4QFY2017 Result Update | Pharma

May 30, 2017

Alkem Laboratories

BUY

CMP

`1,868

Performance Highlights

Target Price

`2,161

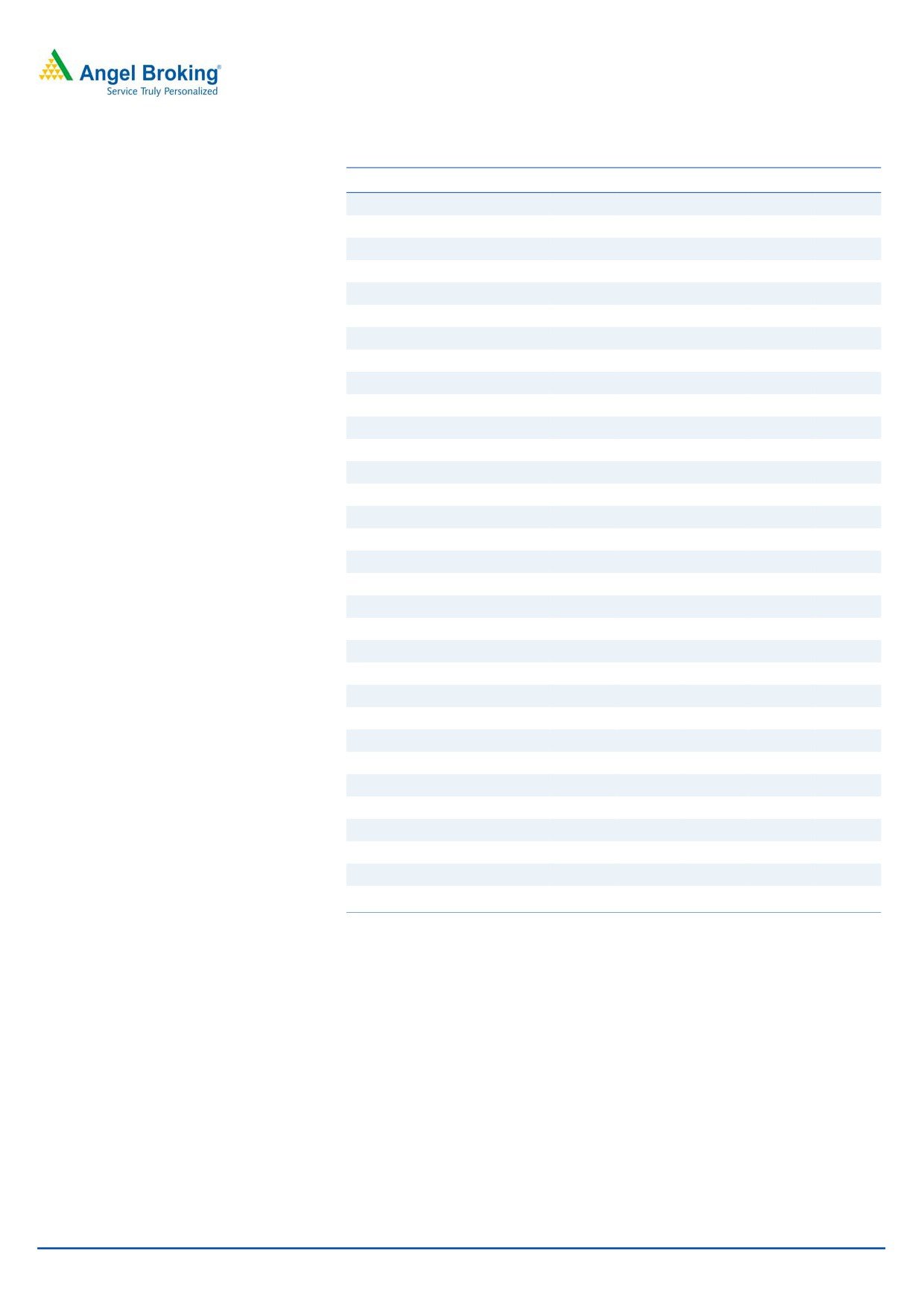

Y/E March (` cr)

4QFY17 4QFY16 % chg (yoy) FY17

FY16

% chg (yoy)

Investment Period

12 Months

Net Sales

1,251

1,149

9.0

5,853

4,992

17.2

EBITDA

149

156

(4.2)

999

848

17.8

Stock Info

EBITDA Margin (%)

11.9

13.6

-164 bp

17.1

17.0

7 bp

Sector

Pharma

Adj. PAT

137

87

58.6

892

673

32.6

Market Cap (` cr)

22,331

Source: Company, Angel Research

Net Debt (` cr)

(23)

Slower growth in domestic and US business: Alkem reported yoy revenue grew of

Beta

0.3

9% in 4QFY17. Domestic revenue grew by 7% yoy to `856cr while exports grew

52 Week High / Low

2,238/1,200

by 14.5% to `385cr. US revenue grew by 19.4% yoy to `291cr. Other exports

Avg. Daily Volume

67,071

were flat at `95cr. Domestic business contributed 69% of the total revenue during

Face Value (`)

2

the quarter. Exports mix remains unchanged (vs. 3QFY17), with US contribution

BSE Sensex

31,159

remaining at 23% of total revenues in 4QFY17.

