IPO Note | Pharmaceutical

July 18, 2016

Advanced Enzyme Technologies

NEUTRAL

Issue Open: July 20, 2016

IPO Note - Potential Priced in

Issue Close: July 22, 2016

Advanced Enzyme Technologies (AET) is the second largest enzyme company in

India and amongst the Top 15 global enzyme companies with a market share of

Issue Details

~0.9%. The company is engaged in research & development, manufacturing and

Face Value: `10

marketing of 400+ proprietary products developed from 60 indigenous enzymes.

Present Eq. Paid up Capital: `21.8cr

Specialized business with high entry barriers: The global enzyme industry is

Issuse details: `50cr fresh capital ,

dominated by few players with the top 3 players (Denmark based Novozymes, US

OFS: up to 4,034,470 shares

based DuPont and Netherlands based DSM) accounting for ~75% of market

Post Eq. Paid up Capital: `22.3cr

share. Among them Novozymes is the only company with a pure play approach

Market Lot: 16 Shares

on enzymes and has an estimated market share of 48%. AET is a marginal player

Issue (amount): `405-411cr

in the global enzyme market with a market share of ~0.9% but we believe it has

Price Band: `880-896

lots to potential to grow and garner a higher market share.

Post-issue implied mkt. cap `1,962cr*-

Robust ROE driven by high margins: While AET posted a CAGR of only 14.4%

1,998cr**

in sales during FY2012-16, it reported a strong EBITDA CAGR of 22.1% during

Note:*at Lower price band and **Upper price band

the same period, thus aiding a net profit CAGR of 23.9%. The performance came

on the back of improved fixed asset turnover and improvement in margins. Thus,

Book Building

the company earns a healthy ROE and stable cash flows. For FY2016, the

company reported a Return on Net worth (RONW) of 32.1%.

QIBs

50%

Non-Institutional

15%

Outlook and Valuation: AET is the second largest player in the Indian enzyme

industry. Given the Management experience in the industry and the Indian

Retail

35%

cost advantage, we believe that the company can post robust growth going

forward. AET has reported a strong CAGR of 23.9% in net profit in-spite of

Post Issue Shareholding Pattern(%)

the 14.4% CAGR in sales during FY2012-16, helped by high entry barriers,

which also enables the company to get high margins. However, we believe

Promoters Group

84.6

that the company’s scale of operations is small in comparison to its global

MF/Banks/Indian

peers and its business is dependent on few products. At `880-896/share,

FIs/FIIs/Public & Others

15.4

which is the lower and upper end of the offer price band, the company is

available at ~6.1-6.2x it’s FY2017E P/BV. We believe the price fully discounts

all the positives. Thus, we recommend a neutral view on the issue.

