Initiating Coverage | Finance

March 9, 2018

Aditya Birla Capital Ltd

BUY

CMP

`155

Target Price

`218

Aditya Birla Nuvo was holding 100% stake of Aditya Birla Capital Ltd (ABCL).

Investment Period

12 Months

Post AB Nuvo’s merger with Grasim, ABCL was carved out as a separate entity

(listed on 1/9/17). Currently, Grasim holds 57% and other promoter group

Stock Info

owns 17% in the company. ABCL has presence across growing businesses like

Sector

Finance

NBFC, HFC, life insurance, asset management and private equity.

Market Cap (` cr)

33,982

NBFC & HFC to drive consolidated business: Aditya Birla Finance (ABFL) has

Beta

0.9

reported healthy loan CAGR of 60% over FY2012-17. Moreover, despite

52 Week High / Low

264/153.5

aggressive asset quality growth and migration of NPL recognition to 90dpd,

Avg. Daily Volume

10,34,921

ABFL has maintained GNPA at 0.5% in FY2017. The company’s well diversified

Face Value (`)

10

portfolio coupled with geographical expansion will drive growth going ahead.

BSE Sensex

33,450

We have valued NBFC business at 3.5x of FY20E BV and it contributes 61% of

Nifty

10,279

SOTP. Aditya Birla Housing Finance (ABHFL) begun operation in FY2015 and

Reuters Code

ADTB.NS

has quickly grown its advance book at `6,752cr as on 3QFY18.

Bloomberg Code

ABCAP.IN

Financialisation of savings to benefit AMC & Life Insurance business:

Financialisation of savings and low penetration would continue to support AMC

Shareholding Pattern (%)

& Life insurance business. Aditya Birla Sun Life Mutual Fund (ABSLMF) is the 4th

Promoters

72.8

largest AMC with `2.41tn AUM, of which 28% is into equities. AMC business is

MF / Banks / Indian Fls

7.1

asset light in nature, hence can generate hefty free cash flow, which can be

FII / NRIs / OCBs

5.9

deployed in growing business such as NBFC & HFC. We have valued AMC

Indian Public / Others

14.3

business at 7.5% of AUM and it contributes 19% of SOTP. Aditya Birla Sun Life

Insurance (ABSLI) is a JV between ABCL and Sun Life Insurance (Canada). ABSLI

was primarily focused on ULIP policies, with almost 100% of new premiums

Abs.(%)

3m 1yr 3yr

sourced from ULIP policies in FY10. Post ULIP regulation in 2010, company

Sensex

0.3

14.6

12.2

changed focus and currently ULIP contributes

35% of product mix.

ABCL

(18.5)

NA NA

Bancassurance tie-up with HDFC, DBS and LVB would help to grow business.

Price chart

Outlook & Valuation: We believe broad based and integrated financial

250

offerings would enable ABCL to take benefit of financialisation of savings. We

expect ABCL’s PAT to grow at CAGR of 49% over FY2017-20E, largely driven by

200

Lending segment and AMC. We initiate coverage on Aditya Birla Capital Ltd

150

and recommend a BUY on the stock with SOTP based target price of `218.

100

Key Financials

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

Revenue

928

1,064

1,653

2,282

3,128

Source: Company, Angel Research

% chg

57%

15%

55%

38%

37%

PBT

869

1,065

1,703

2,337

3,183

PAT

380

529

973

1,313

1,761

% chg

39

84

35

34

EPS

2

2

4

6

8

Jaikishan Parmar

ROE

9

8

13

15

17

022 - 3935 7800 Ext: 6810

P/B

8

5

4

4

3

P/E

89

64

35

26

19

Source: Source: Company, Angel Research; Note: CMP as of March 8, 2018

Please refer to important disclosures at the end of this report

1

Aditya Birla Capital Ltd | Initiating Coverage

NBFC & HFC (Financing) to drive consolidated business

NBFC: Aditya Birla Finance Limited

Aditya Birla Finance Limited is among the leading well-diversified financial services

company in India offering end-to-end lending, financing and wealth management

solutions to a diversified range of customers across the country. ABFL is registered

with RBI as a systemically important non-deposit accepting non-banking finance

company and ranks among the top five largest private diversified NBFCs in India

based on AUM as of March 31, 2017 (source: CRISIL).

ABCL has AA+ (with stable outlook) long term credit rating and short term credit

rating of A1+ by ICRA. This rating is reflection of the company’s strong risk

management systems and processes, its robust profitability indicators (ROA/ROE of

1.90%/14.3% for Q3FY18), pristine asset quality indicators (Gross and net NPAs

of 0.70% and 0.47% respectively as on 3QFY18), diversified funding profile and

adequate capitalisation for the current scale of operations.

