3QCY2015 Result Update | Cement

October 30, 2015

Ambuja Cements

ACCUMULATE

CMP

`207

Performance Highlights

Target Price

`233

Quarterly results (Standalone)

Investment Period

12 Months

Y/E Dec. (` cr)

3QCY2015

2QCY2015

% chg qoq 3QCY2014

% chg yoy

Net Sales

2,095

2,493

(16.0)

2,188

(4.2)

Stock Info

EBIDTA

310

384

(19.2)

393

(21.2)

Sector

Cement

EBIDTA Margin (%)

14.7

15.4

(70bp)

17.9

(317bp

Market Cap (` cr)

32,396

Net Profit

154

226

(32.2)

239

(35.8)

Net Debt (` cr)

(4,610)

Source: Company, Angel Research

Beta

1.1

For 3QCY2015, Ambuja Cements (ACEM) reported an in line set of numbers on

52 Week High / Low

287/196

the operational front. The company reported a 1.7% yoy growth in cement

Avg. Daily Volume

193,085

volumes to

4.9mt (marginally below our estimate of

4.95mt). The

Face Value (`)

2

realization/tonne declined by 5.8% yoy to `4,276 (below our estimate of `4,345).

BSE Sensex

26,838

The EBITDA fell by 21.2% yoy to `310.1cr (in line with our estimate of `318.6cr).

Nifty

8,112

The EBITDA/tonne at `633, is down by 22.5% on a yoy basis (in line of our

Reuters Code

ABUJ.BO

estimate of `643).

Bloomberg Code

ACEM@IN

EBIDTA margin down 317bp yoy: For 3QCY2015, ACEM’s top-line fell by 4.2%

yoy to `2,095.2cr, impacted by weak demand and fall in realization. The

Shareholding Pattern (%)

company’s volume rose by 1.7% yoy (fell 16.7% qoq) to 4.9mt, while realization

Promoters

50.3

was down by 5.8% yoy due to pricing pressure in its key markets of North and

West regions. However, the operating performance was in line with our estimates,

MF / Banks / Indian Fls

12.8

led by operational efficiency. The company’s EBIDTA declined by 21.2% yoy to

FII / NRIs / OCBs

27.1

`310.1cr but was in line with our estimate of `318.9cr. The EBIDTA decline was

Indian Public / Others

9.9

led by weak realization and increase in other expenses (led by `40cr provision for

DMF). Hence the EBIDTA margin, at 14.7%, declined by 317bp yoy, but was in

Abs. (%)

3m 1yr

3yr

line with our estimate. The Reported PAT fell by 35.8% yoy to `153.6cr (below our

Sensex

(1.5)

0.6

45.1

estimate of `220.2cr), mainly due to higher depreciation and lower other income.

ACL

(9.4)

(6.8)

0.0

Outlook and valuation: Going forward, we expect ACEM’s volume growth to

remain under pressure due to lack of capacity, for the next two years. However,

3-year price chart

we expect the top-line to register an 8.1% CAGR over CY2014-17E. At the current

300

market price, the stock is trading at an EV/tonne of US$150 on CY2017E

280

260

installed capacity and

10.6x EV/EBIDTA of CY2017E. We maintain our

240

Accumulate rating on the stock with target price of `233 on 12.5x EV/EBIDTA and

220

200

EV/tonne of US$165 on CY2017E installed capacity.

180

160

Key financials (Standalone)

140

Y/E Dec. (` cr)

CY2013

CY2014

CY2015E

CY2016E

CY2017E

120

100

Net sales

9,176

9,978

10,241

11,624

12,616

% chg

(6.1)

9.1

2.6

13.8

8.6

Adj. net profit

1,030

1,496

1,026

1,375

1,568

% chg

(34.7)

45.3

(31.4)

34.0

14.1

Source: Company, Angel Research

OPM (%)

18.4

19.5

16.8

19.4

20.7

FDEPS (`)

6.7

9.7

6.6

8.9

10.1

P/E (x)

31.1

21.4

31.3

23.3

20.5

P/BV (x)

3.4

3.2

3.1

2.9

2.8

RoE (%)

11.3

15.3

10.0

12.8

13.8

RoCE (%)

11.8

13.3

10.4

14.2

16.0

Shrenik Gujrathi

EV/Sales

3.1

2.8

2.7

2.4

2.2

022-39357800 Ext 6872

EV/EBITDA (x)

