2QFY2016 Result Update | Auto Ancillary

November 5, 2015

Amara Raja Batteries

BUY

CMP

`881

Performance Highlights

Target Price

`1,039

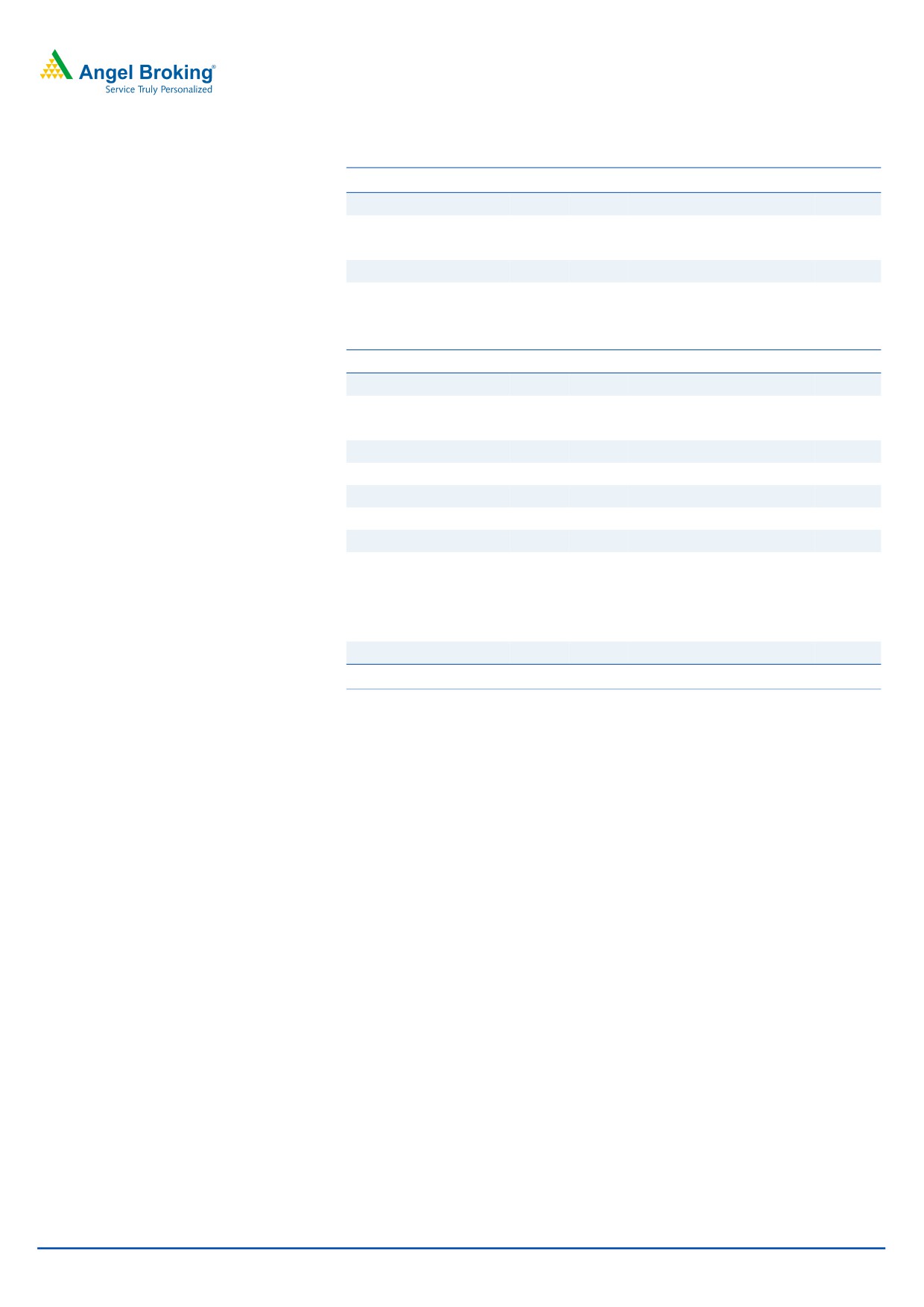

Y/E March (` cr)

2QFY16 2QFY15

% chg (yoy) 1QFY16

% chg (qoq)

Investment Period

12 Months

Net Sales

1,158

1,060

9.2

1,138

1.8

EBITDA

199

180

10.4

199

(0.1)

Stock Info

EBITDA Margin (%)

17.2

17.0

20 bp

17.5

(30 bp)

Sector

Auto Ancillary

Adj. PAT

123

100

22.2

122

0.4

Source: Company, Angel Research

Market Cap (` cr)

15,055

Net Debt (` cr)

(148)

Amara Raja Batteries (ARBL)’s 2QFY2016 results have come in line with

estimates. The top-line continued to grow in double digits, but the growth was

Beta

0.8

slightly moderated given the decrease in realization. Realization declined on

52 Week High / Low

1,132/643

account of passing of lower lead prices to consumers and due to slowdown in the

Avg. Daily Volume

46,950

UPS segment. Still, ARBL managed to keep its margins above the 17% mark. The

Face Value (`)

1

net profit grew in robust double-digits, and came in line with estimates.

BSE Sensex

26,304

Top-line maintains double-digit growth: ARBL’s revenues grew a healthy 9% yoy

Nifty

7,955

to `1,158cr on back of a robust 21% yoy growth in the automotive segment. The

Reuters Code

AMAR.BO

industrial segment was a bit subdued, growing by 5% yoy, due to slowdown in the

Bloomberg Code

AMRJ@IN

UPS segment.

Margin improvement and lower depreciation boosts profitability: For the quarter,

Shareholding Pattern (%)

ARBL’s net profit grew a robust 22% yoy to `122.6cr. Margin improvement due to

Promoters

52.1

soft lead prices coupled with lower depreciation expenses boosted the profits.