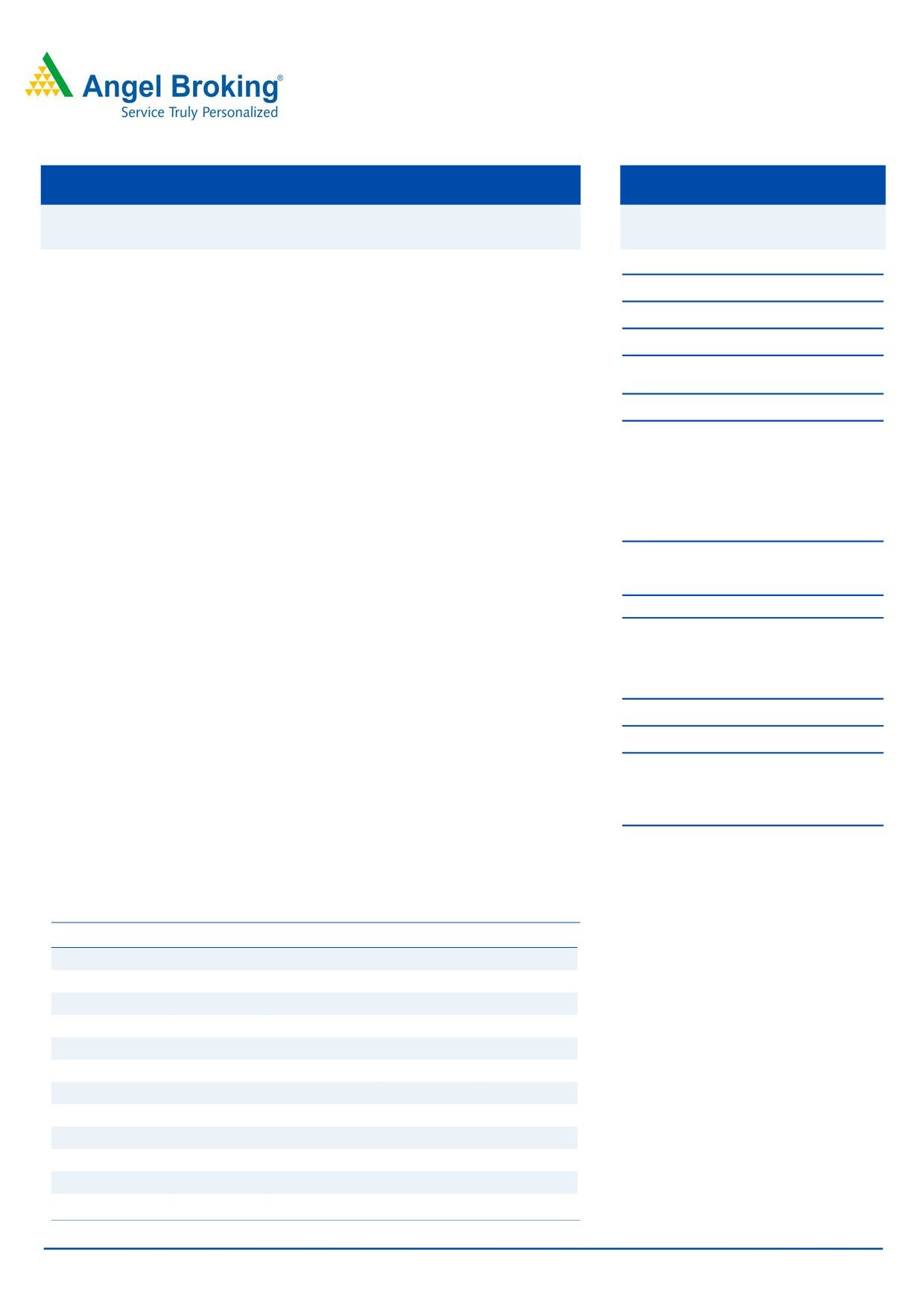

Key Financials

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

Net Sales

220

240

223

294

% chg

28.4

8.7

(6.8)

31.7

Adj. Net Profit

49

74

50

79

% chg

47.4

50.7

(32.2)

56.4

EPS (`)

22.5

33.9

23.0

36.0

EBITDA Margin (%)

40.6

43.3

40.7

47.1

P/E (x)

39.8

26.4

38.9

24.9

RoE (%)

38.1

45.1

26.7

32.1

RoCE (%)

27.9

34.7

28.9

38.1

P/BV (x)

11.8

11.5

9.1

6.9

Sarabjit Kour Nangra

EV/Sales (x)

9.2

8.3

8.8

6.5

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

22.7

19.3

21.5

13.8

Source: Company, Angel Research; Note: The valuations are on the higher price band

Please refer to important disclosures at the end of this report

1

Advance Enzymes Technologies | IPO Note

Company background

Advanced Enzyme Technologies (AET) is the second largest enzyme company in

India and amongst the Top 15 global enzyme companies with a market share of

~0.9%. AET is engaged in the research & development, manufacturing and

marketing of 400+ proprietary products developed from 60 indigenous enzymes.

The company has fermentation experience of more than two decades in the

production of enzymes. It sells these products to more than 700 global customers,

spanning 50 countries. The company has the capability to manufacture enzymes

using all the four natural origins, viz plant, animal, bacterial and fungal. Its major

focus is on developing enzymes through microbial fermentation.

Its Promoters Mr. Chandrakant Laxminarayan Rathi and Mr. Vasant

Laxminarayan Rathi have a cumulative experience of more than seven decades

in the global enzyme industry.