16.7

14.2

16.2

12.4

10.6

Source: Company, Angel Research; Note: CMP as of October 29, 2015

Please refer to important disclosures at the end of this report

1

Ambuja Cements | 3QCY2015 Result Update

Exhibit 1: 3QCY2015 performance (Standalone)

Y/E Dec. (` cr)

3QCY15

2QCY15

% chg qoq

3QCY14

% chg yoy

9MCY15

9MCY14

% chg

Net sales

2,095

2,492.76

(16.0)

2,188

(4.2)

70,125

75,337

(6.9)

Other operating income

16

18

(11.4)

15

8.3

719

377

90.5

Total operating income

2,111

2,510

(15.9)

2,202

(4.1)

70,844

75,714

(6.4)

Net raw-material costs

109

178

(38.9)

149

(26.7)

4,954

5,532

(10.5)

(% of sales)

5.2

7.1

6.8

7.0

7.3

Power & fuel

486

584

(16.8)

510

(4.6)

16,073

17,123

(6.1)

(% of sales)

23.0

23.3

23.2

22.7

22.6

Staff costs

151

150

0.9

142

6.4

4,497

4,122

9.1

(% of sales)

7.2

6.0

6.5

6.3

5.4

Freight & forwarding

554

715

(22.5)

548

1.0

18,897

18,952

(0.3)

(% of sales)

26.2

28.5

24.9

26.7

25.0

Other expenses

500

499

0.3

459

8.9

14,344

14,045

2.1

(% of sales)

23.7

19.9

20.9

20.2

18.5

Total expenditure

1,801

2,127

(15.3)

1,809

(0.4)

58,763

59,773

(1.7)

Operating profit

310

384

(19.2)

393

(21.2)

12,081

15,941

(24.2)

OPM (%)

14.7

15.4

(70bp)

17.9

(317)bp

17.1

21.1

(400bp)

Interest

21

32

(34.3)

18

16.1

737

542

35.9

Depreciation

155

149

4.5

130

19.3

4,615

3,740

23.4

Other income

74

106

(29.9)

89

(16.3)

2,749

3,585

(23.3)

Exceptional Inc./(Exp.)

-

-

-

0

0

PBT

208

309

(32.7)

334

(37.6)

9,478

15,244

(37.8)

Provision for taxation

55

83

(34.2)

95

(42.4)

2,460

3,308

(25.6)

(% of PBT)

26.2

26.8

28.4

26.0

21.7

Reported PAT

154

226

(32.2)

239

(35.8)

7,018

11,936

(41.2)

PATM (%)

7.3

9.0

(174bp)

10.9

(358bp)

9.9

15.8

(586bp)

EPS (`)