MF / Banks / Indian Fls

11.3

Outlook and Valuation: ARBL is likely to continue gaining market share in the

FII / NRIs / OCBs

24.9

automotive battery segment. The strategy followed by automotive OEMs of

Indian Public / Others

11.7

sourcing from multiple vendors as against having a single vendor is likely to

benefit ARBL. Further, given the strengthening distribution network in the Western

and Eastern markets, replacement sales are also expected grow in strong double

Abs. (%)

3m 1yr

3yr

digits, going forward. We also expect the industrial segment to recover from

Sensex

(6.8)

(5.8)

40.2

2HFY2016, given the network expansion by telecom players and with ARBL

Amara Raja

(9.9)

35.7

294.3

entering into tubular battery manufacturing. We expect ARBL to record a healthy

top-line CAGR of 19% over FY2015 to FY2017. Also, given the softness in lead

prices, margins are expected to remain at elevated levels. We expect ARBL to

3-year price chart

clock 27% earnings CAGR over the next two years. Hence, we have a positive

1,200

view on the stock and maintain our Buy rating with a target price of `1,039

1,000

(based on 28x FY2017 earnings).

800

600

Key financials (Standalone)

400

200

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

0

Net Sales

3,452

4,230

4,892

5,871

% chg

16.7

22.5

15.7

20.0

Net Profit

371

418

493

634

% chg

25.5

12.6

17.8

28.8

Source: Company, Angel Research

EBITDA (%)

16.7

17.2

17.4

17.6

EPS (`)

21.7

24.5

28.8

37.1

P/E (x)

40.5

36.0

30.6

23.7

P/BV (x)

11.0

8.9

7.1

5.7

RoE (%)

27.2

24.6

23.4

24.1

RoCE (%)

36.6

34.1

33.0

38.0

Bharat Gianani

EV/Sales (x)

4.3

3.5

3.1

2.5

022-3935 7800 Ext: 6817

EV/EBITDA (x)

25.8

20.5

17.5

14.2

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Amara Raja Batteries | 2QFY2016 Result Update

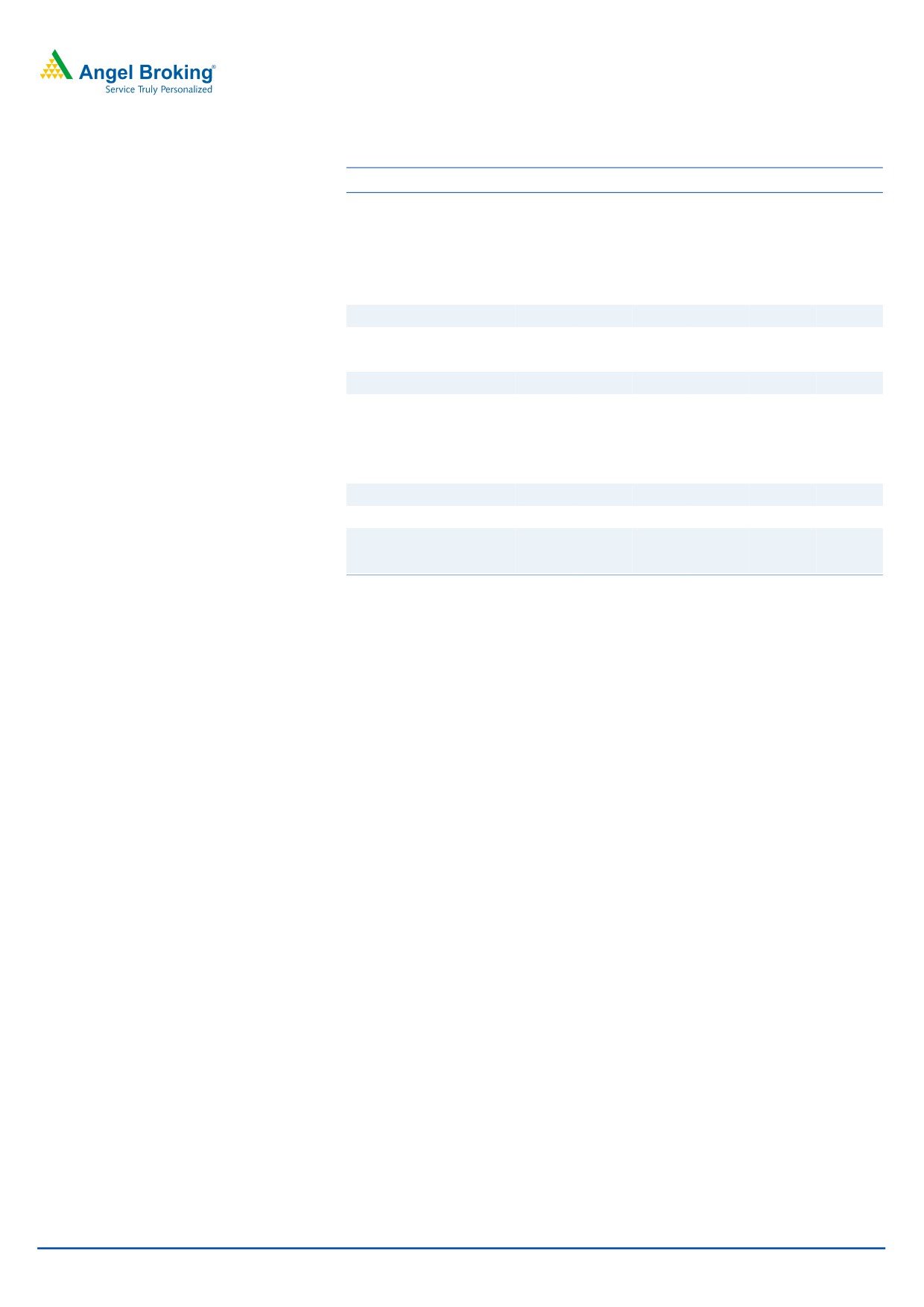

Exhibit 1: Quarterly financial performance (Standalone)

Y/E March (` cr)

2QFY16

2QFY15

% chg (yoy)

1QFY16

% chg (qoq)

1HFY16

1HFY15

% chg (yoy)