Healthy loan book growth: Aditya Birla Finance (ABFL) has reported healthy loan

CAGR of 60% over FY2012-17. Moreover, despite aggressive asset quality growth

and migration of NPL recognition to 90dpd, ABFL has maintained GNPA at 0.5%

in FY2017. The company’s well diversified portfolio coupled with geographical

expansion will drive growth going ahead. We have valued NBFC business at 3.5x

of FY20E BV and it contributes 61% of SOTP. Aditya Birla Housing Finance (ABHFL)

begun operation in FY2015 and has quickly grown its advance book at `6,752cr

as on 3QFY18.

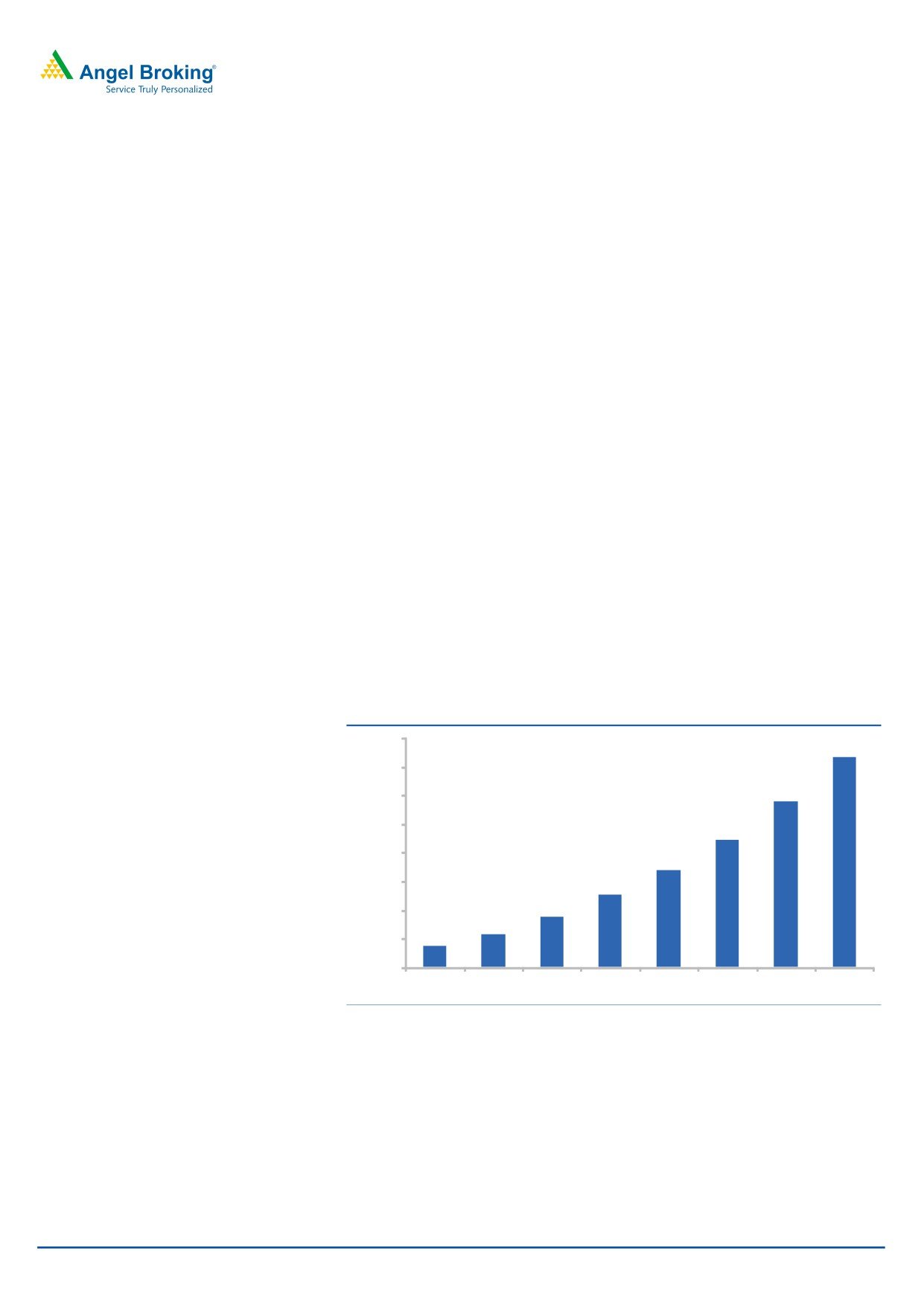

Exhibit 1: Advance has grown at CAGR of 46% over last 4 years

80,000

73,263

70,000

57,688

60,000

50,000

44,375

40,000

33,874

30,000

25,293

17,566

20,000

11,557

7,474

10,000

-

FY13

FY14

FY15

FY16

FY17

FY18E FY19E FY20E

Source: Company, Angel Research

Well diversified lending book: ABFL has commenced its financing business from

capital market related lending, which accounted for 34% of the loan book in

FY2013, accounting for only 14% of the loan book in FY17. ABFL has successfully

diversified across segments and has scaled up its portfolio significantly in the past

three years, through both, new product offerings and geographical expansion.

