Angel Top Picks - November 2017

With 5.3% returns, October proved to be the best month for Indian equities in the

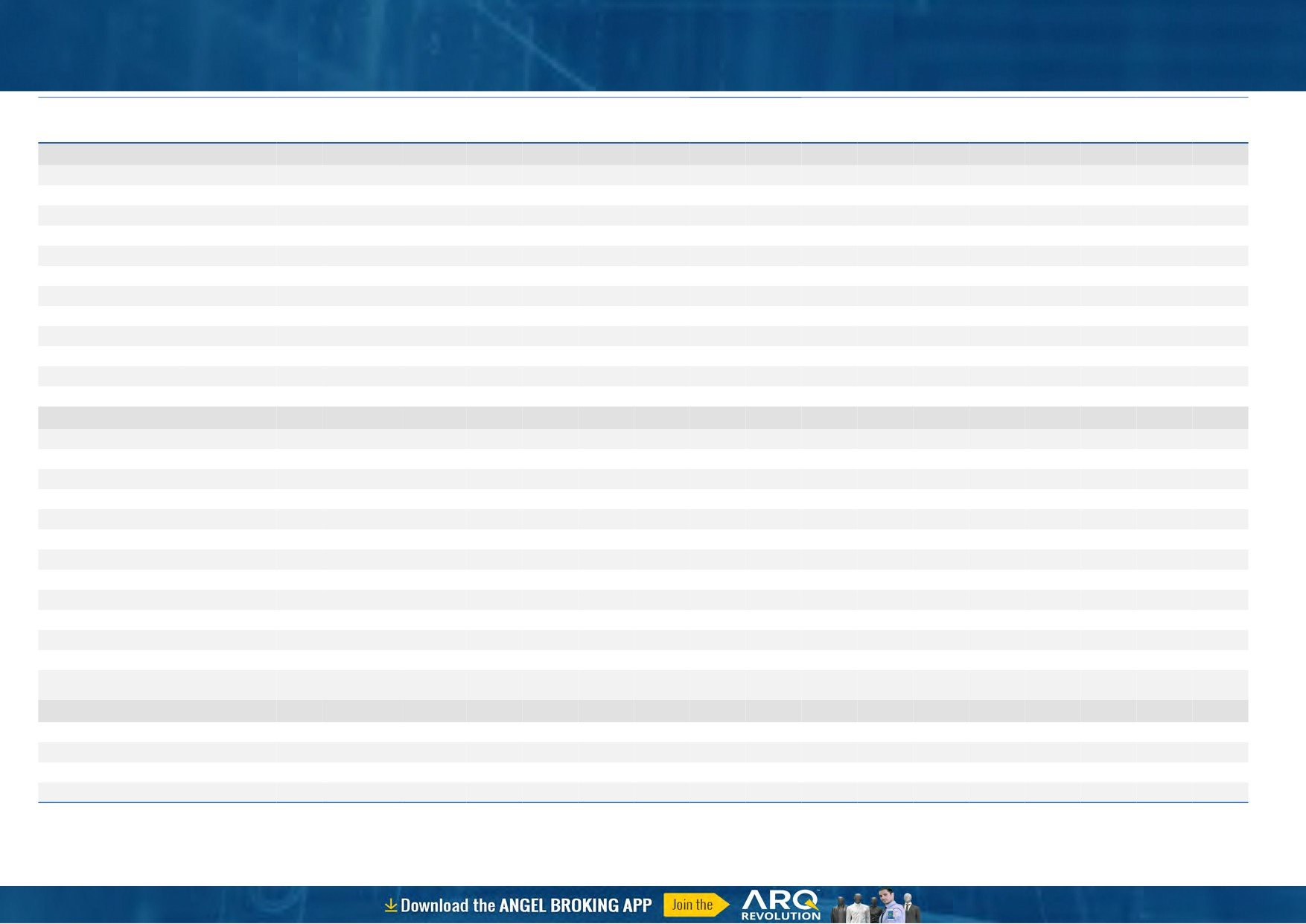

Top Picks

last 19 months. While the government signalled its pro growth stance through its

Company

CMP (`)

TP (`)

bank recapitalization and aggressive capex in the road infrasstrucutre, the 30 rank

Banking/NBFC

jump in the World Bank’s ease of doing busijess proved to be sentimental booster.

Dewan Housing

666

762

While markets are at all time highs, Angel Broking’s Top Picks portfolio has shown

GIC Housing Finance

481

655

a 30% outperformance to BSE 100 index during the last two year period.

Karur Vysa Bank

127

161

Consumption

Government’s focus shifts to growth: Following the slower ecoconimic growth in

Asian Granito

495

572

1QFY18, government had indicated of undertaking a plan to boost the economy.

Accordingly, government has announced a `2.11 lakh cr plan to recapitalize

Blue Star

692

867

public sector banks (PSBs) and `5.35 lakhs cr plan to undertake road construction

Siyaram Silk Mills

607

650

projects. With the host of reforms implemented over the last three years, we believe

LT Foods

73

96

that government’s focus has now shifted towards job creation and growth. The

Media/Automobiles

same can be seen in revision in the excise duty on petrol and diesel as well as the

Maruti Suzuki

8,216

8,890

high probability of revision in the GST rates on common use items to spur the

Music Broadcast

387

434

growth in the economy.

TV Today

379

435

Real Estate/Infra/Logistics/Power

Bank recapitalization to revive credit growth: The recapitalization plan of `2.11

KEI Industries

338

371

lakh cr (~$32.6bn) is expected to be completed over the two fiscals i.e. FY2018

Navkar Corp.

195

265

and FY2019. This will be financed by budgetary provisions

(`18,139cr),

Pharmaceutical

recapitalization bonds (`1.35 lakh cr), and by diluting government equity stake by

Alkem Laboratories

1,926

2,125

raising funds through financial markets (~`58,000cr). In our view, capital infusion

Source: Angel Research;

of PSBs would help to clean-up their NPAs, improve their capital adequacy ratio

Note: CMP as of November 03, 2017

which will support them in bringing credit growth going ahead.

Several sectors to benefit from road capex: Under the name Bharatmala

Pariyojana, govt. has planned to construct 34,800 km of roads over the next 5

years at a capital expenditure of `5.35 lakhs cr ($82.7bn). This is likely to create

14.2cr man days of jobs. The scope of project includes construction of ring roads,

bypasses, elevated corridors and logistics parks. The government envisages that

this project will help in unclogging the bottlenecks on the existing Golden

Quadrilateral highway network. The road capex is expected to be positive for

sectors like construction, cement, steel, automobile, etc. while improved efficiency

will benefit the sectors like logistics and manufacturing.

India’s rank in Ease Of Doing Business improves: With the help of reforms in

taxation, licensing, investor protection, and bankruptcy resolution, India’s rank in

World Bank’s Ease Of Doing Business (EODB) jumped 30 spots to 100. We believe

that jump in EODB ranking highlights India’s firm macro improvement story. The

GST implementation and use of Aadhar in transactions are further expected to

helping improve the domestic fundamentals and improve this ranking. This is

crucial for India to attract the foreign capital and we view this positively.

In the nutshell, we continue to maintain positive stance on the economy and

believe that the affordable housing scheme and Bharatmala Pariyojana project will

help in job creation which will benefit the Indian economy. With the capital

infusion in PSBs we believe that credit growth will also be supported.

We ,maintain positive outlook on Maruti Suzuki, Asian Granito and Blue Star from

consumption sector as well as on the stocks like Music Broadcast, GIC housing

finance, Karur Vysa Bank, Navkar Corp, KEI Industries and Siyaram Silk Mills. We

add LT Foods in the Top Picks portfolio.

