Angel Top Picks - December 2016

Top Picks

Demonetization offers long term gains

Company

CMP (`)

TP (`)

Indian markets corrected sharply in November as demonetization coupled with

Banking/NBFC

outcome of US presidential election created a huge volatility in the markets.

Dewan Housing

257

350

Demonetization has been the boldest reform of the current government which has

Equitas Holdings

161

235

a potential to bring structural long term benefits in the economy, while causing

Consumption

pain in the short term. By far, this looks like the one of the biggest reforms in

Amara Raja

940

1,167

recent years. Due to extraordinary cash crunch in the country, consumption has

Asian Granito

222

351

taken a huge beating. This in our opinion is short term in the nature as consumers

Bajaj Electricals

223

274

are buying only essential items to save cash and as liquidity eases, consumption is

Blue Star

491

634

likely to resume. This implies that demonetization has temporarily slowed the

Mirza International

81

107

economy and growth is likely to return in H2FY2018E with spurt in consumption.

Siyaram Silk Mills

1,250

1,605

We also opine that despite unavoidable short term pain, demonetization offers

IT

several long term benefits like higher tax compliance, lower inflation, improved

HCL Tech

803

1,000

transparency, etc. which will have positive impact on economy.

Infosys

975

1,249

Media

Spending impacted in near term…

Jagran Prakashan

176

225

In the short term, demonetization looks negative for the economy as it impacts

TV Today

315

385

spending ability of the consumers. This means that cash dependent sectors would

Real Estate/Infra/Logistics/Power

be impacted the most in the near term. We believe that demonetization would

Larsen & Toubro

1383

1634

have short to medium term negative impact on sectors like Jewellery and Real

Mahindra Lifespace

377

522

Estate sectors due to involvement of black money in transactions. We also believe

Navkar Corp.

175

265

that recovery is likely to start from mid FY2018E in consumption sectors as

Powr Grid Corporation

192

223

consumers realign their preferences. Overall unorganized segment of the economy

Pharma

would be most hit as most small businesses are hugely dependent on cash for

Alkem Lab.

1,700

1,989

daily transactions.

Lupin

1,503

1,809

Source: Angel Research;

Owing to the temporary slump in demand, corporate earnings are likely to show

Note: CMP as of Nov 30, 2016

negative impact of demonetization in H2FY2017E. Some spillover can be expected

in H1FY2018E, however from H2FY2018E onwards, consumption is likely to pick-

up with ease in liquidity and realignment of consumer preferences. With ~6%

decline in the broader indices after demonetization, markets are likely to have

priced in the negative impact of demonetization; and as dust settles, markets will

track positive impact of the demonetization.

…Benefits in long term

Demonetization is an extraordinary measure to curb black money and corruption

in the country. This is expected to reduce the size of the parallel economy which is

believed to be about 1/4th of the GDP. With the demonization, a significant of this

unaccounted cash will return to the banking system. As of 29th November, 2016,

`8.44trillion of banned currency has returned to the banking system giving a huge

boost to the bank deposits.

Demonetization is going to benefit the economy in multiple ways:

Higher tax revenues to increase public expenditure…: With increased vigilance,

government is likely to receive huge tax revenues this year. Also with better tax

compliance, we believe that tax revenues are likely to be better than previous years

going ahead. This opens up a room for the government to increase spending on

infrastructure, agriculture, defense, rural sector, etc. This will benefit the economy

Please refer to important disclosures at the end of this report

1

Top Picks Report | December 2016

in terms of revival of capex cycle and new job creation leading to have a multiplier

effect on the economy.

…and increase tax benefits: With huge tax revenue collected, government can also

pass on the benefits in form of direct and indirect tax. An increase in tax exemption

limits or reduction in indirect taxes will leave consumers with surplus cash for

discretionary spending. This will also help in reviving the consumption in the

economy.

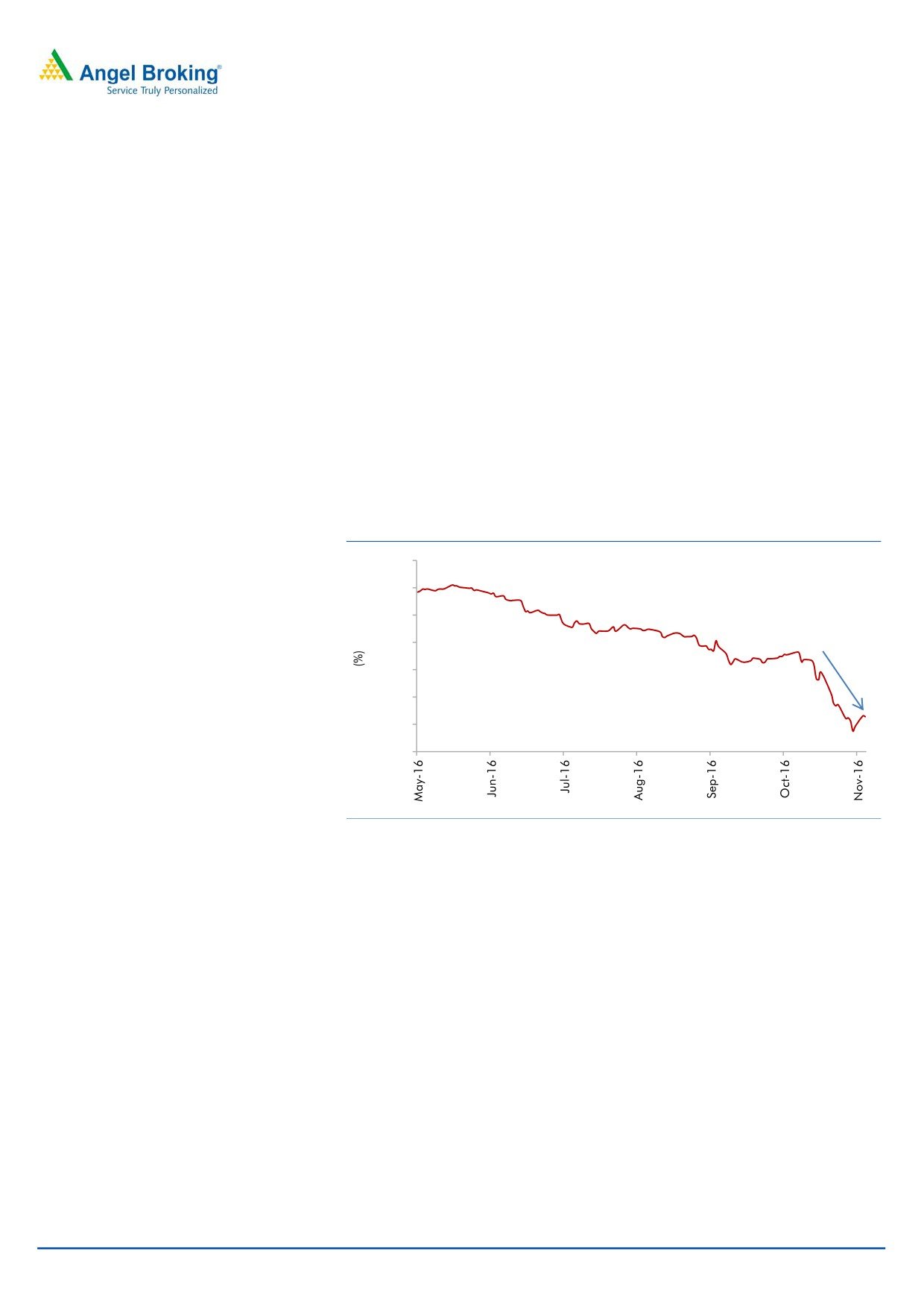

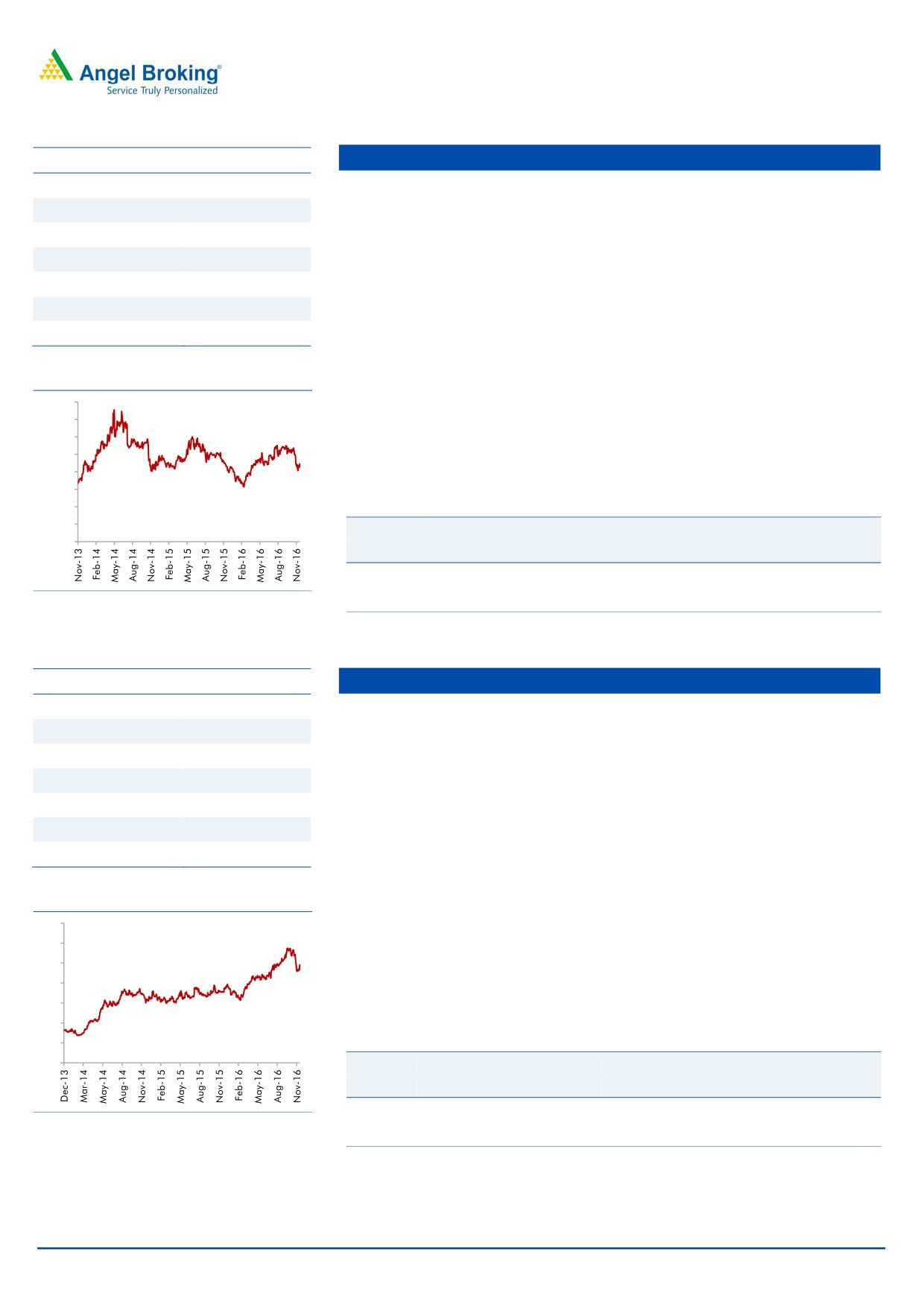

Easing inflation and availability of low cost funds creates room to cut interest rate:

As the consumer demand is expected to remain weak in near term; inflation is

likely to ease further. This month alone, G-Sec bond yield has declined by ~60bps

indicating expectation of aggressive rate cuts by RBI going ahead. Besides, due to

demonetization, banks have received huge amount of low cost funds, which should

also enable them to bring down the interest rates. With this kind of liquidity, bank

will be able to transmit a rate cut to the borrowers efficiently. This will also help to

revive consumption demand in the country.

