Angel Top Picks - January 2016

Angel Top Picks - January 2016

A lot of macro factors are falling in place to create the right conditions for the

markets to rally in the coming year. Brent crude oil prices have declined ~66%

over the last two years to $33 as against ~$99 at the end of CY2013, resulting in

significant savings for the government. Led by lower crude prices, the net import

bill has reduced at a CAGR of 16% to $115bn in CY2015 as against $192 bn in

CY2012, resulting in a steep decline in the current account deficit.

With these savings, the government has also been able to maintain fiscal

discipline, despite an increase in infrastructure spending. We are already seeing a

strong bid pipeline of `120,000cr from the NHAI and of over `244,000cr from

the defense sector, expected to get tendered over the next

12 months.

Accordingly, we expect uptick in government spending to result in private sector

capex cycle revival. We believe the revival in the investment cycle will be the key to

push the earnings trajectory upwards over the next few years led by the multiplier

effect of infrastructure spending.

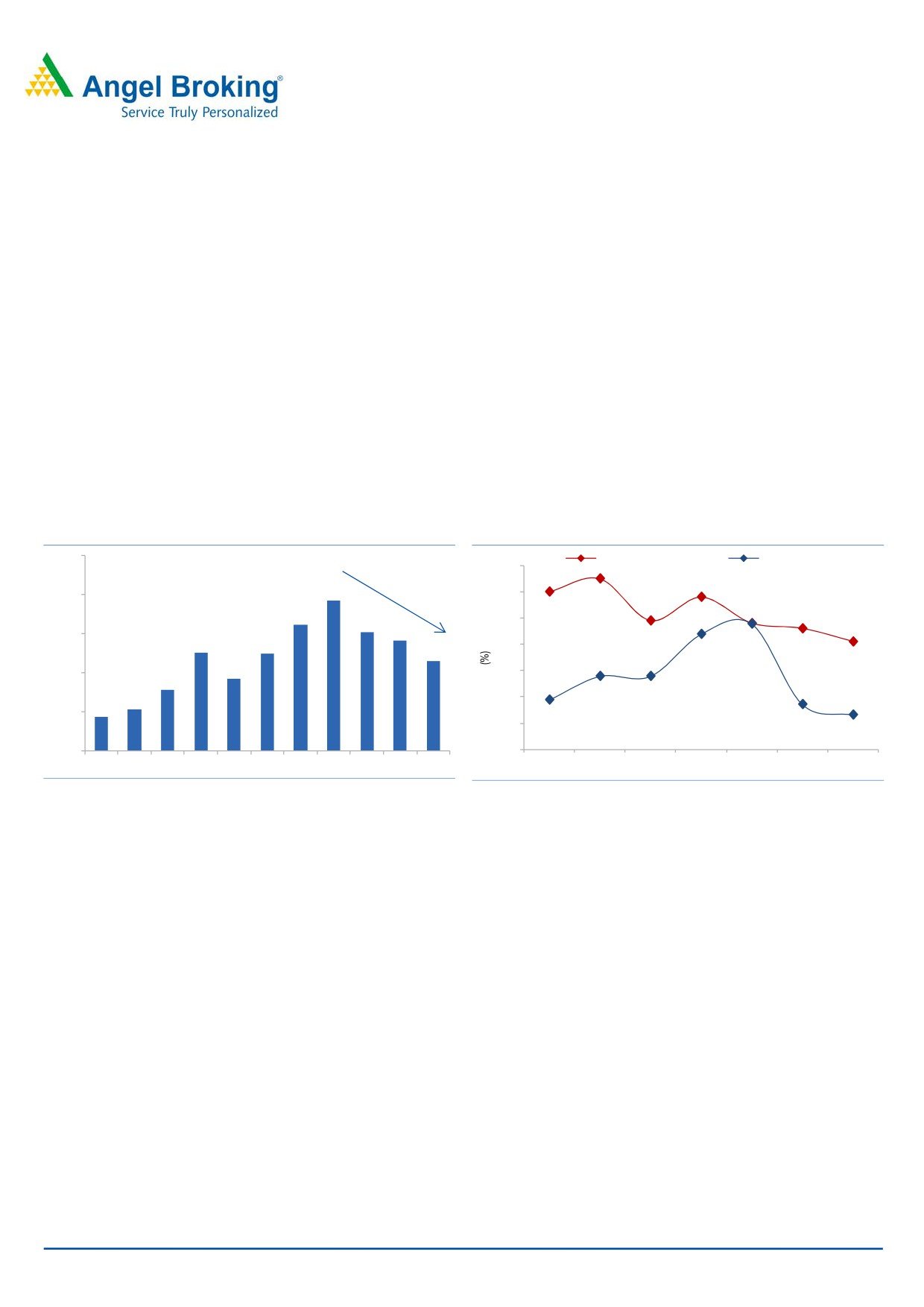

Net imports ($ Bn)

Twin deficits on the decline

250

Fiscal Deficit (% of GDP)

CAD (% of GDP)

7.0

6.0

192

200

162

151

5.0

140

150

126

124

4.0

115

92

100

3.0

78

53

2.0

44

50

1.0

-

-

2005 2006 2007

2008

2009 2010 2011 2012 2013 2014 2015

CY2009

CY2010

CY2011

CY2012

CY2013

CY2014

CY2015

Source: Company, Angel Research, Bloomberg

Source: Company, Angel Research, Bloomberg

Inflation too has been on a firm downtrend with the CPI averaging 4.8% between

Jan-Nov CY2015, as against 6.7% in CY2014, while the WPI has remained

negative. Despite a seasonal uptick in inflation, lower crude prices and sufficient

foodgrains stocks, will help keep overall inflation on the downtrend. With inflation

under check, we believe the RBI will have enough headroom to reduce policy

rates further. Also with banks now beginning to transmit these lower rates, we

expect lending rates to decline by ~100-125bps over the coming year, acting as

a strong catalyst for earnings growth in CY2016.

With growth expected to pick up, India is in fact the best placed among emerging

economies to continue attracting higher fund inflows over the long term as China

continues to grapple with a slowdown in economy and lower commodity prices

will hurt Brazil and Russia. Confidence among domestic investors also continues

to remain strong with strong mutual fund inflows of over `70,000cr in CY2015.

Please refer to important disclosures at the end of this report

1

Top Picks Report | January 2016

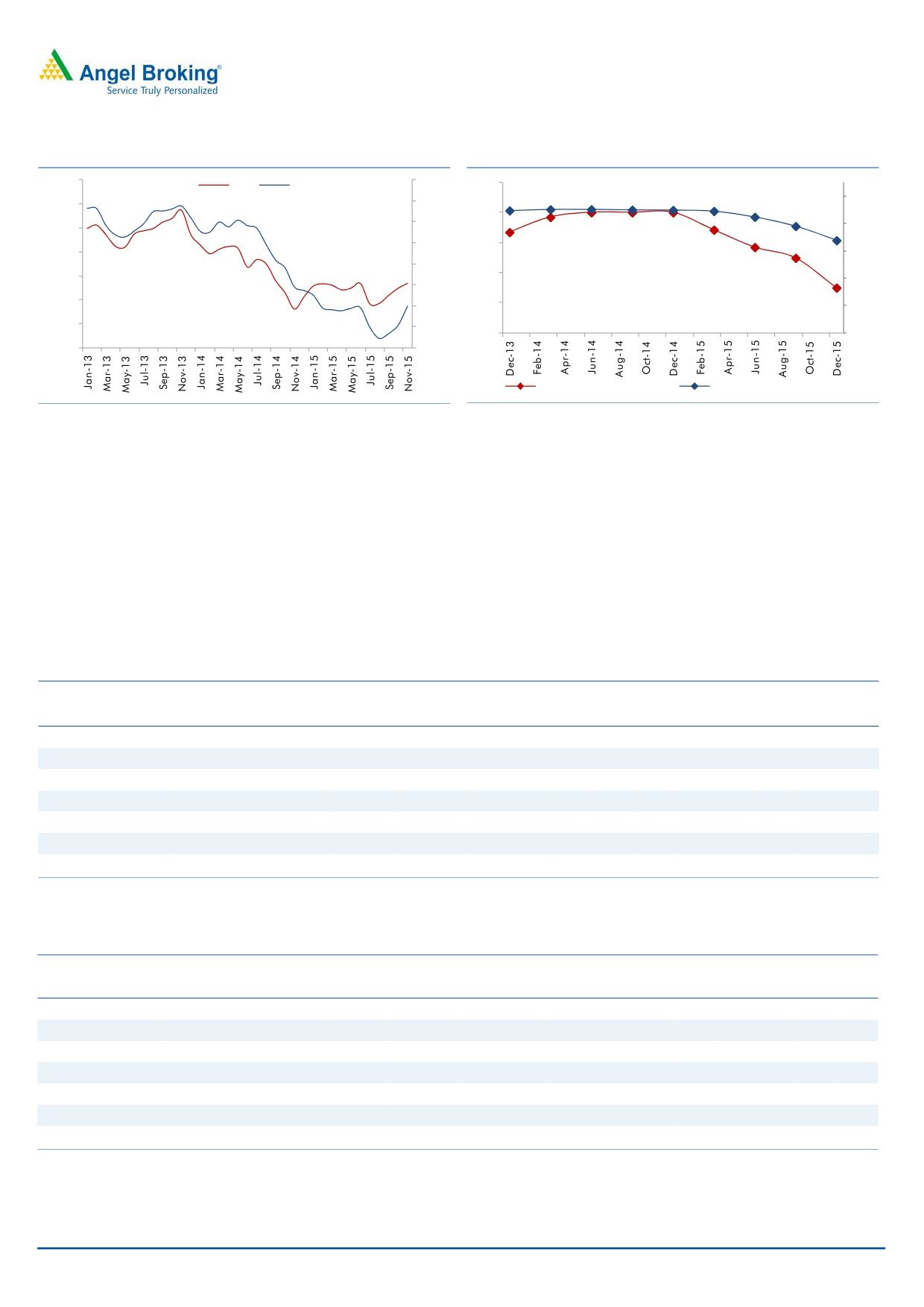

Inflation trajectory firmly on the downtrend

Large headroom for further cuts in lending rates

14.0

10.0

8.5

CPI

WPI

1

0.2

10.3

10.3

10.2

10.2

10.2

10.5

12.0

8.0

10.1

8.0

9.9

6.0

9.7

10.0

10.0

8.0

8.0

8.0

7.9

4.0

7.5

8.0

7.7

7.7

9.5

2.0

7.4

7.0

6.0

7.2

9.0

0.0

4.0

6.5

(2.0)

6.8

8.5

2.0

(4.0)

6.0

8.0

-

(6.0)

RBI Average Policy Rate (%)

Banks Base Rate Average (%)

Source: Angel Research, Bloomberg

Source: Angel Research, Bloomberg

Within large caps we continue to like sectors where earnings growth continues to

remain strong such as automobiles and IT. With falling rates and huge under-

penetration, we believe retail finance companies, especially players focused on

housing finance, are also likely to perform well. From a bottom-up perspective, we

continue to like select emerging midcap companies with strong brands,

entrepreneurial success and healthy growth outlook. We expect Sensex earnings to

increase at a CAGR of 17% over FY2016-18 to ~`1,993. Based on our estimates

our one year Sensex target works out to 31,500, implying a 24% upside from the

current levels.

Large Cap

EPS

PER

EV/Sales

ROE

Company

Sector

Rating

CMP (`) Target (`) Upside (%) FY16 FY17 FY16 FY17 FY16 FY17 FY16 FY17

Amara Raja

Auto & Auto Ancill. Buy

862

1,040

20.6

28.8

37.1

29.9

23.2

3.0

2.4

23.4

24.1

Ashok Leyland

Auto & Auto Ancill. Buy

93

111

19.9

3.4

4.7

27.2

19.7

1.4

1.2

17.7

22.2

HCL Tech^

IT

Buy

840

1,132

34.7

55.8

62.9

15.1

13.4

2.4

1.9

23.0

19.8

HDFC Bank

Financials

Buy

1,065

1,262

18.5

49.3

61.0

21.6

17.4

-

-

18.5

19.7

Infosys

IT

Buy

1,069

1,306

22.1

56.4

63.7

19.0

16.8

3.3

2.9

20.4

19.8

Larsen & Toubro

Construction

Buy

1,240

1,646

32.8

61.5

65.6

20.2

18.9

2.0

1.7

13.4

14.0

LIC Housing Finance Financials

Buy

500

592

18.4

33.0

40.2

15.2

12.4

-

-

19.7

20.5

Source: Angel Research

Mid Cap

EPS

PER

EV/Sales

ROE

Company

Sector

Rating

CMP (`) Target (`) Upside (%) FY16 FY17 FY16 FY17 FY16 FY17 FY16 FY17

Blue Star

Capital Goods

Buy

377

439

16.5

13.7

17.2

27.5

22.0

1.0

0.9

26.1

25.4

Garware Wall RopesOthers

Buy

411

473

15.0

24.9

29.6

16.5

13.9

1.1

0.9

14.6

14.9

Jagran Prakashan Media

Accumulate

169

189

12.0

8.9

9.9

19.0

17.1

2.4

2.2

20.9

20.4

Navkar Corp.