The company is operating in two primary business verticals-Healthcare & Nutrition

(human and animal) (88% of FY2016 sales) and Bio-Processing (food and non-

food) (12% of FY2016 sales). The company supplies value-added and eco-safe

enzyme products to diverse end-user industries like human healthcare & nutrition,

animal nutrition, food processing, baking, dairy & cheese processing, fruit &

vegetable processing, cereal extraction, brewing, grain processing, protein

processing, oil & fat processing, biomass processing, textile processing, leather

processing, paper & pulp processing, bio-fuels, bio-catalysis etc.

Issue details

AET is coming out with an initial public offering (IPO) of 0.459-0.460cr equity

shares (of which offer for sale comprises 0.403cr shares) with a face value of `10

each. The issue is priced at `880-896/share. The company intends to raise `50cr

in fresh capital while the remaining `361cr is offer for sale. Of the fresh capital

rising, `50cr will be used for the repayment of certain loans availed by Advanced

Enzyme USA, its wholly-owned subsidiary.

After deducting the offer related expenses in relation to the fresh Issue, the

company proposes to utilize the funds towards the following objects:

1. Investment in Advanced Enzymes USA, the company’s wholly owned subsidiary,

for repayment / pre-payment of certain loans availed by Advanced Enzymes USA

(`50cr).

