3QFY2016 Result Update | Automobile

February 15, 2016

Ashok Leyland

BUY

CMP

`83

Performance Highlights

Target Price

`111

Quarterly highlights (Standalone)

Investment Period

12 Months

Y/E March (` cr)

3QFY16 3QFY15

% chg (yoy) 2QFY16

% chg (qoq)

Net Sales

4,085

3,361

21.6

4,940

(17.3)

EBITDA

430

240

78.9

594

(27.7)

Stock Info

EBITDA margin (%)

10.5

7.1

340 bp

12.0

(150 bp)

Sector

Automobile

Adj. PAT

205

32

539.2

292

(29.7)

Market Cap (` cr)

23,678

Source: Company, Angel Research

Net Debt (` cr)

1,432

Results in line with estimates: Ashok Leyland Ltd (ALL)’s 3QFY2016 results have

Beta

1.3

come in in line with our estimates. Revenues grew 22% yoy to `4,085cr, driven

52 Week High / Low

100/64

mainly by a 23% yoy growth in volumes. MHCV segment volumes (constituting

Avg. Daily Volume

1,245,853

80% of total volumes) grew strongly by 27% yoy while volumes in the LCV

Face Value (`)

1.0

segment grew by 9% yoy. Realisation/vehicle declined marginally by 1% yoy

BSE Sensex

22,986

mainly due to slight deterioration in the product mix. The operating margin

improved by 340bp yoy to 10.5% given the leverage due to strong volume growth

Nifty

6,981

and soft commodity prices. Margins were slightly lower than our estimate of 11%.

Reuters Code

ASOK.BO

The EBIDTA at `430cr was in line with our expectations of `440cr. During the

Bloomberg Code

AL@IN

quarter, the company incurred an exceptional loss of `6.5cr (`5cr due to

diminution in value of investments in JV/Subsidiary and `1.5cr due to loss on sale

Shareholding Pattern (%)

of immovable property). The Adjusted PAT, at `205cr, is in line with our estimate

Promoters

50.4

of `196cr.

MF / Banks / Indian Fls

10.5

Outlook and valuation: Given the improvement in fleet operators’ sentiments due

FII / NRIs / OCBs

25.5

to revival in the economy, improvement in profitabilities due to falling diesel

Indian Public / Others

13.6

prices, and policy action initiated in the infrastructure and the mining space, we

expect demand for MHCVs to continue to grow in double digits. The MHCV

industry is clearly in an up-cycle and we estimate ~20% CAGR in volume over

Abs. (%)

3m 1yr 3yr

FY2015- FY2017. Also, a better mix (higher proportion of MHCVs), reduction in

Sensex

(11.1)

(20.2)

17.5

record high discounts due to volume growth, and operating leverage would result in

Ashok Leyland

(8.1)

24.1

256.3

margin expansion, going forward. We expect the operating margin to improve from 7.6%

in FY2015 to 11.4% in FY2017 (in line with the margins witnessed in the previous up-cycle

in FY2011). We reiterate our Buy on the stock with a price target of `111 (based on 13x

3 year price chart

FY2017E EV/EBIDTA).

120

100

Key financials (Standalone)

80

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

60

Net Sales

9,943

13,562

18,404

21,995

40

% chg

(20.3)

36.4

35.7

19.5

20

Adjusted net profit

(476)

234

977

1,336

0

% chg

-

-

317.7

36.8

EBITDA (%)

1.7

7.6

11.0

11.4

EPS (`)

(1.8)

0.8

3.4

4.7

Source: Company, Angel Research

P/E (x)

-

98.6

24.2

17.7

P/BV (x)

4.8

4.5

4.3

3.9

RoE (%)

(10.7)

4.6

17.7

22.3

RoCE (%)

(6.0)

5.6

17.7

22.8

Bharat Gianani

EV/Sales (x)

2.5

1.8

1.4

1.1

022-3935 7800 Ext: 6817

EV/EBITDA (x)

150.3

23.8

12.4

9.8

Source: Company, Angel Research; Note: CMP as of February 12, 2016

Please refer to important disclosures at the end of this report

1

Ashok Leyland | 3QFY2016 Result Update

Exhibit 1: Quarterly financial performance (Standalone)

Y/E March (` cr)

3QFY16

3QFY15

% chg (yoy)

2QFY16

% chg (qoq)

9MFY16 9MFY15

% chg (yoy)

Net Sales

4,085

3,361

21.6

4,940

(17.3)

12,866

9,056

42.1

Consumption of RM

2,380

2,237

6.4

3,032

(21.5)

7,724

5,748

34.4

(% of sales)

58.3

66.6

61.4

60.0

63.5

Staff costs

349

277

26.0

378

(7.7)

1,058

852

24.2

(% of sales)

8.5

8.2

7.7

8.2

9.4

Purchase of traded goods

512

266

92.2

446

14.8

1,312

939

39.7

(% of sales)

12.5

7.9

9.0

10.2

10.4

Other expenses

415

341

21.7

490

(15.3)

1,359

948

43.4

(% of sales)

10.1

10.1

9.9

10.6

10.5

Total Expenditure

3,656

3,121

17.1

4,345

(15.9)

11,453

8,487

35.0

Operating Profit

430

240

78.9

594

(27.7)

1,413

570

148.1

OPM (%)