Others

Buy

207

265

28.1

5.6

5.9

36.7

35.2

8.9

7.6

6.3

6.1

Radico Khaitan

Others

Buy

112

156

39.3

5.7

7.1

19.6

15.7

1.4

1.3

8.3

9.6

Siyaram Silk Mills Others

Buy

1,176

1,354

15.2

89.9

104.1

13.1

11.3

0.8

0.7

17.9

17.8

Surya Roshni

Others

Buy

165

201

21.5

14.7

18.3

11.3

9.0

0.5

0.5

9.7

11.0

Source: Angel Research

January 7, 2016

2

Top Picks Report | January 2016

Top Picks - Large Cap

January 7, 2016

3

Top Picks Report | January 2016

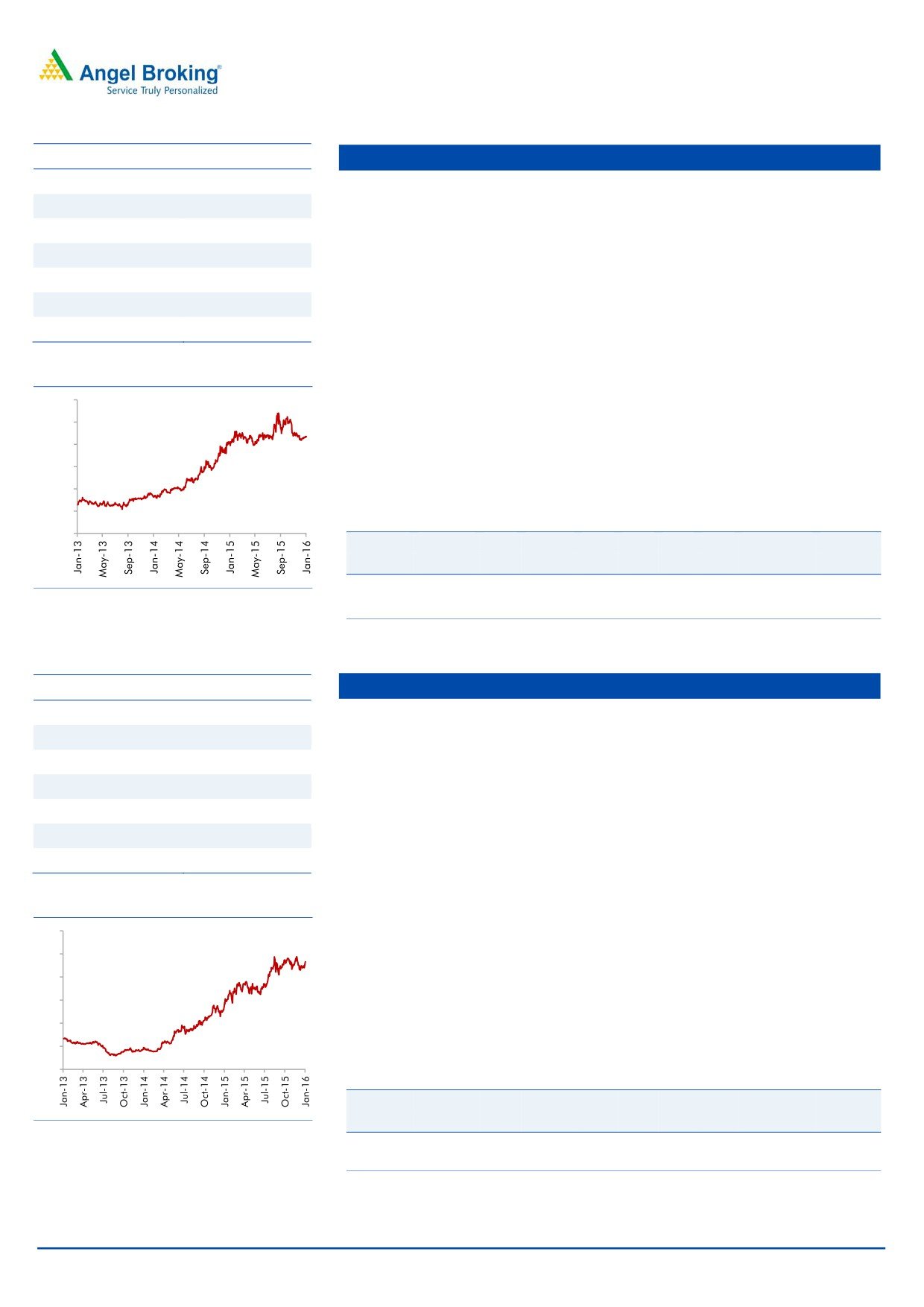

Stock Info

Amara Raja Batteries

CMP

862

Amara Raja Batteries Ltd (ARBL) is the second largest lead acid storage battery

TP

1,040

manufacturer. ARBL has been outpacing market leader Exide (ARBL grew 24%

Upside

21%

CAGR over FY2010-15 as compared to Exide's growth of 13%), leading to

Sector

Auto Ancillary

market share improving from 25% in FY10 to about current 35% . ARBL's

outperformance is mainly due to of ducts developed with from global battery

Market Cap (` cr)

14,728

leader Johnson Controls Inc (which also holds 26% stake in ARBL).

Beta

0.8

With the automotive OEM policy of having multiple vendors and a strong

52 Week High / Low

1,132 / 778

brand recall in the replacement segment, ARBL is well poised to further gain

market share. Given the economic recovery and market share gains, 18% over

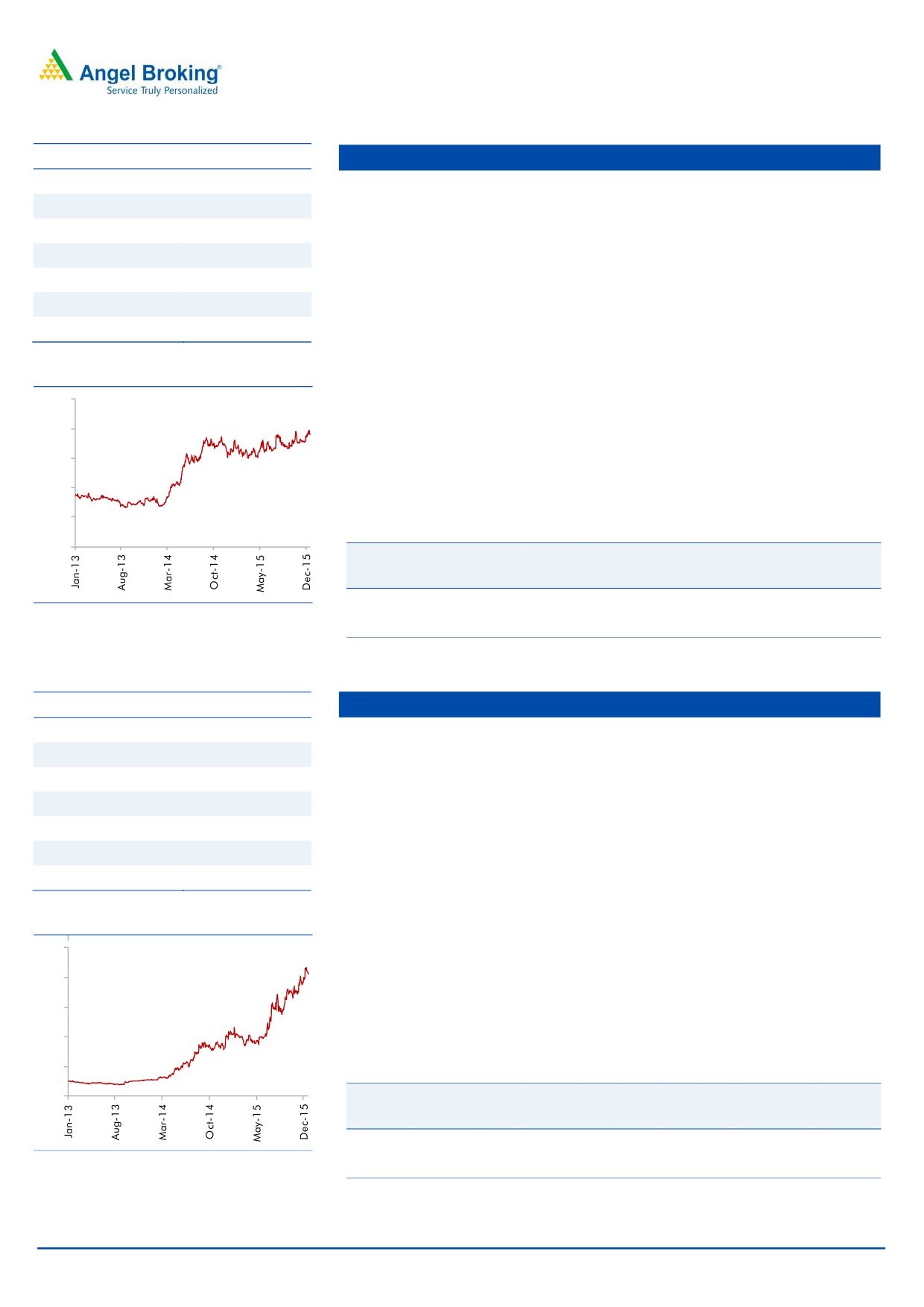

3 year-Chart

the next two years as against industry growth of 10-12%.

1,200

ARBL is a well diversified auto ancillary player having presence across the

1,000

automotive and the industrial segment and a broad OEM as well as

800

replacement customer base. We believe ARBL is a high quality stock to play

600

the auto sector revival. We assign a P/E multiple of 28x to FY2017E earnings

400

and arrive at a target price of `1,040/share.

200

Key Financials

0

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

4,892

17.4

493

28.8

23.4

29.9

7.0

17.3

3.0

FY2017E

5,871

17.6

634

37.1

24.1

23.2

5.6

14.0

2.4

Source: Company, Angel Research

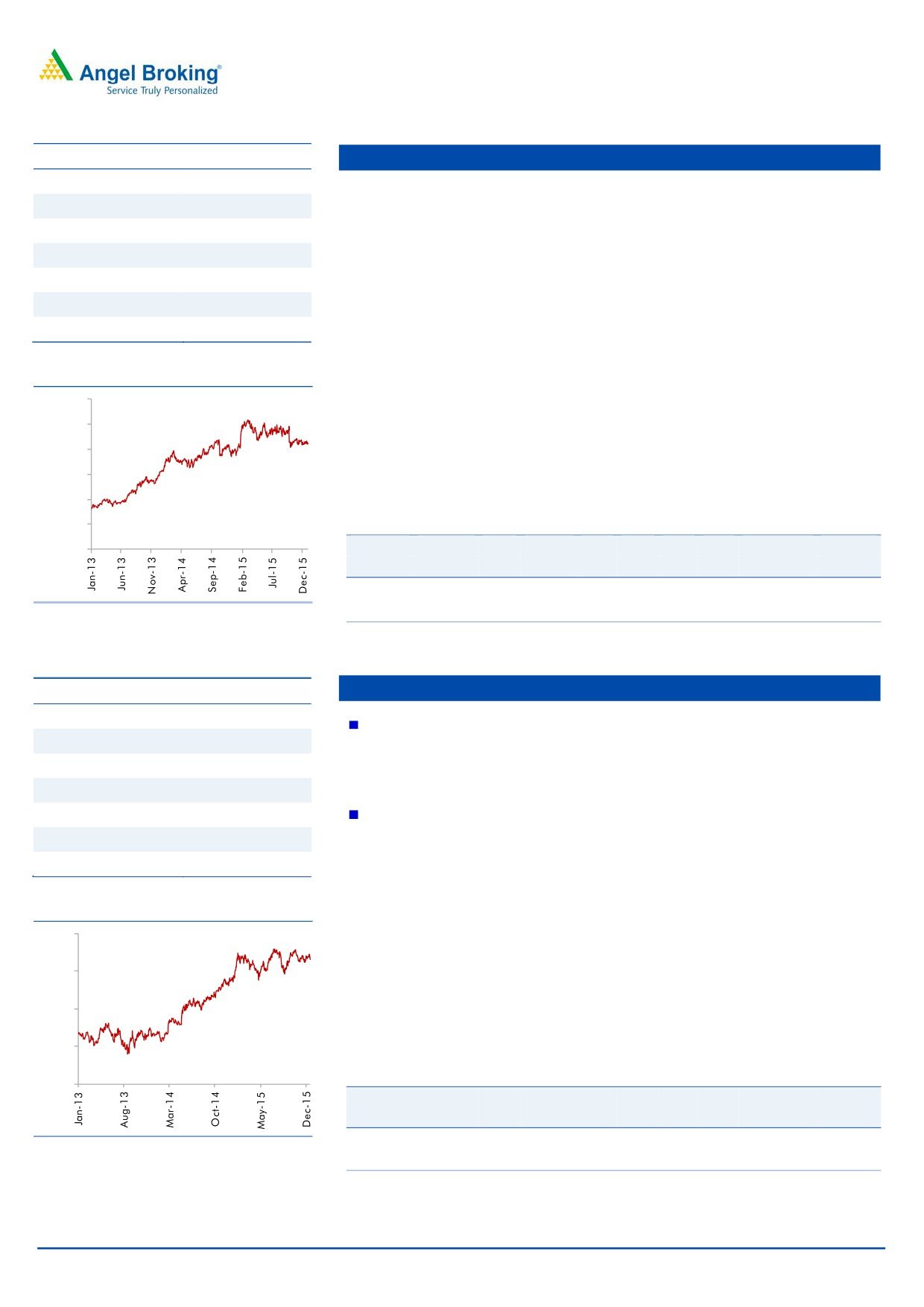

Stock Info

Ashok Leyland

CMP

93

Ashok Leyland Ltd (ALL) is the second largest medium and heavy commercial

TP

111

vehicle (MHCV) manufacturer in the country, commanding a market share of

Upside

19%

about 28%. The MHCV industry is expected to remain in an uptrend (we

expect 15% growth over the next two years) given the better economic growth,

Sector

Automobile

improvement in fleet operators profitability on account of firm freight rates and

Market Cap (` cr)

26,339

decline in diesel prices and increased infrastructure investments.