and

2. General Corporate Purposes.

July 18, 2016

2

Advance Enzymes Technologies | IPO Note

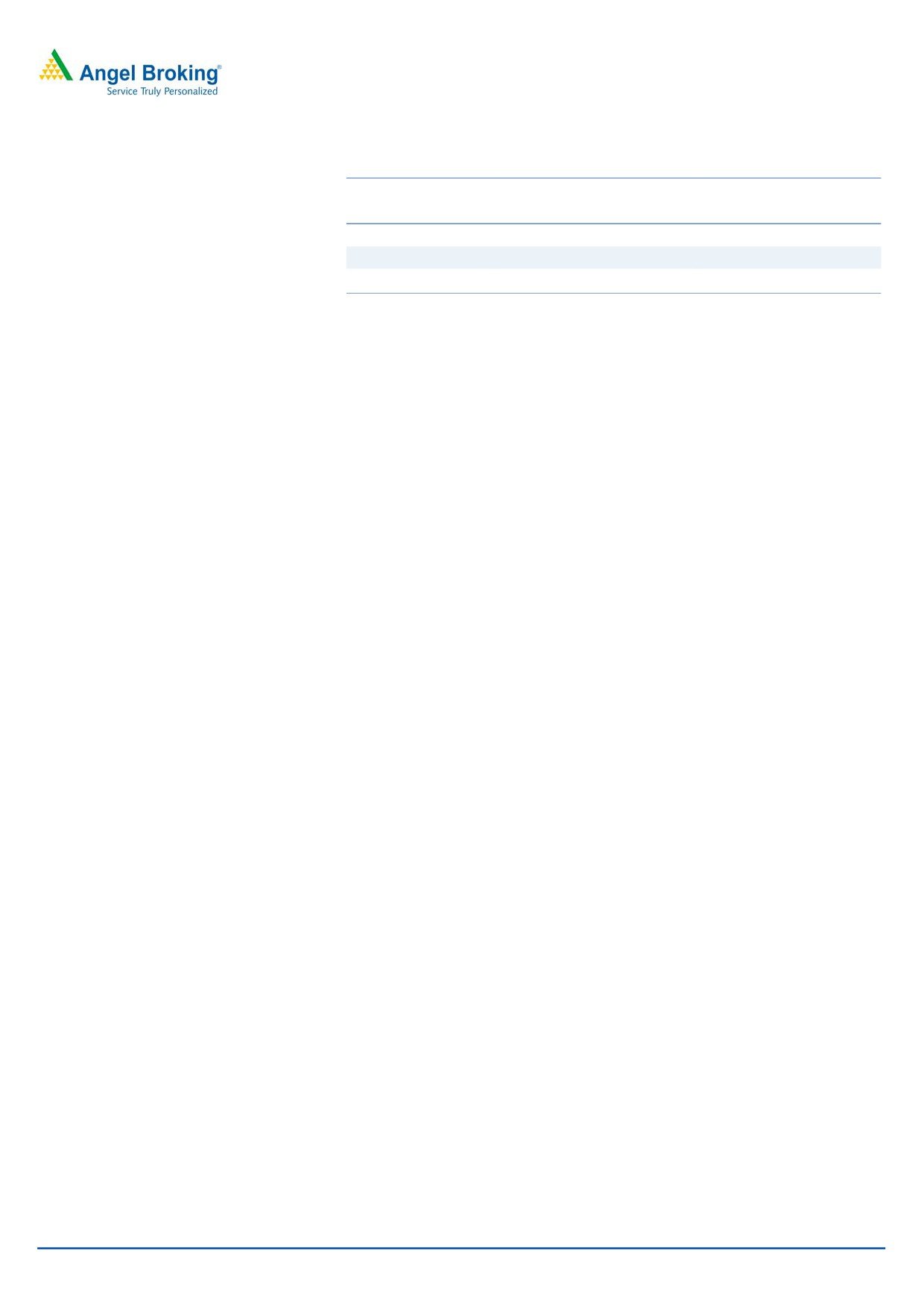

Exhibit 1: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

17,549,000

80.5

14,829,500

66.5

Others

4,251,000

19.5

7,470,500

33.5

Total

21,800,000

100.0

22,300,000

100.0

Source: Company, Angel Research

Industry

Enzymes are sustainable alternatives to hazardous chemicals used in many

industrial bio-chemical processes. Enzymatic processes can occur under moderate

conditions, including normal temperature and with minimal use of water, leading

to reduced energy consumption and elimination of costs associated with

maintaining extreme environments - necessary for many chemical-led reactions.

This decline in energy consumption also benefits the environment by reducing

greenhouse gas emissions.

As chemical-induced reactions lack specificity, they are required in larger volumes

and can lead to toxic by-products which are difficult to dispose off. On the other

hand, since enzymes react specifically and are biodegradable, they are required in

smaller amounts and minimise the production of toxic by-products. In fact, some

enzymatic reactions create end-products which can be treated and used as

fertilisers.

Thus, replacing chemicals with industrial enzymes can lead to cost and time

savings for manufacturers and can help them comply with various

environmental norms. With higher emphasis on energy conservation and more

stringent environmental laws, enzyme demand from various industries is likely

to witness rapid growth. The global enzyme market stood at US$5.1bn in

2012 of which industrial enzymes constituted ~US$3.6bn or ~71%, with the

rest ~29% being contributed by specialty enzymes. Going forward, the global

enzyme demand is expected to experience broad-based growth led by strong

demand across all enzyme types, with market growing by 6.3% every year to

$7.0bn in 2017 from $5.1bn in 2012. The market is further expected to grow

at a 5-year CAGR of 6.5% after 2017, reaching a size of $9.5bn by 2022.

Through this period, the growth in the global enzyme demand is expected to be

led by specialty enzymes, including diagnostic and research and biotechnology

enzymes, as well as biocatalysts and increasing penetration of enzymes into their

potential applications in developing countries. Moreover, falling costs of DNA

manipulation and sequencing, will act as a demand driver allowing for rising use

of enzymes in research and biotechnology and diagnostic applications.

On the other hand, the industrial enzyme market will see modest growth as high

growth in animal feed, food and beverage and cleaning products market will be

partially offset by leveling off of grain-based bio-fuel production and challenging

environment for various technical applications such as starch processing, textile

and leather production. The animal feed and food & beverage enzymes will

experience above-average growth in demand benefitting from the expansion of the

middle class population in rapidly developing economies, which will fuel increased

July 18, 2016

3

Advance Enzymes Technologies | IPO Note

meat consumption and adoption of more western-style diets. Further, the

environmental benefits of enzyme use, such as reduced wastewater production and

energy use, provides room to further boost the industrial enzyme market.

Thus, the share of industrial enzymes is expected to gradually reduce from ~70.8%

in 2012 to 68.5% in 2017 to 66.3% in 2022, while the share of specialty enzymes

is expected to gradually increase from ~29.2% in 2012 to ~31.5% in 2017 and to

~33.7% in 2022, on account of the relatively stronger potential growth of specialty

enzymes over the next few years.