ABFL has one the best diversified loan book, on broader classification; Large

Corporates contribute 36%, SME 26%, Mid Corporates 15%, retail 10% and others

13%.

March 09, 2018

2

Aditya Birla Capital Ltd | Initiating Coverage

Strong risk management framework; best in class asset quality: ABFL has

separate sourcing and underwriting teams for each business segments. In the

case when the company is planning to venture into newer products, it hires

experienced top level management to set up the segment. Additionally, it only

finances to entities with strong promoter backing and only operational long

gestation projets. Stringent practice of monitoring and sourcing asset has led

to maintain best in class asset quality. The company’s reported GNPA and

NPA stood at 0.70% and 0.47% respectively as on 3QFY18. The company has

adopted 90+dpd for NPA recognition from1QFY18.

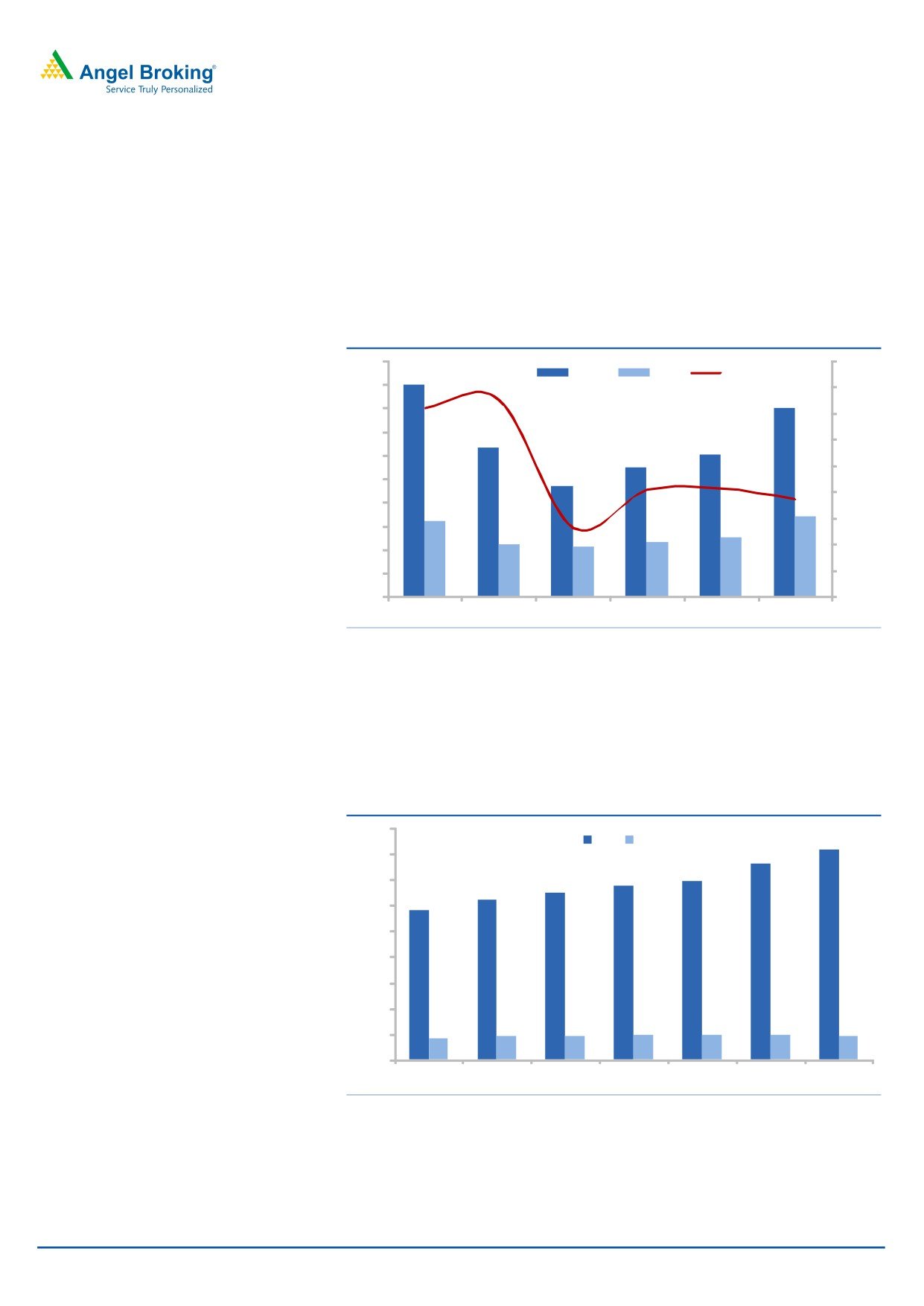

Exhibit 2: Asset quality trend

1.0

68.0

GNPA

NPA

Provision

65.1

0.9

66.0

64.4

0.8

64.0

0.7

62.0

0.6

60.0

58.2

58.3

0.5

57.5

58.0

0.4

55.3

56.0

0.3

54.0

0.2

0.1

52.0

0.9

0.3

0.60.2

0.50.2

0.60.2

0.6

0.3

0.80.3

0.0

50.0

FY15

FY16

FY17

FY18E

FY19E

FY20E

Source: Company, Angel Research

Improving return ratio: ABFL has reported ROE of 13.5% in FY2017, which is

184bps improvement from FY2014. We expect it to report further

improvement in return ratios led by controlling cost-to-income ratio. Further,

investment in digital lending would lower incremental opex.

Exhibit 3: Trend in return ratios (%)

18.0

16.4

ROE ROA

15.2

16.0

13.9

13.5

14.0

13.0

12.4

11.6

12.0

10.0

8.0

6.0

4.0

1.6

1.8

1.8

1.9

1.9

1.9

1.9

2.0

-

FY14

FY15

FY16

FY17

FY18E

FY19E

FY20E

Source: Company, Angel Research

March 09, 2018

3

Aditya Birla Capital Ltd | Initiating Coverage

Income Statement

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

Interest Income

2,344

3,181

4,186

5,425

6,940

Interest Exp

1,544

2,077

2,730

3,533

4,538