Beta

1.2

In order to reduce cyclicality, ALL is also focusing on increasing light

52 Week High / Low

100 /56

commercial vehicles (LCVs) and exports. ALL-Nissan JV developed LCV - "Dost"

has been received well and has captured a market share of 6% within three years

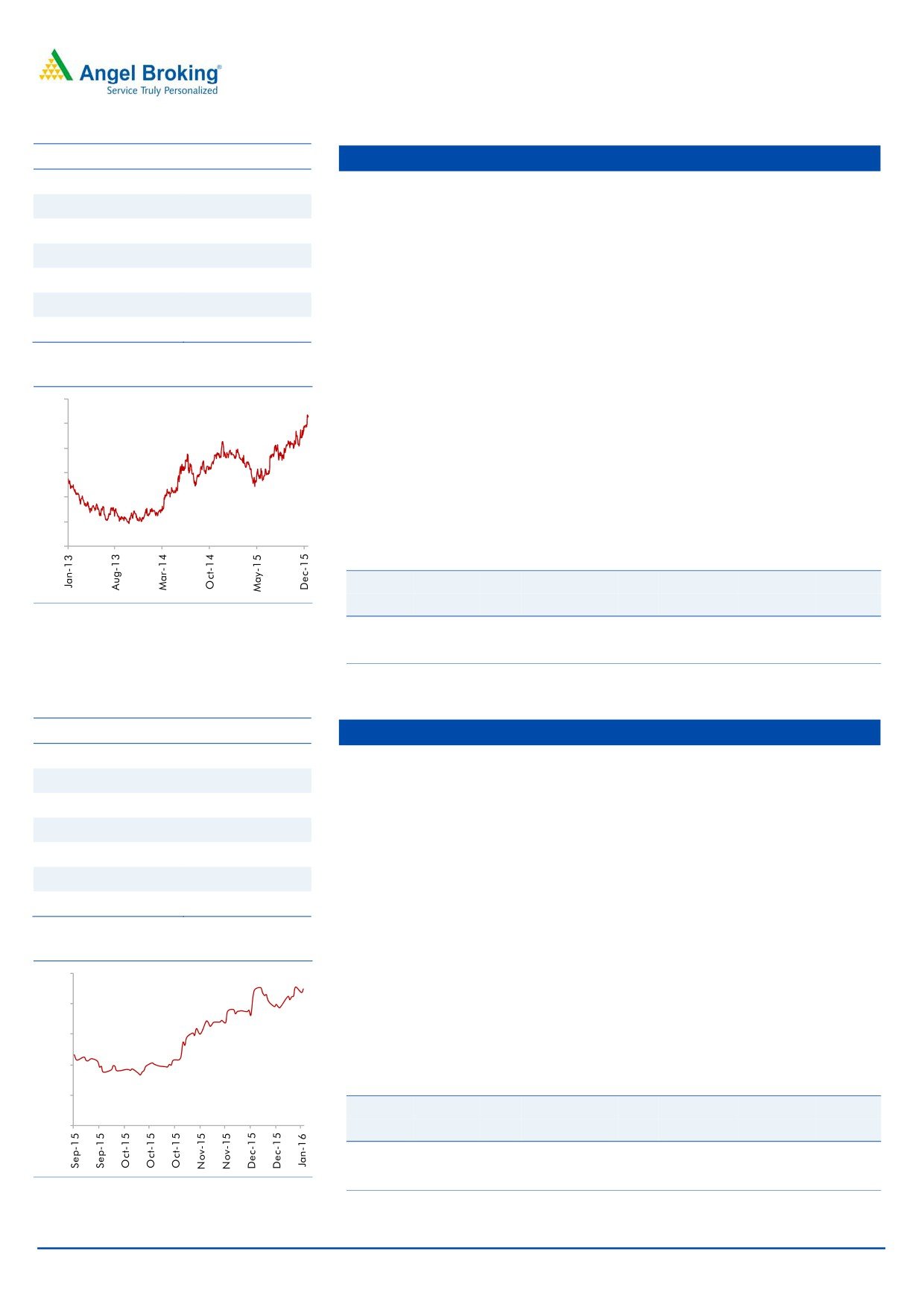

3 year-Chart

of its launch. Also, ALL is targeting new markets in Africa and Middle East to

120

increase export contribution from the current 15% to 33% over the next five years.

100

ALL's margins are likely to improve by 400bp yoy over FY2015-17 period on

80

account of double-digit growth in MHCVs and reduced discounting.

60

We are positive on ALL, given the cyclical upturn in MHCVs and additional

40

growth avenues. We assign a multiple of 13x to FY2017E EBIDTA to arrive at

20

a target price of `111/share.

0

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

17,995

11.4

979

3.4

17.7

27.2

4.8

13.7

1.4

FY2017E

21,544

11.6

1,331

4.7

22.2

19.7

4.4

11.0

1.2

Source: Company, Angel Research

January 7, 2016

4

Top Picks Report | January 2016

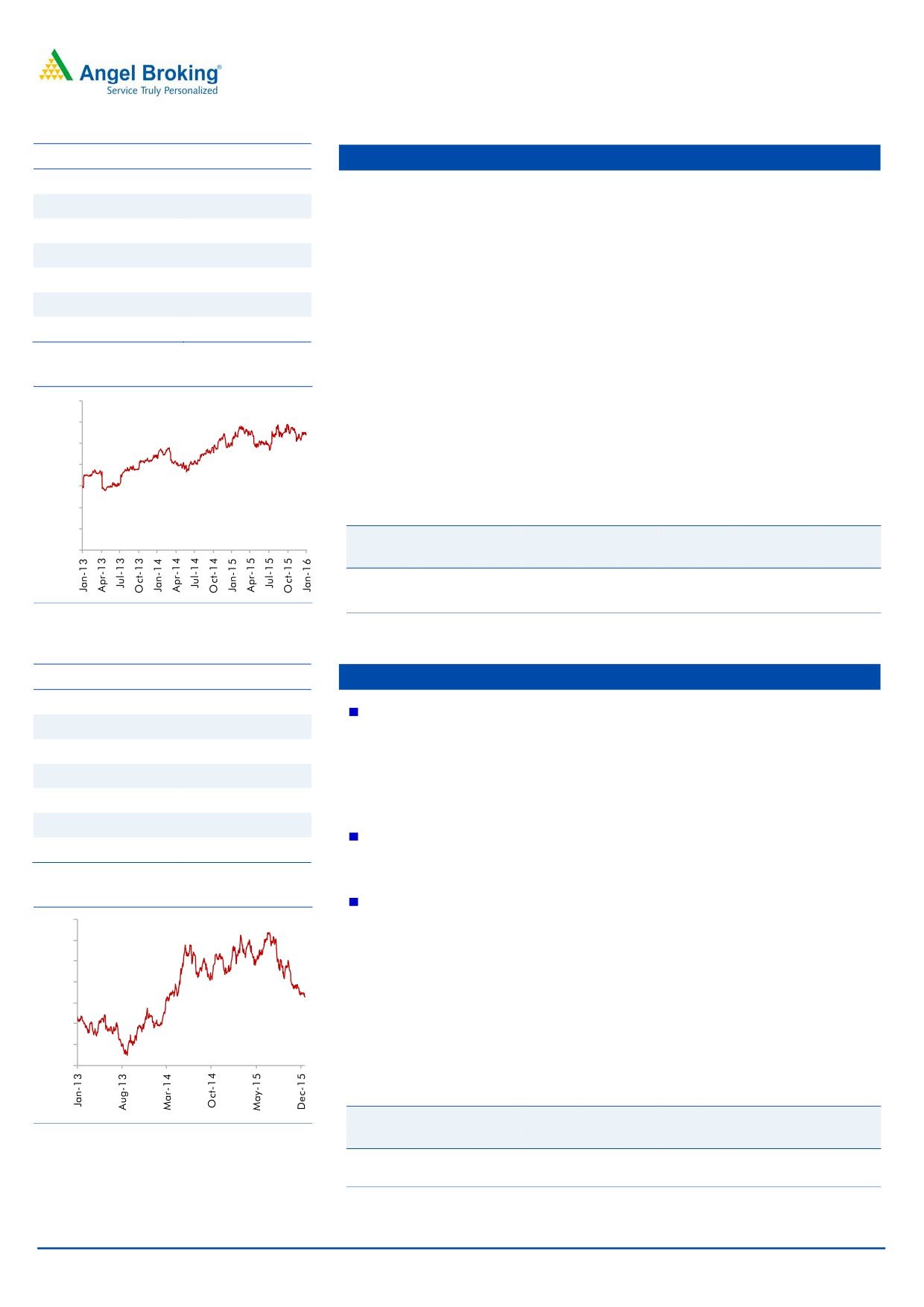

Stock Info

HCL Technologies

CMP

840

Healthy pipeline: In terms of order flow in FY2015, HCL Tech has signed 58

TP

1,132

transformational engagements with US$5bn+ of TCV. During 1QFY2016, the

Upside

35%

company has signed in excess of US$1bn worth of orders and has indicated

Sector

IT

that its order book is 10% higher than its highest order book. These bookings

saw significant momentum driven by Next-gen ITO, Engineering Services

Market Cap (` cr)

118,439

Outsourcing, Digital and Modern Apps deals, each of which had a component

Beta

0.6

of new technology constructs like Digitalization, Cloud etc.

52 Week High / Low

1,058 / 747

Robust outlook: We expect HCL Tech to post a USD and INR revenue CAGR of

13.0% and 13.2%, respectively, over FY2015-17E. On the operating front,

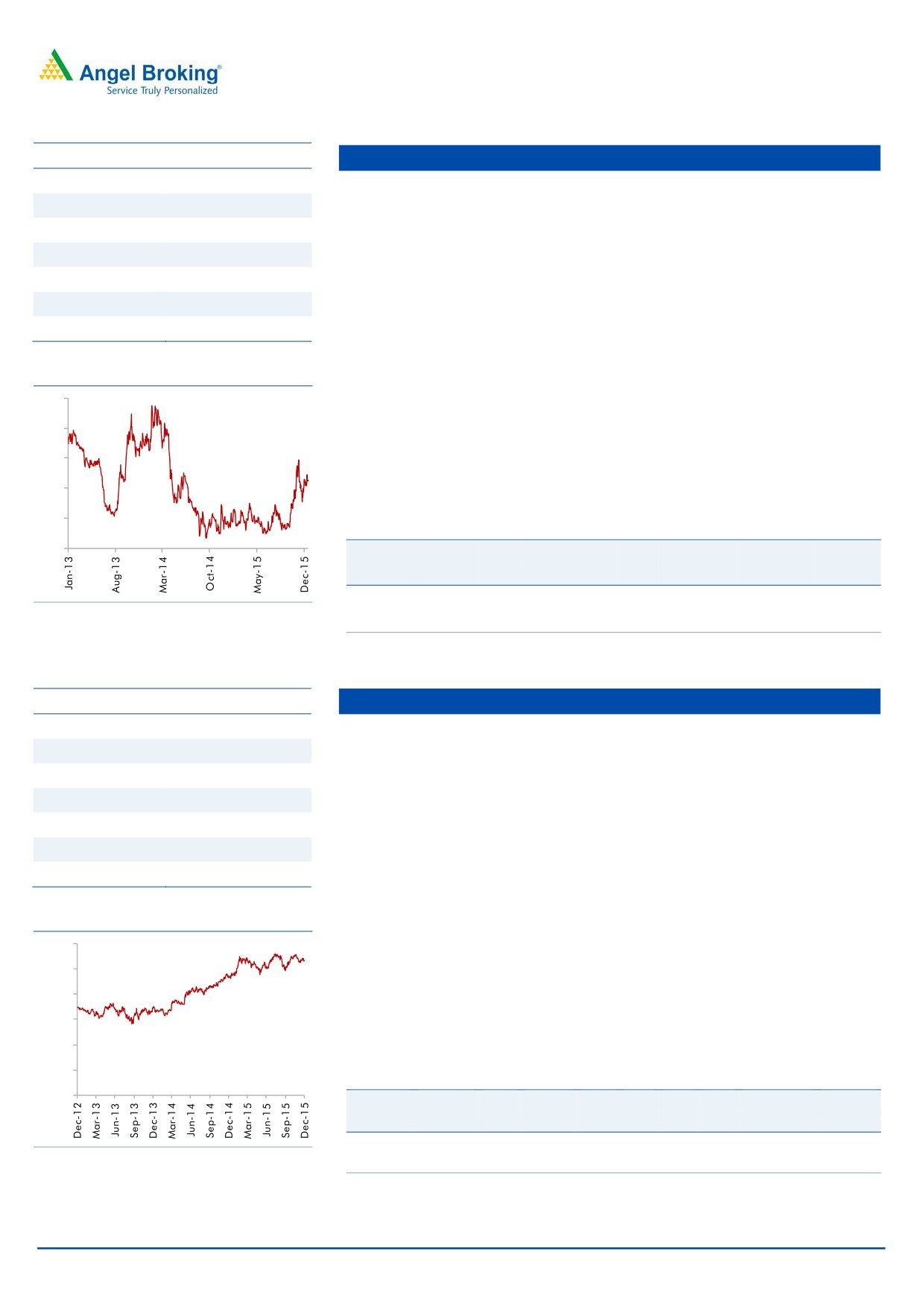

3 year-Chart

HCL Tech's EBIT margin has been around 22.3% in FY2015, a dip of 185bp

1,200.0

over the previous financial year. Going ahead, the Management expects EBIT

1,000.0

margins to sustain at 21-22%. We expect the EBIT and PAT to post a 12.9%

800.0

and 10.6% CAGR, respectively, over FY2015-17E.

600.0

Outlook and Valuations: At current valuations, the stock is attractively valued

400.0

and hence we maintain our buy with a price target of `1,132.