Net Sales

1,158

1,060

9.2

1,138

1.8

2,296

2,089

9.9

Consumption of RM

742

703

5.6

735

0.9

1,477

1,390

6.3

(% of Sales)

64.0

66.3

64.6

64.3

66.5

Staff Costs

58

48

20.8

56

3.7

114

95

19.8

(% of Sales)

5.0

4.5

4.9

5.0

4.5

Other Expenses

160

129

23.4

148

8.3

307

248

23.7

(% of Sales)

13.8

12.2

13.0

13.4

11.9

Total Expenditure

960

880

9.0

939

2.2

1,898

1,734

9.5

Operating Profit

199

180

10.4

199

(0.1)

397

356

11.8

OPM (%)

17.2

17.0

17.5

17.3

17.0

Interest

0

0

-

0

(33.3)

0

0

66.7

Depreciation

34

37

(6.4)

33

4.4

67

68

(0.7)

Other Income

12

11

6.4

13

(10.5)

25

17

46.5

PBT (incl. Extr. Items)

176

154

14.1

179

(1.6)

355

305

16.5

(% of Sales)

15.2

14.5

15.7

15.5

14.6

Provision for Taxation

53

54

(0.9)

57

(5.9)

110

98

12.0

(% of PBT)

30.4

35.0

31.8

31.1

32.3

Exceptional items

-

-

-

-

-

Reported PAT

123

100

22.2

122

0.4

245

206

18.6

Adj PAT

123

100

22.2

122

0.4

245

206

18.6

Adj. PATM

10.6

9.5

10.7

10.7

9.9

Equity capital (cr)

17.1

17.1

17.1

17.1

17.1

Reported EPS (`)

7.2

5.9

22.2

7.1

0.4

14.3

12.1

18.6

Source: Company, Angel Research

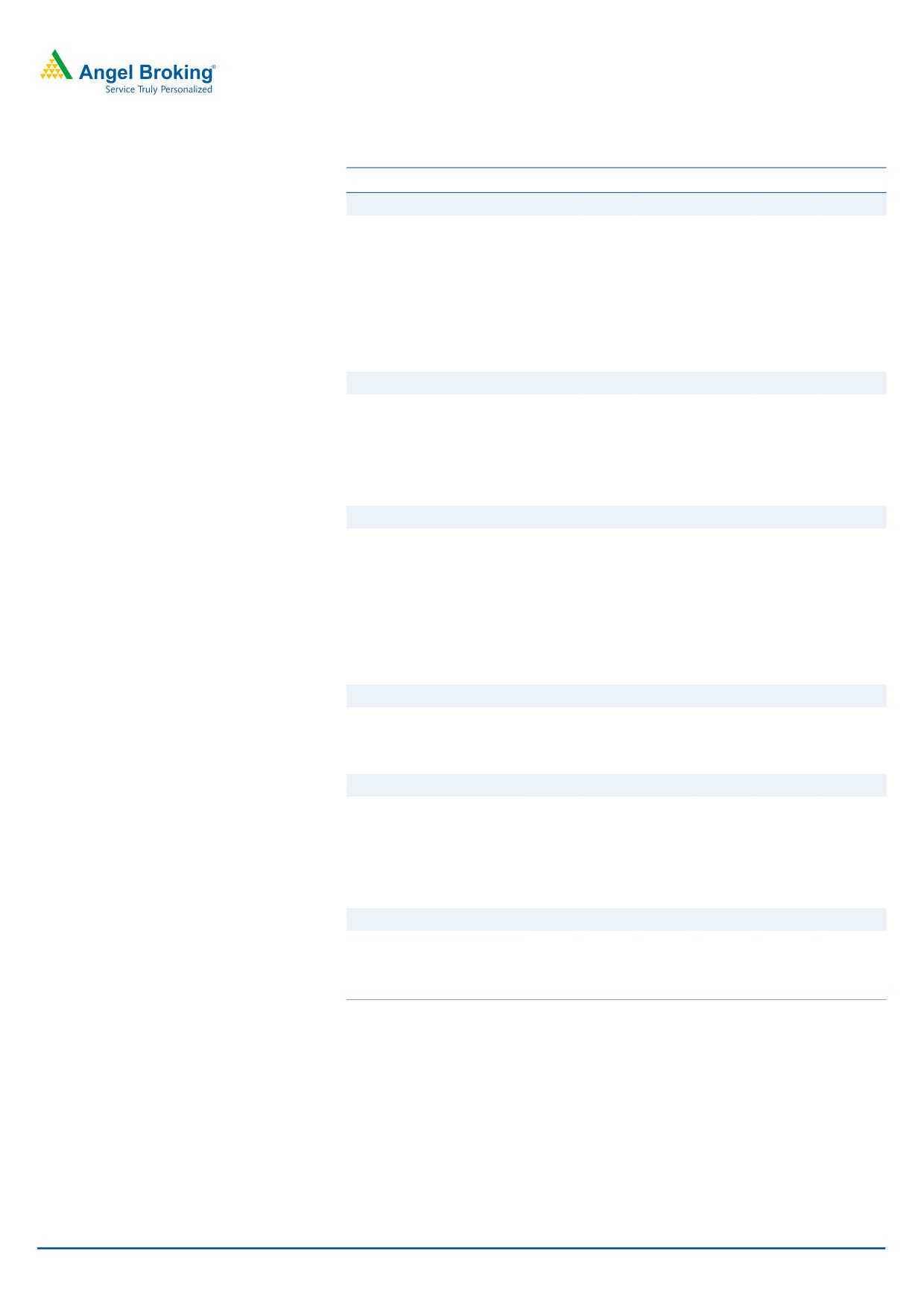

Top-line grows in double digits: ARBL revenues maintained healthy double digit

growth momentum, reporting a 9% yoy growth in 2QFY2016. ARBL continued to

gain market share in the automotive segment (constituting 55% of the topline),

registering a growth of about 21%. The automotive OEM segment reported growth

of 17% whereas the automotive replacement segment grew strongly 23%. The

industrial segment (contributing 45% of revenues) growth was relatively subdued

(reported 5% growth) owing to slowdown in the UPS segment. The revenues were

dragged by the pass thru of lower lead prices (lead prices have dipped by about

7% yoy) in both the automotive OEM and the industrial segment.

