IPO Note | Pharmaceutical

December 7, 2015

Alkem Laboratories

AVOID

Issue Open: December 8, 2015

IPO Note - Valuation provides little comfort

Issue Close: December 10, 2015

Alkem Laboratories (Alkem) is among the largest companies in the Indian

Issue Details

formulation market, having a market share of 3.6%. The company is the fifth

largest pharmaceutical company in India by domestic sales. Currently, domestic

Face Value: `2

markets constitute around 75% of its sales; while in terms of exports, the company

Present Eq. Paid up Capital: `239cr

is at a relatively nascent stage vis-a-vis its peers. In exports (predominately US),

Offer Sale:1.28cr Shares

the company is expanding through both the inorganic and the organic route.

Alkem has 16 manufacturing units, 14 in India and 2 in the US; of which, 5 are

Post Eq. Paid up Capital: `239cr

USFDA, TGA and UK-MHRA approved.

Issue (amount): `1,311-1,350cr

Established Market Leadership in Domestic formulation market: Alkem is one of

Price Band: `1020-1050

India’s leading pharmaceutical companies in the domestic formulation market

Domestic formulations constitute around ~75% of the company’s overall sales. The

Post-issue implied mkt. cap `12,196cr*-

12,554cr**

company ranks fifth in the Indian pharmaceutical market. Its most significant therapeutic

Note:*at Lower price band and **Upper price band

areas accounted for 80.7% of its total sales in the domestic market in FY2015. Its revenues

from domestic operations grew at a CAGR of 17.6% over FY2011 to FY2015.

Expanding in export markets: Although a late entrant in the export markets,

~25% of Alkem’s sales are contributed by exports. The company has expanded

Book Building

internationally through organic growth and through certain strategic acquisitions.

QIBs

50%

The US market is its key focus market (accounting for ~70% of its exports) in

Non-Institutional

15%

terms of its international operations. The revenues from its international

Retail

35%

operations have grown at a CAGR of 45.7% between FY2011 and FY2015. The

contribution of revenues from international operations to overall revenues has

grown from 12.6% in FY2011 to 25.3% FY2015.

Outlook and Valuation: In our view, the company is comparable only to mid-cap

Post Issue Shareholding Pattern(%)

companies like IPCA Laboratories (IPCA) in terms of size and profitability. While the

Promoters Group

66.2

company is growing at a robust pace of >20%, its low profitability is a cause of

MF/Banks/Indian

concern. Also, a major part of the profitability is being accrued from other income

FIs/FIIs/Public & Others

33.8

and aided by low taxation. On an average, the company’s other income accounts

for around ~30-35% of PBT, while tax as % of PBT has been at 5% levels over the

years. Thus, on a like-to-like basis IPCA has a more superior business quality and

we therefore believe that Alkem should trade at a discount to companies like IPCA

Labs. Adjusting for other income, the PE of Alkem stands at 17.3x-17.8x its

FY2016E earnings and 3.3x-3.4x its FY2016E P/BV (at the lower and upper end

of the price band respectively). We believe that the valuation leaves little scope for

further appreciation in the stock price in the near term. Hence, we recommend an

“Avoid” on the issue.