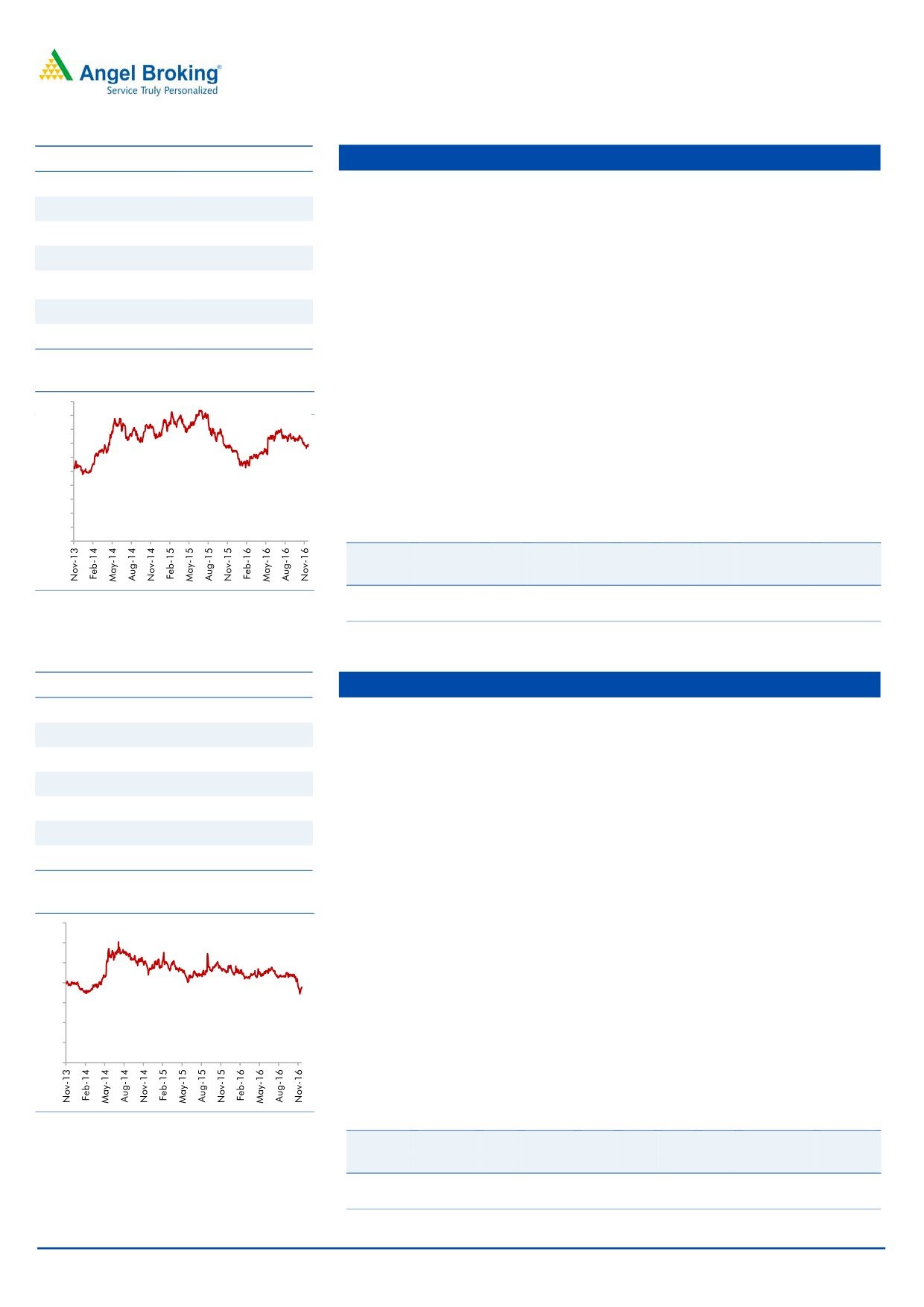

Exhibit 1: G-sec bond yield has corrected sharply in November

7.8

7.5

7.3

7.0

6.8

6.5

6.3

6.0

Source: Angel Research

Organized players to benefit with acceleration in shift from unorganized to

organized segment: While demonetization is expected to impact all sectors with

varying degree, the unorganized players will be impacted the most. Unorganized

segment depends heavily on the cash transactions and together with

demonetization and forthcoming GST, they will suddenly have to become tax

compliant. This will lead to diminish their low price advantage making branded

products more attractive. This is directly going to benefit organized players in terms

of gains in the market share.

Improvement in transparency: Demonetization is also expected to derive some

intangible benefits in the economy by increasing transparency in transactions. This

will lead to improve our ranking in ease of doing business. With this, India will

continue to remain an attractive destination for foreign investors attracting foreign

investments in form of FDI and FII.

December 1, 2016

2

Top Picks Report | December 2016

Demonetization priced in, buy quality large caps

Overall we believe that that demonetization is a shot in the arm for the economy in

the long term as it improves our fundamentals. As liquidity eases, incrementally

pain will also wane out.

Consumption story is likely to pick up with easing rates while with higher

expenditure by government on infrastructure projects, capex cycle will see revival.

Lower interest rates would make sure that high debt quality companies derive the

benefit of lower rates and demonetization and GST will make sure that organized

players are benefitted the most. This in medium to long term looks good for the

stock markets which offer a good stock picking opportunity at the moment.

On this backdrop, we are adding L&T and Powergrid Corporation (government

spending and lower interest rates) and Lupin and Alkem (no impact of

demonetization). We also retain IT stocks given demonetization does not impact

their business and rupee depreciation is likely to be positive for exports. We also

expect pick up in the consumption in H2FY2018E and believe that correction in the

consumption stocks should be used to accumulate quality companies.

December 1, 2016

3

Top Picks Report | December 2016

Top Picks

December 1, 2016

4

Top Picks Report | December 2016

Stock Info

Dewan Housing

CMP

257

3rd largest private sector housing finance company: We expect DHFL’s AUM to

TP

350

grow at a CAGR of 21% over FY2016-18, as demand for housing in the middle

Upside

36.20%

and low income group picks up, while PAT CAGR is expected to be 23%.

Sector

Financials

Seasoned and granular loan book with stable asset quality: Individual

borrowers account for 72%, while the high yielding loan against property (LAP)

Market Cap (` cr)

8,029

+SME and projects loans account for 19% and 9% of advances respectively. Despite

Beta

1.6

strong loan growth, the GNPAs and NNPAs are likely to be at ~1.17% and 0.82%,

52 Week High / Low

337 / 141

respectively, for FY2017. We don’t expect any major deterioration in the asset

quality going ahead.

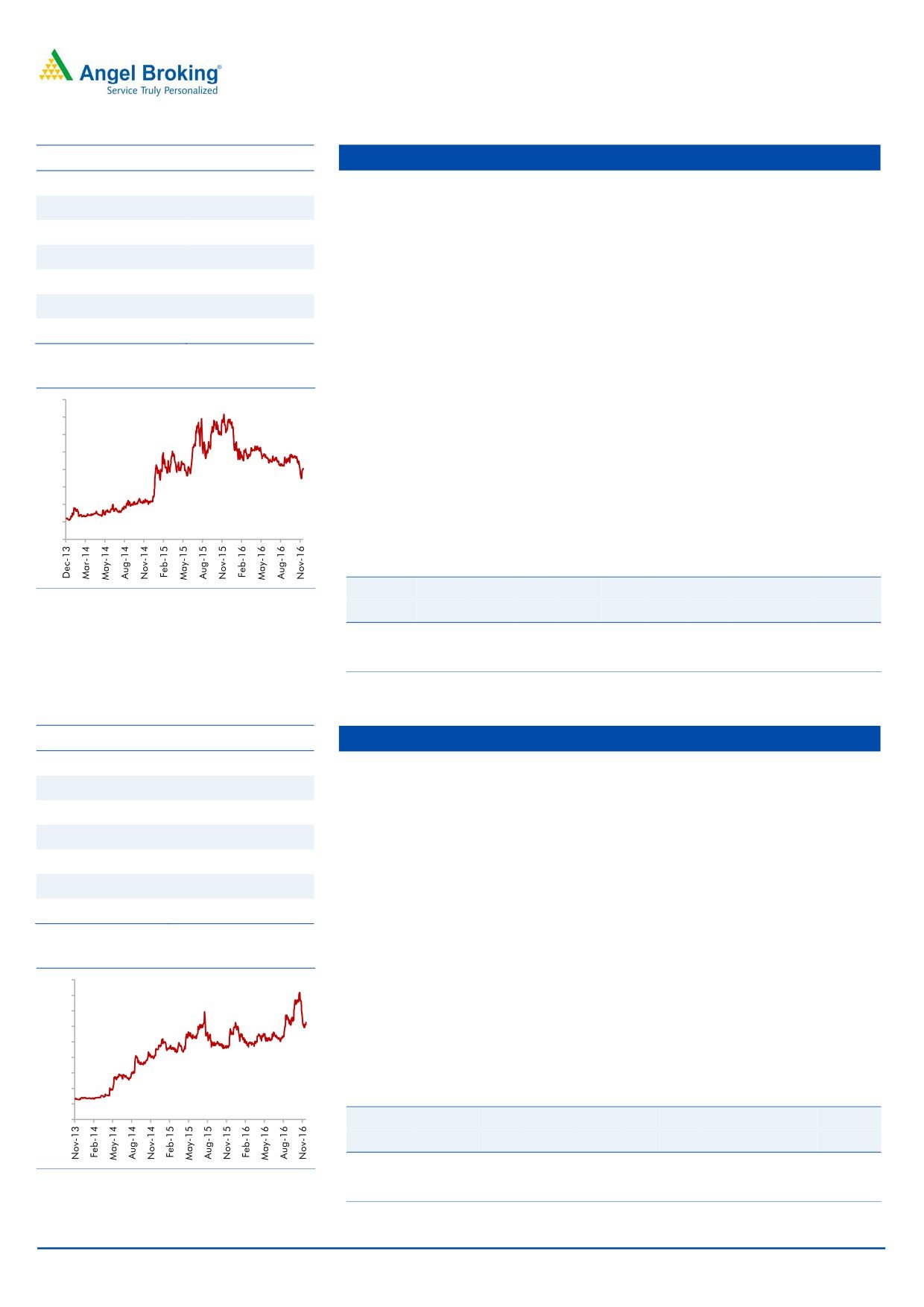

3 year-Chart

Lower cost of funds will help maintain NIM: Nearly

70% of the bank

400

borrowings are due for maturity over the next three years and recently DHFL

350

was able to raise large sum ~ Rs14, 000 cr via NCDs at a competitive rates

300

and this should help maintain its NIM at ~2.9%.

250

200

Outlook: We expect the company to post a healthy loan book CAGR of 21%

150

over FY2015-18E, which is likely to translate in earnings CAGR of 23%, over

100

the same period. The stock currently trades at 1.2x FY2018E ABV. We have a

50

Buy stand on the stock, with a target price of `350.

-

Key Financials

Y/E

Op. Inc NIM

PAT

EPS

ABV ROA ROE P/E P/ABV

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2017E

2,225

2.9

879

29.7

187.8

1.2

16.1

8.7

1.4

FY2018E

2,688

2.9

1,111

34.6

216.4

1.2

16.8

7.4

1.2

Source: Company, Angel Research

Stock Info

Equitas Holdings

CMP

161

Early mover advantage in the SFB category: Equitas was one of the ten NBFCs

TP

235

to get the license to start a small finance bank (SFB). As the entire book of

Upside

46%

Equitas qualifies for PSL, meeting the 75% PSL target will not be a challenge.

Sizeable and diversified loan book will keep it ahead of other upcoming SFBs.

Sector

Financials

Asset quality and return ratios are likely to remain stable: Equitas will have to

Market Cap (` cr)

5,388

maintain CRR & SLR going ahead; hence yield on total assets is likely to come

Beta

0.9

down. However, as a bank it will be able to raise deposits and hence there will

52 Week High / Low

206 / 134

be reduction in cost of funds. As a result, spreads may not decline much which

in turn will help in maintaining the ROE & ROA which although could undergo

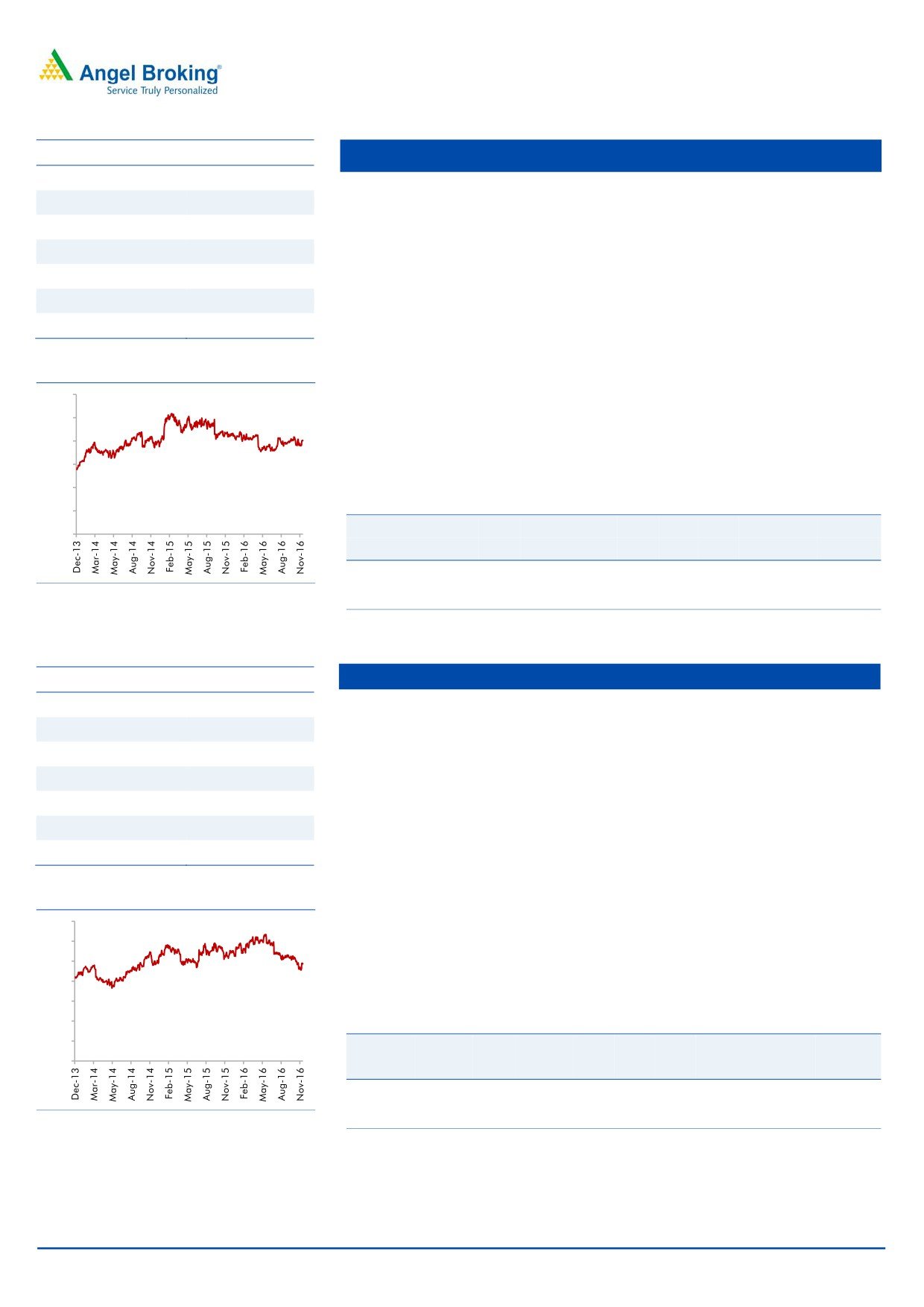

3 year-Chart

a marginal decline. Also we don’t expect any major deterioration in the asset

220

quality going ahead.