10.5

7.1

12.0

11.0

6.3

Interest

67

98

(32.2)

70

(5.1)

213

305

(30.1)

Depreciation

109

100

8.8

113

(3.8)

326

306

6.4

Other income

26

17

49.9

26

(2.2)

79

87

(8.9)

PBT (excl. Extr. Items)

280

59

438

953

45

Extr. income/expense

(7)

0

(5)

(12)

109

(110.7)

PBT (incl. Extr. Items)

274

59

361.0

433

(36.7)

941

154

(% of sales)

6.7

1.8

8.8

7.3

1.7

Provision for taxation

75

27

146

297

49

(% of PBT)

26.8

46.0

33.3

31.1

109.2

Reported PAT

199

32

518.9

287

(30.7)

645

105

515.0

Adj PAT

205

32

292

656

(4)

Adj. PATM

5.0

1.0

5.9

5.1

(0.0)

Equity capital (cr)

285

266

285

285

266

Adjusted EPS (`)

0.7

0.1

1.0

2.3

(0)

Source: Company, Angel Research

Exhibit 2: 3QFY2016 - Actual vs Angel estimates

Y/E March (` cr)

Actual

Estimates

Variation (%)

Net Sales

4,085

4,015

1.7

EBITDA

430

440

(2.4)

EBITDA margin (%)

10.5

11.0

(50 bp)

Adj. PAT

205

196

4.5

Source: Company, Angel Research

Exhibit 3: Quarterly volume performance

(units)

3QFY16

3QFY15

% chg (yoy)

2QFY16

% chg (qoq)

9MFY16

9MFY15

% chg (yoy)

MHCV passenger

5,291

5,007

5.7

7,051

(25.0)

17,509

14,271

22.7

MHCV goods

17,890

13,269

34.8

22,800

(21.5)

57,004

37,123

53.6

Total volume (ex. Dost)

23,181

18,276

26.8

29,851

(22.3)

74,513

51,394

45.0

LCV

7,752

7,049

10.0

7,428

4.4

21,853

19,063

14.6

Total volume (incl. Dost)

30,933

25,325

22.1

37,279

(17.0)