Net Interest Income

800

1,104

1,456

1,891

2,402

- YoY Growth (%)

33

38

32

30

27

Other Income

143

245

326

423

541

Total Income

943

1,350

1,783

2,314

2,943

Cost/Income (%)

24

31

30

29

28

Operating Exp

230

419

543

670

836

Provision

86

99

143

211

304

PBT

626

832

1,097

1,433

1,803

TAX

218

247

329

430

541

PAT

409

585

768

1,003

1,262

Balance sheet

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

Shareholder Fund

3,696

4,991

6,082

7,085

8,347

Borrowing

21,409

28,913

37,587

48,487

62,064

- Growth (%)

46

35

30

29

28

Other Liabilities

1,118

1,515

2,433

4,070

5,072

Total Liability

26,223

35,420

46,102

59,643

75,484

Fixed Asset

21

57

74

96

122

Advance

25,293

33,874

44,375

57,688

73,263

- Growth (%)

44

34

31

30

27

Other Asset

909

1,489

1,653

1,859

2,098

Total Asset

26,223

35,420

46,102

59,643

75,484

DuPont Analysis

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

Net Interest Income

3.6

3.6

3.6

3.6

3.6

(-) Prov. Exp.

0.4

0.3

0.4

0.4

0.5

Adj NII

3.2

3.3

3.2

3.2

3.1

Other Income

0.6

0.8

0.8

0.8

0.8

Op. Income

3.9

4.1

4.0

4.0

3.9

Opex

1.0

1.4

1.3

1.3

1.2

PBT

2.8

2.7

2.7

2.7

2.7

Taxes

1.0

0.8

0.8

0.8

0.8

ROA

1.8

1.9

1.9

1.9

1.9

Leverage

7.0

7.1

7.4

8.0

8.8

ROE

13.0

13.5

13.9

15.2

16.4

March 09, 2018

4

Aditya Birla Capital Ltd | Initiating Coverage

Housing Finance - Aditya Birla Housing Finance Limited

ABHFL begun operation in FY2015 and has grown its book size to `6,752cr as on

Q3FY18. It has disbursed `1,306cr, which is highest ever quarterly disbursement.

Its loan book is diversified, with 59% as housing loans, 12% as construction

finance loans and 30% as LAP/LRD (Q3FY18). Management, since beginning has

focused on multi distribution channels for loan book growth. Presently, AHFL

operates 44 branches with 2,300+ channel partners. Management is targeting to

add 6 new branches to reach to 50 branches by March FY2018.