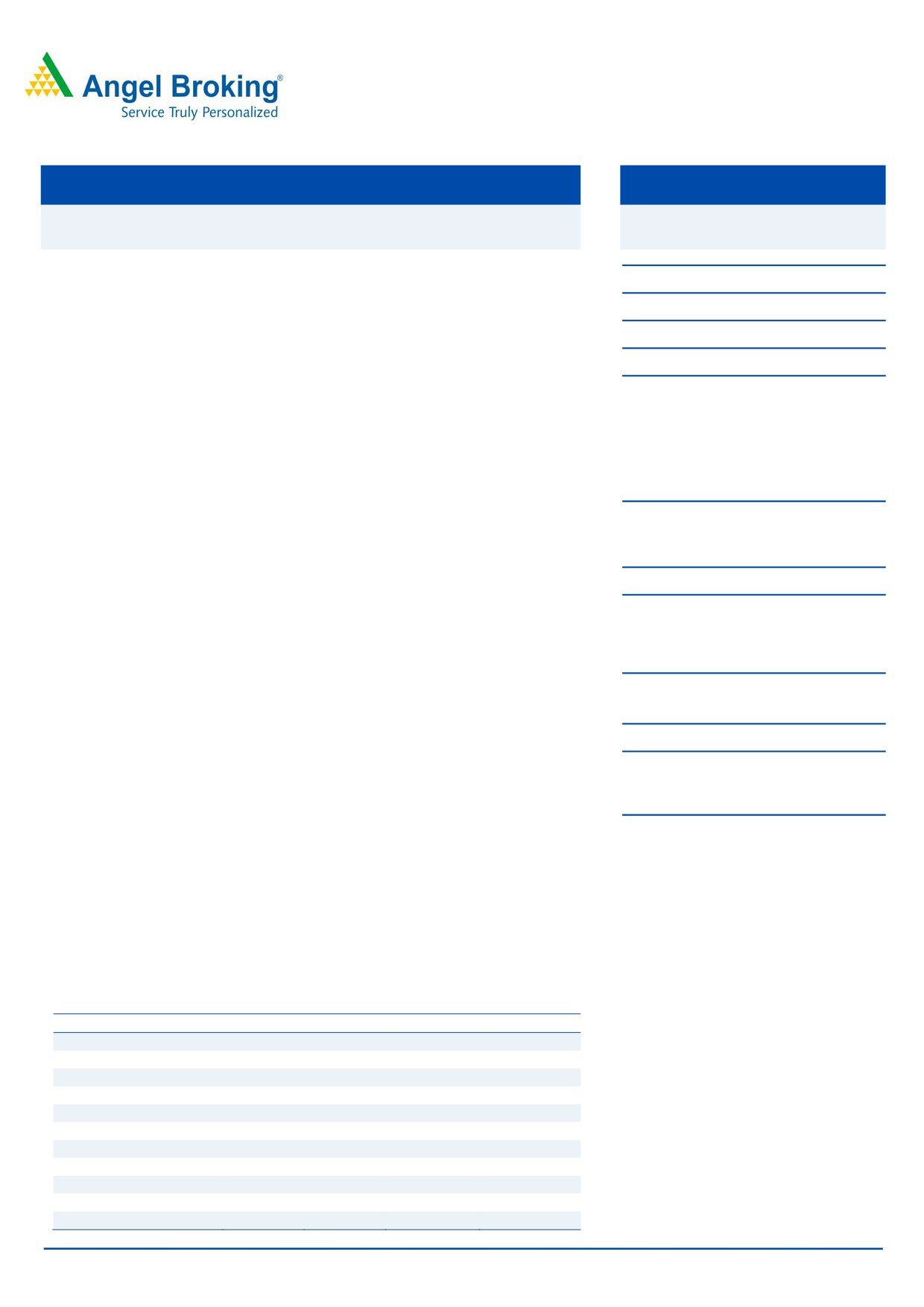

Key Financials

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

Net Sales

2,417

3,033

3,701

4,960

% chg

22.5

25.5

22.0

34.0

Net Profit

384

436

463

785

% chg

(5.7)

13.6

6.3

69.5

OPM (%)

32.1

36.4

38.7

65.6

EPS (`)

11.8

10.5

10.8

15.5

P/E (x)

32.7

28.8

27.1

16.0

P/BV (x)

19.2

18.3

16.6

23.4

RoE (%)

9.7

9.1

10.0

17.4

Sarabjit Kour Nangra

EV/Sales (x)

5.8

4.9

4.2

3.4

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

4.8

4.0

3.1

2.3

Source: Company, Angel Research; Note:*EPS and other valuation parameters is based on upper price band

Please refer to important disclosures at the end of this report

1

Alkem | IPO Note

Company background

Established in 1973 in Patna, Alkem is present in acute and chronic therapeutic

segments. The company has extensive brand share in therapeutic areas in

domestic market in anti-infectives, gastro-intestinal, pain and analgesics, and

vitamins, minerals and nutrients. These therapeutic areas accounted for 80.7% of

the company’s total sales in the domestic market in FY2015. It has a portfolio of

800 brands and has 14 manufacturing facilities across 7 locations in India and 2

in the US. For FY2015, Alkem was the fifth largest pharmaceutical company in

India by domestic sales. In the US, it has filed 69 abbreviated new drug

applications (ANDAs; of which 21 have received final approval and 30 are Para-

IV including first-to-file [FTF]).