200

NIM likely to remain healthy: After conversion to SFB the company has started

180

raising deposits at a lower cost vs borrowings leading to better cost of funds.

160

Hence we expect the NIM to remain strong at ~10-11%, going ahead.

Outlook: We expect the company to post a strong loan book & earnings

140

CAGR of 38% & 37% over FY2016-18E. The stock currently trades at 2.1x

120

FY2018E ABV. We maintain Buy on the stock, with a target price of `235.

100

Key Financials

Y/E

Op. Inc NIM

PAT

EPS

ABV ROA ROE P/E P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

Source: Company, Angel Research

FY2017E

9,39

11.7

224

5.8

68.2

2.8

10.9

27.8

2.4

FY2018E

1,281

11.5

315

8.2

77.6

2.8

11.5

19.6

2.1

Source: Company, Angel Research

December 1, 2016

5

Top Picks Report | December 2016

Stock Info

Amara Raja Batteries

CMP

940

Amara Raja Batteries Ltd (ARBL) is the second largest lead acid storage battery

TP

1,167

manufacturer in the country. It has been outpacing market leader Exide (ARBL

Upside

24.1%

grew at a 21% CAGR over FY2010-16 as compared to standalone Exide's

growth of 7%), leading to its market share improving from 25% in FY10 to

Sector

Auto Ancillary

about 35% currently. ARBL's outperformance has been mainly on back of its

Market Cap (` cr)

16,060

association with global battery leader Johnson Controls Inc (which also holds

Beta

0.8

26% stake in ARBL) for manufacturing ducts.

52 Week High / Low

1,077 / 773

With the automotive OEMs following a policy of having multiple vendors and

with ARBL’s products enjoying a strong brand recall in the replacement

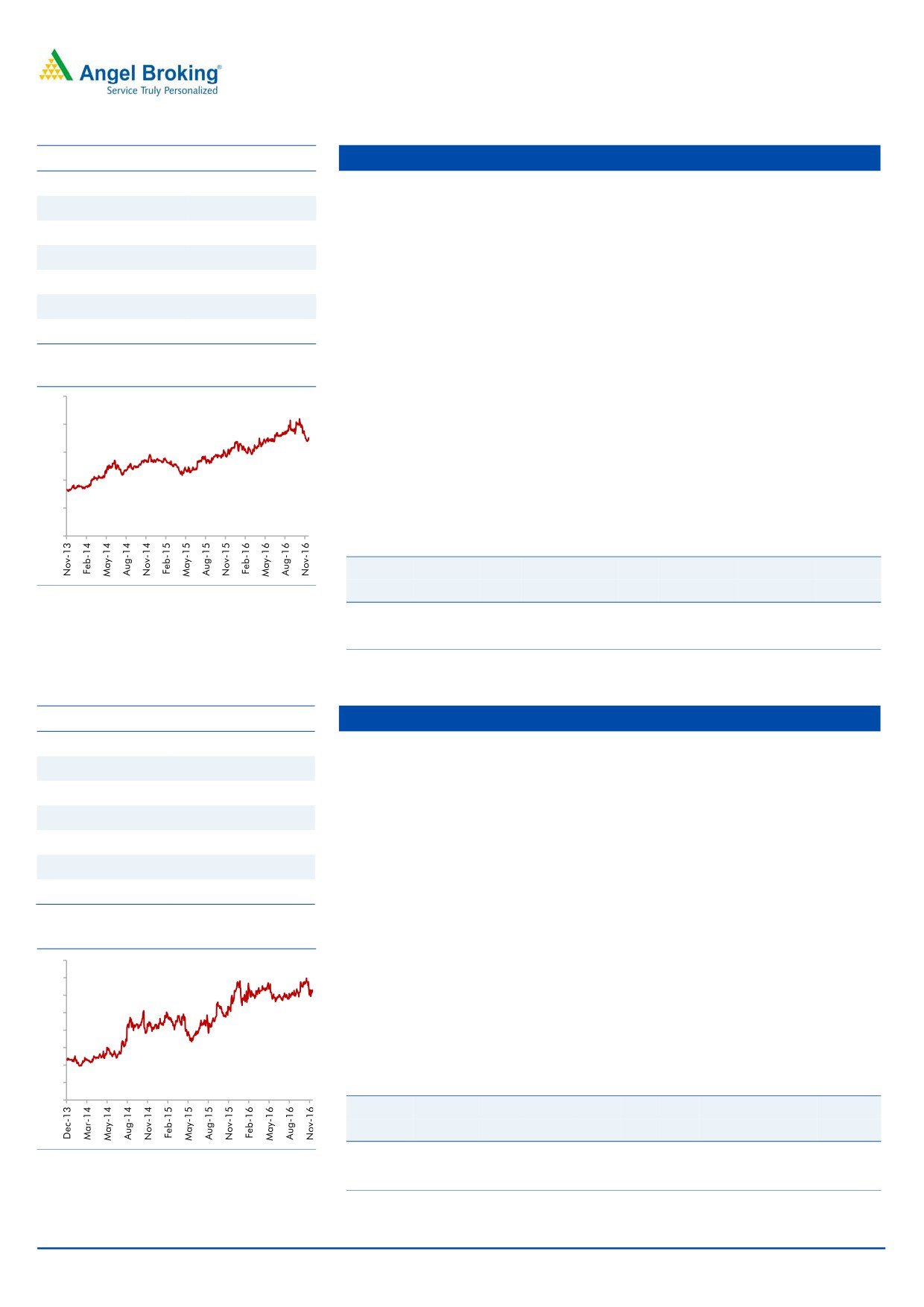

3 year-Chart

segment, the company is well poised to gain further market share. Given the

1,200

economic recovery and market share gains, the company is expected to grow at

a CAGR of 18% over the next two years as against industry growth of 10-12%.

1,000

800

ARBL is a well diversified auto ancillary player having presence across the

automotive and the industrial segment. It has a broad OEM as well as

600

replacement customer base. We believe ARBL is a high quality stock to play

400

the auto sector revival. We maintain our Buy rating on the stock.

200

Key Financials

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

5,504

17.6

571

33.4

22.1

28.1

6.2

16.5

4.7

Source: Company, Angel Research

FY2018E

6,605

17.5

699

40.9

22.0

23.0

5.0

13.7

3.8

Source: Company, Angel Research

Stock Info

Asian Granito

CMP

222

AGIL’s current, vitrified sales (35%) are lower as compared to its peers like

TP

351

Somany Ceramics (47%) and Kajaria Ceramics (61%). Recently, AGIL has

Upside

58.1%

launched various products in premium segment. Going forward, we expect

AGIL’s profit margin to improve due to increase in focus for higher vitrified

Sector

Ceramics

product sales, which is a high margin business.

Market Cap (` cr)

668

AGIL is continuously putting efforts to increase the B2C sales from the current

Beta

1.4

level (35% in FY16). It is expected to reach up to 50% in next 2-3 years on the

52 Week High / Low

304 / 109

back of various initiatives taken by AGIL to increase direct interaction with customers

like strengthening distribution network, participation in key trade exhibition, etc.

3 year-Chart

In July FY2016, AGIL acquired Artistique Ceramic which has a better margin

350

profile. Going forward, we expect the company to improve its operating

300

margin from 7.5% in FY16 (excluding merger) to 12-12.5% in coming

250

financial year. Artisique Ceramics has a contract with RAS GAS to supply

200

quality natural gas at a discounted rate of 50% to current market rate, which

150

would reduce the overall power & fuel cost of the company.

100

We expect AGIL to report a net revenue CAGR of ~9% to ~`1,182cr and net

50

profit CAGR of ~39% to `48cr over FY2016-18E. We have a Buy rating on

-

the stock and target price of `351.

Key Financials

Y/E

Sales OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

1,071

12.1

38

12.7

9.5

17.5

1.7

7.6

0.9

FY2018E

1,182

12.4

48

16.0

10.7

13.9

1.5

6.4

0.8

Source: Company, Angel Research

December 1, 2016

6

Top Picks Report | December 2016

Stock Info

Bajaj Electricals

CMP

223

The company is among the top 4 players in the consumer durables space

TP

274

across all its product categories (leader in small appliances; number-4 in fans

and lighting). It has a strong distribution reach with 4,000 distributors

Upside

22.9%

reaching out to 400,000 retailers.

Sector

Cons. Durable

In the 3 years preceding FY2016, the company’s E&P segment had been

Market Cap (` cr)

2,249

underperforming owing to cost overruns and delays in project executions.

Beta

0.9

However, the segment has turned around in FY2016 on the profitability front

52 Week High / Low

280 / 155

and delivered a healthy EBIT margin of ~6% for the year. Currently the

segment’s order book stands at `2,480cr.

3 year-Chart

With expectation of timely execution of new projects in the E&P segment and

400

with the Lighting and Consumer Durables segments expected to benefit from

350

an improvement in consumer sentiments going forward, we expect the

300

company’s top-line to grow at a CAGR of ~8% to `5,351cr and bottom-line to

250

grow at a CAGR of 20% to `138cr over FY2016-FY2018E. We recommend a

200

Buy rating on the stock.

150

100

Key Financials

50

Y/E

Sales OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

-

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

4,801

5.7

105

10.4

12.4

21.4

2.6

8.5

0.5

FY2018E

5,351

6.2

138

13.7

14.5

16.3

2.4

7.0

0.4

Source: Company, Angel Research

Source: Company, Angel Research

Stock Info

Blue Star

CMP

491

BSL is one of the largest air-conditioning companies in India. With a mere

TP

634

3% penetration level of ACs vs 25% in China, the overall outlook for the room

Upside

29.1%

air-conditioner (RAC) market in India is favourable.

Sector

Cons. Durable

BSL’s RAC business has been outgrowing the industry by ~10% points over the

Market Cap (` cr)

4,697

last few quarters, resulting in the company consistently increasing its market

share (~7% in FY2014 to 10.5% at present). This has resulted in the Cooling

Beta

0.6

Products Division (CPD)'s share in overall revenues increasing from~23% in

52 Week High / Low

581 / 306

FY2010 to ~42% in FY2016 (expected to improve to ~47% in FY2018E). With

strong brand equity and higher share in split ACs, we expect the CPD to

3 year-Chart

continue to drive growth.

700

Aided by increasing contribution from the CPD, we expect the overall top-line

600

to post a revenue CAGR of ~16% over FY2016-18E and margins to improve

500

from 5.3% in FY2015 to 7.3% in FY2018E. Moreover, the merger of Blue Star

400

Infotech has infused cash and strengthened the balance sheet. We have an

300

Accumulate recommendation on the stock.

200

100

Key Financials

-

Y/E

Sales OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

4,283

5.9

141

14.9

20.4

33.0

6.4

18.1

1.1

Source: Company, Angel Research

FY2018E

5,077

7.3

211

22.1

26.4

22.2

5.4

12.6

1.0

Source: Company, Angel Research

December 1, 2016

7

Top Picks Report | December 2016

Stock Info

Mirza International

CMP

81

In the branded domestic segment, we expect the company to report a ~21%

TP

107

CAGR over FY2016-18E to `258cr. We anticipate strong growth for the

Upside

32.1%

company on the back of (a) the company’s wide distribution reach through its

1,000+ outlets including 120 exclusive brand outlets (EBOs) in 35+ cities and

Sector

Footwear

the same are expected to reach 200 over the next 2-3 years and (b) strong

Market Cap (` cr)

973

branding (Red Tape) in the shoes segment.

Beta

1.5

MIL’s major export revenue comes from the UK (73%), followed by the US

52 Week High / Low

143 /69

(14%) and the balance from ROW. Export constitutes ~75% of the company’s

total revenue. We expect the company to report healthy growth over the next

2-3 years on back of recovery in the UK market, strong growth in the US market

3 year-Chart

and with it tapping newer international geographies like the Middle East countries.