Reported GNPA and NPA stood at 0.33% and 0.26% respectively as on 3QFY18

as compared with 0.34% and 0.28% respectively as on FY2017.

We expect loan book to continue to growth at healthy rate owing to government

flagship schemes, PMAY, Housing for All, Smart Cities, etc.

Income Statement

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

Interest Income

89

298

560

939

1,429

Interest Exp

60

211

402

655

976

Net Interest Income

30

86

158

283

452

- YoY Growth (%)

191%

83%

79%

60%

Other Income

12

17

33

56

86

Total Income

42

103

191

339

539

Cost/Income (%)

149

102

78

62

43

Operating Exp

62

105

149

212

232

Provision

10

14

27

51

86

PBT

(30)

(15)

15

77

220

TAX

-

-

4

23

66

PAT

(30 )

(15 )

11

54

154

Balance Sheet

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

Shareholder Fund

205

367

675

729

883

Borrowing

1,505

3,587

6,456

10,136

14,901

- Growth (%)

-

138

80

57

47

Other Liabilities

287

230

699

1,662

3,139

Total Liability

1,997

4,185

7,830

12,528

18,923

Fixed Asset

8

10

19

29

41

Advance

1,979

4,152

7,764

12,422

18,633

- Growth (%)

-

110

87

60

50

Other Asset

10

23

48

77

249

Total Asset

1,997

4,185

7,830

12,528

18,923

March 09, 2018

5

Aditya Birla Capital Ltd | Initiating Coverage

AMC - Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life Mutual Fund (ABSLMF) is the 4th largest AMC with `2.43tn

AUM, of which 28% is into equities. It has recorded average AUM CAGR of 24%

over FY2013-17 owing to regular fund performance, rising distribution reach and

presence across multiple products. Post demonetization and subdued performance

by other asset classes, MF industry has witnessed huge new money inflow.

AMC business is asset light in nature, and hence it would generate hefty free cash

flow, which can be deployed in growing businesses such as NBFC and HFC. The

AMC segment has reported average ROE of 25% over the last 5 years.

ABSLMF has reported revenue/EBITDA/PAT CAGR of 24%/29%/26%, respectively

over FY2014-17. We expect revenue/EBITDA/PAT to grow at CAGR of

22%/31%/31%, respectively, owing to operating leverage.

Income Statement

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

Revenues from Operations

776

1,013

1,308

1,700

2,210

Employee Expenses

174

198

262

323

398

Other Expenses

280

472

505

655

811

Total Expenses

453

669

767

978

1,209

EBITDA

322

344

541

722

1,001

EBITDA (%)

42

34

41

42

45

Depreciation

9

8

8

9

10

Interest Expenses

0

0

0

0

0

Other Income

0

1

2

2

2

PBT

314

337

535

715

993

Prov. for Taxation

111

114

182

243

338

PAT

203

223

353

472

655

Balance Sheet

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

Share Capital

18

18

18

18

18

Reserve & Surplus

761

924

1,277

1,749

2,404

Net Worth

779

942

1,295

1,767

2,422

Minority Interest

-

-

-

-

-

Other Long Term Liabilities

46

53

68

88

115

Total Liabilities

825

994

1,363

1,855

2,537

Total Fixed Assets

14

18

58

77

99

Investments

664

901

901

901

901

Cash & Cash equivalents

26

26

377

857

1,521

Other Current Assets

239

255

294

367

466

Current Liability

118

205

266

346

450

Total Assets

825

994

1,363

1,855

2,537

Growth YoY

20%

37%

36%

37%

March 09, 2018

6

Aditya Birla Capital Ltd | Initiating Coverage

Insurance - Aditya Birla Sun Life Insurance Co Ltd (ABSLI)

Aditya Birla Sun Life Insurance Company Limited, is one of the leading private

sector life insurance companies in India in terms of market share (7.1%) of first

year premium (FYP), with single premium considered at 10% (Source: Life

Insurance Council).

ABSLI is a JV between ABCL and Sun Life Insurance (Canada). ABSLI was primarily

focused on ULIP policies, with almost 100% of new premiums sourced from ULIP

policies in FY10. Post IRDA’s ULIP regulation in 2010, company changed focus

and incremental efforts were made to improve the product mix. This resulted into

decline in ULIP contribution to 35%.