November 5, 2015

2

Amara Raja Batteries | 2QFY2016 Result Update

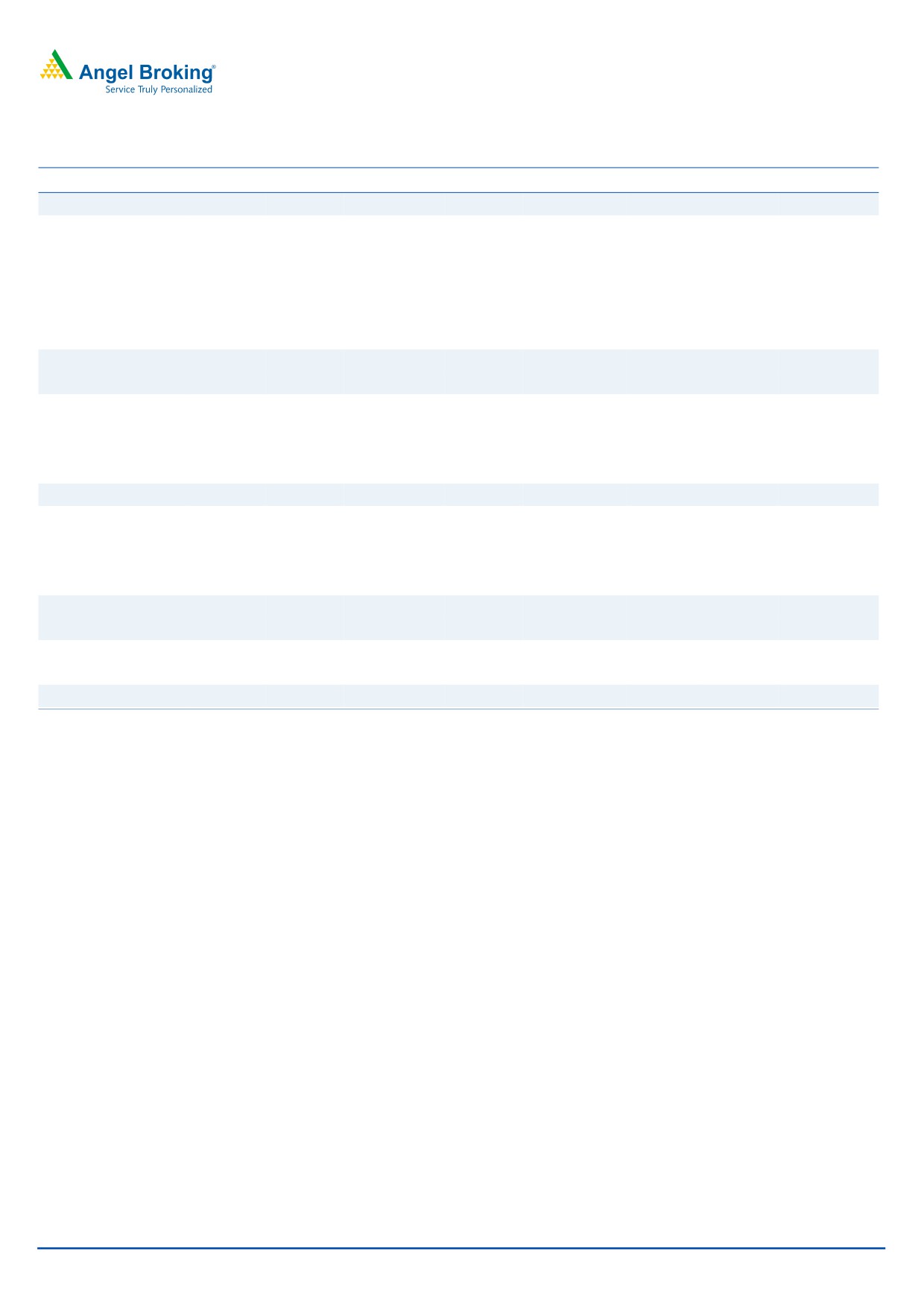

Exhibit 2: Double digit top-line growth continues

1,400

35

1,200

30

1,000

25

800

20

600

15

400

10

200

5

0

0

Net sales (` cr)

% yoy growth

Source: Company, Angel Research

Soft lead prices boost operating performance: ARBL continued to maintain margins

upward of the 17% mark. The margin for the quarter, at 17.2%, improved

marginally

20bp yoy. Raw material cost as a percentage of sales dipped

230bp yoy to 64%, given the softness in the price of lead, which is its key

raw material.