96,366

70,457

36.8

Source: Company, Angel Research

February 15, 2016

2

Ashok Leyland | 3QFY2016 Result Update

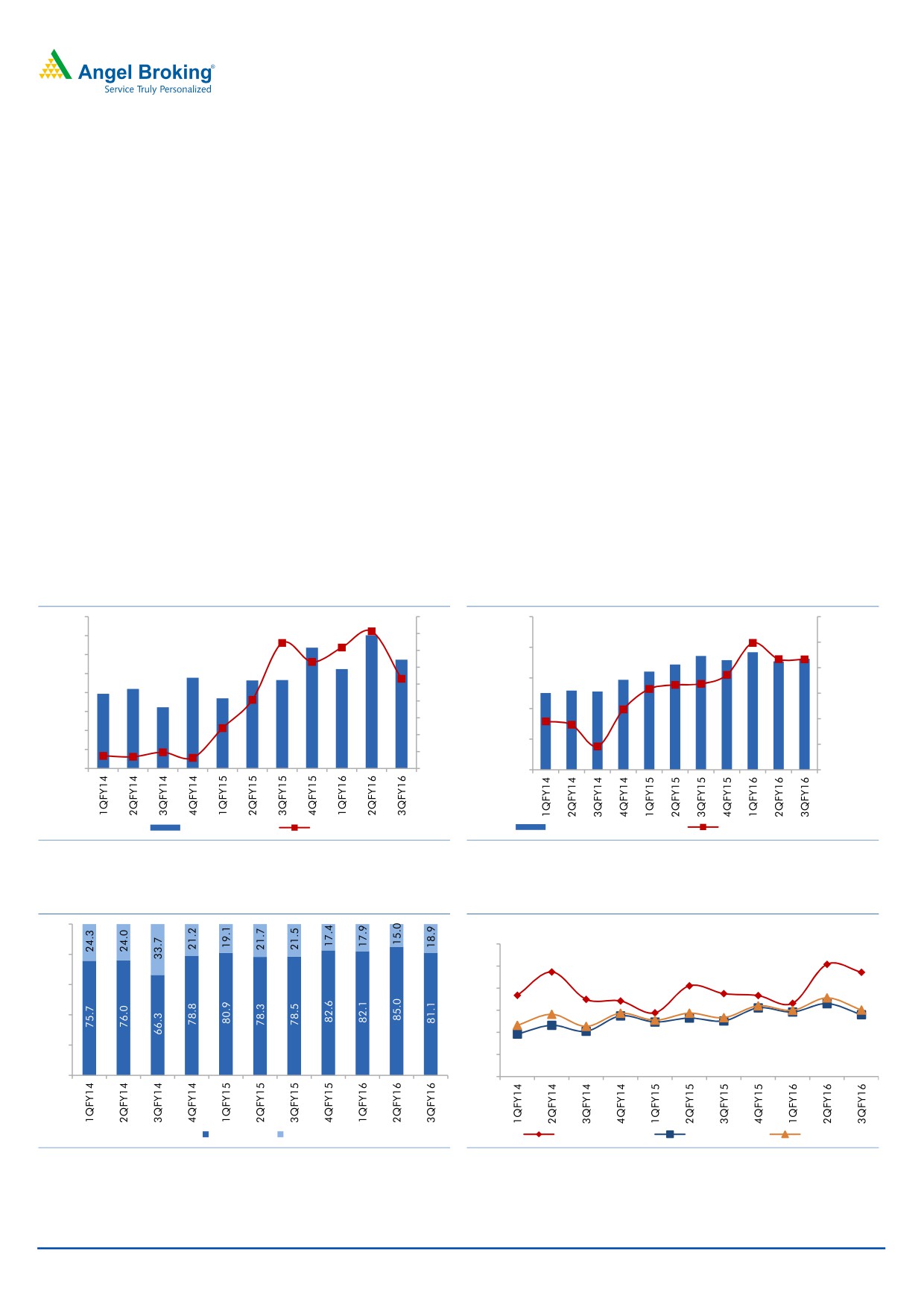

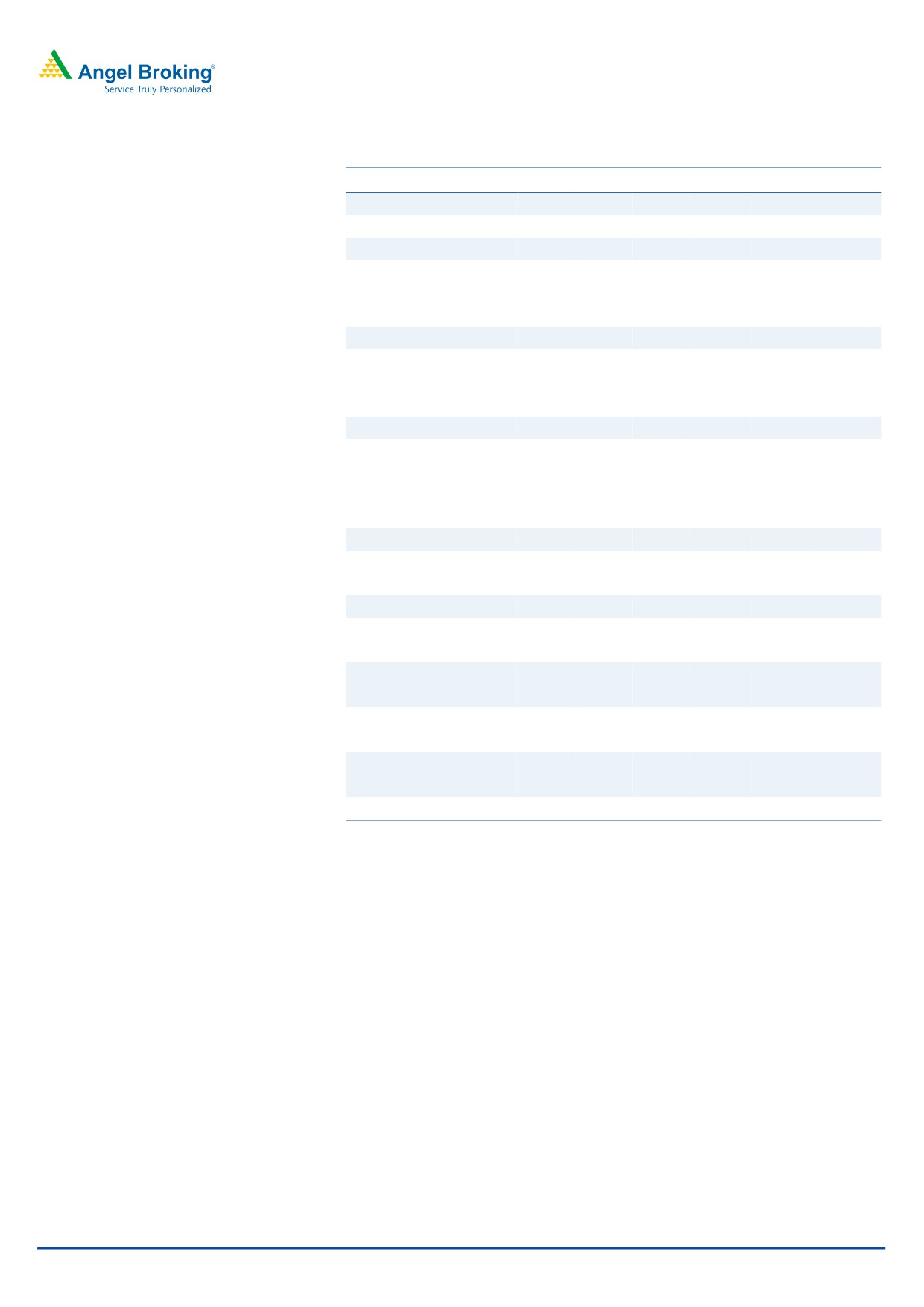

ALL’s volumes continued to improve, reporting double-digit growth for the

sixth consecutive quarter. During 3QFY2016, volumes grew by a robust 23%

yoy. The MHCV segment continued to outperform, growing by 27% yoy,

helped by huge pent up demand, lower fuel prices which have led to

improvement in fleet operators’ profitability and revival in infrastructure

projects. LCV volumes recovered, growing by 9% yoy during the quarter.

Realisation/vehicle declined marginally by 1% yoy to `1,425,019, due to

deterioration in the product mix (lower defense supplies). Contribution/vehicle

grew 13% yoy to `416,315, given the soft commodity prices, increased

contribution from excise free Pantnagar plant and raw material control

initiatives.