Nifty

9,625

Reuters Code

ALKE.BO

Gross margins declined by ~35bps on qoq basis but improved by 67bps on yoy

Bloomberg Code

ALKEM IN

basis. EBITDA declined by 4.2% yoy at `149cr vs. `156r in 4QFY16. EBITDA

margins were at 11.9% vs. 13.6% in 4QFY16 and 18.1% in 3QFY17. The decline

in EBITDA margins was largely on account of higher employee cost and increased

Shareholding Pattern (%)

R&D expenditure. PAT was at `137cr in 4QFY17 showing a yoy growth of 58.6%,

Promoters

67.0

due to the lower tax in the quarter.

MF / Banks / Indian Fls

2.5

FII / NRIs / OCBs

6.7

Outlook and valuation: The stock at the CMP of `1,868 is available at P/E of

Indian Public / Others

23.8

18.6x of FY19E EPS of `101. We have cut our EPS estimates by ~5% due to the

recent slowdown in domestic business, likely disruption in the pharma industry

due to higher GST and pricing pressure in the US. We expect company to report

Abs. (%)

3m 6m 1yr

CAGR of 15.8% and 15.3% in top line and bottom line respectively in next two

Sensex

8.5

17.0

16.9

years. The company is expected to witness improvement in its return ratios owing

Alkem

(12.8)

10.1

48.4

to the rising profitability of US business. Moreover Alkem’s all manufacturing

facilities are current with USFDA which gives confidence that company will deliver

3-year price chart

strong results over next two years. Considering these factors, we rate Alkem Buy

2,500

with price target of `2,161 based on 21.5x of FY19E EPS.

2,000

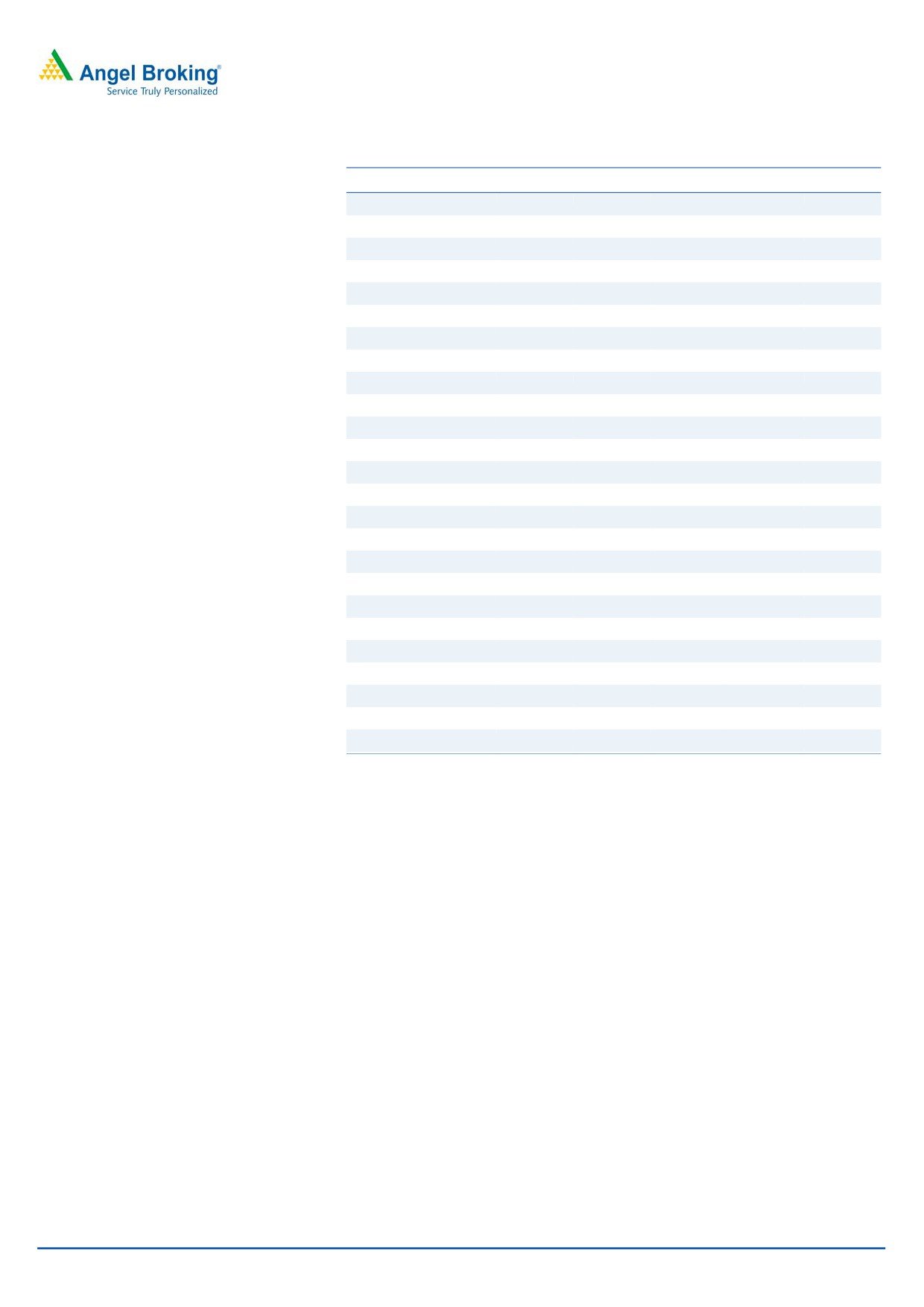

Key financials (Consolidated)

Y/E March (` cr)