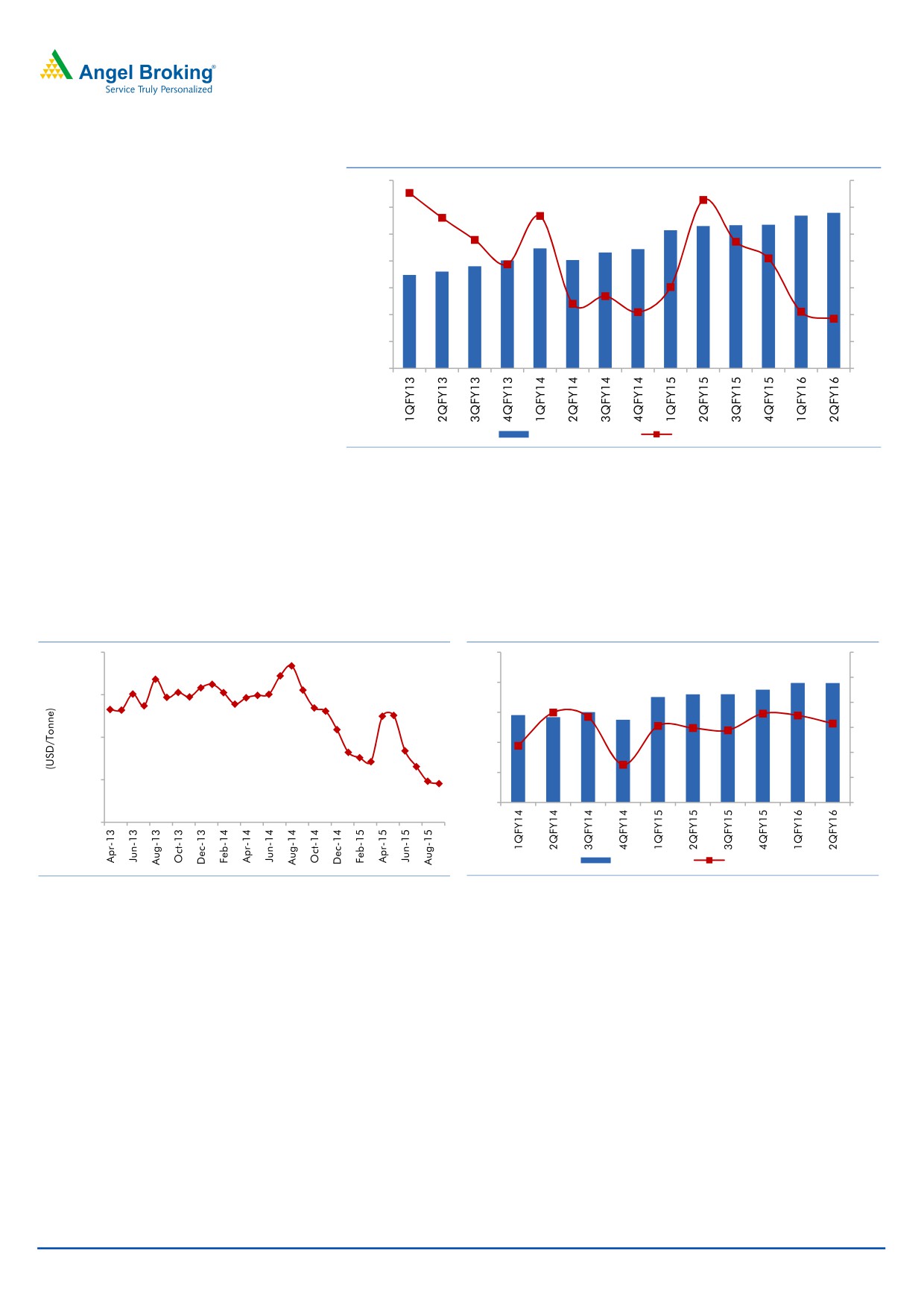

Exhibit 3: Average lead price trend

Exhibit 4: Soft lead prices boost EBITDA margin

2,300

250

20

19

200

2,100

18

150

17

1,900

100

16

50

1,700

15

0

14

1,500

EBIDTA (` cr)

Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

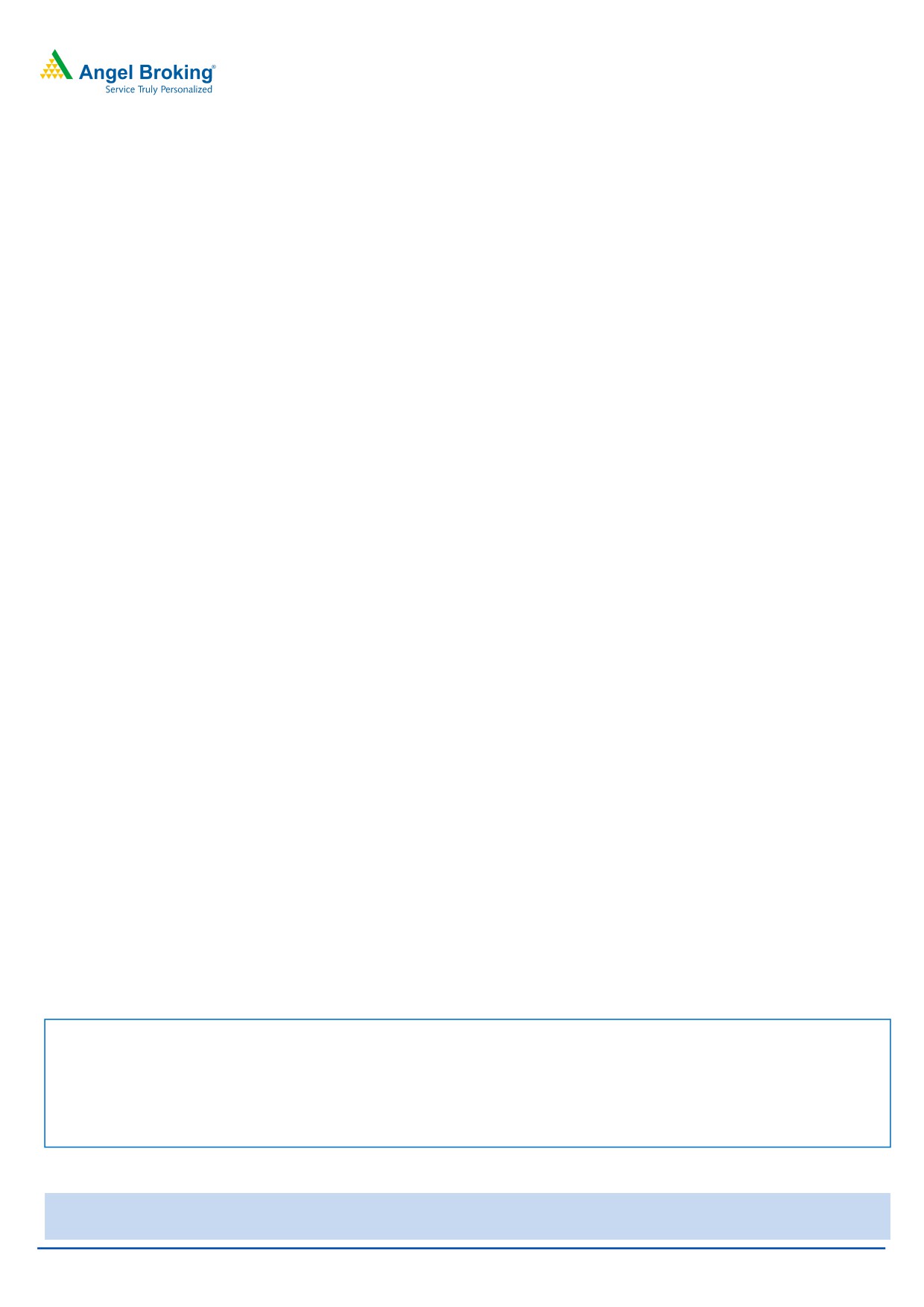

Net profit grows strongly on back of healthy top-line growth and margin

improvement: ARBL’s adjusted net profit for the quarter grew strongly by 22% yoy

to `123cr, tracking robust operating performance.

November 5, 2015

3

Amara Raja Batteries | 2QFY2016 Result Update

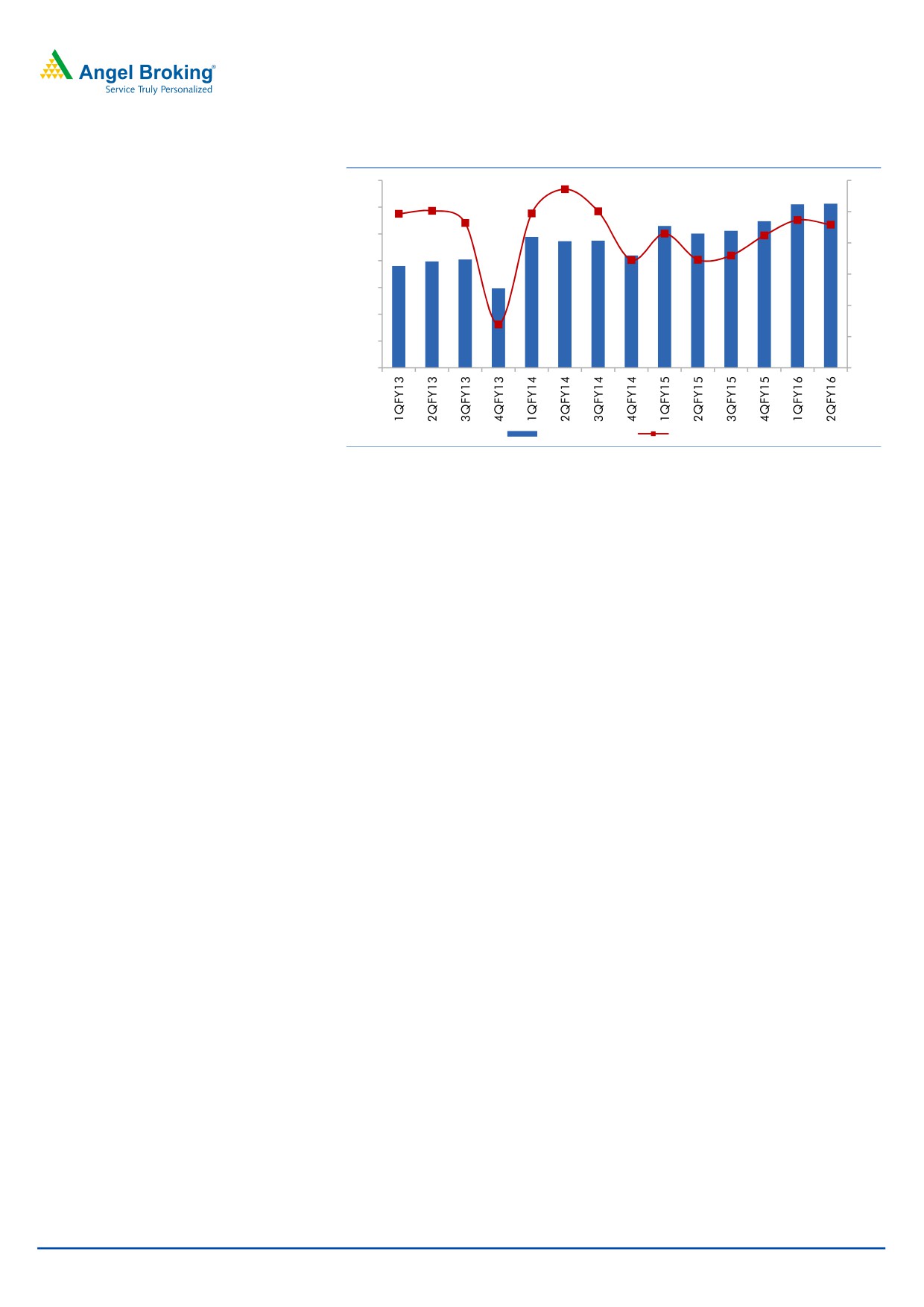

Exhibit 5: Strong bottom-line growth

140

12

120

11

100

10

80

9

60

8

40

7

20

0

6

Net Profit (` cr)

Margin (%)

Source: Company, Angel Research

November 5, 2015

4

Amara Raja Batteries | 2QFY2016 Result Update

Conference call - Key highlights

ARBL continues to outpace the automotive battery segment growth, on the

back of market share gains. During 1HFY2016, ARBL’s automotive

replacement segment, which constitutes about 36% of its revenues, grew by a

healthy 21% yoy. ARBL outpaced the auto replacement industry growth of 11-

12% yoy. ARBL’s current market share in the auto replacement segment stands

at about 25%.

ARBL outgrew the automotive OEM industry as well. In the 4W OEM segment

(which forms 15% of its top-line), ARBL grew 17% yoy as against industry

growth of 6-7% yoy. Similarly in the 2W OEM segment (which constitutes

about 4% of its topline), ARBL’s revenue grew 15% yoy as against a flat

industry.