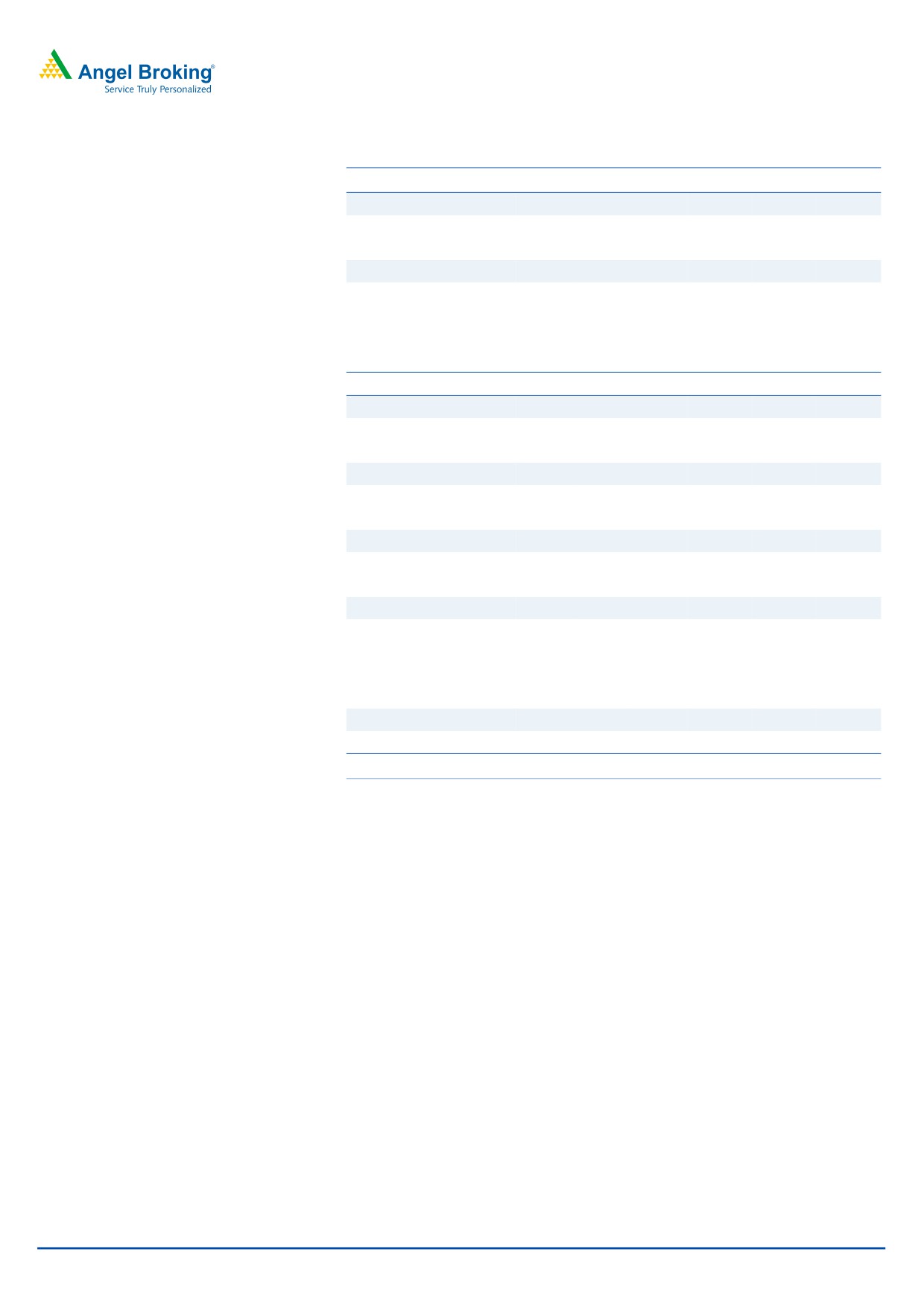

ALL continued to gain market share on back of higher proportion of the fast

growing heavy trucks and geographical expansion. ALL’s MHCV market share

improved 490bp yoy from 27% in 9MFY2015 to 31.9% in 9MFY2016. Its

MHCV truck market share improved 460bp yoy from 25.5% in 9MFY2015 to

30.1% in 9MFY2016. Similarly, ALL’s market share in the MHCV passenger

segment increased

790bp yoy from

35.8% in 9MFY2015 to

43.7% in

9MFY2016.