Please refer to important disclosures at the end of this report

1

Top Picks Report | November 2017

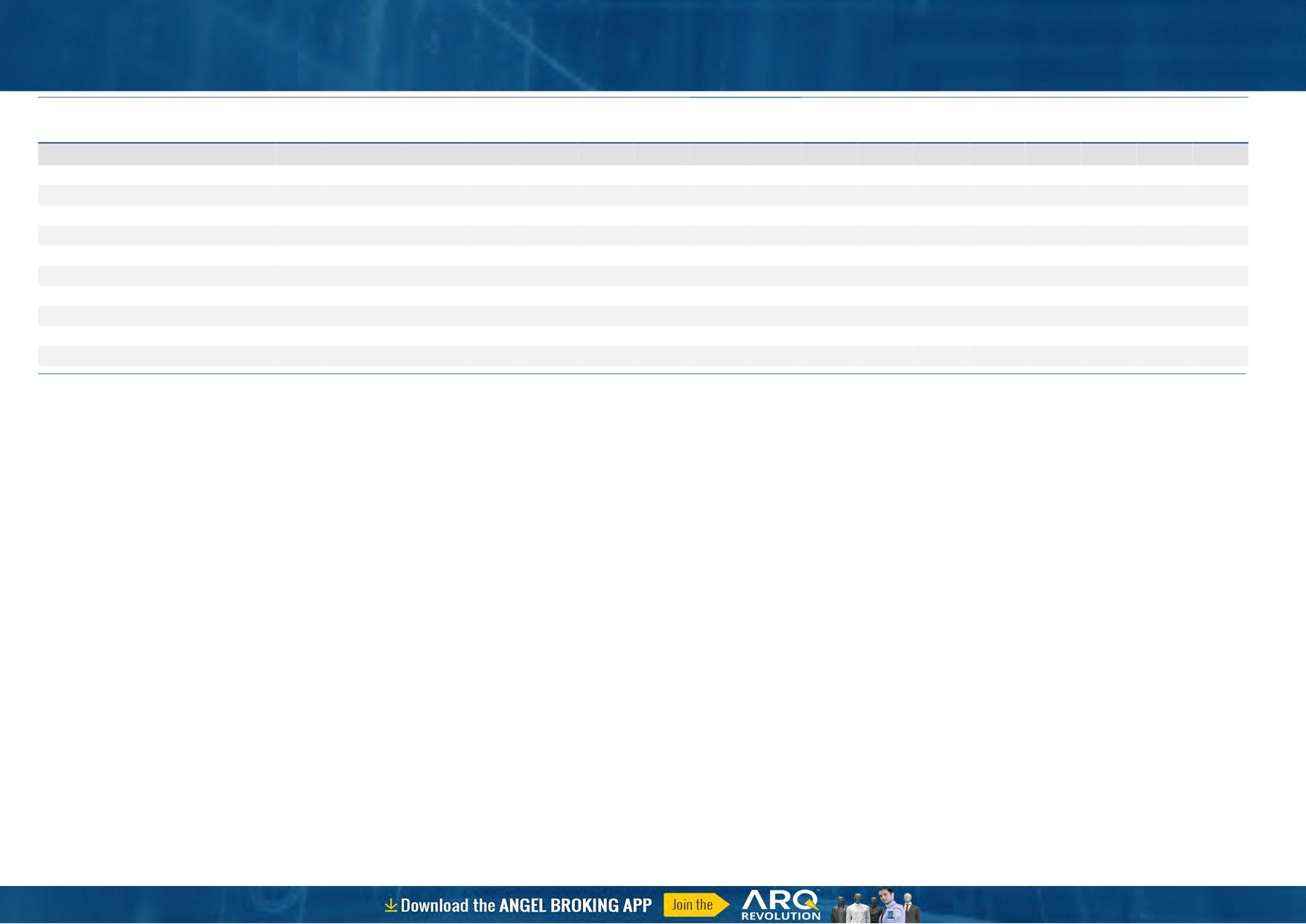

Top Picks

November 6, 2017

2

Top Picks Report | November 2017

Stock Info

Dewan Housing

CMP

666

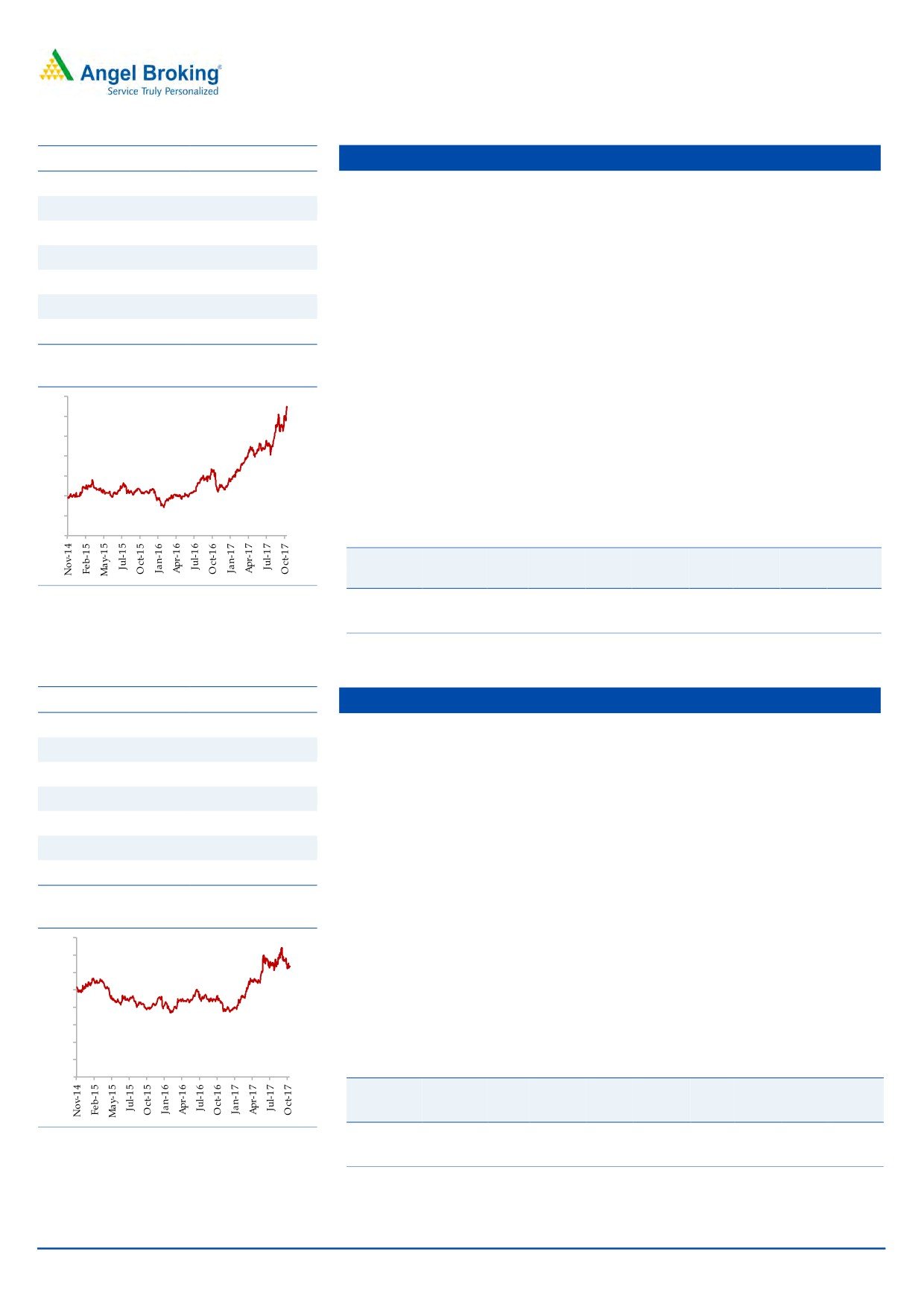

Loan growth to remain strong going ahead: Backed by healthy capital

TP

762

adequacy and increasing demand for home loans DHFL’s loan book is

Upside

14.5%

expected to report 23% loan growth over next two three years.

Sector

Financials

Strong Capital adequacy lends visibility for growth: DHFL sold 50% stake held

Market Cap (` cr)

20,876

by it in DFHFL Pramerica Life Insurance Co Ltd which added `1,969 cr to its

Beta

2.1

net worth and increases its CAR by 400 bps, to 19.3% which should fuel

52 Week High / Low

679 / 213

growth for next 2-3 years.

Asset quality has been strong: Strong NIM on the back of lower cost of funds

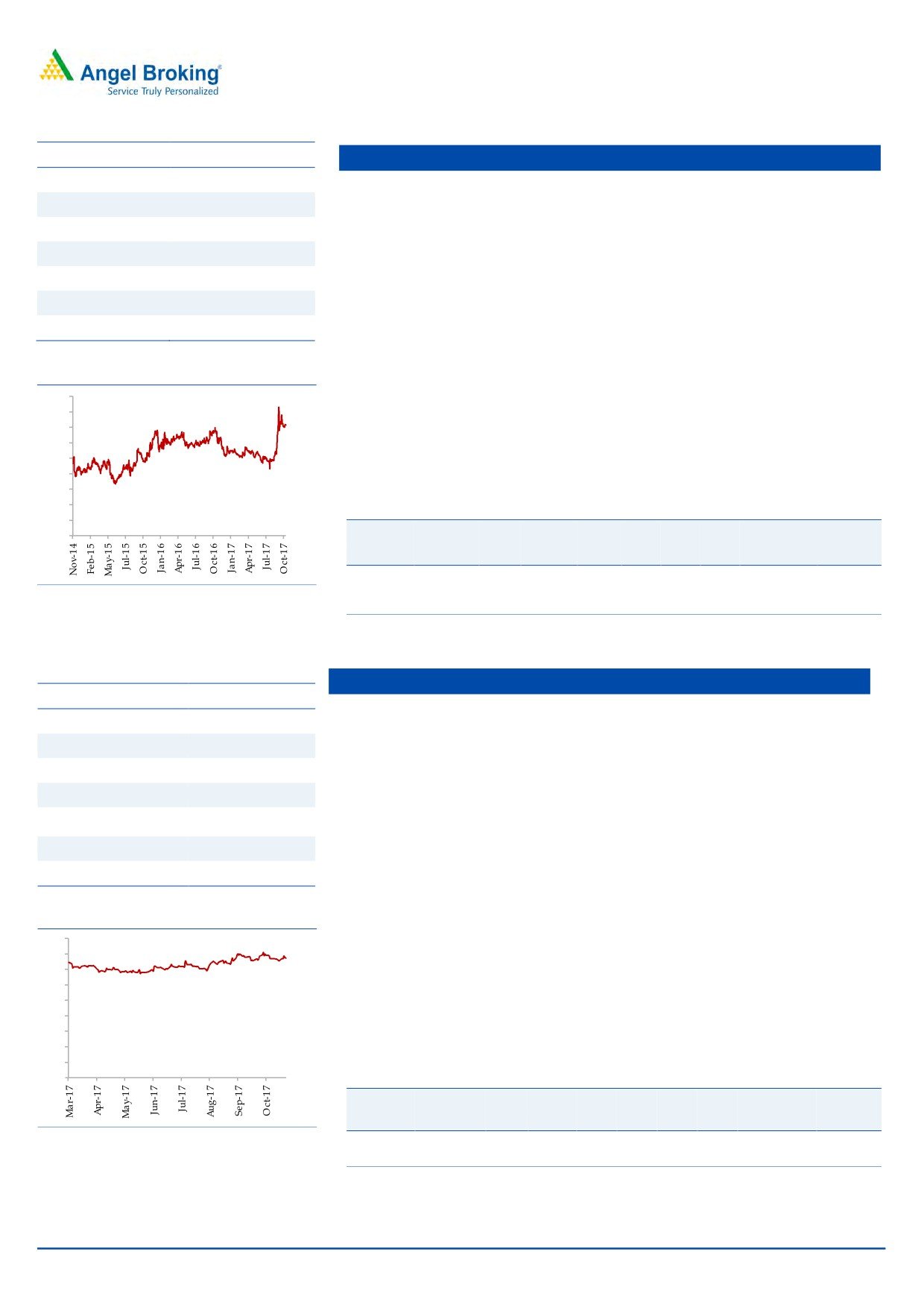

3 year-Chart

and lower credit cost will ensure healthy return ratios for the company. Despite

700

strong growth the company has maintained stable asset quality and we expect

600

the trend to continue.

500

Outlook: We expect the company’s loan growth to remain 23% over next two

400

years and earnings growth is likely to be more than 28%.The stock currently

300

trades at 2.2x FY2019E ABV. We maintain Buy on the stock with a target price of

200

`762.

100

-

Key Financials

Y/E

Op. Inc NIM

PAT

EPS

ABV ROA ROE P/E P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

Source: Company, Angel Research

FY2018E

2,279

2.4

1,171

37.4

268

1.3

13.8

17.9

2.5

FY2019E

2,927

2.7

1,556

49.7

305

1.5

16.2

13.5

2.2

Source: Company, Angel Research

Stock Info

Karur Vysa Bank

CMP

127

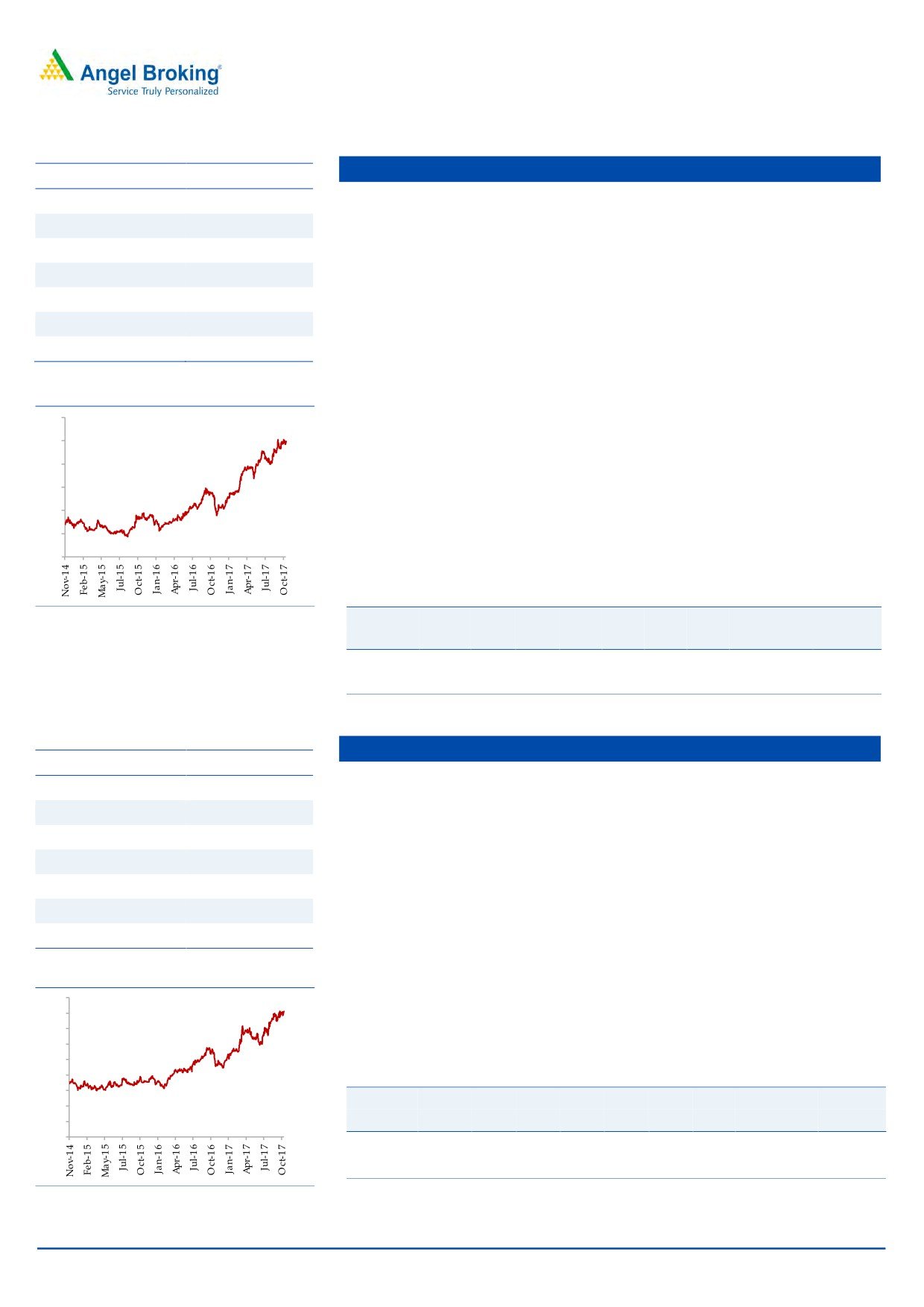

Loan growth to pick up from FY18 onwards: KVB had a fairly strong loan

TP

161

CAGR of 14.9% over FY11-17.However, FY17 was year of consolidation and

Upside

27%

loan book grew by only 4.7%. We expect loan growth to pick up to 11% over

Sector

Banking

FY17-19. Deposit growth is expected at 9% during the period.

Market Cap (` cr)

7,699

Asset quality likely to stabilize going ahead: KVB’s slippages remained high

during FY17 and hence GNPAs % went up to 3.58% vs 1.3%. However, large

Beta

0.9

part of the troubled accounts has been classified as NPAs and hence gradually

52 Week High / Low

150 / 74

we expect the asset quality to improve. While in Q1FY18 we saw some

pressure on asset quality, it still remained fairly under control.