1.0

1.5

1.5

4.5

7.5

Source: Company, Angel Research

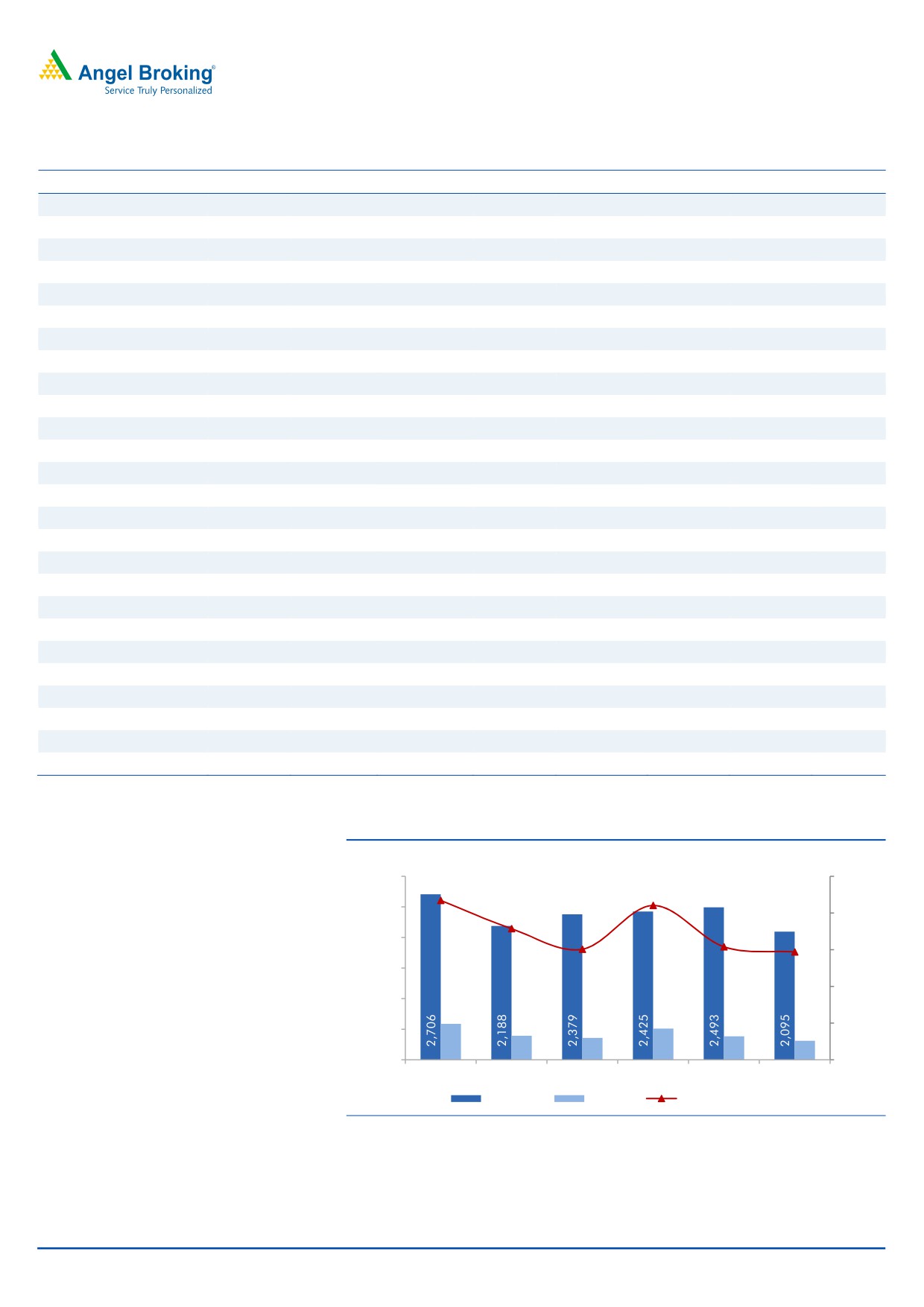

Exhibit 2: Financial performance

(` cr)

(%)

3,000

25.0

21.7

2,500

21.0

20.0

17.9

2,000

15.1

15.4

14.7

15.0

1,500

10.0

1,000

588

510

393

358

384

5.0

500

310

-

0.0

2QCY14

3QCY14

4QCY14

1QCY15

2QCY15

3QCY15

Net Sales

EBITDA

EBITDA margin (%)