200.0

Key Financials

0.0

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

42,038

23.2

7,869

55.8

23.0

15.1

3.5

10.4

2.4

FY2017E

47,503

23.5

8,879

62.9

19.8

13.4

2.7

8.2

1.9

Source: Company, Angel Research

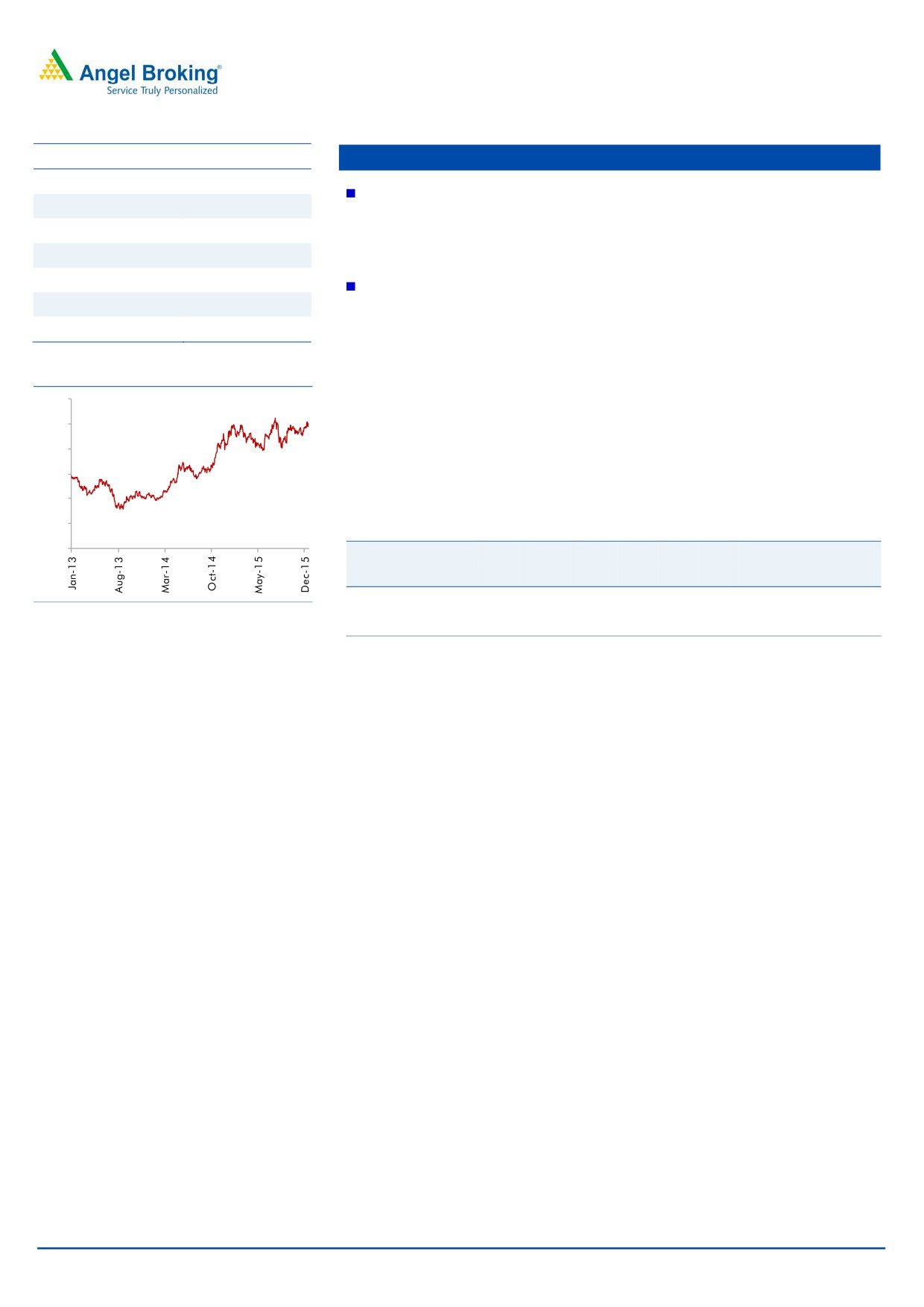

Stock Info

HDFC Bank

CMP

1,065

Strong capital adequacy, expanding network, to sustain traction in market

TP

1,262

share: HDFC Bank’s capital adequacy ratio as of 2QFY2016 stood strong at

Upside

19%

15.5%, with Tier1 ratio at 12.8%, which positions the bank to continue on its

growth path and increase its market share.

Sector

Financials

Market Cap (` cr)

268,997

Asset quality rock-solid: The bank has been able to maintain its asset quality

consistently. Asset quality continued to remain healthy with the Gross NPA

Beta

0.89

ratio and the Net NPA ratio at 0.91% and 0.25%, respectively, as of

52 Week High / Low

1,128 / 932

2QFY2016, in a challenging macro environment.

Outlook: The bank’s credit and deposit growth continues to beat the industry

3 year-Chart

growth rate, driven by dominant market position in most retail business,

1,200

healthy CASA and continued network expansion. This provides strong visibility

for robust 20% earnings trajectory, coupled with high quality of earnings, and

1,000

its focus on high quality retail business as well as strategic focus on short-term

800

highly rated corporate business. This in our view justifies a premium valuation

multiple. At the current market price, the bank is trading at 3.2x FY2017E

600

ABV. We recommend a Buy rating on the stock, with a target price of `1,262.

Key Financials

400

Y/E

Op. Inc NIM

PAT

EPS ABV ROA ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2016E

38,309

4.3

12,363

49.3

285.4

1.9

18.5

21.6

3.7

FY2017E

47,302

4.3

15,302

61.0

332.2

1.9

19.7

17.4

3.2

Source: Company, Angel Research

January 7, 2016

5

Top Picks Report | January 2016

Stock Info

Infosys

CMP

1,069

Guidance - to achieve a 10-12% CC growth in FY2016: During 2QFY2016

TP

1,306

Infosys has reinforced its USD revenue growth guidance of 10-12% on CC

Upside

22%

basis in FY2016; it has decreased its growth guidance for the current financial

Sector

IT

year from 7.2%-9.2% in US$ terms (given in 1QFY2016) to 6.4%-8.4% in US$

terms. This change in the dollar revenue is mainly to factor in the anticipated

Market Cap (` cr)

245,647

currency movement. We expect the company to post ~10.7% USD revenue

Beta

0.7

growth in FY2016.

52 Week High / Low

1,219 / 933

Aims to be US$20bn company by FY2020: The company expects its revenue

to rise to US$20bn by FY2020, up from US$8.7bn now, as it focuses on

3 year-Chart

acquisitions and win more new technology services, implying a 14% CAGR

1,400

over the period. Over the near term, we expect Infosys to post a 10.7% USD

1,200

revenue growth in FY2016. Over FY2015-17E, we expect USD and INR

1,000

revenue to grow at a CAGR of 10.9% and 12.1%, respectively.

800

Outlook and Valuations: The stock trades at current valuations of 16.8x FY2017E

600

earnings. We recommend a Buy on the stock with a price target of `1,306.

400

Key Financials

200

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

0

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

60,250

27.0

12,955

56.4

20.4

19.0

3.9

12.4

3.3

FY2017E

66,999

28.0

14,629

63.7

19.8

16.8

3.3

10.2

2.9

Source: Company, Angel Research

Stock Info

Larsen & Toubro

CMP

1,240

L&T's management sees a bid pipeline of `3,70,000cr, which are at different

TP

1,646

stages of awarding. Considering the bid-pipeline and its presence across sub-

Upside

33%

verticals, it should attain its 5-7% order inflow growth guidance for FY2016E.

L&T as of 2QFY2016-end, is sitting on order book of `2,44,097cr, which

Sector

Infrastructure

gives revenue visibility for 30+ months. Considering its huge order book, we

Market Cap (` cr)

112,584

expect L&T to report 12.5% yoy top-line growth for FY2016E.

Beta

1.2

With legacy Hydro-carbons projects in Middle-East nearing completion, we

52 Week High / Low

1,893/1,237

expect Hydro-carbons business to show signs of turn-around by 4QFY2016.

Accordingly, consol. EBITDA margins could expand from here-on.

3 year-Chart

Standalone D/E ratio (2QFY2016) stands at 0.41x. Divestment of non-

2,000

strategic holdings, further equity infusion in infra projects and listing of L&T

1,800

InfoTech would address the IDPL equity requirements up to certain extent.

1,600

Ascribing separate values to parent business (on P/E basis) and investments in

1,400

subsidiaries (using P/E, P/BV and M-cap basis), we arrive at FY2017E based

1,200

Target price of `1,646. At the current market price of `1,257, standalone

1,000

entity is trading at implied P/E multiple of 12x (FY2017E), which is attractive.

800

We are of the view that L&T is a proxy play for investors wanting to ride on

600

Indian infrastructure growth story. We recommend a Buy on the stock.

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

64,148

11.5

5,776

61.5

13.4

20.2

2.0

17.5

2.0

FY2017E

73,241

11.7

6,155

65.6

14.0

18.9

1.9

15.2

1.7

Source: Company, Angel Research

January 7, 2016

6

Top Picks Report | January 2016

Stock Info

LIC Housing Finance

CMP

500

Significant under penetration of mortgages in India: India is expected to

TP

592

witness a robust housing finance growth going forward as the mortgage

Upside

18%

penetration in India remains at very low levels at 8% to GDP as compared to

Sector

Financials

the developed countries where it is in the range of 60-100%.

Market Cap (` cr)

25,210

NIM expansion visible: LIC Housing Finance is able to raise funds from low-

Beta

1.35

cost NCDs due to its strong AAA credit rating and backing by strong

52 Week High / Low

526 / 389

promoters like LIC. In a declining interest rate environment, NBFC's like LIC

Housing are well-placed to increase margins in our view.

3 year-Chart

Outlook: Despite competition in mortgages, volume growth in the individual

600

loans segment remains fairly strong. LICHF continues to grow its retail loan

500

book at a healthy pace with healthy asset quality. We expect the company to

post a healthy loan book CAGR of 18.7% over 2015-17E which is likely to

400

reflect in an earnings CAGR of 20.5%, over the same period. At the current

300

market price, it is trading at 2.4x FY2017E ABV. We recommend a Buy rating

200

on the stock, with a target price of `592.

100

Key Financials

0

Y/E

Op. Inc NIM

PAT

EPS ABV ROA ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2016E

3,101

2.5

1,664

33.0

176.7

1.4

19.7

15.2

2.8

FY2017E

3,745

2.5

2,029

40.2

207.6

1.4

20.5

12.5

2.4

Source: Company, Angel Research

January 7, 2016

7

Top Picks Report | January 2016

Top Picks - Mid Cap

January 7, 2016

8

Top Picks Report | January 2016

Stock Info

Blue Star

CMP

377

BSL is one of the largest air-conditioning companies in India. With a mere 3%

TP

439

penetration level vs 25% in China, the overall outlook for the room air-

Upside

17%

conditioner (RAC) market in India is favourable.

Sector

Cons. Durable

BSL’s RAC business has been outgrowing the industry by ~10% points over the

Market Cap (` cr)

3,388

last few quarters, resulting in the company consistently increasing its market

Beta

0.7

share (~7% in FY2014 to 10% at present). This has resulted in CPD's share in

52 Week High / Low

398 / 274

overall revenues increasing from~23% in FY2010 to ~42% in FY2015

(expected to improve to ~48% in FY2018E). With strong brand equity and

3 year-Chart

higher share in split ACs, we expect the CPD to continue to drive growth.

500

Aided by increasing contribution from the CPD, we expect the overall top-line

400

to post a revenue CAGR of 11.2% over FY2015-18E and margins to improve

300

from 5.3% in FY2015 to 7.1% in FY2018E. Moreover, the proposed merger

with Blue Star Infotech will provide cash influx and thus strengthen the balance

200

sheet. We maintain our Buy recommendation on the stock.

100

Key Financials

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

3,548

6.3

123

13.7

26.1

27.5

6.9

16.6

1.0

FY2017E

3,977

6.9

164

17.2

25.4

22.0

4.5

13.0

0.9

Source: Company, Angel Research

Stock Info

Garware Wall Ropes

CMP

411

We expect Garware Wall Ropes (GWRL) to report a healthy top-line CAGR of

TP

473

~11% over FY2015-17E, on the back of higher growth in exports. Going

Upside

15%

forward, we expect GWRL to report export sales CAGR of ~23% over FY2015-

Sector

Textile

17E on back of higher demand for aquaculture and sports products globally.

Market Cap (` cr)

899

Going forward, we believe that the company would be able to increase its

Beta

1.0

operating margins owing to (a) easing raw material prices including that of

52 Week High / Low

438/165

High Density Polyethylene, Polyethylene, Nylon etc. which are crude based raw

materials, and (b) higher contribution of exports which is a high margin

3 year-Chart

business.

500

GWRL has been consistently repaying debt over the past four years, resulting

400

in debt having come down from ~ `140cr in FY2012 to `45cr in FY2015.

Going forward, we believe the company will continue repaying debt with

300

strong cash flows, which in turn will lead to reduction in interest cost. Hence,

200

we recommend a Buy rating on the stock with a target price of `473.

100

Key Financials

0

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

861

10.9

54

24.9

14.6

16.5

2.5

9.3

1.1

FY2017E

967

10.9

65

29.6

14.9

13.9

2.2

7.9

0.9

Source: Company, Angel Research

January 7, 2016

9

Top Picks Report | January 2016

Stock Info

Jagran Prakashan

CMP

169

We expect JPL to register a net sales CAGR of ~15% over FY2015-17E, on

TP

189

back of (a) strong growth in advertising revenue due to improvement in GDP

Upside

12%

growth, (b) improvement in circulation revenue owing to combination of

Sector

Media

increase in cover price and volume growth.

Market Cap (` cr)

5,518

Further the acquisition of Radio City would also boost the company's revenue

Beta

0.6

going ahead. Radio City has ~20 stations across 7 states in the country and is

second only to ENIL in all its operating circles, ie Delhi, Mumbai, Bengaluru,

52 Week High / Low

172/108

Chennai, Ahmedabad, Hyderabad, Pune and Lucknow. The company covers

~51% (~66mn people) of the total radio population.