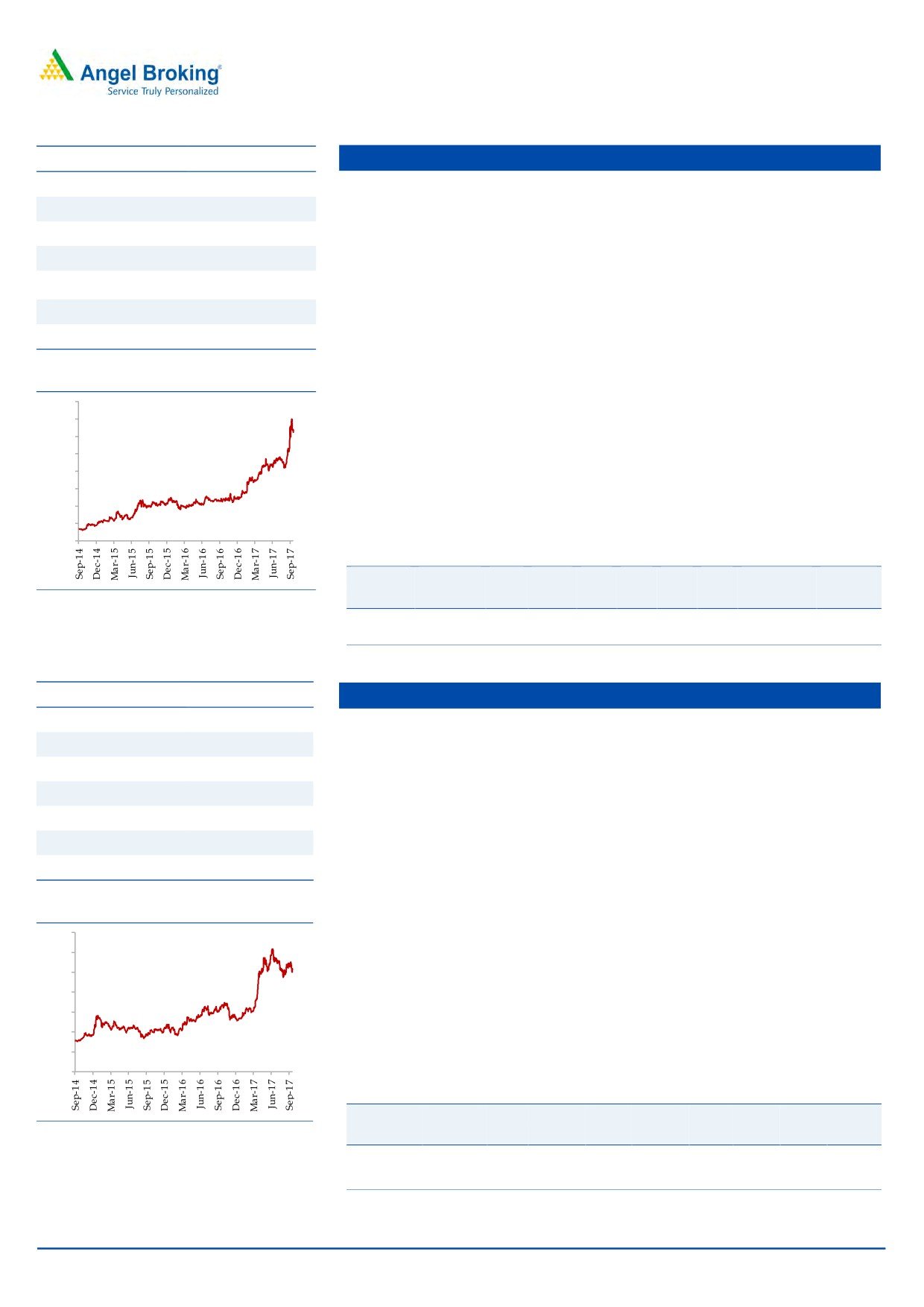

3 year-Chart

NIM likely to see further improvement: There were 25 bps improvements in

160

NIM during FY17, with share of CASA growing and cost of fund coming down

140

NIM is expected to improve further going ahead.

120

100

Outlook: We expect KVB to post a strong loan book & earnings CAGR of 11%

80

& 22% over FY2017-19E. The stock currently trades at 1.4x FY2019E ABV. We

60

have a BUY rating on the stock.

40

20

Key Financials

-

Y/E

Op. Inc NIM

PAT

EPS

ABV ROA ROE P/E P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2018E

2,388

3.7

660

10.8

77.8

1

12.5

11.8

1.6

Source: Company, Angel Research

FY2019E

2,757

3.9

858

14.1

89.6

1.2

14.7

9.0

1.4

Source: Company, Angel Research

November 6, 2017

3

Top Picks Report | November 2017

Asian Granito

Stock Info

CMP

495

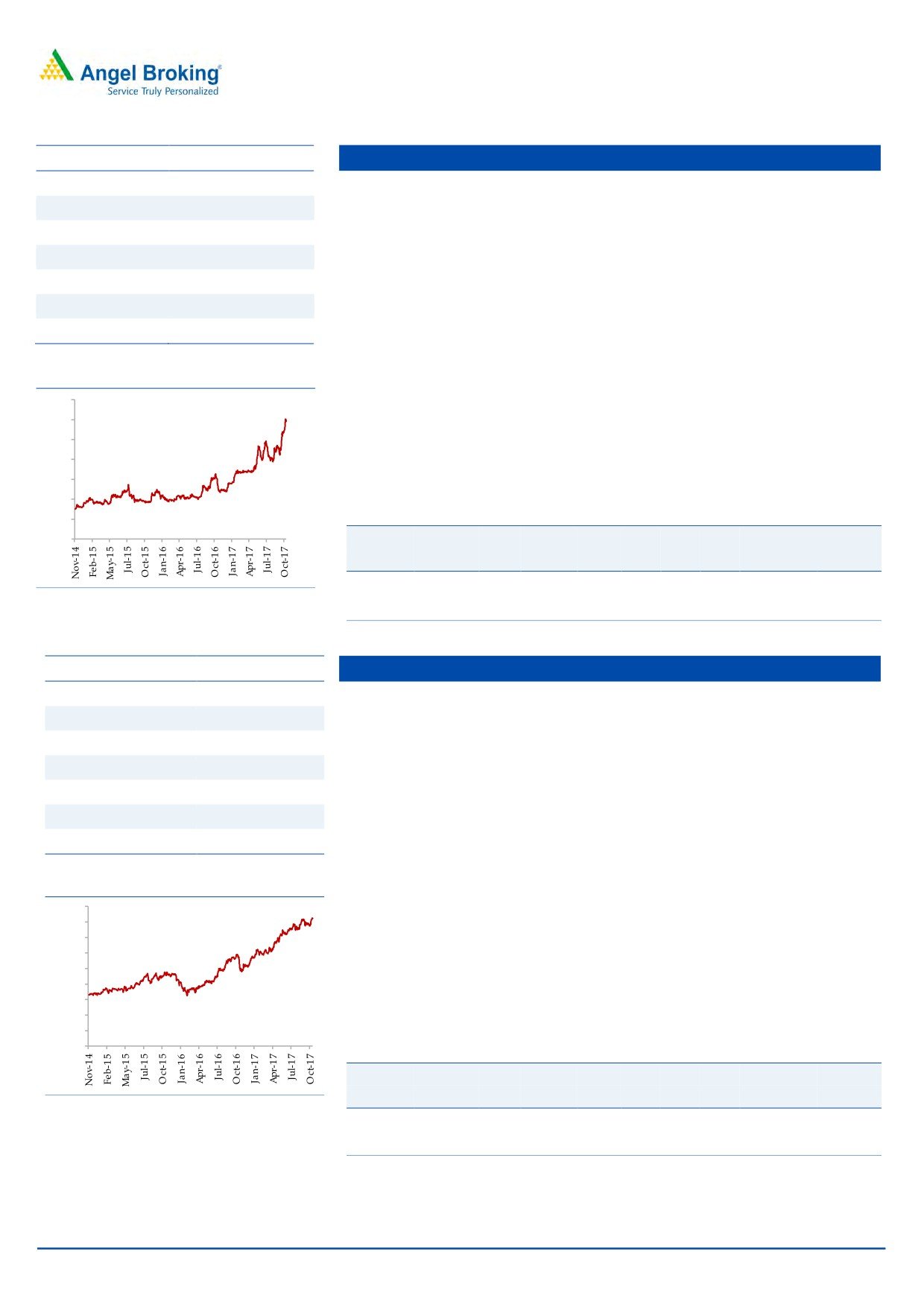

AGIL’s current, vitrified sales (35%) are lower as compared to its peers like

Somany Ceramics (47%) and Kajaria Ceramics (61%). Recently, AGIL has

TP

572

launched various products in premium segment. Going forward, we expect

Upside

15%

AGIL’s profit margin to improve due to increase in focus for higher vitrified

Sector

Cons. Durable

product sales, which is a high margin business.

Market Cap (` cr)

1,488

AGIL is continuously putting efforts to increase the B2C sales from the current

Beta

1.9

level (35-36% in FY17). It is expected to reach up to 50% in next 2-3 years on

52 Week High / Low

518 / 176

the back of various initiatives taken by AGIL to increase direct interaction with

customers like strengthening distribution network, participation in key trade

exhibition, etc.

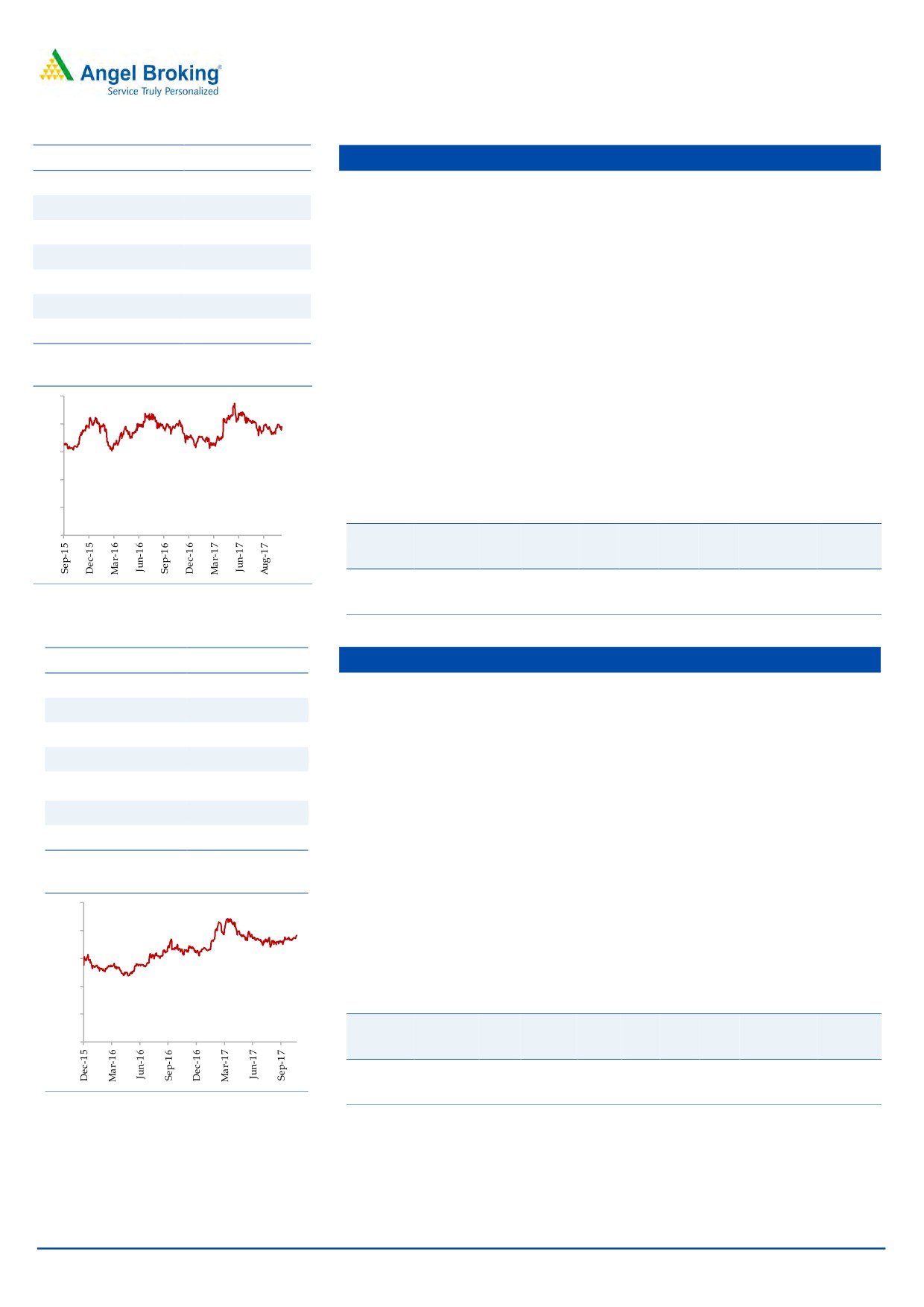

3 year-Chart

In July FY2016, AGIL acquired Artistique Ceramic which has a better margin

600

profile. Going forward, we expect the company to improve its operating

500

margin from 7.5% in FY16 (excluding merger) to

12-12.5% in coming

400

financial year. Artisique Ceramics has a contract with RAS GAS to supply

300

quality natural gas at a discounted rate of 50% to current market rate, which

200

would reduce the overall power & fuel cost of the company.

100

We expect AGIL to report a net revenue CAGR of ~8.5% to ~`1,286cr and

net profit CAGR of ~23% to `59cr over FY2017-19E. We recommend a Buy

-

rating on the stock.

Key Financials

Source: Company, Angel Research

Y/E

Sales OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

1,169

12.5

48

16.0

10.7

31.0

3.3

12.0

1.5

FY2019E

1,286

12.5

59

19.7

11.6

25.1

2.9

10.7

1.3

Source: Company, Angel Research

Blue Star

Stock Info

CMP

692

BSL is one of the largest air-conditioning companies in India. With a mere 3%

penetration level of ACs vs 25% in China, the overall outlook for the room air-

TP

867

conditioner (RAC) market in India is favourable.