Exhibit 4: Double-digit volume growth continues

Exhibit 5: Realisation & contribution trend

40,000

60

1,700,000

500,000

35,000

50

450,000

40

1,500,000

30,000

30

400,000

25,000

1,300,000

20

20,000

350,000

10

15,000

1,100,000

0

300,000

10,000

(10)

900,000

250,000

5,000

(20)

0

(30)

700,000

200,000

Overall Volumes

yoy chg %

Realisation/vehicle (`)

Contribution/vehicle (`)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 6: MHCVs share in product mix rises yoy

Exhibit 7: Domestic market share trend

100

(%)

60

80

50

60

40

40

30

20

20

10

0

0

MHCV (%)

LCV (%)

MHCV Passenger

MHCV Goods

Overall MHCV

Source: SIAM, Angel Research

Source: SIAM, Angel Research

February 15, 2016

3

Ashok Leyland | 3QFY2016 Result Update

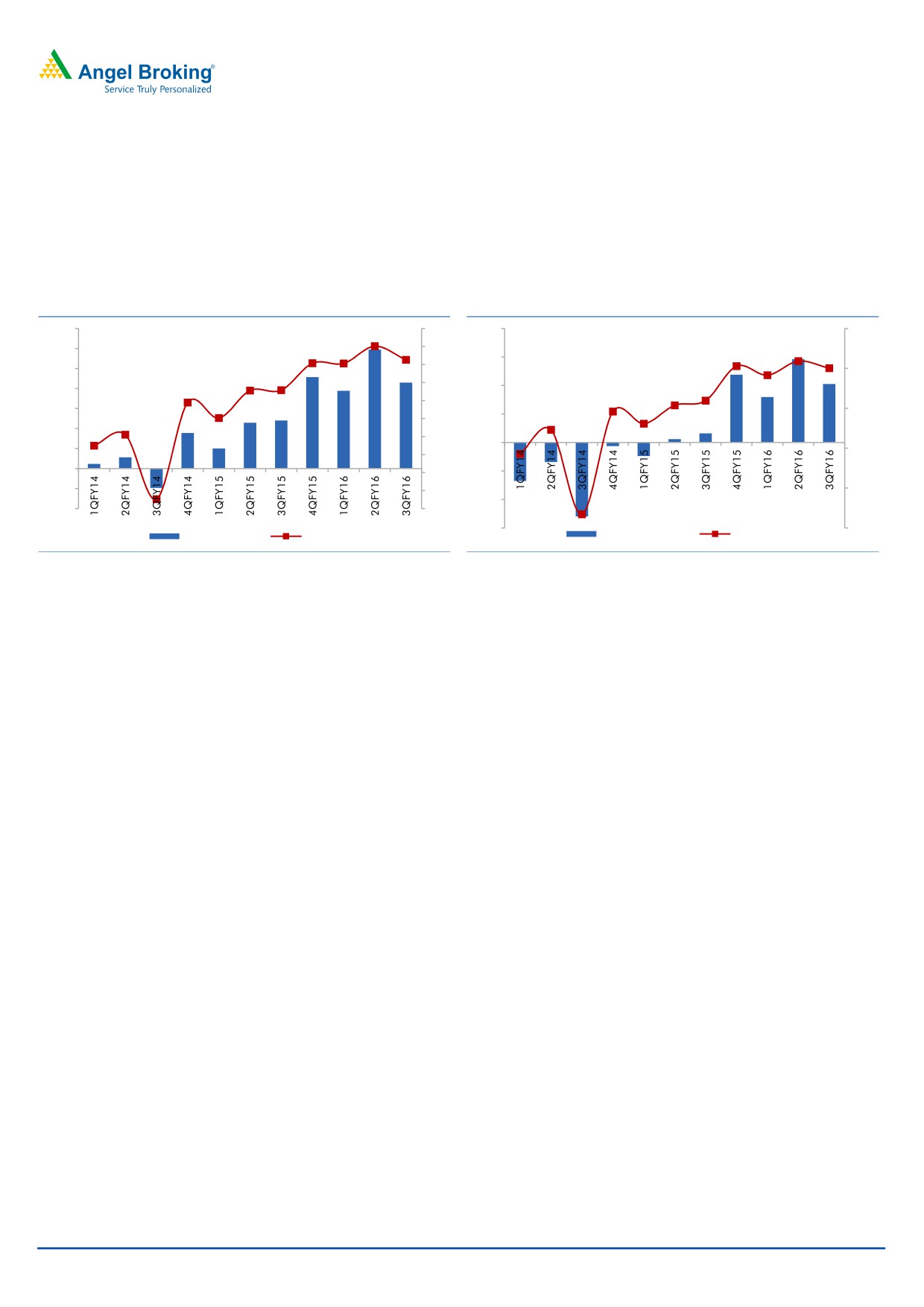

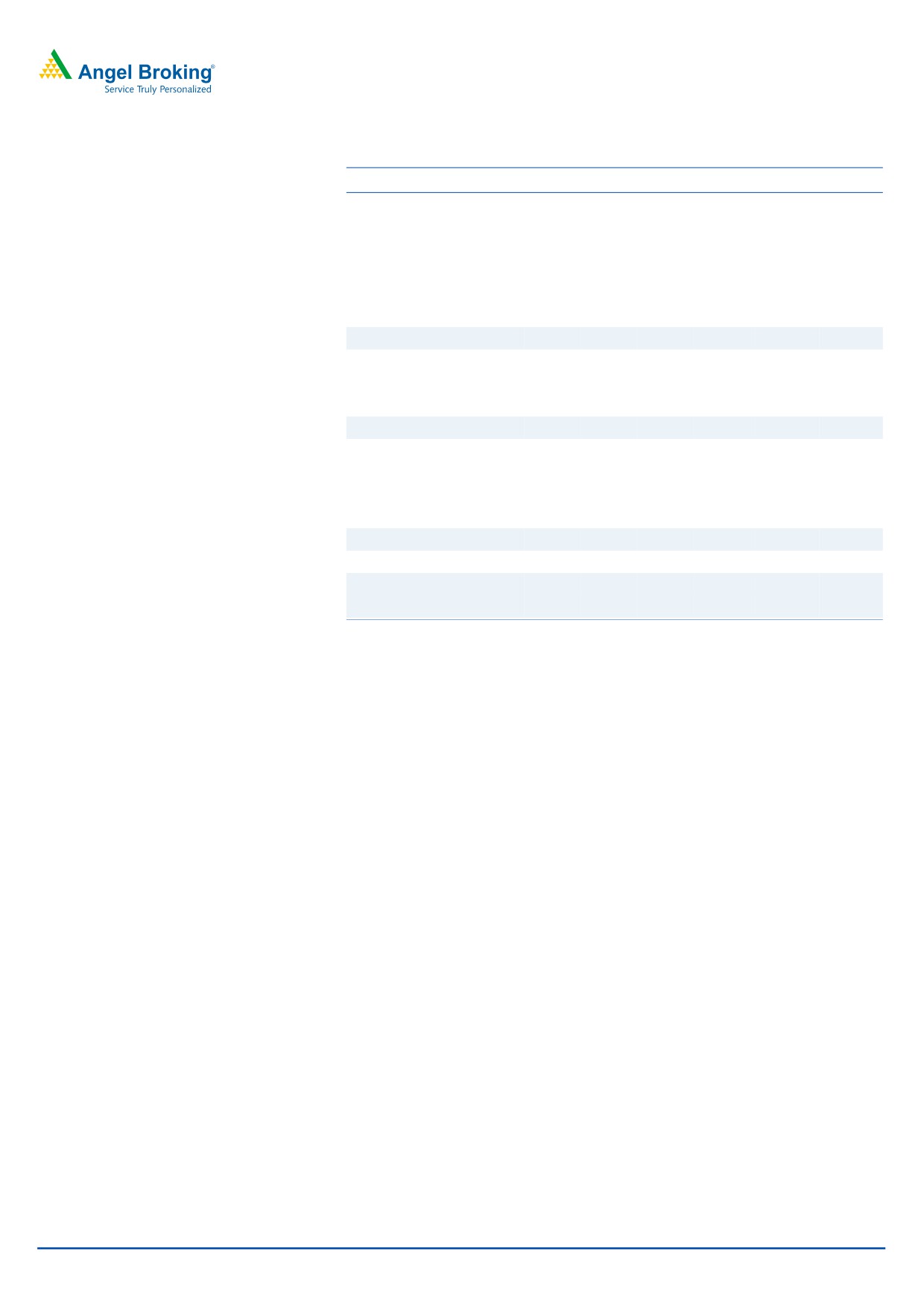

ALL maintained its double-digit margin for the fourth consecutive quarter, with

its margin for 3QFY2016 coming in at 10.5%. Higher proportion of MHCVs in

the product mix, benign commodity prices and operating leverage led to the

steep improvement in margins on a yoy basis.

ALL’s profits continue to improve, led by strong operating performance.

Exhibit 8: EBITDA margin improves sharply yoy

Exhibit 9: Bottom-line continues to improve yoy

700

14

400

10

600

12

300

10

500

5

8

200

400

6

300

0

100

4

200

2

0

100

(5)

0

0

(2)

(100)

(100)

(4)

(10)

(200)

(200)

(6)

(300)

(15)

EBIDTA (` cr)

Margin %

Net Profit (` cr)

Margin %

Source: Company, Angel Research

Source: Company, Angel Research

Conference call - Key highlights

The MHCV industry continues to maintain its strong momentum, reporting a

23% yoy growth in 3QFY2016. Better freight movement on back of improved