Alkem has also expanded through the inorganic route, having acquired Ascend in

July 2010, which provided it with the commercial platform for the world's largest

drug market, the US. Further, in December 2012, it acquired manufacturing assets

from Norac Inc in the US, focused primarily on manufacturing specialty active

pharmaceutical ingredients (APIs) and providing contract research and

manufacturing services. Earlier in June 2009, it had acquired a majority stake in

Pharmacor Pty Ltd to enter the Australian market. Pharmacor targets individual

pharmacies, pharmacy groups, pharmacy co-ops, aged care and hospitals to offer

prescription drugs and over-the-counter generic medicines. Two months ago, it

acquired a formulation manufacturing facility from Long Pharmaceuticals LLC in

the US that has semi-solids, liquid and nasal formulation manufacturing

capabilities.

Issue details

Alkem is coming out with an initial public offering (IPO) to raise `1,311-1,350cr

from the equity market at a price band of `1,020-1,050/equity share. Through the

IPO, the company proposes to offer 1.29cr equity shares for sale by promoter and

other selling shareholders. Since the offer is being made through offer for sale, the

proceeds from the offer will be remitted to the respective shareholders. The

company will not receive any proceeds from the offer.

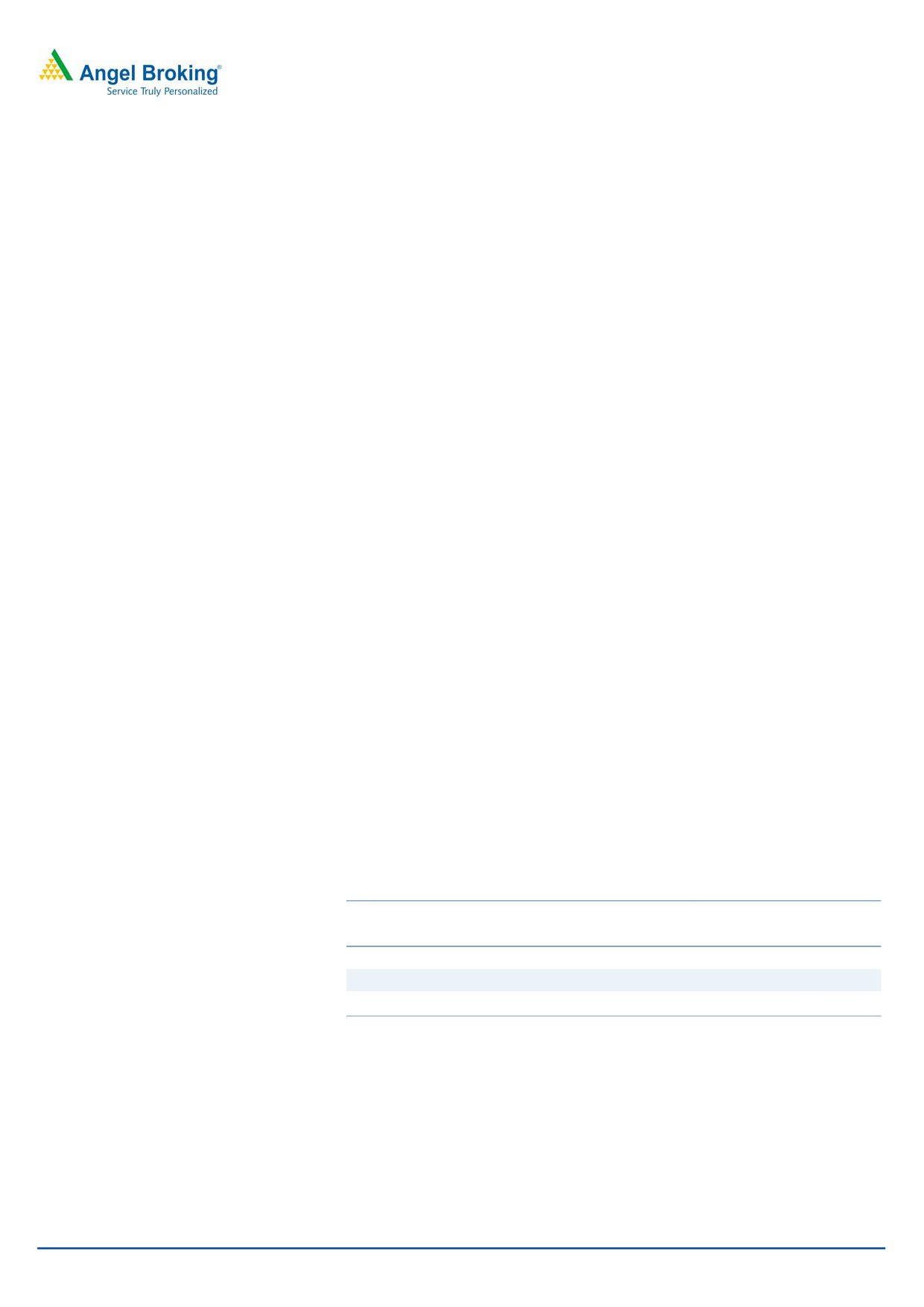

Exhibit 1: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

84,735,715.5

70.87

79,187,899.5

66.23

Others

34,829,284.5

29.13

40,377,100.5

33.77

Total

119,565,000

100.0

119,565,000

100.0

Source: Company, Angel Research

Key investment rationale

Established Market Leadership in Indian markets

Alkem is one of India’s leading pharmaceutical companies in the domestic

formulations markets; domestic formulations constitute around ~75% of its overall

sales. The company’s most significant therapeutic areas in the domestic market are

anti-infectives, gastro-intestinal, pain and analgesics, and vitamins, minerals and

December 7, 2015

2

Alkem | IPO Note

nutrients. These therapeutic areas accounted for 80.7% of its total sales in the

domestic market for FY2015. In these categories, the company has a leadership

position, ie the company has a market share of 11.2% in anti-infectives, and is

ranked third in terms of market share for both the gastro-intestinal (with a market

share of 5.6%) and pain/analgesics (with a market share of 5.0%) therapeutic