Upside

25%

BSL's RAC business has been outgrowing the industry by ~10% points over the

Sector

Cons. Durable

last few quarters, resulting in the company consistently increasing its market

Market Cap (` cr)

6,626

share. This has resulted in the Cooling Products Division (CPD)'s share in

Beta

0.7

overall revenues increasing from~23% in FY2010 to ~45% in FY2017

52 Week High / Low

826 / 436

(expected to improve to ~47-48% in FY2018E). With strong brand equity and

higher share in split ACs, we expect the CPD to continue to drive growth.

3 year-Chart

Aided by increasing contribution from the Unitary Products, we expect the

900

overall top-line to post a revenue CAGR of ~19% over FY2017-19E and

800

700

margins to improve from

5.8% in FY2017 to

6.6% in FY2019E. We

600

recommend an buy rating on the stock.

500

400

Key Financials

300

Y/E

Sales OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

200

100

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

-

FY2018E

5,220

6.3

161

16.8

19.0

41.2

8.2

25.3

1.2

FY2019E

6,207

6.6

214

22.3

23.3

31.1

7.2

18.7

1.0

Source: Company, Angel Research

Source: Company, Angel Research

November 6, 2017

4

Top Picks Report | November 2017

Stock Info

Siyaram Silk Mills

CMP

607

SSML has strong brands which cater to premium as well as popular mass

TP

650

segments of the market. Further, SSML entered the ladies' salwar kameez and

Upside

7%

ethnic wear segment. Going forward, we believe that the company would be able to

Sector

Textile

leverage its brand equity and continue to post strong performance.

Market Cap (` cr)

2,845

The company has a nationwide network of about 1,600 dealers and business

partners. It has a retail network of 160 stores and plans to add another

Beta

0.9

300-350 stores going forward. Further, the company's brands are sold across

52 Week High / Low

222/626

3,00,000 multi brand outlets in the country.

Going forward, we expect SSML to report a net sales CAGR of ~12% to

3 year-Chart

~`1,981cr and adj.net profit CAGR of ~16% to `123cr over FY2017-19E on

700

back of market leadership in blended fabrics, strong brand building, wide

600

distribution channel, strong presence in tier II and tier III cities and emphasis

500

on latest designs and affordable pricing points. At the current market price,

400

SSML trades at an inexpensive valuation. We have an accumulate

300

recommendation on the stock and target price of `650.

200

100

Key Financials

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

1,769

12.7

106

113.1

15.4

26.8

4.1

13.3

1.8

Source: Company, Angel Research

FY2019E

1,981

12.7

123

131.1

15.5

23.1

3.6

11.9

1.6

Source: Company, Angel Research

Stock Info

Maruti Suzuki

CMP

8,216

The Automobile sector is expected to benefit from the GST implementation.

TP

8,890

The sector has seen a pick up in the volumes in FY17 as there were several

Upside

8%

positive factors like normal monsoon and lower interest rates.

Sector

Automobiles

Maruti Suzuki continues to hold ~51% market share in the passenger vehicles.

Market Cap (` cr)

2,48,201

The launch of exciting models has helped the company to ride on the

premiumization wave that is happening in the country. In the last two years,

Beta

1.2

company has seen improvement in the business mix with the pie of the utility

52 Week High / Low

8,370/4,769

vehicles growing from ~4% to current 15%. With the 3-4 months of waiting

period on these models, strong demand and GST led price decrease; we

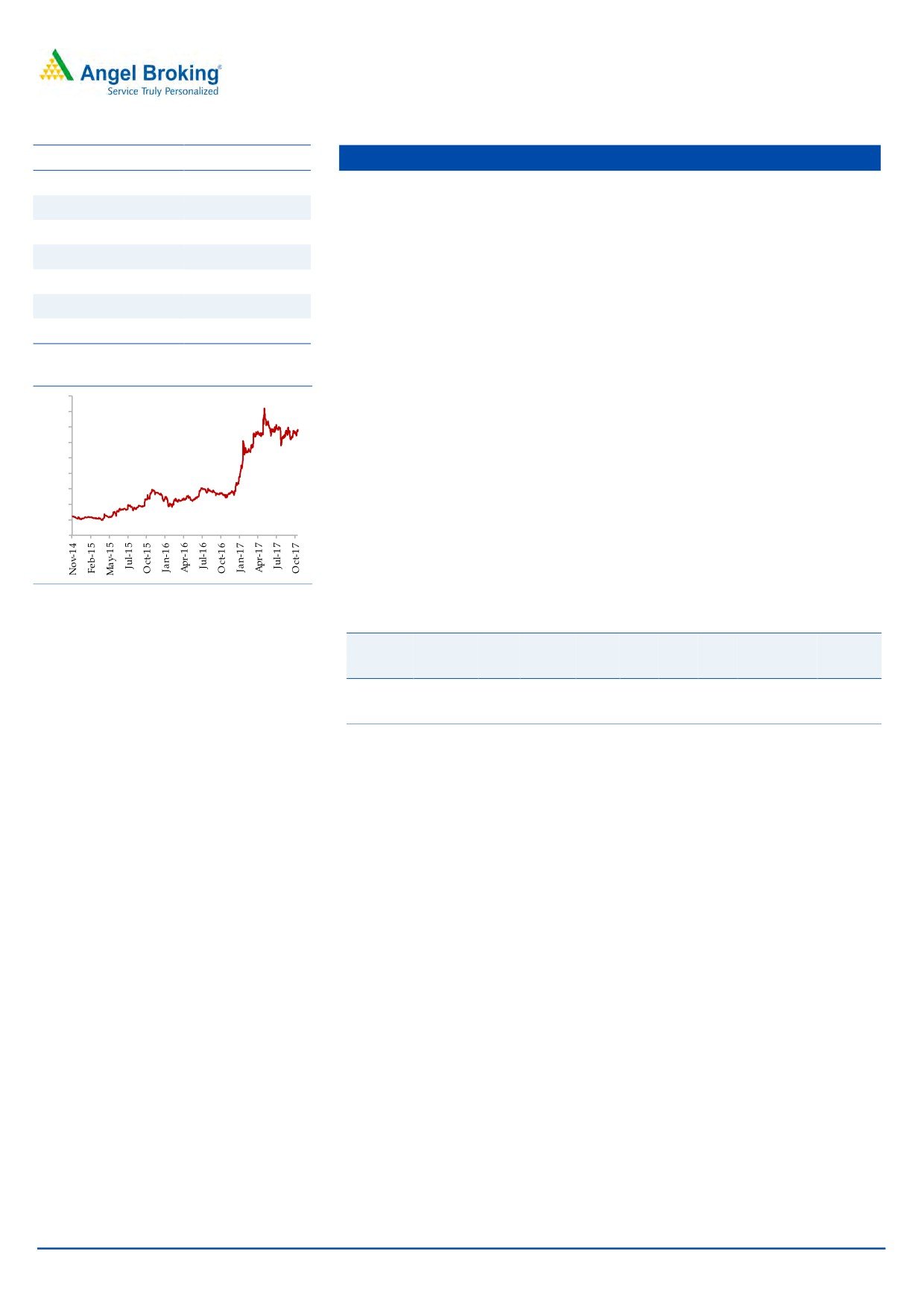

3 year-Chart

believe that this pie is expected to grow to ~20% in FY19E.

9,000

Due to the favorable business mix, company has also been seeing

8,000

7,000

improvement in the margins. Company has already moved from ~11-12%

6,000

EBITDA margin range in FY14 to current ~17% margin range in 2QFY18.

5,000

Together with higher operating leverage at Gujarat plant, increasing Nexa

4,000

3,000

outlets, and improving business mix, we believe that company has further

2,000

room to improve its margins. We have an accumulate rating on the stock.

1,000

-

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

Source: Company, Angel Research

FY2018E

80,985

15.6

8,526

282.3

21.8

29.1

6.3

17.5

2.7

FY2019E

97,917

16.9

11,187

370.4

23.1

22.2

5.1

12.7

2.2

Source: Company, Angel Research

November 6, 2017

5

Top Picks Report | November 2017

Stock Info

TV Today Network

CMP

379

TTNL enjoys a strong viewership ranking in the Hindi and English news

TP

435

channel categories. The company’s Hindi news channel - Aaj Tak has

Upside

15%

maintained its market leadership position occupying the No.1 rank for several

Sector

Media

consecutive years in terms of viewership. Its English news channel - India

Today too has been continuously gaining viewership; it has now captured the

Market Cap (` cr)

2,263

No. 2 ranking from No. 4 earlier. Its other channels like Dilli Aaj Tak and Tez

Beta

0.6

are also popular among viewers.

52 Week High / Low

434 /210

TTNL is a play of higher operating leverage that would be visible as

advertisement revenues gain traction. Going ahead, we expect EBITDA

3 year-Chart

margins would improve.

450

400

350

We expect TTNL to report a net revenue CAGR of ~9% to ~`727cr and net

300

profit CAGR of ~14% to `121cr over FY2017-19E. We have a buy rating on

250

the stock

200

150

100

Key Financials

50

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

667

27.7

111

18.6

15.6

20.4

3.2

10.5

2.9

Source: Company, Angel Research

FY2019E

727

27.7

121

20.1

17.3

18.7

3.2

9.8

2.7

Source: Company, Angel Research

Music Broadcast

Stock Info

Radio Industry is protected by licenses for 15 years, thereby restricting the entry

CMP

387

of new players. This would support the existing companies to strengthen their

TP

434

position and maintain a healthy growth rate.

Upside

12.1%

It has grabbed the Number 1 position in Mumbai, Bengaluru and Delhi in

Sector

Media

terms of number of listener. This is helping MBL to charge premium rate,

Market Cap (` cr)

2,206

which resulting into higher EBITDA margin (33.6%) compare to 22% of ENIL.

Beta

0.6

MBL outperformed its closest peer with 18.4% CAGR in revenue over FY2013-

52 Week High / Low

415/333

17 (ENIL reported 13.2% CAGR in revenue). On the profitability front too,

MBL, with 32.3% CAGR in PAT over FY2013-17, has performed much better

3 year-Chart

than ENIL (-5.2% CAGR in PAT). Moreover, Radio City posted a six year CAGR

450

of 12.1% v/s. 9.1% of industry owing to higher advertising volumes.

400

350

Capex for 39 licenses have been done for the next 15 years, hence no heavy

300

incremental Capex requirement would emerge. Moreover, the maintenance

250

Capex would be as low as `5-10cr. This would leave sufficient cash flow to

200

150

distribute as dividend. We have a Buy recommendation on the stock and

100

target price of `434.

50

-

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

Source: Company, Angel Research

FY2018E

317

34.4

56

9.8

9.3

39.4

3.7

18.5

6.4

FY2019E

372

34.9

80

14.0

12.0

27.7

3.3

15.0

5.2

Source: Company, Angel Research

November 6, 2017

6

Top Picks Report | November 2017

Stock Info

KEI Industries

CMP

338

KEI’s current order book (OB) stands at `2,780cr (segmental break-up:

TP

371

`1,990cr in EPC, `560cr in Cable & `230cr in EHV). Its OB grew by ~28% in

Upside

19%

the last 3 years due to strong order inflows from State Electricity Boards, Power

Sector

Cable

grid, etc.

Market Cap (` cr)

2,425

KEI’s consistent effort to increase its retail business from 30-32% of revenue in

Beta

0.9

FY17 to 40-45% of revenue in the next 2-3 years on the back of strengthening

52 Week High / Low

367 / 99

distribution network (currently 926 which is expect to increase `1,500 by FY19)

and higher ad spend (increased from `2cr in FY13 to `7.5cr in FY17 and

expected to spend).

3 year-Chart

400

KEI’s export (FY17 - 8-10% of revenue) is expected to reach a level of ~14-

350

15% in next two years with higher order execution from current OB and

300

participation in various international tenders. We expect a strong ~26%

250

200

growth CAGR over FY2017-19 in exports. We expect KEI to report net revenue

150

CAGR of ~14% to ~`3,392cr and net profit CAGR of ~13% to `125cr over

100

FY2017-19E. Hence we have a Buy rating on the stock.

50

-

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

Source: Company, Angel Research

FY2018E

3,001

10.0

100

13.0

18.2

26.0

4.7

10.4

1.0

FY2019E

3,392

10.0

125

16.1

18.7

21.0

3.9

9.2

0.9

Source: Company, Angel Research

Stock Info

GIC Housing Finance Ltd

CMP

481

Backed by the new management, GICHF is aiming for 2.0x growth in the loan

TP

655

book over the period of FY16-FY19E to `16,000cr. GICHF has healthy capital

Upside

37%

adequacy, and is seeing an increase in demand for home loans. GICHF’s

Sector

Financials

loan book is expected to report 24.3% loan growth over next two years.

GICHF is consistently decreasing bank borrowing and increasing high yield

Market Cap (` cr)

2,586

loan book which is expected to boost its Net Interest Margin. The share of

Beta

1.7

bank borrowing was 75% in FY15, which fell to 55% in FY17. In our opinion,

52 Week High / Low

623 /251

the impetus on lower bank borrowings and increasing high yield loan book is

likely to result in 17bps NIM over FY16-FY19E.