economic growth and improvement in fleet operators’ sentiment due to firm

freight rates and decline in diesel prices are spurring demand for MHCVs.

Further, a pick-up in infrastructure activities is also boosting MHCV demand.

MHCV demand is estimated to remain robust with ALL’s Management

expecting a healthy double digit industry growth in FY2017.

ALL continues to gain market share across regions backed by its improving

distribution network. ALL’s market share improved from 27% in 9MFY2015 to

about 32% in 9MFY2016.

In a bid to gain further market share, ALL would introduce two new products in

the intermediate commercial vehicle segment where it has relatively lower

market share. ALL would introduce a passenger variant (Sunshine) and a

goods carrier (Guru).

The production in the excise free Pantnagar plant stood at 10,000 units in

3QFY2016 as against 4,000 units in the corresponding quarter of last year.

Discounting/vehicle in the MHCV space continues to remain high. In

3QFY2016 the blended discounting increased to `2.4 lakh from `2.25 lakh in

2QFY2016. ALL however has been taking periodic price increases to

neutralize the impact of high discounts. ALL undertook a price increase of

about 1% in 3QFY2016.

ALL expects commodity prices to remain soft in the near term as lower raw

material prices flow into the P&L with a lag of a quarter.

February 15, 2016

4

Ashok Leyland | 3QFY2016 Result Update

ALL continues to focus on the export markets, particularly the Middle East and

Africa to enable diversification and reduce cyclicality. ALL aims to increase the

export contribution from 15% currently to 33% over the next three to five years.

ALL has guided for overall capex and subsidiary investment of `500cr in

FY2016. The capex would be towards new product development and R&D.