Industrial enzymes constitute the larger portion of the world enzyme demand

accounting for ~$US3.6bn, or ~70.8% in 2012. The global demand for industrial

enzymes is expected to grow at a 5-year CAGR of 5.6% to reach ~US$4.8bn in

2017 and 10-year CAGR of 5.7%, to reach a size of US$6.3bn by 2022. The

strongest demand for industrial enzymes shall be experienced in the sub-segments

of food and beverages and animal feed.

World demand for specialty enzymes will grow by a strong 7.9% per annum to

$2.2bn in 2017. Growth will be fairly robust in all markets, with the fastest gains in

the diagnostics and research and biotechnology markets. The ongoing

demographic shift toward older populaces in developed countries will also support

higher diagnostic enzyme demand. Research and biotechnology will continue to

benefit from robust investment in the biotechnology sector at both the corporate

and national levels. On a geographic basis, growth will be in Central and South

America, and the Asia / Pacific and Africa / Mideast regions as strong economic

growth and rising disposable incomes boost demand for improved health care,

and as pharmaceutical and other fine chemical companies increasingly turn to

Brazil, China and India for contract manufacturing solutions.

North America dominates the global enzyme market accounting for ~41.5% of the

global enzyme demand in 2012, implying a market size of $2.1bn. Western

Europe, Asia Pacific and other regional markets (which include Central & South

America, Eastern Europe and Africa / Mideast) accounted for 21.2%, 21.6% and

15.7% of the global enzyme market in 2012. However, even by 2022, North

America shall continue to be the largest regional market, accounting for ~34.8%

of the global enzyme demand, with the Asia Pacific region, Western Europe and

other regional markets accounting for ~18.1%, ~29.2% and ~18.0% of the

market size respectively. Demand for enzymes in Eastern Europe is also expected

to be above average. The Indian enzyme market is expected to grow from

US$105mn in 2015 to US$279mn in 2022 at a CAGR of 15.0%.

July 18, 2016

4

Advance Enzymes Technologies | IPO Note

Key investment rational

Specialized business with high entry barriers

The enzyme industry is very concentrated and consists of very few players like

Biocon in the domestic market and foreign MNCs like Novozymes, DSM

Nutritional Products and DuPont Danisco. According to our research, Top

3

players (Denmark based Novozymes, US based DuPont and Netherlands based

DSM) account for ~75% market share, with Novozymes being the only company

with a pure play approach to enzymes, having an estimated market share of 48%.

The industry structure is concentrated because manufacturing of enzymes, enzyme

products and enzyme solutions requires specialised knowledge of enzyme

fermentation and the diverse end-user industries. Technical and niche nature of the

business, heavy reliance on R&D and dearth of qualified professionals (with

experience in enzyme & biotechnology industry) act as entry barriers to new

players. As a result, the enzyme industry has very few players and the top players

account for a significant portion of the global market share.

AET, being one of the Indian players run by technocrats in the industry, has the

potential to garner market share in the industry. Currently the company, with a

global market share of ~0.9% is a marginal player and hence has lots to scope to

grow. In India, though the market is relatively small at around US$105mn (in

2015), the company is the second largest enzyme company in India.

Fully integrated with presence across the enzyme value chain

AET is an integrated company with presence across the enzyme value chain,

covering the entire range of activities

- from R&D, commercial scale

manufacturing, to marketing of enzyme products. It also delivers customized

enzyme solutions, which helps the company to remain cost-competitive besides

ensuring end-to-end quality control (resulting in superior products). The company’s

business model is designed to capture opportunities arising from global

megatrends by combining strong production capabilities with application of

expertise and local delivery.

AET has invested significant resources in the R&D of various enzymes, proprietary

enzyme products and customized enzyme solutions since inception. In the fiscal

years of 2016, 2015 and 2014 on a standalone basis, the company spent ~5.8%,

7.2% and 5.9%, respectively on R&D activities. Currently, the company has four

R&D facilities located at Thane, Sinnar and Chino (California, USA). These R&D

facilities are supported by a team of

55+ members comprising scientists,

microbiologists, engineers, food technologists and biotechnologists.

It is one of the leading enzyme manufacturers globally with fermentation capacity

of 360 cubic meters. It has six geographically diversified manufacturing facilities.