FY15

FY16

FY17

FY18E

FY19E

1,500

Net Sales

3,743

4,992

5,853

6,901

7,850

1,000

% chg

19.7

33.3

17.2

17.9

13.8

500

Net Profit

392

684

905

1,016

1,202

0

% chg

(10.0)

71.9

32.6

13.9

18.3

OPM (%)

11.3

17.0

17.1

18.4

19.1

EPS (`)

32.8

56.3

74.6

85.0

100.5

Source: Company, Angel Research

P/E (x)

57.0

33.2

25.0

22.0

18.6

P/BV (x)

7.4

6.4

5.3

4.4

3.7

RoE (%)

13.1

19.2

21.1

20.2

20.1

RoCE (%)

8.0

17.6

18.0

19.7

20.0

EV/Sales (x)

6.0

4.4

3.8

3.2

2.8

Shrikant Akolkar

EV/EBITDA (x)

53.2

25.8

22.2

17.5

14.7

022-3935 7800 Ext: 6846

Source: Company, Angel Research; Note: CMP as of May 30, 2017

Please refer to important disclosures at the end of this report

1

Alkem Laboratories |4QFY2017 Result Update

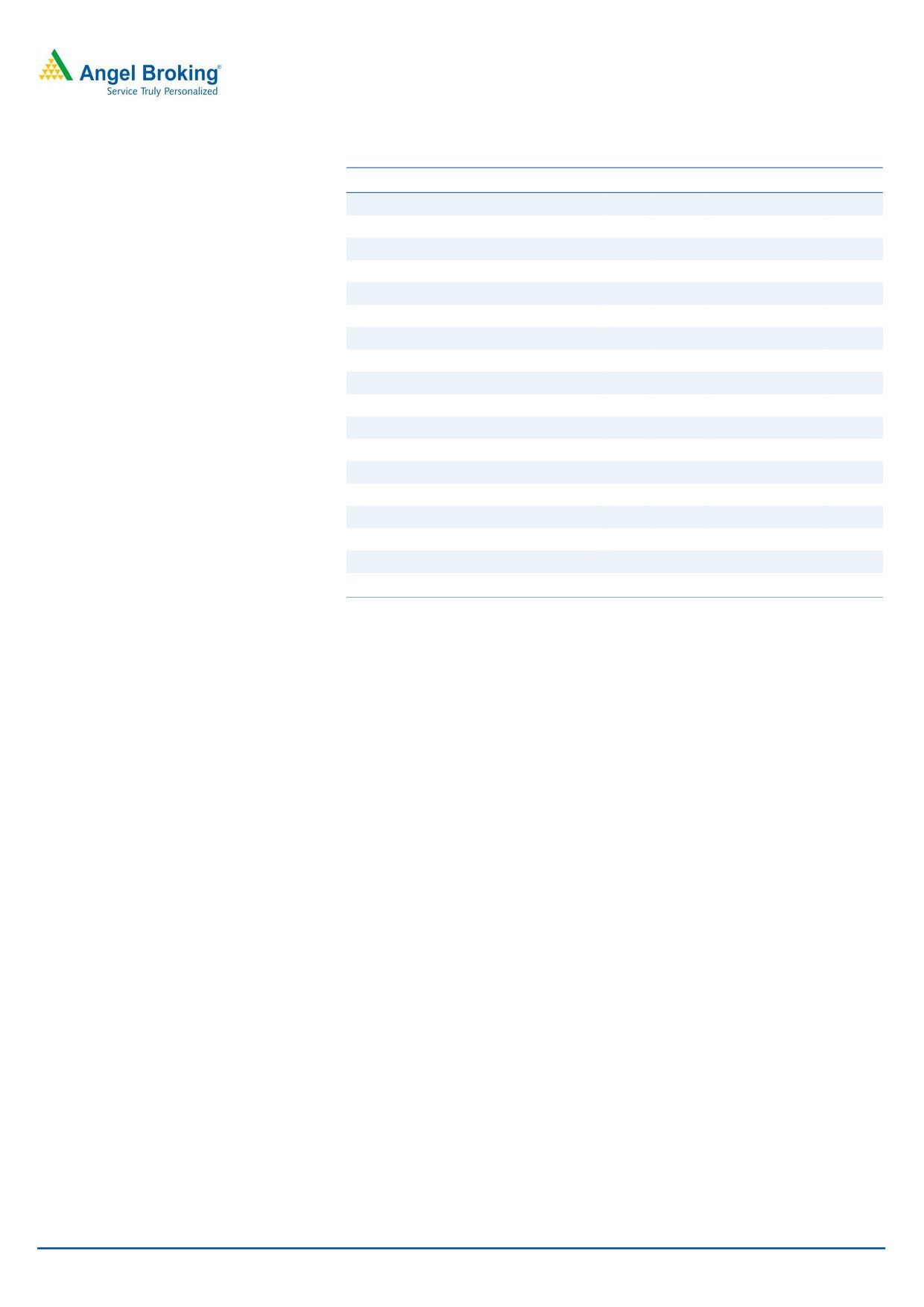

Exhibit 1: Quarterly financial performance

Y/E March (` cr)

4QFY17

4QFY16

% chg (yoy) 3QFY17

% chg (qoq) FY17 FY16

% chg (yoy)

Net sales

1,251

1,149

9.0

1,482

(15.6)

5,853

4,992

17.2

Consumption of RM

461

431

7.0

540

(14.7)

2,222

1,961

13.3

(% of Sales)

36.8

37.5

36.5

38.0

39.3

Staff costs

229

191

19.3

271

(15.7)