ARBL expects the outperformance in the automotive segment (which forms

about 56% of the revenues) to continue given the increased sourcing by OEMs

and continued market share gains in the automotive replacement space given

the strengthening of its distribution network particularly in the Eastern and the

Western markets where it has a relatively lesser presence.

ARBL expects demand in the industrial segment (which forms about 44% of the

top-line) to pick up in 2HFY2016. Increased data usage and the need to

improvise on the call quality has led to tower additions by telecom players

(telecom forms about 22% of the top-line) which would boost demand, going

forward. Further, ARBL expects the UPS segment (which forms 15% of the top-

line) and other industrial segments to recover from 2HFY2016, which would

augment the industrial revenues.

In order to meet increased demand in both the automotive and the industrial

space, ARBL is expanding capacities. In the automotive 4W segment, ARBL has

current capacity of 8.25mn units with capacity utilization of 85%. ARBL can

enhance the 4W capacity by 6mn units by introducing new manufacturing

lines within the current location. In the automotive 2W segment, ARBL has

current capacity of 8.4mn units with the utilization level at 90%. ARBL is in the

process of expanding its 2W capacity to 11mn units by FY2016-end.

Similarly in the industrial segment, ARBL is enhancing large VRLA capacity

(suitable for making telecom batteries) by 20% to 1.4bn Ah which would come

on stream by FY2016-end. The capacity utilization in LVRLA stands at 97%. In

MVRLA (suitable for UPS), the company has capacity of 850mn Ah and the

capacity utilization currently stands at 80%.

In order to effectively tap the home inverter segment, ARBL is setting up a

tubular battery manufacturing plant with a capacity of 1.4mn units. ARBL is

investing `500cr in the plant and expects a revenue potential of `1,000cr at

full utilization. The first phase with capacity of 0.9mn units would commence in

December 2015 with the balance coming in by December 2016. ARBL

currently sells home inverters through the trading route and the current run

rate is of 0.35mn units.

ARBL has guided for overall capex of `900cr over the next two years.

November 5, 2015

5

Amara Raja Batteries | 2QFY2016 Result Update

As per ARBL, changes in lead prices are a pass thru to 60% of the customer

base (automotive OEM and the entire industrial segment). ARBL takes a call on

pricing in the automotive replacement market depending on the competitive

scenario. Currently, ARBL has not taken any pricing action in the replacement

space and is enjoying the benefits of lower lead prices.

November 5, 2015

6

Amara Raja Batteries | 2QFY2016 Result Update

Investment arguments

Demand scenario for automotive and industrial batteries to remain positive in

the long run: We expect growth traction in the automotive battery segment to

continue over the next two years. The automotive OEM segment has witnessed

volume recovery in FY2015 post improvement in consumer sentiments.

Further, robust automotive replacement demand is likely to maintain growth

momentum. Also, given the economic recovery, the industrial segment

(railways, UPS and telecom) is also poised to register double-digit growth over

the next two years.

Likely to outpace industry growth on increased sourcing from automotive OEM

segment: ARBL has outpaced the battery industry over the last four to five

years. Penetration into the new automotive OEM segment has led to market

share gains for ARBL. OEM customers both in the 4W and 2W segments have

strategically opted to source from ARBL in order to have multiple sourcing and

reduce dependence on a single supplier. Also, by strengthening its distribution

reach in the Eastern and Western markets, ARBL is likely to gain market share

in the automotive replacement segment as well. We believe ARBL would

continue to gain market share in the near term and expect it to post a top-line

CAGR of 21% over FY2015-2017.

Outlook and valuation

ARBL is likely to continue gaining market share in the automotive battery segment.

The strategy followed by automotive OEMs of sourcing from multiple vendors as

against having a single vendor is likely to benefit ARBL. Further, given the

strengthening distribution network in the Western and Eastern markets,

replacement sales are also expected grow in strong double digits, going forward.

We also expect the industrial segment to recover from 2HFY2016, given the

network expansion by telecom players and with ARBL entering into tubular battery

manufacturing. We expect ARBL to record a healthy top-line CAGR of 19% over

FY2015 to FY2017. Also, given the softness in lead prices, margins are expected

to remain at elevated levels. We expect ARBL to clock 27% earnings CAGR over the

next two years. Hence, we have a positive view on the stock and maintain our Buy

rating with target price of `1,039 (based on 28x FY2017 earnings).

Company background

Amara Raja Batteries Ltd (ARBL) is a leading automobile and industrial battery

manufacturer in India. It is the second largest lead acid battery manufacturer

having a market share of about 35% in the organized battery industry. ARBL has a

technological tie up with US based Johnson Controls, which also holds 26% stake

in it. The automotive and industrial battery segments each accounted for 50% of

the company's total revenue in FY2015.

November 5, 2015

7

Amara Raja Batteries | 2QFY2016 Result Update

Profit and loss statement (Standalone)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

2,375

2,959

3,452

4,230

4,892

5,871

% chg

34.4

24.6

16.7

22.5

15.7

20.0

Total expenditure

2,017

2,508

2,876

3,502

4,039

4,840

Net raw material costs

1,598

1,991

2,283

2,776

3,195

3,851

Employee expenses

100

126

158

195

234

274

Other expenses

319

390

435

531

611

715

EBITDA

357

451

575

728

853

1,031

% chg

38.4

26.1

27.6

26.5

17.2

20.9

(% of total op. income)

15.1

15.2

16.7

17.2

17.4

17.6

Depreciation & amort.