Further, ALL would invest for meeting the funding requirements of its

subsidiaries as well.

Investment arguments

Double-digit volume growth expected over the medium term as ALL would be a

direct beneficiary of the improving CV cycle: ALL is a pure CV play and is poised to

report strong double digit growth (~23% over FY2015-FY2017), given the uptrend

in the CV cycle. The MHCV segment, accounting for 80% of ALL’s total volumes,

has undergone a sharp improvement, growing by 45% yoy in 9MFY2016.

Improvement in fleet operators’ sentiments on back of better economic outlook,

and increase in profitability due to fall in diesel prices, would lead to continued

improvement in demand. The MHCV industry has shown improvement after a gap

of three years and we believe the industry would remain in an upcycle in the

medium term. Further we also expect improvement in the LCV segment in FY2016

on back of gradual improvement in sentiments.

EBITDA margin to improve amid volume improvement and operating leverage: We

expect ALL’s margins to improve sharply in FY2016/FY2017 and reach the pre-

down cycle levels. We estimate ALL’s margins to improve from 7.6% in FY2015

and reach ~11% in FY2017 (in line with margin levels reported by the company in

the FY2011 up-cycle). We believe the margin improvement would be driven by: (a)

a sharp improvement in MHCV volumes, (b) benefits of operating leverage, given

the sharp improvement in volumes, and (c) reduction in discounting levels.

Currently the discount/vehicle, at `2.5 lakh, is at record levels and is expected to

come down with sustained pick-up in demand.

Outlook and valuation

Given the improvement in fleet operators’ sentiments due to revival in the

economy, improvement in profitabilities due to falling diesel prices, and policy

action initiated in the infrastructure and the mining space, we expect demand for

MHCVs to continue to grow in double digits. The MHCV industry is clearly in an

up-cycle and we estimate ~20% CAGR in volume over FY2015- FY2017. Also, a

better mix (higher proportion of MHCVs), reduction in record high discounts due to

volume growth, and operating leverage would result in margin expansion, going forward.

We expect the operating margin to improve from 7.6% in FY2015 to 11.4% in FY2017 (in

line with the margins witnessed in the previous up-cycle in FY2011). We reiterate our Buy

rating on the stock with a price target of `111 (based on 13x FY2017E EV/EBIDTA).

February 15, 2016

5

Ashok Leyland | 3QFY2016 Result Update

Exhibit 10: Key assumptions

(units)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

MHCV passenger

26,312

23,472

19,328

20,722

24,866

27,602

MHCV goods

67,425

55,442

40,976

56,938

80,925

95,287

LCV

7,593

34,918

28,205

26,904

30,559

34,216

Total volume (units)

101,990

114,612

88,509

104,564

136,351

157,104

% yoy chg

8.4

12.4

(22.8)

18.1

30.4

15.2

Source: Company, Angel Research

Company background

Ashok Leyland Ltd (ALL) is the country's second largest CV manufacturer. The

company has a strong presence in the MHCV segment, with a domestic market

share of ~28% as of FY2015. ALL enjoys a dominant position in southern India,

with a ~50% market share, and is currently focusing on expanding its presence in

northern and western India by increasing its touch points in the regions. The

company, through its JV with Nissan Motor and John Deere, intends to expand its

product portfolio and reduce the dependence on domestic truck industry which

contributes about 65% of the revenues.

February 15, 2016

6

Ashok Leyland | 3QFY2016 Result Update

Profit and loss statement (Standalone)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

12,904

12,481

9,943

13,562

18,404

21,995

% chg

13.0

(3.3)

(20.3)

36.4

35.7

19.5

Total expenditure

11,807

11,650

9,777

12,536

16,373

19,479

Net raw material costs

9,464

9,123

7,603

9,965

12,986

15,684

Employee expenses

1,036

1,087

1,000

1,184

1,478

1,535

Other

1,030

1,140

925

1,386

1,909

2,260

EBITDA

1,098

831

167

1,027

2,030

2,516

% chg

(9.6)

(24.2)

(81.0)

516.4

97.8

23.9

(% of total op. income)

8.5

6.7

1.7

7.6

11.0

11.4

Depreciation & amortization

353

381

377

416

446

455

EBIT

745

451

(530)

466

1,530

2,064

% chg

(21.3)

(39.5)

NA

NA

228.5

34.9

(% of total op. income)

5.8

3.6

(5.3)

3.4

8.3

9.4

Interest and other charges

255

377

453

394

293

308

Other income

201

397

67

124

119

155

Recurring PBT

690

471

(597)

341

1,411

1,909

% chg

(13.9)

(31.8)

NA

NA

313.4

35.3

Extraordinary income/(exp.)