Its manufacturing facilities are flexible and multi-purpose in nature, and are

capable of developing quality enzyme products & solutions with varying batch sizes

(customized to meet clients’ requirements). The large production capacities,

coupled with a globally competitive cost base, have enabled the company to

July 18, 2016

5

Advance Enzymes Technologies | IPO Note

develop new enzymes, enzyme products and customized solutions across business

verticals for the domestic as well as international markets.

Diversified product portfolio and wide customer base

AET has a diversified product portfolio, catering to various verticals and end-user

industries with more than 400 proprietary enzyme products developed from 60

enzymes. The company has a wide presence in healthcare & nutrition and bio-

processing verticals, and caters to some of the leading companies such as Sanofi

India, Cipla, etc. Its top 10 customers accounted for less than 40% of total

revenues on a consolidated basis in FY2016. The company offers these products

to its global clientele of more than 700 customers spanning presence across

50 countries worldwide. In terms of geographical presence, USA, India, Asia (ex-

India), Europe and other geographies (ex-India and USA) accounted for 54.9%,

36.4%, 3.6%, 3.8% and 1.2% of total revenues, respectively in FY2016.

Robust ROEs driven by high margins

While AET has posted sales CAGR of only 14.4% during FY2012-16, it reported a

strong EBITDA CAGR of 22.1% during the same period, thus aiding the net profit

to post a CAGR of 23.9%. This was on back of improved fixed asset turnover (FTA)

(from 1.6x in FY2012 to 2.4x in FY2016) and improvement in margins (OPM of

36.2% in FY2012 to 47.1% in FY2016). Thus, the company earns healthy ROEs

and stable cash flows. During FY2016, the company reported Return on Net worth

(RONW) of 32.1%. This has also led to an improvement in its long-term

borrowings-to-equity ratio to 0.04x in FY2016 from 1.4x in FY2012.

Valuation

AET is the second largest player in the Indian enzyme industry. Given the

Management experience in the industry and the Indian cost advantage, we believe

that the company can post robust growth going forward. AET has reported a

strong CAGR of 23.9% in net profit in-spite of the 14.4% CAGR in sales during

FY2012-16, helped by high entry barriers, which also enables the company to get

high margins.

We believe that the company’s scale of operations is very small in comparison to

its global peers and is dependent on few people (especially on the R&D front,

which is critical for the business) and few products for sustaining its business. In

addition, the impending Chinese competition could pose a threat to the company’s

profitability. Further at `880-896/share, which is the lower and upper end of the

offer price band, the company is available at ~6.1-6.2x its FY2017E P/BV, which

we believe fully discounts all the positives. Thus, we recommend a neutral on the

issue.

July 18, 2016

6

Advance Enzymes Technologies | IPO Note

Risks

AET derives a significant portion of its revenues from exports and is exposed to

foreign currency fluctuations. In FY2016, around 63.5% of its revenues came

from international operations.

The company has not entered into any long-term or definitive agreements with

its customers. If customers choose not to source their requirements from AT

then it could impact its business and financials.

The company gets less than 40% of its total revenues from its top

10

customers. The company doesn’t enter into any long term contracts, and loss

of any client could impact its sales.

The company has been significantly dependent on sales of its top five

product groups. For the six months period ended September 30, 2015,

these top five product groups accounted for 39.6% of its total revenues.

Any reduction or discontinuation in demand or a temporary or permanent

discontinuation in manufacturing of these product groups would have a

material adverse effect on its business, prospects, financial condition and

operations. Further, introduction of similar products by its competitors in

future could also adversely affect its business, prospects, financial

condition and results of operations.

Any change in government policy or introduction of new legislation or

amendment to the existing regulation or any adverse event as a result of

which customers are adversely affected, or company have to incur

additional compliance costs; will have a material adverse impact on its

business, financial conditions and results of operations.

Environmental issues, including climate changes impact & influence the

global enzyme markets significantly. Enzymes are affected by a number of

environmental issues, both at the production and consumption level, which

may adversely affect its enzyme production and the end product quality,

thus affecting its business and results of operations.

Any delay in the grant of approvals for new products, or any withdrawal of

approval for existing products would adversely affect our results of

operations.