3 year-Chart

GICHF’s asset quality is on the higher side compared to other HFCs (As on

700

FY17 GNPA-2.3% and NPA-0.3%). This is primarily due to GICHF has not

600

written off any bad asset and has not sold any bad assets to ARC. New

500

Management is expediting asset quality improvement.

400

We expect the GICHF’s loan growth to grow at a CAGR of 24.3% over next

300

two years and RoA/RoE to improve from 1.7%/19.0% in FY17 to 2.0%/23.0%

200

in FY19E.The stock is currently trading at 2.2x FY2019E ABV. We have a Buy

100

rating on the stock.

-

Key Financials

Y/E

Op. Inc NIM

PAT

EPS

ABV ROA ROE P/E P/ABV

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2018E

376

3.6

180

33

184

1.7

20

14

2.6

FY2019E

477

3.7

215

40

219

1.9

23

12

2.2

Source: Company, Angel Research

November 6, 2017

7

Top Picks Report | November 2017

Stock Info

Navkar

CMP

195

NCL is one of the largest and one of the three CFS at JNPT with rail

TP

265

connectivity, helping it garner high market share at the port. NCL is in a massive

Upside

35%

expansion mode where it is increasing its capacity by 234% to 1,036,889 TEUs

Sector

Logistics

at JNPT and coming up with an ICD at Vapi (with Logistics Park).

Market Cap (` cr)

2,778

The ICD with rail link should benefit from first mover advantage in a region

Beta

1.0

that has huge market potential and accounts for ~27% of volumes at JNPT.

The ICD should be able to capture the EXIM volumes from the region through

52 Week High / Low

247 / 155

rail link that till now was being custom cleared at JNPT (Import) or being

transported via road and consolidated at JNPT (Export). South Gujarat

3 year-Chart

volumes will now head straight to the Vapi ICD; thus the company can now

250

cater to bulk commodities and domestic traffic that it had been rejecting owing

200

to capacity constraints at CFS.

150

We expect NCL to successfully use its rail advantage and scale up its

100

utilizations at both JNPT and Vapi ICD. We have a Buy rating on the stock.

50

Key Financials

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

450

41.5

124

8.7

8.4

22.5

1.8

16.6

6.9

Source: Company, Angel Research

FY2019E

617

41.5

181

12.7

11.0

15.4

1.6

12.0

5.0

Source: Company, Angel Research

Stock Info

Alkem Laboratories

CMP

1,926

Alkem is 5th largest pharma company is the domestic market and also has

TP

2,125

presence in US. It derives 73% of its revenues come from the Indian markets

Upside

10%

while rest come from the other countries. Alkem has leadership position in the

domestic anti infective segment and it is ranked #3 in Gastro-Intestinal and

Sector

Pharmaceutical

Pain/Analgesics segments. Company holds ~3.6% and ~7.9% market share

Market Cap (` cr)

23,028

in the formulations and overall prescriptions in the country.

Beta

0.4

In the domestic market, company operates in acute and chronic segments. It is

52 Week High / Low

2,400 /1,455

a prominent player in acute segment has forayed in chronic segment from

which it expects faster growth. Alkem has been outperforming the domestic

3 year-Chart

industry growth which is likely to continue. Company is focusing on

2,500

monetization of its pipeline (92 ANDAs) in the US with high single digit ANDA

launches to grow the US revenues at ~20% growth rate from FY17-FY19E.

2,000

Overall outlook remains strong with 9% CAGR in the topline and 13% CAGR

1,500

in the bottom-line. We have an accumulate rating on the stock.

1,000

Key Financials

500

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

-

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

6,320

17.5

869

72.7

17.7

26.5

4.7

20.4

3.6

FY2019E

7,341

19.8

1,155

96.6

19.8

19.9

4.0

15.2

3.0

Source: Company, Angel Research

Source: Company, Angel Research

November 6, 2017

8

Top Picks Report | November 2017

Stock Info

LT Foods

CMP

73

LT Foods LTD (LTFL) is a branded specialty Foods Company engaged in

TP

96

milling, processing and marketing of branded and non-branded basmati rice

Upside

31%

and manufacturing of rice food products in the domestic and overseas

Sector

Food Processing

markets.

Market Cap (` cr)

1,960

LTFL’s flagship brand Daawat enjoys 22% market share in the branded rice

Beta

1.0

market of India. The company also has strong market share in North America

52 Week High / Low

84 / 21

selling Basmati rice under the brand name ‘Royal’. Currently it has access to

1,40,000 traditional retail outlets Reach -93% of towns with over 2 lakh

3 year-Chart

population Access to 3000 Wholesalers. Moreover, it has also strong network

90

in modern trade. LTFL is the 1st Rice company to place Brown Basmati Rice in

80

70

Medical Chains.

60

50

The company has a well-diversified product basket catering to consumers of

40

all income groups. The company is present in segments like Basmati rice,

30

20

Specialty rice (non-Basmati) and Other food products.

10

-

Overall outlook remains strong with ~14% CAGR in the top-line and 20 %

CAGR in the bottom-line. We recommend Buy on the stock with Target Price of

`96 (15x FY2019E EPS).

Source: Company, Angel Research

Key Financials

Y/E

Sales OPM

PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

3,747

11.5

139

5.2

17.5

14.0

2.4

8.2

0.9

FY2019E

4,234

11.5

170

6.4

17.6

11.4

2.0

7.2

0.8

Source: Company, Angel Research

November 6, 2017

9

Top Picks Report | November 2017

Macro watch

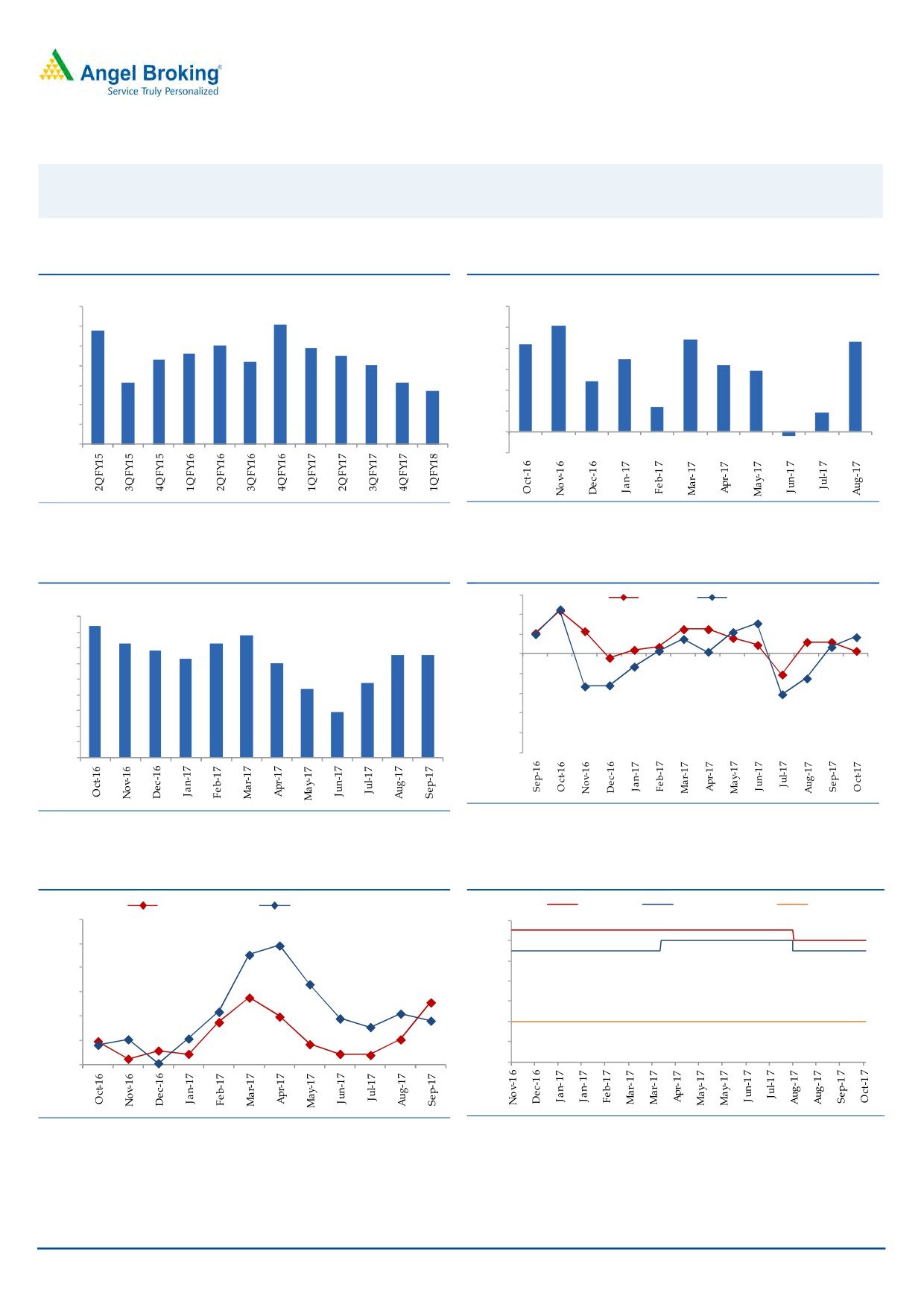

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

10.0

6.0

9.1

5.1

8.8

9.0

5.0

4.4

4.3

8.0

7.9

4.2

7.6

7.5

8.0

7.3

7.2

4.0

3.5

7.0

3.2

2.9

7.0

6.1

6.1

3.0

2.4

5.7

6.0

2.0

1.2

0.9

5.0

1.0

4.0

-

3.0

(1.0)

(0.2)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

4.5

4.2

54.0

3.9

4.0

3.6

3.7

52.0

3.4

3.2

3.3

3.3

3.5

3.0

50.0

3.0

2.4

48.0

2.5

2.2

2.0

46.0

1.5

1.5

44.0

1.0

42.0

0.5

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

60.0

6.50

50.0

6.00

5.50

40.0

5.00

30.0

4.50

20.0

4.00

10.0

3.50

0.0

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

November 6, 2017

10

Top Picks Report | November 2017

Global watch

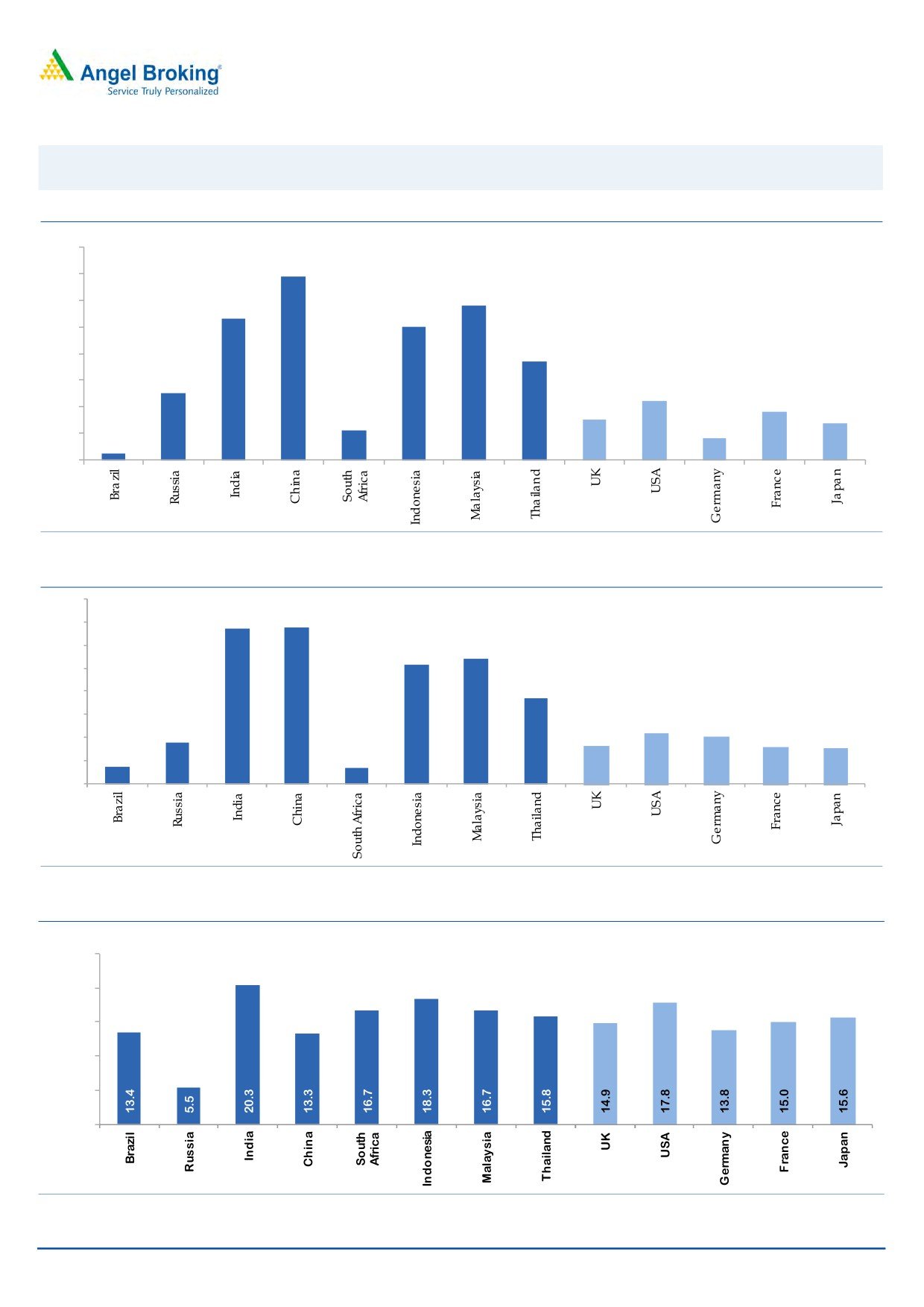

Exhibit 8: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 9: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