3 year-Chart

Raw material prices have been in a declining trend. Thus, considering lower

180

news print costs, healthy sales, and higher margins in the radio business, we

160

expect an adj. net profit CAGR of ~20% over FY2015-17E to `325cr.

140

Considering Dainik Jagran's strong presence in the rapidly growing Hindi

120

markets, we expect JPL to benefit from an eventual recovery in the Indian

100

economy. Hence, we maintain an Accumulate rating on the stock with a target

80

price of stock with a target price of `189.

60

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

2,170

27.2

290

8.9

20.9

19.0

4.0

8.8

2.4

FY2017E

2,355

26.2

325

9.9

20.5

17.1

3.5

8.4

2.2

Source: Company, Angel Research

Stock Info

Navkar

CMP

207

NCL is one of the largest and one of the three CFS at JNPT with rail

TP

265

connectivity, helping garner high market share at the port. NCL is in a massive

Upside

28%

expansion mode where it is increasing its capacity by 234% to 1,036,889

Sector

Logistics

TEUS at JNPT and coming up with an ICD at Vapi (with Logistics Park).

Market Cap (` cr)

2,951

The ICD with rail link should benefit from first mover advantage in a region

Beta

0.6

that has huge market potential and accounts for ~27% of volumes at JNPT.

52 Week High / Low

221 / 151

The ICD should be able to capture the EXIM volumes from the region through

rail link that till now was being custom cleared at JNPT (Import) or being

transported via road and consolidated at JNPT (Export). Although, South

3 year-Chart

Gujarat volume will now head straight to Vapi ICD, the company can now

220

cater to bulk commodities and domestic traffic that it had been rejecting owing

200

to capacity constraints at CFS.

180

We expect NCL to successfully use its rail advantage and scale up its

utilisations at both JNPT and Vapi ICD. We have a Buy rating on the stock.

160

Key Financials

140

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

120

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

365

38.3

80

5.6

6.3

36.7

2.3

23.2

8.9

FY2017E

436

37.5

84

5.9

6.1

35.2

2.2

20.3

7.6

Source: Company, Angel Research

January 7, 2016

10

Top Picks Report | January 2016

Stock Info

Radico Khaitan

CMP

112

The IMFL segment is under penetrated. Going forward, increase in income

TP

156

levels would lead to higher growth in IMFL brands. RKL has strong brands in

Upside

39%

the premium liquor category which reported a CAGR of ~26% over the last

seven-year period. We expect the growth momentum to continue.

Sector

Breweries & Distilleries

Market Cap (` cr)

1,485

We expect the price of ENA, a key raw material, to remain stable and

potentially even decline going forward due to higher sugar production and

Beta

0.8

lower demand for ethanol from Indian oil marketing companies

52 Week High / Low

131/78

We expect a significant hike in liquor prices in the coming financial year as

there haven't been any significant ones in recent times. Also, we believe that

3 year-Chart

industry leader - United Spirit would shift focus on profitability over volume

170

growth considering the debt on its Balance Sheet, which in turn, would lead to

150

increased scope for other liquor companies to hike prices.

130

RKL is trading at 1-year forward EV/Sales multiple of 1.3x, which is at huge

discount to its close peer, United Spirits (4.6x). We have a Buy rating on the

110

stock and target price of and target price of `156 (22x FY2017E EPS).

90

Key Financials

70

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

1,565

12.2

75

5.7

8.3

19.6

1.7

11.8

1.4

FY2017E

1,687

13.0

95

7.1

9.6

15.7

1.5

10.1

1.3

Source: Company, Angel Research

Stock Info

Siyaram Silk Mills

CMP

1,176

SSML has strong brands which cater to premium as well as popular mass

TP

1,354

segments of the market. Further, in FY2014, SSML entered the ladies' salwar

Upside

15%

kameez and ethnic wear segment. Going forward, we believe that the

Sector

Textile

company would be able to leverage its brand equity and continue to post

strong performance.

Market Cap (` cr)

1,102

The company has a nationwide network of about 1,600 dealers and business

Beta

0.8

partners. It has a retail network of 160 stores and plans to add another 300-

52 Week High / Low

1,400/857

350 stores going forward. Further, the company's brands are sold across

3,00,000 multi brand outlets in the country.

3 year-Chart

Going forward, we expect SSML to report a net sales CAGR of ~10% to

1,200

~`1,815cr and adj.net profit CAGR of ~11% to `98cr over FY2015-17E on

1,000

back of market leadership in blended fabrics, strong brand building, wide

distribution channel, strong presence in tier II and tier III cities and emphasis

800

on latest designs and affordable pricing points. At the current market price,

600

SSML trades at an inexpensive valuation. We have a Buy rating on the stock

400

and target price of stock and target price of stock and target price of `1,354.

200

Key Financials

0

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

1,636

11.5

84

89.9

17.9

13.1

2.2

7.0

0.8

FY2017E

1,815

11.5

98

104.1

17.8

11.3

1.9

6.3

0.7

Source: Company, Angel Research

January 7, 2016

11

Top Picks Report | January 2016

Stock Info

Surya Roshni

CMP

165

We expect SRL to benefit from the structural shift in the lighting industry

TP

201

towards LED lighting, which is expected to post CAGR of 28% over FY2015E-21E.

Upside

21%

SRL is the 2nd largest lighting company in India with a market share of ~ 25%. With

Sector

Con. Durable

growing demand for LEDs, SRL would be a key beneficiary, given that "Surya" brand

is well recognized and has superior reach comprising of 2 lakh plus retailers.

Market Cap (` cr)

725

Beta

1.7

SRL's other business, Steel Pipes, entails low profitability and has higher debt,

having resulted in high overall debt/equity. The Lighting business' contribution

52 Week High / Low

182 / 101

to overall top-line has increased from 30% in FY2012 to 40% in FY2015. The

latter commands higher margins (10.7%) vs. the steel business (2.9%) and

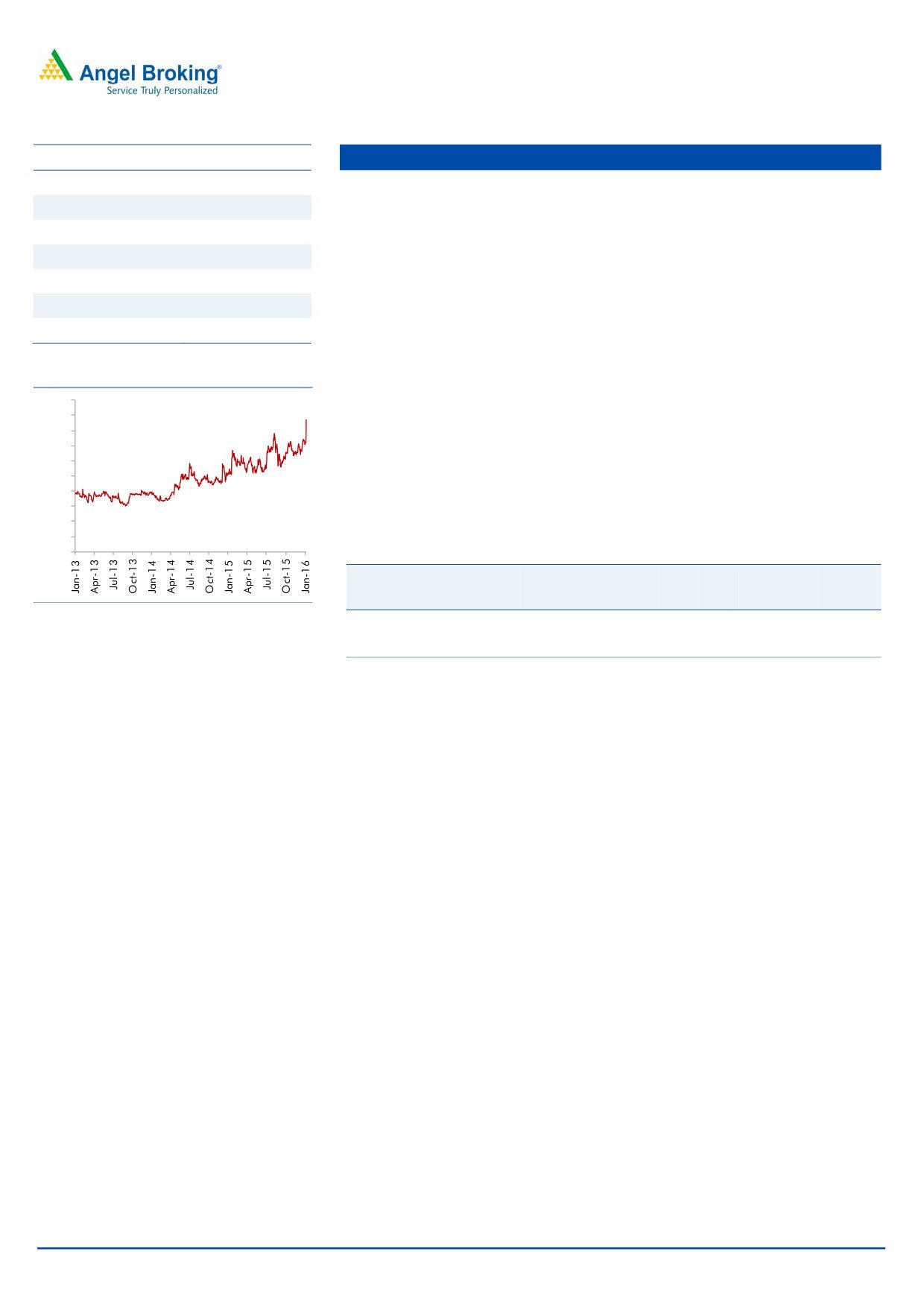

3 year-Chart

contributes 70% to the profitability.

200

180

In a declining interest rate scenario, we expect SRL's interest expense to be

160

lower and we expect the company to use its healthy cash flows from the

140

Lighting business to slowly reduce its debt.

120

100

Since our December Top Picks recommendation, the stock has generated

80

60

returns of 23.0% and at CMP, SRL trades at 9.0x its FY2017E earnings. We

40

maintain our Buy recommendation on SRL with revised target of `201.

20

-

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

2,992

8.1

64

14.7

9.7

11.3

1.0

6.4

0.5

FY2017E

3,223

8.4

80

18.3

11.0

9.0

1.0

5.7

0.5

Source: Company, Angel Research

January 7, 2016

12

Top Picks Report | January 2016

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

9.0

8.4

12.0

9.8

8.0

7.5

7.5

7.4

10.0

7.0

7.0

6.7

6.7

6.6

7.0

6.4

8.0

6.3

6.0

6.0

4.8

5.0

4.2

4.3

4.7

3.6

3.8

5.0

4.0

2.8

3.0

2.5

2.5

4.0

2.0

3.0

-

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

(%)

56.0

Mfg. PMI

Services PMI

6.0

5.4

5.4

5.4

5.2

5.3

4.9

5.0

5.0

54.0

5.0

4.4

4.3

52.0

3.7

3.7

4.0

50.0

3.0

48.0

2.0

1.0

46.0

-

44.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

Exports yoy growth

Imports yoy growth

Repo rate

Reverse Repo rate

CRR

(%)

(%)

0.0

8.00

7.50

(5.0)

7.00

(10.0)

6.50

6.00

(15.0)

5.50

(20.0)

5.00

(25.0)

4.50

4.00

(30.0)

3.50

(35.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

January 7, 2016

13

Top Picks Report | January 2016

Global watch

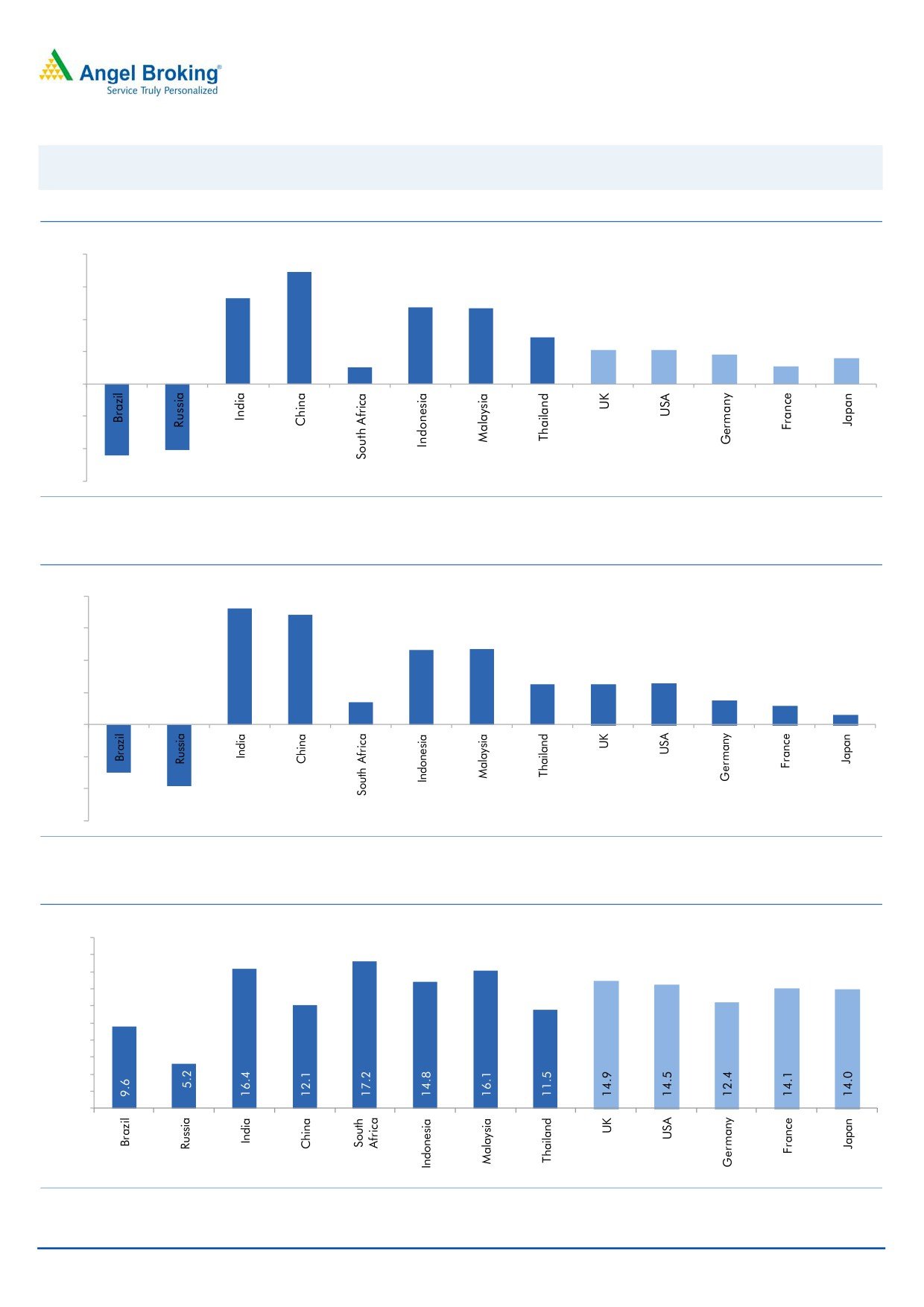

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

6.0

5.3

4.7

4.7

4.0

2.9

2.1

2.1

1.8

1.6

2.0

1.0

1.1

-

(2.0)