160

140

In FY2016, the company acquired Genesis Footwear which has a better

120

margin profile than it. The deal resulted in MIL’s EPS increasing by ~4% and

100

ROE improving from 15.9% to 17.5%. Further, due to this merger, the

80

company’s capacity has increased from 5.4mn to 6.4mn units.

60

We expect MIL to report a net revenue CAGR of ~9% to ~`1,106cr and net

40

profit CAGR of ~9% to `92cr over FY2016-18E. We have a Buy rating on the

20

-

stock and target price of `107.

Key Financials

Y/E

Sales OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

987

18.0

79

6.5

15.9

12.4

2.0

6.6

1.2

FY2018E

1,106

18.0

92

7.6

15.7

10.6

1.7

5.9

1.1

Source: Company, Angel Research

Stock Info

Siyaram Silk Mills

CMP

1,250

SSML has strong brands which cater to premium as well as popular mass

TP

1,605

segments of the market. Further, SSML entered the ladies' salwar kameez and

Upside

28.4%

ethnic wear segment. Going forward, we believe that the company would be able to

Sector

Textile

leverage its brand equity and continue to post strong performance.

Market Cap (` cr)

1,172

The company has a nationwide network of about 1,600 dealers and business

partners. It has a retail network of 160 stores and plans to add another

Beta

0.8

300-350 stores going forward. Further, the company's brands are sold across

52 Week High / Low

1,690/925

3,00,000 multi brand outlets in the country.

Going forward, we expect SSML to report a net sales CAGR of ~10% to

3 year-Chart

~`1,948cr and adj.net profit CAGR of ~11% to `107cr over FY2016-18E on

1,800

back of market leadership in blended fabrics, strong brand building, wide

1,600

distribution channel, strong presence in tier II and tier III cities and emphasis

1,400

1,200

on latest designs and affordable pricing points. At the current market price,

1,000

SSML trades at an inexpensive valuation. We have a buy recommendation on

800

the stock and target price of `1,605.

600

400

Key Financials

200

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

1,733

11.6

91

96.6

15.3

12.9

2.0

7.5

0.9

Source: Company, Angel Research

FY2018E

1,948

11.7

107

114.7

15.7

10.9

1.7

7.6

0.8

Source: Company, Angel Research

December 1, 2016

8

Top Picks Report | December 2016

Stock Info

HCL Technologies

CMP

803

Healthy pipeline: Company’s engineering services has been seeing lumpy

TP

1,000

growth over the last few quarters. This is however largely a function of the

Upside

24.5%

timing of large transformational deals. 6-8 of the large deals signed a few

Sector

IT

quarters ago will aid the company to continue to post industry leading growth.

Market Cap (` cr)

1,13,255

We expect HCL Tech to post a USD and INR revenue CAGR of 16.3% and

Beta

0.6

18.0%, respectively, over FY2016-18E (inclusive of the acquisition of

52 Week High / Low

890 / 707

Geometric Software and the Volvo deal).

Robust outlook: For FY2017 revenues are expected to grow between 12.0-

3 year-Chart

14.0% in CC. Revenue guidance is based on FY2016 (April to March’2016)

1,200

average exchange rates. The above constant currency guidance translates to

1,000

11.2% to 13.2% growth in US$ terms.

800

Outlook and Valuations: The stock is attractively valued at the current market

600

price and hence we maintain our Buy with a price target of `1,000.

400

Key Financials

200

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

-

June

(`cr)

(%)

(`cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

49,242

20.5

7,862

55.7

20.3

14.9

3.0

9.2

1.9

Source: Company, Angel Research

FY2018E

57,168

20.5

9,037

64.1

17.9

13.0

2.3

7.0

1.4

Source: Company, Angel Research

Stock Info

Infosys

CMP

975

Revenue guidance for FY17: The Management has lowered its guidance for

TP

1,249

FY2017, to 8-9% in CC terms and 9.2-10.2% in INR terms (exchange rate as

Upside

28.1%

on March 31, 2016). For FY2016, the company posted a 13.3% growth in CC

Sector

IT

terms V/s a guidance of 12.8-13.2% growth (in CC). We expect the company

Market Cap (` cr)

2,24,056

to post ~9.0% USD revenue growth in FY2017.

Beta

0.8

Aims to be US$20bn company by FY20: Company expects its revenue to rise

52 Week High / Low

1,278 / 900

to US$20bn by FY2020, up from US$8.7bn in FY2015, as it focuses on

acquisitions and winning more new technology services, implying a

3 year-Chart

14% CAGR over the period. Over the near term, we expect Infosys to post a

1,400

9.0% USD revenue growth in FY2017. Over FY2016-18E, we expect

1,200

USD and INR revenue to grow at a CAGR of 9.0% and 9.5%, respectively.

1,000

Outlook and Valuations: The stock trades at a valuation of 14.1x FY2018E

800

earnings. We recommend Buy on the stock with a price target of `1,249.

600

400

Key Financials

200

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

-

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

68,350

27.0

14,354

62.5

21.3

15.7

3.3

10.8

2.9

FY2018E

77,236

27.0

15,928

69.4

21.6

14.1

3.1

9.4

2.5

Source: Company, Angel Research

Source: Company, Angel Research

December 1, 2016

9

Top Picks Report | December 2016

Stock Info

Jagran Prakashan

CMP

176

We expect JPL to register a net sales CAGR of ~12% over FY2016-18E, on

TP

225

back of (a) strong growth in advertising revenue due to improvement in GDP

Upside

27.8%

growth, and (b) improvement in circulation revenue owing to combination of

Sector

Media

increase in cover price and volume growth.

Market Cap (` cr)

5,744

Further the acquisition of Radio City would also boost the company's revenue

going ahead. Radio City has ~20 stations across 7 states in the country and is

Beta

0.6

second only to ENIL in all its operating circles, ie Delhi, Mumbai, Bengaluru,

52 Week High / Low

213/144

Chennai, Ahmedabad, Hyderabad, Pune and Lucknow. The company covers

~51% (~66mn people) of the total radio population.

3 year-Chart

Raw material prices have been in a declining trend. Thus, considering lower

250

news print costs, healthy sales, and higher margins in the radio business, we

200

expect an adj. net profit CAGR of ~12% over FY2016-18E to `409cr.

150

Considering Dainik Jagran's strong presence in the rapidly growing Hindi

markets, we expect JPL to benefit from an eventual recovery in the Indian

100

economy. Hence, we maintain a Buy rating on the stock with a target price of

50

`225.

-

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

Source: Company, Angel Research

FY2017E

2,355

28.0

353

10.8

21.7

16.3

3.5

8.7

2.5

FY2018E

2,635

28.0

409

12.5

21.7

14.1

3.1

7.6

2.2

Source: Company, Angel Research

Stock Info

TV Today Network

CMP

315

TTNL enjoys a strong viewership ranking in the Hindi and English news

TP

385

channel categories. The company’s Hindi news channel - Aaj Tak has

Upside

22.2%

maintained its market leadership position occupying the No.1 rank for several

Sector

Media

consecutive years in terms of viewership. Its English news channel - India

Today too has been continuously gaining viewership; it has now captured the

Market Cap (` cr)

1,882

No. 2 ranking from No. 4 earlier. Its other channels like Dilli Aaj Tak and Tez

Beta

1.3

are also popular among viewers.

52 Week High / Low

360 /260

Out of the 7 radio stations, TTNL has sold off 4 (Jodhpur, Amritsar, Patiala

and Shimla) for `4cr. The remaining 3 stations are in the process of getting

3 year-Chart

sold off to ENIL but the sale will have to wait until concerns raised by the MIB

400

are resolved. Going forward, we expect them to be sold off and this would

350

prop up the company’s profitability.

300

250

We expect TTNL to report a net revenue CAGR of ~16% to ~`743cr and net

200

profit CAGR of ~16% to `128cr over FY2016-18E. We have an Accumulate

150

recommendation on the stock and target price of `385

100

50

Key Financials

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

637

27.5

110

18.4

17.4

17.2

3.0

9.3

2.6

Source: Company, Angel Research

FY2018E

743

27.5

128

21.4

17.2

14.8

2.5

7.6

2.1

Source: Company, Angel Research

December 1, 2016

10

Top Picks Report | December 2016

Stock Info

Larsen & Toubro

CMP

1,383

L&T’s, order backlog remains robust at `2.5trn (2.5x of FY16 revenues) of

TP

1,634

which 29.0% is international order backlog. It’s consolidated order inflow

Upside

18.1%

increased by 8.7% yoy to `311bn due to higher domestic order inflows in

2QFY17. Domestic and international orders accounted for 76.3% and 23.7%

Sector

Infrastructure

respectively in the inflows. Order growth was mainly from domestic

Market Cap (` cr)

1,28,855

infrastructure and international hydrocarbon segment.

Beta

1.4

L&T has maintained its guidance of (a) 15% growth in consolidated order

52 Week High / Low

1,615 / 1,017

inflows; (b) a 12-15% rise in consolidated revenues; and (c) up to a 50bps

improvement in EBITDA margins in core engineering. However, management

3 year-Chart

acknowledged is uncertain of the impact of currency de-monetization at

2,000

present. L&T’s order book has ~6% exposure to the high-end realty space.

1,800

1,600

Going forward we expect the company to report healthy top-line and bottom-

1,400

line growth on the back of execution of domestic orders. L&T’s order prospects

1,200

1,000

continue to remain strong. We are of the view that L&T is a proxy play for

800

investors wanting to ride on Indian infrastructure growth story. We recommend

600

400

a Buy on the stock with Target Price of `1,634.

200

Key Financials

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

1,11,017

11.0

5,691

61.1

13.1

22.6

2.7

7.2

2.2

Source: Company, Angel Research

FY2018E

1,24,908

11.0

6,216

66.7

13.0

20.7

2.5

6.6

2.0

Source: Company, Angel Research

Stock Info

Mahindra Lifespace

CMP

377

MLF has 13 projects under implementation across cities. MLF has exhibited

TP

522

fast completion of projects compared to others. Sales cycle in ~65% of

Upside

28.5%

projects is faster than execution cycle, contrary to industry trends. This fast

execution and sales is optimal, as it helps MLF in revenue recognition,

Sector

Real Estate

inventory cycle (better than Oberoi, DLF), cash flows and profitability. This

Market Cap (` cr)

1,547

translates in creating a virtuous cycle of continuous fast growth.

Beta

0.4

MLF as of 4QFY2016 is pursuing ~4.0mn sq. ft. of sale of the total ~15.0mn

52 Week High / Low

500 / 343

sq. ft. of saleable area. Having sold ~60% of ongoing projects, we expect MLF

to launch ~2.8mn sq.ft. of saleable area in rational way during 4QFY2016-

3 year-Chart

2QFY2018E, across 6 cities. Maturity at existing projects, new launches give better

700

revenue visibility for medium-term. Further, MLF is sitting on land bank of 11.0mn

600

sq.ft across 4 cities, which allays any concern over long-term revenue growth.

500

With Real Estate Regulatory Bill closer to reality, MLF should be minimally

400

impacted, given their strong parentage and ethically implemented processes.

300

In the longer-term organized, professionally run, well funded players would

200

enjoy strong trust due to their reliable and fast execution strategies. With

100

improvement in company’s fundamentals, strong earnings growth visibility

-

and long-term growth outlook, at current valuations of 1.1x FY2017E P/BV,

MLF looks attractive. We maintain BUY on MLF with target price of `522.

Key Financials

Source: Company, Angel Research

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

1,152

22.7

75

29.9

7.6

12.6

0.9

14.7

2.1

FY2018E

1,300

24.6

138

35.8

8.6

10.5

0.9

9.1

1.7

Source: Company, Angel Research

December 1, 2016

11

Top Picks Report | December 2016

Stock Info

Navkar

CMP

175

NCL is one of the largest and one of the three CFS at JNPT with rail

TP

265

connectivity, helping it garner high market share at the port. NCL is in a massive

Upside

51.4%

expansion mode where it is increasing its capacity by 234% to 1,036,889 TEUs

Sector

Logistics

at JNPT and coming up with an ICD at Vapi (with Logistics Park).

Market Cap (` cr)

2,893

The ICD with rail link should benefit from first mover advantage in a region

Beta

0.6

that has huge market potential and accounts for ~27% of volumes at JNPT.

52 Week High / Low

224 / 151

The ICD should be able to capture the EXIM volumes from the region through

rail link that till now was being custom cleared at JNPT (Import) or being

3 year-Chart

transported via road and consolidated at JNPT (Export). South Gujarat

250

volumes will now head straight to the Vapi ICD; thus the company can now

200

cater to bulk commodities and domestic traffic that it had been rejecting owing

to capacity constraints at CFS.

150

We expect NCL to successfully use its rail advantage and scale up its

100

utilizations at both JNPT and Vapi ICD. We have a Buy rating on the stock.