2.0

0.7

1.5

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 10: One year forward P-E ratio across select developing and developed countries

(x)

25.0

20.0

15.0

10.0

5.0

-

Source: IMF, Angel Research

November 6, 2017

11

Top Picks Report | November 2017

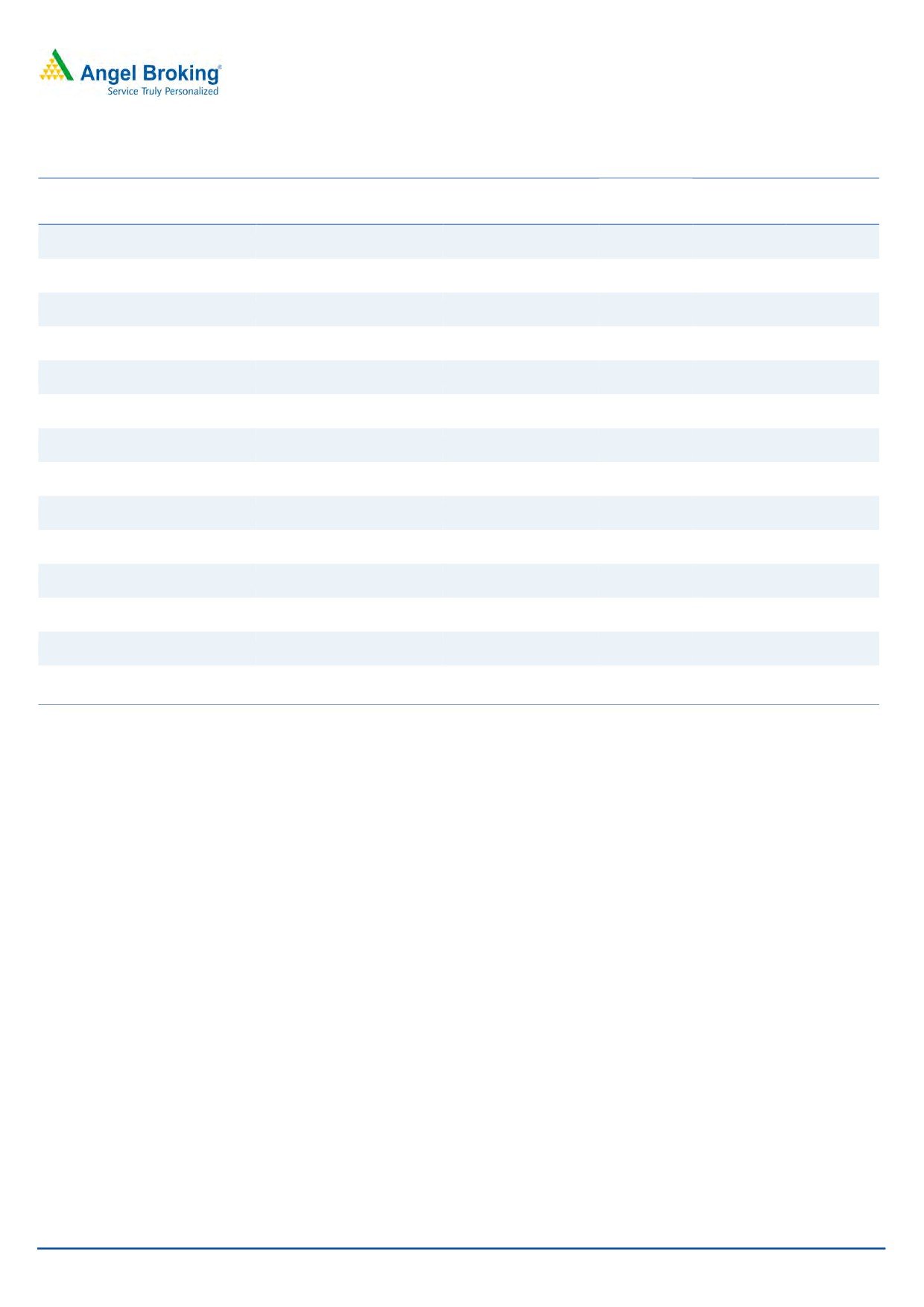

Exhibit 11: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

73,915

(0.6)

11.0

14.8

Russia

Micex

2,081

0.4

5.9

6.0

India

Nifty

10,453

6.0

3.3

21.2

China

Shanghai Composite

3,372

0.8

3.0

8.2

South Africa

Top 40

53,199

5.2

7.9

19.6

Mexico

Mexbol

48,535

(4.3)

(5.8)

3.5

Indonesia

LQ45

1,006

1.4

3.4

8.0

Malaysia

KLCI

1,741

(1.1)

(1.1)