Source: Company, Angel Research

October 30, 2015

2

Ambuja Cements | 3QCY2015 Result Update

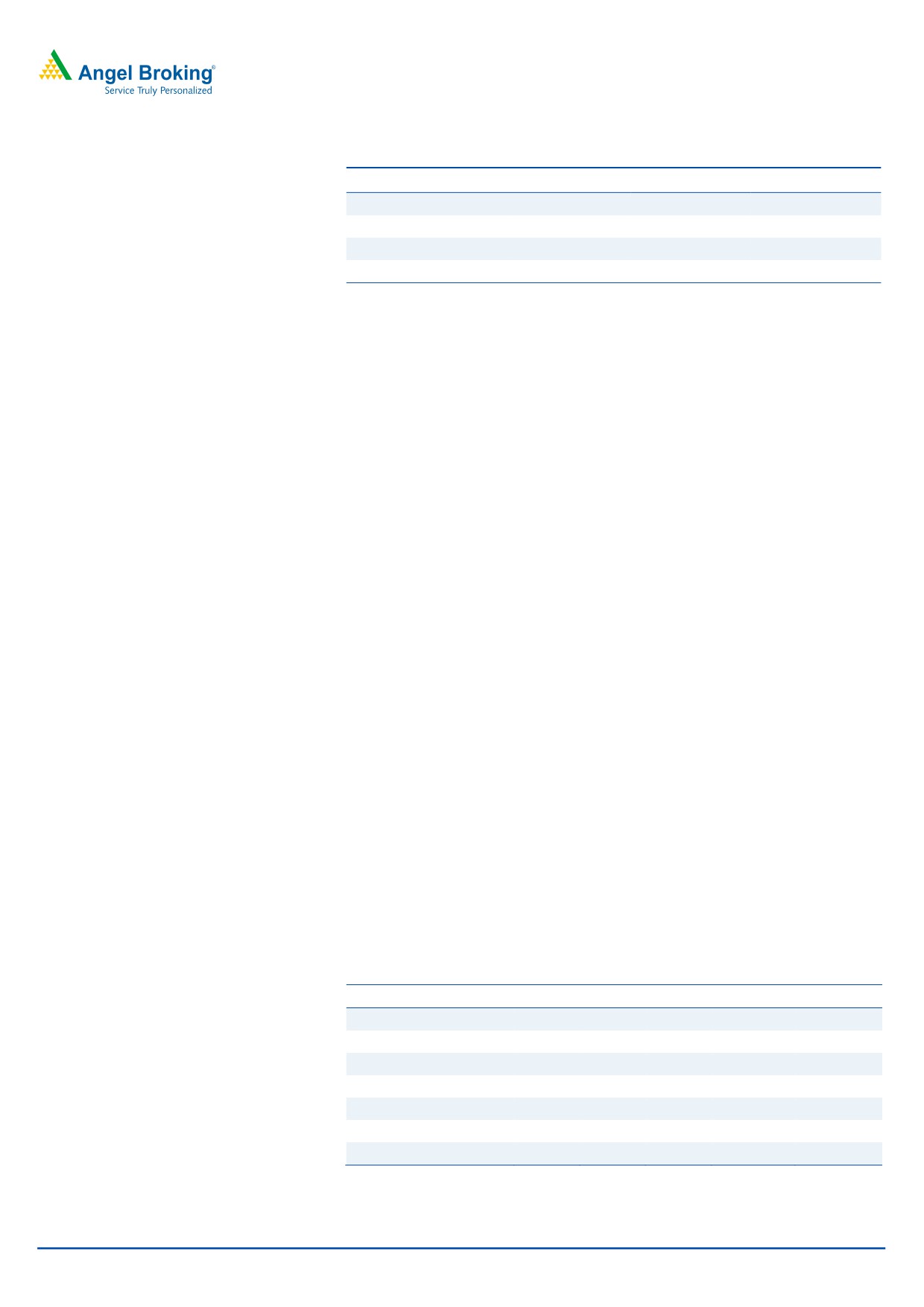

Exhibit 3: 3QCY2015 - Actual vs Angel estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

2,095

2,153

(2.7)

EBIDTA

310

319

(2.7)

EBIDTA Margin (%)

14.7

14.7

-

Net profit

154

220

(30.3)

Source: Company, Angel Research

Performance highlights

Top-line declines 4.2% yoy

ACEM’s standalone top-line for the quarter fell by 4.2% yoy to `2,095.2cr

(marginally below our estimate of `2.152.7cr), impacted by weak demand and

higher-than-expected fall in realization. The company registered a volume growth

of

1.7% yoy to

4.9mt, but the same was below our estimate of

4.95mt.

Realization/tonne was down by 5.8% yoy to `4,276 (below our estimate of

`4,345), mainly due to pricing pressure in its key markets of North and West

regions.

EBIDTA margin down 317bp yoy

ACEM’s EBIDTA margin fell by 317bp yoy to 14.7% impacted by fall in realization

and increase in other expenses (led by `40cr provision for DMF). Total operating

expenses were down by 0.4% yoy, led by 26.7% yoy fall in raw material costs and

4.6% yoy fall in power costs. Power costs were down mainly due to lower pet coke

and imported coal prices. The EBIDTA declined by 21.2% yoy to `310.1cr and was

in line with our estimate of `318.6cr. The EBITDA/tonne was down by 22.5% yoy

to `633 (in line with our estimate of `643).

Per-tonne analysis

For 3QCY2015, ACEM’s realization/tonne fell 5.8% on a yoy basis, (up 0.9%

qoq). Raw material cost/tonne declined 17.3%/26.6% yoy/qoq. Freight cost/tonne

declined by 0.6%/7.1% yoy/qoq to `1,130, led by fall in diesel prices. Power and

fuel (P&F) costs/tonne fell by 6.2%/0.2% yoy/qoq to `992. Other expenses/tonne

increased 7.1%/20.3% yoy/qoq to `1,021, mainly due to provision related to

DMF. The operating profit/tonne stood at `633, down by 22.5% yoy, led by fall in

realization and increase in other expenses.