(4.0)

(4.1)

(4.5)

(6.0)

Source: Bloomberg, Angel Research

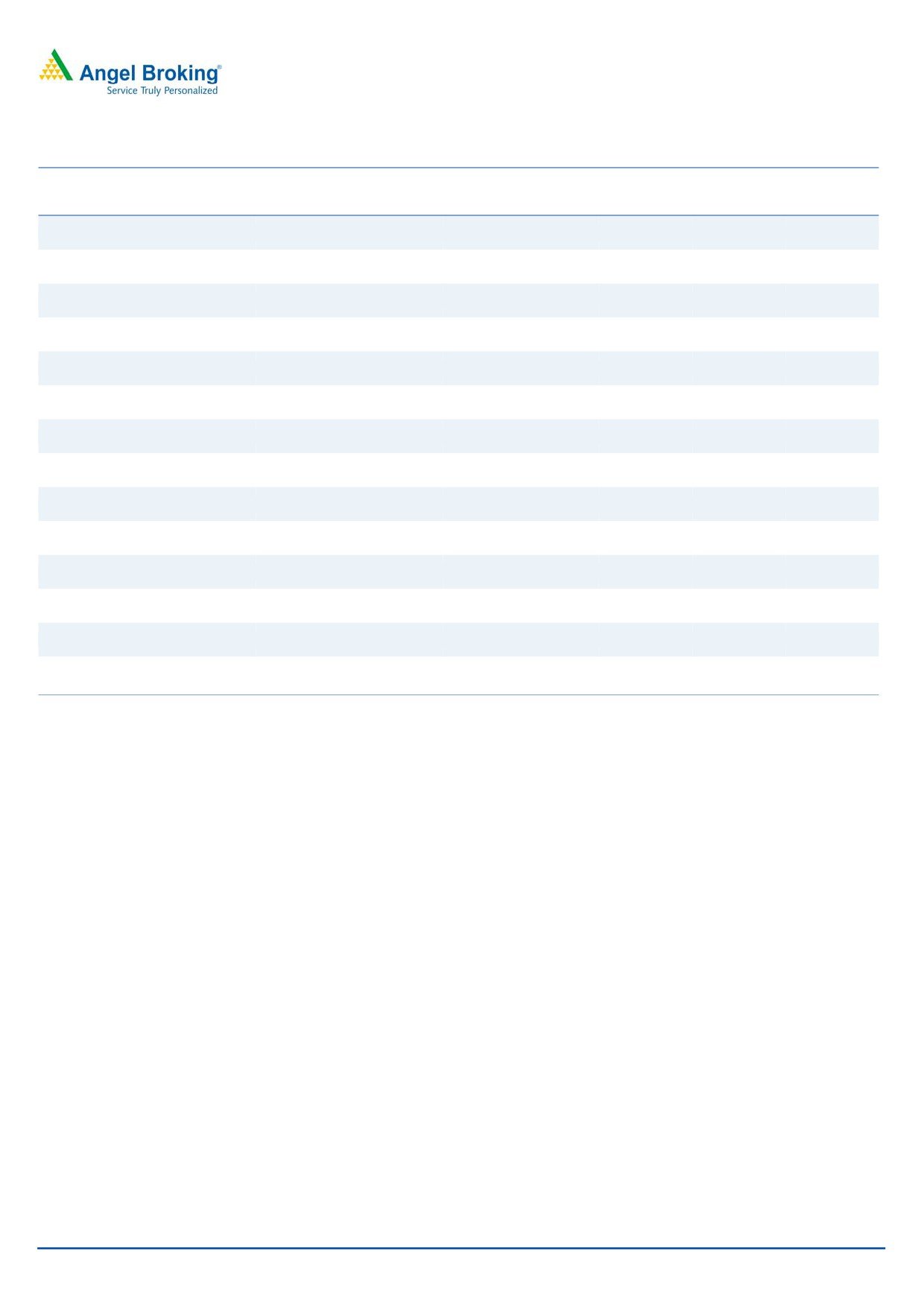

Exhibit 2: 2015 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

8.0

7.3

6.8

6.0

4.7

4.7

4.0

2.5

2.5

2.6

1.4

1.5

2.0

1.2

0.6

-

(2.0)

(3.0)

(4.0)

(3.8)

(6.0)

Source: IMF, Angel Research

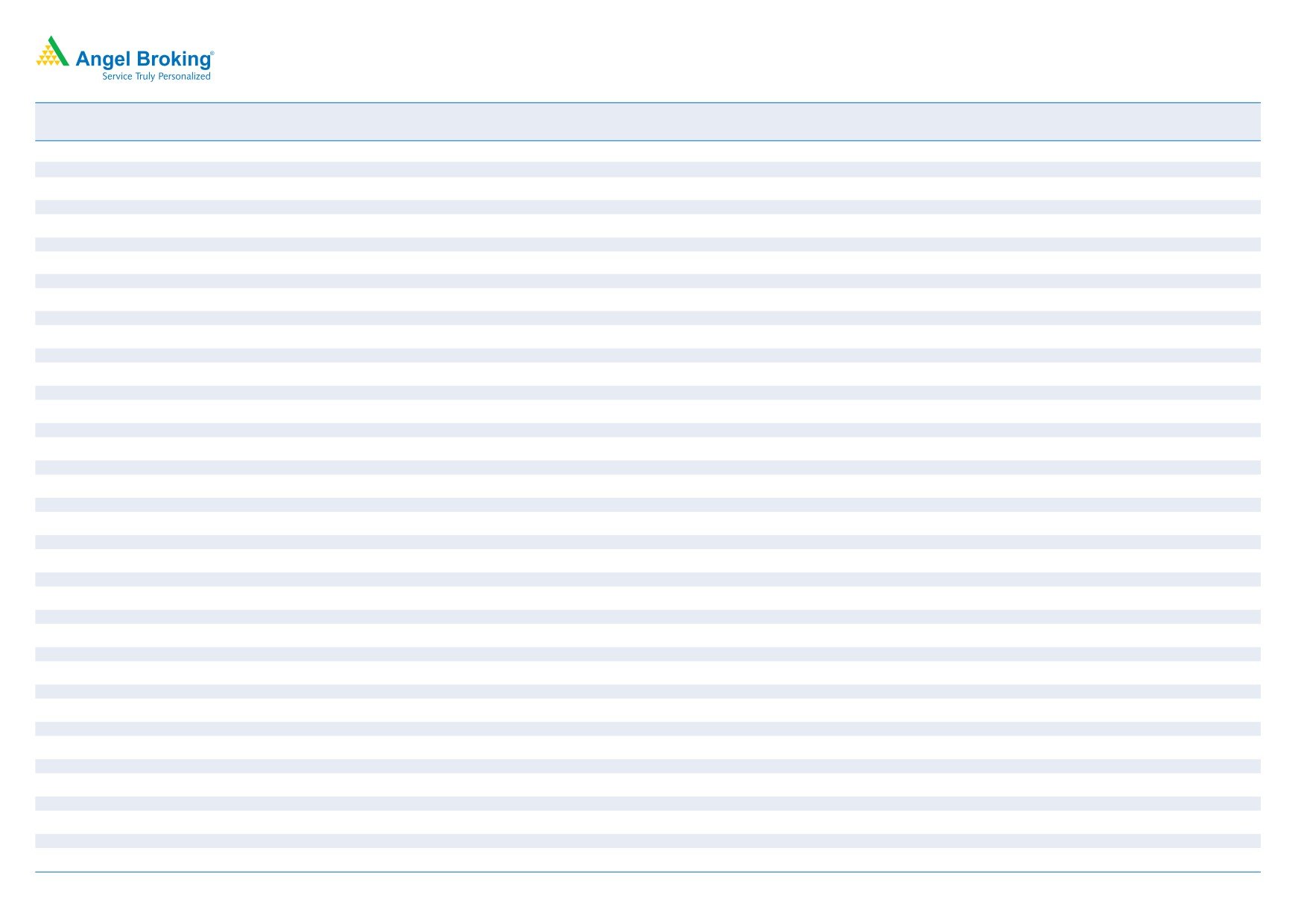

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

January 7, 2016

14

Top Picks Report | January 2016

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

41,773

(7.3)

(5.3)

(16.7)

Russia

Micex

1,749

(2.2)

5.8

18.1

India

Nifty

7,741

(0.5)

(2.6)

(6.6)

China

Shanghai Composite

3,362

(10.1)

1.1

0.7

South Africa

Top 40

44,150

(4.1)

(5.4)

3.3

Mexico

Mexbol

41,691

(3.1)

(2.4)

0.9

Indonesia

LQ45

802

0.9

11.3

(10.6)

Malaysia

KLCI

1,668

(0.5)

2.1

(5.7)

Thailand

SET 50

790

(9.2)

(8.9)

(22.8)

USA

Dow Jones

16,907

(3.3)

0.8

(3.9)

UK

FTSE

6,073

(5.4)

(3.6)

(7.6)

Japan

Nikkei

18,191

(8.8)

4.6

1.9

Germany

DAX

10,214

(9.3)

6.9

3.8

France

CAC

4,480

(5.3)

(3.9)

4.4

Source: Bloomberg, Angel Research

January 7, 2016

15

Top Picks Report | January 2016

Stock Watch

January 7, 2016

16

Stock Watch | January 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Agri / Agri Chemical