4.0

Thailand

SET 50

1,079

0.9

7.6

14.9

USA

Dow Jones

23,539

3.9

6.8

31.2

UK

FTSE

7,560

1.2

0.6

11.1

Japan

Nikkei

22,539

10.5

12.8

30.0

Germany

DAX

13,479

4.5

10.9

28.6

France

CAC

5,518

2.8

5.9

22.9

Source: Bloomberg, Angel Research

November 6, 2017

12

Top Picks Report | November 2017

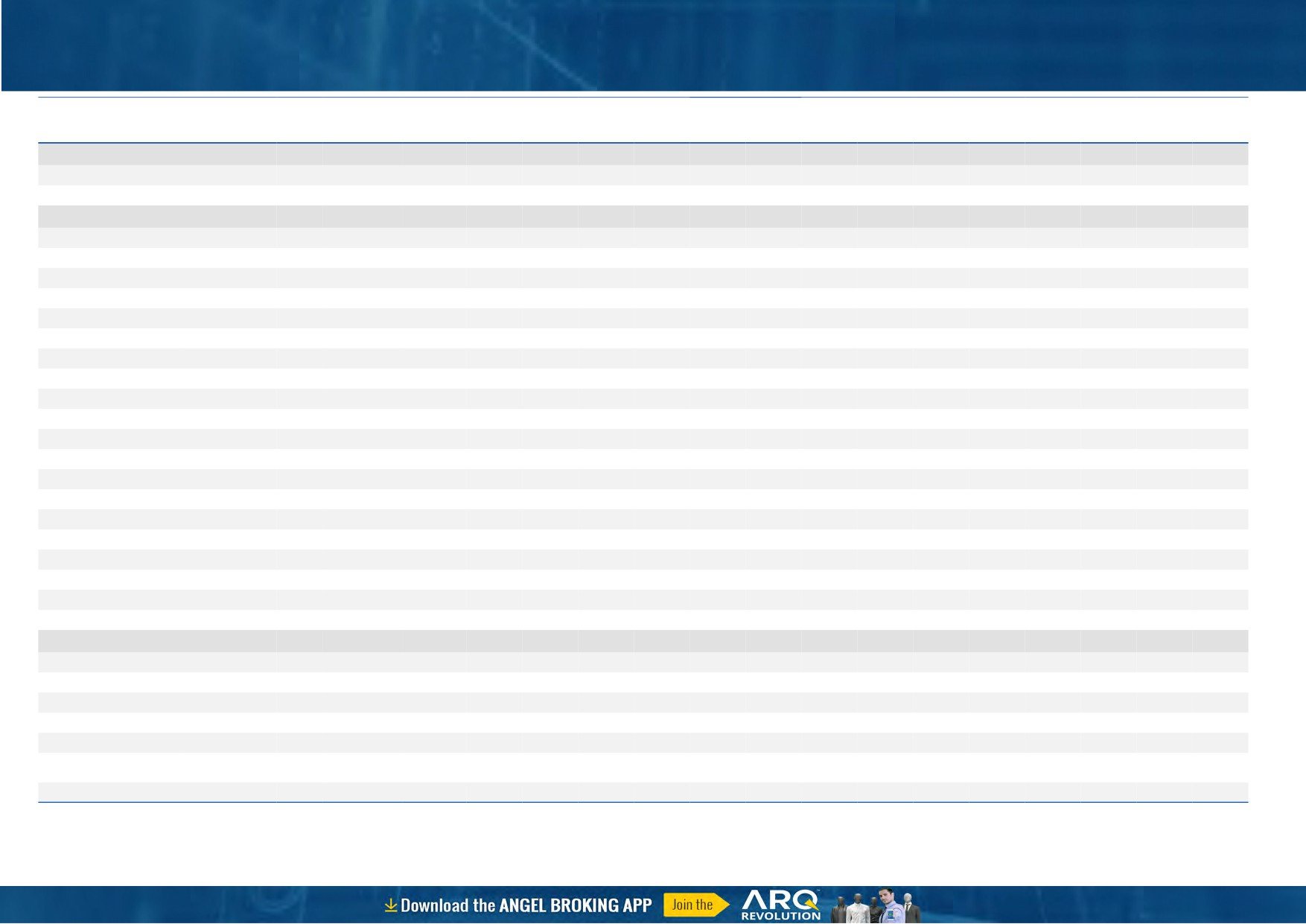

Stock Watch

November 6, 2017

13

Top Picks Report

November 06, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

Agri / Agri Chemical

Rallis

Reduce

240

209

4,666

1,873

2,099

15.0

15.0

9.5

10.5

25.3

22.9

3.8

3.5

15.8

16.0

2.4

2.2

United Phosphorus

Accumulate

777

820

39,449

18,922

21,949

18.0

18.5

36.2

45.6

21.5

17.0

4.5

3.7

22.7

23.8

2.2

1.9

Auto & Auto Ancillary

Ashok Leyland

Neutral

124

-

36,187

23,339

27,240

10.1

10.8

4.7

6.2

26.6

19.9

5.3

4.7

20.0

23.6

1.5

1.3

Bajaj Auto

Neutral

3,223

-

93,266

23,936

27,955

19.5

20.1

142.7

167.3

22.6

19.3

4.9

4.4

21.8

22.8

3.5

2.9

Bharat Forge

Buy

706

875

32,850

7,637

8,755

21.7

23.2

36.1

47.3

19.6

14.9

3.5

3.0

18.5

20.8

4.2

3.5

Eicher Motors

Neutral

31,235

-

85,030

19,043

22,837

19.5

19.9

835.4

1,019.0

37.4

30.7

14.0

10.8

40.9

37.8

4.3

3.6

Gabriel India

Neutral

199

-

2,855

1,782

2,033

9.7

10.2

7.1

8.9

28.0

22.5

5.7

4.8

21.0

22.2

1.6

1.3

Hero Motocorp

Accumulate

3,691

4,129

73,704

32,239

36,878

16.0

15.6

184.4

206.5

20.0

17.9

6.3

5.5

31.3

30.7

2.1

1.8

Jamna Auto Industries Neutral

66

-

2,622

1,441

1,662

14.4

14.8

13.9

17.6

4.7

3.7

1.3

1.1

30.0

31.0

1.8

1.5

Mahindra and Mahindra Neutral

1,331

-

82,677

46,971

53,816

13.6

14.0

67.7

79.8

19.7

16.7

2.8

2.5

15.0

15.9

1.6

1.4

Maruti

Accumulate

8,216

8,658

248,201

81,825

101,245

15.0

15.0

283.5

356.0

29.0

23.1

6.3

5.2

21.9

22.4

2.7

2.1

Minda Industries

Neutral

910

-

7,867

4,328

5,084

11.0

11.9

27.3

36.4

33.4

25.0

7.1

5.5

23.1

25.6

1.9

1.6

Motherson Sumi

Neutral

365

-

76,786

55,937

64,445

10.8

11.4

16.9

21.1

21.6

17.3

4.8

4.9

25.2

25.4

1.4

1.2

Tata Motors

Neutral

447

-

129,036

303,167

343,649

11.8

13.8

33.1

54.7

13.5

8.2

2.2

1.8

16.9

23.0

0.5

0.4

TVS Motor

Neutral

695

-

33,014

13,992

16,216

9.0

9.4

17.1

20.3

40.8

34.2

10.8

8.4

29.7

27.7

2.3

1.9

Amara Raja Batteries

Buy

691

858

11,801

6,140

7,122

14.3

15.6

29.3

39.0

23.6

17.7

4.0

3.4

17.1

19.0

1.9

1.6

Exide Industries

Neutral

205

-

17,421

8,689

9,854

15.1

15.2

9.7

11.0

21.2

18.6

3.8

3.3

15.7

16.1

1.7

1.5

Apollo Tyres

Neutral

236

-

12,031

15,739

17,326

13.3

14.6

20.4

26.7

11.6

8.9

1.4

1.2

20.4

26.7

1.0

0.9

Ceat

Neutral

1,695

-

6,856

6,661

7,717

11.1

14.2

116.2

178.2

14.6

9.5

2.5

2.1

15.2

21.3

1.1

1.0

JK Tyres

Neutral

145

-

3,299

8,318

9,239

16.2

16.4

21.0

27.5

6.9

5.3

1.4

1.1

19.1

20.4

0.8

0.7

Swaraj Engines

Neutral

1,964

-

2,439

788

889

16.4

16.5

71.6

81.0

27.4

24.3

7.9

7.3

29.6

31.0

2.8

2.4

Subros

Neutral

252

-

1,513

1,855

2,135

11.6

11.8

10.3

14.7

24.6

17.2

3.7

3.2

15.8

19.1

1.0

0.9

Capital Goods

BEML

Neutral

1,740

-

7,246

4,286

5,194

7.1

8.2

42.9

58.1

40.6

30.0

3.3

3.0

7.6

8.7

1.8

1.4

Bharat Electronics

Neutral

183

-

44,963

10,258

12,470

19.6

19.5

7.3

8.6

25.1

21.3

0.5

0.4

20.4

21.9

3.9

3.2

Voltas

Neutral

548

-

18,129

6,778

8,004

9.6

11.0

17.1

22.4

32.0

24.5

7.6

6.7

17.7

19.8

2.4

2.0

BHEL

Neutral

100

-

36,732

33,200

39,167

6.8

9.5

6.2

11.2

16.1

8.9

0.7

0.7

4.6

8.0

0.7

0.5

Blue Star

Buy

692

867

6,626

5,220

6,207

6.3

6.6

16.8

22.3

41.2

31.1

8.2

7.2

19.9

23.3

1.2

1.0

CG Power and Industrial

Neutral

85

-

5,324

6,555

7,292

7.5

7.5

-

0.8

8,495.0

106.2

1.3

1.3

0.1

1.2

0.9

0.8

Solutions

Greaves Cotton

Neutral

128

-

3,123

1,778

1,993

14.7

15.1

8.1

9.1

15.8

14.1

3.5

3.3

21.8

23.6

1.5

1.4

Top Picks Report

November 06, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

Capital Goods

KEC International

Accumulate

314

350

8,071

9,779

11,113

9.4

9.8

14.2

18.2

22.1

17.3

4.2

3.5

21.1

22.1

1.1

1.0

KEI Industries

Accumulate

338

380

2,629

3,001

3,391

10.0

10.0

13.0

16.1

26.0

21.0

4.7

3.9

18.2

18.7

1.1

0.9

Thermax

Neutral

959

-

11,429

4,125

4,747

10.3

10.8

26.7

31.5

35.9

30.5

4.0

3.7

11.2

12.0

2.5

2.2

VATech Wabag

Buy

588

681

3,207

3,867

4,126

9.6

10.0

34.9

39.8

16.8

14.8

2.8

2.4

17.7

17.5

0.8

0.8

Cement

ACC

Neutral

1,804

-

33,870

12,255

13,350

13.5

14.3

58.0

66.2

31.1

27.3

3.7

3.4

11.5

12.2

2.7

2.5

Ambuja Cements

Neutral

282

-

56,045

10,250

11,450

17.5

19.0

7.2

8.3

39.2

34.0

2.8

2.7

7.0

7.8

5.2

4.6

India Cements

Neutral

187

-

5,750

6,135

6,750

14.8

15.2

8.5

11.5

22.0

16.2

1.1

1.0

4.8

6.2

1.3

1.1

JK Cement

Neutral

1,000

-

6,994

4,150

4,775

19.2

20.0

49.0

63.5

20.4

15.8

3.2

2.8

17.0

18.5

2.1

1.8

J K Lakshmi Cement

Neutral

439

-

5,163

3,422

3,757

15.5

17.0

13.5

23.2

32.5

18.9

3.4

2.9

10.8

15.5

1.9

1.7

Orient Cement

Neutral

176

-

3,600

2,215

3,233

16.8

17.0

5.9

6.9

29.8

25.5

2.3

2.1

10.8

10.1

2.6

1.7

UltraTech Cement

Neutral

4,369

-

119,938

28,250

35,150

20.2

23.5

77.5

122.2

56.4

35.8

4.8

4.3

9.6

14.8

4.7

3.8

Construction

KNR Constructions

Neutral

273

-

3,840

1,846

2,203

14.5

14.5

12.1

13.7

22.6

20.0

1.2

1.1

17.5

16.7

2.1

1.8

Larsen & Toubro

Neutral

1,235

-

172,967

95,787

109,476

10.2

11.6

44.5

50.8

27.8

24.3

3.5

3.2

12.9

13.1

2.4

2.1

Gujarat Pipavav Port

Neutral

137

-

6,611

739

842

61.6

62.7

5.1

6.2

26.8

22.2

3.3

3.3

12.7

14.9

8.4

7.3

PNC Infratech

Neutral

199

-

5,114

2,040

2,935

13.0

13.0

6.4

9.0

31.2

22.2

0.8

0.7

9.7

12.2

2.5

1.8

Simplex Infra

Neutral

524

-

2,591

6,012

6,619

11.6

11.7

21.1

31.0

24.9

16.9

1.7

1.6

6.5

8.6

1.0

0.9

Sadbhav Engineering

Neutral

308

-

5,287

3,823

4,426

10.7

10.8

10.3

11.8

29.9

26.1

3.6

3.1

10.1

10.5

1.7

1.5

NBCC

Neutral

263

-

23,652

9,099

12,706

6.4

6.4

7.3

9.6

36.1

27.5

1.6

1.3

27.5

30.5

2.5

1.8

MEP Infra

Neutral

106

-

1,723

2,403

2,910

18.3

16.8

2.4

6.1

45.1

17.5

17.1

11.5

35.2

55.8

1.9

1.5

SIPL

Neutral

128

-

4,516

2,060

2,390

46.8

47.7

(5.8)

(3.1)

4.8

5.5

(14.2)

(2.3)

7.0

6.5

Engineers India

Neutral

192

-

12,942

1,795

2,611

21.1

22.4

5.9

8.1

32.6

23.7

2.3

2.3

12.9

16.1

5.6

3.7

Financials

Axis Bank

Accumulate

540

580

129,470

32,558

35,843

3.5

3.2

27.8

41.0

19.4

13.2

2.1

1.8

11.4

14.9

-

-

Bank of Baroda

Neutral

172

-

39,574

22,533

26,079

2.4

2.4

12.0

20.9

14.3

8.2

0.9

0.9

6.6

11.0

-

-

Canara Bank

Neutral

404

-

24,128

17,925

20,235

2.0

2.1

18.5

36.5

21.8

11.1

0.8

0.8

3.4

6.2

-

-

Can Fin Homes

Buy

467

2,128

6,220

586

741

3.5

3.5

107.8

141.0

4.3

3.3

1.0

0.8

24.1

25.6

-

-

Cholamandalam Inv. &

Neutral

1,241

-

19,403

2,826

3,307

6.3

6.3

53.7

64.6

23.1

19.2

3.9

3.4

18.3

18.9

-

-

Fin. Co.