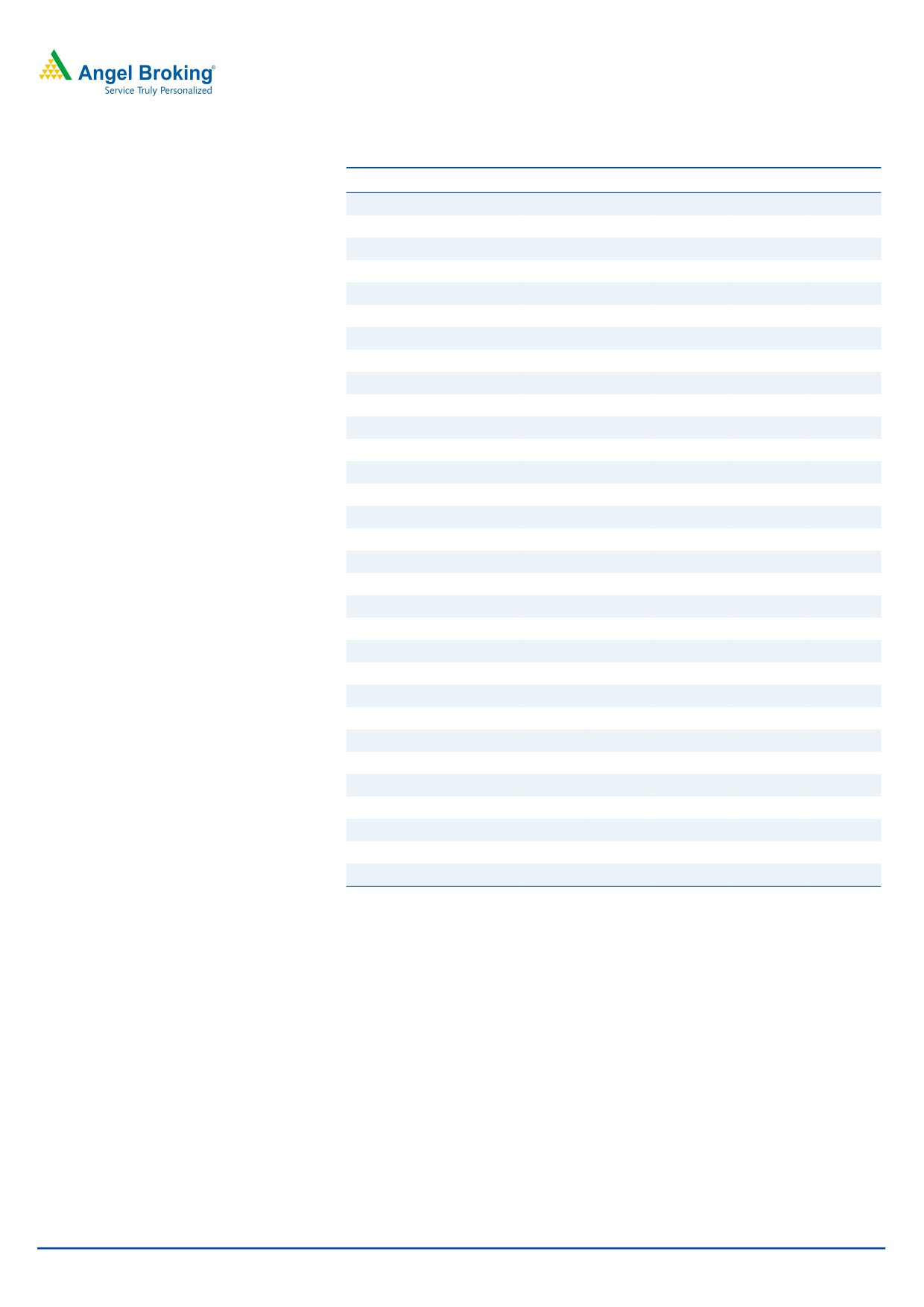

Exhibit 4: Per tonne analysis

(`/tonne)

3QCY15

3QCY14

2QCY15

% chg (yoy)

% chg (qoq)

Realization/tonne

4,276

4,538

4,239

(5.8)

0.9

Raw-material cost/tonne

222

269

303

(17.3)

(26.6)

Power and fuel cost/tonne

992

1,058

994

(6.2)

(0.2)

Freight cost/tonne

1,130

1,138

1,216

(0.6)

(7.1)

Other costs/tonne

1,021

953

848

7.1

20.3

Operating costs/tonne

3,675

3,752

3,617

(2.1)

1.6

Operating Profit/tonne

633

816

653

(22.5)

(3.0)

Source: Company, Angel Research

October 30, 2015

3

Ambuja Cements | 3QCY2015 Result Update

Investment rationale

Lack of capacity addition impacting top-line growth

ACEM has seen a 6.9% yoy decline in its top-line during 9MCY2015, led by soft

demand and weak pricing environment in its key markets. There has been a

volume de-growth of 4.2% yoy during the same period. Going forward, we believe

the company will continue to lose market share as there is no visibility of new

capacity addition for the next two years. We expect ACEM’s volumes to grow at a

CAGR of 4.1% during CY2014-17. Lack of capacity addition would lead to

underperformance in terms of volume growth. However cement prices are

expected to remain strong on back of demand boost led by government spending

on infrastructure, housing and smart cities schemes.