50

Key Financials

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

369

42.9

103

7.2

7.3

24.2

1.8

17.9

8.0

Source: Company, Angel Research

FY2018E

561

42.3

164

11.5

10.5

15.2

1.6

11.9

5.3

Source: Company, Angel Research

Stock Info

Power Grid Corporation

CMP

192

During the 1HFY2017, the company has already capitalized assets worth

TP

223

`120bn and is on track to achieve the capitalization guidance of `280bn-

Upside

16.2%

300bn for the full year. During the year, PGCIL has already commissioned

Sector

Power

pole-2 of the Assam-Agra HVDC line and is likely to commission its poles - 3

& 4, in addition to the `65bn Champa - Kurukshetra HVDC project, `19bn

Market Cap (` cr)

1,00,447

Srikakulam - Angul line and `36bn Wardha - Nizamabad line. Based on

Beta

0.71

status of pipeline of projects, we expect commissioning to be strong in rest of

52 Week High / Low

194 / 127

the year.

During the 1HFY2017, the total order awarded was `181bn. Total order size

3 year-Chart

to be awarded over next 18 months is ~ `330bn which indicates its healthy

250

prospects.

200

Going forward, we expect the company to report strong top-line CAGR of

150

~16% and bottom-line CAGR of ~19% on back of strong capitalization

guidance. We recommend a Buy on the stock with Target Price of `223.

100

50

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

-

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

25,315

88.2

7,405

14.2

15.2

13.6

2.1

9.8

8.6

Source: Company, Angel Research

FY2018E

29,193

88.7

8,979

17.2

16.1

11.2

1.8

8.7

7.7

Source: Company, Angel Research

December 1, 2016

12

Top Picks Report | December 2016

Stock Info

Alkem Leboratories

CMP

1,700

Alkem is 5th largest pharma company is the domestic market. It has presence

TP

1,989

in India, US and a few other countries. The 73% of its revenues come from the

Upside

17.0%

Indian markets while 20% come from the US and rest from the other countries.

The company has leadership position in the anti infective segment in India and

Sector

Pharma

it is ranked as no. 3 in Gastro-Intestinal and Pain/Analgesics segments.

Market Cap (` cr)

20,314

Overall it holds 3.6% market share in the domestic formulations business and

Beta

0.25

7.9% share in in overall prescriptions in country.

52 Week High / Low

1,853/ 1,175

In the domestic market, company operates in acute and chronic segments. It is

a prominent player in acute segment but still an entrant in chronic segment. It

3 year-Chart

has aggressively hired sales force in last three years to increase its sales from

2,000

chronic segment. Alkem has a strong track record of growth in the domestic

1,500

market which is likely to continue. In the US, company is focusing on

monetization of its ANDA pipeline. As of September 2016, company has a

1,000

pipeline of 76 ANDAs of which 34 are approved. Company expects to launch

~7-8 ANDAs each year and expects to improve the filing rate as well. Overall

500

US revenues are expected to grow at ~25% growth rate.

-

Overall outlook remains strong with 17.6% CAGR in the topline and 22.3%

CAGR in the bottom-line. We have a Buy rating on the stock.

Key Financials

Source: Company, Angel Research

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

6,043

18.7

962

80.5

22.3

21.1

4.7

17.6

3.3

FY2018E

6,893

19.3

1,062

88.8

20.3

19.1

3.9

14.8

2.8

Source: Company, Angel Research

Stock Info

Lupin

CMP

1,503

Lupin is the fastest growing company among the top 5 companies in domestic

TP

1,809

formulation space, registering a CAGR of 20.0% vs. market growth of ~13-

Upside

20.3%

14%. Six of Lupin's products are among the top 300 brands in the country.

Sector

Pharma

In US market, Lupin is currently the 5th largest generic player with 5.3% market

Market Cap (` cr)

67,770

share in prescriptions. Lupin has total 338 ANDA filings, of which 196 have

Beta

0.77

been approved, with 45 FTFs valued at more than US$13bn. Lupin plans to

launch 25-30 products in the US in FY2017. We expect a CAGR of 22.9% in

52 Week High / Low

1,912 / 1,294

US market during FY2016-18E on back of new product launches.

3 year-Chart

Lupin figures among the few Indian companies with a formidable presence in

2,500

Japan, the world’s second largest pharma market. Management believes that

there will be patent expiries of ~US$14-16bn in next two years in the

2,000

Japanese market, which along with increased generic penetration would drive

1,500

growth in the market. The Management expects improvement in growth in the

1,000

next 3-4 years. We recommend to buy this stock with price target of `1,809.

500

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

-

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

15,912

26.4

2,611

58.1

21.4

25.9

5.0

16.4

4.3

Source: Company, Angel Research

FY2018E

18,644

26.7

3,117

69.3

20.9

21.7

4.1

13.3

3.6

Source: Company, Angel Research

December 1, 2016

13

Top Picks Report | December 2016

Macro watch

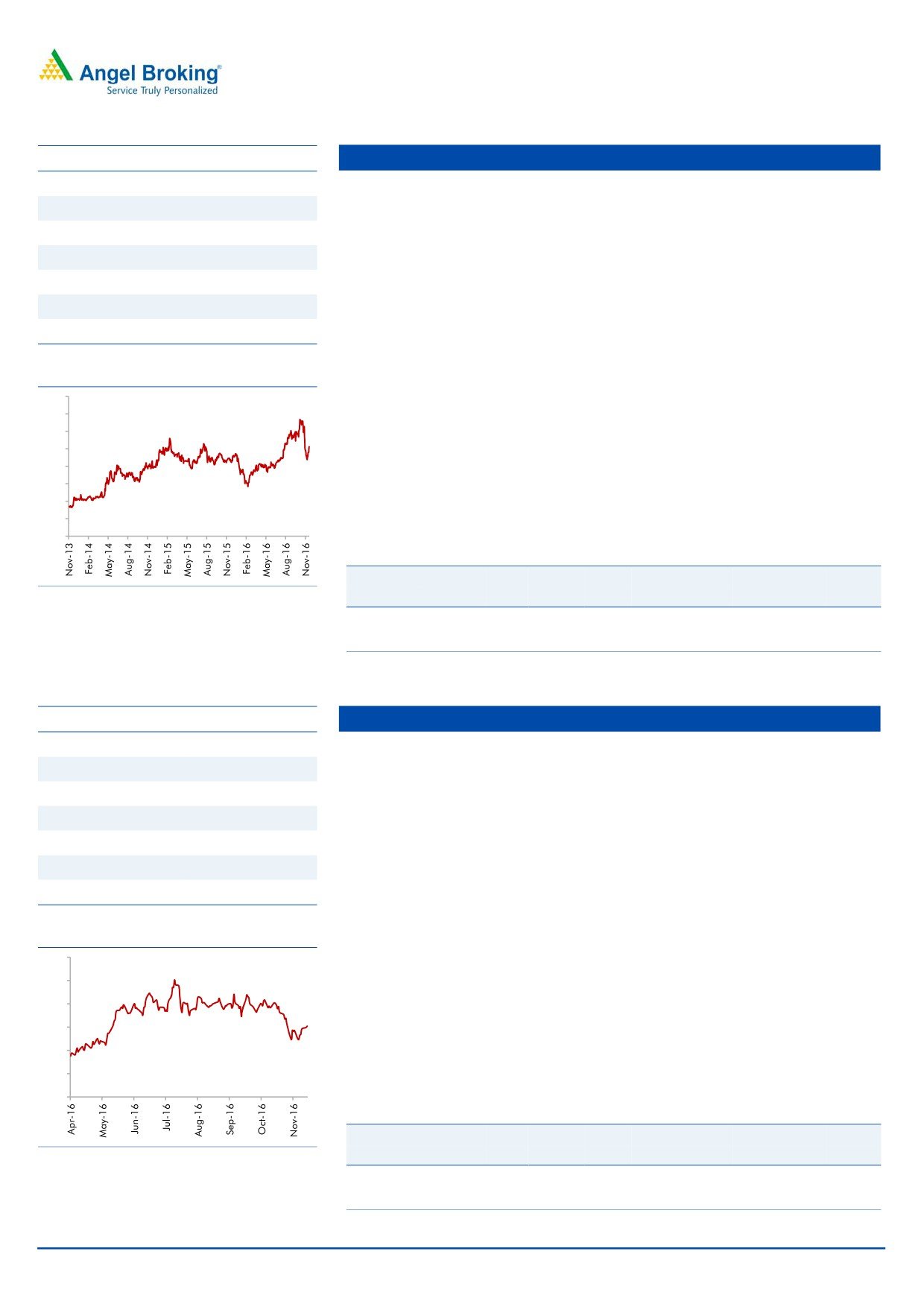

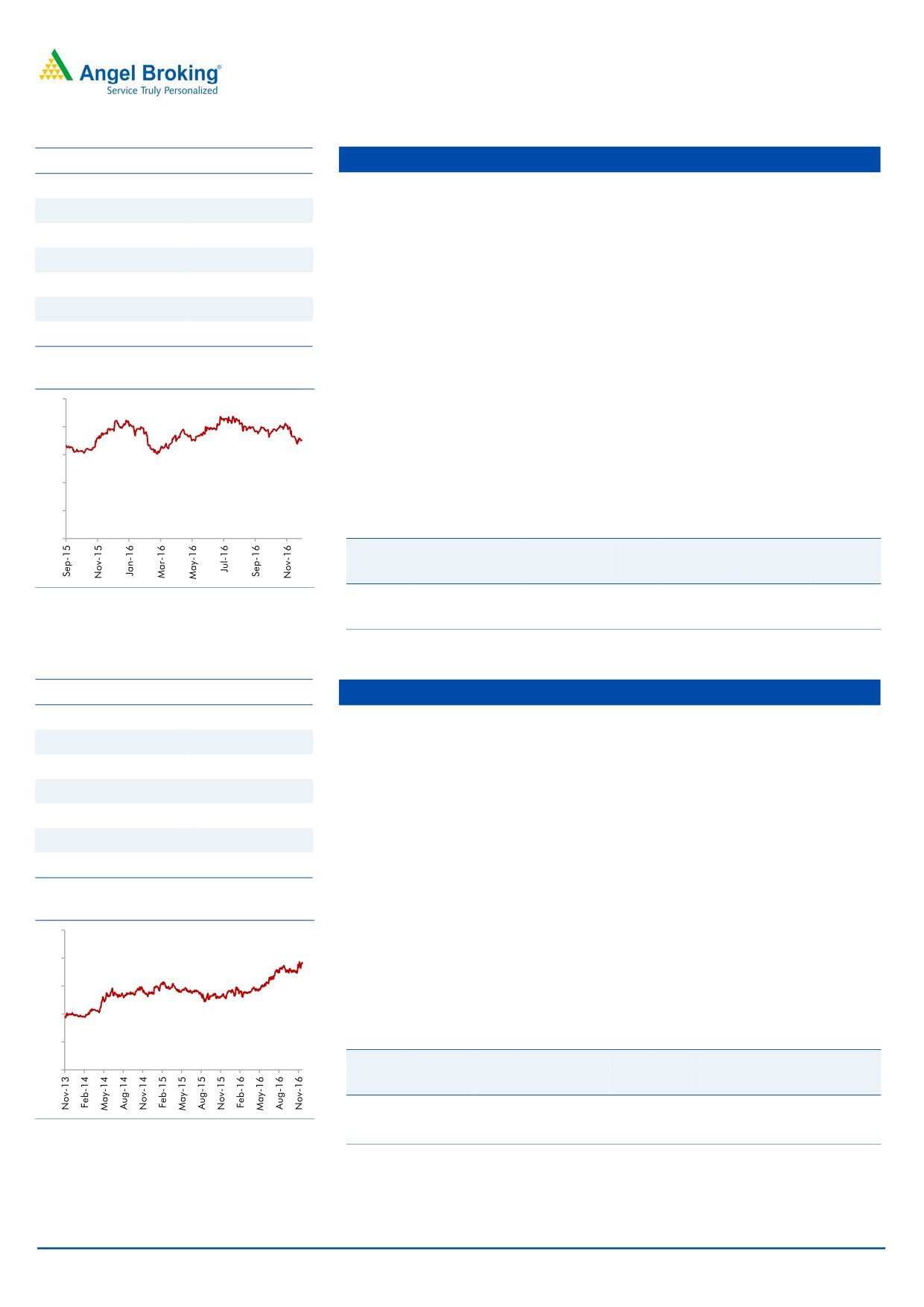

Exhibit 2: Quarterly GDP trends

Exhibit 3: IIP trends

(%)

(%)

9.0

8.3

3.0

2.2

7.9

1.9

7.8

8.0

7.5

7.5

7.6

2.0

1.3

7.2

7.1

0.7

6.6

6.7

1.0

0.3

7.0

6.4

5.8

-

6.0

(1.0)

5.0

(0.7)

(0.9)

(2.0)

(1.3)

(1.6)

4.0

(3.0)

(2.5)

3.0

(4.0)

(3.4)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 4: Monthly CPI inflation trends