Rallis

Neutral

173

-

3,362

2,097

2,415

14.4

14.4

9.5

11.0

18.2

15.7

3.6

3.1

21.1

21.3

1.6

1.4

United Phosphorus

Buy

442

510

18,940

13,698

15,752

17.6

17.6

32.1

38.5

13.8

11.5

2.7

2.2

21.4

21.3

1.5

1.2

Auto & Auto Ancillary

Ashok Leyland

Buy

93

111

26,339

17,995

21,544

11.4

11.6

3.4

4.7

27.2

19.7

4.8

4.4

17.7

22.2

1.4

1.2

Bajaj Auto

Accumulate

2,486

2,728

71,922

23,695

27,298

21.3

20.4

134.6

151.5

18.5

16.4

5.9

5.0

31.8

30.6

2.6

2.2

Bharat Forge

Accumulate

876

943

20,387

7,867

8,881

20.0

20.3

34.4

41.0

25.5

21.4

4.9

4.1

21.1

20.9

2.7

2.4

Eicher Motors

Accumulate 17,525

19,036

47,588

15,379

16,498

15.6

16.6

473.2

574.8

37.0

30.5

13.7

10.2

36.7

33.2

3.0

2.8

Gabriel India

Neutral

96

-

1,385

1,415

1,544

8.7

9.0

4.6

5.4

21.0

17.9

3.8

3.4

18.1

18.9

1.0

0.8

Hero Motocorp

Accumulate

2,582

2,774

51,554

28,561

31,559

14.7

14.7

151.1

163.2

17.1

15.8

6.6

5.6

38.7

35.6

1.6

1.5

Jamna Auto Industries Neutral

145

-

1,158

1,292

1,486

9.3

9.8

6.0

7.5

24.2

19.3

5.0

4.2

20.7

21.8

1.0

0.8

L G Balakrishnan & Bros Neutral

505

-

792

1,254

1,394

11.6

11.8

35.9

41.7

14.1

12.1

1.9

1.7

13.5

13.8

0.7

0.7

Mahindra and Mahindra Buy

1,224

1,449

76,003

39,031

44,440

13.8

13.9

57.9

67.6

21.1

18.1

3.4

3.0

16.1

16.6

1.6

1.3

Maruti

Neutral

4,480

-

135,318

57,865

68,104

16.4

16.7

176.3

225.5

25.4

19.9

4.9

4.2

19.4

21.2

2.1

1.7

Minda Industries

Neutral

916

-

1,452

2,567

2,965

8.0

8.3

46.1

57.8

19.9

15.8

3.3

2.7

16.7

17.3

0.7

0.6

Motherson Sumi

Accumulate

281

313

37,228

39,343

45,100

8.8

9.1

10.1

12.5

27.9

22.5

8.8

6.9

35.3

34.4

1.0

0.9

Rane Brake Lining

Accumulate

345

366

273

454

511

11.1

11.4

23.8

28.1

14.5

12.3

2.1

1.9

14.2

15.3

0.7

0.7

Setco Automotive

Neutral

41

-

544

594

741

12.7

13.7

1.7

3.2

23.9

12.7

2.5

2.2

10.4

16.9

1.4

1.1

Tata Motors

Accumulate

366

409

105,585

266,022

312,667

12.8

13.1

26.3

38.3

13.9

9.5

1.8

1.5

8.4

12.1

0.6

0.5

TVS Motor

Buy

287

338

13,614

11,569

13,648

7.3

8.7

10.3

16.1

27.8

17.8

6.9

5.4

24.8

30.5

1.2

1.0

Amara Raja Batteries

Buy

862

1,040

14,728

4,892

5,871

17.4

17.6

28.8

37.1

29.9

23.2

7.0

5.6

23.4

24.1

3.0

2.4

Exide Industries

Accumulate

142

162

12,049

6,950

7,784

14.4

14.8

6.6

7.3

21.5

19.4

2.7

2.5

12.6

12.8

1.4

1.3

Apollo Tyres

Accumulate

155

171

7,905

12,146

12,689

16.8

16.0

21.2

19.0

7.3

8.2

1.2

1.1

16.5

13.0

0.7

0.8

Ceat

Neutral

1,069

-

4,326

6,041

6,597

14.1

13.7

99.5

111.9

10.7

9.6

2.1

1.8

19.6

18.5

0.9

0.7

JK Tyres

Neutral

115

-

2,606

7,446

7,669

15.2

14.0

19.6

18.4

5.9

6.2

1.5

1.2

25.2

19.5

0.7

0.6

Swaraj Engines

Neutral

964

-

1,198

552

630

14.2

14.7

44.6

54.1

21.6

17.8

5.0

4.6

23.2

25.6

2.0

1.7

Subros

Neutral

105

-

632

1,268

1,488

11.6

11.9

3.7

6.6

28.5

16.0

1.9

1.7

6.8

11.4

0.8

0.7

Indag Rubber

Neutral

216

-

567

283

329

17.0

17.2

13.0

15.4

16.7

14.0

3.6

3.0

21.8

21.6

1.7

1.4

Banking

Allahabad Bank

Neutral

68

-

4,081

8,569

9,392

2.8

2.9

16.3

27.5

4.2

2.5

0.4

0.31

7.6

11.9

-

-

Axis Bank

Buy

431

630

102,484

26,473

31,527

3.5

3.6

35.7

43.5

12.1

9.9

2.3

2.02

17.9

18.9

-

-

Bank of Baroda

Neutral

149

-

34,251

18,485

21,025

1.9

2.0

13.5

21.1

11.0

7.0

0.9

0.8

7.3

10.6

-

-

Bank of India

Neutral

114

-

9,040

15,972

17,271

1.9

2.0

15.3

33.3

7.5

3.4

0.3

0.3

3.6

7.6

-

-

Canara Bank

Neutral

229

-

12,410

15,441

16,945

2.0

2.1

46.6

70.4

4.9

3.2

0.4

0.4

8.0

11.2

-

-

Dena Bank

Neutral

40

-

2,607

3,440

3,840

2.1

2.3

7.2

10.0

5.6

4.0

0.4

0.3

6.1

7.9

-

-

Federal Bank

Neutral

55

-

9,428

3,477

3,999

3.0

3.0

5.0

6.2

10.9

8.8

1.1

1.0

10.5

11.9

-

-

HDFC

Neutral

1,208

-

190,781

10,358

11,852

3.3

3.3

41.1

47.0

29.4

25.7

5.6

5.1

24.7

24.9

-

-

HDFC Bank

Buy

1,065

1,262

268,997

38,309

47,302

4.3

4.3

49.3

61.0

21.6

17.4

3.7

3.21

18.5

19.7

-

-

ICICI Bank

Buy

250

354

145,363

34,279

39,262

3.3

3.3

21.0

24.4

11.9

10.3

2.0

1.7

14.4

14.7

-

-

January 7, 2016

17

Stock Watch | January 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

IDBI Bank

Neutral

83

-

13,329

9,625

10,455

1.8

1.8

8.5

14.2

9.7

5.8

0.6

0.5

5.9

9.3

-

-

Indian Bank

Neutral

111

-

5,324

6,160

6,858

2.4

2.5

24.5

29.8

4.5

3.7

0.4

0.3

7.7

8.6

-

-

LIC Housing Finance

Buy

500

592

25,210

3,101

3,745

2.5

2.5

33.0

40.2

15.2

12.4

2.8

2.4

19.7

20.5

-

-

Oriental Bank

Neutral

135

-

4,040

7,643

8,373

2.4

2.4

37.2

45.4

3.6

3.0

0.3

0.3

8.2

9.4

-

-

Punjab Natl.Bank

Neutral

110

-

21,590

23,638

26,557

2.8

2.8

17.9

27.2

6.1

4.0

0.6

0.5

8.5

12.0

-

-

South Ind.Bank

Neutral

20

-

2,714

1,965

2,185

2.5

2.5

2.5

3.3

8.1

6.1

0.8

0.7

9.5

11.6

-

-

St Bk of India

Buy

217

283

168,452

82,520

93,299

2.7

2.8

20.0

24.5

10.8

8.9

1.2

1.0

11.5

12.8

-

-

Union Bank

Neutral

143

-

9,848

12,646

14,129

2.3

2.4

31.0

39.1

4.6

3.7

0.5

0.4

9.8

11.4

-

-

Vijaya Bank

Neutral

34

-

2,912

3,536

3,827

1.8

1.9

5.5

6.7

6.1

5.1

0.5

0.5

7.8

8.8

-

-

Yes Bank

Buy

703

921

29,487

7,190

9,011

3.2

3.3

58.2

69.7

12.1

10.1

2.2

1.8

19.2

19.6

-

-

Capital Goods

ACE

Neutral

47

-

467

660

839

4.7

8.2

1.0

3.9

47.2

12.1

1.5

1.3

3.2

11.3

0.9

0.7

BEML

Neutral

1,256

-

5,232

3,277

4,006

6.0

8.9

29.2

64.3

43.0

19.5

2.4

2.2

5.7

11.7

1.7

1.3

Bharat Electronics

Neutral

1,353

-

32,482

7,737

8,634

16.8

17.2

54.0

61.0

25.1

22.2

3.6

3.2

39.3

45.6

3.3

2.8

Voltas

Buy

306

353

10,122

5,363

5,963

8.0

9.1

11.0

13.8

27.8

22.2

4.3

3.7

16.2

17.9

1.8

1.6

BGR Energy

Neutral

133

-

959

3,615

3,181

9.5

9.4

16.7

12.4

8.0

10.7

0.7

0.7

10.0

7.0

0.7

0.8

BHEL

Neutral

165

-

40,483

33,722

35,272

10.8

11.7

10.5

14.2

15.8

11.6

1.2

1.1

7.0

9.0

1.3

1.2

Blue Star

Buy

377

439

3,388

3,548

3,977

6.3

6.9

13.7

17.2

27.5

22.0

6.9

4.5

26.1

25.4

1.0

0.9

Crompton Greaves

Accumulate

193

204

12,068

13,484

14,687

4.9

6.2

4.5

7.1

42.8

27.1

3.0

2.8

7.2

10.8

1.0

0.9

Inox Wind

Buy

364

458

8,083

4,980

5,943

17.0

17.5

26.6

31.6

13.7

11.5

4.1

3.0

35.0

30.0

1.8

1.4

KEC International

Neutral

151

-

3,873

8,791

9,716

6.1

6.8

5.4

8.2

27.9

18.4

2.8

2.6

10.0

14.0

0.7

0.6

Thermax

Neutral

869

-

10,360

6,413

7,525

7.4

8.5

30.5

39.3

28.5

22.1

4.4

3.8

15.0

17.0

1.6

1.3

Cement

ACC

Buy

1,327

1,630

24,905

13,151

14,757

16.4

18.3

63.9

83.4

20.8

15.9

2.7

2.5

13.3

16.1

1.7

1.5

Ambuja Cements

Accumulate

203

233

31,535

11,564

12,556

19.4

20.7

8.9

10.1

22.8

20.1

2.9

2.7

12.8

13.8

2.4

2.1

HeidelbergCement

Neutral

77

-

1,745

1,772

1,926

13.3

15.4

1.0

3.0

77.0

25.7

1.9

1.8

2.6

7.9

1.6

1.3

India Cements

Accumulate

98

112

3,015

4,216

4,840

18.0

19.5

4.0

9.9

24.5

9.9

1.0

0.9

4.0

9.5

1.0

0.8

JK Cement

Buy

578

744

4,044

3,661

4,742

10.1

15.8

18.0

61.0

32.1

9.5

2.3

2.1

7.5

22.9

1.6

1.2

J K Lakshmi Cement

Buy

331

430

3,892

2,947

3,616

16.7

19.9

11.5

27.2

28.8

12.2

2.7

2.4

9.8

20.8

1.7

1.4

Mangalam Cements

Neutral

199

-

531

1,053

1,347

10.5

13.3

8.4

26.0

23.7

7.6

1.0

0.9

4.3

12.5

0.9

0.6

Orient Cement

Buy

150

183

3,070

1,854

2,524

21.2

22.2

7.7

11.1

19.5

13.5

2.8

2.4

13.3

15.7

2.4

1.7

Ramco Cements

Neutral

389

-

9,249

4,036

4,545

20.8

21.3

15.1

18.8

25.7

20.7

3.1

2.8

12.9

14.3

2.8

2.4

Shree Cement^

Neutral

11,423

-

39,793

7,150

8,742

26.7

28.6

228.0

345.5

50.1

33.1

7.4

6.2

15.7

20.3

5.3

4.3

UltraTech Cement

Buy

2,737

3,282

75,099

25,021

30,023

19.1

21.6

89.0

132.0

30.7

20.7

3.6

3.1

12.2

15.9

3.1

2.6

Construction

ITNL

Neutral

93

-

3,059

7,360

8,825

34.0

35.9

7.0

9.0

13.3

10.3

0.5

0.4

3.2

3.7

3.8

3.7

KNR Constructions

Buy

559

673

1,572

937

1,470

14.3

14.0

33.5

38.6

16.7

14.5

2.5

2.2

15.4

15.4

1.8

1.1

Larsen & Toubro

Buy

1,240

1,646

115,438

65,065

77,009

11.5

11.7

61.5

65.6

20.2

18.9

2.0

1.9

13.4

14.0

2.0

1.7

Gujarat Pipavav Port

Neutral

158

-

7,641

629

684

51.0

52.2

6.4

5.9

24.7

26.8

3.3

3.0

15.9

12.7

11.8

10.6

MBL Infrastructures

Buy

219

285

907

2,313

2,797

12.2

14.6

19.0

20.0

11.5

10.9

1.2

1.1

11.3

10.6

1.1

1.0

Nagarjuna Const.

Neutral

79

-

4,375

7,892

8,842

8.8

9.1

3.0

5.3

26.2

14.8

1.3

1.2

5.0

8.5

0.8

0.7

PNC Infratech

Neutral

539

-

2,767

1,873

2,288

13.2

13.5

24.0

32.0

22.5

16.9

2.2

1.9

12.1

12.3

1.6

1.3

Simplex Infra

Neutral

319

-

1,577

5,955

6,829

10.3

10.5

16.0

31.0

19.9

10.3

1.1

1.0

5.3

9.9

0.8

0.7

Power Mech Projects

Neutral

660

-

971

1,539

1,801

12.8

12.7

59.0

72.1

11.2

9.2

1.7

1.4

18.6

16.8

0.6

0.5

January 7, 2016

18

Stock Watch | January 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Sadbhav Engineering