areas. The top 20 brands of the company account for around 55% of its domestic

revenues. Alkem has a strong marketing and distribution network in India

comprising of a field force of 5,856 medical representatives.

According to IMS Health, the company was the third-fastest growing company in

terms of sales during FY2011-15 and is among the ten largest pharmaceutical

companies in the Indian domestic formulations market. The net revenues from the

company’s domestic operations grew at a CAGR of 17.6% over FY2011 to

FY2015.

Expanding in Export markets

Although a late entrant in the exports market, exports now account for ~25% of

Alkem’s sales. Alkem has expanded internationally through both organic growth

and through certain strategic acquisitions. The US market is the key focus market

(accounting for ~70% of its exports) for its international operations. It markets and

sells products in the US under the brand name Ascend to major pharmacy chains’

stores, wholesalers, managed care companies, distributors, food and grocery

stores and pharmaceutical retailers. Ascend currently sells 17 products in the

market, out of which 12 are its own products and 5 are in-licensed from third

parties. The revenues from its international operations have grown at a CAGR of

45.7% between FY2011 and FY2015. The contribution of net revenues from

international operations to overall revenues has grown from 12.6% in FY2011 to

25.3% in 2015.

The company’s largest facility servicing the US market is in Daman, which was last

inspected by the USFDA_in 2013. Another US servicing facility in Baddi has

received Establishment Inspection Report in Oct-Nov 2015, which means it can

continue supplying to the US market. Overall the company has three USFDA

approved facilities in India and two in the US.

Research and development skills

Alkem has employed 483 scientists working on various drug products and

substances in India and the US. The research and development department carries

out process development, formulation development and analytical research for

domestic and international markets. The company has a strong pipeline of

products under development for its focused markets. It has a robust ANDA pipeline

with cumulative filing of 69, with 45 ANDAs pending for approval. Alkem has 30

para IV filings which include FTFs as well. The company spent 4.5% of its net sales

towards R&D in FY2015.