During FY2014, there was an exceptional item of `53.16cr, reported by

the company. Some of the consignments of goods of enzymes sold by the

company were reported to have potential contamination. Hence, during

the second half of FY2014, the company had done voluntary recall of

those specific lots and got goods returned back from some of its

customers. Accordingly, the group had to charge a one time inventory

write off, settle claims of some of the customers and incur certain expenses

related to recall. Thus, such events given the size of the company can

impact the financials of the company significantly.

Currently, the global enzyme industry is highly concentrated; increased

competition from low cost producers from countries like India or China

(especially in the feed and technical industries) could impact business. The

July 18, 2016

7

Advance Enzymes Technologies | IPO Note

competition is further intensified by Chinese enzyme manufacturers

exploring overseas markets.

Company’s promoters Mr. Chandrakant Laxminarayan Rathi and Mr.

Vasant Laxminarayan Rathi have a cumulative experience of more than

seven decades in the enzymes industry. According to the draft, company

depends on the management skills and guidance of its promoters for

development of business strategies, monitoring its successful

implementation and meeting future challenges. Its promoters, along with

its key managerial personnel, who form an integral part of its company,

have over the years built relations with suppliers, customers and other key

stakeholders associated with the company. Thus according to the

company, its future performance will depend largely on its ability to retain

the continued service of its management team. According to the company,

if one of its key managerial personnel are unable or unwilling to continue

in his/ her present position, it could be difficult for them to find a suitable

or timely replacement and its business could be adversely affected.