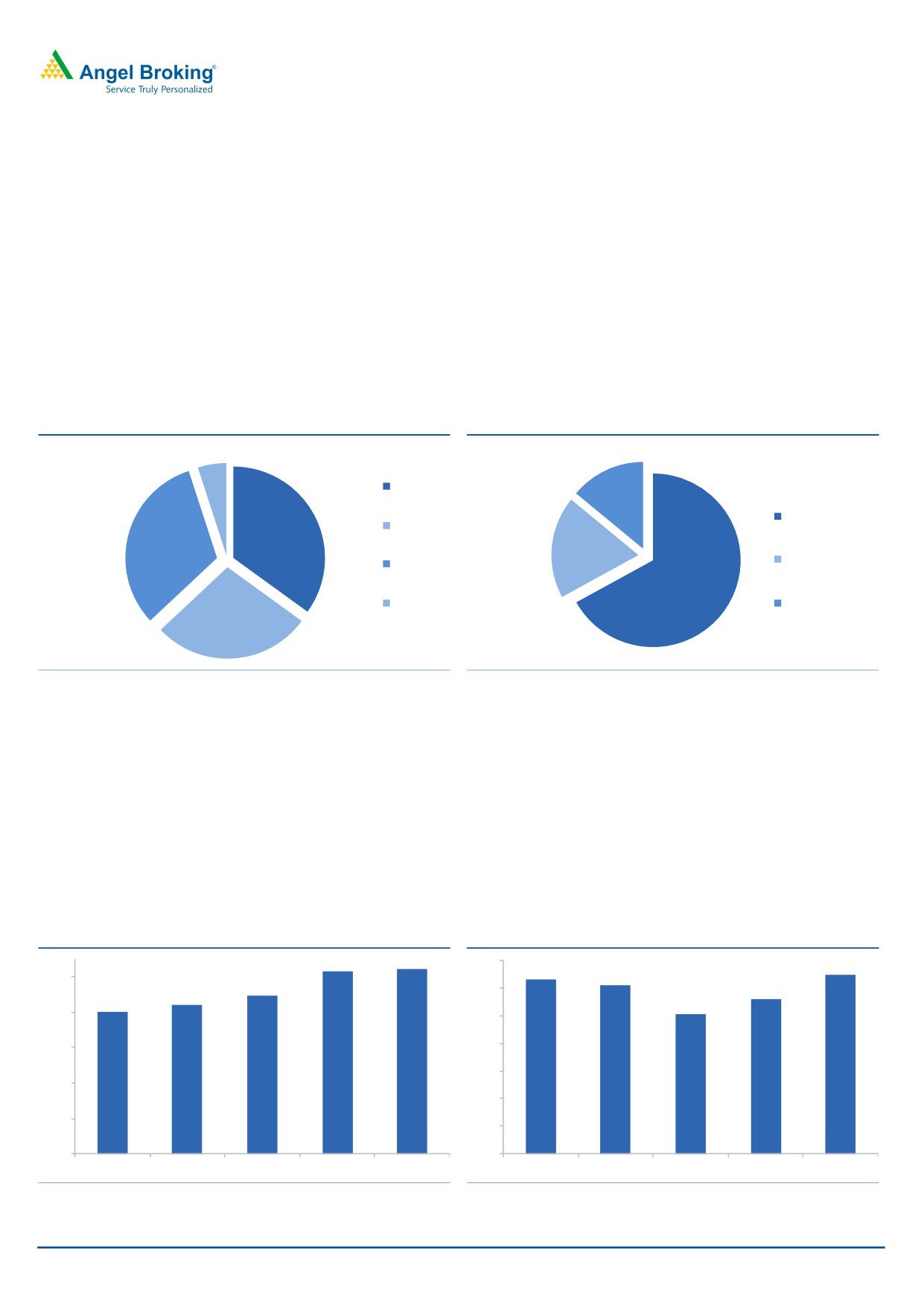

Exhibit 4: Individual Life (Product Mix)

Exhibit 5: Individual New Business Mix

5%

ULIP

14%

Agency

35%

PAR

32%

19%

Third party

Non PAR

67%

Term

Direct Marketing

28%

Source: Company, Angel Research

Source: Company, Angel Research

Bancassurance and operational efficiency to drive future growth

ABSLI has tied-up with Karur Vysya Bank, DCB Bank and Deutsche Bank.

Additionally, in 3QFY18 it also tied-up with HDFC Bank under the open

architecture model. We expect ABSLI to reap the full benefits of the recent deal

from the next fiscal onwards following integration and training of staff.

One of the important ratios in insurance industry is persistency ratio, which is

improving over a period of time. Persistency ratio shows what proportion of

policyholders stick with their products and keep funding it, and for how long.