1004

917

9.5

(% of Sales)

18.3

16.7

18.3

17.2

18.4

Other expenses

413

371

11.4

402

2.6

1628

1265

28.7

(% of Sales)

33.0

32.3

27.1

27.8

25.3

Total Expenditure

1,102

993

11.0

1,214

(9.2)

4,854

4,143

17.1

Operating Profit

149

156

(4.2)

268

(44.3)

999

848

17.8

OPM

11.93

13.57

18.1

17.1

17.0

Depreciation

26

24

9.2

26

0.0

101

101

0.6

Other income

25

104

(76.2)

25

(3.1)

112

165

(31.9)

Finance cost

11

10

13.8

12

(2.3)

45

67

(32.7)

PBT (excl. Extr. Items)

136

225

(39.6)

255

(46.7)

965

845

14.1

Extr. Income/(Expense)

0

0

0

0

0

PBT (incl. Extr. Items)

136

225

(39.6)

255

(46.7)

965

845

14.1

(% of Sales)

10.9

19.6

17.2

16.5

16.9

Tax

(1)

139

(100.7)

19

(104.7)

60

161

(62.7)

(% of PBT)

-0.7

61.6

7.5

6.2

19.0

Reported PAT

137

87

58.3

236

(42.0)

905

684

32.2

Minority interest and Associate Company

(0)

0

(1,600.0)

3

(110.5)

12

11

8.9

Adj PAT

137

87

58.6

233

(41.2)

892

673

32.6

Adj. PATM

11.0

7.5

15.7

15.2

13.5

Equity capital (cr)

24

24

24

24

24

Adjusted EPS (`)

11

7

58.6

20

(41.2)

75

56

32.6

Source: Company, Angel Research

Alkem reported revenue grew of 9% yoy. Domestic revenue grew by 7% yoy to

`856cr while exports grew by 14.5% to `385cr.

In the therapeutic segments, company grew by

4.7% in the quarter

underperforming industry growth of 6.6%. Main reason behind this is negative

growth rate that company clocked in Anti-infective and respiratory segments.

US revenue was at `291cr vs. `243cr in 4QFY16. US revenue growth was at

19.4% yoy, slower than our expectations. Other exports were flat on yoy basis

to `95cr in 4QFY17. Company continues to focus on the US market which is

clearly reflected in the numbers.

The company continues to maintain its market share in the Anti-infective, GI

and pain management segments. In the acute segment, company has mainly

put a subdued performance, however in the chronic segment; company has

gained market share, especially in derma, cardiac and anti-diabetic segments.

Domestic business contributed

69% of the total revenue while exports

contributed the rest.

February 14, 2017

2

Alkem Laboratories |4QFY2017 Result Update

Export mix remains unchanged with US contribution at 23% in 4QFY17 vs.

23.2% in 3QFY17. On yoy basis, this contribution has grown by 200bps.

Gross margins improved by~67bps on yoy basis but declined by 35bps on

qoq basis.

Staff costs was at `229cr, showing a yoy increase of 19.3%. As % of net sales,

staff cost was at 18.3% in the quarter vs. 16.7% in 4QFY16 and 18.3% in

3QFY17.

EBITDA came in at `149cr vs. `156cr in 4QFY16 showing a yoy decline of

4.2%.

EBITDA margins at 11.9% in the quarter declined by ~164bps on yoy basis

and by ~616bps on qoq basis, mainly due to higher R&D and staff costs as

mentioned above.

Net profit grew by 58.6% yoy from `87cr in 4QFY16 to `137cr in 4QFY17.

This was due to lower tax rate in the quarter.