46

66

65

134

178

204

EBIT

323

431

541

617

725

920

% chg

45.4

33.7

25.5

14.1

17.5

26.9

(% of total op. income)

13.6

14.6

15.7

14.6

14.8

15.7

Interest and other charges

4

0

1

0

1

1

Other income

12

47

30

24

50

93

Recurring PBT

319

431

541

617

724

919

% chg

44.5

35.3

25.4

14.2

17.4

26.9

Extraordinary items

-

(9)

(4)

(7)

PBT (reported)

319

422

537

610

724

919

Tax

104

135

169

199

232

285

(% of PBT)

32.5

31.4

31.3

32.2

32.0

31.0

PAT (reported)

215

287

367

411

493

634

ADJ. PAT

215

296

371

418

493

634

% chg

45.7

37.6

25.5

12.6

17.8

28.8

(% of total op. income)

9.1

10.0

10.8

9.9

10.1

10.8

Adj. EPS (`)

12.6

17.3

21.7

24.5

28.8

37.1

% chg

45.7

37.6

25.5

12.6

17.8

28.8

November 5, 2015

8

Amara Raja Batteries | 2QFY2016 Result Update

Balance sheet statement (Standalone)

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015 FY2016E FY2017E

SOURCES OF FUNDS

Equity share capital

17

17

17

17

17

17

Reserves & surplus

806

1,043

1,346

1,682

2,091

2,618

Shareholders’ Funds

823

1,060

1,363

1,700

2,108

2,635

Total loans

84

87

84

74

50

50

Deferred tax liability

22

20

30

37

37

37

Other long term liabilities

Total Liabilities

930

1,166

1,477

1,811

2,195

2,722

APPLICATION OF FUNDS

Gross block

621

680

996

1,441

2,041

2,341

Less: Acc. depreciation

267

321

372

497

675

878

Net Block

355

359

623

944

1,367

1,463

Capital work-in-progress

32

103

145

86

100

100

Investments

16

16

16

16

22

25

Other noncurrent assets

0

0

0

0

0

0

Current assets

949

1,292

1,199

1,341

1,395

1,960

Cash

229

411

295

222

119

427

Loans & advances

131

201

113

140

160

192

Other

589

680

792

980

1,116

1,341

Current liabilities

422

604

506

578

689

827

Net current assets

527

688

693

764

707

1,134

Total Assets

930

1,166

1,477

1,811

2,195

2,722

November 5, 2015

9

Amara Raja Batteries | 2QFY2016 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015 FY2016E FY2017E

Profit before tax

319

422

537

610

724

919

Depreciation

43

55

51

125

178

204

Change in working capital

55

21

(121)

(143)

(45)

(120)

Others

2

(2)

11

5

-

-

Direct taxes paid

(104)

(135)

(169)

(199)

(232)

(285)

Cash Flow from Operations

314

360

308

397

625

718

(Inc.)/Dec. in fixed assets

(76)

(130)

(357)

(388)

(614)

(300)

(Inc.)/Dec. in investments

(0)

-

-

-

(6)

(3)

Cash Flow from Investing

(76)

(130)

(357)

(388)

(620)

(303)

Issue of equity

Inc./(Dec.) in loans

(11)

3

(3)

(10)

(24)

-

Dividend paid (Incl. Tax)

(38)

(50)

(65)

(72)

(84)

(108)

Others

0

0

(0)

(0)

-

-

Cash Flow from Financing

(48)

(47)

(68)

(82)

(108)

(108)

Inc./(Dec.) in cash

189

182

(117)

(72)

(103)

308

Opening Cash balances

40

229

412

295

222

120

Closing Cash balances

229

412

295

222

120

427

November 5, 2015

10

Amara Raja Batteries | 2QFY2016 Result Update

Key ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

70.0

50.9

40.5

36.0

30.6

23.7

P/CEPS

57.6

41.6

34.5

27.3

22.5

18.0

P/BV

18.3

14.2

11.0

8.9

7.1

5.7

Dividend yield (%)

0.2

0.3

0.4

0.4

0.6

0.7

EV/Sales

6.3

5.0

4.3

3.5

3.1

2.5

EV/EBITDA

41.6

32.6

25.8

20.5

17.5

14.2

EV / Total Assets

16.0

12.6

10.0

8.2

6.8

5.4

Per Share Data (`)

EPS (Basic)

12.6

17.3

21.7

24.5

28.8

37.1

EPS (fully diluted)

12.6

17.3

21.7

24.5

28.8

37.1

Cash EPS

15.3

21.2

25.5

32.3

39.2

49.1

DPS

1.9

2.5

3.2

3.6

4.9

6.3

Book Value

48.2

62.0

79.8

99.5

123.4

154.3

Dupont Analysis

EBIT margin

13.6

14.6

15.7

14.6

14.8

15.7

Tax retention ratio

0.7

0.7

0.7

0.7

0.7

0.7

Asset turnover (x)

3.4

3.9

2.9

2.7

2.4

2.6

ROIC (Post-tax)

31.1

39.2

31.4

26.3

23.8

27.7

Cost of Debt (Post Tax)

3.2

0.2

0.6

0.2

1.1

1.4

Leverage (x)

(0.2)

(0.3)

(0.2)

(0.1)

(0.0)

(0.1)

Operating ROE

26.2

27.3

26.7

24.1

23.0

23.9

Returns (%)

ROCE (Pre-tax)

34.7

37.0

36.6

34.1

33.0

33.8

Angel ROIC (Pre-tax)

46.1

57.1

45.8

38.9

34.9

40.1

ROE

26.1

27.9

27.2

24.6

23.4

24.1

Turnover ratios (x)

Asset Turnover (Gross Block)

3.8

4.3

3.5

2.9

2.4

2.5

Inventory / Sales (days)

41.0

36.1

35.4

36.1

35.9

36.1

Receivables (days)

49.1

47.0

47.9

47.8

46.8

46.8

Payables (days)

64.9

74.5

53.5

49.8

51.4

51.4

WC cycle (ex-cash) (days)

45.8

34.2

42.1

46.7

43.8

43.9

Solvency ratios (x)

Net debt to equity

(0.2)

(0.3)

(0.2)

(0.1)

(0.0)

(0.1)

Net debt to EBITDA

(0.4)

(0.7)

(0.4)

(0.2)

(0.1)

(0.4)

Interest Coverage (EBIT / Int.)

80.5

1603.1

753.9

2572.4

906.5

920.4

November 5, 2015

11

Amara Raja Batteries | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Amara Raja Batteries

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 5, 2015

12