December 7, 2015

3

Alkem | IPO Note

Valuation

Alkem is valued at a P/E multiple of 15.5x-16.0x its FY2016E EPS at the lower and

upper ends of the price band, respectively. In our view, the company is comparable only

to mid-cap companies like IPCA in terms of size and profitability. However the profitability

of the company in the recent past has been subject to variations owing to its investments

in infrastructure and building man power in Indian markets. This is evident from the OPM

of the company coming in at 10.8% in FY2015 from 16.9% in FY2013 and the ROE

consequently dropping from 22.4% in FY2013 to 16.6% in FY2015. However,

1HFY2016 has seen a recovery in the operating performance with the OPM expanding

to 16.5%, thus moving back to earlier levels.

The growth of the company is robust at >20%, while its low profitability in the

recent past is a cause of concern. Also, a major part of the company’s profitability

is being accrued by other income and low taxation. On an average, the company

has other income of around ~30-35% of PBT, while tax as % of PBT has been at

5%. Thus, on a like -to-like basis, IPCA, which in our coverage is the closest

comparison, has a more superior business quality. Thus we would like to get more

comfort on profitability improvement and sustenance of the same for Alkem. We

believe that the stock should trade at a discount to companies like IPCA Labs(

which trade at 18x one year forward normalized earnings). Adjusting for other

income, we believe that the PE of the company is 17.3x-17.8x its FY2016E

earnings and 3.3x-3.4x its FY2016E P/BV (at the upper and lower end of the price

band respectively). We believe that the valuation leaves little scope for further

appreciation in the stock price in the near term.

Hence, we recommend an “Avoid” on the issue. Investors could consider waiting for

a possible correction in the stock price post the listing of the IPO.

Risks for the company

Any adverse outcome of inspection of the USFDA approved sites could affect

the financials of the company and hamper future growth and profitability.

Domestic formulations constitute 75% of total sales, with Alkem’s top 20

brands accounting for 55% of domestic sales. Thus, inclusion of its key brands

under NLEM could severely impact its revenues and profitability.