Exhibit 5: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

55.0

7.0

6.1

5.6

5.7

5.8

5.8

54.0

5.4

5.5

6.0

5.3

4.8

5.1

53.0

5.0

4.4

4.2

52.0

4.0

51.0

50.0

3.0

49.0

2.0

48.0

1.0

47.0

-

46.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

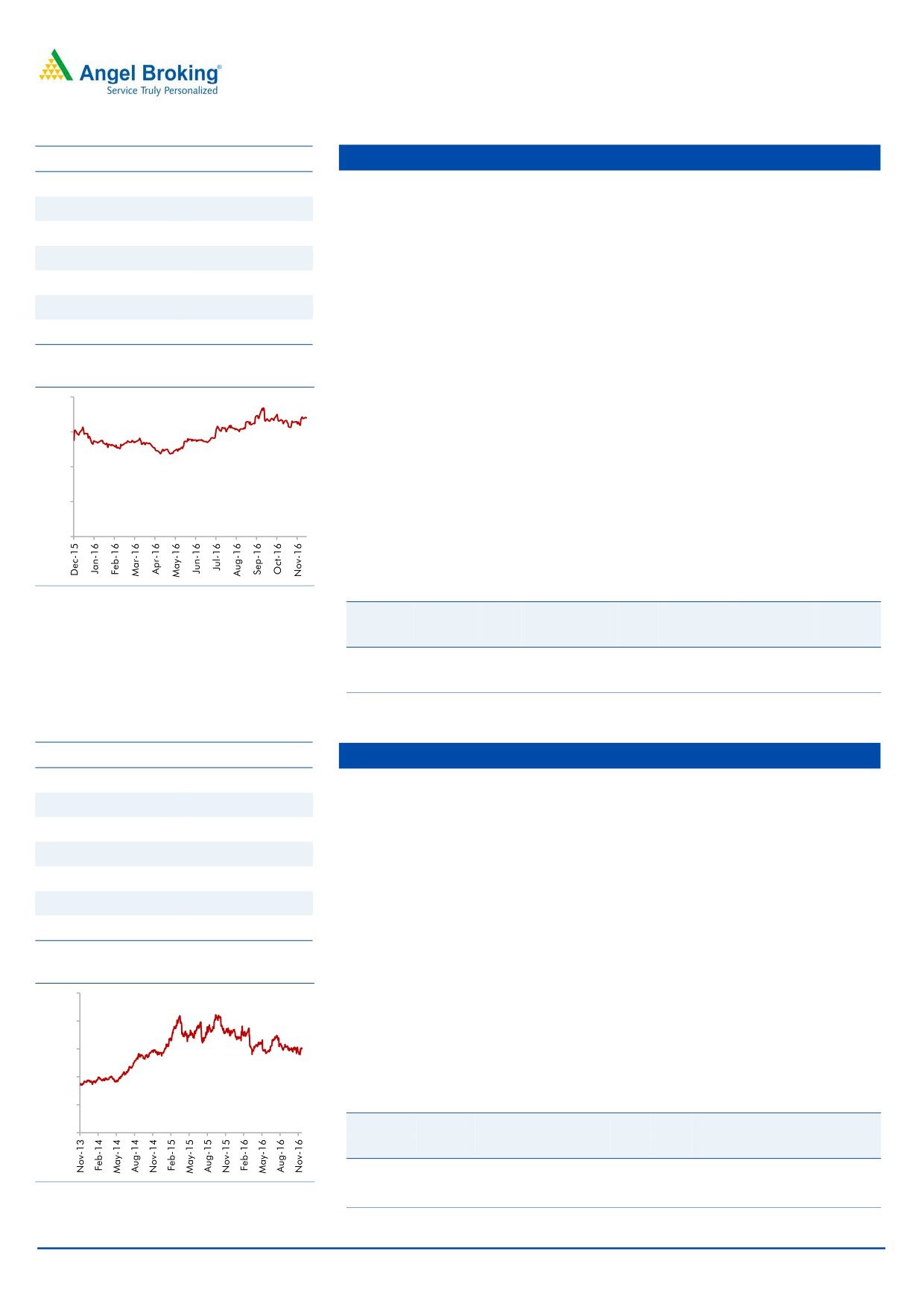

Exhibit 6: Exports and imports growth trends

Exhibit 7: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

15.0

7.00

10.0

6.50

5.0

6.00

0.0

(5.0)

5.50

(10.0)

5.00

(15.0)

4.50

(20.0)

4.00

(25.0)

3.50

(30.0)