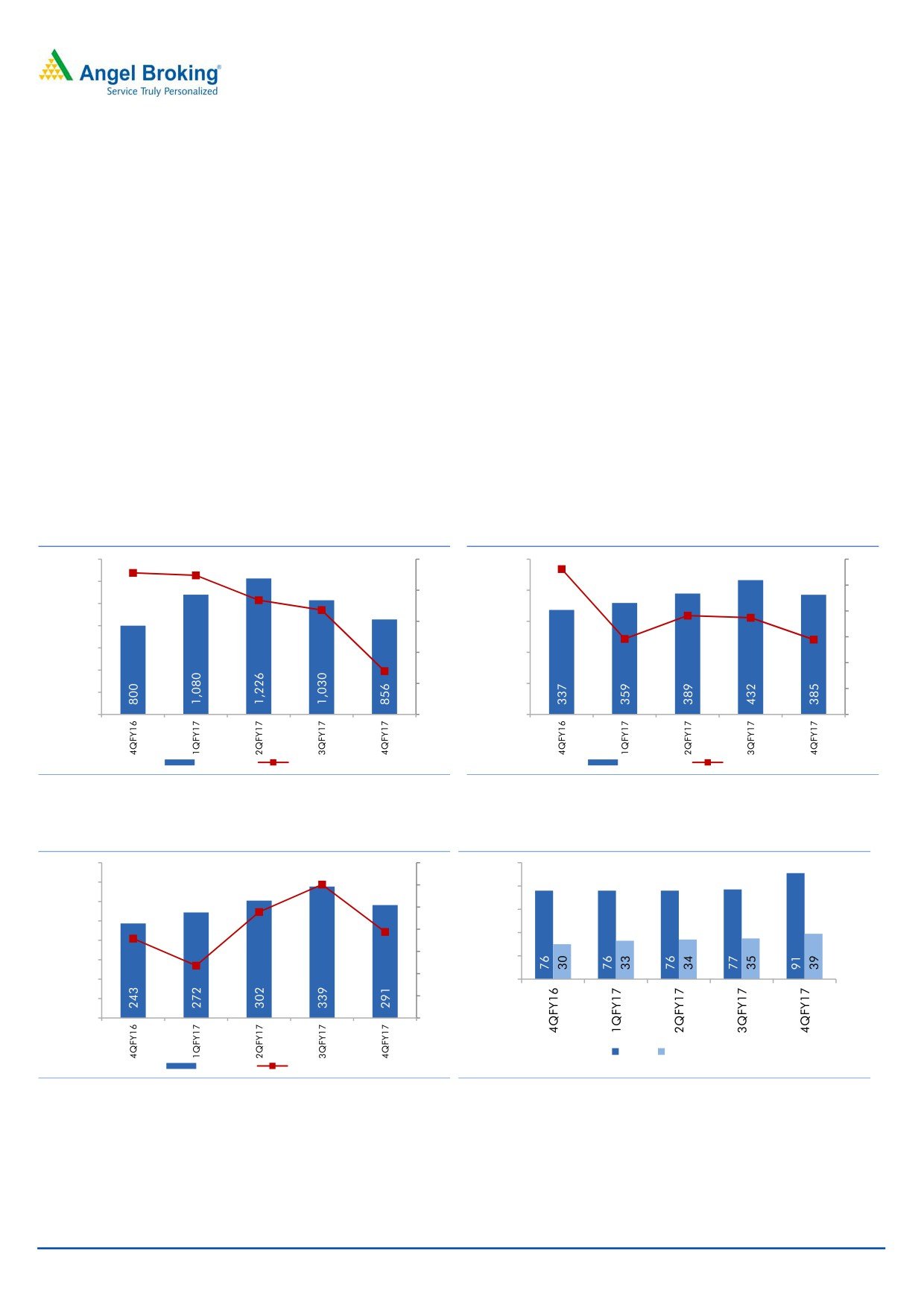

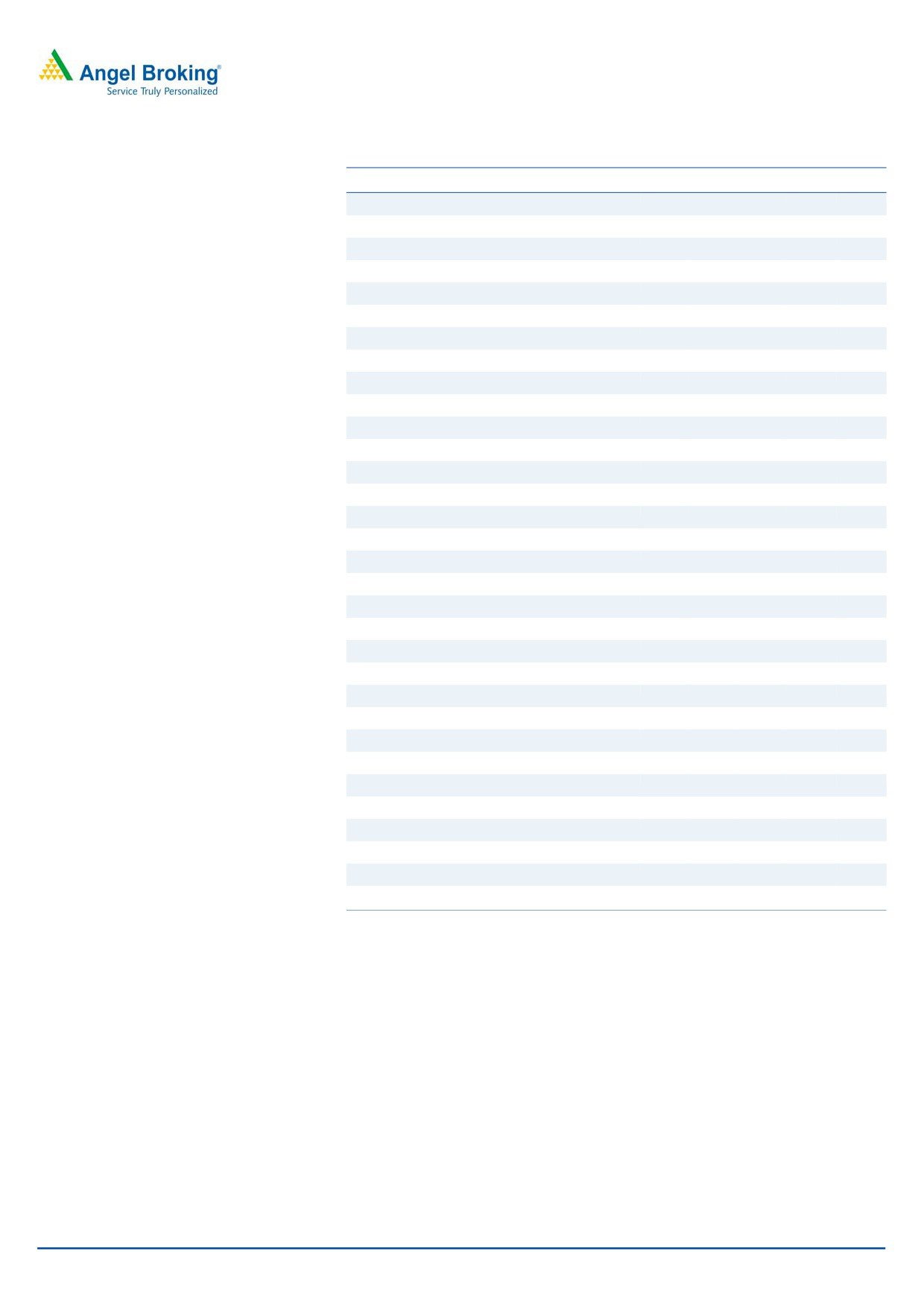

Exhibit 2: Domestic business growth at 7%

Exhibit 3: Exports continues to grow, albeit slowly

1,400

22.8

22.4

25

500

28.1

30

18.4

1,200

25

16.8

20

400

1,000

19.1

18.7

20

15

300

14.6

14.5

800

15

600

7.0

10

200

10

400

5

100

5

200

0

0

0

0

Domestic

yoy growth (%)

Total exports

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 4: US growth at 19% due to seasonality

Exhibit 5: ANDA pipeline, 14 ANDA additions in 4Q

400

35

100

30.1

350

30

80

23.9

300

17.9

25

60

19.4

250

20

40

200

11.8

15

150

20

10

100

0

50

5

0

0

Filed

Approval

US sales

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

February 14, 2017

3

Alkem Laboratories |4QFY2017 Result Update

Conference call - Key highlights

Company has indicated of pricing pressure in the US. The 4th quarter lower

EBITDA was due to the seasonality.

The slower growth in the domestic revenues is on the account of

demonetisation and DPCO initiated price cuts and negative WPI inflation.

Anti-infective segment contributes ~40% of its top line and de-growth in this

segment has hurt its overall growth in the quarter.

In the chronic segment, company has grown faster than the market and has

also moved higher in ranks of the respective segments.

In the US, company has gained market share in its products, the growth in 4Q

also was due to the new product launches. In the FY17, company has made 7

drug launches in US.

The company has received EIR for all the three facilities on which it had earlier

received minor observations.

The effective GST rate would be 12% vs. current 9.5%. The industry is seeking

government approval for price hike post-GST.

Company expects higher single-digit products launches in the US this year.

R&D expenses guidance of 6% of net sales for FY18E.

FY18E capex likely to be ~`600cr.

Company maintains the guidance to launch high single digit ANDAs per year

going ahead.