4

271

506

101

(5)

PBT

686

200

(91)

442

1,405

1,909

Tax

124

37

(121)

107

434

573

(% of PBT)

18.1

18.5

132.2

24.3

30.9

30.0

PAT (reported)

566

434

29

335

972

1,336

ADJ. PAT

562

163

(476)

234

977

1,336

% chg

(10.7)

(71.0)

NA

NA

317.7

36.8

(% of total op. income)

4.4

1.3

(4.8)

1.7

5.3

6.1

Basic EPS (`)

2.1

1.6

0.1

1.2

3.4

4.7

Adj. EPS (`)

2.1

0.6

(1.8)

0.8

3.4

4.7

% chg

(10.7)

(71.0)

NA

NA

317.7

36.8

February 15, 2016

7

Ashok Leyland | 3QFY2016 Result Update

Balance sheet statement (Standalone)

Y/E March (` cr)

FY2012 FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity share capital

266

266

266

285

285

285

Reserves & surplus

3,942

4,189

4,182

4,834

5,239

5,716

Shareholders’ Funds

4,208

4,455

4,448

5,119

5,524

6,000

Total loans

2,395

3,505

3,884

2,591

2,500

2,400

Deferred tax liability

490

527

407

510

510

510

Other long term liabilities

4

2

2

2

4

4

Long term provisions

77

79

68

79

129

154

Total Liabilities

7,174

8,568

8,809

8,301

8,667

9,069

APPLICATION OF FUNDS

Gross block

7,256

7,991

8,699

8,555

8,755

8,955

Less: Acc. depreciation

2,343

2,709

3,012

3,300

3,746

4,201

Net Block

4,914

5,282

5,686

5,256

5,010

4,755

Capital work-in-progress

548

689

155

120

155

155

Goodwill

-

-

-

Investments

1,534

2,338

2,790

2,649

2,990

3,340

Long term loans and adv.

608

480

673

983

1,012

1,210

Other noncurrent assets

7

12

33

19

60

75

Current assets

4,304

4,297

3,471

4,285

6,751

8,272

Cash

33

14

12

751

349

550

Loans & advances

810

967

801

569

1,533

1,937

Other

3,461

3,315

2,659

2,964

4,869

5,784

Current liabilities

4,741

4,529

3,999

5,011

7,311

8,738

Net current assets

(438)

(233)

(528)

(726)

(560)

(466)

Misc. exp. not written off

-

-

-

Total Assets

7,174

8,568

8,809

8,301

8,667

9,069

February 15, 2016

8

Ashok Leyland | 3QFY2016 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015 FY2016E FY2017E

Profit before tax

690

471

(91)

442

1,405

1,909

Depreciation

353

381

303

287

446

455

Change in working capital

22

(47)

274

609

(568)

107

Others

407

359

(325)

146

(18)

(187)

Other income

(201)

(397)

-

Direct taxes paid

(124)

(37)

121

(107)

(434)

(573)

Cash Flow from Operations

1,147

730

281

1,377

832

1,711

(Inc.)/Dec. in fixed assets

(755)

(876)

(174)

178

(235)

(200)

(Inc.)/Dec. in investments

(304)

(803)

(452)

141

(342)

(350)

Other income

201

397

-

-

Cash Flow from Investing

(859)

(1,282)

(626)

319

(576)

(550)

Issue of equity

0

(1)

-

19

-

-

Inc./(Dec.) in loans

47

1,110

379

(1,293)

(91)

(100)

Dividend paid (Incl. Tax)

309

187

-

(128)

(571)

(860)

Others

(793)

(761)

(37)

446

-

-

Cash Flow from Financing

(436)

534

342

(957)

(663)

(960)

Inc./(Dec.) in cash

(148)

(18)

(2)

740

(408)

202

Opening Cash balances

180

32

14

12

751

349

Closing Cash balances

32

14

12

751

349

550

February 15, 2016

9

Ashok Leyland | 3QFY2016 Result Update

Key ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

39.5

149.1

NA

101.0

24.2

17.7

P/CEPS

24.4

41.7

NA

36.3

16.6

13.2

P/BV

7.6

5.0

5.0

4.6

4.3

3.9

Dividend yield (%)

1.2

0.7

NA

NA

2.1

3.1

EV/Sales

2.0

2.0

2.6

1.8

1.4

1.1

EV/EBITDA

23.7

28.7

153.5

24.4

12.4

9.8

EV / Total Assets

3.6

2.9

2.9

3.0

2.9

2.7

Per Share Data (`)

EPS (Basic)

2.1

0.6

(1.8)

0.8

3.4

4.7

EPS (fully diluted)

2.1

0.6

(1.8)

0.8

3.4

4.7

Cash EPS

3.4

2.0

(0.4)

2.3

5.0

6.3

DPS

1.0

0.6

-

-

1.7

2.6

Book Value

10.9

16.7

16.7

18.0

19.4

21.1

Returns (%)

ROCE (Pre-tax)

10.6

2.8

(6.0)

5.6

17.7

22.8

Angel ROIC (Pre-tax)

12.8

2.8

(6.0)

6.2

18.4

24.2

ROE

13.8

3.2

(10.7)

4.6

17.7

22.3

Turnover ratios (x)

Asset Turnover (Gross Block)

1.9

1.5

1.1

1.6

2.1

2.5

Inventory / Sales (days)

63

55

44

45

45

45

Receivables (days)

34

42

48

48

48

48

Payables (days)

108

123

144

145

145

145

WC cycle (ex-cash) (days)

(6)

(26)

(52)

(52)

(52)

(52)

Solvency ratios (x)

Net debt to equity

0.2

0.8

0.8

0.3

0.3

0.2

Net debt to EBITDA

0.8

4.0

20.9

1.4

0.8

0.5

Interest Coverage (EBIT / Int.)

2.9

0.6

(1.2)

1.2

5.2

6.7

February 15, 2016

10

Ashok Leyland | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Ashok Leyland

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

February 15, 2016

11