)

(1,625)

(1,762)

Inc./(Dec.) in Cash

112

(508)

(722)

62

42

20

Opening Cash balances

624

737

926

204

266

308

Closing Cash balances

737

229

204

266

308

328

January 20, 2016

8

Asian Paints | 3QFY2016 Result Update

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

72.8

66.1

57.3

47.5

44.2

40.9

P/CEPS

61.7

53.7

47.9

39.6

36.7

33.9

P/BV

23.9

20.1

17.1

16.3

15.4

14.5

Dividend yield (%)

4.9

3.5

4.0

1.8

1.9

2.1

EV/Sales

7.3

6.3

5.6

5.2

4.6

4.2

EV/EBITDA

46.3

40.1

36.1

29.7

27.7

25.6

EV / Total Assets

11.8

9.8

8.9

8.2

7.6

7.1

Per Share Data (`)

EPS (Basic)

11.6

12.8

14.7

17.8

19.1

20.7

EPS (fully diluted)

11.6

12.8

14.7

17.8

19.1

20.7

Cash EPS

13.7

15.7

17.7

21.3

23.0

24.9

DPS

41.7

29.3

33.8

14.9

16.1

17.4

Book Value

35.3

42.1

49.4

51.9

54.9

58.2

Returns (%)

ROCE

43.4

40.6

37.6

44.3

45.1

46.2

ROE

32.9

30.2

29.4

34.3

34.8

35.5

Turnover ratios (x)

Asset Turnover (Gross Block)

3.2

3.3

3.4

3.5

3.6

3.7

Inventory / Sales (days)

61

59

58

60

62

65

Receivables (days)

33

32

30

32

34

34

Payables (days)

49

51

41

40

40

40

WC cycle (ex-cash) (days)

44

41

47

52

56

59

January 20, 2016

9

Asian Paints | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitian Stock Exchange of India Limited. It is also registered as a Depository Participant

with CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial

interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months. Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in

market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Hindustan Unilever

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

January 20, 2016

10