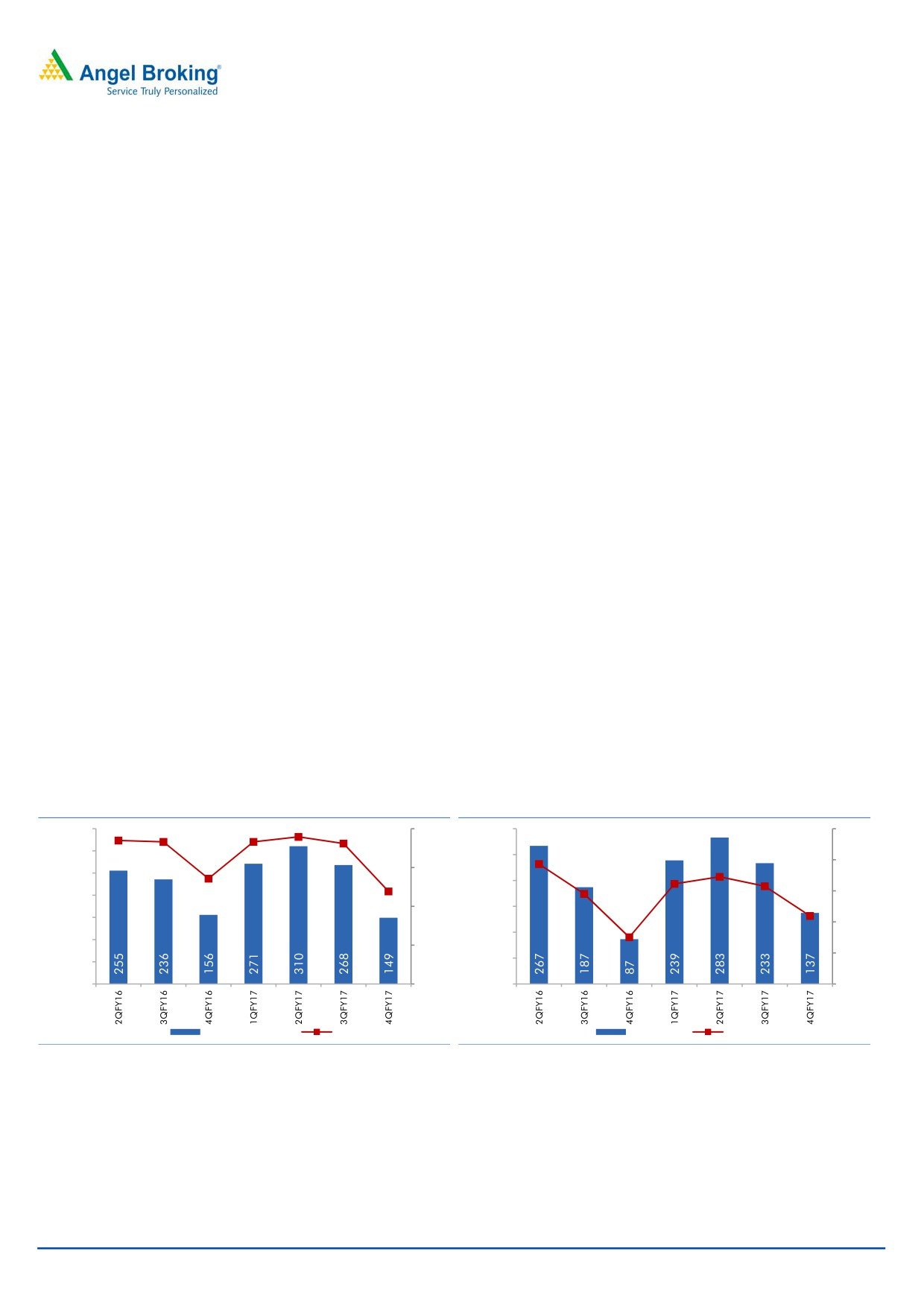

Exhibit 6: Margins dip due to high staff and R&D costs

Exhibit 7: PAT grows 58% yoy due to lower tax

350

18.5

18.3

18.3

19.0

18.1

20.0

300

19.3

17.3

25.0

300

16.1

15.7

250

13.6

20.0

15.0

250

11.9

200

14.5

200

15.0

11.0

10.0

150

150

7.5

10.0

100

100

5.0

5.0

50

50

0

0.0

0

0.0

Operating Profit

OPM

Adj PAT

Adj. PATM

Source: Company, Angel Research

Source: Company, Angel Research

February 14, 2017

4

Alkem Laboratories |4QFY2017 Result Update

Investment arguments

Strong domestic business- Alkem is the 5th largest pharma company in India

in terms of domestic revenues. Its acute segment contributes 88% of domestic

revenue while chronic business contributes

12%. In the acute business,

company is ranked #1 in anti-infective segment and #3 each in pain and

Gastro intestinal segments. Alkem is currently a small player in the chronic

segment but it is expanding this business rapidly.

Domestic business to continue its outperformance vs. industry: Alkem is

expected to continue its outperformance vs. industry due to strong growth in its

acute and chronic segments. Both segments are expected to report strong

growth due to increasing market share as well as increasing productivity of its

marketing and sales staff. We expect domestic sales to grow at 13.8% CAGR

to `5,434cr in FY19E, vs. domestic industry growth of ~12% during the same

period.

US revenue to double with increased ANDA monetization: Alkem’s ANDA

pipeline increased 2.9x from 31 ANDAs in FY12 to 91 ANDAs in FY17. ANDA

approvals also grew by 3.5x during the same period, of this 8 approvals came

in FY17 itself. In next three years company expects increased ANDA launches

on the back of approval to 2/3rd of its pipeline. This will see strong increase in

its US revenue from `1,203cr in FY17 to `1,896cr in FY19E.

Improving operating performance: Alkem’s operating performance is expected

to improve with better sales mix (increasing exports) and market share gains in

chronic segment. The company has already seen margin improvement and

with rising profitability of US business, we estimate

70-100bps margin

expansion.

Outlook and valuation

The stock at the CMP of `1,868 is available at P/E of 18.6x of FY19E EPS of `101.

We have cut our EPS estimates by ~5% due to the recent slowdown in domestic

business, likely disruption in the business due to GST and pricing pressure in the

US. We expect company to report CAGR of 15.8% and 15.3% in top line and

bottom line respectively in next two years. The company is expected to witness

improvement in its return ratios owing to the rising profitability of US business.

Moreover Alkem’s all manufacturing facilities are current with USFDA which gives

confidence that company will deliver strong results over next two years.

Considering these factors, we rate Alkem Buy with PT of 2,161 based on 21.5x of

FY19E EPS.

Company background

Alkem Laboratories is a Mumbai based pharma company engaged in

manufacturing and marketing of generic drugs, APIs and neutraceutical products.

Company sells its drugs in India and ~50 countries including the US. It has 16

manufacturing facilities of which 14 are in India and two in the USA.

February 14, 2017

5

Alkem Laboratories |4QFY2017 Result Update

Profit and loss statement

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Total operating income

3,743

4,992

5,853

6,901

7,850

% chg

19.7

33.3

17.2

17.9

13.8

Total Expenditure

3,322

4,143

4,854

5,631

6,351

Cost of Materials

1,691

1,961

2,222

2,622

2,983

Personnel

646

917

1,004

1,215

1,366

Others Expenses

985

1,265

1,628

1,794

2,002

EBITDA

422

848

999

1,270

1,499

% chg

2.9

101.1

17.8

27.1

18.1

(% of Net Sales)

11.3

17.0

17.1

18.4

19.1

Depr. & Amort.

71

101

101

130

155

EBIT

351

748

898

1,140

1,344

% chg

(1.9)

113.1

20.1

27.0

18.0

(% of Net Sales)

9.4

15.0

15.3

16.5

17.1

Interest & other Charges

81

67

45

47

47

Other Income

181

165

112

117

133

(% of PBT)

40.2

19.5

11.6

9.7

9.3

Recurring PBT

-

-

-

-

-

% chg

451

845

965

1,210

1,431

Prior Period & Extraord. Exp./(Inc.)

4.8

87.5

14.1

25.4

18.3

PBT (reported)

-

-

-

-

-

Tax

451

845

965

1,210

1,431

(% of PBT)

59

161

60

194

229

PAT (reported)

13.1

19.0

6.2

16.0

16.0

Add: Share of earnings of asso.