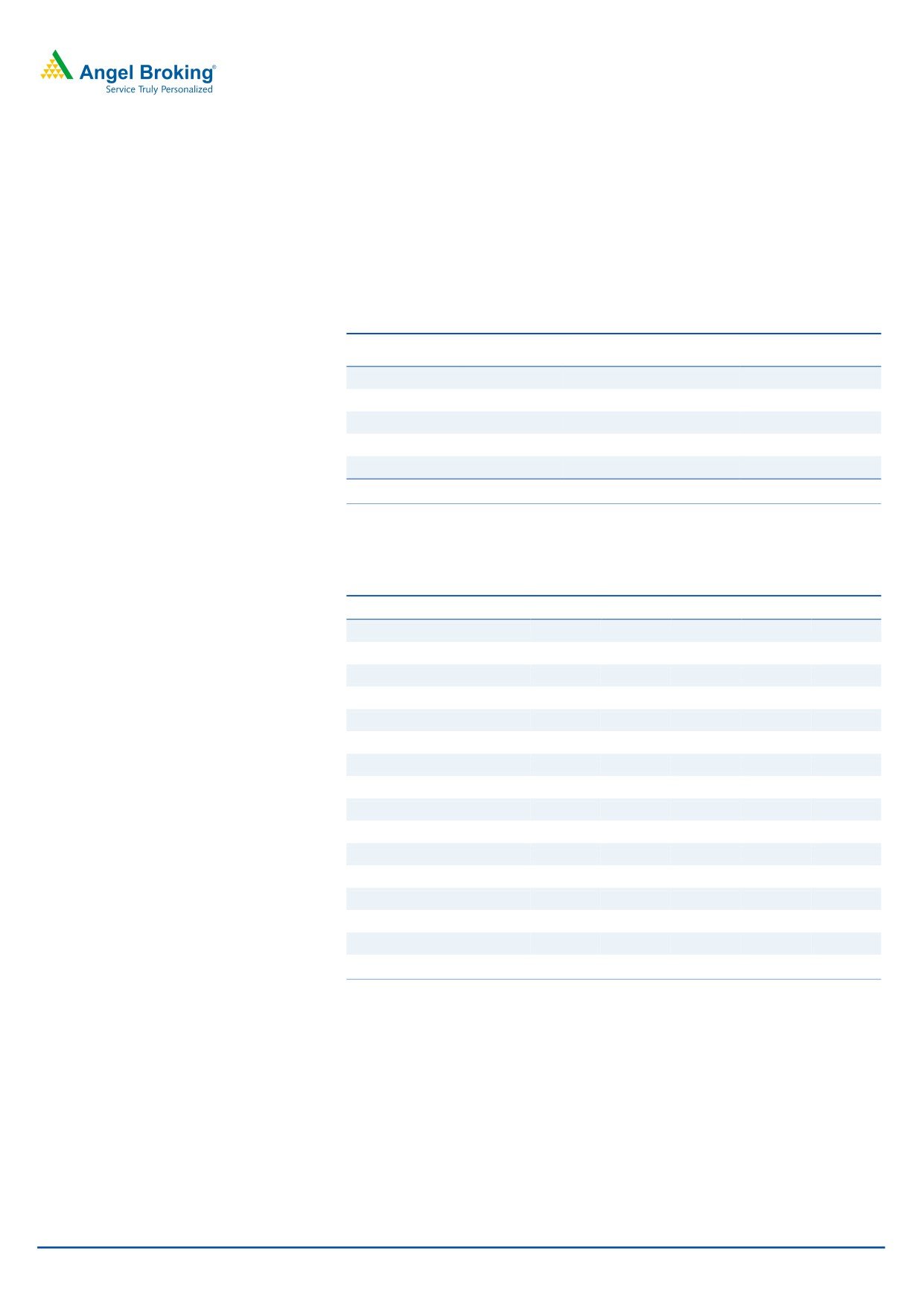

Exhibit 6: 13th Month Persistency (%)

Exhibit 7: VNB margins (%)

71.5%

72.1%

18%

17.0%

16.6%

16.2%

70%

64.7%

16%

15.2%

62.2%

60.0%

14.1%

60%

14%

50%

12%

10%

40%

8%

30%

6%

20%

4%

FY14

FY15

FY16

FY17

Q3FY18

FY13

FY14

FY15

FY16

FY17

Source: Company, Angel Research

Source: Company, Angel Research

March 09, 2018

7

Aditya Birla Capital Ltd | Initiating Coverage

New ventures are at a very nascent stage

Aditya Birla Health Insurance

Aditya Birla Health Insurance Co. Limited (ABHICL) was incorporated in 2015 as a

joint venture between MMI Strategic Investments Private Limited, MMI Holdings

Limited, ABNL and ABCL. ABHICL is engaged in the business of health insurance.