July 18, 2016

8

Advance Enzymes Technologies | IPO Note

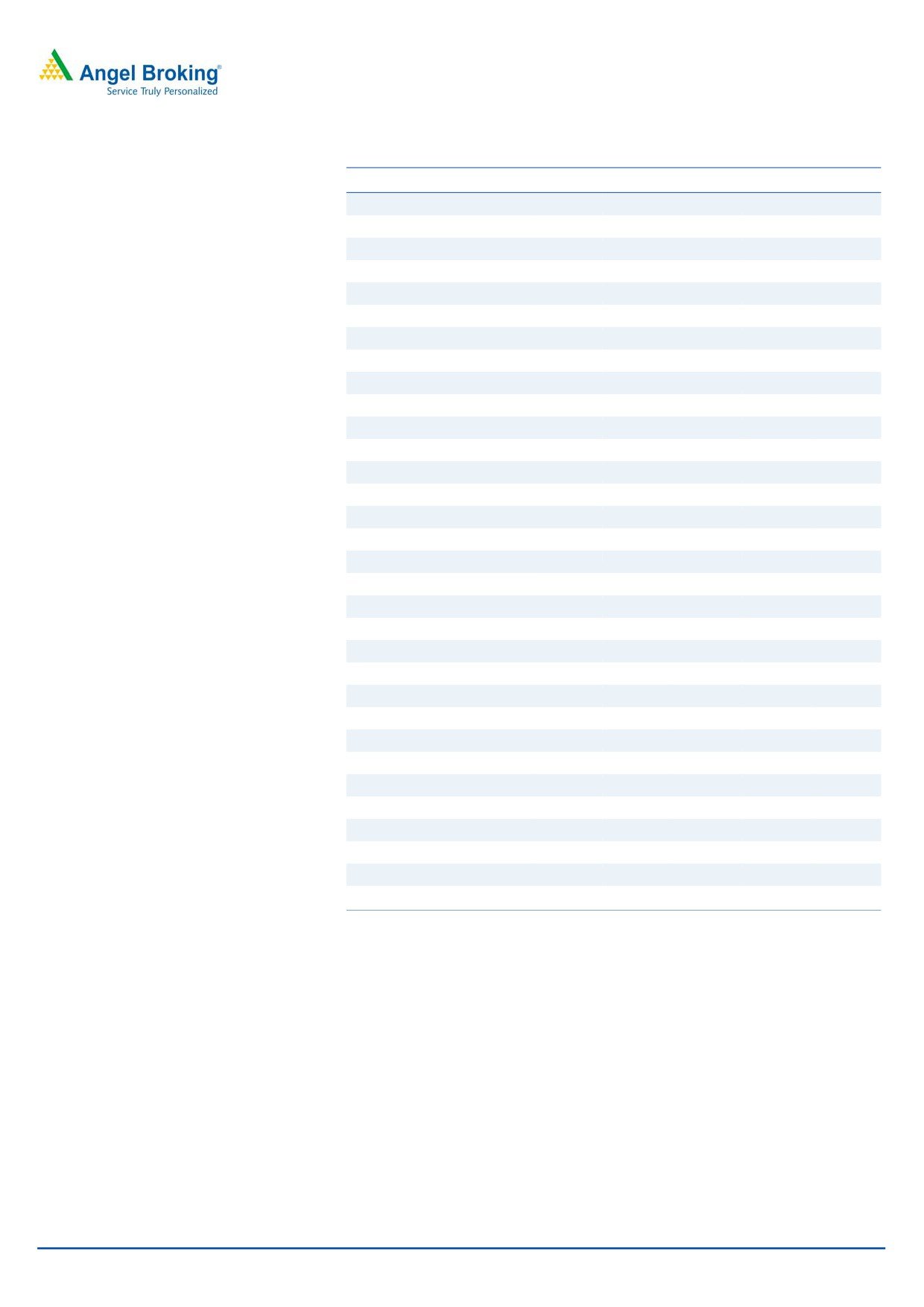

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016

Gross sales

172

220

240

223

294

Less: Excise duty

-

-

-

-

-

Net sales

172

220

240

223

294

Other operating income

3.1

3.7

1.0

1.2

0.9

Total operating income

175

224

241

224

295

% chg

45.4

28.2

7.3

(6.7)

31.4

Total expenditure

110

131

136

132

156

EBITDA

62

90

104

91

138

% chg

43.9

16.0

(12.4)

52.1

(% of Net Sales)

36.2

40.6

43.3

40.7

47.1

Depreciation& amortisation

6

8

10

9

9

Interest & other charges

12

10

13

9

8

Other income

-

-

-

-

-

(% of PBT)

-

-

-

-

-

Share in profit of Associates

-

-

-

-

-

Recurring PBT

48

76

82

74

123

% chg

Extraordinary expense/(Inc.)

-

-

54

-

-

PBT (reported)

48

76

28

74

123

Tax

14.0

25.9

6.4

22.8

43.2

(% of PBT)

30.6

32.7

32.0

30.9

35.2

PAT (reported)

34

50

21

51

79

Add: Share of earnings of asso.

-

-

-

-

-

Less: Minority interest (MI)

0

1

1

1

1

Prior period items

-

-

-

-

-

PAT after MI (reported)

33

49

20

50

79

ADJ. PAT

33

49

74

50

79

% chg

47.4

50.7

(32.2)

56.4

(% of Net Sales)

19.4

22.3

8.4

22.5

26.7

Basic EPS (`)

15.3

22.5

33.9

23.0

36.0

Fully Diluted EPS (`)

15.3

22.5

33.9

23.0

36.0

% chg

47.4

50.7

(32.2)

56.4

July 18, 2016

9

Advance Enzymes Technologies | IPO Note

Consolidated Balance Sheet

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016

SOURCES OF FUNDS

Equity share capital

21

22

22

22

22

Preference Capital

-

-

-

-

-

Reserves & surplus

75

140

145

188

257

Shareholders funds

96

162

166

210

279

Minority Interest

1.6

2.4

3.6

4.5

5.4

Total loans

139

117

88

54

39

Deferred tax liability

6

13

13

15

17

Total liabilities

243

294

270

283

340

APPLICATION OF FUNDS

Net block

50

116

115

111

112

Capital work-in-progress

155

171

171

171

171

Goodwill

60

2

4

10

10

Long Term Loans and Adv.

12

14

17

16

18

Investments

0.1

0.1

0.1

0.1

0.1

Current assets

73

94

102

110

140

Cash

5

4

3

4

26

Loans & advances

4

6

7

9

5

Other

63

85

92

96

109

Current liabilities

106

102

138

135

111

Net current assets

(34)

(8)

(36)

(25)

29

Mis. Exp. not written off

-

-

-

-

-

Total Assets

243

295

271

283

340

July 18, 2016

10

Advance Enzymes Technologies | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure:

Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the

company covered by Analyst. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst has not served as an officer,

director or employee of company covered by Analyst and has not been engaged in market making activity of the company covered by

Analyst.

July 18, 2016

11