392

684

905

1,016

1,202

Less: Minority interest (MI)

-

-

-

-

-

PAT after MI (reported)

-

11

12

-

-

ADJ. PAT

392

673

892

1,016

1,202

% chg

392

673

892

1,016

1,202

(% of Net Sales)

(10.0)

71.9

32.6

13.9

18.3

Basic EPS (`)

10.5

13.5

15.2

14.7

15.3

Fully Diluted EPS (`)

32.8

56.3

74.6

85.0

100.5

% chg

32.8

56.3

74.6

85.0

100.5

February 14, 2017

6

Alkem Laboratories |4QFY2017 Result Update

Balance sheet statement

Y/E March (` cr)

FY15

FY16

FY17E

FY18E

FY19E

SOURCES OF FUNDS

Equity Share Capital

24

24

24

24

24

Reserves& Surplus

2,975

3,479

4,204

5,007

5,956

Shareholders’ Funds

2,999

3,503

4,228

5,031

5,980

Minority Interest

86

97

97

97

97

Total Loans

1,381

739

750

750

750

Deferred Tax Liability

126

153

153

153

153

Total Liabilities

4,591

4,490

5,227

6,030

6,979

APPLICATION OF FUNDS

Gross Block

1,745

1,889

2,519

3,169

3,819

Less: Acc. Depreciation

371

447

548

678

833

Net Block

1,374

1,442

1,970

2,490

2,985

Capital Work-in-Progress

111

172

250

300

300

Investments

481

422

422

422

422

Current Assets

3,325

3,394

3,696

4,144

4,794

Inventories

784

909

1,074

1,267

1,441

Sundry Debtors

527

565

641

756

860

Cash

791

796

529

410

545

Loans & Advances

175

240

281

331

377

Other Assets

1,048

884

1,171

1,380

1,570

Current liabilities

733

998

1,169

1,385

1,580

Net Current Assets

2,592

2,396

2,527

2,759

3,214

Deferred Tax Asset

34

58

58

58

58

Mis. Exp. not written off

-

-

-

-

-

Total Assets

4,591

4,490

5,227

6,030

6,979

Note: Cash includes cash with scheduled banks on dividend current accounts

February 14, 2017

7

Alkem Laboratories |4QFY2017 Result Update

Cash flow statement

Y/E March (` cr)

FY15

FY16

FY17E FY18E FY19E

Profit before tax

451

845

965

1,210

1,431

Depreciation

71

101

101

130

155

Change in Working Capital

(12)

14

(398)

(352)

(319)

Interest / Dividend (Net)

(53)

(59)

45

47

47

Direct taxes paid

(106)

(198)

(60)

(194)

(229)

Others

(26)

24

-

-

-

Cash Flow from Operations

325

726

653

842

1,085

(Inc.)/ Dec. in Fixed Assets

(235)

189

(708)

(700)

(650)

(Inc.)/ Dec. in Investments

-

-

-

-

-

Cash Flow from Investing

(235)

189

(708)

(700)

(650)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

87

(671)

11

-

-

Dividend Paid (Incl. Tax)

(57)

(185)

(179)

(213)

(252)

Interest / Dividend (Net)

569

598

(45)

(47)

(47)

Cash Flow from Financing

599

(258)

(213)

(261)

(300)

Inc./(Dec.) in Cash

690

657

(267)

(119)

135

Opening Cash balances

101

140

796

529

410

Closing Cash balances

791

796

529

410

545

February 14, 2017

8

Alkem Laboratories |4QFY2017 Result Update

Key ratios

Y/E March

FY15

FY16

FY17E

FY18E

FY19E

Valuation Ratio (x)

P/E (on FDEPS)

57.0

33.2

25.0

22.0

18.6

P/CEPS

4.6

48.3

28.4

22.2

19.5

P/BV

7.4

6.4

5.3

4.4

3.7

Dividend yield (%)

1.4

0.3

0.8

0.8

1.0

EV/Sales

6.0

4.4

3.8

3.2

2.8

EV/EBITDA

53.2

25.8

22.2

17.5

14.7

EV / Total Assets

4.2

4.0

3.5

3.0

2.6

Per Share Data (`)

EPS (Basic)

32.8

56.3

74.6

85.0

100.5

EPS (fully diluted)

32.8

56.3

74.6

85.0

100.5

Cash EPS

407.7

38.7

65.7

84.1

95.9

DPS

26.6

4.7

15.4

15.0

17.9

Book Value

250.9

293.0

353.7

420.8

500.2

Dupont Analysis

EBIT margin

9.4

15.0

15.3

16.5

17.1

Tax retention ratio

0.9

0.8

0.9

0.8

0.8

Asset turnover (x)

1.2

1.7

1.5

1.4

1.4

ROIC (Post-tax)

9.8

20.0

20.9

19.3

19.6

Cost of Debt (Post Tax)

0.1

0.1

0.1

0.1

0.1

Leverage (x)

0.0

(0.1)

(0.0)

(0.0)

(0.0)

Operating ROE

10.2

17.3

19.9

19.0

18.9

Returns (%)

ROCE

8.0

17.6

18.0

19.7

20.0

Angel ROIC (Pre-tax)

11.3

24.7

22.3

23.0

23.3

ROE

13.1

19.2

21.1

20.2

20.1

Turnover ratios (x)

Asset Turnover (Gross Block)

2.1

2.6

2.3

2.2

2.1

Inventory / Sales (days)

49

67

67

67

67

Receivables (days)

33

41

40

40

40

Payables (days)

29

42

42

42

42

WC cycle (ex-cash) (days)

53

65

65

65

65

February 14, 2017

9

Alkem Laboratories |4QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Alkem Laboratories

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

February 14, 2017

10