Outlook and valuation

Going forward, we expect ACEM’s volume growth to remain under pressure due to

lack of capacity. However, we expect the top-line to register an 8.1% CAGR over

CY2014-17E. At the current market price, the stock is trading at an EV/tonne of

US$150 on CY2017E capacity and 10.6x EV/EBIDTA of CY2017E. We maintain

our Accumulate rating on the stock with a target price of `233 on 12.5x

EV/EBIDTA and EV/tonne of US$165 on CY2017E installed capacity.

October 30, 2015

4

Ambuja Cements | 3QCY2015 Result Update

Company Background

Swiss cement major, Holcim acquired a controlling stake in ACEM in 2005. In

India, the Holcim Group currently controls one-fifth of the total cement capacity

through ACEM and ACC. On a standalone basis, ACEM is the third largest cement

player in India with total capacity of 27mtpa. The company majorly focuses on

northern and western India, with no plants in southern India. Of its current total

capacity, 40% capacity is in the western, 38% in northern, 16% in eastern and

northeastern and 6% capacity is in the central region of the country.

October 30, 2015

5

Ambuja Cements | 3QCY2015 Result Update

Profit & loss statement (Standalone)

Y/E December (` cr)

CY2013

CY2014

CY2015E

CY2016E

CY2017E

Net Sales

9,087

9,911

10,166

11,564

12,556

Other operating income

90

67

74

60

60

Total operating income

9,176

9,978

10,241

11,624

12,616

% chg

(5.8)

8.7

2.6

13.5

8.5

Total Expenditure

7,509

8,050

8,532

9,382

10,018

Net Raw Materials

765

810

820

928

1,012

Other Mfg costs

2,063

2,265

2,337

2,544

2,699

Personnel

502

582

640

704

760

Other

4,179

4,393

4,736

5,205

5,547

EBITDA

1,668

1,928

1,708

2,242

2,598

% chg

(32.9)

15.6

(11.4)

31.3

15.9

(% of Net Sales)

18.4

19.5

16.8

19.4

20.7

Depreciation& Amortisation

490

510

545

594

643

EBIT

1,178

1,419

1,163

1,648

1,955

% chg

(38.7)

20.5

(18.0)

41.7

18.6

(% of Net Sales)

13.0

14.3

11.4

14.3

15.6

Interest & other Charges

65

64

71

76

76

Other Income

378

429

440

480

462

(% of PBT)

25

24

29

23

20

Recurring PBT

1,490

1,783

1,531

2,052

2,341

% chg

(31.7)

19.7

(14.1)

34.0

14.1

Extraordinary Expense/(Inc.)

(266)

-

-

-

-

PBT (reported)

1,756

1,783

1,531

2,052

2,341

Tax

460

287

505

677

772

(% of PBT)

26.2

16.1

33.0

33.0

33.0

PAT (reported)

1,295

1,496

1,026

1,375

1,568

ADJ. PAT

1,030

1,496

1,026

1,375

1,568

% chg

(34.7)

45.3

(31.4)

34.0

14.1

(% of Net Sales)

11.3

15.1

10.1

11.9

12.5

Basic EPS (`)

6.7

9.7

6.6

8.9

10.1

Fully Diluted EPS (`)

6.7

9.7

6.6

8.9

10.1

October 30, 2015

6

Ambuja Cements | 3QCY2015 Result Update

Balance sheet (Standalone)

Y/E December (` cr)