The current product portfolio comprises Retail Activ Health, Group Activ Health and

Group Activ Secure (Fixed Benefit). ABHICL’s multi-channel distribution strategy

drives scale and comprises of agency, bancassurance, brokers, digital and online

tele-assisted channels and all such channels are active. As on Q4FY17, agency roll

out was achieved in seven cities and nine branches with around 1,800 agents and

ABHICL has partnered with four banks including HDFC Bank. ABHICL also has

over 50 brokers.

Aditya Birla PE Advisors Ltd

Aditya Birla PE Advisors is a wholly owned subsidiary of ABCL. It provides financial

advisory and management services with focus on managing venture capital funds

and alternate investment funds. ABPE is presently appointed as an investment

manager to two SEBI registered domestic venture capital funds, namely, Aditya

Birla Private Equity - Fund I and Aditya Birla Private Equity - Sunrise Fund, where it

currently manages a gross AUM of Rs. 11.79 billion under these two funds

Aditya Birla My Universe Ltd

Aditya Birla MyUniverse Limited (ABMUL) was incorporated in 2008 and ventured

into the personal finance management space in 2012 through its online money

account aggregation of all financial services products including bank accounts,

credit cards, loans, mutual funds, demat accounts, insurance, incomes and

expenses in a highly secure environment. MyUniverse provides the customers with

a single window view of their personal financial universe thereby helping them in

evaluation of their net worth.

MyUniverse, in addition to aggregation, analyses and presents data in an

intelligible format to the customers and also provides financial transaction

capabilities. MyUniverse works with over 45 financial institutions and offers their

services and products.

Aditya Birla Money Ltd

Aditya Birla Money Limited (ABML) is a listed company. Its shares are listed on the

BSE and NSE since 2008. ABML is currently engaged in the business of securities

broking and is registered as a stock broker with SEBI. It is a member of BSE and

NSE and offers equity and derivatives trading through NSE and BSE. It holds

license from SEBI and offers portfolio management services. It has a combined

pan India distribution network of over 40 branches, and 737 franchisee offices. It

also has a robust online and offline model with a strong technological backbone

to support a large registered customer base of over 300,000 customers.

March 09, 2018

8

Aditya Birla Capital Ltd | Initiating Coverage

Aditya Birla Insurance Brokers Ltd

Aditya Birla Insurance Brokers Limited (ABIBL) is one of India’s leading

composite general insurance brokers, licensed by the Insurance Regulatory

and Development Authority of India (IRDAI). The company specializes in

providing general insurance broking and risk management solutions to

companies and individuals. It also offers Reinsurance solutions to insurance

companies and has developed strong relations with Indian as well as global

insurers and reinsurers.

Key risks

Financing business: NBFC has maintained good asset quality. Higher share of

corporate and SME could impact profitability, in case of subdued economic

growth or down turn.

AMC: Any slowdown in Indian market would adversely impact financials of the

AMC business.

Insurance: If the recent tie-up with HDFC Bank does not pick up then it would

impact embedded value growth assumption.

March 09, 2018

9

Aditya Birla Capital Ltd | Initiating Coverage

Outlook & valuation

We believe broad based and integrated financial offering enable ABCL to take

benefit of finacialisation of savings. We expect ABCL PAT to grow at CAGR of 49%

over FY17-FY20E, largely driven by Lending segment and AMC. We recommend a

buy rating on the stock and an SOTP-based target price of `218.

Exhibit 8: SOTP valuation summary

Valuation

Particulars

Stake

Value/share (`)

Methodology

NBFC

100%

3.5x FY20E PBV

133

HFC

100%

4x FY20E PBV

16

AMC

51%

7.5% of Q3FY18 AUM

42

Life Insurance

51%

3x Q2FY18 EV

26

ABML

74%

CMP

1

Fair value per share

218

Source: Company, Angel Research

Consolidated Profit & Loss

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

Segment PBT

NBFC

626

832

1,097

1,433

1,803

Life Insurance

-

-

150

180

216

Asset Management

314

337

535

715

993

HFC

-30

-15

15

77

220

Other Financial Services

9

-45

-145

-123

-105

Total PBT

928

1,064

1,653

2,282

3,128

- YoY Growth (%)

15

55

38

37

Consolidated Adj

-50

-44

50

55

55

Consolidated PBT

869

1,065

1,703

2,337

3,183

Taxes

345

375

579

795

1,082

Tax Rate (%)

40

35

34

34

34

Consolidated PAT

524

690

1,124

1,542

2,101

Minority Interest

144

161

151

229

340

Consolidated PAT Post MI

380

529

973

1,313

1,761

- YoY Growth (%)

39

84

35

34

March 09, 2018

10

Aditya Birla Capital Ltd | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Aditya Birla Capital Ltd

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

March 09, 2018

11