December 7, 2015

4

Alkem | IPO Note

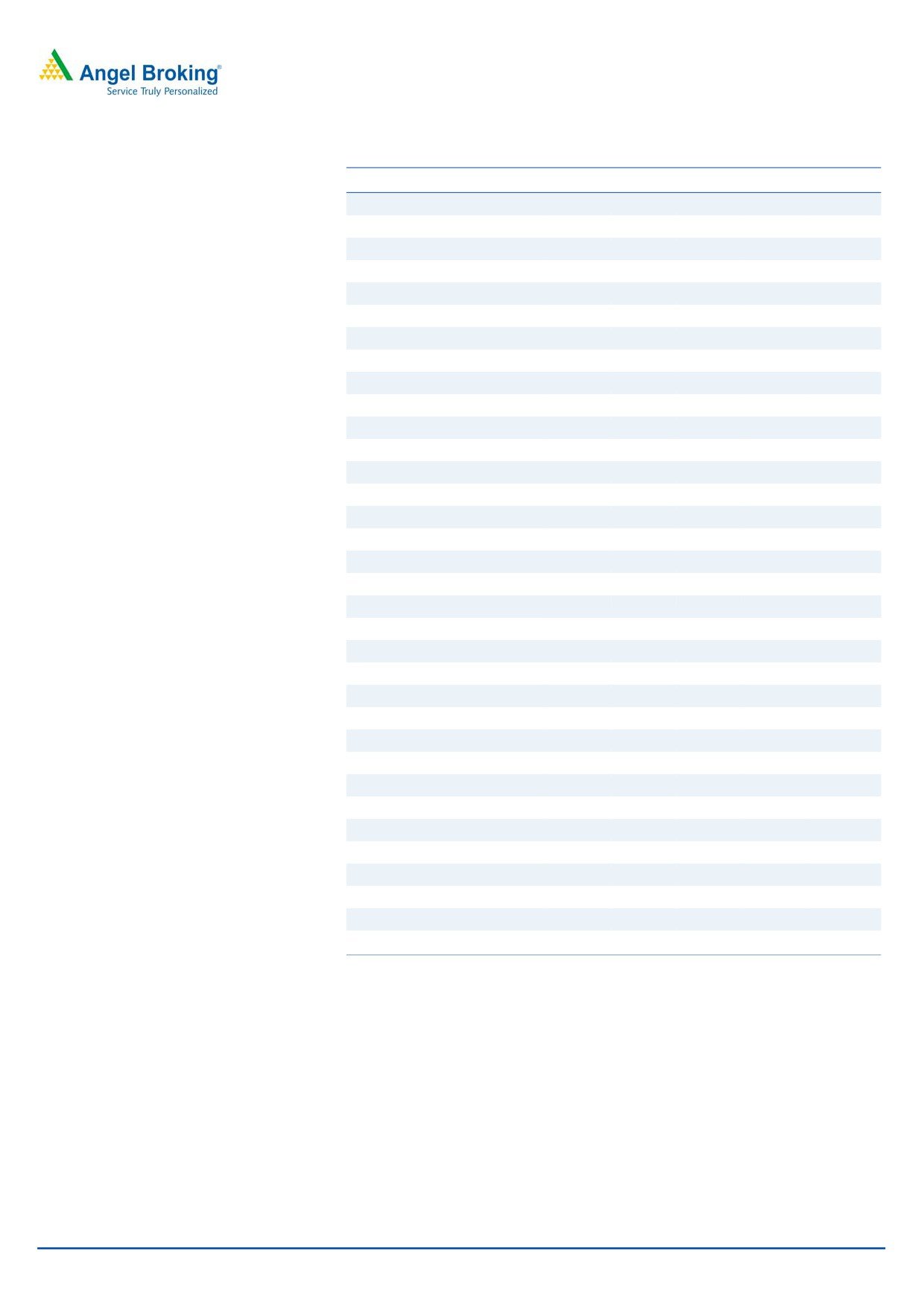

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

Gross sales

2,028

2,497

3,138

3,818

5,140

Less: Excise duty

55

80

105

117

180

Net sales

1,973

2,417

3,033

3,701

4,960

Other operating income

187.9

245.1

258.1

268.3

268.3

Total operating income

2,161

2,662

3,291

3,970

5,228

% chg

19.2

23.2

23.6

20.6

31.7

Total expenditure

1,640

2,133

2,716

3,302

4,193

Net raw materials

834

1,056

1,386

1,691

1,977

Personnel

303

412

532

638

853

Other

503

665

799

974

1,363

EBITDA

333

285

317

400

767

(% of Net Sales)

16.9

11.8

10.5

10.8

15.5

Depreciation& amortisation

29

40

52

70

82

Interest & other charges

58

88

93

81

81

Other income

0

-

0

0

-

(% of PBT)

0

-

0

0

-

Share in profit of Associates

-

-

-

-

-

Recurring PBT

434

402

430

517

872

% chg

Extraordinary expense/(Inc.)

-

-

-

-

-

PBT (reported)

434

402

430

517

872

Tax

28

18

(5)

54

87

(% of PBT)

6.3

4.5

(1.3)

10.5

10.0

PAT (reported)

406

384

436

463

785

Add: Share of earnings of asso.

-

-

-

-

-

Less: Minority interest (MI)

(1)

-

-

-

-

Prior period items

-

-

-

-

-

PAT after MI (reported)

407

384

436

463

785

ADJ. PAT

407

384

436

463

785

% chg

37.5

(5.7)

13.6

6.3

69.5

(% of Net Sales)

20.6

15.9

14.4

12.5

15.8

Basic EPS (`)

34.0

32.1

36.4

38.7

65.6

Fully Diluted EPS (`)

34.0

32.1

36.4

38.7

65.6

% chg

37.5

(5.7)