(35.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

December 1, 2016

14

Top Picks Report | December 2016

Global watch

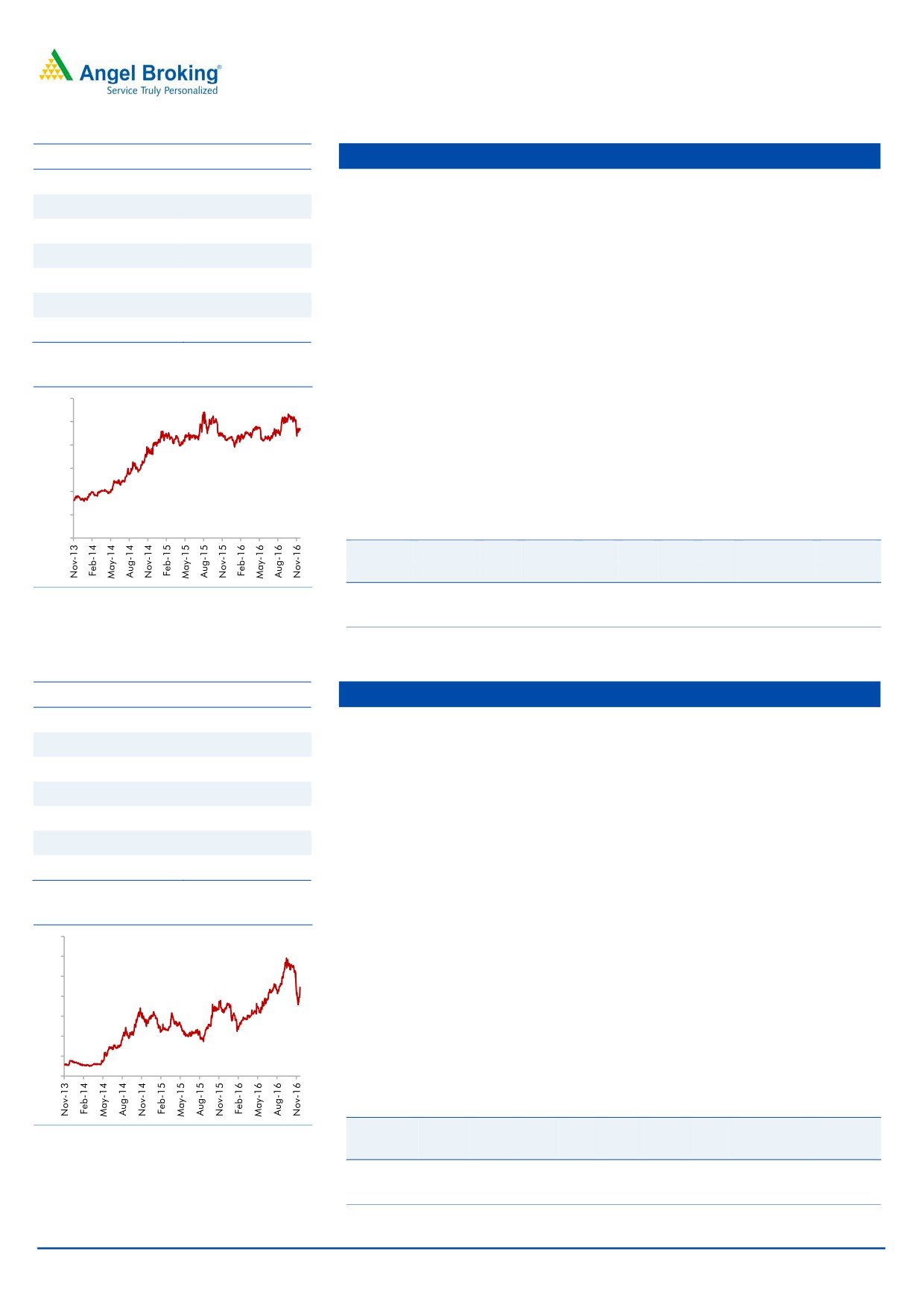

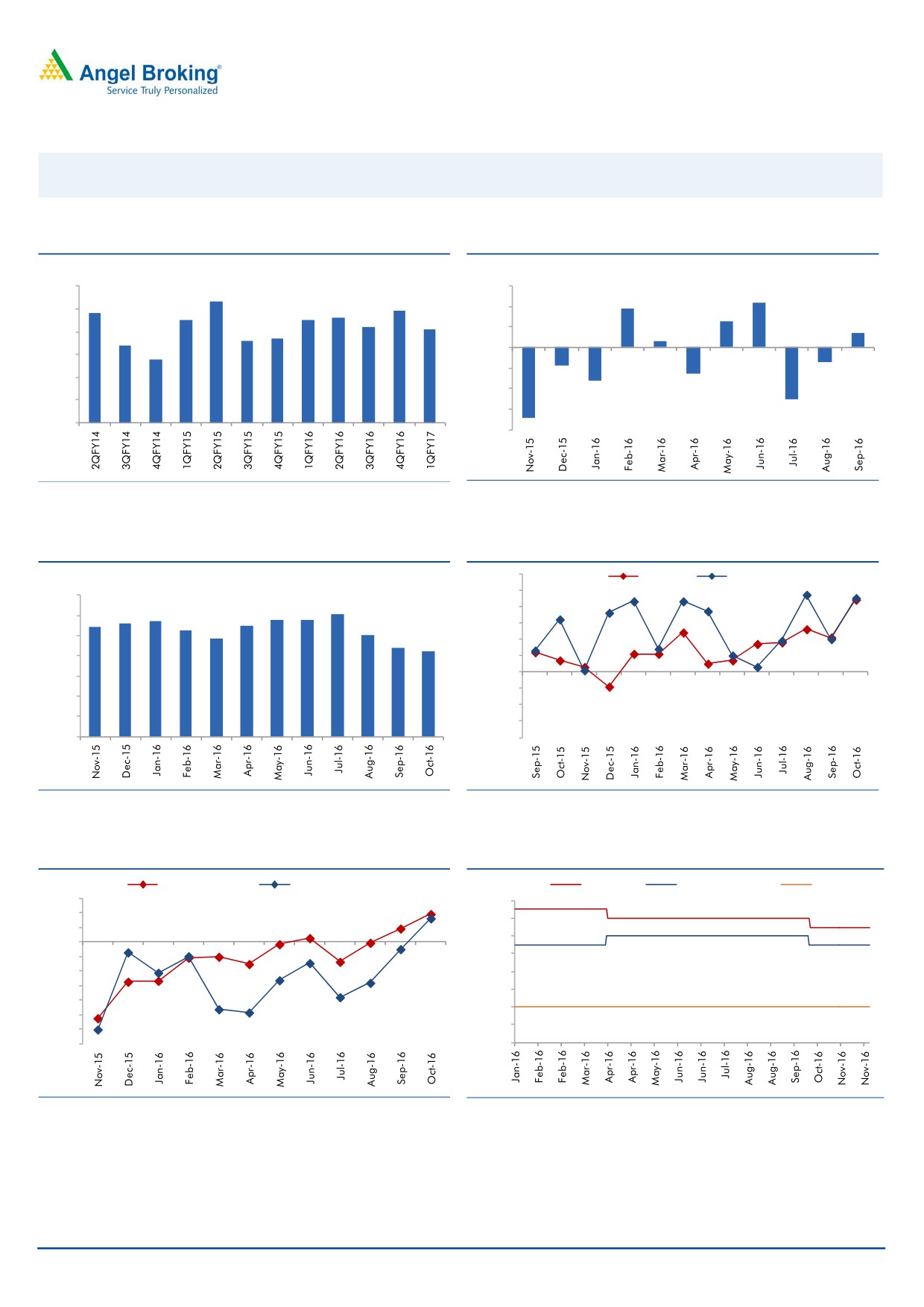

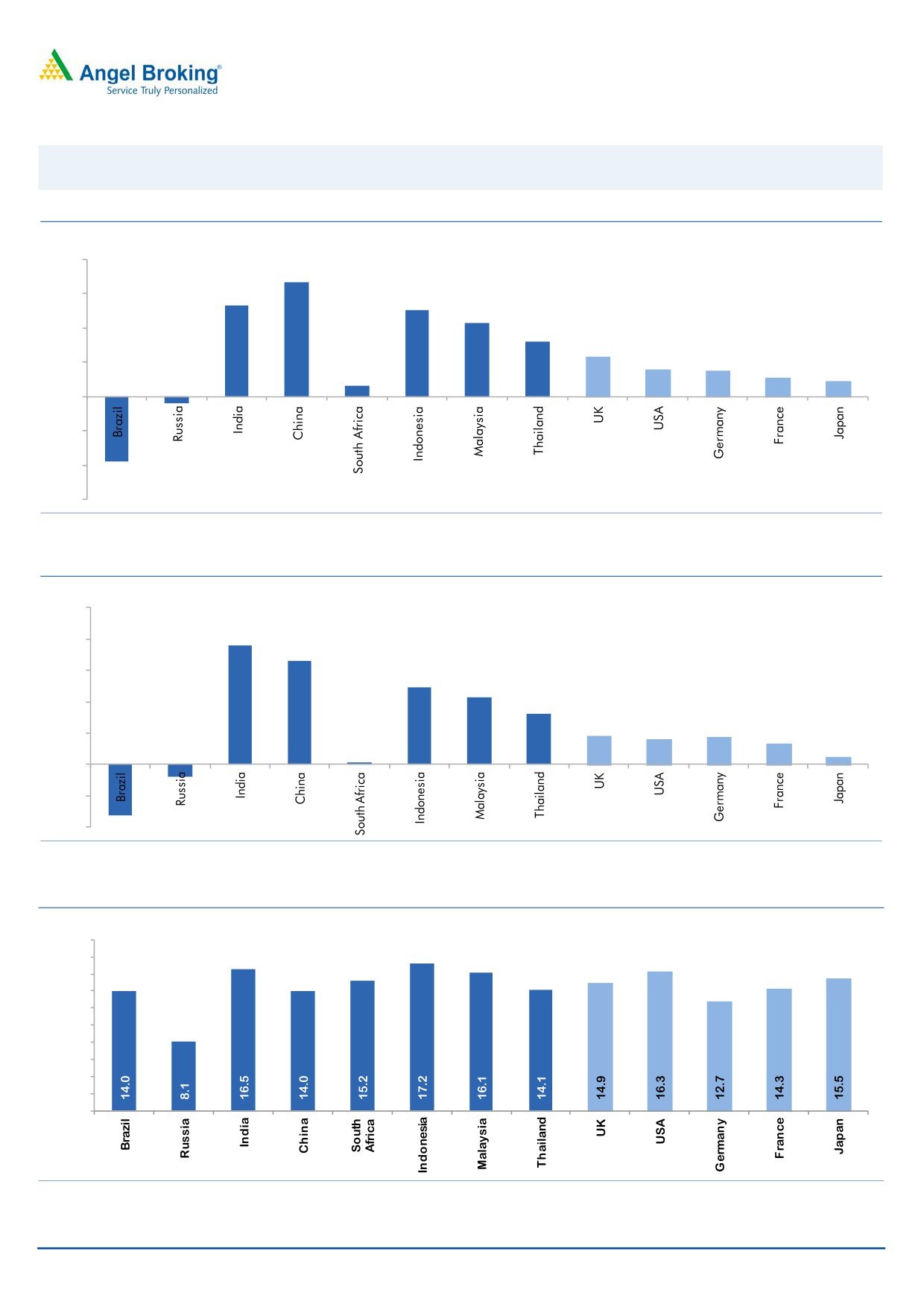

Exhibit 8: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.7

6.0

5.3

0.6

5.0

4.3

4.0

3.2

2.3

1.6

1.5

2.0

1.1

0.9

-

(2.0)

(0.4)

(4.0)

(3.8)

(6.0)

Source: Bloomberg, Angel Research

Exhibit 9: 2016 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

10.0

7.6

8.0

6.6

6.0

4.9

4.3

4.0

3.2

1.8

1.6

1.7

2.0

1.3

(0.8)

0.5

(3.3)

0.1

-

(2.0)

(4.0)

Source: IMF, Angel Research

Exhibit 10: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

December 1, 2016

15

Top Picks Report | December 2016

Exhibit 11: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

61,906

(3.6)

7.3

32.1

Russia

Micex

2,105

6.2

6.8

18.9

India

Nifty

8,225

(4.8)

(4.3)

4.8

China

Shanghai Composite

3,250

4.7

5.9

(9.5)

South Africa

Top 40

43,691

(0.7)

(5.4)

(5.7)

Mexico

Mexbol

45,316

(5.8)

(4.8)

4.4

Indonesia

LQ45

857

(6.1)

(5.1)

11.4

Malaysia

KLCI

1,619

(3.2)

(3.8)

(3.5)

Thailand

SET 50

943

0.7

(4.1)

6.1

USA

Dow Jones

19,124

5.3

3.6

7.9

UK

FTSE

6,784

(2.5)

0.6

8.1

Japan

Nikkei

18,308

5.6

10.6

(7.8)

Germany

DAX

10,640

(0.2)

0.4

(1.4)

France

CAC

4,578

1.5

3.1

(1.3)

Source: Bloomberg, Angel Research

December 1, 2016

16

Top Picks Report | December 2016

Stock Watch

December 1, 2016

17

Stock Watch | December 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Agri / Agri Chemical