Dewan Housing Finance Accumulate

666

712

20,872

2,676

3,383

2.4

2.7

37.4

49.7

17.8

13.4

2.3

2.0

13.8

16.2

-

-

Equitas Holdings

Buy

147

235

4,963

1,125

1,380

9.6

9.8

1.5

6.0

97.7

24.4

2.2

2.1

2.4

8.2

-

-

Federal Bank

Accumulate

116

125

22,597

4,896

5,930

2.8

3.1

5.4

7.6

21.6

15.3

1.8

1.7

8.5

11.0

-

-

Top Picks Report

November 06, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

Financials

GIC Housing

Buy

481

655

2,588

376

477

3.6

3.7

33.0

40.0

14.6

12.0

2.6

2.2

20.0

23.0

-

-

HDFC Bank

Neutral

1,831

-

473,194

55,236

63,253

4.5

4.4

68.9

82.4

26.6

22.2

4.6

3.8

18.7

18.5

-

-

ICICI Bank

Neutral

316

-

202,654

42,361

51,378

3.6

3.9

18.4

25.7

17.2

12.3

1.9

1.8

11.3

15.0

-

-

Karur Vysya Bank

Buy

127

180

7,699

3,289

3,630

3.7

3.9

10.8

14.1

11.8

9.1

1.4

1.3

12.5

14.7

-

-

LIC Housing Finance

Neutral

609

-

30,721

4,895

6,332

3.4

3.7

50.7

66.8

12.0

9.1

2.4

2.0

21.7

23.8

-

-

Punjab Natl.Bank

Neutral

207

-

44,113

23,708

25,758

2.1

2.1

5.9

16.4

35.3

12.6

1.0

1.0

3.0

8.3

-

-

RBL Bank

Neutral

520

-

21,473

2,309

2,888

2.6

2.5

16.4

19.1

31.8

27.3

4.0

3.6

13.3

13.8

-

-

Repco Home Finance

Buy

613

825

3,838

496

597

4.4

4.2

38.5

48.7

16.0

12.6

2.9

2.4

19.6

20.6

-

-

South Ind.Bank

Neutral

32

-

5,711

3,195

3,567

3.0

3.1

3.0

3.8

10.5

8.3

1.0

0.9

10.5

11.9

-

-

St Bk of India

Neutral

325

-

280,542

105,827

121,056

2.4

2.5

16.1

25.6

20.2

12.7

1.6

1.4

6.6

9.9

-

-

Union Bank

Neutral

173

-

12,589

14,650

16,225

2.3

2.3

23.1

32.5

7.5

5.3

0.6

0.5

7.1

9.2

-

-

Yes Bank

Neutral

326

-

74,647

11,088

13,138

3.0

2.9

84.0

99.3

3.9

3.3

0.6

0.5

16.3

16.8

-

-

FMCG

Akzo Nobel India

Neutral

1,861

-

8,924

3,164

3,607

13.8

13.7

58.6

67.9

31.8

27.4

7.8

6.9

24.5

25.1

2.7

2.3

Asian Paints

Neutral

1,173

-

112,552

17,603

20,615

18.6

18.6

2,128.9

2,543.3

0.6

0.5

11.6

9.8

28.0

28.9

6.2

5.2

Britannia

Neutral

4,654

-

55,871

9,690

11,278

14.8

15.4

84.0

101.0

55.4

46.1

20.2

16.1

40.6

39.0

5.7

4.9

Colgate

Neutral

1,033

-

28,096

4,420

5,074

24.9

25.3

28.6

32.8

36.1

31.5

14.3

11.5

43.8

40.5

6.1

5.3

Dabur India

Neutral

340

-

59,892

8,346

9,344

19.6

19.9

7.8

9.0

43.6

37.8

8.8

7.9

25.2

24.8

6.8

6.0

GlaxoSmith Con*

Neutral

5,370

-

22,586

5,072

5,760

18.2

18.4

176.3

199.2

30.5

27.0

6.5

5.9

21.2

21.7

3.8

3.3

Godrej Consumer

Neutral

971

-

66,143

10,171

11,682

20.8

21.5

21.7

27.1

44.7

35.8

10.1

8.6

22.3

23.4

6.6

5.7

HUL

Neutral

1,238

-

267,984

37,077

41,508

20.3

21.8

5,189.9

6,318.5

0.2

0.2

37.8

32.2

74.8

82.0

7.1

6.3

ITC

Neutral

265

-

323,265

44,588

49,853

37.0

37.3

9.6

11.0

27.7

24.1

6.8

6.5

25.1

27.3

6.7

6.0

Marico

Neutral

313

-

40,353

6,788

7,766

18.5

19.2

7.1

8.5

44.0

36.8

15.4

13.2

36.9

38.0

5.8

5.0

Nestle*

Neutral

7,409

-

71,430

10,083

11,182

20.0

20.9

119.7

141.3

61.9

52.4

218.1

199.4

36.7

39.8

6.8

6.0

Tata Global

Neutral

225

-

14,219

7,121

7,641

11.9

12.3

6.9

8.0

32.7

28.2

2.2

2.1

6.8

7.2

1.8

1.7

Procter & Gamble

Neutral

8,820

-

28,631

3,034

3,579

27.1

27.7

167.7

198.8

52.6

44.4

14.1

12.2

28.8

29.5

8.9

7.4

Hygiene

IT

HCL Tech^

Buy

848

1,014

120,944

50,009

54,608

22.1

22.1

62.8

67.6

13.5

12.5

3.0

2.6

22.4

20.6

2.1

1.8

Infosys

Buy

927

1,120

212,851

70,333

75,960

26.0

26.0

61.7

65.9

15.0

14.1

2.8

2.6

18.9

18.7

2.4

2.2

TCS

Neutral

2,613

-

514,814

123,384

134,488

26.1

26.1

133.2

143.7

19.6

18.2

5.4

5.0

27.6

27.8

3.8

3.5

Tech Mahindra

Accumulate

464

533

45,228

31,015

33,496

15.0

15.0

35.6

38.1

13.0

12.2

2.2

2.1

17.0

16.3

1.2

1.1

Top Picks Report

November 06, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

IT

Wipro

Neutral

294

-

143,227

54,164

56,544

22.3

22.3

18.8

19.5

15.7

15.1

2.5

2.2

15.0

13.6

1.9

1.6

Media

D B Corp

Neutral

371

-

6,830

2,404

2,625

30.5

31.5

23.7

26.9

15.7

13.8

3.7

3.1

23.5

22.8

2.7

2.4

HT Media

Neutral

102

-

2,371

2,589

2,830

15.1

15.4

8.3

10.9

12.3

9.3

1.0

0.9

8.4

10.4

0.5

0.3

Jagran Prakashan

Buy

177

225

5,788

2,541

2,835

28.5

28.7

12.7

14.1

13.9

12.6

2.9

2.5

21.3

21.4

2.1

1.8

Sun TV Network

Neutral

881

-

34,733

3,238

3,789

51.9

55.1

30.9

38.0

28.5

23.2

8.1

7.1

30.0

31.0

10.2

8.6

Hindustan Media

Neutral

242

-

1,777

1,002

1,074

23.3

23.5

29.2

33.8

8.3

7.2

1.3

1.1

15.6

15.4

0.8

0.5

Ventures

TV Today Network

Accumulate

379

435

2,263

667

727

27.7

27.7

18.6

20.1

20.4

18.9

3.2

3.2

15.6

17.3

2.9

2.7

Music Broadcast Limited Accumulate

387

434

2,206

271

317

91.0

109.0

6.0

10.0

64.4

38.7

4.0

3.7

6.5

9.3

7.7

6.4

Metals & Mining

Coal India

Neutral

287

-

177,904

82,301

91,235

17.0

18.0

17.1

20.5

16.8

14.0

3.2

3.0

45.0

55.0

1.8

1.6

Hind. Zinc

Neutral

322

-

136,119

22,108

24,555

57.0

58.0

22.1

26.3

14.6

12.3

4.7

3.8

32.0

35.0

5.2

4.3

Hindalco

Neutral

269

-

60,241

102,350

105,355

13.5

14.5

21.5

24.5

12.5

11.0

1.7

1.5

15.0

15.2

1.2

1.1

JSW Steel

Neutral

267

-

64,516

64,500

68,245

21.1

21.5

20.1

21.2

13.3

12.6

2.4

2.1

-

-

1.7

1.7

NMDC

Neutral

128

-

40,466

10,209

11,450

47.0

48.0

11.1

12.1

11.5

10.6

1.6

1.5

-

-

3.5

3.1

SAIL

Neutral

87

-

35,829

54,100

63,555

3.0

10.0

(10.0)

1.5

57.8

1.2

1.1

-

-

1.7

1.4

Vedanta

Neutral

338

-

125,678

81,206

87,345

28.0

29.0

26.5

33.5

12.8

10.1

2.9

2.5

-

-

2.3

2.0

Tata Steel

Neutral

709

-

68,850

121,445

126,500

16.2

17.2

65.4

81.3

10.8

8.7

1.7

1.5

-

-

1.1

1.0

Oil & Gas

GAIL

Neutral

464

-

78,400

53,115

52,344

14.2

15.3

30.0

31.1

15.5

14.9

1.9

1.8

-

-

1.2

1.2

ONGC

Neutral

191

-

245,564

83,111

84,934

44.2

44.9

16.4

16.9

11.7

11.3

1.4

1.3

-

-

2.8

2.8

Indian Oil Corp

Neutral

413

-

200,670

396,116

432,560

8.5

8.8

40.1

42.2

10.3

9.8

1.8

1.6

-

-

0.7

0.6

Reliance Industries

Neutral

946

-

615,000

257,711

267,438

17.0

18.2

89.1

89.5

10.6

10.6

1.0

0.9

-

-

2.0

2.0

Pharmaceuticals

Alembic Pharma

Buy

505

600

9,524

3,903

4,584

18.2

19.2

21.8

27.2

23.2

18.6

4.2

3.5

19.8

20.6

2.5

2.1

Alkem Laboratories Ltd

Accumulate

1,926

2,079

23,028

6,320

7,341

17.5

19.8

72.7

96.6

26.5

19.9

4.7

4.0

16.7

18.7

3.6

3.0

Aurobindo Pharma

Neutral

788

-

46,162

17,086

19,478

22.1

22.0

44.7

51.4

17.6

15.3

3.9

3.2

24.7

22.7

2.8

2.5

Aventis*

Neutral

4,609

-

10,615

2,508

2,862

16.8

16.8

139.9

153.8

33.0

30.0

4.8

3.9

23.5

25.8

3.8

3.2

Cadila Healthcare

Reduce

496

426

50,819

11,584

13,228

20.3

20.4

18.7

21.3

26.6

23.3

5.9

4.9

24.6

22.9

4.2

3.6

Cipla

Sell

640

458

51,468

16,619

19,437

15.4

16.2

19.7

24.3

32.5

26.3

3.7

3.3

12.0

13.2

3.3

2.8

Dr Reddy's

Neutral

2,418

-

40,082

15,844

17,973

17.6

18.2

91.7

111.0

26.4

21.8

3.0

2.7

11.9

13.0

2.7

2.4

GSK Pharma*

Neutral

2,656

-

22,494

3,260

3,651

15.0

18.0

46.1

58.6

57.6

45.3

11.8

12.2

20.0

26.5

6.8

6.2

Indoco Remedies

Sell

277

153

2,554

1,154

1,310

14.9

14.9

11.3

12.7

24.5

21.8

3.5

3.1

15.0

15.0

2.3

2.0

Top Picks Report

November 06, 2017

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

FY18E

FY19E

Pharmaceuticals

Ipca labs

Neutral

525

-

6,623

3,593

4,022

14.5

15.5

19.4

25.2

27.1

20.8

2.5

2.2

9.5

11.2

1.9

1.7

Lupin

Buy

1,049

1,467

47,405

18,657

21,289

21.3

23.3

52.8

66.7

19.9

15.7

3.0

2.6

16.3

17.5

2.6

2.1

Natco Pharma

Accumulate

955

1,057

16,638

1,886

2,016

32.3

29.5

23.2

22.0

41.2

43.3

8.6

7.6

20.9

17.6

8.7

8.1

Sun Pharma

Neutral

552

-

132,486

32,899

36,451

26.9

25.4

31.6

32.3

17.5

17.1

3.1

2.7

18.7

18.8

3.7

3.1

Syngene International

Accumulate

505

557

10,108

1,402

1,823

32.8

36.0

15.9

20.7

31.8

24.5

5.9

4.9

18.7

20.0

7.2

5.5

Power

Tata Power

Neutral

85

-

22,855

32,547

33,806

20.5

20.5

4.7

5.4

18.0

15.8

1.7

1.5

10.5

10.5

1.7

1.6

NTPC

Neutral

182

-

150,191

86,070

101,246

28.3

30.7

12.9

16.2

14.1

11.2

1.5

1.3

10.6

12.4

3.1

2.8

Power Grid

Accumulate

211

223

110,177

29,183

32,946

89.7

90.0

18.0

20.8

11.7

10.1

2.0

1.7

17.7

18.2

7.7

7.2

Real Estate

Prestige Estate

Neutral

298

-

11,166

4,607

5,146

21.0

22.2

7.9

9.8

37.7

30.4

2.3

2.2

10.3

12.0

3.6

3.3

MLIFE

Buy

431

522

2,211

487

590

12.3

17.8

21.0

31.2

20.5

13.8

1.1

1.0

5.2

7.4

3.3

2.7

Telecom

Bharti Airtel

Neutral

541

-

216,399

97,903

105,233

36.0

36.3

9.3

11.1

58.2

49.0

2.8

2.7

5.0

5.6

3.2

2.9

Idea Cellular

Neutral

106

-

38,251

35,012

37,689

27.1

27.7

(4.4)

(2.7)

1.7

1.7

(6.8)

(4.6)

2.4

2.2

zOthers

Abbott India

Neutral

4,329

-

9,198

3,244

3,723

14.9

16.1

167.5

209.4

25.8

20.7

5.7

4.8

23.7

24.8

2.5

2.1

Asian Granito

Buy

495

570

1,488

1,169

1,286

12.5

12.5

16.0

19.7

31.0

25.1

3.3

2.9

10.7

11.6

1.5

1.3

Bajaj Electricals

Neutral

394

-

3,997

4,646

5,301

6.7

7.6

16.1

22.3

24.5

17.7

4.0

3.4

16.4

19.2

0.9

0.8

Banco Products (India)

Neutral

214

-

1,533

1,530

1,695

13.2

12.7

19.0

20.0

11.3

10.7

1.8

1.6

0.2

0.2

0.9

101.2

Coffee Day Enterprises

Neutral

223

-

4,600

3,494

3,913

17.4

18.0

4.8

5.7

-

39.2

2.0

1.9

-

0.1

1.8

1.6

Ltd

Elecon Engineering

Neutral

75

-

840

171

201

15.0

16.2

36.0

43.0

2.1

1.7

0.2

0.2

0.1

0.1

4.3

3.6

Garware Wall Ropes

Neutral

920

-

2,014

928

1,003

15.2

15.2

39.4

43.2

23.3

21.3

3.9

3.3

16.5

15.4

2.0

1.8

Goodyear India*

Neutral

814

-

1,878

1,717

1,866

11.8

12.3

47.9

49.8

17.0

16.4

2.6

2.3

15.6

15.7

0.8

112.9

Hitachi

Neutral

2,385

-

6,485

2,355

2,715

10.3

10.8

49.0

60.9

48.7

39.2

11.4

9.0

0.2

0.2

2.8

2.4

HSIL

Neutral

420

-

3,037

2,240

2,670

14.6

15.0

17.0

22.0

24.7

19.1

2.0

1.9

0.1

0.1

1.6

1.3

Interglobe Aviation

Neutral

1,254

-

45,344

22,570

27,955

14.2

15.0

63.6

81.8

19.7

15.3

10.4

8.8

0.5

0.6

1.7

1.3

Jyothy Laboratories

Neutral

383

-

6,956

1,781

2,044

14.1

15.0

9.4

10.5

41.0

36.5

8.7

8.2

0.2

0.2

4.1

3.5

Linc Pen & Plastics

Neutral

248

-

367

420

462

9.3

9.3

15.3

17.1

16.2

14.5

2.7

2.8

16.9

19.5

0.9

0.8

M M Forgings

Neutral

860

-

1,038

542

642

20.1

21.0

41.6

56.8

20.7

15.2

2.9

2.4

0.1

0.2

2.3

2.0

Mirza International

Neutral

162

-

1,948

1,148

1,285

18.0

18.0

8.0

9.4

20.1

17.3

3.3

2.8

16.3

16.1

1.9

1.6

Navkar Corporation

Buy

195

265

2,778

561

617

41.5

41.5

11.5

12.7

16.9

15.3

1.8

1.6

10.5

10.4

5.6

4.9

Nilkamal

Neutral

1,612

-

2,405

2,317

2,525

11.4

11.1

96.0

105.0

16.8

15.4

2.9

2.5

0.2

0.2

1.0

0.9

Top Picks Report

November 06, 2017

Company Name

Reco

CMP

Target Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY18E FY19E FY18E FY19E FY18E FY19E FY18E FY19E FY18E FY19E FY18E FY19E FY18E FY19E

zOthers

Parag Milk Foods

Neutral

278

-

2,339

1,987

2,379

7.6

9.0

12.4

18.3

22.4

15.2

3.2

2.8

8.2

13.2

1.3

1.1

Radico Khaitan

Neutral

212

-

2,819

1,811

1,992

13.2

13.2

8.1

8.8

26.1

24.1

2.6

2.9

10.1

12.0

1.9

1.7

Relaxo Footwears

Neutral

589

-

7,074

1,981

2,310

13.7

14.5

12.0

15.5

49.1

38.0

9.6

7.7

0.2

0.2

3.6

3.1

Siyaram Silk Mills

Accumulate

607

650

2,845

1,769

1,981

12.7

12.7

22.6

26.2

26.8

23.1

4.2

3.6

15.5

15.5

1.8

1.6

Styrolution ABS India* Neutral

948

-

1,667

1,800

1,980

8.0

8.1

42.0

46.2

22.6

20.5

2.5

2.3

0.1

0.1

1.0

1.0

Surya Roshni

Neutral

372

-

1,629

4,870

5,320

7.7

7.8

22.8

28.1

16.3

13.2

2.2

1.9

0.1

0.1

0.6

0.5

TVS Srichakra

Neutral

3,205

-

2,454

2,729

2,893

12.7

12.5

248.5

265.0

12.9

12.1

3.7

3.0

0.3

0.3

0.9

0.8

Visaka Industries

Neutral

687

-

1,092

1,104

1,214

12.1

12.6

31.0

37.9

22.2

18.2

2.7

2.4

0.1

0.1

1.2

1.1

VIP Industries

Accumulate

280

300

3,957

1,450

1,693

10.4

10.5

6.5

7.8

42.8

35.9

9.0

7.9

21.1

22.1

2.7

2.3

Navin Fluorine

Neutral

727

-

3,586

945

1,154

22.4

22.6

28.7

34.8

25.4

20.9

4.2

3.6

-

-

3.3

2.6

Source: Company, Angel Research; Note: *December year end; #September year end; &October year end; Price as on November 03, 2017

Top Picks Report | November 2017

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)