13.6

6.3

69.5

Note: *EPS calculation is based on Pre IPO outstanding shares

December 7, 2015

5

Alkem | IPO Note

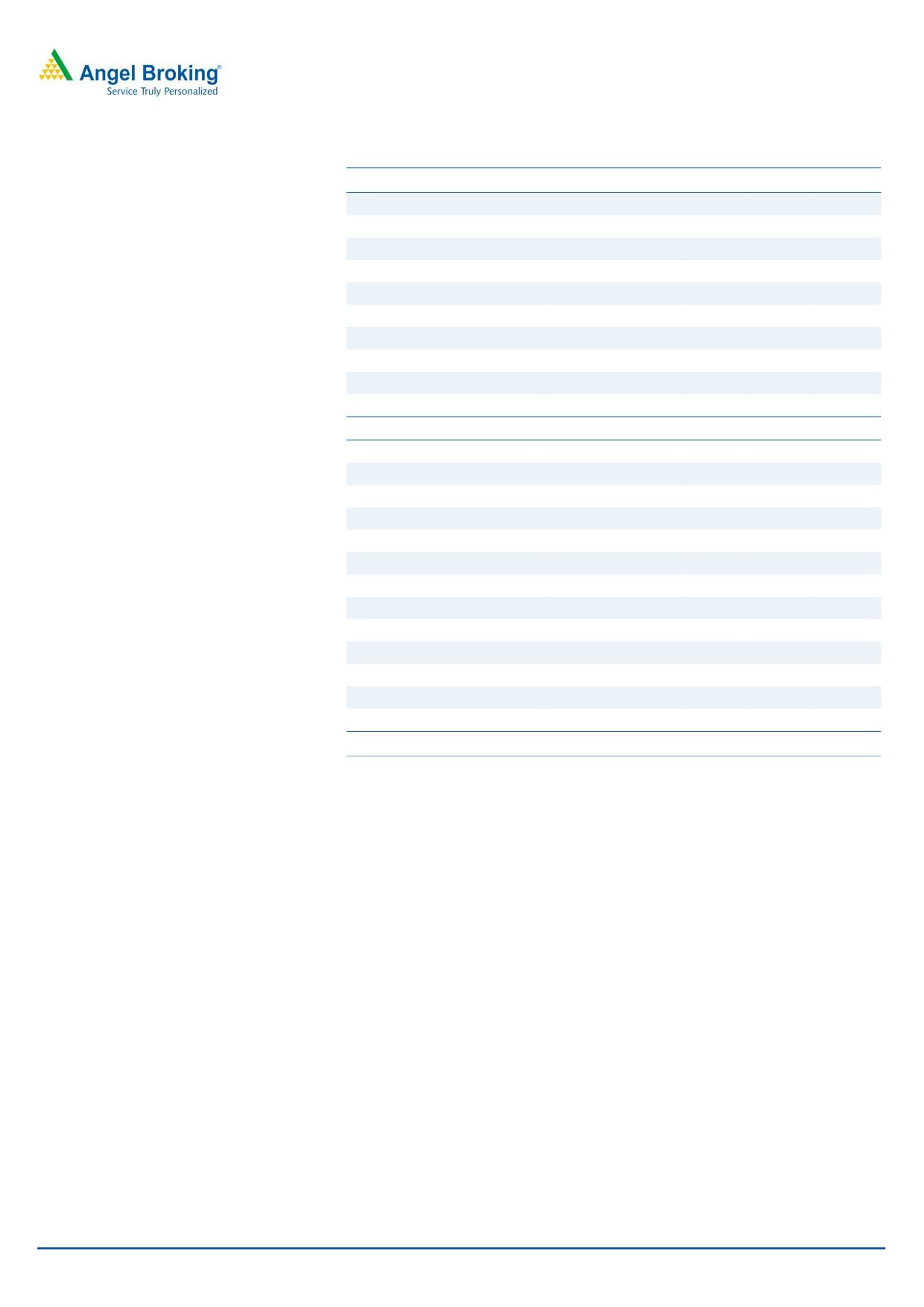

Consolidated Balance Sheet

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

SOURCES OF FUNDS

Equity share capital

12.0

12.0

12.0

23.9

23.9

Preference Capital

-

-

-

-

-

Reserves & surplus

1,802

2,160

2,567

2,971

3,699

Shareholders funds

1,814

2,172

2,579

2,995

3,723

Minority Interest

0.2

89.2

89.2

Other Long Term Liabilities

0.2

12.3

7.8

5.1

5.1

Long Term Provisions

185.2

49.5

47.4

71.7

71.7

Total loans

309

256

232

33

33.4

Deferred tax liability

33

47

39

90

90.1

Total liabilities

2,342

2,536

2,906

3,285

3,924

APPLICATION OF FUNDS

Net block

674

896

980

1,143

1,261

Capital work-in-progress

-

-

-

-

-

Goodwill

245

176

190

342

342

Long Term Loans and Advances

259

339

418

542

542

Investments

299

410

338

420

420

Current assets

1,302

2,156

1,602

2,344

3,088

Cash

514

995

206

791

901

Loans & advances

97

133

126

130

282

Other

691

1,028

1,270

1,423

1,905

Current liabilities

1,114

1,735

1,406

2,012

2,403

Net current assets

189

421

197

332

685

Other non-current assets

677

293

783

506

675

Total assets

2,342

2,536

2,906

3,285

3,924

December 7, 2015

6

Alkem | IPO Note

Consolidated Cash Flow Statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

Profit before tax

434

402

430

517

872

Depreciation

29

40

52

70

82

(Inc)/Dec in Working Capital

(145)

(59)

(381)

102

(281)

Less: Other income

-

-

-

-

-

Direct taxes paid

31

18

(5)

54

87

Cash Flow from Operations

287

364

107

635

586

(Inc.)/Dec.in Fixed Assets

(248)

(110)

(93)

(816)

(150)

(Inc.)/Dec. in Investments

(261)

(111)

72

(82)

-

Other income

-

-

-