Rallis

Neutral

204

-

3,967

1,937

2,164

13.3

14.3

9.0

11.0

22.7

18.5

3.9

3.4

18.4

19.8

2.1

1.8

United Phosphorus

Accumulate

633

684

32,111

15,176

17,604

18.5

18.5

37.4

44.6

16.9

14.2

3.3

2.7

21.4

21.2

2.2

1.9

Auto & Auto Ancillary

Amara Raja Batteries

Buy

940

1,167

16,060

5,504

6,605

17.6

17.5

33.4

40.9

28.1

23.0

6.2

5.0

22.1

22.0

2.9

2.4

Apollo Tyres

Buy

191

235

9,725

12,877

14,504

14.3

13.9

21.4

23.0

8.9

8.3

1.4

1.2

16.4

15.2

0.9

0.9

Ashok Leyland

Buy

80

111

22,639

22,407

26,022

10.6

10.6

5.2

6.4

15.2

12.4

3.4

2.9

23.6

24.7

1.1

0.9

Bajaj Auto

Neutral

2,684

-

77,659

25,093

27,891

19.5

19.2

143.9

162.5

18.6

16.5

5.2

4.5

30.3

29.3

2.8

2.5

Bharat Forge

Neutral

905

-

21,059

7,726

8,713

20.5

21.2

35.3

42.7

25.6

21.2

4.7

4.3

18.9

20.1

2.8

2.4

Ceat

Accumulate

1,280

1,450

5,176

7,524

8,624

13.0

12.7

131.1

144.3

9.8

8.9

1.8

1.5

19.8

18.6

0.8

0.7

Eicher Motors

Neutral

21,620

-

58,722

16,583

20,447

17.5

18.0

598.0

745.2

36.2

29.0

12.4

9.4

41.2

38.3

3.4

2.7

Exide Industries

Neutral

181

-

15,389

7,439

8,307

15.0

15.0

8.1

9.3

22.4

19.5

3.1

2.8

14.3

16.7

1.7

1.5

Gabriel India

Buy

110

130

1,579

1,544

1,715

9.0

9.3

5.4

6.3

20.4

17.4

3.8

3.4

18.9

19.5

1.0

0.9

Hero Motocorp

Accumulate

3,169

3,541

63,281

30,958

34,139

15.7

15.7

193.6

208.3

16.4

15.2

6.4

5.3

34.2

30.5

1.9

1.7

Indag Rubber

Neutral

186

-

487

286

326

19.8

16.8

11.7

13.3

15.9

13.9

2.7

2.5

17.8

17.1

1.4

1.2

Jamna Auto Industries Neutral

178

-

1,423

1,486

1,620

9.8

9.9

15.0

17.2

11.9

10.4

2.6

2.2

21.8

21.3

1.0

0.9

JK Tyres

Neutral

122

-

2,764

7,455

8,056

15.0

15.0

21.8

24.5

5.6

5.0

1.2

1.0

22.8

21.3

0.5

0.4

L G Balakrishnan & Bros Neutral

615

-

965

1,302

1,432

11.6

11.9

43.7

53.0

14.1

11.6

2.0

1.8

13.8

14.2

0.8

0.8

Mahindra and Mahindra Neutral

1,186

-

73,658

46,534

53,077

11.6

11.7

67.3

78.1

17.6

15.2

2.9

2.5

15.4

15.8

1.6

1.3

Maruti

Accumulate

5,263

6,006

158,998

68,057

82,958

15.8

15.5

212.1

261.2

24.8

20.2

4.9

4.1

19.8

20.3

2.0

1.6

Minda Industries

Neutral

307

-

2,431

2,728

3,042

9.0

9.1

68.2

86.2

4.5

3.6

1.0

0.8

23.8

24.3

0.9

0.8

Motherson Sumi

Neutral

309

-

43,414

45,896

53,687

7.8

8.2

13.0

16.1

23.7

19.2

7.6

6.1

34.7

35.4

1.0

0.8

Rane Brake Lining

Neutral

974

-

771

511

562

11.3

11.5

28.1

30.9

34.7

31.5

5.3

4.8

15.3

15.0

1.6

1.5

Setco Automotive

Neutral

39

-

518

741

837

13.0

13.0

15.2

17.0

2.6

2.3

0.4

0.4

15.8

16.3

1.1

1.0

Subros

Neutral

172

-

1,032

1,488

1,681

11.7

11.9

6.4

7.2

26.9

24.0

2.8

2.6

10.8

11.4

0.9

0.8

Swaraj Engines

Neutral

1,327

-

1,648

660

810

15.2

16.4

54.5

72.8

24.4

18.2

7.6

6.9

31.5

39.2

2.3

1.9

Tata Motors

Neutral

459

-

132,624

300,209

338,549

8.9

8.4

42.7

54.2

10.8

8.5

1.7

1.5

15.6

17.2

0.6

0.5

TVS Motor

Neutral

372

-

17,676

13,390

15,948

6.9

7.1

12.8

16.5

29.2

22.5

7.3

5.7

26.3

27.2

1.4

1.1

Banking

Axis BaAxis Bank

Buy

470

630

112,118

46,932

53,575

3.5

3.4

32.3

44.6

14.5

10.5

1.9

1.62

13.6

16.5

-

-

Bank of Baroda

Neutral

164

-

37,846

19,980

23,178

1.8

1.8

11.5

17.3

14.3

9.5

1.6

1.3

8.3

10.1

-

-

Canara Bank

Neutral

318

-

17,278

15,225

16,836

1.8

1.8

14.5

28.0

21.9

11.4

1.5

1.2

5.8

8.5

-

-

Dewan Housing Finance Buy

257

350

8,029

2,225

2,688

2.9

2.9

29.7

34.6

8.6

7.4

1.4

1.2

16.1

16.8

-

-

Equitas Holdings

Buy

161

235

5,388

939

1,281

11.7

11.5

5.8

8.2

27.7

19.6

2.4

2.1

10.9

11.5

-

-

Federal Bank

Neutral

71

-

12,139

9,353

10,623

2.9

2.9

4.4

5.8

16.1

12.2

1.5

1.4

9.5

11.0

-

-

HDFC

Neutral

1,265

-

199,945

11,475

13,450

3.4

3.4

45.3

52.5

27.9

24.1

5.4

4.8

20.2

20.5

-

-

HDFC Bank

Accumulate

1,200

1,350

303,708

46,097

55,433

4.5

4.5

58.4

68.0

20.5

17.6

3.6

3.01

18.8

18.6

-

-

ICICI Bank

Buy

265

315

154,208

42,800

44,686

3.1

3.3

18.0

21.9

14.7

12.1

2.0

1.9

11.1

12.3

-

-

Lakshmi Vilas Bank

Buy

149

174

2,682

3,339

3,799

2.7

2.8

11.0

14.0

13.6

10.7

1.4

1.3

11.2

12.7

-

-

December 1, 2016

18

Stock Watch | December 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

LIC Housing Finance

Accumulate

564

630

28,453

3,712

4,293

2.6

2.5

39.0

46.0

14.5

12.3

2.7

2.3

19.9

20.1

-

-

Punjab Natl.Bank

Neutral

138

-

29,409

23,532

23,595

2.3

2.4

6.8

12.6

20.3

11.0

3.1

2.2

3.3

6.5

-

-

RBL Bank

Neutral

364

-

13,452

1,783

2,309

2.6

2.6

12.7

16.4

28.6

22.2

3.1

2.8

12.8

13.3

-

-

South Ind.Bank

Neutral

22

-

2,903

6,435

7,578

2.5

2.5

2.7

3.1

8.0

6.9

1.0

0.9

10.1

11.2

-

-

St Bk of India

Neutral

258

-

200,590

88,650

98,335

2.6

2.6

13.5

18.8

19.1

13.7

1.8

1.6

7.0

8.5

-

-

Union Bank

Neutral

152

-

10,442

13,450

14,925

2.3

2.3

25.5

34.5

6.0

4.4

0.9

0.7

7.5

10.2

-

-

Yes Bank

Neutral

1,171

-

49,316

8,978

11,281

3.3

3.4

74.0

90.0

15.8

13.0

3.0

2.5

17.0

17.2

-

-

Capital Goods

ACE

Neutral

50

-

498

709

814

4.1

4.6

1.4

2.1

35.9

24.0

1.5

1.4

4.4

6.0

0.9

0.8

BEML

Neutral

842

-

3,507

3,451

4,055

6.3

9.2

31.4

57.9

26.8

14.5

1.6

1.5

6.3

10.9

1.1

0.9

Bharat Electronics

Neutral

1,439

-

32,143

8,137

9,169

16.8

17.2

58.7

62.5

24.5

23.0

3.8

3.4

44.6

46.3

2.9

2.6

Voltas

Buy

315

407

10,406

6,511

7,514

7.9

8.7

12.9

16.3

24.4

19.3

4.4

3.8

16.7

18.5

1.3

1.1

BGR Energy

Neutral

112

-

807

16,567

33,848

6.0

5.6

7.8

5.9

14.3

19.0

0.8

0.8

4.7

4.2

0.1

0.1

BHEL

Neutral

130

-

31,904

28,797

34,742

-

2.8

2.3

6.9

56.7

18.9

1.0

0.9

1.3

4.8

0.8

0.5

Blue Star

Buy

491

634

4,679

4,283

5,077

5.9

7.3

14.9

22.1

33.0

22.2

6.4

5.4

20.4

26.4

1.1

1.0

Crompton Greaves

Neutral

77

-

4,832

5,777

6,120

5.9

7.0

3.3

4.5

23.4

17.1

1.0

1.0

4.4

5.9

0.8

0.7

Greaves Cotton

Neutral

126

-

3,079

1,755

1,881

16.8

16.9

7.8

8.5

16.2

14.8

3.2

3.0

20.6

20.9

1.4

1.3

Inox Wind

Neutral

191

-

4,232

5,605

6,267

15.7

16.4

24.8

30.0

7.7

6.4

2.1

1.6

25.9

24.4

0.8

0.7

KEC International

Neutral

146

-

3,741

9,294

10,186

7.9

8.1

9.9

11.9

14.7

12.2

2.2

1.9

15.6

16.3

0.6

0.6

Thermax

Neutral

843

-

10,050

5,421

5,940

7.3

7.3

25.7

30.2

32.8

27.9

4.0

3.6

12.2

13.1

1.7

1.6

VATech Wabag

Buy

496

681

2,705

3,136

3,845

8.9

9.1

26.0

35.9

19.1

13.8

2.4

2.0

13.4

15.9

0.8

0.6

Cement

ACC

Neutral

1,343

-

25,212

11,225

13,172

13.2

16.9

44.5

75.5

30.2

17.8

2.9

2.6

11.2

14.2

2.2

1.9

Ambuja Cements

Neutral

210

-

41,778

9,350

10,979

18.2

22.5

5.8

9.5

36.3

22.1

3.0

2.7

10.2

12.5

4.5

3.8

India Cements

Neutral

120

-

3,671

4,364

4,997

18.5

19.2

7.9

11.3

15.1

10.6

1.1

1.1

8.0

8.5

1.6

1.4

JK Cement

Neutral

728

-

5,091

4,398

5,173

15.5

17.5

31.2

55.5

23.3

13.1

2.8

2.4

12.0

15.5

1.7

1.4

J K Lakshmi Cement

Buy

412

565

4,849

2,913

3,412

14.5

19.5

7.5

22.5

54.9

18.3

3.4

2.8

12.5

18.0

2.2

1.9

Orient Cement

Buy

136

215

2,783

2,114

2,558

18.5

20.5

8.1

11.3

16.8

12.0

2.5

2.1

9.0

14.0

1.9

1.5

UltraTech Cement

Neutral

3,594

-

98,638

25,768

30,385

21.0

23.5

111.0

160.0

32.4

22.5

4.1

3.6

13.5

15.8

3.9

3.3

Construction

Engineers India

Neutral

293

-

9,866

1,725

1,935

16.0

19.1

11.4

13.9

25.7

21.1

3.5

3.4

13.4

15.3

4.6

4.2

Gujarat Pipavav Port

Neutral

140

-

6,773

705

788

52.2

51.7

5.0

5.6

28.0

25.0

2.8

2.5

11.2

11.2

9.3

7.8

ITNL

Neutral

101

-

3,329

8,946

10,017

31.0

31.6

8.1

9.1

12.5

11.1

0.5

0.5

4.2

5.0

3.7

3.4

KNR Constructions

Accumulate

735

802

2,068

1,385

1,673

14.7

14.0

41.2

48.5

17.8

15.2

3.3

2.9

14.9

15.2

1.6

1.3

Larsen & Toubro

Buy

1,383

1,634

128,855

111,017

124,908

11.0

11.0

61.1

66.7

22.6

20.7

2.7

2.5

13.1

13.0

2.2

2.0

MEP Infra

Neutral

37

-

597

1,877

1,943

30.6

29.8

3.0

4.2

12.3

8.8

5.9

4.0

0.6

0.6

1.7

1.5

Nagarjuna Const.

Neutral

80

-

4,459

8,842

9,775

9.1

8.8

5.3

6.4

15.1

12.5

1.2

1.1

8.2

9.1

0.7

0.6

NBCC

Neutral

228

-

13,686

7,428

9,549

7.9

8.6

8.2

11.0

27.8

20.7

1.4

1.1

28.2

28.7

1.6

1.1

PNC Infratech

Buy

111

143

2,837

2,350

2,904

13.1

13.2

9.0

8.8

12.3

12.6

0.4

0.4

15.9

13.9

1.3

1.1

December 1, 2016

19

Stock Watch | December 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Power Mech Projects

Neutral

469

-

689

1,801

2,219

12.7

14.6

72.1

113.9

6.5

4.1

1.2

1.0

16.8

11.9

0.4

0.3

Sadbhav Engineering

Accumulate

276

298

4,734

3,598

4,140

10.3

10.6

9.0

11.9

30.7

23.2

3.2

2.8

9.9

11.9

1.6

1.4

Simplex Infra

Neutral

302

-

1,494

6,829

7,954

10.5

10.5

31.4

37.4

9.6

8.1

1.0

0.9

9.9

13.4

0.6

0.5

SIPL

Neutral

90

-

3,174

1,036

1,252

65.5

66.2

(8.4)

(5.6)

-

-

3.4

3.9

(22.8)

(15.9)

11.3

9.4

FMCG

Asian Paints

Neutral

970

-

93,028

17,128

18,978

16.8

16.4

19.1

20.7

50.8

46.9

17.7

16.7

34.8

35.5

5.3

4.8

Britannia

Buy

3,038

3,626

36,444

9,594

11,011

14.6

14.9

80.3

94.0

37.8

32.3

15.6

12.0

41.2

-

3.7

3.1

Colgate

Accumulate

934

995

25,408

4,605

5,149

23.4

23.4

23.8

26.9

39.3

34.7

21.7

17.0

64.8

66.8

5.4

4.8

Dabur India

Accumulate

283

304

49,845

8,315

9,405

19.8

20.7

8.1

9.2

35.0

30.8

9.7

8.1

31.6

31.0

5.6

5.0

GlaxoSmith Con*

Neutral

4,992

-

20,993

4,350

4,823

21.2

21.4

179.2

196.5

27.9

25.4

7.4

6.3

27.1

26.8

4.2

3.7

Godrej Consumer

Neutral

1,452

-

49,444

10,235

11,428

18.4

18.6

41.1

44.2

35.3

32.8

7.8

6.6

24.9

24.8

4.9

4.3

HUL

Neutral

844

-

182,727

35,252

38,495

17.8

17.8

20.6

22.4

40.9

37.7

39.1

33.5

95.6

88.9

5.0

4.6

ITC

Buy

233

284

281,129

40,059

44,439

38.3

39.2

9.0

10.1

25.9

23.0

7.2

6.3

27.8

27.5

6.5

5.9

Marico

Buy

252

300

32,551

6,430

7,349

18.8

19.5

6.4

7.7

39.4

32.8

11.9

10.0

33.2

32.5

4.9

4.2

Nestle*

Neutral

6,257

-

60,324

10,073

11,807

20.7

21.5

124.8

154.2

50.1

40.6

20.6

18.5

34.8

36.7

5.8

4.9

Procter & Gamble

Accumulate

6,639

7,369

21,551

2,939

3,342

23.2

23.0

146.2

163.7

45.4

40.6

101.7

97.5

25.3

23.5

6.9

6.0

Tata Global

Neutral

124

-

7,817

8,675

9,088

9.8

9.8

7.4

8.2

16.7

15.1

1.9

1.8

7.9

8.1

0.8

0.8

IT

HCL Tech^

Buy

803

1,000

113,255

49,242

57,168

20.5

20.5

55.7

64.1

14.4

12.5

2.9

2.2

20.3

17.9

2.2

1.7

Infosys

Buy

975

1,249

224,056

68,350

77,326

27.0

27.0

62.5

69.4

15.6

14.1

3.3

3.0

21.3

21.6

2.7

2.3

TCS

Buy

2,277

2,620

448,617

119,025

133,308

27.6

27.6

131.2

145.5

17.4

15.6

5.6

5.2

32.4

33.1

3.5

3.1

Tech Mahindra

Buy

485

600

47,123

29,673

32,937

15.5

17.0

32.8

39.9

14.8

12.2

2.9

2.5

19.6

20.7

1.3

1.1

Wipro

Buy

465

590

113,053

55,440

60,430

18.1

18.1

35.9

39.9

13.0

11.7

2.3

2.1

19.0

19.3

1.7

1.6

Media

D B Corp

Neutral

363

-

6,676

2,297

2,590

27.4

28.2

21.0

23.4

17.3

15.5

4.0

3.5

23.7

23.1

2.7

2.3

Hindustan Media Ven.

Neutral

271

-

1,991

1,016

1,138

24.3

25.2

27.3

30.1

9.9

9.0

1.9

1.7

16.2

15.8

1.3

1.1

HT Media

Neutral

72

-

1,664

2,693

2,991

12.6

12.9

7.9

9.0

9.1

7.9

0.8

0.7

7.8

8.3

0.2

0.1

Jagran Prakashan

Buy

176

225

5,744

2,355

2,635

28.0

28.0

10.8

12.5

16.3

14.1

3.5

3.0

21.7

21.7

2.5

2.1

Sun TV Network

Neutral

471

-

18,557

2,850

3,265

70.1

71.0

26.2

30.4

18.0

15.5

4.6

4.1

24.3

25.6

6.1

5.2

TV Today Network

Buy

315

385

1,882

637

743

27.5

27.5

18.4

21.4

17.2

14.8

3.0

2.5

17.4

17.2

2.6

2.1

Metal

Coal India

Neutral

308

-

194,670

84,638

94,297

21.4

22.3

24.5

27.1

12.6

11.4

5.2

5.0

42.6

46.0

1.8

1.6

Hind. Zinc

Neutral

282

-

119,260

14,252

18,465

55.9

48.3

15.8

21.5

17.9

13.1

2.9

2.5

17.0

20.7

8.4

6.5

Hindalco

Neutral

176

-

36,323

107,899

112,095

7.4

8.2

9.2

13.0

19.1

13.5

0.9

0.9

4.8

6.6

0.9

0.8

JSW Steel

Neutral

1,727

-

41,733

53,201

58,779

16.1

16.2

130.6

153.7

13.2

11.2

1.8

1.6

14.0

14.4

1.5

1.3

NMDC

Neutral

122

-

38,599

6,643

7,284

44.4

47.7

7.1

7.7

17.2

15.8

1.5

1.4

8.8

9.2

3.6

3.2

SAIL

Neutral

51

-

21,146

47,528

53,738

(0.7)

2.1

(1.9)

2.6

-

19.7

0.6

0.5

(1.6)

3.9

1.3

1.2

Tata Steel

Neutral

415

-

40,301

121,374

121,856

7.2

8.4

18.6

34.3

22.3

12.1

1.4

1.3

6.1

10.1

1.0

0.9

Vedanta

Neutral

230

-

68,143

71,744

81,944

19.2

21.7

13.4

20.1

17.2

11.4

1.5

1.3

8.4

11.3

1.3

1.0

December 1, 2016

20

Stock Watch | December 2016

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

FY17E

FY18E

Oil & Gas

Cairn India

Neutral

252

-

47,275

9,127

10,632

4.3

20.6

8.8

11.7

28.7

21.6

0.9

0.9

3.3

4.2

6.6

5.5

GAIL

Neutral

425

-

53,885

56,220

65,198

9.3

10.1

27.1

33.3

15.7

12.8

1.4

1.3

9.3

10.7

1.1

1.0

Indian Oil Corp

Neutral

307

-

148,931

373,359

428,656

5.9

5.5

54.0

59.3

5.7

5.2

0.9

0.8

16.0

15.6

0.5

0.5

ONGC

Neutral

289

-

247,254

137,222

152,563

15.0

21.8

19.5

24.1

14.8

12.0

1.3

1.2

8.5

10.1

2.1

1.9

Reliance Industries

Neutral

993

-

321,894

301,963

358,039

12.1

12.6

87.7

101.7

11.3

9.8

1.2

1.1

10.7

11.3

1.5

1.3

Pharmaceuticals

Alembic Pharma

Neutral

663

-

12,490

3,483

4,083

20.2

21.4

24.3

30.4

27.3

21.8

6.2

5.0

25.5

25.3

3.5

2.9

Aurobindo Pharma

Buy

740

877

43,294

15,720

18,078

23.7

23.7

41.4

47.3

17.9

15.6

4.6

3.6

29.6

26.1

3.0

2.6

Aventis*

Neutral

4,466

-

10,284

2,277

2,597

17.3

18.3

149.4

172.0

29.9

26.0

5.0

4.0

25.1

28.8

4.2

3.4

Cadila Healthcare

Neutral

402

-

41,129

10,429

12,318

22.6

22.0

16.9

19.2

23.8

20.9

6.1

4.9

28.5

25.7

3.9

3.2

Cipla

Reduce

567

490

45,526

15,378

18,089

17.4

18.4

21.6

27.2

26.2

20.8

3.4

3.0

13.7

15.2

3.2

2.6

Dr Reddy's

Neutral

3,199

-

53,004

16,043

18,119

20.8

22.4

112.4

142.9

28.5

22.4

3.8

3.3

14.1

15.9

3.3

2.9

Dishman Pharma

Neutral

237

-

3,827

1,718

1,890

22.7

22.8