CY2013

CY2014

CY2015E

CY2016E

CY2017E

SOURCES OF FUNDS

Equity Share Capital

309

310

310

310

310

Preference Capital

-

-

-

-

-

Reserves& Surplus

9,176

9,793

10,188

10,716

11,319

Shareholders Funds

9,486

10,103

10,498

11,026

11,629

Total Loans

40

21

21

21

21

Deferred Tax Liability

564

589

589

589

589

Other Long term liabilities

18

18

18

18

18

Long term provisions

248

248

248

248

248

Total Liabilities

10,356

10,979

11,373

11,902

12,504

APPLICATION OF FUNDS

Gross Block

10,826

11,429

12,229

13,329

14,429

Less: Acc. Depreciation

4,764

5,202

5,747

6,341

6,985

Net Block

6,063

6,227

6,482

6,988

7,444

Capital Work-in-Progress

695

690

890

790

490

Other non current assets

-

289

289

289

289

Intangible assets

-

-

-

-

-

Investments

1,788

2,173

2,173

2,173

2,173

Long term loans and advances

647

647

647

647

647

Current Assets

3,771

3,874

3,660

3,963

4,587

Cash

2,341

2,458

1,971

1,986

2,445

Loans & Advances

208

254

287

332

383

Other

1,223

1,162

1,402

1,645

1,760

Current liabilities

2,609

2,922

2,769

2,948

3,126

Net Current Assets

1,163

952

892

1,014

1,461

Mis. Exp. not written off

-

-

-

-

-

Total Assets

10,356

10,979

11,373

11,902

12,504

October 30, 2015

7

Ambuja Cements | 3QCY2015 Result Update

Cash flow statement (Standalone)

Y/E December (` cr)

CY2013

CY2014

CY2015E CY2016E CY2017E

Profit before tax

1,756

1,783

1,531

2,052

2,341

Depreciation

490

510

545

594

643

(Inc)/Dec in Working Capital

(150)

328

(427)

(108)

12

Add: Interest expenses

65

64

71

76

76

Less: Other income

378

429

440

480

462

Less: Direct taxes paid

460

287

505

677

772

Cash Flow from Operations

1,322

1,969

776

1,457

1,838

(Inc)/ Dec in Fixed Assets

(885)

(598)

(1,000)

(1,000)

(800)

(Inc)/ Dec in Investments

(133)

(384)

-

-

-

Other income

378

429

440

480

462

Cash Flow from Investing

(640)

(553)

(560)

(520)

(338)

Issue of Equity

42

52

-

-

-

Inc./(Dec.) in loans

(2)

(20)

-

-

-

Dividend Paid (Incl. Tax)

651

921

632

846

965

Others

(16)

409

71

76

76

Cash Flow from Financing

(595)

(1,298)

(703)

(922)

(1,041)

Inc./(Dec.) in Cash

88

117

(487)

15

459

Opening Cash balances

2,253

2,341

2,458

1,971

1,986

Closing Cash balances

2,341

2,458

1,972

1,986

2,445

October 30, 2015

8

Ambuja Cements | 3QCY2015 Result Update

Key ratios

Y/E December

CY2013

CY2014

CY2015E

CY2016E

CY2017E

Valuation Ratio (x)

P/E (on FDEPS)

31.1

21.4

31.3

23.3

20.5

P/CEPS

17.9

16.0

20.4

16.3

14.5

P/BV

3.4

3.2

3.1

2.9

2.8

Dividend yield (%)

1.7

2.4

1.7

2.2

2.5

EV/Sales

3.1

2.8

2.7

2.4

2.2

EV/EBITDA

16.7

14.2

16.2

12.4

10.6

EV / Total Assets

2.7

2.5

2.4

2.3

2.2

Per Share Data (`)

EPS (Basic)

6.7

9.7

6.6

8.9

10.1

EPS (fully diluted)

6.7

9.7

6.6

8.9

10.1

Cash EPS

11.5

12.9

10.1

12.7

14.3

DPS

3.6

5.0

3.4

4.6

5.2

Book Value

61.4

65.2

67.7

71.1

75.0

Dupont Analysis

EBIT margin

12.8

14.2

11.4

14.2

15.5

Tax retention ratio

73.8

83.9

67.0

67.0

67.0

Asset turnover (x)

1.2

1.2

1.1

1.2

1.3

ROIC (Post-tax)

11.3

14.4

8.7

11.4

13.1

Returns (%)

ROCE (Pre-tax)

11.8

13.3

10.4

14.2

16.0

Angel ROIC (Pre-tax)

16.6

18.7

14.2

18.7

20.9

ROE

11.3

15.3

10.0

12.8

13.8

Turnover ratios (x)

Asset Turnover (Gross Block)

0.9

0.9

0.9

0.9

0.9

Inventory / Sales (days)

38

33

35

38

39

Receivables (days)

9

8

9

9

9

Payables (days)

129

125

122

111

111

WC cycle (ex-cash) (days)

(50)

(49)

(46)

(32)

(28)

Solvency ratios (x)

Net debt to equity

(0.2)

(0.2)

(0.2)

(0.2)

(0.2)

Net debt to EBITDA

(1.4)

(1.3)

(1.1)

(0.9)

(0.9)

Interest Coverage (EBIT / Int.)