-

-

Cash Flow from Investing

(509)

(221)

(21)

(898)

(150)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

10

(53)

(23)

(199)

-

Dividend Paid (Incl. Tax)

(21)

(52)

(32)

(57)

(57)

Others

224

443

(821)

1,103

(269)

Cash Flow from Financing

213

338

(876)

847

(326)

Inc./(Dec.) in Cash

(10)

482

(789)

584

110

Opening Cash balances

524

514

995

206

791

Closing Cash balances

514

995

206

791

901

December 7, 2015

7

Alkem | IPO Note

Key Ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

Valuation Ratio (x)

P/E (on FDEPS)

30.8

32.7

28.8

27.1

16.0

P/CEPS

28.8

29.6

25.7

23.5

14.5

P/BV

6.9

5.8

4.9

4.2

3.4

Dividend yield (%)

0.1

0.2

0.2

0.2

0.2

EV/Sales

6.2

4.8

4.0

3.1

2.3

EV/EBITDA

36.9

40.5

38.5

28.3

14.6

EV / Total Assets

5.2

4.5

4.2

3.4

2.9

Per Share Data (`)

EPS (Basic)

34.0

32.1

36.4

38.7

65.6

EPS (fully diluted)

34.0

32.1

36.4

38.7

65.6

Cash EPS

36.5

35.4

40.8

44.6

72.5

DPS

1.4

2.5

2.5

2.5

2.5

Book Value

151.8

181.7

215.8

250.5

311.4

Returns (%)

ROCE (Pre-tax)

13.0

9.7

9.1

10.0

17.4

Angel ROIC (Pre-tax)

27.6

16.6

13.7

14.1

28.3

ROE

22.4

19.2

18.3

16.6

23.4

Turnover ratios (x)

Asset Turnover (Gross Block)

4.8

5.1

5.3

3.7

3.4

Inventory / Sales (days)

40.4

36.0

32.0

31.9

28.1

Receivables (days)

33.9

29.6

28.1

29.2

24.3

Payables (days)

45.7

43.2

44.2

39.7

29.5

WC cycle (ex-cash) (days)

0.6

(61.6)

(32.4)

(21.6)

(23.6)

Solvency ratios (x)

Net debt to equity

(0.1)

(0.3)

0.0

(0.3)

(0.2)

Net debt to EBITDA

(0.6)

(2.6)

0.1

(1.9)

(1.1)

Interest Coverage (EBIT / Int.)

5.2

2.8

2.8

4.1

8.4

Note:*EPS and other valuation parameters is based on upper price band

December 7, 2015

8

Alkem | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

December 7, 2015

9