Neutral

334

-

5,728

3,481

4,219

10.7

10.8

8.0

12.0

41.7

27.8

3.9

3.4

10.3

13.5

1.9

1.6

NBCC

Accumulate

1,009

1,089

12,113

7,382

9,506

7.7

8.6

39.8

54.4

25.4

18.6

6.1

4.8

26.7

29.1

1.4

1.0

MEP Infra

Neutral

47

-

771

1,956

1,876

28.1

30.5

1.3

3.0

36.5

15.8

7.7

5.2

21.2

32.8

1.8

1.8

SIPL

Neutral

95

-

3,330

675

1,042

62.4

64.7

-

-

3.5

4.0

-

-

16.6

11.2

FMCG

Asian Paints

Neutral

887

-

85,038

16,553

19,160

16.0

16.2

17.7

21.5

50.2

41.2

13.3

12.0

29.4

31.2

5.0

4.3

Britannia

Neutral

3,003

-

36,034

8,065

9,395

9.6

10.2

47.2

65.5

63.6

45.9

21.1

20.0

38.3

41.2

4.3

3.7

Colgate

Neutral

949

-

25,801

4,836

5,490

19.5

19.7

48.5

53.2

19.6

17.8

14.3

12.5

99.8

97.5

5.2

4.6

Dabur India

Neutral

276

-

48,517

9,370

10,265

17.1

17.2

7.3

8.1

37.6

34.0

11.3

9.2

33.7

30.6

5.1

4.6

GlaxoSmith Con*

Neutral

6,659

-

28,003

4,919

5,742

17.2

17.4

168.3

191.2

39.6

34.8

11.2

9.6

28.8

28.9

5.3

4.5

Godrej Consumer

Neutral

1,306

-

44,458

10,168

12,886

16.1

16.1

32.1

38.4

40.7

34.0

8.3

7.6

19.7

21.0

4.5

3.5

HUL

Neutral

841

-

182,068

34,940

38,957

17.5

17.7

20.8

24.7

40.4

34.1

45.0

36.0

110.5

114.2

5.0

4.5

ITC

Buy

315

382

253,236

41,068

45,068

37.8

37.4

13.9

15.9

22.6

19.8

7.6

6.7

34.1

33.8

5.8

5.2

Marico

Neutral

227

-

29,222

6,551

7,766

15.7

16.0

10.4

12.5

21.8

18.1

6.3

5.3

33.2

32.4

4.4

3.7

Nestle*

Buy

5,717

6,646

55,120

11,291

12,847

22.2

22.3

158.9

184.6

36.0

31.0

18.8

16.9

55.0

57.3

4.7

4.1

Tata Global

Neutral

145

-

9,167

8,635

9,072

9.8

9.9

6.5

7.6

22.3

19.1

2.2

2.1

6.8

7.4

1.0

0.9

IT

HCL Tech^

Buy

840

1,132

118,439

42,038

47,503

23.2

23.5

55.8

62.9

15.1

13.4

3.5

2.7

23.0

19.8

2.4

1.9

Infosys

Buy

1,069

1,306

245,647

60,250

66,999

27.0

28.0

56.4

63.7

19.0

16.8

3.9

3.3

20.4

19.8

3.3

2.9

TCS

Buy

2,381

3,165

469,198

111,274

126,852

28.4

28.7

125.4

143.9

19.0

16.5

7.5

6.9

39.9

42.2

3.8

3.3

Tech Mahindra

Buy

524

646

50,619

25,566

28,890

16.0

17.0

26.3

31.9

19.9

16.4

3.6

3.0

17.9

18.6

1.7

1.5

Wipro

Buy

555

719

137,167

50,808

58,713

23.7

23.8

37.3

42.3

14.9

13.1

2.8

2.5

19.0

17.9

2.3

1.8

Media

D B Corp

Accumulate

325

356

5,969

2,241

2,495

27.8

27.9

21.8

25.6

14.9

12.7

3.9

3.4

26.7

28.5

2.6

2.3

HT Media

Neutral

89

-

2,062

2,495

2,603

11.2

11.2

7.3

8.6

12.1

10.3

1.0

0.9

7.4

8.1

0.3

0.3

Jagran Prakashan

Accumulate

169

189

5,518

2,170

2,355

27.2

26.2

8.9

9.9

19.0

17.1

4.0

3.5

20.9

20.4

2.4

2.2

Sun TV Network

Neutral

422

-

16,613

2,779

3,196

70.2

70.5

22.8

27.3

18.5

15.4

4.6

4.1

26.7

28.3

5.7

5.0

Hindustan Media

Neutral

289

-

2,118

920

1,031

20.0

20.0

19.2

20.9

15.0

13.8

2.5

2.1

16.4

15.3

1.8

1.6

Metal

Coal India

Buy

328

380

206,861

76,167

84,130

19.9

22.3

22.4

25.8

14.6

12.7

5.3

5.1

35.5

41.0

2.0

1.8

Hind. Zinc

Buy

146

175

61,690

14,641

14,026

50.4

50.4

17.7

16.0

8.3

9.1

1.3

1.2

16.2

13.2

1.8

1.7

Hindalco

Neutral

81

-

16,623

104,356

111,186

8.7

9.5

6.7

11.1

12.0

7.3

0.4

0.4

3.5

5.9

0.7

0.6

JSW Steel

Neutral

1,058

-

25,566

42,308

45,147

16.4

20.7

(10.3)

49.5

-

21.4

1.2

1.1

(1.0)

5.6

1.6

1.5

NMDC

Neutral

91

-

35,960

8,237

10,893

46.6

44.5

9.9

11.7

9.1

7.8

1.0

0.9

12.4

13.0

4.2

3.2

SAIL

Neutral

50

-

20,650

45,915

53,954

7.2

10.5

1.5

4.4

33.2

11.4

0.5

0.5

2.3

4.1

1.1

1.0

Vedanta

Neutral

89

-

26,356

71,445

81,910

26.2

26.2

12.9

19.2

6.9

4.6

0.5

0.4

7.2

8.9

0.8

0.6

Tata Steel

Neutral

269

-

26,077

126,760

137,307

8.9

11.3

6.4

23.1

42.2

11.6

0.8

0.8

2.0

7.1

0.8

0.7

Oil & Gas

Cairn India

Neutral

140

-

26,276

11,323

12,490

49.4

51.0

20.7

20.6

6.8

6.8

0.4

0.4

6.4

6.1

1.4

0.7

GAIL

Neutral

372

-

47,206

64,856

70,933

9.1

9.6

24.0

28.9

15.5

12.9

1.3

1.2

8.8

9.6

0.9

0.8

January 7, 2016

19

Stock Watch | January 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

ONGC

Neutral

237

-

203,107

154,564

167,321

36.8

37.4

28.6

32.5

8.3

7.3

1.1

1.0

12.7

13.5

1.5

1.4

Petronet LNG

Neutral

267

-

20,006

29,691

31,188

5.8

6.2

12.8

13.4

20.9

19.9

3.1

2.8

15.8

14.8

0.7

0.7

Indian Oil Corp

Neutral

451

-

109,464

359,607

402,760

5.9

6.1

42.5

48.7

10.6

9.3

1.4

1.3

14.1

14.3

0.4

0.4

Reliance Industries

Accumulate

1,032

1,150

334,270

304,775

344,392

12.6

13.4

91.3

102.6

11.3

10.1

1.3

1.1

11.8

12.0

1.0

0.9

Pharmaceuticals

Alembic Pharma

Neutral

676

-

12,748

2,658

3,112

24.1

20.2

24.6

23.9

27.5

28.3

9.9

7.5

42.5

30.2

4.8

4.0

Aurobindo Pharma

Neutral

867

-

50,636

14,923

17,162

22.0

23.0

35.7

42.8

24.3

20.3

7.1

5.4

34.0

30.2

3.8

3.2

Cadila Healthcare

Accumulate

319

352

32,688

10,224

11,840

21.0

22.0

14.6

17.6

21.9

18.1

6.0

4.7

30.8

29.0

3.3

2.7

Cipla

Neutral

652

-

52,403

14,211

16,611

20.6

19.0

27.0

28.9

24.2

22.6

4.1

3.5

18.4

16.8

3.7

3.1

Dr Reddy's

Buy

3,047

3,933

51,968

16,838

19,575

25.0

23.1

167.5

178.8

18.2

17.0

3.8

3.2

23.1

20.4

3.0

2.5

Dishman Pharma

Neutral

343

-

2,769

1,733

1,906

21.5

21.5

17.0

19.9

20.2

17.2

2.0

1.8

10.5

11.2

2.1

1.8

GSK Pharma

Neutral

3,262

-

27,633

2,870

3,158

20.0

22.1

59.5

68.3

54.8

47.8

16.2

16.6

28.5

34.3

9.1

8.3

Indoco Remedies

Neutral

314

-

2,896

1,033

1,199

15.9

18.2

9.4

13.6

33.4

23.1

5.0

4.2

15.7

19.7

2.9

2.5

Ipca labs

Buy

714

900

9,009

3,363

3,909

12.9

18.6

13.4

28.0

53.3

25.5

3.8

3.3

7.4

14.0

3.0

2.5

Lupin

Neutral

1,754

-

79,024

13,092

16,561

25.0

27.0

50.4

68.3

34.8

25.7

7.2

5.7

22.8

24.7

5.7

4.4

Sanofi India*

Neutral

4,260

-

9,812

2,082

2,371

17.4

20.8

118.2

151.5

36.0

28.1

5.3

4.2

19.9

25.5

4.4

3.6

Sun Pharma

Buy

793

950

190,724

28,163

32,610

25.8

30.7

17.4

26.9

45.5

29.5

4.3

3.7

13.0

16.6

6.2

5.2

Power

Tata Power

Neutral

69

-

18,608

35,923

37,402

22.6

22.8

4.1

5.2

17.0

13.4

1.3

1.2

7.5

9.3

1.5

1.3

NTPC

Accumulate

141

157

116,632

87,064

98,846

23.4

23.5

11.7

13.2

12.1

10.7

1.3

1.3

11.4

12.1

2.4

2.1

Power Grid

Buy

140

170

73,059

20,702

23,361

86.7

86.4

12.1

13.2

11.6

10.6

1.7

1.5

15.6

15.1

8.4

7.9

Telecom

Bharti Airtel

Neutral

322

-

128,656

101,748

109,191

32.1

31.7

12.0

12.5

26.8

25.7

1.8

1.7

6.9

6.7

1.9

1.7

Idea Cellular

Neutral

135

-

48,605

34,282

36,941

32.0

31.5

5.9

6.2

22.9

21.8

2.1

1.9

9.9

9.3

2.0

1.9

Others

Abbott India

Neutral

5,777

-

12,276

2,715

3,153

14.5

14.1

134.3

152.2

43.0

37.9

10.7

8.8

27.4

25.6

4.2

3.6

Bajaj Electricals

Buy

203

290

2,053

4,719

5,287

5.2

5.8

8.6

12.7

23.8

16.1

2.7

2.4

11.4

14.8

0.4

0.4

Banco Products (India)

Neutral

146

-

1,043

1,208

1,353

10.9

12.3

10.8

14.5

13.5

10.1

1.5

1.4

11.9

14.5

0.8

0.7

Coffee Day Enterprises

Neutral

274

-

5,651

2,692

2,964

17.0

18.6

-

4.7

-

57.9

3.4

3.2

0.1

5.5

2.5

2.3

Competent Automobiles Neutral

158

-

97

1,040

1,137

3.2

3.1

25.7

28.0

6.1

5.6

0.9

0.8

15.0

14.3

0.1

0.1

Elecon Engineering

Neutral

82

-

894

1,369

1,533

13.7

14.9

3.3

6.1

24.7

13.5

1.6

1.5

6.6

11.4

1.0

0.9

Finolex Cables

Neutral

256

-

3,918

2,520

2,883

12.2

12.0

12.7

14.2

20.2

18.0

2.8

2.4

13.6

13.5

1.3

1.1

Garware Wall Ropes

Buy

411

473

899

861

967

10.9

10.9

24.9

29.6

16.5

13.9

2.5

2.2

14.6

14.9

1.1

0.9

Goodyear India*

Accumulate

564

622

1,300

1,888

1,680

12.1

11.9

62.2

56.6

9.1

10.0

2.1

1.8

25.9

19.7

0.5

0.5

Hitachi

Neutral

1,320

-

3,588

1,779

2,081

7.8

8.8

21.8

33.4

60.5

39.5

9.8

7.9

17.4

22.1

2.1

1.8

HSIL

Neutral

296

-

2,143

2,123

2,384

16.1

16.5

15.0

18.9

19.7

15.7

1.5

1.4

8.0

9.4

1.3

1.2

Interglobe Aviation

Neutral

1,235

-

44,518

17,022

21,122

20.7

14.5

63.9

53.7

19.3

23.0

29.0

23.7

149.9

103.2

2.6

2.1

Jyothy Laboratories

Neutral

308

-

5,576

1,620

1,847

11.5

11.5

7.3

8.5

42.2

36.3

5.5

5.1

13.3

14.4

3.3

2.8

Kirloskar Engines India

Neutral

246

-

3,555

2,471

2,826

8.8

10.4

9.1

13.3

26.9

18.4

2.6

2.4

9.7

13.4

1.1

0.9

January 7, 2016

20

Stock Watch | January 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY16E

FY17E FY16E FY17E FY16E

FY17E FY16E

FY17E FY16E FY17E FY16E FY17E FY16E FY17E

Linc Pen & Plastics

Neutral

238

-

352

340

371

8.3

8.9

10.8

13.2

22.1

18.0

3.5

3.1

16.0

17.1

1.1

1.0

M M Forgings

Buy

525

614

633

511

615

21.7

21.6

43.1

55.8

12.2

9.4

2.2

1.8

19.9

21.2

1.4

1.1

MRF

Accumulate 40,446

45,575

17,154

20,316

14,488

21.4

21.1

5,488.0

3,797.9

7.4

10.6

2.5

2.0

41.1

21.2

0.8

1.1

MT Educare

Neutral

187

-

744

286

366

18.3

17.7

7.7

9.4

24.2

19.9

5.1

4.5

20.2

21.1

2.5

1.9

Navkar Corporation

Buy

207

265

2,951

365

436

38.3

37.5

5.6

5.9

36.7

35.2

2.3

2.2

6.3

6.1

8.9

7.6

Navneet Education

Neutral

95

-

2,265

998

1,062

24.1

24.0

5.8

6.1

16.5

15.6

3.6

3.2

22.0

20.5

2.4

2.2

Nilkamal

Neutral

1,403

-

2,094

1,910

2,083

10.5

10.3

63.3

69.2

22.2

20.3

3.6

3.1

17.6

16.5

1.2

1.0

Page Industries

Neutral

13,680

-

15,259

1,929

2,450

19.8

20.1

229.9

299.0

59.5

45.8

26.3

18.2

52.1

47.0

7.9

6.2

Radico Khaitan

Buy

112

156

1,485

1,565

1,687

12.2

13.0

5.7

7.1

19.6

15.7

1.6

1.5

8.3

9.6

1.4

1.3

Relaxo Footwears

Neutral

504

-

6,049

1,767

2,152

12.3

12.5

19.2

25.1

26.2

20.1

6.4

4.9

27.7

27.8

3.5

2.8

Siyaram Silk Mills

Buy

1,176

1,354

1,102

1,636

1,815

11.5

11.5

89.9

104.1

13.1

11.3

2.2

1.9

17.9

17.8

0.8

0.7

Styrolution ABS India*

Neutral

758

-

1,334

1,271

1,440

8.6

9.2

32.0

41.1

23.7

18.5

2.4

2.2

10.7

12.4

1.0

0.9

Surya Roshni

Buy

165

201

725

2,992

3,223

8.1

8.4

14.7

18.3

11.3

9.0

1.0

0.9

9.7

11.0

0.5

0.5

The Byke Hospitality

Neutral

158

-

633

222

287