18.1

22.0

16.3

21.6

25.6

October 30, 2015

9

Ambuja Cements | 3QCY2015 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

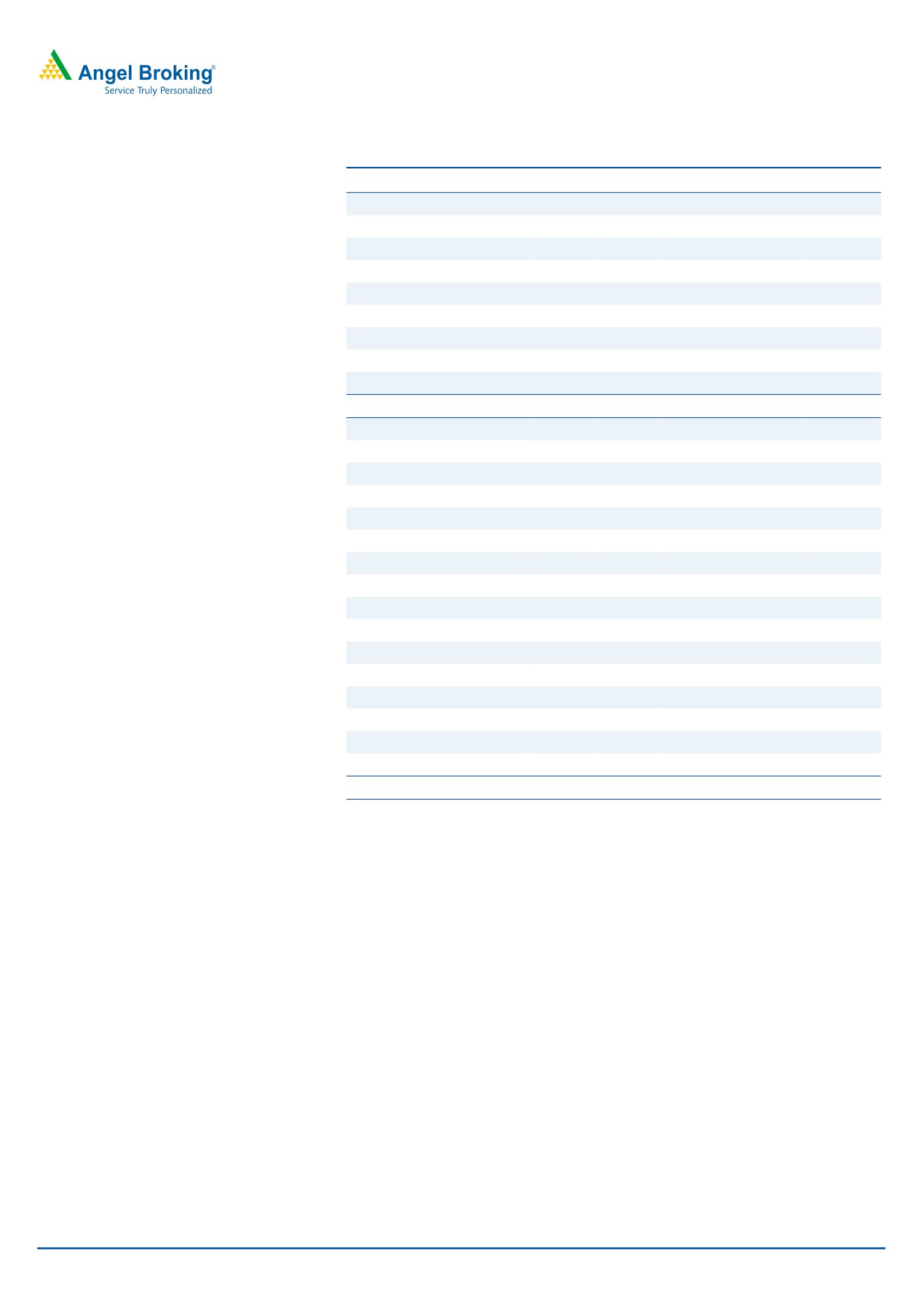

Disclosure of Interest Statement

Ambuja Cements

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

October 30, 2015

10